Natural Gas–Electricity Price Linkage Analysis Method Based on Benefit–Cost and Attention–VECM Model

Abstract

1. Introduction

2. Gas–Electricity Price Linkage Analysis Method Based on Benefit–Cost Model of Gas Unit

2.1. Revenue Model of Gas Unit

2.2. Cost Model of Gas Market for Gas-Generating Units

3. VECM-Model-Based Gas–Electricity Price Linkage Analysis

3.1. Gas–Electricity Price Stability Test

3.2. Gas–Electricity Price Co-Integration Test

- First, the ordinary least squares (OLS) method is used to estimate the gas–electricity price fitting equation and calculate the corresponding residual value:where and are the optimal parameters obtained by fitting; is the estimated electricity price; and is the residual difference between the real value and the predicted value of electricity price.

- Second, the stationarity of is tested. If is a stationary series, it is considered that there is a co-integration relationship between gas price and electricity price. In this case, there is no pseudo-regression problem in the equation obtained by regression.

3.3. Granger Causality Test of Gas–Electricity Price Based on VECM Model

- (1)

- Estimate the unconstrained regression model () and the constrained regression model () of electricity price , respectively:

- (2)

- Change the sequence of causality between gas price and electricity price, and use the same method in (1) to test.

- (3)

- If the test results both reject “gas price is not the reason for the change of electricity price” and accept “electricity price is not the reason for the change of gas price”, it can be concluded that “gas price is the Granger cause of electricity price”.

4. Time-Lag Analysis of Gas–Electricity Price Based on Soft Attention Mechanism

5. Case Studies

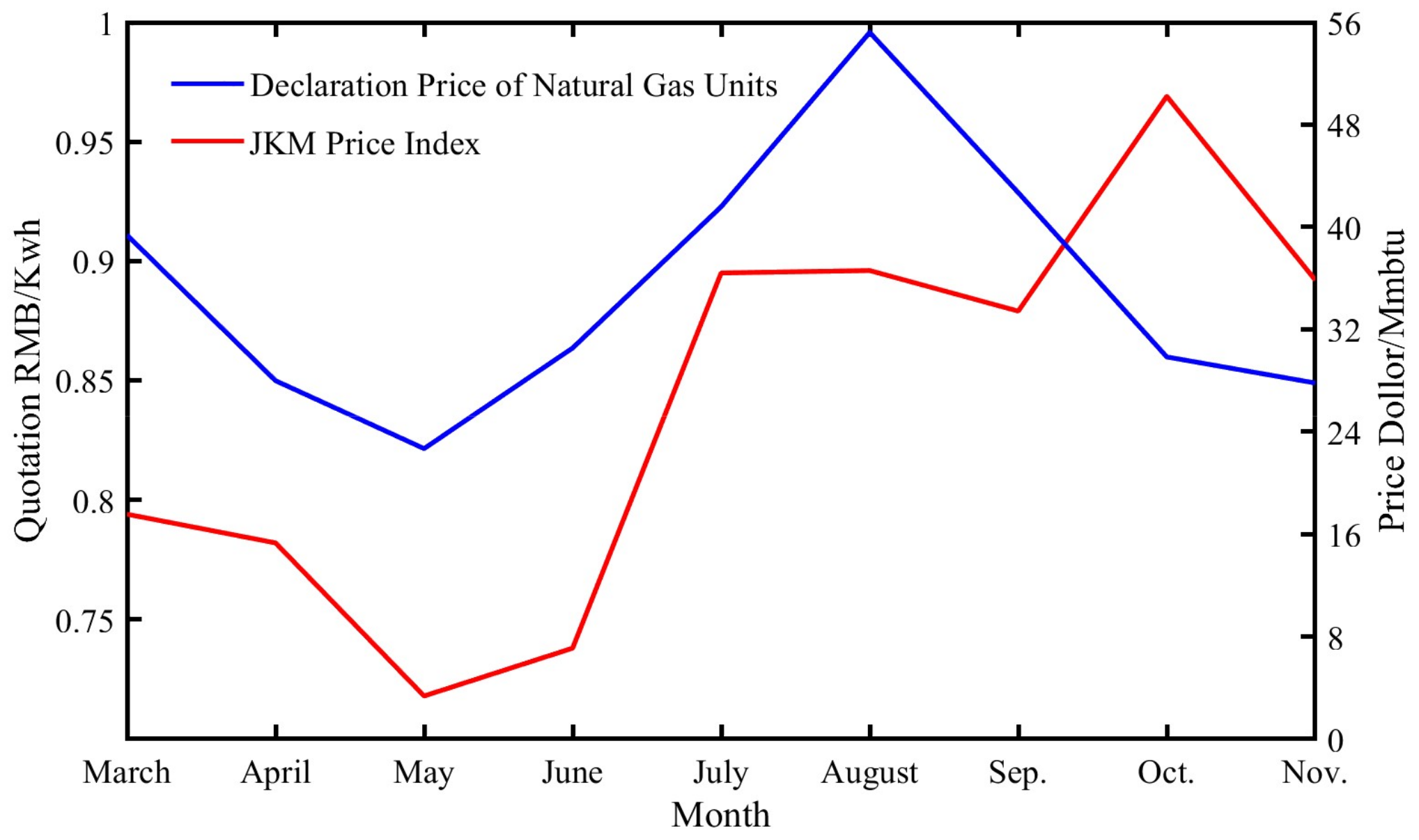

5.1. Analysis of Benefit–Cost Model of Gas Unit

5.2. Analysis of VECM Model of Gas–Electricity Price

5.3. Gas–Electricity Price Time Delay Analysis Results

6. Conclusions

- (1)

- The gas unit benefit–cost model proposed in this paper captures the quotation behavior of gas units in the market by assessing the profitability of the units. This model provides valuable gas and electricity price information for the co-ordinated operation of the gas and electricity market, thereby helping market participants to manage market risks, such as an insufficient natural gas supply.

- (2)

- Calculation reveals the co-integration relationship of long-term gas and electricity price stability. The results demonstrate a goodness of fit value greater than 0.7, indicating a strong correlation between the two. Additionally, this paper employs the VECM model to study the short-term volatility of gas and electricity prices. The results reveal the existence of an error correction mechanism, suggesting that short-term volatility will eventually tend to balance. This finding further confirms the presence of a long-term equilibrium relationship between gas and electricity prices. To analyze the causality relationship between prices in different periods, the processed gas and electricity price time series are subjected to a Granger causality test. The comparison of the results with actual market conditions reveals that the supply and demand situation in the gas and electricity market is continually changing.

- (3)

- In this paper, an attention mechanism is used to quantitatively describe the conduction delay time of gas–electricity price fluctuations. Compared with determining the lag order by the VAR model, the proposed method comprehensively reflects the influence weight of the delay in each time period, and the results are more consistent with the actual price transmission process. An analysis of the weight value of each cycle and the cumulative influence weight reveals that the time delay is mainly within the first three weeks, and there is no time delay accounting for absolute proportion in the results. Therefore, it can be qualitatively concluded that the existing gas–electricity price linkage is not strong.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Wu, C.; Wu, Z.; Yi, Z.; Yang, L. Strategic bidding of gas-fired units with tanks in coupled electricity and natural gas markets. Sustain. Energy Grids Netw. 2023, 34, 101021. [Google Scholar] [CrossRef]

- Jing, Z. Analysis and prospect of global natural gas market in 2022. Int. Pet. Econ. 2021, 29, 34–43, 106. [Google Scholar]

- Han, Y. Supply-demand situation of European natural gas market in winter 2022. Int. Pet. Econ. 2022, 30, 80–85. [Google Scholar]

- Ruijin, Z.; Weilin, G.; Xuejiao, G. Short-term electricity load forecasting considering the correlation between natural gas and electricity load. J. Electr. Power Syst. Autom. 2019, 31, 27–32. [Google Scholar]

- Chen, C.; Liang, H.; Zhai, X.; Zhang, J.; Liu, S.; Lin, Z.; Yang, L. Review of restoration technology for renewable-dominated electric power systems. Energy Convers. Econ. 2022, 3, 287–303. [Google Scholar] [CrossRef]

- Poyrazoglu, P.G. Impact of gas price on electricity price forecasting via supervised learning and random walk. In Proceedings of the 2019 16th International Conference on the European Energy Market (EEM), Ljubljana, Slovenia, 18–20 September 2019; pp. 1–5. [Google Scholar]

- Wang, T.; Qu, W.; Zhang, D.; Ji, Q.; Wu, F. Time-varying determinants of China’s liquefied natural gas import price: A dynamic model averaging approach. Energy 2022, 259, 125013. [Google Scholar] [CrossRef]

- Zhang, R.; Jiang, T.; Li, F.; Li, G.; Li, X.; Chen, H. Conic optimal energy flow of integrated electricity and natural gas systems. J. Mod. Power Syst. Clean Energy 2021, 9, 963–967. [Google Scholar] [CrossRef]

- Liu, S.; You, S.; Lin, Z.; Zeng, C.; Li, H.; Wang, W.; Hu, X.; Liu, Y. Data-driven event identification in the U.S. power systems based on 2D-OLPP and RUSBoosted trees. IEEE Trans. Power Syst. 2022, 37, 94–105. [Google Scholar] [CrossRef]

- Xiaolong, S.; Renan, J. Simulation and evaluation on implementation effect of coal and electricity linkage related control policies in Transition period. Autom. Electr. Power Syst. 2012, 36, 55–61. [Google Scholar]

- Shan, L.; Qing, D.; Guojian, Y. Comprehensive benefits and evaluation of natural gas power plants. J. Electr. Power Syst. Autom. 2015, 27, 7–12, 60. [Google Scholar]

- Yang, J.; Dong, Z.Y.; Wen, F.; Chen, Q.; Liang, B. Spot electricity market design for a power system characterized by high penetration of renewable energy generation. Energy Convers. Econ. 2021, 2, 67–78. [Google Scholar] [CrossRef]

- Zhang, T.; Liu, S.; Qiu, W.; Lin, Z.; Zhu, L.; Zhao, D.; Qian, M.; Yang, L. KPI-based Real-time Situational Awareness for Power Systems with a High Proportion of Renewable Energy Sources. CSEE J. Power Energy Syst. 2022, 8, 1060–1073. [Google Scholar]

- Wang, T.; Zhang, D.; Ji, Q.; Shi, X. Market reforms and determinants of import natural gas prices in China. Energy 2020, 196, 117105. [Google Scholar] [CrossRef]

- Yin, J.; Wang, Y. Research on affordability of natural gas for domestic use. Price Theory Pract. 2012, 336, 47–48. [Google Scholar]

- Dongyu, L.; Jun, Z.; Yan, Z. Study on Rationality of Chinese Residential Gas Ladder Pricing—An Analysis of Urumqi Residential Gas Ladder Price based on Utility function and resource allocation. Price Theory Pract. 2017, 392, 100–103. [Google Scholar]

- Liu, G. Research on price block in upstream and downstream natural gas industries. Price Theory Pract. 2018, 406, 60–63. [Google Scholar]

- Chen, C.; Li, Y.; Qiu, W.; Liu, C.; Zhang, Q.; Li, Z.; Lin, Z.; Yang, L. Cooperative-Game-Based Day-Ahead Scheduling of Local Integrated Energy Systems with Shared Energy Storage. IEEE Trans. Sustain. Energy 2022, 13, 1994–2011. [Google Scholar] [CrossRef]

- Wang, C.; Wei, W.; Wang, J.; Wu, L.; Liang, Y. Equilibrium of interdependent gas and electricity markets with marginal price based bilateral energy trading. IEEE Trans. Power Syst. 2018, 33, 4854–4867. [Google Scholar] [CrossRef]

- Nandakumar, N.; Annaswam, A.M. Impact of increased renewables on natural gas markets in eastern United States. J. Mod. Power Syst. Clean Energy 2017, 5, 424–438. [Google Scholar] [CrossRef]

- Khani, H.; Farag, H.E.Z. Optimal Day-Ahead scheduling of power-to-gas energy storage and gas load management in wholesale electricity and gas markets. IEEE Trans. Sustain. Energy 2018, 9, 940–951. [Google Scholar] [CrossRef]

- Shiri, A.; Afshar, M.; Rahimi-Kian, A.; Maham, B. Electricity price forecasting using support vector machines by considering oil and natural gas price impacts. In Proceedings of the 2015 IEEE International Conference on Smart Energy Grid Engineering (SEGE), Oshawa, ON, Canada, 17–19 August 2015; pp. 1–5. [Google Scholar]

- Xiaoping, Z.; Jianing, L.; Hao, F. Reform and challenge of electricity retail market in UK. Autom. Electr. Power Syst. 2016, 40, 10–16. [Google Scholar]

- Danistya, D.R.; Qaulifa, F.; Ramadani, Y.A.; Yulita, I.N.; Ardisasmita, M.N.; Agustian, D. Prediction New Cases of COVID-19 in Indonesia Using Vector Autoregression (VAR) and Long-Short Term Memory (LSTM) Methods. In Proceedings of the 2021 International Conference on Artificial Intelligence and Big Data Analytics, Bandung, Indonesia, 27–19 October 2021; pp. 1–4. [Google Scholar]

- Toda, H.Y.; Taku, Y. Statistical inference in vector autoregressions with possibly integrated processes. J. Econom. 1995, 66, 225–250. [Google Scholar] [CrossRef]

- Peng, W.; Mingyu, Z.; Bian, F. Study on the linkage relationship between gas and electricity prices in Britain. Price Issue 2020, 522, 23–29. [Google Scholar]

- Zhang, J.; Hu, W.; Zhang, X. The Relative Performance of VAR and VECM Model. In Proceedings of the 2010 3rd International Conference on Information Management, Innovation Management and Industrial Engineering, Kunming, China, 26–28 November 2010; pp. 132–135. [Google Scholar]

- Parvin, R.; Ferdows, R. The Nexus between Financial Development and Economic Growth: An Application of the VECM Model and Machine Learning Algorithms. In Proceedings of the 2022 25th International Conference on Computer and Information Technology (ICCIT), Cox’s Bazar, Bangladesh, 17–19 December 2022; pp. 360–365. [Google Scholar]

- Chen, Y.; Lu, J.; Ma, M. How Does Oil Future Price Imply Bunker Price—Cointegration and Prediction Analysis. Energies 2022, 15, 3630. [Google Scholar] [CrossRef]

- Kang, Z.; Zhang, B. Analysis on Cointegration of FDI, International Trade and Chinese Economic Growth and VECM Model. J. Int. Trade 2006, 2, 73–78. [Google Scholar]

- Zhao, B.; Wang, Z.P.; Ji, W.J.; Gao, X.; Li, X.B. CNN-GRU short-term Power load forecasting Method based on Attention mechanism. Power Grid Technol. 2019, 43, 4370–4376. [Google Scholar]

- Huan, R.; Wang, X. Review on Attention Mechanism. J. Comput. Appl. 2021, 41, 1–6. [Google Scholar]

- Zhou, Y.H.; Zou, L.G. Study on the Price relationship between Chinese soybean futures Market and international soybean futures Market—An Empirical Analysis based on VAR Model. J. Agrotech. Econ. 2007, 1, 55–62. [Google Scholar]

- Luo, Z.; Li, J.; Zhu, Y. A Deep Feature Fusion Network Based on Multiple Attention Mechanisms for Joint Iris-Periocular Biometric Recognition. IEEE Signal Process. Lett. 2021, 28, 1060–1064. [Google Scholar] [CrossRef]

- Li, K.J.; Qu, R.X. The impact of technological progress on China’s carbon emission: An empirical study based on vector error correction model. China Soft Sci. 2012, 258, 51–58. [Google Scholar]

- Asari, F.F.A.H.; Baharuddin, N.S.; Jusoh, N.; Mohamad, Z.; Shamsudin, N.; Jusoff, K. A vector error correction model (VECM) approach in explaining the relationship between interest rate and inflation towards exchange rate volatility in Malaysia. World Appl. Sci. J. 2011, 12, 49–56. [Google Scholar]

| Sequence of Variables | ADF Test Value | Statistical Probability at the Significance Level of 5% | Inspection Result |

|---|---|---|---|

| 0.686 | 0.8626 | Unstable | |

| −2.519 | 0.3185 | Unstable | |

| −10.489 | 0.0000 | Stable | |

| −12.815 | 0.0000 | Stable |

| Equation Coefficient | Optimal Parameter Value | t-Test Value | Statistical Probability |

|---|---|---|---|

| 0.9404 | 17.2245 | 0.0000 | |

| 2.3983 | 43.1492 | 0.0000 |

| Error Correction Term | ||

|---|---|---|

| Coint Equation (1) | −0.4218 (0.1941) | −0.1082 (0.1136) |

| −0.0782 (0.2151) | 1.3195 (0.0835) | |

| 2.1982 (0.0029) | −0.5194 (0.1837) |

| Time | Actual Situation of Gas and Electricity Market | Null Hypothesis | Statistical Probability | Conclusion |

|---|---|---|---|---|

| August 2020 | Gas is cheap, and electricity supply environment is easy | Gas price is not the cause of electricity price changes | 0.79 | Electricity price causes gas price change |

| Electricity price is not the cause of gas price changes | 0.08 | |||

| May 2021 | Gas price is high, and electricity supply environment is tight | Gas price is not the cause of electricity price changes | 0.09 | There is a two-way causal relationship between gas price and electricity price |

| Electricity price is not the cause of gas price changes | 0.06 | |||

| From March to July 2022 | Gas price is high, and electricity supply environment is tight | Gas price is not the cause of electricity price changes | 0.08 | Gas price causes electricity price change |

| Electricity price is not the cause of gas price changes | 0.98 | |||

| From August to November 2022 | Gas price is high, and electricity supply environment is easy | Gas price is not the cause of electricity price changes | 0.85 | There is no obvious causal relationship between gas price and electricity price |

| Electricity price is not the cause of gas price changes | 0.39 |

| Number of Cycles | Cycle Scale Weight Value | Cumulative Influence Weight |

|---|---|---|

| 2 | 0.24 | 0.24 |

| 1 | 0.21 | 0.45 |

| 3 | 0.19 | 0.64 |

| 4 | 0.14 | 0.78 |

| 6 | 0.08 | 0.86 |

| Order of Lag | AIC |

|---|---|

| 1 | −2.41 |

| 2 * | −5.13 |

| 3 | −4.88 |

| 4 | −4.64 |

| 5 | −3.08 |

| 6 | −3.32 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, S.; Gan, W.; Liu, A.; Jiang, X.; Shen, C.; Wang, Y.; Yang, L.; Lin, Z. Natural Gas–Electricity Price Linkage Analysis Method Based on Benefit–Cost and Attention–VECM Model. Energies 2023, 16, 4155. https://doi.org/10.3390/en16104155

Zhou S, Gan W, Liu A, Jiang X, Shen C, Wang Y, Yang L, Lin Z. Natural Gas–Electricity Price Linkage Analysis Method Based on Benefit–Cost and Attention–VECM Model. Energies. 2023; 16(10):4155. https://doi.org/10.3390/en16104155

Chicago/Turabian StyleZhou, Sheng, Wen Gan, Ang Liu, Xinyue Jiang, Chengliang Shen, Yunchu Wang, Li Yang, and Zhenzhi Lin. 2023. "Natural Gas–Electricity Price Linkage Analysis Method Based on Benefit–Cost and Attention–VECM Model" Energies 16, no. 10: 4155. https://doi.org/10.3390/en16104155

APA StyleZhou, S., Gan, W., Liu, A., Jiang, X., Shen, C., Wang, Y., Yang, L., & Lin, Z. (2023). Natural Gas–Electricity Price Linkage Analysis Method Based on Benefit–Cost and Attention–VECM Model. Energies, 16(10), 4155. https://doi.org/10.3390/en16104155