Economic Analysis of Recently Announced Green Hydrogen Projects in Russia: A Multiple Case Study

Abstract

1. Introduction

2. Literature Review

3. Methodology and Data

- —fixed OPEX, including maintenance of production equipment costs;

- —variable OPEX, including fuel/electricity and CCS/water costs;

- H—the total amount of hydrogen produced;

- r—the discount rate.

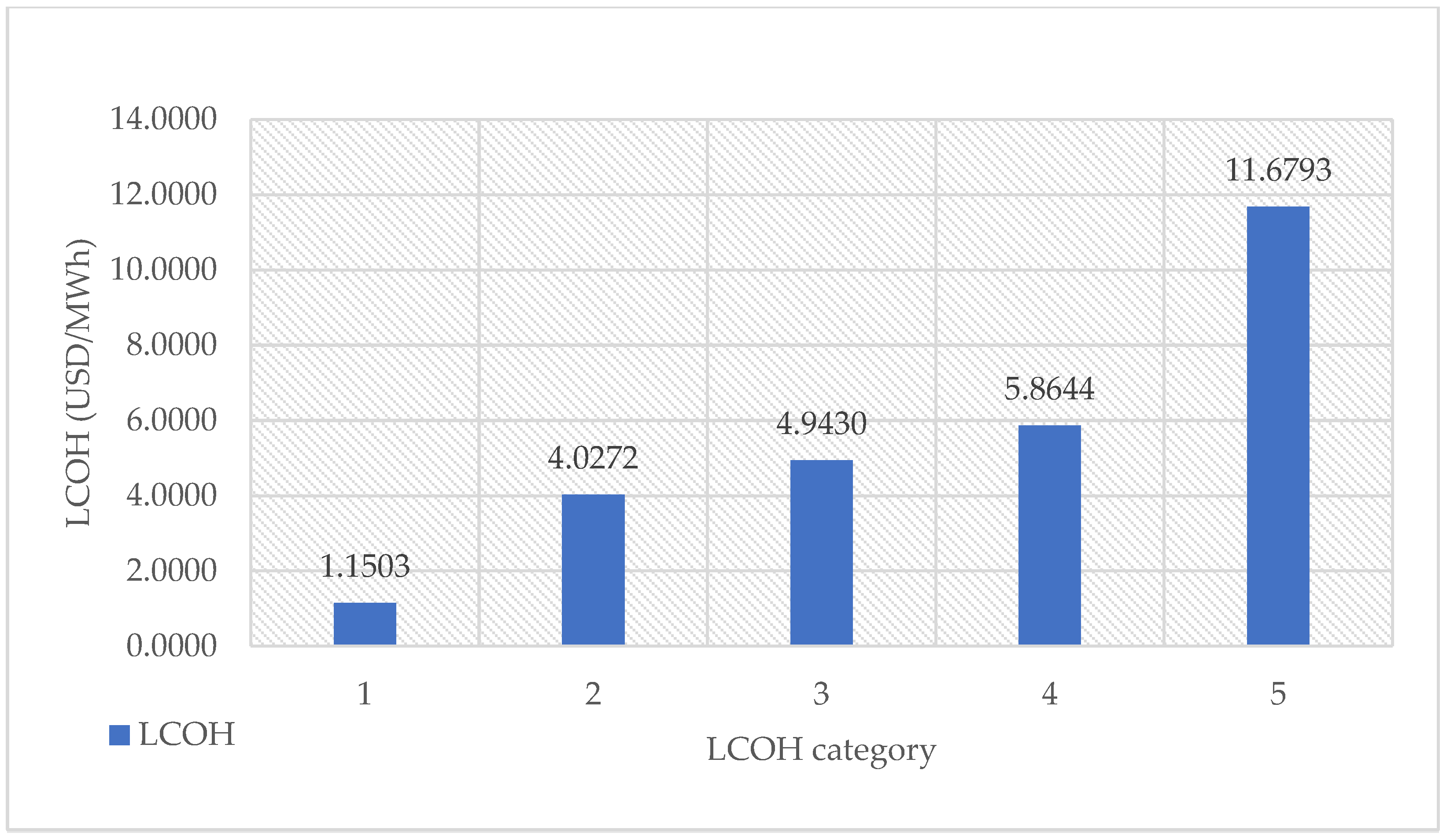

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Ozturk, M.; Dincer, I. A Comprehensive Review on Power-to-Gas with Hydrogen Options for Cleaner Applications. Int. J. Hydrogen Energy 2021, 46, 31511–31522. [Google Scholar] [CrossRef]

- Cipriani, G.; Di Dio, V.; Genduso, F.; La Cascia, D.; Liga, R.; Miceli, R.; Galluzzo, G.R. Perspective on Hydrogen Energy Carrier and Its Automotive Applications. Int. J. Hydrogen Energy 2014, 39, 8482–8494. [Google Scholar] [CrossRef]

- Sherif, S.A.; Goswami, D.Y.; Stefanakos, E.K. Handbook of Hydrogen Energy, 1st ed.; Steinfeld, A., Ed.; CRC Press: Boca Raton, FL, USA, 2014. [Google Scholar] [CrossRef]

- Oruc, O.; Dincer, I. Environmental Impact Assessment of Using Various Fuels in a Thermal Power Plant. Int. J. Glob. Warm. 2019, 18, 191. [Google Scholar] [CrossRef]

- Ozturk, M.; Dincer, I. Life Cycle Assessment of Hydrogen-Based Electricity Generation in Place of Conventional Fuels for Residential Buildings. Int. J. Hydrogen Energy 2020, 45, 26536–26544. [Google Scholar] [CrossRef]

- Hydrogen for Net Zero—A Critical Cost-Competitive Energy Vector. Available online: https://hydrogencouncil.com/wp-content/uploads/2021/11/Hydrogen-for-Net-Zero.pdf (accessed on 12 March 2023).

- Rabiee, A.; Keane, A.; Soroudi, A. Technical Barriers for Harnessing the Green Hydrogen: A Power System Perspective. Renew. Energy 2021, 163, 1580–1587. [Google Scholar] [CrossRef]

- Tarkowski, R.; Uliasz-Misiak, B. Towards Underground Hydrogen Storage: A Review of Barriers. Renew. Sustain. Energy Rev. 2022, 162, 112451. [Google Scholar] [CrossRef]

- Gordon, J.A.; Balta-Ozkan, N.; Nabavi, S.A. Socio-Technical Barriers to Domestic Hydrogen Futures: Repurposing Pipelines, Policies, and Public Perceptions. Appl. Energy 2023, 336, 120850. [Google Scholar] [CrossRef]

- Moradi, R.; Groth, K.M. Hydrogen Storage and Delivery: Review of the State of the Art Technologies and Risk and Reliability Analysis. Int. J. Hydrogen Energy 2019, 44, 12254–12269. [Google Scholar] [CrossRef]

- Yue, M.; Lambert, H.; Pahon, E.; Roche, R.; Jemei, S.; Hissel, D. Hydrogen Energy Systems: A Critical Review of Technologies, Applications, Trends and Challenges. Renew. Sustain. Energy Rev. 2021, 146, 111180. [Google Scholar] [CrossRef]

- Jovan, D.J.; Dolanc, G. Can Green Hydrogen Production Be Economically Viable under Current Market Conditions. Energies 2020, 13, 6599. [Google Scholar] [CrossRef]

- Glenk, G.; Reichelstein, S. Economics of Converting Renewable Power to Hydrogen. Nat. Energy 2019, 4, 216–222. [Google Scholar] [CrossRef]

- Armijo, J.; Philibert, C. Flexible Production of Green Hydrogen and Ammonia from Variable Solar and Wind Energy: Case Study of Chile and Argentina. Int. J. Hydrogen Energy 2020, 45, 1541–1558. [Google Scholar] [CrossRef]

- Macedo, S.F.; Peyerl, D. Prospects and Economic Feasibility Analysis of Wind and Solar Photovoltaic Hybrid Systems for Hydrogen Production and Storage: A Case Study of the Brazilian Electric Power Sector. Int. J. Hydrogen Energy 2022, 47, 10460–10473. [Google Scholar] [CrossRef]

- Zhiznin, S.Z.; Shvets, N.N.; Timokhov, V.M.; Gusev, A.L. Economics of Hydrogen Energy of Green Transition in the World and Russia. Part I. Int. J. Hydrogen Energy 2023, S0360319923010832. [Google Scholar] [CrossRef]

- Vechkinzova, E.; Steblyakova, L.P.; Roslyakova, N.; Omarova, B. Prospects for the Development of Hydrogen Energy: Overview of Global Trends and the Russian Market State. Energies 2022, 15, 8503. [Google Scholar] [CrossRef]

- Bazhenov, S.; Dobrovolsky, Y.; Maximov, A.; Zhdaneev, O.V. Key Challenges for the Development of the Hydrogen Industry in the Russian Federation. Sustain. Energy Technol. Assess. 2022, 54, 102867. [Google Scholar] [CrossRef]

- Kopteva, A.; Kalimullin, L.; Tcvetkov, P.; Soares, A. Prospects and Obstacles for Green Hydrogen Production in Russia. Energies 2021, 14, 718. [Google Scholar] [CrossRef]

- Velazquez, A.A.; Dodds, P.E. Green Hydrogen Characterisation Initiatives: Definitions, Standards, Guarantees of Origin, and Challenges. Energy Policy 2020, 138, 111300. [Google Scholar] [CrossRef]

- Bünger, U.; Michalski, J.; Crotogino, F.; Kruck, O. Large-Scale Underground Storage of Hydrogen for the Grid Integration of Renewable Energy and Other Applications. In Compendium of Hydrogen Energy; Woodhead Publishing: Sawston, UK, 2016. [Google Scholar]

- Dincer, I. Green Methods for Hydrogen Production. Int. J. Hydrogen Energy 2012, 37, 1954–1971. [Google Scholar] [CrossRef]

- Boretti, A. There Are Hydrogen Production Pathways with Better than Green Hydrogen Economic and Environmental Costs. Int. J. Hydrogen Energy 2021, 46, 23988–23995. [Google Scholar] [CrossRef]

- Hermesmann, M.; Müller, T.E. Green, Turquoise, Blue, or Grey? Environmentally Friendly Hydrogen Production in Transforming Energy Systems. Prog. Energy Combust. Sci. 2022, 90, 100996. [Google Scholar] [CrossRef]

- Arcos, J.M.M.; Santos, D.M.F. The Hydrogen Color Spectrum: Techno-Economic Analysis of the Available Technologies for Hydrogen Production. Gases 2023, 3, 25–46. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Li, Y.; Rasoulinezhad, E.; Mortha, A.; Long, Y.; Lan, Y.; Zhang, Z.; Li, N.; Zhao, X.; Wang, Y. Green Finance and the Economic Feasibility of Hydrogen Projects. Int. J. Hydrogen Energy 2022, 47, 24511–24522. [Google Scholar] [CrossRef]

- Kakoulaki, G.; Kougias, I.; Taylor, N.; Dolci, F.; Moya, J.; Jäger-Waldau, A. Green Hydrogen in Europe—A Regional Assessment: Substituting Existing Production with Electrolysis Powered by Renewables. Energy Convers. Manag. 2021, 228, 113649. [Google Scholar] [CrossRef]

- Zhang, W.; Li, X.; Yang, J.; Liu, J.; Xu, C. Economic Analysis of Hydrogen Production from China’s Province-Level Power Grid Considering Carbon Emissions. Clean Energy 2023, 7, 30–40. [Google Scholar] [CrossRef]

- Clark, W.W.; Rifkin, J. A Green Hydrogen Economy. Energy Policy 2006, 34, 2630–2639. [Google Scholar] [CrossRef]

- Barhoumi, E.M.; Salhi, M.S.; Okonkwo, P.C.; Ben Belgacem, I.; Farhani, S.; Zghaibeh, M.; Bacha, F. Techno-Economic Optimization of Wind Energy Based Hydrogen Refueling Station Case Study Salalah City Oman. Int. J. Hydrogen Energy 2023, 48, 9529–9539. [Google Scholar] [CrossRef]

- Okonkwo, P.C.; Barhoumi, E.M.; Mansir, I.B.; Emori, W.; Uzoma, P.C. Techno-Economic Analysis and Optimization of Solar and Wind Energy Systems for Hydrogen Production: A Case Study. Energy Sour. Part A Recovery Util. Environ. Eff. 2022, 44, 9119–9134. [Google Scholar] [CrossRef]

- Valente, A.; Iribarren, D.; Dufour, J. Harmonising the Cumulative Energy Demand of Renewable Hydrogen for Robust Comparative Life-Cycle Studies. J. Clean. Prod. 2018, 175, 384–393. [Google Scholar] [CrossRef]

- Schrotenboer, A.H.; Veenstra, A.A.T.; uit het Broek, M.A.J.; Ursavas, E. A Green Hydrogen Energy System: Optimal Control Strategies for Integrated Hydrogen Storage and Power Generation with Wind Energy. Renew. Sustain. Energy Rev. 2022, 168, 112744. [Google Scholar] [CrossRef]

- Dong, Z.Y.; Yang, J.; Yu, L.; Daiyan, R.; Amal, R. A Green Hydrogen Credit Framework for International Green Hydrogen Trading towards a Carbon Neutral Future. Int. J. Hydrogen Energy 2022, 47, 728–734. [Google Scholar] [CrossRef]

- Hazrat, M.A.; Rasul, M.G.; Jahirul, M.I.; Chowdhury, A.A.; Hassan, N.M.S. Techno-Economic Analysis of Recently Improved Hydrogen Production Pathway and Infrastructure. Energy Rep. 2022, 8, 836–844. [Google Scholar] [CrossRef]

- Tarhan, C.; Çil, M.A. A Study on Hydrogen, the Clean Energy of the Future: Hydrogen Storage Methods. J. Energy Storage 2021, 40, 102676. [Google Scholar] [CrossRef]

- Elberry, A.M.; Thakur, J.; Santasalo-Aarnio, A.; Larmi, M. Large-Scale Compressed Hydrogen Storage as Part of Renewable Electricity Storage Systems. Int. J. Hydrogen Energy 2021, 46, 15671–15690. [Google Scholar] [CrossRef]

- Aziz, M.; Wijayanta, A.T.; Nandiyanto, A.B.D. Ammonia as Effective Hydrogen Storage: A Review on Production, Storage and Utilization. Energies 2020, 13, 3062. [Google Scholar] [CrossRef]

- Park, C.; Koo, M.; Woo, J.; Hong, B.I.; Shin, J. Economic valuation of green hydrogen charging compared to gray hydrogen charging: The case of South Korea. Int. J. Hydrogen Energy 2022, 47, 14393–14403. [Google Scholar] [CrossRef]

- Ohaeri, E.; Eduok, U.; Szpunar, J. Hydrogen Related Degradation in Pipeline Steel: A Review. Int. J. Hydrogen Energy 2018, 43, 14584–14617. [Google Scholar] [CrossRef]

- Yang, C.; Ogden, J. Determining the Lowest-Cost Hydrogen Delivery Mode. Int. J. Hydrogen Energy 2007, 32, 268–286. [Google Scholar] [CrossRef]

- Correa, G.; Volpe, F.; Marocco, P.; Muñoz, P.; Falagüerra, T.; Santarelli, M. Evaluation of Levelized Cost of Hydrogen Produced by Wind Electrolysis: Argentine and Italian Production Scenarios. J. Energy Storage 2022, 52, 105014. [Google Scholar] [CrossRef]

- Fan, J.-L.; Yu, P.; Li, K.; Xu, M.; Zhang, X. A Levelized Cost of Hydrogen (LCOH) Comparison of Coal-to-Hydrogen with CCS and Water Electrolysis Powered by Renewable Energy in China. Energy 2022, 242, 123003. [Google Scholar] [CrossRef]

- Yang, B.; Zhang, R.; Shao, Z.; Zhang, C. The Economic Analysis for Hydrogen Production Cost towards Electrolyzer Technologies: Current and Future Competitiveness. Int. J. Hydrogen Energy 2023, 48, 13767–13779. [Google Scholar] [CrossRef]

- Ali Khan, M.H.; Daiyan, R.; Neal, P.; Haque, N.; MacGill, I.; Amal, R. A Framework for Assessing Economics of Blue Hydrogen Production from Steam Methane Reforming Using Carbon Capture Storage & Utilisation. Int. J. Hydrogen Energy 2021, 46, 22685–22706. [Google Scholar] [CrossRef]

- Hydrogen. Technology Brief- UNECE. Available online: https://unece.org/sites/default/files/2021-10/Hydrogen%20brief_EN_final_0.pdf (accessed on 1 March 2023).

- Collodi, G.; Azzaro, G.; Ferrari, N.; Santos, S. Techno-Economic Evaluation of Deploying CCS in SMR Based Merchant H2 Production with NG as Feedstock and Fuel. Energy Procedia 2017, 114, 2690–2712. [Google Scholar] [CrossRef]

- Amin, M.; Shah, H.H.; Fareed, A.G.; Khan, W.U.; Chung, E.; Zia, A.; Rahman Farooqi, Z.U.; Lee, C. Hydrogen Production through Renewable and Non-Renewable Energy Processes and Their Impact on Climate Change. Int. J. Hydrogen Energy 2022, 47, 33112–33134. [Google Scholar] [CrossRef]

- Coal 2024. Analysis and Forecast for 2024—IEA. Available online: https://www.iea.org/reports/coal-2021 (accessed on 9 March 2023).

- Pruvost, F.; Cloete, S.; Cloete, J.H.; Dhoke, C.; Zaabout, A. Techno-Economic Assessment of Natural Gas Pyrolysis in Molten Salts. Energy Convers. Manag. 2022, 253, 115187. [Google Scholar] [CrossRef]

- Vom Scheidt, F.; Qu, J.; Staudt, P.; Mallapragada, D.S.; Weinhardt, C. Integrating Hydrogen in Single-Price Electricity Systems: The Effects of Spatial Economic Signals. Energy Policy 2022, 161, 112727. [Google Scholar] [CrossRef]

- Mansilla, C.; Louyrette, J.; Albou, S.; Bourasseau, C.; Dautremont, S. Economic Competitiveness of Off-Peak Hydrogen Production Today—A European Comparison. Energy 2013, 55, 996–1001. [Google Scholar] [CrossRef]

- Li, Y.; Chen, D.W.; Liu, M.; Wang, R.Z. Life Cycle Cost and Sensitivity Analysis of a Hydrogen System Using Low-Price Electricity in China. Int. J. Hydrogen Energy 2017, 42, 1899–1911. [Google Scholar] [CrossRef]

- Tang, O.; Rehme, J.; Cerin, P. Levelized Cost of Hydrogen for Refueling Stations with Solar PV and Wind in Sweden: On-Grid or off-Grid? Energy 2022, 241, 122906. [Google Scholar] [CrossRef]

- Minutillo, M.; Perna, A.; Forcina, A.; Di Micco, S.; Jannelli, E. Analyzing the Levelized Cost of Hydrogen in Refueling Stations with On-Site Hydrogen Production via Water Electrolysis in the Italian Scenario. Int. J. Hydrogen Energy 2021, 46, 13667–13677. [Google Scholar] [CrossRef]

- Gallardo, F.I.; Monforti Ferrario, A.; Lamagna, M.; Bocci, E.; Garcia, D.A.; Baeza-Jeria, T.E. A Techno-Economic Analysis of Solar Hydrogen Production by Electrolysis in the North of Chile and the Case of Exportation from Atacama Desert to Japan. Int. J. Hydrogen Energy 2021, 46, 13709–13728. [Google Scholar] [CrossRef]

- Qolipour, M.; Mostafaeipour, A.; Tousi, O.M. Techno-Economic Feasibility of a Photovoltaic-Wind Power Plant Construction for Electric and Hydrogen Production: A Case Study. Renew. Sustain. Energy Rev. 2017, 78, 113–123. [Google Scholar] [CrossRef]

- Jahangiri, M.; Shamsabadi, A.A.; Mostafaeipour, A.; Rezaei, M.; Yousefi, Y.; Pomares, L.M. Using Fuzzy MCDM Technique to Find the Best Location in Qatar for Exploiting Wind and Solar Energy to Generate Hydrogen and Electricity. Int. J. Hydrogen Energy 2020, 45, 13862–13875. [Google Scholar] [CrossRef]

- Lei, G.; Song, H.; Rodriguez, D. Power Generation Cost Minimization of the Grid-Connected Hybrid Renewable Energy System through Optimal Sizing Using the Modified Seagull Optimization Technique. Energy Rep. 2020, 6, 3365–3376. [Google Scholar] [CrossRef]

- Benalcazar, P.; Komorowska, A. Prospects of Green Hydrogen in Poland: A Techno-Economic Analysis Using a Monte Carlo Approach. Int. J. Hydrogen Energy 2022, 47, 5779–5796. [Google Scholar] [CrossRef]

- Touili, S.; Alami Merrouni, A.; El Hassouani, Y.; Amrani, A.; Rachidi, S. Analysis of the Yield and Production Cost of Large-Scale Electrolytic Hydrogen from Different Solar Technologies and under Several Moroccan Climate Zones. Int. J. Hydrogen Energy 2020, 45, 26785–26799. [Google Scholar] [CrossRef]

- Hydrogen Production Costs 2021—Department for Energy Security and Net Zero. Available online: https://www.gov.uk/government/publications/hydrogen-production-costs-2021 (accessed on 9 March 2023).

- Pandas-Based Library to Visualize and Compare Datasets—Python. Available online: https://pypi.org/projects/sweetviz/ (accessed on 12 January 2023).

- World Energy Outlook—IEA. Available online: https://www.iea.org/reports/world-energy-outlook-2022 (accessed on 12 January 2023).

- Assessment of Hydrogen Production Costs from Electrolysis: United States and Europe—ICCT. The International Council on Clean Transportation. Available online: https://theicct.org/publication/assessment-of-hydrogen-production-costs-from-electrolysis-united-states-and-europe/ (accessed on 21 December 2022).

- Moberg, T. Levelised Cost of Green Hydrogen Produced at Onshore Wind Farm Sites. Available online: https://www.diva-portal.org/smash/get/diva2:1693942/FULLTEXT01.pdf (accessed on 21 December 2022).

- Zhiznin, S.Z.; Timokhov, V.M.; Gusev, A.L. Economic Aspects of Nuclear and Hydrogen Energy in the World and Russia. Int. J. Hydrogen Energy 2020, 45, 31353–31366. [Google Scholar] [CrossRef]

- Global Average Levelized Cost of Hydrogen Production by Energy Source and Production—International Energy Agency. Available online: https://www.iea.org/data-and-statistics/charts/global-average-levelised-cost-of-hydrogen-production-by-energy-source-and-technology-2019-and-2050 (accessed on 21 December 2022).

- Low-Carbon Hydrogen Energy Industry Development Program—Ministry of Energy of Russian Federation. Available online: https://minenergo.gov.ru/en (accessed on 21 December 2022).

| № | Project | Technology | Projected Production Volume of Hydrogen, kg of Hydrogen/Year | LCOH | Equivalent International Project | Technology | Projected Production Volume of Hydrogen, kg of Hydrogen/Year | LCOH |

|---|---|---|---|---|---|---|---|---|

| 1 | Production of “green” hydrogen by water electrolysis using the electric power of the Nizhnekamsk HPS | Electrolysis | 2,500,000 | 4.94 | Ari Products Arizona | Alkaline electrolysis | 4,000,000 | 5.86 |

| 2 | Production of “green” hydrogen/ammonia by water electrolysis using the electric power of the Ust-Ilimsk HPS | Electrolysis | 5,400,000 | 4.94 | Bad Lauchstädt energy park | Alkaline electrolysis | 5,000,000 | 5.86 |

| 3 | Production of “green” hydrogen by water electrolysis using the electric power of the Mamakan HPS | Electrolysis | 6,000,000 | 4.94 | Candem County (GA), green power plant | Proton exchange membrane electrolysis | 5,000,000 | 5.86 |

| 4 | Production of “green” hydrogen by water electrolysis using the electric power of the WPS | Electrolysis | 3,500,000 | 5.86 | Energía Los Cabos | Proton exchange membrane electrolysis | 4,000,000 | 5.86 |

| 5 | Production of “green” hydrogen by water electrolysis using the electric power of the Tugur tidal power plant | Electrolysis | 350,000,000 | 4.94 | Helios Green Fuels—Neom | Alkaline electrolysis | 483,000,000 | 5.86 |

| 6 | Production of “green” hydrogen by water electrolysis using the electric power of the WPS | Electrolysis | 16,000,000 | 1.15 | Huadian Baotou City Damaoqi Hydrogen Production Electrolysis Project | Alkaline electrolysis | 17,000,000 | 5.86 |

| 7 | Production of “green” hydrogen/ammonia by water electrolysis using the electric power of the Irkutsk HPS | Electrolysis | 4,200,000 | 4.94 | Linde Leuna Chemical Complex | Proton exchange membrane electrolysis | 4,000,000 | 5.86 |

| 8 | Production of “green” hydrogen by water electrolysis using the electric power of the Mezen tidal power plant with a capacity of up to 12 GW | Electrolysis | 500,000,000 | 4.94 | Murchison | Proton exchange membrane electrolysis | 749,700,000 | 5.86 |

| 9 | Production of “green” hydrogen/ammonia by water electrolysis using the electric power of the Onda HPS | Electrolysis | 5,200,000 | 1.15 | Ningxia Solar Hydrogen Project, Phase 1 | Proton exchange membrane electrolysis | 5,000,000 | 5.86 |

| 10 | Production of “green” hydrogen by water electrolysis using the electric power of the Ust-Srednekansk HPS | Electrolysis | 16,000,000 | 4.94 | RWE-Thyssenkrupp Duisburg steel plant (HydrOxy Hub Walsum) | Alkaline electrolysis | 17,000,000 | 5.86 |

| 11 | “Production of “green” hydrogen by water electrolysis using the electric power of a 1 GW WPS | Electrolysis | 50,000,000 | 5.86 | Steag-Thyssenkrupp Duisburg steel plant (HydrOxy Hub Walsum) | Alkaline electrolysis | 69,000,000 | 5.86 |

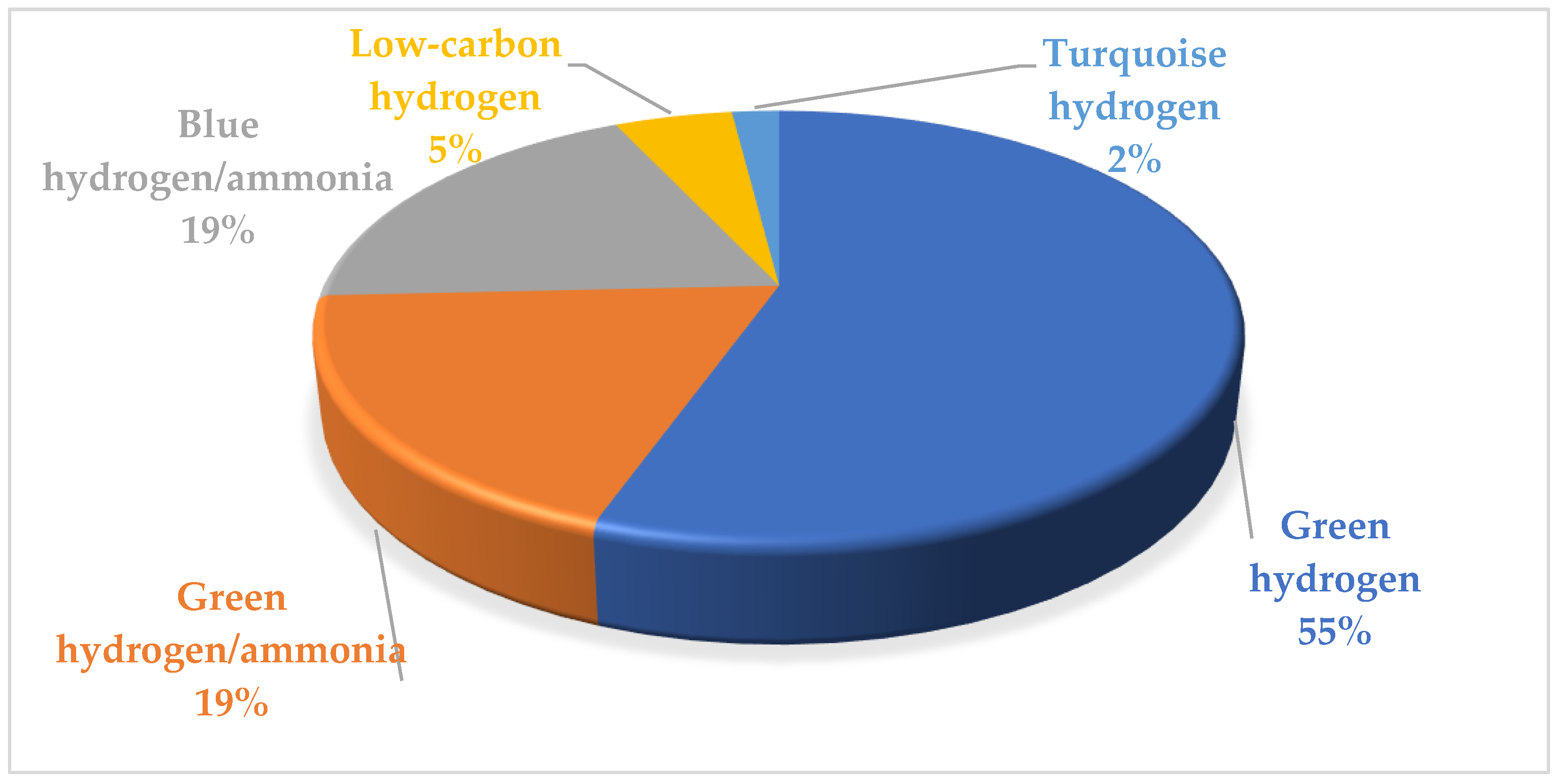

| Number of Projects | Percentage of All Projects | Type of Project |

|---|---|---|

| 8 | 14.81% | Production of “green” hydrogen by water electrolysis using the electric power of HPS |

| 7 | 12.96% | Production of “green” hydrogen by water electrolysis using the electric power of WPS |

| 7 | 12.96% | Production of “green” hydrogen/ammonia by water electrolysis using the electric power of HPS |

| 3 | 5.56% | Production of “green” hydrogen by water electrolysis using the electric power of the tidal power plant |

| 3 | 5.56% | Production of “green” hydrogen by water electrolysis using the electric power of a solar power plant |

| 2 | 3.70% | Production of “blue” ammonia by steam methane reforming with carbon capture and long-term underground storage technology |

| 2 | 3.70% | Production of “blue” hydrogen/ammonia by steam methane reforming with CO2 capture |

| 2 | 3.70% | Production of “green” hydrogen by water electrolysis using the electric power of hydropower plants |

| 1 | 1.85% | Production and supply of hydrogen for the Nord Stream 2 project |

| 1 | 1.85% | Supply of hydrogen from Russia to Japan |

| 1 | 1.85% | Production and supply of hydrogen |

| 1 | 1.85% | Conversion of turbines to operate on hydrogen-containing fuel gas mixtures |

| 1 | 1.85% | Project for hydrogen generation at Yamal LNG plant |

| 1 | 1.85% | Establishment of railway transportation using hydrogen fuel cell trains |

| 1 | 1.85% | Reduction in greenhouse gas emissions through the use of hydrogen |

| 1 | 1.85% | Production of methane-hydrogen mixtures and creation of transportation infrastructure |

| 1 | 1.85% | Fund for participation in selection processes for new green energy generation programs in Russia |

| 1 | 1.85% | Complex processing of natural gas with production of hydrogen, ammonia, and other low-carbon products using carbon capture and long-term underground storage technology |

| 1 | 1.85% | Creating and using autonomous modules for hydrogen production and storage at individual nuclear power plants |

| 1 | 1.85% | Industrial production of hydrogen using advanced energy technologies |

| 1 | 1.85% | Production of “blue” ammonia by steam methane reforming with CO2 capture |

| 1 | 1.85% | Production of “blue” ammonia based on gas fields with CO2 capture technology |

| 1 | 1.85% | Hydrogen Energy Scientific and Technical Center |

| 1 | 1.85% | Production of “blue” ammonia by gasification of brown coal with CO2 capture and storage technology |

| 1 | 1.85% | Production of low-carbon hydrogen by water electrolysis using the electric power of WPS |

| 1 | 1.85% | Production of “turquoise” hydrogen by methane pyrolysis at the Sosnogorsk GPP |

| 1 | 1.85% | Production of low-carbon hydrogen by water electrolysis using the electric power of NPS |

| 1 | 1.85% | Investment in Russian developments in the field of hydrogen energy |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gomonov, K.; Reshetnikova, M.; Ratner, S. Economic Analysis of Recently Announced Green Hydrogen Projects in Russia: A Multiple Case Study. Energies 2023, 16, 4023. https://doi.org/10.3390/en16104023

Gomonov K, Reshetnikova M, Ratner S. Economic Analysis of Recently Announced Green Hydrogen Projects in Russia: A Multiple Case Study. Energies. 2023; 16(10):4023. https://doi.org/10.3390/en16104023

Chicago/Turabian StyleGomonov, Konstantin, Marina Reshetnikova, and Svetlana Ratner. 2023. "Economic Analysis of Recently Announced Green Hydrogen Projects in Russia: A Multiple Case Study" Energies 16, no. 10: 4023. https://doi.org/10.3390/en16104023

APA StyleGomonov, K., Reshetnikova, M., & Ratner, S. (2023). Economic Analysis of Recently Announced Green Hydrogen Projects in Russia: A Multiple Case Study. Energies, 16(10), 4023. https://doi.org/10.3390/en16104023