3.1. Master–Slave Game Model

In 1952, Stackel-berg proposed the concept of the leader–follower game, where the leader has a strategic advantage and occupies a dominant or advantageous position, while the follower makes decisions following the leader. In real life, there are many specific examples of leader–follower games, such as the game between central and local governments, between a company and their subsidiaries, etc.

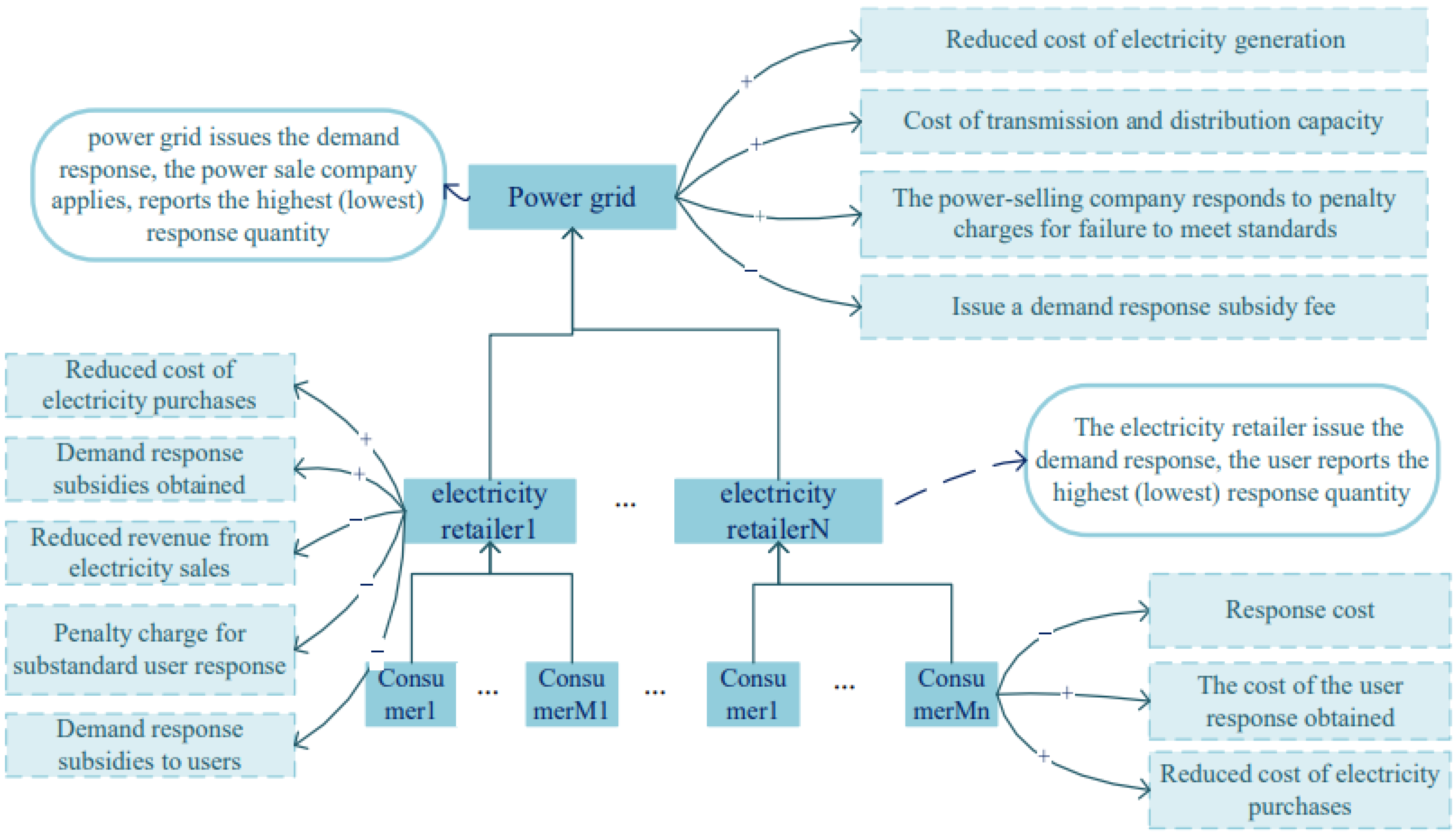

This paper considered the competition relationship between the three parties of “power grid–electricity retailer–user” and constructs a two-layer master–slave game model, as depicted in

Figure 1. The higher-level demand response model involves the grid, which acts as a leader in the game. The grid publishes demand responses and takes into account constraints based on market electricity prices and electricity sales. The subsidy unit price of each electricity sales company is set with the aim of maximizing the grid’s own income. Each electricity retailer in the lower-level model acts as a follower. After receiving the demand response information of the grid, they optimize their internal response volume and subsidy price to the user with the aim of maximizing their own revenue. The grid then adjusts the subsidy price according to the response strategy of the electricity retailer. This process creates a leader–follower sequential game and constitutes a Stackelberg game relationship [

22], as well as a non-cooperative game relationship between each electricity seller.

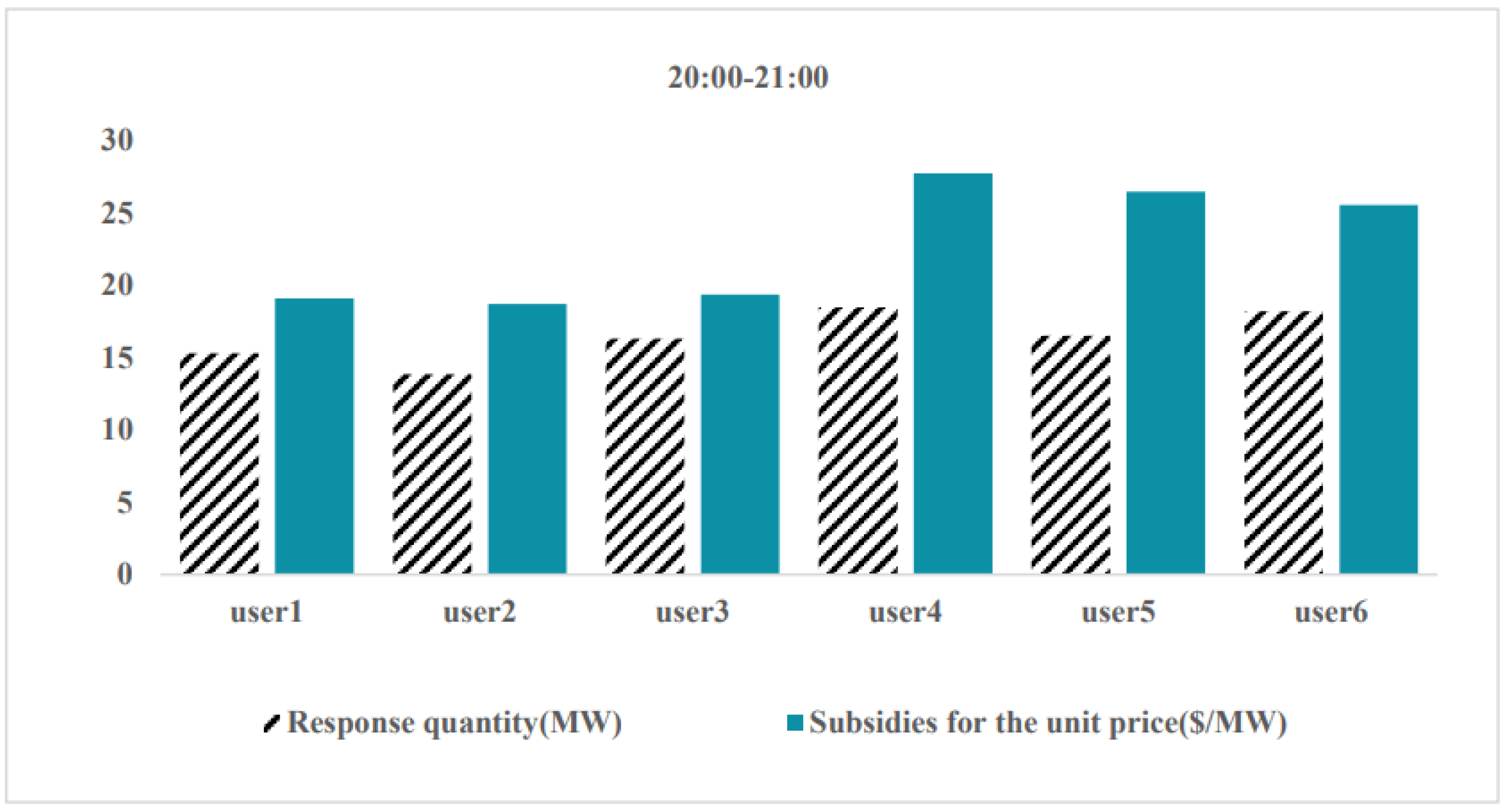

In the lower-level model, the electricity sales company plays the role of a leader, publishes demand responses, combines its own power purchase constraints, and sets the subsidy unit price of each user with the goal of maximizing its personal income. Each user also acts as a follower. After receiving the demand response information from the electricity retailer, they optimize the response volume and power purchase period in order to maximize their own income. The electricity retailer then adjusts the subsidy price again based on the user’s response strategy. This creates a leader–follower sequential game, constituting a Stackelberg game relationship. Each user also constitutes a non-cooperative game relationship in this model.

3.2. Game Model Solving

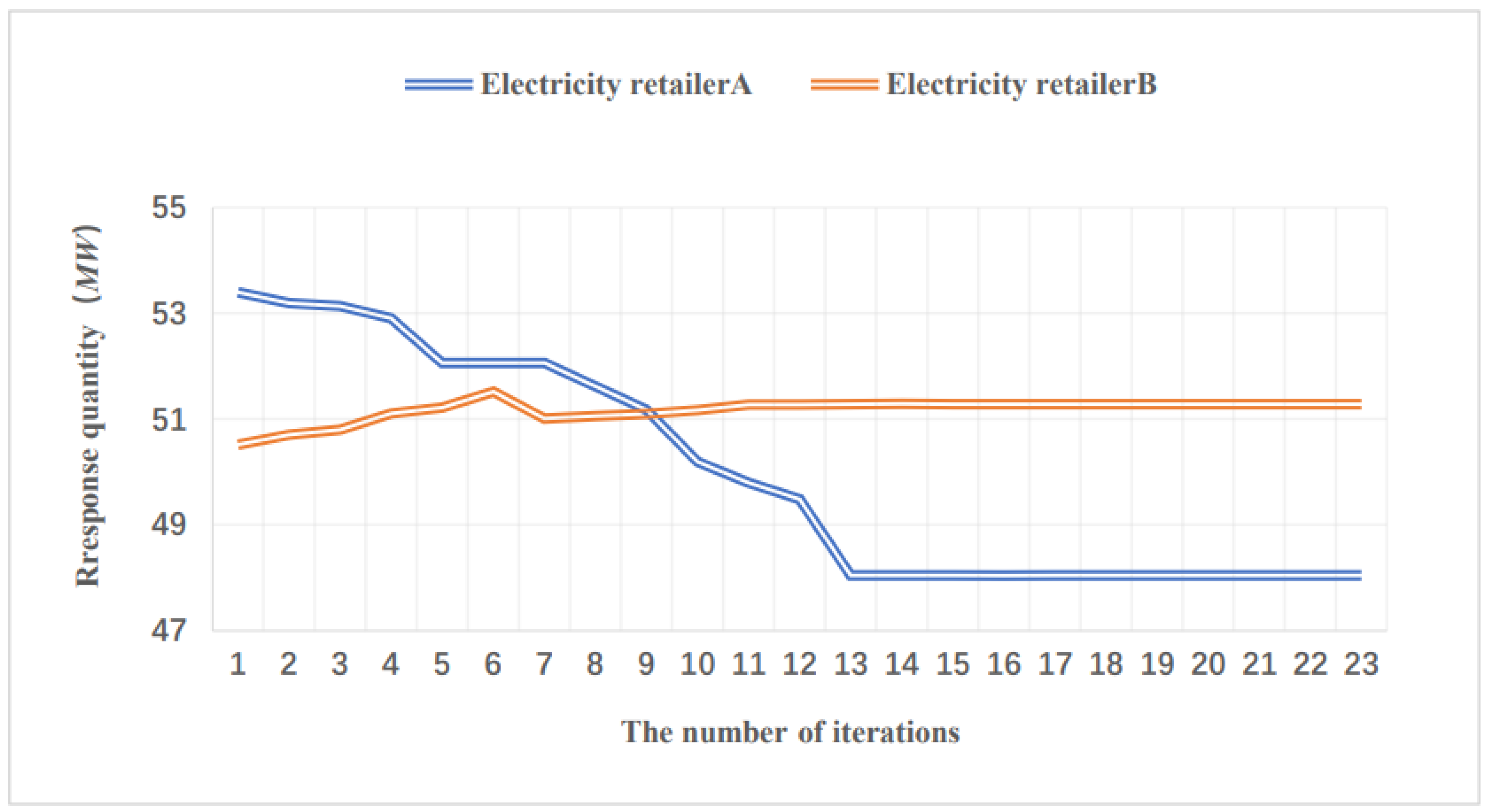

The game flow is as follows: The game model proposed earlier transforms the demand-side electricity purchasing decision problem into a multi-objective optimization problem, enabling more comprehensive and scientific purchasing decisions. The MOMVO algorithm [

23] is a global search optimization algorithm with strong convergence speed, fast convergence rate, and good robustness, and it has been widely applied in many fields. In this paper, the game model was combined with the MOMVO algorithm by converting the objective functions and constraints in the master–slave game model into multiple fitness functions, and using the MOMVO algorithm to solve it. This method not only improves the efficiency of solving game models but also provides a new method for addressing optimization problems with multiple objectives.

The MOMVO algorithm utilizes the multiverse theory [

24], which regards each optimal solution as a universe, to find all optimal solutions by simulating the interaction and variation of universes. The algorithm includes steps such as population initialization, individual evaluation, individual selection, individual evolution, and determining stopping conditions, and ultimately outputs all the found optimal solutions. This algorithm boasts several benefits, including potent global search capability, swift convergence speed and exceptional robustness, and has found extensive application across various domains.

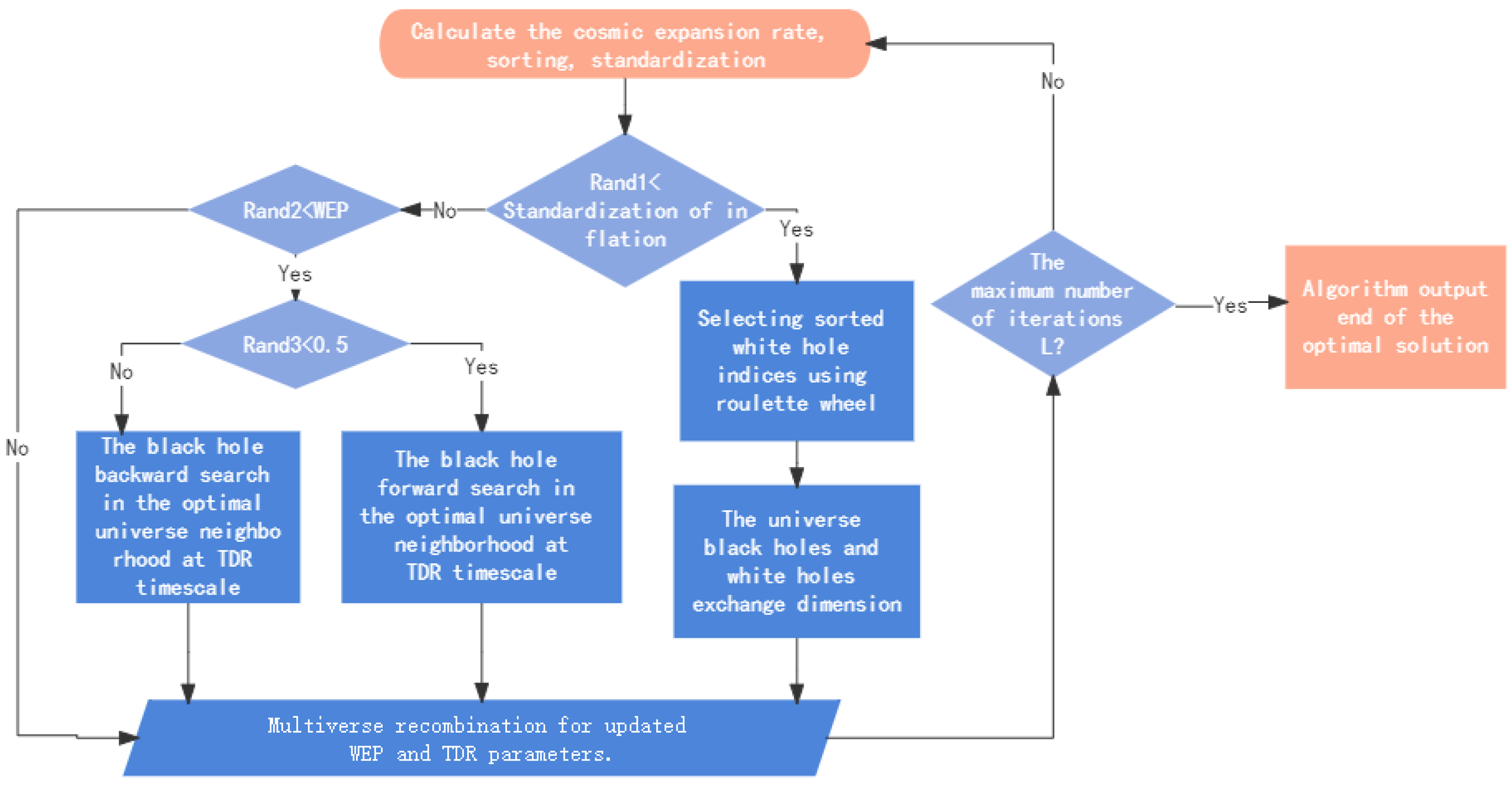

The MVO algorithm is based on the multiverse theory’s three main concepts: white hole, black hole, and wormhole. It establishes a mathematical model for optimization with candidate solutions defined as universes and their fitness measured by expansion rates. Each iteration uses black holes as candidate solutions, selecting better universes as white holes via roulette wheel selection. Black and white holes exchange their contents while some black holes can use wormholes to search for the best universes. The algorithm’s internal loop structure’s logical flow is illustrated in

Figure 2.

In

Figure 2, black holes update dimensions using two mechanisms.

(1) Based on sorted normalized expansion rates, white hole indices are selected using the roulette wheel selection principle and black holes exchange dimensional information with the selected white hole.

(2) When

, black holes travel through wormholes and update their dimensions using

parameters in the optimal universe neighborhood. The iteration Formula (22) is used, with

j representing the specific dimension of the optimized problem.

In Formulas (22)–(24), and represent the current and maximum iterations, and represent the boundaries of the problem, represents the position of the optimal universe, and and are important parameters of the Multiverse Optimization Algorithm for the probability of wormhole existence and the travel distance rate. Formula (23) indicates that the parameter of the Multiverse Optimization Algorithm is a concave decreasing function during the iteration, decreasing rapidly at first and gradually slowing down, while the WEP parameter increases linearly.

MOMVO is the multi-objective version of MVO, designed to store the best non-dominant solutions. To select the best solutions from the archive, a tunnel is established between solutions using the leader selection mechanism. In this approach, the crowding distance between each solution in the archive is initially selected, and the number of solutions in its neighborhood is used as a measure of coverage or diversity. MOMVO uses roulette wheel selection to improve the distribution of solutions across all objectives, favoring solutions with fewer individuals in the archive. The following equation is used to achieve this improvement.

Using a constant parameter h greater than 1 and kept constant, the equation favors solutions near the i-th solution while reducing the fitness of hypercubes with more particles as a form of fitness sharing. This equation provides high probability solutions for regions with fewer solutions, improving other areas and attracting solutions to these regions with fewer individuals in the archive. It ultimately increases the coverage of the obtained Pareto optimal front.

Archives can only accommodate a limited number of non-dominated solutions and can become full during the optimization process. Therefore, a mechanism is needed to remove unnecessary solutions from the archive. An unnecessary solution is one that is surrounded by many solutions and thus requires cleanup to save space. The inverse Equation (26) is used to discard unwanted solutions from the archive and provide high probability for the MOMVO algorithm.

To quantify convergence, this paper selected the generational distance (GD) [

25] and inverted generational distance (IGD) [

26] proposed by Veldhuizen in 1998. These performance metrics serve to quantify the distribution of Pareto optimal solutions obtained. The corresponding mathematical equations for these performance measures are as follows:

where

indicate the count of Pareto optimal solutions, and

represent the Pareto optimal solution, and reference concentration is the most close to the true Pareto optimal solutions of m Euclidean distance. Please note that the Euclidean distances are calculated respectively in their target space.

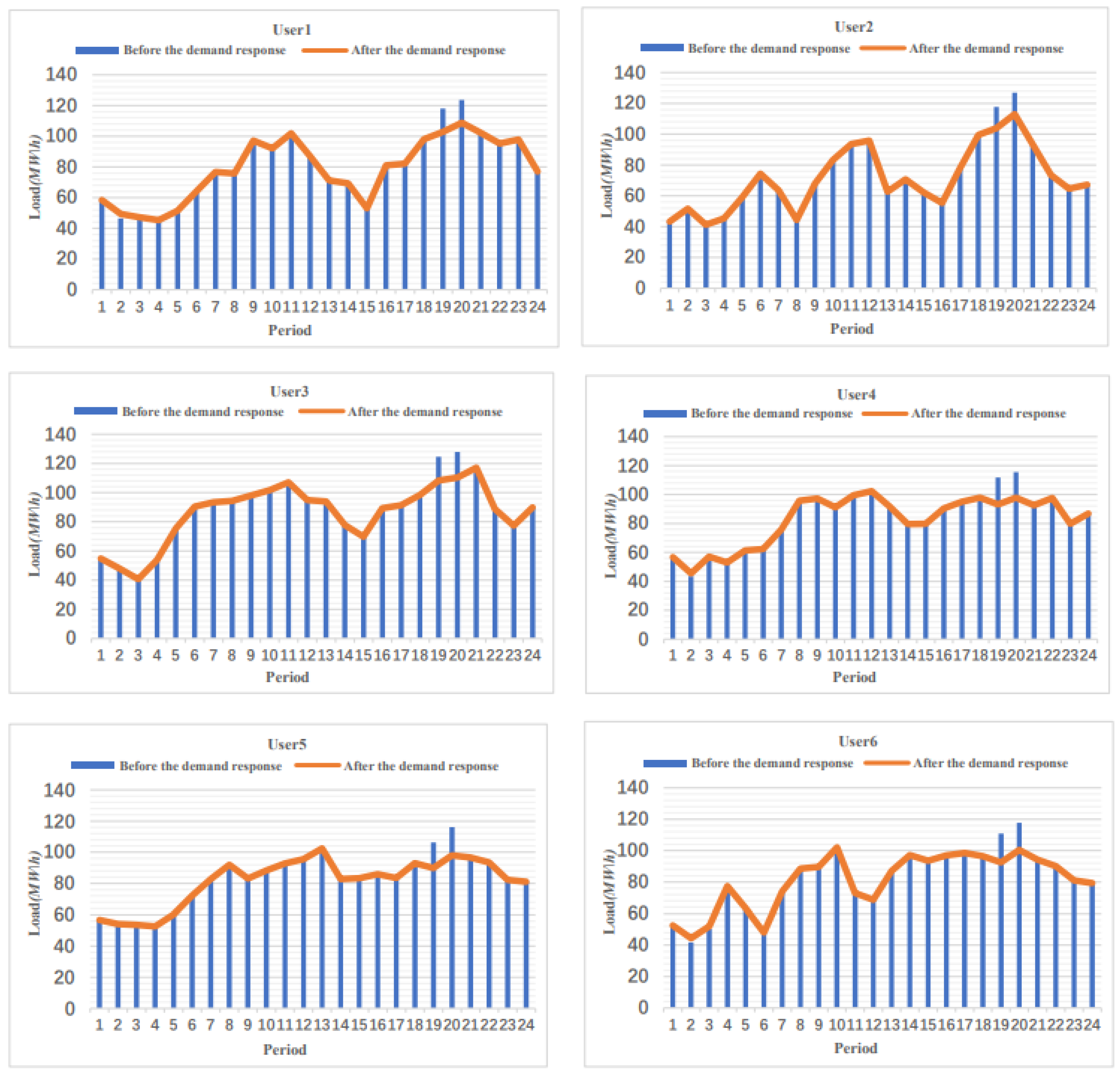

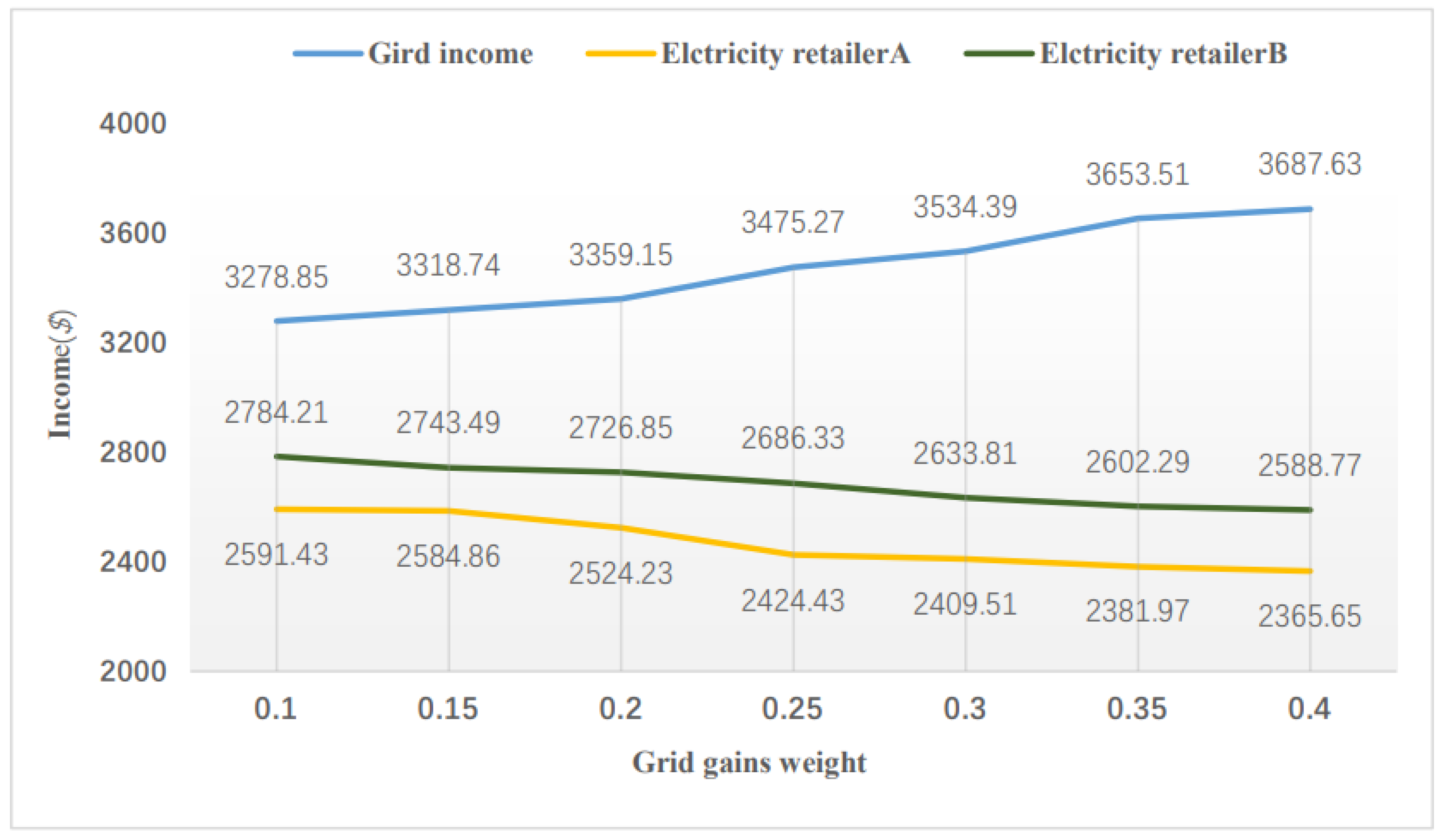

In order to assist decision makers in selecting the optimal solution from the Pareto frontier, this paper modified the weights of individual indicators using a comprehensive evaluation index method and integrated them into a single objective function. The considered indicators included grid revenue, electricity retailer revenue, user revenue, peak load (valley filling) reduction, user electricity consumption comfort, and participation response satisfaction. The changes in indicator weights are related to the fairness of demand response and the optimal strategy chosen by the decision maker.

The electricity consumption comfort level

u of users represents the sum of the standard deviations of the response volume in which all users are involved in the demand response, as in Equation (29). User satisfaction

v represents the sum of the standard deviations of the unit price of subsidies obtained by all users participating in demand response, as shown in Equation (30), where

M is a collection of all users, and

.

In the model, the weight coefficient matrix of each index is formulated as

, where

represent the weights of grid, electricity retailer, user revenue, peak load (valley filling) reduction, user electricity consumption comfort, and participation response satisfaction, respectively. The process of determining the indicator weights in this paper involved employing the CRITIC method, as expounded in [

27], which is an objective weighting method that is superior to entropy weighting and standard deviation weighting methods. The CRITIC method takes into account the conflict and contrast intensity among indicators, and can simultaneously consider the size and correlation of indicator variability, using the inherent properties of the data for scientific evaluation.