Dynamic Risk Spillover Effect between the Carbon and Stock Markets under the Shocks from Exogenous Events

Abstract

1. Introduction

2. Empirical Methods

2.1. Risk Spillover Index Model

2.2. Event Study Method

3. Empirical Evidence

3.1. Data Collection

3.2. Analysis of Static Risk Spillover Effects

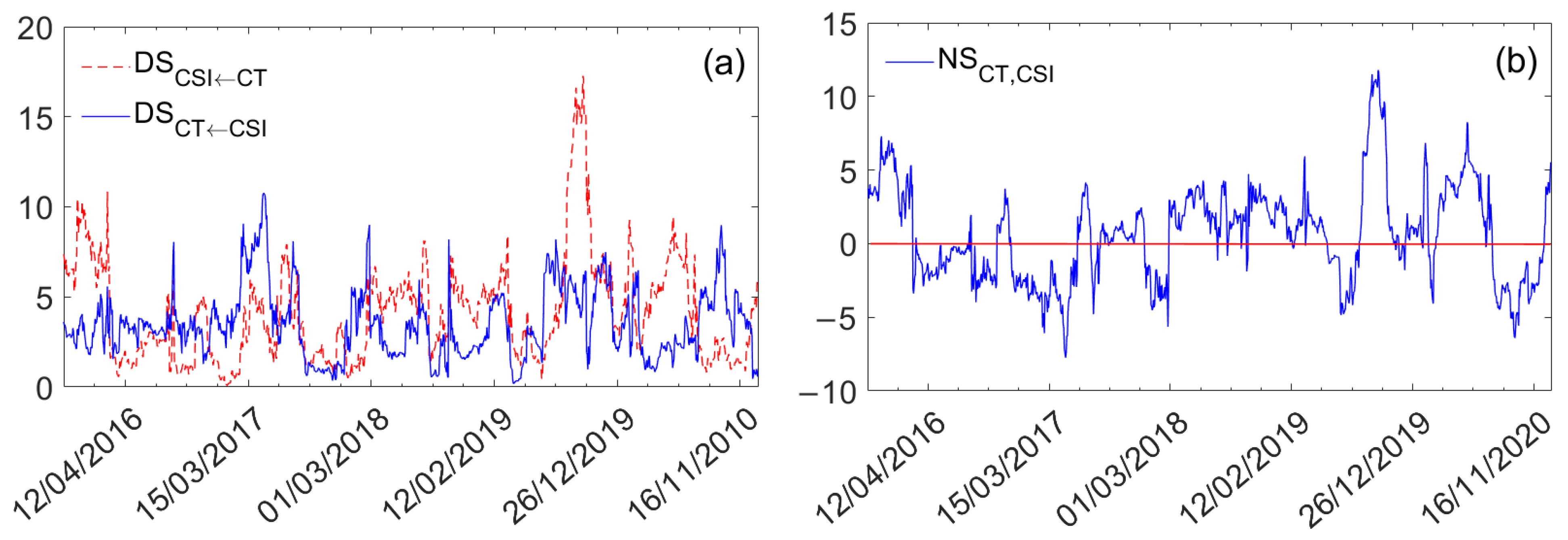

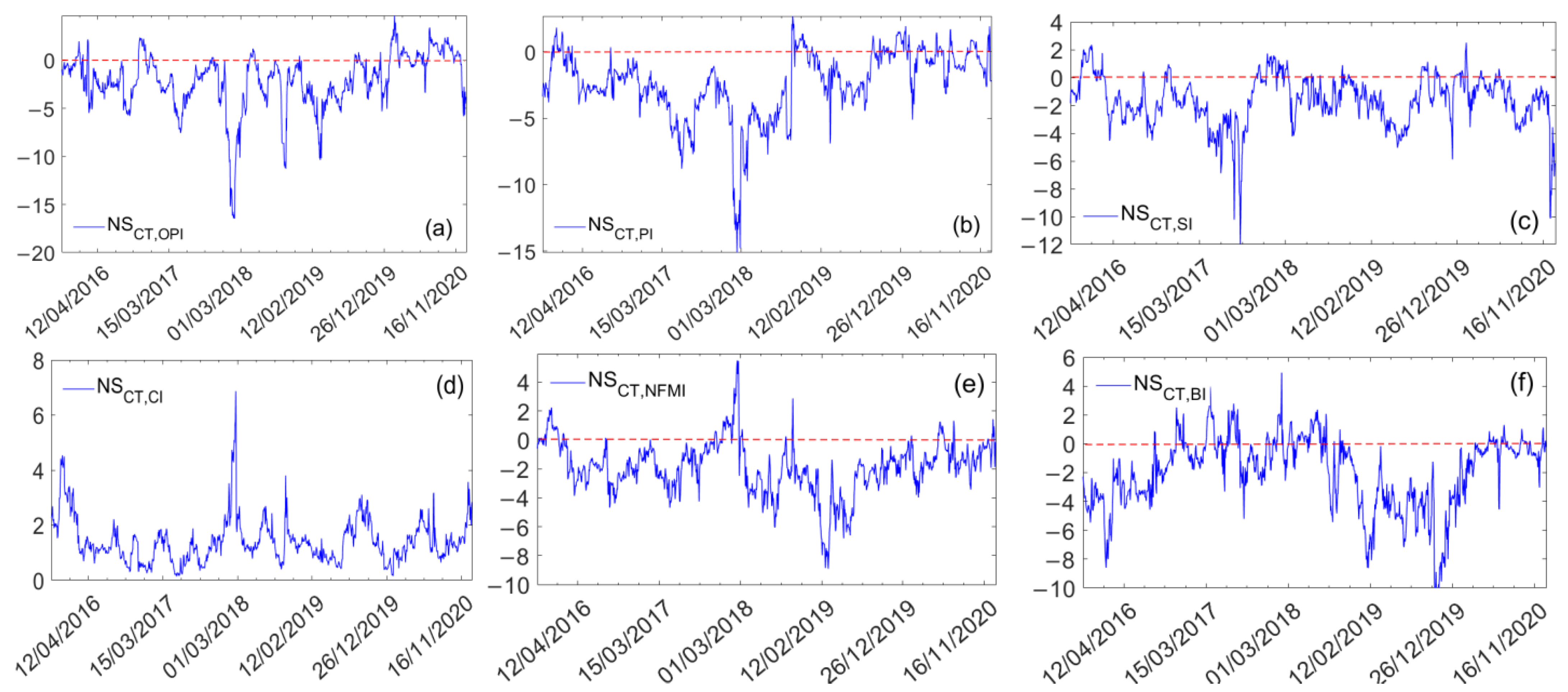

3.3. Analysis of Dynamic Risk Spillover Effects

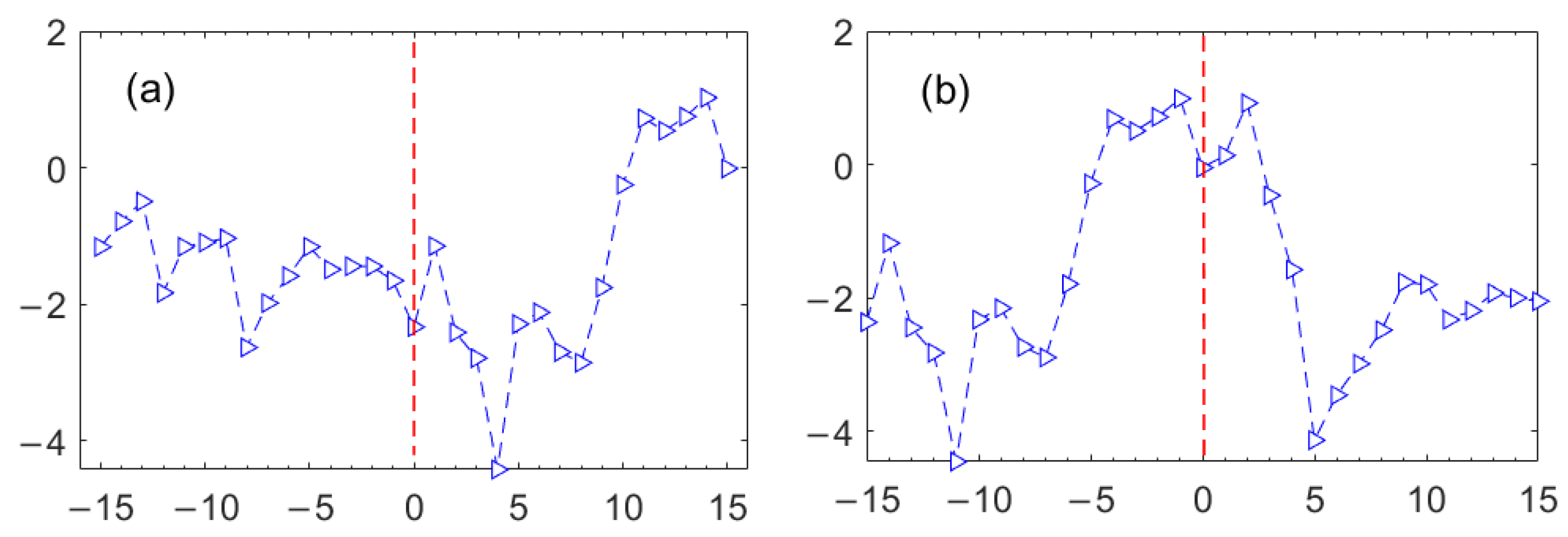

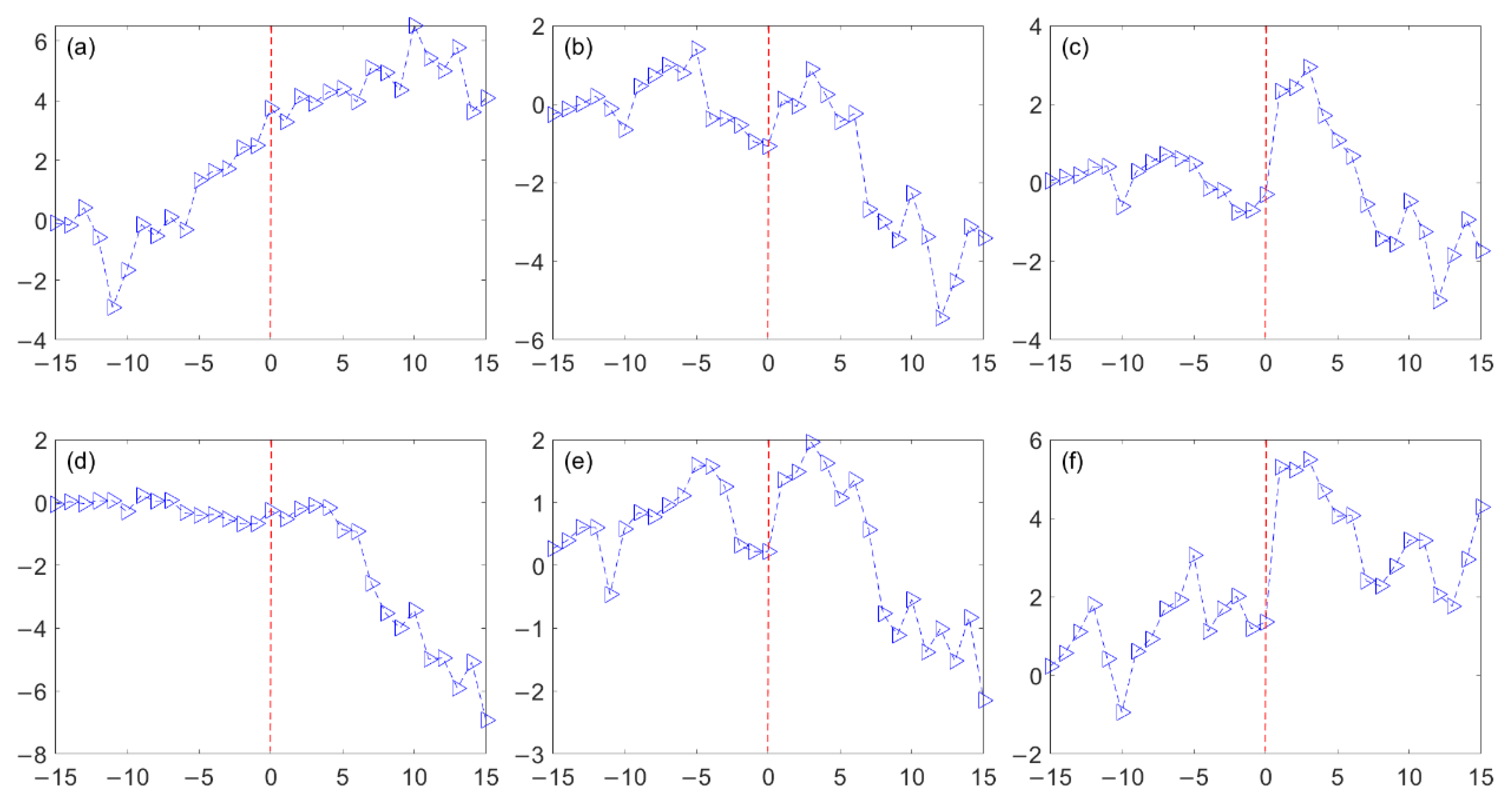

3.4. Analysis of Exogenous Event Shocks Affecting Risk Spillover Effects

4. Conclusions and Discussion

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

References

- Tan, X.; Sirichand, K.; Vivian, A.; Wang, X. How connected is the carbon market to energy and financial markets? A systematic analysis of spillovers and dynamics. Energy Econ. 2020, 90, 104870. [Google Scholar] [CrossRef]

- Wen, X.Q.; Bouri, E.; Roubaud, D. Can energy commodity futures add value to carbon assets? Econ. Model. 2017, 62, 194–206. [Google Scholar] [CrossRef]

- Zheng, Y.; Yin, H.; Zhou, M.; Liu, W.H.; Wen, F.H. Impacts of oil shocks on the EU carbon emissions allowances under different market conditions. Energy Econ. 2021, 104, 105683. [Google Scholar] [CrossRef]

- Liu, X.; Jin, Z. An analysis of the interactions between electricity, fossil fuel and carbon market prices in Guangdong, China. Energy Sustain. Dev. 2020, 55, 82–94. [Google Scholar] [CrossRef]

- Chang, K.; Zhang, C.; Wang, H.W. Asymmetric dependence structures between emission allowances and energy markets: New evidence from China’s emissions trading scheme pilots. Environ. Sci. Pollut. Res. 2020, 27, 21140–21158. [Google Scholar] [CrossRef]

- Wang, Y.; Guo, Z. The dynamic spillover between carbon and energy markets: New evidence. Energy 2018, 149, 24–33. [Google Scholar] [CrossRef]

- Liu, H.H.; Chen, Y.C. A study on the volatility spillovers, long memory effects and interactions between carbon and energy markets: The impacts of extreme weather. Econ. Model. 2013, 35, 840–855. [Google Scholar] [CrossRef]

- Zhang, Y.J.; Sun, Y.F. The dynamic volatility spillover between European carbon trading market and fossil energy market. J. Clean. Prod. 2016, 112, 2654–2663. [Google Scholar] [CrossRef]

- Ji, Q.; Zhang, D.; Geng, J. Information linkage, dynamic spillovers in prices and volatility between the carbon and energy markets. J. Clean. Prod. 2018, 198, 972–978. [Google Scholar] [CrossRef]

- Cao, H.; Khan, M.K.; Rehman, A.; Dagar, V.; Oryani, B.; Tanveer, A. Impact of globalization, institutional quality, economic growth, electricity and renewable energy consumption on carbon dioxide Emission in OECD countries. Environ. Sci. Pollut. Res. Int. 2022, 29, 24191–24202. [Google Scholar] [CrossRef]

- Yuan, N.; Yang, L. Asymmetric risk spillover between financial market uncertainty and the carbon market: A GAS–DCS–copula approach. J. Clean. Prod. 2020, 259, 120750. [Google Scholar] [CrossRef]

- Liu, X.; Bouri, E.; Jalkh, N. Dynamics and Determinants of Market Integration of Green, Clean, Dirty Energy Investments and Conventional Stock Indices. Front. Environ. Sci. 2021, 9, 786528. [Google Scholar] [CrossRef]

- Jiang, C.; Wu, Y.F.; Li, X.L.; Li, X. Time-frequency connectedness between coal market prices, new energy stock prices and CO2 emissions trading prices in China. Sustainability 2020, 12, 2823. [Google Scholar] [CrossRef]

- Nie, D.; Li, Y.; Li, X. Dynamic spillovers and asymmetric spillover effect between the carbon emission trading market, fossil energy market, and new energy stock market in China. Energies 2021, 14, 6438. [Google Scholar] [CrossRef]

- Dutta, A.; Bouri, E. Carbon Emission and Ethanol Markets: Evidence from Brazil. Biofuels Bioprod. Biorefining 2019, 13, 458–463. [Google Scholar] [CrossRef]

- Oestreich, A.M.; Tsiakas, I. Carbon emissions and stock returns: Evidence from the EU Emissions Trading Scheme. J. Bank. Financ. 2015, 58, 294–308. [Google Scholar] [CrossRef]

- Chevallier, J. Carbon futures and macroeconomic risk factors: A view from the EU ETS. Energy Econ. 2009, 31, 614–625. [Google Scholar] [CrossRef]

- Oberndorfer, U. EU emission allowances and the stock market: Evidence from the electricity industry. Ecol. Econ. 2009, 68, 1116–1126. [Google Scholar] [CrossRef]

- Jiang, Y.; Liu, L.; Mu, J. Nonlinear dependence between China’s carbon market and stock market: New evidence from quantile coherency and causality-in-quantiles. Environ. Sci. Pollut. Res. 2022, 29, 46064–46076. [Google Scholar] [CrossRef]

- Dutta, A.; Bouri, E.; Noor, M.H. Return and volatility linkages between CO2 emission and clean energy stock prices. Energy 2018, 164, 803–810. [Google Scholar] [CrossRef]

- Krokida, S.I.; Lambertides, N.; Savva, C.S.; Tsouknidis, D.A. The effects of oil price shocks on the prices of EU emission trading system and European stock returns. Eur. J. Financ. 2020, 26, 1–13. [Google Scholar] [CrossRef]

- Wen, F.H.; Weng, K.Y.; Zhou, W.X. Measuring the contribution of Chinese financial institutions to systemic risk: An extended asymmetric CoVaR approach. Risk Manag. 2020, 22, 310–337. [Google Scholar] [CrossRef]

- Wen, F.H.; Zhao, L.L.; He, S.Y.; Yang, G.Z. Asymmetric relationship between carbon emission trading market and stock market: Evidences from China. Energy Econ. 2020, 91, 104850. [Google Scholar] [CrossRef]

- Razzaq, A.; Sharif, A.; An, H.; Aloui, C. Testing the directional predictability between carbon trading and sectoral stocks in China: New insights using cross-quantilogram and rolling window causality approaches. Technol. Forecast. Soc. Change 2022, 182, 121846. [Google Scholar] [CrossRef]

- Li, Y.B.; Dan, N.; Li, B.K.; Li, X.Y. The Spillover Effect between Carbon Emission Trading (CET) Price and Power Company Stock Price in China. Sustainability 2020, 12, 6573. [Google Scholar] [CrossRef]

- Adekoya, O.B.; Oliyide, J.A.; Noman, A. The volatility connectedness of the EU carbon market with commodity and financial markets in time-and frequency-domain: The role of the US economic policy uncertainty. Resour. Policy 2021, 74, 102252. [Google Scholar] [CrossRef]

- Dutta, A.; Jalkh, N.; Bouri, E.; Dutta, P. Assessing the Risk of the European Union Carbon Emission Allowance Market: Structural Breaks and Forecasting Performance. Int. J. Manag. Financ. 2020, 16, 49–60. [Google Scholar] [CrossRef]

- Wielechowski, M.; Czech, K. Companies’ Stock Market Performance in the Time of COVID-19: Alternative Energy vs. Main Stock Market Sectors. Energies 2021, 15, 106. [Google Scholar] [CrossRef]

- Beatty, T.; Shimshack, J.P. The impact of climate change information: New evidence from the stock market. B.E. J. Econ. Anal. Policy 2010, 10, 105. [Google Scholar] [CrossRef]

- Bouri, E.; Chen, Q.; Lien, D.; Lv, X. Causality between oil prices and the stock market in China: The relevance of the reformed oil product pricing mechanism. Int. Rev. Econ. Financ. 2017, 48, 34–48. [Google Scholar] [CrossRef]

- Zhang, P.; Sha, Y.; Xu, Y. Stock market volatility spillovers in G7 and BRIC. Emerg. Mark. Financ. Trade 2021, 57, 2107–2119. [Google Scholar] [CrossRef]

- Hillier, D.; Loncan, T. Political uncertainty and stock returns: Evidence from the Brazilian political crisis. Pac.-Basin Financ. J. 2019, 54, 1–12. [Google Scholar] [CrossRef]

- Zhou, D.; Zhou, R. ESG Performance and Stock Price Volatility in Public Health Crisis: Evidence from COVID-19 Pandemic. Int. J. Environ. Res. Public Health 2021, 19, 202. [Google Scholar] [CrossRef] [PubMed]

- Pagnottoni, P.; Spelta, A.; Pecora, N.; Flori, A.; Pammolli, F. Financial earthquakes: SARS-CoV-2 news shock propagation in stock and sovereign bond markets. Phys. A 2021, 582, 126240. [Google Scholar] [CrossRef] [PubMed]

- Filimonov, V.; Sornette, D. Quantifying reflexivity in financial markets: Toward a prediction of flash crashes. Phys. Rev. E 2012, 85, 056108. [Google Scholar] [CrossRef] [PubMed]

- Diebold, F.X.; Yilmaz, K. Measuring financial asset return and volatility spillovers, with application to global equity markets. Econ. J. 2009, 119, 158–171. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. Better to give than to receive: Predictive directional measurement of volatility spillovers. Int. J. Forecast. 2012, 28, 57–66. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. On the network topology of variance decompositions: Measuring the con nectedness of financial firms. J. Econom. 2014, 182, 119–134. [Google Scholar] [CrossRef]

- Ji, Q.; Xia, T.; Liu, F.; Xu, J.H. The information spillover between carbon price and power sector returns: Evidence from the major European electricity companies. J. Clean. Prod. 2019, 208, 1178–1187. [Google Scholar] [CrossRef]

- Demirer, R.; Kutan, A.M. The behavior of crude oil spot and futures prices around OPEC and SPR announcements: An event study perspective. Energy Econ. 2010, 32, 1467–1476. [Google Scholar] [CrossRef]

- Chen, Z.H.J.; Li, S.P.; Cai, M.L.; Zhong, L.X.; Ren, F. Cross-region risk spillover between the stock and stock index futures markets under exogenous shocks. N. Am. J. Econ. Financ. 2021, 58, 101451. [Google Scholar] [CrossRef]

- Jia, S.S.; Dong, H.; Yang, H.W. Asymmetric Risk Spillover of the International Crude Oil Market in the Perspective of Crude Oil Dual Attributes. Front. Environ. Sci. 2021, 9, 720278. [Google Scholar] [CrossRef]

- Yao, Y.; Tian, L.; Cao, G. The Information Spillover among the Carbon Market, Energy Market, and Stock Market: A Case Study of China’s Pilot Carbon Markets. Sustainability 2022, 14, 4479. [Google Scholar] [CrossRef]

| Mean | Std. Dev. | Minimum | Maximum | Skewness | Kurtosis | JB | ADF | |

|---|---|---|---|---|---|---|---|---|

| RCT,t | 1.08 × 10−4 | 0.050 | −0.446 | 0.341 | −0.547 | 12.2070 | 4550 *** | −31.558 *** |

| RCSI,t | 2.82 × 10−4 | 0.016 | −0.091 | 0.099 | −0.535 | 9.1351 | 2053 *** | −25.169 *** |

| ROPI,t | −9.94 × 10−4 | 0.017 | −0.105 | 0.103 | −0.275 | 10.3011 | 2837 *** | −26.407 *** |

| RPI,t | −2.75 × 10−4 | 0.016 | −0.081 | 0.094 | −0.401 | 10.7696 | 3228 *** | −25.311 *** |

| RSI,t | −1.87 × 10−4 | 0.020 | −0.093 | 0.118 | −0.317 | 6.9273 | 838 *** | −26.658 *** |

| RCI,t | 3.30 × 10−4 | 0.019 | −0.085 | 0.099 | −0.485 | 7.8332 | 1286 *** | −23.197 *** |

| RNFMI,t | 1.10 × 10−4 | 0.022 | −0.089 | 0.106 | −0.220 | 6.4984 | 658 *** | −24.270 *** |

| RBI,t | 0.65 × 10−4 | 0.015 | −0.105 | 0.087 | −0.118 | 9.8582 | 2492 *** | −24.973 *** |

| CT | CSI | From | |

|---|---|---|---|

| CT | 99.1373 | 0.8627 | 0.8627 |

| CSI | 1.3810 | 98.6190 | 1.3810 |

| To | 1.3810 | 0.8627 | 1.1218 |

| Net | 0.5183 | −0.5183 |

| CT | OPI | PI | SI | CI | NFMI | BI | From | |

|---|---|---|---|---|---|---|---|---|

| CT | 94.5664 | 1.4274 | 0.9697 | 0.8534 | 0.7953 | 0.7958 | 0.7920 | 5.6336 |

| OPI | 0.4598 | 38.0214 | 13.6338 | 12.7272 | 12.1597 | 10.7477 | 12.2505 | 61.9786 |

| PI | 0.3384 | 9.6958 | 28.4504 | 17.1517 | 19.5165 | 16.7793 | 8.0679 | 71.5496 |

| SI | 0.3419 | 9.3058 | 18.0224 | 28.0366 | 18.1639 | 18.4982 | 7.6312 | 71.9634 |

| CI | 0.3313 | 8.7459 | 19.8300 | 17.4078 | 27.1025 | 21.0104 | 5.5721 | 72.8975 |

| NFMI | 0.2697 | 8.0249 | 17.9119 | 18.5623 | 22.0278 | 27.8217 | 5.3816 | 72.1783 |

| BI | 0.5276 | 14.1463 | 13.2806 | 11.4424 | 8.6567 | 7.8601 | 44.0863 | 55.9137 |

| To | 2.2688 | 51.3461 | 83.6484 | 78.1448 | 81.3198 | 75.6914 | 39.6953 | 58.8449 |

| Net | −3.1648 | −10.6325 | 12.0988 | 5.9815 | 8.4223 | 3.5131 | −16.2183 |

| Event | Serial | Event Description | Dates |

|---|---|---|---|

| Policies | A1 | Three-year action plan to fight air pollution | 3 July 2018 |

| A2 | Resolution to promote the difficult battle of pollution prevention and control following the law | 30 July 2018 | |

| Sino–U.S. trade war | B1 | U.S. imposes tariffs on USD 60 billion of Chinese imports | 26 March 2018 |

| B2 | U.S. Department of Commerce puts 11 Chinese companies on the “entity list” | 20 July 2020 | |

| COVID-19 outbreak | C1 | Lockdown imposed in Wuhan | 23 January 2020 |

| A1 | A2 | B1 | B2 | C1 | |

|---|---|---|---|---|---|

| OPI | −1.73 | 19.85 | 23.21 | 13.54 | 20.01 |

| PI | 0.15 | 4.57 | 16.03 | 6.02 | 0.72 |

| SI | −5.47 | −2.88 | 0.26 | −7.36 | 10.48 |

| CI | 13.89 | −10.39 | −16.82 | 14.01 | −1.85 |

| NFMI | −2.10 | −4.90 | −6.25 | 2.62 | 7.50 |

| BI | 3.05 | −0.65 | 7.32 | 4.31 | 24.76 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xia, M.; Chen, Z.-H.; Wang, P. Dynamic Risk Spillover Effect between the Carbon and Stock Markets under the Shocks from Exogenous Events. Energies 2023, 16, 97. https://doi.org/10.3390/en16010097

Xia M, Chen Z-H, Wang P. Dynamic Risk Spillover Effect between the Carbon and Stock Markets under the Shocks from Exogenous Events. Energies. 2023; 16(1):97. https://doi.org/10.3390/en16010097

Chicago/Turabian StyleXia, Mengli, Zhang-Hangjian Chen, and Piao Wang. 2023. "Dynamic Risk Spillover Effect between the Carbon and Stock Markets under the Shocks from Exogenous Events" Energies 16, no. 1: 97. https://doi.org/10.3390/en16010097

APA StyleXia, M., Chen, Z.-H., & Wang, P. (2023). Dynamic Risk Spillover Effect between the Carbon and Stock Markets under the Shocks from Exogenous Events. Energies, 16(1), 97. https://doi.org/10.3390/en16010097