Wind Power in Iran: Technical, Policy, and Financial Aspects for Better Energy Resource Management

Abstract

:1. Introduction

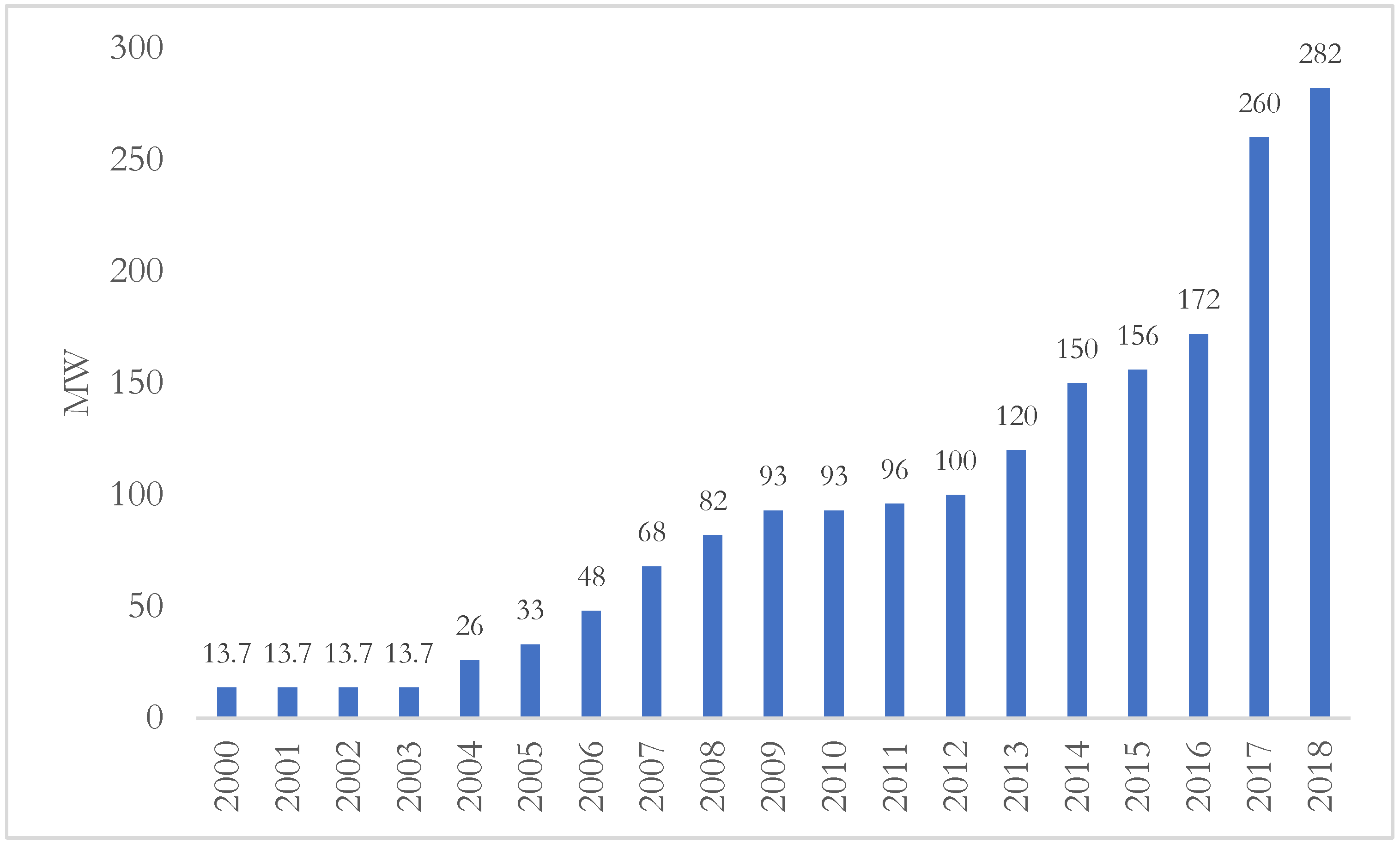

2. Background

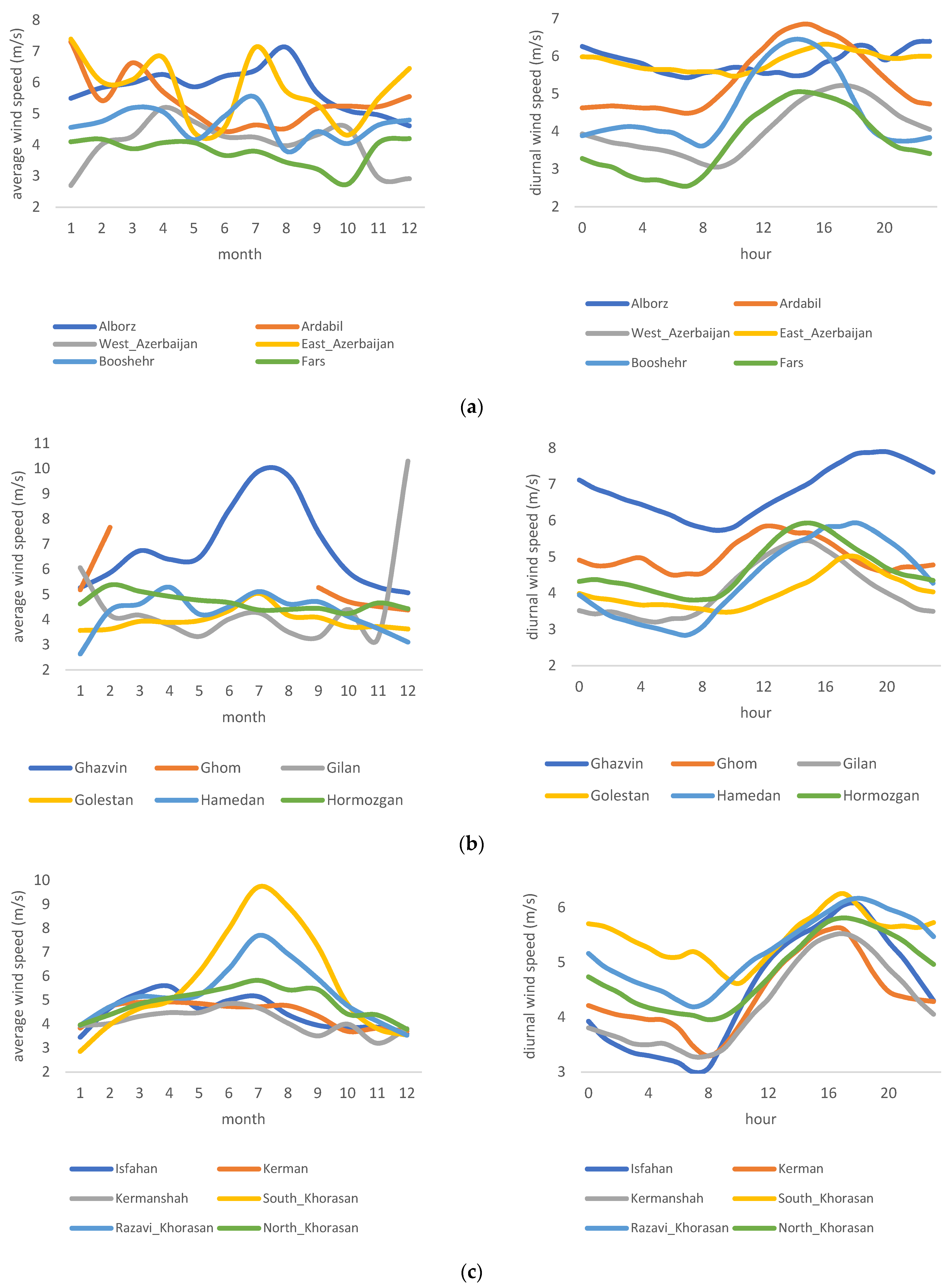

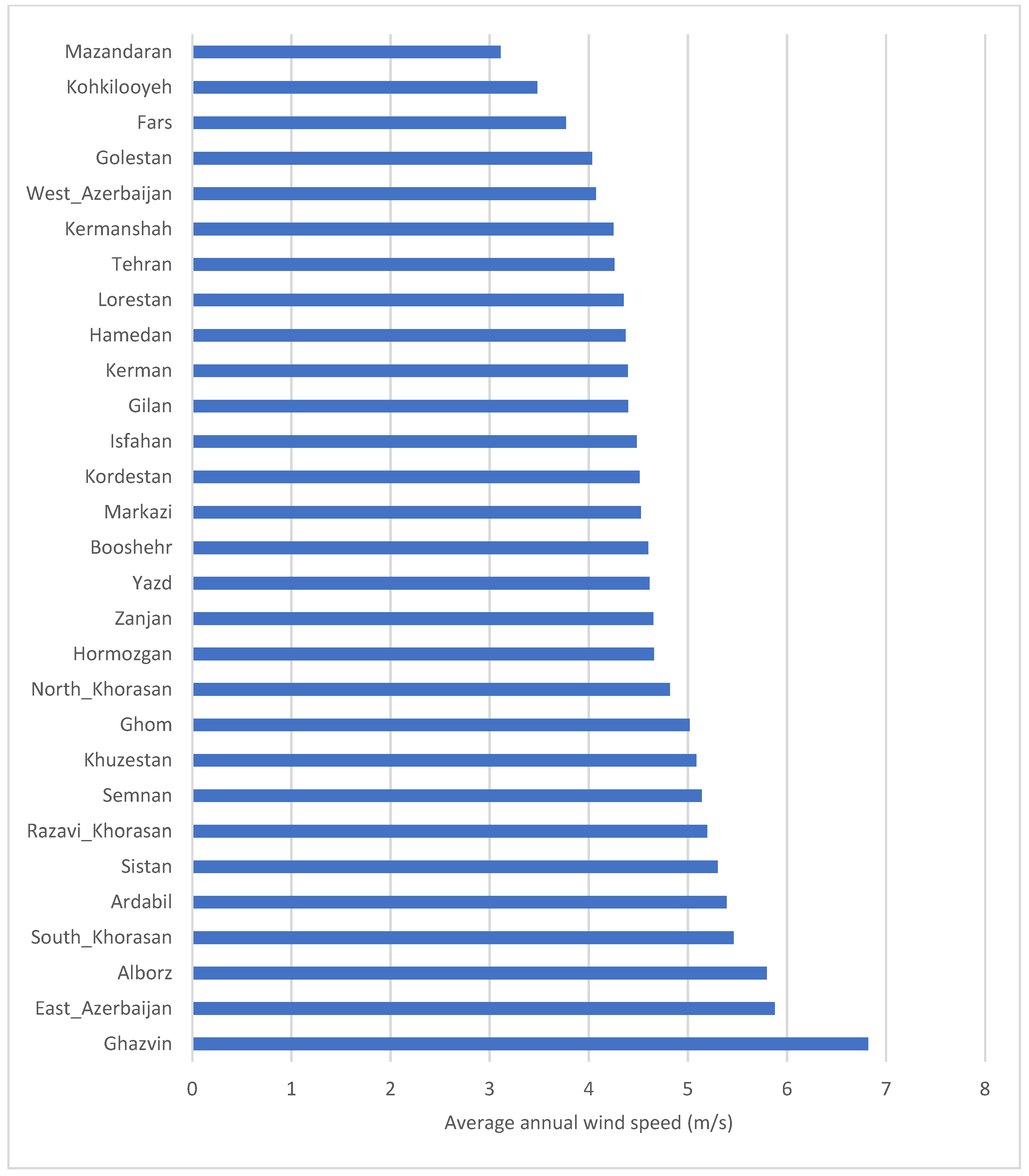

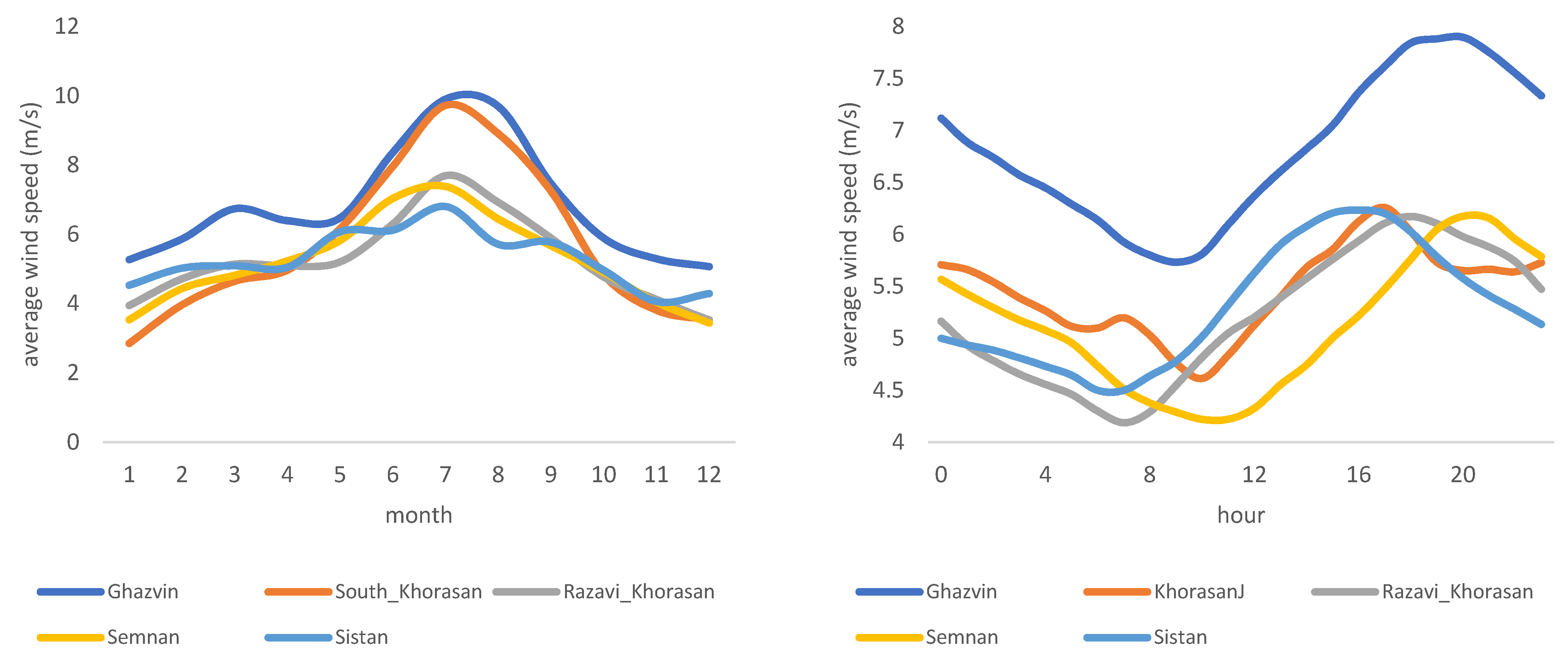

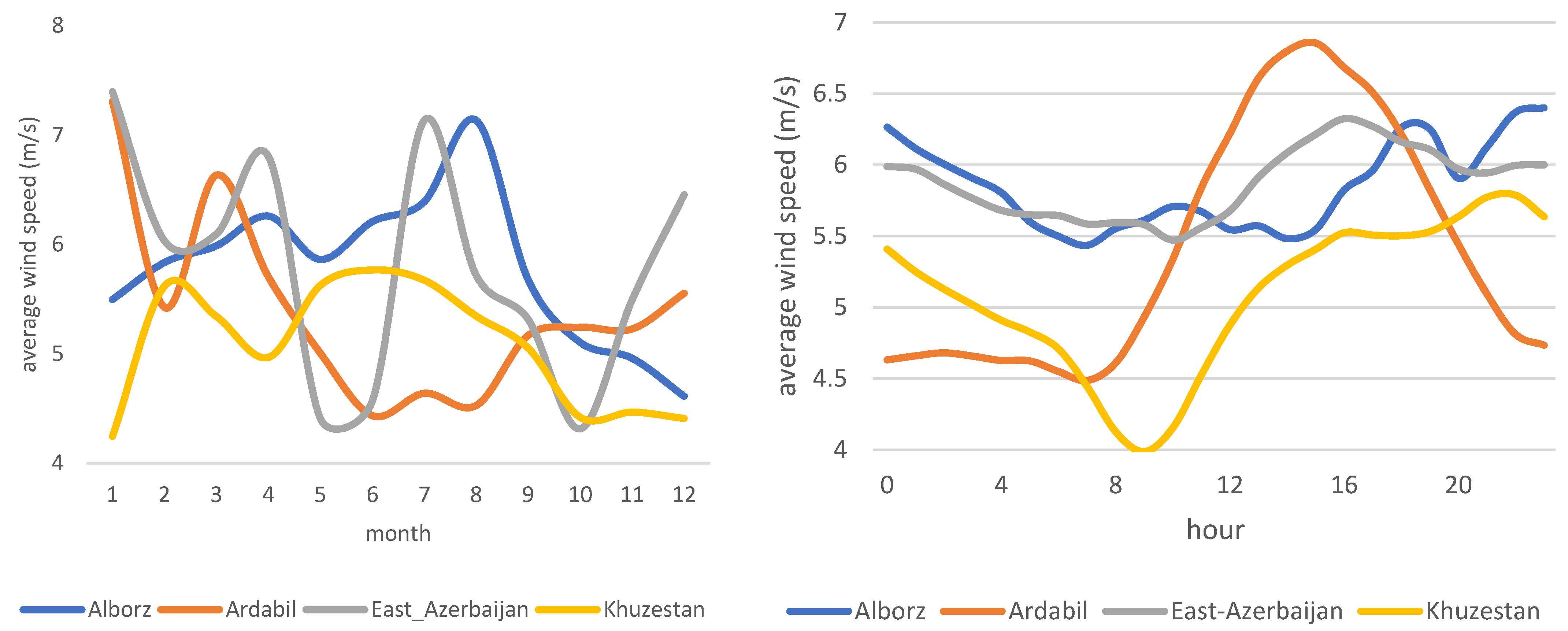

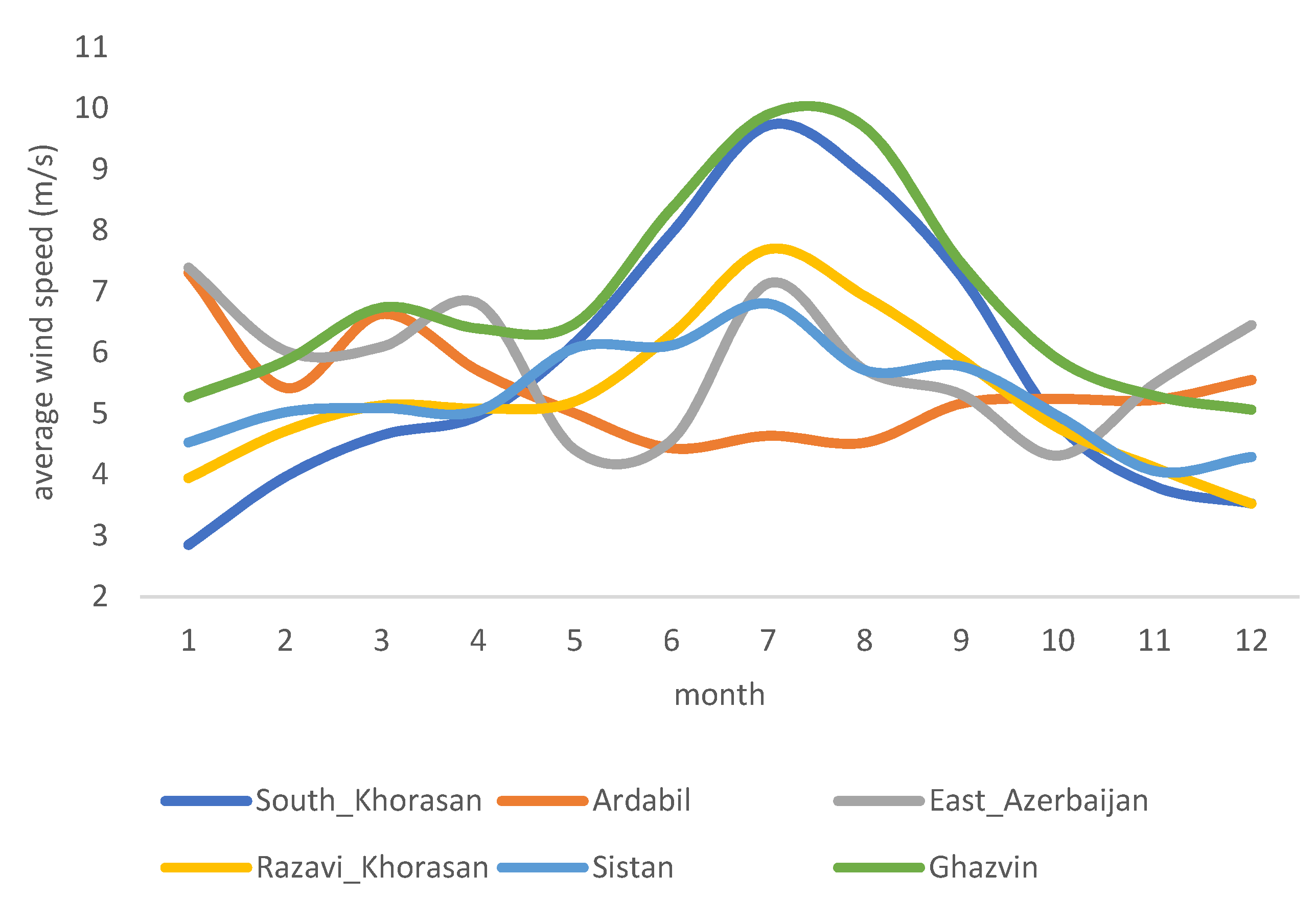

3. Wind Resource Assessment

4. Technical, Economic, and Regulatory Assessments

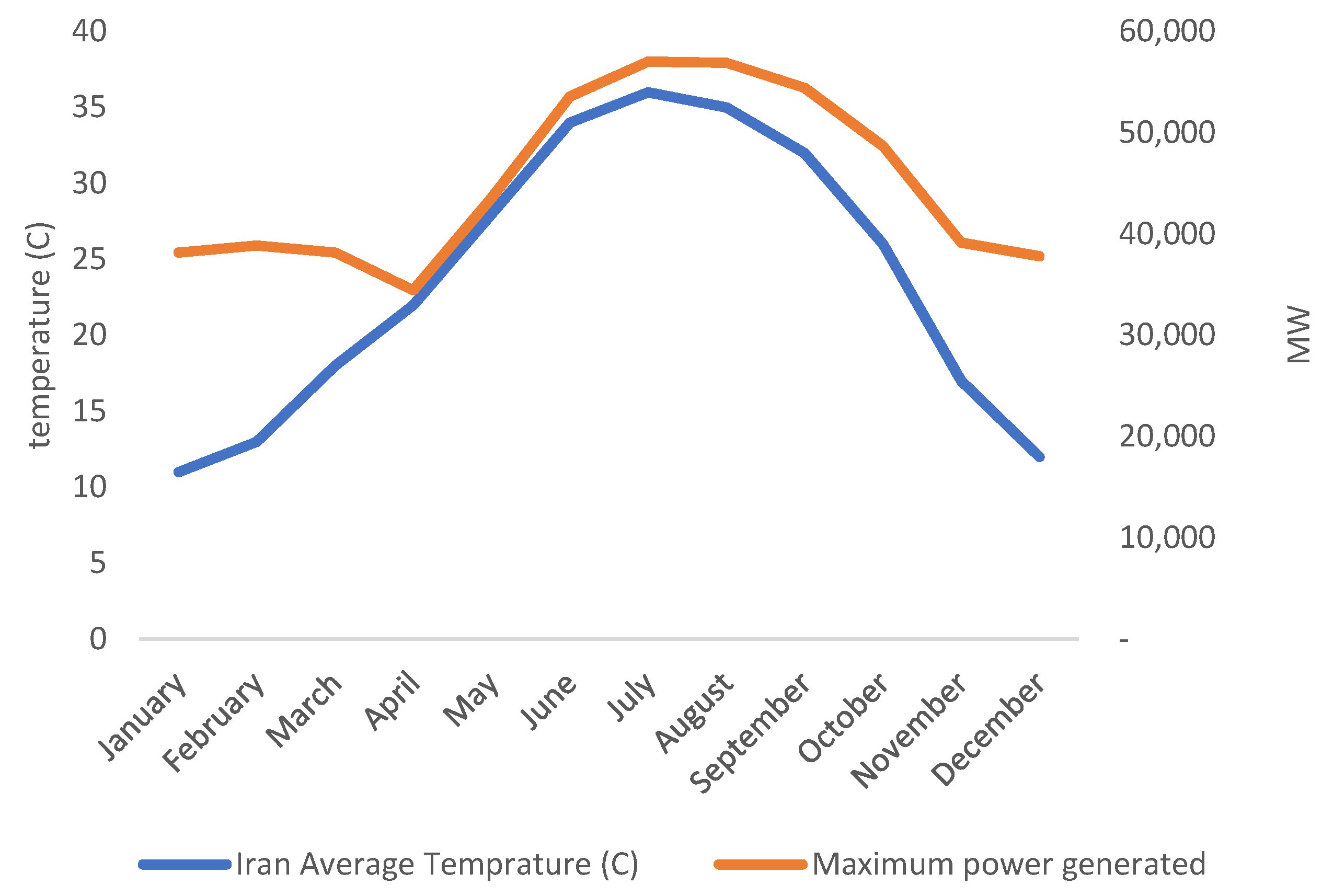

4.1. Technical Assessment

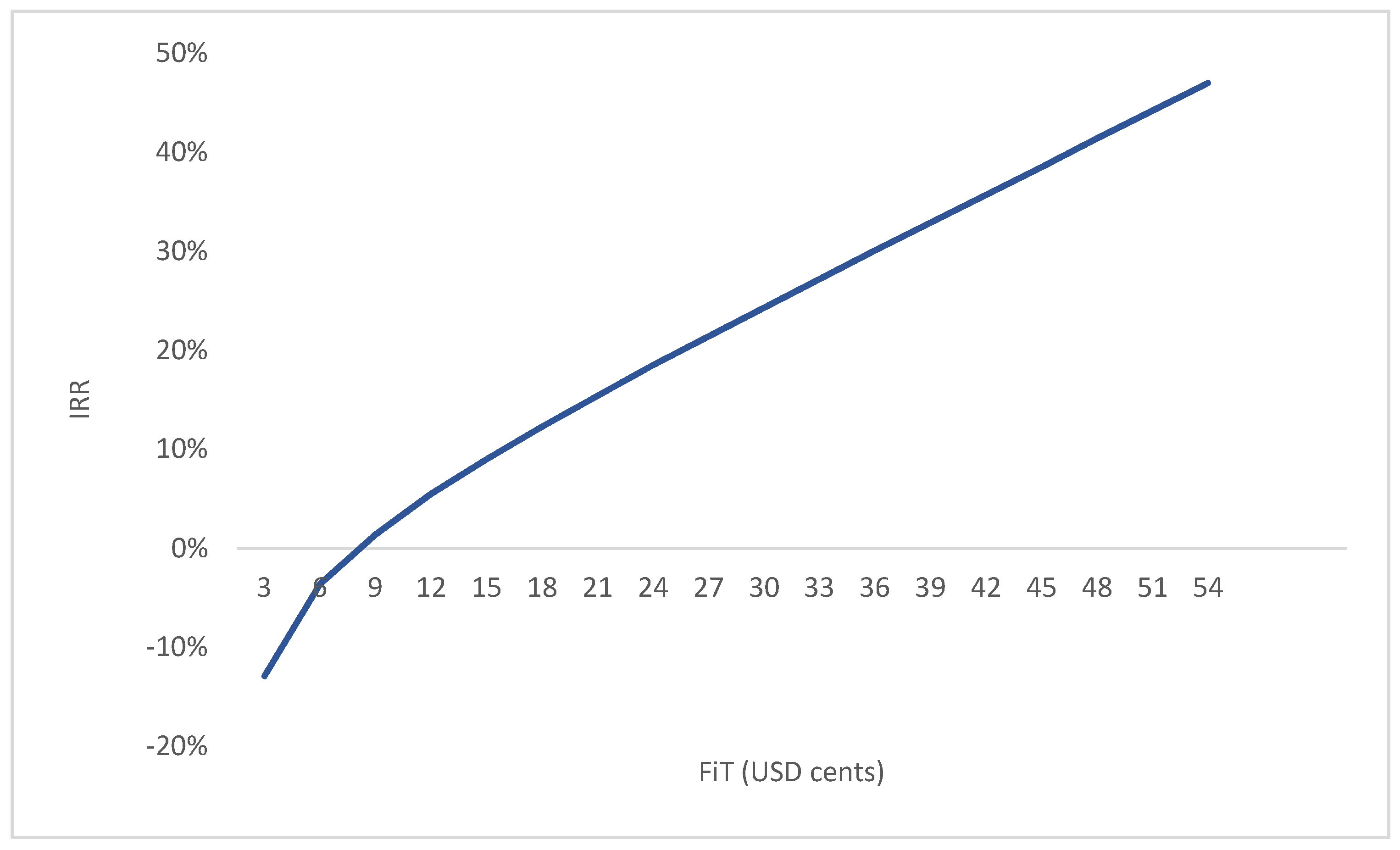

4.2. Economic Assessment

- Scenario 1 is based on the current FiT of 3.5 cents per kWh.

- Scenario 2 refers to the 2010–2019 average FiT for wind energy in 26 OECD countries with such available data.

- Scenario 3 refers to the 2010–2019 average FiT for wind energy in 45 OECD and non-OECD countries worldwide with such available data.

- Scenario 4 is Switzerland’s 2010–2019 average FiT for wind, the highest figure among the 26 OECD countries.

- Scenario 5 is the 2010–2019 average FiT for wind in the Dominican Republic, the highest figure among the 45 OECD and non-OECD countries worldwide (Please see Appendix B for available data on FiT for all countries between 2010 and 2019).

4.3. Policy Assessment

- (1)

- Announcement of guaranteed electricity purchase prices from renewable energy plants by SATBA in 2016 (Satba.gov.ir, accessed on 3 February 2022).

- (2)

- The possibility of exporting electricity from renewable energy plants in 2018.

- (3)

- Assigning 8% of total electricity sales to invest in rural electrification and construction of renewable farms in the annual budget of 2013 and afterward.

5. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Ρ | 1.225 kg/m3 |

| d | 47 m |

| A | 1735 m2 |

| Betz limit | 59% |

| Total yield losses | 50% |

| Capacity factor | 50% |

| Capacity | 660 KW |

| Wind speed limitation | 3 m/s to 25 m/s |

| Price | USD 593,000 |

| Other costs (transportation, installation, and integration) | USD 177,900 or 30% of the price of the turbine |

| Annual O&M cost | 8895 |

Appendix B

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Average 2010–2019 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Algeria | 0.090 | 0.090 | 0.090 | 0.090 | 0.090 | 0.090 | |||||

| Argentina | 0.004 | 0.004 | 0.003 | 0.003 | 0.002 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.002 |

| Armenia | 0.086 | 0.093 | 0.087 | 0.080 | 0.074 | 0.084 | |||||

| Belarus | 0.000 | 0.153 | 0.153 | 0.153 | 0.153 | 0.122 | |||||

| Bosnia and Herzegovina | 0.000 | 0.095 | 0.088 | 0.091 | 0.091 | 0.073 | |||||

| Bulgaria | 0.110 | 0.679 | 0.628 | 0.648 | 0.648 | 0.000 | 0.000 | 0.000 | 0.086 | 0.081 | 0.288 |

| China | 0.083 | 0.087 | 0.089 | 0.090 | 0.091 | 0.086 | 0.077 | 0.072 | 0.069 | 0.000 | 0.075 |

| Croatia | 0.117 | 0.123 | 0.163 | 0.167 | 0.166 | 0.139 | 0.000 | 0.000 | 0.000 | 0.000 | 0.088 |

| Cyprus | 0.220 | 0.231 | 0.186 | 0.000 | 0.000 | 0.000 | 0.076 | 0.077 | 0.081 | 0.000 | 0.087 |

| Dominican Republic | 0.530 | 0.530 | 0.530 | 0.530 | 0.530 | 0.530 | |||||

| Ecuador | 0.094 | 0.091 | 0.091 | 0.117 | 0.000 | 0.079 | |||||

| India | 0.076 | 0.074 | 0.091 | 0.087 | 0.088 | 0.083 | 0.080 | 0.000 | 0.000 | 0.000 | 0.058 |

| Indonesia | 0.119 | 0.123 | 0.115 | 0.103 | 0.091 | 0.081 | 0.081 | 0.097 | 0.091 | 0.091 | 0.099 |

| Iran | 0.120 | 0.116 | 0.101 | 0.067 | 0.171 | 0.115 | |||||

| Jordan | 0.000 | 0.000 | 0.113 | 0.113 | 0.113 | 0.068 | |||||

| Kazakhstan | 0.000 | 0.000 | 0.000 | 0.149 | 0.127 | 0.055 | |||||

| Kenya | 0.120 | 0.120 | 0.120 | 0.120 | 0.120 | 0.120 | |||||

| North Macedonia | 0.118 | 0.124 | 0.114 | 0.118 | 0.118 | 0.119 | |||||

| South Africa | 0.171 | 0.129 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.030 |

| Austria | 0.129 | 0.135 | 0.122 | 0.125 | 0.125 | 0.105 | 0.105 | 0.101 | 0.097 | 0.091 | 0.113 |

| Canada | 0.156 | 0.162 | 0.127 | 0.113 | 0.105 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.066 |

| Czech Republic | 0.117 | 0.129 | 0.114 | 0.108 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.047 |

| Denmark | 0.074 | 0.077 | 0.072 | 0.074 | 0.074 | 0.062 | 0.062 | 0.063 | 0.066 | 0.000 | 0.062 |

| Estonia | 0.097 | 0.102 | 0.069 | 0.071 | 0.071 | 0.060 | 0.059 | 0.061 | 0.063 | 0.060 | 0.071 |

| Finland | 0.000 | 0.146 | 0.135 | 0.140 | 0.140 | 0.116 | 0.092 | 0.094 | 0.099 | 0.094 | 0.106 |

| France | 0.109 | 0.114 | 0.105 | 0.109 | 0.109 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.055 |

| Germany | 0.109 | 0.115 | 0.115 | 0.117 | 0.118 | 0.099 | 0.098 | 0.095 | 0.114 | 0.108 | 0.109 |

| Greece | 0.116 | 0.122 | 0.113 | 0.117 | 0.117 | 0.097 | 0.108 | 0.000 | 0.000 | 0.000 | 0.079 |

| Ireland | 0.087 | 0.094 | 0.089 | 0.093 | 0.094 | 0.079 | 0.000 | 0.000 | 0.000 | 0.000 | 0.054 |

| Israel | 0.381 | 0.390 | 0.242 | 0.129 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.114 |

| Italy | 0.000 | 0.000 | 0.000 | 0.252 | 0.247 | 0.172 | 0.236 | 0.241 | 0.058 | 0.056 | 0.126 |

| Japan | 0.000 | 0.000 | 0.276 | 0.225 | 0.208 | 0.182 | 0.202 | 0.196 | 0.254 | 0.252 | 0.179 |

| Korea | 0.093 | 0.097 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.019 |

| Latvia | 0.159 | 0.167 | 0.154 | 0.159 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.064 |

| Lithuania | 0.000 | 0.000 | 0.000 | 0.096 | 0.096 | 0.071 | 0.000 | 0.000 | 0.000 | 0.000 | 0.026 |

| Luxembourg | 0.109 | 0.113 | 0.104 | 0.106 | 0.122 | 0.102 | 0.101 | 0.103 | 0.108 | 0.102 | 0.107 |

| Netherlands | 0.127 | 0.186 | 0.141 | 0.146 | 0.146 | 0.153 | 0.152 | 0.095 | 0.099 | 0.078 | 0.132 |

| Portugal | 0.099 | 0.104 | 0.096 | 0.099 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.040 |

| Slovak Republic | 0.107 | 0.113 | 0.104 | 0.093 | 0.093 | 0.078 | 0.078 | 0.050 | 0.052 | 0.000 | 0.077 |

| Slovenia | 0.121 | 0.127 | 0.117 | 0.121 | 0.121 | 0.101 | 0.101 | 0.103 | 0.000 | 0.000 | 0.091 |

| Spain | 0.103 | 0.108 | 0.100 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.031 |

| Switzerland | 0.122 | 0.225 | 0.229 | 0.232 | 0.235 | 0.223 | 0.218 | 0.218 | 0.220 | 0.231 | 0.215 |

| Turkey | 0.728 | 0.727 | 0.073 | 0.073 | 0.073 | 0.073 | 0.073 | 0.073 | 0.073 | 0.073 | 0.204 |

| United Kingdom | 0.084 | 0.087 | 0.086 | 0.078 | 0.246 | 0.164 | 0.069 | 0.063 | 0.061 | 0.056 | 0.099 |

| United States | 0.085 | 0.072 | 0.064 | 0.060 | 0.011 | 0.004 | 0.003 | 0.002 | 0.011 | .. | 0.035 |

References

- Moghaddam, N.B.; Mousavi, S.M.; Nasiri, M.; Moallemi, E.A.; Yousefdehi, H. Wind energy status of Iran: Evaluating Iran’s technological capability in manufacturing wind turbines. Renew. Sustain. Energy Rev. 2011, 15, 4200–4211. [Google Scholar] [CrossRef]

- Shafiei, E.; Saboohi, Y.; Ghofrani, M.B. Impact of innovation programs on development of energy system: Case of Iranian electricity-supply system. Energy Policy 2009, 37, 2221–2230. [Google Scholar] [CrossRef]

- Nelson, J.; Johnston, J.; Mileva, A.; Fripp, M.; Hoffman, I.; Petros-Good, A.; Blanco, C.; Kammen, D.M. High-resolution modeling of the western North American power system demonstrates low-cost and low-carbon futures. Energy Policy 2012, 43, 436–447. [Google Scholar] [CrossRef]

- DeCesaro, J.; Porter, K.; Milligan, M. Wind energy and power system operations: A review of wind integration studies to date. Electr. J. 2009, 22, 34–43. [Google Scholar] [CrossRef] [Green Version]

- Keyhani, A.; Ghasemi-Varnamkhasti, M.; Khanali, M.; Abbaszadeh, R. An assessment of wind energy potential as a power generation source in the capital of Iran, Tehran. Energy 2010, 35, 188–201. [Google Scholar] [CrossRef]

- Mirhosseini, M.; Sharifi, F.; Sedaghat, A. Assessing the wind energy potential locations in province of Semnan in Iran. Renew. Sustain. Energy Rev. 2011, 15, 449–459. [Google Scholar] [CrossRef]

- Mostafaeipour, A.; Sedaghat, A.; Dehghan-Niri, A.A.; Kalantar, V. Wind energy feasibility study for city of Shahrbabak in Iran. Renew. Sustain. Energy Rev. 2011, 15, 2545–2556. [Google Scholar] [CrossRef]

- Mostafaeipour, A.; Jadidi, M.; Mohammadi, K.; Sedaghat, A. An analysis of wind energy potential and economic evaluation in Zahedan, Iran. Renew. Sustain. Energy Rev. 2014, 30, 641–650. [Google Scholar] [CrossRef]

- Mostafaeipour, A. Feasibility study of harnessing wind energy for turbine installation in province of Yazd in Iran. Renew. Sustain. Energy Rev. 2010, 14, 93–111. [Google Scholar] [CrossRef]

- Mohammadi, K.; Mostafaeipour, A. Using different methods for comprehensive study of wind turbine utilization in Zarrineh, Iran. Energy Convers. Manag. 2013, 65, 463–470. [Google Scholar] [CrossRef]

- Fazelpour, F.; Soltani, N.; Soltani, S.; Rosen, M.A. Assessment of wind energy potential and economics in the north-western Iranian cities of Tabriz and Ardabil. Renew. Sustain. Energy Rev. 2015, 45, 87–99. [Google Scholar] [CrossRef]

- Mostafaeipour, A.; Sedaghat, A.; Ghalishooyan, M.; Dinpashoh, Y.; Mirhosseini, M.; Sefid, M.; Pour-Rezaei, M. Evaluation of wind energy potential as a power generation source for electricity production in Binalood, Iran. Renew. Energy 2013, 52, 222–229. [Google Scholar] [CrossRef]

- Dabbaghiyan, A.; Fazelpour, F.; Abnavi, M.D.; Rosen, M.A. Evaluation of wind energy potential in province of Bushehr, Iran. Renew. Sustain. Energy Rev. 2016, 55, 455–466. [Google Scholar] [CrossRef]

- Mohammadi, K.; Mostafaeipour, A. Economic feasibility of developing wind turbines in Aligoodarz, Iran. Energy Convers. Manag. 2013, 76, 645–653. [Google Scholar] [CrossRef]

- Nedaei, M.; Assareh, E.; Biglari, M. An extensive evaluation of wind resource using new methods and strategies for development and utilizing wind power in Mah-shahr station in Iran. Energy Convers. Manag. 2014, 81, 475–503. [Google Scholar] [CrossRef]

- Gorjian, S.; Zadeh, B.N.; Eltrop, L.; Shamshiri, R.R.; Amanlou, Y. Solar photovoltaic power generation in Iran: Development, policies, and barriers. Renew. Sustain. Energy Rev. 2019, 106, 110–123. [Google Scholar] [CrossRef]

- Hirbodi, K.; Enjavi-Arsanjani, M.; Yaghoubi, M. Techno-economic assessment and environmental impact of concentrating solar power plants in Iran. Renew. Sustain. Energy Rev. 2020, 120, 109642. [Google Scholar] [CrossRef]

- Moslem Mousavi, S.; Bagheri Ghanbarabadi, M.; Bagheri Moghadam, N. The competitiveness of wind power compared to existing methods of electricity generation in Iran. Energy Policy 2012, 42, 651–656. [Google Scholar] [CrossRef]

- Girard, R.; Laquaine, K.; Kariniotakis, G. Assessment of wind power predictability as a decision factor in the investment phase of wind farms. Appl. Energy 2013, 101, 609–617. [Google Scholar] [CrossRef] [Green Version]

- Foley, A.M.; Leahy, P.G.; Marvuglia, A.; McKeogh, E.J. Current methods and advances in forecasting of wind power generation. Renew. Energy 2012, 37, 1–8. [Google Scholar] [CrossRef] [Green Version]

- Elberg, C.; Hagspiel, S. Spatial dependencies of wind power and interrelations with spot price dynamics. Eur. J. Oper. Res. 2015, 241, 260–272. [Google Scholar] [CrossRef] [Green Version]

- Albadi, M.; El-Saadany, E. Overview of wind power intermittency impacts on power systems. Electr. Power Syst. Res. 2010, 80, 627–632. [Google Scholar] [CrossRef]

- Kazemi, A.; Bashirzadeh, R.; Aryaee, S. Iran’s Electrical Energy Demand Forecasting Using Meta-Heuristic Algorithms. Iran. J. Energy 2020, 22, 27–44. [Google Scholar]

- Rostami, M.; Khademvatani, A.; Omidali, M. Forecasting Electricity Demand in Iran: The application of a Hybrid Dynamic Partial Adjustment and ARIMA Model. J. Appl. Econ. Stud. Iran 2018, 7, 177–199. [Google Scholar] [CrossRef]

- Fatemi Ardestani, S.F.; Barakchian, S.M.; Shokoohian, H. Short-term Forecast of Hourly Electricity Demand in Iran Using a Forecast Combination Method. J. Plan. Budg. 2020, 24, 57–73. [Google Scholar] [CrossRef]

- Walz, R.; Schleich, J.; Ragwitz, M. How Regulation Influences Innovation: An Indicator based Approach for the Case of Renewable Energy Technologies. 2008. Available online: https://hdl.handle.net/1853/39796 (accessed on 11 March 2020).

- Palmer, K. Diversification by Regulated Monopolies and Incentives for Cost-Reducing R&D. Am. Econ. Rev. 1991, 81, 266–270. [Google Scholar]

- Nicoletti, G.; Scarpetta, S. Regulation and Economic Performance; OECD Publishing: Paris, France, 2005. [Google Scholar]

- Viljainen, S. Regulation Design in the Electricity Distribution Sector: Theory and Practice; Lappeenranta University of Technology: Lappeenranta, Finland, 2005. [Google Scholar]

- Schankerman, M. Symmetric regulation for competitive telecommunications. Inf. Econ. Policy 1996, 8, 3–23. [Google Scholar] [CrossRef]

| Name | City | Province | Installed Capacity | Year Developed |

|---|---|---|---|---|

| Mahbad | SiaahPoush | Ghazvin | 61.2 | 2017 |

| Mapna | Aghkand | Azerbaijan Sharghi | 50 | 2017 |

| Mapna | Kahak | Ghazvin | 55 | 2015 |

| Atrin | Khaaf | Khorasan Razavi | 2.5 | 2016 |

| Behin | Khaaf | Khorasan Razavi | 1.5 | 2013 |

| Binalood | Binalod | Khorasan Razavi | 28.5 | 2010 |

| Dizbad | Neyshabour | Khorasan Razavi | 4 | 2015 |

| Manjil | Manjil | Gilan | 92.5 | 1994 |

| Ben Ali | Tbariz | Azarbayjan Sharghi | 2 | 2009 |

| Qazvin | Razavi Khorasan | East Azerbaijan | Sistan Baluchestan | Ardabil | South Khorasan | |

|---|---|---|---|---|---|---|

| January | 5.3 | 5.3 | 11.3 | 4.9 | 15.2 | 3.4 |

| February | 5.9 | 6.5 | 8.1 | 5.7 | 6.1 | 4.6 |

| March | 6.7 | 8.7 | 7.6 | 5.8 | 9.2 | 4.8 |

| April | 6.4 | 12.4 | 8.6 | 6.3 | 6.4 | 5.0 |

| May | 6.5 | 8.9 | 4.0 | 7.9 | 6.5 | 6.7 |

| June | 8.4 | 8.1 | 4.5 | 10.5 | 4.4 | 7.7 |

| July | 9.9 | 11.7 | 6.9 | 13.2 | 5.1 | 9.7 |

| August | 9.7 | 10.3 | 5.4 | 11.0 | 4.4 | 9.0 |

| September | 7.5 | 11.0 | 5.3 | 8.7 | 5.7 | 7.7 |

| October | 5.9 | 8.7 | 4.8 | 6.3 | 7.6 | 6.0 |

| November | 5.3 | 5.9 | 7.3 | 4.8 | 9.0 | 5.0 |

| December | 5.1 | 4.9 | 10.1 | 4.9 | 12.0 | 4.7 |

| Qazvin | Razavi Khorasan | East Azerbaijan | Sistan Baluchestan | Ardabil | South Khorasan | |

|---|---|---|---|---|---|---|

| January | 17,072 | 17,538 | 169,522 | 14,062 | 407,164 | 4611 |

| February | 22,005 | 29,639 | 57,260 | 19,717 | 24,856 | 10,629 |

| March | 35,716 | 75,601 | 51,642 | 23,160 | 90,960 | 12,670 |

| April | 29,529 | 216,775 | 71,146 | 27,585 | 29,340 | 13,726 |

| May | 31,684 | 82,854 | 7252 | 57,623 | 31,327 | 35,433 |

| June | 66,053 | 59,881 | 10,187 | 132,512 | 9765 | 52,239 |

| July | 113,289 | 188,679 | 38,660 | 266,267 | 15,564 | 106,974 |

| August | 106,207 | 128,529 | 17,939 | 155,427 | 9909 | 85,191 |

| September | 46,924 | 148,562 | 17,211 | 73,955 | 20,939 | 51,595 |

| October | 23,843 | 77,313 | 12,507 | 29,242 | 52,174 | 24,771 |

| November | 16,763 | 22,700 | 43,743 | 12,145 | 81,883 | 13,803 |

| December | 15,185 | 13,725 | 120,923 | 14,018 | 202,177 | 11,944 |

| Total | 524,270 | 1,061,795 | 617,992 | 825,714 | 976,058 | 423,588 |

| Qazvin | Razavi Khorasan | East Azerbaijan | Sistan Baluchestan | Ardabil | South Khorasan | Total | |

|---|---|---|---|---|---|---|---|

| Estimated total demand (GWh) | 4675.82 | 15,164.50 | 7958.68 | 5733.72 | 1854.55 | 1710.99 | 37,098.26 |

| Number of turbines needed to meet 5% of the estimated demand | 446 | 714 | 644 | 347 | 95 | 202 | 2448 |

| Farm capacity (MW) | 294.32 | 471.30 | 424.98 | 229.15 | 62.70 | 133.30 | 1615.75 |

| CapEx (million USD) | 343.77 | 550.50 | 496.39 | 267.65 | 73.24 | 155.69 | 1887.25 |

| OpEx (million USD) | 3.97 | 6.35 | 5.73 | 3.09 | 0.85 | 1.80 | 21.78 |

| Annual revenue (million USD) | 8.18 | 26.54 | 13.93 | 10.03 | 3.25 | 2.99 | 64.92 |

| IRR | −17.2% | −4.8% | −10.7% | −7.5% | −5.7% | −15.4% | −10.2% |

| NPV (million USD) | −296.05 | −153.13 | −338.12 | −131.83 | −26.07 | −133.54 | −1078.74 |

| Scenario 1 Fit = 3.5 Cents per kWh | Scenario 2 Fit = 9 Cents per kWh | Scenario 3 Fit = 12 Cents per kWh | Scenario 4 Fit = 21.5 Cents per kWh | Scenario 5 Fit = 53 Cents per kWh | |

|---|---|---|---|---|---|

| Annual revenue (million USD) | 64.92 | 166.94 | 222.59 | 398.81 | 983.10 |

| IRR | −10.2% | 1.4% | 5.5% | 15.9% | 46.0% |

| NPV (million USD) | −1078.74 | 910.63 | 1995.74 | 5431.92 | 16,825.56 |

| FiT = 12 Cents per kWh | FiT = 21.5 Cents per kWh | FiT = 53 Cents per kWh | |

|---|---|---|---|

| Estimated total electricity demand for Iran (TWh) | 250 | 250 | 250 |

| 5% of the estimated total electricity demand (TWh) | 12.5 | 12.5 | 12.5 |

| Number of turbines needed to meet 5% of demand | 16,497 | 16,497 | 16,497 |

| CapEx & OpEx (million USD) | 12,865 | 12,865 | 12,865 |

| CapEx & OpEx as a percentage of a conservative figure of USD 70 billion fossil fuel subsidies (%) | 18% | 18% | 18% |

| Total cost of the FiT for the Government (million USD) | 1500 | 2688 | 6625 |

| Cost of FiT as a percentage of a conservative figure of USD70 billion fossil fuel subsidies (%) | 2.14% | 3.84% | 9.46% |

| PPA Terms | ||

|---|---|---|

| Issue | Term | |

| Term | 20 years, the developer can sell the electricity produced to the open market. | |

| Completion Due Date | There is a grace period between the signing of the contract and the actual generation of electricity. This period varies on the source of energy. | |

| Payment Currency | Iranian rials | |

| Taxation | The developer will be subject to Iranian corporate and VAT taxes but will receive tax credits for investing in less developed regions of Iran. | |

| Land Cost | To be covered by the developer. | |

| Guarantee purchase tariff rates | ||

| Installed Capacity | Feed-in-Tariff (cents per kWh) | |

| Wind Farm | 50 MW and less | 3.5 |

| 1 MW and less | 4.75 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mirnezami, S.R.; Mohseni Cheraghlou, A. Wind Power in Iran: Technical, Policy, and Financial Aspects for Better Energy Resource Management. Energies 2022, 15, 3230. https://doi.org/10.3390/en15093230

Mirnezami SR, Mohseni Cheraghlou A. Wind Power in Iran: Technical, Policy, and Financial Aspects for Better Energy Resource Management. Energies. 2022; 15(9):3230. https://doi.org/10.3390/en15093230

Chicago/Turabian StyleMirnezami, Seyed Reza, and Amin Mohseni Cheraghlou. 2022. "Wind Power in Iran: Technical, Policy, and Financial Aspects for Better Energy Resource Management" Energies 15, no. 9: 3230. https://doi.org/10.3390/en15093230

APA StyleMirnezami, S. R., & Mohseni Cheraghlou, A. (2022). Wind Power in Iran: Technical, Policy, and Financial Aspects for Better Energy Resource Management. Energies, 15(9), 3230. https://doi.org/10.3390/en15093230