1. Introduction

In enterprise risk management, risk is defined as any event or action that may adversely affect an organization’s ability to achieve its objectives and execute its strategies [

1], where two types of risk have been among the most studied: variability risk and vulnerability risk [

2]. Variability risk is the difference between the actual and expected returns on an investment [

3,

4,

5] and vulnerability risk includes default and bankruptcy risks [

6,

7]. In particular, variability risk management involves optimizing portfolios to allocate capital in a way that reduces the exposure of assets to risk [

8,

9]. One optimization method that has been applied with great success in the energy sector [

10] is the establishment of efficient portfolios based on the determination of the efficient minimum portfolio risk for a given return [

11,

12].

Portfolio management in the electricity sector has been applied to all activities in the production chain but has mainly focused on the wholesale side of the electricity market. Only a few works have explored the retail side [

9,

13]. In particular, electricity retailers have to match supply with varying consumer demand [

9] which causes their decisions to focus on the creation of portfolios based on purchasing strategies that mix power exchange purchases with longer-term purchases through bilateral contracts and can include self-generating capacity [

14,

15,

16,

17]. Within this framework, strategies can include forward contracts, call options, and interruptible contracts [

9]. Recent research on optimal portfolios for retailers has mainly used the mean-variance approach [

15,

16,

18] and stochastic optimization [

9,

13,

19] with various measures such as value at risk (VaR), and conditional value at risk (CVaR) [

9,

14,

17,

19,

20]. Some studies have proposed static models with no analysis of time [

16,

19,

21] whereas others use dynamic models with timelines ranging from hourly portfolios [

14], to one week [

15], and on to medium-term planning of four weeks [

18,

22] to two months [

9,

13,

17].

This paper focuses on the management of the variability risks faced by electricity retailers due to price uncertainty, exploring new issues in portfolio management for energy retailers that permit making two contributions. First, we considered weather uncertainty as a factor that increases the risks derived from energy price variability. Prior to our review, this key factor in Colombian energy markets had not been analyzed by other studies. Second, we developed a multi-period approach to portfolio construction that uses the “Buy and Hold” and the “Fixed-Mix” strategies, for electricity retailers in the Colombian context. Each strategy was considered within the climatic scenarios generated for price forecasting. We used the portfolio theory proposed by Markowitz [

11], and we considered a planning scenario of one year, divided into quarters, for both multi-period strategies [

23]. We showed that through providing short-term purchasing strategies this model will help energy retailers in countries such as Colombia hedge risks due to uncertain supply caused by weather phenomena, such as El Niño.

This document is divided into five sections. This introduction briefly describes the context and introduces electricity market risk management. The second part reviews the literature related to the Colombian electricity market, allocation strategies used to create optimal multi-period energy purchasing portfolios, and methodologies for forecasting electricity periods. The third section describes the methodology used to solve the problem. It contains our power exchange price model that includes weather variables and contracts, which can be used to find retailers’ margins. It is followed by the formulation of multi-period portfolios using the two most common allocation strategies. Finally, the relevant results and conclusions of the investigation are analyzed.

4. Results and Discussion

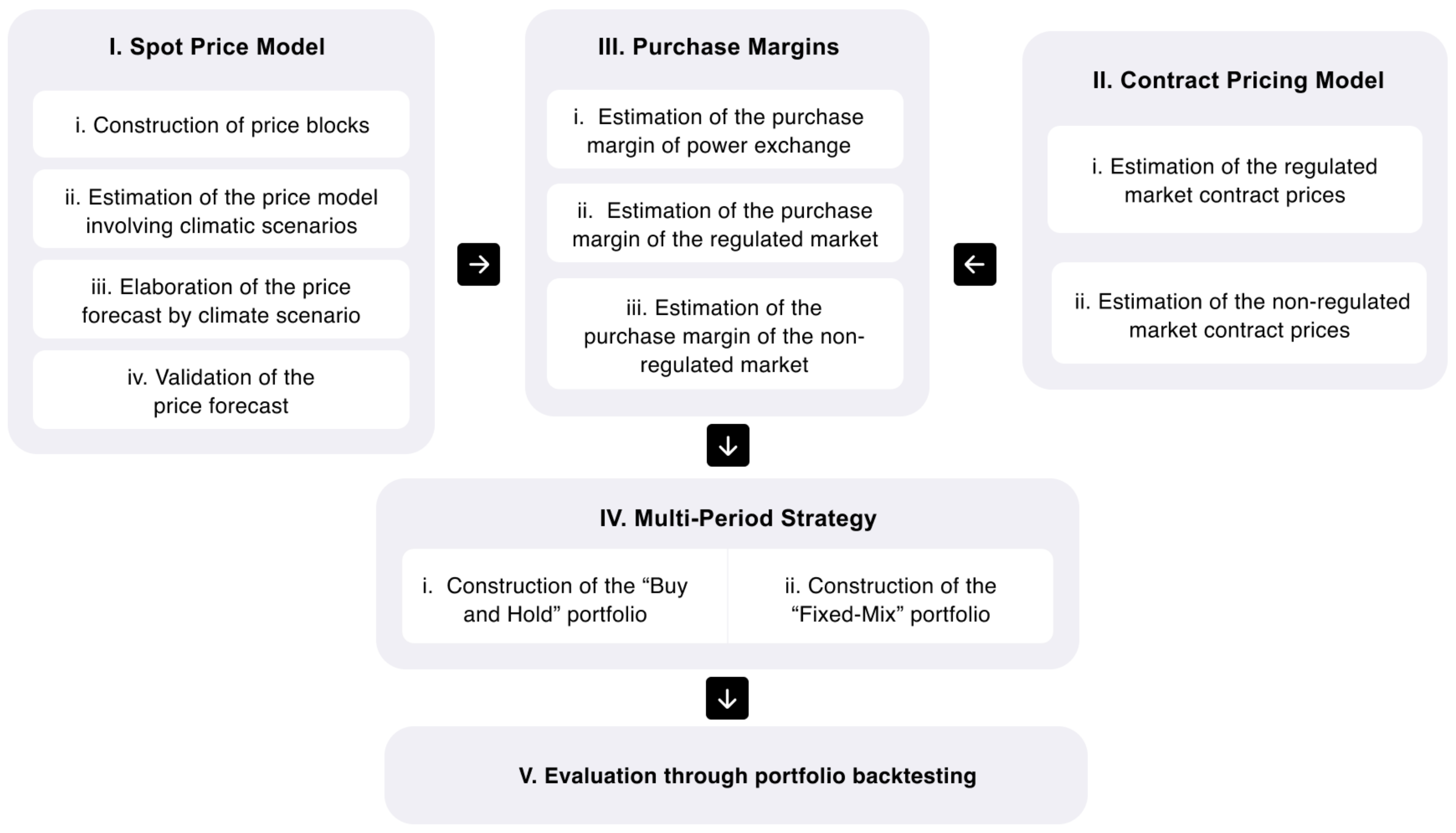

In this section we present results from the pricing models for various purchasing strategies and from the allocation strategies used for the mean-variance portfolios.

- I.

Spot price model

- i.

Construction of price blocks

Using the cluster analysis technique, we confirmed the four hourly blocks proposed in Contreras & Rodríguez [

47]: Block 1 (0–7 h), Block 2 (8–17 h), Block 3 (18–21 h), and Block 4 (22–23 h). The data were reduced from 35,064 hourly observations to 5844 four-hour observations over the four years of the period.

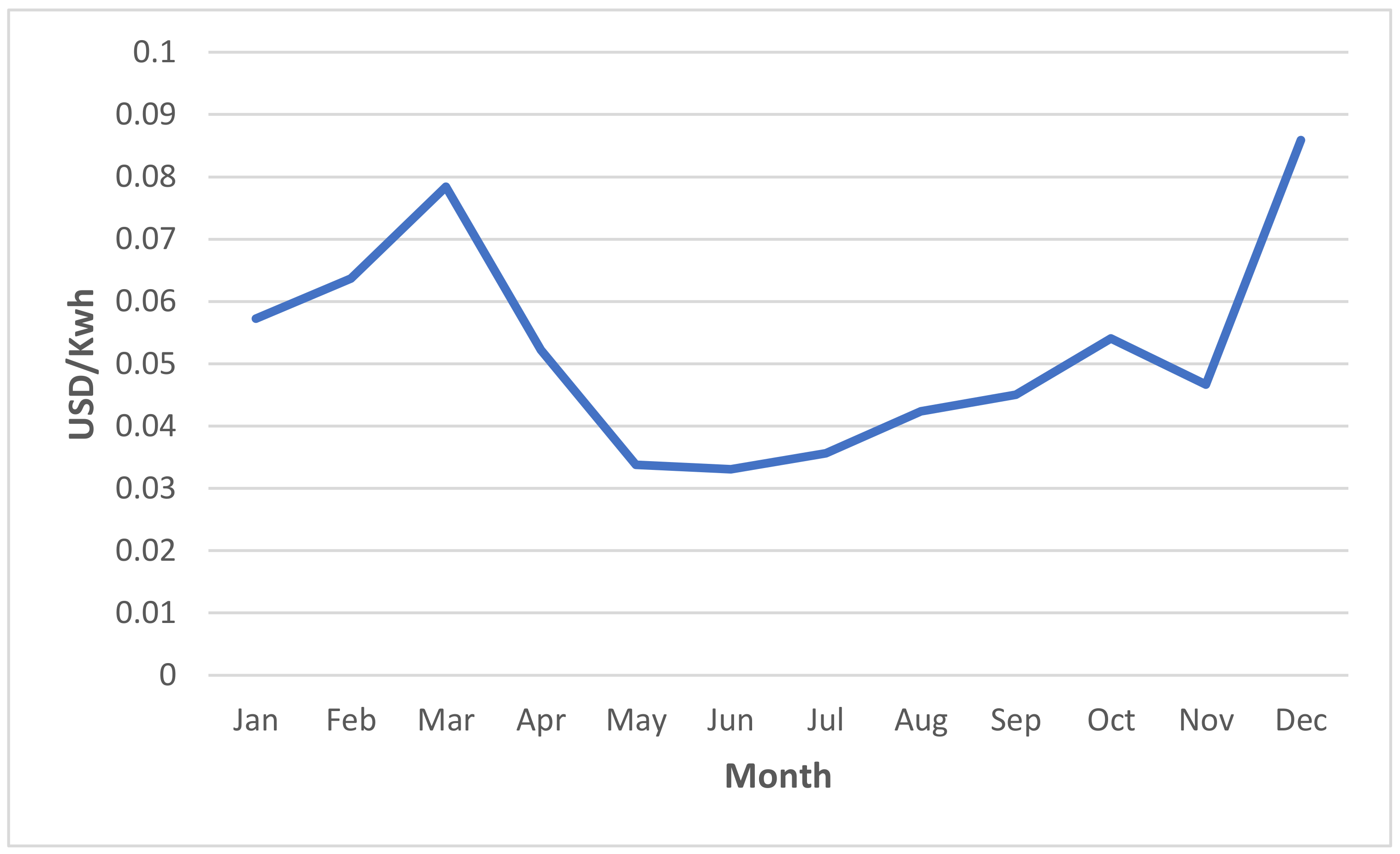

Figure 4 shows the average monthly behavior of energy prices for 2015 to 2017.

As in the study by Contreras & Rodríguez, the highest prices are in Block 3, and the lowest price peaks are in Block 1. Price peaks occur in March and October, whereas the lowest prices occur in June and July [

47].

- ii.

Estimation of the price model involving climatic scenarios

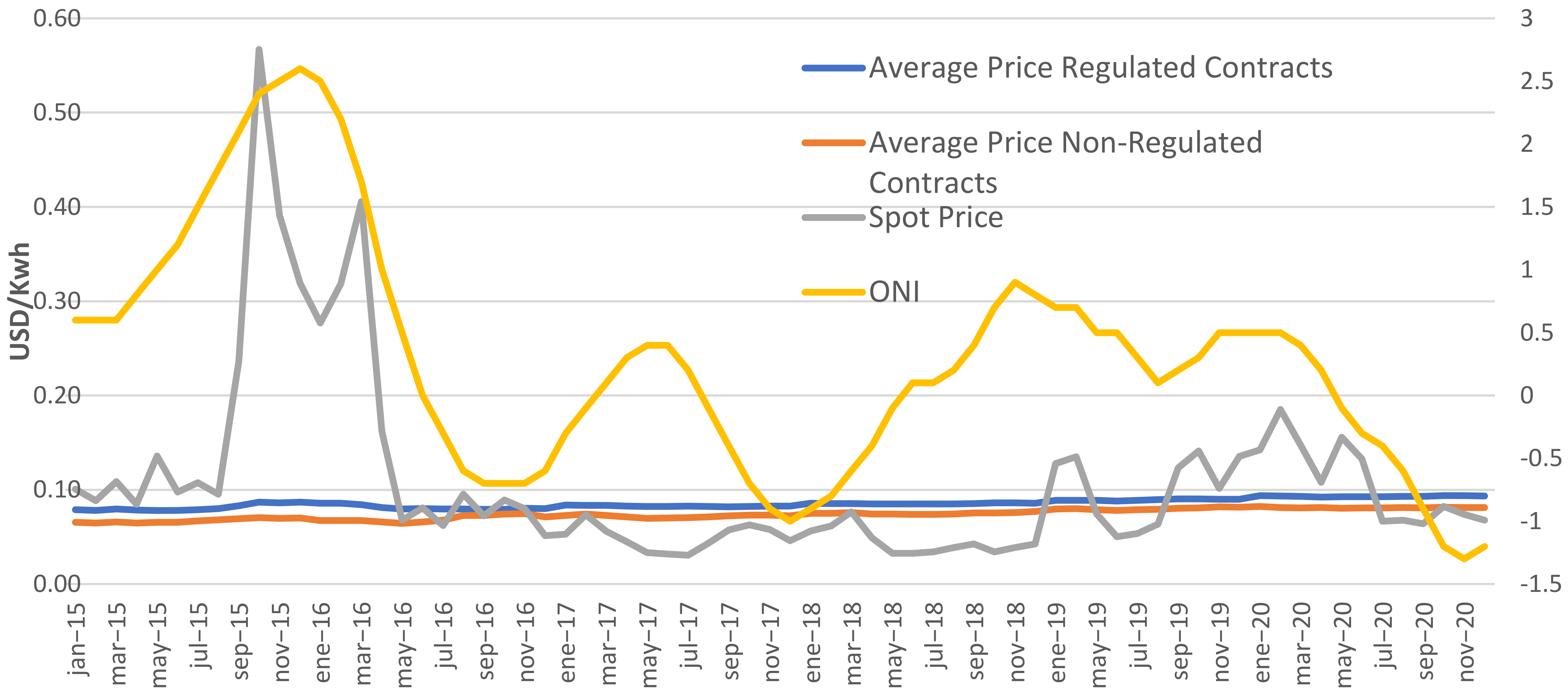

The 2015–2017 period was the basis for our price model. Since CREG has set a trigger price for capping the power exchange of USD 0.36/kWh, all prices higher than this were assumed to be USD 0.36. This period was divided into into seven climatic periods, using the ONI (see

Table 2). These climatic periods were then classified into two weak El Niño periods (January-2015 to June-2015 and April-2016 to May-2016), one strong El Niño period (July-2015 to March-2016), two La Niña periods (August-2016 to December-2016 and October-2017 to December-2017) and two neutral periods (June-2016 to July-2016 and January-2017 to September-2017).

The ARIMA–GARCH method was used to model power exchange prices for each climatic period. Finally, the three models that best fit the data were selected for forecasting prices for each scenario: El Niño (April-2016 to May-2016), La Niña (October-2017 to December-2017), and a neutral period (January-2017 to Septemeber-2017).

Since the price series are not stationary, we applied a logarithmic transformation and took the difference between the logarithm of price at t and the logarithm of price at t-1. The significance of the parameters was verified at the 5% level of each of the estimated models and tests of hypotheses were performed on standardized and squared residuals. Finally, the models were used to forecast of the prices of each of the scenarios for 2018.

Table 3 presents the estimated parameters for the ARIMA–GARCH models chosen for each scenario.

The models for the logarithms of the block prices for each weather scenario were estimated as an ARIMA (3,1,6)–GARCH (1,1) for El Niño, La Niña, and for neutral weather. Auto regressive parameters are represented as in each model. It can be seen that block prices depend on the three previous periods (the previous 24 h). Moving average parameters are represented by which for the La Niña scenario and the neutral weather scenario affect the previous two, four, and six hourly blocks, whereas in the El Niño scenario it only affects the second and sixth hourly blocks.

The variance model showed that using GARCH (1,1) with parameters

,

, and

estimated using the maximum likelihood method would be a good choice. In this case,

is the average value at which certain variations occur,

is the effect of volatility that occurred in the previous period (corresponding to the ARCH term), and

shows the prediction of the variance in the last known historical period. This means that the variance of the logarithm of block prices depends on the variance and the error of a previous period. In each of the estimated models the significance of the parameters was verified at the 5% level and tests of hypotheses on the residuals were performed.

Table 4 presents goodness of fit tests for each climatic scenario.

Five goodness of fit tests were analyzed. The mean absolute percentage error measures the accuracy of the model in terms of the percentage of error. The Theil inequality coefficient lies between 0 and 1. The smaller its value is, the better the forecast is. This test is composed of three proportions: bias, variance, and covariance whose sum is equal to 1. Bias represents a systematic error and variance indicates the ability of the forecasts to replicate the degree of variability. Both two variables are expected to be close to zero. Covariance measures the unsystematic error and is expected to be close to 1. All five tests met expectations: the mean absolute percentage error was lower than 10%, the Theil coefficient, the bias, and the variance were all very close to 0, and the covariance was greater than 0.95%. This confirms that our forecasts fluctuate in the same way as the original series.

- iii.

Elaboration of the price forecast by climate scenario

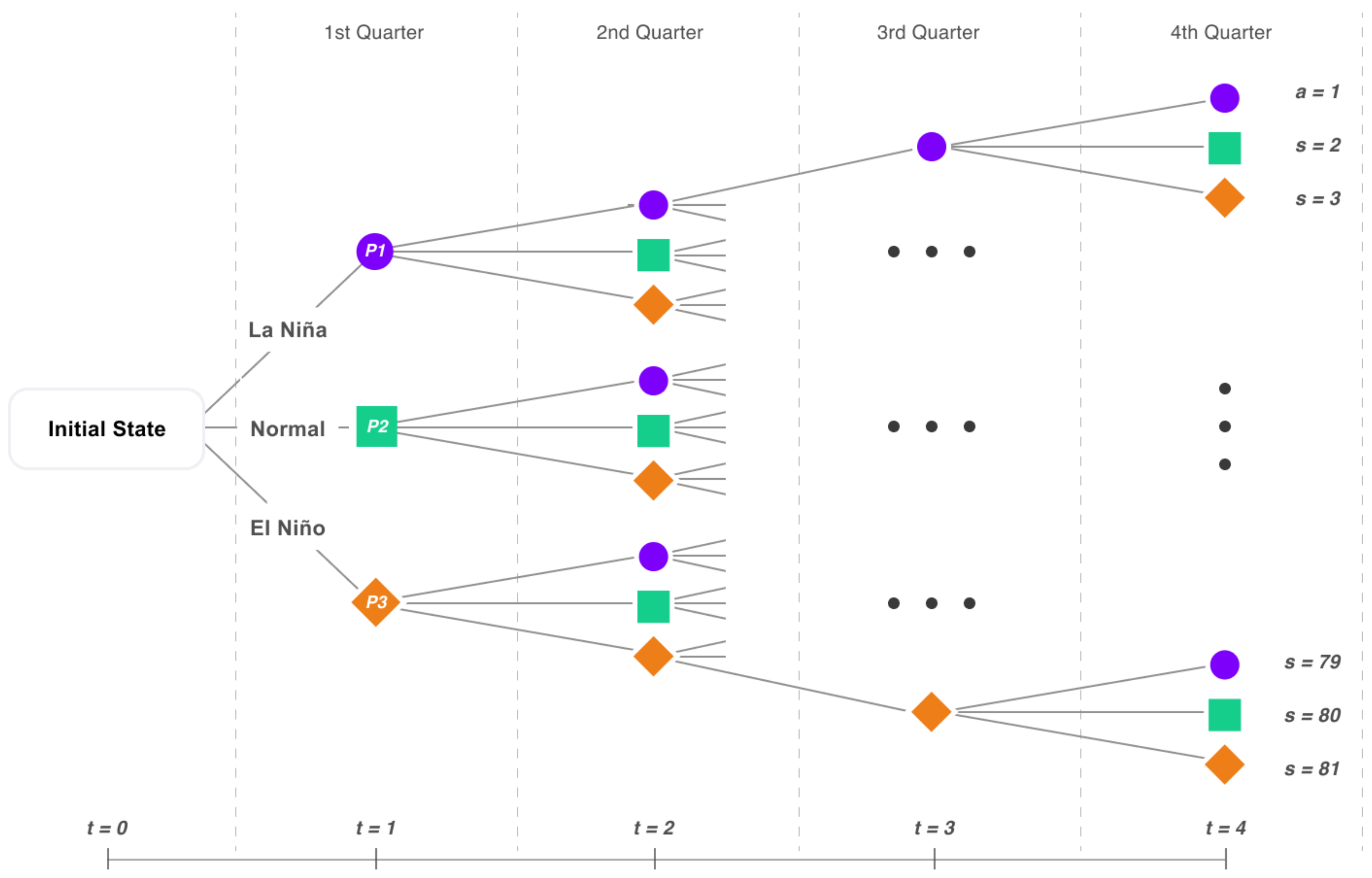

Eighty-one scenarios were constructed using the predictions of the Oceanic Niño Index of the International Institute for Climate and Society Research, and as shown in

Figure 3. Each scenario has its own probability of occurrence. Of these 81 scenarios, the last 27 scenarios represent the first quarter of 2018. In that quarter, El Niño’s probability of occurrence was 0%. On this basis, 54 predicted price series were generated. Then, using the sum-product with the price series and the probability of occurrence of each scenario, we produced the forecast for prices per hourly block for 2018 (

Figure 5).

- iv.

Validation of price forecast

Table 5 presents the monthly average absolute errors of the forecast prices and the real prices for 2018.

The performance of the forecast prices is reasonable because the absolute errors of the year were all less than 15% except for August, for which the error was 15.47%.

- II.

Contract Pricing Model

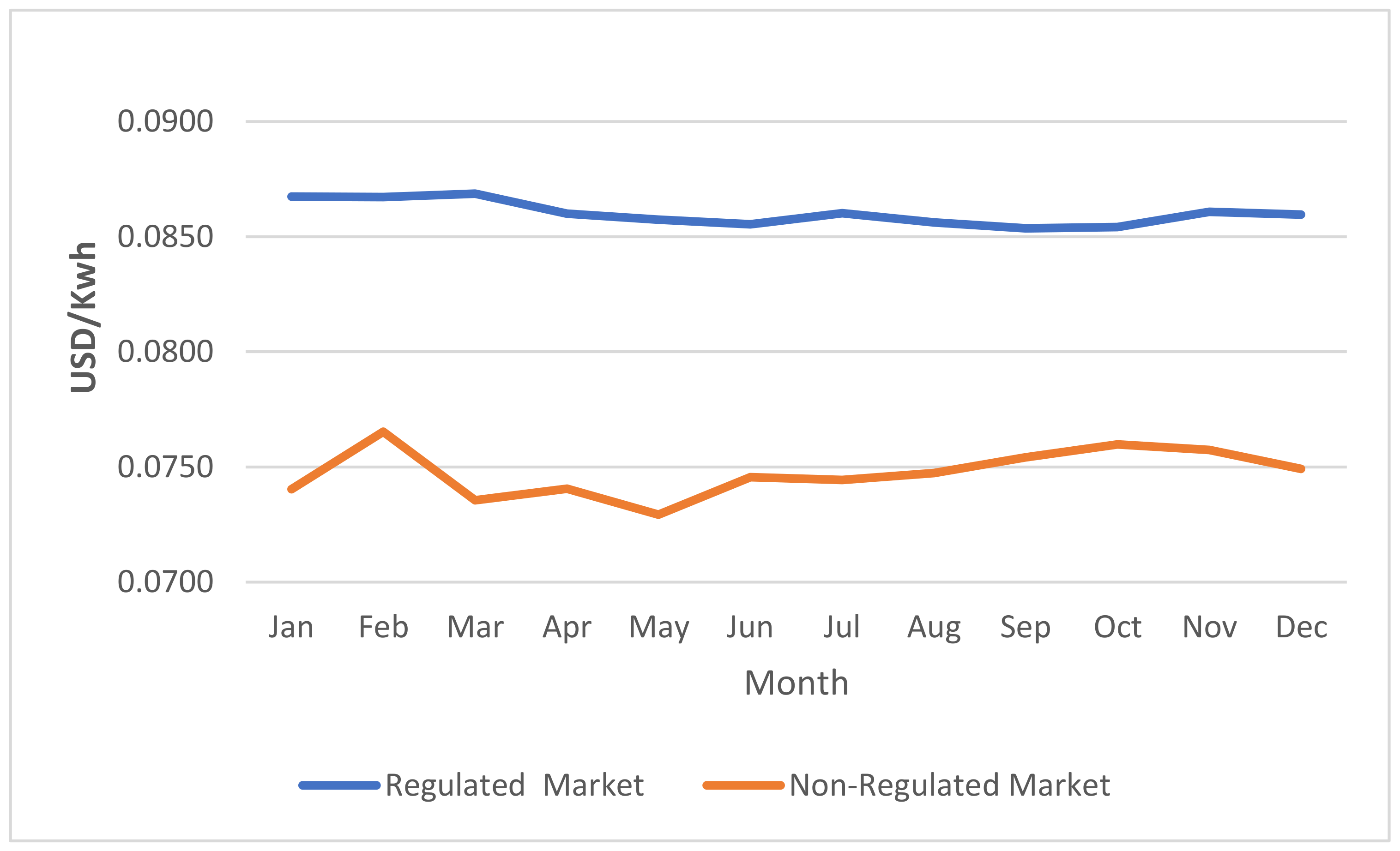

Using complete information on prices of retailers’ purchase and sale contracts from the regulated and non-regulated markets, we found that the 2017 growth rate for purchase prices in the regulated market was 7.48% and the monthly average was 0.62%. In the non-regulated market the 2017 growth rate of purchase prices was 5.53% whereas the monthly average was 0.46% (see

Figure 6).

The 2015–2017 annual growth of regulated market sales prices was 6.32% whereas the monthly average was 0.52%. For the non-regulated market these figures were 2.24% and 0.20%, respectively (see

Figure 7). We forecast the prices of 2018 using these estimated growth rates.

- III.

Purchase Margins

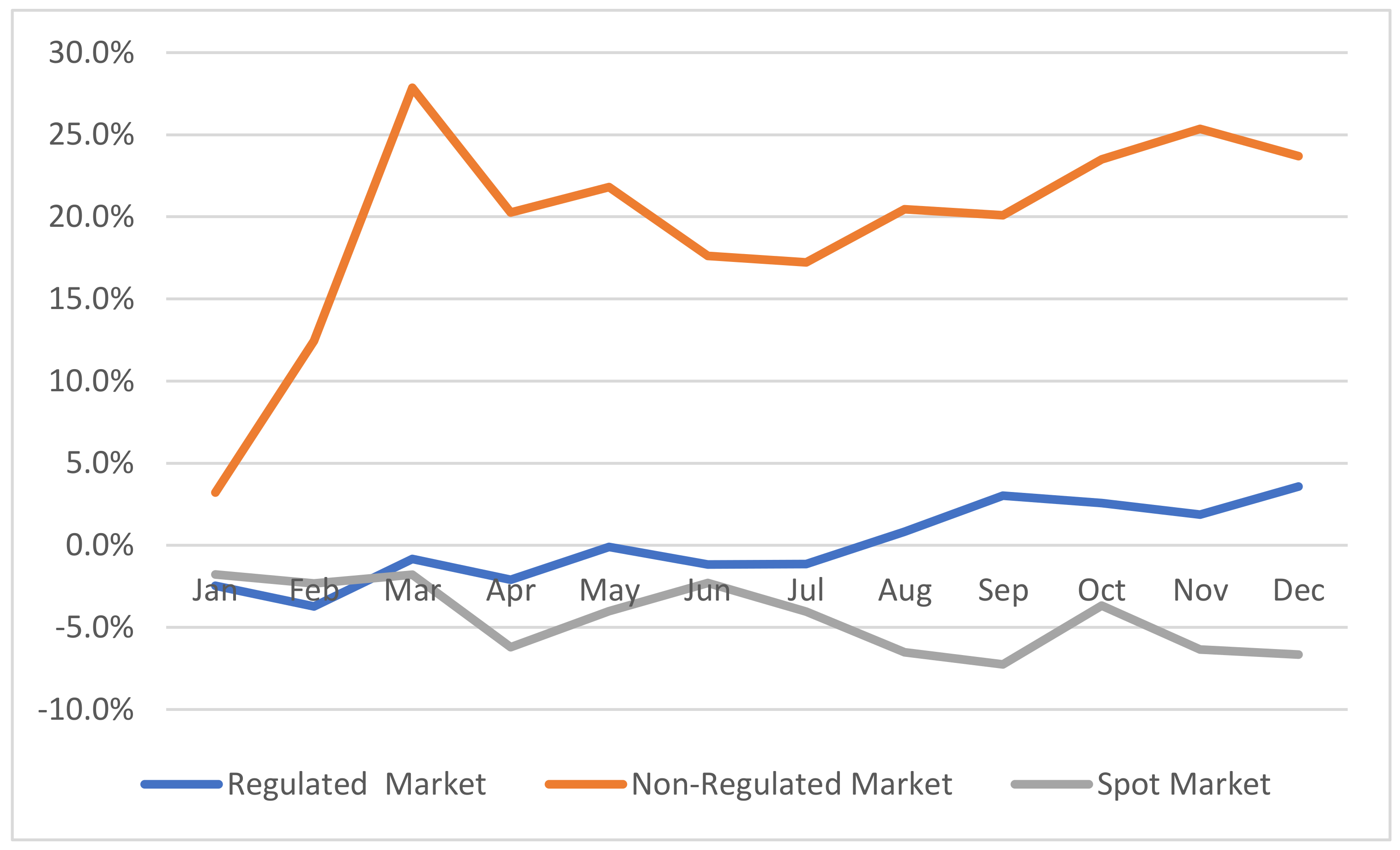

Purchase margins were calculated based on forecast prices for each strategy.

Figure 8 shows estimated purchase margins of 2018 for the three purchasing strategies for retailers operating in the country: energy purchases in the power exchange, non-regulated bilateral contracts, and regulated bilateral contracts.

Volatility was greatest for spot purchases on the power exchange, and the 2018 forecast’s average purchase margin for the power exchange was −4.409% with a standard deviation of 2.090%. Profit margins were highest, on average 19.462% per month, for the non-regulated market, but volatility was also highest here, with a standard deviation of 6.527%. On the other hand, the regulated market’s monthly average margin was just 0.027% with positive margins for some months and negative margins for others. Volatility was very similar to that of the power exchange, with a standard deviation of 2.340%. In general, a retailer can hedge against the risks of spot prices with bilateral contracts, so many retailers prefer to contract in advance for longer periods.

Table 6 presents descriptive statistics for actual and forecast purchase margins.

The highest returns occur in the non-regulated market. As expected, the greatest volatility occurs in the actual purchase margins of the power exchange. Forecast purchase margin behavior is similar to that of actual margins, so these forecasts should be useful for improving retailers’ portfolio decisions.

- IV.

Multi-Period Strategy

We calculated weights for each purchase strategy to compare results for actual and forecast data from 2018. We used the mean-variance portfolio and two multi-period portfolio models: “Buy and Hold” and “Fixed-Mix”.

- i.

Estimation of the “Buy and Hold” portfolio

We used the mean-variance model for both predicted average purchase margins and actual average purchase margins for 2018 for allocation of portfolios in the “Buy and Hold” strategy.

Table 7 presents 11 points that correspond to an efficient portfolio on the Markowitz efficient frontier for the forecast margins. Each of the portfolios is evaluated using both margins and the matrix of variance and covariance to obtain the risk and the real margins.

We can see that in this strategy the expected purchase margins are very close to the purchase margins that would have been caused by those decisions.

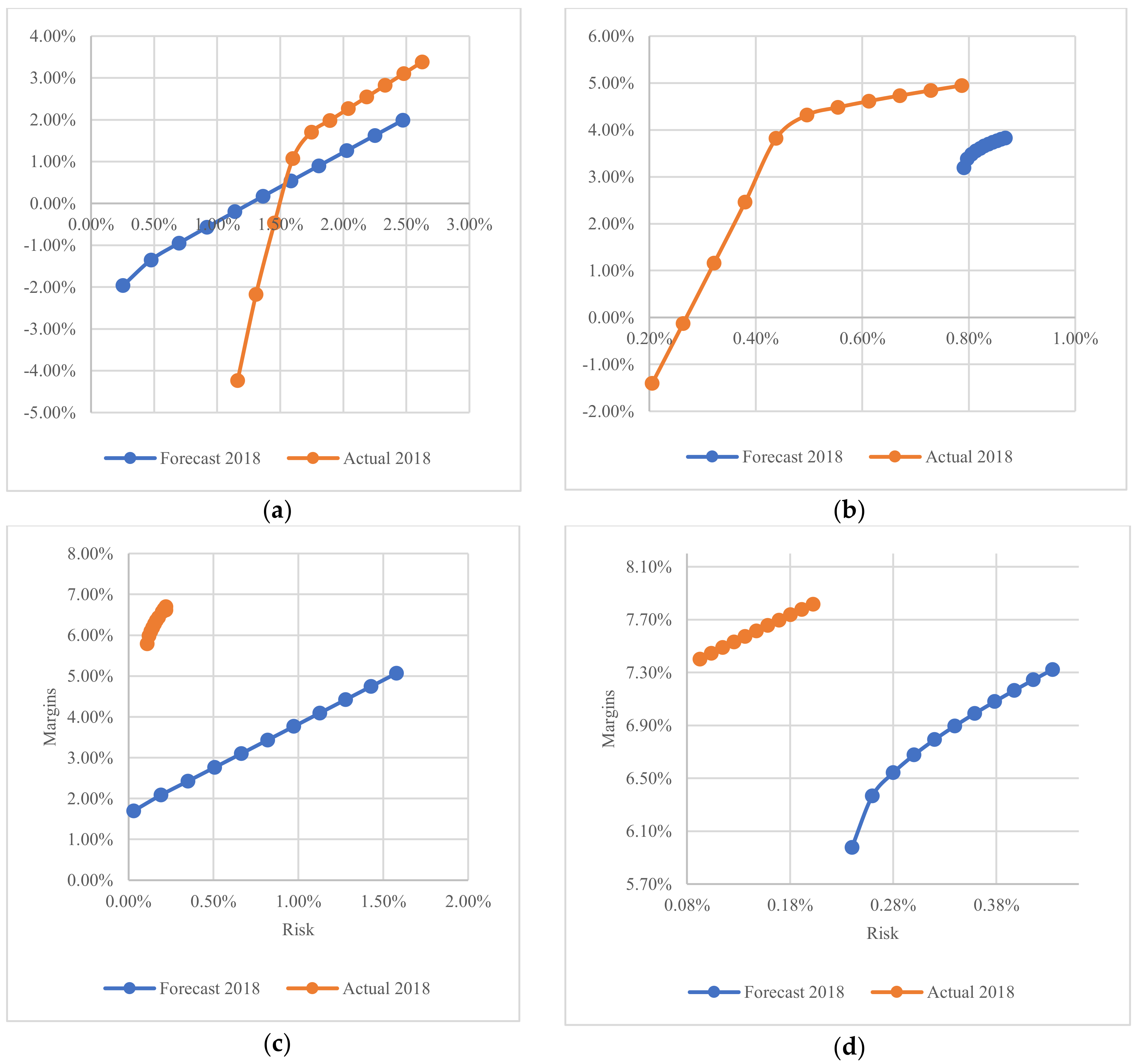

Figure 9 presents efficient frontiers for the actual and forecast data from 2018. The average purchase margins and the risk for the efficient frontier of the actual data were compared with the real information for 2018. Each of the portfolios obtained with the forecast data was evaluated.

The results show that the most efficient portfolios are those that allow margins over 3% while also maintaining relatively low levels of risk. Portfolios including more than 50% of purchases on the power exchange have actual risks that are much higher than expected.

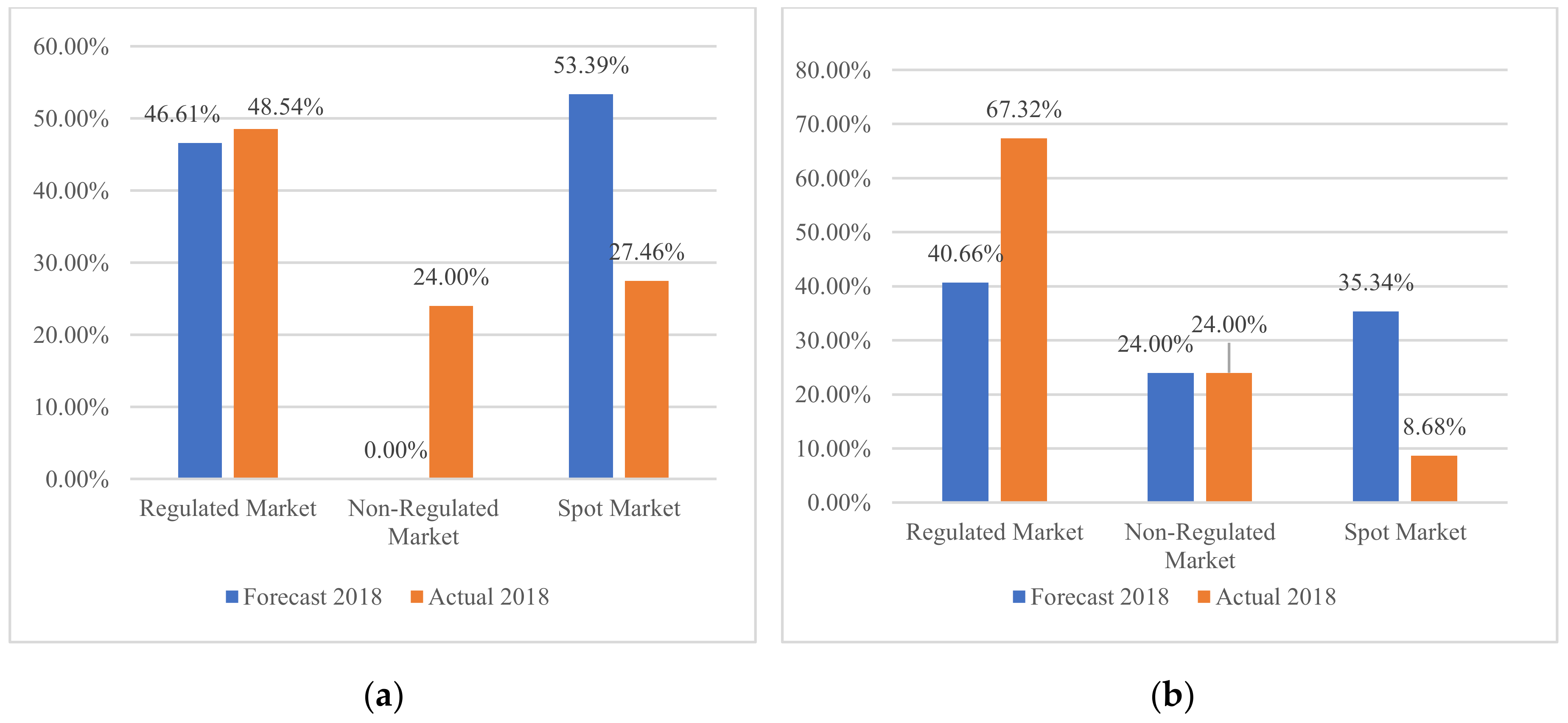

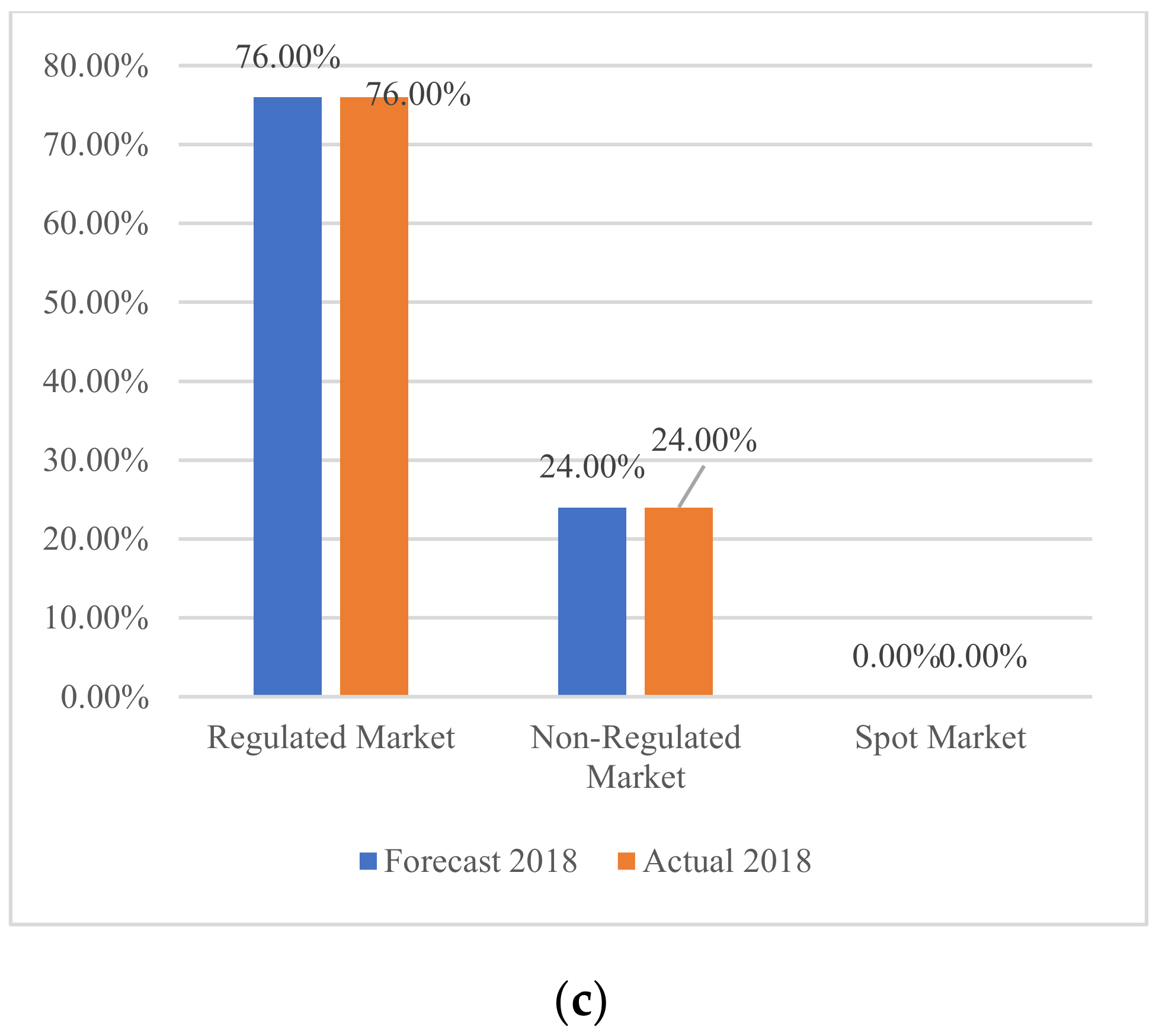

To contrast the retailers’ various possible decisions,

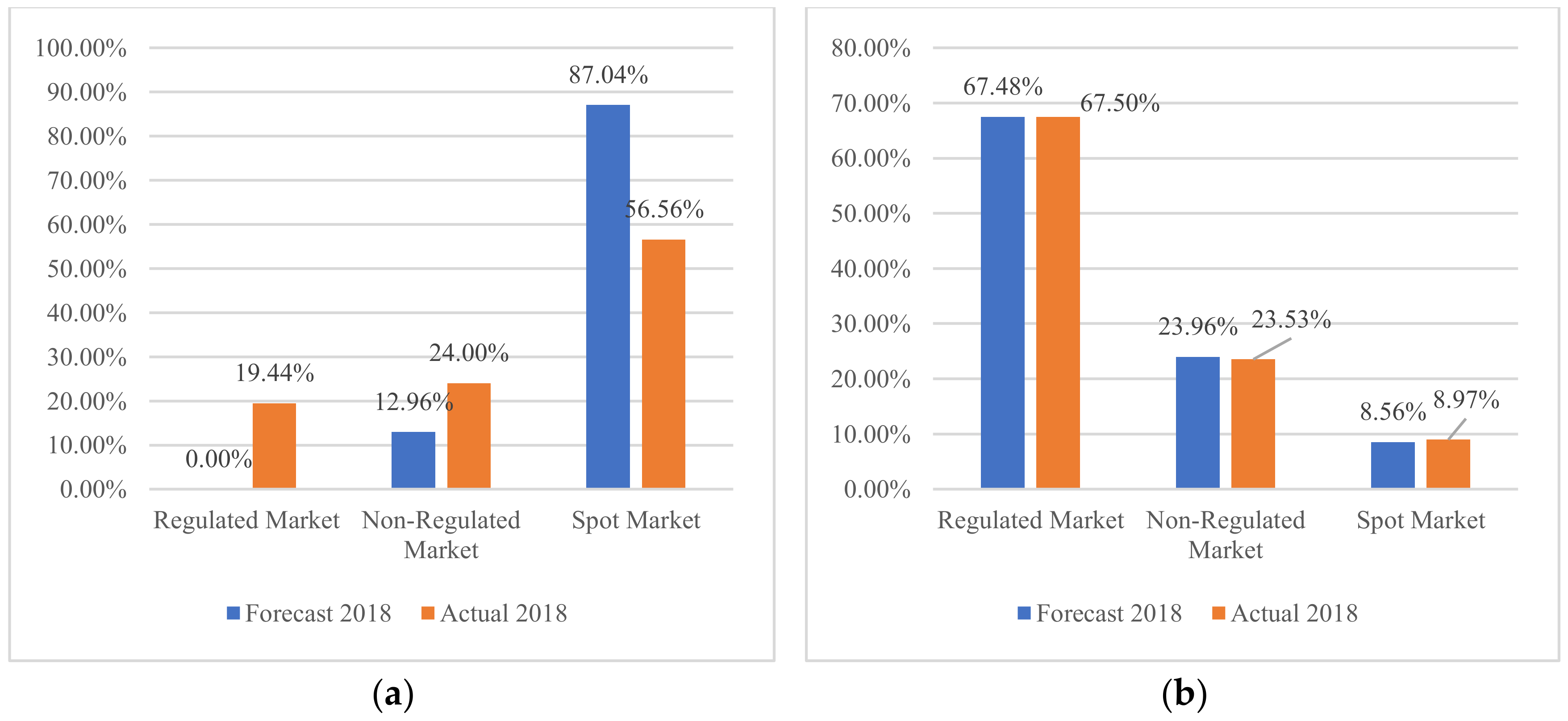

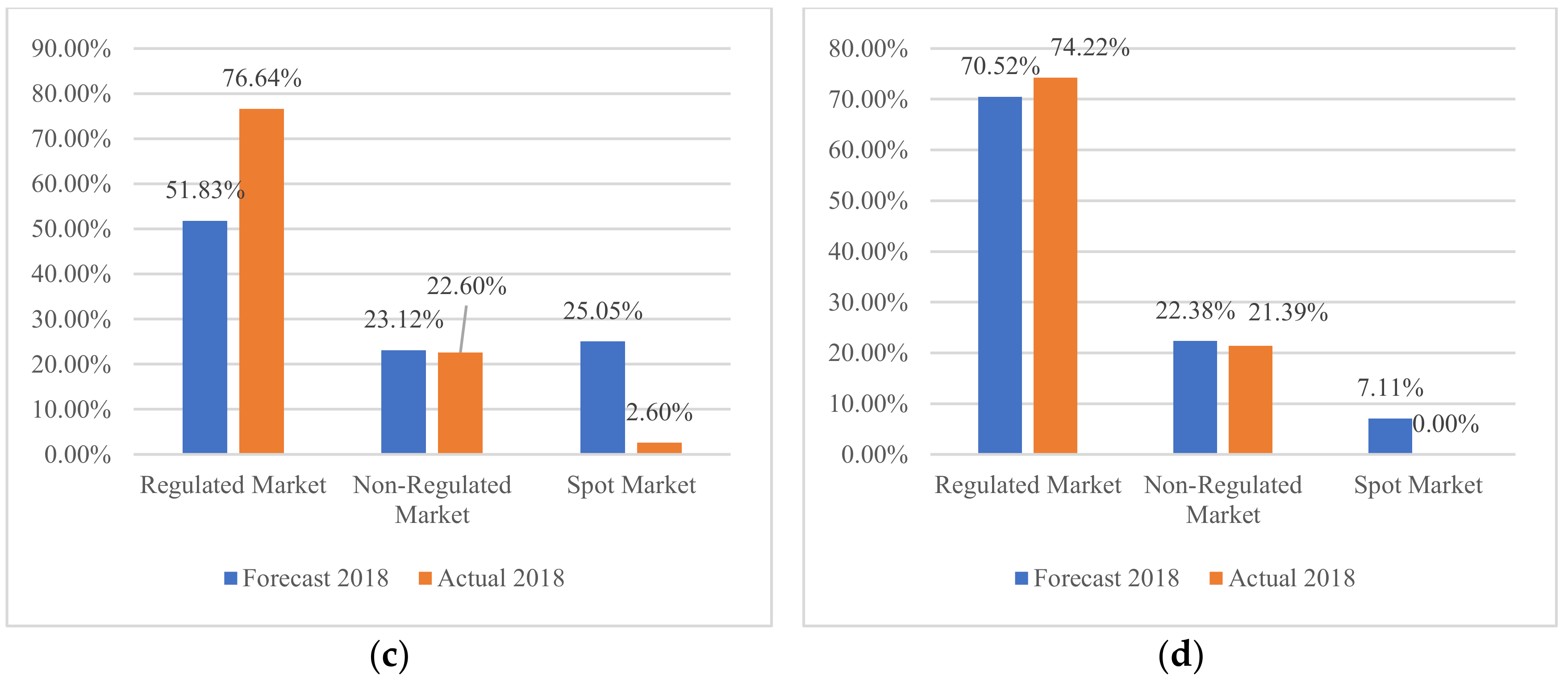

Figure 10 presents the portfolio weights of purchases in the three markets in the minimum-, maximum-, and medium-risk portfolios. It compares the predicted data against the complete real information.

The result shows that at any point on the efficient frontier with the actual data of 2018, the portfolios will be allocated with maximum purchases of 24% in the non-regulated market. This will generate returns of 3.5% in the minimum-risk portfolio, 4.91% in the medium-risk portfolio and 5.6% in the maximum-risk portfolio. At both frontiers, the greatest risk is derived from portfolios with high proportions of purchases in the power exchange.

- ii.

Estimation of the “Fixed-Mix” portfolio

The same purchase margin data was used for each “Fixed-Mix” portfolio purchase strategy as in the previous portfolios, but this model allows rebalancing every three months based on new information in an effort towards optimization.

Table 8 presents descriptive statistics for forecast and actual purchase margins for the power exchange for each quarter.

This strategy has much greater variation between forecast data and actual data than the purchase of energy through bilateral contracts. It seems that the forecast data is more stable than the actual data since the forecast data has lower losses and lower variance in each quarter with respect to returns. Nevertheless, there are still commonalities such as the fact that the minimum average return and the highest variance of returns in both forecast and actual data occur in the third quarter. Furthermore, the signs of bias are consistent in both data sets. Due to rebalancing of weights every period in the “Fixed-Mix” model, an efficient frontier is created in each period, as can be seen in

Figure 11.

In this figure, the frontier formed by predicted data is compared with the results obtained (margin and risk) from the portfolios created with the actual data for 2018. As in the “Buy and Hold” model, portfolios that allow optimization of retailers’ purchase margins are generally those in which when the risk raises the midpoint, given that portfolios obtain much more risk than expected for lower values.

Table 9 presents the weights and expected purchase margins and standard deviations of the three portfolios for each quarter. It shows the weights for each purchasing strategy, the risks and purchase margins for the forecast data, and the margins that a retailer could obtain by evaluating portfolios formed with the actual 2018 data.

As can be observed, higher risk corresponds to a higher percentage of purchases in the power exchange which accords with the logic that this market is more volatile. To obtain higher returns without such recourse to the power exchange, retailers need to allocate the maximum weight available to bilateral contracts in the non-regulated market. However, in the first quarter something contradictory happens, because the minimum risk portfolio places the greatest weight in the power exchange. This can be explained by the fact that this quarter’s climatic scenario has the highest probability of La Niña (see

Table 1) which is reflected in the lowest volatility of the spot price in that quarter (see

Table 6).

These results also confirm the observation in

Figure 11 that margins obtained with the actual data are closer to the margins obtained by medium- and higher-risk portfolios. Medium-risk portfolios with more moderate attitudes allow greater diversification of strategies. As a result, the forecast portfolios perform better. Using the forecast data, a purchase margin of −1.14% would have been obtained in the first quarter, whereas with the actual data, 1.98% would have been obtained given that the loss in the power exchange would have been greater than expected. For the second quarter, the composition of the portfolios is very similar; margins of 4.34% would have been obtained with forecast data, higher than the 4.23% that would be obtained with portfolio formation based on the actual 2018 data. With complete information, the third quarter purchase margin obtained would be 5.99% whereas the fourth quarter margin would be 6.79%. With the forecast data, the final result for these quarters would have been 3.29% and 5.35%, respectively, because these portfolios give greater weight to the power-exchange-limiting margins, while allowing a more balanced portfolio.

It is important to recognize that this analysis allows the use of more information between periods than the “Buy and Hold” strategy. Since the volatility of power exchange prices varies greatly between periods, this strategy can provide benefits.

Figure 12 compares portfolios based on forecast data and those based on 2018 actual data.

A comparison of the weighting of portfolios created with forecast information and those created with actual information for each quarter of 2018 shows great similarities in every quarter except for the first quarter. Although in the minimum-risk portfolio we would have 100% for the power exchange with actual and forecast data, the maximum-risk portfolio based on the actual data is more like all the maximum-risk portfolios where the weights are distributed more evenly with purchases in the market for bilateral contracts and with the maximum participation possible in the non-regulated market. The results show that exceeding overall medium risk allows a portfolio to maximize margins for that portfolio’s minimum risk purchases which cannot be achieved with an overall lower portfolio risk.

- V.

Portfolio Performance Evaluation

The performance of each portfolio was evaluated using the backtesting method. First, we evaluated the results obtained with the actual data for 2018 for all three portfolios in both of the two strategies.

Table 10 shows the purchase margins that would have been obtained in each month of 2018.

Results for the “Fixed-Mix” strategy are better even for the minimum-risk portfolio that also has the smallest margin. It is certain that a strategy that allows making changes over time can better take into account volatility in the power exchange and margins that vary from one period to another in a way that can generate losses if not taken into account. Considering price changes due to changing weather patterns can clearly improve risk-management decision-making.

- VI.

Portfolio evaluation through backtesting

Table 11 presents the four criteria that were used to evaluate how a portfolio would have performed to help retailers make the best decisions.

Analyses of the different criteria show that for portfolios with minimum risk, the “Fixed-Mix” strategy outperforms “Buy and Hold” in all the three portfolio evaluation ratios which indicates that these portfolios receive greater returns relative to the expected level of risk. Although this strategy also has a higher maximum drawdown for the minimum-risk portfolio than the “Buy and Hold” strategy for the same portfolio, the “Fixed-Mix” strategy is still preferred.

The Sharpe and Omega ratios indicate that the “Buy and Hold” strategy is better for the medium-risk portfolio given that it has a higher return for each unit of risk and that the probability of positive margins is much higher than the probability of negative months, but the maximum drawdown and the Sterling ratio indicate that the “Fixed-Mix” strategy is best. For our case it is also important to note that the annual volatility in the “Buy and Hold” strategy is not quite half the volatility in the “Fixed-Mix” portfolio without any penalty in the annual margins. Although the “Buy and Hold” portfolio had a maximum drawdown of 0.029, this number is quite close to the 0.022 of the “Fixed-Mix” portfolio. Even though both have similar annual margins, the “Buy and Hold” strategy is advisable if a moderate risk is expected since its volatility is far less than that of the “Fixed-Mix” portfolio, and the probability of positive margins is much higher than for any other strategy.

Finally, we can ensure that the maximum-risk portfolio’s performance improves using a “Fixed-Mix” strategy with respect to the risk taken by using the “Buy and Hold” strategy since it allows a greater margin at lower annual volatility. This is true even though the maximum drawdowns of the two strategies are the same size as the three high-performing ratios for the “Buy and Hold” portfolio, indicating that the portfolio will receive greater returns per unit of risk.