Servitization of Energy Sector: Emerging Service Business Models and Startup’s Participation

Abstract

:1. Introduction

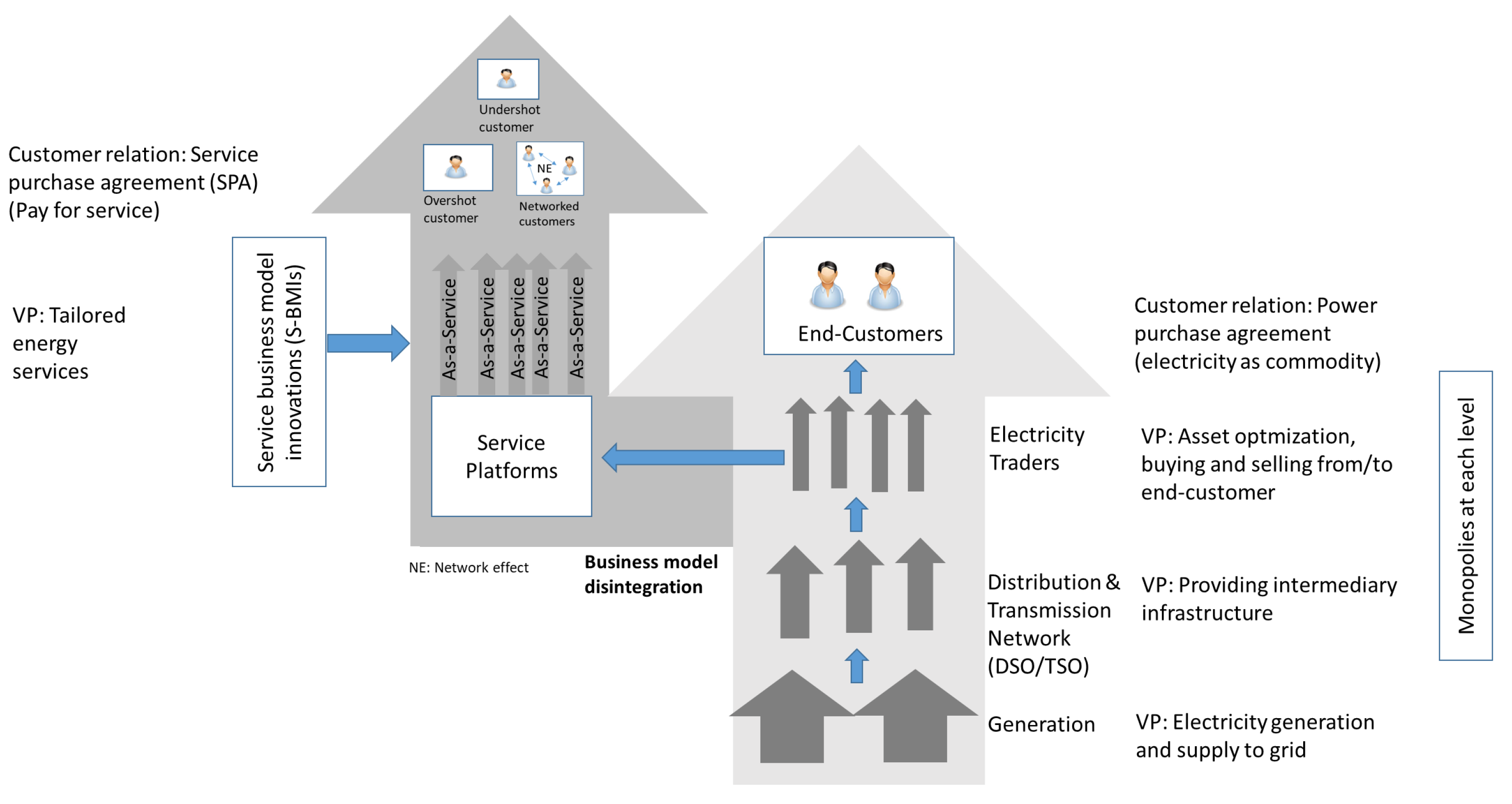

- Value capture: What role do energy startups play in service business model innovations and how do energy services capture value by disintegrating the value chain in the energy sector?

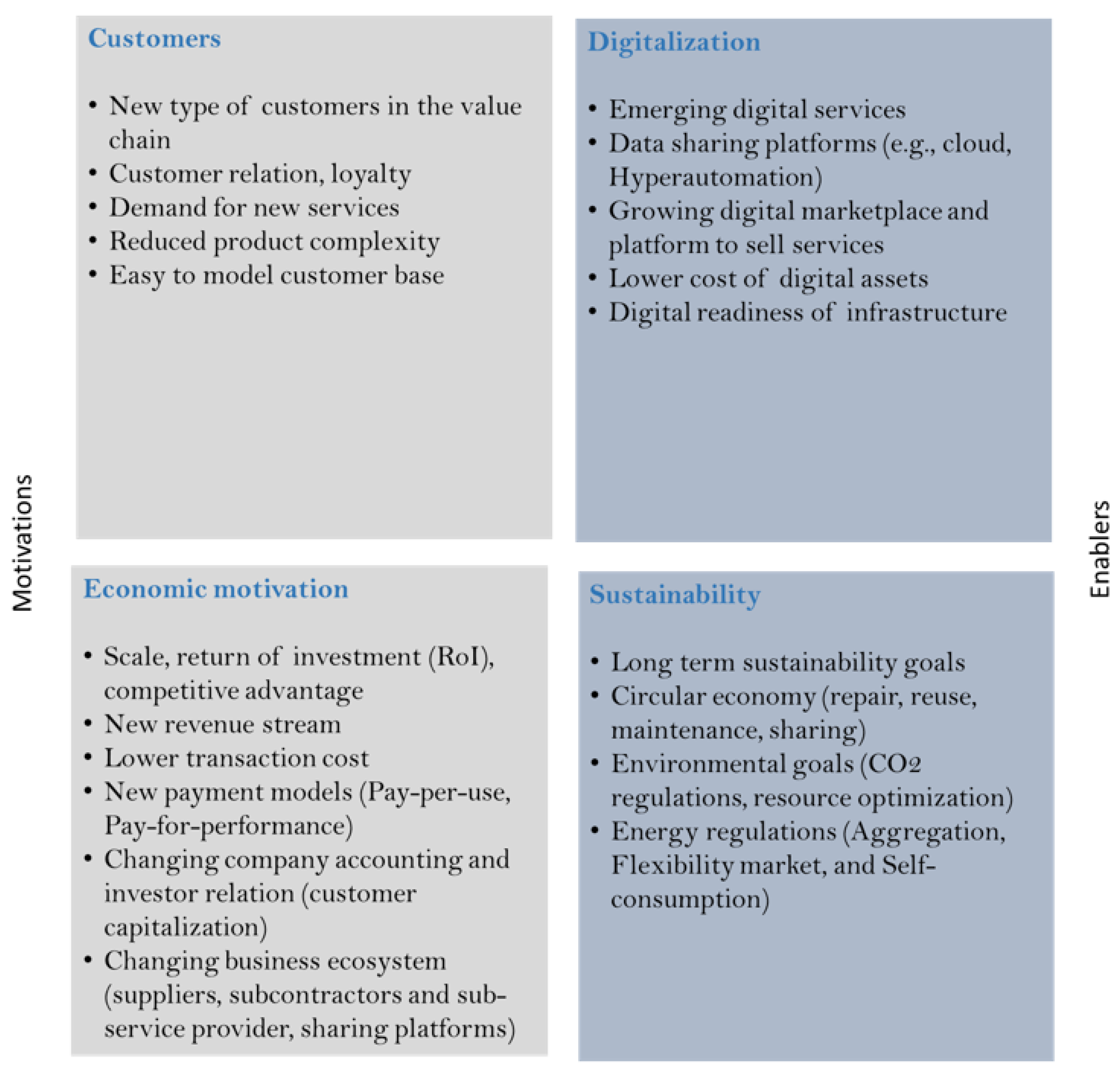

- Service motivation: What kind of service business model innovations do energy startups bring? Which factors are encouraging energy companies to develop and use service-based business models?

- Success factors: How to measure the success of service-based business models (financial performance, funding and investment indicators for startups practicing service business models)?

- First, it provides a comprehensive overview of the business models of incipient services active in the energy sector. It also provides an analysis of the motivation and enablers for energy services.

- Second, the proposed methodology analyzes and compares various service business models by putting startups at the focal point of discussion.

2. State of Research and Motivation

3. Value Chain Disintegration in Energy Sector

- Undershot customers: Customers who are not satisfied with the existing energy-related services and can afford to pay for either new or improved services [27]. The limited features of existing services is the main pain point for undershoot customers. Customers use their services, but with a great expectation of future improvements. A classic example of this is when customers continue to use conventional heating or cooling systems, but are willing to pay for remotely programmable services for better control over their desired comfort level.

- Overshot customers: A group of customers who find the current services are not useful and prefer to pay for certain features of service [28]. For instance, customers might not be interested in having smart home services but prefer to use services related to indoor thermal comfort management (e.g., heating and comfort-as-a-service). The premium for services encourages such customers to look for customized and inexpensive service solutions. Overshot customers allow a low-end disruption of the value chain.

- Network customers: Customers are connected through a network effect (NE) and enjoy positive network externality (P-NE) of certain services. The value of the network increases in proportion to the number of users. As an example, EV users using charging-as-a-service benefit from the charging network offered by the charging infrastructure owner [29,30].

4. Motivation and Enablers for Servitization

4.1. Service Business Models in Energy Sector

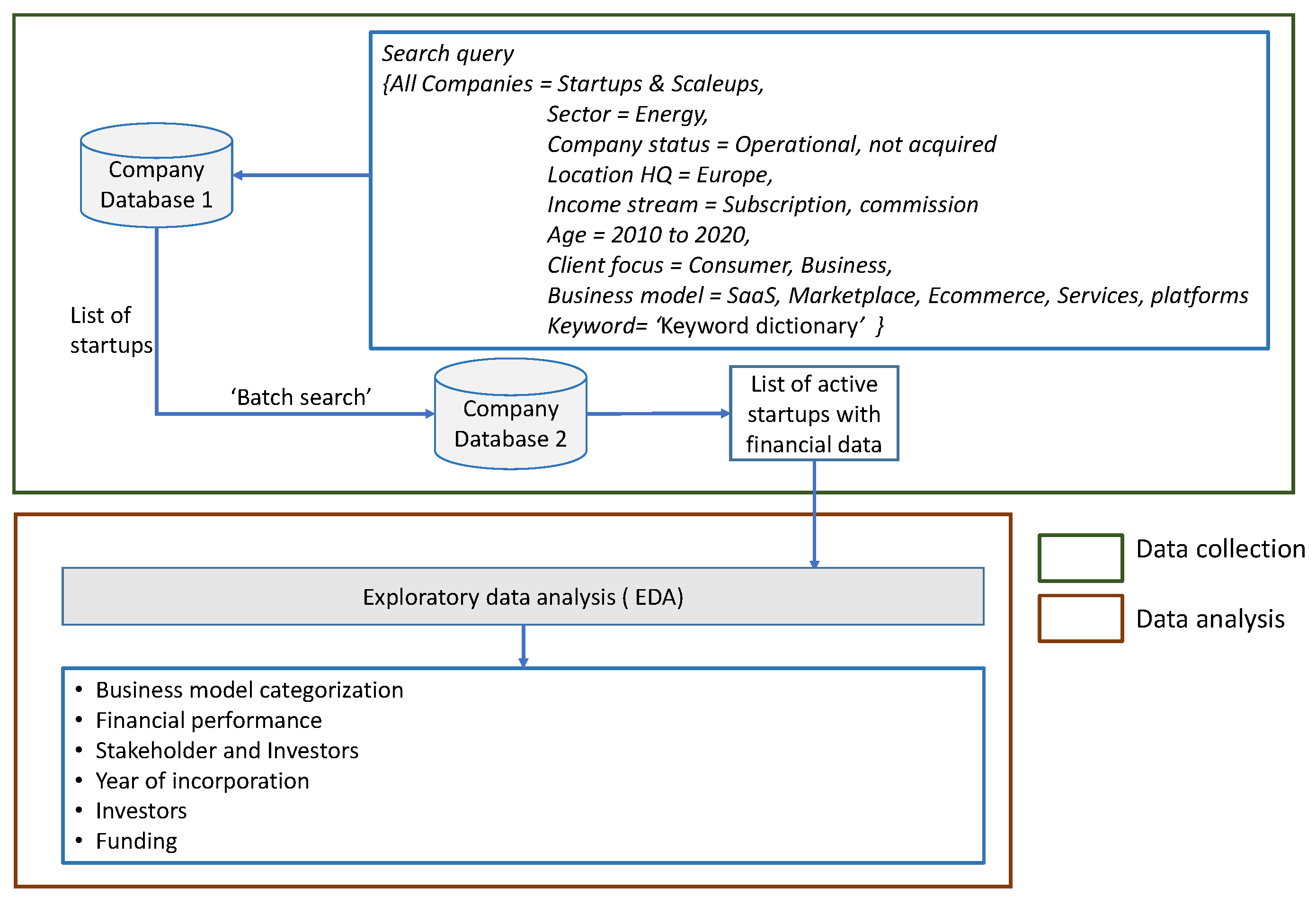

5. Data and Methodology

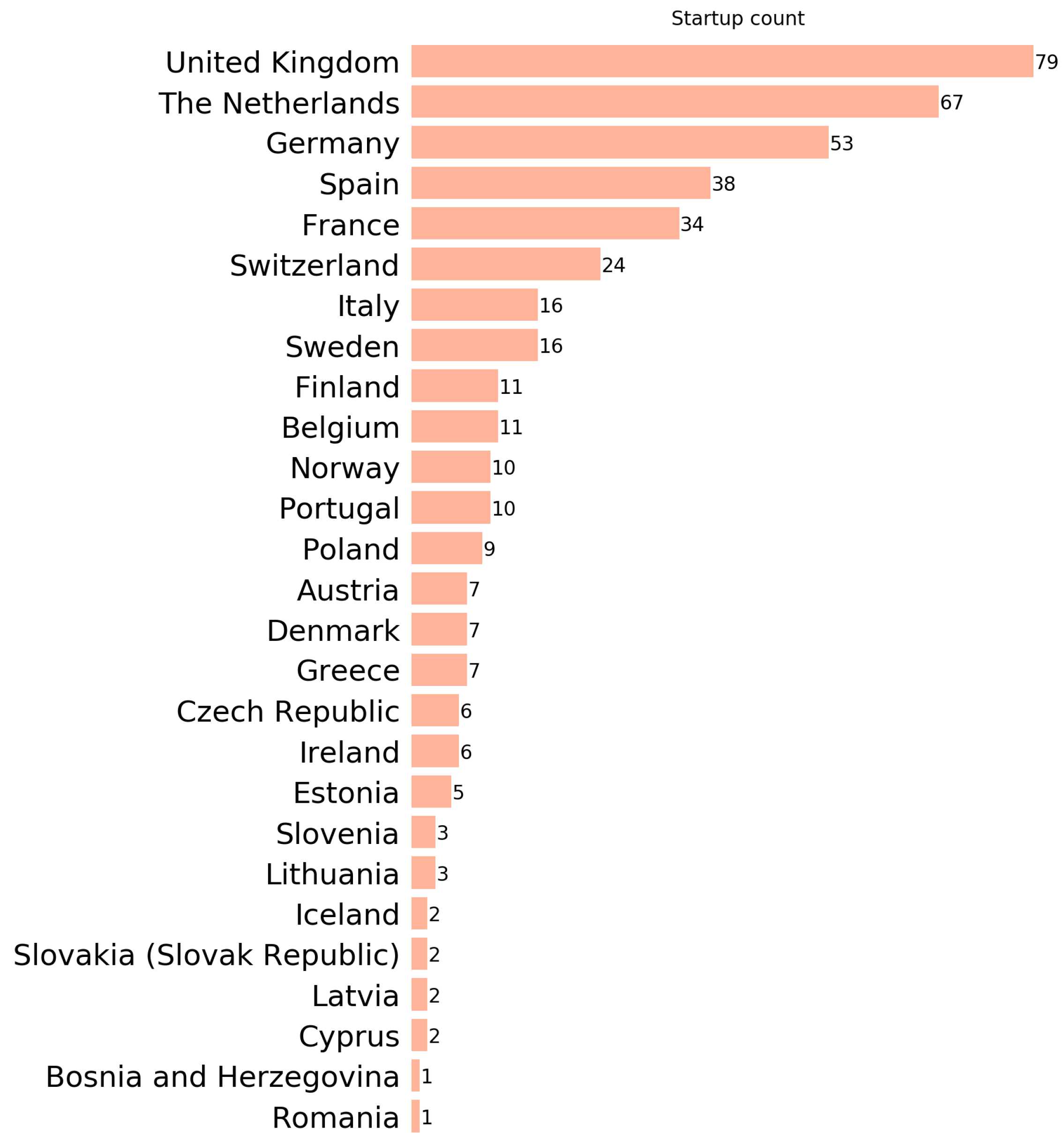

5.1. Data

5.2. Methodology

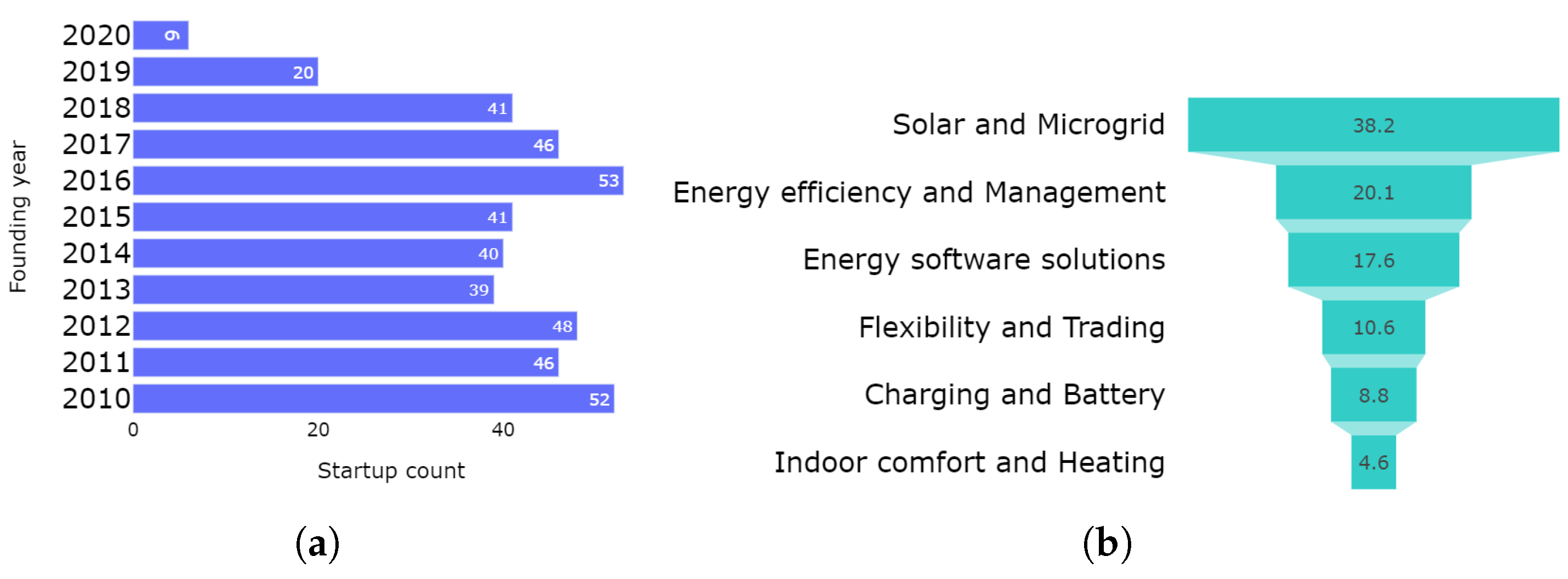

6. Results

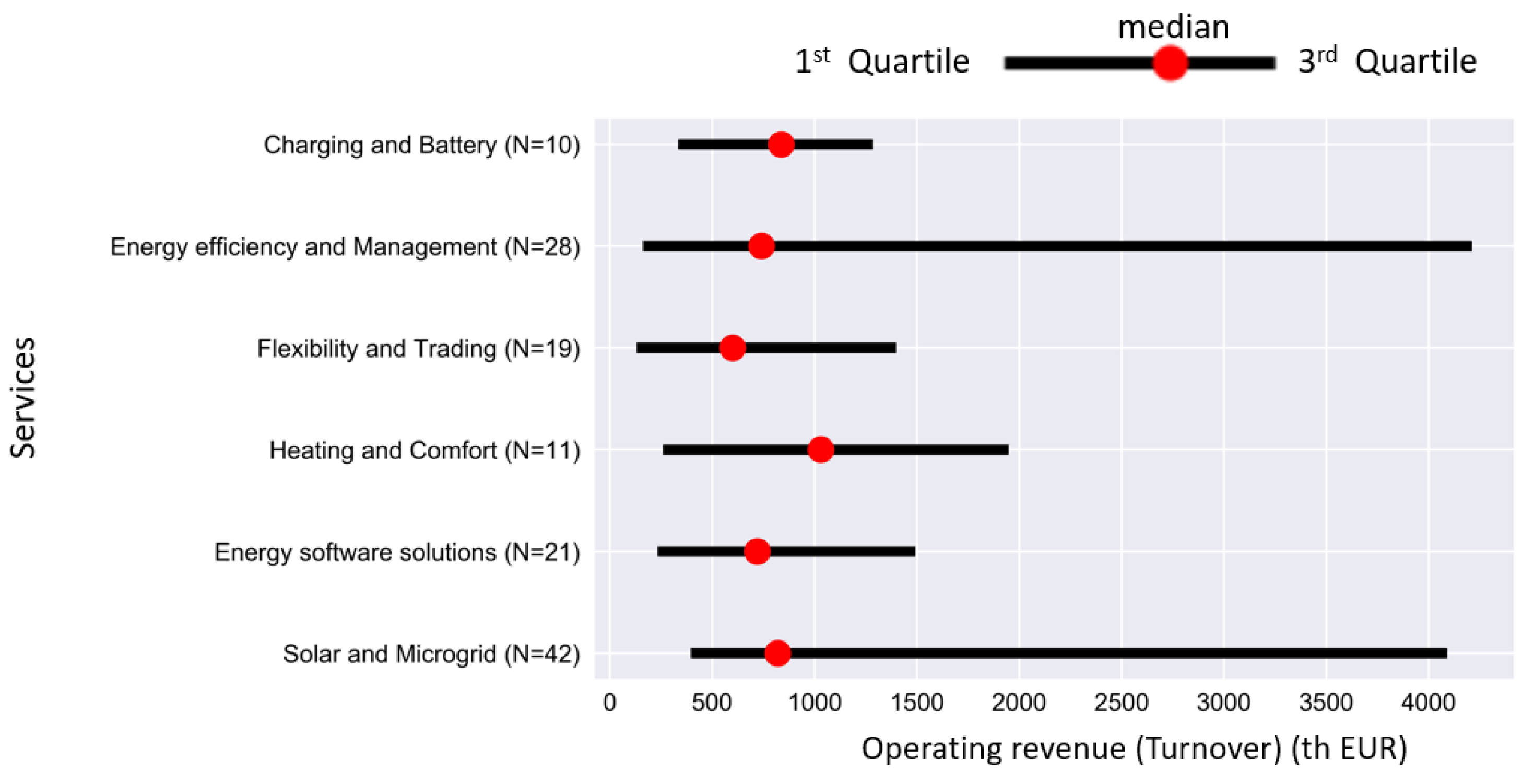

6.1. Financial Performance: Operating Revenue

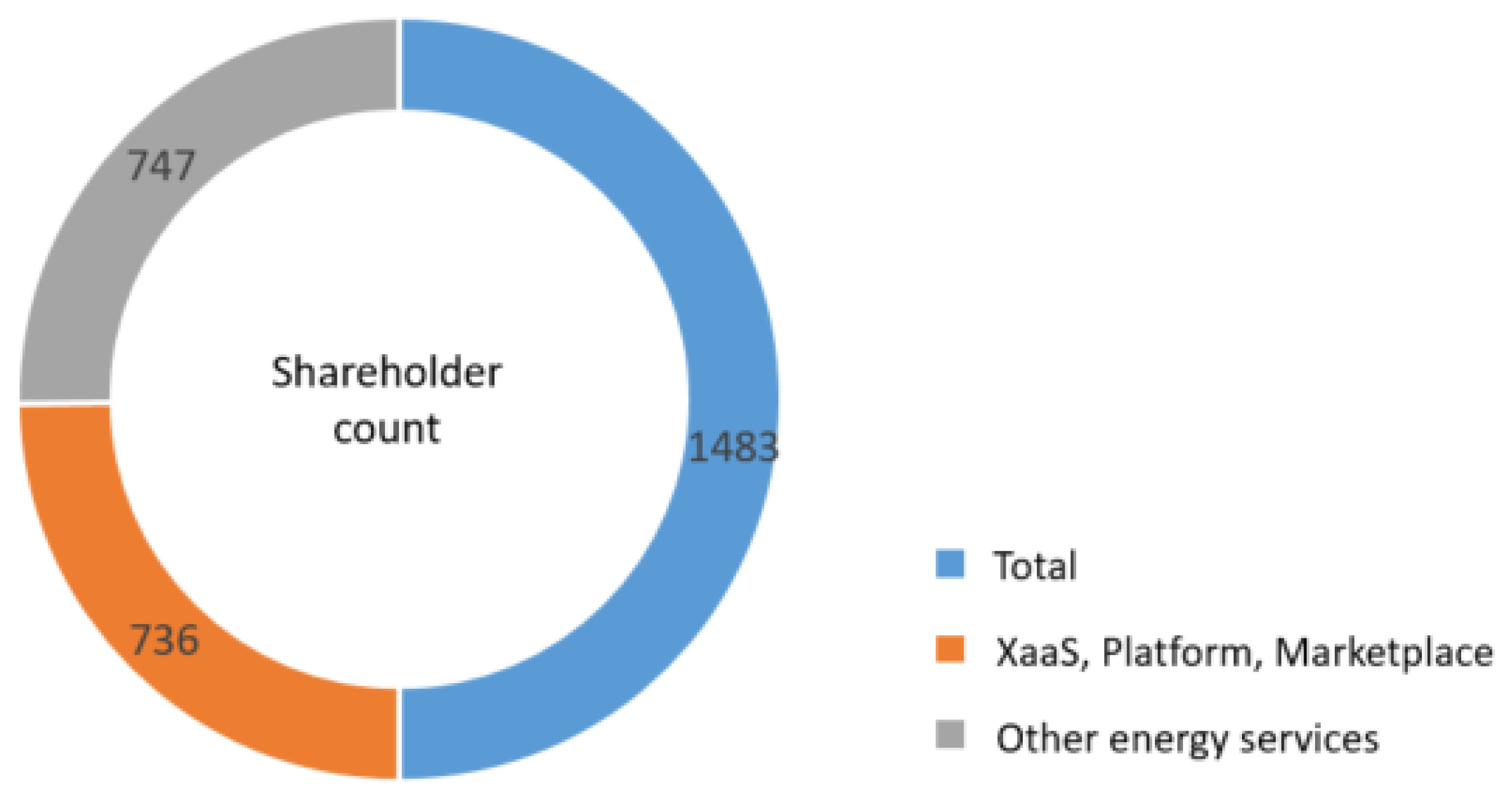

6.2. Shareholder Fund Analysis

6.3. Funding and Investors Analysis

7. Discussion

8. Conclusions and Future Scope

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| AI | Artificial Intelligence |

| CBCV | Customer-based Corporate Valuation |

| DT | Digital-Twin |

| DTL | Distributed Ledger Technology |

| ESCOs | Energy efficiency service companies |

| EU | European Union |

| EDA | Exploratory Data Analysis |

| ICT | Information and Communication Technology |

| IQR | Interquartile range |

| IoT | Internet of Things |

| PPA | Power Purchase agreement |

| RoI | Return of Investment |

| S-BMI | Service Business Model Innovation |

| SME | Small and Medium Enterprise |

| VCs | Venture Capitalists |

| VPP | Virtual Power Plant |

| XaaS | X-as-a-Service |

References

- Richter, M. Business model innovation for sustainable energy: German utilities and renewable energy. Energy Policy 2013, 62, 1226–1237. [Google Scholar] [CrossRef] [Green Version]

- Kohtamäki, M.; Parida, V.; Oghazi, P.; Gebauer, H.; Baines, T. Digital servitization business models in ecosystems: A theory of the firm. J. Bus. Res. 2019, 104, 380–392. [Google Scholar] [CrossRef]

- Duch-Brown, N.; Rossetti, F. Digital platforms across the European regional energy markets. Energy Policy 2020, 144, 111612. [Google Scholar] [CrossRef]

- Bartczak, K. Digital Technology Platforms as an Innovative Tool for the Implementation of Renewable Energy Sources. Energies 2021, 14, 7877. [Google Scholar] [CrossRef]

- Li, C.; Sun, H.; Tang, H.; Luo, Y. Adaptive resource allocation based on the billing granularity in edge-cloud architecture. Comput. Commun. 2019, 145, 29–42. [Google Scholar] [CrossRef]

- Kloppenburg, S.; Boekelo, M. Digital platforms and the future of energy provisioning: Promises and perils for the next phase of the energy transition. Energy Res. Soc. Sci. 2019, 49, 68–73. [Google Scholar] [CrossRef]

- Elia Group Belgium. Towards a Consumer-Centric and Sustainable Electricity System; White Paper, Published on Elia Website; 2021; Available online: https://www.eliagroup.eu/en/ccmd# (accessed on 1 December 2021).

- Cseres, K. The Active Energy Consumer in EU Law. Eur. J. Risk Regul. 2018, 9, 227–244. [Google Scholar] [CrossRef] [Green Version]

- Commission Delegated Regulation (EU) 2020/2155, Supplementing Directive (EU) 2010/31/EU of the European Parliament and of the Council by Establishing an Optional Common European Union Scheme for Rating the Smart Readiness of Buildings. 2020. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32020R2155&from=en (accessed on 1 December 2021).

- Kowalkowski, C.; Gebauer, H.; Kamp, B.; Parry, G. Servitization and deservitization: Overview, concepts, and definitions. Ind. Mark. Manag. 2017, 60, 4–10. [Google Scholar] [CrossRef]

- Fell, M.J. Energy services: A conceptual review. Energy Res. Soc. Sci. 2017, 27, 129–140. [Google Scholar] [CrossRef]

- Chasin, F.; Paukstadt, U.; Gollhardt, T.; Becker, J. Smart energy driven business model innovation: An analysis of existing business models and implications for business model change in the energy sector. J. Clean. Prod. 2020, 269, 122083. [Google Scholar] [CrossRef]

- Roberta, B.; Jean-François, S.; Phevos, S. Utilities’ New Business Models: As-a-Service Breaking Through. 2018. Available online: https://www.capgemini.com/wp-content/uploads/2018/08/IDC-Utilities-New-Business-Models-2018.pdf (accessed on 10 November 2021).

- Khanra, S.; Dhir, A.; Parida, V.; Kohtamäki, M. Servitization research: A review and bibliometric analysis of past achievements and future promises. J. Bus. Res. 2021, 131, 151–166. [Google Scholar] [CrossRef]

- Martin, R.L. The Age of Customer Capitalism, Harvard Business Review. 2010. Available online: https://hbr.org/2010/01/the-age-of-customer-capitalism (accessed on 10 November 2021).

- Markey, R. Are You Undervaluing Your Customers? Harvard Business Review. 2020. Available online: https://hbr.org/2020/01/are-you-undervaluing-your-customers (accessed on 15 October 2021).

- Mauboussin, M.J.; Callahan, D. The Economics of Customer Businesses Calculating Customer-Based Corporate Valuation. 2021. Available online: https://www.morganstanley.com/im/en-gb/intermediary-investor/insights/articles/the-economics-of-customer-businesses.html (accessed on 1 November 2021).

- Duan, Y.; Fu, G.; Zhou, N.; Sun, X.; Narendra, N.C.; Hu, B. Everything as a Service (XaaS) on the Cloud: Origins, Current and Future Trends. In Proceedings of the 2015 IEEE 8th International Conference on Cloud Computing, New York, NY, USA, 27 June–2 July 2015; pp. 621–628. [Google Scholar] [CrossRef]

- Hamwi, M.; Lizarralde, I. A Review of Business Models towards Service-Oriented Electricity Systems. Procedia CIRP 2017, 64, 109–114. [Google Scholar] [CrossRef]

- Park, C. Expansion of servitization in the energy sector and its implications. WIREs Energy Environ. 2022, e434. [Google Scholar] [CrossRef]

- Singh, M.; Jiao, J.; Klobasa, M.; Frietsch, R. Making Energy-transition headway: A Data driven assessment of German energy startups. Sustain. Energy Technol. Assess. 2021, 47, 101322. [Google Scholar] [CrossRef]

- Immonen, A.; Kiljander, J.; Aro, M. Consumer viewpoint on a new kind of energy market. Electr. Power Syst. Res. 2020, 180, 106153. [Google Scholar] [CrossRef]

- Rossignoli, F.; Lionzo, A. Network impact on business models for sustainability: Case study in the energy sector. J. Clean. Prod. 2018, 182, 694–704. [Google Scholar] [CrossRef]

- Paiola, M.; Schiavone, F.; Grandinetti, R.; Chen, J. Digital servitization and sustainability through networking: Some evidences from IoT-based business models. J. Bus. Res. 2021, 132, 507–516. [Google Scholar] [CrossRef]

- Accenture. Capturing Value in Managing Energy Flexibility. 2020. Available online: https://www.accenture.com/be-en/insights/utilities/capturing-value-managing-energy-flexibility (accessed on 5 October 2021).

- Hoffmann, A. Value Capture in Disintegrated Value Chains; Springer: Berlin/Heidelberg, Germany, 2015. [Google Scholar]

- Mayle, D. Managing Innovation and Change. Strateg. Dir. 2009, 206–207. [Google Scholar] [CrossRef]

- Yun, J. User Open Innovation-Based Business Model Developing Circle; Springer: Singapore, 2017. [Google Scholar] [CrossRef]

- Springel, K. Network Externality and Subsidy Structure in Two-Sided Markets: Evidence from Electric Vehicle Incentives. Am. Econ. J. 2017, 13, 393–432. [Google Scholar] [CrossRef]

- Li, S.; Tong, L.; Xing, J.; Zhou, Y. The Market for Electric Vehicles: Indirect Network Effects and Policy Design. J. Assoc. Environ. Resour. Econ. 2017, 4, 89–133. [Google Scholar] [CrossRef]

- Raddats, C.; Baines, T.; Burton, J.; Story, V.; Zolkiewski, J. Motivations for servitization: The impact of product complexity. Int. J. Oper. Prod. Manag. 2016, 36, 572–591. [Google Scholar] [CrossRef] [Green Version]

- Burger, S.P.; Luke, M. Business models for distributed energy resources: A review and empirical analysis. Energy Policy 2017, 109, 230–248. [Google Scholar] [CrossRef]

- Kufeoglu, S.; Liu, G.; Anaya, K.; Pollitt, M. Digitalisation and New Business Models in Energy Sector, Cambridge Working Paper in Economics; Technical Report; Energy Policy Research Group, University of Cambridge: Cambridge, UK, 2019. [Google Scholar]

- Guo, S.; Qian, X.; Liu, J. Charging-as-a-Service: On-demand battery delivery for light-duty electric vehicles for mobility service. arXiv 2020, arXiv:2011.10665. [Google Scholar]

- International Data Corporation (IDC). Worldwide Whole Cloud Forecast, 2021–2025: The Path Ahead for Cloud in a Digital-First World. Technical Report. 2021. Available online: https://www.idc.com/getdoc.jsp?containerId=US47397521 (accessed on 3 December 2021).

- Powercloud. Available online: https://power.cloud/ (accessed on 4 January 2022).

- Valarezo, O.; Gómez, T.; Chaves-Avila, J.P.; Lind, L.; Correa, M.; Ulrich Ziegler, D.; Escobar, R. Analysis of New Flexibility Market Models in Europe. Energies 2021, 14, 2351. [Google Scholar] [CrossRef]

- Zhang, K.; Troitzsch, S.; Hanif, S.; Hamacher, T. Coordinated Market Design for Peer-to-Peer Energy Trade and Ancillary Services in Distribution Grids. IEEE Trans. Smart Grid 2020, 11, 2929–2941. [Google Scholar] [CrossRef]

- Abhi, A.; Gopal, S.; Khan, I. The Shift to Flexible Consumption, The shift to Flexible Consumption. White paper, Deloitte Insight. 2018. Available online: https://www2.deloitte.com/content/dam/Deloitte/my/Documents/risk/my-risk-sdg12-the-shift-to-flexible-consumption.pdf (accessed on 10 November 2021).

- Tiko Energy. Available online: https://tiko.energy/solutions/ (accessed on 10 January 2022).

- Fischer, D.; Erge, T.; Triebel, M.A.; Hollinger, R. Business Models Using the Flexibility of Heat Pumps—A Discourse. In Proceedings of the 12th IEA Heat Pump Conference, Rotterdam, The Netherlands, 15–18 May 2017. [Google Scholar]

- Srivastava, R. Emerging Opportunities Series: Energy as a Service, American Council for an Energy-Efficient Economy (ACEEE), Washington, DC. 2019. Available online: https://www.aceee.org/topic-brief/eo-energy-as-service (accessed on 12 October 2021).

- International Renewable Energy Agency (IRENA). Energy as a Service Innovation Landscape Brief; IRENA: Abu Dhabi, United Arab Emirates, 2020. [Google Scholar]

- Ecoligo. What Is a Solar-as-a-Service Contract? 2020. Available online: https://ecoligo.com/auf-solarenergie-umsteigen/energie-faqs/ (accessed on 4 November 2021).

- International Energy Agency (IEA). Innovative Business Models and Financing Mechanisms for PV Deployment in Emerging Regions; IEA: Paris, France, 2014. [Google Scholar]

- Svatikova, K.; Artola, I.; Slingerland, S.; Fischer, S. Selling Solar Services as a Contribution to a Circular Economy. Technical Report. 2015. Available online: https://www.ecologic.eu/13071 (accessed on 12 November 2021).

- Laing, S.; Kühl, N. Comfort-as-a-Service: Designing a User-Oriented Thermal Comfort Artifact for Office Buildings. arXiv 2018, arXiv:2004.03323. [Google Scholar]

- Gómez-Romero, J.; Molina-Solana, M.; Ros, M.; Ruiz, M.D.; Martin-Bautista, M.J. Comfort as a Service: A New Paradigm for Residential Environmental Quality Control. Sustainability 2018, 10, 3053. [Google Scholar] [CrossRef] [Green Version]

- Kattouw, J.W. Comfort as a Service with Smart Hvac. Master’s Thesis, University of Twente, Twente, The Netherlands, 2016. Available online: https://essay.utwente.nl/71011/ (accessed on 12 October 2021).

- Jiao, N.; Evans, S. Business Models for Sustainability: The Case of Second-life Electric Vehicle Batteries. Procedia Cirp 2016, 40, 250–255. [Google Scholar] [CrossRef] [Green Version]

- NIO Newsroom. NIO Launches Battery as a Service. 2020. Available online: https://www.nio.com/news/nio-launches-battery-service (accessed on 12 November 2021).

- Asmus, P.; Lawrence, M. Emerging Microgrid Business Models; Research Brief; Navigant Consulting, Inc.: Chicago, IL, USA, 2016. [Google Scholar]

- Inês, C.; Guilherme, P.L.; Esther, M.G.; Swantje, G.; Stephen, H.; Lars, H. Regulatory challenges and opportunities for collective renewable energy prosumers in the EU. Energy Policy 2020, 138, 111212. [Google Scholar] [CrossRef]

- Morstyn, T.; Farrell, N.; Darby, S.; Mcculloch, M. Using peer-to-peer energy-trading platforms to incentivize prosumers to form federated power plants. Nat. Energy 2018, 3, 94–101. [Google Scholar] [CrossRef]

- Sonnen (Acquired by Shell). Available online: https://sonnen.de/sonnencommunity/ (accessed on 10 January 2022).

- Vandebron (Acquired by Essent). Available online: https://vandebron.nl/ (accessed on 15 January 2022).

- European Commission. An EU Strategy on Heating and Cooling: Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions; EU Commission: Brussels, Belgium, 2016. [Google Scholar]

- Energy Systems Catapult. Heating as a Service: An introduction, 2019b. Available online: https://es.catapult.org.uk/report/ssh2-introduction-to-heat-as-a-service/ (accessed on 12 February 2022).

- Energy Systems Catapult. Field Trial Learnings—Insight Report. 2019. Available online: https://es.catapult.org.uk/reports/ssh2-field-trial-learnings-insight-report/ (accessed on 20 November 2021).

- Britton, J.; Minas, A.M.; Marques, A.C.; Pourmirza, Z. Exploring the potential of heat as a service in decarbonization: Evidence needs and research gaps. Energy Sources Part Econ. Plan. Policy 2021, 16, 999–1015. [Google Scholar] [CrossRef]

- Light as a Service. Available online: https://www.signify.com/de-at/lighting-services/managed-services/light-as-a-service (accessed on 15 January 2021).

- ENGIE, Reliability as a Service. Available online: https://innovation.engie.com/en/distributed-energy-resources-management-system (accessed on 11 December 2021).

- Innovation Systems Data-Excellence Center (ISDEC). Available online: https://www.isi.fraunhofer.de/de/themen/data-science.html (accessed on 1 February 2022).

- Singh, M.; Jiao, J.; Klobasa, M.; Frietsch, R. Emergence of digital and X-as-a-service platforms in german ENERGY sector. In Proceedings of the 1st IAEE Online Conference, Online, 7–9 June 2021. [Google Scholar]

- Dealroom. Available online: https://dealroom.co/ (accessed on 10 December 2021).

- Hojnik, J. The servitization of industry: EU law implications and challenges. Common Mark. Law Rev. 2016, 53, 1575. [Google Scholar] [CrossRef]

| X-as-a-Service Business Model | Central Value Proposition | Key Stakeholders | Financial Viability | Use Case/Example |

|---|---|---|---|---|

| Charging-as-a-service (CaaS) |

|

|

|

|

| Software-as-a-service (SaaS) |

|

|

|

|

| Flexibility-as-a-service (FaaS) |

|

|

|

|

| Energy-as-a-service (EaaS) |

|

|

|

|

| Solar-as-a-service (SoaaS) ✝ |

|

|

|

|

| Comfort-as-a-service (CoaaS) ✝ |

|

|

|

|

| Battery-as-a-service (BaaS) |

|

|

|

|

| Microgrid-as-a- service (MaaS) |

|

|

|

|

| Trading-as-a-service(Peer-2-peer) (TaaS) |

|

|

|

|

| Heating-as-a-service (HaaS) |

|

|

|

|

| Service Category | Screening Keywords | |

|---|---|---|

| Comfort and Heating |

|

|

| Flexibility and Trading |

|

|

| Energy Efficiency and Management |

|

|

| Solar and Microgrid |

|

|

| Charging and Battery |

|

|

| Energy Software Solutions |

|

|

| Service Category | No. of Companies | Average | Standard Deviation | Median | Upper Limit |

|---|---|---|---|---|---|

| Solar and Microgrid | 84 | 4978 | 21,166 | 190 | 168,118 |

| Heating and Comfort | 14 | 439 | 1874 | 23 | 6849 |

| Energy Software solutions | 49 | 519 | 1581 | 70 | 9899 |

| Flexibility and Trading | 29 | 2769 | 8428 | 108 | |

| Charging and Battery | 25 | 1767 | 6183 | 75 | |

| Energy efficiency | 49 | 1817 | 9316 | 105 | |

| and Management |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Singh, M.; Jiao, J.; Klobasa, M.; Frietsch, R. Servitization of Energy Sector: Emerging Service Business Models and Startup’s Participation. Energies 2022, 15, 2705. https://doi.org/10.3390/en15072705

Singh M, Jiao J, Klobasa M, Frietsch R. Servitization of Energy Sector: Emerging Service Business Models and Startup’s Participation. Energies. 2022; 15(7):2705. https://doi.org/10.3390/en15072705

Chicago/Turabian StyleSingh, Mahendra, Jiao Jiao, Marian Klobasa, and Rainer Frietsch. 2022. "Servitization of Energy Sector: Emerging Service Business Models and Startup’s Participation" Energies 15, no. 7: 2705. https://doi.org/10.3390/en15072705

APA StyleSingh, M., Jiao, J., Klobasa, M., & Frietsch, R. (2022). Servitization of Energy Sector: Emerging Service Business Models and Startup’s Participation. Energies, 15(7), 2705. https://doi.org/10.3390/en15072705