1. Introduction

In a bid to enhance the economy and maximize wealth, humans continue to engage in activities that are detrimental to the environment. As a result, the world is faced with the challenges of climate change, such as floods and heat waves [

1]. Concern for environment-related issues is increasing globally and, recently, among enterprises and institutions, leading to the development of various means of evaluating it. Consequently, countries have been assessed and classed according to their environmental performance ranking, where leading countries are awarded the ‘Champion of the Earth Award’ based on their adopted environmental measures [

2]. Additionally, financial institutions are given the ‘Golden Peacock Climate Management Award’, while the ‘Global Green Economy Index’ and many other evaluation indexes are utilized to rank the global economies. Climate change remains one of the biggest problems facing both developed and developing countries in the world [

3]. As most developing countries are in the transition period for economic and social development, they are, on the one hand, very vulnerable to climate change and, on the other hand, dependent on global climate finance to support climate protection and mitigation programs. However, many developing nations, such as Bangladesh, are struggling to reap this benefit due to their lack of effective institutions with project design and planning expertise [

1,

3].

Bangladesh is considered one of the world’s top emerging nations, with an immense investment and economic growth potential to be a dominant player in the 21st century [

4]. However, the country is faced with the threats of climate change and its associated environmental implications. For instance, Bangladesh is considered one of the most susceptible nations in the world to the impact of climate changes such as the rise in global sea level, which has affected the natural ecosystem and expanded the economic deprivation of the population [

5]. As a result, it has adopted numerous policies to reduce the risks and adverse environmental effects of climate change [

6]. Some of the major strategies undertaken to prevent the degradation of the environment include the introduction of green banking and financing, in line with the global standard and the promotion of sustainable growth [

1]. Green finance is a holistic concept whose key component is green banking [

2]. Green Banking (GB) refers to banking activities that emphasize economic, social and ecological factors to protect the climate and natural resources [

7,

8]. Green banking requires investments in environmental products and services to combat climate change and protect the ecosystem. In a country like Bangladesh, GB is considered an important aspect of sustainable economic growth, as stated by Haque and Murtaz [

9]. Therefore, it can also be said that GB plays an essential part in the global efforts to resolve climate change problems and achieve sustainable development goals (SDGs).

In recent years, the role of the banking community in environmental conservation and sustainability has been enormously highlighted within international forums such as the Paris Agreement, with the G20 group significantly considering the topic in their plans [

2]. Therefore, GB is a broad term for principles and regulations that make banks economically, environmentally and socially sustainable [

10]. The purpose is to enhance the effectiveness and efficiency of banking processes and the utilization of IT and physical infrastructure with zero or minimal ecological consequences. Furthermore, green- and environment-related policies are particularly important to emerging economies, given these economies’ high susceptibility to climate change and global warming. Among other countries, Bangladesh is considered one of the first countries to pronounce the adoption of GB-related practices, having done so in 2011, to achieve sustainable economic development [

11]. Bangladesh Bank (BB), the central bank and operator of the banking sector in Bangladesh, has been at the forefront of implementing green financing through GB development, which is pivotal to the progress and transition to a green economy towards the achievement of SDGs. GB is an important antecedent to the establishment of an effective green economy [

5], which serves as an avenue for economic development in emerging markets and a medium to secure sustainability via low energy consumption and pollution [

12,

13].

Additionally, various studies have recently been conducted in the area of GB, globally [

2,

3,

11,

14,

15,

16,

17,

18,

19,

20,

21]. However, these studies are mainly focused on GB activities and its development in the context of Bangladesh [

15,

22,

23]; green banking adoption [

16,

24,

25]; GB performance and environmental sustainability [

19,

21,

22,

26]; and green finance [

1,

5,

27]. Besides these, a couple of studies have been conducted to measure the impact of GB practices on banks’ environmental performance in Pakistan [

16], Nepal [

28], India [

18] and Sri Lanka [

29]. In the context of Bangladesh, few studies have been conducted which examine the relationship between GB practices, green banking performance and banks’ environmental performance [

15,

19,

21,

22]. However, there exist limited studies in the direction of GB practices’ impact on banks’ environmental performance and the sources of green financing based on the primary data in the context of PCBs in Bangladesh.

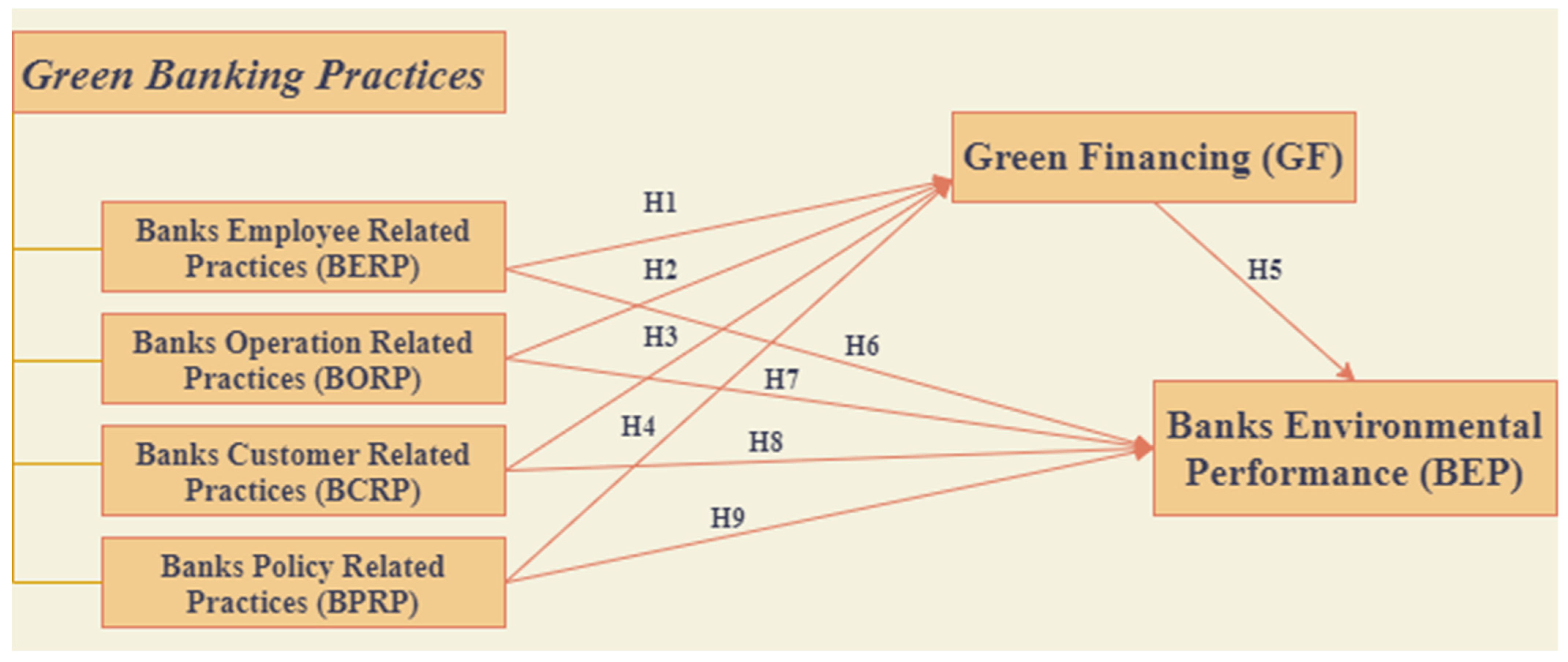

As such, this study endeavors to fill the previously established research gap in these ways: First, this study identifies various GB practices, including banks’ employee-, operations-, customer- and policy-related practices in the context of PCBs, some of the significant contributors of green growth and green financing in Bangladesh [

1,

5,

30]. Second, the study shows the impact of GB practices on banks’ environmental performance based on bankers’ perceptions. Third, the present study also analyzes the effect of these practices on the sources of green financing of PCBs based on primary data. Therefore, the main purpose of the study is to identify the impact of GB practices on banks’ environmental performance and the sources of green financing in the context of PCBs in Bangladesh. In achieving the aforementioned objectives, the central research question of this study is as follows: What are the impacts of GB practices on banks’ environmental performances (BEP) and the sources of green financing (SGF) in the context of PCBs in Bangladesh?

This study contributes to the existing literature, especially on GB, green finance and banks’ environmental performance, in the following ways: First, the current study explores the research gap by analyzing the various GB practices theoretically and empirically based on bankers’ knowledge of Bangladesh’s banking sector. Second, the study measures the effect of GB practices on banks’ environmental performance based on the structural equation modeling (SEM), as previous studies have mainly used descriptive statistics and multiple regression analysis to validate the relationships between study variables [

14,

18,

28,

29]. Third, this is a pioneering study that analyzes the relationship between various GB practices and the banks’ sources of green financing based on the primary data obtained from bank’s employees. To the best of the researcher’s knowledge, no study has examined this issue globally, including in developing countries, such as Bangladesh, to date. Hence, we concentrate on bankers of PCBs who have strong understandings of GB activities, green finance and banks’ internal environmental management in the context of Bangladesh.

The rest of the paper is structured accordingly:

Section 2 discusses the relevant literature on GB, GB in Bangladesh, GB practices and banks’ environmental performance, GB practices and green financing and hypotheses development.

Section 3 introduces the research methods, which include study instruments, sample and data collection and methods of analysis.

Section 4 presents the results, followed by discussions thereof in

Section 5. Lastly, the major policy implications for GB growth and banks’ mitigation of environmental effects through green financing are discussed, subsequent to the presentation of study limitations and future directions. The list of abbreviations and terminologies used in the study are presented in

Table 1.

5. Discussions

As exhibited in

Figure 4, the empirical findings indicated that Hypothesis 1 is supported and that a significant relationship exists between banks’ employee-related practices in GB and the sources of green financing by PCBs in Bangladesh. This result is consistent with the findings of Raihan [

62] and Zheng et al. [

1], which states that bankers’ knowledge, beliefs and attitude towards GB practices have a positive influence on the various sources of green financing towards the achievement of sustainable economic development in Bangladesh. As a result, it can be concluded that GB practices (including employee-related practices) play a crucial role in the development of sustainable financing of PCBs in Bangladesh.

Based on the results, Hypothesis 2, which maintains that banks’ daily operation-related practices have positive impact on the sources of green financing by PCBs, is also validated. This finding is in agreement with past studies [

1,

16]. As stated, the green-related daily practices of banks, such as the provision of eco-friendly banking services and a reduction in paper consumption, have positively influenced the financing of banks’ green projects. On the other hand, Hypotheses 3 is not validated, as no significant relationship exists between banks’ customer-related practices and green projects financing. Therefore, this finding is in agreement with the study conducted by [

1,

28,

29], which indicates that banks’ customer-related practices such as the provision of online banking and assessment of customers’ environmental risks, have not directly affected banks’ green financing decisions. However, it can be observed that banks’ customer-related activities are considered one of the GB practices, as it fails to comply with the decision of green projects financing by banking institutions, owing to its direct relation with customers.

The results indicate the acceptance of Hypothesis 4 and highlight a statistically significant relationship between banks’ policy-related practices and the sources of green financing. Recently, a study conducted by Rehman et al. [

16] identified the positive relationship existent between banks’ policy-related practices and green projects’ financing towards the adoption of GB in Pakistan; therefore, our findings are validated by the present study. Furthermore, the empirical result indicates the validity of Hypothesis 5 and confirms that the sources of green financing have a positive impact on the environmental performances of banks. This finding is in line with the study conducted by Kala et al. [

18], which indicates that green projects’ financing has a positive influence on the overall environmental performances of banks. Therefore, it can also be established that green finance has become a new growth accelerator, fostering green economic growth, with social responsibility and environmental concerns being its priorities. More surprisingly, the empirical evidence indicates the non-existence of a meaningful association between banks’ employee-related practices and environmental performance, consequently invalidating Hypothesis 6. This result is inconsistent with results obtained from other studies [

18,

28,

29], which highlight that employee-related GB practices, comprising the provision of environment-related training and education, sustainable performance evaluation systems and green reward facilities, have a positive impact on the environmental performances of banks. However, our findings may differ from previous studies due to a lack of GB knowledge and environmental training and education among bank employees. Therefore, it is recommended that banking authorities provide sufficient training to their employees to improve GB performance and reduce the adverse environmental impact on the society through the provision of green financing.

Since the output validates Hypothesis 7, the daily operation-related practices of GB have a positive impact on banks’ environmental performances. Consequently, this finding is supported by previous studies [

18,

28,

29]. As stated, GB daily operation-related practices, such as the provision of online banking and reduction in paper consumption, have directly contributed to the reduction of negative environmental impacts and improved banks’ environmental performances. Moreover, based on these results, Hypothesis 8 is invalidated because no significant relationship exists between banks’ customer-related practices and the environmental performances of PCBs in Bangladesh. Therefore, this result is consistent with previously conducted studies [

28,

29]. It has been discovered in the study that banks’ customer-related practices have not directly influenced their environmental performances. Although banks’ customer-related practices are regarded as one of the activities of GB, they do not contribute directly to their environmental performances due to its direct connection to customers. Finally, Hypothesis 9 is validated as indicated by its statistical significance. Banks’ green policy-related practices have a positive impact on their environmental performances, and our findings are supported by past studies [

18,

28,

29]. They opine that banks’ green policy-related practices, including the establishment of more green branches, the implementation of a green policy and the promotion of green partnership among suppliers and investors, positively affect banks’ environmental performance. Therefore, it can be concluded that GB activities, such as employee, customer, policy and operation-related practices, have direct and indirect effects on the green project financing of banks and their environmental performances, owing to their contributions towards the achievement of sustainable development in the country.

6. Conclusions

The aim of the study was to identify the impact of GB practices on banks’ environmental performance and the sources of green financing in the context of PCBs in Bangladesh. Primary data were obtained from bankers of PCBs in Bangladesh and were subsequently analyzed using factor analysis (EFA and CFA) techniques for the study validity, reliability and assessment of the model fit among the variables of the research model. The empirical findings suggested that the overall study model was accepted and deemed satisfactory, based on the output of various model fit indices. Afterwards, the SEM technique was employed to assess the research hypotheses. The empirical findings revealed that the BERP, BORP and BCRP of GB practices have significant positive effects on green financing, contrary to the BCRP of GB practice, which was not statistically significant. Additionally, banks’ green project financing exhibited a strong and positive influence on banks’ environmental performance. Moreover, BORP and BPRP of GB practices were observed to have significant impacts on banks’ environmental performance, in contrast to the BERP and BCRP of GB practices. Therefore, major policy implications, limitations and directions for future research in the concerned area were discussed further.

The findings of the study provide valuable implications for academics, banking institutions, bankers, managers and government officials in Bangladesh through the promotion of green banking and provision of green funding to boost banks’ environmental performances and, consequently, the country’s sustainable economic development. This research helps academics to comprehend the effect of GB practices on the funding of green projects and the environmental performance of banks, while the output of the study also contributes to the GB literature. The main policy implications were subsequently explored: First, GB practices such as bank employees, daily-operation and green policy-related practices, were observed to positively affect the sources of green financing of PCBs in Bangladesh. Therefore, a proposal was made to maintain PCBs and provide employees with necessary environmental training programs to support green financing via the adoption of GB in their daily banking operations. Second, the results indicated that the customer-related practices of GB have not affected banks’ sources of green financing. However, it could not be concluded that banks’ customer-related activities are considered a GB practice, as they failed to comply with the decisions of green project financing by banking institutions, which are directly related to customers. Thus, the PCBs and government of Bangladesh should conduct various seminars, training and symposiums on the advantages of GB to increase the sensitivity of bank clients and the public towards green practices. Third, the daily operation and policy-related practices of GB had a positive influence on the environmental performances of banks. Therefore, the managers of PCBs are requested to incorporate daily operation and policy-related activities of GB in the banking system through the reduction of paper usage, provision of ecofriendly-banking practices such as ATMs and online banking, establishment of green branches and implementation of green policies to improve banks’ environmental performance. Fourth, the effect of the employees and the customer-related activities of GB on the environmental performance of banks were observed to be statistically insignificant. This indicates that the employees and customers of banks lack the knowledge of GB concerning its reducing the negative environmental performance of the banking system. To bridge this knowledge gap among bank employees and customers, PCBs should be provided with environmental training and education to improve their environmental performances. Finally, the study indicated that the cooperation between the government, banking institutions and international organizations is required to adopt GB practices through green financing and determine how these practices influence banks’ environmental performances, in general. In this respect, BB should play a dynamic role in the education, organization, promotion and monitoring of GB-related activities, to help in the attainment of a country’s sustainable economic growth.

Similar to other studies, the present research also had some limitations. First, since employees of PCBs were incorporated in the study, the results can only be applied to a particular community. Therefore, the results of the present study could be strengthened by analyzing different stakeholders (e.g., customers and owners) among other banking institutions operated in Bangladesh, such as state-owned banks (SCBs), foreign-owned commercial banks (FCBs), Islamic banks (IBs) and non-bank financial institutions (NBFIs). Second, future research could extend the range of this study by examining the impact of green banking practices on the sustainable performance and profitability of banks through analysis of the mediating effects of green financing. Third, employees’ knowledge of GB practices may differ between SCBs, IBs, FCBs and NBFIs. Therefore, this could be discussed by various companies in future research. Finally, in order to assess green finance and banks’ environmental performance sources, rather than considering the views of customers and owners of sample banks, the analysis only took employee opinions on different GB practices into account.