Natural Gas Scarcity Risk for Countries along the Belt and Road

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Local Natural Gas Scarcity Risk (LGSR)

3.1.1. Probability of Natural Gas Scarcity (GP)

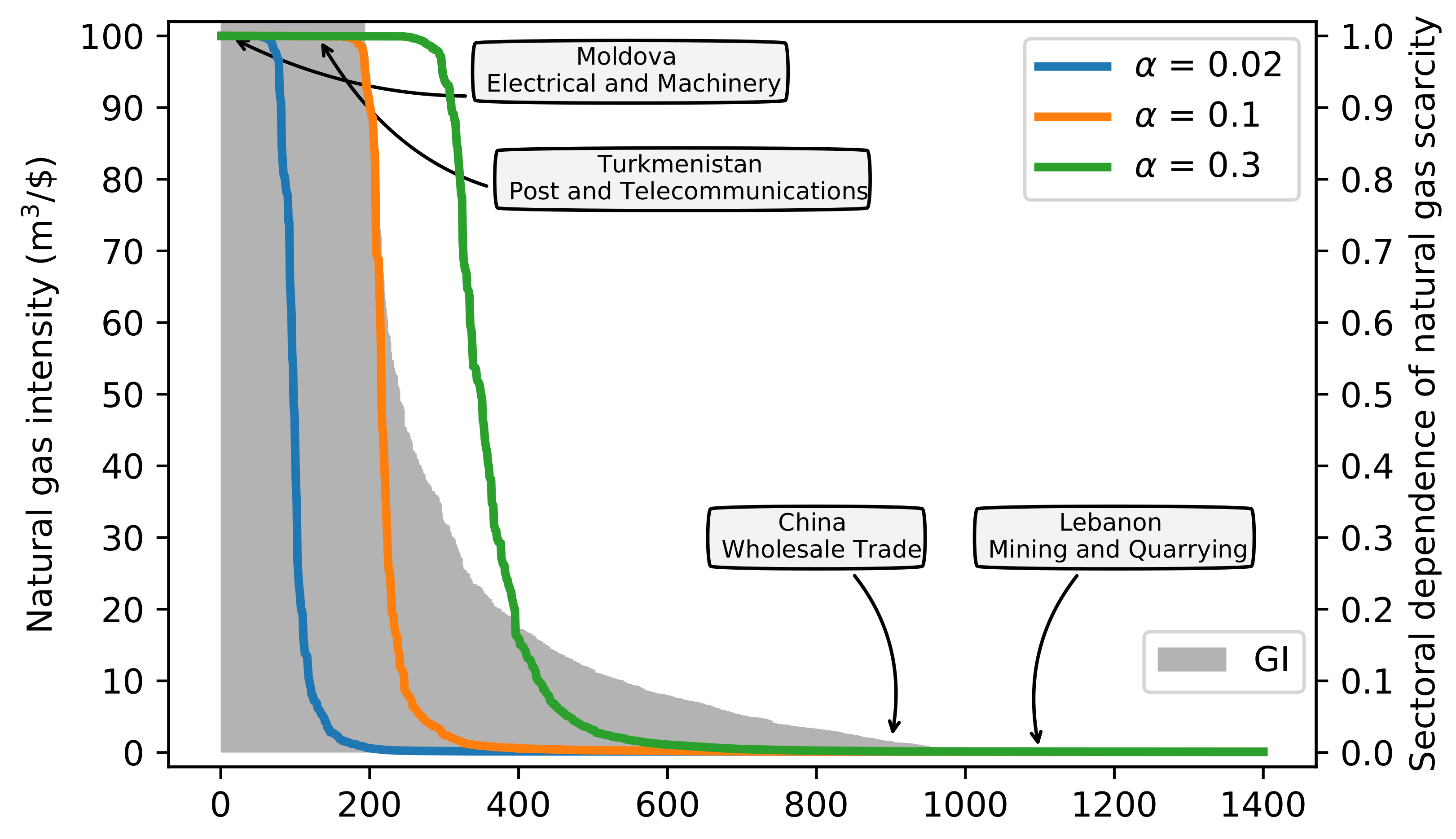

3.1.2. Sectoral Natural Gas Dependence (GD)

3.2. Embodied Natural Gas Scarcity Risk (EGSR)

3.3. Top Network Analysis

3.4. Data

4. Results

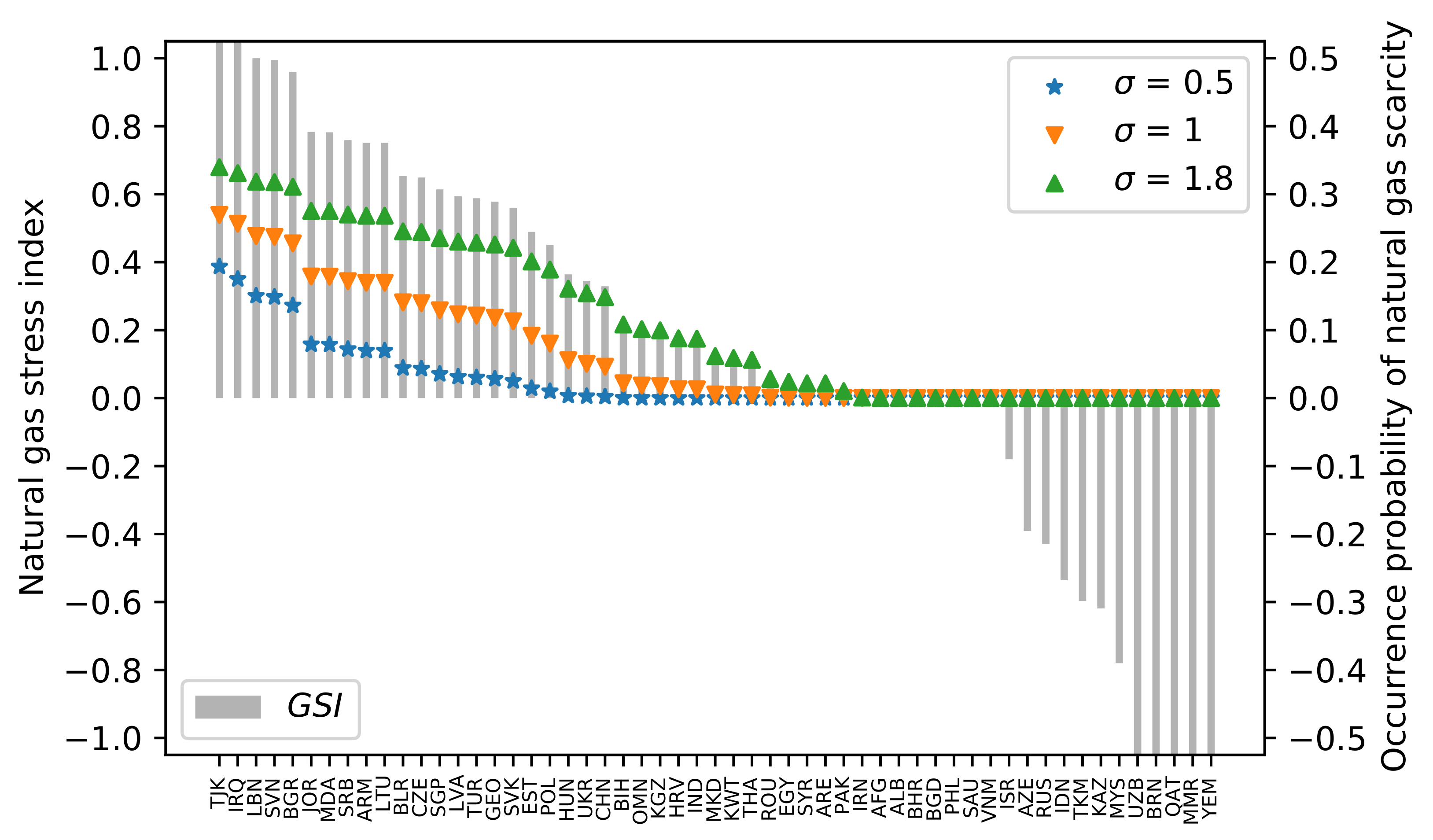

4.1. Local Natural Gas Scarcity Risk

4.2. Embodied Natural Gas Scarcity Risk

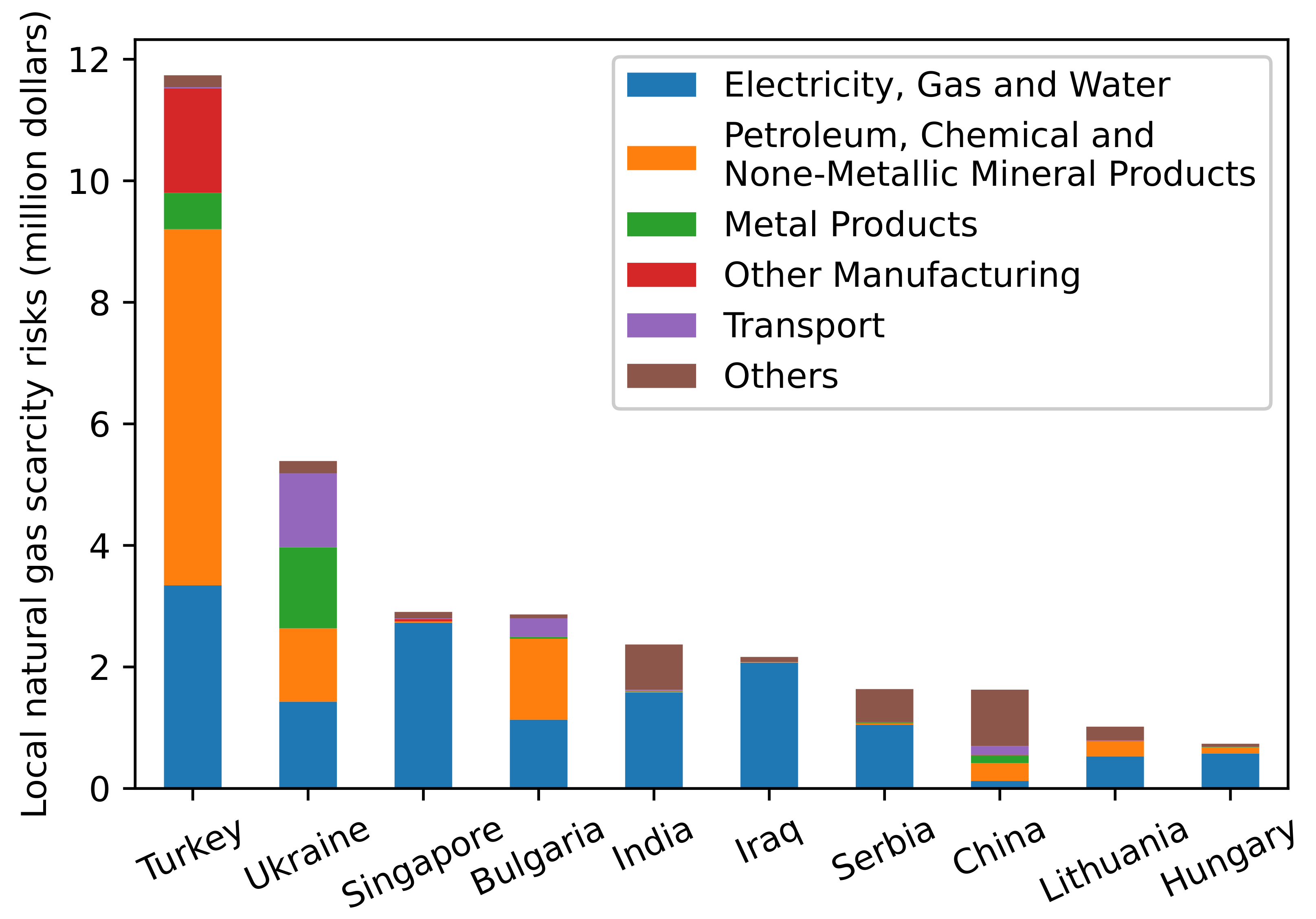

4.2.1. Country Level Results

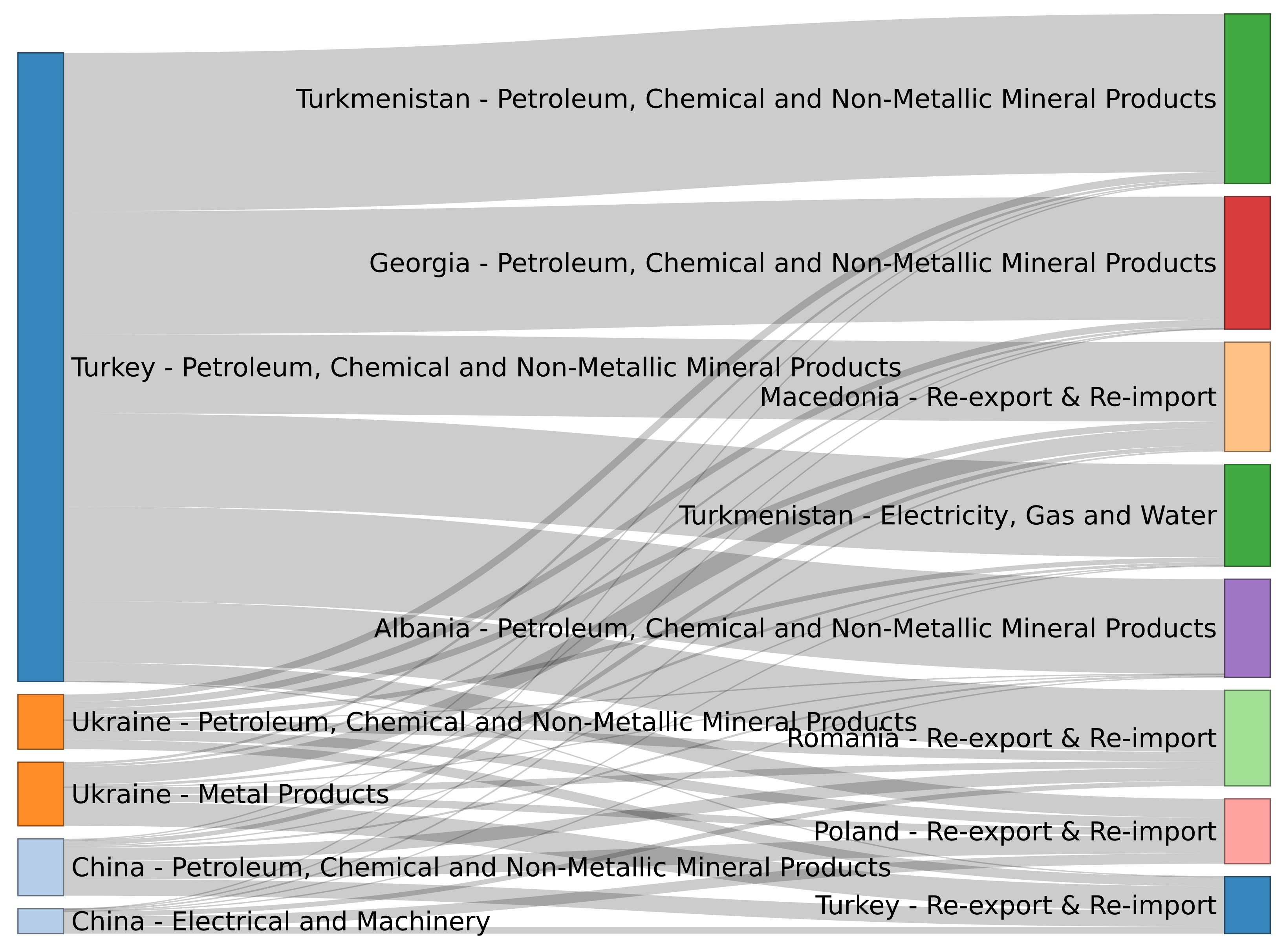

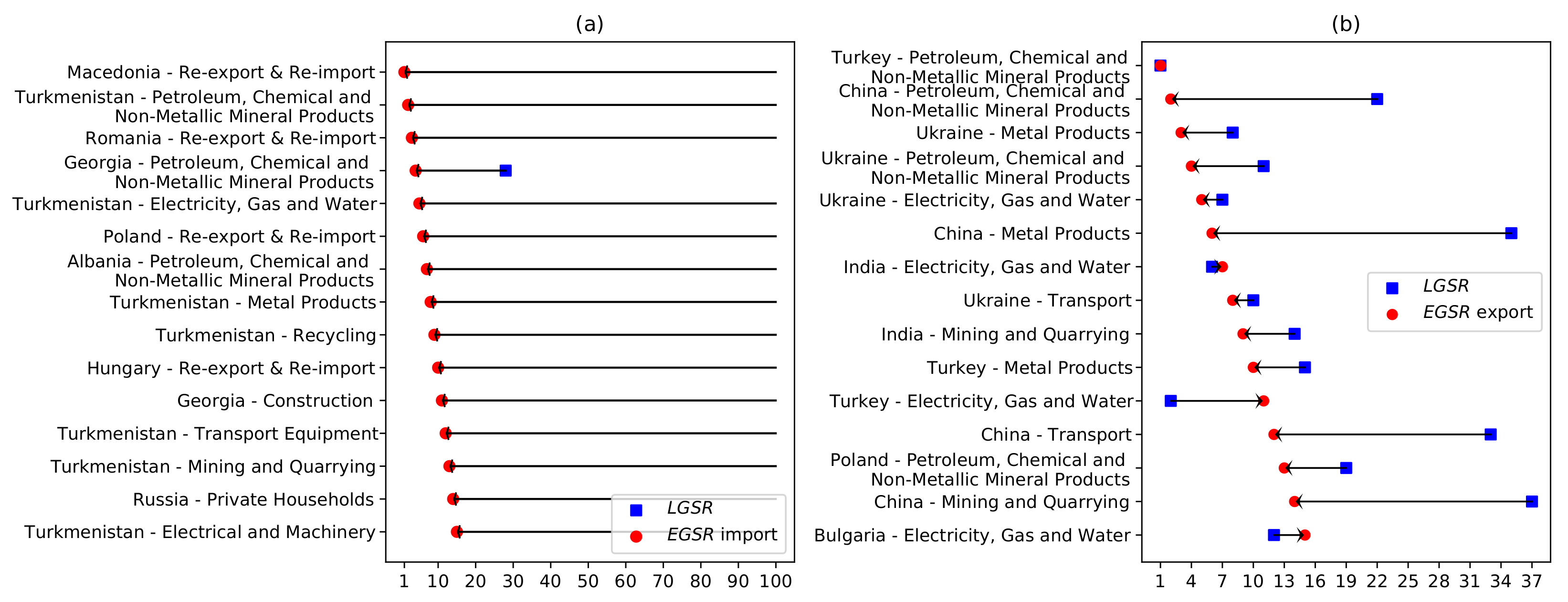

4.2.2. Sector Level Results

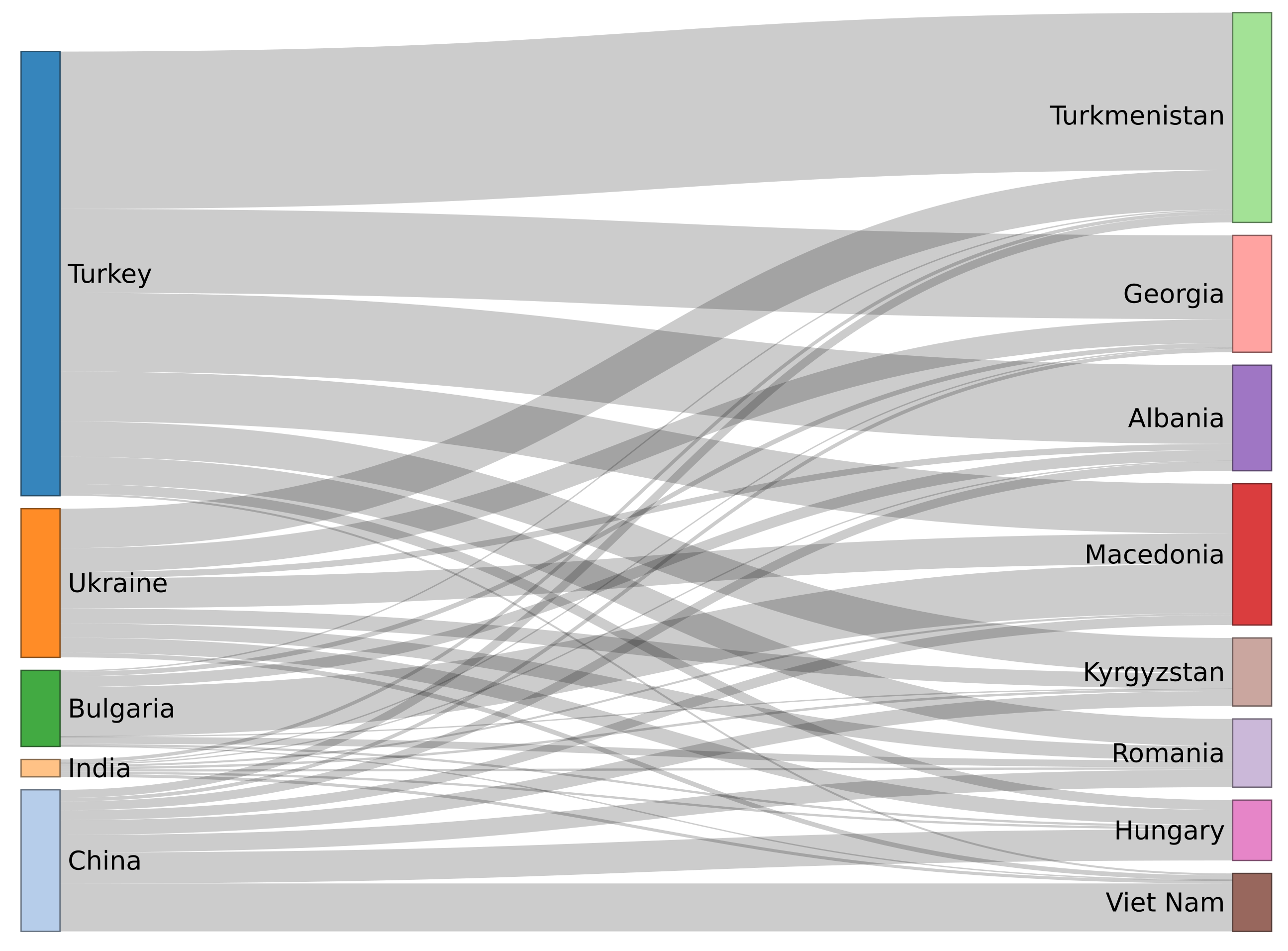

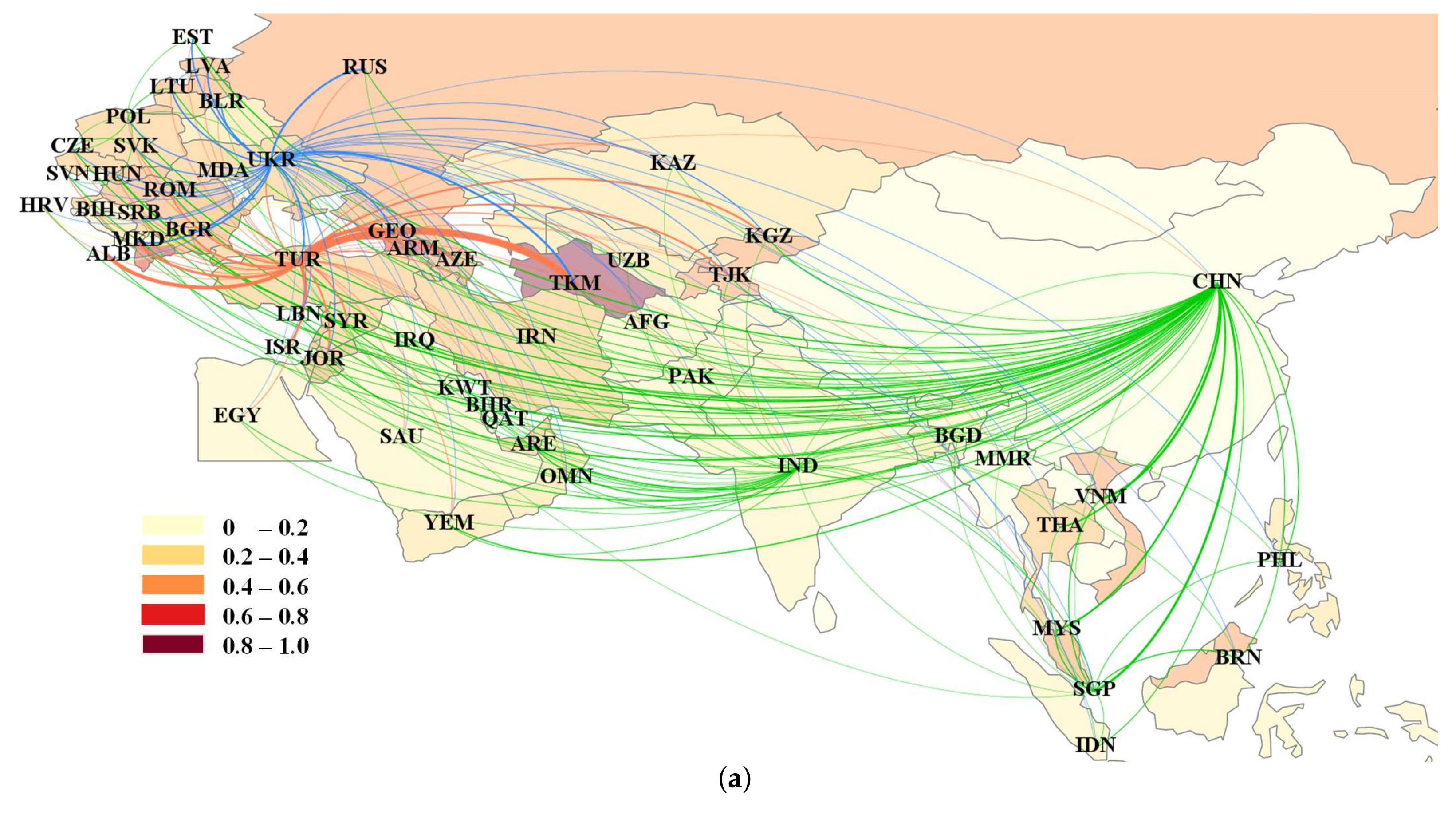

4.3. Top Network Analysis

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Code | Sector |

|---|---|

| S1 | Agriculture |

| S2 | Fishing |

| S3 | Mining and Quarrying |

| S4 | Food & Beverages |

| S5 | Textiles and Wearing Apparel |

| S6 | Wood and Paper |

| S7 | Petroleum, Chemical and Non-Metallic Mineral Products |

| S8 | Metal Products |

| S9 | Electrical and Machinery |

| S10 | Transport Equipment |

| S11 | Other Manufacturing |

| S12 | Recycling |

| S13 | Electricity, Gas and Water |

| S14 | Construction |

| S15 | Maintenance and Repair |

| S16 | Wholesale Trade |

| S17 | Retail Trade |

| S18 | Hotels and Restraurants |

| S19 | Transport |

| S20 | Post and Telecommunications |

| S21 | Finacial Intermediation and Business Activities |

| S22 | Public Administration |

| S23 | Education, Health and Other Services |

| S24 | Private Households |

| S25 | Others |

| S26 | Re-export & Re-import |

| Country | Code | Continent | Country | Code | Continent |

|---|---|---|---|---|---|

| Afghanistan | AFG | Asia | Lithuania | LTU | Europe |

| Albania | ALB | Europe | Malaysia | MYS | Asia |

| Armenia | ARM | Asia | Moldova | MDA | Europe |

| Azerbaijan | AZE | Asia | Myanmar | MMR | Asia |

| Bahrain | BHR | Asia | Oman | OMN | Asia |

| Bangladesh | BGD | Asia | Pakistan | PAK | Asia |

| Belarus | BLR | Europe | Philippines | PHL | Asia |

| Bosnia and Herzegovina | BIH | Europe | Poland | POL | Europe |

| Brunei | BRN | Asia | Qatar | QAT | Asia |

| Bulgaria | BGR | Europe | Romania | ROU | Europe |

| China | CHN | Asia | Russia | RUS | Europe |

| Croatia | HRV | Europe | Saudi Arabia | SAU | Asia |

| Czech Republic | CZE | Europe | Serbia | SRB | Europe |

| Egypt | EGY | Arica | Singapore | SGP | Asia |

| Estonia | EST | Europe | Slovakia | SVK | Europe |

| Georgia | GEO | Asia | Slovenia | SVN | Europe |

| Hungary | HUN | Europe | Syria | SYR | Asia |

| India | IND | Asia | Tajikistan | TJK | Asia |

| Indonesia | IDN | Asia | TFYR Macedonia | MKD | Europe |

| Iran | IRN | Asia | Thailand | THA | Asia |

| Iraq | IRQ | Asia | Turkey | TUR | Asia |

| Israel | ISR | Asia | Turkmenistan | TKM | Asia |

| Jordan | JOR | Asia | UAE | ARE | Asia |

| Kazakhstan | KAZ | Asia | Ukraine | UKR | Europe |

| Kuwait | KWT | Asia | Uzbekistan | UZB | Asia |

| Kyrgyzstan | KGZ | Asia | Vietnam | VNM | Asia |

| Latvia | LVA | Europe | Yemen | YEM | Asia |

| Lebanon | LBN | Asia |

References

- Zou, C.; Zhao, Q.; Zhang, G.; Xiong, B. Energy revolution: From a fossil energy era to a new energy era. Nat. Gas Ind. B 2016, 3, 1–11. [Google Scholar] [CrossRef] [Green Version]

- International Energy Agency. 2020. Available online: https://www.iea.org/data-and-statistics (accessed on 26 September 2021).

- BP Statistical Review World Energy. 2020. Available online: https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy/natural-gas.html (accessed on 28 September 2021).

- Kan, S.; Chen, B.; Wu, X.; Chen, Z.; Chen, G. Natural gas overview for world economy: From primary supply to final demand via global supply chains. Energy Policy 2019, 124, 215–225. [Google Scholar] [CrossRef]

- Zhang, C.; Fu, J.; Pu, Z. A study of the petroleum trade network of countries along “The Belt and Road Initiative”. J. Clean. Prod. 2019, 222, 593–605. [Google Scholar] [CrossRef]

- Van de Graaf, T.; Colgan, J.D. Russian gas games or well-oiled conflict? Energy security and the 2014 Ukraine crisis. Energy Res. Soc. Sci. 2017, 24, 59–64. [Google Scholar] [CrossRef] [Green Version]

- Geng, J.B.; Ji, Q.; Fan, Y. A dynamic analysis on global natural gas trade network. Appl. Energy 2014, 132, 23–33. [Google Scholar] [CrossRef]

- Li, J.; Dong, X.; Jiang, Q.; Dong, K.; Liu, G. Natural gas trade network of countries and regions along the belt and road: Where to go in the future? Resour. Policy 2021, 71, 101981. [Google Scholar] [CrossRef]

- Wang, X.; Yao, M.; Li, J.; Ge, J.; Wei, W.; Wu, B.; Zhang, M. Global embodied rare earths flows and the outflow paths of China’s embodied rare earths: Combining multi-regional input-output analysis with the complex network approach. J. Clean. Prod. 2019, 216, 435–445. [Google Scholar] [CrossRef]

- Hewings, G.J.; Jensen, R.C. Regional, interregional and multiregional input-output analysis. In Handbook of Regional and Urban Economics; Elsevier: Amsterdam, The Netherlands, 1987; Volume 1, pp. 295–355. [Google Scholar]

- Wang, Z.; Yang, Y.; Wang, B. Carbon footprints and embodied CO2 transfers among provinces in China. Renew. Sustain. Energy Rev. 2018, 82, 1068–1078. [Google Scholar] [CrossRef]

- Zhang, C.; Anadon, L.D. A multi-regional input–output analysis of domestic virtual water trade and provincial water footprint in China. Ecol. Econ. 2014, 100, 159–172. [Google Scholar] [CrossRef]

- Zhang, C.; Zhong, L.; Liang, S.; Sanders, K.T.; Wang, J.; Xu, M. Virtual scarce water embodied in inter-provincial electricity transmission in China. Appl. Energy 2017, 187, 438–448. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Y.; Zhang, J.H.; Tian, Q.; Liu, Z.H.; Zhang, H.L. Virtual water trade of agricultural products: A new perspective to explore the Belt and Road. Sci. Total Environ. 2018, 622, 988–996. [Google Scholar] [CrossRef]

- Chen, G.; Li, J.; Chen, B.; Wen, C.; Yang, Q.; Alsaedi, A.; Hayat, T. An overview of mercury emissions by global fuel combustion: The impact of international trade. Renew. Sustain. Energy Rev. 2016, 65, 345–355. [Google Scholar] [CrossRef]

- White, D.J.; Feng, K.; Sun, L.; Hubacek, K. A hydro-economic MRIO analysis of the Haihe River Basin’s water footprint and water stress. Ecol. Model. 2015, 318, 157–167. [Google Scholar] [CrossRef]

- Wang, L.; Zou, Z.; Liang, S.; Xu, M. Virtual scarce water flows and economic benefits of the Belt and Road Initiative. J. Clean. Prod. 2020, 253, 119936. [Google Scholar] [CrossRef]

- Chen, K.; Luo, P.; Sun, B.; Wang, H. Which stocks are profitable? A network method to investigate the effects of network structure on stock returns. Phys. A Stat. Mech. Appl. 2015, 436, 224–235. [Google Scholar] [CrossRef]

- Gao, X.; Fang, W.; An, F.; Wang, Y. Detecting method for crude oil price fluctuation mechanism under different periodic time series. Appl. Energy 2017, 192, 201–212. [Google Scholar] [CrossRef]

- Du, R.; Dong, G.; Tian, L.; Wang, Y.; Zhao, L.; Zhang, X.; Vilela, A.L.; Stanley, H.E. Identifying the peak point of systemic risk in international crude oil importing trade. Energy 2019, 176, 281–291. [Google Scholar] [CrossRef]

- Du, R.; Wang, Y.; Dong, G.; Tian, L.; Liu, Y.; Wang, M.; Fang, G. A complex network perspective on interrelations and evolution features of international oil trade, 2002–2013. Appl. Energy 2017, 196, 142–151. [Google Scholar] [CrossRef]

- Sun, X.; Li, J.; Qiao, H.; Zhang, B. Energy implications of China’s regional development: New insights from multi-regional input-output analysis. Appl. Energy 2017, 196, 118–131. [Google Scholar] [CrossRef]

- Fan, J.; Meng, J.; Ashkenazy, Y.; Havlin, S.; Schellnhuber, H.J. Network analysis reveals strongly localized impacts of El Niño. Proc. Natl. Acad. Sci. USA 2017, 114, 7543–7548. [Google Scholar] [CrossRef] [Green Version]

- Meng, J.; Fan, J.; Ashkenazy, Y.; Havlin, S. Percolation framework to describe El Niño conditions. Chaos Interdiscip. J. Nonlinear Sci. 2017, 27, 035807. [Google Scholar] [CrossRef]

- Schweitzer, F.; Fagiolo, G.; Sornette, D.; Vega-Redondo, F.; Vespignani, A.; White, D.R. Economic networks: The new challenges. Science 2009, 325, 422–425. [Google Scholar] [CrossRef]

- Chen, B.; Wang, X.; Li, Y.; Yang, Q.; Li, J. Energy-induced mercury emissions in global supply chain networks: Structural characteristics and policy implications. Sci. Total Environ. 2019, 670, 87–97. [Google Scholar] [CrossRef]

- Chen, B.; Li, J.; Chen, G.; Wei, W.; Yang, Q.; Yao, M.; Shao, J.; Zhou, M.; Xia, X.; Dong, K.; et al. China’s energy-related mercury emissions: Characteristics, impact of trade and mitigation policies. J. Clean. Prod. 2017, 141, 1259–1266. [Google Scholar] [CrossRef]

- Chen, B.; Li, J.; Wu, X.; Han, M.; Zeng, L.; Li, Z.; Chen, G. Global energy flows embodied in international trade: A combination of environmentally extended input–output analysis and complex network analysis. Appl. Energy 2018, 210, 98–107. [Google Scholar] [CrossRef]

- Gao, C.; Su, B.; Sun, M.; Zhang, X.; Zhang, Z. Interprovincial transfer of embodied primary energy in China: A complex network approach. Appl. Energy 2018, 215, 792–807. [Google Scholar] [CrossRef]

- Sun, X.; An, H.; Gao, X.; Jia, X.; Liu, X. Indirect energy flow between industrial sectors in China: A complex network approach. Energy 2016, 94, 195–205. [Google Scholar] [CrossRef]

- Liang, X.; Yang, X.; Yan, F.; Li, Z. Exploring global embodied metal flows in international trade based combination of multi-regional input-output analysis and complex network analysis. Resour. Policy 2020, 67, 101661. [Google Scholar] [CrossRef]

- Li, H.; Qin, W.; Li, J.; Tian, Z.; Jiao, F.; Yang, C. Tracing the global tin flow network: Highly concentrated production and consumption. Resour. Conserv. Recycl. 2021, 169, 105495. [Google Scholar] [CrossRef]

- Deng, G.; Lu, F.; Wu, L.; Xu, C. Social network analysis of virtual water trade among major countries in the world. Sci. Total Environ. 2021, 753, 142043. [Google Scholar] [CrossRef] [PubMed]

- Zhao, H.; Qu, S.; Guo, S.; Zhao, H.; Liang, S.; Xu, M. Virtual water scarcity risk to global trade under climate change. J. Clean. Prod. 2019, 230, 1013–1026. [Google Scholar] [CrossRef]

- Zhao, H.; Qu, S.; Liu, Y.; Guo, S.; Zhao, H.; Chiu, A.C.; Liang, S.; Zou, J.P.; Xu, M. Virtual water scarcity risk in China. Resour. Conserv. Recycl. 2020, 160, 104886. [Google Scholar] [CrossRef]

- Liu, Y.; Chen, B. Water-energy scarcity nexus risk in the national trade system based on multiregional input-output and network environ analyses. Appl. Energy 2020, 268, 114974. [Google Scholar] [CrossRef]

- Qu, S.; Liang, S.; Konar, M.; Zhu, Z.; Chiu, A.S.; Jia, X.; Xu, M. Virtual water scarcity risk to the global trade system. Environ. Sci. Technol. 2018, 52, 673–683. [Google Scholar] [CrossRef]

- Miller, R.E.; Blair, P.D. Input-Output Analysis: Foundations and Extensions; Cambridge University Press: Cambridge, UK, 2009. [Google Scholar]

- Zhang, W.; Fan, X.; Liu, Y.; Wang, S.; Chen, B. Spillover risk analysis of virtual water trade based on multi-regional input-output model-A case study. J. Environ. Manag. 2020, 275, 111242. [Google Scholar] [CrossRef]

- Dietzenbacher, E. In vindication of the Ghosh model: A reinterpretation as a price model. J. Reg. Sci. 1997, 37, 629–651. [Google Scholar] [CrossRef]

- Zhou, M.; Wu, G.; Xu, H. Structure and formation of top networks in international trade, 2001–2010. Soc. Netw. 2016, 44, 9–21. [Google Scholar] [CrossRef]

- Lenzen, M.; Kanemoto, K.; Moran, D.; Geschke, A. Mapping the structure of the world economy. Environ. Sci. Technol. 2012, 46, 8374–8381. [Google Scholar] [CrossRef]

- Lenzen, M.; Moran, D.; Kanemoto, K.; Geschke, A. Building Eora: A global multi-region input–output database at high country and sector resolution. Econ. Syst. Res. 2013, 25, 20–49. [Google Scholar] [CrossRef]

- Central Intelligence Agency. 2020. Available online: https://www.cia.gov/the-world-factbook/ (accessed on 1 October 2021).

- Tang, M.; Hong, J.; Liu, G.; Shen, G.Q. Exploring energy flows embodied in China’s economy from the regional and sectoral perspectives via combination of multi-regional input–output analysis and a complex network approach. Energy 2019, 170, 1191–1201. [Google Scholar] [CrossRef]

| Country | EGSR Imports | Country | EGSR Imports per Unit Output | Country | EGSR Exports | Country | EGSR Exports per Unit Output |

|---|---|---|---|---|---|---|---|

| Turkmenistan | 3.474 | Qatar | 0.805 | Turkey | 14.617 | Bulgaria | 0.015 |

| Macedonia | 2.411 | Belarus | 0.109 | China | 11.131 | Turkey | 0.014 |

| Georgia | 1.934 | Kyrgyzstan | 0.089 | Ukraine | 8.345 | Ukraine | 0.011 |

| Albania | 1.757 | Georgia | 0.078 | India | 2.704 | Thailand | 0.007 |

| Romania | 1.250 | Turkmenistan | 0.064 | Bulgaria | 1.934 | Lithuania | 0.004 |

| Vietnam | 1.230 | Albania | 0.063 | Singapore | 1.798 | Poland | 0.004 |

| Kyrgyzstan | 1.204 | Tajikistan | 0.058 | Poland | 0.781 | Belarus | 0.003 |

| Bulgaria | 1.198 | Armenia | 0.052 | Czech | 0.397 | Georgia | 0.003 |

| Hungary | 1.161 | Thailand | 0.025 | Lithuania | 0.302 | Singapore | 0.002 |

| Jordan | 1.079 | Estonia | 0.021 | Hungary | 0.297 | Serbia | 0.002 |

| Sector | EGSR Imports | Sector | EGSR Imports per Unit Output |

| Macedonia-S26 | 0.484 | Russia-S24 | 1349.738 |

| Turkmenistan-S7 | 0.390 | Kyrgyzstan-S2 | 205.742 |

| Romania-S26 | 0.320 | Kyrgyzstan-S24 | 203.642 |

| Georgia-S7 | 0.299 | Romania-S25 | 176.951 |

| Turkmenistan-S13 | 0.259 | Hungary-S24 | 145.022 |

| Poland-S26 | 0.245 | Slovakia-S24 | 114.939 |

| Turkey-S26 | 0.238 | Romania-S24 | 89.722 |

| Albania-S7 | 0.236 | Myanmar-S26 | 43.331 |

| Turkmenistan-S8 | 0.225 | Vietnam-S26 | 42.837 |

| Turkmenistan-S12 | 0.224 | Jordan-S26 | 39.649 |

| Sector | EGSRExports | Sector | EGSRExports per Unit Output |

| Turkey-S7 | 12.453 | Turkey-S7 | 0.237 |

| China-S7 | 4.448 | Bulgaria-S7 | 0.159 |

| Ukraine-S8 | 2.856 | Ukraine-S8 | 0.108 |

| Ukraine-S7 | 2.168 | Bulgaria-S13 | 0.083 |

| China-S9 | 2.065 | Ukraine-S7 | 0.082 |

| Ukraine-S13 | 1.830 | Singapore-S13 | 0.073 |

| China-S8 | 1.557 | Ukraine-S13 | 0.065 |

| Singapore-S13 | 1.532 | Ukraine-S19 | 0.049 |

| India-S13 | 1.514 | Turkey-S8 | 0.039 |

| Bulgaria-S7 | 1.317 | Lithuania-S7 | 0.030 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Du, R.; Wu, Q.; Dong, G.; Tian, L.; Vilela, A.L.M.; Zhao, L.; Zheng, X. Natural Gas Scarcity Risk for Countries along the Belt and Road. Energies 2022, 15, 1053. https://doi.org/10.3390/en15031053

Du R, Wu Q, Dong G, Tian L, Vilela ALM, Zhao L, Zheng X. Natural Gas Scarcity Risk for Countries along the Belt and Road. Energies. 2022; 15(3):1053. https://doi.org/10.3390/en15031053

Chicago/Turabian StyleDu, Ruijin, Qi Wu, Gaogao Dong, Lixin Tian, André L. M. Vilela, Linfeng Zhao, and Xiaoxia Zheng. 2022. "Natural Gas Scarcity Risk for Countries along the Belt and Road" Energies 15, no. 3: 1053. https://doi.org/10.3390/en15031053

APA StyleDu, R., Wu, Q., Dong, G., Tian, L., Vilela, A. L. M., Zhao, L., & Zheng, X. (2022). Natural Gas Scarcity Risk for Countries along the Belt and Road. Energies, 15(3), 1053. https://doi.org/10.3390/en15031053