1. Introduction

The human need for energy and the increase in the consumption of fossil fuels such as oil, natural gas and coal, as well as economic growth and industrial development in the past decades, have created changes in the climate of the Earth, one of the prominent examples of which is the increase in greenhouse gas emissions in the atmosphere. One thing that should be considered in environmental considerations is the transportation sector’s contribution to producing carbon dioxide from fuel combustion. Examining the global approach of the automobile industry based on fuel consumption and pollution shows that fuel consumption must be reduced to reduce the amount of pollutants and greenhouse gases.

Previous studies on reducing CO

2 and other greenhouse gas emissions and energy consumption have been conducted from the fleet perspective [

1,

2]. These concerned the launch and use of zero-emission vehicles (ZEVs) and lightweight vehicles, which require attention to the material and energy flows associated with developing high-tech vehicles [

3,

4]. Reducing CO

2 emissions depends on the number of vehicles registered as in use. Projections for different countries, regions and cities show an increase in the number of vehicles used in the future, highlighting the importance of initiatives aimed at reducing emissions by the automotive sector. This is particularly important for developing countries such as Iran. Projections conducted for the megacity of Tehran using multiple econometric and emission models show that the passenger car (PC) stock will grow 70% by 2035 and reach 5.4 million [

5]. Similar conclusions can be drawn from research conducted using auto-regressive moving-average (ARMA) models in Turkey, where the annual increase in the number of passenger cars (M1) category is over 6% per year. This scenario corresponds to an increase in road-transport profiles from 16.7 million to 28 million in the 2019–2030 period. Unfortunately, despite the tax advantage given to EVs, the share of the number of electric vehicles is minimal due to their high price and insufficient infrastructure (0.03% in 2018) [

6].

Iran is ranked as the 12th largest car producer in the world and the largest car manufacturer in the Middle East [

7]. Iran is a major car manufacturer in the Middle East. However, despite its high production and import of cars to the Iranian market, the demand is far beyond its supply [

8]. The importance of cars to Iran is related to the existing barriers imposed on the transfer of modern technologies, which inhibits the development of low-emission vehicles. The research shows the need for the Iranian automotive industry to develop appropriate strategies for successful technology transfer [

9]. In this context, it should be emphasized that the sectoral environment (i.e., technological regimes, market regimes and government policies) of Iran’s automobile industry (IAI) is characterized by ineffective technology transfer, diverse technological areas, high tacit knowledge, extensive backward linkages, under-developed domestic supply chain, oligopolistic structure and a homogeneous market [

10,

11].

Unfortunately, in developing countries such as Iran, due to the high tariff support and the creation of an exclusive space in the car market, manufacturers have no incentive to improve the combustion quality of their products, while domestically produced engines are one of the most critical and widespread energy consumers. Therefore, in such countries, cars produce more pollution and affect the decisions of investors to invest in the car industry. Carbon dioxide emissions, as an essential measure of companies’ environmental impacts, affect stock pricing decisions because a large number of investors claim to consider non-financial information in their investment decisions.

Research based on a sample of companies listed on the London Stock Exchange from 2016 to 2020 shows that environmental innovation can lead to lower carbon emissions. Multivariate regression analysis supported the hypothesis about the impact of environmental innovation on CO

2 emissions, including Scope 1 and Scope 2 emissions. It also proved that environmental innovation leads to lower CO

2 emissions in firms with better environmental governance [

12].

Most likely, significant restrictions on CO

2 emissions will be applied in the coming years, and companies whose activities or products are related to high-level greenhouse gas emissions will be affected by these restrictions [

13].

The average cost of CO

2 emissions in Europe is growing rapidly, which is a big problem for companies [

14,

15,

16]. The highest cost increases in the EU were recorded in countries such as Poland and Estonia. It is difficult for enterprises in these countries because production costs increase significantly, lowering their competitive position [

17,

18,

19,

20,

21,

22]. These units are becoming less attractive to investors.

Due to the production specificity, the automotive sector must meet strict regulations to increase mobility while reducing emissions to demonstrate environmental stewardship. Trust in the promise of a sustainable Fahrvergnügen was broken with scandals such as “Dieselgate” [

23]. Volkswagen (VW) used illegal means to hide the fact that their vehicles did not meet emission levels required by the Clean Air Act. Fraud committed by the German automaker spread to surrounding companies within the industry, contaminating market values and costing American firms around USD 6.44 billion [

24]. In addition, there is rich empirical evidence that the announcement of environmental regulation violations and poor environmental performance substantially damages a firm’s stock [

25,

26,

27]. Talay et al. [

28] have shown a link between short-term stock market returns to new product preannouncements (NPPA) and the post-launch new product performance under various industry and firm conditions. This is crucial for the automotive industry, which is moving towards producing zero-emission cars in the future. According to the efficient market hypothesis (EMH), market value is an unbiased estimate of the net present value of a firm’s future cash flows and stock prices. EMH fully reflects all publicly available information. Therefore, the information provided to investors about environmental innovations in the area of CO

2 reduction can contribute significantly to the increase in the value of car manufacturing companies.

The situation is different for countries that do not produce cars, such as Norway, where corporate stakeholders are not penalized for non-compliance with environmental regulations. However, it is a strong political signal in favor of accelerated market uptake of low- and zero-emission cars in general and battery electric vehicles (BEVs) in particular [

27,

28].

Therefore, due to the application of these restrictions, investors are most concerned about the risk associated with the return of purchased shares. Considering these cases, it can be expected that the risk related to carbon emissions from all economic activities will be reflected in the yield level and, thus, the stock price. In addition, due to the unique and dangerous conditions of the emission of CO2 in developing countries, one of the leading causes of which is vehicle pollutants, we focus on the effects of greenhouse gas emissions. Therefore, in this study, we collect Iranian automobile companies’ data and investigate the effect of CO2 gas emissions on the market value, price and yield of shares in the panel data concept.

The study consists of six parts.

Section 2 discusses the study’s theoretical background and provides an in-depth description of the relationship between CO

2 emissions and stock markets.

Section 3 presents models used to investigate the effect of CO

2 emissions on automobile companies’ market value, price and stock return.

Section 4 contains the methodology, i.e., the database used and the methods applied for further analysis.

Section 5 discusses the results, while the final section provides general conclusions and indicates further research directions.

2. Literature Review

Many studies seek to explain the cross-sectional pattern of stock returns based on exposure to aggregate risk factors such as size and book-to-market ratios or firm-specific risk associated with observable firm characteristics [

29] One of the variables that has been missing in the analysis so far is the carbon dioxide emissions of companies. This omission may be for historical reasons, as concerns about global warming due to greenhouse gas emissions as a result of human activities have gained attention. It is generally accepted in the scientific community that carbon dioxide emission, which is the cause of global warming, is due to the use of fossil fuels such as coal, oil and gas as energy sources. Therefore, reducing the effects of global warming and climate change requires significantly reducing fossil fuel energy use.

Tamazian et al. [

30] investigated the relationship between stock markets and CO

2 emissions in BRIC countries from 1992 to 2004. They concluded that developing financial systems reduce CO

2 emissions per capita in developing countries. Such an approach requires a negative correlation between stock market returns and CO

2 emissions. This negative effect drives financial decisions in a direction that contributes to higher stock returns and lower CO

2 emissions. In a study of 22 developing countries, Secker [

31] found a positive relationship between stock market growth and energy demand. In addition, it has been reported in several studies that the increase in energy demand leads to a rise in CO

2 emissions [

31,

32,

33]. Additionally, Ziaei [

34] found that stock market returns have a one-way and positive effect on energy consumption.

However, Paramati et al. [

35] investigated the relationship between stock market growth and renewable energy production in G20 countries from 1991 to 2012. They found that using renewable energy sources reduces CO

2 emissions and increases economic growth. Shahbaz et al. [

36] investigated bidirectional causality between financial development variables and CO

2 emissions in Malaysia from 1971 to 2011. Their results show that financial development reduces CO

2 emissions. In addition, energy consumption and economic growth increase CO

2 emissions. Omri [

37], by examining the two-way causal relationship between energy consumption and CO

2 emissions using the data of several developing countries from 1990–2011, shows a two-way causal relationship between energy consumption and economic growth. This study shows that environmental and energy policies should consider the relationship between energy consumption and economic development to maintain sustainable economic growth in the Middle East and North Africa. Ren et al. [

38] also investigated the relationship of causality and found that the causality was from financial investments to CO

2 emissions in China from 2000 to 2010. Additionally, Su et al. [

39] reached similar results between China’s GDP and CO

2 emissions between 1992 and 2010. Staples et al. [

40] also argue that if fossil fuels are replaced with environmentally sustainable energy sources in heat production and electricity production, greenhouse gas emissions will be reduced by 9–68%.

Chang et al. [

41] used a financial market-based approach to investigate whether positive stock returns cause changes in CO

2 emissions or vice versa. Additionally, they used the Granger causality test to determine the effect path. Their results show that when stock returns increase by 1 percent, CO

2 emissions from coal combustion decrease by 9 percent among countries included in the MSCI World Index. Moreover, when stock returns increase by 1%, CO

2 emissions from oil combustion increase by 2%, but stock returns do not significantly affect CO

2 emissions from gas combustion.

Bolton and Kakperzic [

42] studied the effect of carbon emissions on stock returns using cross-sectional data from the United States. They concluded that companies that expect higher carbon dioxide have higher returns. Using data from 51 developed and emerging countries, Bhutto et al. [

43] concluded that small businesses experience a greater decrease in efficiency due to carbon dioxide emissions. The effect of company size is dominant with profitability and the amount of investment. Therefore, with the increase in carbon dioxide emissions, high profitability and investment will also result in a sharper return decrease. Castro and others [

44], using the panel data of 16 European countries during the years 2005–2017, which were collected at the company level, showed a positive relationship between the environmental performance of companies and the company’s market value. Tang et al. [

45] examined Chinese companies’ stocks and concluded that the plan to limit carbon emissions in this country has significantly increased the value of companies through innovative activities.

Shobande and Ogbeifun [

46] used the annual data of the World Bank of developed countries from 1980 to 2019 and applied the fixed effects and the dynamic methods of Arellano-Bover and Blundel-Bond to conclude that the stock market affects carbon emissions. Additionally, Usman Khurram [

47] concluded that reducing carbon emissions has a positive and significant effect on stock prices by studying the shares of the Shanghai Stock Exchange. In their study, Rohhelder and others [

48] concluded that decarbonization is the reason for the decrease in stock prices.

Ferrat [

49] said that the relationship between environmental and financial performance had been a source of great debate. He reexamined the impact of carbon emission performance (CEP) on corporate financial performance (CFP) by studying the moderating effect of CFP horizon, CEP materiality and regional attributes. Using an international sample of firms between 2015 and 2020, the results suggested that short-term CFP was negatively affected by CEP and solely high materiality firms would derive heightened CFP in the long run. Radu and Maram’s [

50] study sheds light on the role of industrial-sector polluting levels and the influence of firms’ environment or sustainable development committee on the market valuation of their reported carbon emissions. Their results for Canadian firms from 2004 to 2017 show a negative association between GHG emissions and firm value. Moreover, companies with an environment or sustainable development committee have, on average, higher levels of GHG emissions than companies with no similar committee. Aswani et al. [

51] believe emissions, stock returns and operating performance are strongly correlated. Still, associations between emissions and returns disappear after accounting for firm size, industry clustering and vendor estimation. In contrast, Lee and Cho [

52] used 841 Korean firms between 2013 and 2017 and showed a positive relationship between carbon emissions and firm value.

3. Theoretical Principles

Considering what was said about the importance of greenhouse gas emissions on stock returns, in this research, we used three models to investigate the effect of CO2 emissions on the market value, price and stock return of automobile companies listed on the Tehran Stock Exchange. In the first model, the effect of CO2 emissions on the stock prices of automobile companies has been investigated. So, the dependent variable in the first model is the stock price of automobile companies (PRICE), and the most important explanatory variable is CO2 emissions (kg per USD Dollar 2015 of GDP). In the second model, the dependent variable is the stock returns of automobile companies (RETURN), and the effect of CO2 gas emissions on the stock returns of automobile companies has been examined. In the third model, the dependent variable is the market value of automobile companies (MARKETVALUE), and we examine the relationship between CO2 gas emissions and the market value of automobile companies’ stocks. The other yearly elementary variables are the number of vehicles (VEHICLES), total accidents (TOTALACCIDENT), firm size (SIZE), annual percent of consumer prices inflation (INFLATION), board independence (BLND), management duality (DUALITY), institutional investors (OWN), management ownership (COE_SHARE), audit effort (ACM), board effort (BMS), audit committee expertise (CLNDP), audit committee independence (ACI), board expertise (BSN) and CEO expertise (CEO). We use the dummy variable LOSS if there is a one-year loss equaling one; otherwise, it equals zero. Furthermore, by adding a year and industrial dummy variables, we control the year and industrial fixed effects. The error term is ε. These three models are:

3.1. Normality Test of Variables

To use parametric tests such as t, z, F, etc., we have to check the variables’ normality before running the models. So, the normality of the research variables was checked. In non-parametric statistics, one of the measurements and test methods related to distribution is the Kolmogorov–Smirnov test. With the help of this test, it is possible to determine whether the statistical population follows the desired distribution. Additionally, using this test, it is possible to check the co-distribution between two societies.

3.2. Correlation of Research Variables

This test examines the relationship between the variables used in the models two by two. The diameter of this matrix is always one since it examines the correlation of each variable with itself, which means perfect correlation. The closer these numbers are to one, the more direct the correlation; the closer to zero, the smaller the correlation. Negative numbers also indicate an inverse correlation. So, we use the Pearson correlation coefficient to show the direct effect of co2 emissions on dependent variables.

The other tests include autocorrelation, heteroskedasticity, and the Ramsey RESET test. Autocorrelation analysis measures the relationship of the observations between the different points in time and thus seeks a pattern or trend over the time series. We use the Wooldridge autocorrelation test. There are many tests for heteroscedasticity, but, in this paper, we use the Breusch-Pagan test. We use GMM and ABB dynamic panel data models to evaluate the result of these tests.

5. Empirical Results and Discussion

5.1. Model One Estimation

By the first model, the effect of CO2 gas emission on the stock price of the mining companies has been measured. According to the integration test results, this model should be estimated by the panel data method. Additionally, according to the result of the Hausman test, it was determined that the random effects data method should be used to achieve the best regression fit. Therefore, the first model includes four estimation methods. The first model is the fixed effects method of panel data. In the second model, the variable of fatal accidents has been used instead of the total number of accidents. The dynamic GMM method is used in the third model due to heterogeneity variance. The fourth estimation model is the dynamic panel data method of ABB due to the high correlation of the stock price with the stock price of the previous year and the use of annual data.

According to the estimation results of the first model in

Table 5, the variable coefficient of CO

2 emission is equal to −0.535. Hence, CO

2 emission will decrease the company’s stock price at the 99% confidence level. The negative correlation between CO

2 emissions and stock prices is in line with the results of the studies of Usman Khurram [

47] and Rohleder et al. [

30]. Additionally, the variable coefficient of total accidents equal to −90.316 has been obtained, which at the 99% confidence level is the reason for the company’s decrease in the stock price. Contrary to that, the variable coefficient of the number of vehicles has been obtained equal to 8.710, which at the 99% confidence level is the reason for the company’s stock price increase. Among the control variables of the model, size, inflation and CEO-share variables increase the stock price, and own and clndp variables decrease the stock price of automobile companies. Among the research years, 2013, 2014 and 2016 have lower average stock prices than other years, and 2018 has higher average stock prices than other years.

In the second model, the number of fatal accidents was used instead of the total number. According to the results of this model, the number of fatal accidents compared to the total number of accidents has caused a decrease in stock prices. Therefore, at 99% certainty, an accident leading to death more than twice as much as other accidents reduces the stock price of the automobile company. After that, in the third model using the GMM method, the variable intercept coefficient of the stock price at the 99% confidence level is equal to 0.717. Therefore, this variable’s gap in the previous year values more than 70% of the stock price each year. Similarly, with the ABB method, the variable intercept coefficient of the stock price at the 99% confidence level has been obtained as 0.610.

5.2. Model Two Estimation

By the second model, the effect of CO2 gas emission on the stock returns of micro-processing companies has been measured. According to the integration test results, this model should be estimated by the panel data method. Additionally, according to the result of the Hausman test, it was determined that the random effects data method should be used to achieve the best regression fit. The second model is similar to the first regression model and includes four estimation methods.

According to the estimation results of the first random effects model in

Table 6, the variable coefficient of the effect of CO

2 emission is equal to −0.073. Therefore, carbon dioxide emission is the reason for the reduction of stock returns of automotive companies at the 99% confidence level. This result is in line with the results of studies by Tamazian et al. [

30], Chang et al. [

41], Bhutto et al. [

43] and Sadorsky [

29]. Contrary to that, the variable coefficient of vehicles equal to 2.405 has been obtained, which is the factor of increasing stock returns at the 99% confidence level. Among the control variables of the model, the size and own variables are the factors for reducing the stock returns, and the ceo-share, bsm, acm, and clndp variables are the factors for increasing the stock returns. In addition, the results of the Granger causality test show that the direction of causality is from the side of CO

2 emissions to the stock returns of automobile companies, and the opposite of this relationship is not true.

According to the second fitting, the number of fatal accidents was used instead of the total number. Neither of the two variables of the total number of accidents and the number of accidents leading to death affect the stock returns of automobile companies. After that, in the third fit using the GMM method, the variable intercept coefficient of stock returns at the 99% confidence level is equal to 0.636. Therefore, more than 60% of stock returns each year are valued by the previous year’s lag of this variable. Similarly, the ABB method’s variable intercept coefficient of stock returns at the 99% confidence level equals 0.292.

5.3. Model Three Estimation

By the third model, the effect of CO2 emissions on the market value of micro-processing companies has been measured. According to the integration test results, this model should be estimated by the panel data method. Additionally, according to the result of the Hausman test, it was determined that the random effects data method should be used to achieve the best regression fit. The third model, similar to the previous two models, includes four estimation methods.

According to the results in

Table 7 of the first fitting of the third model, the variable coefficient of CO

2 emission is equal to −4.563. Therefore, carbon dioxide emission causes a decrease in the company’s market value at the 95% confidence level. Therefore, contrary to the studies of Castro et al. [

44] and Tang et al. [

45], there is a negative correlation between market value and CO

2 emissions. In addition, the variable coefficient of the number of vehicles equal to 7.334 has been obtained, increasing the company’s market value at the 99% confidence level. Among the control variables of the model, ceo, aci, size, duality and acm variables increase the market value, and the ceo-share variable decreases the market value of companies. Among the years of research data, 2012 has a higher average market value, and 2015 has a lower average market value than the average of other years.

For the second fitting, the number of fatal accidents was used instead of the total number. The total number of accidents and accidents leading to death increase automobile companies’ market value. Since the increase in car production, the total number of accidents and the number of accidents leading to death has increased; as a result, the company’s market value has also increased. After that, in the third fit using the GMM method, the company’s market value variable intercept coefficient was obtained at the 99% confidence level equal to 0.785. Therefore, more than 75% of the company’s market value every year is valued by this variable’s gap in the previous year. Similarly, with the ABB method, the variable intercept coefficient of the market value at the 90% confidence level is equal to 1.153.

5.4. Tests after the Estimation of Regressions

According to the results of

Table 8, in the first model and the third model, the variance of the heterogeneity and the second model of the variance are the same. Additionally, there is a serial correlation in all three models. To solve these two problems, the econometric methods of ABB, GMM and robust random effects were used, and the problem of serial autocorrelation and heterogeneity was solved. In addition, according to the results of the model specification test, Ramsey RESET, all three models do not have omitted variables, so the results are not biased.

Another test that should be checked after estimating the model is the collinearity between explanatory variables.

Table 9 shows the results of the VIF collinearity test of three regression models. Since these three models have the same explanatory variables, the collinearity results of these three models are also the same. According to the obtained VIF statistic, which is less than 10 for all variables, there is no collinearity between any of the variables of these models. Therefore, there is no problem with collinearity in the regressions.

6. Conclusions

Unfortunately, in developing countries such as Iran, due to high tariff support and the creation of an exclusive space in the car market, manufacturers have no incentive to improve the combustion quality of their products. Most likely, significant restrictions on CO2 emissions will be applied in the coming years, and companies whose activities or products are related to high-level greenhouse gas emissions will be affected by these restrictions. Therefore, due to the application of these restrictions, investors are most concerned about the risk associated with the return of purchased shares. Considering these cases, it can be expected that the risk related to carbon emissions will be reflected in the yield level and, thus, the stock price.

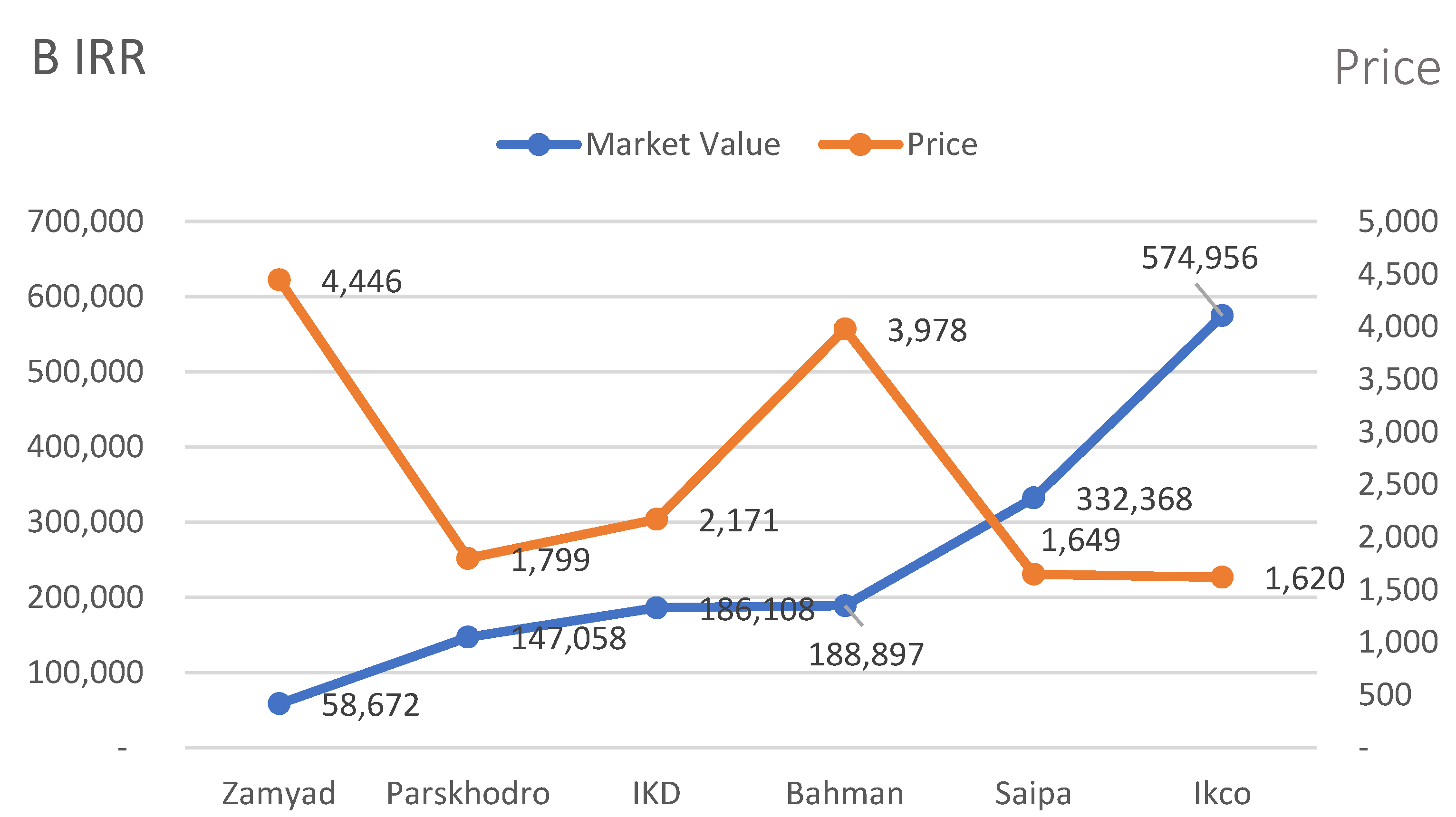

In this research, we used three main models to investigate the effect of CO

2 gas emissions on the market value, price and yield of automobile companies listed on the Tehran Stock Exchange. The data collected in the form of tabular data include six automobile companies. By conducting various tests and panel data estimations, especially the dynamic panel data method, it was determined that CO

2 emissions reduce stock prices, returns and market value of automobile companies. These findings are in line with Tamazian et al. [

30], Shahbaz et al. [

36], Chang et al. [

41], Bhutto et al. [

43], Tang et al. [

44], Lee et al. [

52] and Usman Khurram [

47]. The number of vehicles also positively affects these companies’ price, efficiency and market value. In addition, the results of the causality test show that the direction of causality is from CO

2 emissions to the efficiency of automobile companies.

The results of our research refer only to one stock exchange in Tehran. In the future, we plan to examine the impact of CO2 gas emissions on the market value in the example of car manufacturers in highly developed countries in the context of energy policies promoting the production of electric cars.