A Review of Electricity Tariffs and Enabling Solutions for Optimal Energy Management

Abstract

1. Introduction

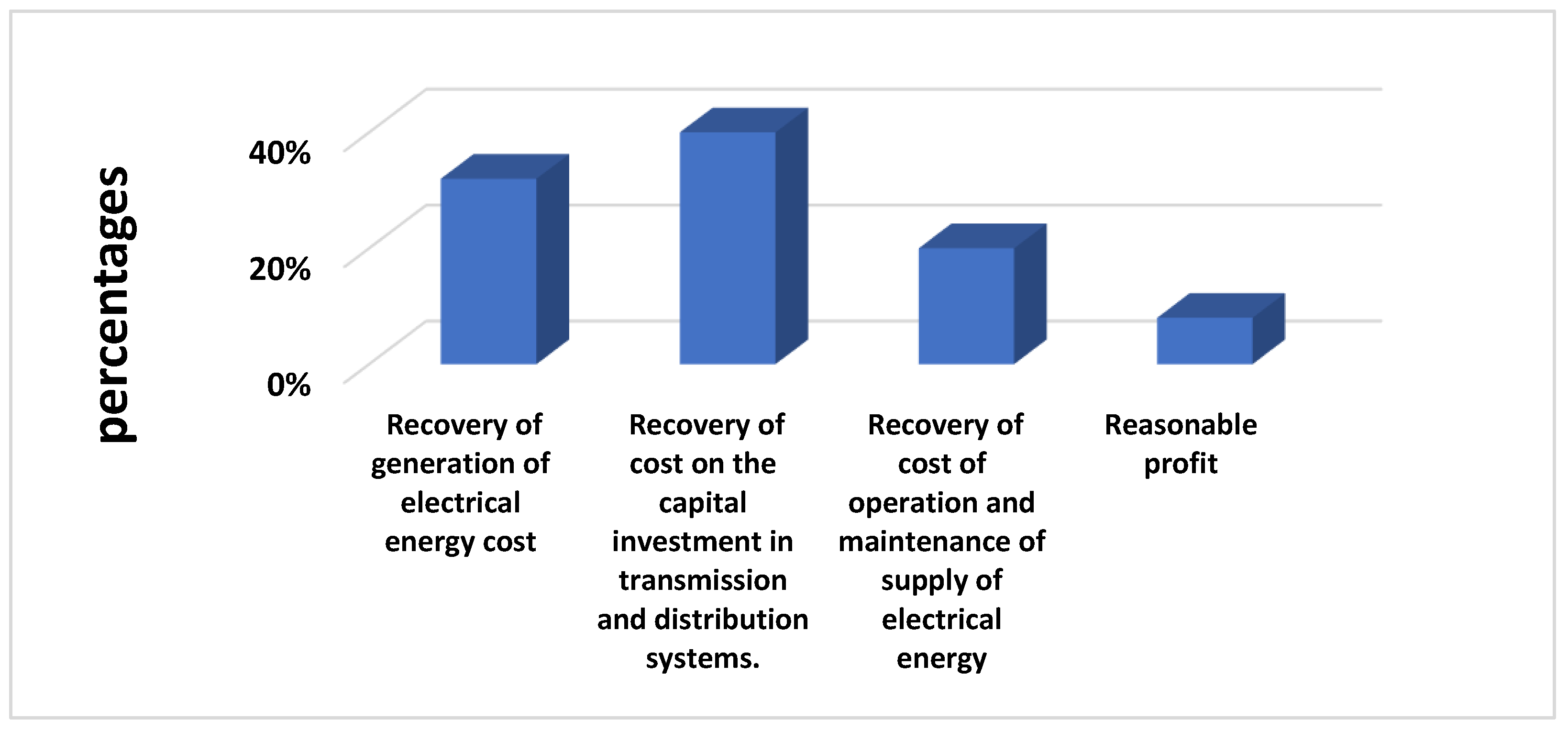

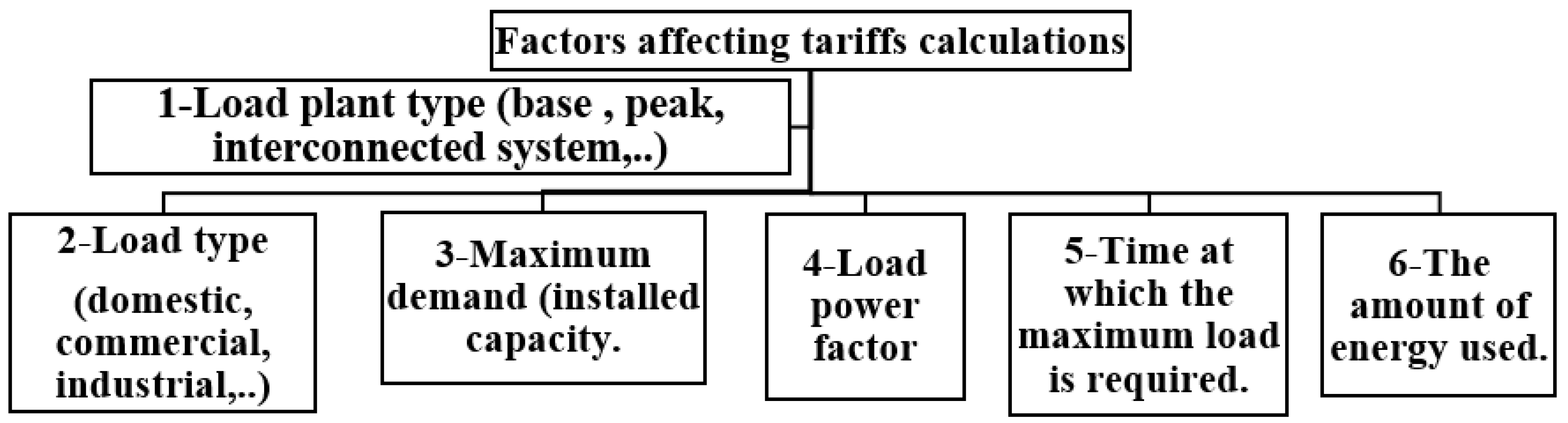

Electricity Tariffs and Energy Management

2. Main Types of Electricity Tariffs

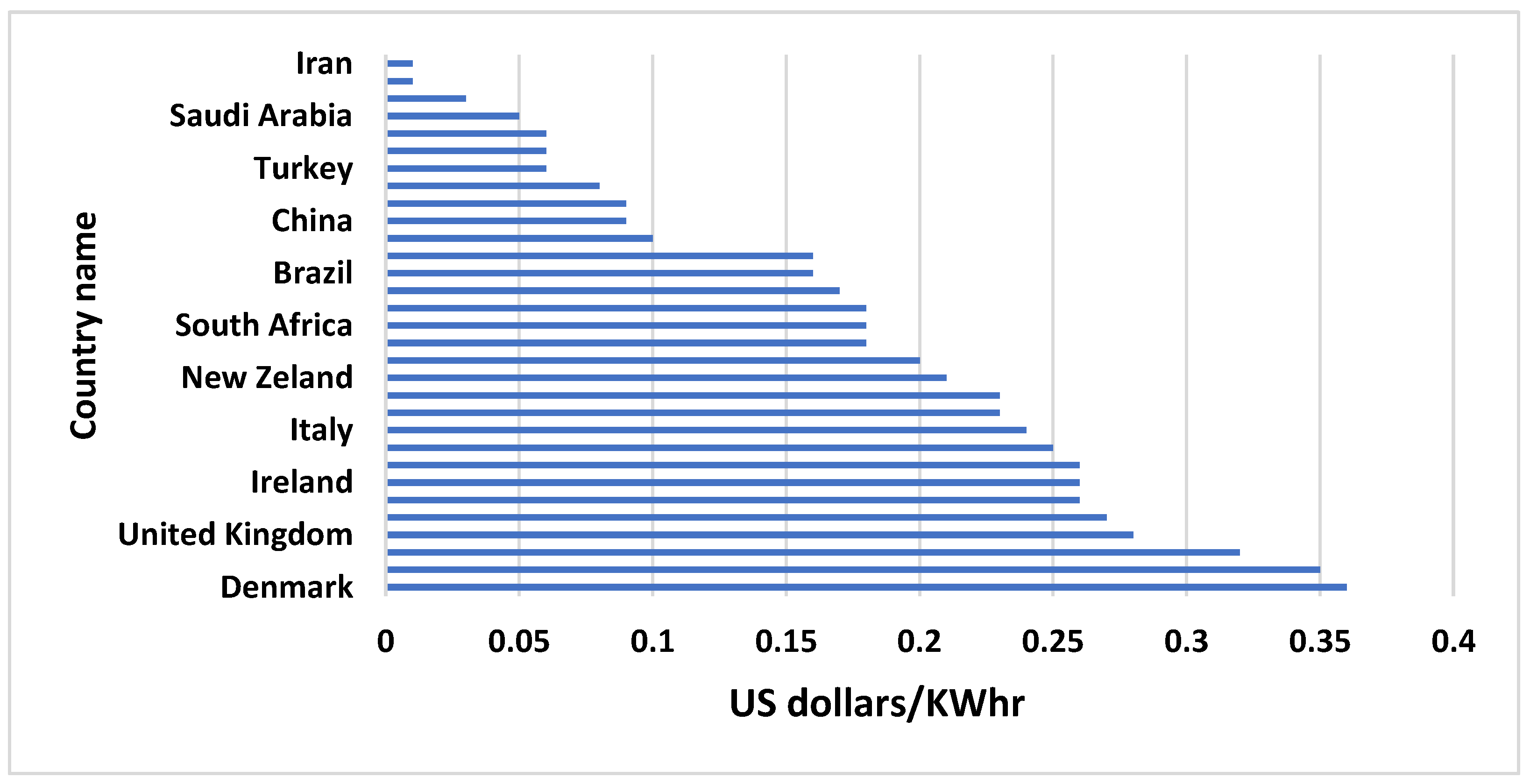

3. Electricity Tariffs Applied in Some Countries

4. Case Study in the MENA Region (Egypt)

4.1. Challenges Facing the Good Electricity Market in the MENA Region

- National and regional governmental independence so that regulators’ decisions cannot be affected.

- Expertise, where responsibilities and authorities define a minimal set of skills that define a regulator’s specific duties.

- Accountability refers to how a regulator takes responsibility and can demonstrate the outcomes of its regulatory changes.

- Transparency, which facilitates understanding the regulator’s work for the consumers.

- Enforcement, which guarantees that market participants follow the rules.

- Internal organization, the ability to make clear decisions.

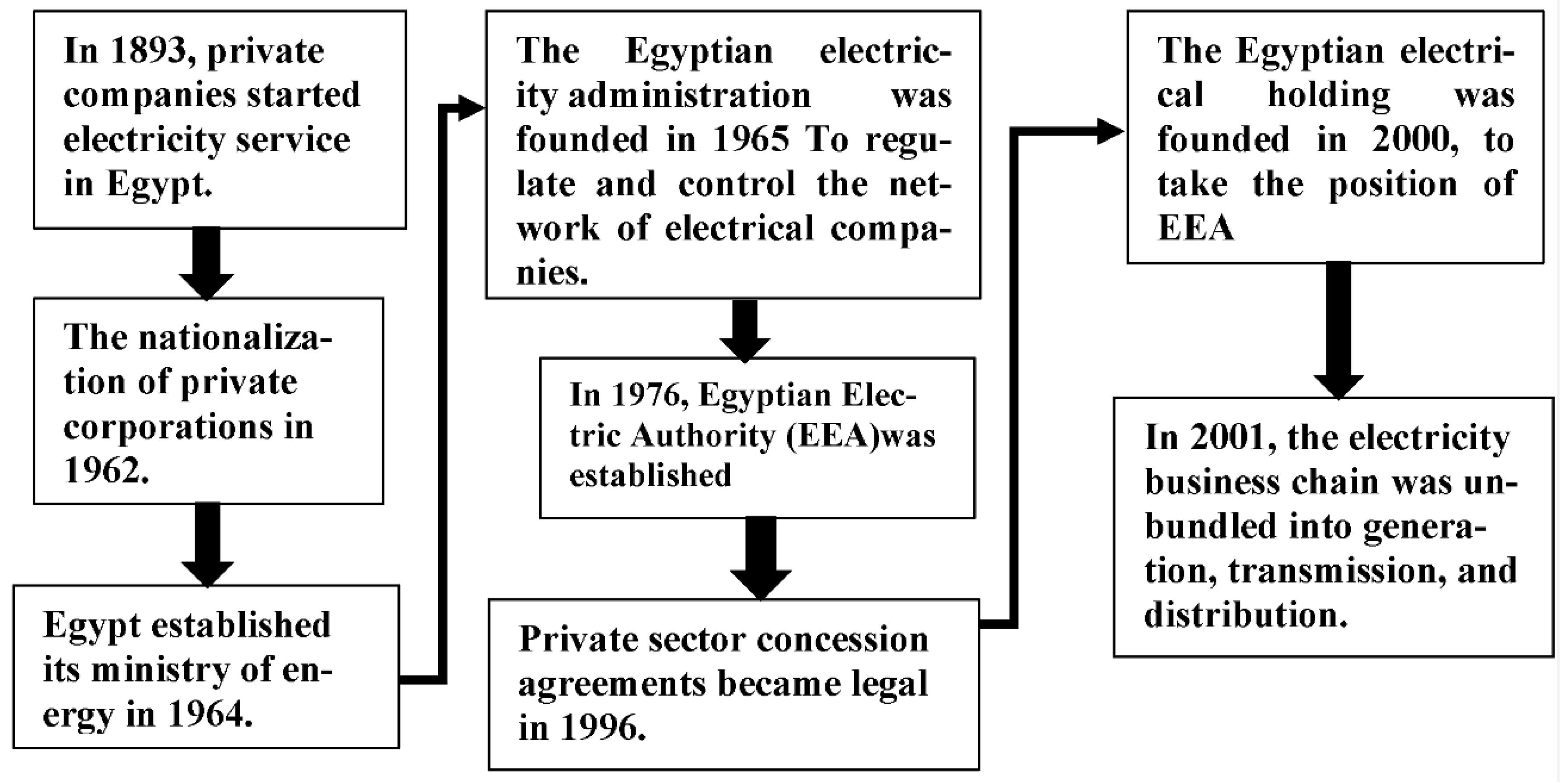

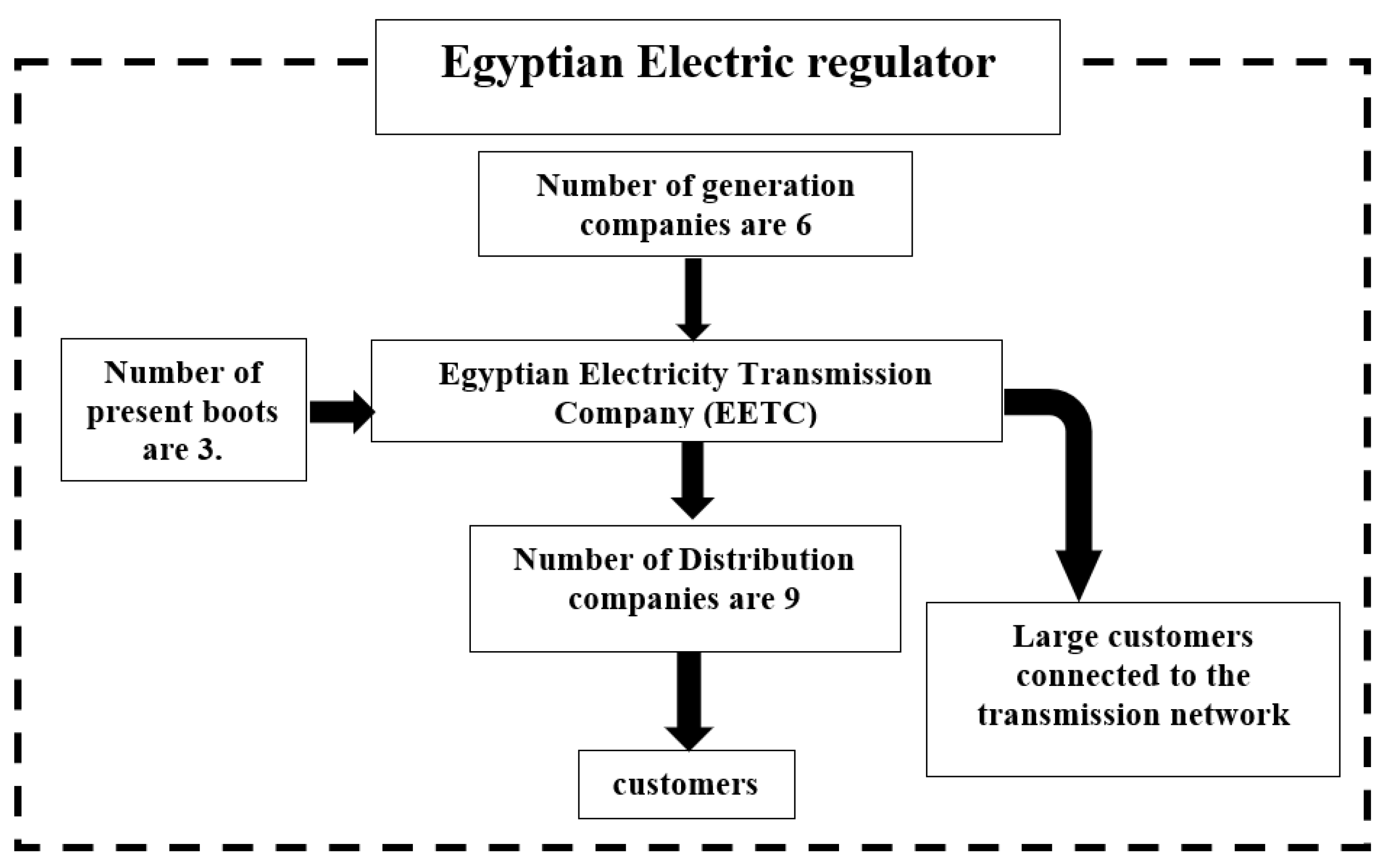

4.2. Egypt’s Electricity Sector Overview

- -

- The current situation regarding the energy sector in Egypt:

- -

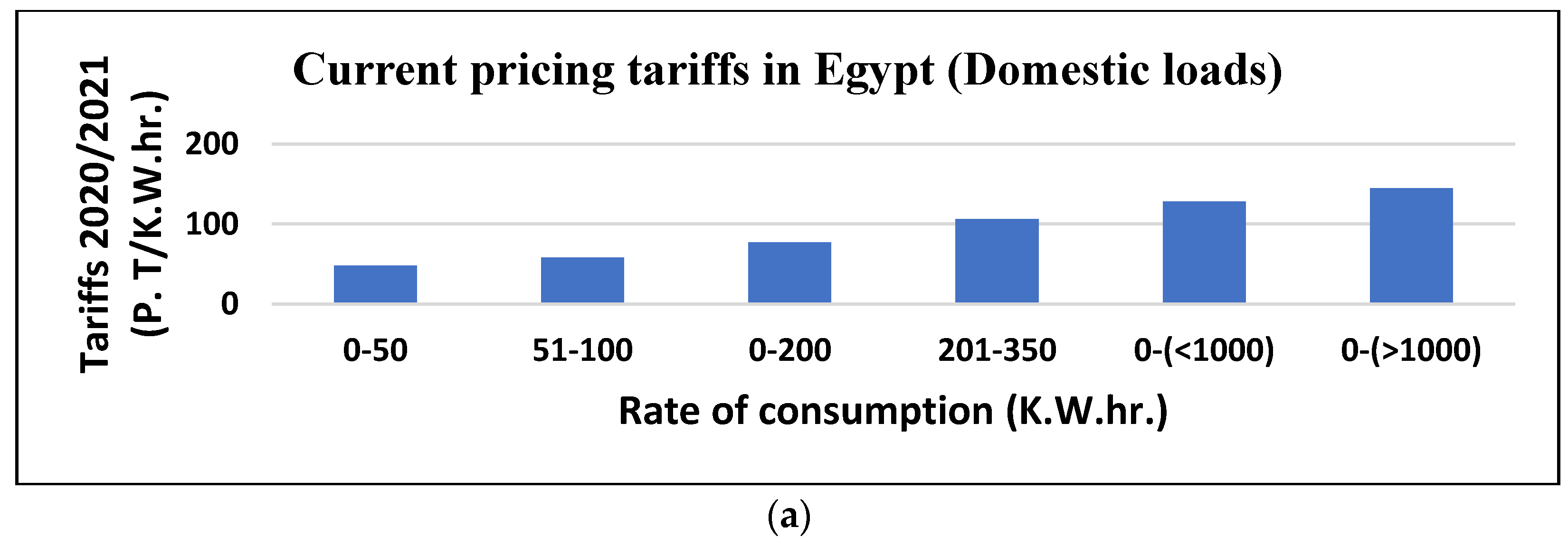

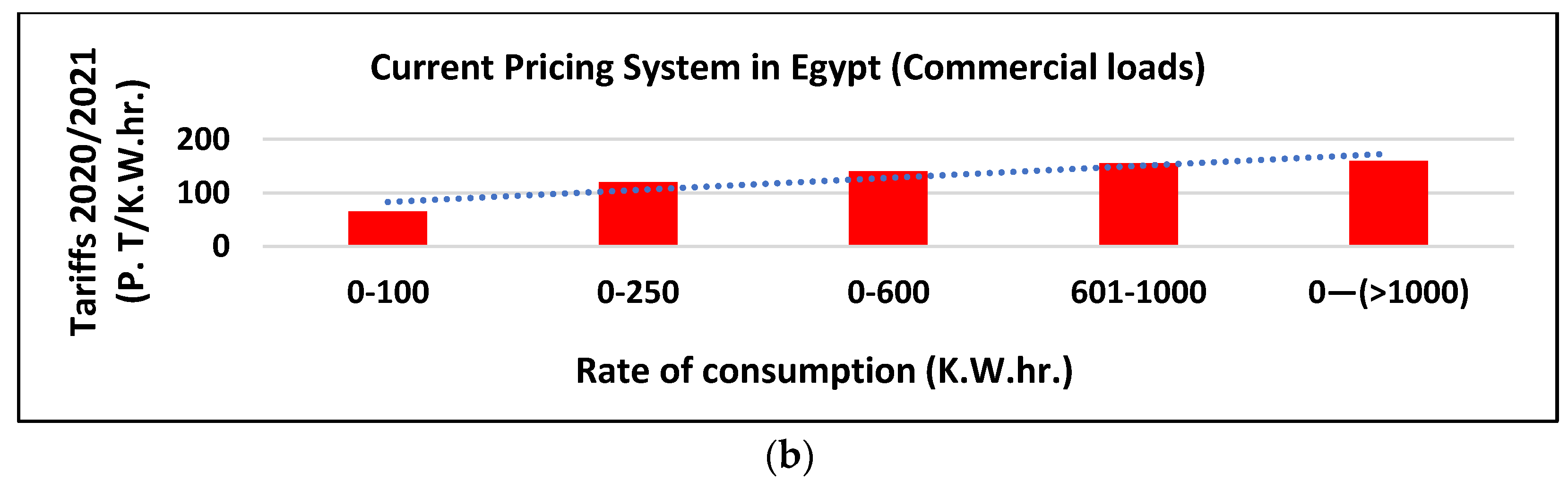

- Egypt’s Current Pricing System:

5. Recommended Solutions for Improving Electricity Tariff Design

5.1. General Recommendations

- i.

- Software technologies:

- ii.

- Media:

- iii.

- Smart meters utilization:

- iv.

- Electricity tariffs research developments:

5.2. Suggested Solutions for Overcoming Problems in Egypt

- Increasing the end-user’s awareness of the tariff’s methodologies applied in Egypt through the media, including printed, outdoor, online, and TV ads. Additionally, consumers should be aware of their social responsibilities.

- Increasing public campaigns that encourage consumers to regulate their consumption and change their attitudes and knowledge regarding optimal energy usage. These campaigns should categorize their targets according to age, language, and the living standard of the end-users.

- Starting these behavioural changes and awareness in the new generations by teaching new curricula in basic education.

- Persistence and constant reminders are very important for long-term success.

- Tariffs applied should take into consideration the living standard of consumers.

- Applying various software tools to facilitate tariff calculations and enable the end-users to optimize their consumption.

- Smart meter development and improving the AMI of smart grids.

- Introducing mobile applications with lower prices designed by specialized companies to enable the end-users to calculate their bills according to the best-fit tariff.

- The break-up of governmental utilities to profitable companies, introducing ISO (Independent System Operator), and allowing market participation opportunities.

- TOU and dynamic tariffs should be applied, as they have many advantages, such as fostering competition for sustainable energy prices [83].

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviation

| A | charges per kW of the demand |

| An | variable cost per kW of the demand (n = 1, 2, ….) |

| B | charges per kWh of energy consumed |

| Bn | variable cost per kWh of energy consumed |

| Cn | constant |

| EMS | energy management systems |

| EU | European Union |

| FIT | feed-in tariffs |

| FR | flat demand rate tariff |

| MENA | Middle East and North Africa |

| TC | total charge for a specific period |

| TOU | tiered within USE/time of use |

| X | the demand during a certain period (kW) |

| x max | maximum demand (kW) |

| Y | energy consumed during a certain period (KWh) |

| y max | maximum energy consumed (KWh) |

References

- Lam, P.-L. Pricing of electricity in China. Energy 2004, 29, 287–300. [Google Scholar] [CrossRef]

- Ansarin, M.; Ghiassi-Farrokhfal, Y.; Ketter, W.; Collins, J. The economic consequences of electricity tariff design in a renewable energy era. Appl. Energy 2020, 275, 115317. [Google Scholar] [CrossRef]

- Albadi, M.; El-Saadany, E. A summary of demand response in electricity markets. Electr. Power Syst. Res. 2008, 78, 1989–1996. [Google Scholar] [CrossRef]

- Ritzenhofen, I.; Spinler, S. Optimal design of feed-in-tariffs to stimulate renewable energy investments under regulatory uncertainty—A real options analysis. Energy Econ. 2016, 53, 76–89. [Google Scholar] [CrossRef]

- Mendonça, M. Feed in Tariffs Accelerating the Deployment of Renewable Energy, 1st ed.; Routledge: Oxfordshire, UK, 2009. [Google Scholar]

- Jenner, S.; Groba, F.; Indvik, J. Assessing the strength and effectiveness of renewable electricity feed-in tariffs in European Union countries. Energy Policy 2012, 52, 385–401. [Google Scholar] [CrossRef]

- del Río, P. The dynamic efficiency of feed-in tariffs: The impact of different design elements. Energy Policy 2012, 41, 139–151. [Google Scholar] [CrossRef]

- Stokes, L.C. The politics of renewable energy policies: The case of feed-in tariffs in Ontario, Canada. Energy Policy 2013, 56, 490–500. [Google Scholar] [CrossRef]

- Phuangpornpitak, N.; Tia, S. Opportunities and Challenges of Integrating Renewable Energy in Smart Grid System. Energy Procedia 2013, 34, 282–290. [Google Scholar] [CrossRef]

- Haas, R.; Resch, G.; Panzer, C.; Busch, S.; Ragwitz, M.; Held, A. Efficiency and effectiveness of promotion systems for electricity generation from renewable energy sources—Lessons from EU countries. Energy 2011, 36, 2186–2193. [Google Scholar] [CrossRef]

- Stavrogiannis, L. Electricity Tariff Design and Implementation for the Smart Grid. In MSc in Artificial Intelligence; University of Southampton: Southampton, UK, 2010. [Google Scholar]

- Bommel, S.P.-V. A Reasonable Price for Electricity. J. Consum. Policy 2016, 39, 141–158. [Google Scholar] [CrossRef]

- Barbose, G.; Goldman, C.; Neenan, B. A Survey of Utility Experience with Real Time Pricing; Technical Report Paper; Lawrence Berkeley National Lab.: Berkeley, CA, USA, 2004. [Google Scholar] [CrossRef]

- Faruqui, A.; George, S.S. The Value of Dynamic Pricing in Mass Markets. Electr. J. 2002, 15, 45–55. [Google Scholar] [CrossRef]

- Kirschen, D. Demand-Side View of Electricity Markets. IEEE Trans. Power Syst. 2003, 18, 520–527. [Google Scholar] [CrossRef]

- Goldberg, M. Measure Twice, Cut Once. IEEE Power Energy Mag. 2010, 8, 46–54. [Google Scholar] [CrossRef]

- Faruqui, A. The Ethics of Dynamic Pricing. Electr. J. 2010, 23, 13–27. [Google Scholar] [CrossRef]

- Braithwait, S.; Hansen, D.; O’Sheasy, M. Retail Electricity Pricing and Rate Design in Evolving Markets; Technical Report; Edison Electric Institute: Washington, DC, USA, 2007. [Google Scholar]

- Borenstein, S. Time-Varying Retail Electricity Prices. Electr. Deregul. Choices Chall. 2013, 4, 317–354. [Google Scholar] [CrossRef]

- Allcott, H. Real Time Pricing and Electricity Markets; Technical Report; Harvard University: Cambridge, MA, USA, 2009. [Google Scholar]

- Hirst, E. Price-responsive demand in wholesale markets: Why is so little happening? Electr. J. 2001, 14, 25–37. [Google Scholar] [CrossRef]

- Hirst, E. The Financial and Physical Insurance Benefits of Price-Responsive Demand. Electr. J. 2002, 15, 66–73. [Google Scholar] [CrossRef]

- IBM Global Business Services. E-Meter Strategic Consulting: Smart Price Pilot Final Report; Technical Report; Ontario Energy Board: Toronto, ON, Canada, 2007.

- Barbose, G.; Bharvirkar, R.; Goldman, C.; Hopper, N.; Neenan, B. Killing Two Birds with One Stone: Can Real-Time Pricing Support Retail Competition and Demand Response? Technical Report Paper LBNL59739; Lawrence Berkeley National Laboratory: Berkeley, CA, USA, 2006. [Google Scholar]

- Poongavanam, E.; Kasinathan, P.; Kanagasabai, K. Optimal Energy Forecasting Using Hybrid Recurrent Neural Networks. Intell. Autom. Soft Comput. 2023, 36, 249–265. [Google Scholar] [CrossRef]

- Zorita, A.L.; Fernandez-Temprano, M.A.; Garcia-Escudero, L.-A.; Duque-Perez, O. A statistical model-ing approach to detect anomalies in energetic efficiency of buildings. Energy Build. 2016, 110, 377–386. [Google Scholar] [CrossRef]

- Ouedraogo, S.; Faggianelli, G.A.; Pigelet, G.; Notton, G.; Duchaud, J.L. Performanc-es of energy management strategies for a Photovoltaic/Battery microgrid considering battery degradation. Sol. Energy 2021, 230, 654–665. [Google Scholar] [CrossRef]

- Wu, Y.; Liu, Z.; Li, B.; Liu, J.; Zhang, L. Energy management strategy and optimal battery capacity for flexible PV-battery system under time-of-use tariff. Renew. Energy 2022, 200, 558–570. [Google Scholar] [CrossRef]

- Zhao, J.; Wang, W.; Guo, C. Hierarchical optimal configuration of multi-energy microgrids system considering energy management in electricity market environment. Int. J. Electr. Power Energy Syst. 2023, 144, 108572. [Google Scholar] [CrossRef]

- Qayyum, F.; Jamil, H.; Jamil, F.; Kim, D. Predictive Optimization Based Energy Cost Minimization and Energy Sharing Mechanism for Peer-to-Peer Nanogrid Network. IEEE Access 2022, 10, 23593–23604. [Google Scholar] [CrossRef]

- Iscan, S.; Arikan, O. Energy Management Planning According to the Electricity Tariff Models in Turkey: A Case Study. Turk. J. Electr. Power Energy Syst. 2022, 2, 46–57. [Google Scholar] [CrossRef]

- Fleten, S.E.; Lemming, J. Constructing forward price curves in electricity markets. Energy Econ. 2003, 25, 409–424. [Google Scholar] [CrossRef]

- Goldman, C.; Hopper, N.; Bharvirkar, R.; Neenan, B.; Boisvert Cappers, D. Customer Strategies for Responding to Day-Ahead Market Hourly Electricity Pricing; Technical Report Paper LBNL-57128; Lawrence Berkeley National Laboratory: Berkeley, CA, USA, 2005. [Google Scholar]

- Eakin, K.; Faruqui, A. Pricing Retail Electricity: Making Money Selling a Commodity; Regulatory Economics and Policy Series; Springer: Berlin/Heidelberg, Germany, 2000; pp. 5–31. [Google Scholar] [CrossRef]

- Kirschen, D.; Strbac, G. Fundamentals of Power System Economics, 2nd ed.; Wiley: Hoboken, NJ, USA, 2018. [Google Scholar]

- Harris, C. Electricity Markets: Pricing, Structures and Economics; Wiley: Hoboken, NJ, USA, 2006. [Google Scholar]

- Brigham, B.; Waterson, M. Strategic Change in The Market for Domestic Electricity in the UK; Technical Report; University of Warwick: Coventry, UK, 2003. [Google Scholar]

- Caves, D.W.; Herriges, J.A.; Kuester, K.A. Load Shifting Under Voluntary Residential Time-of-Use Rates. Energy J. 1989, 10. [Google Scholar] [CrossRef]

- Holland, S.P.; Mansur, E.T. The Short-Run Effects of Time-Varying Prices in Competitive Electricity Markets. Energy J. 2006, 27. [Google Scholar] [CrossRef]

- Borenstein, S.; Jaske, M.; Rosenfeld, A. Dynamic Pricing, Advanced Metering and Demand Response in Electricity Markets; Technical Report; University of California Energy Institute: Berkeley, CA, USA, 2002. [Google Scholar]

- Burger, S. Rate Design for the 21st Century: Improving Economic Efficiency and Distributional Equity in Electricity Rate De-Sign. Ph.D. Thesis, Massachusetts Institute of Technology, Boston, MA, USA, 2019. [Google Scholar]

- Ortega, M.P.R.; Perez-Arriaga, I.; Abbad, J.R.; González, J.P. Distribution network tariffs: A closed question? Energy Policy 2008, 36, 1712–1725. [Google Scholar] [CrossRef]

- Reneses, J.; Ortega, M.P.R. Distribution pricing: Theoretical principles and practical approaches. IET Gener. Transm. Distrib. 2014, 8, 1645–1655. [Google Scholar] [CrossRef]

- Borenstein, S. The economics of fixed cost recovery by utilities. Electr. J. 2016, 29, 5–12. [Google Scholar] [CrossRef]

- Neuteleers, S.; Mulder, M.; Hindriks, F. Assessing fairness of dynamic grid tariffs. Energy Policy 2017, 108, 111–120. [Google Scholar] [CrossRef]

- Yakubovich, V.; Granovetter, M.; Mcguire, P. Electric charges: The social construction of rate systems. Theory Soc. 2005, 34, 579–612. [Google Scholar] [CrossRef]

- Burger, S.; Schneider, I.; Botterud, A.; Pérez-Arriaga, I. Chapter 8—Fair, Equitable, and Efficient Tariffs in the Presence of Distributed Energy Resources. In Consumer, Prosumer, Prosumager; Academic Press: Cambridge, MA, USA, 2019; pp. 155–188. [Google Scholar] [CrossRef]

- Mehta, V.K.; Mehta, R. Tariff. In Principles of Power Systems, Revised ed.; S. Chand Publishing: New Delhi, India, 2010; pp. 87–100. [Google Scholar]

- Ansarin, M.; Ghiassi-Farrokhfal, Y.; Ketter, W.; Collins, J. A review of equity in electricity tariffs in the renewable energy era. Renew. Sustain. Energy Rev. 2022, 161, 112333. [Google Scholar] [CrossRef]

- Blumsack, S. Basic economics of power generation, transmission and distribution. Energy Market, Policy and Regulation Course, PennState College Department of Energy and Mineral Engineering. 2018, Volume 13. Available online: https://www.e-education.psu.edu/eme801/ (accessed on 16 October 2022).

- Steffen, B. Estimating the cost of capital for renewable energy projects. Energy Econ. 2020, 88, 104783. [Google Scholar] [CrossRef]

- Borenstein, S. The Private Net Benefits of Residential Solar PV: The Role of Electricity Tariffs, Tax Incentives and Rebates. J. Assoc. Environ. Resour. Econ. 2017, 4, 85–122. [Google Scholar] [CrossRef]

- Bento, A.M. Equity Impacts of Environmental Policy. Annu. Rev. Resour. Econ. 2013, 5, 181–196. [Google Scholar] [CrossRef]

- Convery, F.J.; Mohlin, K.; Spiller, E. Policy brief—Designing electric utility rates: Insights on achieving efficiency, equity, and environmental goals. Rev. Environ. Econ. Policy 2017, 11, 156–164. [Google Scholar] [CrossRef]

- Steffen, B. The importance of project finance for renewable energy projects. Energy Econ. 2018, 69, 280–294. [Google Scholar] [CrossRef]

- Poruschi, L.; Ambrey, C.L.; Smart, J. Revisiting feed-in tariffs in Australia: A review. Renew. Sustain. Energy Rev. 2018, 82, 260–270. [Google Scholar] [CrossRef]

- Al Arrouqi, R.A.; Ellabban, O.; Rasheed, M.B.; Al-Fagih, L. An assessment of different elec-tricity tariffs on residential photovoltaic system profitability: Australian case study. In Proceedings of the 2nd International Conference on Smart Grid and Sustainable energy (SGRE), Doha, Qatar, 19–21 November 2019. [Google Scholar]

- Zahedi, A. A review on feed-in tariff in Australia, what it is now and what it should be. Renew. Sustain. Energy Rev. 2010, 14, 3252–3255. [Google Scholar] [CrossRef]

- Young, S.; Bruce, A.; MacGill, I. Potential impacts of residential PV and battery storage on Australia’s electricity networks under different tariffs. Energy Policy 2019, 128, 616–627. [Google Scholar] [CrossRef]

- Simpson, G.; Clifton, J. Subsidies for residential solar photovoltaic energy systems in Western Australia: Distributional, procedural and outcome justice. Renew. Sustain. Energy Rev. 2016, 65, 262–273. [Google Scholar] [CrossRef]

- Yurdakul, M.; Tansel İç, Y. Development of a new support mechanism to calculate feed-in tariffs for electricity gen-eration from sustainable energy sources in Turkey. Process Integr. Optim. Sustain. 2019, 3, 423–436. [Google Scholar] [CrossRef]

- Batman, A.; Bagriyanik, F.G.; Aygen, Z.E.; Gül, O.; Bagriyanik, M. A feasibility study of grid-connected photovoltaic systems in Istanbul, Turkey. Renew. Sustain. Energy Rev. 2012, 16, 5678–5686. [Google Scholar] [CrossRef]

- Çetinkaya, M.; Başaran, A.A.; Bağdadioğlu, N. Electricity reform, tariff and household elasticity in Turkey. Util. Policy 2015, 37, 79–85. [Google Scholar] [CrossRef]

- Celik, A.N.; Özgür, E. Review of Turkey’s photovoltaic energy status: Legal structure, existing installed power and comparative analysis. Renew. Sustain. Energy Rev. 2020, 134, 110344. [Google Scholar] [CrossRef]

- Karlsen, S.S.; Hamdy, M.; Attia, S. Methodology to assess business models of dynamic pricing tariffs in all-electric houses. Energy Build. 2019, 207, 109586. [Google Scholar] [CrossRef]

- Rosenow, J.; Fawcett, T.; Eyret, N.; Vlasis, O. Energy efficiency and the policy mix. Build. Res. Form. 2016, 44, 562–574. [Google Scholar] [CrossRef]

- Rosenow, J.; Bayer, E. Costs and benefits of Energy Efficiency Obligations: A review of European programmes. Energy Policy 2017, 107, 53–62. [Google Scholar] [CrossRef]

- Thomas, S.; Rosenow, J. Drivers of increasing energy consumption in Europe and policy implications. Energy Policy 2019, 137, 111108. [Google Scholar] [CrossRef]

- Ma, J. On-grid electricity tariffs in China: Development, reform and prospects. Energy Policy 2011, 39, 2633–2645. [Google Scholar] [CrossRef]

- Wang, C.; Zhou, K.; Yang, S. A review of residential tiered electricity pricing in China. Renew. Sustain. Energy Rev. 2017, 79, 533–543. [Google Scholar] [CrossRef]

- Ming, Z.; Ximei, L.; Na, L.; Song, X. Overall review of renewable energy tariff policy in China: Evolution, implementation, problems and countermeasures. Renew. Sustain. Energy Rev. 2013, 25, 260–271. [Google Scholar] [CrossRef]

- Rickerson, W.; Bennhold, F.; Bradbury, J. Feed-In Tariffs and Renewable Energy in the USA—A Policy Update; Heinrich Böll: Washington, DC, USA, 2008. [Google Scholar]

- Meza, C. A review on the Central America electrical energy scenario. Renew. Sustain. Energy Rev. 2014, 33, 566–577. [Google Scholar] [CrossRef]

- Borenstein, S. Regional and Income Distribution Effects of Alternative Retail Electricity Tariffs; Energy Institute at HAAS: Berkeley, CA, USA, 2011. [Google Scholar]

- Ito, K. Do Consumers Respond to Marginal or Average Price? Evidence from Nonlinear Electricity Pricing. Am. Econ. Rev. 2014, 104, 537–563. [Google Scholar] [CrossRef]

- Strielkowski, W.; Štreimikienė, D.; Bilan, Y. Network charging and residential tariffs: A case of household photo-voltaics in the United Kingdom. Renew. Sustain. Energy Rev. 2017, 77, 461–473. [Google Scholar] [CrossRef]

- Hast, A.; Syri, S.; Jokiniemi, J.; Huuskonen, M.; Cross, S. Review of green electricity products in the United Kingdom, Germany and Finland. Renew. Sustain. Energy Rev. 2015, 42, 1370–1384. [Google Scholar] [CrossRef]

- Letova, K.; Yao, R.; Davidson, M.; Afanasyeva, E. A review of electricity markets and reforms in Russia. Util. Policy 2018, 53, 84–93. [Google Scholar] [CrossRef]

- Strielkowski, W.; Sherstobitova, A.; Rovny, P.; Evteeva, T. Increasing Energy Efficiency and Modernization of Energy Systems in Russia: A Review. Energies 2021, 14, 3164. [Google Scholar] [CrossRef]

- Institutional MEDREG. Good Regulatory Principles in The Mediterranean Countries; Institutional MEDREG: Milano, Italy, 2012. [Google Scholar]

- Matthäus, D.; Mehling, M. De-risking Sustainable Energy Investments in Developing Countries: A Multilateral Guarantee Mechanism. Joule 2020, 4, 2627–2645. [Google Scholar] [CrossRef]

- Hussien Osman, S. Overview of the Electricity Sector in Egypt. In Proceedings of the 2nd Capacity Building Reporting Methodologies: How to Collect Data and Monitor Regulated Entities, Milan, Italy, 19–20 April 2016. [Google Scholar]

- Economic Consulting Associates Ltd. Development of a Load Management Program and Design of Time of Use/Seasonal Pricing. September 2008. Available online: http://hdl.handle.net/10986/18922 (accessed on 16 October 2022).

- International Renewable Energy Agency IRENA. Renewable Energy Outlook Egypt; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2018. [Google Scholar]

- Yousri, D.M. The Egyptian Electricity Market: Designing A Prudent Peak Load Pricing Model; German University: New Cairo, Egypt, 2011. [Google Scholar]

- Atalay, Y.; Kalfagianni, A. Sustainable energy support mechanisms in the Gulf Cooperation Council states: Ana-lyzing the feasibility of feed-in tariffs and auction mechanisms. Renew. Sustain. Energy Rev. 2017, 72, 723–733. [Google Scholar] [CrossRef]

- Harp, S.; Brignone, S.; Wollenberg, B.; Samad, T. SEPIA. A simulator for electric power industry agents. IEEE Control Syst. 2000, 20, 53–69. [Google Scholar] [CrossRef]

- Nicolaisen, J.; Petrov, V.; Tesfatsion, L. Market power and efficiency in a computational electricity market with discriminato-ry double-auction pricing. Evolutionary Computation. IEEE Trans. Evol. Comput. 2001, 5, 504–523. [Google Scholar] [CrossRef]

- Sun, J.; Tesfatsion, L. Dynamic Testing of Wholesale Power Market Designs: An Open-Source Agent-Based Framework. Comput. Econ. 2007, 30, 291–327. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Tadiparthi, G.R. An agent-based decision support system for wholesale electricity market. Decis. Support Syst. 2008, 44, 425–446. [Google Scholar] [CrossRef]

- Zhou, Z.; Chan, W.K.; Chow, J.H. Agent-based simulation of electricity markets: A survey of tools. Artif. Intell. Rev. 2007, 28, 305–342. [Google Scholar] [CrossRef]

- Conzelmann, G.; North, M.; Boyd, G.; Cirillo, R.; Koritarov, V.; Macal, C. Simulating strategic market behavior using an agent-based modeling approach. In Proceedings of the 6th IAEE European Energy Conference on Modeling in Energy Economics and Policy, Zurich, Switzerland, 1–14 September 2004. [Google Scholar]

- Weidlich, A.; Veit, D. A critical survey of agent-based wholesale electricity market models. Energy Econ. 2008, 30, 1728–1759. [Google Scholar] [CrossRef]

- Czernohous, C.; Fichtner, W.; Veit, D.J.; Weinhardt, C. Management decision support using long-term market simulation. Inf. Syst. e-Bus. Manag. 2003, 1, 405–423. [Google Scholar] [CrossRef]

- Veit, D.J.; Weidlich, A.; Yao, J.; Oren, S.S. Simulating the dynamics in two-settlement electricity markets via an agent-based approach. Int. J. Manag. Sci. Eng. Manag. 2006, 1, 83–97. [Google Scholar] [CrossRef][Green Version]

- Nurunnabi, M.; Roy, N.K. Grid connected hybrid power system design using HOMER. In Proceedings of the International Conference on Advances in Electrical Engineering (ICAEE), Dhaka, Bangladesh, 17–19 December 2015. [Google Scholar]

- Al Garni, H.Z.; Awasthi, A.; Ramli, M.A.M. Optimal design and analysis of grid-connected photovoltaic un-der different tracking systems using HOMER. Energy Convers. Manag. 2018, 155, 42–57. [Google Scholar] [CrossRef]

- Gurupira, T.; Rix, A.J. PV simulation software comparisons: PVSYST, NREL, SAM And PVLIB. SAUPEC Alberto Boretti; Jamal Nayfeh; Wael Al-Kouz. Simulation of large PV energy facilities with SAM HCPV and PV detailed models. In Proceedings of the 5th International Conference on Sustainable and Renewable Energy Engineering (ICSREE), 181, Paris, France, 6–9 May 2020. [Google Scholar]

- Akram, W.; Kumar, R. A study on positive and negative effects of social media on society. Int. J. Comput. Sci. Eng. 2017, 5, 351–354. [Google Scholar] [CrossRef]

- Siddiqui, S.; Singh, T. Social media its impact with positive and negative aspects. Int. J. Comput. Appl. Technol. Res. 2016, 5, 71–75. [Google Scholar] [CrossRef]

- Aziz, A.; Khalid, S.; Mustafa, M.; Shareef, H.; Aliyu, G. Artificial Intelligent Meter development based on Advanced Metering Infrastructure technology. Renew. Sustain. Energy Rev. 2013, 27, 191–197. [Google Scholar] [CrossRef]

- Czétány, L.; Vámos, V.; Horváth, M.; Szalay, Z.; Mota-Babiloni, A.; Deme-Bélafi, Z.; Csok-Nyai, T. Development of electricity consumption profiles of residential buildings based on smart meter data clustering. Energy Build. 2021, 252, 111376. [Google Scholar] [CrossRef]

- Matrenin, P.; Antonenkov, D.; Arestova, A. Energy Efficiency Improvement of Industrial Enterprise Based on Machine Learning Electricity Tariff Forecasting. In Proceedings of the International Scientific-Technical Conference on Actual Problems of Electronic Instrument Engineering (APEIE), Novosibirsk, Russia, 19–21 November 2021. [Google Scholar]

- Perez-Montalvo, E.; Zapata-Velasquez, M.-E.; Benitez-Vazquez, L.-M.; Cermeno-Gonzalez, J.-M.; Alejandro-Miranda, J.; Martinez-Cabero, M.-A.; de la Puente-Gil, A. Model of monthly electricity consumption of healthcare buildings based on climatological variables using PCA and linear regression. Energy Rep. 2022, 8, 250–258. [Google Scholar] [CrossRef]

- Castro, F.A.; Callaway, D.S. Optimal electricity tariff design with demand-side investments. Energy Syst. 2019, 11, 551–579. [Google Scholar] [CrossRef]

- Alves, M.J.; Antunes, C.H.; Soares, I. Optimizing prices and periods in time-of-use electricity tariff design using bilevel programming. In Proceedings of the European Conference on Evolutionary Computation in Combinatorial Optimization, Seville, Spain, 1–17 April 2020. [Google Scholar]

- Ansarin, M.; Ghiassi-Farrokhfal, Y.; Ketter, W.; Collins, J. Cross-subsidies among residential electricity prosumers from tariff design and metering infrastructure. Energy Policy 2020, 145, 111736. [Google Scholar] [CrossRef]

- Chemetova, S.; Santos, P.; Pires, A.J. Peak load forecasting in electrical deregulated market environment—The dynamic tariffs. In Proceedings of the IECON 2019—45th Annual Conference of the IEEE Industrial Electronics Society, Lisbon, Portugal, 14–17 October 2019. [Google Scholar]

- Rogers, W.; Carroll, P.; McDermott, J. A genetic algorithm approach to the smart grid tariff design problem. Soft Comput. 2017, 23, 1393–1405. [Google Scholar] [CrossRef]

- Schönfeldt Karlsen, S. Investigation of Grid Rent Business Models as Incentive for Demand-Side Management in Buildings a Case Study on Fully Electric Operated Houses in Norway; Department of Civil and Environmental Engineering at NTNU: Trondheim, Norway, 2018. [Google Scholar]

| No. | Tariff Name | Time of Energy Consumption Dependency | Energy/Power Dependency | Smart Meters | Equation | |

|---|---|---|---|---|---|---|

| 1 | Simple or uniform tariff | independent | (Energy-based) | Not needed | TC = C | (1) |

| 2 | FR | independent | (Power-based) | Not needed | TC = A ∗ x | (2) |

| 3 | Straight-line meter rate tariff | independent | (Energy-based) | Not needed | TC = B ∗ y | (3) |

| 4 | Increasing/Block meter rate tariff | independent | (Energy-based) | Not needed | C1, 0 < t1 < t2 C2, t2 < t < t3 | (4) |

| 5 | Two-part tariff | independent | (Energy- and power-based) | Not needed | TC = A ∗ x + B ∗ y, | (5) |

| 6 | Seasonal rate tariff | independent | (Energy-based) | Not needed | TC = B ∗ y max. (yearly) | (6) |

| 7 | Peak-load tariff | independent | (Energy-based) | Not needed | TC = B ∗ y max. (Same as Equation (6) but calculated on daily basis) | |

| 8 | Three-part electricity tariff | independent | (Energy- and power-based) | Not needed | TC = A ∗ x + B ∗ y + C | (7) |

| 9 | Power factor tariff | independent | Power-based | Not needed | -------- | |

| 10 | Tiered (or step) Tariff | independent | (Energy-based) | Not needed | TC = Bn ∗ y | (8) |

| 11 | Tiered/TOU | dependent | (Power-based) | needed | TC = An ∗ x | (9) |

| 12 | Demand rates | independent | Power-based | Not needed | TC = A ∗ x max | (10) |

| 13 | Weekend/holiday rates | independent | (Energy-based) | Not needed | TC = Bn ∗ y. (Same as Equation (8) but calculated on weekends and holidays) | |

| 14 | FIT | independent | (Energy-based) | Not needed | -------- | |

| 15 | Net metering | independent | (Energy-based) | Not needed | --------- | |

| 16 | Critical peak pricing | dependent | (Energy-based) | Needed | TC = An ∗ x. (Same as Equation (9) but time intervals are longer) | |

| 17 | Real-time pricing /Dynamic pricing | dependent | (Energy-based) | Needed | ---------- | |

| 18 | Two-part real-time pricing (Block- and-Index Pricing | dependent | (Energy-based) | Needed | TC = An ∗ x + extra charges (Same as Equation (9) but extra charges are added.) | |

| 19 | Sell back | dependent | (Energy-based) | Needed | ----------- | |

| 20 | Stand by rates | dependent | (Energy-based) | Needed | --------- | |

| 21 | Ramsey pricing | independent | (Energy-based) | Not needed | TCα1/y, | (11) |

| 22 | Tempo tariff | dependent | (Energy-based) | Needed | ---------- | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zaki, D.A.; Hamdy, M. A Review of Electricity Tariffs and Enabling Solutions for Optimal Energy Management. Energies 2022, 15, 8527. https://doi.org/10.3390/en15228527

Zaki DA, Hamdy M. A Review of Electricity Tariffs and Enabling Solutions for Optimal Energy Management. Energies. 2022; 15(22):8527. https://doi.org/10.3390/en15228527

Chicago/Turabian StyleZaki, Dina A., and Mohamed Hamdy. 2022. "A Review of Electricity Tariffs and Enabling Solutions for Optimal Energy Management" Energies 15, no. 22: 8527. https://doi.org/10.3390/en15228527

APA StyleZaki, D. A., & Hamdy, M. (2022). A Review of Electricity Tariffs and Enabling Solutions for Optimal Energy Management. Energies, 15(22), 8527. https://doi.org/10.3390/en15228527