Community Energy Markets with Battery Energy Storage Systems: A General Modeling with Applications

Abstract

1. Introduction

1.1. Background and Motivation

1.2. Literature Review

1.3. Main Contributions

- Development of an optimization model that includes a prompt and appropriate representation of BESSs in a community-based market;

- Analysis of the insertion of BESS at three different arrangements in the community market: (i) at the prosumer level (prosumage); (ii) as an individual agent in the community (intracommunity); (iii) as a separate community (intercommunity);

- Assessment of the impacts that BESS can cause on the SW of a community-based market, considering different market organizations;

- Analysis of the social effects that BESS can have on the community energy market, as well as on the satisfaction of its agents when inserted in different arrangements in the market.

1.4. Paper Structure

2. Overview of the Community-Based Market with Battery Energy Storage System

2.1. General Framework of the Community-Based Market

2.2. BESS Operational Complexity

3. Modeling of the Community-Based Market with Battery Energy Storage System

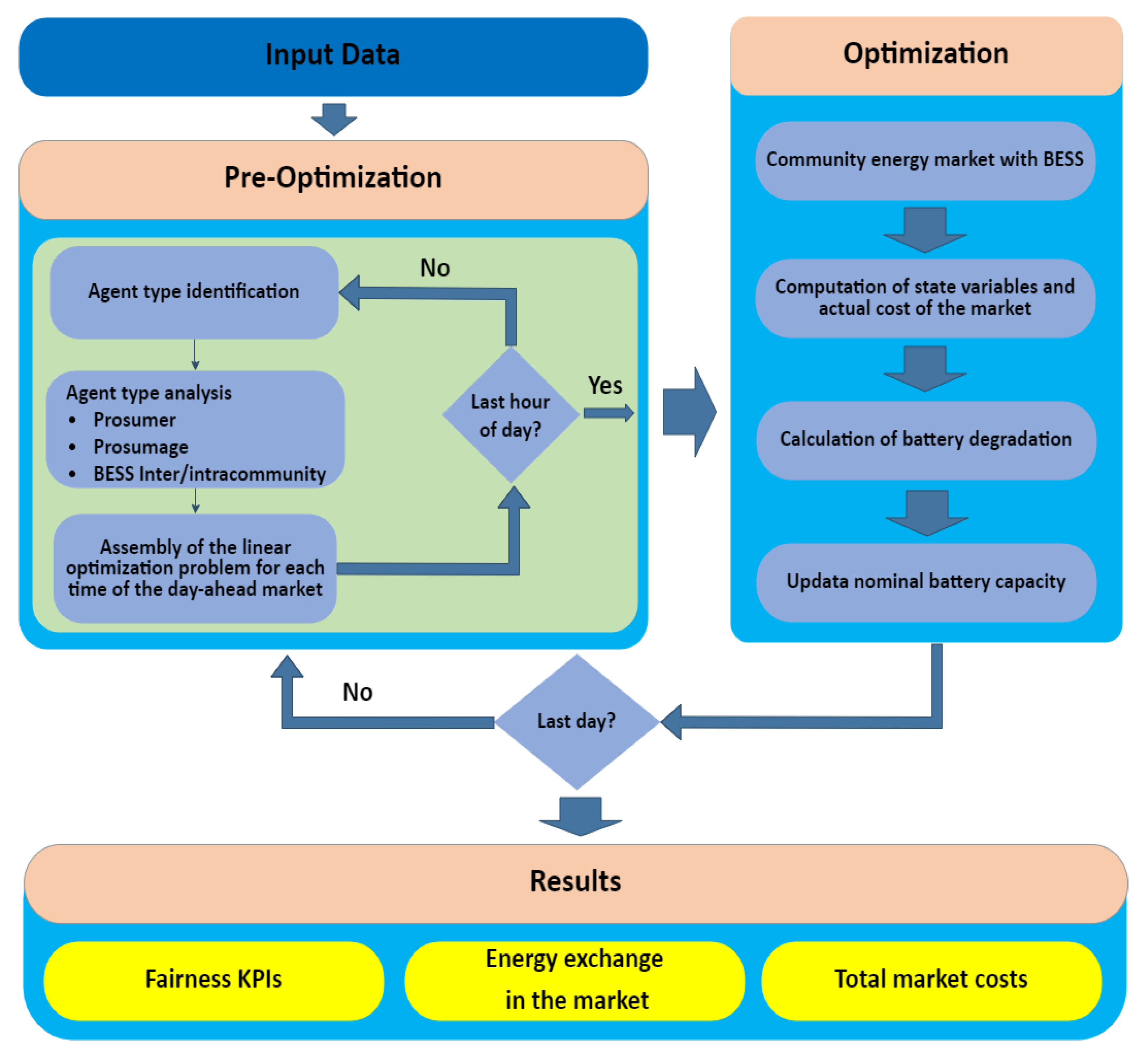

3.1. Proposed Model

- The community agent can be primarily modeled as a prosumage (Figure 1a), as it is the type of agent that has the greatest variety of energy assets to be traded;

- The community agent can assume only one role (consumer/producer) within its community, but this is not necessarily the same assumed in the scope of the external market. For example, a prosumage can play in a given period as a consumer at the community level and as a producer for the external player;

- In the case of agents without a BESS, such as consumers, producers, and prosumers, their respective roles are predefined by themselves. In contrast, the role of agents with BESS, such as the prosumages and the intra and intercommunity BESS agents, are respectively defined by the CM, as discussed in the previous section.

3.2. Adjustments for the Intra/Intercommunity BESS

3.3. Adjustments for Agents without BESS

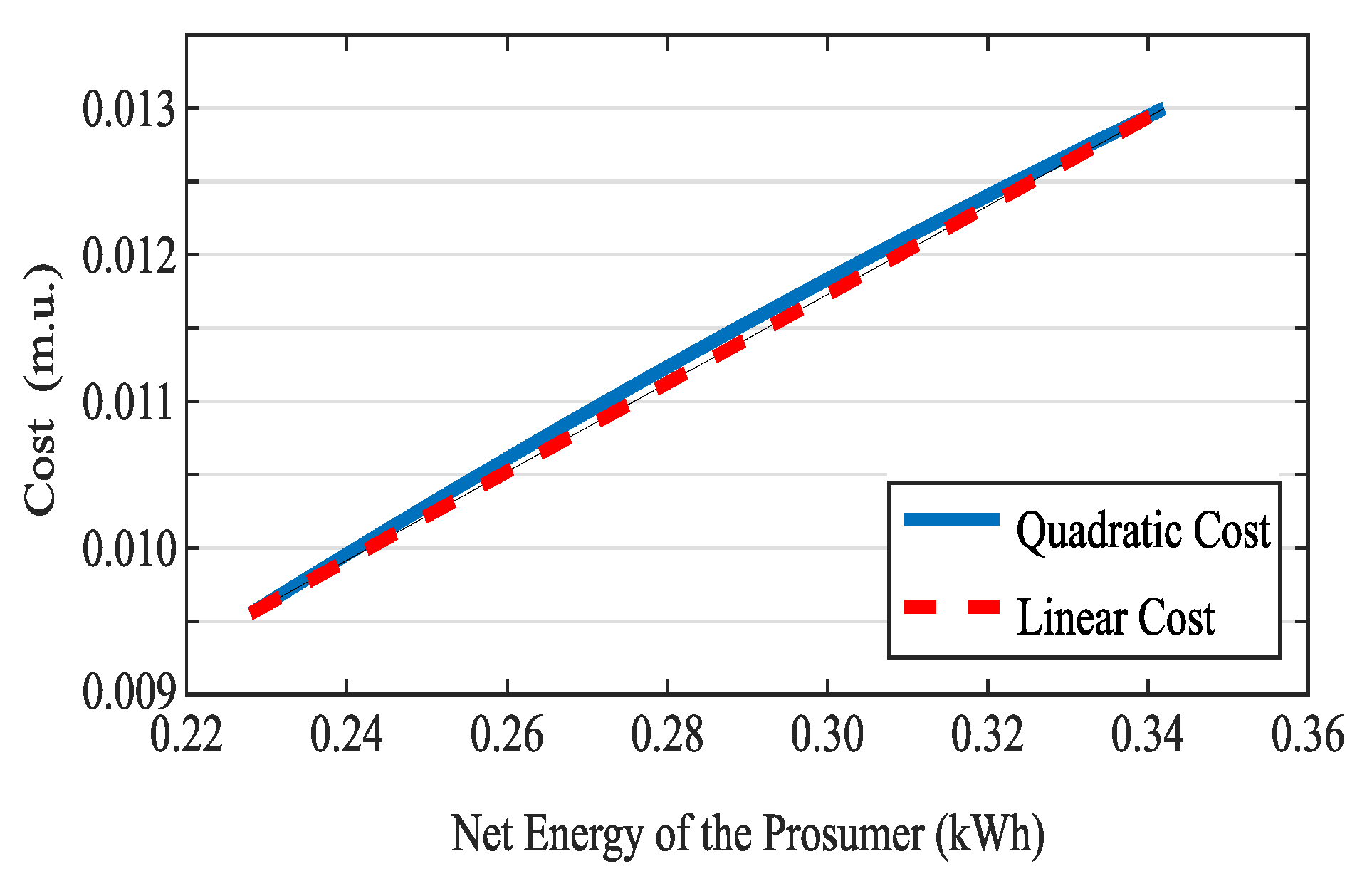

3.4. Battery Degradation

4. Study Description

4.1. Base Case—A Community Market without BESS

4.2. Study Cases—Insertion of BESS in Different Arrangements of the Market

4.3. Simulation Details

4.4. Key Performance Indicators—Fairness and Economic Approaches

5. Simulations

5.1. Computational Performance

5.2. Results

5.3. Energy Balance

- Community 1: (i) Prosumage 1 exports 0.4872 kWh of its solar generation and 0.3619 kWh from its BESS to its community; (ii) Prosumage 2 imports the amount from Prosumage 1 and 0.4755 kWh from its own BESS, in addition to 0.6534 kWh from other communities; (iii) Prosumage 3 imports 0.9442 kWh from its BESS and 0.7298 kWh from other communities;

- Community 2: (i) Prosumage 1 exports 0.4872 kWh of its solar generation to other communities/external players and 0.4045 kWh from its BESS to Prosumage 2; (ii) Prosumage 2 imports 0.7902 kWh from its own community to supply the domestic load and charge its BESS; (iii) Prosumage 3 exports 1.9350 kWh from its solar generation to other communities/external player and 0.3857 kWh from its BESS to Prosumage 2;

- Community 3: (i) Prosumage 1 exports 0.0296 kWh of its solar generation and 0.0148 kWh of its BESS to other communities/external players; (ii) Prosumage 2 exports 1.9350 kWh of its solar generation to other communities/external player; (iii) Prosumage 3 exports 1.4388 kWh of its solar generation to other communities/external player;

- External player imports 4.4572 kWh from Communities 2 and 3.

5.4. Discussions

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Nomenclature

| Parameters | |

| , | Battery charging and discharging efficiency |

| Cost of transactions inside the communities | |

| Cost of export transactions | |

| Cost of import transactions | |

| Variation between import and export costs | |

| Energy price related to asset | |

| Energy price related to asset | |

| , | Battery charge and discharge rate |

| Self-discharge rate | |

| Time horizon | |

| Set of communities | |

| Set of decision variables | |

| Set of agents that have or are BESS | |

| Set of agents that are prosumers | |

| n | Number of agents that make up the community |

| Temporal degradation of BESS | |

| BESS lifetime reported in its datasheet | |

| Variables | |

| Battery nominal capacity | |

| Net energy balance | |

| Energy used to charge or discharge the battery | |

| Energy consumed from/or provided for internal sharing | |

| Energy imported by the agent | |

| Energy exported by the agent | |

| Energy imported by the community from another or from an external agent | |

| Energy exported by the community from another or from an external agent | |

| Battery state of charge | |

| Auxiliary variable—represents intra/intercommunity battery export and import | |

| exchanges | |

| Equivalent number of BESS’s charge/discharge cycles | |

| Number of BESS’s charge/discharge cycles | |

| Daily degradation rate due to cyclic aging | |

| Subscript | |

| j | Agent belonging to the communities |

| Charging | |

| Discharging | |

| Self-discharge | |

| t | Simulation period |

| d | Day |

| Importation | |

| Exportation | |

| Community | |

| Spread | |

| Depth of discharge | |

| Superscript | |

| Net energy balance costs (m.u.) | |

| Battery’s energy costs (m.u.) |

References

- Renewables 2020. Global Status Report; REN21 Secretariat: Paris, France, 2020; Available online: https://www.ren21.net/gsr-2020/ (accessed on 28 August 2020).

- Deotti, L.; Guedes, W.; Dias, B.; Soares, T. Technical and economic analysis of battery storage for residential solar photovoltaic systems in the Brazilian regulatory context. Energies 2020, 13, 6517. [Google Scholar] [CrossRef]

- Gardiner, D.; Schmidt, O.; Heptonstall, P.; Gross, R.; Staffell, I. Quantifying the impact of policy on the investment case for residential electricity storage in the UK. J. Energy Storage 2020, 27, 101140. [Google Scholar] [CrossRef]

- Ralon, P.; Taylor, M.; Ilas, A.; Diaz-Bone, H.; Kairies, K. Electricity Storage and Renewables: Costs and Markets to 2030; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2017; Volume 164. [Google Scholar]

- Zafeiropoulou, M.; Mentis, I.; Sijakovic, N.; Terzic, A.; Fotis, G.; Maris, T.I.; Vita, V.; Zoulias, E.; Ristic, V.; Ekonomou, L. Forecasting transmission and distribution system flexibility needs for severe weather condition resilience and outage management. Appl. Sci. 2022, 12, 7334. [Google Scholar] [CrossRef]

- Adewumi, O.B.; Fotis, G.; Vita, V.; Nankoo, D.; Ekonomou, L. The impact of distributed energy storage on distribution and transmission networks’ power quality. Appl. Sci. 2022, 12, 6466. [Google Scholar] [CrossRef]

- Say, K.; Schill, W.P.; John, M. Degrees of displacement: The impact of household PV battery prosumage on utility generation and storage. Appl. Energy 2020, 276, 115466. [Google Scholar] [CrossRef]

- Schopfer, S.; Tiefenbeck, V.; Staake, T. Economic assessment of photovoltaic battery systems based on household load profiles. Appl. Energy 2018, 223, 229–248. [Google Scholar] [CrossRef]

- Masson, G.; Kaizuka, I. Trends 2019 in Photovoltaic Applications; Photovoltaic Power Systems Programme: Rheine, Germany, 2019. [Google Scholar]

- Nousdilis, A.I.; Christoforidis, G.C.; Papagiannis, G.K. Active power management in low voltage networks with high photovoltaics penetration based on prosumers’ self-consumption. Appl. Energy 2018, 229, 614–624. [Google Scholar] [CrossRef]

- Von Hirschhausen, C. Prosumage and the future regulation of utilities: An introduction. Econ. Energy Environ. Policy 2017, 6, 1–6. [Google Scholar] [CrossRef]

- Khorasany, M.; Najafi-Ghalelou, A.; Razzaghi, R. A framework for joint scheduling and power trading of prosumers in transactive markets. IEEE Trans. Sustain. Energy 2020, 12, 955–965. [Google Scholar] [CrossRef]

- Moret, F.; Pinson, P. Energy collectives: A community and fairness based approach to future electricity markets. IEEE Trans. Power Syst. 2018, 34, 3994–4004. [Google Scholar] [CrossRef]

- Sousa, T.; Soares, T.; Pinson, P.; Moret, F.; Baroche, T.; Sorin, E. Peer-to-peer and community-based markets: A comprehensive review. Renew. Sustain. Energy Rev. 2019, 104, 367–378. [Google Scholar] [CrossRef]

- Oliveira, C.; Botelho, D.F.; Soares, T.; Faria, A.S.; Dias, B.H.; Matos, M.A.; de Oliveira, L.W. Consumer-centric electricity markets: A comprehensive review on user preferences and key performance indicators. Electr. Power Syst. Res. 2022, 210, 108088. [Google Scholar] [CrossRef]

- He, L.; Zhang, J. A community sharing market with PV and energy storage: An adaptive bidding-based double-side auction mechanism. IEEE Trans. Smart Grid 2020, 12, 2450–2461. [Google Scholar] [CrossRef]

- Kalkbrenner, B.J. Residential vs. community battery storage systems–consumer preferences in Germany. Energy Policy 2019, 129, 1355–1363. [Google Scholar] [CrossRef]

- Parra, D.; Swierczynski, M.; Stroe, D.I.; Norman, S.A.; Abdon, A.; Worlitschek, J.; O’Doherty, T.; Rodrigues, L.; Gillott, M.; Zhang, X.; et al. An interdisciplinary review of energy storage for communities: Challenges and perspectives. Renew. Sustain. Energy Rev. 2017, 79, 730–749. [Google Scholar] [CrossRef]

- Crespo-Vazquez, J.L.; AlSkaif, T.; González-Rueda, Á.M.; Gibescu, M. A community-based energy market design using decentralized decision-making under uncertainty. IEEE Trans. Smart Grid 2020, 12, 1782–1793. [Google Scholar] [CrossRef]

- Ma, L.; Wang, L.; Liu, Z. Multi-level trading community formation and hybrid trading network construction in local energy market. Appl. Energy 2021, 285, 116399. [Google Scholar] [CrossRef]

- Grzanić, M.; Morales, J.M.; Pineda, S.; Capuder, T. Electricity cost-sharing in energy communities under dynamic pricing and uncertainty. IEEE Access 2021, 9, 30225–30241. [Google Scholar] [CrossRef]

- Chakraborty, P.; Baeyens, E.; Poolla, K.; Khargonekar, P.P.; Varaiya, P. Sharing storage in a smart grid: A coalitional game approach. IEEE Trans. Smart Grid 2018, 10, 4379–4390. [Google Scholar] [CrossRef]

- Paudel, A.; Chaudhari, K.; Long, C.; Gooi, H.B. Peer-to-peer energy trading in a prosumer-based community microgrid: A game-theoretic model. IEEE Trans. Ind. Electron. 2018, 66, 6087–6097. [Google Scholar] [CrossRef]

- Rocha, R.; Collado, J.V.; Soares, T.; Retorta, F. Local energy markets for energy communities with grid constraints. In Proceedings of the 2020 17th International Conference on the European Energy Market (EEM), Stockholm, Sweden, 16–18 September 2020; pp. 1–6. [Google Scholar]

- Barbosa, P.H.P.; Dias, B.H.; Soares, T. Analysis of consumer-centric market models in the Brazilian context. In Proceedings of the 2020 IEEE PES Transmission & Distribution Conference and Exhibition—Latin America (T&D LA), Chicago, IL, USA, 12–15 October 2020; pp. 1–6. [Google Scholar]

- Khorasany, M.; Razzaghi, R.; Gazafroudi, A.S. Two-stage mechanism design for energy trading of strategic agents in energy communities. Appl. Energy 2021, 295, 117036. [Google Scholar] [CrossRef]

- Cornélusse, B.; Savelli, I.; Paoletti, S.; Giannitrapani, A.; Vicino, A. A community microgrid architecture with an internal local market. Appl. Energy 2019, 242, 547–560. [Google Scholar] [CrossRef]

- Reis, I.F.; Gonçalves, I.; Lopes, M.A.; Antunes, C.H. Assessing the influence of different goals in energy communities’ self-sufficiency—An optimized multiagent approach. Energies 2021, 14, 989. [Google Scholar] [CrossRef]

- Lüth, A.; Zepter, J.M.; del Granado, P.C.; Egging, R. Local electricity market designs for peer-to-peer trading: The role of battery flexibility. Appl. Energy 2018, 229, 1233–1243. [Google Scholar] [CrossRef]

- Zepter, J.M.; Lüth, A.; Del Granado, P.C.; Egging, R. Prosumer integration in wholesale electricity markets: Synergies of peer-to-peer trade and residential storage. Energy Build. 2019, 184, 163–176. [Google Scholar] [CrossRef]

- Martins, R.; Musilek, P.; Hesse, H.C. Optimization of photovoltaic power self-consumption using linear programming. In Proceedings of the 2016 IEEE 16th International Conference on Environment and Electrical Engineering (EEEIC), Florence, Italy, 7–10 June 2016; pp. 1–5. [Google Scholar]

- Dulout, J.; Luna, A.; Anvari-Moghaddam, A.; Alonso, C.; Guerrero, J.; Jammes, B. Optimal scheduling of a battery-based energy storage system for a microgrid with high penetration of renewable sources. In Proceedings of the ELECTRIMACS 2017, Toulouse, France, 4–6 July 2017; p. 6. [Google Scholar]

- Long, C.; Wu, J.; Zhou, Y.; Jenkins, N. Peer-to-peer energy sharing through a two-stage aggregated battery control in a community Microgrid. Appl. Energy 2018, 226, 261–276. [Google Scholar] [CrossRef]

- Schram, W.L.; AlSkaif, T.; Lampropoulos, I.; Henein, S.; van Sark, W.G. On the trade-off between environmental and economic objectives in community energy storage operational optimization. IEEE Trans. Sustain. Energy 2020, 11, 2653–2661. [Google Scholar] [CrossRef]

- Schmidt, O.; Melchior, S.; Hawkes, A.; Staffell, I. Projecting the future levelized cost of electricity storage technologies. Joule 2019, 3, 81–100. [Google Scholar] [CrossRef]

- Hesse, H.C.; Schimpe, M.; Kucevic, D.; Jossen, A. Lithium-ion battery storage for the grid—A review of stationary battery storage system design tailored for applications in modern power grids. Energies 2017, 10, 2107. [Google Scholar] [CrossRef]

- DiOrio, N.; Dobos, A.; Janzou, S.; Nelson, A.; Lundstrom, B. Technoeconomic Modeling of Battery Energy Storage in SAM; Technical report; National Renewable Energy Laboratory (NREL): Golden, CO, USA, 2015. [Google Scholar]

- Marsh, G.; Wignall, C.; Thies, P.R.; Barltrop, N.; Incecik, A.; Venugopal, V.; Johanning, L. Review and application of Rainflow residue processing techniques for accurate fatigue damage estimation. Int. J. Fatigue 2016, 82, 757–765. [Google Scholar] [CrossRef]

- Xiao, J.; Zhang, Z.; Bai, L.; Liang, H. Determination of the optimal installation site and capacity of battery energy storage system in distribution network integrated with distributed generation. IET Gener. Transm. Distrib. 2016, 10, 601–607. [Google Scholar] [CrossRef]

- He, G.; Chen, Q.; Kang, C.; Pinson, P.; Xia, Q. Optimal bidding strategy of battery storage in power markets considering performance-based regulation and battery cycle life. IEEE Trans. Smart Grid 2015, 7, 2359–2367. [Google Scholar] [CrossRef]

- Ratnam, E.L.; Weller, S.R.; Kellett, C.M.; Murray, A.T. Residential load and rooftop PV generation: An Australian distribution network dataset. Int. J. Sustain. Energy 2017, 36, 787–806. [Google Scholar] [CrossRef]

- Ziras, C.; Sousa, T.; Pinson, P. What do prosumer marginal utility functions look like? Derivation and analysis. IEEE TRansactions Power Syst. 2021, 36, 4322–4330. [Google Scholar] [CrossRef]

- Power Plus Energy. LiFe Premium 2RU19 Specification. Available online: https://www.powerplus-energy.com.au/wp-content/uploads/2019/03/LiFe-Premium-2RU19-Specifications-REV03.pdf (accessed on 10 February 2021).

- Jain, R.K.; Chiu, D.M.W.; Hawe, W.R. A Quantitative Measure of Fairness and Discrimination; Eastern Research Laboratory, Digital Equipment Corporation: Hudson, MA, USA, 1984. [Google Scholar]

- Hoßfeld, T.; Skorin-Kapov, L.; Heegaard, P.E.; Varela, M. Definition of QoE fairness in shared systems. IEEE Commun. Lett. 2016, 21, 184–187. [Google Scholar] [CrossRef]

- MathWorks. Matlab. Available online: https://www.mathworks.com/products/matlab.html (accessed on 10 October 2021).

- MathWorks. Intlinprog. Available online: https://www.mathworks.com/help/optim/ug/intlinprog.html (accessed on 10 October 2021).

- MathWorks. Linprog. Available online: https://www.mathworks.com/help/optim/ug/linprog.html (accessed on 10 October 2021).

- Absolute Values. Available online: http://lpsolve.sourceforge.net/5.1/absolute.htm (accessed on 15 October 2021).

| Reference | Year | Method | Energy Market | Market Structure | Battery Degradation | Battery Insertion Arrangement | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Hour-Ahead | Day-Ahead | Intra-Day | Real-Time | Prosumage | Intracommunity * | Intercommunity ** | |||||

| [23] | 2018 | Noncooperative game theory | Community-based P2P Market | X | No | X | |||||

| [16] | 2020 | Noncooperative game/Bilateral Nash game | Community-based Market | X | X | No | X | ||||

| [26] | 2021 | Two-stage mechanism | Community-based Market | X | X | Yes | X | ||||

| [19] | 2020 | Stochastic programming/ADMM | Community-based Market | X | X | No | X | ||||

| [27] | 2019 | Non-linear bilevel | Community-based Market | X | No | X | |||||

| [28] | 2021 | Distributed artificial intelligence and optimization | Community-based Market | X | No | X | |||||

| [29] | 2018 | Linear optimization | Community-based P2P Market | X | No | X | X | ||||

| [30] | 2019 | Two-stage stochastic linear program | Community-based P2P Market | X | X | No | X | ||||

| Proposed Model | 2021 | Linear optimization | Community-based Market | X | Yes | X | X | X | |||

| Agent | Community 1 | Community 2 | Community 3 |

|---|---|---|---|

| Prosumer 1 | 2 kWp | 2 kWp | 6.2 kWp |

| Prosumer 2 | 2.7 kWp | 4.2 kWp | 8 kWp |

| Prosumer 3 | 3 kWp | 8 kWp | 9.9 kWp |

| Parameter | Value | Reference |

|---|---|---|

| / | 0.2/0.8 | [33] |

| / | 0.5/0.9375 | [43] |

| 8.6086 × | [43] | |

| / | 0.96/0.96 | [43] |

| / | 38,200/−0.02686 | [39,43] * |

| Case | Agent | Community | |||

|---|---|---|---|---|---|

| 1 | 2 | 3 | Extra | ||

| 1 | Prosumage 1 | 1.65 kWh | 1.65 kWh | 3.3 kWh | - |

| 1 | Prosumage 2 | 1.65 kWh | 1.65 kWh | 3.3 kWh | - |

| 1 | Prosumage 3 | 3.3 kWh | 3.3 kWh | 3.3 kWh | - |

| 2 | Intracommunity | 6.6 kWh | 6.6 kWh | 9.9 kWh | - |

| 3 | Intercommunity | - | - | - | 23.1 kWh |

| Case Analyzed | SW | Shared Energy Inside the Communities () | Energy Exchanges in the Market (, ) | QoS | QoE | ||||

|---|---|---|---|---|---|---|---|---|---|

| Provided | Consumed | Imported | Exported | Mean | St. Dev. | Mean | St. Dev. | ||

| Base Case | 2649.60 m.u. | 1456.10 kWh | −1456.10 kWh | 43,754 kWh | 43,754 kWh | 0.7344 | 0.0850 | 0.7529 | 0.4014 |

| Case 1 | 2359.10 m.u. | 2096.20 kWh | −2096.20 kWh | 37,809 kWh | 37,809 kWh | 0.7361 | 0.0952 | 0.3955 | 0.3656 |

| Case 2 | 2885 m.u. | 44,459 kWh | −44,459 kWh | 45284 kWh | 45,284 kWh | 0.6875 | 0.0695 | 0.8955 | 0.1978 |

| Case 3 | 2976.30 m.u. | 1451.70 kWh | −1451.70 kWh | 57,506 kWh | 57,506 kWh | 0.7392 | 0.0858 | 0.7526 | 0.4006 |

| Market Agents | p | q | s | ||

|---|---|---|---|---|---|

| Community 1 | |||||

| Prosumage 1 | −0.4872 | 0.8491 | 0 | 0 | −0.3619 |

| Prosumage 2 | 1.9780 | −0.8491 | 0.6534 | 0 | −0.4755 |

| Prosumage 3 | 1.6740 | 0 | 0.7298 | 0 | −0.9442 |

| Community 2 | |||||

| Prosumage 1 | −0.4872 | 0.4045 | 0 | 0.4872 | −0.4045 |

| Prosumage 2 | 0.6852 | −0.7902 | 0 | 0 | 0.1050 |

| Prosumage 3 | −1.9350 | 0.3857 | 0 | 1.9350 | −0.3857 |

| Community 3 | |||||

| Prosumage 1 | −0.0296 | 0 | 0 | 0.0444 | −0.0148 |

| Prosumage 2 | −1.9350 | 0 | 0 | 1.9350 | 0 |

| Prosumage 3 | −1.4388 | 0 | 0 | 1.4388 | 0 |

| External Player | 4.4572 | 0 | 4.4572 | 0 | 0 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guedes, W.; Deotti, L.; Dias, B.; Soares, T.; de Oliveira, L.W. Community Energy Markets with Battery Energy Storage Systems: A General Modeling with Applications. Energies 2022, 15, 7714. https://doi.org/10.3390/en15207714

Guedes W, Deotti L, Dias B, Soares T, de Oliveira LW. Community Energy Markets with Battery Energy Storage Systems: A General Modeling with Applications. Energies. 2022; 15(20):7714. https://doi.org/10.3390/en15207714

Chicago/Turabian StyleGuedes, Wanessa, Lucas Deotti, Bruno Dias, Tiago Soares, and Leonardo Willer de Oliveira. 2022. "Community Energy Markets with Battery Energy Storage Systems: A General Modeling with Applications" Energies 15, no. 20: 7714. https://doi.org/10.3390/en15207714

APA StyleGuedes, W., Deotti, L., Dias, B., Soares, T., & de Oliveira, L. W. (2022). Community Energy Markets with Battery Energy Storage Systems: A General Modeling with Applications. Energies, 15(20), 7714. https://doi.org/10.3390/en15207714