1. Introduction

Climate change mitigation has become an issue of great concern for policymakers and researchers around the world in the last few decades. This is because the last century has seen an increase of nearly one degree in global temperatures, which has potentially dire consequences for human livelihoods and the environment, as manifested in sea level rise, floods, drop in crop yields, and the extinction of species, among others. It is not surprising, therefore, that the [

1] has described greenhouse gas targets, climate change, and universal access to energy as crucial issues for the century. This supports the argument of [

2] that, in striving for global sustainability of economic development, reduction in CO

2 emissions in energy production must be at the forefront of policy. Africa’s share of global emissions is only 20% of the global average, but it is the worst affected by climate change impacts [

3]. The negative effects of traditional sources of energy have led to calls for alternative sources of clean fossil and renewable energy to deal with the problem [

4,

5,

6]. This is consistent with the recent World Nuclear Association report (2019), which claimed that the need for reliable, predictable, and clean electricity generated by nuclear has never been greater.

Generally, clean, and renewable energy systems produce little or no carbon dioxide emissions and, therefore, have the twin benefits of mitigating global warming and promoting energy security [

7,

8]. The Africa Progress Panel [

9] suggested that renewable energy could enable the transformation of the African continent because of its flexibility and adaptability. The [

10,

11] noted that lack of access to energy critically limits the growth of African countries. Ref. [

12] suggested that universal access to sustainable energy is critical in supporting overall economic development through the protection of ecosystems and enhancing income distribution. Ref. [

13] reported that increasing the production of renewable energy (RE) can contribute to achieving many of the SDGs, which seek to enhance the overall welfare of citizens. SDG 7 has the objective of facilitating access to clean energy, encouraging energy efficiency and promoting the use of cleaner fossil-fuel technology by 2030. Any serious effort to achieve the sustainable development goals will require an invigorated agenda to promote clean energy development. This is pertinent when it is considered that 50% of the population in developing nations reside in homes without clean cooking facilities, which corresponds to 38% of the global population who must pursue their lives without clean cooking facilities, most of those affected living in developing Asia (41%) and SSA (55%) [

14]. Moreover, the abundance of renewable sources of energy (solar and wind), especially in many parts of Africa, makes it imperative for countries to consider their development.

According to the [

11,

15,

16], in 2014, renewables represented almost 50% of the world’s new power generation capacity and over 60% in 2016. The [

17] also indicated that, in the last 15 years, the world has invested nearly USD 3.0 trillion in clean energy, and noted that global investments in renewables exceeded USD 200 billion annually. With an investment worth USD 126.6 billion, China was leading the rest of the world with respect to investment in renewables, and that investment was further increased by 31 per cent in 2016. Ref. [

17] reported that 2017 recorded the highest growth in clean energy production. This was possible due to a substantial increase in renewable power capacity, accompanied by advances in enabling technologies, as well as increases in investment in renewables. Of interest is the observation that Africa’s relative share is only about 2–3%, which suggests considerable potential for renewable energy deployment. This is buttressed by the fact that, although the installed solar energy capacity increased by over 27,000 times over the period 2000–2015, from 0.88 GW to 222 GW, the African continent contribution increased from 500 MW to 2100 MW for the period 2013–2015, with the largest capacity being installed in South Africa [

18]. Ref. [

19] asserted that Africa has great potential for renewable energy development and suggested that 70% of African countries are suitable for investment in renewables. More importantly, in most of SSA, the potential for clean renewable energy can match its current domestic energy consumption. Accordingly, the onus is on us to discover and understand the key drivers of clean energy to provide the policy space for its accelerated development and use. This responsibility motivates this study.

Motivated by global energy demand and usage, this study examines the key determinants of pollutant emission and their environmental implications for energy development and consumption. In the recent past, scholarly attention in the energy-induced growth literature has focused increasingly on examination of the dynamic relationship between foreign direct investment (FDI), energy consumption, economic growth, the price of crude oil, and financial development. Of particular interest are capital flows of foreign direct investment and the nature of the financial sector in clean renewable development. Many studies have looked at the independent or individual effects of FDI and financial development (FD) on clean energy, with some looking at their combined effect, among other control variables, on clean energy development. The results of these studies have been inconsistent [

7,

20,

21,

22]. We argue that many of the studies suffer from omitted variable bias as many of the studies ignore the influence of political factors in clean energy development. The [

23], for example, suggests that government policy is critical to reducing the negative effects of climate change because over 70% of global energy investments are government-driven. Additionally, the authors report that economic or technical problems are not fundamentally responsible for transition problems, but such challenges are politically and institutionally based reflected in the calamitous scale of cross-country differences in source and impact vulnerability. Simply put, clean energy consumption cannot be discussed without taking into consideration both the economic and political institutions through which clean energy policy decisions are made [

7,

24,

25].

However, these issues have not been addressed in the empirical literature as determinants of conventional energy development. Accordingly, in achieving the research objective, we contribute to the literature in three main ways. First, this is one of the first studies, of which the authors are aware, that takes into consideration the economic and political institutions in the development and consumption of conventional energy, as well as the use of broader measures for financial development, represented by three different proxy measures of financial development indices, namely, domestic credit to the private sector (% of GDP), domestic credit provided by the financial sector (% of GDP), and domestic credit to the private sector by banks (% of GDP) to provide a holistic picture. The motivation of the SSA bloc arises from the fact that SSA ranks high on energy deficit, i.e., energy poverty, with approximately 600 million people lacking access to the electric power supply. The limited access to electricity has led to increased pollution and death [

26]. However, the bloc has contributed the least to global CO

2 emissions, contrary to the dominant argument in the extant literature. The region’s emissions contributions are the least, but it suffers the greatest effects of climate change due to the channels of emissions through trade, financial development, and industrialization/globalization.

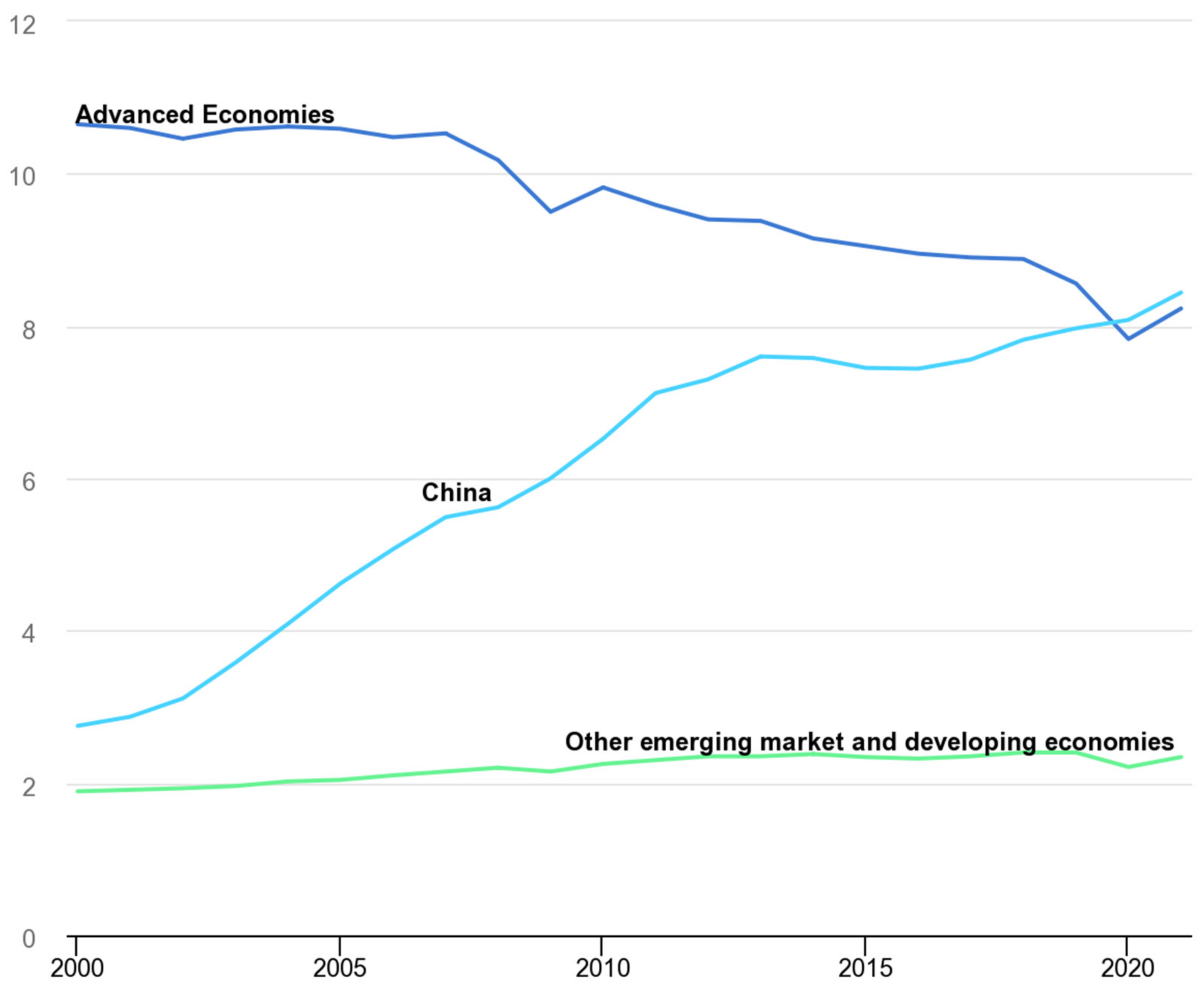

Figure A1 (see

Appendix A section) highlights global CO

2 emissions for different regions, illustrating that advanced or developed economies emit more CO

2 relative to the less developed blocs, such as SSA. International bodies, such as African Progress has promoted (2016) the need for a paradigm shift to clean energy sources to mitigate the adverse effects of fossil-fuel energy [

21]. This study seeks to bridge the gap in the related literature in the context of the SSA bloc which has received little attention. Second, unlike many other studies, this study investigates whether there are differential determinants for non-renewable and renewable consumption. Third, the current study contrasts with previous studies in terms of method by utilizing the recent and robust panel econometrics tool, two-step system GMM, to contribute to an evidence-based conventional energy policy.

The remainder of the paper is organized as follows:

Section 2 focuses on a review of related literature.

Section 3 describes the methodological procedure, while

Section 4 presents interpretations of the empirical results. Finally,

Section 5 provides the conclusions and suggestions for future policy direction.

2. Review of the Literature

In the FDI literature, the consensus is that the host nations’ benefit is pronounced as a result of the enhancement of the nation’s productivity, as well as the promotion of economic growth. In other words, while FDI is guaranteed to bring about direct capital financing (DCF), its contributions transcend DCF to include the creation of positive externalities using new technologies and technological know-how. The augmentation and efficiency properties of FDI are, thus, expected to exert a positive effect on both economic growth and environmental quality. With respect to energy, however, it could be argued that competition and direct knowledge transfer are the key channels through which FDI impacts energy consumption [

27]. These views are consistent with ecological modernization theory which suggests that new technologies provide enormous opportunities and have the potential to solve the ecological problems caused by industrialization. From a practical point of view, ecological modernization theory is applied in the development and implementation of renewable energy solutions.

From the perspective of new trade theory, Ref. [

28] argues that, upon entry into new markets, foreign firms, especially in developing countries, usually raise the threshold for efficiency in service delivery for all firms. Ref. [

29], for example, noted that FDI discourages the use of unclean energy, and that, therefore, the influx of FDI acts as a catalyst for improving the energy efficiency of domestic firms. A similar argument was made by [

30], who suggested that FDI promotes competition and spurs the development and use of clean energy by domestic firms as most foreign firms maintain high standards from their home country. The authors note that only weak evidence supports the view that some foreign investments occur in sectors characterized by a high level of pollution. Furthermore, because of the successful adoption of FDI, the energy intensity of the host nations is reduced, and new technological innovations are developed. As [

31] have claimed, the introduction of technological innovations into the nexus of FDI, CO

2 emissions and financial development injects a unique dynamic into scholarly debate For instance, with technological innovation, switching from non-renewable to renewable energy sources becomes relatively easily attainable [

32].

The empirical findings from the study of [

33] in which data from 1980 to 2011 was used to investigate the role of the energy-saving potential of FDI in thirteen East African nations, suggest that the bidirectional reinforcement that existed between FDI and industrialization was the fundamental foundation required to enhance energy productivity. Additionally, the authors reported that income and globalization reinforced the FDI-energy productivity relationship. Ref. [

34] studied the effect of domestic and foreign investment on clean energy development for EU, G20, and OECD countries, spanning the period 1993–2012. The authors demonstrated that both domestic and FDI had a positive effect on clean energy use. Furthermore, in a comparative study of the three blocs of countries, Ref. [

32] found that factors such as FDI, political globalization, and stock market development, played a significant role in determining the long-run promotion of clean energy use. Specifically, political globalization and clean energy consumption exerted negative effects on CO

2 emissions; however, a positive linkage was established between clean energy consumption and economic growth for the OECD, G20 and EU economies.

In a related study of the same group of countries using the FMOLS, [

35] reported that both stock market development and FDI had a significant impact on clean energy and a negative effect on carbon dioxide emissions. In an earlier study of 20 emerging economies, spanning the period 1991–2012, Ref. [

22] demonstrated that, after controlling for cross-sectional dependence, FDI and stock markets positively impacted clean energy consumption. In a recent study of frontier economies in Africa, Ref. [

36] found that trade integration, economic integration, and financial integration were key determinants of energy demand. More specifically, the results showed that a positive and direct relationship between FDI and trade led to an increase in clean energy consumption, while energy consumption, in turn, determined the reactions in terms of stock market indicators and industrialization. The authors, therefore, recommended that environmental planning in the countries studied should boost economic growth and energy demand using trade and financial development as tools. Ref. [

37] employed a spatial econometric approach to test the merging of energy intensity and reported that FDI could stimulate the convergence of energy intensity. The authors noted that this could be attributed to the spillover effect of FDI. Ref. [

38] examined the case for the BRICS region from the period 1985–2017, using the Fourier ARDL technique, to show that, while FDI had a positive effect on clean energy in Russia, it had no effect in South Africa and China; trade, however, had a negative effect in Russia, China, and South Africa.

On the other hand, Ref. [

39] examined the case for G20 economies over the period 1971–2009 and demonstrated that FDI did not have a significant impact on clean energy use. Ref. [

40] examined the case of South Asia based on FE, RE, and LSDV techniques for the period 1990–2013. The results suggested that FDI had no significant effect on energy intensity. Similarly, Ref. [

41] used OLS and panel analysis to examine micro-level panel data for 60 developing countries for the period 1975–2004. The results showed no support for the view that FDI inflows reduced the energy intensity of developing countries. Of interest is the finding that foreign development aid appeared to be related to energy efficiency gains. Ref. [

42] contributed to the literature by comparing domestic and foreign investment and demonstrated that the Chinese favor indigenous innovations as a prerequisite for energy intensity more than foreign innovations. Using 13 years of data starting from 2000, Ref. [

42] found, for 30 provinces in China, that the impact of foreign innovation was dependent on the technological absorptive capacity of the host country. Ref. [

43] examined the causal factors affecting European Union energy intensity over the period 1995–2015 and found that FDI did not influence energy intensity, while the price of coal had a negative effect on energy intensity. Thus, the energy-saving role of FDI was not supported.

Ref. [

27] investigated the energy-saving role of FDI for 100 countries over the period 1980–2015 and found that the results were determined by the level of development. The authors reported a differential effect for low, middle, and high-income countries. More importantly, the authors showed that there was an inverted U –shaped relationship between FDI and energy consumption. A similar result was reported for imports when income level was controlled for. Ref. [

44] studied the case of Bangladesh using time-series data spanning 1980–2015 and found no causal relationship between FDI and renewable energy in the short run.

Similar results were also reported for the financial development and clean energy consumption relationship. Ref. [

45] argued that financial development offers more opportunities to develop the renewable energy sector by providing more funds to innovative firms. Thus, financial development leads to improvements in financial activities, such as the stock market and banking sector activities, and possibly bond market activities [

41,

46]. In addition, countries can increase renewable energy supply and consumption through efficient policy direction and sound financial systems. In the case of FATF countries, policy direction encouraged the use of key financial instruments, such as dynamic fundraising schemes, vibrant venture capital industry, green bonds, and loan schemes for energy-efficient technology, in their campaign for increased clean energy consumption.

Using panel data techniques to examine the determinants of clean energy, [

47] found that economic growth enhanced clean energy, but financial development reduced it. Using OECD data from 1990 to 2014, Ref. [

48] established a crucial link between renewable energy and financial development. The study further confirmed variance in the impact of financial development on the innovation growth rate and carbon intensity. It was noted that non-biomass and biomass renewable energy technologies affected the interactions between energy and financial development. The authors concluded that, for technological development to thrive, the financial markets must function well. In a related study of OECD countries during the period 1980–2016, based on the Driscoll–Kray standard errors panel regression technique, Ref. [

49] found an inverted U-shape relationship between financial development and energy consumption, as well as between economic growth and energy consumption. Ref. [

50] reported similar findings in a study of 28 EU countries in the European Union (EU) over the period 1990–2015. However, they observed that capital market development did not influence renewable energy in new EU Member states.

In a study of 28 Chinese provinces over the period 1999–2014, based on the GMM estimation technique, Ref. [

12] showed that a poorly functioning financial system has a negative effect on energy intensity. The authors argued that inadequate access to finance reduces the incentive for investment in the energy sector. Ref. [

51] investigated the financial development—energy consumption nexus in China for the period 1980–2016 and demonstrated that financial development increased energy demand, while globalization had a negative and significant impact on energy demand. In contrast, Ref. [

52], using 141 listed Chinese firms, investigated the relationship between clean energy and financial development. Their findings suggest that while green financial development should be coveted, its long-term and short-term impacts differed sharply in the case of the investigated Chinese firms. As reported, generally, bank loan issuance decreased with increasing development of green financing and tended to slow the pace of development in renewable energy investment efficiency. However, for short- and intermediate-term impacts, investment efficiency resulting from the issuing of bank loans was minimal in the short-term, with no traceable effects observed in the long run.

Ref. [

53] examined 150 listed Chinese firms, finding a curvilinear relationship between green economy development and renewable energy investment. Their results indicated a dual-threshold effect of green credit on renewable energy and green economy development. However, Ref. [

54], in a study of 32 high-income countries, found negligible effects of financial development on energy consumption, though an increase in the stock market index was associated with a slight decline in energy consumption. Using panel data techniques to examine the determinants of clean energy, [

20]) found that economic growth enhanced clean energy use but financial development reduced it. On the other hand, FDI was not found to have a significant impact on clean energy for countries in the BRICS bloc. Ref. [

55] using data from 22 emerging economies and application of the GMM technique, evaluated how energy consumption in the countries considered was impacted by investments in financial development from 1990 to 2005. Their results confirmed the existence of a relationship between energy consumption and financial development, especially when financial development was measured using stock mark criteria.

Ref. [

56] examined the energy savings role of banking sector performance for 43 SSA countries from 1998 to 2012 and reported that improved banking performance fostered energy efficiency, both in the short and long run. Interestingly, this study found that democracy had the opposite effect. The authors argued that achieving energy efficiency would require special initiatives to achieve necessary developments in the banking sector and to safeguard the sector from policy directions of democratic governments in the sub-region. Ref. [

7] investigated the determinants of renewable energy in China and found that the financial sector was critically important for China’s renewable energy development. More importantly, the results revealed that the capital market had the most significant effect, followed by foreign investment. Additionally, the authors reported that effective policies were needed to upgrade the energy structure to cope with climate change. This supports [

24] assertion that the smooth development of renewable energy is inseparable from a supportive legal framework. Ref. [

57] also showed that the transition to green innovation and energy efficiency was driven by a country’s institutional quality. In an examination of the energy efficiency performance of a cross-section of 71 developing and developed countries, the authors reported that strong government support and reliable government institutions were critical in promoting energy innovations.

While acknowledging the relationships and interdependencies among FDI, and clean energy use, it is important to point out that the degree of dependency or influence may be altered by the policy direction or strategies implemented in the study context. For instance, Ref. [

58] posited that policies such as low-carbon city construction, when used with a preferential policy such as financial subsidy, had the potential to not only increase and improve the productivity of energy-intensive industries, but also to mitigate against the associated risk of operating such energy-intensive industries by encouraging a complete shift to low-carbon development. In other words, while FDI has been empirically demonstrated to improve host clean energy use, the application of such policies, as discussed above, can foster greater impact of FDI on CO

2 emissions, or even renewable energy use.

Furthermore, in economies that encourage the implementation of green finance policy, that is, where there is intentional commitment by government and the global financial system to prioritize channeling investment into green projects [

59], it is expected that climate change mitigation will be attained faster in comparison to nations without such policies. In the context of SSA, where such policy is either non-existent or in a fledging state, it is important to note that reliance on FDI inflow in ameliorating emissions is critical to the mitigation goals of the bloc. Given that policy directions or developmental strategies may be influential in determining the outcome of investments in clean energy and the associated pollutant-related emissions, SSA’s adoption of institutional regulatory policies, alongside FDI inflow, is essential to the attainment of climate change mitigation goals.

3. Data, Model and Methods

The present study contributes to the politics of the CO

2 emissions debate focusing on SSA countries. According to [

60], panel data models can be either static or dynamic. The former accommodates individual fixed effects, studying behavior in a repetitive framework. However, GMM estimation techniques incorporate various instrumental variables to circumvent endogeneity issues. This implies that the GMM approach provides consistent, reliable, and robust coefficient estimates even in the face of heterogeneity (see [

61]). For robustness analysis, post-estimation tests are outlined in a later section to illustrate the superiority of the GMM estimation in comparison to conventional panel ordinary least squares, random effect and fixed effect models. The GMM model is robust to other static models and corrects for fixed or country-specific correlations, such as cross-sectional issues. Thus, to achieve the study objective, the following functional form was structured [

8,

62] as follows:

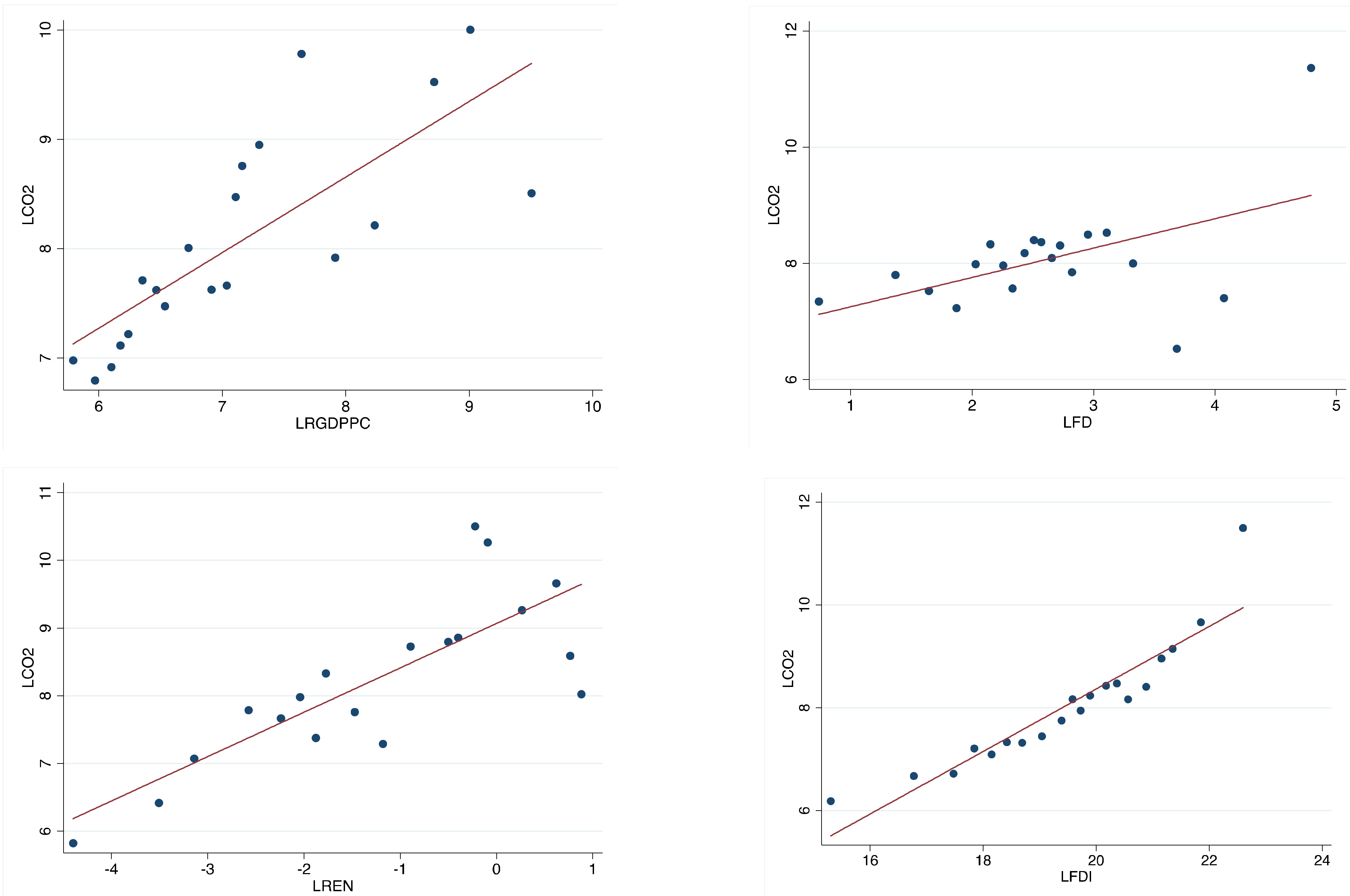

where Ln denotes the natural logarithm transformation of all series to make elasticity interpretations and inferences; CO

2 = carbon emission; FDI = foreign direct investment net inflow (Bop); REN = renewable energy consumption; RGDP = economic growth; FD = financial development, proxied by three indicators, namely, (i) domestic credit provided to the private sector by banks (% of GDP) (DCPB), (ii) domestic credit provided by the financial sector (% of GDP), and (iii) domestic credit to the private sector as % of GDP (DCFS), to check for the robustness of the study objectives; the other variables ROL, GOV, COC, RQI, VOA and POL represent rule of law, government effectiveness, control of corruption, regulatory quality, voice and accountability, and political stability, respectively.

The data employed to achieve the study objective cover the period 2002 to 2014 for 31 countries in sub-Saharan Africa, including Angola, Burkina Faso, Cameroon, Cape Verde, Central African Republic, Democratic Republic of the Congo, Equatorial Guinea, Gabon, Ghana, Guinea, Ivory Coast, Kenya, Lesotho, Madagascar, Malawi, Mali, Mauritius, Mozambique, Namibia, Nigeria, Republic of the Congo, Rwanda, Sao Tome and Principe, Senegal, Sierra Leone, South Africa, Sudan, Tanzania, Togo, Uganda and Zambia. The exclusion of other countries was due to data availability; other SSA countries without data for all study variables under consideration limited extension of the study data significantly. The variables and sources for the current study are presented in

Table 1. The institutional variables range between −2.5 and 2.5 following the world bank’s standard measurement of these factors.