4.1. Energy Consumption Analysis

Best practices for the study of energy consumption in specific industrial sectors recommend that analyses are based on physical units of production (instead of economic data), as the information must be sufficiently disaggregated to allow for the analysis of processes and sites, and the models used in the evaluation should be general enough to be applied in different sectors [

74]. Therefore, the use of the information from energy audits is ideal to define the sectoral specific energy consumption (SEC) [

34]. The use of linear regression models is widely used for benchmarking analysis and energy efficiency measures [

75,

76,

77,

78,

79] and a methodology for the characterization of productive sectors from energy audits has been developed and tested in a previous work (for a different industrial sector) [

25]. Hence, the first step of the present work is to analyse the primary energy consumption (in tonnes of equivalent oil, normalized according to official conversion factors [

80]) and the final electrical (in GWh) and thermal (in TJ) yearly consumptions as a function of the annual refined crude oil (in tonnes). The results of the regression are presented in

Appendix A.

The linear regression between energy consumption and production presents a very high correlation (R2 > 0.9), with a coefficient of correlation higher than critical Pearson correlation coefficient (Rcrit = 0.7079, for a sample size n = 10 and α = 0.01). Moreover, the low p-values (<0.0001) confirm that the analysis is statistically significant. However, as presented, the intercept of the regression presents a low reliability (the p-value associated with a two-tailed test “Prob > |t|” > 0.01) and a negative value. Hence, the correlation is not valid in all the crude oil refining range. As it is explained in the following, the range of validity of the correlation can be divided in three intervals of production:

- -

From 1.5 Mt to 3 Mt—No reliable

- -

From 3 Mt to 6 Mt—Medium reliability

- -

From 6 Mt to 15 Mt—High reliability

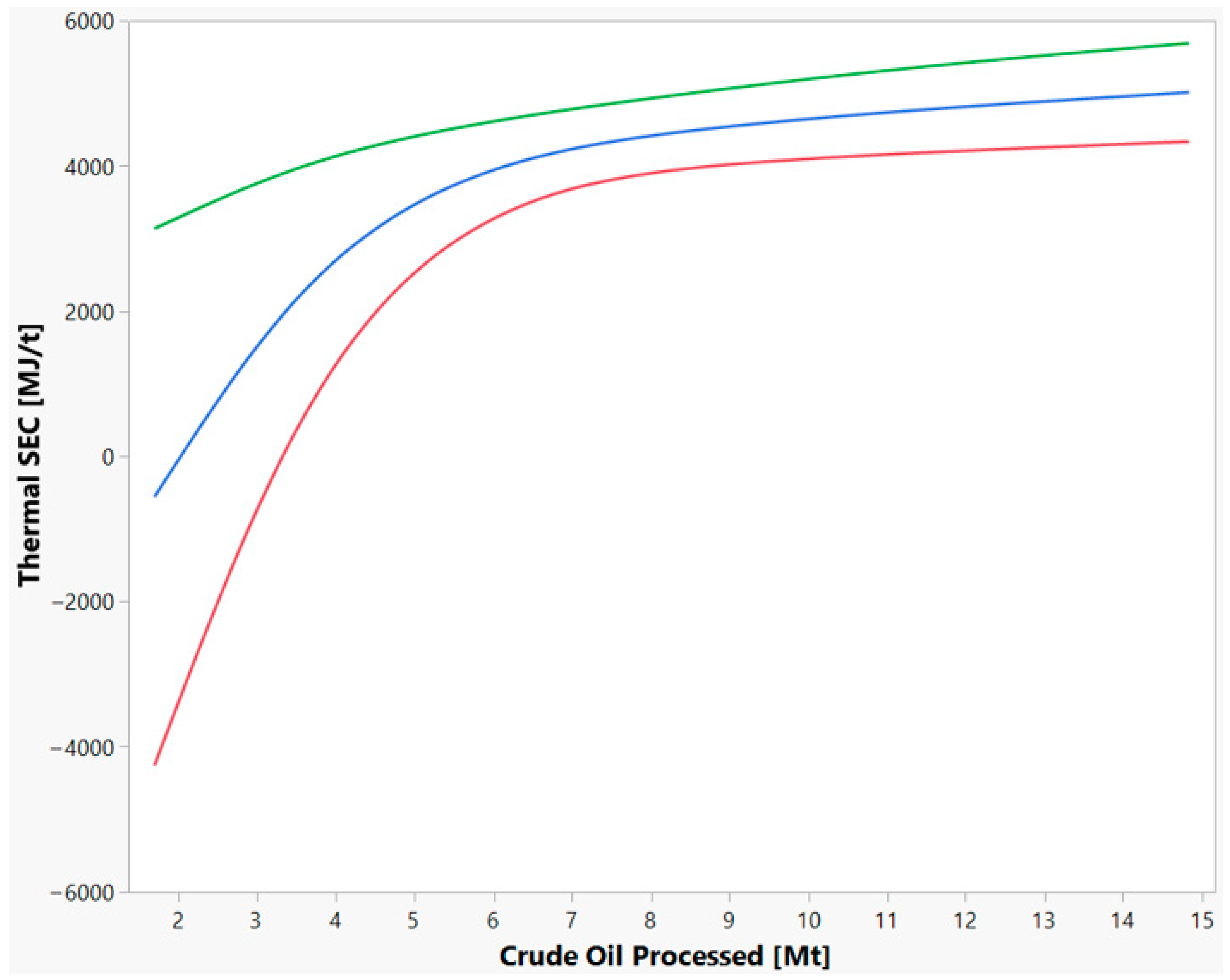

The SEC is defined as the ratio of energy used for refining a tonne of crude oil. Thus, SEC is calculated dividing both sides of the production function (from linear regression) and is represented by a hyperbolic function:

where

and

respectively represent the slope and the intercept of the linear regression line. The values of primary, electrical and thermal SEC are presented in

Table 2.

The analysis of the SEC model uncertainty was developed to a significance level (α = 0.05). Upper and lower limit curves of statistical significance (SECmodel ± 2σ) have been defined through the propagation of the statistical error (based on the covariance matrix). The results for electrical and thermal SEC are presented in

Figure 4 and

Figure 5.

It is possible to observe that there is not an economy of scale in the production, from an energy point of view. In other words, the energy consumption increases with production. This is due to the fact that there is no direct correlation between refining capacity and complexity and subsequent product slate (that define the main consumptions) of the refinery. An additional parameter that impacts on the energy consumption is the crude quality (i.e., API gravity or sulphur content) and its effect cannot be evaluated from energy audits information [

41].

This analysis also shows that the SEC model presents two different areas. If production is higher than 6 Mt, energy consumption increases linearly with production and the mean and limits of the model are consistent with SEC mean values. For lower productions, the model uncertainty increases, and its accuracy decreases significantly (particularly under 3 Mt). Hence, for low productions the model is not reliable.

In the analysed energy audits, the allocation of energy flows inside the refinery is divided among the different standardized sub-processes and units [

81]. The final production distribution directly depends on the presence and capacity of specific units as functions of NCI. Hence, the production slate directly impacts the energy consumption and on the subsequent allocation of GHG emissions by product [

40].

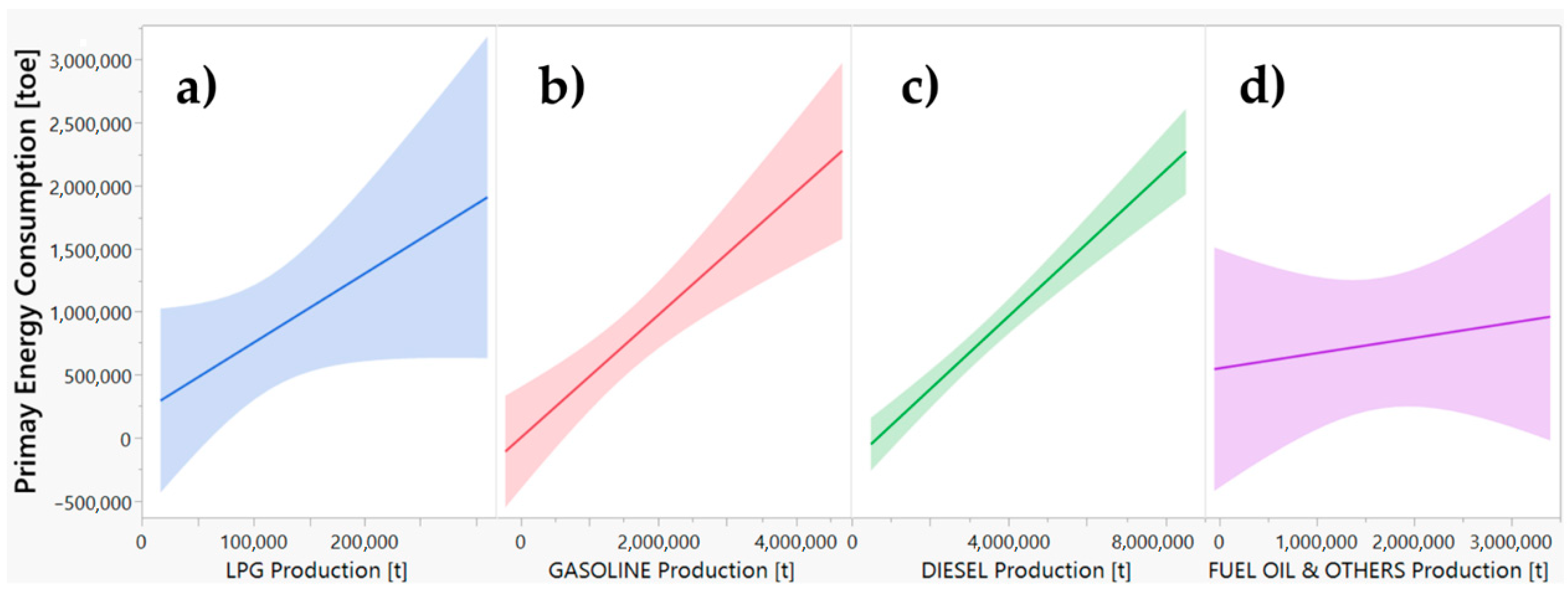

Therefore, an additional analysis based on linear regression was carried out to evaluate the correlation between primary, electrical and thermal energy consumptions and the final production in four different classes:

LPG: includes liquefied petroleum gas and other gaseous products (propane, propylene, etc.)

GASOLINE: mainly includes gasoline and virgin naptha

DIESEL: includes distillates mainly diesel and jet fuel. Other products are kerosene and heating oil

FUEL OIL & OTHERS: includes other vacuum distillation products: heavy fuel oil, petcoke, lubricating oils, waxes, asphalt, etc.

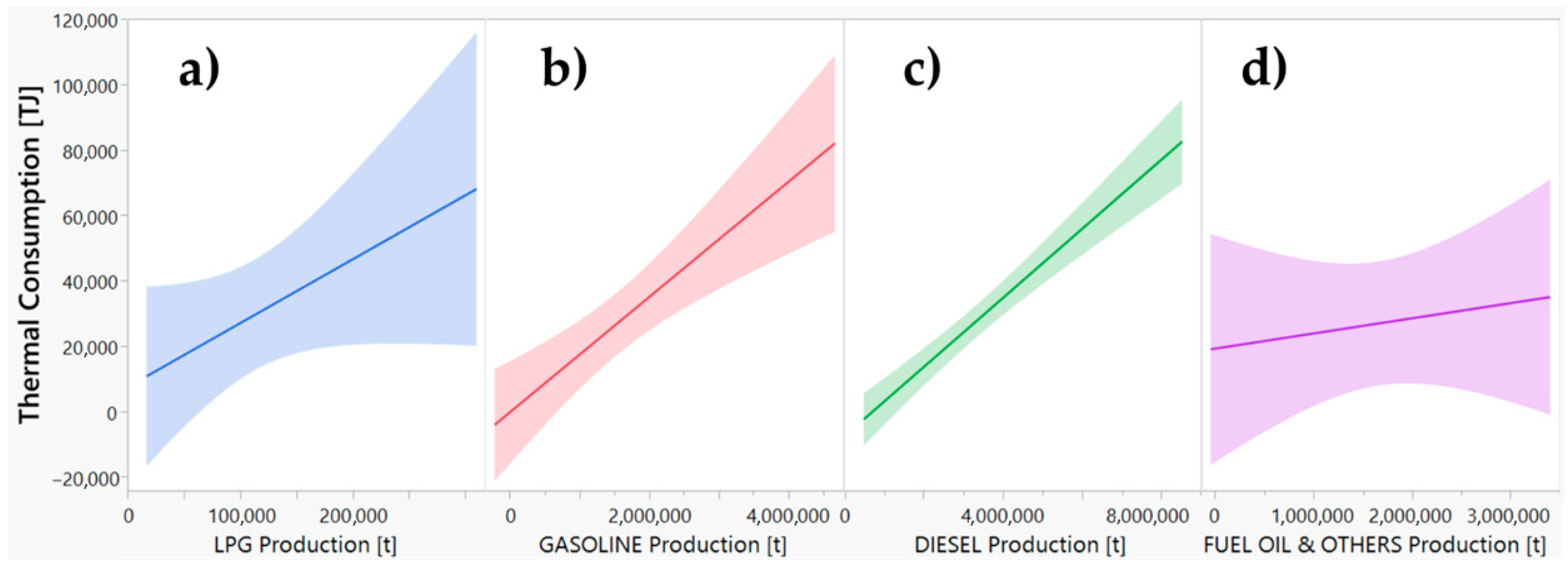

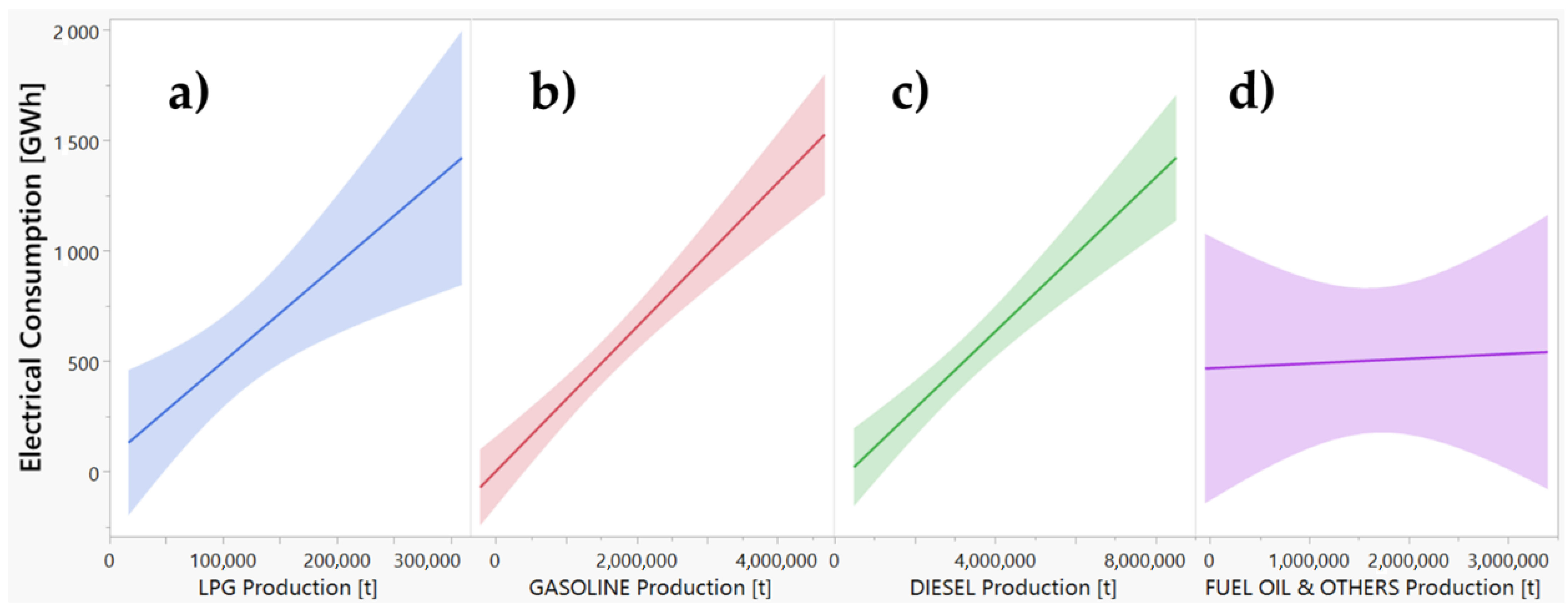

The linear correlations betweeen energy consumption and refined product classes (and their confidence intervals) are presented in

Figure 6,

Figure 7 and

Figure 8. The confidence intervals, which are displayed as the shaded area between linear regression and confidence curves, provide a range of values for the predicted mean for a given value of the predictor for α = 0.05. The bands represent the uncertainty in the estimation of the true line, thus, uncertainity of the correlation increases with the confidence interval area.

Table 3 summarizes the statistical regression parameters of

Figure 6,

Figure 7 and

Figure 8.

It is important to note that the three energy consumption analyses present a very high correlation with diesel production. The coefficients of determination for diesel production are: R2(primary) = 0.940, R2(thermal) = 0.935, and R2(electrical) = 0.890. The energy consumption presents a high correlation with the production of gasolines (R2 > 0.75) with a very high correlation with electrical consumption R2(electrical) = 0.914. On the contrary, energy consumption presents a low correlation with LPG production and a null correlation with Fuel oil and others. Hence it is possible to hypothize that energy consumption of Italian refineries is primarly dependent on the middle distillates production and secondly from gasolines.

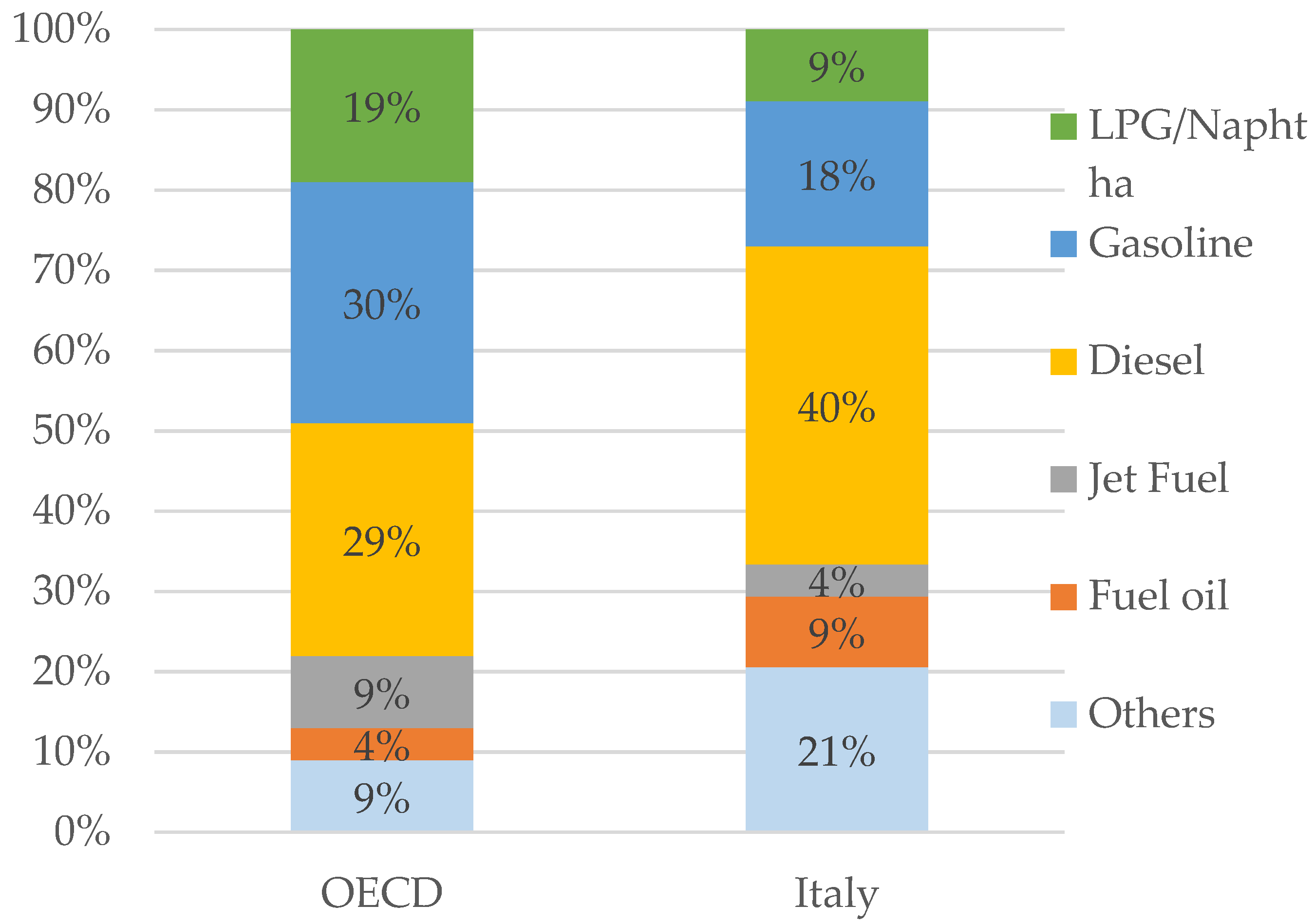

The main reason is linked with the relative weight of both products in the overall production. Diesel accounts for 50% of the global products, meanwhile gasoline accounts for 25%. However, it is important to note that gasoline production routes involve more processes than other products [

40]. Hence the higher product-specific energy consumption ratio increases the correlation between energy consumption and gasoline products. Specifically, electricity-intensive units are mainly correlated to gasoline production (alkylation, hydrocracking and fluid catalytic cracking) [

30] and this is reflected in a slightly higher correlation (R

2electrical[Gasoline] = 0.914 vs. R

2electrical[Diesel] = 0.890).

The importance of the diesel and gasoline ratios is in line with the literature data [

38]. However this analysis is limited due to the lack of information contained in the energy audits, specifically the product slate and the mass flows in the sub-processes. Therefore it is not possible to analyse in detail the allocation of energy performance by specific product (Gasoline, Diesel, Jet, RFO, LPG and Petcoke) and to compare them with other sources [

35,

40,

41].

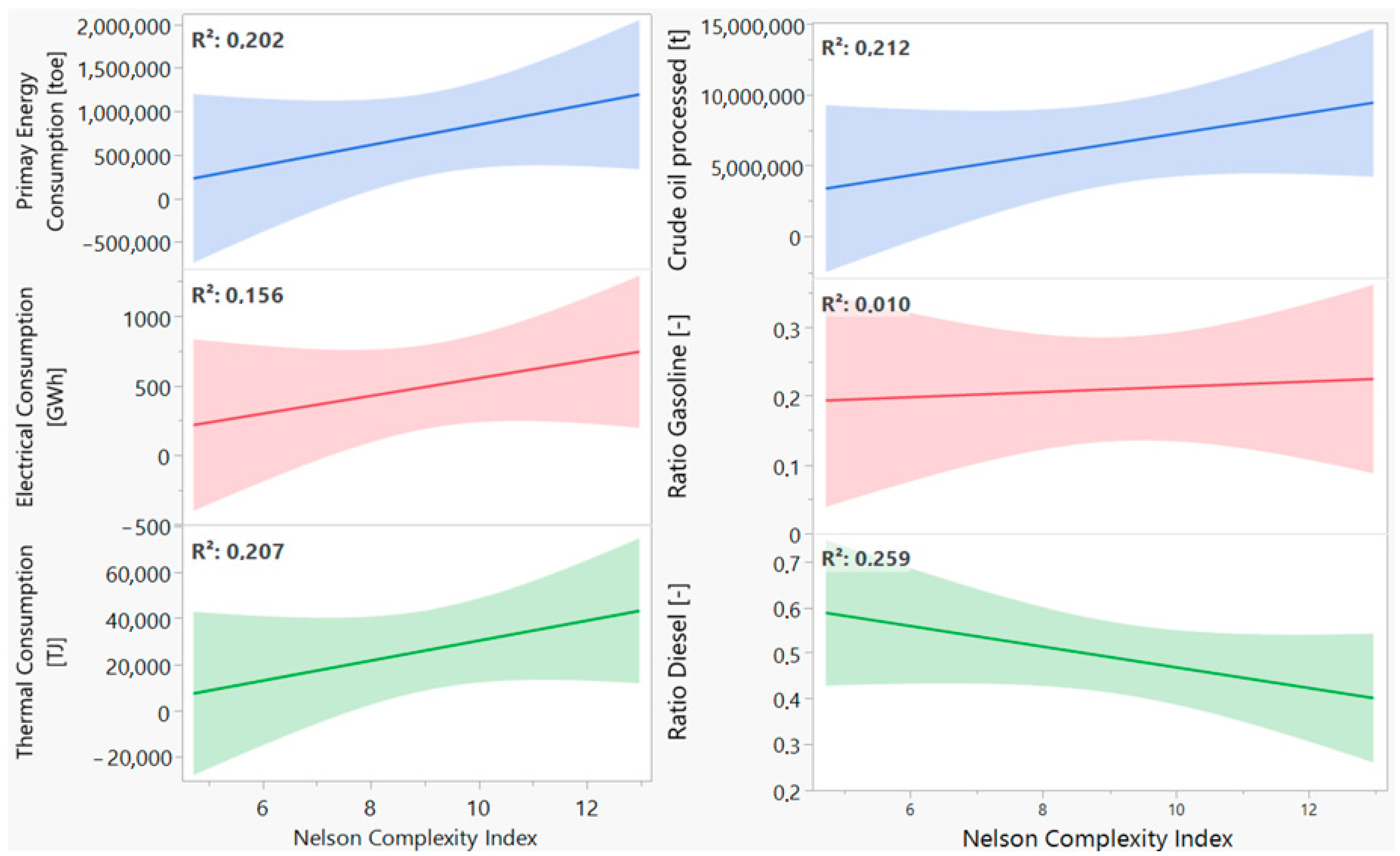

Given the identified correlation between products distribution, despite the missing correspondence between NCI and capacity [

4], it would be plausible to hypothesize a correlation between refineries complexity and their energy consumption and product slate as presented in [

39,

40,

41]. However, not-statistically significant and very low correlations between NCI and energy consumption and production are observed (

Figure 9). This result is in agreement with literature data where only a low correlation between NCI and capacity has been observed [

4,

45]. The lack of correlation between NCI and energy consumption is also linked to the low correlation with product slate. Usually, NCI increases with gasoline ratio, and decreases with diesel ratio. This trend is weakly observed only in diesel, showing a practically null correlation with the gasoline ratio.

It is important to note that this correlation can be also partially due to the uncertainty of the calculation of NCI. The values have been calculated from the information contained in the energy audits, but the capacity of each unit has been estimated from literature.

4.2. Energy Perfomance Improvement Actions (EPIAs) Analysis

For the ten examined refineries, energy audits also include information on energy efficiency measures implemented in the last four years, namely in the period between the last energy audit available (referred to as the December 2019 deadline) and the previous mandatory energy audit. The measures are described in terms of investments and energy savings and thus a cost effectiveness indicator can be computed, expressing the cost of saving one tonne of oil equivalent in different intervention areas.

Information on identified energy efficiency measures is also available, and on the potential savings associated with them: indeed, these measures are not yet planned, and their possible planning could be deferred in time. For these measures, a simple payback period is also available, computed without considering the access to existing incentive mechanisms for energy efficiency [

82].

The energy needed for the refining process represents more than 60% of total refining costs [

28] and this confirms that energy efficiency is a relevant issue also in the refining sector. Moreover, refineries are energy intensive industries and according to the Legislative Decree 73/2020 they are obliged to implement at least one of the energy efficiency measures identified in the energy audit. The analysis of implemented and planned measures shows the importance of interventions related to the production process, which are in each case very specific to the refining site examined and difficult to categorise. In fact, refineries are in general very complex sites, with different process units highly integrated with each other (

Figure 3) and this implies very diversified industrial profiles.

According to the information provided in the energy audits, the refineries examined in the last four years have introduced 27 measures to improve energy efficiency. Among these measures, more than 80% have quantitative information on savings, which are equal to 44 ktoe/year of final energy and to additional 5 ktoe/year of primary energy. In the final energy savings, the main intervention category is production lines, with 30 ktoe of annual saving (66% of the total), referrings to intervention such as integration of heat recovery systems (in furnaces), flare gas recovery units, or the electrification of mechanical systems (mainly in air coolers and FCC units). This result is aligned with best available techniques as suggested by national regulations [

55]. Pressure systems represent 9 ktoe (21%), followed by thermal power plant and other heat recovery systems with 5.5 ktoe (13%). The cost effectiveness indicator has the best value for production lines, around 1100 Euro/toe, followed by Pressure systems with a slightly higher value (1300 Euro/toe)

Energy audits also report 39 measures identified by the refineries analysed. Also in this case, quantitative information on savings is available for more than 80% of the measures (see

Table 4). Potential savings of final energy are equal to 54 ktoe/year and potential savings of primary energy are almost negligible, since the unique measure identified in the production category from renewable sources (photovoltaic) is associated with a savings of 14 toe/year. As for implemented measures, the production lines category is associated with the majority of savings (80%, 43 ktoe/year), with interventions mainly focused on heat recovery systems and revamping of units (mainly VDU and HDS) and burners, followed by electric motors/inverters (12%, 6.3 ktoe/year), and thermal power plant and other heat recovery systems (5%, 2.5 ktoe/year). The production lines category has a good value for cost effectiveness indicator, which is around 900 Euro/toe; measures in the electric motor/inverter category have a similar value to the indicator, whereas measures in pressure systems have again a value around 1300 Euro/toe. In terms of simple payback time, the lowest value was observed in the thermal power plant and heat recovery category (lower than 2 years), followed by pressure systems and production lines (around 3 years).

The sum of implemented and identified EPIAs in the energy audits accounts for global energy savings close to 1.5% of final energy consumption of the analysed refineries. It is important to note that EPIAs usually are implemented during maintenance turnarounds of the refineries. These planned breaks in production are periodically carried out to have preventive maintenance, renovations, or upgrades. The turnarounds of the refineries take place every three or five years and for some weeks the production is stopped. Therefore, the costs are very high, and they require extensive and careful efforts in planning and coordination of the works. Hence, the analysis of EPIAs in energy audits should be integrated in the turnaround planning.