The Weighted Average Cost of Capital and Its Universality in Crisis Times: Evidence from the Energy Sector

Abstract

1. Introduction

2. Literature Review

3. Methods

4. Results and Discussion

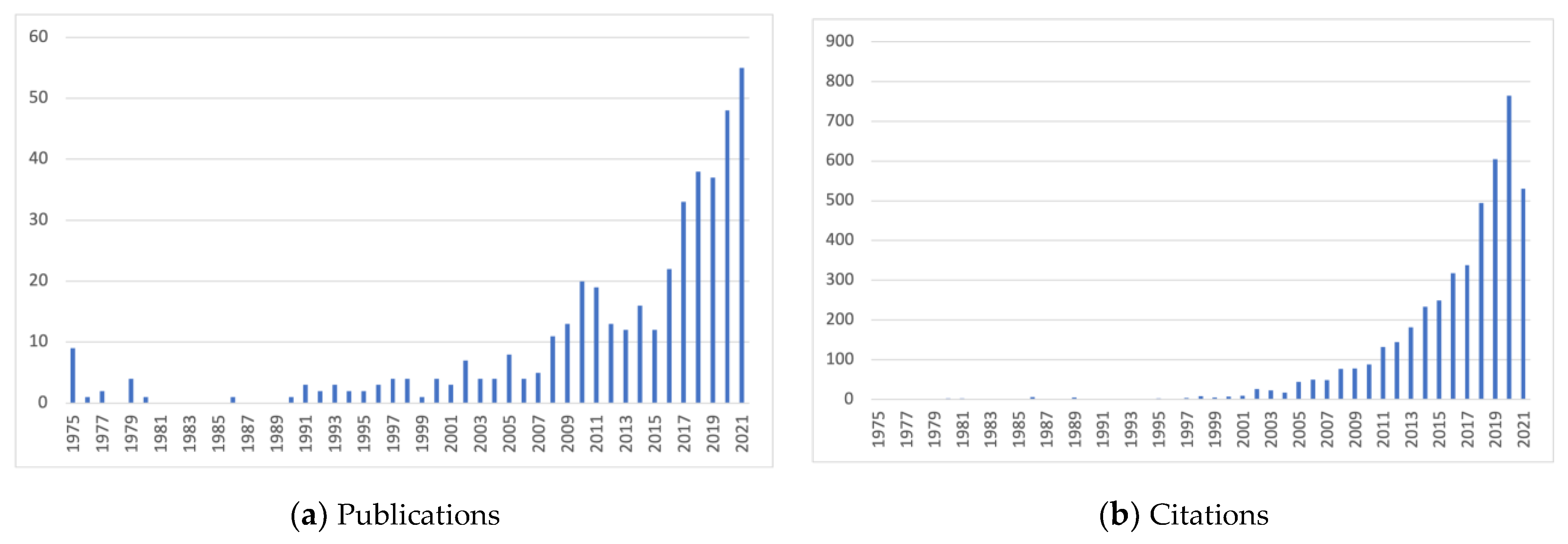

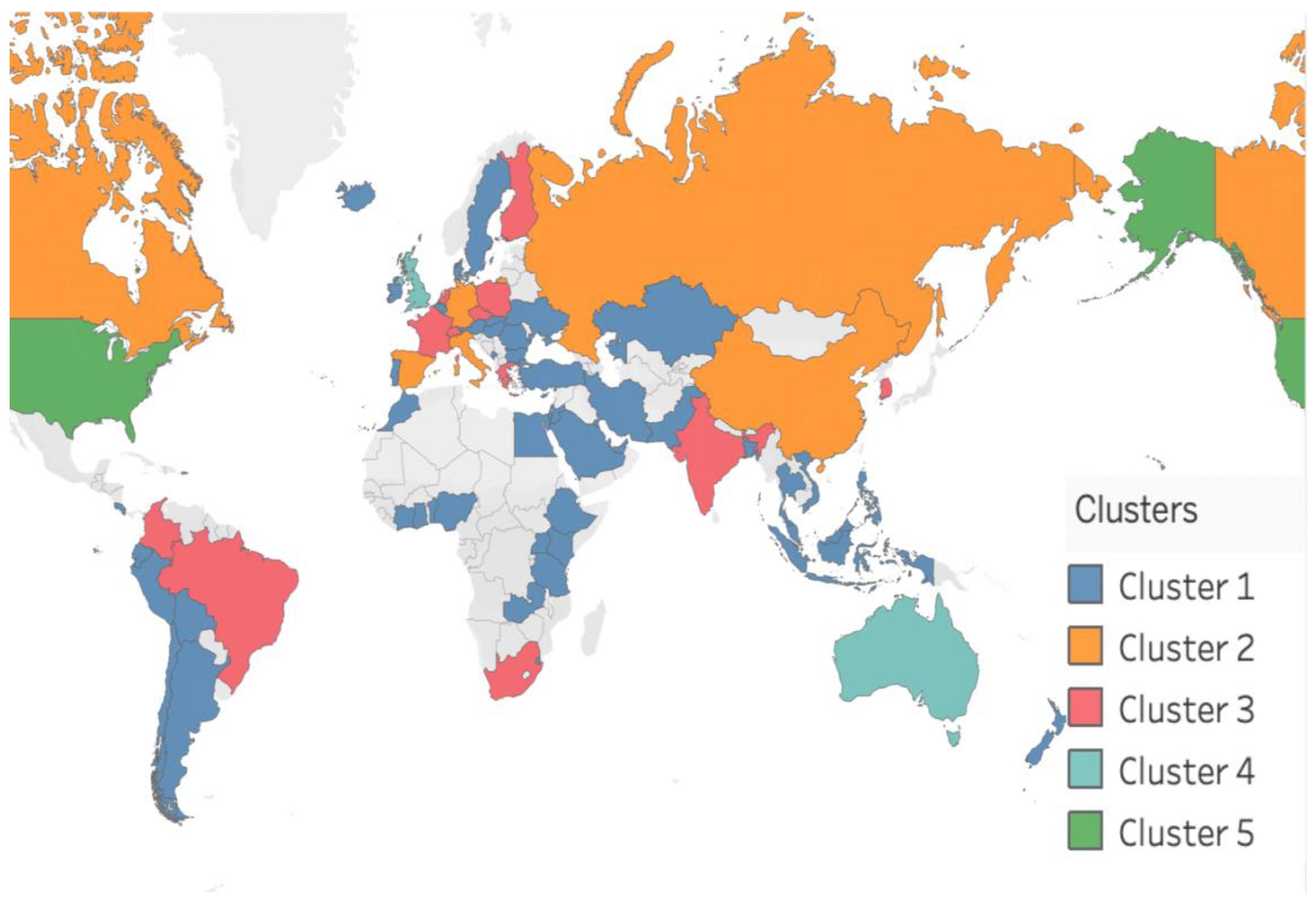

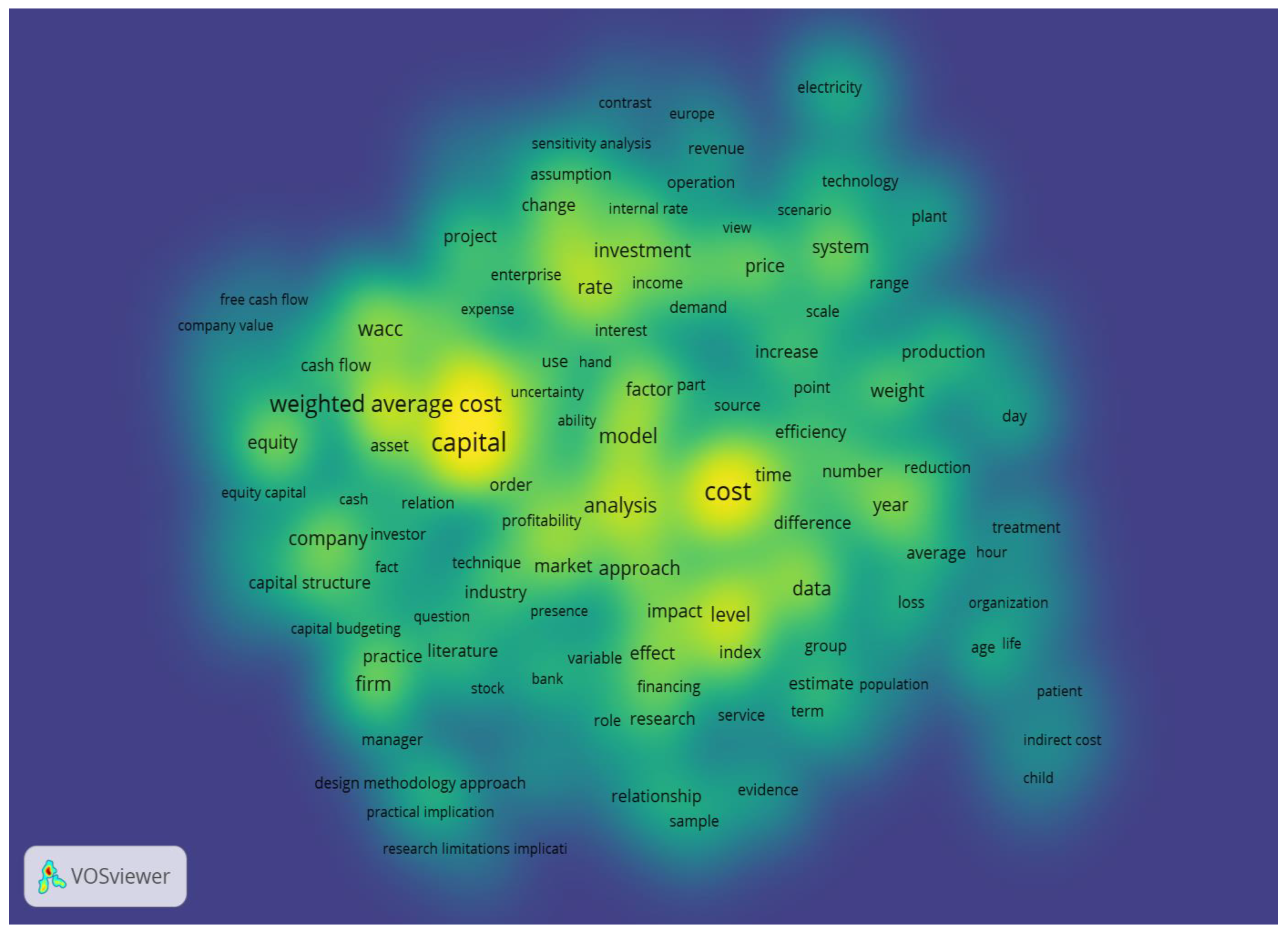

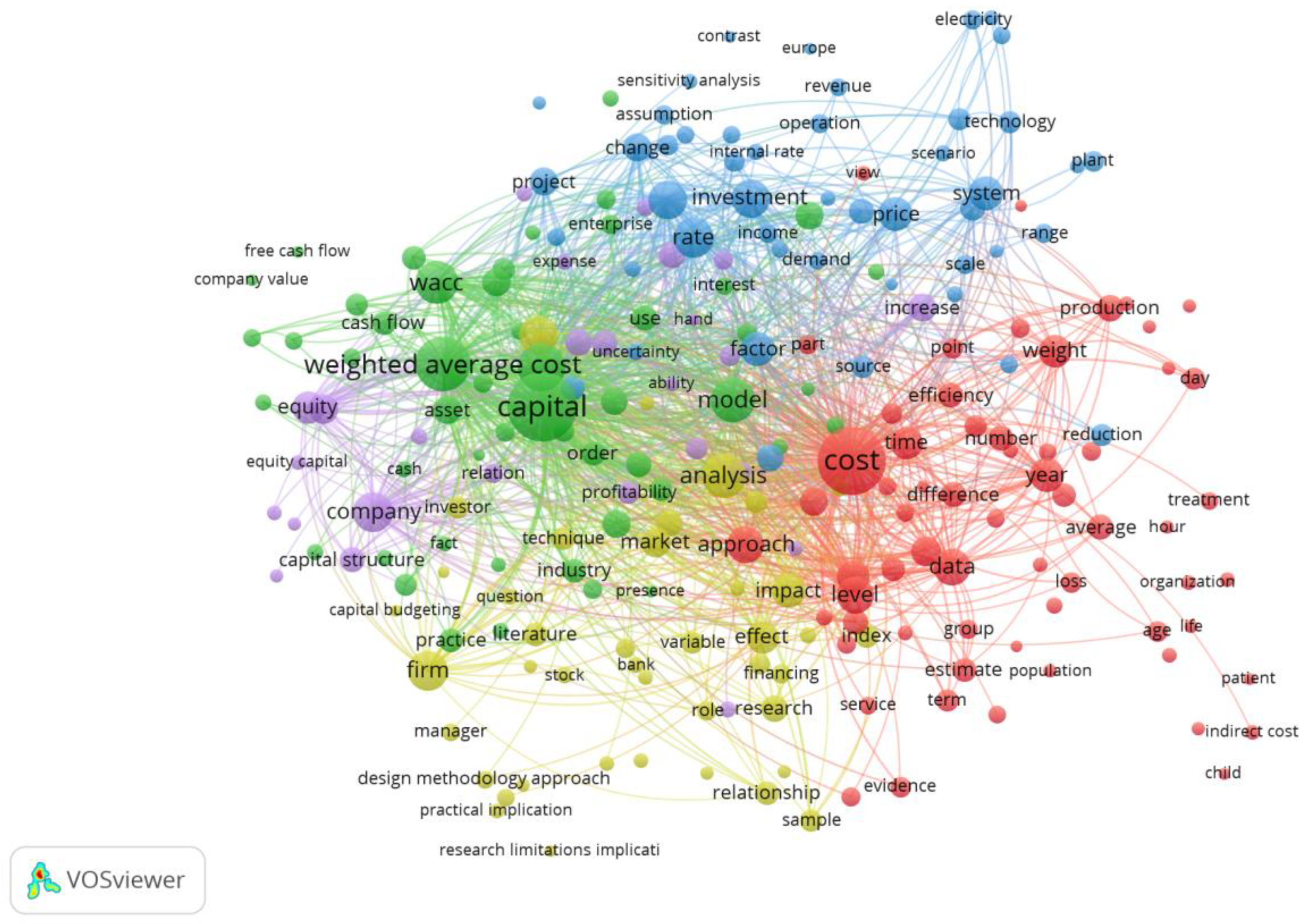

4.1. Bibliomegric Analysis

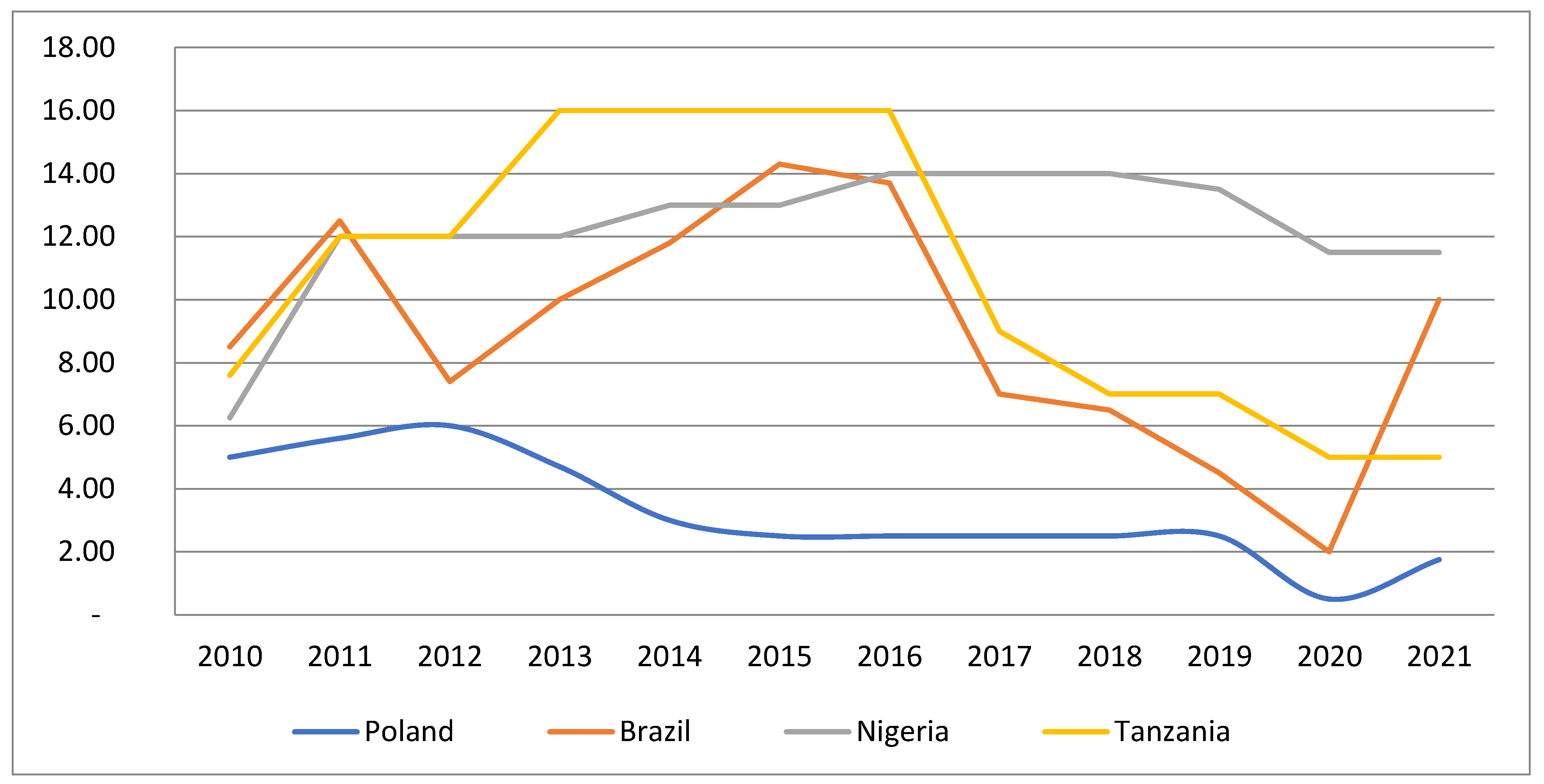

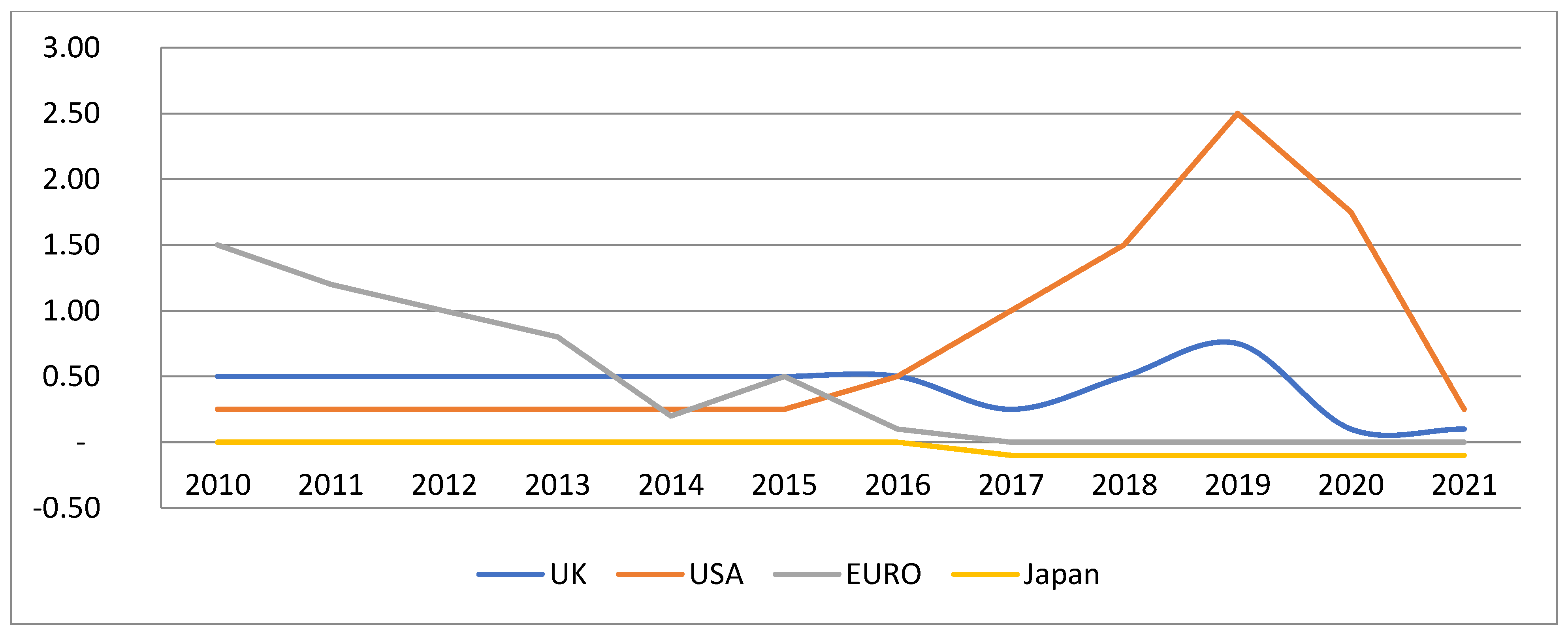

4.2. Analysis of Central Bank Interest Rates

- (a)

- interest rates change in each economy, irrespective of the degree of stabilization;

- (b)

- the difference between interest rate volatility, however, is the frequency and the extent of changes;

- (c)

- assuming a proportional change in bank lending rates, compared with the evolution of base rates, the objectivity of the financial calculations in favor of the stabilized economies is very low.

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Dobrowolski, Z. Why some countries win and others loose from the COVID-19 pandemic? Navigating the uncertainty. Eur. Res. Stud. J. 2021, 24, 1217–1226. [Google Scholar] [CrossRef]

- Chrysafis, K.A.; Papadopoulos, B.K. Decision Making for Project Appraisal in Uncertain Environments: A Fuzzy-Possibilistic Approach of the Expanded NPV Method. Symmetry 2020, 13, 27. [Google Scholar] [CrossRef]

- Akkaya, B.; Jermsittiparsert, K.; Abid Malik, M.; Kocyigit, Y. Emerging Trends in and Strategies for Industry 4.0 During and Beyond Covid-19; De Gruyter: Berlin, Germany, 2021; p. 167. [Google Scholar]

- Akkaya, B.; Gunsel, A.; Yikilmaz, I. Digital Management Towards Society 5.0: A Review of the Framework for Kurt Lewin Theory During COVID-19 Pandemic. In Emerging Challenges, Solutions, and Best Practices for Digital Enterprise Transformation; IGI Global: Hershey, PA, USA, 2021; pp. 20–137. [Google Scholar]

- Khalatur, S.; Velychko, L.; Pavlenko, O.; Karamushka, O.; Huba, M. A model for analyzing the financial stability of banks in the VUCA-world conditions. Banks Bank Syst. 2021, 16, 182–194. [Google Scholar] [CrossRef]

- Nurdiani, T.W. Integrating Marketing and Finance to Increase Company Performance in Vuca World: A Case Study on Banking State-Owned Enterprise in Indonesia (MANDIRI, BRI, BTN, BNI). Eur. J. Bus. Innov. Res. 2021, 9, 27–32. [Google Scholar]

- Modigliani, F.; Miller, M.H. The cost of capital, corporation finance and the theory of investment. Am. Econ. Rev. 1958, 48, 261–297. [Google Scholar]

- Modigliani, F.; Miller, M.H. Corporate income taxes and the cost of capital: A correction. Am. Econ. Rev. 1963, 53, 433–443. [Google Scholar]

- Miller, M.H.; Modigliani, F. Some estimates of the cost of capital to the electric utility industry, 1954–1957. Am. Econ. Rev. 1966, 56, 333–391. [Google Scholar]

- Dragotă, V.; Braşoveanu, M.L.O.; Dragotă, I.M. Management Financiar; Editura Economică: Bucharest, Romania, 2012. [Google Scholar]

- Brusov, P.; Filatova, T.; Orehova, N.; Brusov, P.; Brusova, N. From Modigliani–Miller to general theory of capital cost and capital structure of the company. Res. J. Econ. Bus. ICT 2011, 2, 16–21. [Google Scholar]

- Tannous, K.; Le, T.P.V. The impact of ownership structure on capital structure decision: Empirical evidence from Vietnamese listed firms. In Proceedings of the 27th Australasian Finance and Banking Conference, Shangri-la Hotel, Sydney, Australia, 16–18 December 2014. [Google Scholar]

- Brusov, P.; Filatova, T.; Orekhova, N.; Eskindarov, M. New Mechanism of Formation of the Company’s Optimal Capital Structure, Different from Suggested by Trade-Off Theory. In Modern Corporate Finance, Investments and Taxation; Springer: Cham, Switzerland, 2015; pp. 73–92. [Google Scholar]

- Le, T.P.V.; Tannous, K. Ownership Structure and Capital Structure: A Study of Vietnamese Listed Firms. Aust. Econ. Pap. 2016, 55, 319–344. [Google Scholar] [CrossRef]

- Topyan, K. Levered-Beta and Cost of Capital Sensitivities: An Experimental Investigation in Capital Structure. J. Risk Financ. Manag. 2021, 14, 152. [Google Scholar] [CrossRef]

- Drozdowski, G. Economic Calculus Qua an Instrument to Support Sustainable Development under Increasing Risk. J. Risk Financ. Manag. 2021, 14, 15. [Google Scholar] [CrossRef]

- Dobrowolski, Z.; Drozdowski, G.; Dobrowolska, M.; Sobon, J.; Sobon, D. Economic Calculus and Weak Signals: Prevention Against Foggy Bottom. Eur. Res. Stud. J. 2021, 24, 165–174. [Google Scholar] [CrossRef]

- Dobrowolski, Z.; Drozdowski, G. Does the Net Present Value as a Financial Metric Fit Investment in Green Energy Security? Energies 2022, 15, 353. [Google Scholar] [CrossRef]

- Dobrowolski, Z.; Drozdowski, G.; Panait, M.; Babczuk, A. Can the Economic Value Added Be Used as the Universal Financial Metric? Sustainability 2022, 14, 2967. [Google Scholar] [CrossRef]

- Filatova, T.; Brusov, P.; Orekhova, N. Impact of Advance Payments of Tax on Profit on Effectiveness of Investments. Mathematics 2022, 10, 666. [Google Scholar] [CrossRef]

- Leland, H.E. Corporate debt value, bond covenants, and optimal capital structure. J. Financ. 1994, 49, 1213–1252. [Google Scholar] [CrossRef]

- Arnold, T.; Crack, T.F. Using the WACC to Value Real Options. Financ. Anal. J. 2004, 60, 78–82. [Google Scholar] [CrossRef]

- Farber, A.; Gillet, R.L.; Szafarz, A.A. General Formula for the WACC. Int. J. Bus. 2006, 11, 212–218. [Google Scholar]

- Fernandez, P. A General Formula for the WACC: A Comment. Int. J. Bus. 2007, 12, 1–5. [Google Scholar]

- Fernandez, P. The value of tax shields is NOT equal to the present value of tax shields. J. Financ. Econ. 2004, 73, 145–165. [Google Scholar] [CrossRef]

- Fernández, P. WACC: Definition, Misconceptions, and Errors. Bus. Valuat. Rev. 2010, 29, 138–144. [Google Scholar] [CrossRef]

- Mian, M.A.; Velez-Pareja, I. Applicability of the Classic WACC Concept in Practice. Lat. Am. Bus. Rev. 2008, 8, 19–40. [Google Scholar] [CrossRef]

- Koziol, C. A simple correction of the WACC discount rate for default risk and bankruptcy costs. Rev. Quant. Financ. Account. 2014, 42, 653–666. [Google Scholar] [CrossRef]

- Magni, C.A. Investment, financing and the role of ROA and WACC in value creation. Eur. J. Oper. Res. 2015, 244, 855–866. [Google Scholar] [CrossRef]

- Krüger, P.; Landier, A.; Thesmar, D. The WACC Fallacy: The Real Effects of Using a Unique Discount Rate. J. Financ. 2015, 70, 1253–1285. [Google Scholar] [CrossRef]

- Frank, M.Z.; Shen, T. Investment and the weighted average cost of capital. J. Financ. Econ. 2016, 119, 300–315. [Google Scholar] [CrossRef]

- Vartiainen, E.; Masson, G.; Breyer, C.; Moser, D.; Román Medina, E. Impact of weighted average cost of capital, capital expenditure, and other parameters on future utility-scale PV levelised cost of electricity. Prog. Photovolt. Res. Appl. 2020, 28, 439–453. [Google Scholar] [CrossRef]

- Pavel, Z. The Impact of Cash Flows and Weighted Average Cost of Capital to Enterprise Value in the Oil and Gas Sector. J. Rev. Glob. Econ. 2018, 7, 138–145. [Google Scholar] [CrossRef]

- Ortiz, H. Political Imaginaries of the Weighted Average Cost of Capital: A Conceptual Analysis. Valuat. Stud. 2021, 8, 5–36. [Google Scholar] [CrossRef]

- Morrone, D.; Schena, R.; Conte, D.; Bussoli, C.; Russo, A. Between saying and doing, in the end there is the cost of capital: Evidence from the energy sector. Bus. Strat. Environ. 2022, 31, 390–402. [Google Scholar] [CrossRef]

- Miles, J.A.; Ezzell, J.R. The weighted average cost of capital, perfect capital markets, and project life: A clarification. J. Financ. Quant. Anal. 1980, 15, 719–730. [Google Scholar] [CrossRef]

- Harris, R.S.; Pringle, J.J. Risk-Adjusted Discount Rates-Extensions from the Average-Risk Case. J. Financ. Res. 1985, 8, 237–244. [Google Scholar] [CrossRef]

- Sharfman, M.P.; Fernando, C.S. Environmental risk management and the cost of capital. Strategy Manag. J. 2008, 29, 569–592. [Google Scholar] [CrossRef]

- Miller, R.A. The weighted average cost of capital is not quite right. Q. Rev. Econ. Financ. 2009, 49, 128–138. [Google Scholar] [CrossRef]

- Myers, S.C. Capital Structure. J. Econ. Perspect. 2001, 15, 81–102. [Google Scholar] [CrossRef]

- Gahlon, J.M.; Gentry, J.A. On the Relationship between Systematic Risk and the Degrees of Operating and Financial Leverage. Financ. Manag. 1982, 11, 15. [Google Scholar] [CrossRef]

- Wnuczak, P. Zastosowanie ekonomicznej wartości dodanej (EVA) w procesie optymalizacji struktury kapitału przedsiębiorstwa. Zesz. Nauk. Uniw. Szczec. 2011, 640, 505–516. [Google Scholar]

- Harris, M.; Raviv, A. The Theory of Capital Structure. J. Financ. 1991, 46, 297–355. [Google Scholar] [CrossRef]

- Siminica, M.; Cristea, M.; Sichigea, M.; Noja, G.G.; Anghel, I. Well-Governed Sustainability and Financial Performance: A New Integrative Approach. Sustainability 2019, 11, 4562. [Google Scholar] [CrossRef]

- Siminica, M.; Motoi, A.G.; Dumitru, A. Financial Management as Component of Tactical Management. Pol. J. Manag. Stud. 2017, 15, 206–217. [Google Scholar] [CrossRef]

- Jain, M.; Sharma, G.D.; Srivastava, M. Can Sustainable Investment Yield Better Financial Returns: A Comparative Study of ESG Indices and MSCI Indices. Risks 2019, 7, 15. [Google Scholar] [CrossRef]

- Khan, S.A.; Yu, Z.; Panait, M.; Janjua, L.R.; Shah, A. (Eds.) Global Corporate Social Responsibility Initiatives for Reluctant Businesses; IGI Global: Hershey, PA, USA, 2021. [Google Scholar] [CrossRef]

- Jankalová, M.; Kurotová, J. Sustainability Assessment Using Economic Value Added. Sustainability 2019, 12, 318. [Google Scholar] [CrossRef]

- Atan, R.; Alam, M.M.; Said, J.; Zamri, M. The impacts of environmental, social, and governance factors on firm performance: Panel study of Malaysian companies. Manag. Environ. Qual. Int. J. 2018, 29, 182–194,. [Google Scholar] [CrossRef]

- Gjergji, R.; Vena, L.; Sciascia, S.; Cortesi, A. The effects of environmental, social and governance disclosure on the cost of capital in small and medium enterprises: The role of family business status. Bus. Strat. Environ. 2021, 30, 683–693. [Google Scholar] [CrossRef]

- Mariani, M.; Pizzutilo, F.; Caragnano, A.; Zito, M. Does it pay to be environmentally responsible? Investigating the effect on the weighted average cost of capital. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 1854–1869. [Google Scholar] [CrossRef]

- Felix, P.; Mirela, P.; Vasile, A.J.; Iza, G. Non-financial Performance of Energy Companies Listed on the Bucharest Stock Exchange and Relevance for Stakeholders. In Digitalization and Big Data for Resilience and Economic Intelligence; Springer: Cham, Switzerland, 2022; pp. 183–201. [Google Scholar] [CrossRef]

- Zhang, G.; Han, J.; Pan, Z.; Huang, H. Economic policy uncertainty and capital structure choice: Evidence from China. Econ. Syst. 2015, 39, 439–457. [Google Scholar] [CrossRef]

- Drobetz, W.; El Ghoul, S.; Guedhami, O.; Janzen, M. Policy uncertainty, investment, and the cost of capital. J. Financ. Stab. 2018, 39, 28–45. [Google Scholar] [CrossRef]

- Pham, A.V. Political risk and cost of equity: The mediating role of political connections. J. Corp. Financ. 2019, 56, 64–87. [Google Scholar] [CrossRef]

- Xu, Z. Economic policy uncertainty, cost of capital, and corporate innovation. J. Bank. Financ. 2020, 111, 105698. [Google Scholar] [CrossRef]

- Paudyal, K.; Thapa, C.; Koirala, S.; Aldhawyan, S. Economic policy uncertainty and cross-border mergers and acquisitions. J. Financ. Stab. 2021, 56, 100926. [Google Scholar] [CrossRef]

- Tabot Lious, N.A.; Cecilio, H.G.; Felix, P.G. Capital structure determinants: Evidence from Spanish listed firms. Corp. Ownersh. Control 2016, 13, 506–519. [Google Scholar] [CrossRef][Green Version]

- Enríquez-Díaz, J.; Castro-Santos, L.; Puime-Guillén, F. (Eds.) Financial Management and Risk Analysis Strategies for Business Sustainability; IGI Global: Hershey, PA, USA, 2021. [Google Scholar]

- Reiter, K.L.; Wheeler, J.R.C.; Smith, D.G. Liquidity Constraints on Hospital Investments when Credit Markets are Tight. J. Health Care Financ. 2008, 35, 24–33. [Google Scholar]

- Holcomb, A.J.; Smith, D.G. Hospital capital budgeting during a public health crisis. J. Health Care Financ. 2020, 46, 23–35. [Google Scholar]

- Rizvi, S.K.A.; Yarovaya, L.; Mirza, N.; Naqvi, B. The impact of COVID-19 on the valuations of non-financial European firms. Heliyon 2022, 8, e09486. [Google Scholar] [CrossRef] [PubMed]

- Morrison, E.; Okie, A.; Leonhardt, K. Valuing Firms in a World of Pandemic-Induced Bankruptcies. Annalisys Group, Laws 360. Available online: https://www.analysisgroup.com/globalassets/insights/publishing/2020_valuing_firms_in_world_of_pandemic_bankruptcies.pdf (accessed on 2 April 2022).

- Liu, Y. Valuation of Walt Disney Company under Influence of COVID-19. In Proceedings of the 2nd International Conference on the Frontiers of Innovative Economics and Management (FIEM 2021), Suzhou, China, 21–22 August 2021; pp. 139–146. [Google Scholar]

- Muir, B. The Discount Rate in Business Valuations during the COVID-19 Pandemic. Baltim. Bus. Rev. A Md. J. 2021, 31. Available online: https://www.cfasociety.org/baltimore/Documents/Muir.pdf (accessed on 12 April 2022).

- Setiawan, G.E.; Sumirat, E. Stock Valuation of Indonesia Pharmaceutical Company with COVID-19 Vaccination Development Prospects Amidst Pandemic Situation (Case Study of PT. Kalbe Farma, Tbk.). Eur. J. Bus. Manag. Res. 2021, 6, 127–131. [Google Scholar] [CrossRef]

- Ikeda, N.; Inoue, K.; Yamasa, T. How COVID-19 Affects Corporate Investment Plans in the US and Japan. J. Behav. Econ. Financ. 2020, 13, S8–S11. [Google Scholar]

- Kaczmarek, T.; Perez, K.; Demir, E.; Zaremba, A. How to survive a pandemic: The corporate resiliency of travel and leisure companies to the COVID-19 outbreak. Tour. Manag. 2021, 84, 104281. [Google Scholar] [CrossRef]

- Fernández-González, R.; Pérez-Pérez, M.I.; Pérez-Vas, R. Real options for a small company in a context of market concentration: A case study of investment in a turbot farming plant in Spain. Mar. Policy 2021, 134, 104828. [Google Scholar] [CrossRef]

- Franc-Dąbrowska, J.; Mądra-Sawicka, M.; Milewska, A. Energy Sector Risk and Cost of Capital Assessment—Companies and Investors Perspective. Energies 2021, 14, 1613. [Google Scholar] [CrossRef]

- Olleik, M.; Hamie, H.; Auer, H. Using Natural Gas Resources to De-Risk Renewable Energy Investments in Lower-Income Countries. Energies 2022, 15, 1651. [Google Scholar] [CrossRef]

- Prabatha, T.; Hewage, K.; Sadiq, R. An Energy Performance Contract Optimization Approach to Meet the Competing Stakeholder Expectations under Uncertainty: A Canadian Case Study. Sustainability 2022, 14, 4334. [Google Scholar] [CrossRef]

- Pavlovic, N.; Ignjatovic, D.; Subaranovic, T. Possibility of Using Wind and Solar Sources for Electric Power Generation on Serbian Opencast Coal Mines. Mater. Proc. 2021, 5, 50. [Google Scholar] [CrossRef]

- Fernández-González, R.; Puime-Guillén, F.; Vila-Biglieri, J.E. Environmental strategy and the petroleum industry: A sustainability balanced scorecard approach. J. Pet. Explor. Prod. Technol. 2022, 11, 1–12. [Google Scholar] [CrossRef]

- Castro-Santos, L.; Bento, A.R.; Guedes Soares, C. The Economic Feasibility of Floating Offshore Wave Energy Farms in the North of Spain. Energies 2020, 13, 806. [Google Scholar] [CrossRef]

- Coelho Junior, L.M.; Fonseca, A.J.; Castro, R.; Mello, J.C.; Santos, V.H.; Pinheiro, R.B.; Sousa, W.L.; Santos Júnior, E.P.; Ramos, D.S. Empirical Evidence of the Cost of Capital under Risk Conditions for Thermoelectric Power Plants in Brazil. Energies 2022, 15, 4313. [Google Scholar] [CrossRef]

- Castro-Santos, L.; Silva, D.; Bento, A.R.; Salvação, N.; Guedes Soares, C. Economic feasibility of wave energy farms in Portugal. Energies 2018, 11, 3149. [Google Scholar] [CrossRef]

- Kopecky, K.J.; Li, Z.; Sugrue, T.F.; Tucker, A.L. Revisiting M&M with Taxes: An Alternative Equilibrating Process. Int. J. Financ. Stud. 2018, 6, 10. [Google Scholar] [CrossRef]

- Barrientos, J.H. Regionalized discount rate to evaluate renewable energy projects in Colombia. Int. J. Energy Econ. Policy 2020, 10, 670216917. [Google Scholar]

- Saługa, P.W.; Kamiński, J. The cost of equity in the energy sector. Polit. Energ. 2018, 21, 81–96. [Google Scholar] [CrossRef]

- Evdokimova, M.; Kuzubov, S. Non-Financial Reporting and the Cost of Capital in BRICS Countries; Paper No. WP BRP 83/FE/2021; Higher School of Economics: Moscow, Russia, 2021. [Google Scholar]

- Ahmetshina, A.; Vagizova, V.; Kaspina, R. The Use of Management Accounting Information in Non-financial Reporting and Interaction with Stakeholders of Public Companies. In The Impact of Globalization on International Finance and Accounting; Springer: Cham, Switzerland, 2018; pp. 433–439. [Google Scholar] [CrossRef]

- Madra-Sawicka, M. Differences in the cost of capital: The case of food companies from emerging and developed european economies. Acta Sci. Pol. Oecon. 2020, 19, 49–56. [Google Scholar] [CrossRef]

- NBP. Podstawowe Stopy Procentowe NBP w Latach 1998–2020. 2021. Available online: www.nbp.pl/home.aspx?f=/dzienne/stopy_archiwum.htm (accessed on 23 August 2021).

- Japan Interest Rate. 2021. Available online: www.tradingeconomics.com/japan/interest-rate (accessed on 12 March 2021).

- United Kingdom Interest Rate. 2021. Available online: www.tradingeconomics.com/united-kingdom/interest-rate (accessed on 4 March 2021).

- Romania Interest Rate. 2021. Available online: https://tradingeconomics.com/romania/interest-rate (accessed on 6 August 2021).

- Euro Area Interest Rate. 2021. Available online: www.tradingeconomics.com/euro-area/interest-rate (accessed on 11 August 2021).

- The United States Fed Funds Rate. 2021. Available online: https://tradingeconomics.com/united-states/interest-rate (accessed on 10 March 2021).

- Hungary Interest Rate. 2021. Available online: www.tradingeconomics.com/hungary/interest-rate (accessed on 3 July 2021).

- Croatia Overnight Credit Rate. 2021. Available online: www.tradingeconomics.com/croatia/interest-rate (accessed on 21 July 2021).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dobrowolski, Z.; Drozdowski, G.; Panait, M.; Apostu, S.A. The Weighted Average Cost of Capital and Its Universality in Crisis Times: Evidence from the Energy Sector. Energies 2022, 15, 6655. https://doi.org/10.3390/en15186655

Dobrowolski Z, Drozdowski G, Panait M, Apostu SA. The Weighted Average Cost of Capital and Its Universality in Crisis Times: Evidence from the Energy Sector. Energies. 2022; 15(18):6655. https://doi.org/10.3390/en15186655

Chicago/Turabian StyleDobrowolski, Zbysław, Grzegorz Drozdowski, Mirela Panait, and Simona Andreea Apostu. 2022. "The Weighted Average Cost of Capital and Its Universality in Crisis Times: Evidence from the Energy Sector" Energies 15, no. 18: 6655. https://doi.org/10.3390/en15186655

APA StyleDobrowolski, Z., Drozdowski, G., Panait, M., & Apostu, S. A. (2022). The Weighted Average Cost of Capital and Its Universality in Crisis Times: Evidence from the Energy Sector. Energies, 15(18), 6655. https://doi.org/10.3390/en15186655