Impacts of Trade Friction and Climate Policy on Global Energy Trade Network

Abstract

:1. Introduction

1.1. Background

1.2. Literature Review

1.3. Contribution of This Study

2. Materials and Methods

2.1. Configuring Bilateral Trade in MESSAGEix

2.2. The Effect of Sea Distance on Trade Cost

2.3. Scenario Assumptions

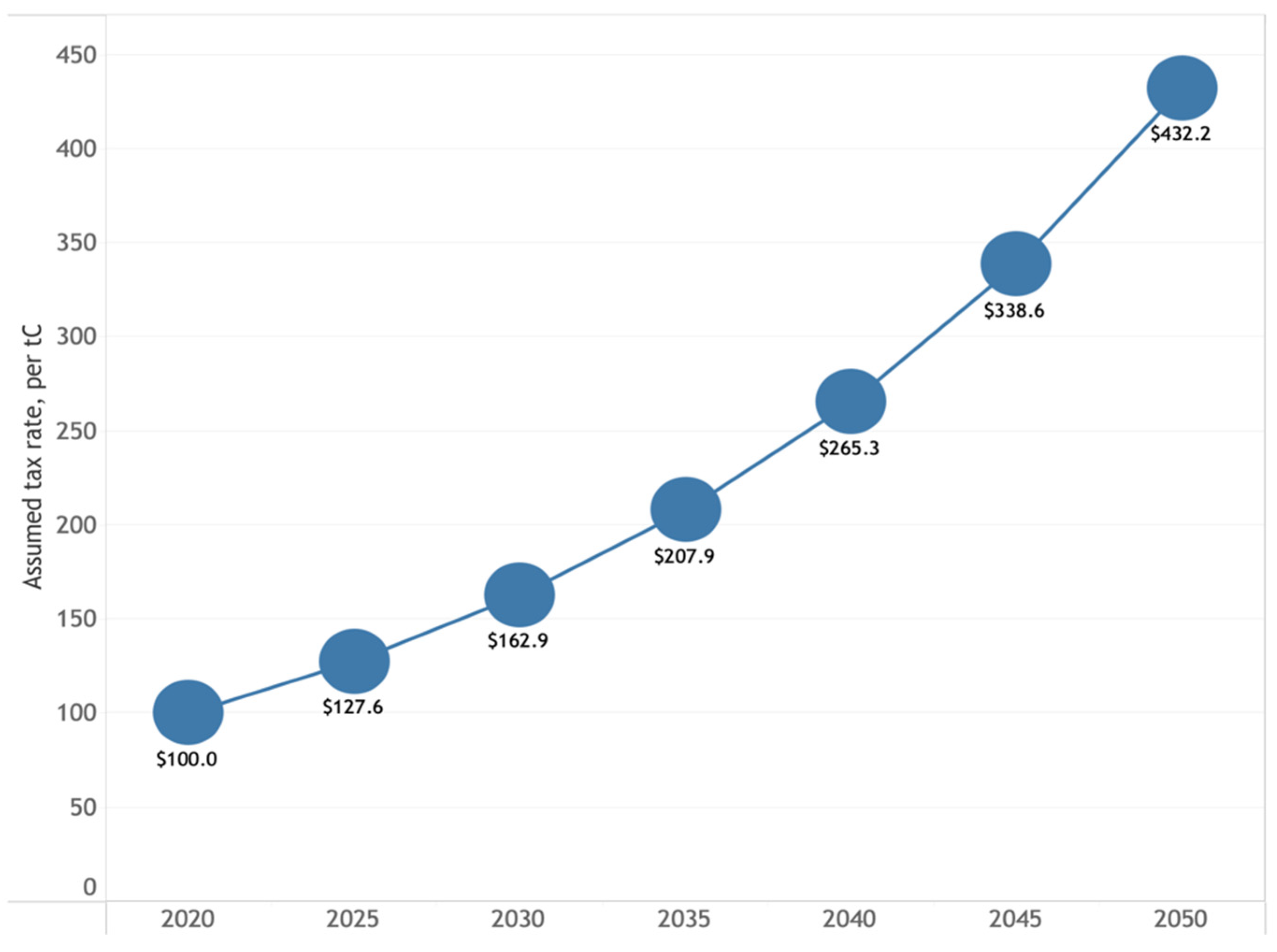

- Baseline tariffs (Scenario 1);

- High tariffs (Scenario 2);

- Low/no tariffs (Scenario 3);

- Emissions tax ($27/tCO2) and baseline tariffs (Scenario 4);

- Emissions tax ($27/tCO2) and high tariffs (Scenario 5);

- Emissions tax ($27/tCO2) and low tariffs (Scenario 6).

2.4. Energy Security Metrics

3. Results

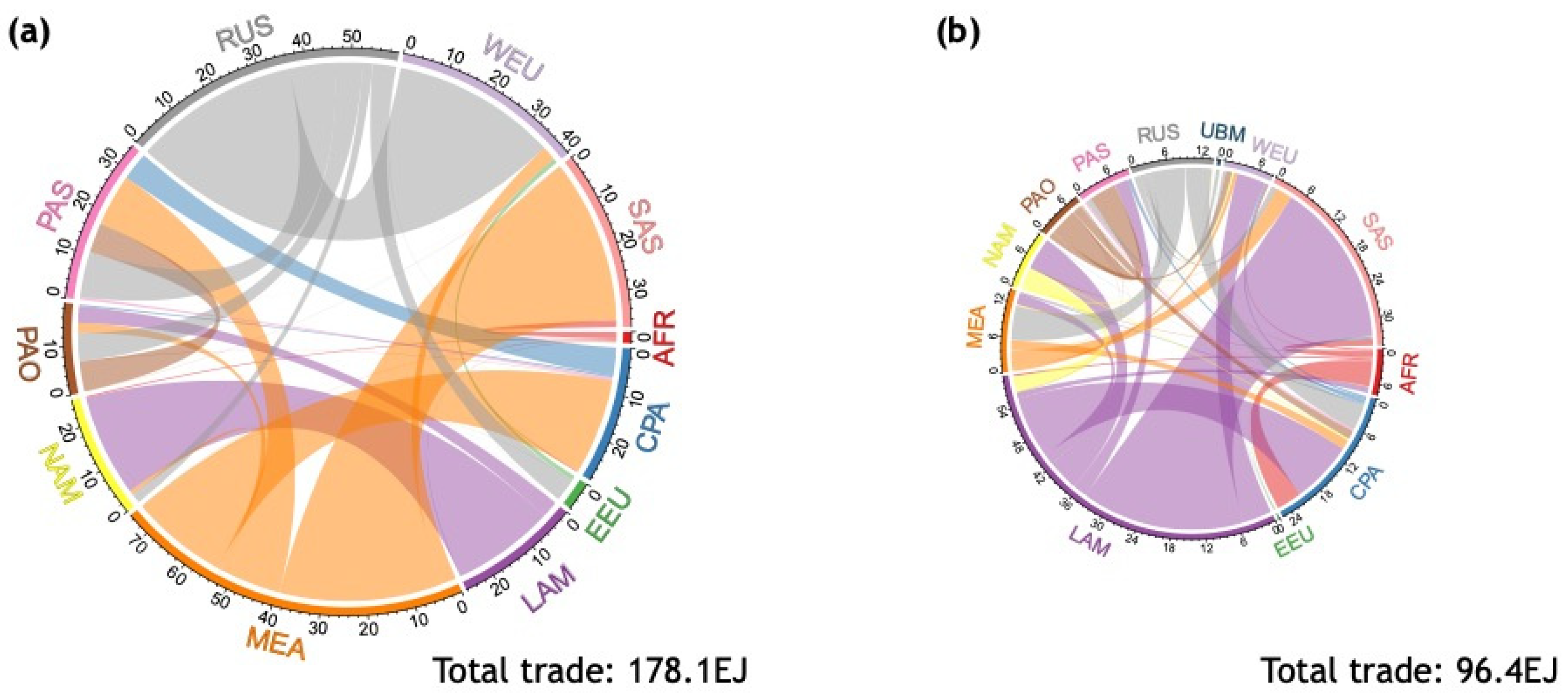

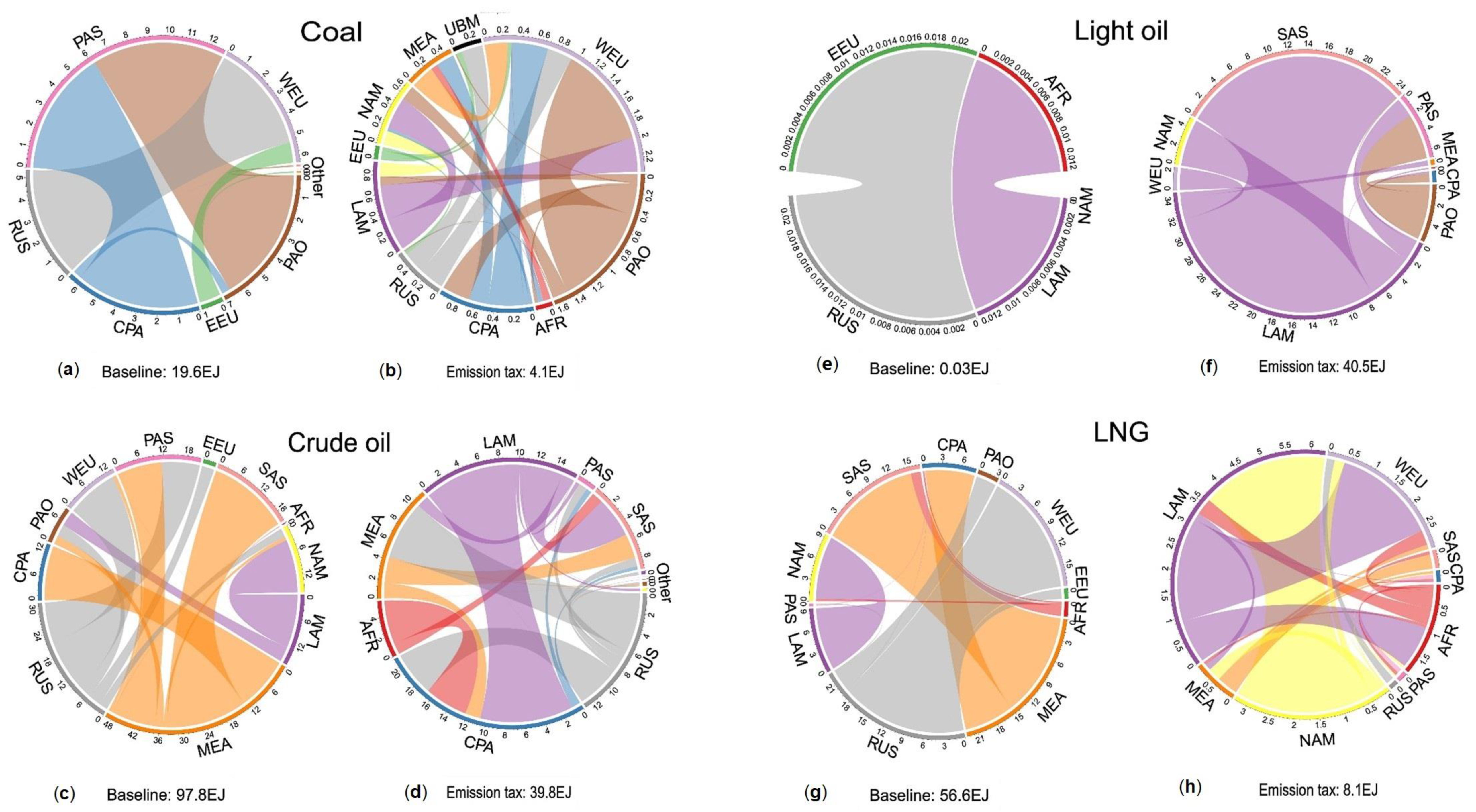

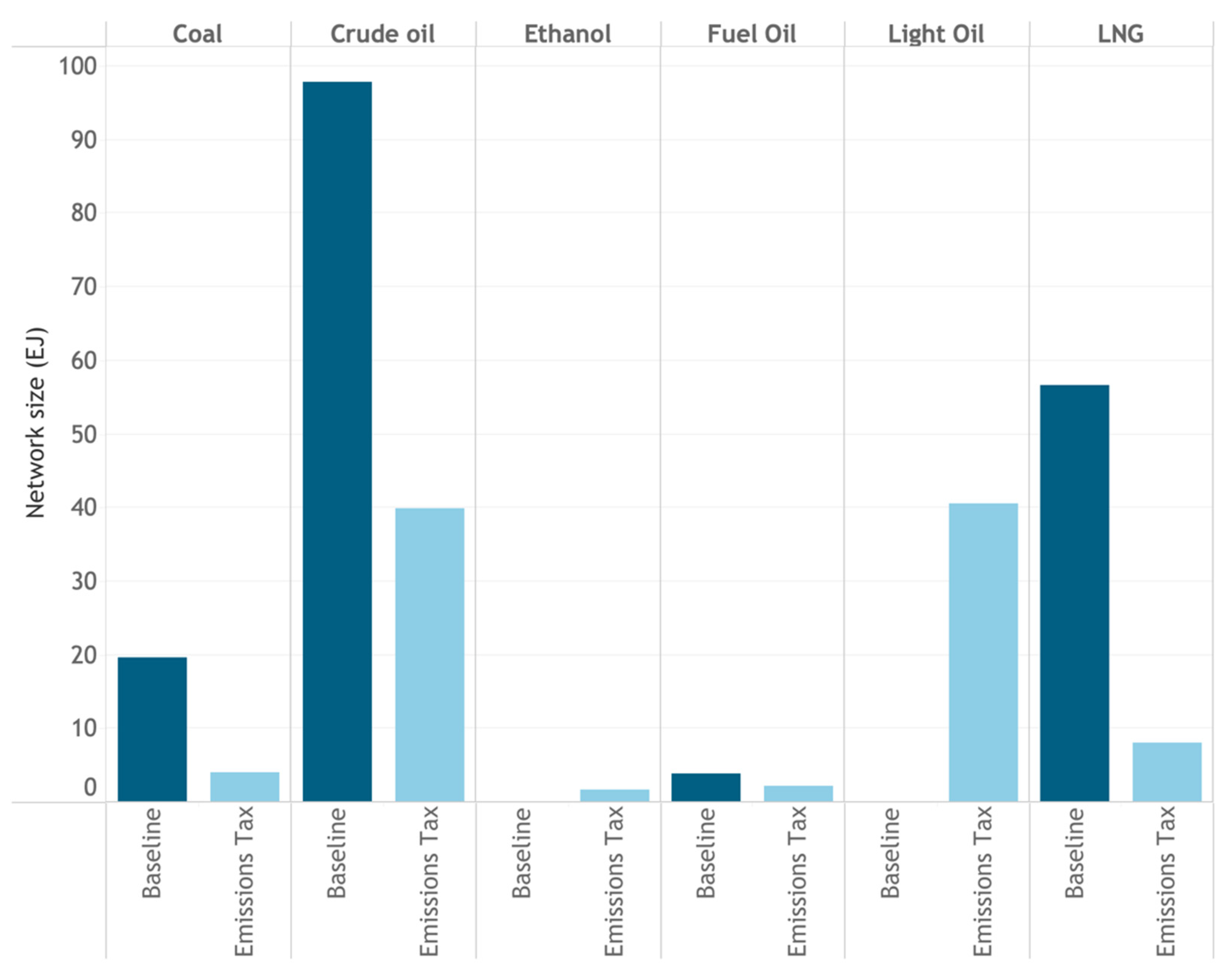

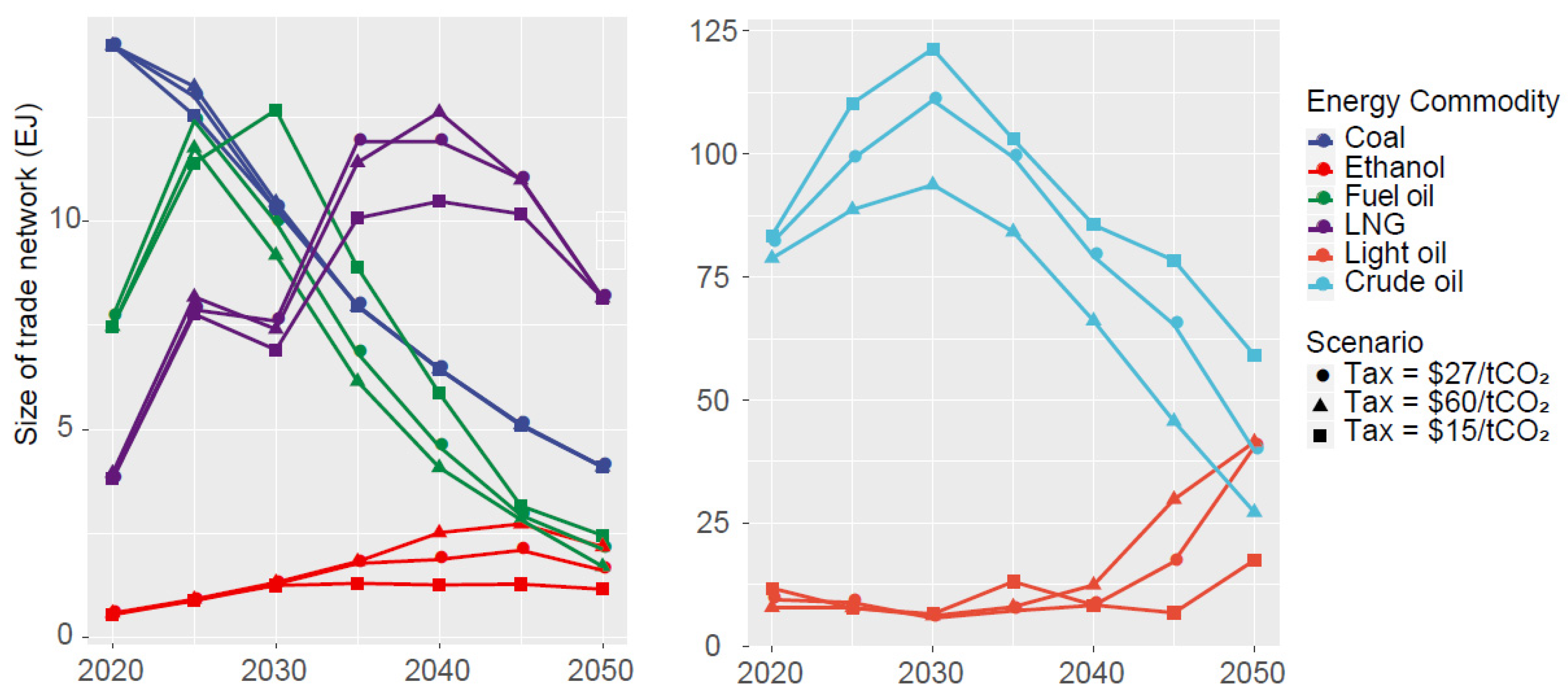

3.1. Effects on Network Size and Composition

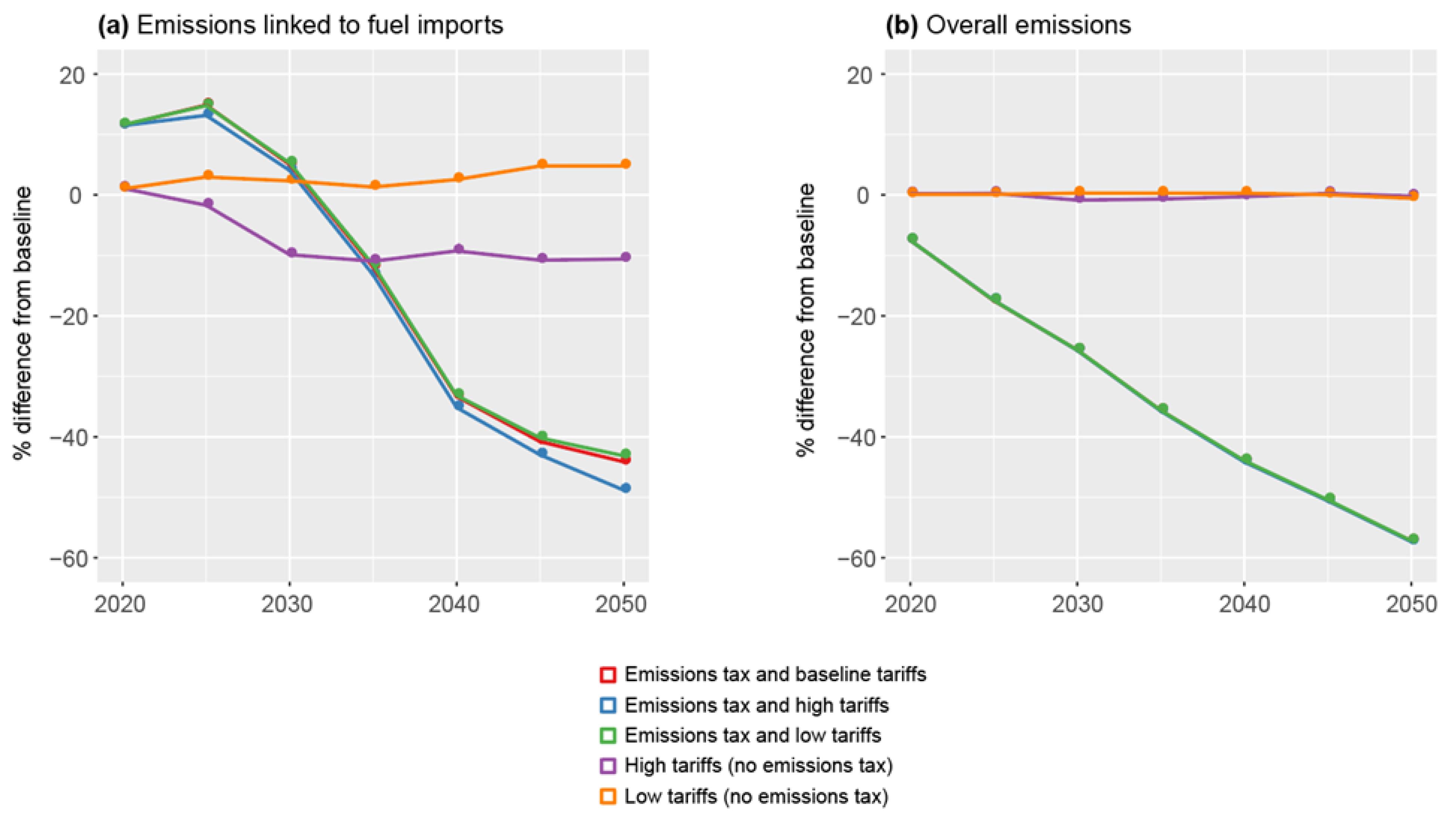

3.2. Effects on Global Emissions

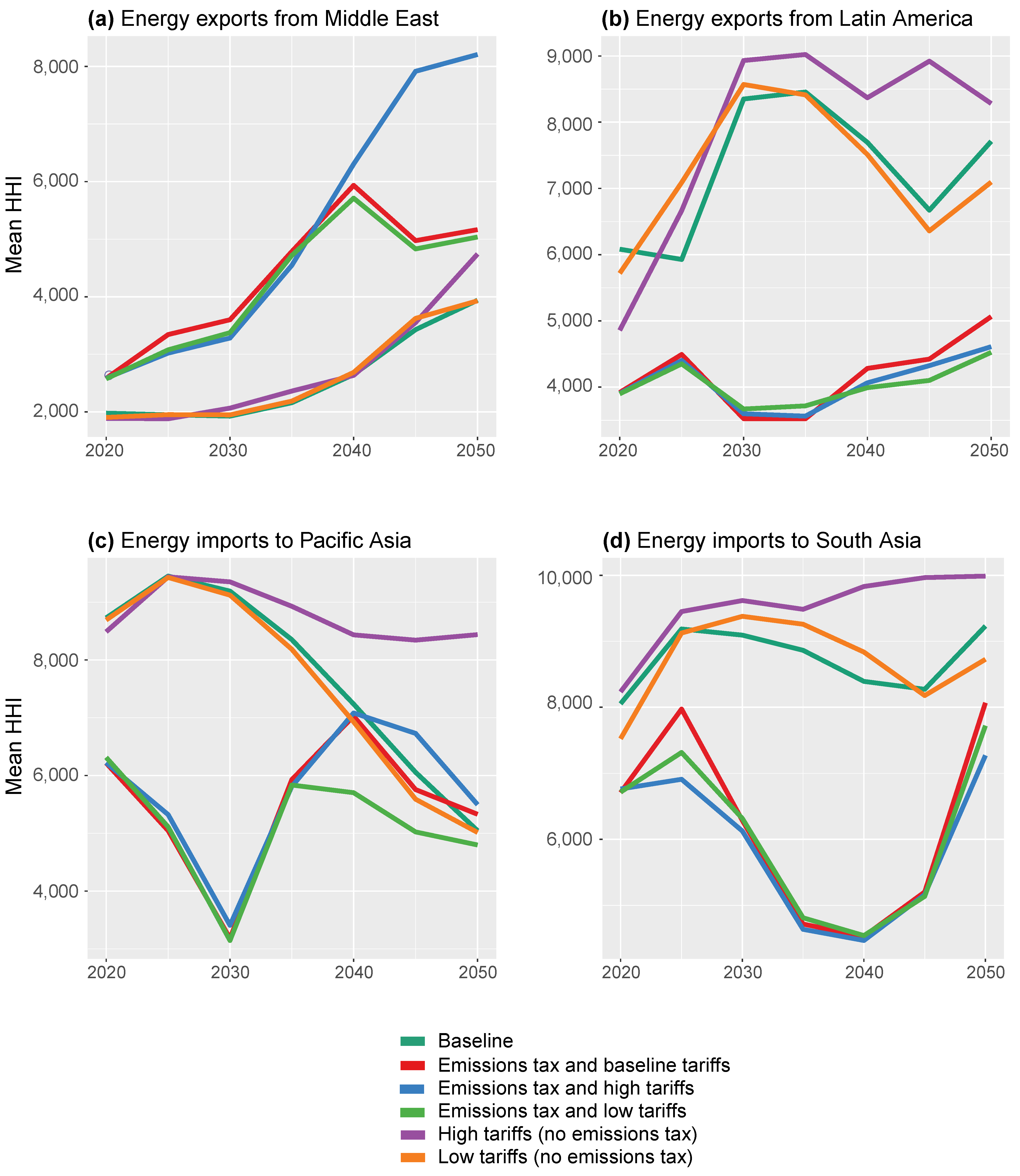

3.3. Effects on Energy Security

3.4. Sensitivity Analysis

4. Discussion

4.1. Limitations of This Study

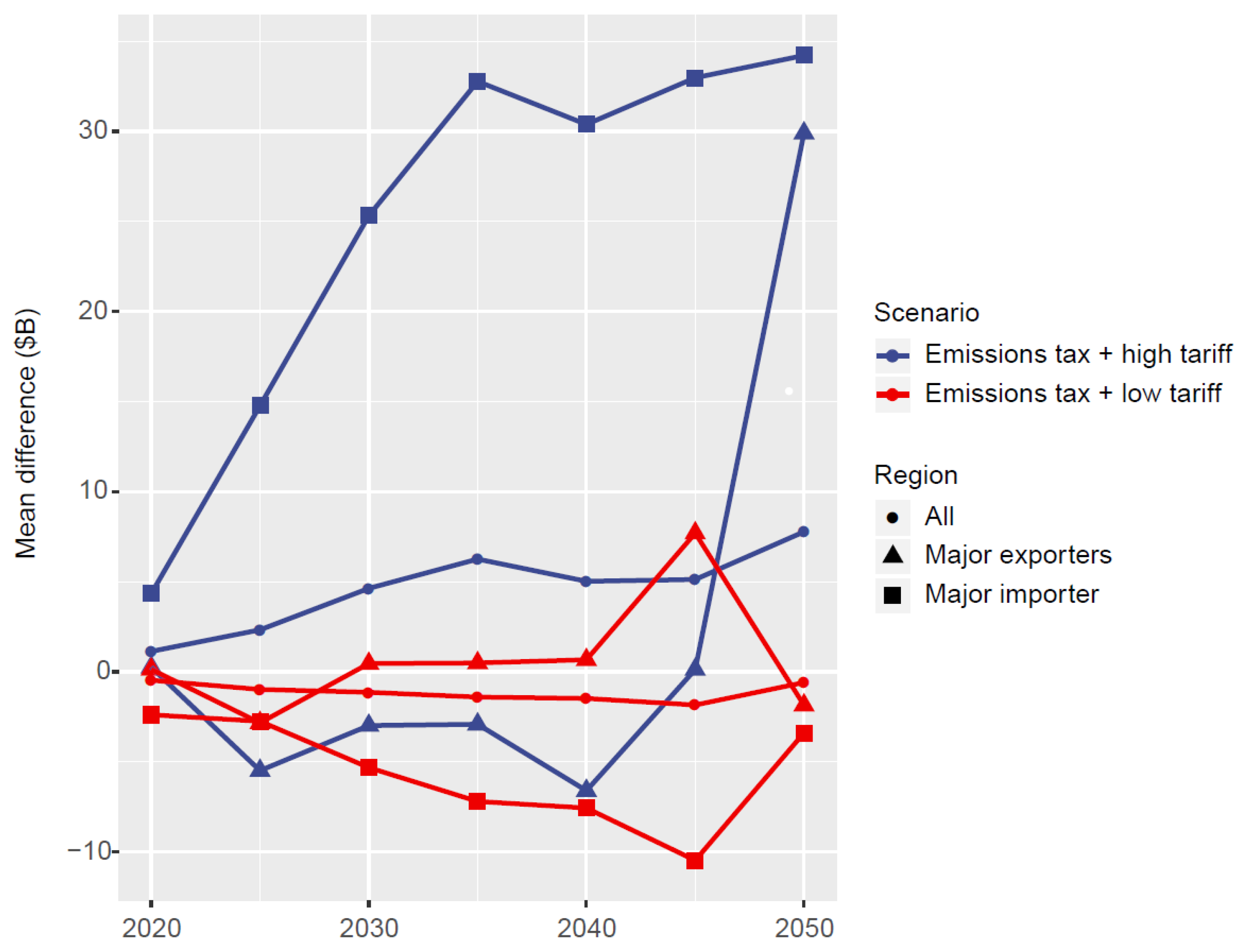

4.2. Trade Frictions Make Climate Policy More Expensive

4.3. Energy Security Is Supply Chain Security, and Vice Versa

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Riahi, K.; Bertram, C.; Huppmann, D.; Rogelj, J.; Bosetti, V.; Cabardos, A.-M.; Deppermann, A.; Drouet, L.; Frank, S.; Fricko, O.; et al. Cost and Attainability of Meeting Stringent Climate Targets without Overshoot. Nat. Clim. Chang. 2021, 11, 1063–1069. [Google Scholar] [CrossRef]

- Rogelj, J.; den Elzen, M.; Höhne, N.; Fransen, T.; Fekete, H.; Winkler, H.; Schaeffer, R.; Sha, F.; Riahi, K.; Meinshausen, M. Paris Agreement Climate Proposals Need a Boost to Keep Warming Well below 2 °C. Nature 2016, 534, 631–639. [Google Scholar] [CrossRef] [PubMed]

- UNFCCC. INDCs as Comunicated by Parties; UNFCCC: Paris, France, 2015. [Google Scholar]

- Dong, C.; Dong, X.; Jiang, Q.; Dong, K.; Liu, G. What Is the Probability of Achieving the Carbon Dioxide Emission Targets of the Paris Agreement? Evidence from the Top Ten Emitters. Sci. Total Environ. 2018, 622–623, 1294–1303. [Google Scholar] [CrossRef] [PubMed]

- Pischke, E.C.; Solomon, B.; Wellstead, A.; Acevedo, A.; Eastmond, A.; De Oliveira, F.; Coelho, S.; Lucon, O. From Kyoto to Paris: Measuring Renewable Energy Policy Regimes in Argentina, Brazil, Canada, Mexico and the United States. Energy Res. Soc. Sci. 2019, 50, 82–91. [Google Scholar] [CrossRef]

- Cai, H.; Huang, S.; Wu, Z. The Impact of COVID-19 on the International Energy Trade Network Centrality and Community Structures. Appl. Econ. Lett. 2022. [Google Scholar] [CrossRef]

- Hao, X.; An, H.; Qi, H.; Gao, X. Evolution of the Exergy Flow Network Embodied in the Global Fossil Energy Trade: Based on Complex Network. Appl. Energy 2016, 162, 1515–1522. [Google Scholar] [CrossRef]

- Zhong, W.; An, H.; Shen, L.; Fang, W.; Gao, X.; Dong, D. The Roles of Countries in the International Fossil Fuel Trade: An Emergy and Network Analysis. Energy Policy 2017, 100, 365–376. [Google Scholar] [CrossRef]

- Amaro, S. Russia Nears Gas Shutdown in Europe as Germany Rejects Claims It Can’t Fulfill Contracts. Available online: https://www.cnbc.com/2022/07/19/russia-nears-gas-shutdown-in-europe-as-germany-rejects-claims-it-cant-fulfil-contracts.html (accessed on 11 August 2022).

- Natural Gas Supply Statistics. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Natural_gas_supply_statistics (accessed on 11 August 2022).

- From Deep Crisis, Profound Change. Available online: https://rmi.org/insight/from-deep-crisis-profound-change/ (accessed on 11 August 2022).

- China’s Spending on Russian Oil, Gas, Coal Jumps to $6.4 Billion in June—Bloomberg. Available online: https://www.bloomberg.com/news/articles/2022-07-20/china-s-spending-on-russian-energy-jumps-to-6-4-billion-in-june (accessed on 11 August 2022).

- Jakob, M. Climate Policy and International Trade—A Critical Appraisal of the Literature. Energy Policy 2021, 156, 112399. [Google Scholar] [CrossRef]

- Jewell, J.; McCollum, D.; Emmerling, J.; Bertram, C.; Gernaat, D.E.H.J.; Krey, V.; Paroussos, L.; Berger, L.; Fragkiadakis, K.; Keppo, I.; et al. Limited Emission Reductions from Fuel Subsidy Removal except in Energy-Exporting Regions. Nature 2018, 554, 229–233. [Google Scholar] [CrossRef]

- Jewell, J.; Vinichenko, V.; McCollum, D.; Bauer, N.; Riahi, K.; Aboumahboub, T.; Fricko, O.; Harmsen, M.; Kober, T.; Krey, V.; et al. Comparison and Interactions between the Long-Term Pursuit of Energy Independence and Climate Policies. Nat. Energy 2016, 1, 16073. [Google Scholar] [CrossRef] [Green Version]

- Matsuoka, Y.; Kainuma, M.; Morita, T. Scenario Analysis of Global Warming Using the Asian Pacific Integrated Model (AIM). Energy Policy 1995, 23, 357–371. [Google Scholar] [CrossRef]

- Huppmann, D.; Gidden, M.; Fricko, O.; Kolp, P.; Orthofer, C.; Pimmer, M.; Kushin, N.; Vinca, A.; Mastrucci, A.; Riahi, K.; et al. The MESSAGE Integrated Assessment Model and the Ix Modeling Platform (Ixmp): An Open Framework for Integrated and Cross-Cutting Analysis of Energy, Climate, the Environment, and Sustainable Development. Environ. Model. Softw. 2019, 112, 143–156. [Google Scholar] [CrossRef]

- Stehfest, E.; voor de Leefomgeving, P. Integrated Assessment of Global Environmental Change with IMAGE 3.0: Model Description and Policy Applications; PBL Netherlands Environmental Assessment Agency: The Hague, NL, 2014; ISBN 978-94-91506-71-0. [Google Scholar]

- Hare, B.; Brecha, R.; Schaeffer, M. Integrated Assessment Models: What Are They and How Do They Arrive at Their Conclusions? Climate Analytics: Berlin, DE, USA, 2018. [Google Scholar]

- Berdysheva, S.; Ikonnikova, S. The Energy Transition and Shifts in Fossil Fuel Use: The Study of International Energy Trade and Energy Security Dynamics. Energies 2021, 14, 5396. [Google Scholar] [CrossRef]

- Yergin, D. Ensuring Energy Security. Foreign Affairs 2006, 85, 69–82. [Google Scholar] [CrossRef]

- Greene, D.L. Measuring Energy Security: Can the United States Achieve Oil Independence? Energy Policy 2010, 38, 1614–1621. [Google Scholar] [CrossRef]

- Le Coq, C.; Paltseva, E. Measuring the Security of External Energy Supply in the European Union. Energy Policy 2009, 37, 4474–4481. [Google Scholar] [CrossRef]

- Kruyt, B.; van Vuuren, D.P.; de Vries, H.J.M.; Groenenberg, H. Indicators for Energy Security. Energy Policy 2009, 37, 2166–2181. [Google Scholar] [CrossRef]

- International Trade during the COVID-19 Pandemic: Big Shifts and Uncertainty. Available online: https://www.oecd.org/coronavirus/policy-responses/international-trade-during-the-covid-19-pandemic-big-shifts-and-uncertainty-d1131663/ (accessed on 19 July 2022).

- Tollefson, J. What the War in Ukraine Means for Energy, Climate and Food. Nature 2022, 604, 232–233. [Google Scholar] [CrossRef] [PubMed]

- Gao, C.; Sun, M.; Shen, B. Features and Evolution of International Fossil Energy Trade Relationships: A Weighted Multilayer Network Analysis. Appl. Energy 2015, 156, 542–554. [Google Scholar] [CrossRef]

- Chen, G.Q.; Wu, X.F. Energy Overview for Globalized World Economy: Source, Supply Chain and Sink. Renew. Sustain. Energy Rev. 2017, 69, 735–749. [Google Scholar] [CrossRef]

- Shepard, J.U.; Pratson, L.F. Hybrid Input-Output Analysis of Embodied Energy Security. Appl. Energy 2020, 279, 115806. [Google Scholar] [CrossRef]

- Schrattenholzer, L. The Energy Supply Model Message; Research Reports/Internationales Institut für Angewandte Systemanalyse; International Institut for Applied Systems Analysis: Laxenburg, Austria, 1981; ISBN 978-3-7045-0024-3. [Google Scholar]

- Elliott, J.; Foster, I.; Kortum, S.; Munson, T.; Cervantes, F.P.; Weisbach, D. Trade and Carbon Taxes. Am. Econ. Rev. 2010, 100, 465–469. [Google Scholar] [CrossRef]

- Bergman, L. General Equilibrium Effects of Environmental Policy: A CGE-Modeling Approach. Environ. Resour. Econ. 1991, 1, 43–61. [Google Scholar] [CrossRef]

- Rivers, N.; Schaufele, B. The Effect of Carbon Taxes on Agricultural Trade: Effect of Carbon Taxes on Agricultural Trade. Can. J. Agric. Econ./Rev. Can. D’agroeconom. 2015, 63, 235–257. [Google Scholar] [CrossRef]

- Martin, R.; de Preux, L.B.; Wagner, U.J. The Impact of a Carbon Tax on Manufacturing: Evidence from Microdata. J. Public Econ. 2014, 117, 1–14. [Google Scholar] [CrossRef]

- Messner, S.; Schrattenholzer, L. MESSAGE–MACRO: Linking an Energy Supply Model with a Macroeconomic Module and Solving It Iteratively. Energy 2000, 25, 267–282. [Google Scholar] [CrossRef]

- UNFCCC. Climate Change 2014: Mitigation of Climate Change: Working Group III Contribution to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; Intergovernmental Panel on Climate Change; Edenhofer, O., Ed.; Cambridge University Press: New York, NY, USA, 2014; ISBN 978-1-107-05821-7. [Google Scholar]

- Sullivan, P.; Krey, V.; Riahi, K. Impacts of Considering Electric Sector Variability and Reliability in the MESSAGE Model. Energy Strategy Rev. 2013, 1, 157–163. [Google Scholar] [CrossRef]

- Zhang, S.; Yi, B.-W.; Worrell, E.; Wagner, F.; Crijns-Graus, W.; Purohit, P.; Wada, Y.; Varis, O. Integrated Assessment of Resource-Energy-Environment Nexus in China’s Iron and Steel Industry. J. Clean. Prod. 2019, 232, 235–249. [Google Scholar] [CrossRef]

- Zhao, F.; Fan, Y.; Zhang, S. Assessment of Efficiency Improvement and Emission Mitigation Potentials in China’s Petroleum Refining Industry. J. Clean. Prod. 2021, 280, 124482. [Google Scholar] [CrossRef]

- Gaulier, G.; Zignago, S. BACI: A World Database of International Trade at the Product-Level 1995–2004; Centre D’Etudes Prospectives et D’Informations Internationales (CEPII): Paris, France, 2010. [Google Scholar]

- Helpman, E.; Melitz, M.; Rubinstein, Y. Estimating Trade Flows: Trading Partners and Trading Volumes. Q. J. Econ. 2008, 123, 441–487. [Google Scholar] [CrossRef] [Green Version]

- Guimbard, H.; Jean, S.; Mimouni, M.; Pichot, X. MAcMap-HS6 2007, an Exhaustive and Consistent Measure of Applied Protection in 2007. Économie Int. 2012, 130, 99–121. [Google Scholar] [CrossRef]

- Bouët, A.; Decreux, Y.; Fontagné, L.; Jean, S.; Laborde, D. Assessing Applied Protection across the World. Rev. Int. Econ. 2008, 16, 850–863. [Google Scholar] [CrossRef]

- York, E. Tracking the Economic Impact of Tariffs. Tax Foundation, 1 April 2022. [Google Scholar]

- Barron, A.R.; Hafstead, M.A.C.; Morris, A.C. Policy Insights from Comparing Carbon Pricing Modeling Scenarios; Brookings Institution: Washington, DC, USA, 2019. [Google Scholar]

- Jakob, M.; Ward, H.; Steckel, J.C. Sharing Responsibility for Trade-Related Emissions Based on Economic Benefits. Glob. Environ. Chang. 2021, 66, 102207. [Google Scholar] [CrossRef]

- Riahi, K.; van Vuuren, D.P.; Kriegler, E.; Edmonds, J.; O’Neill, B.C.; Fujimori, S.; Bauer, N.; Calvin, K.; Dellink, R.; Fricko, O.; et al. The Shared Socioeconomic Pathways and Their Energy, Land Use, and Greenhouse Gas Emissions Implications: An Overview. Glob. Environ. Chang. 2017, 42, 153–168. [Google Scholar] [CrossRef]

- Fricko, O.; Havlik, P.; Rogelj, J.; Klimont, Z.; Gusti, M.; Johnson, N.; Kolp, P.; Strubegger, M.; Valin, H.; Amann, M.; et al. The Marker Quantification of the Shared Socioeconomic Pathway 2: A Middle-of-the-Road Scenario for the 21st Century. Glob. Environ. Chang. 2017, 42, 251–267. [Google Scholar] [CrossRef]

- Rodrigue, J.-P.; Comtois, C.; Slack, B. The Geography of Transport Systems, 4th ed.; Routledge: London, UK, 2016; ISBN 978-1-315-61815-9. [Google Scholar]

- Shepard, J.U.; Pratson, L.F. The Myth of US Energy Independence. Nat. Energy 2022, 7, 462–464. [Google Scholar] [CrossRef]

| Commodity | Total Trade (EJ) | Largest Interregional Flows |

|---|---|---|

| Coal | 19.35 | Pacific OECD to South Asia (3.51 EJ) Pacific Asia to Centrally Planned Asia (3.51 EJ) Pacific OECD to Centrally Planned Asia (3.07 EJ) |

| Crude oil | 53.20 | Middle East to Centrally Planned Asia (9.79 EJ) Middle East to South Asia (6.69 EJ) Middle East to Western Europe (6.55 EJ) |

| Fuel oil | 17.50 | Western Europe to Middle East (1.35 EJ) Middle East to Western Europe (1.31 EJ) Middle East to Pacific Asia (1.09 EJ) |

| LNG | 13.01 | Middle East to Western Europe (2.32 EJ) Central Asian States to Centrally Planned Asia (1.53 EJ) Middle East to South Asia (1.43 EJ) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shepard, J.U.; van Ruijven, B.J.; Zakeri, B. Impacts of Trade Friction and Climate Policy on Global Energy Trade Network. Energies 2022, 15, 6171. https://doi.org/10.3390/en15176171

Shepard JU, van Ruijven BJ, Zakeri B. Impacts of Trade Friction and Climate Policy on Global Energy Trade Network. Energies. 2022; 15(17):6171. https://doi.org/10.3390/en15176171

Chicago/Turabian StyleShepard, Jun U., Bas J. van Ruijven, and Behnam Zakeri. 2022. "Impacts of Trade Friction and Climate Policy on Global Energy Trade Network" Energies 15, no. 17: 6171. https://doi.org/10.3390/en15176171

APA StyleShepard, J. U., van Ruijven, B. J., & Zakeri, B. (2022). Impacts of Trade Friction and Climate Policy on Global Energy Trade Network. Energies, 15(17), 6171. https://doi.org/10.3390/en15176171