The Role of Clean Hydrogen Value Chain in a Successful Energy Transition of Japan

Abstract

1. Introduction

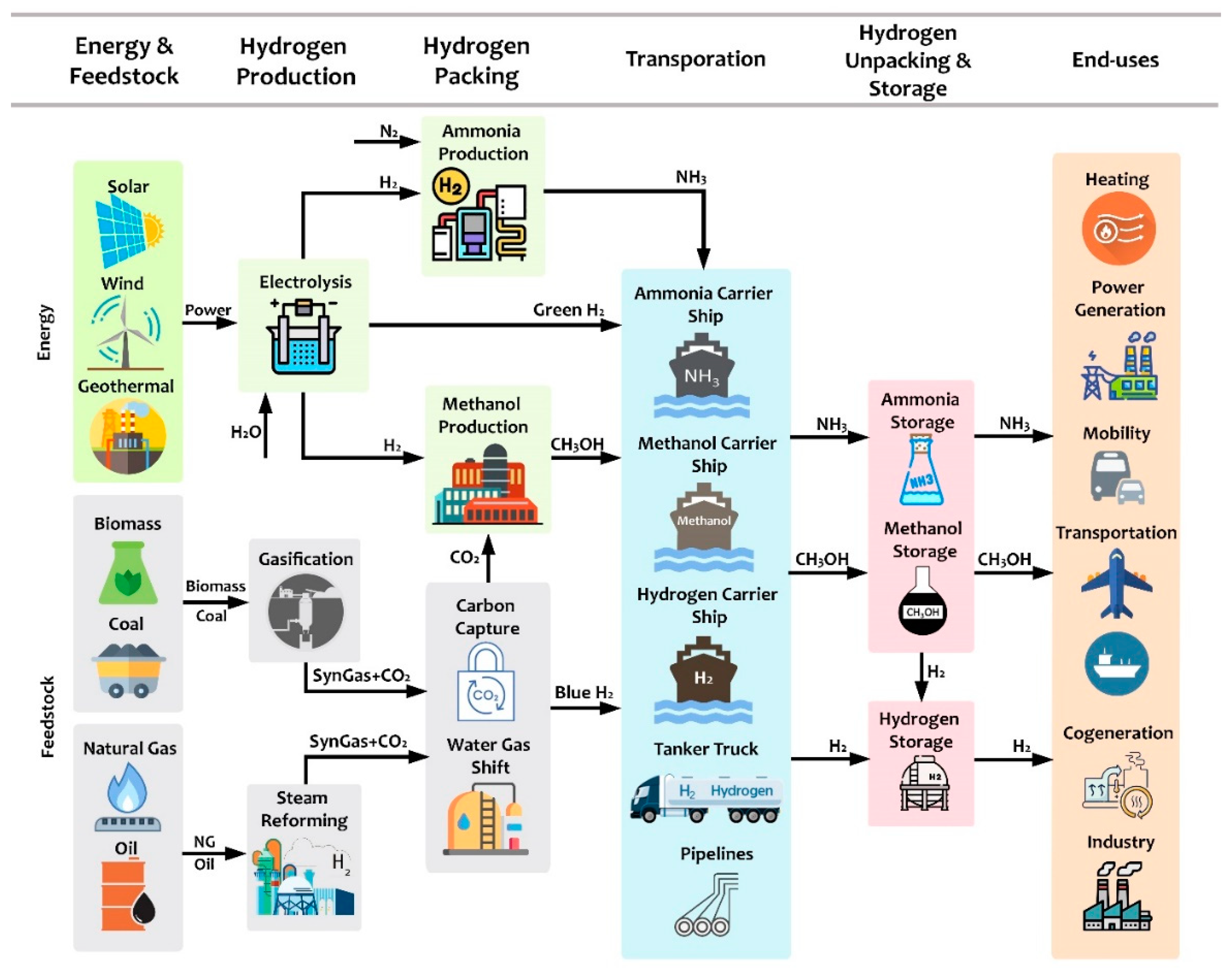

2. Hydrogen Value Chain

2.1. Hydrogen Production

2.1.1. Hydrogen from Fossil Fuels (Gray and Blue Hydrogen)

2.1.2. Hydrogen from Renewable Power (Green Hydrogen)

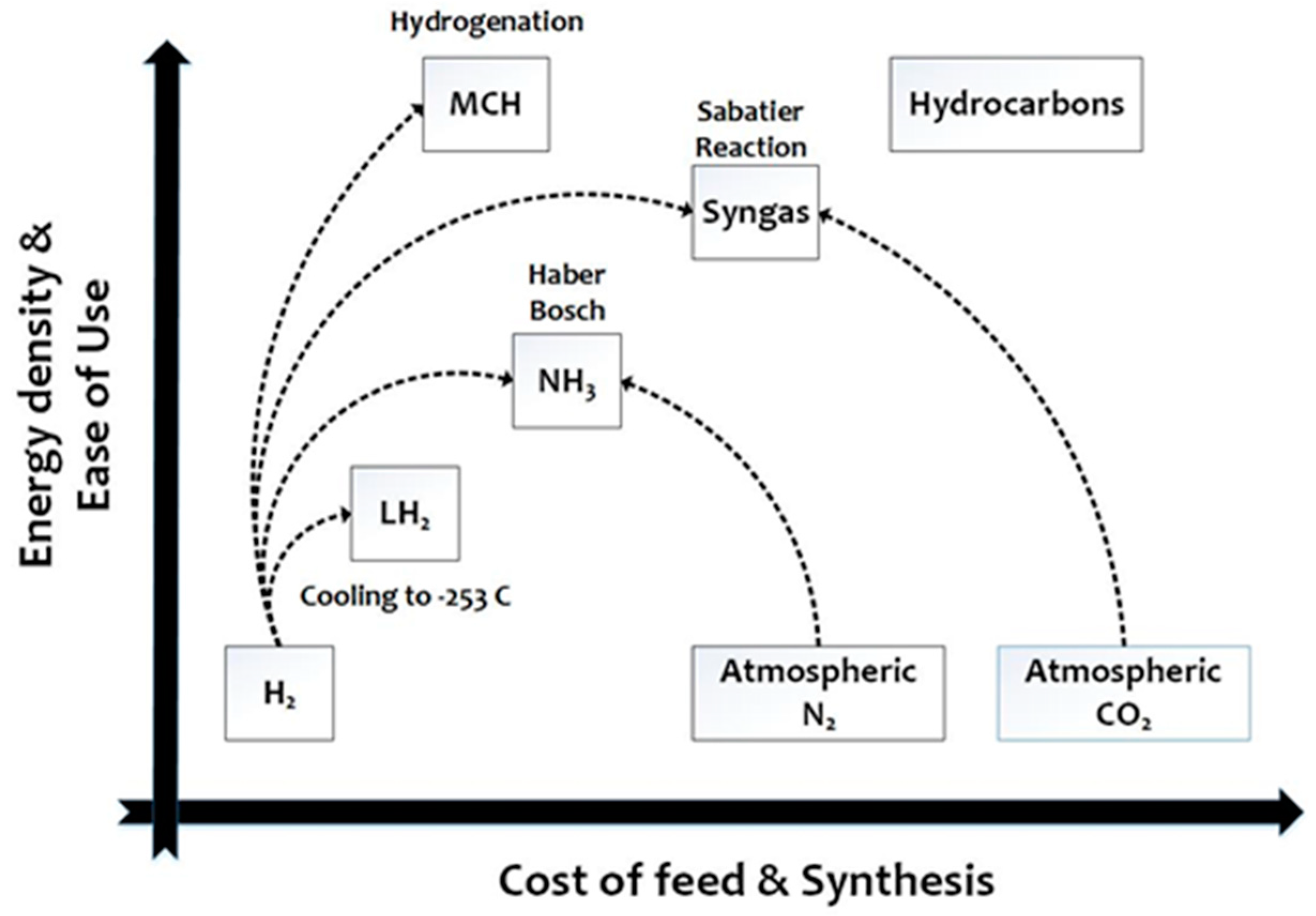

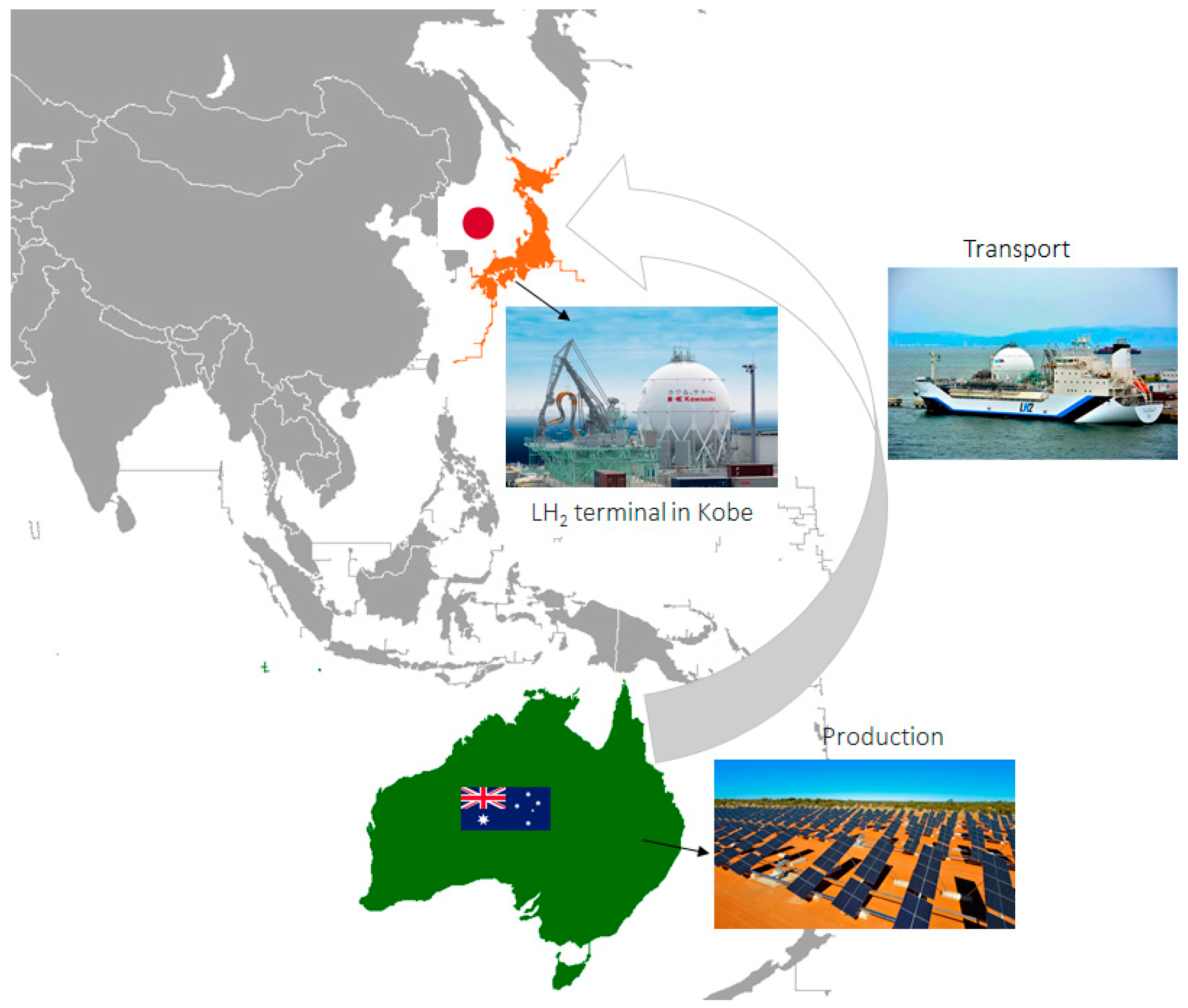

2.2. Transportation and Storage

2.3. End-Use Sectors

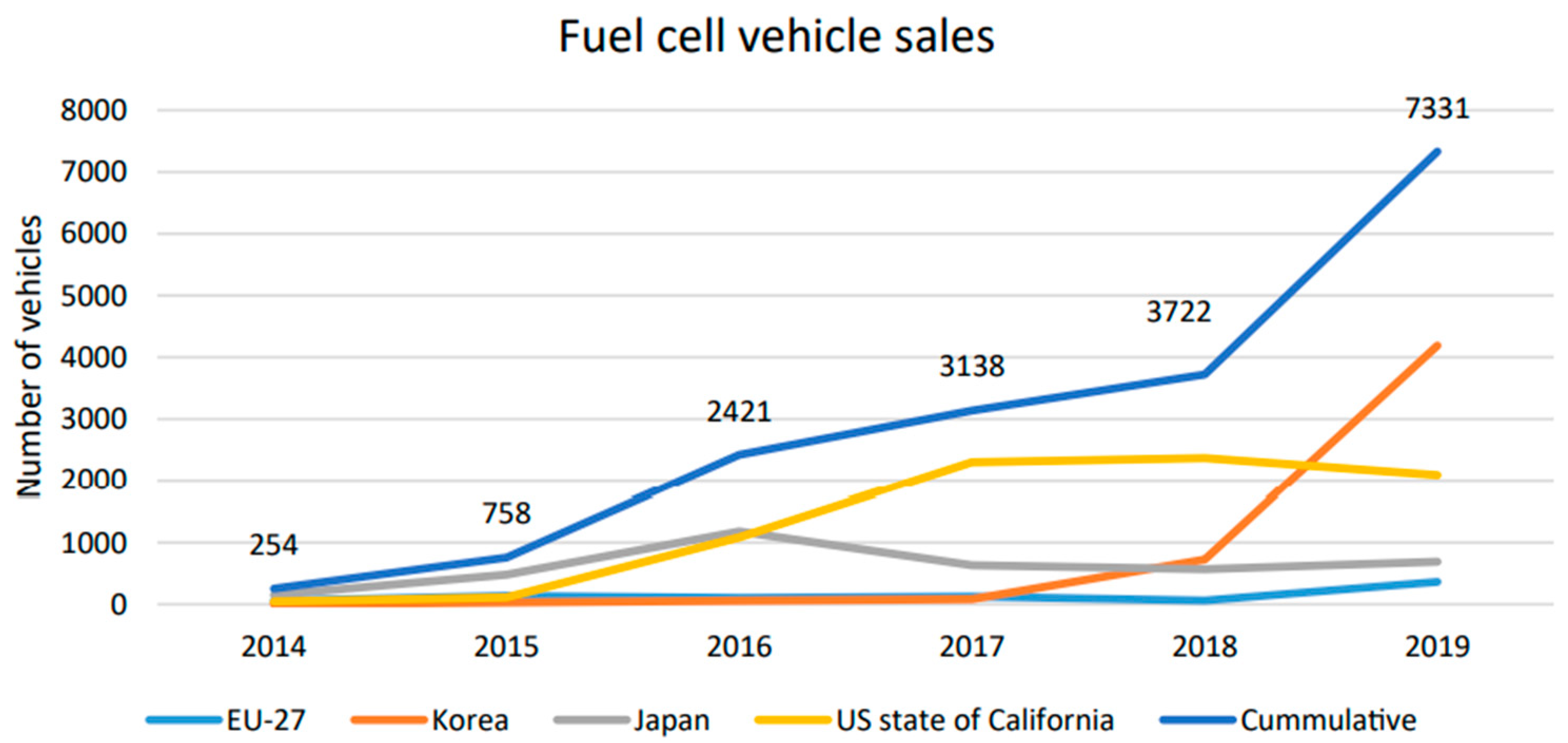

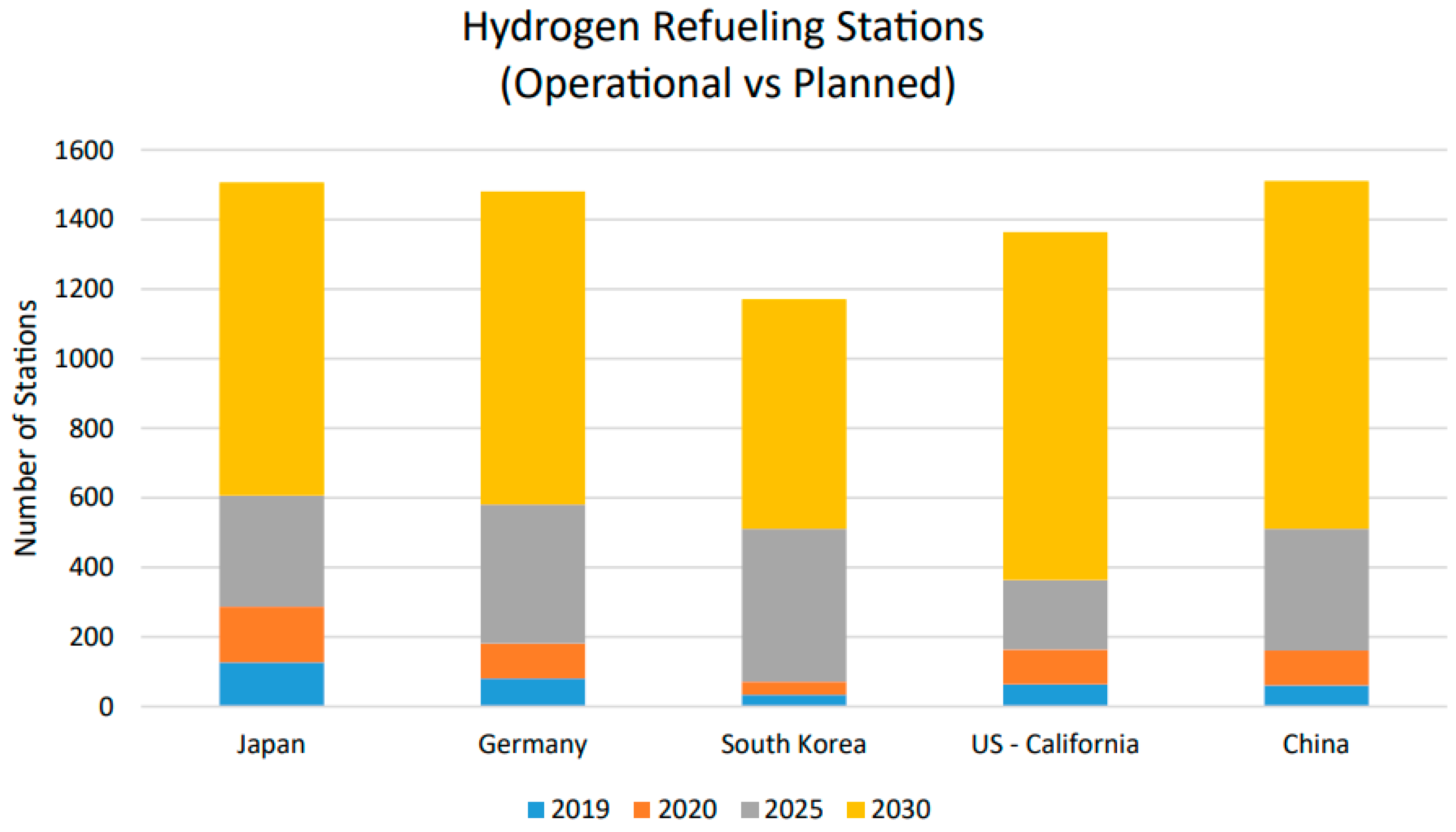

2.3.1. Transport: Fuel Cell Vehicles (FCV)

2.3.2. Cogeneration Systems

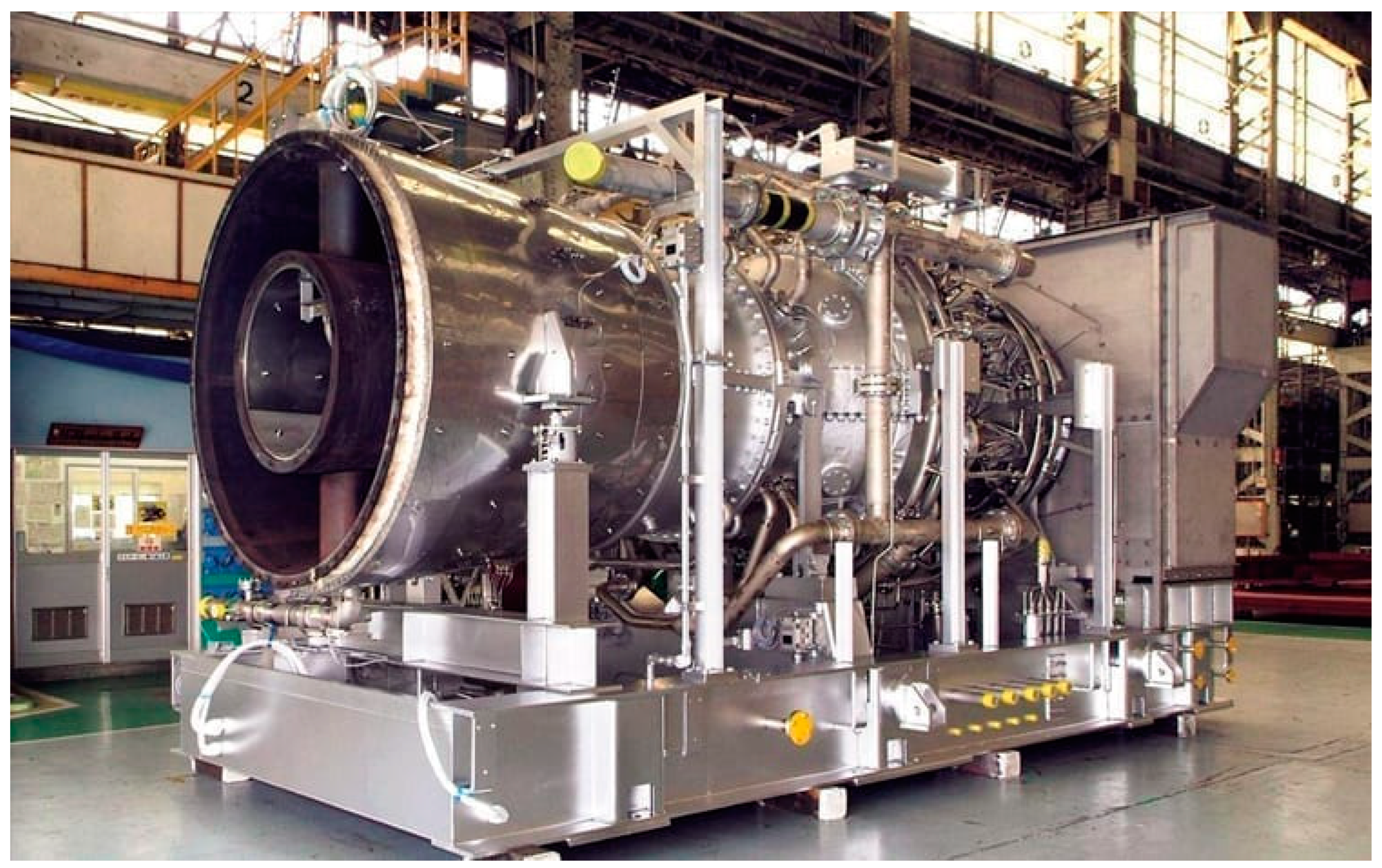

2.3.3. Power Generation

2.3.4. Industry

2.3.5. Aerospace Industry

3. SWOT Analysis

3.1. Strengths

3.2. Weaknesses

3.2.1. Obstacles of FCV

3.2.2. High Prices and the Small Number of Customers

3.2.3. Regulatory Barriers

3.2.4. PtH Challenges for Japan

3.3. Opportunities

3.4. Threats

4. Recommended Strategies

5. Conclusions and Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- UNFCCC. Historic Paris Agreement on Climate Change-195 Nations set path to keep temperature rise well below 2 degrees Celsius. Unfccc 2015, 1, 1–7. [Google Scholar] [CrossRef]

- IRENA-International Renewable Energy Agency. World Energy Transitions Outlook: 1.5 °C. Pathway. Int. Renew. Energy Agency 2021. Available online: https://www.h2knowledgecentre.com/content/researchpaper1609 (accessed on 15 June 2022).

- Moe, E. Energy transition. In Essential Concepts of Global Environmental Governance; Routledge: London UK, 2020; pp. 86–88. [Google Scholar]

- Kraan, O.; Kramer, G.J.; Haigh, M.; Laurens, C. An Energy Transition That Relies Only on Technology Leads to a Bet on Solar Fuels. Joule 2019, 3, 2286–2290. [Google Scholar] [CrossRef]

- Lacey, F.; Monk, M.; Odey, A. Why the energy transition is about more than generating clean power. Trustnet 2020. [Google Scholar]

- Soltani, S.M.; Lahiri, A.; Bahzad, H.; Clough, P.; Gorbounov, M.; Yan, Y. Sorption-enhanced Steam Methane Reforming for Combined CO2 Capture and Hydrogen Production: A State-of-the-Art Review. Carbon Capture Sci. Technol. 2021, 1, 100003. [Google Scholar] [CrossRef]

- Detz, R.J.; Reek, J.N.H.; Van Der Zwaan, B.C.C. The future of solar fuels: When could they become competitive? Energy Environ. Sci. 2018, 11, 1653–1669. [Google Scholar] [CrossRef]

- Shih, C.F.; Zhang, T.; Li, J.; Bai, C. Powering the Future with Liquid Sunshine. Joule 2018, 2, 1925–1949. [Google Scholar] [CrossRef]

- Hydrogen Council. How Hydrogen Empowers the Energy Transition. 2017, pp. 1–28. Available online: https://hydrogencouncil.com/wp-content/uploads/2017/06/Hydrogen-Council-Vision-Document.pdf (accessed on 17 September 2020).

- Kovač, A.; Paranos, M.; Marciuš, D. Hydrogen in energy transition: A. review. Int. J. Hydrogen Energy 2021, 46, 10016–10035. [Google Scholar] [CrossRef]

- IEA. The Future of Hydrogen. Futur. Hydrog. 2019, 203, 50. [Google Scholar]

- Gisbert, N.; Careaga, Í. Hydrogen: Opportunities and Challenges of Its Value Chain; CIC EnergiGUNE: Álava, Spain, 2021. [Google Scholar]

- IRENA. Geopolitics of the Energy Transformation: The Hydrogen Factor; IRENA: Abu Dhabi, United Arab Emirates, 2022; p. 117. [Google Scholar]

- Tashie-Lewis, B.C.; Nnabuife, S.G. Hydrogen Production, Distribution, Storage and Power Conversion in a Hydrogen Economy-A Technology Review. Chem. Eng. J. Adv. 2021, 8, 100172. [Google Scholar] [CrossRef]

- Scipioni, A.; Manzardo, A.; Ren, J. Hydrogen Economy: Supply Chain, Life Cycle Analysis and Energy Transition for Sustainability. In Hydrogen Economy: Supply Chain, Life Cycle Analysis and Energy Transition for Sustainability; Academic Press: Cambridge, MA, USA, 2017; pp. 1–328. [Google Scholar]

- Yue, M.; Lambert, H.; Pahon, E.; Roche, R.; Jemei, S.; Hissel, D. Hydrogen energy systems: A critical review of technologies, applications, trends and challenges. Renew. Sustain. Energy Rev. 2021, 146, 111180. [Google Scholar] [CrossRef]

- Okolie, J.A.; Patra, B.R.; Mukherjee, A.; Nanda, S.; Dalai, A.K.; Kozinski, J.A. Futuristic applications of hydrogen in energy, biorefining, aerospace, pharmaceuticals and metallurgy. Int. J. Hydrogen Energy 2021, 46, 8885–8905. [Google Scholar] [CrossRef]

- Khan, U.; Yamamoto, T.; Sato, H. An insight into potential early adopters of hydrogen fuel-cell vehicles in Japan. Int. J. Hydrogen Energy 2021, 46, 10589–10607. [Google Scholar] [CrossRef]

- Borhani, T.N. Chapter 11-Energy storage. In Woodhead Publishing Series in Energy; Sharifzadeh, F.C., Ed.; Academic Press: Cambridge, MA, USA, 2020; pp. 311–332. [Google Scholar]

- Thema, M.; Bauer, F.; Sterner, M. Power-to-Gas: Electrolysis and methanation status review. Renew. Sustain. Energy Rev. 2019, 112, 775–787. [Google Scholar] [CrossRef]

- Vázquez, F.V.; Koponen, J.; Ruuskanen, V.; Bajamundi, C.; Kosonen, A.; Simell, P.; Ahola, J.; Frilund, C.; Elfving, J.; Reinikainen, M.; et al. Power-to-X technology using renewable electricity and carbon dioxide from ambient air: SOLETAIR proof-of-concept and improved process concept. J. CO2 Util. 2018, 28, 235–246. [Google Scholar] [CrossRef]

- Daiyan, R.; Macgill, I.; Amal, R. Opportunities and Challenges for Renewable Power-to-X. ACS Energy Lett 2020, 5, 3843–3847. [Google Scholar] [CrossRef]

- Qaiser, I. A comparison of renewable and sustainable energy sector of the South Asian countries: An application of SWOT methodology. Renew. Energy 2022, 181, 417–425. [Google Scholar] [CrossRef]

- Agyekum, E.B. Energy poverty in energy rich Ghana: A SWOT analytical approach for the development of Ghana’s renewable energy. Sustain. Energy Technol. Assess. 2020, 40, 100760. [Google Scholar] [CrossRef]

- Terrados, J.; Almonacid, G.; Hontoria, L. Regional energy planning through SWOT analysis and strategic planning tools. Impact on renewables development. Renew. Sustain. Energy Rev. 2007, 11, 1275–1287. [Google Scholar] [CrossRef]

- Elavarasan, R.M.; Afridhis, S.; Vijayaraghavan, R.R.; Subramaniam, U.; Nurunnabi, M. SWOT analysis: A framework for comprehensive evaluation of drivers and barriers for renewable energy development in significant countries. Energy Rep. 2020, 6, 1838–1864. [Google Scholar]

- Chen, W.M.; Kim, H.; Yamaguchi, H. Renewable energy in eastern Asia: Renewable energy policy review and comparative SWOT analysis for promoting renewable energy in Japan, South Korea, and Taiwan. Energy Policy 2014, 74, 319–329. [Google Scholar] [CrossRef]

- Chaube, A.; Chapman, A.; Shigetomi, Y.; Huff, K.; Stubbins, J. The role of hydrogen in achieving long term Japanese energy system goals. Energies 2020, 13, 4539. [Google Scholar] [CrossRef]

- METI. Basic Hydrogen Strategy (Key Points), Ministry of Economy, Trade and Industry; METI: Tokyo, Japan, 2017.

- Kannah, R.Y.; Kavitha, S.; Preethi; Karthikeyan, O.P.; Kumar, G.; Dai-Viet, N.V.; Banu, J.R. Techno-economic assessment of various hydrogen production methods–A review. Bioresour. Technol. 2021, 319, 124175. [Google Scholar] [CrossRef] [PubMed]

- Hosseinpour, M.; Hajialirezaei, A.H.; Soltani, M.; Nathwani, J. Thermodynamic analysis of in-situ hydrogen from hot compressed water for heavy oil upgrading. Int. J. Hydrogen Energy 2019, 44, 27671–27684. [Google Scholar] [CrossRef]

- Zedtwitz, P.V.; Hirsch, D.; Steinfeld, A. Hydrogen production via the solar thermal decarbonization of fossil fuels. Int. Sol. Energy Conf. 2003, 80, 107–109. [Google Scholar] [CrossRef]

- Howard, K. World’s First Liquid Hydrogen Shipment to Set Sail for Japan; Australian Government: Barton, Australia, 2022.

- Ahmad, M.S.; Ali, M.S.; Rahim, N.A. Hydrogen energy vision 2060: Hydrogen as energy Carrier in Malaysian primary energy mix–Developing P2G case. Energy Strateg. Rev. 2021, 35, 100632. [Google Scholar] [CrossRef]

- Nagashima, M. Japan’s Hydrogen Strategy and Its Economic and Geopolitical Implications. In Études de l’Ifri; Ifri: Paris, France, 2018; p. 75. [Google Scholar]

- Li, M.; Bai, Y.; Zhang, C.; Song, Y.; Jiang, S.; Grouset, D.; Zhang, M. Review on the research of hydrogen storage system fast refueling in fuel cell vehicle. Int. J. Hydrogen Energy 2019, 44, 10677–10693. [Google Scholar] [CrossRef]

- Hydrogen, T.; Ministerial, E. Spera Hydrogen for the Future; Chiyoda: Yokohama, Japan, 2020. [Google Scholar]

- Center for Strategic & International Studies. Japan’s Hydrogen Industrial Strategy; Center for Strategic & International Studies: Washington, DC, USA, 2021. [Google Scholar]

- Energy Connects. Japanese Consortium Ships Hydrogen from Brunei to Fuel Power Generation; Energy Connects: Singapore, 2020. [Google Scholar]

- SABIC. Aramco Completes Acquisition of 70% Stake in SABIC from PIF; SABIC: Dhahran, United Arab Emirates, 2020. [Google Scholar]

- Ito, H. Economic and environmental assessment of residential micro combined heat and power system application in Japan. Int. J. Hydrogen Energy 2016, 41, 15111–15123. [Google Scholar] [CrossRef]

- Watabe, A.; Leaver, J. Comparative economic and environmental benefits of ownership of both new and used light duty hydrogen fuel cell vehicles in Japan. Int. J. Hydrogen Energy 2021, 46, 26582–26593. [Google Scholar] [CrossRef]

- Newborough, M.; Cooley, G. Developments in the global hydrogen market: Electrolyser deployment rationale and renewable hydrogen strategies and policies. Fuel Cells Bull. 2020, 2020, 16–22. [Google Scholar] [CrossRef]

- Palmer, K.H. Forecasting the Impact of Growing Shares of Hybrid and Electric Vehicles on Future Emissions of Carbon Dioxide and Air Quality Pollutants; University of Leeds: Leeds, UK, 2019. [Google Scholar]

- Lotrič, A.; Sekavčnik, M.; Kuštrin, I.; Mori, M. Life-cycle assessment of hydrogen technologies with the focus on EU critical raw materials and end-of-life strategies. Int. J. Hydrogen Energy 2021, 46, 10143–10160. [Google Scholar] [CrossRef]

- Maruta, A. Japan’s ENE-FARM programme. In Fuel Cells: Why Is Austria Not Taking Off? IEA Research Cooperation: Vienna, Austria, 2016. [Google Scholar]

- Nose, M.; Kawakami, M.; Nakamura, T.; Kuroki, S.; Kataoka, H.; Yuri, M. Development of Hydrogen/Ammonia Firing Gas Turbine for Decarbonized Society. Mitsubishi Heavy Ind. Tech. Rev. 2021, 58, 1. [Google Scholar]

- Toit, M.H.D.; Avdeenkov, A.V.; Bessarabov, D. Reviewing H2 Combustion: A Case Study for Non-Fuel-Cell Power Systems and Safety in Passive Autocatalytic Recombiners. Energy Fuels 2018, 32, 6401–6422. [Google Scholar] [CrossRef]

- Patel, S. Mitsubishi Power Developing 100% Ammonia-Capable Gas Turbine. Bachelor’s Thesis, Høgskulen på Vestlande, Bergen, Norway, 2021. [Google Scholar]

- Gao, W.; Fan, L.; Ushifusa, Y.; Gu, Q.; Ren, J. Possibility and Challenge of Smart Community in Japan. Procedia-Soc. Behav. Sci. 2016, 216, 109–118. [Google Scholar] [CrossRef][Green Version]

- Bicer, Y.; Dincer, I. Life cycle evaluation of hydrogen and other potential fuels for aircrafts. Int. J. Hydrogen Energy 2017, 42, 10722–10738. [Google Scholar] [CrossRef]

- Baroutaji, A.; Wilberforce, T.; Ramadan, M.; Olabi, A.G. Comprehensive investigation on hydrogen and fuel cell technology in the aviation and aerospace sectors. Renew. Sustain. Energy Rev. 2019, 106, 31–40. [Google Scholar] [CrossRef]

- World’s Largest Green Hydrogen Hub Unveiled in Texas, Which Could Help Fuel Space Travel. Available online: https://www.upstreamonline.com/energy-transition/worlds-largest-green-hydrogen-hub-unveiled-in-texas-which-could-help-fuel-space-travel/2-1-1178809, (accessed on 15 June 2022).

- Salimi, M.; Hosseinpour, M.; Borhani, T.N. Analysis of Solar Energy Development Strategies for a Successful Energy Transition in the UAE. Processes 2022, 10, 1338. [Google Scholar] [CrossRef]

- Trencher, G.; Taeihagh, A.; Yarime, M. Overcoming barriers to developing and diffusing fuel-cell vehicles: Governance strategies and experiences in Japan. Energy Policy 2020, 142, 111533. [Google Scholar] [CrossRef]

- Shibata, Y. Is Power to Gas Feasible in Japan? The Institute of Energy Economics (IEEJ): Tokyo, Japan, 2016. [Google Scholar]

- Lebrouhi, B.E.; Djoupo, J.J.; Lamrani, B.; Benabdelaziz, K.; Kousksou, T. Global hydrogen development-A technological and geopolitical overview. Int. J. Hydrogen Energy 2022, 47, 7016–7048. [Google Scholar] [CrossRef]

- Vakulchuk, R.; Overland, I.; Scholten, D. Renewable energy and geopolitics: A review. Renew. Sustain. Energy Rev. 2020, 122, 109547. [Google Scholar] [CrossRef]

| Strengths (S): | Weaknesses (W): | |

| S1: No infrastructure is required for fuel transfer (due to the transportation methods available for compressed gases). S2: Readiness of community for the energy transition. S3: Control of power fluctuations for optimal integration with alternating renewable energy sources is possible. S4: Energy security. | W1: The low availability and high cost of small electrolysis systems are problematic W2: No support for after-sales services. W3: High purchase cost. W4: Conversion to hydrogen is not cheap. W5: Conversion equipment is expensive, and the process consumes a lot of energy. W6: Undeveloped hydrogen infrastructure. | |

| Opportunities (O): | SO Strategies: | WO Strategies: |

| O1: Support of Japanese government. O2: New job opportunities. O3: Diversity of companies in the energy sector. O4: Reducing environmental impacts. O5: Carbon dioxide emission-limiting norms may be an incentive to accelerate the development of hydrogen technology. O6: High social acceptability. |

|

|

| Threats (T): | ST Strategies: | WT Strategies: |

| T1: Inexperienced users. T2: Insufficient business plan. T3: Inadequate legal framework. T4: Many barriers, especially low cost and efficiency, prevent large-scale hydrogen technology’s introduction. T5: Unconfirmed market potentials |

|

|

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Salimi, M.; Hosseinpour, M.; N.Borhani, T. The Role of Clean Hydrogen Value Chain in a Successful Energy Transition of Japan. Energies 2022, 15, 6064. https://doi.org/10.3390/en15166064

Salimi M, Hosseinpour M, N.Borhani T. The Role of Clean Hydrogen Value Chain in a Successful Energy Transition of Japan. Energies. 2022; 15(16):6064. https://doi.org/10.3390/en15166064

Chicago/Turabian StyleSalimi, Mohsen, Morteza Hosseinpour, and Tohid N.Borhani. 2022. "The Role of Clean Hydrogen Value Chain in a Successful Energy Transition of Japan" Energies 15, no. 16: 6064. https://doi.org/10.3390/en15166064

APA StyleSalimi, M., Hosseinpour, M., & N.Borhani, T. (2022). The Role of Clean Hydrogen Value Chain in a Successful Energy Transition of Japan. Energies, 15(16), 6064. https://doi.org/10.3390/en15166064