Abstract

The use of biomass as an energy source has advanced in recent decades, given the scientific evidence that it is a solution to the environmental problems faced globally. In this context, biofuels derived from biomass have a prominent role. Among the countries where this alternative is the most promising, Brazil stands out, just behind the USA. It is, therefore, necessary to assess whether such a replacement is economically viable. For such an assessment, the behavior of the relative price of bioethanol/gasoline is crucial. In the present work, the degree of temporal persistence of relative prices, considering the existence of shocks to which they are exposed, is evaluated, considering 15 important Brazilian capitals, via the detrended fluctuation analysis (). The degree of correlation is also evaluated through the detrended cross-correlation analysis () between fuel prices in São Paulo, the capital of the most populous state and main producer of bioethanol, with the capitals of the 14 states selected for the analysis. The period of analysis takes place between 2004 and 2020. The use of with sliding windows was recently proposed and we also evaluate dynamically in this way, and this, together with an extended sample in the context of Brazilian fuel prices, represents the main innovations of the present work. We found that the degree of persistence varies significantly depending on the capitals analyzed, which means that price variations are localized and demand regional stimulus policies. Furthermore, it was found that the correlation with São Paulo is less intense in the most geographically distant capitals. Such evidence is important and complementary to infer how integrated the national bioethanol market is, in order to support public policies aimed at its consolidation.

1. Introduction

1.1. Contextualization

Much of the economic work has focused on analyzing relative fuel prices aims to identify their main drivers for a better understanding of their dynamics and support strategies to reduce volatility and the possible negative consequences for economies as a whole. In recent decades, it has become increasingly important to identify alternatives to fossil fuels in the global context. In Brazil, ethanol, a biofuel produced from sugarcane and corn, has been a consolidated alternative since the 1970s.

Theoretically, there are several advantages in the existence of an alternative to a strategic good in defining logistics costs, particularly for the service sector (tourism, home deliveries, postal services, food deliveries), distribution and access to goods in the retail trade (supermarkets, restaurants, and many other products purchased via the internet), in addition to other activities involving light transport, such as cars and motorcycles. This advantage is most strongly expressed by the reduction in exposure to price volatility and related costs. Changes in price volatility can also affect other variables by changing, for example, costs.

Product homogeneity is a characteristic of competitive markets. Differentiated or substitute products do not stimulate competition, but other forms of markets, such as monopolistic competition, do so when they are in the same category and can be differentiated by quality. The aforementioned costs could be reduced, particularly those of holding inventories (conceptually, not equal to the cost of storage), interest (opportunity cost of financial resources), financing of insurance operations against unexpected changes in prices, increasing transparency and facilitating the administration of services involving automotive transport. However, as such markets hardly operate in competitive conditions, market failures of different natures occur, requiring government intervention through public policies, given the strategic importance of fuel in the economy.

Thus, many studies seek to analyze the behavior of price series, based on the concept of an efficient market for evaluation and proposal of adjustments, when necessary. Numerous researchers have already looked for past data, which can explain and infer future values, and therefore, how close the market is to efficiency. However, this concept is still subject to intense debate in the academic community.

One way to provide theoretical foundations and facilitate understanding of market responses to policies that may affect fuel prices is by analyzing the behavior of relative ethanol-gasoline prices, more specifically in the case of hydrous ethanol and gasoline C (ethanol anhydrous added to gasoline). In Brazil, this is particularly interesting, given the importance of flex-fuel vehicles, which represented 67.1% of the fleet in 2018 [1], mostly in the fleet of light vehicles.

In Brazil, there is a history of government intervention in the market. Costa and Burnquist [2] analyzed the impacts of gasoline prices on the prices and supply of hydrated ethanol, between 2006 and 2015. The authors concluded that the effects depend on the period analyzed, as the results of intervention in gasoline prices are sometimes harmful and sometimes beneficial to the consumption of hydrous ethanol, as a substitute for gasoline at lower relative prices.

It should be noted, however, that gasoline C and hydrated ethanol have different energy efficiency, the latter being advantageous only when the relative price (ethanol-gasoline) is less than 70%, due to the lower yield of hydrated ethanol [3,4,5]. It is important to note, therefore, that the prices of hydrous ethanol and gasoline C have peculiarities in the Brazilian scenario, being two distinct products and perfect substitutes in the case of flex-fuel cars [6].

According to Fama [7], the efficient market hypothesis (EMH) is verified when the prices reflect all the available information, so that it is not possible to obtain abnormal profits using only the set of available information. This concept works with the idea of a random walk-in time series, against other types of behavior, such as persistence and anti-persistence, in which the idea of predictability is embedded.

In the case of light automotive fuels in Brazil, the predictability of relative price changes means exploring the behavior of the relative price (hydrated ethanol-gasoline C), to assess the degree of price persistence, in line with [8], as well as the synchronization (cross-correlation) of relative prices between different regions, through correlation analysis, focusing on the retail market in the main Brazilian capitals.

To the best of our knowledge, the price behavior of relative prices of ethanol-gasoline in the main cities or regions of Brazil was only analyzed in the work of [5,9]. The work of [5] covers up to the year 2014, prior to the new import parity policy by Petrobras, which started in 2016. The investigation by [9] starts in 2012 and reaches 2019, separating into the pre- and post-periods and setting up a static analysis. So, there is a lack of knowledge about the aspects of price behavior of ethanol-gasoline relative prices over a relatively extended period, from a dynamic point of view.

1.2. Objectives

The present analysis aims to investigate the following two research questions: (i) does the efficiency of ethanol-relative prices vary over time? (ii) Is there correlation over time in the changes of the relative prices of São Paulo city with other important Brazilian capitals?

To do so, a recent methodology is used to capture accurately whether there is joint efficiency between the fuel markets in different regions of the country. If this is not identified, it is considered useful to assess whether markets work efficiently at least in individual terms.

We analyze the correlation between the relative price of São Paulo versus other important Brazilian capitals of states that can produce and/or consume ethanol in greater volumes, which allows for inferences regarding the degree of predictability of prices in different Brazilian capitals, as well as the degree of correlation between relative prices in these capitals and in the city of São Paulo, the capital of the main hydrous ethanol producing state and with the largest automotive fleet in the country. This can determine the degree of persistence of relative ethanol prices, following [4,8], as well as whether this relative price has a national or regional character, in line with [5,9].

1.3. Hypothesis

In principle, there are reasons to expect there will be no correlation between the relative price pairs of São Paulo and the various other Brazilian capitals, as the exogenous factors that influence ethanol supply are different. For example, the supply of ethanol derived from agro-industrial products may be reduced if weather conditions are not favorable [10]. In the case of gasoline C, one of the main determinants has been the new price policy adopted by Petrobras in 2016, which provides the internalization of variations in oil prices in the international market, in addition to differentiated tariffs between ethanol and gasoline, favoring consumption of hydrated ethanol when international oil prices are high [11].

1.4. Justification and Contribution

Here, we advance the investigation by [9] with a larger sample, which includes the period from the beginning of the launch of flex-fuel cars to the first impacts of the COVID-19 pandemic, with our sample extending from May 2004 to December 2020. In addition, we use a robust methodology of econophysics using sliding windows, which allows for the dynamic analysis of the price trajectory, in view of the static analysis between delimited periods.

Thus, the analysis of local fuel prices is justified to support the formulation of policies for the sector for regulatory agencies and other market participants involved in the commercialization and consumption of fuels, such as distributors, retails and consumers. It has also been observed that fuel price behavior problems are even more important in emerging economies, which are more vulnerable to energy price and/or exchange rate shocks [12].

The present research contributes to the investigation regarding the persistence of relative price variations, as well as the degree of correlation between them. The persistence of fuel prices is important, as it provides an indication of the degree of predictability of the price trajectory, in line with the approach by [11] for hydrous ethanol and gasoline prices. From an exogenous shock in prices, the results allow the understanding of the expected behavior of the series. In turn, the degree of correlation analyzed in this work is important to assess whether the movements of price variations show synchronized behavior between São Paulo and the other capitals, in order to identify whether the movements are characteristic of a unified or regionalized market.

The structure of this article is as follows: after this introduction, Section 2 presents a literature review; Section 3 presents an overview of the regional aspects of ethanol and gasoline pricing at the retail level in Brazil; Section 4 describes the methodology and data used; Section 5 discusses the main results, and finally, Section 6 elaborates the final conclusions.

2. Literature Review

After the resurgence of ethanol as a possible substitute for gasoline in Brazil, with the advent of the bi-fuel car that launched in 2003, there is extensive literature on the possible relationship between ethanol prices and other commodities, especially “food × fuel”. This debate concerns possible co-movements in food and energy prices; in particular, the effect of policies to stimulate the production of biofuels in the face of rising food prices.

Janda and Kristoufek [13] conduct an excellent survey on the main work on this topic. Many of the studies cited involve, in addition to food prices, oil prices, which can have a great influence on commodity prices as a whole, and in particular, on ethanol prices, both in the US and Brazil.

Another recently explored topic is the possible relationship between Brazilian ethanol spot and futures prices at the Brazilian Exchange, B3 [14,15], as well as the possible relationship between ethanol prices in the Brazilian and USA markets [15,16,17,18,19].

Following recent concerns about global warming and ways of decarbonizing the economy, there are ESG (environmental, social and governance) investments, including investments in companies that seek to follow environmentally correct practices in the production process. This tends to favor investments that contribute to mitigating the effects of greenhouse gas emissions (GHG), gradually becoming more evident in the market. Carbon emission prices emerge as a need for pricing this externality, as well as its possible relationship with prices of other renewable energies, such as Brazilian ethanol [20].

Other studies seek to determine the impacts of different sources of market uncertainties on biofuel prices. Uddin et al. [21] used the VIX (Market Volatility Index), EPU (Economic Policy Uncertainty Index), GPR (Geopolitical Risk Index) and St Louis Fed Financial Stress Index (FSI) to analyze the influence of uncertainties on biofuel prices, including Brazilian ethanol. In the context of the Brazilian domestic market, there are investigations into the degree of persistence of national ethanol prices at the producer level [22], as well as national retail prices of ethanol and gasoline [11].

Specifically in relation to the relative price of Brazilian ethanol-gasoline, Barros et al. [8] studied the degree of persistence of ethanol and gasoline consumption in Brazil, as well as its relative price between 2000 and 2012, concluding that ethanol and gasoline consumption are persistent, with an order of integration lower than the unit, and therefore with a mean reversion tendency. However, for the relative price, the estimated coefficient was higher than the unit, which suggests non-reverting behavior to the mean and character of permanence in response to shocks.

El Montasser et al. [4], with a sample from 2000 to 2012 and based on the right-tailed ADF test, which is commonly used to test the formation of price bubbles, verified the occurrence of two bubbles in the relative ethanol-gasoline price in this period, which are as follows: the first starting in June 2006 and collapsing in March 2007; and the second, starting in June 2010 and lasting until the end of the sample, in December 2012. The first coincided with President Lula’s re-election campaign, and the second with the withdrawal of CIDE in 2008 and the government’s attempts to use policies to freeze gasoline prices.

Laurini [5] analyzed the evolution of the relative prices of ethanol-gasoline in Brazil between 2007 and 2014 through a continuous spatial model, which analyzes the distribution of prices continuously in space and time, concluding that after 2009, hydrous ethanol lost its competitiveness to gasoline C. More specifically, in 2007–2009, ethanol was competitive in most of the Brazilian territory, but gradually lost competitiveness from 2010 onwards, where it showed an advantage in only part of the Southeast Region.

Nascimento Filho et al. [9] studied the behavior of the relative prices of ethanol-gasoline within the scope of fuel distributors and dealers, comparing the pre- and post-implementation periods of the fuel import price parity policy in Brazil in the main capitals of the country between 2012 and 2019. This policy resulted in the end of the artificial control of gasoline prices, which allowed ethanol to become more competitive, especially in periods of high international oil prices. For this purpose, nonparametric Mann–Whitney and Levene tests were used. They verified that, after the change in the pricing policy, there was an increase in the median and in the coefficients of variation in the relative prices in most of the capitals analyzed, especially in the distribution market segment. This suggests that Petrobras’ new pricing policy has unequally affected the relative prices among the various Brazilian capitals.

The next section will show the main specificities of Brazilian ethanol and gasoline pricing mechanisms, including regional differences between them.

3. Regional Aspects and Pricing of Ethanol and Gasoline in Brazilian Retail Market

First, it is important to highlight in general terms how fuel prices are formed, and then highlight the regional specificities, by product, of the fuel pricing process in Brazil.

3.1. Pricing of Gasoline and Ethanol at Retail Markets

Law No. 9478 of August 1997, the Petroleum Law, effective as of 2002, introduced changes that deregulated the fuel pricing process, aiming for greater efficiency if these are determined by the laws of market supply and demand. The Petroleum Law instituted the Brazilian National Council for Energy Policy (CNPE) and the Brazilian National Agency for Petroleum, Natural Gas and Biofuels (ANP), operationalizing a gradual liberalization of prices, in order to converge with those practiced in the international market [23]. Despite this law, Petrobras maintained its dominant position in the refining activity, determining prices in the domestic market [24].

This event led to structural changes in the dynamics of the Brazilian fuel market. It is important to point out that, according to [25], as of January 2002, the fuel sector began to operate as a free market, with deregulated prices at the refinery. From then, the importation of petroleum derivatives by private companies was allowed.

Regarding the formation of fuel prices in Brazil, the retail price of gasoline is composed of the following four components: (i) the realization price of the producer or importer; (ii) cost of anhydrous ethanol; (iii) taxes (ICMS, a local government tax, defined by each state) and (PIS/PASEP and COFINS–federal taxes) and CIDE (contribution whose primary objective is to maintain roads in good condition); and (iv) sales margins for distributors and resale via gas stations. It is important to note that retail prices remained practically constant at the refinery, with low volatility in the subsequent links of the chain, between 2006 and 2015. The variations were mainly due to changes in wholesale and retail profit margins, as well as variations in anhydrous ethanol prices [26]

Although the deregulation policy in fuel distribution aimed to increase market competitiveness, what was really observed was a significant increase in the concentration of the hydrous ethanol distributor market, measured by the HHI index between 2006 and 2015. The concentration in the hydrous ethanol market is lower than that of gasoline or diesel, as the ethanol wholesale market is more dispersed and facilitates logistics for small distributors [27]. However, in 2021, plants located in the Northeast were authorized to deliver ethanol directly to gas stations, due to the political lobbies of local agents.

Distribution and retail margins vary depending on the fuel, as each one has different costs, in addition to different market structures. Regarding fuel retail in the composition of the margins, there are both fixed costs and expenses (e.g., land, environmental impact analysis, “flag” in the case of branded gas station, taxes) and variables (freight, water, electricity, operating and financial expenses, among others) [28].

At the end of 2019, Brazil had more than 40,970 gas stations, 38.2% located in the Southeast, 25.6% in the Northeast, 19.2% in the South, 9% in the Midwest and 8% in the North [29].

The large number of gas stations in Brazil could suggest that it is a highly fragmented, competitive market, where each one considers it has no power over the prices of the product it sells. However, despite a relatively high number of participants, it is not a market that operates according to perfect competition, being a frequent target of investigation by the antitrust authorities in Brazil, which recurrently bring to light the formation of cartels [30].

Quintino and David [24] show there was a significant increase in the concentration of ethanol distributors between 2004 and 2011, due to various mergers and acquisitions by major market players. Table 1 shows the degree of concentration in 2019. Da Silva et al. [30] argue that the problem of gasoline price asymmetry between distributors and service stations is not a national problem, but contingent on each specific city or region.

Table 1.

Market share of the main distributors, by type of fuel, in 2019. Source: own elaboration with data from [29].

In addition to economic concentration, another important point to be highlighted is the role of taxes in the formation of fuel prices.

According to Decree 9101/2017, the main taxes applied to fuels are as follows: the tax on circulation of goods and services (ICMS), defined by each state, (PIS/PASEP, COFINS) and the contribution for intervention in the economic domain (CIDE). Despite its primary objective, CIDE is identified as the main mechanism to induce the consumption of ethanol rather than gasoline. This was established in 2001 and although not created for this specific purpose, it is the main public policy instrument to stimulate the demand for ethanol, when applied to gasoline [12,31].

ICMS is a state tax, but 25% is appropriated by the municipality where the fuel is sold. At least 75% corresponds to the added value of state revenue along the value-added chain generated in the corresponding municipality. Thus, a municipality that has a refinery receives a higher transfer of state ICMS than other municipalities. There have been no taxes on fuel imports and exports in Brazil since 2002. In addition, there are no rules establishing the distribution of such resources within the competence of the Federal Government [32].

3.2. Regional Aspects of Ethanol Supply in Brazil

Historically, sugarcane is grown mainly in the state of São Paulo, in the Centre-South, and in the states of Bahia, Pernambuco and Paraíba, in the Northeast. It is also worth mentioning that sugarcane is a perennial crop, so the supply response to changes in its prices can take 2 to 4 years [33].

The Midwest Region gained importance with the expansion of ethanol production activity in the mid-2000s, considering that it has flat lands and an appropriate climate for high productivity [34]. As opposed to when Proálcool was launched, when the region was practically ignored, after the launch of flex-fuel vehicles in 2003, the Midwest Region became the main area for expanded sugarcane production [35]. In addition, as an incentive factor for this region, there was an increase in land prices in São Paulo [36], pushing production costs, combined with the productive decline of the Northeast Region, a traditional sugar-producing region.

The costs associated with increased mechanization, as well as the inflation of land prices through competition for arable areas, motivated the search for other suitable land, in order to minimize production costs, with a focus on the states of Goiás and Mato Grosso do Sul, where production has grown greatly in the last 40 years [37]. The states of Goiás and Mato Grosso do Sul began to expand their production more significantly in the 2000s, becoming the main producing states in the country after the state of São Paulo.

Table 2 shows the high growth rate of Brazilian production of hydrous ethanol in the period 2006–2010, accompanied by growth in all regions of Brazil, especially in the Southeast, with an increase of approximately 187.2%, starting from a high base of comparison, considering that it represented 62.5% of the total supply in the previous period (2001–2005) and reached 68.3% in 2006–2010. During this period, a reversal in the contribution to total supply began, with the Midwest Region overtaking the Northeast.

Table 2.

Average five-year production of hydrous ethanol in Brazil, in thousand cubic meters, by the 5 major geographic regions, and their respective shares in the total supply. Source: own calculation with data from [29,38].

However, the crisis occurred in 2011–2015 when the Midwest and North Regions were the only ones showing growth compared to the previous period. However, the North Region’s share was still quite small (0.5% of the national supply), while the Midwest Region’s share practically doubled, from 16.6% to 32%. Finally, in the last period (2015–2020), all regions showed growth, except for the South Region. In short, throughout the period, the Southeast Region was still the major supplier of ethanol, but there was a deconcentration of the total supply, as the Midwest Region became more representative to the detriment of the Northeast and South Regions.

Therefore, one would expect an increase in the convergence of relative prices between the Midwest and the Southeast, especially São Paulo, to the detriment of the Northeast and South Regions, which lost their relative share. Throughout the period, the North Region did not have a significant share in the supply, despite the growth in regional supply.

4. Methods and Data

In the present work, the empirical strategy involves the use of (detrended fluctuation analysis) and (detrended cross-correlation analysis) coefficients, which will be defined in the next item.

4.1. Methods

As previously highlighted, we want to assess the degree of persistence of price variations in the main Brazilian capitals (Manaus, Rio Branco, Belém, Fortaleza, Recife, Salvador, Goiânia, Brasília, Cuiabá, São Paulo, Rio de Janeiro, Belo Horizonte, Curitiba, Florianópolis and Rio Grande do Sul), as well as the degree of correlation between the capital of São Paulo, the main producer and consumer state of ethanol in Brazil, and the other capitals. The data source and choice criteria will be specified in the data subsection.

For this task, we used the econophysics techniques of (detrended fluctuation analysis) and (detrended cross-correlation analysis).

, developed by [39], initially to analyze the behavior of DNA, has been extended to many other areas, including economics and finance.

is calculated as follows. is a time series, with i , and equidistant observations. The following is a cumulative sum of the detrended series, given by the Equation (1):

where refers to average of .

Afterwards, is divided into non-overlapping boxes of size n (box size). For each box, a local trend is estimated via ordinary least squares (OLS). The next step is to create a detrended series of each box n, in order to obtain the expression of the Equation (2), which is as follows:

After this procedure is carried out for every window of dimension n, where , we have a power law given by ; a log-linear relationship whose parameter of interest is the Hurst coefficient H. After calculating H, the following result possibilities will be obtained:

- First, 0 < H < 0.5 anti-persistent series, or simply means reversal behavior. That is, there is a greater than 50% probability that a negative value will be preceded by a positive one. The strength of this behavior will depend on how close the H is to zero;

- Second, H = 0.5 series has a random walk distribution (white noise, efficient market), meaning that it has no long memory. Thus, the variation in the cumulative deviations must increase proportionally to the square root of the time variable;

- Third, 0.5 < H < 1 persistent series, meaning there is a probability of repetition of a value above 50%;

- Fourth, H = 1 identifies a pink noise and H > 1 means that long-range dependence is not explained by a power law, but these two results are uncommon in economic and financial time series.

It is important to note that has the advantage of being robust in relation to several time series features, such as non-stationarity [40,41], breaks [42] and other nonlinear forms [43,44]. The application of with moving windows is used in different areas of finance and economics, for example in the work of [45,46,47,48].

In addition to the , we used the correlation coefficient () of [49], derived from the procedure of [50], in order to verify the degree of correlation between the capital of São Paulo and the other major Brazilian capitals distributed over all five main regions.

Regarding the , the first step is also the integration of the series and according to equation 1. Afterwards, the series are divided into time series of the same length n and are detrended by OLS, that is, the same procedure as the is used to filter the trend of the series. In particular, the objective is to obtain the covariance of the residuals, vis-à-vis the variance, which is the object of the . In algebraic terms, we have

This is used to calculate the covariance given by the following equation:

After this is carried out for all sizes of n boxes, the exponent is obtained by means of a power law. The final step is obtained by

The functions and are the mean square fluctuations of the series xi e yi, respectively. As with Pearson’s correlation, which is suitable for evaluating linear relationships, . If , there is perfect correlation. In a symmetrical way, if , there is perfect anti-correlation. When , there is no evidence of correlation between the variables.

The correlation coefficient also presents interesting and desirable properties. It is robust in relation to nonlinearities and nonstationarity [51,52,53,54]. The robustness of the correlation coefficient is verified through its use in several areas, and particularly in energy economics, for example, [55,56,57,58,59,60,61,62,63].

In order to capture the time-varying dynamics, sliding windows will be used for both and . The sliding windows will consider 250 observations, consistent with the analysis by [47] and [64] for and , respectively.

4.2. Data

The relative prices were calculated by collecting weekly data of gasoline C and hydrated ethanol prices, obtained from the statistical database of the ANP (Brazilian National Agency of Petroleum, Natural Gas and Biofuels) [65], referring to the period from 14 May 2004 to 26 December 2020 for a total of 855 weeks. Table 3 illustrates the criterion for choosing the municipalities, based on [9,58,60], namely cities with more than 500,000 inhabitants, being the state capital and limited to three capitals per region. In this way, we have a representative set covering large capitals and in different regions of the country, which allows a proper diagnosis of local Brazilian specificities.

Table 3.

Geographic coordinates of the analyzed capitals. Source: Murari et al. [60].

By restricting attention to prices, some variations in the local market are not considered, such as fleet size, logistical conditions, fuel distribution, among others, in line with recent investigations by [9,58,60]. The present text advances in the sample dimension, from the beginning of the series in May 2004 to December 2020, including the COVID-19 crisis, which strongly shook the global economy, especially the Brazilian economy, one of the countries most affected by the pandemic.

Table 4 presents the descriptive statistics. The capitals of São Paulo (SAO) and Rio de Janeiro (RIO), both in the Southeast Region, and Belém (BEL) in the North Region, were the only ones to show extreme fluctuations of maximum and minimum values, in levels less than two digits. RIO presented the smallest drop recorded, of only −5%, followed by Florianópolis (FLN), with −8%. Among the biggest increases are Cuiabá, CGB, (17%), followed by Brasília, BSB, (16%) and Goiânia, GYN, (15%), all in the Midwest Region. In terms of asymmetric distribution, the largest are also located in the Midwest Region (CGB, BSB and GYN).

Table 4.

Descriptive statistics of hydrous ethanol/gasoline C returns by capitals, between 4 May to 20 December.

Positive asymmetries mean that positive returns are more frequent than negative ones. It is worth mentioning that increases in the relative price of hydrous ethanol-gasoline C occur more frequently than decreases. Regarding the most negative asymmetries, these are Manaus (MAO), in the North Region, and Fortaleza (FOR) and Recife (REC), both in the Northeast. Finally, with regard to kurtosis, the most leptokurtic distributions associated with higher values are Rio Branco (RBR) and Manaus (MAO), both in the North Region, followed by CGB, (Midwest). The lowest levels occurred in RIO (Southeast), FLN (South) and SAO (Southeast).

5. Results

After initial inspection of the distribution of price returns, given by the logarithm return of the series, given by r(t) = ln(pt) − ln(pt − 1), where pt is the relative price of ethanol-gasoline, we verified the degree of persistence of the series through the Hurst coefficient via , with a static analysis with the total sample and then dynamically through the sliding windows.

Among all the capitals analyzed in Table 5, Manaus (North), Recife and Salvador (Northeast) show anti-persistent behavior (H < 0.5). This means that positive returns tend to be followed by negative returns, and vice versa. In contrast, with evidence of persistent behavior (H > 0.5), there is Belém (North Region), Cuiabá (Midwest), Porto Alegre and Curitiba (South) and the capitals of the Southeast, namely, Belo Horizonte, Rio de Janeiro and Sao Paulo. Among the capitals whose results oscillate around the efficiency hypothesis (H = 0.5) are Fortaleza and Salvador (Northeast), Florianópolis (South) and Goiânia and Brasília (Midwest). In regional terms, therefore, we have evidence that the largest producer and consumer region of gasoline and ethanol presents returns with a long-term dependence behavior, while in the other regions, the behavior of returns has no well-defined pattern.

Table 5.

estimates for Brazilian capitals.

5.1. Analysis of the Degree of Persistence (DFA) of Ethanol/Gasoline Relative Price Returns

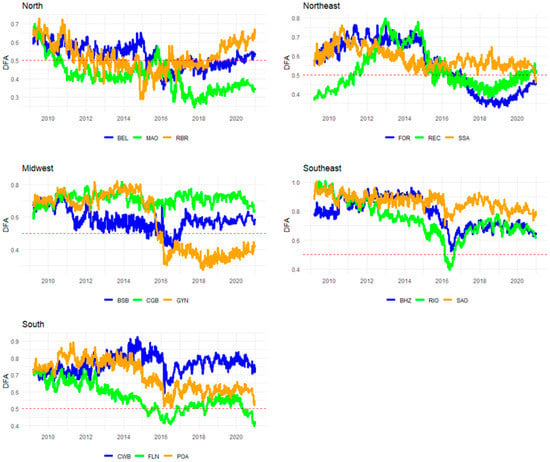

The analyzes concerning the with sliding windows for all regions (North, Northeast, Midwest, Southeast and South) discussed in the respective sub-items are shown in to Figure 1.

Figure 1.

Persistence behavior (Hurst H exponent) in Brazilian capitals through the 250-day moving window. The dashed line (H = 0.5) represents the random walk.

5.1.1. North

In the North Region, after 2010, the relative price of Manaus (MAO) presents values lower than those of efficiency in almost the entire period, with the exception of a short period in the second half of 2015. Belém (BEL) presents higher values until the end of 2015, and after that period oscillates around the efficiency level from 2017 until the end of the sample in December 2020, after showing lower values in 2016.

In Rio Branco (RBR), there was a large fluctuation in the dynamic behavior; between 2009 and 2010, the values were significantly higher than the efficiency values, and they started to fluctuate at this level, but with great volatility, between 2011 and the beginning of 2019, except for a short period in 2015, when there was strong anti-persistent behavior. Since the second half of 2019, however, the values have been systematically above the efficient reference.

Regarding the most recent dynamics, very different values of coefficients can be observed in these three capitals, including persistence (RBR), anti-persistence (MAO) and around efficiency (BEL).

5.1.2. Northeast

For Salvador (SSA), the coefficient fluctuated above the efficiency value throughout the period, especially until the beginning of 2014. In later periods, the values were closer to the reference level, but almost always at higher levels, until the end of the period. Fortaleza (FOR) also showed strong persistence until 2015, and only in mid-2016 was there a shift to values below efficiency, whose declining trend remained until mid-2018, where a change in trend can be noted, that of an increase towards efficiency until the end of the period.

Finally, Recife (REC) demonstrates anti-persistence values up to 2011, where the upward trend continues until early 2013. Between 2013 and 2014, it fluctuates at high levels, until it shows a downward trend in 2015. Between 2015 and 2016, the movements take place around efficiency, and in 2017 and 2018, the values decline and begin to operate in the space of anti-persistence. Between 2019 and 2020, the slope of the trend is reversed, and the indices start to show positive trend values towards the reference level.

Therefore, after presenting different dynamics, mainly REC at the beginning of the period and SSA after the middle of the sampling window, in a more recent period, the three coefficients start to oscillate with values closer to each other and to the efficiency level.

5.1.3. Midwest

In the entire sample, Cuiabá (CGB) always presents persistent values, and does not show a strong downward or upward trend, but oscillates around a high level of persistence. In turn, Brasília (BSB) shows a similar behavior until the end of 2010, but as of 2011, it starts to fluctuate at lower levels than CGB, and therefore closer to the efficiency value. Finally, with regard to Goiânia (GYN), until mid-2015, its behavior is very similar to CGB, but from this point, an abrupt change in behavior is evident. In 2016, with values already below the reference level, it oscillates in the anti-persistence interval, until the end of the sample.

Therefore, also in this region, there are three different behaviors for the return of the relative prices at the end of the period, with BSB and especially CGB showing persistence, and GYN with anti-persistence behavior.

5.1.4. Southeast

In the whole sample, Belo Horizonte (BHZ) presents behavior above the reference. However, from mid-2015, the values start to fluctuate at lower levels, but still higher than the reference, showing persistence. Rio de Janeiro (RIO) presents behavior similar to that of BHZ until 2012, when it moves and starts to show a declining trend until mid-2016, exhibiting anti-persistent behavior, although for a very short period. However, at the end of 2016, RIO converged again to the behavior of BHZ of a persistent nature, which remained until the end of the period.

Finally, until 2010, São Paulo (SAO) presents very similar behavior to that of RIO, and between 2011 and 2014, it shows similar dynamics to BHZ. After 2016, however, SAO shows systematic behavior of greater persistence, moving away from efficiency, compared to the two capitals of the same region, until the end of the period.

5.1.5. South

In Curitiba (CWB), the behavior observed was of high persistence throughout the sample period, and, additionally, a period of high volatility in early 2016. A possible factor is that production in this state is more directed to sugar for export, to the detriment of ethanol. Porto Alegre (POA) does not produce sugarcane, and presents behavior similar to that of CWB in the initial phase, although with greater volatility, until mid-2014. Then, it starts to oscillate closer to the reference index, although with higher values, which configures the persistence character. Florianópolis (FLN) also starts with a high coefficient, but with a downward trend, and from 2015 until the end of the period, it oscillates around the efficiency reference.

Thus, at the end of the moving window period, CWB’s behavior diverges from the other southern capitals.

5.2. Analysis of Detrended Cross-Correlations Analysis (DCCA)

5.2.1. North

The capitals of the North Region did not present a significant correlation in the scales of 4 and 8 weeks (4 s and 8 s), being brief and of low magnitude (Figure 2). In relation to the other time windows, Manaus (MAO) presents correlation only until mid-2012, mainly in the longer scales of 32 s and 64 s. Belém (BEL) exhibits a higher magnitude and significant correlation until 2015 in the intermediate scale (16 s) and longer scales (32 s and 64 s), because, as is the case with MAO in the most recent period, post-2015, it does not present a significant correlation.

Figure 2.

Evolution of between the relative prices of São Paulo and other capitals in the North Region, with time scales of 4, 8, 16, 32 and 64 weeks, and moving window w = 250. Shaded lines are the upper and lower confidence intervals, in the sense that values between these are not statistically significant, according to the critical values of [66].

In the Rio Branco market (RBR), the returns did not show a significant positive correlation, except for longer stopovers and in the pre-2011 period. On the contrary, in certain periods, there is even a negative and statistically significant correlation, which shows the great discrepancy in the behavior of returns in this capital in relation to São Paulo.

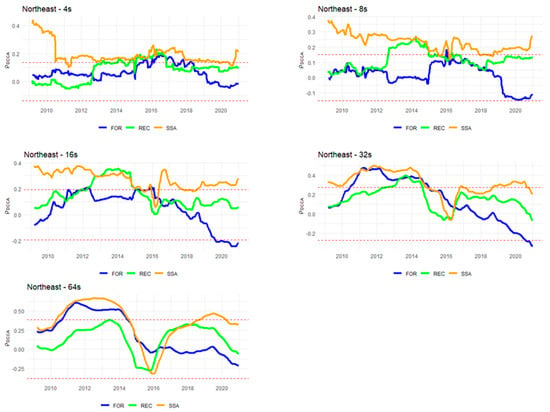

5.2.2. Northeast

Among the capitals of the Northeast, Salvador (SSA) has the most significant positive correlation at the beginning of the sampling window (Figure 3). As of 2016, however, it has only a marginally significant positive correlation on the shorter scales, up to 16 weeks. Recife (REC) only showed a positive correlation in the middle of this time interval, except in the 64 s scale, when there is no significant association, particularly in the periods of 2013 and 2014, being insignificant in most of the moving window interval.

Figure 3.

Evolution of between the relative prices of São Paulo and other capitals in the Northeast Region, with time scales of 4, 8, 16, 32 and 64 weeks, and moving window w = 250. Shaded lines are the upper and lower confidence intervals, in the sense that values between these are not statistically significant, according to the critical values of [66].

In relation to Fortaleza (FOR), there was also only some positive correlation in the first half of the window, up to mid-2014, and in the longer-term scales of 32 s and 64 s. In the most recent period, after 2016, no significant positive association was observed.

5.2.3. Midwest

Brasília (BSB) has practically no significant correlation in the 4 s scale, and a weak and moderate character in the 8 s and 16 s scales, respectively, until early 2016, since in the subsequent period, there is no significant association (Figure 4). On the other hand, the correlation strength increases in the longer scales of 32 s and 64 s until the beginning of 2016, and after this period, a positive association is observed in the rest of the sample, although with a lower relationship. Cuiabá (CGB) shows some positive correlation in the short scales of 4 s, 8 s and 16 s until the beginning of 2016. In the most recent period, there is practically no positive association in such scales, except in the period after 2020. In contrast, in the longer ranges of 32 s and 64 s, CGB shows a significant positive correlation. Finally, Goiânia (GYN), with the exception of the 4 s scale, almost always shows a positive correlation in the other scales and sample period, and in the same way, a stronger association with the other capitals of this region, with few exceptions in the entire period analyzed.

Figure 4.

Evolution of between the relative prices of São Paulo and other capitals in the Midwest Region, with time scales of 4, 8, 16, 32 and 64 weeks, and moving window w = 250. Shaded lines are the upper and lower confidence intervals, in the sense that values between these are not statistically significant, according to the critical values of [66].

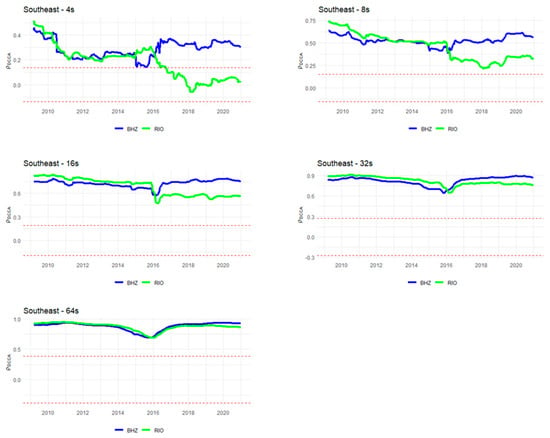

5.2.4. Southeast

On the 4 s scale, Rio de Janeiro (RIO) and Belo Horizonte (BHZ) walk very close with a significant correlation until early 2016, where BHZ shows stability in its correlation, while RIO no longer shows a significant positive association (Figure 5). For the other time scales, RIO has a higher correlation against BHZ, but this scenario changes after 2016, with BHZ surpassing the strength of correlation against RIO. It is worth mentioning that in the longer scales of 32 s and 64 s, however, there is a convergence of such correlations of strong magnitude.

Figure 5.

Evolution of between the relative prices of São Paulo and other capitals in the Southeast Region, with time scales of 4, 8, 16, 32 and 64 weeks, and moving window w = 250. Shaded lines are the upper and lower confidence intervals, in the sense that values between these are not statistically significant, according to the critical values of [66].

This strong correlation between the returns of the Southeast capitals is not paralleled in any other capital, with the exception of Curitiba (CWB) in the South Region, but neighboring São Paulo (SAO).

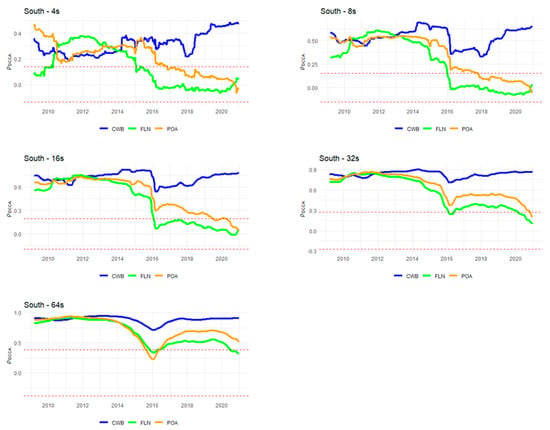

5.2.5. South

Curitiba (CWB) is the only southern capital that presents a significant correlation in all temporal scales, as well as in the whole sample (Figure 6). In general, there is a significant correlation already in the shorter scales of 4 s and 8 s, temporarily interrupted in early 2016 (8 s) and 2018 (4 s). On the longer scales, this break was smoothed out, so that the strong correlation was restored after the temporary shock. Florianópolis (FLN) and Porto Alegre (POA) present very similar behavior in all time scales, except for the very short term of 4 s.

Figure 6.

Evolution of between the relative prices of São Paulo and other capitals in the South Region, with time scales of 4, 8, 16, 32 and 64 weeks, and moving window w = 250. Shaded lines are the upper and lower confidence intervals, in the sense that values between these are not statistically significant, according to the critical values of [66].

On this scale, specifically, there is no significant correlation post-2015 (FLN) and post-2016 (POA). It is noted that for both capitals, after the shock in mid-2016, on the longer scales of 32 s and 64 s, there is a partial recovery of the correlation strength shown in the period prior to the shock, but this loses strength and shows a declining trend as it approaches the end of the sample period.

5.3. Discussion of Results

In summary, our main results indicate that, in relation to persistence, different behaviors were shown between the capitals of different regions, as well as in some cases between capitals of the same region. The capitals of the Southeast (BHZ, RIO and SAO) and CWB (South) showed persistent behavior in the most recent period. The other capitals of the South Region (FLN and POA) tended to show dynamics closer to the random walk in the most recent period.

The capitals of the Midwest (BSB, CGB and GYN) also diverged, with BSB and CGB showing persistent behavior and GYN anti-persistent dynamics. In the Northeast Region, after divergent trajectories between the capitals, in the most recent period there is behavior closer to the random walk, with values close to this reference level. Finally, in the North Region, the biggest divergence between capitals occurs in the most recent period, with persistent behavior (RBR), random walk (BEL) and anti-persistent (MAO).

With regard to correlation, in the North Region, despite the correlation at the beginning of the sampling window in BEL and MAO on longer scales, in the most recent period, a more consistent behavior of correlation is not observed in any time scales, except for some occasional temporary situations, but of low magnitude. In the Northeast, the relationship bears a certain similarity to the North, as there was a correlation in SSA at the beginning of the window (in other capitals this also occurred, depending on the time scale considered). However, at the end of the window, only SSA showed correlation in the shorter scales, but with low strength.

In the Midwest, there is a significant correlation only for GYN on the 8 and 16-week scales, while on the longer scales, all capitals show a significant positive association. In the Southeast, there is a positive correlation in all time scales considered, with the exception of RIO in the very short term, 4 weeks. Finally, in the South Region, only CWB has a positive correlation in the most recent period in all time scales, with the exception of POA in the long-term scale, but with a downward trend in the correlation strength towards the absence of correlation.

We emphasize that our results are in line with those obtained by [5], as there is evidence that the relative prices of ethanol-gasoline are more favorable in consumer centers close to ethanol producers in the post-crisis period from 2009 to 2014. Furthermore, they are consistent with the results of [9], when considering a more recent sample between 2012 and 2019 and verifying that after the new pricing policy (IPP) of Petrobrás in 2016, the capitals SAO, BHZ (both Southeast), CWB (South) and GYN and CGB (Midwest) maintained a favorable price ratio for ethanol compared to gasoline.

6. Conclusions

The present work aimed to analyze the efficiency of automotive fuel markets, in a market where fuels can be chosen by the consumer, according to their relative price. The degree of persistence in the relative price returns of hydrous ethanol-gasoline C in the main Brazilian capitals was evaluated, as well as the degree of correlation between the relative price return of the city of São Paulo and other Brazilian capitals. The city of São Paulo is the capital of the homonymous state, the main ethanol producing state in Brazil, as well as the state with the largest financial and industrial center and the largest flex-fuel fleet.

As an empirical strategy, and with sliding windows were used to analyze the degree of persistence of the series of relative prices, in line with the investigations by [47,67], as well as the new version of the cross correlation coefficient [49], namely dynamic with sliding windows [68,69]. For better understanding of our final remarks, we split them into three sub-sections.

6.1. Main Conclusions

Returning to our research question, we used the following two points of investigation: (i) is the efficiency of the relative prices of ethanol-gasoline time-varying, and (ii) is there a degree of time-varying correlation of the changes in relative price relationships in the city of São Paulo with other Brazilian capitals?

Among our main results, it was found that the degree of persistence of capitals in the Southeast has a different pattern from capitals in other states, where the results within the same region differ. There is evidence that in large regions (or states) where the supply of ethanol is greater, such as in the Southeast (SAO and BHZ) and in parts of the Midwest (CGB) and South (CWB), the trajectory of return tends to be persistent.

This suggests that in large ethanol producing regions, relative price returns tend to be more predictable and that relative price rises (falls) tend to be followed by rises (falls). In this way, the analysis helps to identify the trends in relative prices after a shock. This helps the formation of expectations for the agents of the fuel chain and for the formulation of policies in the sector. There is evidence that such behavior is not exclusive to the volume produced and consumed, but also related to the number of refiners, where the definition of retail price plays a fundamental role. Currently, there are 13 refineries in Brazil, of which 7 are located in these states [70]. It should be noted that four of these are located in the State of São Paulo (President Bernardes Refinery-RPBC, Paulínia Refinery-Replan, Henrique Lage Refinery-Revap, and Capuava Refinery-Recap), two located in Paraná (Shale manufacturing-SIX and Presidente Getúlio Vargas Refinery-Repar), and one in Minas Gerais (Gabriel Passos Refinery-Regap).

Regarding the strength of the correlation, it was also found that the regions geographically closer to São Paulo (Southeast Region) and relevant suppliers of ethanol, such as the Midwest (on longer time scales) and CWB (in the South Region, but neighboring São Paulo and with relevant production of ethanol), have a stronger price correlation, and with increasing strength as the time scale grows.

However, there is a discrepancy with the other capitals of the South Regions (FLN and POA), as well as the capitals of the North-Northeast Regions. Thus, there is strong evidence of a regionalized character, rather than a national one, of the behavior of relative ethanol prices in Brazil, especially in the most recent period of the sampling window.

6.2. Policy Implications for Private Agents and the Public Sector

This work can also help private sector agents to diversify investments in fuel retail, by verifying the specific behavior in each geographical region, as well as varying over time depending on the price policy and/or exogenous shocks. They can consider the regional behavior of relative prices in order to minimize portfolio risks at the national level, since the higher the correlation coefficients, the lower the benefits of diversifying investments. In addition, the estimates of the convergence of returns, by associating the strength of the correlation with the number of weeks of lag, can also be valuable information in building traders and brokers’ expectations, since this information is strategic in the commercialization of hydrated ethanol.

Another point is that this methodological tool can also be used by intelligence agencies in the ANP, together with other databases such as wholesale prices, in order to create auxiliary indicators in the analysis of cartelization practices or tacit collusion [58,60]. If prices are persistent, when prices rise, they tend to continue rising. In this case, the authorities, together with other metrics, can verify whether this dynamic of increasing relative prices is associated with market conditions (lower ethanol supply, oil price drops, among others) or anti-competitive practices (fraud, cartelization, etc.) that distort relative prices.

In the case of cross-correlations, these indicate how a specific location behaves in relation to other capitals in the same region. Thus, there are important elements to assist in the diagnosis when assessing whether the behavior (convergent or divergent) has economic fundamentals, or if it is the result of some price distortion.

The CADE (Administrative Council for Economic Defence), after successive increases in the prices at gas stations in a generalized way in all states of the country, began to investigate suspicions of collusion, which can occur not only explicitly, as well as tacitly, through signalization published by the media. Between 2012 and 2020, the sector was fined more than BRL 500 million [71].

As policy suggestions, there is maintenance of the fuel price policy, in parity with the prices practiced in the international market. A key issue that is difficult to resolve quickly involves a sustainable macroeconomic policy in the long term, which prevents the continuous devaluation of the national currency. In addition to making the internationalization of oil prices less costly, it also acts to control inflation, which also indirectly affects the demand for fuel, by reducing families’ purchasing power.

From the recent Brazilian experience, the government’s price control, in addition to causing losses for Petrobras’ cash, whose largest shareholder is the government, also resulted in governance problems due to minority shareholders. In particular, a large part of the burden was transferred to the sugar-energy sector, by discouraging the use of ethanol, and thus discouraging investment and the decarbonization of the economy. In addition, favoring the use of ethanol in several locations in Brazil stimulates local economies from the point of view of investments (sugarcane producers, mills and other related activities), in order to generate regional jobs in these locations.

In line with the suggestion of aligning international prices, it is necessary to encourage investments in ethanol throughout Brazil, in order to consolidate it as a viable alternative to gasoline, as well as to meet decarbonization targets. Thus, it is necessary to strengthen public agencies to formulate policies to promote the entire production chain, from sugarcane farmers to retail market ethanol.

Recent global uncertainties, both with regard to the crisis caused by the pandemic and the war between Russia and Ukraine, have had asymmetric effects on Brazilian local prices. The lower demand for fuels due to lockdown during the COVID-19 crisis, with low oil prices at the beginning of the pandemic, did not result in a significant drop in retail fuel prices. However, with the sharp rise in oil prices as a result of the war, there has been a significant transmission of those prices along the production chain, before reaching retail prices.

In Brazil, in particular, there is evidence of an asymmetric effect of fuel price shocks in various regions of the country [30], due to several aspects, among which market concentration in fuel distribution and cartelization in certain capitals and periods of time can be highlighted. In regions where the supply of ethanol is significant, this adverse shock was mitigated in certain periods, when the relative price of ethanol-gasoline was favorable, which allows the substitution of goods for a relevant proportion of consumers who use flex-fuel cars.

6.3. Limitations and Research Agenda

The present work is limited by focusing on the main capitals of each macro-region of the country, the North, Northeast, Midwest, South and Southeast, and on only three capitals per region. Future studies could analyze the dynamics of relative prices in medium and small cities located in the main ethanol producing regions, the Southeast and Midwest, to determine whether there is a convergence of prices from inland cities to their respective capitals. Future research could also lengthen the sample in order to contemplate the resurgence of global inflation and the war between Russia and Ukraine, with a strong impact on commodities generally, and energy, food and minerals in particular.

Author Contributions

Conceptualization, D.D.Q., H.L.B. and P.F.; Data curation, D.D.Q., H.L.B. and P.F.; Formal analysis, D.D.Q., H.L.B. and P.F.; Methodology, D.D.Q., H.L.B. and P.F.; Writing—original draft, D.D.Q., H.L.B. and P.F.; Writing—review and editing, D.D.Q., H.L.B. and P.F. All authors have read and agreed to the published version of the manuscript.

Funding

Derick Quintino and Heloisa Burnquist wish to acknowledge the CAPES for funding support. This study was financed in part by the Coordenação de Aperfeiçoamento de Pessoal de Nível Superior, Brasil (CAPES), Finance Code 001. Paulo Ferreira also acknowledges the financial support of Fundação para a Ciência e a Tecnologia (grants UIDB/05064/2020 and UIDB/04007/2020).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Acknowledgments

We are indebted to the insightful comments from Marta Marjotta-Maistro and Leonardo Zilio in a previous version of this paper. We also acknowledge the comments from the participants of the III International Congress on Sustainable Development, Landscape and Planning and Territorial Governance, 2021, Portalegre, Portugal. We also acknowledge the three anonymous reviewers who helped to improve the paper. All usual disclaimers apply here.

Conflicts of Interest

The authors declare no conflict of interest.

References

- SINDIPEÇAS. Relatório da Frota Circulante. 2019. Available online: https://www.sindipecas.org.br/sindinews/Economia/2019/RelatorioFrotaCirculante_Maio_2019.pdf (accessed on 5 January 2022).

- Costa, C.C.D.; Burnquist, H.L. Impactos do controle do preço da gasolina sobre o etanol biocombustível no Brasil. Estud. Econômicos 2016, 46, 1003–1028. [Google Scholar] [CrossRef][Green Version]

- Figueira, S.R.; Burnquist, H.L.; Bacchi, M.R.P. Forecasting fuel ethanol consumption in Brazil by time series models: 2006–2012. Appl. Econ. 2010, 42, 865–874. [Google Scholar] [CrossRef]

- El Montasser, G.; Gupta, R.; Martins, A.L.; Wanke, P. Are there multiple bubbles in the ethanol–gasoline price ratio of Brazil? Renew. Sustain. Energy Rev. 2015, 52, 19–23. [Google Scholar] [CrossRef]

- Laurini, M.P. The spatio-temporal dynamics of ethanol/gasoline price ratio in Brazil. Renew. Sustain. Energy Rev. 2017, 70, 1–12. [Google Scholar] [CrossRef]

- Debnath, D.; Whistance, J.; Thompson, W.; Binfield, J. Complement or substitute: Ethanol’s uncertain relationship with gasoline under alternative petroleum price and policy scenarios. Appl. Energy 2017, 191, 385–397. [Google Scholar] [CrossRef]

- Fama, E.F. Efficient capital markets: II. J. Financ. 1991, 46, 1575–1617. [Google Scholar] [CrossRef]

- Barros, C.P.; Gil-Alana, L.A.; Wanke, P. Ethanol consumption in Brazil: Empirical facts based on persistence, seasonality and breaks. Biomass Bioenergy 2014, 63, 313–320. [Google Scholar] [CrossRef]

- Nascimento Filho, A.S.; Saba, H.; dos Santos, R.G.; Calmon, J.G.A.; Araújo, M.L.; Jorge, E.M.; Murari, T.B. Analysis of Hydrous Ethanol Price Competitiveness after the Implementation of the Fossil Fuel Import Price Parity Policy in Brazil. Sustainability 2021, 13, 9899. [Google Scholar] [CrossRef]

- Samanez, C.P.; da Rocha Ferreira, L.; do Nascimento, C.C.; de Almeida Costa, L.; Bisso, C.R. Evaluating the economy embedded in the Brazilian ethanol-gasoline flex-fuel car: A real options approach. Appl. Econ. 2014, 46, 1565–1581. [Google Scholar] [CrossRef]

- David, S.A.; Inacio Junior, C.M.C.; Quintino, D.D.; Machado, J.A.T. Measuring the Brazilian ethanol and gasoline market efficiency using DFA-Hurst and fractal dimension. Energy Econ. 2020, 85, 104614. [Google Scholar] [CrossRef]

- Da Costa, C.C.; Burnquist, H.L.; Guilhoto, J.J.M. The Impact of Changes in Fuel Policies on the Brazilian Economy. Econ. Apl. 2017, 21, 635–657. [Google Scholar]

- Janda, K.; Kristoufek, L. The relationship between fuel and food prices: Methods and outcomes. Annu. Rev. Resour. Econ. 2019, 11, 195–216. [Google Scholar] [CrossRef]

- Quintino, D.D.; David, S.A.; Vian, C.E.F. Analysis of the relationship between ethanol spot and futures prices in Brazil. Int. J. Financ. Stud. 2017, 5, 11. [Google Scholar] [CrossRef]

- Capitani, D.H.D.; Junior, J.C.C.; Tonin, J.M. Integration and hedging efficiency between Brazilian and US ethanol markets. Contextus–Rev. Contemp. De Econ. E Gestão 2018, 16, 93–117. [Google Scholar]

- Dutta, A. Are global ethanol markets a ‘one great pool’? Biomass Bioenergy 2020, 132, 105–436. [Google Scholar] [CrossRef]

- Hernandez, J.A.; Uddin, G.S.; Dutta, A.; Ahmed, A.; Kang, S.H. Are ethanol markets globalized or regionalized? Phys. A Stat. Mech. Appl. 2020, 551, 124094. [Google Scholar] [CrossRef]

- Quintino, D.D.; Cantarinha, A.; Ferreira, P.J.S. Relationship between US and Brazilian ethanol prices: New evidence based on fractal regressions. Biofuels Bioprod. Biorefining 2021, 15, 1215–1220. [Google Scholar] [CrossRef]

- Palazzi, R.B.; Meira, E.; Klotzle, M.C. The sugar-ethanol-oil nexus in Brazil: Exploring the pass-through of international commodity prices to national fuel prices. J. Commod. Mark. 2022, 100257. [Google Scholar] [CrossRef]

- Dutta, A.; Bouri, E. Carbon emission and ethanol markets: Evidence from Brazil. Biofuels Bioprod. Biorefining 2019, 13, 458–463. [Google Scholar] [CrossRef]

- Uddin, G.S.; Hernandez, J.A.; Wadström, C.; Dutta, A.; Ahmed, A. Do uncertainties affect biofuel prices? Biomass Bioenergy 2021, 148, 106006. [Google Scholar] [CrossRef]

- David, S.A.; Quintino, D.D.; Inacio Junior, C.M.C.; Machado, J.T. Fractional dynamic behavior in ethanol prices series. J. Comput. Appl. Math. 2018, 339, 85–93. [Google Scholar] [CrossRef]

- Almeida, E.L.F.D.; Oliveira, P.V.D.; Losekann, L. Impactos da contenção dos preços de combustíveis no Brasil e opções de mecanismos de precificação. Rev. Bras. De Econ. Política 2015, 35, 531–556. [Google Scholar] [CrossRef]

- Quintino, D.D.; David, S.A. Quantitative analysis of feasibility of hydrous ethanol futures contracts in Brazil. Energy Econ. 2013, 40, 927–935. [Google Scholar] [CrossRef]

- Marjotta-Maistro, M.C.; Barros, G.S.A.D.C. Relações comerciais e de preços no mercado nacional de combustíveis. Rev. De Econ. E Sociol. Rural. 2003, 41, 829–858. [Google Scholar] [CrossRef][Green Version]

- Moraes, M.A.F.D.; Zilberman, D. Production of Ethanol from Sugarcane in Brazil: From State Intervention to a Free Market; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2014; Volume 43. [Google Scholar]

- Paulillo, L.F.; Soares, S.S.; Feltre, C.; Marques, D.S.P.; Vian, C.E.F. As transformações e os desafios do encadeamento produtivo do etanol no Brasil. In Quarenta Anos de Etanol em Larga Escala no Brasil; IPEA: Brasília, Brazil, 2016; p. 187. Available online: https://www3.eco.unicamp.br/nea/images/arquivos/Book_Quarenta_Anos_de_Etanol.pdf (accessed on 17 January 2022).

- EPE. Empresa de Pesquisa Energética. Série de Formação de Preços de Combustíveis: Margem Bruta de Distribuição e Revenda. 2020. Available online: https://www.epe.gov.br/sites-pt/publicacoes-dados-abertos/publicacoes/PublicacoesArquivos/publicacao-413/topico-476/SP-EPE-DPG-SDB-Abast-02-2019_DistrRev.pdf (accessed on 25 February 2021).

- ANP. Anuário Estatístico Brasileiro de Petróleo, Gás Natural e Biocombustíveis 2020. 2020. Available online: https://www.gov.br/anp/pt-br/centrais-de-conteudo/publicacoes/anuario-estatistico/arquivos-anuario-estatistico-2020/anuario-2020.pdf (accessed on 1 June 2021).

- Da Silva, A.S.; Vasconcelos, C.R.F.; Vasconcelos, S.P.; de Mattos, R.S. Symmetric transmission of prices in the retail gasoline market in Brazil. Energy Econ. 2014, 43, 11–21. [Google Scholar] [CrossRef]

- Margarido, M.A.; Dos Santos, G.R.; Vian, C.E.F.; Shikida, P.A.; Bauermann, B.C. CIDE and elasticity oscillation on the ethanol and gasoline market: Brazilian taxation policy under discussion. Ital. Rev. Agric. Econ. 2020, 75, 3–17. [Google Scholar]

- EPE. Empresa de Pesquisa Energética. Série de Formação de Preços de Combustíveis: Tributos Incidentes Sobre a Comercialização de Combustíveis no Brasil. 2020. Available online: https://www.epe.gov.br/sites-pt/publicacoes-dados-abertos/publicacoes/PublicacoesArquivos/publicacao-413/topico-562/SP-EPE-DPG-SDB-Abast-01-2020_Tributos_comercializa%C3%A7%C3%A3o.pdf (accessed on 25 February 2021).

- Mączyńska, J.; Krzywonos, M.; Kupczyk, A.; Tucki, K.; Sikora, M.; Pińkowska, H.; Wielewska, I. Production and use of biofuels for transport in Poland and Brazil–The case of bioethanol. Fuel 2019, 241, 989–996. [Google Scholar] [CrossRef]

- Vian, C.E.F. Agroindústria Canavieira: Estratégias Competitivas e Modernização; Editora Átomo: Rio de Janeiro, Brazil, 2003. [Google Scholar]

- Moraes, M.L.D.; Bacchi, M.R.P. Etanol: Do início às fases atuais de produção. Rev. De Política Agrícola 2015, 23, 5–22. [Google Scholar]

- Zilio, L.B.; Lima, R.A.D.S. Atratividade de canaviais paulistas sob a ótica da Teoria das Opções Reais. Rev. De Econ. E Sociol. Rural 2015, 53, 377–394. [Google Scholar] [CrossRef]

- Granco, G.; Caldas, M.M.; Bergtold, J.S.; Sant’Anna, A.C. Exploring the policy and social factors fueling the expansion and shift of sugarcane production in the Brazilian Cerrado. GeoJournal 2017, 82, 63–80. [Google Scholar] [CrossRef]

- ANP. Anuário Estatístico Brasileiro de Petróleo, Gás Natural e Biocombustíveis 2010. 2010. Available online: https://www.gov.br/anp/pt-br/centrais-de-conteudo/publicacoes/anuario-estatistico/arquivos-anuario-estatistico-2010/versao-para-impressao.pdf (accessed on 1 June 2021).

- Peng, C.K.; Buldyrev, S.V.; Havlin, S.; Simons, M.; Stanley, H.E.; Goldberger, A.L. On the mosaic organization of DNA sequences. Phys. Rev. E 1994, 49, 1685–1689. [Google Scholar] [CrossRef] [PubMed]

- Hwa, R.C.; Ferree, T.C. Scaling properties of fluctuations in the human electroencephalogram. Phys. Rev. E 2002, 66, 021901. [Google Scholar] [CrossRef] [PubMed]

- Mohti, W.; Dionísio, A.; Ferreira, P.; Vieira, I. Frontier markets’ efficiency: Mutual information and detrended fluctuation analyses. J. Econ. Interact. Coord. 2019, 14, 551–572. [Google Scholar] [CrossRef]

- Chen, Z.; Ivanov, P.C.; Hu, K.; Stanley, H.E. Effect of nonstationarities on detrended fluctuation analysis. Phys. Rev. E 2002, 65, 041107. [Google Scholar] [CrossRef]

- Hu, K.; Ivanov, P.C.; Chen, Z.; Carpena, P.; Stanley, H.E. Effect of trends on detrended fluctuation analysis. Phys. Rev. E 2001, 64, 011114. [Google Scholar] [CrossRef]

- Kantelhardt, J.W.; Zschiegner, S.A.; Koscielny-Bunde, E.; Havlin, S.; Bunde, A.; Stanley, H.E. Multifractal detrended fluctuation analysis of nonstationary time series. Phys. A Stat. Mech. Appl. 2002, 316, 87–114. [Google Scholar] [CrossRef]

- Cajueiro, D.O.; Tabak, B.M. The Hurst exponent over time: Testing the assertion that emerging markets are becoming more efficient. Phys. A Stat. Mech. Appl. 2004, 336, 521–537. [Google Scholar] [CrossRef]

- Cajueiro, D.O.; Tabak, B.M. Evidence of long range dependence in Asian equity markets: The role of liquidity and market restrictions. Phys. A Stat. Mech. Appl. 2004, 342, 656–664. [Google Scholar] [CrossRef]

- Alvarez-Ramirez, J.; Rodriguez, E.; Ibarra-Valdez, C. Long-range correlations and asymmetry in the Bitcoin market. Phys. A Stat. Mech. Appl. 2018, 492, 948–955. [Google Scholar] [CrossRef]

- Ferreira, P. Dynamic long-range dependences in the Swiss stock market. Empir. Econ. 2020, 58, 1541–1573. [Google Scholar] [CrossRef]

- Zebende, G.F. DCCA cross-correlation coefficient: Quantifying level of cross-correlation. Phys. A Stat. Mech. Appl. 2011, 390, 614–618. [Google Scholar] [CrossRef]

- Podobnik, B.; Stanley, H.E. Detrended cross-correlation analysis: A new method for analyzing two nonstationary time series. Phys. Rev. Lett. 2008, 100, 084102. [Google Scholar] [CrossRef] [PubMed]

- Kristoufek, L. Measuring correlations between non-stationary series with DCCA coefficient. Phys. A Stat. Mech. Appl. 2014, 402, 291–298. [Google Scholar] [CrossRef]

- Kristoufek, L. Detrending moving-average cross-correlation coefficient: Measuring cross-correlations between non-stationary series. Phys. A Stat. Mech. Appl. 2014, 406, 169–175. [Google Scholar] [CrossRef]

- Wang, G.J.; Xie, C.; Chen, Y.J.; Chen, S. Statistical properties of the foreign exchange network at different time scales: Evidence from detrended cross-correlation coefficient and minimum spanning tree. Entropy 2013, 15, 1643–1662. [Google Scholar] [CrossRef]

- Zhao, X.; Shang, P.; Huang, J. Several fundamental properties of DCCA cross-correlation coefficient. Fractals 2017, 25, 1750017. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Rivera-Castro, M.A.; Zebende, G.F. Oil and US dollar exchange rate dependence: A detrended cross-correlation approach. Energy Econ. 2014, 42, 132–139. [Google Scholar] [CrossRef]

- Pal, D.; Mitra, S.K. Interdependence between crude oil and world food prices: A detrended cross correlation analysis. Phys. A Stat. Mech. Appl. 2018, 492, 1032–1044. [Google Scholar] [CrossRef]

- Paiva, A.S.S.; Rivera-Castro, M.A.; Andrade, R.F.S. DCCA analysis of renewable and conventional energy prices. Phys. A Stat. Mech. Appl. 2018, 490, 1408–1414. [Google Scholar] [CrossRef]

- Nascimento Filho, A.S.; Pereira, E.J.A.L.; Ferreira, P.; Murari, T.B.; Moret, M.A. Cross-correlation analysis on Brazilian gasoline retail market. Phys. A Stat. Mech. Appl. 2018, 508, 550–557. [Google Scholar] [CrossRef]

- Mitra, S.K.; Bhatia, V.; Jana, R.K.; Charan, P.; Chattopadhyay, M. Changing value detrended cross correlation coefficient over time: Between crude oil and crop prices. Phys. A Stat. Mech. Appl. 2018, 506, 671–678. [Google Scholar] [CrossRef]

- Murari, T.B.; Nascimento Filho, A.S.; Pereira, E.J.; Ferreira, P.; Pitombo, S.; Pereira, H.B.; Moret, M.A. Comparative analysis between hydrous ethanol and gasoline c pricing in Brazilian retail market. Sustainability 2019, 11, 4719. [Google Scholar] [CrossRef]

- Lima, C.R.A.; de Melo, G.R.; Stosic, B.; Stosic, T. Cross-correlations between Brazilian biofuel and food market: Ethanol versus sugar. Phys. A Stat. Mech. Appl. 2019, 513, 687–693. [Google Scholar] [CrossRef]

- Fan, X.; Li, X.; Yin, J. Dynamic relationship between carbon price and coal price: Perspective based on Detrended Cross-Correlation Analysis. Energy Procedia 2019, 158, 3470–3475. [Google Scholar] [CrossRef]

- Ferreira, P.; Loures, L.C. An Econophysics Study of the S&P Global Clean Energy Index. Sustainability 2020, 12, 662. [Google Scholar]

- Casa Nova, A.; Ferreira, P.; Almeida, D.; Dionísio, A.; Quintino, D. Are Mobility and COVID-19 Related? A Dynamic Analysis for Portuguese Districts. Entropy 2021, 23, 786. [Google Scholar] [CrossRef]

- ANP. Série Histórica do Levantamento de Preços. 2021. Available online: https://www.gov.br/anp/pt-br/assuntos/precos-e-defesa-da-concorrencia/precos/precos-revenda-e-de-distribuicao-combustiveis/serie-historica-do-levantamento-de-precos (accessed on 1 June 2021).

- Podobnik, B.; Jiang, Z.Q.; Zhou, W.X.; Stanley, H.E. Statistical tests for power-law cross-correlated processes. Phys. Rev. E 2011, 84, 066118. [Google Scholar] [CrossRef]

- Ferreira, P. Long-range dependencies of Eastern European stock markets: A dynamic detrended analysis. Phys. A Stat. Mech. Appl. 2018, 505, 454–470. [Google Scholar] [CrossRef]

- Tilfani, O.; Ferreira, P.; El Boukfaoui, M.Y. Dynamic cross-correlation and dynamic contagion of stock markets: A sliding windows approach with the DCCA correlation coefficient. Empir. Econ. 2019, 60, 1127–1156. [Google Scholar] [CrossRef]

- Guedes, E.F.; Zebende, G.F. DCCA cross-correlation coefficient with sliding windows approach. Phys. A Stat. Mech. Appl. 2019, 527, 121286. [Google Scholar] [CrossRef]

- PETROBRÁS. Refinarias. 2022. Available online: https://petrobras.com.br/pt/nossas-atividades/principais-operacoes/refinarias/ (accessed on 13 January 2022).

- ESTADÃO. Cade vai Monitorar o Preço dos Combustíveis em Postos de todo o País. 2021. Available online: https://economia.estadao.com.br/noticias/geral,cade-vai-monitorar-o-preco-de-combustiveis-em-postos-de-todo-o-pais,70003621206 (accessed on 25 February 2021).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).