A Scientometric Analysis and Review of the Emissions Trading System

Abstract

1. Introduction

2. Materials and Methodology

2.1. Quantitative Statistic

2.2. Qualitative Analysis

3. Quantitative Statistics Results

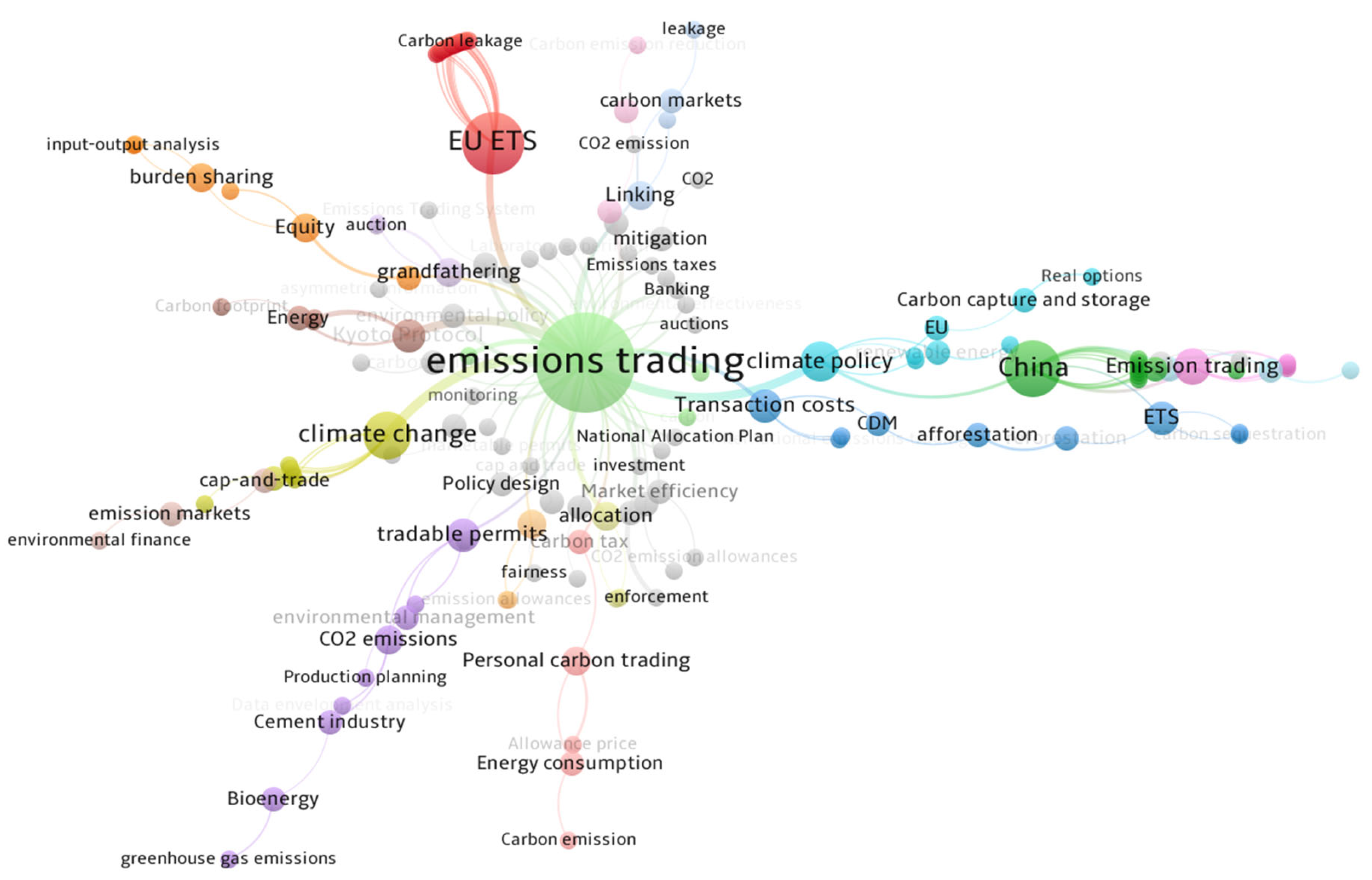

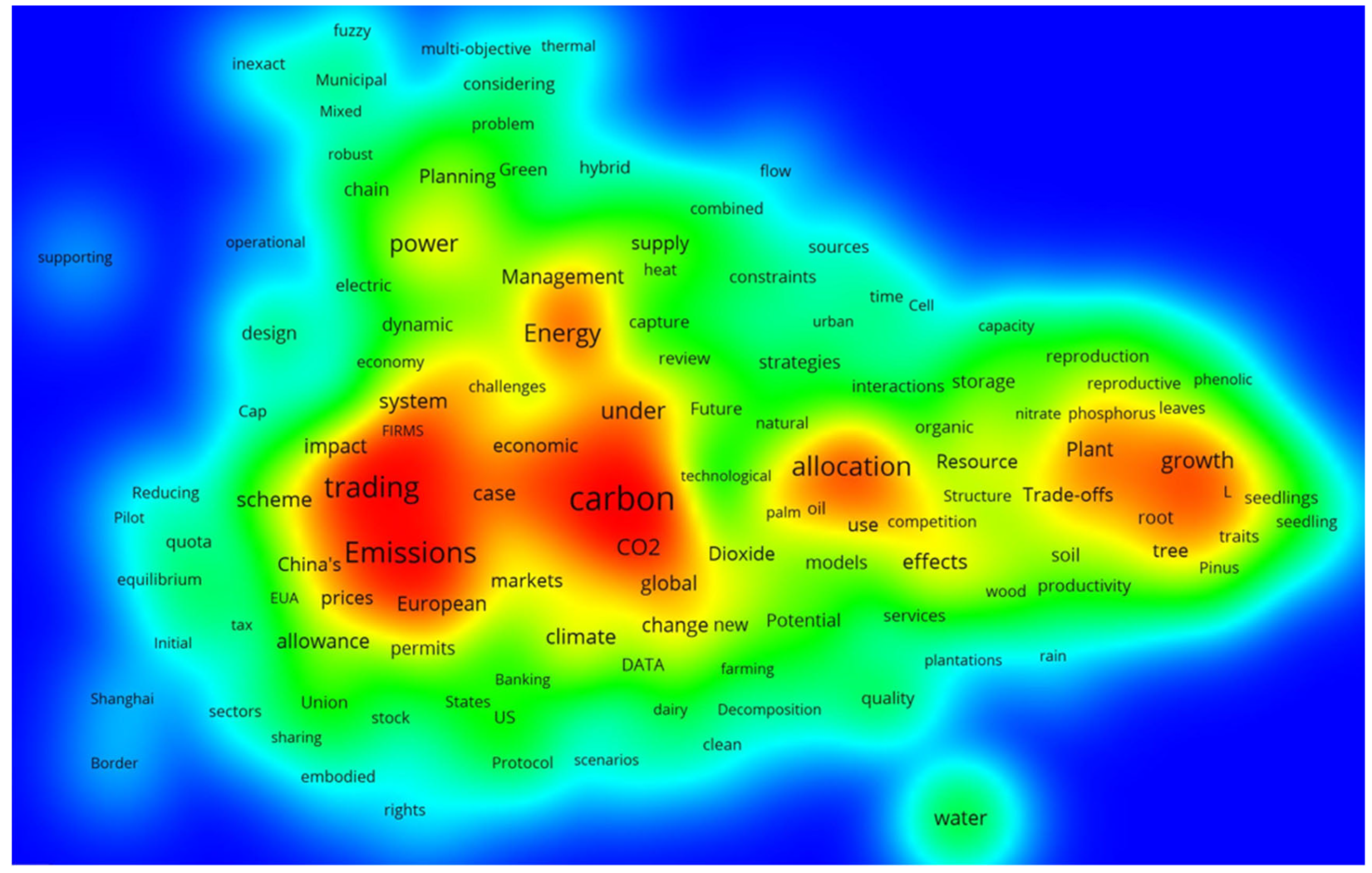

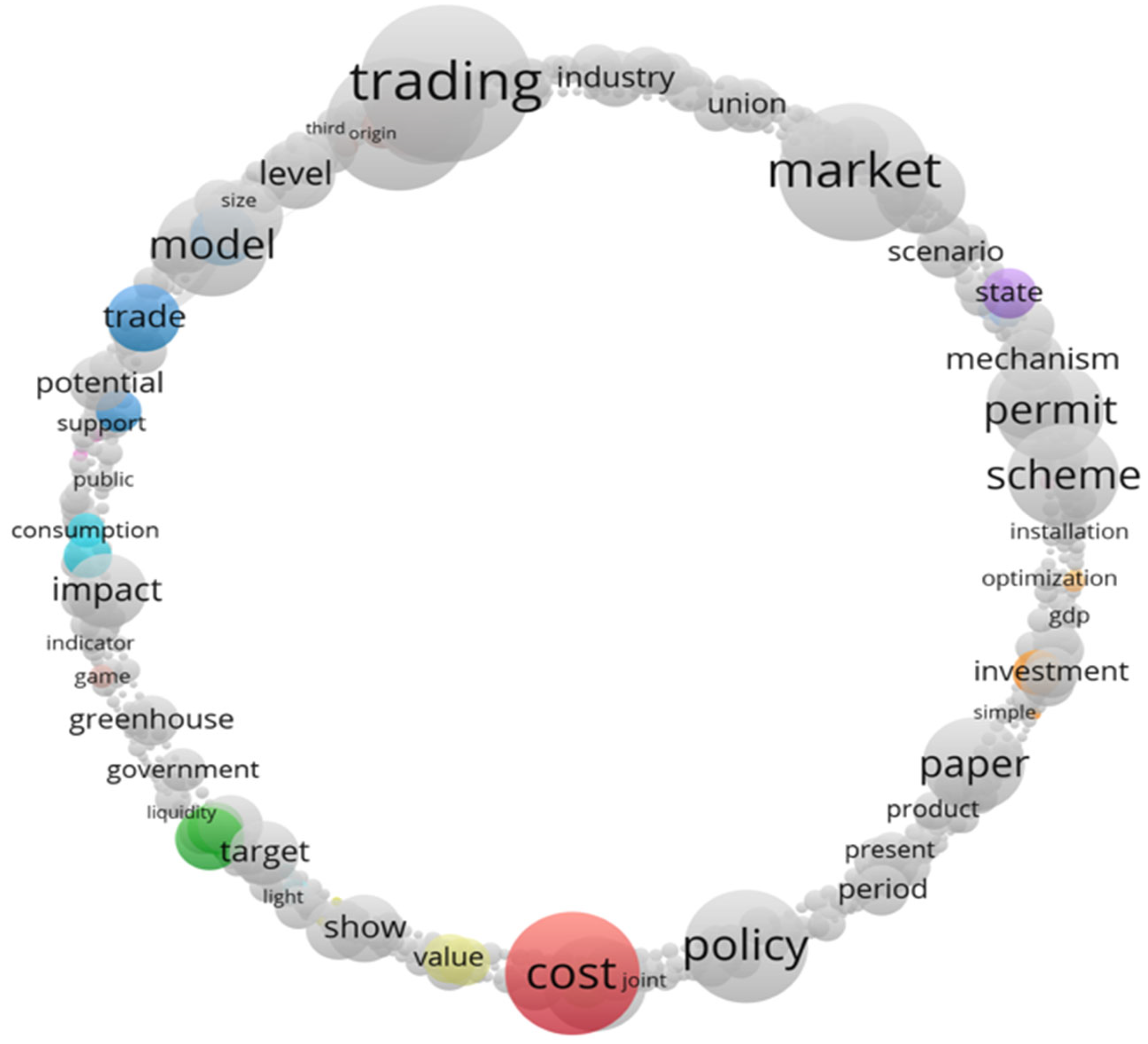

3.1. Research Hotspots on ETS Research: Allowance Allocation

3.2. Productive Subjects of Research on Allowance Allocation

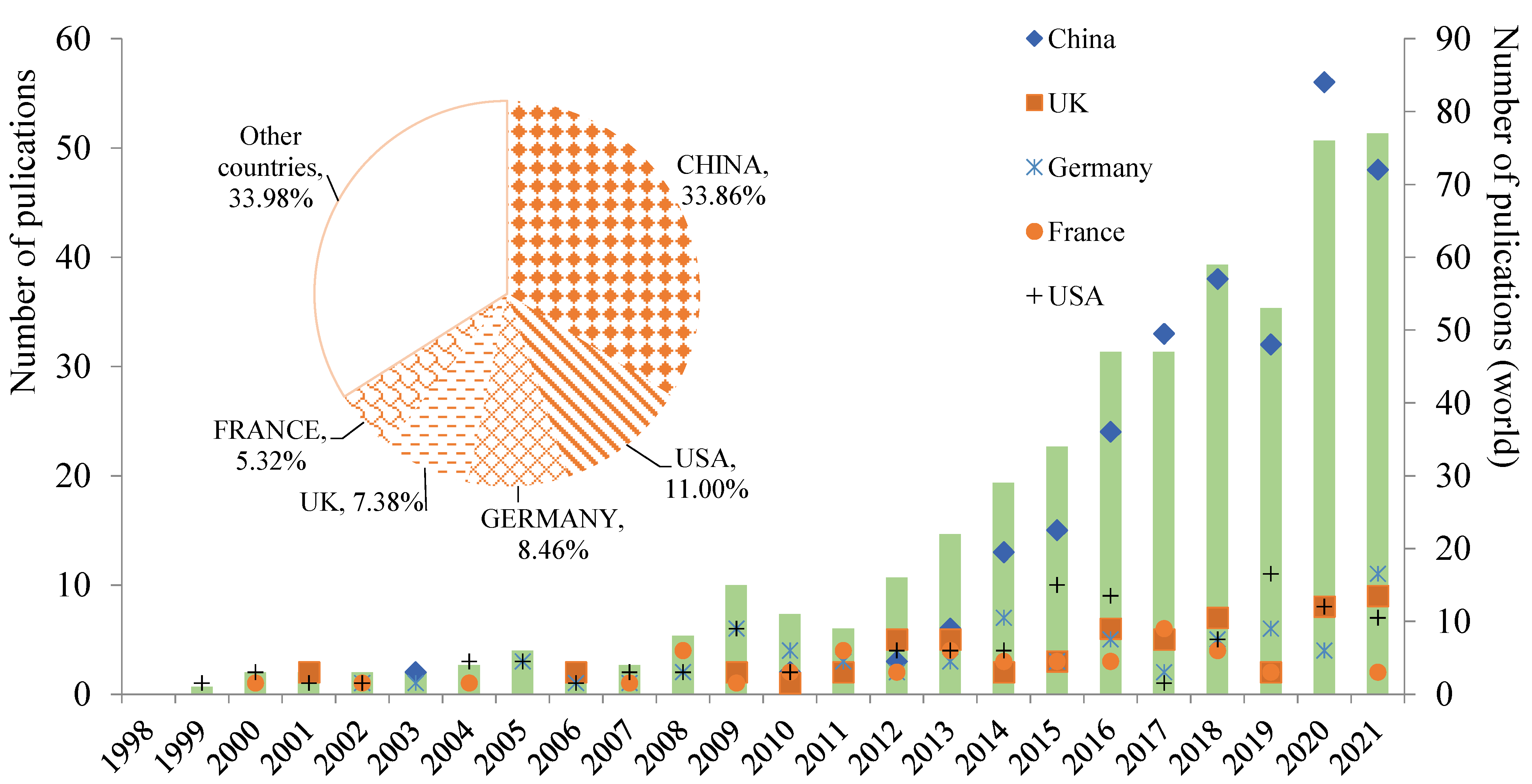

3.3. The Amount and Distribution of Publications on Allowance Allocation

3.4. Productive Authors and Institutions and the Co-Operation between Them

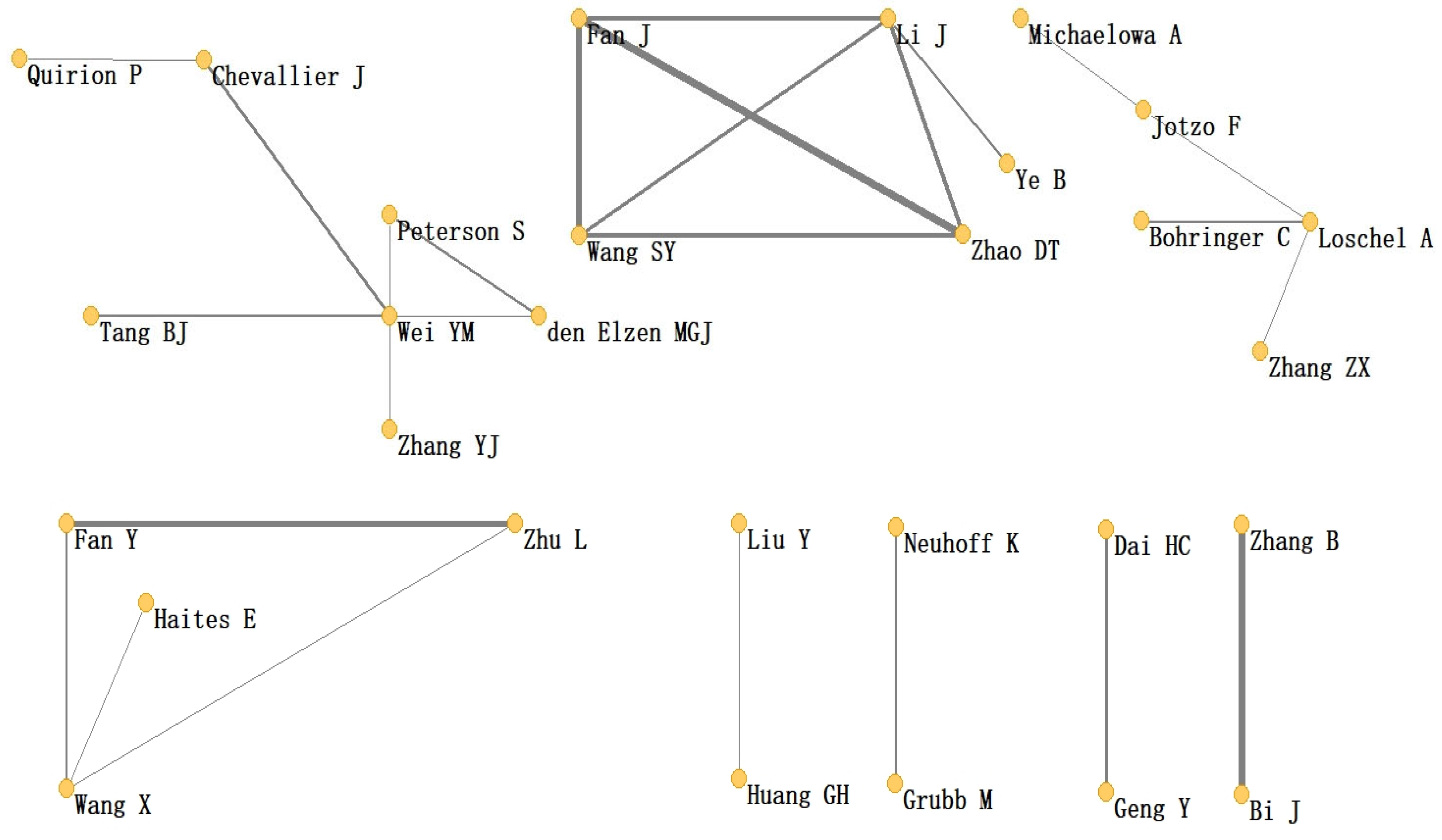

3.4.1. Productive Authors and the Co-Operation between Them

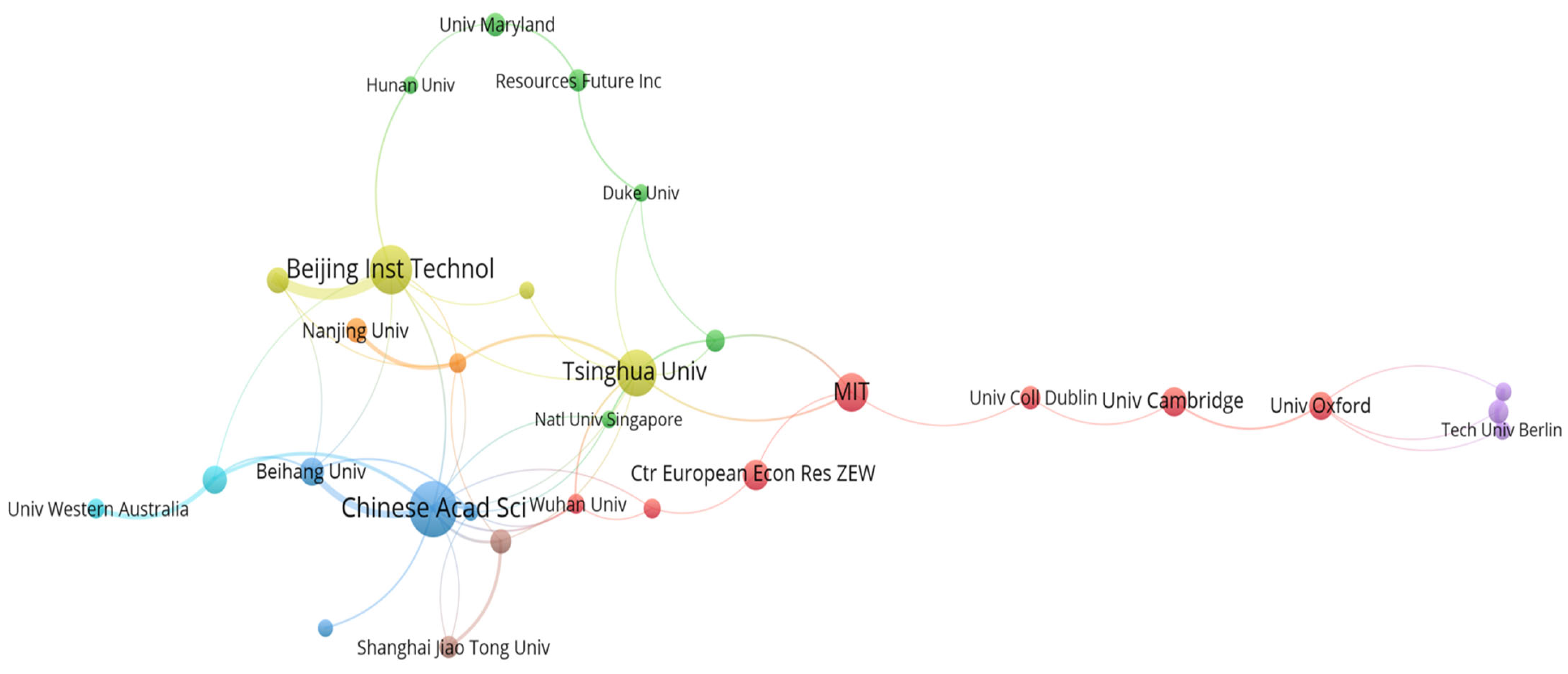

3.4.2. Productive Institutions and Co-Operation between them

4. Research Hotspots

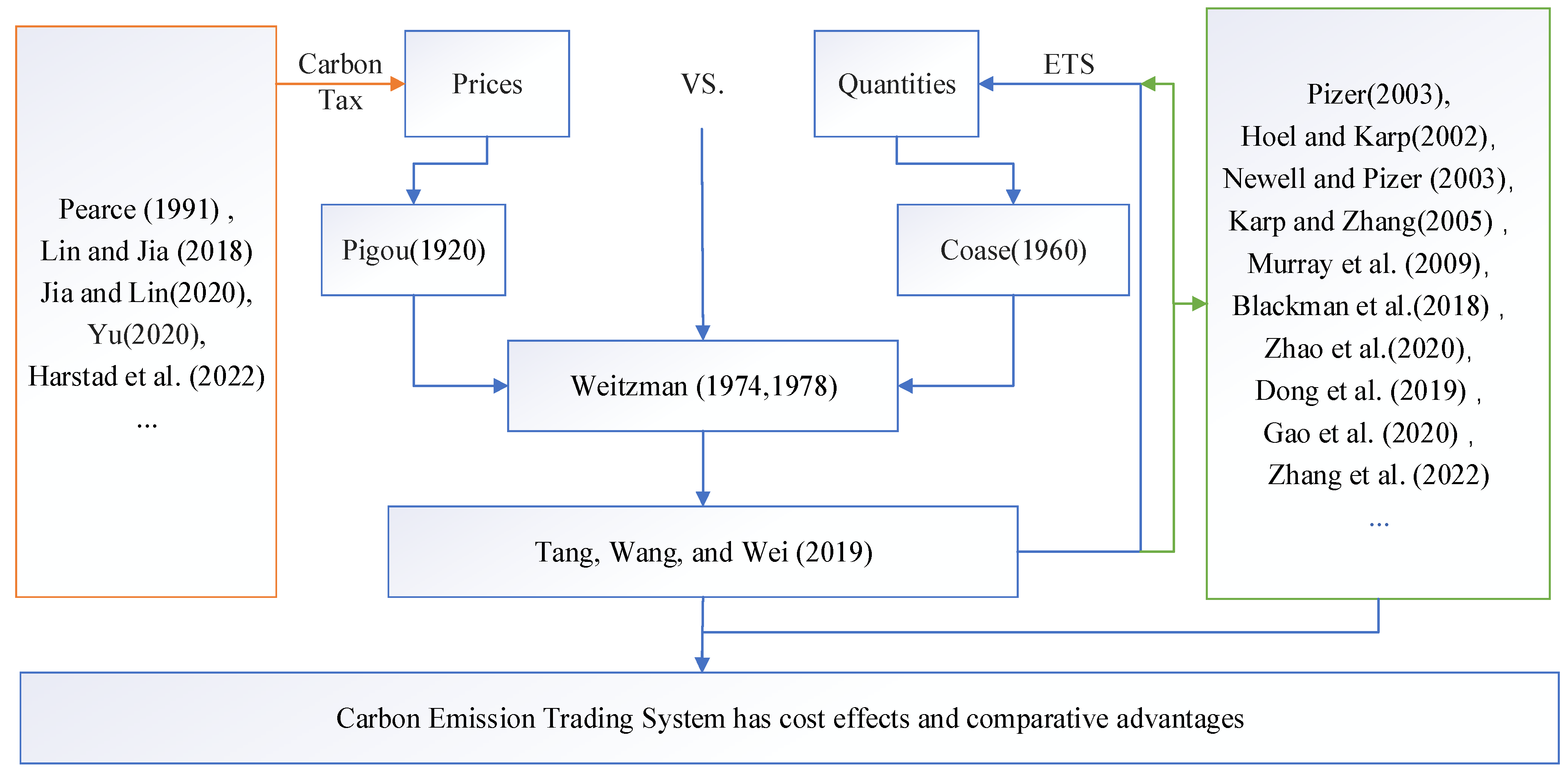

4.1. Carbon Emissions Trading System Has Cost Effects and Comparative Advantages

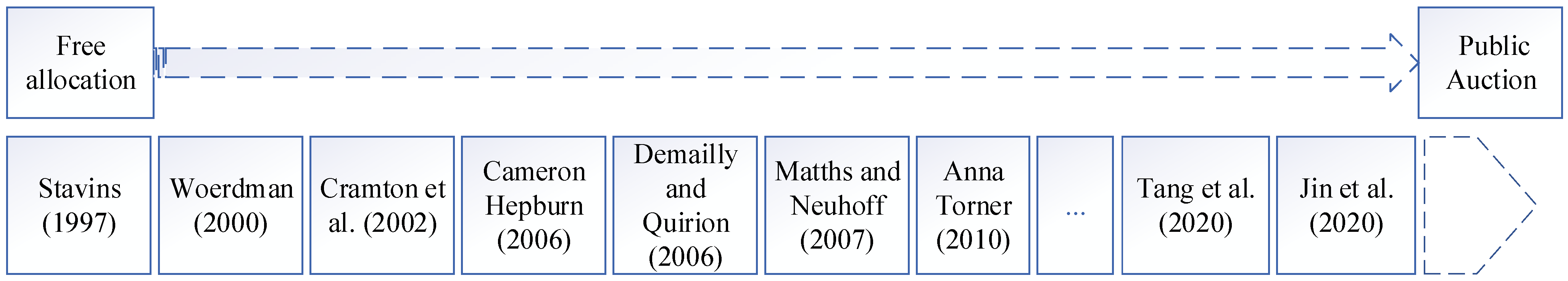

4.2. Methods of Allowance Allocation in the ETS

4.3. Research on the Impact of Allowance Allocation and Evidence from the Power Sector

5. Conclusions and Discussion

6. Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- IPCC. Climate Change 2022: Mitigation of Climate Change; Skea, J., Shukla, P.R., Slade, R., al Khourdajie, A., van Diemen, R., McCollum, D., Pathak, M., Some, S., Vyas, P., Fradera, R., et al., Eds.; IPCC: Geneva, Switzerland, 2022. [Google Scholar]

- ICAP. Emissions Trading Worldwide: Status Report 2022; ICAP: Berlin, Germany, 2022. [Google Scholar]

- Coase, R.H. The Problem of Social Cost. J. Law Econ. 1960, 3, 1–44. [Google Scholar] [CrossRef]

- Cañas-Guerrero, I.; Mazarrón, F.R.; Calleja-Perucho, C.; Pou-Merina, A. Bibliometric analysis in the international context of the “Construction & Building Technology” category from the Web of Science database. Constr. Build. Mater. 2014, 53, 13–25. [Google Scholar]

- Du, H.; Li, B.; Brown, M.A.; Mao, G.; Rameezdeen, R.; Chen, H. Expanding and shifting trends in carbon market research: A quantitative bibliometric study. J. Clean. Prod. 2015, 103, 104–111. [Google Scholar] [CrossRef]

- Kiriyama, E.; Kajikawa, Y.; Fujita, K.; Iwata, S. A lead for transvaluation of global nuclear energy research and funded projects in Japan. Appl. Energy 2013, 109, 145–153. [Google Scholar] [CrossRef]

- Wei, Y.-M.; Mi, Z.-F.; Huang, Z. Climate policy modeling: An online SCI-E and SSCI based literature review. Omega 2015, 57, 70–84. [Google Scholar] [CrossRef]

- Yu, H.; Wei, Y.-M.; Tang, B.-J.; Mi, Z.; Pan, S.-Y. Assessment on the research trend of low-carbon energy technology investment: A bibliometric analysis. Appl. Energy 2016, 184, 960–970. [Google Scholar] [CrossRef]

- Zhang, K.; Wang, Q.; Liang, Q.-M.; Chen, H. A bibliometric analysis of research on carbon tax from 1989 to 2014. Renew. Sustain. Energy Rev. 2016, 58, 297–310. [Google Scholar] [CrossRef]

- Wang, X.-Y.; Tang, B.-J. Review of comparative studies on market mechanisms for carbon emission reduction: A bibliometric analysis. Nat. Hazards 2018, 94, 1141–1162. [Google Scholar] [CrossRef]

- Ji, C.J.; Li, X.Y.; Hu, Y.J.; Wang, X.Y.; Glade, T.; Murty, T.S. Research on carbon price in emissions trading scheme: A bibliometric analysis. Nat. Hazards 2019, 99, 1381–1396. [Google Scholar] [CrossRef]

- Tang, L.; Wang, H.; Li, L.; Yang, K.; Mi, Z. Quantitative models in emission trading system research: A literature review. Renew. Sustain. Energy Rev. 2020, 132, 110052. [Google Scholar] [CrossRef]

- Hepburn, C. Regulation by Prices, Quantities, or Both: A Review of Instrument Choice. Oxf. Rev. Econ. Policy 2006, 22, 226–247. [Google Scholar] [CrossRef]

- Weitzman, M. Prices vs. Quantities; Massachusetts Institute of Technology (MIT), Department of Economics: Cambridge, MA, USA, 1973. [Google Scholar]

- Weitzman, M.L. Optimal Rewards for Economic Regulation. Am. Econ. Rev. 2001, 68, 683–691. [Google Scholar]

- Pierce, D. The role of carbon taxes in adjusting to global warming. Econ. J. 1991, 101, 938–948. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. Impact of quota decline scheme of emission trading in China: A dynamic recursive CGE model. Energy 2018, 149, 190–203. [Google Scholar] [CrossRef]

- Gao, Y.; Li, M.; Xue, J.; Liu, Y. Evaluation of effectiveness of China’s carbon emissions trading scheme in carbon mitigation. Energy Econ. 2020, 90, 104872. [Google Scholar] [CrossRef]

- Jia, Z.; Lin, B. Rethinking the choice of carbon tax and carbon trading in China. Technol. Forecast. Soc. Chang. 2020, 159, 120187. [Google Scholar] [CrossRef]

- Harstad, B.; Lancia, F.; Russo, A. Prices vs. quantities for self-enforcing agreements. J. Environ. Econ. Manag. 2022, 111, 102595. [Google Scholar] [CrossRef]

- Tang, B.-J.; Wang, X.-Y.; Wei, Y.-M. Quantities versus prices for best social welfare in carbon reduction: A literature review. Appl. Energy 2019, 233–234, 554–564. [Google Scholar] [CrossRef]

- Zhao, L.; Yang, C.; Su, B.; Zeng, S. Research on a single policy or policy mix in carbon emissions reduction. J. Clean. Prod. 2020, 267, 122030. [Google Scholar] [CrossRef]

- Allen, B.; Li, Z.; Liu, A.A. Efficacy of Command-and-Control and Market-Based Environmental Regulation in Developing Countries. Annu. Rev. Resour. Econ. 2018, 10, 381–404. [Google Scholar] [CrossRef]

- Wei, C. China’s urban CO2 marginal abatement costs and its influencing factors. World Econ. 2014, 431, 115–137. [Google Scholar]

- Soto, H.D. The Mystery of Capital: Why Capitalism Triumphs in the West and Fails Everywhere Else; Basic Books: New York, NY, USA, 2000. [Google Scholar]

- Hoel, M.; Karp, L. Taxes versus quotas for a stock pollutant. Resour. Energy Econ. 2002, 24, 367–384. [Google Scholar] [CrossRef]

- Hoel, M.; Karp, L. Taxes vs. Quotas for a Stock Pollutant with Multiplicative Uncertainty. Resour. Energy Econ. 2001, 82, 91–114. [Google Scholar]

- Newell, R.G.; Pizer, W.A. Regulating stock externalities under uncertainty. J. Environ. Econ. Manag. 2003, 45, 416–432. [Google Scholar] [CrossRef]

- Larry Karp, J.Z. Regulation of Stock Externalities with Correlated Abatement Costs. Environ. Resour. Econ. 2005, 32, 273–300. [Google Scholar] [CrossRef]

- Murray, B.C.; Newell, R.G.; Pizer, W.A. Balancing Cost and Emissions Certainty: An Allowance Reserve for Cap-and-Trade. Rev. Environ. Econ. Policy 2009, 3, 84–103. [Google Scholar] [CrossRef]

- Dong, F.; Dai, Y.; Zhang, S.; Zhang, X.; Long, R. Can a carbon emission trading scheme generate the Porter effect? Evidence from pilot areas in China. Sci. Total Environ. 2019, 653, 565–577. [Google Scholar] [CrossRef]

- Dong, Z.; Xia, C.; Fang, K.; Zhang, W. Effect of the carbon emissions trading policy on the co-benefits of carbon emissions reduction and air pollution control. Energy Policy 2022, 165, 112998. [Google Scholar] [CrossRef]

- Zhang, W.; Li, G.; Guo, F. Does carbon emissions trading promote green technology innovation in China? Appl. Energy 2022, 315, 119012. [Google Scholar] [CrossRef]

- Ringius, L.; Torvanger, A.; Holtsmark, B. Can multi-criteria rules fairly distribute climate burdens?: OECD results from three burden sharing rules. Energy Policy 1998, 26, 777–793. [Google Scholar] [CrossRef]

- William, N. A Question of Balance: Weighing the Options on Global Warming Policies; Yale University Press: London, UK, 2008; Volume 9, pp. 146–147. [Google Scholar]

- Rose, A.; Stevens, B.; Edmonds, J.; Wise, M. International Equity and Differentiation in Global Warming Policy. Environ. Resour. Econ. 1998, 12, 25–51. [Google Scholar] [CrossRef]

- Miao, Z.; Geng, Y.; Sheng, J. Efficient allocation of CO2 emissions in China: A zero sum gains data envelopment model. J. Clean. Prod. 2016, 112, 4144–4150. [Google Scholar] [CrossRef]

- Wang, K.; Zhang, X.; Wei, Y.-M.; Yu, S. Regional allocation of CO2 emissions allowance over provinces in China by 2020. Energy Policy 2013, 54, 214–229. [Google Scholar] [CrossRef]

- Ellerman, A.D.; Buchner, B.K. The European Union Emissions Trading Scheme: Origins, Allocation, and Early Results. Rev. Environ. Econ. Policy 2007, 1, 66–87. [Google Scholar] [CrossRef]

- Betz, R.; Eichhammer, W.; Schleich, J. Designing National Allocation Plans for Eu-Emissions Trading—A First Analysis of the Outcomes. Energy Environ. 2004, 15, 375–425. [Google Scholar] [CrossRef]

- Betz, R.; Rogge, K.; Schleich, J. EU emissions trading: An early analysis of national allocation plans for 2008–2012. Clim. Policy 2006, 6, 361–394. [Google Scholar] [CrossRef]

- Wei, Y.-M.; Zou, L.-L.; Wang, K.; Yi, W.-J.; Wang, L. Review of proposals for an Agreement on Future Climate Policy: Perspectives from the responsibilities for GHG reduction. Energy Strategy Rev. 2013, 2, 161–168. [Google Scholar] [CrossRef]

- Stavins, R.N. Policy Instruments for Climate Change: How Can National Governments Address a Global Problem? Univ. Chic. Leg. Forum 1997, 1997, 10. [Google Scholar]

- Woerdman, E. Implementing the Kyoto protocol: Why JI and CDM show more promise than international emissions trading. Energy Policy 2000, 28, 29–38. [Google Scholar] [CrossRef]

- Matthes, F.C.; Neuhoff, K. Auctioning in the European Union Emissions Trading Scheme; Öko-Institut: Berlin, Germany; University of Cambridge: Cambridge, UK, 2007. [Google Scholar]

- Egenhofer, C.; Georgiev, A.; Torner, A.; van den Bergh, H. Benchmarking in the EU: Lessons from the EU Emissions Trading System for the Global Climate Change Agenda; CEPS Task Force Report, 11 June 2010; Centre for European Policy Studies: Brussels, Belgium, 2022. [Google Scholar]

- Li, S.; Wang, J. The impact of the transaction under the different distribution of initial emission rights on the market structure. J. Wuhan Univ. Technol. (Transp. Sci. Eng. Ed.) 2004, 28, 40–43. [Google Scholar]

- Bangtao, H.T.W. Emissions trading pricing model based on governance cost and pollutant income. Shanghai Manag. Sci. 2004, 6, 34–36. [Google Scholar]

- Min, H. Analysis of Shadow Price Model for Emission Permit Pricing. Price Mon. 2007, 2, 19–22. [Google Scholar]

- Yunhua, L. On the pricing mechanism and influencing factors of the emissions trading market. Contemp. Econ. Manag. 2009, 31, 1–4. [Google Scholar]

- Yan, L.; Wu, T. Initial allocation and transaction model of emission rights based on shadow price. J. Chongqing Univ. Technol. (Soc. Sci. Ed.) 2010, 24, 53–56. [Google Scholar]

- Demailly, D.; Quirion, P. CO2 abatement, competitiveness and leakage in the European cement industry under the EU ETS: Grandfathering versus output-based allocation. Clim. Policy 2006, 6, 93–113. [Google Scholar] [CrossRef]

- Hepburn, C.; Grubb, M.; Neuhoff, K.; Matthes, F.; Tse, M. Auctioning of EU ETS phase II allowances: How and why? Clim. Policy 2006, 6, 137–160. [Google Scholar] [CrossRef]

- Cramton, P.; Kerr, S. Tradeable carbon permit auctions: How and why to auction not grandfather. Energy Policy 2002, 30, 333–345. [Google Scholar] [CrossRef]

- Tang, B.-J.; Ji, C.-J.; Hu, Y.-J.; Tan, J.-X.; Wang, X.-Y. Optimal carbon allowance price in China’s carbon emission trading system: Perspective from the multi-sectoral marginal abatement cost. J. Clean. Prod. 2020, 253, 119945. [Google Scholar] [CrossRef]

- Jin, Y.; Liu, X.; Chen, X.; Dai, H. Allowance allocation matters in China’s carbon emissions trading system. Energy Econ. 2020, 92, 105012. [Google Scholar] [CrossRef]

- Baifu, X. Allowable Total Distributing Method and Equity-Benefit Principle. Pollut. Prev. Technol. 1994, 1, 14–16. [Google Scholar]

- Ding Ding, F.J. On the choice of China’s carbon trading quota allocation method. Int. Bus. (J. Univ. Int. Bus. Econ.) 2013, 1, 83–92. [Google Scholar]

- Qi, S.; Wang, B. Initial quota allocation for carbon trading: A comparative analysis of patterns and methods. J. Wuhan Univ. (Philos. Soc. Sci. Ed.) 2013, 5, 19–28. [Google Scholar]

- Li, F.; Wang, W. Comparative Research on Quota Allocation Methods in China’s Pilot Carbon Market. Res. Econ. Manag. 2015, 36, 9–15. [Google Scholar]

- Böhringer, C.; Lange, A. Economic Implications of Alternative Allocation Schemes for Emission Allowances: A Theoretical and Applied Analysis. ZEW Discuss. Pap. 2003, 107, 563–581. [Google Scholar]

- Li, W.; Jia, Z. The impact of emission trading scheme and the ratio of free quota: A dynamic recursive CGE model in China. Appl. Energy 2016, 174, 1–14. [Google Scholar] [CrossRef]

- Li, W.; Zhang, Y.-W.; Lu, C. The impact on electric power industry under the implementation of national carbon trading market in China: A dynamic CGE analysis. J. Clean. Prod. 2018, 200, 511–523. [Google Scholar] [CrossRef]

- Zhang, L.; Li, Y.; Jia, Z. Impact of carbon allowance allocation on power industry in China’s carbon trading market: Computable general equilibrium based analysis. Appl. Energy 2018, 229, 814–827. [Google Scholar] [CrossRef]

- Burtraw, D.; Palmer, K.; Bharvirkar, R.; Paul, A. The Effect on Asset Values of the Allocation of Carbon Dioxide Emission Allowances. Electr. J. 2002, 15, 51–62. [Google Scholar] [CrossRef]

- Neuhoff, K.; Åhman, M.; Betz, R.; Cludius, J.; Ferrario, F.; Holmgren, K.; Pal, G.; Grubb, M.; Matthes, F.; Rogge, K.; et al. Implications of announced phase II national allocation plans for the EU ETS. Clim. Policy 2006, 6, 411–422. [Google Scholar] [CrossRef][Green Version]

- Neuhoff, K.; Grubb, M.; Keats, K. Impact of the allowance allocation on prices and efficiency. Camb. Work. Pap. Econ. 2005, 19–603. [Google Scholar] [CrossRef]

- Neuhoff, K.; Martinez, K.K.; Sato, M. Allocation, incentives and distortions: The impact of EU ETS emissions allowance allocations to the electricity sector. Clim. Policy 2006, 6, 73–91. [Google Scholar] [CrossRef]

- Chen, Y.; Sijm, J.; Hobbs, B.F.; Lise, W. Implications of CO2 emissions trading for short-run electricity market outcomes in northwest Europe. J. Regul. Econ. 2008, 34, 251–281. [Google Scholar] [CrossRef]

- Lise, W.; Sijm, J.; Hobbs, B.F. The Impact of the EU ETS on Prices, Profits and Emissions in the Power Sector: Simulation Results with the COMPETES EU20 Model. Environ. Resour. Econ. 2010, 47, 23–44. [Google Scholar] [CrossRef]

- Sijm, J.; Neuhoff, K.; Chen, Y. CO2 cost pass-through and windfall profits in the power sector. Clim. Policy 2006, 6, 49–72. [Google Scholar] [CrossRef]

- Sijm, J.P.M.; Bakker, S.J.A.; Chen, Y.; Harmsen, H.W.; Lise, W. CO2 price dynamics: The implications of EU emissions trading for electricity prices & operations. In Proceedings of the 2006 IEEE Power Engineering Society General Meeting, Montreal, QC, Canada, 18–22 June 2006; p. 4. [Google Scholar]

- Sterner, T.; Muller, A. Output and abatement effects of allocation readjustment in permit trade. Clim. Chang. 2008, 86, 33–49. [Google Scholar] [CrossRef]

- Zhou, X.; James, G.; Liebman, A.; Dong, Z.Y.; Ziser, C. Partial Carbon Permits Allocation of Potential Emission Trading Scheme in Australian Electricity Market. IEEE Trans. Power Syst. 2010, 25, 543–553. [Google Scholar] [CrossRef]

- Cong, R.-G.; Wei, Y.-M. Potential impact of (CET) carbon emissions trading on China’s power sector: A perspective from different allowance allocation options. Energy 2010, 35, 3921–3931. [Google Scholar] [CrossRef]

- Cong, R.-G.; Wei, Y.-M. Experimental comparison of impact of auction format on carbon allowance market. Renew. Sustain. Energy Rev. 2012, 16, 4148–4156. [Google Scholar] [CrossRef]

- Westner, G.; Madlener, R. The impact of modified EU ETS allocation principles on the economics of CHP-based district heating systems. J. Clean. Prod. 2012, 20, 47–60. [Google Scholar] [CrossRef]

- Jouvet, P.-A.; Solier, B. An overview of CO2 cost pass-through to electricity prices in Europe. Energy Policy 2013, 61, 1370–1376. [Google Scholar] [CrossRef]

- Ahn, J. Assessment of initial emission allowance allocation methods in the Korean electricity market. Energy Econ. 2014, 43, 244–255. [Google Scholar] [CrossRef]

- Liu, L.; Sun, X.; Chen, C.; Zhao, E. How will auctioning impact on the carbon emission abatement cost of electric power generation sector in China? Appl. Energy 2016, 168, 594–609. [Google Scholar] [CrossRef]

- Goulder, L.H.; Long, X.; Lu, J.; Morgenstern, R.D. China’s unconventional nationwide CO2 emissions trading system: Cost-effectiveness and distributional impacts. J. Environ. Econ. Manag. 2022, 111, 102561. [Google Scholar] [CrossRef]

| Subjects | Publications | Percentage |

|---|---|---|

| Environmental Studies | 318 | 38.22% |

| Environmental Sciences | 286 | 34.38% |

| Economics | 285 | 34.26% |

| Energy Fuels | 205 | 24.64% |

| Green Sustainable Science Technology | 126 | 15.14% |

| Environmental Engineering | 77 | 9.26% |

| Public Administration | 76 | 9.14% |

| Chemical Engineering | 37 | 4.45% |

| Operations Research/Management Science | 22 | 2.64% |

| Business | 21 | 2.52% |

| Journal | 2021 Impact Factor | Average Citations | h Index |

|---|---|---|---|

| Energy Policy | 5.354 | 38.29 | 30 |

| Journal of Cleaner Production | 7.646 | 23.55 | 24 |

| Energy Economics | 7.042 | 37.78 | 23 |

| Applied Energy | 9.007 | 40.42 | 22 |

| Climate Policy | 5.085 | 21.63 | 22 |

| Ecological Economics | 4.718 | 45.36 | 9 |

| Sustainability | 2.806 | 7.71 | 9 |

| Energy | 6.255 | 32.08 | 9 |

| Renewable and Sustainable Energy Reviews | 12.549 | 35.69 | 8 |

| Journal of Environmental Economics and Management | 4.624 | 14.69 | 8 |

| Authors | Average Citations per Article | h Index | Country |

|---|---|---|---|

| Bohringer C | 29.88 | 13 | Germany |

| Wei YM | 32.37 | 11 | China |

| Chevallier J | 28.47 | 10 | France |

| Loschel A | 25.50 | 9 | Germany |

| Den Elzen MGJ | 30.67 | 9 | Netherlands |

| Burtraw D | 29.50 | 9 | USA |

| Ellerman AD | 67.30 | 8 | USA |

| Stranlund JK | 16.67 | 8 | USA |

| Zhang ZX | 17.88 | 7 | China |

| Jotzo F | 29.13 | 7 | Australia |

| Fan Y | 14.54 | 7 | China |

| Quirion P | 45.63 | 7 | France |

| Neuhoff K | 59.88 | 7 | Germany |

| Cason TN | 33.71 | 7 | USA |

| Wettestad J | 13.71 | 6 | Norway |

| Institutions | All Articles | All Citations | h Index | Country |

|---|---|---|---|---|

| Beijing Inst. Technol. | 33 | 786 | 15 | China |

| MIT | 25 | 905 | 13 | USA |

| Univ. Cambridge | 18 | 887 | 12 | UK |

| Chinese Acad. Sci. | 39 | 635 | 12 | China |

| Potsdam Inst. Climate Impact Res. | 14 | 291 | 10 | Germany |

| Univ. Maryland | 14 | 349 | 10 | USA |

| Ctr. European Econ. Res. ZEW | 19 | 387 | 10 | Germany |

| Tsinghua Univ. | 31 | 260 | 10 | China |

| Univ. Paris 09 | 12 | 211 | 9 | France |

| Harvard Univ. | 9 | 357 | 9 | USA |

| ETH | 13 | 277 | 9 | Switzerland |

| Univ. Massachusetts | 12 | 373 | 9 | USA |

| Univ. Groningen | 15 | 190 | 9 | Netherlands |

| Resources Future Inc. | 13 | 256 | 9 | USA |

| Univ. Coll. Dublin | 14 | 366 | 9 | Ireland |

| Title | Authors, Year | Regions | Model |

|---|---|---|---|

| Economic Implications of Alternative Allocation Schemes for Emission Allowances | Bohringer C, Lange A. 2005 | EU and USA | CGE |

| The impact of emission trading scheme and the ratio of free quota: A dynamic recursive CGE model in China | Li W, Jia ZJ. 2016 | China | CGE |

| The impact on electric power industry under the implementation of national carbon trading market in China: A dynamic CGE analysis | Wei Li, Yan-Wu Zhang, Can Lu. 2018 | China | A dynamic CGE |

| Impact of carbon allowance allocation on power industry in China’s carbon trading market: Computable General Equilibrium based analysis | Lirong Zhang, Yakun Li, Zhijie Jia. 2018 | China | CGE |

| Impact of quota decline scheme of emission trading in China: A dynamic recursive CGE model | Boqiang Lin, Zhijie Jia. 2018 | China | A dynamic recursive CGE model |

| Title | Authors, Year | Regions | Model |

|---|---|---|---|

| The Effect of Allowance Allocation on the Cost of Carbon Emission Trading | Dallas Burtraw, Karen Palmer, RanjitBharvirkar, and Anthony Paul. 2001 | USA | Haiku model with an Industrial Sector Model (INSECT) |

| Allocation of carbon emission certificates in the power sector: how generators profit from grandfathered rights | Martinez KK; Neuhoff K. 2005 | EU | Integrated Planning Model® (IPM) |

| Impact of the allowance allocation on prices and efficiency | Karsten Neuhoff, Michael Grubb and Kim Keats. 2005 | EU | Analytic models and IPM |

| CO2 cost pass-through and windfall profits in the power sector | Sijm J; Neuhoff K; Chen Y. 2006 | Germany and Netherlands | COMPETES and IPM |

| Allocation, incentives and distortions: the impact of EU ETS emissions allowance allocations to the electricity sector | Neuhoff K; Martinez KK; Sato M. 2006 | EU | IPM |

| Implications of CO2 emissions trading for short-run electricity market outcomes in northwest Europe | Chen YH; Sijm J; Hobbs BF; Lise W. 2008 | Nortwesern Europe | COMPETES |

| The Impact of the EU ETS on Prices, Profits and Emissions in the Power Sector: Simulation Results with the COMPETES EU20 Model | Lise W; Sijm J; Hobbs BF. 2010 | EU | Carbon cost pass-through, COMPETES |

| CO2 price dynamics: The implications of EU emissions trading for the price of electricity | J.P.M. Sijm, S.J.A. Bakker, Y. Chen H.W. Harmsen, W. Lise. 2005. | Nortwesern Europe | COMPETES model |

| Output and abatement effects of allocation readjustment in permit trade | Sterner T; Muller A. 2008 | EU | A multiple-period model |

| Partial Carbon Permits Allocation of Potential Emission Trading Scheme in Australian Electricity Market | Zhou X; James G; Liebman A; Dong ZY; Ziser C. 2010 | Australian | Australian National Electricity Market modeling |

| The impact of modified EU ETS allocation principles on the economics of CHP-based district heating systems | Westner G; Madlener R. 2012 | EU | A spread-based real options model and discounted cash-flow model |

| An overview of CO2 cost pass-through to electricity prices in Europe | Pierre-AndréJouvet, BorisSolier. 2013 | EU | The marginal abatement cost function |

| Assessment of initial emission allowance allocation methods in the Korean electricity market | Jaekyun Ahn. 2014 | Korea | A mixed complementarity problem (MCP) model |

| How will auctioning impact on the carbon emission abatement cost of electric power generation sector in China? | Liu LW; Sun XR; Chen CX; Zhao ED. 2016 | China | The modified Trans-log production function, dynamic simulation model and multi-objective linear programming |

| China’s unconventional nationwide CO2 emissions trading system: Cost-effectiveness and distributional impacts | Lawrence H. Goulder, Xianling Long, Jieyi Lu, Richard D. Morgenstern. 2022 | China | Analytically and numerically solved models |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hu, Y.-J.; Yang, L.; Duan, F.; Wang, H.; Li, C. A Scientometric Analysis and Review of the Emissions Trading System. Energies 2022, 15, 4423. https://doi.org/10.3390/en15124423

Hu Y-J, Yang L, Duan F, Wang H, Li C. A Scientometric Analysis and Review of the Emissions Trading System. Energies. 2022; 15(12):4423. https://doi.org/10.3390/en15124423

Chicago/Turabian StyleHu, Yu-Jie, Lishan Yang, Fali Duan, Honglei Wang, and Chengjiang Li. 2022. "A Scientometric Analysis and Review of the Emissions Trading System" Energies 15, no. 12: 4423. https://doi.org/10.3390/en15124423

APA StyleHu, Y.-J., Yang, L., Duan, F., Wang, H., & Li, C. (2022). A Scientometric Analysis and Review of the Emissions Trading System. Energies, 15(12), 4423. https://doi.org/10.3390/en15124423