1. Introduction

In 1982, Chile enacted a comprehensive reform of its Electricity Act to create a wholesale energy market for generation companies and large customers to negotiate supply contracts [

1]. To create the energy market, the Act unbundled generation and transmission activities, obliging transmission asset owners to give generators open access to their facilities, although without initially prohibiting vertical integration.

Appendix A briefly describes the Chilean energy market design.

As of 2020, the Chilean transmission system consisted of about 2000 facilities, including 34,877 km of lines. Of this total, 6241 km corresponded to lines with a voltage between 23 kV and 100 kV, 5598 km to 110 kV lines, 1438 km to 154 kV lines; 16,445 km to 220 kV; 408 km to 345 kV; and 4747 km to 500 kV lines.

This paper describes the Chilean original transmission regulation, assesses the pertinence of subsequent changes, and describes the present challenge resulting from the rapid expansion of renewables.

Unbundling of generation and transmission has been common in most electric reforms, a change that significantly transformed the traditional power industry and brought new challenges to transmission planning and financing (see [

2,

3]). Uncertainty in the initial market rules and the return on investment in the transition period discouraged transmission investment. In particular, unbundling was generally accompanied by the transfer of the risk of grid expansion errors from consumers, who previously compensated for any grid expansion regardless of its efficiency, to private investors (see [

4]).

Chile was not immune to these problems. The Chilean Act provided the establishment of transmission networks open to all participants but limited access to unused capacity and left it to the parties to negotiate tolls. Thus, generation companies became responsible for expanding the transmission system when their additional needs exceeded the available capacity. They could do so independently or negotiate terms with owners of existing transmission facilities.

The Act drafters expected a competitive electricity market in which generators would decide and pay for their transmission investments or hire transmission services as they do for other assets. Thus, they left transmission unregulated, except for the obligation to interconnect facilities and provide open access. This design ignored the scale and scope economies in transmission development, the latter resulting from the use that different pairs of suppliers and demanders make of the same transmission facilities. The reliance on merchant investment decisions caused significant difficulties in grid access and expansion, a possibility considered by Ref. [

5] in a model that incorporates some realistic features of the transmission network.

The above situation led lawmakers to amend the Act in 2004 [

1]. First, they strengthened the institutional framework of the electricity sector by creating an independent adjudication body for conflict resolution: The Panel of Electrical Experts (Panel). Moreover, a 2005 legal change incorporated representatives of large customers into the boards of the energy dispatch centers, which were previously composed of representatives of generators and transmission companies only. In 2016, the two existing dispatch centers merged to prepare the interconnection of the transmission systems at the end of 2017. The merged institution, created by law as an independent institution, became known as the Coordinator. To simplify notation, we will call dispatch centers the Coordinator. Second, the amended Act instructs the regulatory agency—the National Energy Commission (the Commission)—to prepare an annual transmission expansion plan. Interested parties (consumers, generators, and transmission owners) may petition for modifications to the Commission’s preliminary plan and appeal to the Panel those requests that the Commission rejects. Once the Commission issues the final expansion plan, incorporating the Panel’s decisions, the Act mandates the dispatch centers to publicly auction the projects in the plan using as award criteria the annual compensation for twenty years requested by the bidders.

Thus, the new transmission regulatory design combines centralized expansion planning, involving both the regulator and interested parties, with a market mechanism—auctions—to award projects and determine transmission remuneration. Central planning, first limited to the backbone transmission system, was extended to the whole transmission system in 2016.

The 2004 legal change also modified the payment regime for transmission facilities not auctioned or operating for more than 20 years. The Commission calculates every four years for each section the remuneration that covers its efficient investment, operation, maintenance, and administration costs. The Act also enabled open access to transmission facilities non-discriminatory by abolishing incumbent generators’ grandfathering. Indeed, the 2004 Act mandates prorating available transmission capacity based on users’ needs regardless of whether they are incumbents or entrants.

Regarding the financing of transmission payments, the 2004 Act reform establishes that generators pay the so-called tariff revenue to the owner of each transmission section. The tariff revenue equals the section’s marginal cost of transmission multiplied by the energy flow. The marginal cost of transmission corresponds to the section’s transmission energy loss valued using the node spot price. It, thus, corresponds to the difference between the locational marginal prices at the two ends of the section (see

Appendix B). As noted by Ref. [

4], markets that employ locational marginal pricing consider network constraints explicitly.

The tariff revenue (congestion revenue) is likely insufficient to compensate for the total costs of a section capacity [

6,

7]. Therefore, the Act establishes a second payment that covers the difference between a section’s remuneration and its tariff revenue, known as the basic toll. For auctioned installations, the approach is similar, the differences being that the tendered installation is equivalent to a section, and the remuneration is the auction award payment. The 2004 amendment allocated the basic toll to consumers and generators based on usage criteria. A 2016 legal change transferred the entire burden exclusively to final clients, pro rata to their consumption.

Table 1 summarizes the original transmission regulation and its subsequent changes.

Chilean transmission regulatory changes summarized in

Table 1 progressed in the direction of the best practices reported in the literature. The current regulation tends to meet the standards for ensuring efficient transmission investments set in [

8]: (i) using a forward-looking cost-benefit analysis to decide on expansion and identify the expected beneficiaries, and (ii) assigning transmission costs to the beneficiaries. The Commission develops an annual expansion plan according to forward-looking welfare-maximizing criteria. Competitive auctions determine the remuneration for new installations, and the regulator sets the compensation for old transmission sections according to efficiency criteria. The tendering of the expansion works based on guaranteed revenues for 20 years resolves the difficulties that [

9] finds in various transmission payment mechanisms.

The allocation of the fixed charges of the transmission system among consumers based on their consumption would be the sole departure from the established best-practice standard. However, measuring the benefits generators and consumers derive from the transmission system is complex. The same transmission path may benefit consumers or generators depending on the time of day, season, hydrology, or other conditions. The transmission regulations usually assign fixed transmission charges among beneficiaries based on some usage measure devoid of a theoretical basis [

8]. Moreover, they normally ignore market power issues. In this sense, as we analyze later, the Chilean allocation of transmission costs has merit regarding increasing competition in the energy market.

Despite seemingly appropriate transmission regulations in Chile, significant amounts of renewable energy have spilled over due to congested transmission lines in recent years, resulting in a less efficient and sustainable electric system operation. Three factors combine to cause this outcome. The first one is the rapid expansion of photovoltaic (PV) and wind energy from 2015 onwards. PV generation increased from 2% of the total country’s generation in 2015 to 13% in 2021, while wind generation increased from 3% to 9% in the same period. The second is the location of these renewable resources away from conventional power plants, requiring the construction of new lines to transport energy to the large demand centers. The last factor is the delays in the commissioning of the lines.

The authorities foresaw the above trends, as evidenced by three features introduced in the Act in 2016. The first is the mandate to the Ministry of Energy (Ministry) to publish a 30-year horizon prospective study every five years. The second is the power given to the Ministry to identify areas with abundant Renewable Energy (RE) where developments are likely (development zones) and instruct the Commission to consider them in the annual transmission plans. The third feature is undertaking strip studies by the Ministry for the land used by new transmission installations, including graveling the strip with easements and carrying out a strategic environmental impact study. Their purpose was to anticipate and guide the RE expansion, reduce the approval times for the environmental impact study, facilitate the negotiation of the easements, and foresee technological advances.

There is still incipient experience in the application of these planning tools. The long-term strategic plan for the 2023–2027 period considers two development zones. The process still requires the initiation of the strategic environmental assessment. Moreover, there are two unfinished processes of strip studies, referring to the expansion plans for the years 2017 and 2020, respectively. This slow application of new powers by the Ministry of Energy illustrates the difficulties in solving the transmission expansion challenges.

The curtailment of RE is not new [

10]. Transmission expansion has become a global concern in the process of decarbonizing the energy matrix [

11]. Citizen opposition, based on environmental apprehensions, has made it difficult to obtain construction permits for the necessary lines [

12]. Ref. [

13] notes that due to public opposition to the construction of new lines on environmental grounds, “… quite often, ten years will pass before construction can be started—and, in some cases, the license can be even denied, so that construction never starts at all”. In short, transmission expansions have become time-intensive [

14].

The Chilean experience shows that implementation problems delay much-needed investments even with a centralized planning scheme, which plots transmission based on forecasts of expected demand and territorial generation expansion. Further analysis of incentive mechanisms to expedite transmission expansion in rapid technological change is needed.

The rest of this paper is organized as follows.

Section 2 describes the shortcomings of the initial transmission regulations. The

Section 3 assesses the regulatory changes.

Section 4 evaluates the Chilean current transmission norms. The

Section 5 analyses the application of these norms. The

Section 6 concludes the work.

2. The Shortcomings of the Initial Regulation

The Chilean Act issued in 1982 mandated all electricity companies located in an area to interconnect and obliged the owners of transmission assets to grant generators access to their facilities if capacity was available. The obligation applied to installations operating under a concession regime, a condition satisfied by almost all installations operated as it facilitated using public property and imposing easements on private land. Although the Act provided that generators had to compensate owners of transmission facilities for their investment, maintenance, and operating costs based on their peak-hour usage, it left to the parties to negotiate the tolls.

The Act excluded any form of centralized planning, leaving the expansion of the grid to individual decisions. It stipulated that a generator planning to increase its power transmission beyond the available capacity of some facilities had to expand them at its own expense. Furthermore, the Act did not establish any special requirements for those planning to build a transmission line, apart from obtaining the usual sectoral permits and coordinating the connection with the owners of existing facilities.

The shortcomings of the initial approach soon revealed themselves [

1]. The strong economies of scale in transmission development and the activity’s weak regulation gave the owners of transmission assets substantial market power. This situation was particularly critical in a vertical-integration context where the largest generator in the Central Interconnected System owned the backbone transmission system. Moreover, it was hard for generation companies to build and finance grid expansions, which also required agreements with their owners.

In 1990, legislators addressed these issues by introducing a mandatory arbitration process if the parties could not agree on transmission tolls (Law 18922, Mining Ministry). The amendment also established criteria for calculating tolls unless the parties agreed otherwise. The length, cost, and unpredictability, as previous decisions did not create case law, made arbitration an ineffective solution. Moreover, arbitrations did not guarantee efficient pricing, as their resulting tolls depended on their sophistication, likely less than a regulatory process [

15].

The guidelines distinguished three components in the remuneration of transmission assets: the ‘tariff revenue’, the ‘basic toll’, and, where appropriate, the ‘additional toll’. The tariff revenue of a transmission section corresponded to the locational hourly marginal cost of energy differential between its end nodes times the electricity flow. The Coordinator computed (and computes) the locational hourly marginal cost of energy—usually referred to as the node spot prices—with the model used to optimize the operation of the electricity system. A section’s basic toll equaled the difference between its total cost and its tariff revenue.

Power plant owners were required to contribute pro rata to their uses to pay the basic toll of all the facilities affected by their energy injections, the so-called Areas of Influence (AI). The payment of the basic toll entitled the power plant to withdraw electricity at all system nodes located in its AI and at all nodes from which net energy transmissions to the AI occurred under typical system operating conditions.

The power plant owners willing to withdraw electricity at nodes different from those listed in the previous paragraph had to agree with the proprietors of the installations involved on additional tolls. The payment of these tolls granted the plant owner the right to withdraw electricity at all nodes from which there were net physical transmissions to the nodes covered by the additional tolls under typical system operating conditions. The Act mandated calculating these tolls the same way as the basic ones.

The guidelines for calculating transmission payments left a wide margin for determining aspects, such as the apportionment of basic tolls between plants and the cost of transmission services. The vertical integration of the electricity sector exacerbated the difficulties in regulating transmission. Despite distinguishing three activities (generation, transmission, and distribution), the 1982 Act had not prohibited their vertical integration. In 1990, Endesa, the largest generation company in the Central Interconnected System, owned the backbone of that system.

Vertical integration gave Endesa a competitive edge as its rivals did suffer the costs and uncertainty associated with the transmission tariff setting process. Although rival generators could access the transmission system before agreeing on tolls, they risked signing power supply contracts without knowing the transmission cost. Endesa had greater bargaining power when there was no transmission capacity, as it was under no obligation to expand the grid.

Four years after the 1990 legal change, Endesa had only concluded temporary contracts with the users of its transmission facilities. Additionally, in all negotiations between Endesa and another generator (Colbún), reaching an agreement took the maximum legal time (280 days), and, on average, the settlement payment was 50% less than the amount Endesa had intended [

16]. Chilgener, at this time the other large generator in the most extensive interconnected system, connected to the biggest consumption center through its lines.

In 1990, Colbún asked Endesa to transport energy from a power plant that was to come on stream that year. Unable to reach an agreement, they initiated an arbitration process. In 1994, given the length of the process and fearing an adverse ruling, Colbún chose to build a transmission line, estimating its annual investment and operating costs at US$11.5 million. After learning of Colbún’s plan, Endesa lowered the requested annual toll from US$21 million to US$10.3 million. However, Colbún stood by its decision and built a line that became operational in 1997.

The Antitrust Resolution Commission (ARC) ruled in 1997 that Endesa should transfer its transmission assets to a subsidiary with a single business line listed on the stock exchange and open to third-party shareholders. The ARC ruling also called on the lawmakers to amend the law as soon as possible to clarify existing ambiguities regarding usage and fees of transmission facilities.

The government issued Decree 327 in 1999, slightly refining the criteria introduced in 1990. The decree also entrusted the system coordinator, for reference purposes only, to (i) establish the AI of each generating plant; (ii) prepare annual five-year projections of the available capacity in the different sections of the system; (iii) calculate the value of the basic toll; and (iv) collect information regarding the projections of energy transmission needs and tariff revenues.

In 2000, Endesa sold the transmission subsidiary it had created (Transelec). In 2003, the government supplemented Decree 327 by detailing the Coordinator’s criteria in determining the plants’ influence areas. It also mandated the Coordinator to calculate referential prorations of the basic tolls among the plants.

All agents did not share the criteria for remunerating transmission facilities and sharing the load between generators. In particular, the new owner of the backbone transmission system complained that the provisions that allowed generators to withdraw power without payment at nodes where electricity flowed in the direction of their areas of influence left some lines unremunerated [

15]. Thus, it had slowed down its expansion after its divestiture from Endesa, leaving the regulator hands-tied as owners of transmission assets had no obligation to expand capacity.

3. Transmission Regulatory Changes

The situation described in the previous section was the prelude to the first comprehensive change in transmission regulation implemented by Chilean lawmakers in 2004 (Law 19,940), modifications that Law 20,936 deepened 12 years later.

The 2004 Act amendment distinguished three types of transmission segments: the national transmission systems (NTS), the zonal transmission systems (ZTS), and the dedicated transmission systems (DTS). From 2004 to 2016, the NTS was called Backbone System, the ZTS—Sub-transmission System, and the DTS—Additional Lines.

The NTSs interconnect the other transmission segments, allowing the formation of an electricity market. The ZTSs, in turn, are those systems essentially set up for the supply of territorially identifiable regulated customers. Finally, the DTSs primarily supply energy to unregulated clients or evacuate it from generating plants.

The amended Act subjects NTS and ZTS systems to an open-access regime and service obligation, abolishing grandfathering rights in transmission access. DTSs’ spare capacities were subject to the same regime when they used forced easements on private property (based on concessions) or public assets. The 2016 Act Amendment removed the latter conditions and detailed the criteria for determining DTSs’ capacity availability.

The 2016 Act amendment also introduced two new transmission categories: the development pole transmission systems (DPTS) and the International Interconnection Systems (IIS). The DPTSs consist of facilities intended to transport RE produced in a territorially identifiable area, whose exploitation using a single transmission system is in the public interest. In turn, the IISs consist of facilities for transporting electricity to and from abroad.

The 2004 Act amendment introduced central planning for the NTS. It mandates the Commission to carry out an annual process to elaborate an expansion plan that must consider a horizon of at least twenty years and the long-term energy planning report developed by the Ministry of Energy after 2016. The responsibility for expanding other systems rested with their owners. The 2016 Act amendment expanded planning to the ZTSs, the DPTSs, and the DTSs if they also transport electricity for regulated consumers.

Planning aims to select the set of projects that meet future transport needs at the minimum system costs for the planning horizon. The latter implies minimizing investment costs in generation and transmission and system operating costs for given demand projections. The plan considers power plants under construction, but otherwise, the generation expansion considered in the planning is only indicative since generation investment decisions are decentralized.

The planning process includes the participation of all interested parties. The Commission convenes an instance for investors to present project proposals and then issues a preliminary technical report with the annual expansion plan, which the participants may observe. The Commission then issues the final technical report on the plan, accepting or rejecting the observations raised. The participants may object to the Commission’s decisions with the Panel of Experts.

Between 2014 and 2021, the Panel resolved 111 petitions on works included or proposed not considered in the expansion plan. About 45% of them were resolved favorably by the Panel of Experts, or the Commission accepted the request as part of the discrepancy resolution process. After the Panel rules on the objections, the Commission prepares the final annual expansion plan, including reserved maximum values for the works, and the Coordinator later auctions the works.

Projects are qualified as new works or as enlargements of existing facilities. As of 2004, the Coordinator awards the new works to the bidders submitting the lowest annual payment bid for their construction, maintenance, administration, and operation for 20 years. Owners, first, and the Coordinator, after 2016, award enlargement works to those construction companies bidding the lowest investment value (IV) for executing them. The owners finance the enlargement works and receive for 20 years the annual investment value (AIV) plus the annual operation, maintenance, and administration costs (OMAC).

The calculation of the AIV of an enlargement work considers the auction’s IV, its expected lifetime, and the discount rate, which the 2004 Act amendment set at 10% before taxes. Since 2016, it has been determined using the capital asset pricing model (CAPM) but confined to a 7–10% range after taxes.

Currently, the Electricity Act treats NTS facilities commissioned before 2004 and ZTS facilities before 2016, which we will refer to as regulated facilities, similarly to enlargement. The sole difference is that the Commission fixes their IVs every four years, based on their physical and technical characteristics and valuing assets at current market prices according to an efficient acquisition principle.

In the same regulatory process, the Commission defines transmission sub-systems and determines the OMAC of each of them, assuming that a single efficient company operates all facilities. Then, broadly speaking, it apportions the total OMAC to owners of transmission sections based on the VI of their assets (the OMAC allocated to auctioned installations does not modify their annual payments). Asset owners can challenge the Commission’s estimates to the Panel of Experts.

This process also allocates the remuneration of the NTS among users. For this purpose, the Act, after the 2004 reform, established a two-tier tariff consisting of a variable congestion charge and a basic toll charge. The latter covers the difference between the remuneration, determined by the Commission or set in the corresponding auction process, and the congestion revenue.

A transmission section’s congestion variable charge equals the marginal loss of electricity valued using the system’s locational hourly marginal costs of energy (HMCE). Generators finance the congestion charge through the difference of HMCEs between the entry node and the exit node of transmission sections (see

Appendix B). Thus, a section’s congestion remuneration—the congestion revenue—equals the variable congestion charge times the amount of energy flowing through it.

The 2004 reform allocated the basic toll among consumers and generators. It provided the financing of the Area of Common Influence, which corresponds to the highest energy injection and withdrawal density NTS zone, by generators (80%) and consumers (20%). Each generator’s financing share was a fixed value determined pro rata of its expected usage of the area facilities, while the consumers’ part was allocated based on energy withdrawals. As for the other NTS facilities, the 2004 legal change introduced sharing methods (Generalized Generation Distribution Factor, GGDF, and Generalized Load Distribution Factor, GLDF) to allocate the costs among generators and consumers (the latter through contracts with generators that withdraw energy from the system to supply them).

As of 2016, the Act assigns the entire payment of the basic toll to consumers in proportion to their consumption.

The 2004 Act amendment instructed the Commission to calculate tolls for ZTS sections aiming to cover their efficient AIV and OMAC. The Commission estimated these tolls ex ante using demand projections, but there was no ex post reconciliation, as was the case with the NTS causing a financial risk for developers. The 2016 Act amendment assimilated the mechanism for awarding and remunerating ZTS projects to that of the NTS. In turn, interested parties finance the DTS facilities, but if regulated consumers use these facilities, they must pay their share based on consumption.

The 2016 amendment to the Act also directs the Commission to qualify system facilities in any category every four years based on usage estimates from regulated consumers, unregulated consumers, and generators. Discrepancies arise because changing an installation’s qualification from dedicated to zonal or national transfers the financing burden to all consumers in the area or country, as the case may be, freeing its direct users (generators or large consumers), who are usually the owners. Interested parties may appeal the qualifications to the Panel of Experts.

The 2016 amendment also introduced the Strip Studies. The Ministry of Energy may auction a Strip Study for those priority works in the annual expansion plan. The study must include a strategic environmental assessment and may encumber the strip with one or more easements for reasons of public utility. The projects’ awardees must submit a study for a transmission route based on the strip study to the Environmental Assessment Service. Once the Service issues a favorable environmental qualification, the Ministry establishes a legal easement over the final transmission line route.

These legal changes aim to speed up the procedures to approve the environmental impact study and facilitate the negotiation of the easements. Likewise, the 2016 law change expressly includes the consideration of slackness for transmission planning. This criterium follows the recommendation of Ref. [

17] that investment in transmission should be favored as its cost represents around 4–11% of an average consumer’s bill.

4. An Evaluation of the Chilean Transmission Norms

Chile transitioned from a merchant approach to central planning in transmission expansion to consider development scale and scope economies in transmission development. Ref. [

18] writes that substituting merchant transmission could lead to regulatory failure, which is more pervasive than market failure. Chilean regulatory design attempts to reduce regulatory failures. First, all stakeholders—transmission companies, generators, and consumers—may participate in the planning process. This participatory planning reduces the risks of inefficient expansions by improving electricity generation and consumption forecasts with stakeholders’ inputs.

Second, ex ante market competition determines the payments for new installations, avoiding tariff regulation problems. The auction of transmission projects has also facilitated the entry of new transmission companies. Furthermore, establishing a guaranteed cost-adjusted payment for 20 years reduces bidders’ risk and, thereby, the discount rate they use in their bids. Consequently, consumers bear the costs of inefficient expansion projects, but they are better positioned than investors to absorb them as transmission represents a minor part of their electricity costs [

17]. Finally, knowing the value of the works auctioned, the regulator can better estimate the VI of the regulated facilities.

Transmission planning is, in principle, adequate. The projects in the annual plan should minimize the investment, maintenance, and operating costs of transmission and generation over the planning horizon, taking into account existing facilities and those under construction. The only shortcoming is that the generation projects in the planning are only indicative, as this sector is decentralized. Notwithstanding the above, the transmission expansion plans affect investors’ decisions on generation investment, as transmission capacity availability should be a factor in plant siting.

Transmission companies’ entry causes losing scale economies in administration, maintenance and operation. These economies of scale are likely to be small since, otherwise, several companies of different sizes would not bid in the auctions for the transmission projects, as is the case here. In addition, companies have emerged that provide operation and maintenance services to smaller transmission firms, capturing scale economies. In any case, this loss of scale economies would be the price to pay for having ex ante competition in transmission expansion.

The allocation of basic tolls to final clients pro rata of their consumption departs from the beneficiary-pay principle. Its main shortcoming is partially eliminating the location signal for generation companies and consumers (the locational signaling of the congestion variable charge remains), thus increasing transmission costs. However, the magnitude of this problem is an empirical question. Exogenous factors strongly influence the location of power plants. Fossil fuel plants are near port terminals, hydropower plants close to water resources, solar farms in high solar radiation areas, and wind parks in windy areas. Environmental restrictions also constrain locations. Therefore, the inefficiency caused by losing the locational signaling would likely be minor.

Secondly, transmission systems also benefit consumers by enhancing competition (see [

3]) and reducing generation backup needs, besides transporting electricity. A line linking two disjoint systems will increase competition (even if it does not transport electricity), harming generators and benefiting consumers [

17]. The reduction in the energy prices paid by unregulated consumers brought by the interconnection of the two Chilean electricity systems in 2017 illustrates this point [

19]. Therefore, the measurement of transmission benefits to users should take into account the generators’ market power. Otherwise, the assessments would underestimate the benefits to consumers and overestimate those to generators. Usually, the benefit measures omit market power issues because of the difficulty of modeling them, resulting in imperfect locational signals.

Moreover, the users’ benefits change with modifications in the grid configuration. Therefore, although theoretically imperfect, the Chilean approach facilitates the financial assessment of generation investments and reduces their uncertainty. These features ease the entry of new generation companies, especially smaller ones. In this sense, the decision of Chilean legislators to exclude generators from financing the fixed charges of transmission favors competition in generation, but whether it compensates for the loss of efficiency resulting from the partial elimination of the locational signal remains to be seen.

In short, Chilean transmission regulation has evolved in the right direction. Despite this, some NTS lines have been highly congested in recent years. The following section analyzes this phenomenon.

5. Transmission Congestion in Recent Years

After the regulatory changes, the transmission grid provided adequate support to the energy market for about a decade. However, lately, the grid has been highly congested. The most visible expression of this has been the curtailment of non-conventional renewable energy (NCRE) generation, where NCRE excludes hydropower plants with a capacity greater than 20 MW. The rapid expansion of photovoltaic and wind farms, whose location usually differs from conventional plants, has forced the construction of new transmission lines. However, their pace and timing have been insufficient to transport all the incoming power.

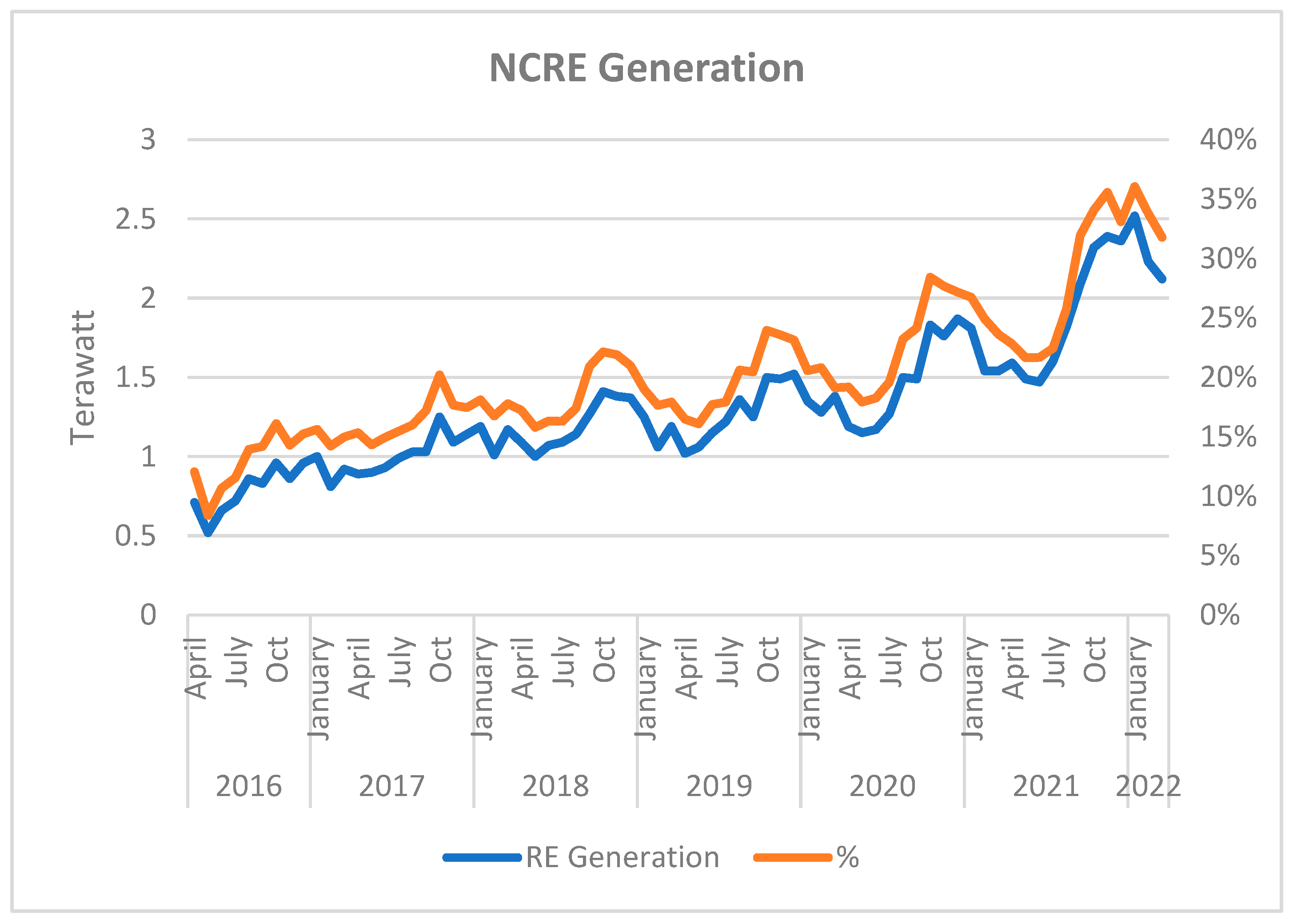

Figure 1 shows the rapid expansion of NCRE, although with a marked seasonality due to stronger winds in spring and higher solar irradiation in summer that conditions wind and PV generation, respectively. In addition, NCRE generation concentrates on certain hours. Towards the end of 2021, NCRE generation represented around 35% of the generation in the national electric system but reached 66% at 4 PM on 28 November 2021, increasing the pressure on the transmission system.

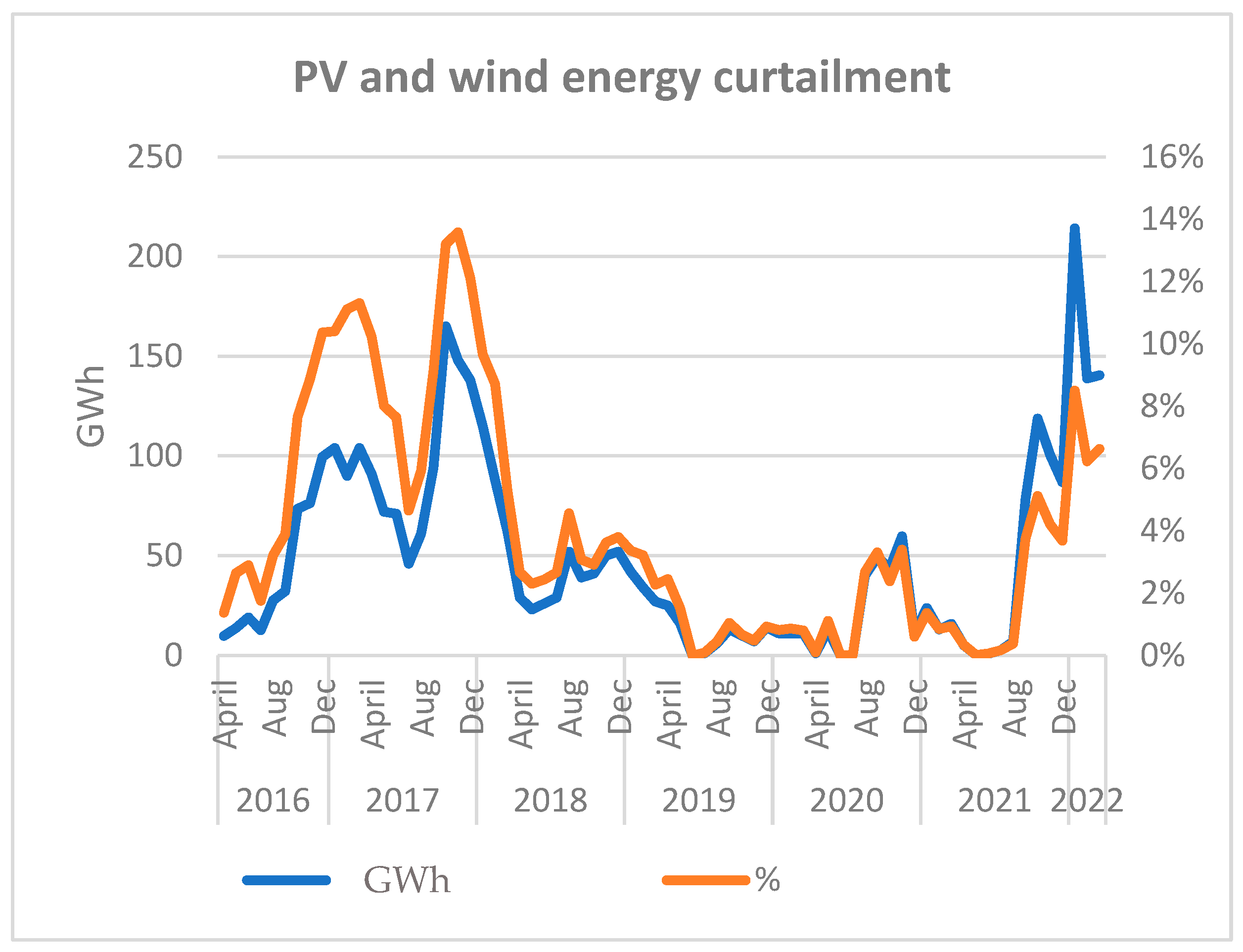

Despite the regulatory changes introduced in 2016 (prospective study, strip studies, and development zones), the NCRE spillover trend has increased in the last years, as shown in

Figure 2, although with fluctuations explained by the entry into service of lines connecting the locations of NCRE plants to large demand centers.

In November 2017, the interconnection of the two large systems (Kapatur–Cardones line) significantly reduced NCRE curtailments. The synchronization of different Cardones–Polpaico line segments to the system in January 2018, May 2018, and May 2019 caused similar effects, reaching minimum curtailment in mid-2019. However, the continued rapid expansion of NCRE absorbed the new capacity, recording January 2022 as the highest monthly energy loss on record. The Kimal–Lo Aguirre, included in the 2017 annual plan that will run parallel to the Kapatur–Polpaico line, should solve the problem, but it was only awarded in December 2021.

What explains RE curtailments if regulatory changes have progressed in the right direction? One explanation is that they were too late, and their implementation was too sparing to avoid RE curtailments. Another plausible hypothesis is a lack of foresight regarding the sociocultural variables that have delayed transmission investments. A third possibility is a lack of capacity in the country to build all the new transmission projects required by the rapid expansion of NCRE. The available information does not allow us to determine the definitive causes of the transmission construction delays, so we concentrate on analyzing the time it takes for expansion plans to materialize.

We had access to the Coordinator’s data on transmission expansion works between 2014 and 2019, including the dates of awarding and commissioning of works. On the other hand, the expansion decrees specify a maximum of months for constructing the projects after their awarding. Using these data, we calculate (i) the average time elapsed from expansion decrees and the project awarding and (ii) the construction delays.

The average time to award expansion plan projects has been 23 months, with significant variations between projects and years (Time to award projects in

Figure 3). Although public auctions have significant advantages regarding transparency and cost-effectiveness, they take longer than solutions such as direct allocation. Indeed, the Coordinator has to design the auction rules, publicize them, and allow a few months for potential bidders to prepare their proposals before awarding projects. Although the inclusion of works in the expansion decrees not for immediate execution could distort this figure, the 23-month period for awarding projects seems excessive.

The sum of the time it takes to award the projects in the expansion decrees and the maximum construction time specified in the decrees averages 51 months (Time to award projects + decree’s construction deadlines).

In addition to the above-mentioned average times, there are construction delays. Five of the nine awarded projects of the 2014 expansion plan were unfinished by mid-April 2022 and already 20 or more months behind. A sixth was due to start operations in April 2022. The three remaining projects started operating on schedule. Similarly, eight of the ten awarded works of the 2015 expansion decree are unfinished and between 20 and 28 months behind schedule (the remaining two started on time).

The difficulties that project developers face in obtaining the required permits due to the greater empowerment of civil society is the most likely cause of delays. In 2010, an amendment to the Environmental Act specified that the authority’s environmental resolutions must account for the observations made by citizens through well-founded pronouncements. Moreover, the jurisprudence of the Environmental Courts has established that citizens can appeal the regulator’s resolutions that do not consider their observations or reject them without sufficient grounds [

20]). In addition, several appeals for remedies filed by citizens in the appeals courts have succeeded in paralyzing construction works, if not stopping them altogether.

Given the persistence of delays, unless there was a radical change in this regard, the Commission plans should consider more realistic estimates of the time needed to execute projects. However, the longer it takes to materialize transmission investments, the harder it is to anticipate the expansion needs of the transmission system since these depend on decentralized decisions on generation expansion, which in turn are conditioned by technological progress and grid expansion.

The Ministry could use more fringe studies to facilitate investors obtaining environmental permits and land easements timely. The studies could even include the environmental approval of projects. The Ministry could be reluctant to act before other public authorities. However, interested parties can always appeal in environmental or ordinary courts if they disagree with the outcomes. In addition, the Ministry could tender these studies to third parties. The regulations could also establish criteria for the remuneration of easements that considers the visual and acoustic pollution they cause. These measures would make tendering for the construction of planned works more attractive, as investors would face less opposition and fewer risks.

The non-discriminatory access to the grid aggravates the congestion problem. Today, when transmission capacity is constrained, the Coordinator must apportion it among incumbents and entrants according to their energy flows. Thus, a company evaluating building a power plant that it anticipates will temporarily congest some transmission facilities will only consider its losses, not its negative externality. Returning to the old “first-come, first-served” approach solves this problem. Its potential drawback is that it could reduce the entrance of new plants and, therefore, the pressure on the transmission planner to anticipate transmission needs.

6. Conclusions

Transmission plays a crucial role in the operation of the energy market. The impact of energy prices on growth [

21] reinforces the relevance of transmission regulation. This paper draws lessons from the Chilean experience. We analyze the initial transmission regulations, the impact of the changes lawmakers introduced in the last two decades, and the reasons behind recent transmission congestions.

We posit that Chile’s current transmission regulation is adequate and consistent with well-established best practices [

8]. Its main regulatory features are (i) centralized planning that considers economies of scale and scope, (ii) the awarding of new transmission projects through international auctions based on the annual remuneration requested, (iii) total remuneration of efficient non-auctioned facilities, and (iv) a two-tier system to finance transmission, which consists of a variable congestion charge paid by generators via locational marginal price differences and a fixed charge—the difference between the transmission remuneration and the congestion revenue—allocated to consumers based on their consumption.

Despite the above, RE curtailments caused by transmission congestion have been significant in recent years. Implementation difficulties that systematically delay the start-up of planned works explain this outcome. The increasing empowerment of civil society in the decision-making processes of new investments is relevant in explaining delays, especially in approving environmental permits.

In a nutshell, an essential lesson of this paper is that it is not enough to have transmission regulations in which access, planning, remuneration, and charging for the service criteria are adequate. Practice shows that it is also necessary to establish conditions that ensure the development of the projects within planned deadlines that assume realistic timelines.

Some possible measures to narrow down the problem would be: updating the Ministry’s prospective study annually, resorting more to the definition of development poles to anticipate and channel future transportation needs, assuming greater risks of building lines with significant slack for long periods, and increasing efforts to reduce the time that elapses between the decision to make a project and its public bidding.

The above measures would reduce delays, but consensus building in civil society is crucial for grid development. The Ministry of Energy considers early citizen participation, i.e., prior to the entry of projects into the Environmental Impact Assessment System. Perhaps what is lacking is to weigh this process in the following steps to ensure better results in the final approval or rejection of projects.

Our future work will focus on collecting more data to establish statistically robust relationships between regulatory tools and their outcomes. For example, comparing the regulated facilities’ tariffs with the tendered facilities’ payments would allow us to evaluate the benefits of the tenders vs. their costs (mainly execution delays). The availability of information is scarce in the institutions themselves. We plan to request basic information to build databases, which, once processed, should be helpful in the regulatory function.