Economic Policy Uncertainty and Energy Prices: Empirical Evidence from Multivariate DCC-GARCH Models

Abstract

:1. Introduction

Literature Review

2. Materials and Methods

2.1. Univariate GARCH Models

2.2. Multivariate GARCH (MGARCH) Techniques

2.3. Data

3. Results

3.1. Dynamics of the Monthly Russian Economic Policy Uncertainty and Energy Prices and Their Returns

3.2. Stationarity (Unit Root) Test Results

3.3. Estimates of Univariate Models

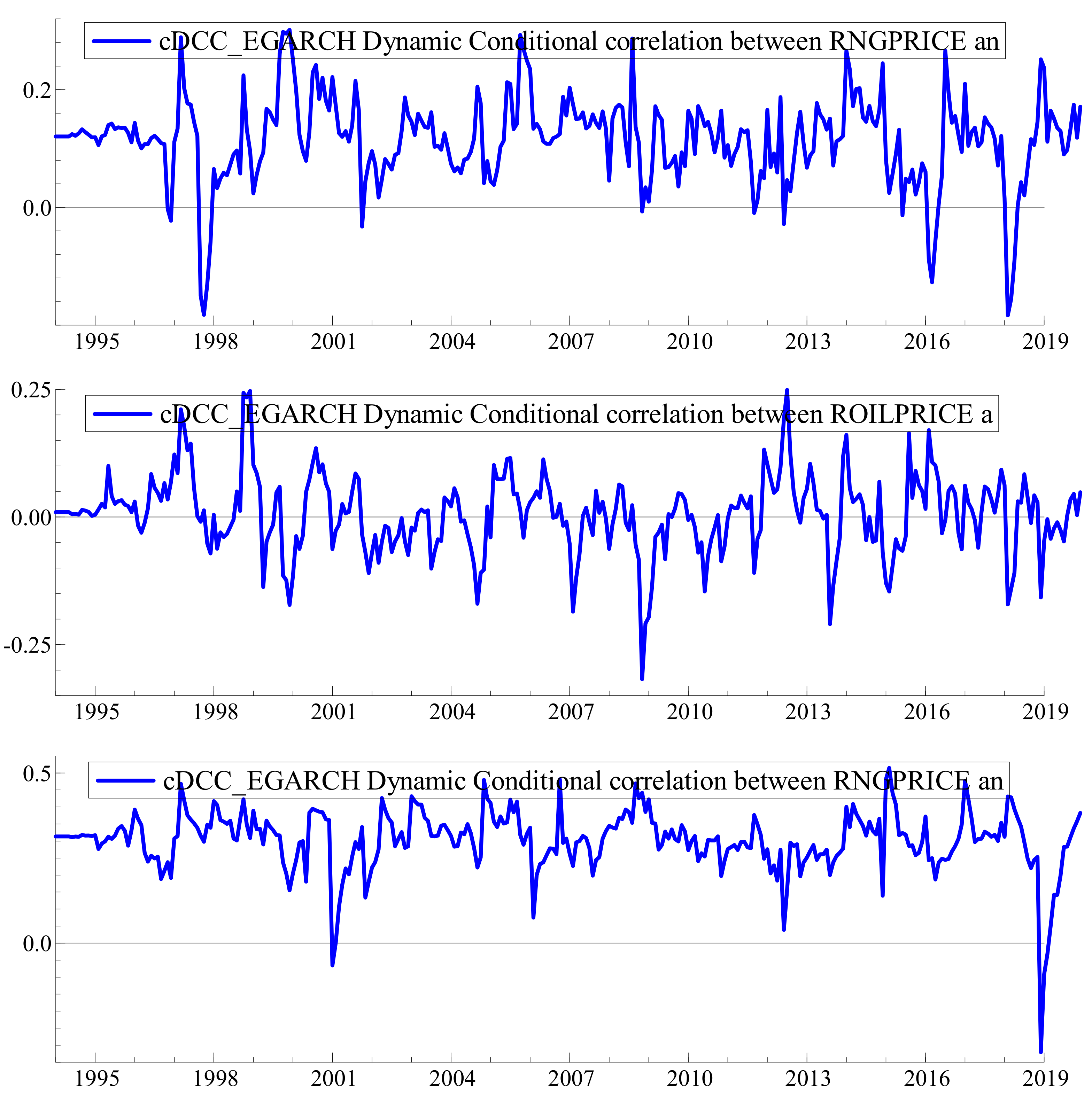

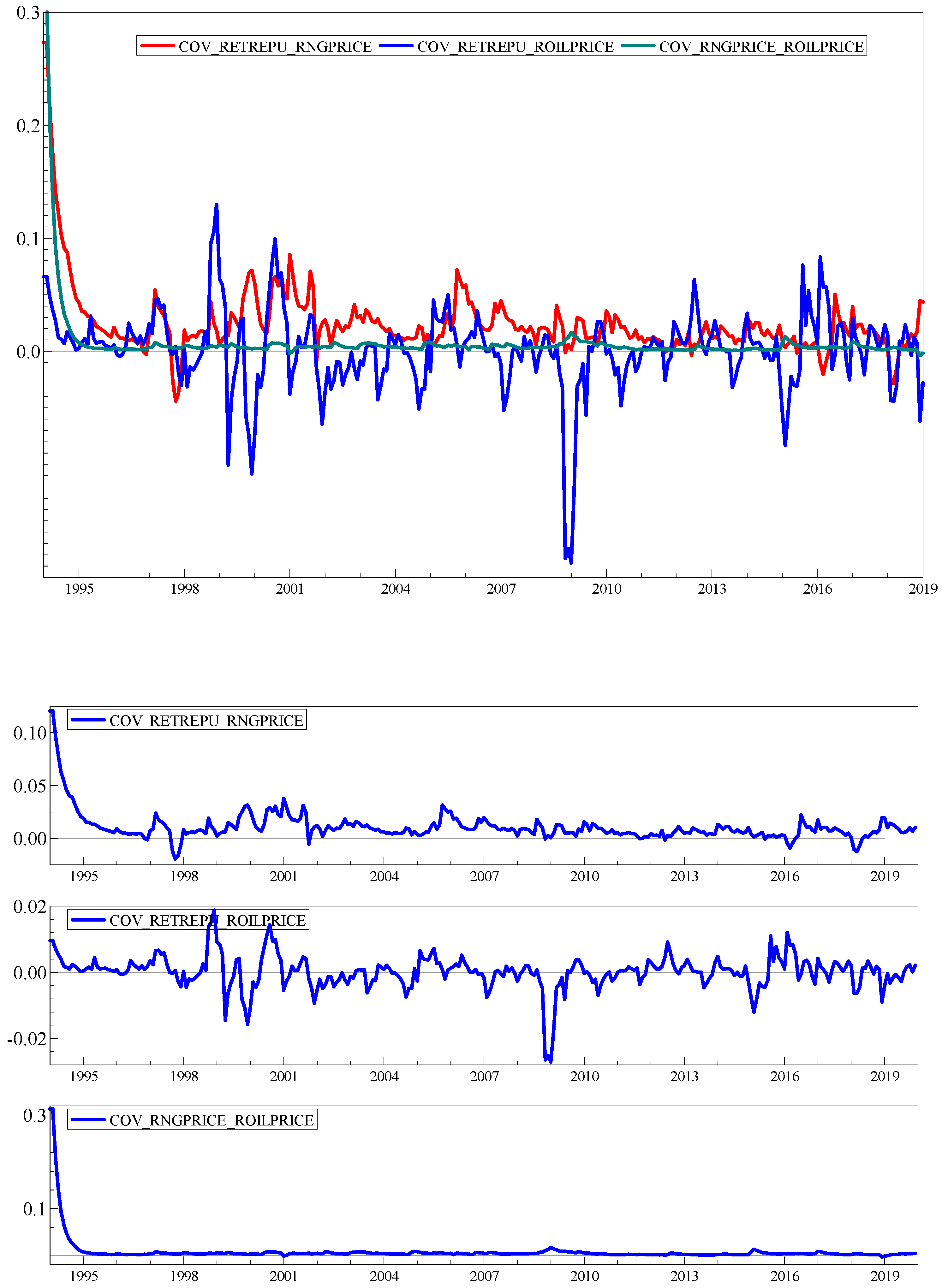

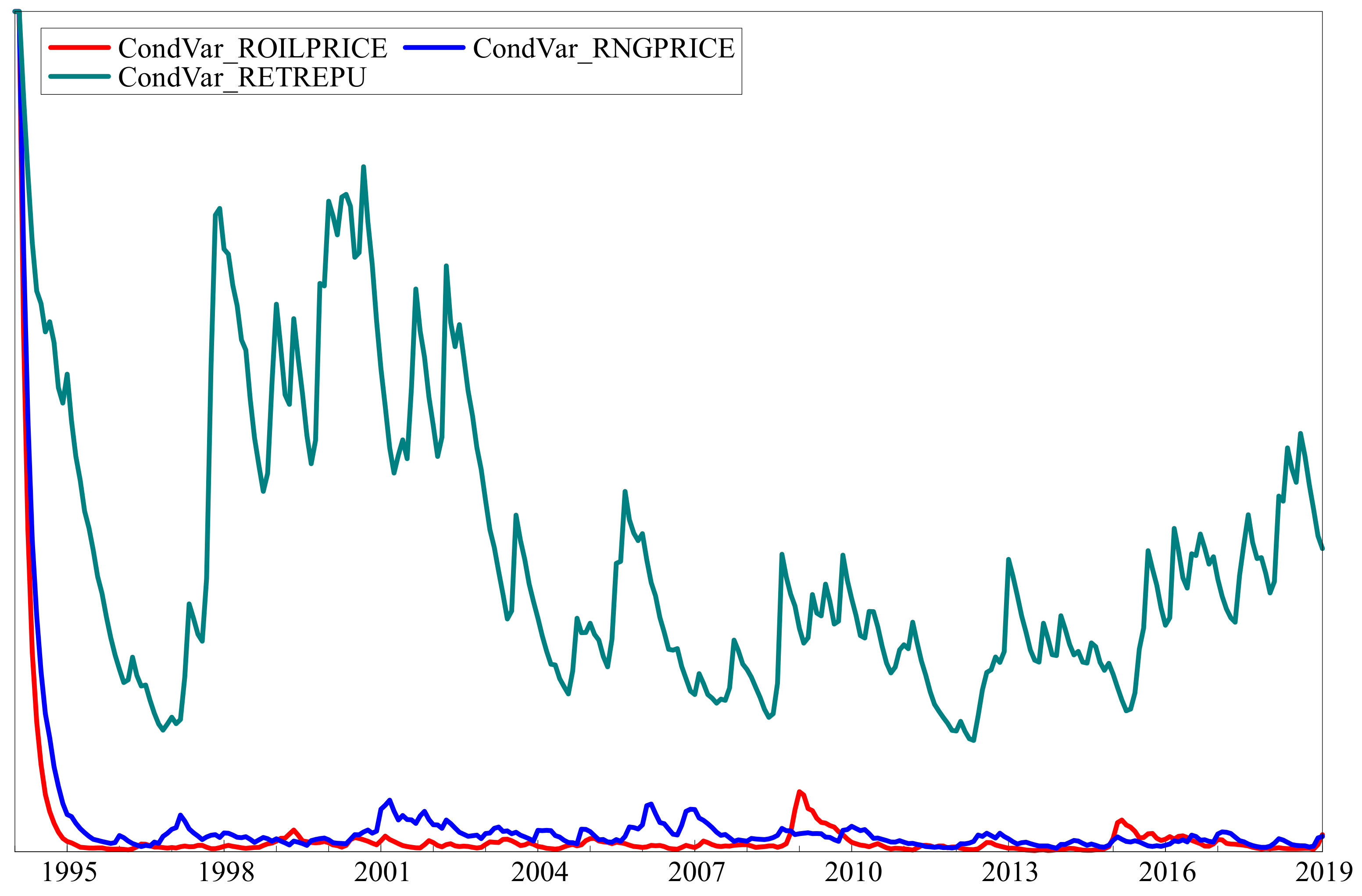

3.4. Results of Multivariate Models

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- IEA—International Energy Agency. Available online: https://www.iea.org (accessed on 19 March 2022).

- Shi, X.; Variam, H.M.P.; Shen, Y. Trans-ASEAN gas pipeline and ASEAN gas market integration: Insights from a scenario analysis. Energy Policy 2019, 132, 83–95. [Google Scholar] [CrossRef]

- EIA. Perspectives on the Development of LNG Market Hubs in the Asia Pacific Region; U.S. Energy Information Administration: Washington, DC, USA, 2017.

- BP Statistical Review of World Energy 2017. Available online: https://www.connaissancedesenergies.org/sites/default/files/pdf-actualites/bp-statistical-review-of-world-energy-2017-full-report.pdf (accessed on 19 March 2022).

- The World Factbook Archives. The World Factbook. 2018. Available online: https://www.cia.gov/the-world-factbook/about/archives (accessed on 19 March 2022).

- Bloom, N. The impact of uncertainty shocks. Econometrica 2009, 77, 623–685. [Google Scholar]

- Alexopoulos, M.; Cohen, J. Uncertain times, uncertain measures. Univ. Tor. Dep. Econ. Work. Pap. 2009, 352, 8. [Google Scholar]

- Baker, S.R.; Bloom, N.; Canes-Wrone, B.; Davis, S.J.; Rodden, J. Why has US policy uncertainty risen since 1960? Am. Econ. Rev. 2014, 104, 56–60. [Google Scholar] [CrossRef] [Green Version]

- Caggiano, G.; Castelnuovo, E.; Groshenny, N. Uncertainty Shocks and Unemployment Dynamics: An Analysis of Post-WWII US Recessions; Working Paper; Dipartimento di Scienze Economiche “Marco Fanno”: Padova, Italy, 2013. [Google Scholar]

- Leduc, S.; Liu, Z. Uncertainty shocks are aggregate demand shocks. J. Monet. Econ. 2016, 82, 20–35. [Google Scholar] [CrossRef] [Green Version]

- Aloui, R.; Gupta, R.; Miller, S.M. Uncertainty and crude oil returns. Energy Econ. 2016, 55, 92–100. [Google Scholar] [CrossRef] [Green Version]

- Chang, T.; Chen, W.Y.; Gupta, R.; Nguyen, D.K. Are stock prices related to the political uncertainty index in OECD countries? Evidence from the bootstrap panel causality test. Econ. Syst. 2015, 39, 288–300. [Google Scholar] [CrossRef] [Green Version]

- Chen, J.; Jin, F.; Ouyang, G.; Ouyang, J.; Wen, F. Oil price shocks, economic policy uncertainty and industrial economic growth in China. PLoS ONE 2019, 14, e0215397. [Google Scholar] [CrossRef]

- Jiang, Y.; Zhou, Z.; Liu, C. Does economic policy uncertainty matter for carbon emission? Evidence from US sector level data. Environ. Sci. Pollut. Res. 2019, 26, 24380–24394. [Google Scholar] [CrossRef]

- Converse, N. Uncertainty, capital flows, and maturity mismatch. J. Int. Money Financ. 2018, 88, 260–275. [Google Scholar] [CrossRef]

- Handley, K.; Limao, N. Trade and investment under policy uncertainty: Theory and firm evidence. Am. Econ. J. Econ. Policy 2015, 7, 189–222. [Google Scholar] [CrossRef] [Green Version]

- Rodrik, D. Policy uncertainty and private investment in developing countries. J. Dev. Econ. 1991, 36, 229–242. [Google Scholar] [CrossRef] [Green Version]

- Arouri, M.; Roubaud, D. On the determinants of stock market dynamics in emerging countries: The role of economic policy uncertainty in China and India. Econ. Bull. 2016, 36, 760–770. [Google Scholar]

- You, W.; Guo, Y.; Zhu, H.; Tang, Y. Oil price shocks, economic policy uncertainty and industry stock returns in China: Asymmetric effects with quantile regression. Energy Econ. 2017, 68, 1–18. [Google Scholar] [CrossRef]

- Kang, W.; Ratti, R.A.; Vespignani, J.L. Oil price shocks and policy uncertainty: New evidence on the effects of US and non-US oil production. Energy Econ. 2017, 66, 536–546. [Google Scholar] [CrossRef] [Green Version]

- Reboredo, J.C.; Uddin, G.S. Do financial stress and policy uncertainty have an impact on the energy and metals markets? A quantile regression approach. Int. Rev. Econ. Financ. 2016, 43, 284–298. [Google Scholar] [CrossRef]

- Degiannakis, S.; Filis, G.; Panagiotakopoulou, S. Oil price shocks and uncertainty: How stable is their relationship over time? Econ. Model. 2018, 72, 42–53. [Google Scholar] [CrossRef] [Green Version]

- Han, L.; Liu, Y.; Yin, L. Uncertainty and currency performance: A quantile-on-quantile approach. North. Am. J. Econ. Financ. 2019, 48, 702–729. [Google Scholar] [CrossRef]

- Akarca, A.T.; Long, T.V. On the relationship between energy and GNP: A reexamination. J. Energy Dev. 1980, 5, 326–331. [Google Scholar]

- Kraft, J.; Kraft, A. On the relationship between energy and GNP. J. Energy Dev. 1978, 3, 401–403. [Google Scholar]

- Proops, J.L. Modelling the energy-output ratio. Energy Econ. 1984, 6, 47–51. [Google Scholar] [CrossRef]

- Işik, C. Natural gas consumption and economic growth in Turkey: A bound test approach. Energy Syst. 2010, 1, 441–456. [Google Scholar] [CrossRef]

- Lim, H.-J.; Yoo, S.-H. Natural gas consumption and economic growth in Korea: A causality analysis. Energy Sources Part B Econ. Plan. Policy 2012, 7, 169–176. [Google Scholar] [CrossRef]

- Solarin, S.A.; Shahbaz, M. Natural gas consumption and economic growth: The role of foreign direct investment, capital formation and trade openness in Malaysia. Renew. Sustain. Energy Rev. 2015, 42, 835–845. [Google Scholar] [CrossRef] [Green Version]

- Rafindadi, A.A.; Ozturk, I. Natural gas consumption and economic growth nexus: Is the 10th Malaysian plan attainable within the limits of its resource? Renew. Sustain. Energy Rev. 2015, 49, 1221–1232. [Google Scholar] [CrossRef]

- Ozturk, I.; Al-Mulali, U. Natural gas consumption and economic growth nexus: Panel data analysis for GCC countries. Renew. Sustain. Energy Rev. 2015, 51, 998–1003. [Google Scholar] [CrossRef]

- Solarin, S.A.; Ozturk, I. The relationship between natural gas consumption and economic growth in OPEC members. Renew. Sustain. Energy Rev. 2016, 58, 1348–1356. [Google Scholar] [CrossRef]

- Hassan, M.S.; Tahir, M.N.; Wajid, A.; Mahmood, H.; Farooq, A. Natural gas consumption and economic growth in Pakistan: Production function approach. Glob. Bus. Rev. 2018, 19, 297–310. [Google Scholar] [CrossRef]

- Sinaga, O. The dynamic relationship between natural gas and economic growth: Evidence from Indonesia. Int. J. Energy Econ. Policy 2019, 9, 388–394. [Google Scholar] [CrossRef] [Green Version]

- Fadiran, G.; Adebusuyi, A.T.; Fadiran, D. Natural gas consumption and economic growth: Evidence from selected natural gas vehicle markets in Europe. Energy 2019, 169, 467–477. [Google Scholar] [CrossRef]

- Akadiri, A.C.; Akadiri, S.S.; Gungor, H. The role of natural gas consumption in Saudi Arabia’s output and its implication for trade and environmental quality. Energy Policy 2019, 129, 230–238. [Google Scholar] [CrossRef]

- Erdoğan, S.; Gedikli, A.; Kırca, M. A note on time-varying causality between natural gas consumption and economic growth in Turkey. Resour. Policy 2019, 64, 101504. [Google Scholar] [CrossRef]

- Liu, W.; Zhang, X.; Fan, J.; Li, Y.; Wang, L. Evaluation of potential for salt cavern gas storage and integration of brine extraction: Cavern utilization, Yangtze River Delta region. Nat. Resour. Res. 2020, 29, 3275–3290. [Google Scholar] [CrossRef]

- Van Robays, I. Macroeconomic uncertainty and oil price volatility. Oxf. Bull. Econ. Stat. 2016, 78, 671–693. [Google Scholar] [CrossRef]

- Litzenberger, R.H.; Rabinowitz, N. Backwardation in oil futures markets: Theory and empirical evidence. J. Financ. 1995, 50, 1517–1545. [Google Scholar] [CrossRef]

- Kilian, L. Not all oil price shocks are alike: Disentangling demand and supply shocks in the crude oil market. Am. Econ. Rev. 2009, 99, 1053–1069. [Google Scholar] [CrossRef] [Green Version]

- Hailemariam, A.; Smyth, R.; Zhang, X. Oil prices and economic policy uncertainty: Evidence from a nonparametric panel data model. Energy Econ. 2019, 83, 40–51. [Google Scholar] [CrossRef]

- Lin, B.; Bai, R. Oil prices and economic policy uncertainty: Evidence from global, oil importers, and exporters’ perspective. Res. Int. Bus. Financ. 2021, 56, 101357. [Google Scholar] [CrossRef]

- Chen, X.; Sun, X.; Li, J. How does economic policy uncertainty react to oil price shocks? A multi-scale perspective. Appl. Econ. Lett. 2020, 27, 188–193. [Google Scholar] [CrossRef]

- Caporin, M.; Fontini, F. The long-run oil–natural gas price relationship and the shale gas revolution. Energy Econ. 2017, 64, 511–519. [Google Scholar] [CrossRef] [Green Version]

- Ramberg, D.J.; Parsons, J.E. The weak tie between natural gas and oil prices. Energy J. 2012, 33. [Google Scholar] [CrossRef] [Green Version]

- Brown, S.P.; Yucel, M.K. What drives natural gas prices? Energy J. 2008, 29, 45–60. [Google Scholar] [CrossRef] [Green Version]

- Wang, T.; Zhang, D.; Ji, Q.; Shi, X. Market reforms and determinants of import natural gas prices in China. Energy 2020, 196, 117105. [Google Scholar] [CrossRef]

- Olanipekun, I.; Olasehinde-Williams, G.; Akadiri, S.S. Gasoline prices and economic policy uncertainty: What causes what, and why does it matter? Evidence from 18 selected countries. Environ. Sci. Pollut. Res. 2019, 26, 15187–15193. [Google Scholar] [CrossRef] [PubMed]

- Scarcioffolo, A.R.; Etienne, X.L. Regime-switching energy price volatility: The role of economic policy uncertainty. Int. Rev. Econ. Financ. 2021, 76, 336–356. [Google Scholar] [CrossRef]

- Dash, S.R.; Maitra, D. Do oil and gas prices influence economic policy uncertainty differently: Multi-country evidence using time-frequency approach. Q. Rev. Econ. Financ. 2021, 81, 397–420. [Google Scholar] [CrossRef]

- Energy Information Administration 2018. Federal Register Recent Federal Regulation Documents. Justia Regulation Tracker. Available online: https://regulations.justia.com/regulations/fedreg/agencies/energy-information-administration/2018 (accessed on 19 March 2022).

- Antonakakis, N.; Chatziantoniou, I.; Filis, G. Dynamic spillovers of oil price shocks and economic policy uncertainty. Energy Econ. 2014, 44, 433–447. [Google Scholar] [CrossRef] [Green Version]

- Bollerslev, T. Modelling the coherence in short-run nominal exchange rates: A multivariate generalized ARCH model. Rev. Econ. Stat. 1990, 72, 498–505. [Google Scholar] [CrossRef]

- Nelson, D.B. Conditional heteroskedasticity in asset returns: A new approach. Econom. J. Econom. Soc. 1991, 59, 347–370. [Google Scholar] [CrossRef]

- Engle, R. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. J. Bus. Econ. Stat. 2002, 20, 339–350. [Google Scholar] [CrossRef]

- Tse, Y.K.; Tsui, A.K.C. A multivariate generalized autoregressive conditional heteroscedasticity model with time-varying correlations. J. Bus. Econ. Stat. 2002, 20, 351–362. [Google Scholar] [CrossRef]

- Ali, F.; Jiang, Y.; Sensoy, A. Downside risk in Dow Jones Islamic equity indices: Precious metals and portfolio diversification before and after the COVID-19 bear market. Res. Int. Bus. Financ. 2021, 58, 101502. [Google Scholar] [CrossRef]

- Botshekan, M.H.; Takaloo, A.; Abdollahi Poor, M.S. Global Economic Policy Uncertainty (GEPU) and Non-Performing Loans (NPL) in Iran’s Banking System: Dynamic Correlation using the DCC-GARCH Approach. J. Money Econ. 2021, 16, 187–212. [Google Scholar] [CrossRef]

- Ghosh, R.; Bagchi, B.; Chatterjee, S. The effect of economic policy uncertainty index on the Indian economy in the wake of COVID-19 pandemic. J. Econ. Adm. Sci. 2022. [Google Scholar] [CrossRef]

- Nguyen, T.N.; Phan, T.K.; Nguyen, T.L. Financial contagion during global financial crisis and covid–19 pandemic: The evidence from DCC–GARCH model. Cogent Econ. Financ. 2022, 10, 2051824. [Google Scholar] [CrossRef]

- Hung, N.T. Directional spillover effects between BRICS stock markets and economic policy uncertainty. Asia-Pac. Financ. Mark. 2021, 28, 429–448. [Google Scholar] [CrossRef]

- Afzal, F.; Haiying, P.; Afzal, F.; Mahmood, A.; Ikram, A. Value-at-risk analysis for measuring stochastic volatility of stock returns: Using GARCH-based dynamic conditional correlation model. SAGE Open 2021, 11, 21582440211005758. [Google Scholar] [CrossRef]

- Qian, P.Y.; Diaz, J.F. Volatility integration of global stock markets with the Malaysian stock market: A Multivariate GARCH approach. Malays. J. Econ. Stud. 2017, 54, 83–117. [Google Scholar] [CrossRef] [Green Version]

- Aielli, G. Consistent Estimation of Large Scale Dynamic Conditional Correlations; Working Paper, No. 47; Department of Economics, Statistics, Mathematics and Sociology, University of Messina: Messina, Italy, 2008. [Google Scholar]

- Aielli, G.P. Dynamic conditional correlation: On properties and estimation. J. Bus. Econ. Stat. 2013, 31, 282–299. [Google Scholar] [CrossRef]

- Davis, S.J. An Index of Global Economic Policy Uncertainty; National Bureau of Economic Research: Cambridge, MA, USA, 2016. [Google Scholar]

- International Energy Agency Global Energy. CO2 Status Report 2018; International Energy Agency: Paris, France, 2019; p. 562. [Google Scholar]

- Alberini, A.; Khymych, O.; Ščasný, M. Estimating Energy Price Elasticities when Salience is High: Residential Natural Gas Demand in Ukraine. 2019. Available online: https://ssrn.com/abstract=3357039 (accessed on 19 March 2022).

- Krichene, N. World crude oil and natural gas: A demand and supply model. Energy Econ. 2002, 24, 557–576. [Google Scholar] [CrossRef]

- Liddle, B.; Smyth, R.; Zhang, X. Time-varying income and price elasticities for energy demand: Evidence from a middle-income panel. Energy Econ. 2020, 86, 104681. [Google Scholar] [CrossRef]

- Liu, B.-C. Natural gas price elasticities: Variations by region and by sector in the USA. Energy Econ. 1983, 5, 195–201. [Google Scholar] [CrossRef]

- Rajabi, M.M.; Mousavi, M. Estimating Industrial Natural Gas Demand Elasticities in Selected OECD Countries. Energy Econ. Lett. 2019, 6, 52–65. [Google Scholar] [CrossRef] [Green Version]

- Abdulkareem, A.; Abdulkareem, K.A. Analysing oil price-macroeconomic volatility in Nigeria. CBN J. Appl. Stat. 2016, 7, 1. [Google Scholar]

| Statistics | NGPRICE | OILPRICE | REPU | RNGPRICE | ROILPRICE | RETREPU |

|---|---|---|---|---|---|---|

| Mean | 4.065109 | 51.81644 | 133.6251 | −8.86 × 10−5 | 0.004430 | −0.001961 |

| Median | 3.332000 | 48.47500 | 109.4615 | −0.003931 | 0.014870 | 0.000306 |

| Maximum | 13.45400 | 133.8800 | 431.2470 | 0.406394 | 0.213866 | 1.752550 |

| Minimum | 1.426000 | 11.35000 | 12.39880 | −0.395570 | −0.331980 | −2.085580 |

| Std. Dev. | 2.218140 | 29.29837 | 85.64058 | 0.118919 | 0.082989 | 0.640805 |

| Skewness | 1.596381 | 0.515347 | 0.990361 | 0.058617 | −0.727490 | −0.230170 |

| Kurtosis | 5.953050 | 2.218325 | 3.560860 | 3.727084 | 4.458716 | 3.424390 |

| Jarque–Bera | 245.8850 | 21.75351 | 55.09169 | 7.051135 | 55.18261 | 5.096266 |

| Probability | 0.000000 | 0.000019 | 0.000000 | 0.029435 | 0.000000 | 0.078228 |

| Observation | 312 | 312 | 312 | 312 | 312 | 312 |

| ARCH test F-stat | 19.84180 [0.0000] | 106.5145 [0.0000] | 19.40484 [0.0000] | 3.564416 [0.0295] | 16.54563 [0.0001] | 6.900444 [0.0090] |

| Q-stat (5) | 11.249 [0.047] | 58.995 [0.000] | 25.186 [0.000] | 13.952 [0.016] | 20.417 [0.001] | 39.746 [0.000] |

| Q-stat (10) | 33.085 [0.000] | 79.183 [0.000] | 44.175 [0.000] | 39.372 [0.000] | 27.316 [0.002] | 45.093 [0.000] |

| Q-square stat (5) | 54.203 [0.000] | 162.03 [0.000] | 11.385 [0.044] | 5.8527 [0.321] | 62.934 [0.000] | 16.442 [0.006] |

| Q-square stat (10) | 62.140 [0.000] | 183.07 [0.000] | 35.492 [0.000] | 16.965 [0.075] | 71.956 [0.000] | 28.048 [0.002] |

| Correlation | ||||||

| Variables | REPU | OILPRICE | NGPRICE | RETREPU | RNGPRICE | ROILPRICE |

| REPU | 1.000000 | |||||

| OILPRICE | 0.184283 | 1.000000 | ||||

| NGPRICE | −0.221694 | 0.426965 | 1.000000 | |||

| RETREPU | 0.366066 | 0.019746 | 0.019361 | 1.000000 | ||

| RNGPRICE | −0.001555 | −0.007310 | 0.127700 | 0.071648 | 1.000000 | |

| ROILPRICE | −0.063296 | 0.036709 | 0.017597 | 0.014554 | 0.227160 | 1.000000 |

| Philips–Perron (PP) Test | ||||||

| At Levels | At First Difference | |||||

| Variables | Constant Only | Constant and Trend | None | Constant Only | Constant and Trend | None |

| NGPRICE | −2.83 * | −2.7921 | −1.2607 | −15.207 *** | −15.21 *** | −15.24 *** |

| OILPRICE | −1.7037 | −2.1123 | −0.3741 | −11.835 *** | −11.821 *** | −11.849 *** |

| REPU | −10.646 *** | −11.982 *** | −3.7897 *** | −57.925 *** | −64.172 *** | −58.074 *** |

| RETREPU | −64.686 *** | −74.446 *** | −64.945 *** | −273.68 *** | −289.64 *** | −275.47 *** |

| RNGPRICE | −14.763 *** | −14.769 *** | −14.79 *** | −218.43 *** | −228.63 *** | −208.79 *** |

| ROILPRICE | −13.481 *** | −13.478 *** | −13.478 *** | −110.03 *** | −109.72 *** | −110.36 *** |

| Augmented Dickey–Fuller (ADF) Test | ||||||

| At Levels | At First Difference | |||||

| Variables | Constant Only | Constant and Trend | None | Constant Only | Constant and Trend | None |

| NGPRICE | −3.0156 ** | −2.9825 | −1.4242 | −15.211 *** | −15.199 *** | −15.236 *** |

| OILPRICE | −2.3086 | −2.7655 | −0.797 | −11.959 *** | −11.948 *** | −11.969 *** |

| REPU | −3.1648 ** | −4.1277 *** | −1.2093 | −16.859 *** | −16.852 *** | −16.883 *** |

| RETREPU | −13.333 *** | −13.33 *** | −13.354 *** | −10.902 *** | −10.888 *** | −10.92 *** |

| RNGPRICE | −14.931 *** | −14.929 *** | −14.955 *** | −14.586 *** | −14.562 *** | −14.61 *** |

| ROILPRICE | −13.531 *** | −13.535 *** | −13.521 *** | −14.026 *** | −14.003 *** | −14.049 *** |

| Variables | RETREPU | RNGPRICE | ROILPRICE | |||

|---|---|---|---|---|---|---|

| GARCH (1 1) | EGARCH (1 1) | GARCH (1 1) | EGARCH (1 1) | GARCH (1 1) | EGARCH (1 1) | |

| Mean Equation | (1) | (2) | (3) | (4) | (5) | (6) |

| Constant | 0.003682 *** (0.005022) | 0.005423 *** (10.27708) | 0.000118 (0.008645) | 0.000229 (0.007496) | 0.008146 (0.005442) | 0.004231 (0.005942) |

| AR(1) | 0.228962 *** (0.071739) | 0.888478 *** (0.028238) | −0.100183 (0.393264) | 0.030043 (0.295992) | 0.117236 (0.401839) | 0.152843 (0.212180) |

| MA(1) | −0.892361 *** (0.030796) | −0.525341 *** (0.060544) | 0.292273 (0.352461) | 0.157007 (0.288022) | 0.046553 (0.406734) | 0.079883 (0.216916) |

| Variance Equation | ||||||

| Constant | 20.76495 (24.18403) | 0.274471 *** (0.036473) | 0.000614 ** (0.000271) | −0.162429 (0.097178) | 0.001234 (0.000849) | −5.451003 (0.938869) |

| ARCH (1) | 0.068362 *** (0.024425) | −0.082649 ** (0.042059) | 0.048252 ** (0.020599) | 0.097178 (0.020578) | 0.138586 ** (0.064689) | 0.034451 (0.143900) |

| GARCH(1) | 0.931601 *** (0.023587) | 0.974469 *** (1.75×10−08) | 0.929866 *** (0.019528) | 0.965722 *** (0.019639) | 0.666913 *** (0.177427) | −0.057089 ** (0.187108) |

| Asymmetry (1) | 0.127181 *** (0.021918) | 0.080962 ** (0.036552) | −0.354448 *** (0.098668) | |||

| Diagnostic Test | ||||||

| SIC | 1.629597 | 1.616514 | −1.187886 | −1.367125 | −2.146591 | −2.149523 |

| ARCH Test | ||||||

| F-statistics | 0.223352 [0.6368] | 0.010984 [0.9166] | 0.008300 [0.9275] | 0.006366 [0.9365] | 0.283098 [0.5951] | 1.024421 [0.3123] |

| nR2 | 0.224640 [0.6355] | 0.011054 [0.9163] | 0.008354 [0.9272] | 0.006408 [0.9362] | 0.284675 [0.5937] | 1.027655 [0.3107] |

| Symmetric Model [GARCH] | Asymmetric Model [EGARCH] | |||

|---|---|---|---|---|

| Variables | DCC Model | cDCC Model | DCC Model | cDCC Model |

| RETREPU vs. RNGPRICE | 0.1189 ** [0.0468] | 0.1178 ** [0.0464] | 0.1226 * [0.0613] | 0.12048 * [0.0608] |

| RETREPU vs. OILPRICE | 0.0098 [0.8768] | 0.011240 [0.8569] | 0.0067 [0.9234] | 0.009536 [0.8903] |

| OILPRICE vs. RNGPRICE | 0.2833 *** [0.0001] | 0.2829 *** [0.0000] | 0.3148 *** [0.0000] | 0.3136 *** [0.0000] |

| Alfa (α) | 0.0470 *** [0.0002] | 0.04603 * [0.0527] | 0.0720 ** [0.0281] | 0.0749 ** [0.0331] |

| Beta (β) | 0.6008 *** [0.0001] | 0.5726 *** [0.0013] | 0.6236 *** [0.0000] | 0.5966 *** [0.0000] |

| Log-likelihood | 357.135 | 357.057 | 306.769 | 306.755 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ringim, S.H.; Alhassan, A.; Güngör, H.; Bekun, F.V. Economic Policy Uncertainty and Energy Prices: Empirical Evidence from Multivariate DCC-GARCH Models. Energies 2022, 15, 3712. https://doi.org/10.3390/en15103712

Ringim SH, Alhassan A, Güngör H, Bekun FV. Economic Policy Uncertainty and Energy Prices: Empirical Evidence from Multivariate DCC-GARCH Models. Energies. 2022; 15(10):3712. https://doi.org/10.3390/en15103712

Chicago/Turabian StyleRingim, Salim Hamza, Abdulkareem Alhassan, Hasan Güngör, and Festus Victor Bekun. 2022. "Economic Policy Uncertainty and Energy Prices: Empirical Evidence from Multivariate DCC-GARCH Models" Energies 15, no. 10: 3712. https://doi.org/10.3390/en15103712

APA StyleRingim, S. H., Alhassan, A., Güngör, H., & Bekun, F. V. (2022). Economic Policy Uncertainty and Energy Prices: Empirical Evidence from Multivariate DCC-GARCH Models. Energies, 15(10), 3712. https://doi.org/10.3390/en15103712