The Impact of Uncertainties on Crude Oil Prices: Based on a Quantile-on-Quantile Method

Abstract

:1. Introduction

2. Research Design

2.1. Research Strategy and Methods

2.1.1. The Wavelet Analysis Method

2.1.2. The Quantile-on-Quantile Regression Method

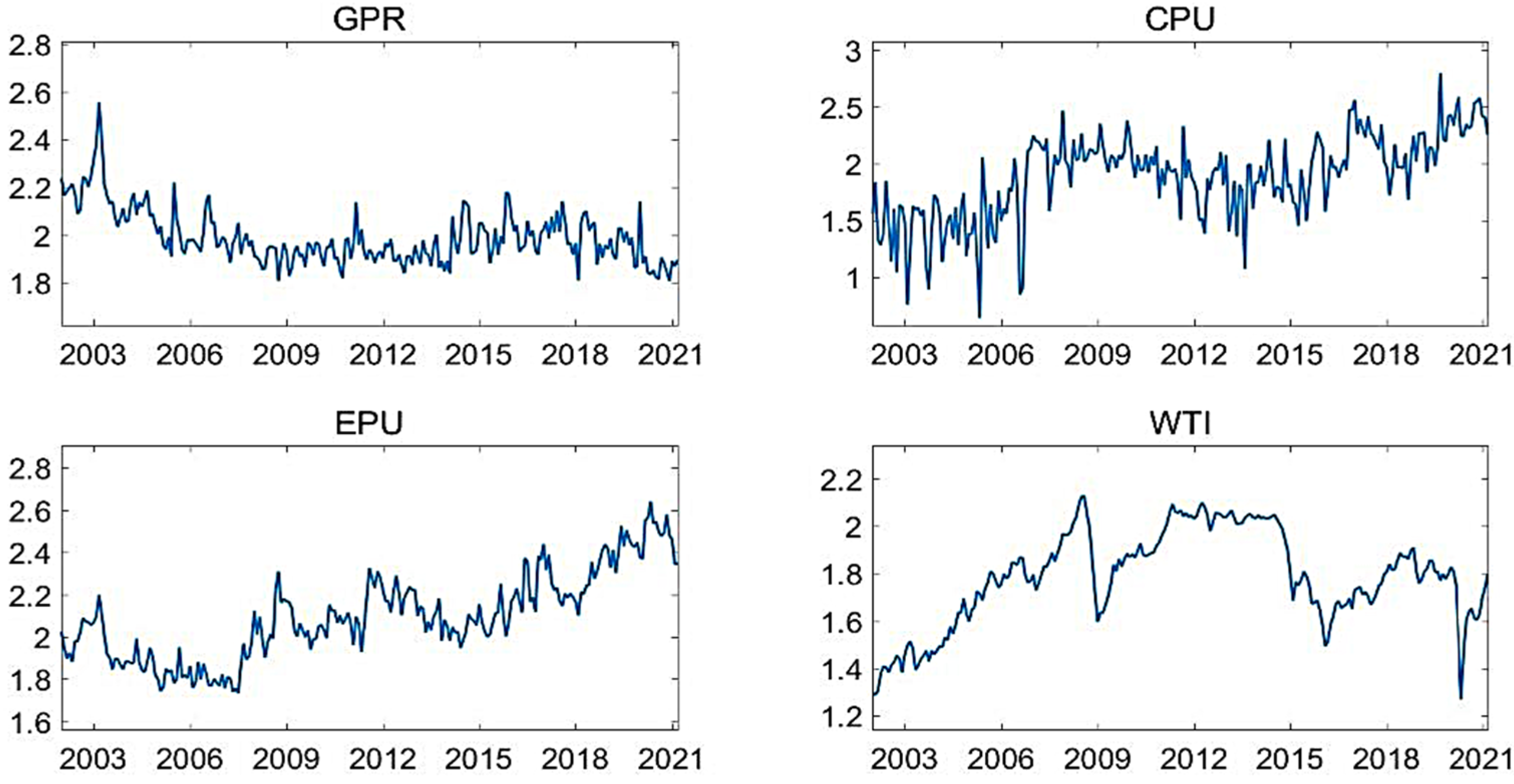

2.2. Variable Description and Data Trend Analysis

3. Empirical Results of the Impact of Uncertainties on Crude Oil Prices

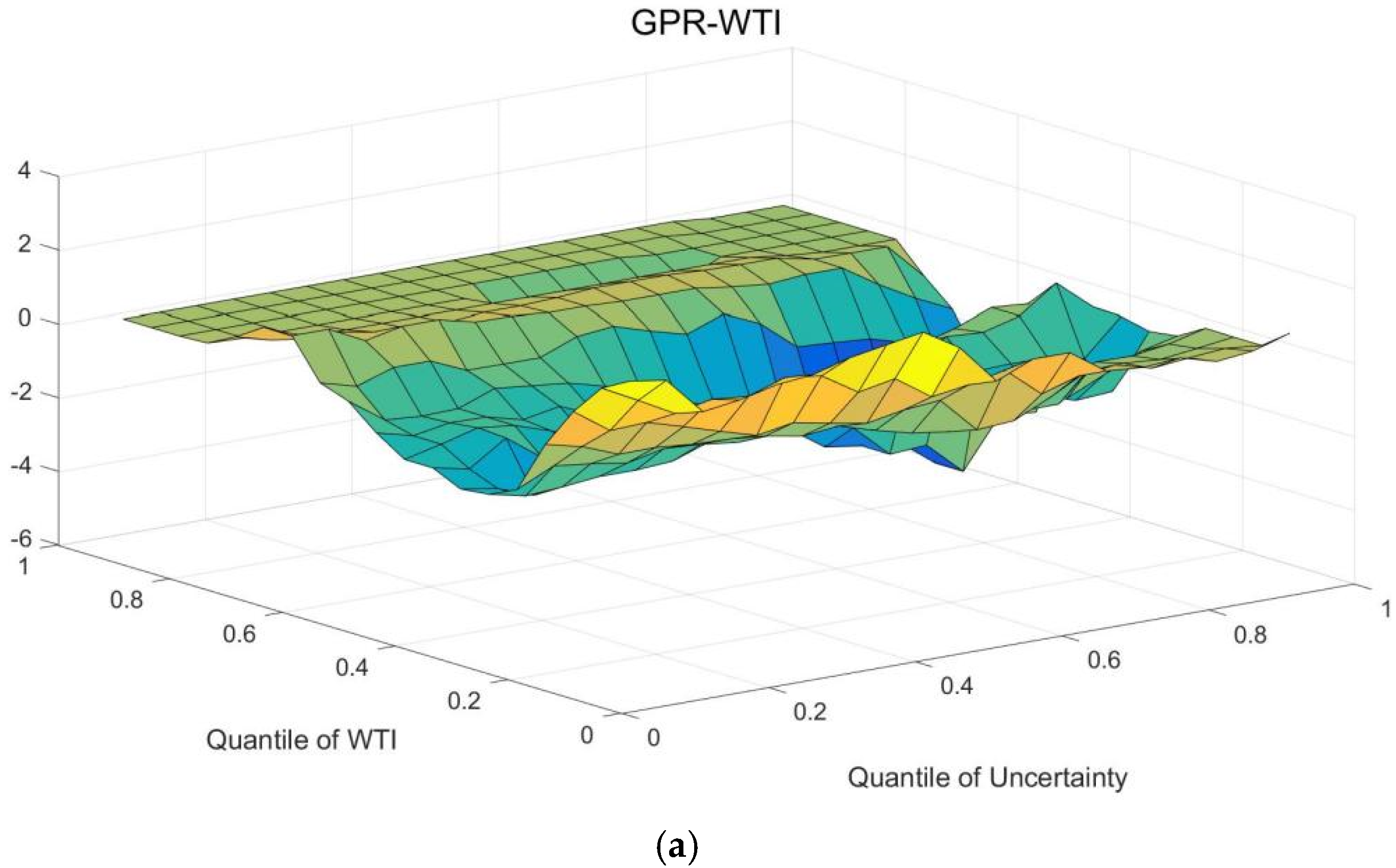

3.1. The Overall Impact of Three Uncertainties on Crude Oil Prices

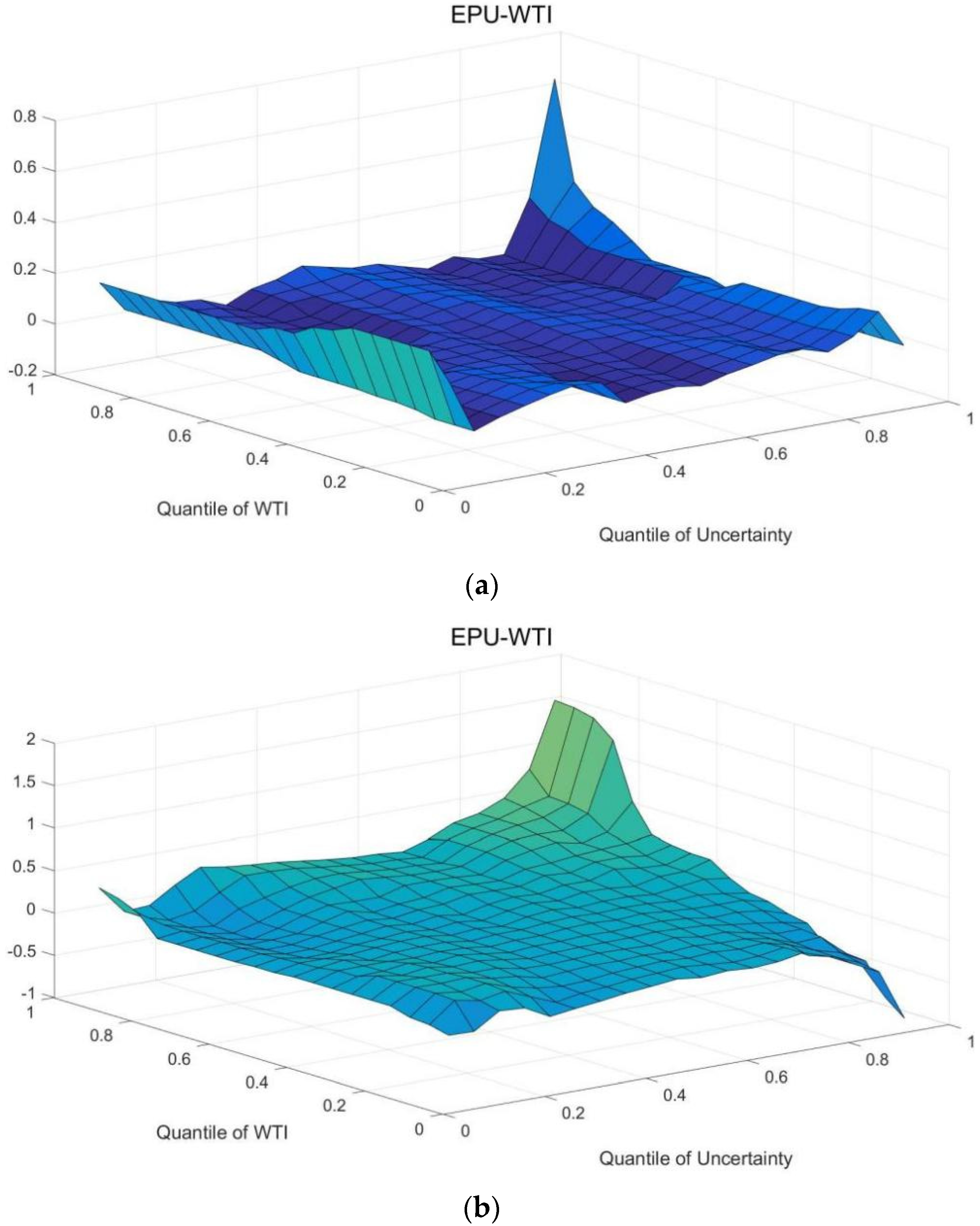

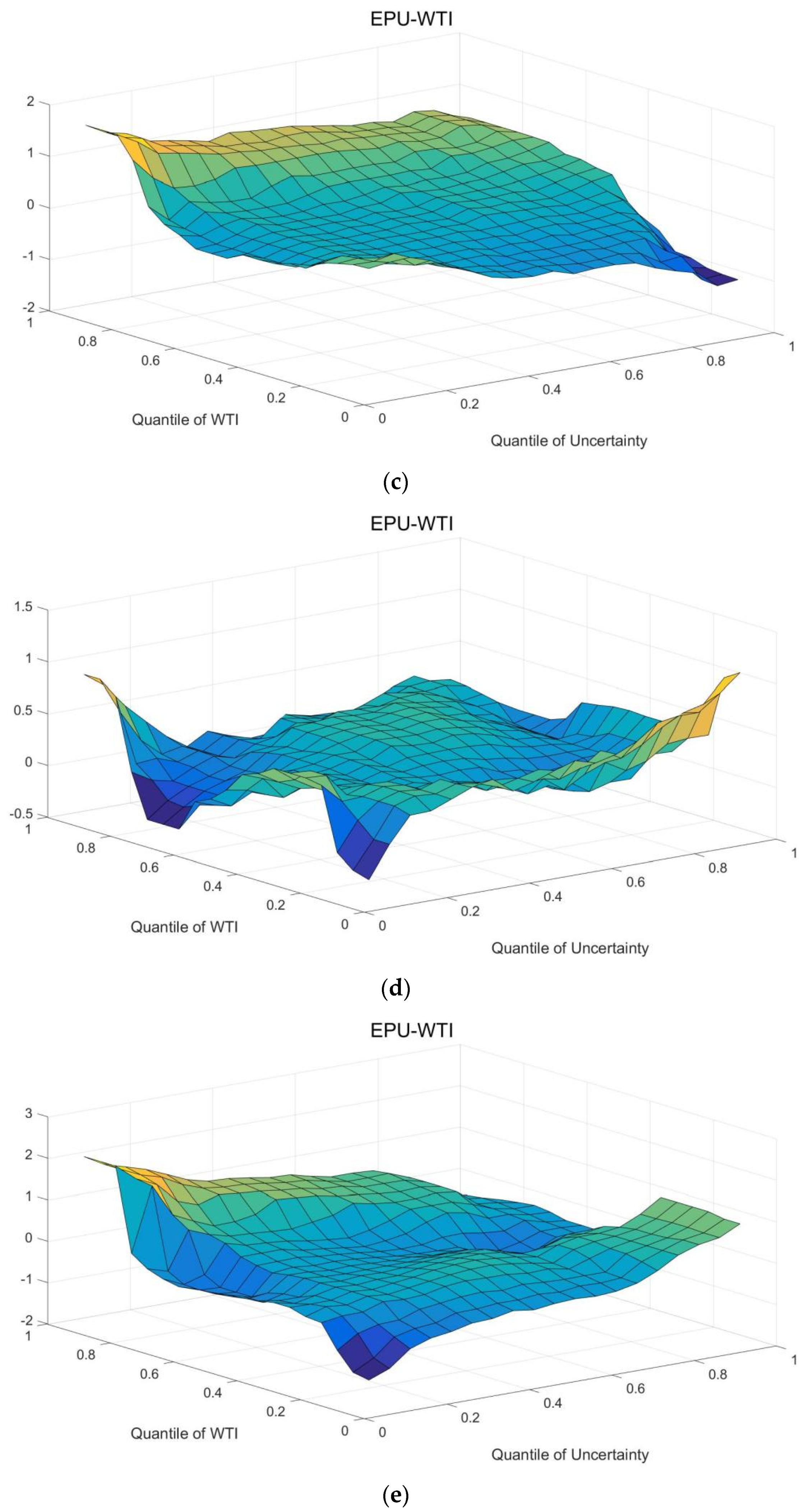

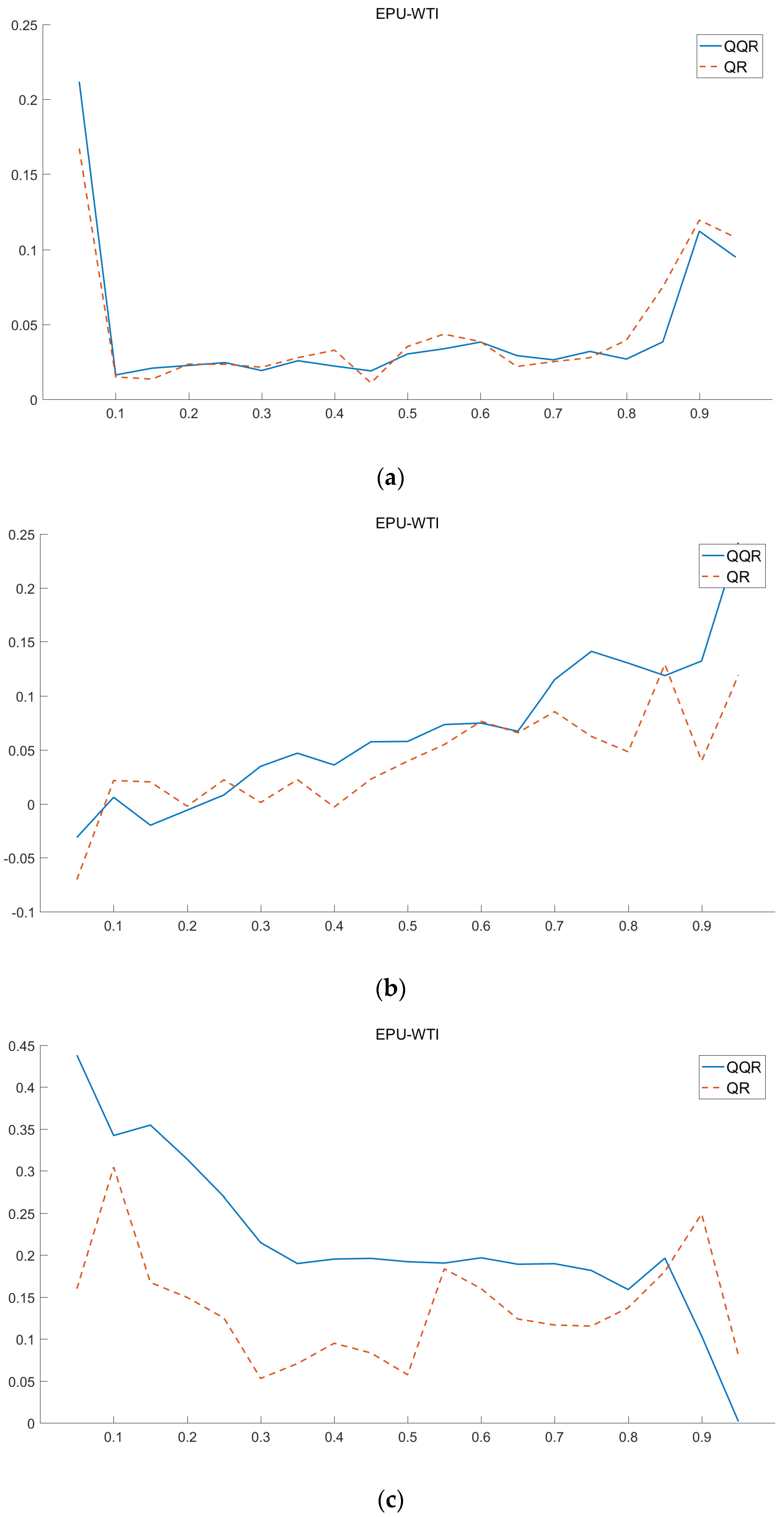

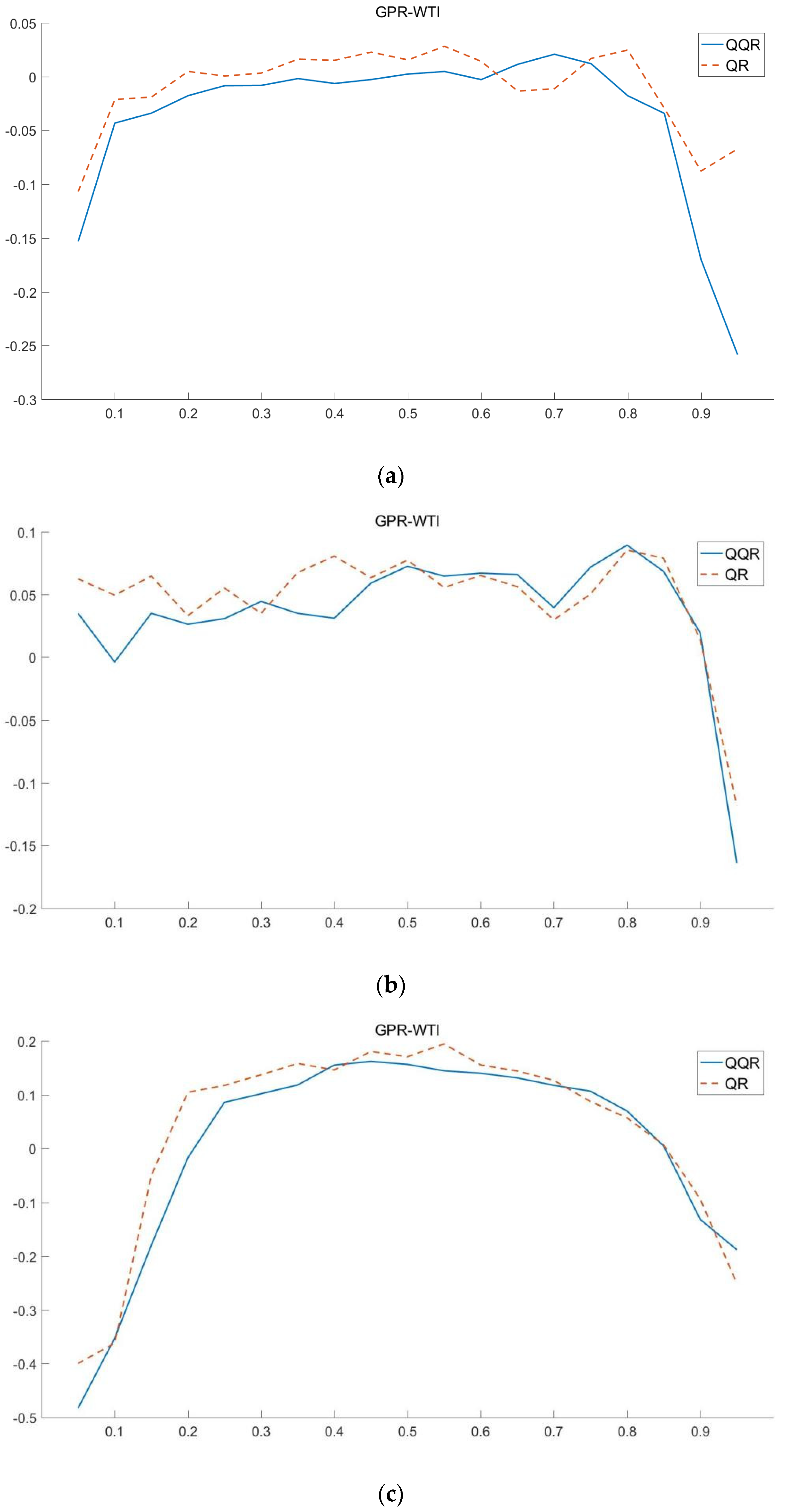

3.2. The Heterogeneous Impact of Economic Policy Uncertainty on Crude Oil Prices

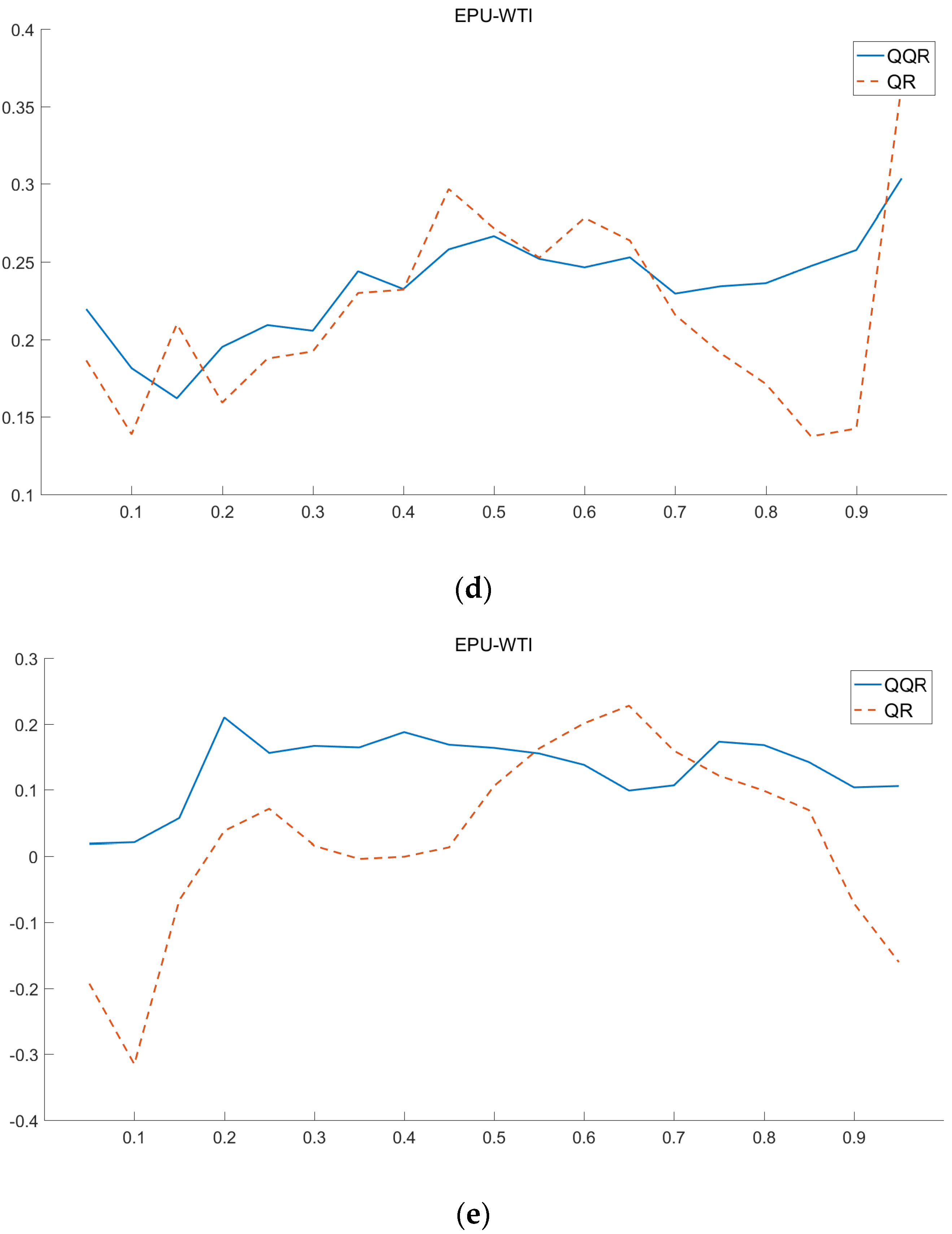

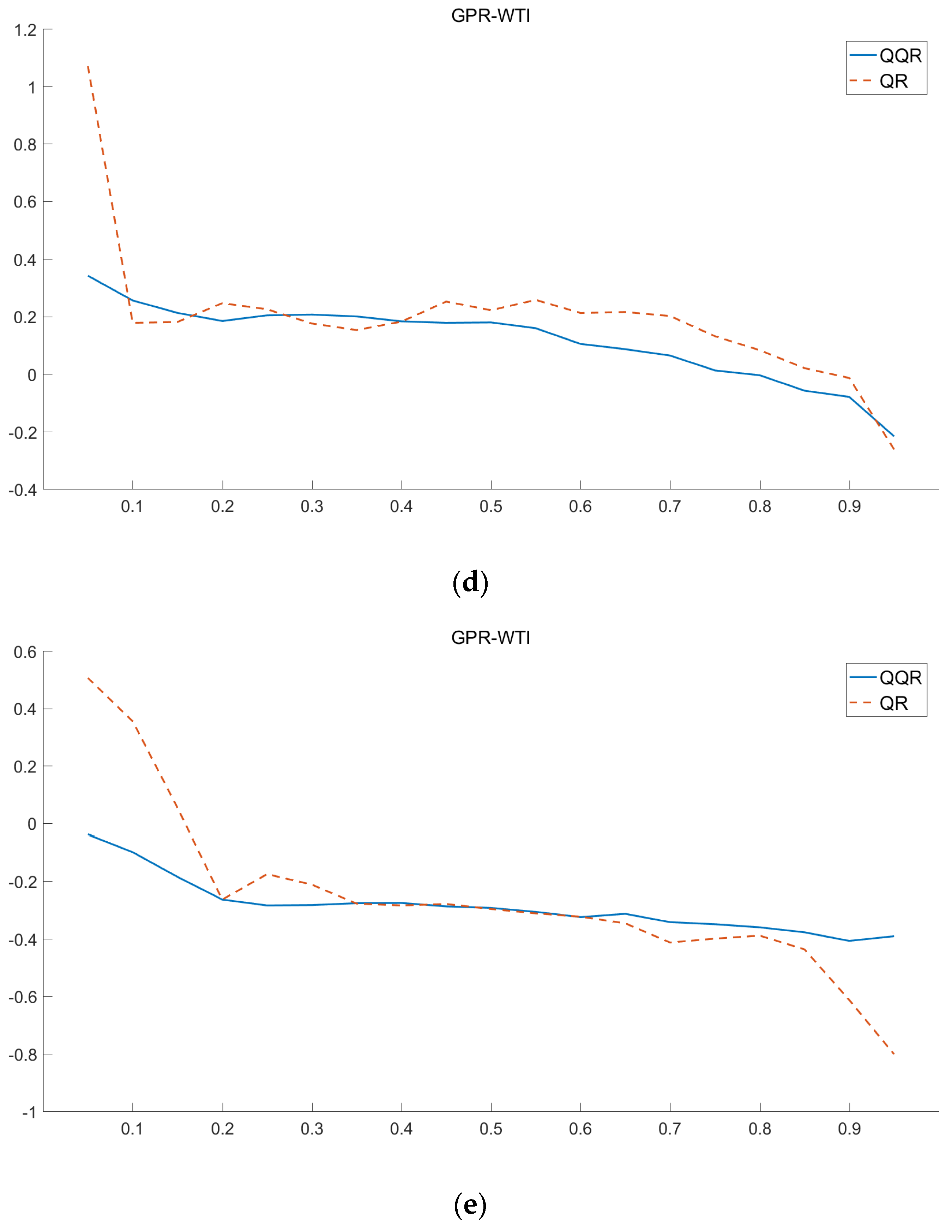

3.3. The Heterogeneous Impact of Geopolitical Risk Uncertainty on Crude Oil Prices

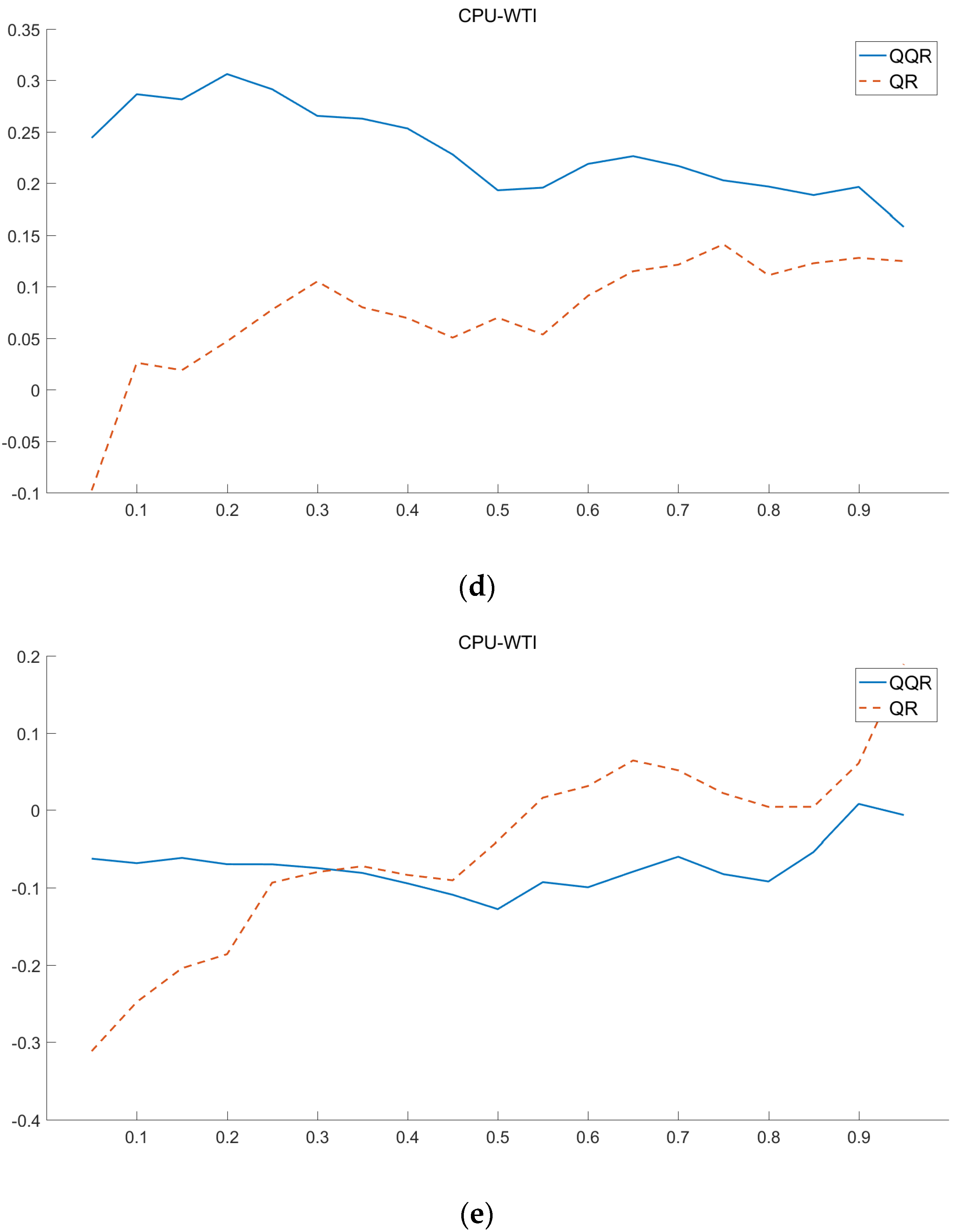

3.4. The Heterogeneous Impact of Climate Policy Uncertainty on Crude Oil Prices

4. Discussion

4.1. Comparison and Discussion on the Overall Impacts of Three Uncertainties on Crude Oil Prices

4.2. Comparison and Discussion on the Impact Intensity of Three Uncertainties on Crude Oil Price under Different Time Scales

4.3. Comparison and Discussion on the Impact Direction and Fluctuation of Three Uncertainties on Crude Oil Price on Different Time Scales

4.4. Robustness Test

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Li, Z.; Dong, H.; Floros, C.; Charemis, A.; Failler, P. Re-examining Bitcoin Volatility: A CAViaR-based Approach. Emerg. Mark. Financ. Trade 2022, 58, 1320–1338. [Google Scholar] [CrossRef]

- Boateng, E.; Asafo-Adjei, E.; Addison, A.; Quaicoe, S.; Yusuf, M.A.; Abeka, M.J.; Adam, A.M. Interconnectedness among commodities, the real sector of Ghana and external shocks. Resour. Policy 2022, 75, 102511. [Google Scholar] [CrossRef]

- Gavriilidis, K. Measuring Climate Policy Uncertainty. 2021. Available online: https://ssrn.com/abstract=3847388 (accessed on 24 June 2021).

- Adekunle, W.; Bagudo, A.M.; Odumosu, M.; Inuolaji, S.B. Predicting stock returns using crude oil prices: A firm level analysis of Nigeria’s oil and gas sector. Resour. Policy 2020, 68, 101708. [Google Scholar] [CrossRef]

- Asai, M.; Gupta, R.; McAleer, M. Forecasting volatility and co-volatility of crude oil and gold futures: Effects of leverage, jumps, spillovers, and geopolitical risks. Int. J. Forecast. 2020, 36, 933–948. [Google Scholar] [CrossRef] [Green Version]

- Chkir, I.; Guesmi, K.; Ben Brayek, A.; Naoui, K. Modelling the nonlinear relationship between oil prices, stock markets, and exchange rates in oil-exporting and oil-importing countries. Res. Int. Bus. Financ. 2020, 54, 101274. [Google Scholar] [CrossRef]

- Li, Z.H.; Zhong, J.H. Impact of economic policy uncertainty shocks on China’s financial conditions. Eur. J. Oper. Res. 2020, 35. [Google Scholar] [CrossRef]

- Huynh, T.L.D.; Burggraf, T.; Nasir, M.A. Financialisation of natural resources & instability caused by risk transfer in commodity markets. Resour. Policy 2020, 66, 101620. [Google Scholar]

- Latunde, T.; Akinola, L.S.; Dare, D.D. Analysis of capital asset pricing model on Deutsche bank energy commodity. Green Financ. 2020, 2, 20–34. [Google Scholar] [CrossRef]

- Aimer, N.; Lusta, A. Asymmetric effects of oil shocks on economic policy uncertainty. Energy 2022, 241, 122712. [Google Scholar] [CrossRef]

- Le, T.-H.; Le, A.T.; Le, H.-C. The historic oil price fluctuation during the COVID-19 pandemic: What are the causes? Res. Int. Bus. Finance 2021, 58, 101489. [Google Scholar] [CrossRef]

- Hailemariam, A.; Smyth, R.; Zhang, X. Oil prices and economic policy uncertainty: Evidence from a nonparametric panel data model. Energy Econ. 2019, 83, 40–51. [Google Scholar] [CrossRef]

- Lyu, Y.; Yi, H.; Wei, Y.; Yang, M. Revisiting the role of economic uncertainty in oil price fluctuations: Evidence from a new time-varying oil market model. Econ. Model. 2021, 103, 105616. [Google Scholar] [CrossRef]

- Sun, X.; Chen, X.; Wang, J.; Li, J. Multi-scale interactions between economic policy uncertainty and oil prices in time-frequency domains. North Am. J. Econ. Financ. 2020, 51, 100854. [Google Scholar] [CrossRef]

- Lin, B.; Bai, R. Oil prices and economic policy uncertainty: Evidence from global, oil importers, and exporters’ perspective. Res. Int. Bus. Financ. 2021, 56, 101357. [Google Scholar] [CrossRef]

- He, H.; Sun, M.; Gao, C.; Li, X. Detecting lag linkage effect between economic policy uncertainty and crude oil price: A multi-scale perspective. Phys. A Stat. Mech. Its Appl. 2021, 580, 126146. [Google Scholar] [CrossRef]

- Su, C.-W.; Huang, S.-W.; Qin, M.; Umar, M. Does crude oil price stimulate economic policy uncertainty in BRICS? Pacific-Basin Financ. J. 2021, 66, 101519. [Google Scholar] [CrossRef]

- Wang, L.; Ma, F.; Hao, J.; Gao, X. Forecasting crude oil volatility with geopolitical risk: Do time-varying switching probabilities play a role? Int. Rev. Financ. Anal. 2021, 76, 101756. [Google Scholar] [CrossRef]

- Liu, Y.; Han, L.; Xu, Y. The impact of geopolitical uncertainty on energy volatility. Int. Rev. Financ. Anal. 2021, 75, 101743. [Google Scholar] [CrossRef]

- Monge, M.; Cristóbal, E. Terrorism and the behavior of oil production and prices in OPEC. Resour. Policy 2021, 74, 102321. [Google Scholar] [CrossRef]

- Chen, H.; Liao, H.; Tang, B.-J.; Wei, Y.-M. Impacts of OPEC’s political risk on the international crude oil prices: An empirical analysis based on the SVAR models. Energy Econ. 2016, 57, 42–49. [Google Scholar] [CrossRef]

- Ivanovski, K.; Hailemariam, A. Time-varying geopolitical risk and oil prices. Int. Rev. Econ. Financ. 2022, 77, 206–221. [Google Scholar] [CrossRef]

- Atri, H.; Kouki, S.; Gallali, M.I. The impact of COVID-19 news, panic and media coverage on the oil and gold prices: An ARDL approach. Resour. Policy 2021, 72, 102061. [Google Scholar] [CrossRef] [PubMed]

- Lee, C.-C.; Olasehinde-Williams, G.; Akadiri, S.S. Are geopolitical threats powerful enough to predict global oil price volatility? Environ. Sci. Pollut. Res. 2021, 28, 28720–28731. [Google Scholar] [CrossRef] [PubMed]

- Hu, M.; Zhang, D.; Ji, Q.; Wei, L. Macro factors and the realized volatility of commodities: A dynamic network analysis. Resour. Policy 2020, 68, 101813. [Google Scholar] [CrossRef] [PubMed]

- Uddin, G.S.; Hernandez, J.A.; Wadström, C.; Dutta, A.; Ahmed, A. Do uncertainties affect biofuel prices? Biomass-Bioenergy 2021, 148, 106006. [Google Scholar] [CrossRef]

- Yi, A.; Yang, M.; Li, Y. Macroeconomic Uncertainty and Crude Oil Futures Volatility–Evidence from China Crude Oil Futures Market. Front. Environ. Sci. 2021, 9, 21. [Google Scholar] [CrossRef]

- Dutta, A.; Bouri, E.; Saeed, T. News-based equity market uncertainty and crude oil volatility. Energy 2021, 222, 119930. [Google Scholar] [CrossRef]

- Dutta, A.; Bouri, E.; Noor, H. Climate bond, stock, gold, and oil markets: Dynamic correlations and hedging analyses during the COVID-19 outbreak. Resour. Policy 2021, 74, 102265. [Google Scholar] [CrossRef]

- Ben Jabeur, S.; Khalfaoui, R.; Ben Arfi, W. The effect of green energy, global environmental indexes, and stock markets in predicting oil price crashes: Evidence from explainable machine learning. J. Environ. Manag. 2021, 298, 113511. [Google Scholar] [CrossRef]

- Fahmy, H. The rise in investors’ awareness of climate risks after the Paris Agreement and the clean energy-oil-technology prices nexus. Energy Econ. 2022, 106, 105738. [Google Scholar] [CrossRef]

- Crowley, P.M. A guide to wavelets for economists. J. Econ. Surv. 2007, 21, 207–267. [Google Scholar] [CrossRef]

- Jiang, Y.; Tian, G.; Wu, Y.; Mo, B. Impacts of geopolitical risks and economic policy uncertainty on Chinese tourism-listed company stock. Int. J. Financ. Econ. 2022, 27, 320–333. [Google Scholar] [CrossRef]

- Gencay, R.; Signori, D. Multi-scale tests for serial correlation. J. Econom. 2015, 184, 62–80. [Google Scholar] [CrossRef]

- Mo, B.; Li, Z.; Meng, J. The dynamics of carbon on green energy equity investment: Quantile-on-quantile and quantile coherency approaches. Environ. Sci. Pollut. Res. 2022, 29, 5912–5922. [Google Scholar] [CrossRef]

- Sim, N.; Zhou, H. Oil prices, US stock return, and the dependence between their quantiles. J. Bank. Financ. 2015, 55, 1–8. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Shahbaz, M.; Ferrer, R.; Kumar, R.R. Tourism-led growth hypothesis in the top ten tourist destinations: New evidence using the quantile-on-quantile approach. Tour. Manag. 2017, 60, 223–232. [Google Scholar] [CrossRef] [Green Version]

- Mo, B.; Chen, C.; Nie, H.; Jiang, Y. Visiting effects of crude oil price on economic growth in BRICS countries: Fresh evidence from wavelet-based quantile-on-quantile tests. Energy 2019, 178, 234–251. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring Economic Policy Uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Caldara, D.; Iacoviello, M. Measuring Geopolitical Risk; Working Paper; Board of Governors of the Federal Reserve Board: Wasington, DC, USA, 2021.

- Jia, S.S.; Dong, H.; Wang, Z.Z. Identifying the Asymmetric Channel of Crude Oil Risk Pass-Through to Macro Economy: Based on Crude Oil Attributes. Front. Energy Res. 2022, 9, 831. [Google Scholar] [CrossRef]

- Liu, Y.Q.; Li, Z.H.; Yao, Y.Y.; Dong, H. Asymmetry of Risk Evolution in Crude Oil Market: From the Perspective of Dual Attributes of Oil. Energies 2021, 14, 4063. [Google Scholar] [CrossRef]

- Jia, S.S.; Dong, H.; Yang, H.W. Asymmetric Risk Spillover of the International Crude Oil Market in the Perspective of Crude Oil Dual Attributes. Front. Environ. Sci. 2021, 9, 335. [Google Scholar] [CrossRef]

- Chen, S.L.; Ouyang, S.Y.; Dong, H. Oil Price Pass-Through Into Consumer and Producer Prices With Monetary Policy in China: Are There Non-linear and Mediating Effects. Front. Energy Res. 2020, 8, 35. [Google Scholar] [CrossRef] [Green Version]

- Liu, Y.; Dong, H.; Failler, P. The Oil Market Reactions to OPEC’s Announcements. Energies 2019, 12, 3238. [Google Scholar] [CrossRef] [Green Version]

- Dong, H.; Liu, Y.; Chang, J.Q. The heterogeneous linkage of economic policy uncertainty and oil return risks. Green Financ. 2019, 1, 46–66. [Google Scholar] [CrossRef]

- Liu, Y.; Li, Z.; Xu, M. The Influential Factors of Financial Cycle Spillover: Evidence from China. Emerg. Mark. Financ. Trade 2019, 56, 1336–1350. [Google Scholar] [CrossRef]

- Li, T.; Li, X.; Liao, G. Business cycles and energy intensity. Evidence from emerging economies. Borsa Istanb. Rev. 2021. [Google Scholar] [CrossRef]

- Zhu, J.; Huang, Z.; Li, Z.; Albitar, K. The Impact of Urbanization on Energy Intensity—An Empirical Study on OECD Countries. Green Financ. 2021, 3, 508–526. [Google Scholar] [CrossRef]

- Atta-Mensah, J. Commodity-linked bonds as an innovative financing instrument for African countries to build back better. Quant. Financ. Econ. 2021, 5, 516–541. [Google Scholar] [CrossRef]

- Qin, Y.; Hong, K.; Chen, J.; Zhang, Z. Asymmetric effects of geopolitical risks on energy returns and volatility under different market conditions. Energy Econ. 2020, 90, 104851. [Google Scholar] [CrossRef]

- Zhu, X.; Liao, J.; Chen, Y. Time-varying effects of oil price shocks and economic policy uncertainty on the nonferrous metals industry: From the perspective of industrial security. Energy Econ. 2021, 97, 105192. [Google Scholar] [CrossRef]

- Li, Z.; Ao, Z.; Mo, B. Revisiting the Valuable Roles of Global Financial Assets for International Stock Markets: Quantile Coherence and Causality-in-Quantiles Approaches. Mathematics 2021, 9, 1750. [Google Scholar] [CrossRef]

- Huang, J.; Ding, Q.; Zhang, H.; Guo, Y.; Suleman, M.T. Nonlinear dynamic correlation between geopolitical risk and oil prices: A study based on high-frequency data. Res. Int. Bus. Financ. 2021, 56, 101370. [Google Scholar] [CrossRef]

- Monge, M.; Gil-Alana, L.A.; de Gracia, F.P. Crude oil price behaviour before and after military conflicts and geopolitical events. Energy 2017, 120, 79–91. [Google Scholar] [CrossRef]

- Li, Z.; Zou, F.; Tan, Y.; Zhu, J. Does Financial Excess Support Land Urbanization—An Empirical Study of Cities in China. Land 2021, 10, 635. [Google Scholar] [CrossRef]

- Fine, J.; Busch, C.; Garderet, R. The upside hedge value of California’s global warming policy given uncertain future oil prices. Energy Policy 2012, 44, 46–51. [Google Scholar] [CrossRef]

- Li, Z.; Chen, L.; Dong, H. What are bitcoin market reactions to its-related events? Int. Rev. Econ. Financ. 2021, 73, 1750. [Google Scholar] [CrossRef]

- You, W.; Guo, Y.; Zhu, H.; Tang, Y. Oil price shocks, economic policy uncertainty and industry stock returns in China: Asymmetric effects with quantile regression. Energy Econ. 2017, 68, 1–18. [Google Scholar] [CrossRef]

- Aloui, R.; Gupta, R.; Miller, S.M. Uncertainty and crude oil returns. Energy Econ. 2016, 55, 92–100. [Google Scholar] [CrossRef] [Green Version]

- Li, Z.; Huang, Z.; Failler, P. Dynamic Correlation between Crude Oil Price and Investor Sentiment in China: Heterogeneous and Asymmetric Effect. Energies 2022, 15, 687. [Google Scholar] [CrossRef]

- Dash, S.R.; Maitra, D. Do oil and gas prices influence economic policy uncertainty differently: Multi-country evidence using time-frequency approach. Q. Rev. Econ. Financ. 2021, 81, 397–420. [Google Scholar] [CrossRef]

- Li, F.; Huang, Z.; Zhong, J.; Albitar, K. Do Tense Geopolitical Factors Drive Crude Oil Prices? Energies 2020, 13, 4277. [Google Scholar] [CrossRef]

- Li, T.; Li, X.; Albitar, K. Threshold effects of financialization on enterprise R & D innovation: A comparison research on heterogeneity. Quant. Financ. Econ. 2021, 5, 496–515. [Google Scholar] [CrossRef]

- Li, Z.; Zou, F.; Mo, B. Does mandatory CSR disclosure affect enterprise total factor productivity? Econ. Res.-Ekon. Istraživanja 2021, D04–D24. [Google Scholar] [CrossRef]

- Kanwal, M.; Khan, H. Does carbon asset add value to clean energy market? Evidence from EU. Green Financ. 2021, 3, 495–507. [Google Scholar] [CrossRef]

- Farouq, I.S.; Sambo, N.U.; Ahmad, A.U.; Jakada, A.H.; Danmaraya, I.A. Does financial globalization uncertainty affect CO2 emissions? Empirical evidence from some selected SSA countries. Quant. Financ. Econ. 2021, 5, 247–263. [Google Scholar] [CrossRef]

- Haas, R.; Ajanovic, A.; Ramsebner, J.; Perger, T.; Knápek, J.; Bleyl, J.W. Financing the future infrastructure of sustainable energy systems. Green Financ. 2021, 3, 90–118. [Google Scholar] [CrossRef]

- Li, F.; Yang, C.; Li, Z.; Failler, P. Does Geopolitics Have an Impact on Energy Trade? Empirical Research on Emerging Countries. Sustainability 2021, 13, 5199. [Google Scholar] [CrossRef]

- Yang, C.; Li, T.; Albitar, K. Does Energy Efficiency Affect Ambient PM2.5? The Moderating Role of Energy Investment. Front. Environ. Sci. 2021, 9, 707751. [Google Scholar] [CrossRef]

| Variable | Characterization Variable | Abbreviation | Data Source |

|---|---|---|---|

| Economic policy uncertainty | The GEPU index | EPU | www.policyuncetainty.com accessed on 5 April 2021. |

| Geopolitical risk uncertainty | The GPR index | GPR | |

| Climate policy uncertainty | The CPU index | CPU | |

| International crude oil price | WTI crude oil spot price | WTI | EIA |

| GPR | CPU | EPU | WTI | |

|---|---|---|---|---|

| Mean | 1.991222 | 1.886567 | 2.096881 | 1.783795 |

| Max | 2.554745 | 2.798664 | 2.640524 | 2.126261 |

| Min | 1.806636 | 0.646404 | 1.735542 | 1.269046 |

| S.D. | 0.115056 | 0.372932 | 0.205722 | 0.200629 |

| Skew | 1.271105 | −0.60545 | 0.351873 | −0.39509 |

| Kurt | 5.617675 | 3.412205 | 2.504763 | 2.465084 |

| J-B | 128.1574 | 15.74837 | 7.127481 | 8.763766 |

| Prob | 0 | 0.00038 | 0.028333 | 0.012502 |

| ADF | −4.46863 | −3.45683 | −4.98621 | −3.11919 |

| Prob | 0.0003 | 0.0101 | 0.0003 | 0.0265 |

| Period | Time Scale | Positive Impact Peak and the Quantiles | Negative Impact Peak and the Quantiles | The Change of the Impact Direction | The Quantiles at Which the Impact Direction Changes |

|---|---|---|---|---|---|

| Short-term | D1 | The peak is around 0.62; both the EPU and the WTI are at the high quantile (0.9–1) | None | None | None |

| D2 | The peak is around 1.5; both the EPU and the WTI are at the high quantile (0.9–1) | The peak is around −1; the EPU is at the high quantile (0.8–1), and the WTI is at the low quantile (0–0.1) | From the negative to the positive | The EPU is at the high quantile (0.8–0.95), and the WTI is at the low quantile (0–0.1) | |

| Mid-term | D3 | The peak is around 1.5; the EPU is at the low quantile (0–0.1), and the WTI is at the high quantile (0.8–1) | The peak is around −1.2; the EPU is at the high quantile (0.8–1), and the WTI is at the low quantile (0–0.1) | From the positive to the negative | The EPU is at the high quantile (0.8–0.95), and the WTI is at the low quantile (0–0.1) |

| D4 | The peak is around 1; the EPU is at the high quantile (0.8–1), and the WTI is at the low quantile (0–0.1) | The peak is around −0.4; the EPU is at the low quantile (0–0.1), and the WTI is at the high quantile (0.6–0.75) | From the negative to the positive; in the “N” shape. | Both the EPU and the WTI are at the low quantile (0–0.2); the EPU is at the low quantile (0–0.1), whereas the WTI is in the full stage. | |

| Long-term | D5 | The peak is around 2; the EPU is at the low quantile (0–0.1), and the WTI is at the high quantile (0.8–1) | The peak is around −1.4; both the EPU and the WTI are at the low quantile (0–0.1) | From the negative to the positive | The EPU is at the low quantile (0–0.1), and the WTI is at the mid-high quantile (0.6–0.8); the EPU is at the middle and high quantile (0.6–0.8), and the WTI is at the low quantile (0–0.1). |

| Period | Time Scale | Positive Impact Peak and the Quantiles | Negative Impact Peak and the Quantiles | The Change of the Impact Direction | The Quantiles at Which the Impact Direction Changes |

|---|---|---|---|---|---|

| Short-term | D1 | None | The peak is around −1.5; the GPR is at the high quantile (0.8–1), and the WTI is at the low quantile (0–0.2) | None | None |

| D2 | The peak is around 0.4; both the GPR and the WTI are at the high quantile (0.8–1) | The peak is around −1.2; the GPR is at the high quantile (0.8–1), and the WTI is at the low quantile (0–0.2) | From the negative to the positive | The GPR is at the high quantile (0.8–1), and the WTI is at the low quantile (0–0.2) | |

| Mid-term | D3 | None | The peak is around −1; the GPR is at the low quantile (0–0.2), and the WTI is at the middle and low quantile (0–0.4) | None | None |

| D4 | The peak is around 1; the GPR is at the low quantile (0–0.2), and the WTI is at the high quantile (0.8–1) | The peak is around −1; the GPR is at the low quantile (0–0.2), and the WTI is at the mid-low quantile (0–0.4) | From the negative to the positive | The GPR is at the low quantile (0–0.2), and the WTI is at the middle quantile (0.4–0.6) | |

| Long-term | D5 | The peak is around 0.5; the GPR is at the high quantile (0.8–1), and the WTI is at the low quantile (0–0.4) | The peak is around −1.54; the GPR is at the low quantile (0–0.2), and the WTI is at the mid-low quantile (0–0.4) | From the negative to the positive | The GPR is at the low quantile (0–0.2), and the WTI is at the middle quantile (0.4–0.6); the GPR is at the mid-high quantile (0.6–0.8), and the WTI is at the mid-low quantile (0–0.4) |

| Period | Time Scale | Positive Impact Peak and the Quantiles | Negative Impact Peak and the Quantiles | The Change of the Impact Direction | The Quantiles at Which the Impact Direction Changes |

|---|---|---|---|---|---|

| Short-term | D1 | The peak is around 0.56; the CPU is at the high quantile (0.8–1), and the WTI is at the mid-high quantile (0.6–0.8) | The peak is around −0.4; the CPU is at the low quantile (0–0.2), and the WTI is at the quantile (0.2–0.4) | In the “M” shape. | The CPU is at the low quantile (0–0.2), and the WTI is at the middle quantile (0.4–0.6); the CPU is at the high quantile (0.8–1), and the WTI is at the mid-high quantile (0.6–0.8). |

| D2 | The peak is around 0.38; the WTI is at the high quantile (0.9–1) | The peak is around −0.4; the CPU is at the low quantile (0–0.2), and the WTI is at the middle quantile (0.4–0.6) | In the “M” shape. | The CPU is at the low quantile (0–0.2), and the WTI is at the middle quantile (0.4–0.6) | |

| Mid-term | D3 | The peak is around 0.8; the CPU is at the mid-high quantile (0.6–0.8), and the WTI is at the high quantile (0.8–1) | The peak is around −1; the EPU is at the low quantile (0–0.2), and the WTI is at the low quantile (0.2–0.3) | In the “M” shape. | The CPU is at the low quantile (0–0.2), and the WTI is at the mid-low quantile (0.2–0.6) |

| D4 | The peak is around 1.25; the CPU is at the low quantile (0–0.2), and the WTI is at the high quantile (0.8–1) | The peak is around −0.3; the CPU is at the low quantile (0–0.2), and the WTI is at the middle quantile (0.4–0.6) | None | None | |

| Long-term | D5 | The peak is around 0.55; the CPU is at the high quantile (0.8–1), and the WTI is at the mid-low quantile (0–0.4) | None | From the negative to the positive | The EPU is at the high quantile (0.7–1), and the WTI is at the high quantile (0.6–0.8). |

| Uncertainty Type | Positive Impact Peak and the Quantiles | Negative Impact Peak and the Quantiles | The Change of the Impact Direction | The Quantiles at Which the Impact Direction Changes |

|---|---|---|---|---|

| EPU | The peak is around 1.6; the EPU is at the quantile (0.2–0.6) and the WTI is near the quantile 0.3 | No obvious peak | From the negative to the positive, then to the negative | When the EPU is at the quantile (0.2–1) and the WTI is at the low quantile (0–0.4) |

| GPR | No obvious peak | The peak is around −4; the GPR is at the mid-high quantile (0.6–0.8) and the WTI is at the mid-low quantile (0.2–0.4) | No obvious change | None |

| CPU | The peak is around 2; the CPU is at the quantile (0.4–0.9), and the WTI is at the low quantile (0–0.1) | The peak is about −15; the CPU is at the mid-low quantile (0.2–0.4) and the WTI is at the low quantile (0.1–0.2) | From the positive to the negative | When the WTI is at low quantile (0–0.2) |

| Uncertainty Type | Impact Intensity Peak and Quantile Position in D1 | Impact Intensity Peak and Quantile Position in D2 | Impact Intensity Peak and Quantile Position in D3 | Impact Intensity Peak and Quantile Position in D4 | Impact Intensity Peak and Quantile Position in D5 |

|---|---|---|---|---|---|

| EPU | The positive impact peak is around 0.62 when both the EPU and the WTI are at the high quantile (0.9–1); no obvious negative impact peak | The positive peak is around 1.5 when both the EPU and the WTI are at the high quantile (0.9–1); the negative impact peak is around −1; the EPU is at the high quantile (0.8–1), and the WTI is at the low quantile (0–0.1) | The positive impact peak is around 1.5; the EPU is at the low quantile (0–0.1), and the WTI is at the high quantile (0.8–1); the negative impact peak is around −1.2; the EPU is at the high quantile (0.8–1), and the WTI is at the low quantile (0–0.1) | The positive impact peak is around 1; the EPU is at the high quantile (0.8–1), and the WTI is at the low quantile (0–0.1); The negative impact peak is around −0.4; the EPU is at the low quantile (0–0.1), and the WTI is at the high quantile (0.6–0.75) | The positive impact peak is around 2; the EPU is at the low quantile (0–0.1), and the WTI is at the high quantile (0.8–1); the negative impact peak is around −1.4; both the EPU and the WTI are at the low quantile (0–0.1) |

| GPR | No obvious positive impact peak; the negative impact peak is around −1.5 when the GPR is at the high quantile (0.8–1), and the WTI is at the low quantile (0–0.2) | The peak is around 0.4 when both the GPR and the WTI are at the high quantile (0.8–1); the negative impact peak is around −1.2 when the GPR is at the high quantile (0.8–1), and the WTI is at the low quantile (0–0.2) | No obvious positive impact peak; the negative impact peak is around −1 when the GPR is at the low quantile (0–0.2), and the WTI is at the middle and low quantile (0–0.4) | The positive impact peak is around 1 when the GPR is at the low quantile (0–0.2), and the WTI is at the high quantile (0.8–1). The negative impact peak is around −1 when the GPR is at the low quantile (0–0.2), and the WTI is at the middle and low quantile (0–0.4) | The positive impact peak is around 0.5 when the GPR is at the high quantile (0.8–1), and the WTI is at the low quantile (0–0.4); the negative impact peak is around −1.54; the GPR is at the low quantile (0–0.2), and the WTI is at the middle and low quantile (0–0.4) |

| CPU | The positive impact peak is around 0.56 when the CPU is at the high quantile (0.8–1), and the WTI is at the mid-high quantile (0.6–0.8); the negative impact peak is around −0.4 when the CPU is at the low quantile (0–0.2), and the WTI is at the quantile (0.2–0.4). | The positive impact peak is around 0.38 when the WTI is at the high quantile (0.9–1); the negative impact peak is around −0.4; the CPU is at the low quantile (0–0.2), and the WTI is at the middle quantile (0.4–0.6) | The positive impact peak is around 0.8 when the CPU is at the mid-high quantile (0.6–0.8), and the WTI is at the high quantile (0.8–1); the negative impact peak is around −1 when the EPU is at the low quantile (0–0.2), and the WTI is at the low quantile (0.2–0.3). | The positive impact peak is around 1.25 when the CPU is at the low quantile (0–0.2), and the WTI is at the high quantile (0.8–1); the negative impact peak is around −0.3; the CPU is at the low quantile (0–0.2), and the WTI is at the middle quantile (0.4–0.6). | The positive impact peak is around 0.55; the CPU is at the high quantile (0.8–1), and the WTI is at the mid-low quantile (0–0.4); no obvious negative impact peak |

| Uncertainty Type | Impact Direction Change and Quantile Position in D1 | Impact Direction Change and Quantile Position in D2 | Impact Direction Change and Quantile Position in D3 | Impact Direction Change and Quantile Position in D4 | Impact Direction Change and Quantile Position in D5 |

|---|---|---|---|---|---|

| EPU | None | From the negative to the positive; the EPU is at the high quantile (0.8–0.95) and the WTI is at the low quantile (0–0.1) | From the positive to the negative. The EPU is at the high quantile (0.8–0.95), and the WTI is at the low quantile (0–0.1) | From the negative to the positive; change in the “N” shape. Both the EPU and the WTI are at the low quantile (0–0.2); the EPU is at the low quantile (0–0.1), whereas the WTI is in the full stage | From the negative to the positive; the EPU is at the low quantile (0–0.1), and the WTI is at the middle and high quantile (0.6–0.8); the EPU is at the middle and high quantile (0.6–0.8), and the WTI is at the low quantile (0–0.1). |

| GPR | None | From the negative to the positive; the GPR is at the high quantile (0.8–1), and the WTI is at the low quantile (0–0.2) | None | From the negative to the positive, when the GPR is at the low quantile (0–0.2) and the WTI is at the middle quantile (0.4–0.6) | From the negative to the positive when the GPR is at the low quantile (0–0.2) and the WTI is at the middle quantile (0.4–0.6); the GPR is at the mid-high quantile (0.6–0.8), and the WTI is at the mid-low quantile (0–0.4) |

| CPU | In the “M” shape, the CPU is at the low quantile (0–0.2), and the WTI is at the middle quantile (0.4–0.6) | In the “M” shape, the CPU is at the low quantile (0–0.2), and the WTI is at the middle quantile (0.4–0.6) | In the “M” shape, the CPU is at the low quantile (0–0.2), and the WTI is at the mid-low quantile (0.2–0.6) | None | From the negative to the positive when the EPU is at the high quantile (0.7–1) and the WTI is at the high quantile (0.6–0.8) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ding, Y.; Liu, Y.; Failler, P. The Impact of Uncertainties on Crude Oil Prices: Based on a Quantile-on-Quantile Method. Energies 2022, 15, 3510. https://doi.org/10.3390/en15103510

Ding Y, Liu Y, Failler P. The Impact of Uncertainties on Crude Oil Prices: Based on a Quantile-on-Quantile Method. Energies. 2022; 15(10):3510. https://doi.org/10.3390/en15103510

Chicago/Turabian StyleDing, Yan, Yue Liu, and Pierre Failler. 2022. "The Impact of Uncertainties on Crude Oil Prices: Based on a Quantile-on-Quantile Method" Energies 15, no. 10: 3510. https://doi.org/10.3390/en15103510

APA StyleDing, Y., Liu, Y., & Failler, P. (2022). The Impact of Uncertainties on Crude Oil Prices: Based on a Quantile-on-Quantile Method. Energies, 15(10), 3510. https://doi.org/10.3390/en15103510