Abstract

The demand for liquefied natural gas (LNG) as an energy commodity is increasing, although its respective supply chain is subjected to risks, uncertainties, and disturbances. An analysis of experiences from the global LNG supply chain highlights many of these risks. As such, there is an incumbent need to develop resilient LNG supply chains. In this study, the risks associated with the LNG supply chain are categorized into four dimensions: Political and regulatory, safety and security, environmental effects, and reliability of new technologies. A SWOT method is then implemented to identify strengths, weaknesses, opportunities, and threats within the LNG supply chain, where the LNG supply chain of Qatar is considered as a case study. Relevant strategies are then recommended using a SWOT matrix to maximize strengths and opportunities, while avoiding or minimizing weaknesses and threats within the LNG supply chain. Finally, major parameters to be considered to develop a resilient LNG management model are listed based on the level of priority from LNG producer and receiver perspectives. Thus, as part of creating a robust LNG supply chain, decision-makers and stakeholders are urged to use the learnings from the SWOT analysis and experiences from LNG supply chain management.

1. Introduction

Natural gas is an energy source that offers higher environmental benefits compared to other fossil fuels. It has been promoted as a transition fuel to bridge the fossil fuel era with that of renewable fuels. Use of natural gas reduces carbon dioxide (CO2) emissions by 30% when compared to oil and coal, with a twofold reduction in nitrogen oxide (NOx) emissions and virtually negligible sulphur dioxide (SO2) emissions [1]. Incidentally, the demand from the international market is the main driver influencing the production volume of liquefied natural gas (LNG). In this regard, the LNG production capacity of the state of Qatar, one of the largest producers of LNG, will increase from 77 million tons per year (MTA) to 110 MTA by 2025, with a customer portfolio spanning across the globe [2]. This expansion is based on certain assumptions related to the further globalization of the LNG market, the rationale of which are as follows: (i) oil market balance maintains high energy prices; (ii) developing nations, particularly India and China, are accelerating the minimization of greenhouse gas emissions (GHG) by increasing the use of natural gas rather than oil and coal; (iii) and natural gas starts to account for an increasing percentage in power generation compared to other forms of fuel [3]. Notably, a significant shift is underway in the LNG global market as it becomes more flexible, and LNG contracts are changing simultaneously in four dimensions: the term and volume of contracts are reduced, the prohibition on the resale of LNG is lifted, and mixed prices are transitioning from oil-based price to gas-to-gas price. The former paradigm, where purchasers of LNG are entirely dependent on producers and have to engage in long-term contracts to recover the manufacturer’s investment costs and sell its natural gas for 20–30 years, is no longer preferred [4]. In addition, significant developments are occurring in the LNG market. For instance, the LNG market has become liberalized with the increase in the volume and variety of LNG traders. In 2018, the global LNG trade reached record levels of 316.5 MT [5]. High price levels in Japan have also declined, following the decline in oil-indexed LNG costs, from approximately US$ 13/MMBtu in 2015 to US$ 9/MMBtu [5]. In September 2021, the Asian LNG spot price reached a higher record of US$ 34.47/MMBtu from US$ 4.78/MMBtu in September 2020 [6]. These shifts have introduced challenges and uncertainties within the complex LNG market and supply chain encompassing production, gas processing, liquefaction, transportation, storage, regasification, and utilization. Failure in one segment might influence other segments and eventually compromise LNG supply resilience. In the drive towards competitiveness and effectiveness, supply chain management is essential in the current economy. The supply chain is composed of all the links necessary to convert consumer demands into usable products and then return those products to customers. Due to this, it is critical to ensure seamless functioning across the whole supply chain. Considering the above, this research analyzes the main issues in the supply chain considering the changing dynamics of the LNG market and provides recommendations on how to address and mitigate these challenges in the drive towards a greener and more resilient future.

LNG is natural gas that has been cooled to a liquid form for transportation and storage purposes. Natural gas has been liquefied for transportation purposes and reaches unreachable gas market by pipelines or a specialized carrier in a safe, reliable, and efficient manner [7]. The LNG supply chain comprises five key entities/processes: exploration, liquefaction, transportation, regasification, or transport to the consumer. The supply chain begins with natural gas extraction and continues with pipeline transportation to a liquefaction facility. The LNG is then transported to regasification facilities located around the globe, where it is re-gasified and supplied to consumers as natural gas. In most parts of the globe, natural gas is the fastest-growing energy source, driven by the low GHG and the ability to generate electricity with high conversion efficiencies. LNG shipping may demonstrate society’s reliance on marine transport infrastructure. The high cost of LNG supply chain operations and infrastructure creates a strong incentive to develop lean and closely linked systems, which increases resource utilization and reduces costs [8]. Uncertainties in the LNG supply chain may occur in one of the five supply chain processes/entities: Production, storage, transportation, loading/unloading, and utilization. The performance of the supply chain may be affected by delays and bottlenecks caused by uncertainly in any of the connections’ functions. As a result, it is essential to exert control over the numerous variables that affect the supply chain. Appropriate planning and management of uncertainties will result in improved scheduling, optimal production levels, on-time delivery, and increased customer satisfaction. Uncertainties tend to prompt decision-makers to establish safety buffers in terms of time, capability, or inventory to avoid a chain/cascade failure. With these buffers, operational performance may be limited, and competitive advantage reduced.

Resilience is a frequently used term in many areas, including engineering, environmental science, and organizational and operations research. It has encouraged scholars and practitioners to further their studies into supply chain resilience and develop conceptual frameworks. A system’s capacity to recover from adversity and return to its original or better state is known as resilience [9]. Organizations consequently need to examine the resilience of their supply chains as part of continuity. In terms of energy resilience, it refers to the need to ensure that a company’s energy supply is consistent and stable, in addition to factoring in the necessary back up in the case of a power outage. Whereas, energy vulnerability is defined as an energy system’s susceptibility to unfavorable events and change [10]. In terms of risk management in the marine supply chain, the characteristics of a transport system that may degrade or restrict its capacity to survive are referred to as vulnerability, managing and withstanding attacks and disrupting events that occur both within and beyond the system’s perimeters [11]. Resilience involves addressing the effects of a disturbance rather than only avoiding disruption. Prior to disruption, however, efforts are undertaken to build a robust system [11]. Identifying the risks within the supply chain will support a resilient supply chain, where risks can be classified into three categories: (i) internal to the firm (e.g., process and control); (ii) external to the firm but internal to the supply chain network (e.g., demand and supply); and (iii) external to the network (e.g., environment) [12].

The SWOT method has been implemented to analyze various objectives, including processes and energy transition strategies, energy resilience, energy vulnerability, environmental innovation and preservation, and business–institutions–NGOs partnership. For instance, Goers et al. (2021) adopted the SWOT method to identify strengths, weaknesses, opportunities, and threats of renewable energy deployment in energy transition for several regions. The study demonstrates strengths, identifies weaknesses, main opportunities, associated threats, and recommended strategies for guiding regional energy transitions [13]. Vasudevan (2021) examined the impediments and limits imposed by EU policies and frameworks on natural gas decarbonization based on SWOT, which includes a PESTEL (Political, Economic, Social, Technological, Environmental and Legal) macroeconomic factor assessment [14]. Moreover, strengths, weaknesses, and opportunities of the energy sector in the Arab Region was demonstrated in the report highlighting the “Energy vulnerability in the Arab Region” implemented by United Nations Economic and Social Commission for Western Asia [15]. The SWOT method has been also used for environmental innovation and preservation. For instance, the four most potential LNG bunkering systems (Truck-to-Ship, Ship-to-Ship, Port-to-Ship, and Terminal-to-Ship, and Mobile Fuel Tanks) using a SWOT analysis method in the context of the Mediterranean port was examined [16]. In addition, the SWOT method is extensively used in business–institutions–NGOs partnership as governments and international agencies seek to identify strengths, weaknesses, opportunities, and threats [17]. Moreover, existing literature has attempted to determine the optimal means of transporting LNG from one point to another. For instance, a thorough analysis of LNG supply chain resilience places a premium on system stability, reducing emissions, and delivery uptime in the case of interruptions resulting in unexpected shutoffs [18]. Bouwmeester and Osterhaven (2017) used non-linear programming to forecast the broader interregional and inter-industry consequences of natural gas supply interruptions. The model educates policymakers on the scale of the broader economic consequences of natural gas supply interruptions and identifies key gas supplier relationships [19]. Moreover, Sesini et al. (2020) presented a novel modeling framework in emergencies defined by very low temperatures and a rise in natural gas requirements [20]. A global LNG supply chain model was developed to assess vulnerabilities in identifying measures that support a resilient LNG supply chain [21]. However, there is limited work in the literature that have implemented SWOT analysis to assess the LNG supply chain and recommended strategies to enhance the resilience of the LNG supply chain, and no study has reported exogenous security threats and disruption risks across the entire LNG supply chain. As such, this study will address the aforementioned gaps using a Qatar case study described below.

Case Study and Objectives

The LNG business is becoming more competitive with over 20 countries now providing consumers throughout the globe, of which the State of Qatar, United States, Australia, Malaysia, and others are currently major LNG suppliers. As the second-largest LNG exporter in the world (at 77 MTA) in 2021, Qatar is investing heavily to retain its position as the world’s most dominant player [22], by expanding LNG production capacity by approximately 64% by 2027 to achieve 126 million metric tons of LNG per year [23]. Considering that production, liquefaction, and transportation are the three key components within LNG supply chain, expanding LNG transportation capabilities can further enhance Qatar’s LNG supply chain, considering that production and liquefaction are well established. The State of Qatar has gained a substantial competitive advantage by constructing one of the world’s most efficient and reliable LNG end to end supply chains, thus owning and managing the whole LNG supply chain, putting it ahead of competitors in the LNG market. As such, Qatar can be more equipped to react to future unforeseen risk occurrences and instantly recover from any potential interruptions if it boasts independent shipping capabilities, in addition to well-established production and liquefaction facilities. Therefore, the reliance of international purchasers on Qatar as a dependable LNG supplier can grow as the country’s LNG supply systems become more resilient. To further elaborate on the above, this study addresses the strength, weaknesses, opportunities, and threats of the Qatari LNG supply chain and then draw strategies to obtain a resilient LNG supply chain. As such, the primary aim of this study is to strengthen the LNG supply chain’s resilience via the identification of strengths, weaknesses, opportunities, and threats. The importance of the study is to mitigate all the risks associated with technical, environmental, economic, geographic, and political aspects. In this study, the LNG supply chain of Qatar is considered as a case study as part of fulfilling the following objectives:

- Examine recent global accidents that can occur for the LNG supply chain.

- Demonstrate lessons learnt in LNG supply chain experiences from around the globe.

- Address strengths, weaknesses, opportunities, and threats that can affect Qatar’s LNG supply chain.

- Recommend strategies to overcome weaknesses, utilize opportunities, and avoid threats.

- Illustrate major parameters and provide a priority plan to enhance the resilience of Qatar’s LNG supply chain.

- Recommends certain strategies to overcome the risks associated with the LNG supply chain.

The remainder of this report is structured as follows. Section 2 details the method implemented in this study. In Section 3, major accidents and experiences that have occurred in LNG supply chain are described. In Section 4, findings of the SWOT method are demonstrated where strengths, weaknesses, opportunities, and threats are mentioned, and recommended strategies are listed based on the SWOT matrix. Finally, Section 5 summarizes the conclusion and limitations of this study.

2. Methodology

A SWOT method is applied in this study to determine Qatar’s LNG supply chain’s strengths, weaknesses, opportunities, and threats. Therefore, databases and directories are widely utilized in this research to locate and gather information important to the LNG supply chain in Qatar from a technical, industrial, and market-oriented perspective. Statistical data, press announcements, and company reports have been used as resources for this research, as well as official publications and databases from a range of various organizations and associations. Most of the information gathered from these sources has been used to provide a comprehensive description of the LNG supply chain, financial system, global network of main players, market classification, downstream sectoral segmentation, regional markets, and major market and technological advancements. With these resources, researchers identified, classified, described, and forecasted changes in Qatar’s LNG supply chain. The collected data are then used to recommend strategies on how to enhance the robustness of the LNG supply chain.

The SWOT method is often used for strategy creation to learn about the present status of an examined item and create future solutions to existing problems. The SWOT method may be used to identify an item’s strengths (elements to leverage and develop), weaknesses (related areas of guidance and assistance), opportunities (related fields of benefit utilization), and threats (components that prevent the object from developing). Internal factors describe strengths and weaknesses, while external factors define opportunities and dangers [24]. The SWOT method was successfully used in energy discipline, for instance, in the study of sustainable energy development [25,26] and transition to renewable energy [27,28]. The main rationale for selecting a SWOT analysis is to address strengths, weaknesses, opportunities, and threats to the Qatari LNG supply chain and then draw strategies to enhance its resilience. Such analysis enables LNG suppliers to discover all elements that may influence the overall LNG market, and how that may then impact operations, allowing them to gather and compare data of various forms and objectives, which together can provide decision makers with all the necessary information to undertake critical decisions, especially with regard to future possibilities and analyzes the company’s capacity to pursue them [29].

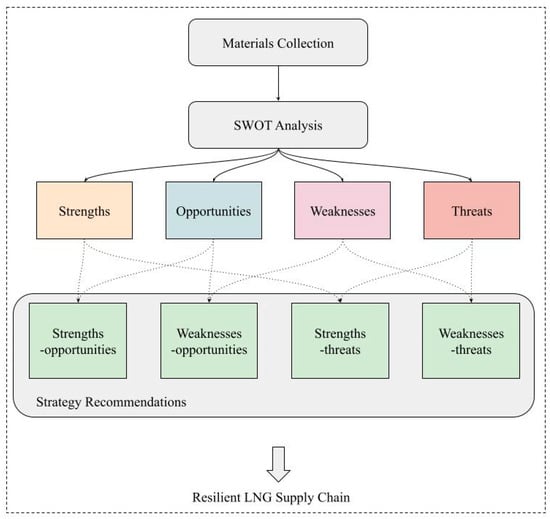

When applying the SWOT method to Qatar’s LNG supply chain, internal and external factors affecting the LNG supply chain in Qatar will first be gathered and evaluated utilizing reports, literature, papers, legislation, and data. The SWOT method used in this study consists of three steps: (i) material collection; (ii) SWOT analysis; and (iii) strategy recommendations. The material collection step aims to amass all pertinent data and materials related to the research subject, including includes rules, reports, books, papers, statutes, national statistics, and legislation. The SWOT analysis phase is used to debate, analyze, and define all aspects of strengths, weaknesses, opportunities, and threats based on the data gathered. Relevant strategies are identified throughout the brainstorming process based on strengths, weaknesses, opportunities, and threats to maximize the use of strengths and opportunities while avoiding or minimizing weaknesses and threats, as illustrated in Figure 1. The SWOT matrix is then applied in four distinct strategies: strengths–opportunities (SO), weaknesses–opportunities (WO), strengths–threats (ST), and weaknesses–threats (WT). SO strategies are achieved by combining internal strengths with external opportunities and employing strengths to benefit from opportunities; internal weaknesses and external opportunities, as well as the possibility to address these weaknesses, which is the foundation of WO strategies; internal strengths and external risks are combined in ST strategies to prevent threats; internal weaknesses are combined with external threats in WT strategies, and weaknesses are reduced to avoid threats. Moreover, identifying strengths, weaknesses, opportunities, and threats can support the development of a resilient LNG supply chain. The recommended strategies can also mitigate possible risks associated, whilst utilizing available opportunities and strengths.

Figure 1.

A flowchart of the applied methodology for the LNG supply chain via a SWOT analysis (Source: Compiled by the authors from [30]).

3. Results and Discussion

In the following sections, major accidents that could occur within the LNG supply chain are described, followed by mentioned experiences of LNG supply chain from around the globe. These experiences are characterized in four categories: Political and regulatory problems, safety and security issues, environmental effects, and reliability of new technologies. Then, the SWOT method findings are demonstrated where strengths, weaknesses, opportunities, and threats are mentioned. Finally, recommended strategies are listed based on the SWOT matrix.

3.1. Experiences in the LNG Supply Chain from around the World

Several significant accidents have occurred on the LNG supply chain. One of the substantial accidents occurred in 2013, when a 10,114 20-foot equivalent unit box ship operated by Hanjin Shipping, Hanjin Italy, collided with the 216,224 m3 LNG carrier in the Malacca Strait. The LNG carrier carrying full LNG cargo for the Futtsu LNG terminal in Japan sailed from Ras Laffan in Qatar in December 2013. Fortunately, the cargo was not damaged, or else it could have been a full-scale disaster. The damage was limited to the forepeak. Both ships remained at the anchorage off Singapore after the accident. Futtsu LNG terminal refused to accept the cargo by damaged operating vessel. Thus, the LNG operating company decided to send another ship and transfer the cargo using a ship-to-ship operation in order to deliver the cargo on time. The damaged vessel was out of service for a particular time for maintenance [31].

Moreover, the LNG transport sector faced a new Black Swan on March 2021 when the containership Evergreen ran aground in the Suez Canal due to high-speed wind. This halted canal traffic, which averaged 50 transits a day, and caused high insecurity in global markets. The Suez Canal plays a key role in the global transit of LNG between the Atlantic basin markets and the Asia Pacific and the Middle East markets. A total of 686 LNG carriers transited the Suez Canal in 2020, comprising laden and ballast carriers. This includes 388 laden LNG vessels that crossed the canal, representing 7% of global LNG transportations. The Suez Canal blockade caused 370 ships to wait to pass through, of which 16 LNG tankers were involved. As there was no knowledge of how long it would take for the interruption to be eliminated, several LNG ships adopted alternative routes, notably to the Cape of Good Hope in Africa. This resulted in increased shipping prices as the shipping periods for LNG from the Middle East to Europe increased to 27 days, or 10 more days, instead of shipping via the Suez Canal. Meanwhile, some LNG ships chose to wait for a transit crisis solution. The blocking of the Suez Canal lasted one week, and the containership and the ship traffic began once again. In this respect, a major interruption to the market for LNG shipments was averted. Each day, about 12% of world commerce, approximately 1 million barrels of oil, and approximately 8% of LNG flow through the canal, and the canal’s earnings was expected to decline by US$ 14M–15M for each day of the blockade. Prior to the epidemic, commerce through the Suez Canal accounted for 2% of Egypt’s Gross Domestic Product [32].

Positive, negative, or mixed risk lessons from across the world may assist businesses and governments in responding to LNG’s strong development and globalization. These lessons apply to all aspects of business, including the safe and secure passage of LNG vessels through congested waterways, the evaluation of technological innovations using the appropriate risk criteria, the management of uninformed public perceptions of unjustified LNG risks, and the assessment of political and regulatory risks. These lessons are important on their own and in combination when it comes to third-party access and multi-user implications. While the risk bank operates on all continents, experience in each nation is unique due to the nature of the government and regulatory structure. For instance, the United States and its territories serve as a testing ground for public views, security and safety, and environmental issues. Additionally, lessons about managing multiple-user terminals in a competitive setting may be learnt from US terminals. Numerous European receiving terminal projects may benefit from the growing US experience, particularly legal and multi-user issues [33]. As a result, the global LNG supply chain’s acquired lessons are classified into four categories: (i) regulatory and political problems; (ii) issues of security and safety; (iii) consequences for the environment; and (iv) reliability of new technology.

3.1.1. Regulatory and Political Problems

Political and regulatory concerns exist throughout the sanctioning process and include the apparent threat of not obtaining official approval and the potential of government intervention and delays, which may decrease the competitiveness of a proposition. Regulation changes or governmental requirements may have an effect on operations and, consequently, project profitability during the post-sanction period. Political and regulatory risks may be successfully managed in some LNG-dependent countries, via a well-defined national strategy and successful government–business partnerships [34]. However, there may be challenges to expanding LNG production due to governance, legal issues, regulatory structure, and layers of authorization [35].

3.1.2. Issues of Security and Safety

For the LNG industry, safety has always been a top concern. Onshore, this has been handled via LNG-specific design standards, vessel type classification, operating procedures, and stringent operational protocols. Diverse fields use various safety regimes to avoid unwanted events, the most important difference occupying a space between consequence-based and risk-based management. In the United States and Asia, incidents are investigated using a consequence-based method based on National Fire Protection Association (NFPA) 59A. The NFPA approach requires less research than the risk-based strategy and may be simpler for the general public to understand [36]. However, this method precludes the evaluation of the efficacy of project-specific measures targeted at decreasing the probability of occurrences by concentrating only on worst-case scenario accident scenarios and disregarding the frequency of events. For instance, laws of Canada outline a risk-based approach, although it does not include specific approval standards, and Canadians rely on the NFPA for plant architecture [37]. A risk-based approach requires the acquisition of knowledge and tools for conducting cutting-edge risk assessments. Rabaska effectively implemented a risk-based approach for constructing an underground unloading line, thus minimizing public hazards [38]. If only the implications were considered without regard for probability, this design improvement would not have been suggested. As security has grown more inextricably linked to risk management by governments, businesses have realized that they would face greater examination for security and safety, particularly downstream. As public opinion and project approval are affected by safety and security, they are critical for the profitability of a project and its survival. The risk analysis of terrorist attacks on the port’s LNG storage tanks was conducted and verified through case studies. The defense capabilities of the police and different prevention strategies were studied [39]. The results show significant differences in accident consequences between different defensive and emergency response forces. Different scenario analyses have been conducted, providing a theoretical basis and method support for public security and urban risk management departments’ security prevention decisions [39].

3.1.3. Consequences for the Environment

Natural gas has developed a reputation for being the most environmentally friendly fossil fuel available. Nonetheless, the LNG business must continuously preserve that image by limiting environmental effects and reducing the likelihood of a disaster. The Paris Agreement was initiated and aimed to substantially reduce global GHGs to limit the global temperature increase to 2 °C above preindustrial levels while pursuing the means to limit the increase to 1.5 °C [40]. Moreover, International Maritime Organization (IMO) 2020 mandates a maximum sulphur content of 0.5% in marine fuels globally [41]. In 2018, CO2 emissions from shipping represented 740 MT. In this regard, the IMO has been actively engaged in a global approach to enhance ships’ energy efficiency further and develop measures to reduce GHG emissions from ships and provide technical cooperation and capacity-building activities [41]. Although environmental protection is a global concern, LNG companies anticipate using cutting-edge technology and operating in more active environmental areas. Offshore projects have unique difficulties associated with air pollution and the potential for marine life disruption during development and operation. There are many instances of environmental conflicts, most notably in the United States. To avoid harming the maritime environment, McMoRan’s Louisiana Main Pass Energy Hub had to switch to a closed-loop system from its original opened-loop design [42]. Additionally, concerns regarding the impact of massive, permanent development in Long Island Sound on marine life are being actively addressed by Broadwater LNG [43]. Similarly, governments and businesses in Europe, Canada, and Australia have cooperated to improve the design of the built environment. For instance, only after strict measures to preserve endangered marine species were put in place by Western Australia’s State Environmental Protection Program was the Gorgon project given the green light [44]. Australia’s North West Shelf is now undergoing a comprehensive Joint Environmental Management Study, which presents both difficulties and opportunities for development [45]. Recent experience demonstrates that players in the LNG industry have successfully managed environmental problems via rigorous planning and risk assessment. This is a significant step forward for expanding the LNG supply chain expansion, whilst also reducing environmental effects.

3.1.4. Reliability of New Technology

As the LNG market grows more competitive, businesses are moving away from tried-and-true conventional technologies in favor of cutting-edge procedures and equipment to save money and improve flexibility, safety, and security. Alternatively, technological advances may result in increased training expenses and unanticipated problems, increasing the level of uncertainty regarding reliability to a point where many operators will not tolerate it. The most important advances have occurred in the building of offshore receiving terminals, where many companies believe that new technology would mitigate the real or perceived risks associated with a land-based posture. The Energy Bridge project aims to design a scalable method for LNG discharge. The Energy Bridge project entails equipping LNG tankers with an onboard regasification plant, a swivel mooring turret and manifold, as well as an offshore buoy and pipeline system to discharge the LNG into the land-based gas grid, all without the requirement for a complete LNG terminal. Additionally, the project allows boats to discharge LNG directly onshore at any port equipped with a gas receiving line, eliminating the requirement for a dedicated LNG single buoy mooring [46]. Nevertheless, there are dangers that should be considered; for example, a leak during berthing may cause catastrophic damage because of cryogenic loads on the terminal’s top level. Auxiliary inventions inspired by FRSUs include the Submerged Turret Loading (STL) buoy [47]. As the industry grows, it faces the Research and Development (R&D) risk that high-tech firms are used to prioritizing investment in a promising concept that may or may not become economically successful in the future. For instance, The TORP HiLoad from Remora Technology, which uses suction cups in conjunction with the vessel’s hull, has gained Det Norske Veritas (DNV) and the American Bureau of Shipping (ABS) Approval in Principle [48]. These credentials are needed for LNG developers to work with risk-averse businesses, particularly financial institutions. To improve efficiency, new technologies are always being created, as shown by the much bigger vessel sizes in the new fleets, such as the Q-Flex and Q-Max, each of which has a maximum capacity of 210,000 and 266,000 m3, respectively [49]. New technology cannot be used to bypass existing quality standards and protections as the industry recognizes. Indeed, the new technology requires additional tests and measures to operate correctly straight out of the box. New technology can only help reduce overall risk if it is regarded as an integral component of the supply chain that must be handled as part of a complete risk management plan.

4. SWOT Analysis

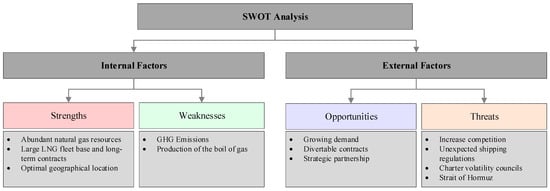

This section presents strengths, weaknesses, opportunities, and threats of the LNG supply chain in Qatar. The obtained internal and external factors of the analysis are demonstrated in Figure 2.

Figure 2.

A summary of obtained findings (internal and external factors) from SWOT analysis for the State of Qatar.

4.1. Strengths

The term “strengths” refers to the areas where a company succeeds and differs from its competitors. Strengths include abundant natural gas resources, a large LNG fleet base, long-term contracts, and optimal geographical location.

4.1.1. Abundant Natural Gas Resources

There is 872 tcm of natural gas reserves in Qatar, making it the third-largest single non-associated gas resource in the world after Russia and Iran. This is equal to 12% of global natural gas production. These reserves are mostly confined to Qatar’s vast offshore North Field, which covers half the country’s land area [50]. The use of these vast reserves is a national priority to maintain national growth and prosperity. The North Gas Field is a stimulant for development in gas production and uses. This is due to the quantity of natural gas in one ideal geographical location, and meteorological conditions that ease production and lower costs in comparison to other locations across the globe. Considering the advantageous characteristics of the North Gas Field in terms of enormous reserves, in addition to its reputation as a source of cleaner energy with a long lifespan, the State of Qatar has embarked on an integrated strategy to develop the field and optimize its resources by securing new investment for the exportation of liquefied gas, the establishment of new gas-based industry segments, and the construction of the necessary facilities.

4.1.2. Large LNG Fleet Base and Long and Short-Term Contracts

Qatar is the world’s biggest LNG exporter, with a fleet of 69 LNG ships (24 conventional, 31 Q-Flex, 14 Q-Max) using the most recent technology to guarantee that gas is transported safely, in ecologically friendly manner, as well as cost-effectively, across the world’s oceans [51]. A major development project in the North Field is now underway, and it will increase Qatar’s present LNG productivity of 77 MTA by 2025 to 110 MTA. To meet the demands of the North Field Expansion Project and Qatar’s future LNG ship fleet obligations, Qatar intends to preserve LNG shipbuilding capacity up to 100 new LNG ships. This will be the world’s biggest LNG shipbuilding project [52]. Due to the high number of long-term contracts Qatar has signed, there will be less fluctuation in cash flow, allowing big, long-term capital expenditures to be financed with more debt. As a result of increased leverage, borrowing costs are reduced. On the downside, long-term contracts prevent the parties to them from benefiting from lucrative short-term trading scenarios [53]. Table 1 shows some of the signed long-term contracts. However, spot and short-term contracts have increased after a drop in spot prices, which keeps long-term deals less attractive [54].

Table 1.

Some examples of recent long-term contracts between Qatar and other countries.

4.1.3. Optimal Geographical Location

Qatar is a Middle Eastern peninsula bordered by Saudi Arabia by land, and extends 160 km into the Arabian Gulf. Due to its central location between the West and the East, Qatar is an attractive LNG export destination because of the reduced transportation costs. Near the northeastern point of Qatar, is Ras Laffan Port, which is just 67 km from North Field. It is a deep-water port with one of the largest artificial harbors in the world, and comprises of six LNG terminals, six liquid product terminals, one sulphur-bearing terminal, and six dry cargo terminals presently in operation [58]. Moreover, the Ras Laffan Port is one of the largest energy export facilities, able to accommodate a broad variety of vessels, including the latest Q-Flex and Q-Max LNG carriers.

4.2. Weaknesses

Weaknesses prevent an organization from operating at maximum efficiency. These are areas in which the company may improve to stay competitive. Weaknesses include GHG emissions and production of Boil-Off Gas (BOG).

4.2.1. GHG Emissions

Globally, many organizations and governments are increasingly concerned about the impact of fossil fuels on the environment and are thus are exploring alternative energy sources [59]. Natural gas is one of those fossil fuels, although it is the cleanest, where GHG is produced throughout its supply chain phases, including production, transportation, storage, loading and unloading, and utilization. In the LNG production phase, natural gas is cooled to its liquid state to a temperature below −160 °C to produce LNG. The source of energy required to drive the liquefaction process and produce LNG is commonly sourced from fossil fuels, where the production of 1 MJ of LNG, can result in approximately 10.29 g of GHG emissions [60]. In the LNG transportation phase, transportation of LNG occurs in vessels that are fueled by fossil fuels, where the generated GHG emissions while transporting LNG by heavy fuel oil (HFO) and by an LNG fueled ocean tanker for a distance of 10,000 nautical miles are approximately 0.65 kg of CO2 eq for 1 kg of HFO and 0.6 kg of CO2 eq for 1 kg of LNG, respectively [60]. Moreover, GHG emissions are produced during the utilization of LNG, where approximately 57.5 g/MJ of GHG emissions are produced when LNG is burned [60]. This indicates that GHG emissions are produced in all the phases of the LNG supply chain.

4.2.2. Production of Boil Off-Gas

Boil off-gas (BOG) is an unavoidable phenomenon occurring in different phases of the LNG supply chain, namely land storage and transportation. In the transportation phase, BOG occurs in conventional vessels, whereas the vessels (Q-Flex and Q-Max) have a re-liquefaction unit that can capture BOG and convert it back into a liquid or utilize it directly as gas for propulsion purposes [61]. BOG production occurs in tanks due to temperature differences between the ambient temperature and LNG temperature. The generated BOG must be removed from LNG tanks to maintain the tank pressure. Removal of produced BOG in an LNG tank reduces LNG quantity, affecting LNG value from technical, economic, and environmental perspectives. For instance, the daily BOG production rate of storing LNG in a 160,000 m3 land-storage tank is approximately 0.07%, and the daily BOG production rate from an LNG conventional tanker is 0.12% [62]. Production of BOG in the LNG supply chain also reduces the economic benefits of selling LNG. While accounting for produced BOG as a cost, both production and transportation costs increase, consequently reducing the economic benefits of selling LNG [63].

4.3. Opportunities

Opportunities relate to external circumstances that benefit an organization and may provide it with a competitive edge. Opportunities include growing demand, strategic partnership, and divertible contracts.

4.3.1. Growing Demand

Natural gas will be the fastest-growing fossil fuel, rising by 0.9% between 2020 and 2035 [53]. Due to the region’s economic and demographic development, LNG consumption in Asia is rising much quicker than the rest of the world. Asia’s LNG consumption has grown steadily throughout the first five months of 2021, with China accounting for the majority of the increase. China’s LNG consumption is projected to rise by 11 MT this year, constituting more than half of the 18 MT increase in the worldwide LNG market over the forecast in 2021, and around one-third of global LNG demand growth in 2022. China’s top position seems secure for years to come with its LNG demand backed by governmental backing and solid-gas market fundamentals [64]. The goal of China being carbon-neutral by 2060 is anticipated to drive an increase in the country’s demand for LNG. Consequently, a supply–demand imbalance is likely to develop by the middle of this decade, with less new output entering the market than originally anticipated [65].

4.3.2. Strategic Partnerships

Various businesses are involved in energy transportation, ownership, operation, and the promotion of the LNG natural gas market, and are thus positioned as strategic partners in the LNG sector. As part of its strategy to develop new gas markets, Qatar, the world’s largest LNG exporter, continues to expand its partnership with the largest energy and infrastructure conglomerate in Brazil to contribute to the development of the Brazil natural gas market through a third party [66].

4.3.3. Divertible Contracts

In order to provide the required LNG to the client at a competitive rate, pricing mechanisms can be used. In light of the growing purchasing power of buyers in the presently over-supplied market, this mechanism may provide buyers with a choice or a combination of price indices to consider. When combined with the short-term capacity and route flexibility, the power to turn back LNG cargoes at prices that the buyer deems uncompetitive is a potent combination for a successful LNG export strategy. Divertible contracts mostly applied to European contracts which the cargo diverted from one contract to another with higher price [67].

4.4. Threats

Threats are defined as events or circumstances that have the potential to cause damage to an organization. Threats include increased competition, unexpected shipping regulations, character volatility councils, and potential disturbances at the Strait of Hormoz.

4.4.1. Increase Competition

LNG Production

Unlike other major energy-producing countries, Qatar mainly focuses on LNG transportation, whereas other countries carry crude oil, processed products, and other items with LNG. The demand for vessels is enormous, and the employment of vessels that have their charters expired, and vessels presently under construction, have considerable competition. The long-term competition for LNG charters is based on the price, availability of vessels, size, age and condition of the ship, relationships with the LNG operator and quality, LNG experience, and the operator’s reputation. There has been increased competition in the industry, with shipping and oil majors’ firms indicating an interest in LNG transportation, as illustrated in Table 2. If the firm cannot compete with success, its revenues and market share would decrease in the long term.

Table 2.

Potential competitors/companies to Qatar’s LNG transportation capability (Source: Compiled by the authors from [68]).

Shifting to Hydrogen/Renewable Energy

In the coming years, LNG is expected to be substituted by other renewable energy sources to limit a global temperature rise to 1.5 °C. Meanwhile, comprehensive action is needed to reduce CO₂ and methane emissions across all industries, including oil and gas. The world is increasingly transitioning to renewable energy sources to meet approximately up to 80% of global demand by 2050. As of today, clean-energy investment has been relatively flat to around 30–37% of global energy supply investment [69]. Hydrogen and other carbon-free energy carriers (i.e., ammonia) emerge as potential candidates for overseas energy transport.

4.4.2. Unexpected Shipping Regulations

LNG operations are affected by detailed rules, regulations, agreements, and standards in international waters. Strict legislation on disposal, cleaning of oil and other pollution, air emissions, water discharges, and ballast water control. LNG firms are regulated by many international bodies such as the International Maritime Organization, the European Union, the Pollution Control Authority in Norway, and many more organizations. Marine firms must comply with the amended requirements to keep their licenses for businesses. This requires higher investments and resources that influence LNG businesses’ profitability.

4.4.3. Charter Volatility Councils

The market for tankers has been cyclical. The ability of LNG operators to make profitable use of their vessels would depend on influences by economic conditions in the tanker market, demand for petroleum and petroleum byproducts, global economic and financial conditions, changes in maritime transport, and other patterns. The charter prices rely on the quantity, the degradation rate of older ships, the transformation of tankers to other purposes, the number of out-of-service ships, and environmental concerns and laws. For example, charter prices of a medium-term charter business are changeable and closely linked to the current market rates. If the ships are not profitable or chartered, the financial flows of the firm may be affected.

4.4.4. Strait of Hormuz

The Strait of Hormuz is a waterway that connects the Arabian Gulf with the Gulf of Oman, and it is the sole maritime route that connects the Arabian Gulf and the Indian Ocean. In addition to the enormous quantities of oil products, condensate, and crude oil that flow through the strait, which are equal to 25% of worldwide oil consumption, the Strait of Hormuz is also one of the world’s most significant chokepoints for transportation. The Strait also facilitates one-third of the world’s LNG trade [70].

4.5. SWOT Matrix

SWOT matrix for the LNG supply chain of Qatar is presented in Table 3.

Table 3.

SWOT matrix for the LNG supply chain of Qatar.

4.6. Recommended Strategies

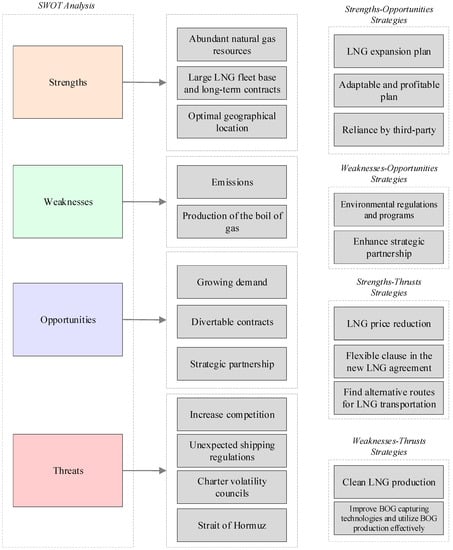

A portfolio of strategies has been created by combining internal factors encompassing “Strengths” and “Weaknesses” with external factors covering “Opportunities” and “Threats” in a SWOT analysis of Qatar’s LNG supply chain. As a result, 10 strategies have been developed, as given in Figure 3.

Figure 3.

A summary of strategies obtained from SWOT analysis findings to be implemented for a resilient LNG supply chain.

4.6.1. Strengths–Opportunities (SO) Strategies

S1O1: Develop an LNG expansion plan, which can increase LNG production capacity to meet global growing demand. Noting that Qatar has implemented such a strategy, increasing LNG capacity production from 77 MTPA to 110 MTPA by implementing an expansion plan in the North Field [71].

S2O2: Prepare adaptable and profitable plans by applying pricing mechanisms, which describe a system in which the dynamics of supply and demand determine the cost of products and the changes in those prices. Therefore, selling LNG cargoes to higher-priced markets result in higher profits.

S3O3: Reliance on LNG producer third parties. Situated in an optimal geographical location can support strategic partnerships as an LNG producer third-party. The third-party owns and operates LNG cargos requested by one of the strategic partnerships to meet their requests.

4.6.2. Weaknesses–Opportunities (WO) Strategies

W1O1: Setting environmental regulations and supporting environmental programs, requesting emissions reduction by implementing carbon capture and storage technologies. In parallel, supporting innovative solutions that reduce produced emissions during the LNG supply chain.

W2O3: Enhance strategic partnerships to reduce LNG shipping distances; consequently, reduce BOG production during transportation of LNG.

4.6.3. Strengths–Threats (ST) Strategies

S1T1: Flexibility in varying LNG price. Since natural gas is abundant in Qatar and the number of LNG suppliers is increasing, with potentially lower production costs relative to other producers, reducing the selling price of LNG can attract more buyers.

S3T2: Develop flexible clauses in agreements in the case of new regulations, for instance unexpected shipping regulations.

S3T4: Identify alternative routes for transportation of natural gas. Since the Strait of Hormuz is the only path for LNG cargoes from Qatar, any political, geographical, environmental supply chain disruption can cause closure of this path and will disrupt LNG trading by sea. Therefore, identifying alternative routes and innovative solutions to transport natural gas/LNG from Qatar is necessary. An alternative solution can be transporting natural gas via a pipeline, however, transporting natural via pipeline is not feasible for distances over 2000 km. Thus, such a solution is optimal for shorter distances [72].

4.6.4. Weaknesses–Threats (WT) Strategies

W1T1: Support production of clean LNG. As countries are aiming to reduce environmental emissions, the production of clean LNG will be favored. Therefore, LNG providers, who capture and utilize carbon emissions from the LNG supply chain are preferred.

W2T2: Improve BOG capturing technologies and utilize BOG production effectively. Since BOG production rates increase as the transportation distance of LNG increases, developing reliable and effective BOG capturing technologies is essential as these technologies can maintain LNG quantity while shipping trips [61].

Recommended strategies from SWOT analysis can support developing resilience in LNG supply chains. The findings from SWOT analysis, including abundant natural gas resources, large LNG fleet base and long-term contracts, and optimal geographical location are strengths that can enhance the resilience of the LNG supply chain. Furthermore, natural gas will be more resilient to accommodate the energy transition driven by climate change more than other fossil fuels since it is the cleanest fossil fuel [65]. Whereas, increased competition, unexpected shipping regulations, charter volatility are the threats that can exacerbate LNG supply chain vulnerability. In addition, opportunities obtained from SWOT analysis, namely growing demand, divertible contracts, and strategic partnership are factors that can enhance LNG supply chain resilience. Moreover, the following represents resilience LNG supply chain parameters from the LNG producer perspective based on Qatar’s LNG company. Such parameters could support more informed decision-making in an efficient and reliable manner to accommodate customers’ needs.

- Manage producer inventory: The inventory of LNG producers should be well planned to avoid tank top or tank bottom situations, which have an impact on vessel availability and deliver the cargo to the customer on time, respectively.

- Deliver cargo on time: The LNG producer is obligated to deliver the cargoes on the agreed time to avoid any customer end user shortage.

- Flexibility in cargo delivery: LNG producers or consumers may request to change either receiving the terminal or delivery date, and the flexibility to accommodate the raised request will add value to the requester. Moreover, the ability to deliver the cargo in an FSRU will maintain the resilience of the LNG supply chain.

- Meet customer needs: With the increasing LNG market demand, the LNG production capacity is to be increased to meet customer requirements.

- Hydrocarbon emissions: As per IMO, the carbon emissions have to be reduced to 50% by 2050 [29], which could be achieved by controlling the emissions produced during loading and transportation processes.

- Reach markets safely, efficiently, and reliably: LNG is a colorless, invisible, and non-toxic chilled methane gas with a temperature of −160 °C, which is inflammable until it comes into contact with air, at which point it quickly changes into vapors that are readily ignited. LNG fire has the potential to grow to 150 m in height and burn for an extended time. As a result, the most serious risks associated with LNG ships are explosions, fumigation, and spills.

- Cost optimization should be considered through the whole LNG supply chain, beginning from production to delivery, to recover the investment and operating costs of the LNG production and delivery.

5. Conclusions

As the demand for LNG continues to increase, the levels of risk and uncertainty within the sector also increase, which is the impetus for the development of resilient LNG supply chains and further developing resilience for the sector as a whole. This study begins by presenting major accidents that have affected the LNG supply chain. Demonstrating such accidents can provide insights into financial, technical, and environmental losses, which can be studied to eliminate such losses in similar future accidents. Moreover, examining experiences or lessons learned in global LNG supply chains can mitigate any potential risks. Any model for LNG resilience management can include the recommendations described within this article as part of its design. While resilient management techniques will not eliminate unexpected shocks, LNG businesses that incorporate them can be more robust. Models that include all significant best practices and lessons, both technical and economic, are more resilient and even less likely to leave policymakers perplexed about accounting for the so-called “unexpected” occurrences that occur in virtually every significant endeavor. Therefore, each policymaker must consider these historical lessons while evaluating LNG projects. In this study, risk drivers from the LNG supply chain are gathered and classified into four categories: Political and regulatory, safety and security, environmental effects, and reliability of new technologies. These experiences can support decision-makers in creating a resilient LNG supply chain. The limitation of the proposed method is that it can be subjective at times. Moreover, SWOT analysis is a one-dimensional assessment procedure in the categorization of attributes. However, some factors may be assigned for multi-attributes. Future research should focus on quantitative methods that can support analysis considering all aspects that may affect the resilience of the LNG supply chain. Furthermore, future can work validate some of the findings with experienced practitioners in the field.

The SWOT method broadly assesses the status of Qatar’s LNG supply chain. It identifies strengths, weaknesses, opportunities, and threats within Qatar’s supply chain. The strengths include abundant natural gas resources, a large LNG fleet base and long-term contracts, and optimal geographical location. The major weaknesses include the production of emissions and BOG (which impacts the carbon cost of the LNG cargo), while the major opportunities are the growing demand for LNG, issuing divertible contracts, and obtaining strategic partnerships. The major threats are increased competition, unexpected shipping regulations, charter volatility councils, and the fact there is only one path for LNG transportation, which is the Strait of Hormuz. Then, a portfolio of strategies is created by combining internal factors covering strengths and weaknesses with external factors covering opportunities and threats in a SWOT analysis of Qatar’s LNG supply chain. Moreover, recommendations to enhance the resilience of the LNG supply chain are listed below:

- Develop a strategy for LNG development that allows the industry to boost its production capacity to satisfy the world’s rising demand.

- Implement pricing mechanisms to create adaptive and lucrative business strategies.

- Support production of clean LNG and improve carbon capture methods.

- Improve strategic alliances to minimize LNG shipping distances, which can in turn reduce BOG generation throughout the LNG transportation process.

- Continue to minimize emissions throughout the supply chain to decrease the carbon content of the LNG cargo in line with growing demand from consumers for low carbon LNG.

- Create a provision in the agreement that allows for flexibility. In the event, that a new shipping law is implemented, a provision like this may address any unanticipated shipping restrictions.

- Support clean transportation options when delivering LNG cargoes. This can be achieved by utilization of cleaner fuels during combustion, for instance, using LNG as bunker fuel instead of using heavy fuel oil.

Author Contributions

Conceptualization, T.A.-A., Y.B., S.A.-H. and M.A.-B.; methodology, S.A.-H. and M.A.-B.; formal analysis, S.A.-H. and M.A.-B.; investigation, S.A.-H. and M.A.-B.; writing—original draft preparation, S.A.-H. and M.A.-B.; writing—review and editing, T.A.-A. and Y.B.; supervision, T.A.-A. and Y.B.; funding acquisition, T.A.-A. and Y.B. All authors have read and agreed to the published version of the manuscript.

Funding

The authors acknowledge the support provided by the Hamad Bin Khalifa University, Qatar Foundation, Qatar. The APC was funded by Hamad Bin Khalifa University, Qatar Foundation, Qatar.

Conflicts of Interest

The authors declare no conflict of interest.

Nomenclature

| BOG | Boil-Off Gas |

| CO2 | Carbon Dioxide |

| Eq | Equivalent |

| FSRU | Floating Storage Regasification Unit |

| GHG | Greenhouse gas |

| IMO | International Maritime Organization |

| km | kilometers |

| LNG | Liquified Natural Gas |

| MT | Million Ton |

| MMBtu | Million British Thermal Unit |

| m3 | Cubic meter |

| m | meter |

| MJ | Megajoule |

| NOx | Nitrogen Oxide |

| O | Opportunities |

| SWOT | Strengths, Weaknesses, Opportunities, Threats |

| S | Strengths |

| SO | Strengths–Opportunities |

| ST | Strengths–Threats |

| SO2 | Sulfur Dioxide |

| T | Threats |

| tcm | trillion cubic feet |

| TEU | 20-foot equivalent unit |

| W | Weaknesses |

| WO | Weaknesses–Opportunities |

| WT | Weaknesses–Threats |

References

- Elengy. LNG: An Energy of the Future. 2020. Available online: https://www.elengy.com/en/lng/lng-an-energy-of-the-future.html (accessed on 10 October 2021).

- IGU. Natural Gas: The Energy for Today and the Future. 2019. Available online: https://www.igu.org/ (accessed on 10 October 2021).

- Razmanova, S.; Steblyanskaya, A. Arctic LNG cluster: New opportunities or new treats? In Proceedings of the IOP Conference Series: Earth and Environmental Science, Saint Petersburg, Russia, 18–19 March 2020; Volume 539. [CrossRef]

- LNG Market Trends and Their Implications. Available online: https://doi.org/10.1787/90c2a82d-en (accessed on 10 November 2021).

- IGU. 2019 World LNG Report. 2019. Available online: https://www.igu.org/wp-content/uploads/2019/06/IGU-Annual-Report-2019_23.pdf (accessed on 15 October 2021).

- Jaganathan, J. Asian LNG Spot Price Reaches Record High of $34.47/mmbtu-Platts Data; Reuters: New York, NY, USA, 2021. [Google Scholar]

- Mokhatab, S.; Mak, J.Y.; Valappil, J.; Wood, D.A. LNG Fundamentals. In Handbook of Liquefied Natural Gas; Mokhatab, S., Mak, J.Y., Valappil, J.V., Wood, D.A., Eds.; Gulf Professional Publishing: Houston, TX, USA, 2014; pp. 1–106. [Google Scholar] [CrossRef]

- Berle, Ø.; Norstad, I.; Asbjørnslett, B.E. Optimization, risk assessment and resilience in LNG transportation systems. Supply Chain Manag. Int. J. 2013, 18, 253–264. [Google Scholar] [CrossRef]

- Southwick, S.M.; Bonanno, G.A.; Masten, A.; Panter-Brick, C.; Yehuda, R. Resilience definitions, theory, and challenges: Interdisciplinary perspectives. Eur. J. Psychotraumatol. 2014, 5, 25338. [Google Scholar] [CrossRef] [Green Version]

- Gatto, A.; Busato, F. Energy vulnerability around the world: The global energy vulnerability index (GEVI). J. Clean. Prod. 2020, 253, 118691. [Google Scholar] [CrossRef]

- Martorell, S. Formal vulnerability assessment: A methodology for assessing and mitigating strategic vulnerabilities in maritime supply chains. In Reliability, Risk, and Safety, Three Volume Set; CRC Press: Boca Raton, FL, USA, 2009; pp. 1073–1080. [Google Scholar]

- Christopher, M.; Peck, H. Building the Resilient Supply Chain. Int. J. Logist. Manag. 2004, 15, 1–14. [Google Scholar] [CrossRef] [Green Version]

- Goers, S.; Rumohr, F.; Fendt, S.; Gosselin, L.; Jannuzzi, G.; Gomes, R.; Sousa, S.; Wolvers, R. The Role of Renewable Energy in Regional Energy Transitions: An Aggregate Qualitative Analysis for the Partner Regions Bavaria, Georgia, Québec, São Paulo, Shandong, Upper Austria, and Western Cape. Sustainability 2020, 13, 76. [Google Scholar] [CrossRef]

- Vasudevan, R.A. SWOT-PESTEL Study of Constraints to Decarbonization of the Natural Gas System in the EU: Tech-no-Economic Analysis of Hydrogen Production in Portugal; KTH Industrial Engineering and Management: Stockholm, Sweden, 2021. [Google Scholar]

- Economic and Social Commission for Western Asia. Energy Vulnerability in the Arab Region; ESCWA: Beirut, Lebanon, 2019. [Google Scholar]

- Satta, G.; Parola, F.; Vitellaro, F.; Morchio, G. LNG Bunkering Technologies in Ports: An Empirical Application of the SWOT Analysis. KMI Int. J. Marit. Aff. Fish. 2021, 13, 1–21. [Google Scholar] [CrossRef]

- Domeisen, N.; Sousa, P. SWOT analysis: NGOs as partners. In International Trade Forum; International Trade Centre: Geneva, Switzerland, 2006; p. 7. [Google Scholar]

- Emenike, S.N.; Falcone, G. A review on energy supply chain resilience through optimization. Renew. Sustain. Energy Rev. 2020, 134, 88–110. [Google Scholar] [CrossRef]

- Bouwmeester, M.C.; Oosterhaven, J. Economic impacts of natural gas flow disruptions between Russia and the EU. Energy Policy 2017, 106, 288–297. [Google Scholar] [CrossRef]

- Sesini, M.; Giarola, S.; Hawkes, A.D. The impact of liquefied natural gas and storage on the EU natural gas infrastructure resilience. Energy 2020, 209, 118367. [Google Scholar] [CrossRef]

- Libby, B.; Christiansen, A. Building resilience to climate-change-related disruptions in the global LNG supply chain. In Proceedings of the 33rd International Conference of the System Dynamics Society, Cambridge, MA, USA, 19–23 July 2015. [Google Scholar]

- Sönnichsen, N. Global Operational LNG Export Capacity by Country. 2021. Available online: https://www.statista.com/statistics/1262074/global-lng-export-capacity-by-country/ (accessed on 15 November 2021).

- Temizer, M. Qatar to Raise LNG Production by 64% to 126 mtpa by 2027. 2019. Available online: https://www.aa.com.tr/en/energy/general/qatar-aims-to-raise-lng-production-by-64-by-2027/27501 (accessed on 10 October 2021).

- Speth, C. The SWOT Analysis: A Key Tool for Developing Your Business Strategy; 2015; pp. 1–27. Available online: https://www.50minutes.com/title/the-swot-analysis/ (accessed on 10 September 2021).

- D’Adamo, I.; Falcone, P.M.; Gastaldi, M.; Morone, P. RES-T trajectories and an integrated SWOT-AHP analysis for biomethane. Policy implications to support a green revolution in European transport. Energy Policy 2020, 138, 111220. [Google Scholar] [CrossRef]

- Chen, W.-M.; Kim, H.; Yamaguchi, H. Renewable energy in eastern Asia: Renewable energy policy review and comparative SWOT analysis for promoting renewable energy in Japan, South Korea, and Taiwan. Energy Policy 2014, 74, 319–329. [Google Scholar] [CrossRef]

- Uhunamure, S.; Shale, K. A SWOT Analysis Approach for a Sustainable Transition to Renewable Energy in South Africa. Sustainability 2021, 13, 3933. [Google Scholar] [CrossRef]

- Fertel, C.; Bahn, O.; Vaillancourt, K.; Waaub, J.-P. Canadian energy and climate policies: A SWOT analysis in search of federal/provincial coherence. Energy Policy 2013, 63, 1139–1150. [Google Scholar] [CrossRef]

- PESTLEanalysis Contributor. 10 Reasons to Use SWOT Analysis for Your Company. 2017. Available online: https://pestleanalysis.com/10-reasons-to-use-swot-analysis-for-your-company/?nowprocket=1 (accessed on 12 September 2021).

- Deshmukh, S. Materials Management: An Integrated Systems Approach. J. Adv. Manag. Res. 2015, 12, 226–228. [Google Scholar] [CrossRef]

- Writer, S. Qatar LNG Vessel Involved in Collision. 2014. Available online: https://www.oilandgasmiddleeast.com/products-services/article-11636-qatar-lng-vessel-involved-in-collision (accessed on 10 October 2021).

- Russon, M.-A. The Cost of the Suez Canal Blockage. BBC News, 29 March 2021. Available online: https://www.bbc.com/news/business-56559073(accessed on 25 September 2021).

- Nafday, A.M. Public Safety Appraisal for Siting Marine Liquefied Natural Gas Terminals in California. J. Energy Eng. 2015, 141, 3. [Google Scholar] [CrossRef]

- Ministery of Development Planning and Statistics. Qatar Second National Development Strategy 2018–2022. 2018. Available online: https://www.psa.gov.qa/en/knowledge/Documents/NDS2Final.pdf (accessed on 15 October 2021).

- Pascal, L. Developments in the Venezuelan Hydrocarbon Sector. Law Bus. Rev. Am. 2009, 15, 531. [Google Scholar]

- NFPA 59A. Standard for the Production, Storage, and Handling of Liquefied Natural Gas (LNG); National Fire Protection Association: Quincy, MA, USA, 2009; p. 63. [Google Scholar]

- Canadian Food Inspection Agency. Enhancing Risk Analysis: A More Systematic and Consistent Approach. 2014. Available online: https://inspection.canada.ca/DAM/DAM-aboutcfia-sujetacia/STAGING/text-texte/cfia_acco_risk_analysis_consult_1401881213845_eng.pdf (accessed on 12 November 2021).

- MIACC. Project Rabaska-Implementation of an LNG Terminal and Related Infrastructure. 2007. Available online: https://files.pca-cpa.org/pcadocs/bi-c/1.%20Investors/3.%20Exhibits/C0530.pdf (accessed on 10 September 2021).

- Zhu, R.; Hu, X.; Bai, Y.; Li, X. Risk analysis of terrorist attacks on LNG storage tanks at ports. Saf. Sci. 2021, 137, 105192. [Google Scholar] [CrossRef]

- Melissa, D. Paris Climate Agreement: Everything You Need to Know. 2018. Available online: https://www.nrdc.org/stories/paris-climate-agreement-everything-you-need-know (accessed on 10 September 2021).

- IMO. IMO 2020–Cutting Sulphur Oxide Emissions. 2020. Available online: https://www.imo.org/en/MediaCentre/HotTopics/Pages/Sulphur-2020.aspx (accessed on 15 October 2021).

- Verdict Media Ltd. n.d. McMoRan Exploration Submits LNG Terminal Plan for Main Pass Energy Hub. Available online: https://www.hydrocarbons-technology.com/projects/main-pass/ (accessed on 15 October 2021).

- Byer, D.; Saffert, H. Liquefied Natural Gas: An Expensive, Dirty, Foreign Fossil Fuel That Threatens Our Natural Gas Energy Independence. 2008. Available online: https://www.cleanoceanaction.org/fileadmin/editor_group1/Issues/LNG/Final_Executive_Summary_LNG_Report.pdf (accessed on 12 October 2021).

- Review, P.E. Gorgon Gas Development Revised and Expanded Proposal. 2008. Available online: https://www.epa.wa.gov.au/sites/default/files/EPA_Report/2937_Rep1323GorgonRevPer30409.pdf (accessed on 10 September 2021).

- CSIRO. North West Shelf Joint Environmental Management Study. In Proceedings of the West Australian Marine Science Conference, Perth, Australia, 25–26 October 2007; p. 40. [Google Scholar]

- Songhurst, B. Floating LNG Update–Liquefaction and Import Terminals. 2019. Available online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2019/09/Floating-LNG-Update-Liquesfaction-and-Import-Terminals-NG149.pdf (accessed on 10 September 2021).

- NOV Inc. Submerged Turret Loading. 2021. Available online: https://www.nov.com/products/submerged-turret-loading (accessed on 20 November 2021).

- Golar LNG Invests in TORP Technology. Golar LNG. 2011. Available online: https://www.golarlng.com/investors/press-releases/archive.aspx (accessed on 10 October 2021).

- Qatargas Oper Co. Ltd. Qatargas; Qatargas’ Chartered Fleet. Available online: http://www.qatargas.com/english/operations/qatargas-chartered-fleet (accessed on 15 September 2021).

- Fawthrop, A. Profiling the Top Five Countries with the Biggest Natural Gas Reserves. 2021. Available online: https://www.nsenergybusiness.com/features/biggest-natural-gas-reserves-countries/ (accessed on 10 October 2021).

- Nakilat. Our Fleet. 2021. Available online: https://www.nakilat.com/our-fleet/ (accessed on 10 September 2021).

- Bajic, A. Qatar Petroleum Issues Tender to Charter LNG Fleet. 2021. Available online: https://www.offshore-energy.biz/qatar-petroleum-issues-tender-to-charter-lng-fleet/ (accessed on 17 September 2021).

- Agosta, A.; Dediu, D.; Heringa, B. Global Gas Outlook to 2050; McKinsey & Company: Brussels, Belgium, 2021. [Google Scholar]

- NDTV. Share of Short-Term LNG Deals to Rise in Domestic Consumption: GAIL. 2020. Available online: https://www.ndtv.com/business/natural-gas-market-news-share-of-short-term-lng-deals-to-rise-in-domestic-consumption-says-gail-2316805 (accessed on 10 October 2021).

- Verdict Media Ltd. Qatar Petroleum Finalises 20-Year LNG Supply Deal with South Korea. 2021. Available online: https://www.offshore-energy.biz/qatar-petroleum-inks-20-year-lng-agreement-with-kogas/ (accessed on 10 September 2021).

- Enrdata. Qatar Petroleum Signs a New Long-Term LNG Contract with Singapore. 2020. Available online: https://www.enerdata.net/publications/daily-energy-news/qatar-petroleum-signs-new-long-term-lng-contract-singapore.html (accessed on 13 November 2021).

- Qatar Pet. Qatargas and Pakistan’s GEIL Sign 20-Year LNG Sales Agreement. 2018. Available online: https://www.qp.com.qa/en/Pages/BannerAdvertisement.aspx?imgname=Banner+English+01.jpg (accessed on 14 October 2021).

- Qatar Pet. Ports Information. 2021. Available online: https://qp.com.qa/en/marketing/Pages/PortsInformation.aspx (accessed on 12 October 2021).

- Jawerth, N. What is the clean energy transition and how does nuclear power fit in? IAEA Bull. 2020, 61, 4–5. [Google Scholar]

- Al-Breiki, M.; Bicer, Y. Comparative life cycle assessment of sustainable energy carriers including production, storage, overseas transport and utilization. J. Clean. Prod. 2021, 279, 123481. [Google Scholar] [CrossRef]

- Al-Kubaisi, A. An Insight into the World’s Largest LNG Ships. In Proceedings of the IPTC 2008: International Petroleum Technology Conference European Association of Geoscientists & Engineers, Kuala Lumpur, Malaysia, 3–5 December 2008. [Google Scholar] [CrossRef]

- Al-Breiki, M.; Bicer, Y. Investigating the technical feasibility of various energy carriers for alternative and sustainable overseas energy transport scenarios. Energy Convers. Manag. 2020, 209, 112652. [Google Scholar] [CrossRef]

- Al-Breiki, M.; Bicer, Y. Comparative cost assessment of sustainable energy carriers produced from natural gas accounting for boil-off gas and social cost of carbon. Energy Rep. 2020, 6, 1897–1909. [Google Scholar] [CrossRef]

- Thompson, G. China Becomes the World’s Largest LNG Market. 2021. Available online: https://www.compressortech2.com/news/china-to-become-world-s-largest-lng-market-in-2021/8013108.article (accessed on 10 September 2021).

- Chestney, N. Global LNG Demand Expected to Almost Double by 2040: Shell. 2021. Available online: https://www.reuters.com/article/us-shell-lng-idUSKBN2AP15S (accessed on 14 September 2021).

- Qatar Pet. Qatar Petroleum Affiliate Ocean LNG Limited Signs a Long Term SPA with Brazil CELSE. 2021. Available online: https://www.qp.com.qa/en/Pages/BannerAdvertisement.aspx?imgname=QP+OLNG+-+CELSE+LNG+SPA+-+English.jpg (accessed on 17 September 2021).

- Power Africa. Understanding Natural Gas and LNG Options. 2016. Available online: https://www.energy.gov/sites/prod/files/2016/12/f34/Understanding%20Natural%20Gas%20and%20LNG%20Options.pdf (accessed on 10 September 2021).

- The World’s Biggest Shipping Companies in 2020. 2020. Available online: https://www.ship-technology.com/features/the-ten-biggest-shipping-companies-in-2020/ (accessed on 14 October 2021).

- McKinsey & Company. The Impact of Decarbonization on the Gas and LNG Industry. 2021. Available online: https://www.mckinsey.com/industries/oil-and-gas/our-insights/the-impact-of-decarbonization-on-the-gas-and-lng-industry (accessed on 14 September 2021).

- U.S. Energy Information Administration. Strait of Hormuz Is Chokepoint for 20% of World’s Oil-Today in Energy-U.S. 2012. Available online: https://www.eia.gov/todayinenergy/detail.php?id=39932 (accessed on 8 October 2021).

- Qatar Pet. Qatar Petroleum Constructs the World’s Largest LNG Project Ever, including Substantial CO2 Capture & Sequestration. 2021. Available online: https://www.euro-petrole.com/qatar-petroleum-constructs-the-worlds-largest-lng-project-ever-including-substantial-co2-capture-sequestration-n-i-21773 (accessed on 10 April 2021).

- Bittante, A.; Jokinen, R.; Pettersson, F.; Saxén, H. Optimization of LNG Supply Chain. Comput. Aided Chem. Eng. 2015, 37, 779–784. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).