Photovoltaics Enabling Sustainable Energy Communities: Technological Drivers and Emerging Markets

Abstract

:1. Introduction

Contributions and Organization

- We perform a focused literature review on the market models, trading mechanisms and applications of local energy systems and energy communities, while clarifying the nuances of important terms, and propose respective definitions;

- We design a practical tool for studying the enhancement in the feasibility of small-scale PV investments by energy communities through the approximation of the annual energy cost reductions, simulating an actual local energy marketplace for the community members;

- The implemented tool departs from state-of-the-art formulations for the operation of a local energy markets, which we significantly enhance in order to accommodate the requirements of our case study—e.g., accounting for load flexibility and prioritizing self sufficiency;

- We present a highly realistic case study, using historical electricity production and consumption data, with the aim of estimating the economic benefits of an energy community that is currently under formation in a Greek municipality;

- We identify crucial factors through economic indices that impact the benefits occurring from the operation of the local energy market.

2. Literature Review

2.1. Definitions

2.1.1. Transactive Energy

2.1.2. Peer-to-Peer Energy Trading

We define “P2P energy networks” as bottom-up, prosumer-based energy networks which are decentralized, autonomous and flexible [16], where all peers are at the same hierarchical level in the market value chain, and no entity has market power over the others. The information flows are decentralized as proposed in [4] and the decisions are formulated by the peers though a horizontal governance scheme.

2.1.3. Energy Community

We regard a Citizen Energy Community (CEC), or alternatively an energy community, as a type of an organization of citizens for collective or cooperative actions in the energy system, where, as a cooperative, the operation is characterized by the seven cooperative principles as defined by the International Cooperative Alliance (ICA) [33]:

2.1.4. Prosumer

Inspired by [36], we understand the prosumer as an entity that is motivated by economical, ideological, environmental and other factors. It refers to residential and commercial customers for which prosumerism is not their primary economic activity.

2.1.5. Local Energy Market

We identify LEMs, as a vehicle for the realization of a decentralized TES, to be fundamental players including a large number of small residential and commercial prosumers and consumers of a specific geographical area connected at the same distribution network subregion. These actors participate either as self-interested players, aiming to maximize their economic benefits, or as coalitions who aim to fulfill their collective goals (economic, energy or environmental related) and satisfy common needs.

2.2. Trading Methods and Pricing Schemes

2.3. Game Theoretic Models

2.4. The Legal Framework for Energy Communities in Greece

2.5. Valorization

3. Community Modeling Tool

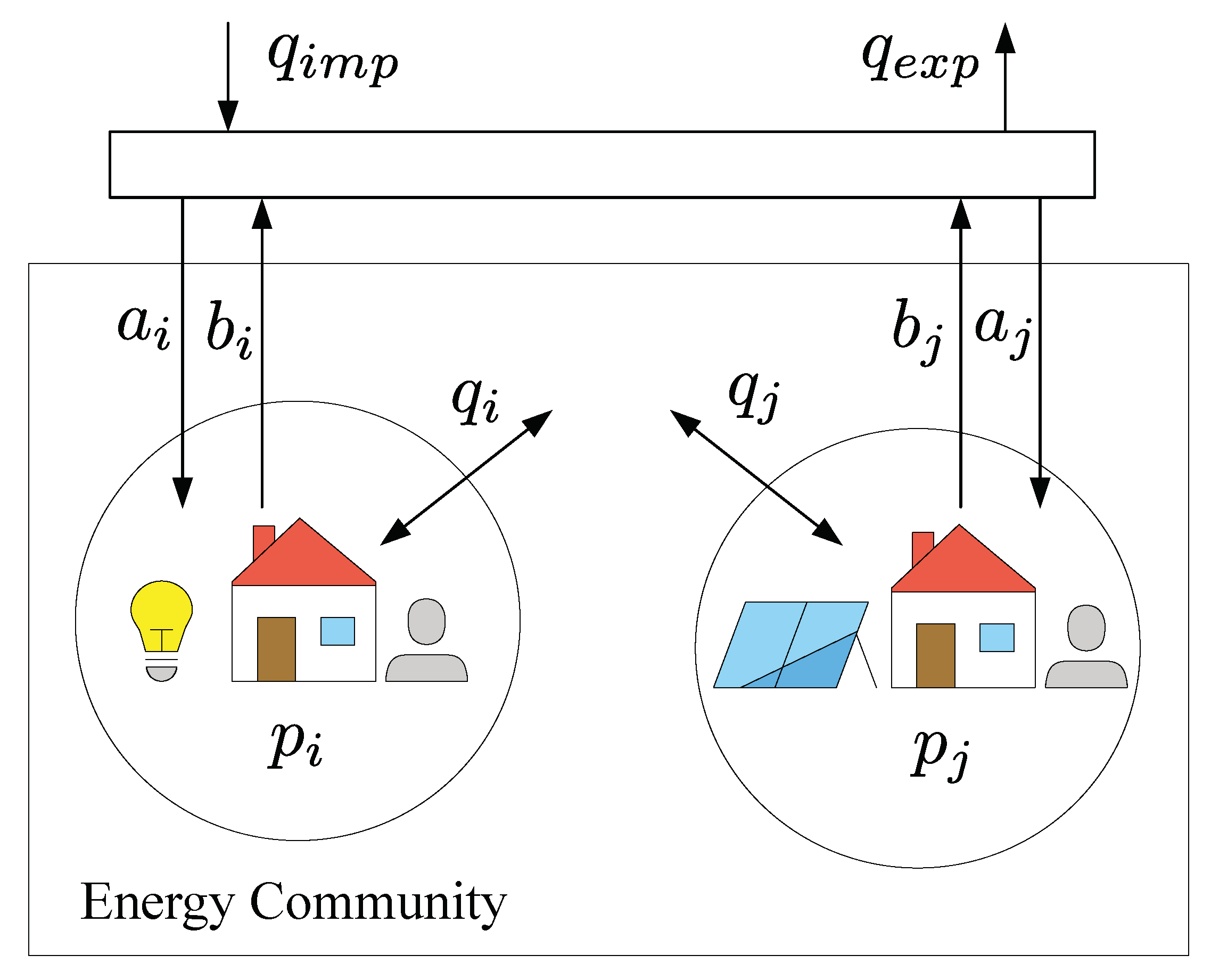

Problem Formulation

- represents the net energy production of each prosumer for a single time step;

- expresses the energy that is exchanged between prosumer j and the community at the time step t; and

- , the total energy that the prosumer j imports from and exports to their retailer, respectively.

4. Case Study

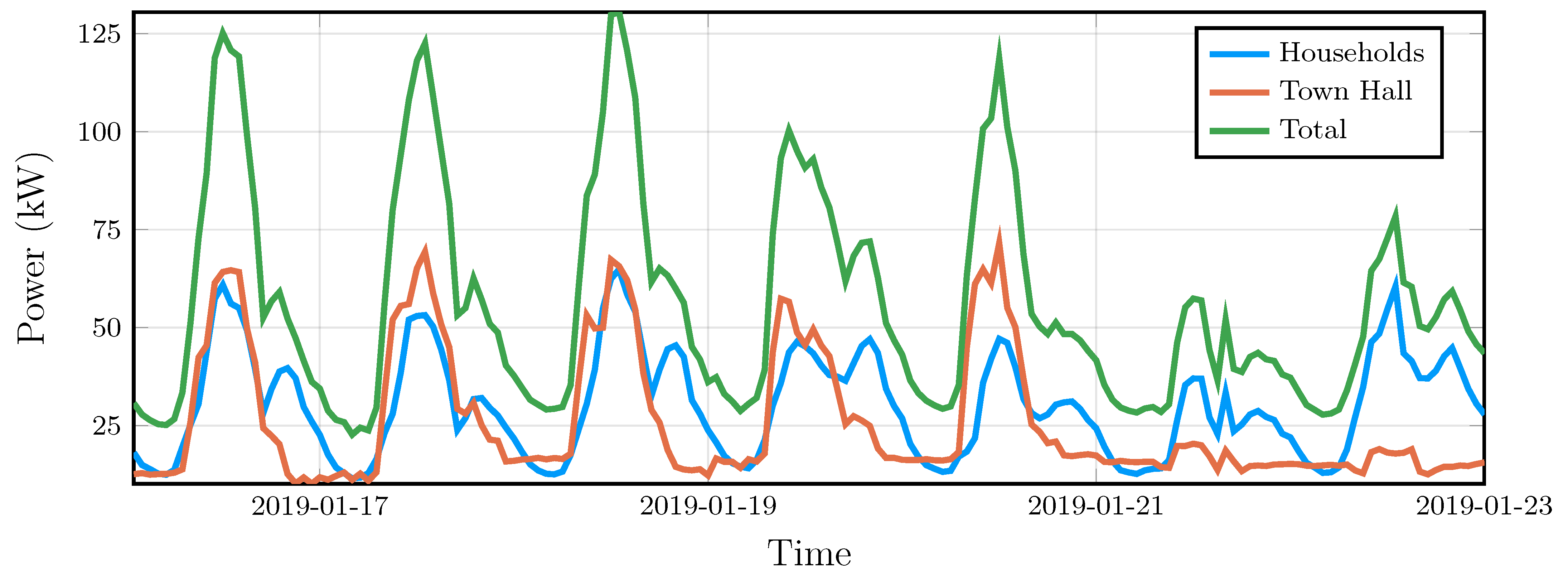

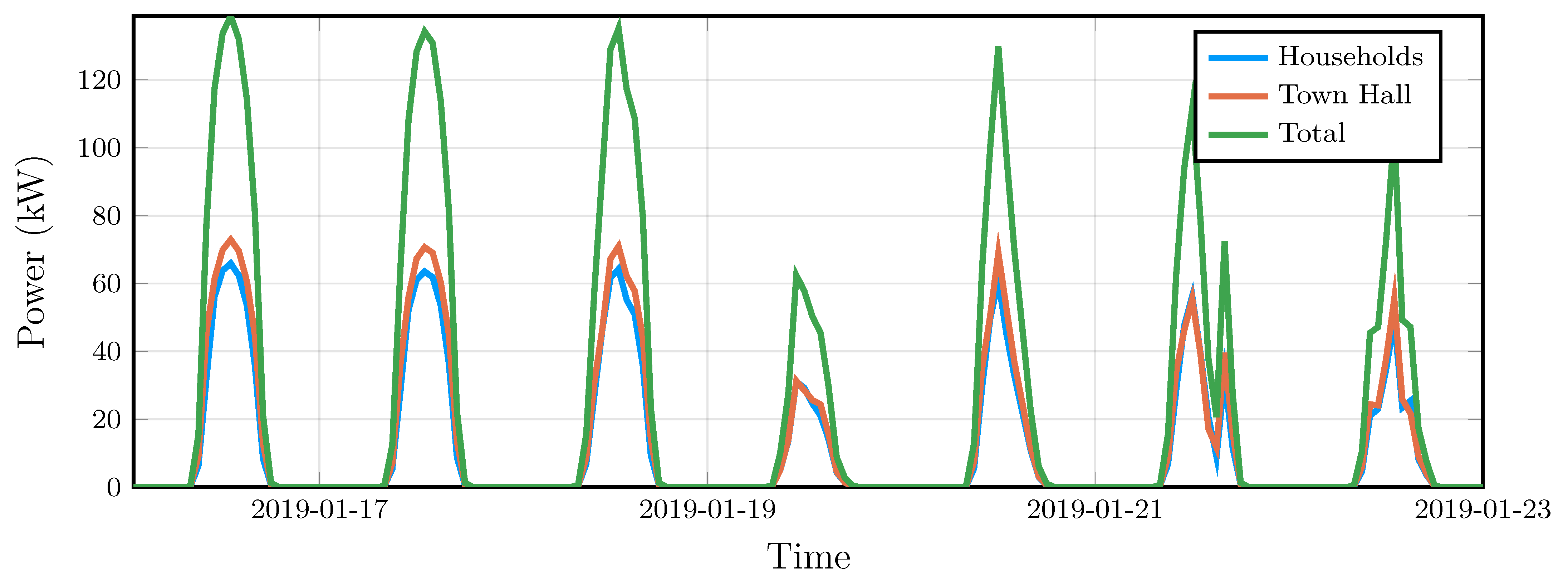

4.1. Data Gathering

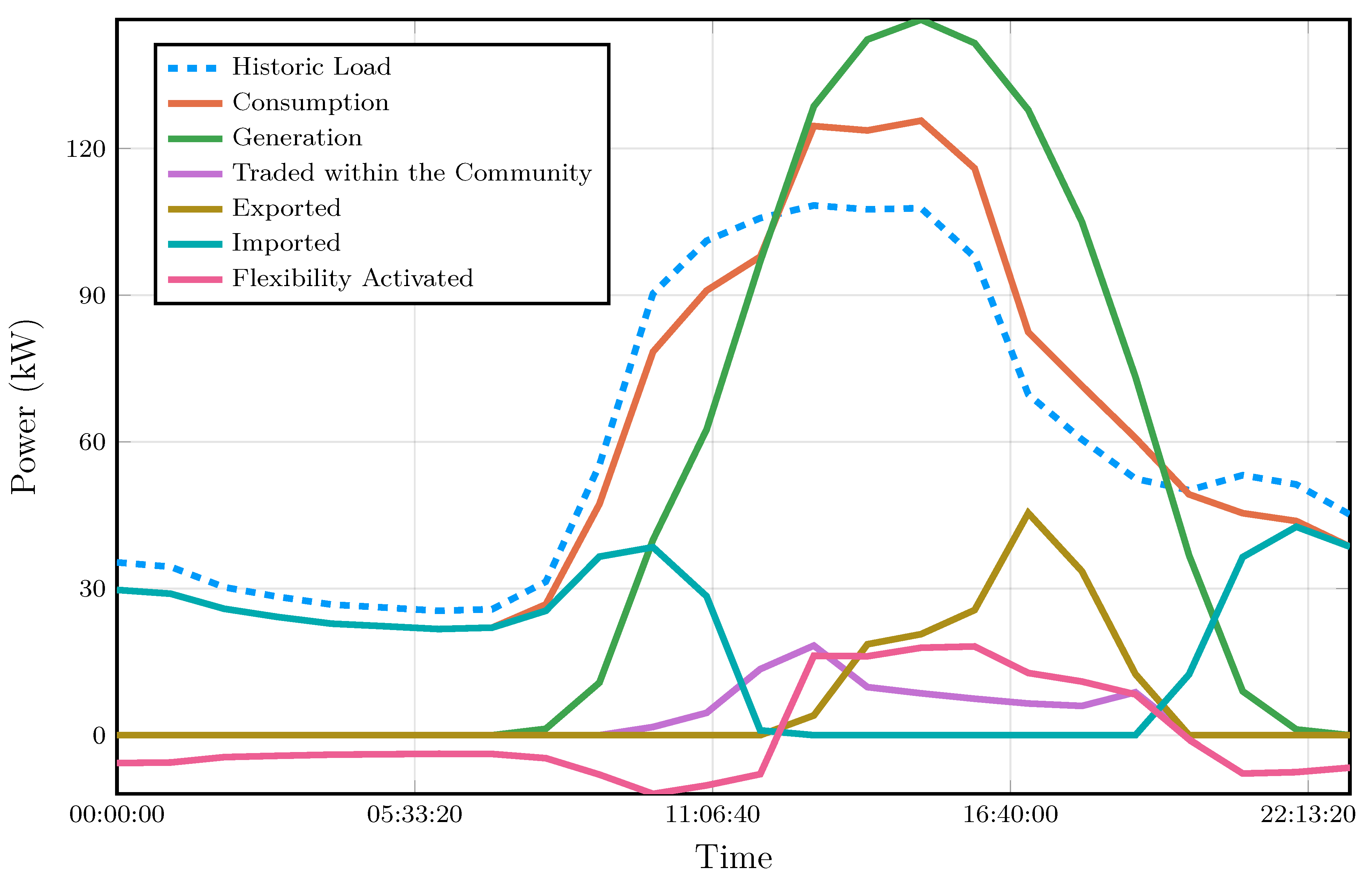

4.2. Simulation Results

5. Discussion

5.1. Investment Feasibility Improvement

5.2. Role of Energy Community

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Nguyen, S.; Peng, W.; Sokolowski, P.; Alahakoon, D.; Yu, X. Optimizing rooftop photovoltaic distributed generation with battery storage for peer-to-peer energy trading. Appl. Energy 2018, 228, 2567–2580. [Google Scholar] [CrossRef]

- Cornélusse, B.; Savelli, I.; Paoletti, S.; Giannitrapani, A.; Vicino, A. A community microgrid architecture with an internal local market. Appl. Energy 2019, 242, 547–560. [Google Scholar] [CrossRef] [Green Version]

- Hatziargyriou, N.D.; Asimakopoulou, G.E. DER integration through a monopoly DER aggregator. Energy Policy 2020, 137, 111124. [Google Scholar] [CrossRef]

- Guerrero, J.; Chapman, A.C.; Verbič, G. Local energy markets in LV networks: Community based and decentralized P2P approaches. In Proceedings of the 2019 IEEE Milan PowerTech, Milan, Italy, 23–27 June 2019; pp. 1–6. [Google Scholar]

- Rogers, J.C.; Simmons, E.A.; Convery, I.; Weatherall, A. Social impacts of community renewable energy projects: Findings from a woodfuel case study. Energy Policy 2012, 42, 239–247. [Google Scholar] [CrossRef]

- Wang, Y.; Wu, X.; Li, Y.; Yan, R.; Tan, Y.; Qiao, X.; Cao, Y. Autonomous energy community based on energy contract. IET Gener. Transm. Distrib. 2020, 14, 682–689. [Google Scholar] [CrossRef]

- Xiao, Y.; Wang, X.; Pinson, P.; Wang, X. Transactive Energy Based Aggregation of Prosumers as a Retailer. IEEE Trans. Smart Grid 2020, 11, 3302–3312. [Google Scholar] [CrossRef]

- Adeyemi, A.; Yan, M.; Shahidehpour, M.; Bahramirad, S.; Paaso, A. Transactive energy markets for managing energy exchanges in power distribution systems. Electr. J. 2020, 33, 106868. [Google Scholar] [CrossRef]

- Zia, M.F.; Benbouzid, M.; Elbouchikhi, E.; Muyeen, S.M.; Techato, K.; Guerrero, J.M. Microgrid Transactive Energy: Review, Architectures, Distributed Ledger Technologies, and Market Analysis. IEEE Access 2020, 8, 19410–19432. [Google Scholar] [CrossRef]

- Abrishambaf, O.; Lezama, F.; Faria, P.; Vale, Z. Towards transactive energy systems: An analysis on current trends. Energy Strategy Rev. 2019, 26, 100418. [Google Scholar] [CrossRef]

- Kouveliotis-Lysikatos, I.; Kokos, I.; Lamprinos, I.; Hatziargyriou, N. Blockchain-Powered Applications for Smart Transactive Grids. In Proceedings of the 2019 IEEE PES Innovative Smart Grid Technologies Europe (ISGT-Europe), Bucharest, Romania, 29 September–2 October 2019; pp. 1–5. [Google Scholar] [CrossRef]

- Daneshvar, M.; Mohammadi-Ivatloo, B.; Asadi, S.; Anvari-Moghaddam, A.; Rasouli, M.; Abapour, M.; Gharehpetian, G.B. Chance-constrained models for transactive energy management of interconnected microgrid clusters. J. Clean. Prod. 2020, 271, 122177. [Google Scholar] [CrossRef]

- GridWise Architecture Council. Available online: https://www.gridwiseac.org/about/transactive_energy.aspx (accessed on 28 February 2021).

- Chen, S.; Liu, C.C. From demand response to transactive energy: State of the art. J. Mod. Power Syst. Clean Energy 2016, 5. [Google Scholar] [CrossRef] [Green Version]

- Krishnan, R.; Smith, M.; Telang, R. The Economics of Peer-to-Peer Networks. J. Inf. Technol. Theory Appl. 2003, 5. [Google Scholar] [CrossRef] [Green Version]

- Parag, Y.; Sovacool, B. Electricity market design for the prosumer era. Nat. Energy 2016, 1, 16032. [Google Scholar] [CrossRef]

- Tushar, W.; Saha, T.K.; Yuen, C.; Smith, D.; Poor, H.V. Peer-to-Peer Trading in Electricity Networks: An Overview. IEEE Trans. Smart Grid 2020, 11, 3185–3200. [Google Scholar] [CrossRef] [Green Version]

- Zhang, C.; Wu, J.; Zhou, Y.; Cheng, M.; Long, C. Peer-to-Peer energy trading in a Microgrid. Appl. Energy 2018, 220, 1–12. [Google Scholar] [CrossRef]

- Guerrero, J.; Chapman, A.; Verbic, G. A study of energy trading in a low-voltage network: Centralised and distributed approaches. In Proceedings of the 2017 Australasian Universities Power Engineering Conference (AUPEC), Melbourne, Australia, 19–22 November 2017; pp. 1–6. [Google Scholar] [CrossRef] [Green Version]

- Abdella, J.; Shuaib, K. Peer to Peer Distributed Energy Trading in Smart Grids: A Survey. Energies 2018, 11, 1560. [Google Scholar] [CrossRef] [Green Version]

- Long, C.; Wu, J.; Zhang, C.; Thomas, L.; Cheng, M.; Jenkins, N. Peer-to-peer energy trading in a community microgrid. In Proceedings of the 2017 IEEE Power Energy Society General Meeting, Chicago, IL, USA, 16–20 July 2017; pp. 1–5. [Google Scholar] [CrossRef]

- Paudel, A.; Chaudhari, K.; Long, C.; Gooi, H.B. Peer-to-Peer Energy Trading in a Prosumer-Based Community Microgrid: A Game-Theoretic Model. IEEE Trans. Ind. Electron. 2019, 66, 6087–6097. [Google Scholar] [CrossRef]

- Tushar, W.; Saha, T.K.; Yuen, C.; Liddell, P.; Bean, R.; Poor, H.V. Peer-to-Peer Energy Trading with Sustainable User Participation: A Game Theoretic Approach. IEEE Access 2018, 6, 62932–62943. [Google Scholar] [CrossRef]

- Directive (EU) 2019/944 of the European Parliament and of the Council of 5 June 2019 on Common Rules for the Internal Market for Electricity and Amending Directive 2012/27/EU; Directorate General for Energy: Brussels, Belgium, 2019.

- Directive (EU) 2018/2001 of the European Parliament and of the Council of 11 December 2018 on the Promotion of the Use of Energy from Renewable Sources; Directorate General for Energy: Brussels, Belgium, 2018.

- Clean Energy for All Europeans; Directorate-General for Energy (European Commission): Brussels, Belgium, 2019. [CrossRef]

- Frieden, D.; Tuerk, A.; Neumann, C.; d’Herbemont, S.; Roberts, J. Collective self-consumption and energy communities: Trends and challenges in the transposition of the EU framework. 2020. Available online: https://www.researchgate.net/publication/346975546_Collective_self-consumption_and_energy_communities_Trends_and_challenges_in_the_transposition_of_the_EU_framework (accessed on 28 February 2021).

- Roberts, J.; Frieden, D.; d’Herbemont, S. Energy Community Definitions. Deliv. Dev. Under Scope Compil. Proj. Integr. Community Power Energy Isl. 2019, 1.0, 5–7. [Google Scholar]

- Caramizaru, A.; Uihlein, A. Energy Communities: An Overview of Energy and Social Innovation; Publications Office of the European Union: Luxembourg, 2020. [Google Scholar] [CrossRef]

- Duchesne, L.; Cotnélusse, B.; Savelli, I. Sensitivity Analysis of a Local Market Model for Community Microgrids. In Proceedings of the 2019 IEEE Milan PowerTech, Milan, Italy, 23–27 June 2019; pp. 1–6. [Google Scholar] [CrossRef] [Green Version]

- Mbuwir, B.V.; Spiessens, F.; Deconinck, G. Distributed optimization for scheduling energy flows in community microgrids. Electr. Power Syst. Res. 2020, 187, 106479. [Google Scholar] [CrossRef]

- Akasiadis, C.; Chalkiadakis, G. Decentralized Large-Scale Electricity Consumption Shifting by Prosumer Cooperatives, ECAI’16; IOS Press: Amsterdam, The Netherlands, 2016; pp. 175–183. [Google Scholar] [CrossRef]

- International Co-operative Alliance. Available online: https://www.ica.coop/en (accessed on 28 February 2021).

- Alvin, T. The Third Wave; William Morrow: New York, NY, USA, 1980. [Google Scholar]

- Jacobs, S. The Energy Prosumer. Ecol. Law Q. 2016, 519, 43. [Google Scholar] [CrossRef]

- Shandurkova, I.; Bremdal, B.; Bacher, R.; Ottesen, S.; Nilsen, A. A Prosumer oriented Energy Market. 2012. Available online: https://www.researchgate.net/publication/326786365_A_Prosumer_Oriented_Energy_Market_-_Developments_and_future_outlooks_for_Smart_Grid_oriented_energy_markets_A_state-of-the-art_perspective (accessed on 28 February 2021).

- Zia, M.F.; Elbouchikhi, E.; Benbouzid, M.; Guerrero, J.M. Microgrid Transactive Energy Systems: A Perspective on Design, Technologies, and Energy Markets. In Proceedings of the IECON 2019—45th Annual Conference of the IEEE Industrial Electronics Society, Lisbon, Portugal, 14–17 October 2019; Volume 1, pp. 5795–5800. [Google Scholar] [CrossRef]

- Baez-Gonzalez, P.; Rodriguez-Diaz, E.; Vasquez, J.C.; Guerrero, J.M. Peer-to-Peer Energy Market for Community Microgrids [Technology Leaders]. IEEE Electrif. Mag. 2018, 6, 102–107. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Diesing, J.; Weinhardt, C. Tracing local energy markets: A literature review. it—Inf. Technol. 2019, 61. [Google Scholar] [CrossRef]

- Ampatzis, M.; Nguyen, P.H.; Kling, W. Local electricity market design for the coordination of distributed energy resources at district level. In Proceedings of the IEEE PES Innovative Smart Grid Technologies, Europe, Istanbul, Turkey, 12–15 October 2014; pp. 1–6. [Google Scholar] [CrossRef]

- Bremdal, B.A.; Olivella, P.; Rajasekharan, J. EMPOWER: A network market approach for local energy trade. In Proceedings of the 2017 IEEE Manchester PowerTech, Manchester, UK, 18–22 June 2017; pp. 1–6. [Google Scholar] [CrossRef]

- Conejo, A.J.; Carrión, M.; Morales, J.M. Decision Making under Uncertainty in Electricity Markets; Springer: Berlin/Heidelberg, Germany, 2010; Volume 1. [Google Scholar]

- Debreu, G. Valuation Equilibrium and Pareto Optimum. Proc. Natl. Acad. Sci. USA 1954, 40, 588–592. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Myerson, R.B. Game Theory; Harvard University Press: Cambridge, MA, USA, 2013. [Google Scholar]

- Thakur, S.; Hayes, B.P.; Breslin, J.G. Distributed Double Auction for Peer to Peer Energy Trade using Blockchains. In Proceedings of the 2018 5th International Symposium on Environment-Friendly Energies and Applications (EFEA), Rome, Italy, 24–26 September 2018; pp. 1–8. [Google Scholar] [CrossRef]

- Li, J.; Ye, Y.; Strbac, G. Stabilizing peer-to-peer energy trading in prosumer coalition through computational efficient pricing. Electr. Power Syst. Res. 2020, 189, 106764. [Google Scholar] [CrossRef]

- Thomas, D.; Kazempour, J.; Papakonstantinou, A.; Pinson, P.; Deblecker, O.; Ioakimidis, C. A Local Market Mechanism for Physical Storage Rights. IEEE Trans. Power Syst. 2020, 35, 3087–3099. [Google Scholar] [CrossRef] [Green Version]

- Ye, G.; Li, G.; Wu, D.; Chen, X.; Zhou, Y. Towards Cost Minimization with Renewable Energy Sharing in Cooperative Residential Communities. IEEE Access 2017, 5, 11688–11699. [Google Scholar] [CrossRef]

- Law 4513/2018. Available online: https://www.e-nomothesia.gr/energeia/nomos-4513-2018-fek-9a-23-1-2018.html (accessed on 19 March 2021).

- Law 4414/2016. Available online: https://www.e-nomothesia.gr/kat-trapezes-pistotika-idrumata/nomos-4416-2016.html (accessed on 19 March 2021).

- Law 4602/2019. Available online: https://www.e-nomothesia.gr/kat-periballon/nomos-4602-2019-phek-45a-9-3-2019.html (accessed on 19 March 2021).

- Law 3468/2006. Available online: https://www.e-nomothesia.gr/energeia/n-3468-2006.html?q=3468 (accessed on 19 March 2021).

- Tounquet, F.; De Vos, L.; Abada, I.; Kielichowska, I.; Klessmann, C. Energy Communities in the European Union. Revised Final Report, ASSET Project Report. Available online: https://asset-ec.eu/wp-content/uploads/2019/07/ASSET-Energy-Comminities-Revised-final-report.pdf (accessed on 28 February 2021).

- Moret, F.; Pinson, P. Energy collectives: A community and fairness based approach to future electricity markets. IEEE Trans. Power Syst. 2018, 34, 3994–4004. [Google Scholar] [CrossRef] [Green Version]

- Sousa, T.; Soares, T.; Pinson, P.; Moret, F.; Baroche, T.; Sorin, E. Peer-to-peer and community-based markets: A comprehensive review. Renew. Sustain. Energy Rev. 2019, 104, 367–378. [Google Scholar] [CrossRef] [Green Version]

- WiseGRID Project. Available online: https://www.wisegrid.eu/ (accessed on 28 February 2021).

- COMPILE Project. Available online: https://www.compile-project.eu/ (accessed on 28 February 2021).

- Frieden, D.; Tuerk, A.; Furlan, M.; Herenčić, L.; Pavlin, B.; Vasilakis, A.; Chronis, A.; Marouço, R.; Primo, N.; Antunes, A.R.; et al. Deliverable 2.3: Regulatory frameworks for energy communities in the pilot site countries Croatia, Spain, Greece, Portugal and Slovenia. 2020. Available online: https://www.compile-project.eu/downloads/ (accessed on 28 February 2021).

| Member Category | Average Annual Consumption (kWh) | Members | Total Annual Consumption (kWh) | Members with PVs | Total Installed PVs (kW) |

|---|---|---|---|---|---|

| Category 1 | 1830 | 10 | 18,300 | 8 | 8 |

| Category 2 | 2520 | 14 | 35,280 | 12 | 18 |

| Category 3 | 3360 | 16 | 53,760 | 14 | 28 |

| Category 4 | 4220 | 14 | 59,080 | 12 | 30 |

| Category 5 | 5030 | 6 | 30,180 | 4 | 12 |

| Town Hall | 193,710 | 1 | 193,710 | 1 | 99 |

| Total | - | 60 | 390,310 | 50 | 96 |

| Scenario | Flexibility Percentage (%) | Town Hall Flexibility (%) | Town Hall PV (kW) | Households with Flexibility |

|---|---|---|---|---|

| S1 | 20 | 20 | 99 | 50 |

| S2 | 20 | 20 | 99 | 60 |

| S3 | 30 | 30 | 99 | 60 |

| S4 | 20 | 20 | 50 | 50 |

| S5 | 20 | 20 | 50 | 60 |

| S6 | 20 | 30 | 50 | 60 |

| S7 | avg 20 | 30 | 50 | 60 |

| S8 | 20 | - | - | 60 |

| Scenarios | Trading Benefit | |||||

|---|---|---|---|---|---|---|

| Scenario | Town Hall PV (kW) | Flexibility | Members with PVs (%) | Members without PV (%) | Town Hall (%) | |

| % of Total Load | Flexible Members | |||||

| S1 | 99 | 20 | 50 | 6.6 | 9.1 | 2.8 |

| S2 | 20 | 60 | 6.6 | 9.1 | 2.7 | |

| S3 | 30 | 60 | 7.0 | 9.5 | 2.9 | |

| S4 | 50 | 20 | 50 | 9.9 | 7.6 | 3.6 |

| S5 | 20 | 60 | 9.8 | 7.5 | 3.5 | |

| S6 | 30 | 60 | 10.1 | 7.6 | 3.5 | |

| S7 | 50 | avg 20 | 60 | 10.3 | 7.5 | 3.6 |

| S8 | - | 20 | 60 | 5.1 | 9.4 | - |

| Scenarios | Traded Energy | |||||

|---|---|---|---|---|---|---|

| Scenario | Town Hall PV (kW) | Flexibility | Members with PVs (%) | Members without PV (%) | Town Hall (%) | |

| % of Total Load | Flexible Members | |||||

| S1 | 99 | 20 | 50 | 12.9 | 37.1 | 5.6 |

| S2 | 20 | 60 | 12.9 | 37.2 | 5.5 | |

| S3 | 30 | 60 | 14.0 | 38.5 | 6.2 | |

| S4 | 50 | 20 | 50 | 19.4 | 30.7 | 12.9 |

| S5 | 20 | 60 | 19.3 | 30.6 | 12.5 | |

| S6 | 30 | 60 | 20.5 | 31.1 | 12.7 | |

| S7 | 50 | avg 20 | 60 | 20.5 | 30.6 | 13.3 |

| S8 | - | 20 | 60 | 9.8 | 37.0 | - |

| Scenarios | Self Consumption | ||||

|---|---|---|---|---|---|

| Scenario | Town Hall PV (kW) | Flexibility | Members with PVs (%) | Town Hall (%) | |

| % of Total Load | Flexible Members | ||||

| S1 | 99 | 20 | 50 | 56.7 | 66.2 |

| S2 | 20 | 60 | 58.0 | 66.2 | |

| S3 | 30 | 60 | 61.3 | 68.8 | |

| S4 | 50 | 20 | 50 | 57.1 | 86.1 |

| S5 | 20 | 60 | 58.4 | 86.1 | |

| S6 | 30 | 60 | 61.2 | 87.6 | |

| S7 | 50 | avg 20 | 60 | 59.7 | 87.6 |

| S8 | - | 20 | 60 | 57.8 | - |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chronis, A.-G.; Palaiogiannis, F.; Kouveliotis-Lysikatos, I.; Kotsampopoulos, P.; Hatziargyriou, N. Photovoltaics Enabling Sustainable Energy Communities: Technological Drivers and Emerging Markets. Energies 2021, 14, 1862. https://doi.org/10.3390/en14071862

Chronis A-G, Palaiogiannis F, Kouveliotis-Lysikatos I, Kotsampopoulos P, Hatziargyriou N. Photovoltaics Enabling Sustainable Energy Communities: Technological Drivers and Emerging Markets. Energies. 2021; 14(7):1862. https://doi.org/10.3390/en14071862

Chicago/Turabian StyleChronis, Alexandros-Georgios, Foivos Palaiogiannis, Iasonas Kouveliotis-Lysikatos, Panos Kotsampopoulos, and Nikos Hatziargyriou. 2021. "Photovoltaics Enabling Sustainable Energy Communities: Technological Drivers and Emerging Markets" Energies 14, no. 7: 1862. https://doi.org/10.3390/en14071862

APA StyleChronis, A.-G., Palaiogiannis, F., Kouveliotis-Lysikatos, I., Kotsampopoulos, P., & Hatziargyriou, N. (2021). Photovoltaics Enabling Sustainable Energy Communities: Technological Drivers and Emerging Markets. Energies, 14(7), 1862. https://doi.org/10.3390/en14071862