1. Introduction

In the context of the energy revolution, photovoltaic (PV) power generation has always been the main choice for human beings to develop new energy, both now and in the future, and centralized photovoltaic (CPV) has attracted significant attention and investment in many countries. In the past, many countries have actively introduced various policies to promote the rapid development of photovoltaic power generation. For example, the renewable portfolio standard (RPS) employed by the UK, the US, and Australia has been implemented in combination with the Tradable Green Certificate (TGC), which requires power producers to generate a certain proportion of renewable energy [

1]. Many European countries have implemented a policy mechanism based on Feed-in-Tariff (FIT) [

2]. The FIT scheme operated by Germany, Denmark, and Spain sets fixed prices or price premiums over the market price of electricity for a specified period [

3,

4]. Italy implemented FIT to bring surplus electricity into the power grid, and PV installed capacity was raised by two orders of magnitude over a ten-year period (2007–2017) [

5]. Sweden does not have any feed-in tariff, although it does have rather favorable government installation subsidies; PV power generation accounts for only 0.24% of the power combination [

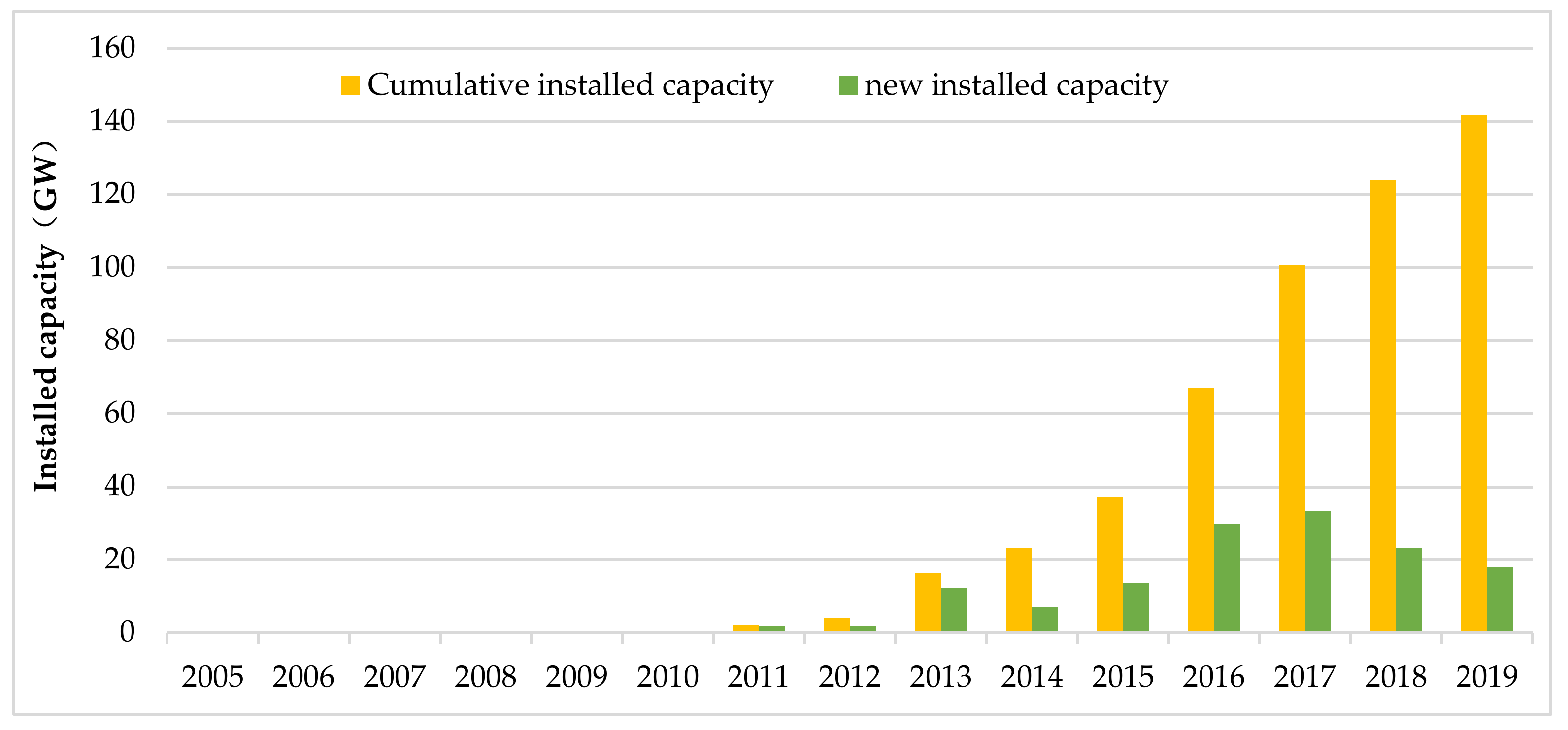

6]. In China, the FIT scheme implemented by the government divides the subsidy price into three levels according to different light resources. This has contributed to the rapid development of CPV. The cumulative installed capacity of CPV had surged to 141.74 GW in 2019, compared with 2.32 GW in 2011, which accounted for more than 20% of the global total installed PV capacity [

7]. China’s CPV capacity ranks first in the world in terms of both newly installed capacity and cumulative installed capacity.

With the rapid increase of CPV installed capacity, its cost continues to fall. In 2019, the cost of CPV power generation in China plummeted to US $0.058/kWh, which was lower than the global cost of large-scale solar PV power generation connected to the grid (US $0.068/kWh). At the same time, FIT has led to a huge gap in government energy subsidies. By the end of 2017, China’s PV subsidy gap had exceeded US $7.615 billion. The energy sector has been reducing the CPV subsidy since 2017, but the subsidy gap has still widened year by year. There is no doubt that it is only a matter of time before FIT will be cancelled, and achieving grid parity could be the key to solving the subsidy problem.

Although the cost of CPV power generation has been greatly reduced, it has not yet reached a level of parity. There are still some challenges in achieving grid parity, mainly due to three aspects. First, after a huge improvement in technology, China’s CPV industry is now in the transition to another relatively stable stage. The proportion of non-technical costs is increasing year by year [

8], and the rate of cost reduction is not as fast as before. Second, CPV policy is changing from FIT to the renewable portfolio standard (RPS) in China [

9]. Indeed, some countries have successfully implemented RPS. However, the conditions of the nation and industrial development are greatly different from country to country [

10]. RPS policy gave rise to some disturbing problems in China’s CPV development because it was the first time this new policy had been implemented. Finally, on September 26, 2019, Premier Li Keqiang announced that China’s coal power would abolish the benchmark on the grid tariff mechanism, and the country would try out the market-oriented mechanism of “benchmark price + fluctuation”. The decline in the price of coal power will make it more difficult for CPV to achieve grid parity. Particularly in the critical transition period of the CPV industry, in order to tackle the above problems, it is urgent to clarify the future installation of CPV and the rate of cost reduction of CPV power generation [

11], and to find out when grid parity can be realized.

Therefore, this paper considers the uncertain factors caused by the policy changes and industrial development changes and focuses on exploring the change curve of China’s CPV power generation cost. To solve this problem, the grey GM (1, 1) model, combined with the learning curve model, is applied to calculate the cost of CPV power generation over the next decade. Firstly, the improved grey GM (1, 1) model is created to predict the installed capacity under the condition of policy uncertainty, and the prediction results are used to calculate the cost. Then, the industry life cycle is divided by analyzing the characteristics of China’s PV industry by giving different learning rates (LRs) at each stage and figuring out the process of the changing cost of CPV power generation. Finally, considering that China’s coal power industry will implement the market mechanism, we compare the CPV power generation cost with desulfurization thermal power benchmark prices and the coal-fired power cost under the market-oriented mechanism and study the amount of time it will take to achieve grid parity and the costs involved.

The structure of this paper is as follows:

Section 2 illustrates the research and achievements that are related to this study.

Section 3 introduces the methodology used in this study.

Section 4 predicts the accumulative installation capacity of CPV, the generation costs of CPV, and the generation cost of coal-fired power generation.

Section 5 discusses the results and analyzes grid parity.

Section 6 presents the conclusion and policy implications.

2. Literature Review

The cost of CPV power generation is a fundamental factor in determining when grid parity can be realized and whether it is competitive in the energy market [

12]. In order to explore how the cost of CPV has changed, this section gives a brief introduction to the research of PV installation volume prediction, learning curves, and grid parity. Finally, the main contribution of this paper is introduced in view of the deficiency of the existing research.

2.1. Installation Capacity Forecast

In the past, scholars have proposed various methods to predict the installed capacity of PV, such as system dynamics, multiple linear regression, game theory, and grey prediction. Baur and Uriona [

13] proposed a system dynamics model to predict PV development in different scenarios in Germany. They concluded that subsidy reductions or even removal would slow down the development of photovoltaics, but this could be alleviated with the improvement of electrification. Zhang et al. [

9] used system dynamics to study the development of China’s PV installed capacity under different policies (FIT and RPS) and put forward suggestions for the government to set relevant policy parameters to promote the PV industry. Guo and Guo [

14] and Zhao et al. [

15] also used system dynamics to predict China’s PV installations under RPS policy. Salman et al. [

16] employed system dynamics to study the development of PV in Malaysia under the FIT policy. Hsu [

17] also followed the same method to discuss the changes of PV installed capacity in Taiwan, China, under FIT. Monica et al. [

18] adopted system dynamics to explore the impact of subsidy reduction on domestic PV and public utility PV installation in the UK, while Lyu et al. [

19] focused on the impact of the combination of RPS and FIT policy on installed capacity over the next decade. In addition, Liu et al. [

20], Zhao et al. [

21], and Zhao and Zhang [

22] all preferred use of the game method to explore the trend of PV installed capacity in the future. Leepa and Unfried [

23] and Fan et al. [

24], respectively, used multiple linear equations to evaluate the PV installed capacity in Germany and China. In both system dynamics and evolutionary game theory, the research object is long-term, cyclical, and stable [

25]. While the stable development of PV in China is only ten years old, these two methods cannot be well applied in China. Generally speaking, the grey system is an effective method of prediction that is widely used because it is easy to use, has a simple modeling process, and requires less data [

26]. In this paper, this method can be used for effective prediction with a small sample and limited information. The GM (1,1) model and other derivative forms of grey prediction have been widely used in the forecasting of energy consumption and production [

27,

28,

29], agricultural output [

30], research output, and growth [

31].

2.2. Learning Curve

The learning curve model is the mainstream method for studying the decrease of energy costs [

32]. Based on the basic assumption that “experience, knowledge, scale, and other factors can improve technical performance”, it describes the downward trend of unit cost with the accumulation of production experience, the increase of knowledge reserve, and the expansion of production scale. Furthermore, some scholars have studied the impact of other factors on cost, including supplementary input, production technology, system integration, and international trade [

33,

34,

35,

36,

37]. Many technical types of research have been published on the learning curve of renewable energy, which can be divided into two types: single-factor learning curve [

38,

39] and two-factor learning curve. For example, Gao et al. [

40] used a single-factor learning curve to study the development of solar PV. Özge et al. [

41] explored the differences in cost learning curves when PV installed capacity is increasing or technology is improved. Zheng and Kammen [

42] constructed a two-stage regression to improve the two-factor model, but the model was limited to individual cases. Radomes and Arango discussed the Bass diffusion model and PV learning curve in the evolution of PV power cost. They concluded that the learning curve plays an important role in the prediction of renewable energy cost and should be up-to-date [

43].

2.3. Grid Parity of CPV Power

The practical significance of grid parity is that PV power generation can compete with traditional power generation [

44]. Generally speaking, grid parity means the achievement of a relatively cheap price when comparing the cost of renewable energy power generation with that of coal power generation, but it does not equal full self-sufficiency [

8]. There are two key points in the achievement of grid parity. One is that the cost of a newly-built PV power station can compete with that of a new coal-fired power station without subsidy. The other is that the power generation cost of a new PV power station is lower than that of an existing coal-fired power station. The existing research compared the cost of renewable energy power generation with the current cost of coal power to study the grid parity of PV power. For example, Zhao and Wang [

12] used the Levelized Cost of Electricity (LCOE) and internal rate of return (IRR) to compare China’s distributed PV and desulfurization coal benchmark electricity prices, and concluded that grid parity can be realized by 2025. Lee and Ahn [

45] used the stochastic approach to estimate the LCOE for solar PV in South Korea. Gao et al. [

40] predicted that the PV cost in China will be US

$0.09138/kWh in 2020 and US

$0.06092/kWh in 2030, which is close to the current price of coal-fired power. Zhang et al. [

46] compared the cost of PV power generation with that of coal-fired power generation in 31 provinces of China and found that, without policy support, grid parity could not achieved by 2020. Zhang and Zhang [

47] predicted that distributed PV would be able to compete strongly with thermal power generation in all but seven provinces by 2025.

2.4. Research Gap

According to the above literature review, in order to explore the change of CPV power generation costs in the current environment, we forecast and analyze the factors affecting the cost of CPV power generation. Specifically, this paper proposes new methods to predict the cumulative installed capacity more accurately, puts forward the variable cost learning rate, and considers the impact of national policy implementation effects. The contributions of this paper mainly lie in these three aspects.

In recent years, scholars have adopted various methods to predict the installed capacity of CPV. Because China’s PV industry has only been on the right track since 2009, it was difficult to compile a large sample of data in such a short time. The drastically changed policies have also caused a great impact on the installed capacity. These factors have therefore led to a lower accuracy in the prediction. The grey model is proposed in order to reduce the influence of small sample on the prediction accuracy, and the GM (1, 1) model is further improved by considering the influence of uncertainty factors on the prediction results. Finally, the grey GM (1, 1) model was created to forecast the changing trend of China’s CPV cumulative installed capacity in the next 10 years under different effects of policy implementation.

As for the study of the learning curve model, although more influencing factors are taken into account, its performance of the learning curve is no better than that of a model using a single factor [

48]. In some ways, it is difficult to clearly separate technological progress from production experience [

7]. Considering that there may be multi-collinearity among the factors that affect the cost, many scholars have proved that the cumulative installed capacity of PV is the most comprehensive factor of cost reduction [

49,

50,

51,

52]. By doing so, this paper takes into consideration all the influencing factors such as scale, technology, and experience by using a single factor learning curve. In addition, most studies are based on the assumption that LRs based on the same influencing factor remain unchanged [

50]. However, as the industry enters different stages of the life cycle, its structural factors usually change. It is not in line with the actual situation to hold the thought that the LR is always fixed. Although some articles have proposed the phased assignment LR [

53], it is only a simple division and does not really explore the internal laws of the industry. In order to overcome the disadvantage that the LR is fixed in the learning curve model, this paper intends to study the cost change from the industry life cycle characteristics. We have divided the life cycle according to the characteristics of China’s photovoltaic industry and assigned different values to the LR at each stage of the life cycle. Three possible scenarios of LRs in the future are given to predict the cost of CPV power generation.

For the study of grid parity, some scholars try to analyze and compare the subject from various perspectives, but the policy and environment are dynamic and complex so that they often get quite different results. In addition, previous studies have mostly compared the cost of CPV power generation with the benchmark price of desulfurization coal when they discuss the possibility of achieving grid parity, without considering the price changes of coal-fired power generation. Recently, China has put forward the policy that no regulation is made on the benchmark price of desulfurization coal. It is definitely going to intensify the price competition between coal-fired power generation and CPV power generation in China’s power market, which, in this paper, is called market-oriented competition. As a result, the cost of coal-fired power will further decline, which makes it more difficult to achieve grid parity. To solve this problem, this paper uses the latest data to predict the cost changes of both CPV and coal, and it also compares the cost of coal power under the benchmark electricity price mechanism and the market mechanism with the cost of CPV power generation, which provides a reliable analysis for grid parity of CPV and provides a reference for policymakers.

3. Methodology

3.1. Grey Model-GM (1, 1)

It has not been for long that China’s CPV industry has been on the right track. It was therefore difficult to compile a large amount of sample data because there was little information about the annual new installed capacity and the accumulated installed capacity (as shown in

Figure 1). In view of the fact that the grey prediction method can effectively make predictions from data with the characteristics of “small sample and poor information”, this paper proposes the grey prediction model to deal with this problem. The installed PV generation capacity, whose cost is much higher than coal-fired generation, is directly affected by policy; the recent policy has changed drastically, so the installed capacity has therefore changed irregularly. Given that fact, we buffer the original data, and then the GM (1, 1) model is established to simulate and predict the installed capacity to improve the prediction accuracy.

The original data is defined in chronological order, as follows:

Because China’s installed capacity has fluctuated greatly under the influence of policy, it is necessary to use a buffer operator to process the initial data, and the average weakening buffer operator is as follows:

where the buffered sequence is set as a new

.

is the 1-AGO sequence of

; it can be represented as follows:

where

Equation (5) is referred to as the original form of model GM (1, 1), which is a difference equation.

Let

be just like definition (1)–(3);

is defined as follows:

where

Equation (8) is referred to as the even form of model GM (1, 1).

The parameter vector

of Formula (8) can be estimated using the least square method, which satisfies:

where

Theorem 1. The time response sequence of the even model GM (1, 1) is as follows: We can obtain the time response formula of

, that is:

The above methods are used to predict the cumulative installed capacity of CPV, but this is not enough to deal with the uncertainties. According to the historical data and experience of CPV installation in China, the uncertainty of CPV policy has a great impact on the installed capacity. Specifically, the time at which FIT policy stops and the implementation effect of RPS policy will both influence the new installed capacity in the next year. Therefore, this paper improves the model in order to deal with the uncertainty brought by the changed policy. The model is as follows:

Equation (13) can be expressed as follows:

where

θ is used to express the effect of policy implementation on the new installed capacity of CPV, and

θ > 0. In this equation,

represents the cumulative installed capacity affected by the parameter

θ, and

represents the cumulative installed capacity in the k − 1 year under the effect of the parameter.

3.2. Industry Life Cycle Analysis

Industry life cycle refers to the process when something emerges until its final withdrawal from social and economic activities. The industry life cycle mainly includes four development stages: introduction stage, growth stage, mature stage, and decline stage. The industry life cycle curve ignores the differences in product models, quality, specifications, etc.; it considers issues from the perspective of the entire industry. For the mature stage, the industry life cycle can be further divided into another two stages, namely early and late maturity. We cannot deny that the process of the industry life cycle truly has an internal impact on development. Therefore, in order to consider the inherent impact of the CPV industry cycle on its development, we divide the life cycle according to the characteristics of the CPV industry.

3.3. Learning Curve Model

To demonstrate the impact of the accumulated installed capacity on the cost of CPV, the influence relationship is shown as follows:

According to Equation (15), the statistical model of the single-factor cost learning curve is as shown in Formula (16):

where

is the cost of one kilowatt-hour in year

t,

is the cost in the initial year,

is the cumulative installed capacity of CPV in year

t, and b is the learning index.

The Calculating learning index as Formula (17).

The improvement rate (

PR) is defined as Formula (18).

The learning rate (LR) is defined as Equation (19).

The higher the LR is, the faster the CPV cost will decrease, and the higher the improvement rate is, the slower the CPV cost will decrease.

4. Results

4.1. Confidence Test and Results Forecast of GM (1, 1)

4.1.1. Model Confidence Test

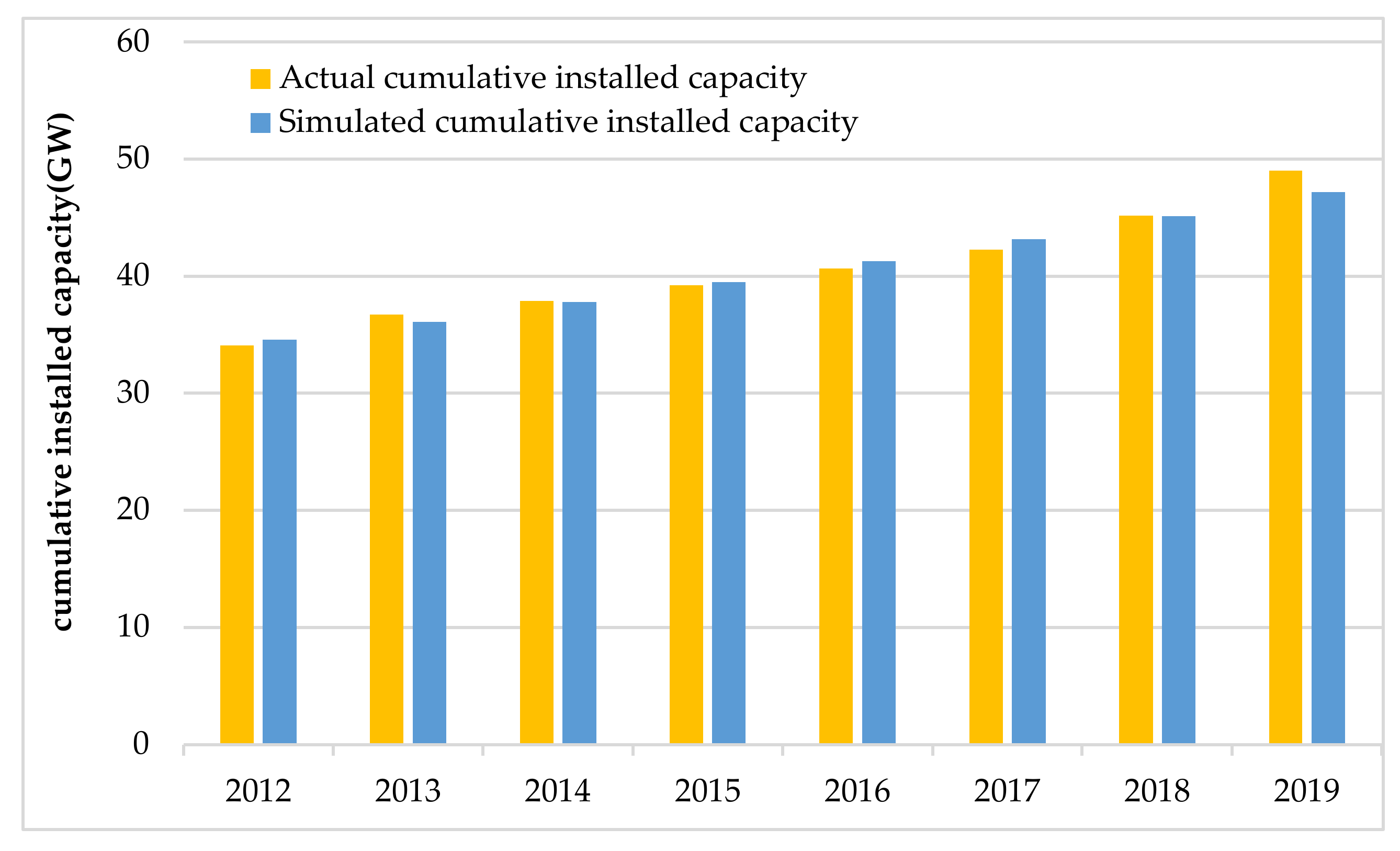

In order to test the fitting effect and prediction accuracy of the model, we used Chinese CPV data to test the model. We first used the cumulative installed capacity and newly installed capacity from 2013 to 2017 in China as the original data to test the fitting degree of the model. Then the 2018–2019 data was reserved as the test data, and the error comparison was made with the future installation data obtained by using the fitting formula.

In the process of model selection, the annual new installed capacity was used to predict the data, but the 1-AGO cumulative data obtained by direct application of GM (1, 1) model (such as Formulas (1), (3)–(8)) had poor smoothness, and the quasi index law was not obvious. The average relative error of fitting the original data reached 38%. After analyzing the original data sequence, we found that there were abnormal data in the sequence; outliers appeared due to the influence of the policy, which caused the investment intention of the newly installed machine to fluctuate greatly. Therefore, the grey sequence operator was given priority to process the original data sequence with the average weakening buffer operator, as shown in Formula (2). After buffering, the simulation error was reduced to 9%, and it still had the chance to go down. Consequently, we used the annual cumulative installed capacity as the original data and then made the prediction after buffering. The simulation error was as low as 1%, as shown in

Table 1.

By comparing the simulation of the data of newly installed CPV and the data of accumulated CPV installations, we can see from the results that it is better to use accumulated CPV installations to simulate and predict. We then verified the prediction accuracy and used CPV cumulative installed capacity data from 2013–2017 as the original data and the data from 2018–2019 as the test data. Results, as shown in

Figure 2, show that the simulation relative error for 2018 was 2.13%, and that, for 2019, it was 3.40%. The errors were both less than 5%, which indicates that the model and data fit well.

In order to further validate the model, the PV data from Germany was selected to test the fitting effect and prediction accuracy of the model. PV development in Germany is quite mature; Germany implemented FIT in the early days and then set up PV laws to reduce subsidies. In this respect, it is very similar to China, so we selected the German PV installation data to validate the model.

Similarly, the cumulative installed capacity of PV in Germany from 2011 to 2015 was the original data, and the data from 2016 to 2019 was the test data. The average relative simulation error between the model fitting data and the original data was 1.002%, and the prediction relative errors from 2015 to 2019 were 1.49%, 2.07%, 0.09%, and 3.7%, respectively; these were all less than 5%. The fitting effect was good, and the results are shown in

Figure 2.

4.1.2. Forecast of Installed Capacity

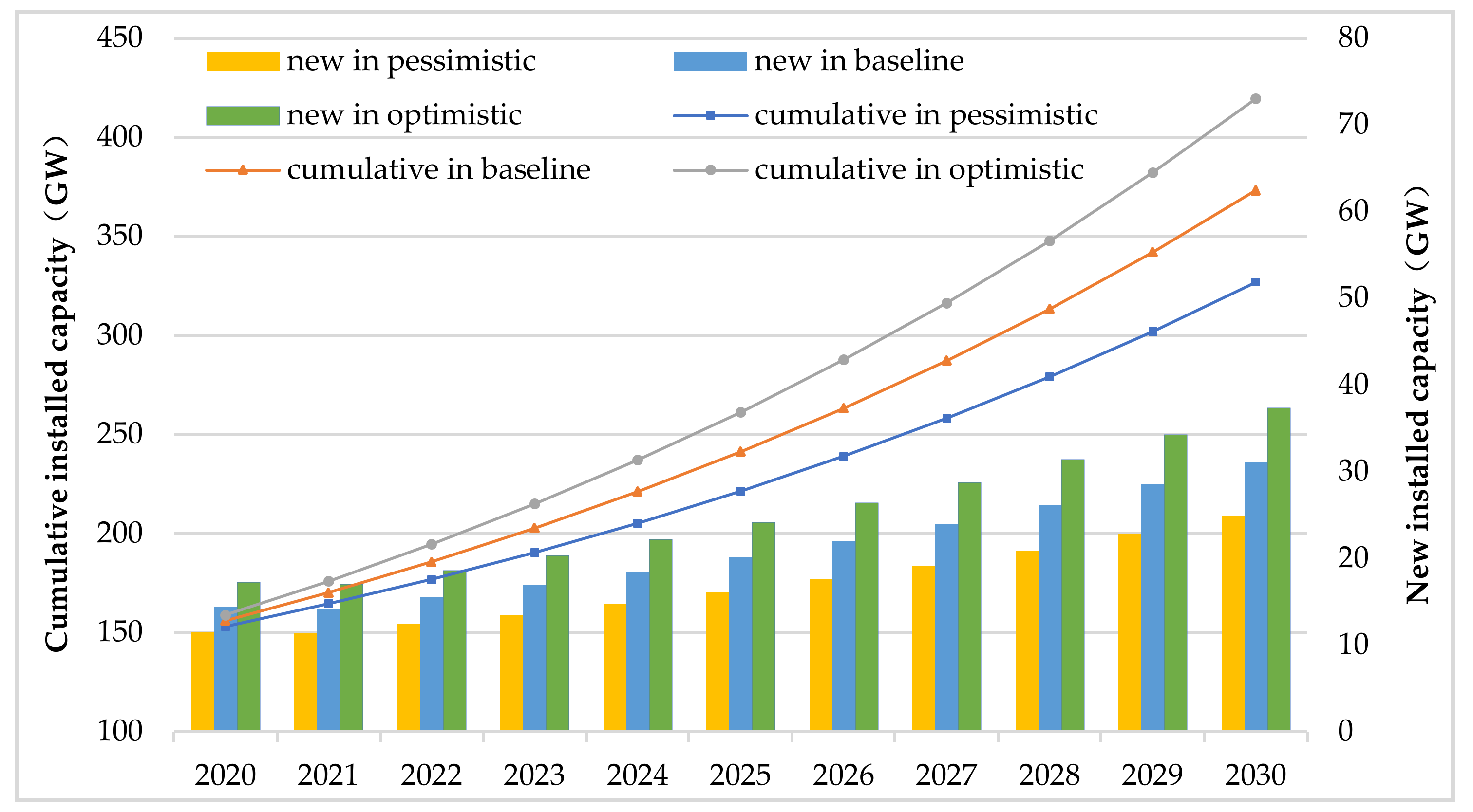

Based on the above analysis, we used the Chinese CPV cumulative installed capacity as original data, then processed the data with the buffer sequence and finally proposed the GM (1, 1) model for prediction. The results will therefore be more accurate and effective. According to the principle of the grey system giving priority to new information, the accumulated installed capacity of CPV system was predicted by using the latest data from 2015 to 2019.

The Chinese government’s attitude toward the CPV industry is changing year by year, and the entire industry is currently in the transition period when the policy changed from FIT to RPS [

3]. Therefore, the future of this industry remains uncertain. The attitude of CPV investors under different policies will cause a change of installation, so the investment attitude can be divided into three possible types: pessimistic, baseline, and optimistic.

Pessimistic investment: FIT policy suddenly drops out when the PV industry is not fully self-sufficient. At the same time, the RPS mechanism of the industry is not effectively implemented, resulting in earning little money or even performs at a loss. As a result, the whole industry is in a downturn. Therefore, the influence parameter on the installed capacity is set as 0.8.

Baseline investment: FIT drops out in a reasonable time, and the RPS mechanism can really be useful. The CPV industry achieves a smooth and orderly transition. The influence parameter on the installed capacity is set as 1.0.

Optimistic investment: The withdrawal time of FIT perfectly matches the development situation of the CPV industry. The cost reduction of CPV can provide room for strong market competition. In other situations, the RPS is implemented smoothly. The CPV industry shows strong vitality and investors are in a fever of investment. The influence parameter on the installed capacity is set as 1.2.

According to the grey GM (1, 1) model of uncertainty in this paper, Formulas (1)–(14) are used to predict the CPV installed capacity under different investment attitudes. The prediction results are shown in

Figure 3.

According to

Figure 3, under pessimistic investment, the cumulative installed capacity in 2030 will reach 326 GW, under baseline investment, it will be 373 GW, and under optimistic investment, it will exceed 419 GW. From the annual installed capacity, we can see that the difference in installed capacity under different investment attitudes will increase year by year. By 2030, the accumulated installed capacity gap between pessimistic and optimistic will be as wide as 100 GW. However, the overall growth trend of installed capacity is stable, and the annual new installed capacity increases steadily. Therefore, the CPV market still has great potential in the future.

4.2. Analysis and Results of Industry Life Cycle

4.2.1. Life Cycle Characteristics Analysis of CPV Power Generation

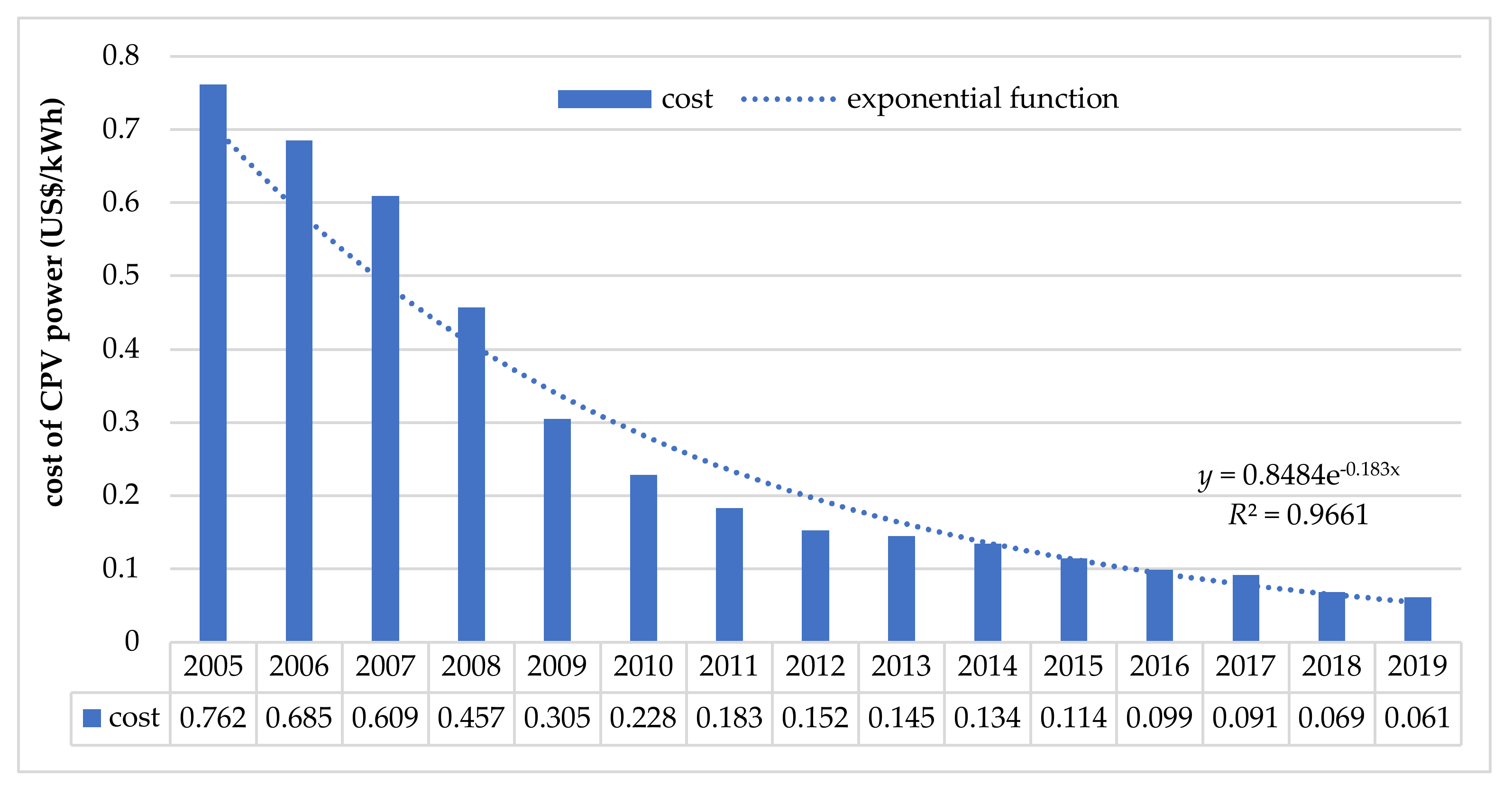

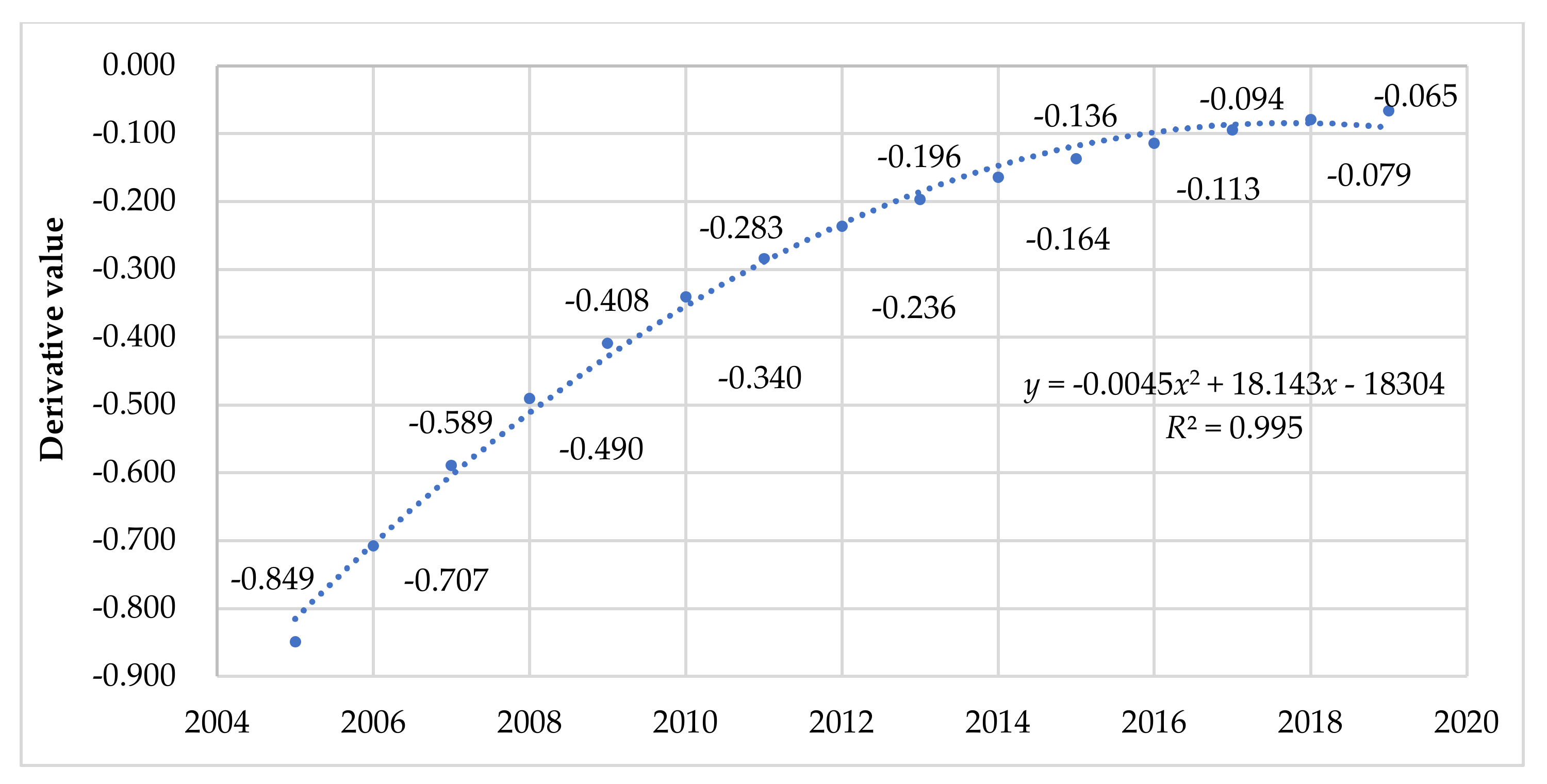

An obvious characteristic of different stages of the industry life cycle is the change of cost. Therefore, we first analyze the change of CPV cost. China’s CPV power cost is divided into three resource areas according to the light resource abundance: area I, area II, and area III. Although the prices of the three areas are different, the overall change trend and amplitude are generally consistent. Therefore, the CPV cost is calculated according to the price of area II, and the fitting function is given to see the cost trend more clearly, as shown in

Figure 4. In order to make the cost change more intuitive, we calculated the cost change rate. The cost is derived according to the fitting function, and the derivative result and fitting function are shown in

Figure 5.

According to

Figure 4 and

Figure 5, The R

2 of the fitting equation is always higher than 0.95, which indicates that the quadratic function has a very good fitting effect. Before 2013, the derivative value of cost decline was above 0.2, and after 2013 it was less than 0.15, with an average of around 0.1. It can be seen that the cost reduction rate of CPV has slowed down significantly since 2013. Therefore, it is reasonable to draw the line from 2013 to divide the life cycle stage of the CPV industry. The reason for the cost reduction is that, before 2013, CPV was in the initial stage of the industry, the cost of CPV power generation was much higher than that of traditional power, the cost base was large, and the decline speed was fast. Since 2013, the country has provided a subsidy for electricity to support the industry. As a result, the rate of cost reduction gradually slowed down. After 2018, the speed of cost reduction was much slower. This is because the CPV industry had gone through a time of price plunging, the technology had experienced rapid progress, and the CPV power generation cost was not far from the benchmark price of desulfurization coal, resulting in limited space for a decline. It can be seen that the volatile decline of cost is closely related to the change of national subsidy policy, and also has a great internal relationship with the objective law of the industry life cycle. The above information proves that the CPV industry is likely to enter the next stage of the industry life cycle in 2020.

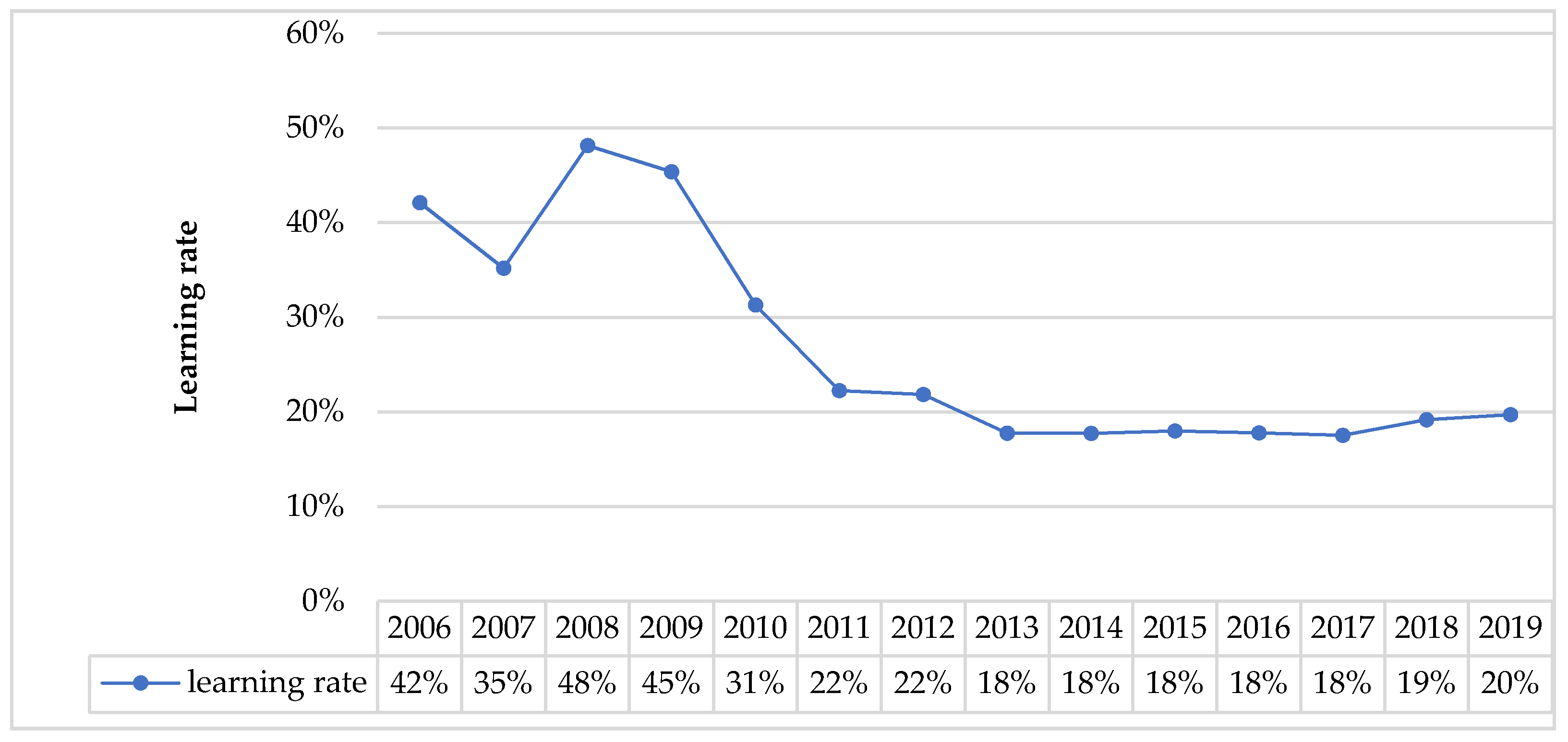

To make the above more convincing, we also analyzed the life cycle changes of CPV from the perspective of historical LR. Using the cumulative installed capacity and power generation cost from the period 2005 to 2019, we get the LR curve according to Formulas (17)–(19). The result is shown in

Figure 6.

According to

Figure 6, it is obvious that the value of the LR is divided into two distinct stages, drawing a line from 2013. From 2006 to 2012, the LR was more than 20%, and the average LR in the first few years was more than 40%. With the progression of time, the LR showed a downward trend; from 2013 to 2019, the LR remained stable at about 18%, and it has increased slightly in the last two years. This is because the government has cut the subsidy since 2017. The precarious subsidy made investors rush to install CPV. As a consequence, the increase of installed CPV capacity accelerated the cost reduction. It can be seen that the industry life cycle and the installed capacity will have an impact on the LR.

4.2.2. Stage Division of CPV Industry Life Cycle

Based on the analysis of the relevant parameters of the CPV industry and combined with the characteristics of the CPV products, we divided the life cycle of the CPV industry. The cost decline curve and LR of CPV show that the cost base of the industry was large, the cost reduction rate was moving fast, and there was no large-scale accumulation of installed capacity before 2013 (

Figure 1), which belonged to the introduction stage of the industry. From 2013 to 2020, the CPV developed at a very high and stable speed, which is typical for the growth period. In 2019, the cost reduction rate will be as low as 0.065, which indicates that the cost would slow the reduction. With 2020 as the boundary, the life cycle of the CPV industry enters the next stage. Because the product life cycle is long, usually 20–30 years, the industry will not go through a recession in the short term, but the LR may be lower after 2025. Therefore, taking 2025 as the boundary, this stage is broken down into the early mature stage and the late mature stage. The specific life cycle stage division is shown in

Table 2.

In addition to the objective impact of the industry life cycle on the cost learning effect, major technological breakthroughs will also have an important impact on LR. Therefore, the setting of LR is not only based on the division of the life cycle of the CPV industry but also takes into account possible technological breakthroughs. In this paper, three kinds of technology development scenarios are set up in the early stage of maturity. In the later stage of maturity, referring to the development experience of other countries, the LR is generally low, taking 8% of the lower limit of LR as the calculation value. According to the following LR data, the b value of CPV power generation cost can be calculated by the Formula (18), and the results are shown in

Table 3.

Scenario 1: Technology no longer declines dramatically, and the non-technical cost is difficult to reduce. LR in the early mature stage is calculated as 10%, and it will be developed more gently in the later stage of maturity by 2025, which is set as 8%.

Scenario 2: Technology continues to grow at the same pace as before; the LR is slightly lower than the present due to the increase in the proportion of non-technical costs. The LR is 18% in the early mature stage, and it is calculated as 8% in the late mature stage.

Scenario 3: There has been a major technological breakthrough in the early mature stage so LR is calculated as 25%, and that in the late mature stage is set as 8%.

4.3. Cost Prediction of CPV Power Generation

Considering that the problem of CPV parity is very important for China’s energy transformation and world carbon emission reduction, the learning curve model (Formula (10)) is used to predict the change of CPV power generation cost from 2020 to 2030. As shown in

Figure 4, the cost of CPV power generation in 2019 is US

$0.06108/kWh, which is recorded as the initial cost; the annual installed capacity is shown in

Figure 3, and the b value under three learning rate settings is shown in

Table 3. Therefore, the prediction results are based on these data.

As shown in

Table 4, the changes of the cost of CPV power generation under three scenarios are obtained (the cost under the baseline investment attitude as an example in

Table 4, and other investment attitudes are shown in the discussion).

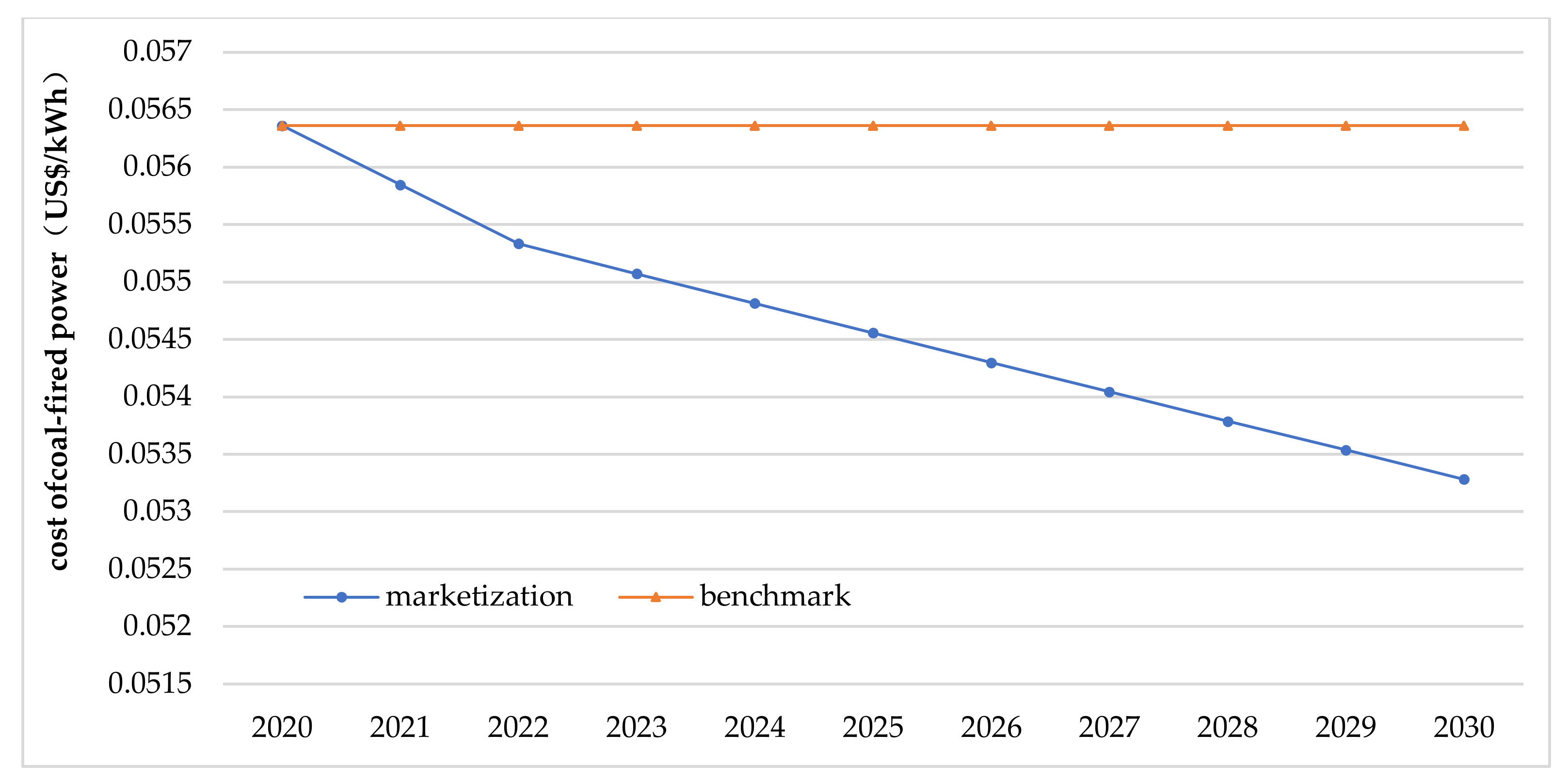

4.4. Evolution of Coal-Burning Generating Cost

Although the benchmark electricity prices of desulfurized coal vary slightly in different provinces in China, the national average price still remains at US

$0.05635/kWh [

24]. The coal power generation and growth rate in the past decade are shown in

Table 5. Considering that the CPV power generation will take part in the market competition in the future, China will implement the market-oriented mechanism instead of the benchmark price of coal-fired. Due to the market competition, coal power generation cost may be lower than it is now. Concerning the long development time and rich industry experience of coal power generation in China, it is difficult to make a major technical breakthrough. Taking a look at hydropower and nuclear power; they have also entered the mature stage, and the LR of hydropower and nuclear power dropped to 3.26% during the 20 year period [

54]. So, the LR of coal-fired generating cost is set at 5%, and the annual generation growth rate is calculated as 4% [

55]. According to Formula (10), we can get the cost of coal-fired under the market-oriented mechanism, as shown in

Figure 7.

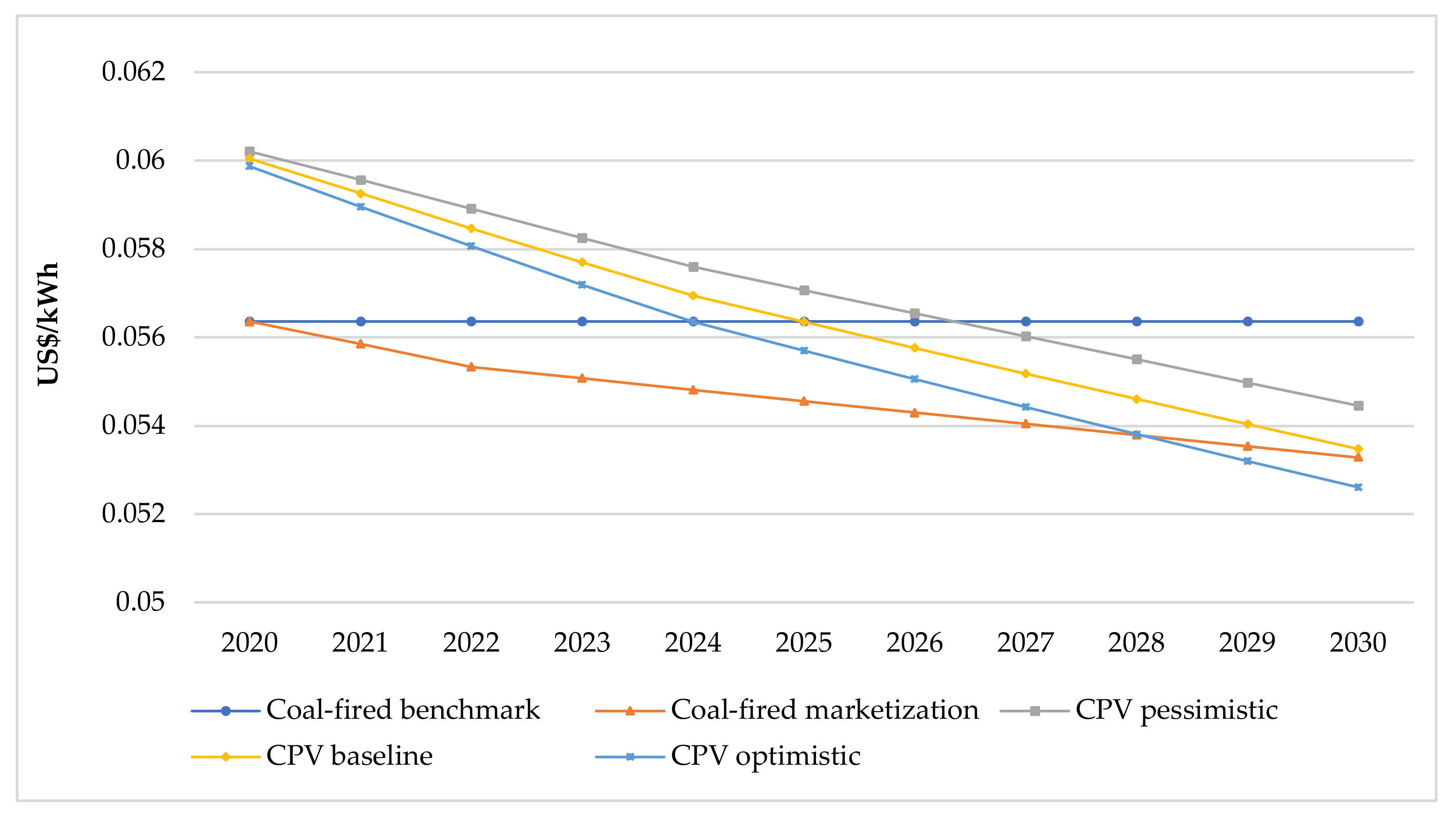

5. Discussion

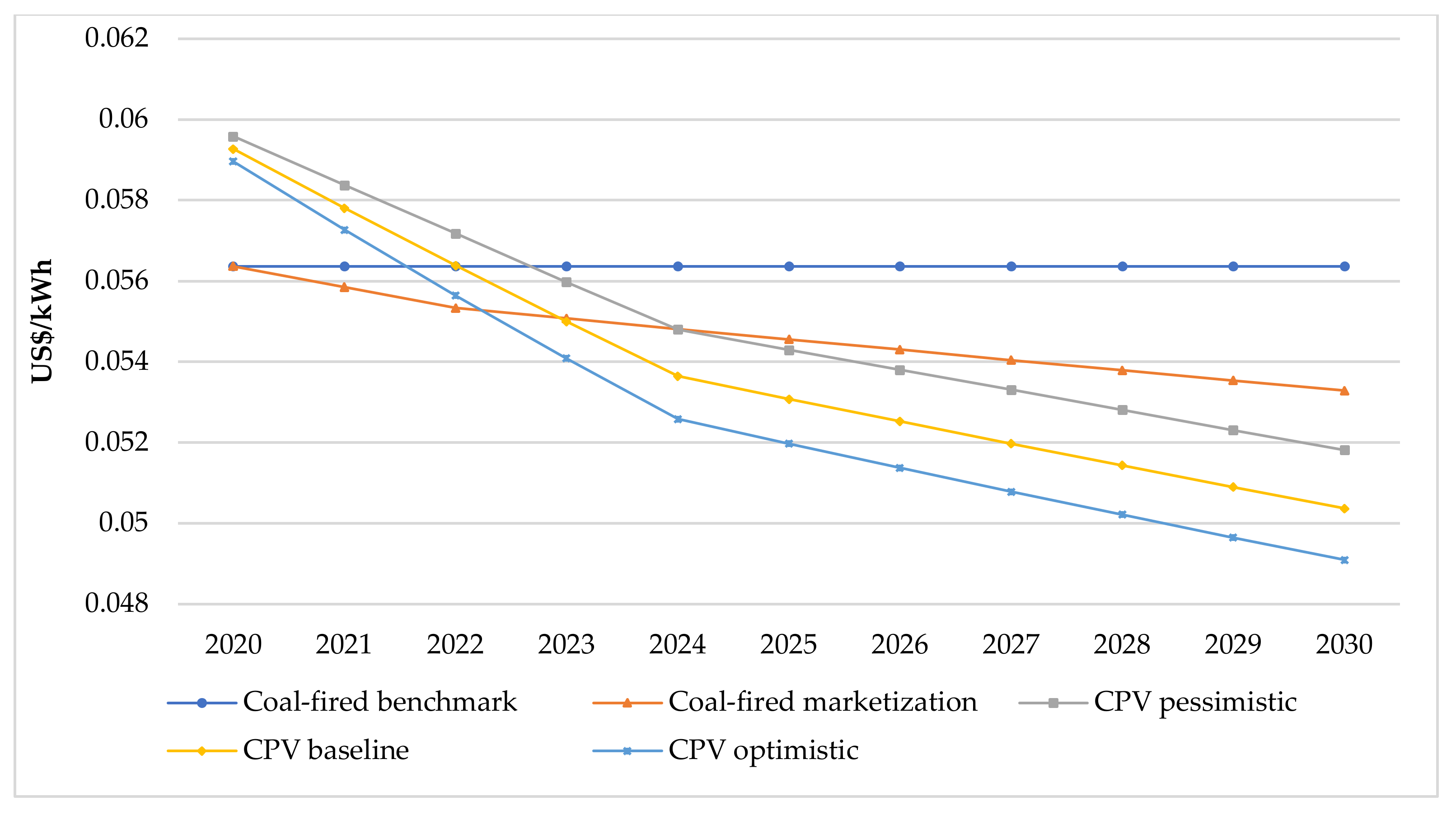

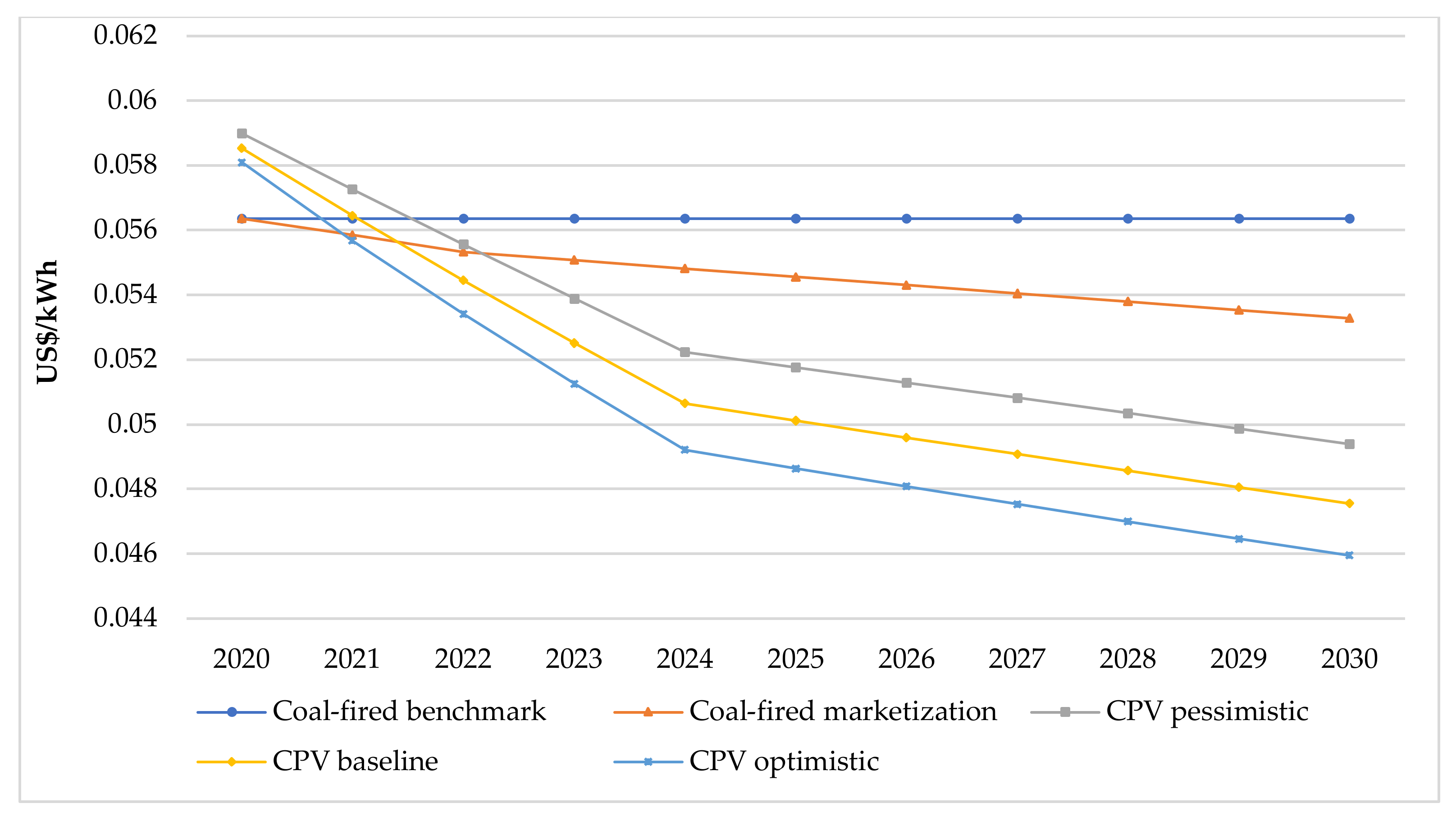

Grid parity is the intersection between CPV power cost on the one side and either desulfurization thermal power benchmark prices or desulfurization thermal power prices under the market-oriented mechanism on the other. So, we compared the predicted costs of them, and the results are shown in

Figure 8,

Figure 9 and

Figure 10.

Under Scenario 1, the cost of CPV power generation under benchmark investment will be lower than the benchmark price of coal in 2025. When coal-fired power is developing under the market-oriented mechanism, the cost of CPV power generation can catch up with the coal-fired price in 2028 under the optimistic investment state. Although the price gap between the other two investment modes and coal price is within US $0.001523/kWh, there is little hope that CPV will be able to threaten coal in the energy market in ten years. If the policy is proposed improperly and the technology is stagnant, it will greatly affect the speed of the cost reduction of CPV, which makes it more difficult for PV to achieve the grid parity and China’s energy transition.

Under Scenario 2, the cost of CPV power generation under the benchmark investment will be equal to the benchmark price of coal power in 2022. When compared with the cost of coal-fired under the market-oriented mechanism, the optimistic investment will be lower than the cost of coal-fired power in 2023, and the cost rate will fall greatly in comparison with that of coal-fired power, which means it will have stronger market competitiveness because of its price. At the least, it will have to be lower than the cost of coal-fired power in 2024 to realize the complete market competition of the CPV industry. At that time, China’s CPV subsidies can be completely canceled.

Scenario 3 is the case when CPV power generation makes a technological breakthrough. Under the baseline investment, the cost of CPV power generation can be lower than the benchmark price of desulfurized coal by around 2021, and lower than the cost of coal power generation under the market-oriented mechanism before 2022. Under optimistic investment, it can be lower than the cost of a market-oriented mechanism in 2021, and even under pessimistic investment, grid parity can be achieved in 2023. If the PV industry makes a breakthrough in technology, the CPV industry in China can get rid of the government subsidy policy within three years and realize grid parity. What is more, it will go to the era of low price at a faster-decreasing speed than the cost of coal-fired power, which is extremely competitive in the market, and may make a difference in China’s energy consumption in the future.

According to the above analysis, this paper compares the time when CPV can reach grid parity from two dimensions: firstly, different investment attitudes are taken as the prerequisite variables: Scenario 1 can realize it at the latest by 2027 and at the earliest by 2024; Scenario 2 can be realized at the latest by 2023 and the earliest by 2022; Scenario 3 can be achieved at the latest by 2022 and at the earliest by 2021. We find that, when the LR gradually increases, the impact of installed capacity on grid parity gradually becomes smaller. Even if the gap between the installed capacities is nearly 100 GW, the time gap of achieving grid parity between the two attitudes is within one year. Then, different scenarios are used as the premise variables to analyze when the CPV achieves grid parity. In the pessimistic attitudes, it should be realized at the latest by 2027 and at the earliest by 2022; in the baseline attitudes, it should be realized at the latest by 2025 and at the earliest by 2021; in the optimistic attitudes, it should be realized at the latest by 2024 and at the earliest by 2021. We find that, when the installed capacity increases gradually, the influence of LR on grid parity is also weakened. However, the weakening level of the two premise variables on the other variable is obviously different. This indicates that, under the same condition, the scenario changes corresponding to the LR set in this paper can affect the cost reduction of CPV to a greater extent than the change of investment attitudes.

In general, the cost of CPV power in China is likely to be lower than the benchmark price of coal-fired power within three years and could be slightly earlier or delayed in different situations. However, if the market-oriented mechanism is implemented for coal-fired power generation, it will indeed make it more difficult for CPV to achieve grid parity. If there is no government support for PV technology, it is hard for CPV power generation cost to be lower than coal-fired cost within five years. Fortunately, coal-fired power generation will no longer be a resistance factor for the development of the CPV industry when it reaches grid parity or if it is even at a low price. This demonstrates that the CPV industry still has a bright future. When cost is lower than the generation cost of traditional energy, the PV industry will occupy an important position in the power market. So this is one of the reasons why the CPV industry has been popular in the world in recent years.

6. Conclusions and Recommendations

In this paper, we calculated the generation cost of CPV under two variable factor dimensions up to 2030. It is obvious that, with the increase of LR or installed capacity, the impact of the other party on the time to reach grid parity will be weakened. The LR and installed capacity are complementary to the development of CPV. It then compares with the current coal-fired price and the coal-fired price under the market mechanism. It can be seen that the cost of CPV power generation in three years will be lower than the current benchmark price of desulfurization coal. However, when the coal-fired power generation market adopts the market-oriented mechanism, the further reduction of coal-fired power generation cost will lead to the difficulty of achieving CPV grid parity. In the next five years, China’s CPV still needs policies to support and guide it. According to the calculation results, the specific conclusions and suggestions are given as follows.

According to the prediction of the GM (1, 1) model, the installed capacity of CPV will continue to increase on a large scale, the cumulative installed capacity will exceed 350 GW around 2030, and the development trend of the industry is promising. However, the effective implementation of the policy will affect the investment attitudes of the industry, which may lead to a cumulative installed capacity gap of nearly 100 GW in ten years.

According to the life cycle division of the CPV industry, China’s CPV industry is going to enter a mature period. This reminds us to explore the corresponding development characteristics of the industry, such as the idea that the cost of LR changes discussed in this paper should be combined with the characteristics of the life cycle. Through analysis, the production scale of China’s CPV industry has reached a certain level, and the era of substantial cost reduction has passed. The mode of CPV industry is changing from subsidy-driven to assessment-driven and it will finally change into market-driven, and its development type will change from high-speed to high-quality. In the key transformation period of PV development, relevant policies should keep pace with the times to ensure the good development of the industry.

By comparing the power generation costs of the two energy sources, we find that the CPV power generation cost is likely to be lower than the benchmark price of desulfurization coal before 2023, and lower than that of the market-oriented mechanism before 2027. Under the most suitable policy and industry environment, the cost of CPV power generation could be as low as US $0.04569/kWh in 2030. Moreover, the costs of CPV are more likely to fall than those of coal power generation, so CPV has a strong competitive advantage. The best time for the government to cancel FIT is when it is lower than the benchmark price of desulfurization coal, and the best time to cancel assessment policies such as RPS is when CPV costs are lower than the coal-fired power generation costs under the market-oriented mechanism.

With the development of China’s CPV industry, the cumulative installed capacity has reached a certain scale, and it is much harder to reduce the cost by expanding the installed capacity. At the same time, the LR of the cost will decrease year by year, and the proportion of the non-technical cost will also increase. In order to achieve grid parity as soon as possible, or produce power that is cheaper than coal-fired, the government should attach importance to technological breakthroughs and tighten the control of non-technical costs.