1. Introduction

In late 2019 and early 2020, COVID-19 triggered a worldwide recession, in conjunction with a global health crisis and uncertainty that continues to evolve with new virus variants at the time of publication, a combination not encountered in the modern history of a global economy [

1]. Governments across the world encouraged different levels of social restrictions, including public health measures, to reduce the spread of the virus and balance the economy. Restrictions have induced abrupt shifts to digital/online business models to compensate for limited mobility that not all industries could uptake swiftly (e.g., tourism, culture, and leisure industries) [

2]. Economies with a high integration in global value chains experienced shortages of intermediary goods [

2] and other disruptions of trade, while import-dependent economies experienced shortages of both goods and labor [

3,

4,

5]. The uncertainty that the virus brought to society halted consumption among consumers and investment cycles among the industry [

4,

5,

6]. In turn, limited mobility labor, goods and services have affected the mix of energy sources [

7], substantially reducing the use of fossil fuels due to travel restrictions but also lowering electricity demand from the industry [

8,

9,

10]. Most, if not all, national economies have suffered a recession, loss of workplaces as well as lack of workers due to safety measures and increased governmental expenditures, namely those related to healthcare, employment insurance and business support. While it was obvious that the global economy experienced a severe contraction, the behavior of individual sectors of that global economy was uncertain. Businesses related to the pandemic (e.g., pulp and paper industry for hygiene products, spirits for disinfectants, online shopping, and delivery services) were gaining momentum, but this was difficult to quantify in a short time span. Governments across the world reacted to the pandemic with different approaches and interventionist measures related to recession and health uncertainties, which gained various levels of support from their citizens [

11]. The pandemic has increased the awareness of the role of the government in society with a strong interconnection between the economy and energy and health systems [

8,

12] where governments are preparing, announcing and implementing recovery plans to re-start and re-shape the economy [

13,

14,

15,

16].

The pandemic created demand and supply shocks in almost every area of human activity [

17]. The ideal recovery investment would have a short production cycle, based on the available (local) inputs, and exhibit a high multiplier effect that would allow a fast return of the invested money into the economy. Biomass is a locally available source that could have a short production cycle (annual crops and post-harvest residues, manure, industry relying on processing primary biomass, biological part of municipal waste). The International Energy Agency (IEA) recovery plan [

18] investigated the effect of clean energy investments on economic growth, jobs and cleaner and more resilient energy systems. It concluded that spending on biofuels had the highest multipliers of investments in the energy sector because of the labor intensity of harvesting and processing feedstocks [

18]. Fuel supply distinguishes bioenergy from fuel-less renewable energy sources where the supply allows for more opportunities for interactions with sustainability aspects along the biomass supply chain and not only at the end-use as a renewable energy source [

19]. Biomass supply, whether it is used for bioenergy or the broader bioeconomy, has the potential to help drive economic growth, jobs and resilience of an economy, particularly if the cross-sectoral framework is set to maximize the desired and discourage the unintended behavior [

20,

21].

The biomass supply chain (BSCh) is an integrated network of facilities and processes, each responsible for a range of activities, varying in scale and complexity [

22]. Bioenergy comes to the market with three end-uses: bioheat, bioelectricity and biofuel for transport—all behaving differently in both supply and demand, and across net energy importers and net energy exporters. The use of biomass for energy production (heat, power or fuel) has numerous benefits, including economic, social as well as environmental. It is particularly of interest to create local jobs and support regional bioeconomies for communities, even in areas where biomass availability is low [

23]. Simultaneously, the BSCh as part of the bioenergy sector is confronted with large volumes of biomass with low densities, low economic value, and is variable in nature, thus causing high costs in logistic operations [

24,

25,

26,

27]. These challenges can affect the continuity of supply, making supply chains susceptible to disruptions [

25,

26,

27]. These disruptions can occur within the operation or technology; however, significant external factors such as a global pandemic or the pandemic’s effect on energy demand are hard to predict [

28]. The factors affecting the supply of biomass for bioenergy also apply to the broader bioeconomy, where other sectors to which biomass supplies renewable carbon can usually tolerate higher biomass prices and, thus, a wider radius of biomass collection or longer distances for biomass supply.

Physical and financial shocks caused by the pandemic disrupted common commercial practices and highlighted the need for securing supply chains, storage and maintained production [

28,

29]. Resilient supply chains need to be able to react to interference to overcome the stress placed on the system and mitigate the impact of the disruption swiftly and effectively [

24]. All stages of supply chain organization and the three principle competitive priorities: cost efficiency, reliability of supply and sustainability [

30], are subject to disruptions from COVID-19.

Modelling and optimization efforts in BSCh design have envisaged the effects induced by the pandemic but would need further refinement to capture observed consequences. Until May 2021, very few publications quantified the impact of the pandemic on BSChs for bioenergy. Traditional assumptions of uncertainty do not sufficiently account for events related to the current pandemic. Uncertainty is typically linked with critical parameters such as biomass demand, prices, resource capacities, availability, quality, and costs [

31,

32,

33]. Zamar et al. [

31] applies a quantile-based approach from stochastic optimization under uncertainty, where their approach is to analyze competing supply chains subject to stochastic demand and supply and argue that those critical parameters are usually uncertain in competing supply chains subject to stochastic demand and supply, while the conventional approach assumes that the operational characteristics and design parameters are deterministic. The uncertainty stems from lack of information (e.g., quality characteristics of available biomass feedstock), noise (e.g., lack of data) and events that have not occurred (e.g., energy demand or feedstock supply shortages) which could be applied to COVID-19 effects to some extent. Medina-Gonzalez et al. [

32] focus on the potential effects of different quality streams on the overall system, which is argued to have been omitted in previous approaches. This study focuses on the challenges of multi-objective approaches (maximize economic performance while minimizing environmental impact) coupled with uncertainty strategies for a quick response against unpredictable situations (e.g., demand, price, availability, quality). The approach can serve as a framework where uncertainty events such as COVID-19 can be introduced, but it is not discussed as such. Hu et al. [

33] use cyberGIS (geographic information science and systems based on advanced cyberinfrastructure and e-science) to address uncertainty in BSChs, which could be expanded for the pandemic. Yet, modelling based on uncertainty requires substantial and reliable data sources which are inherent to all mentioned examples. In the absence of quantitative data, qualitatively modelling methods, such as Delphi, can help assess the possible futures [

34]. Sajid (2021) [

35] studied the impacts of COVID-19 on the performance of BSChs’ modelling risks using a dynamic risk assessment methodological framework, showing a drastic reduction in risk after gradual business re-opening, but the case specificity of the studied value chain vacates space for a more holistic approach, as presented here.

The main aim of this paper is to highlight policy and investment options to supply renewable carbon by enhancing sustainable BSCh contributions to short- and long-term economic recovery, in parallel with a faster transition to a carbon-neutral society. This work stems from the IEA Recovery Plan [

18], which outlined policies and targeted investments coupled with measures for each key energy sector (electricity, transport, industry, buildings, fuels, and emerging low-carbon technologies) that could be implemented from 2021 to 2023 to aid an economic recovery. The purpose of this paper is to:

assess how BSChs responded to the pandemic

identify policy and investment options to enhance sustainable BSCh contributions to short- and long-term economic recovery, and

describe how BSChs could contribute to economic recovery in four alternative post-COVID-19 development scenarios.

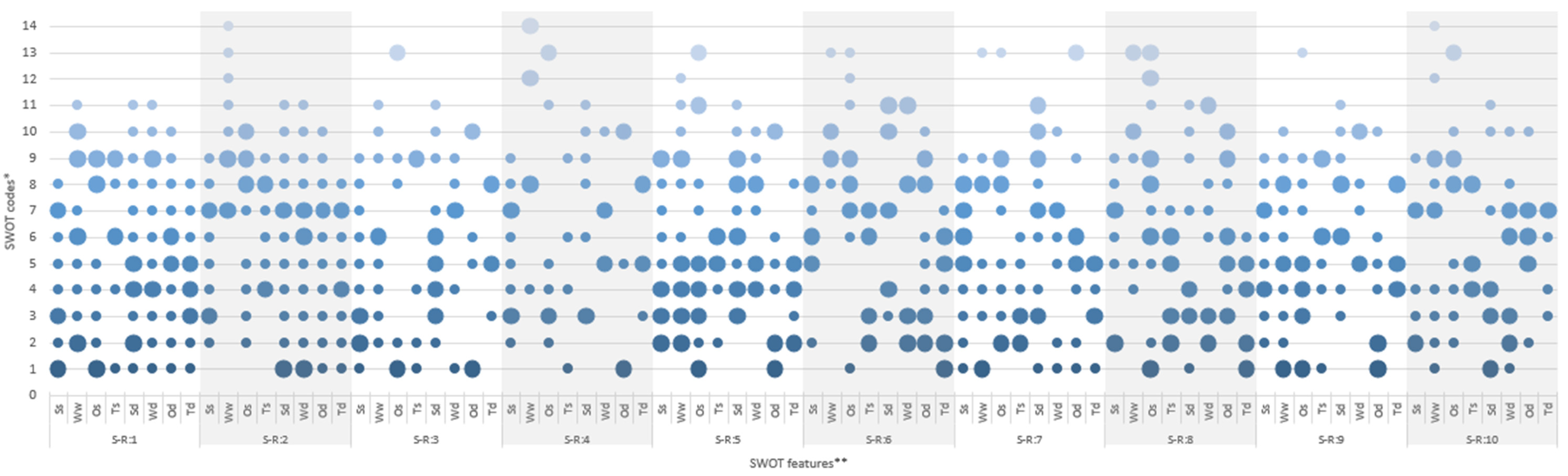

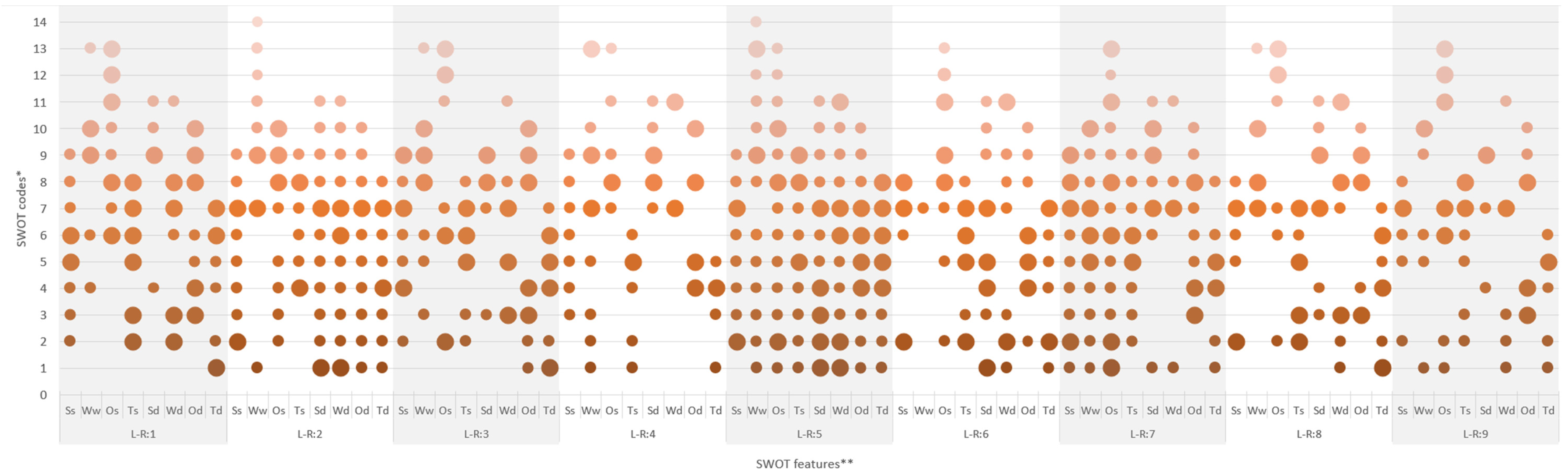

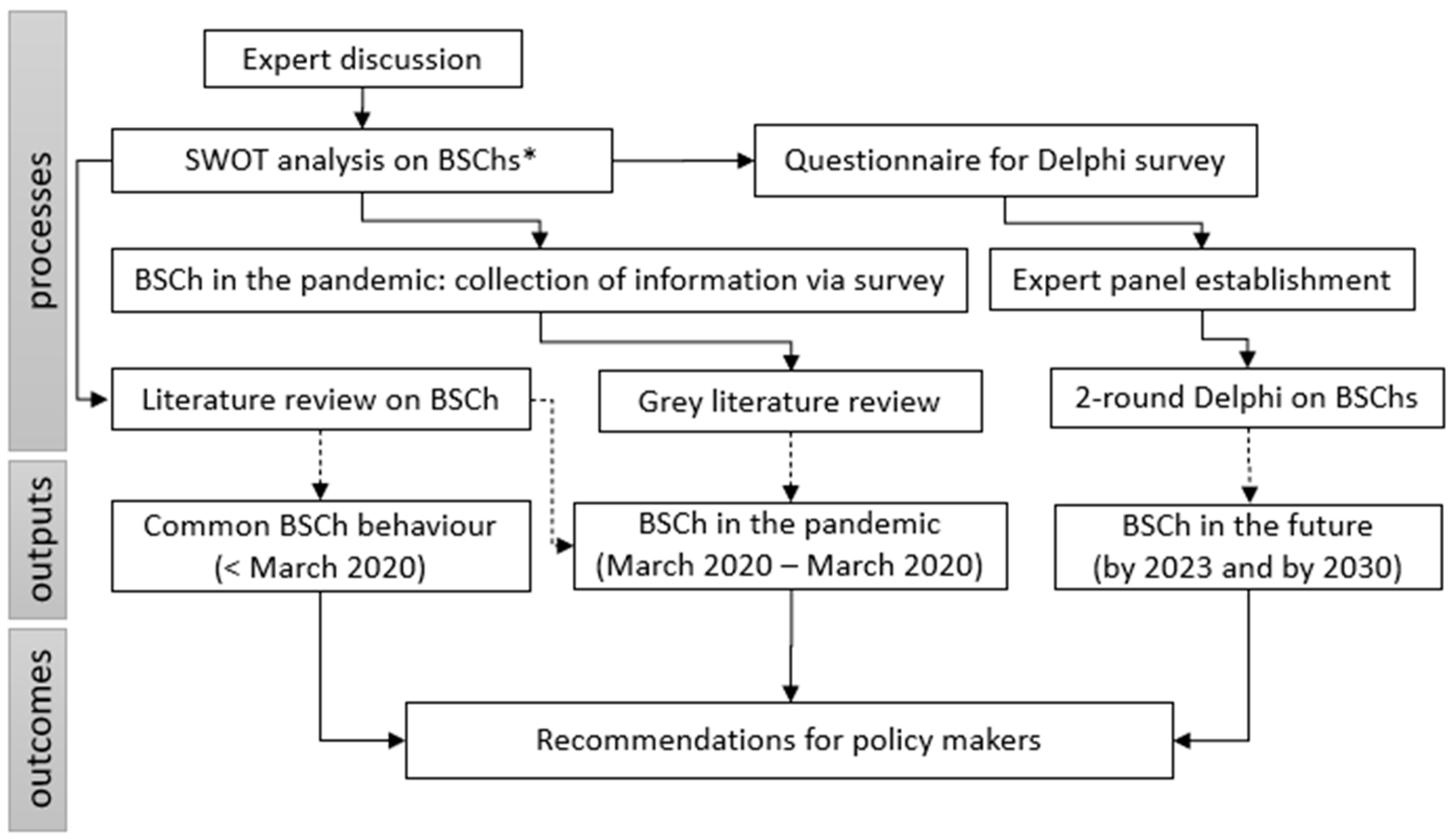

To identify policy options in directing limited recovery funds to generate positive contributions from BSChs in the post-COVID-19 economy, a modified Delphi foresight exercise [

36,

37,

38,

39] is applied, built upon a SWOT analysis, literature review and scan of grey literature, and an international survey of experts was conducted to collect behavior of BSChs in a pandemic.

4. Discussion

Global supply chains survived and thrived through historical disruptive events and have generally shown a high level of resilience. BSCh are characterized by a variety of feedstocks and variable processing technologies for energy, each of them having trade-offs [

22]. In the past, this variability in supply and technology was considered rather influential as resource markets were competing with biomass for bioenergy and putting a constraint on the market [

28]. Due to a shift in the use of resources and energy caused by the ongoing global COVID-19 pandemic, the BSChs have the potential to overcome these constraints and break out into new strategies leading the future energy markets.

While it was evident that the pandemic caused disruptions in supply chains in general and globally [

30,

55], BSChs were re-established faster, especially considering the short supply chains, within a country or administrative border. For the difference in co-productive (food, forestry) BSChs, biofuel industry that relies on dedicated crops would require more than a year to recover [

35]. The SWOT analysis indicated that the biomass for bioenergy within the bioeconomy will very likely come from co-productive systems, in a shape of a by-product, waste or residue from primary production. Hence, the literature review was expanded to the food and wood supply chains in the time of pandemic. A short communication in July 2021 discussed how the resiliency of BSChs in six areas (supply availability, digitalization and automation, collaboration within the supply chain, community-focused energy production, social challenges and opportunities, and policy) can be improved in the post-pandemic scenario. While some areas were challenging in general (supply availability, digitalization and automation), limited mobility of the workforce due to the pandemics resulted in the shortage of labor in BSChs across the supply chain [

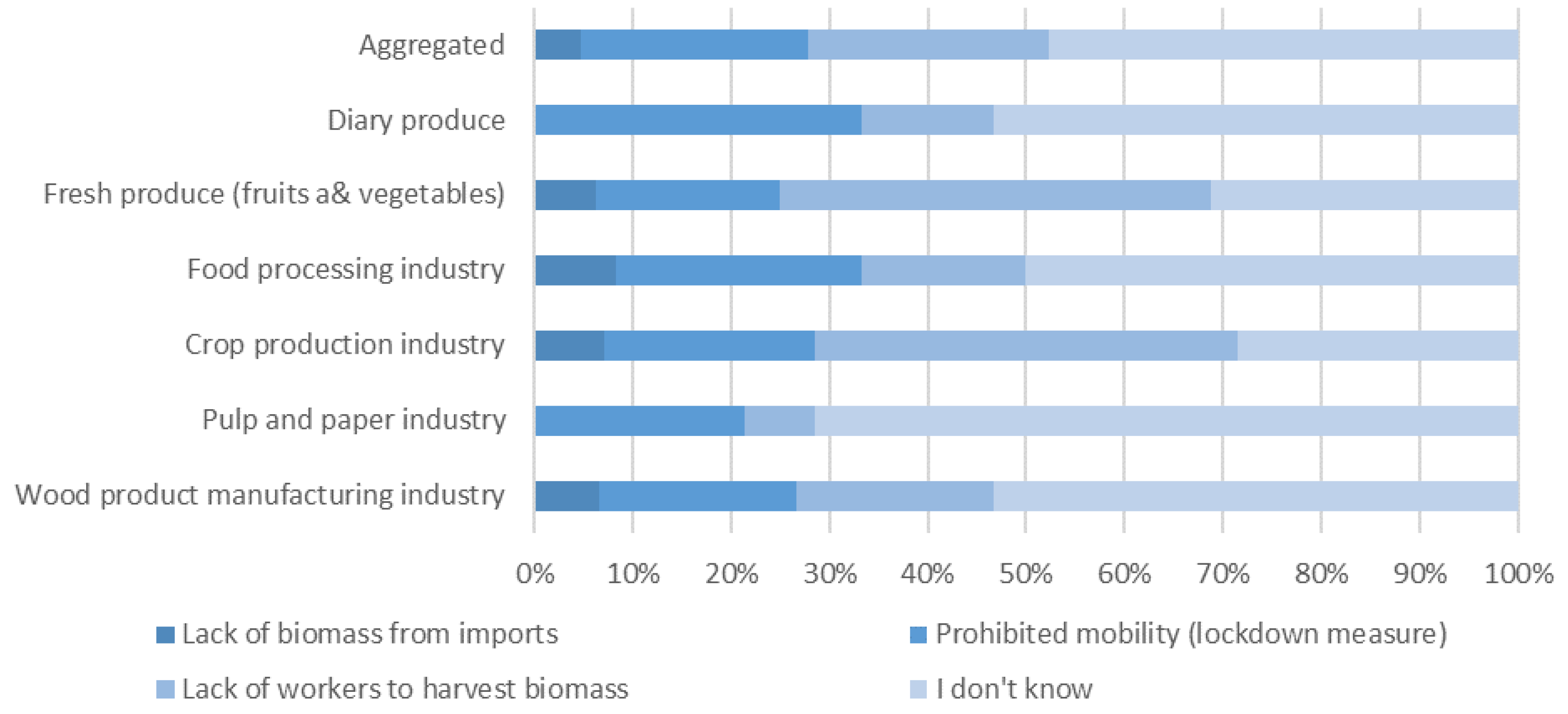

25]. The main issue was the inability to perform agri-technical measures [

3], which was also detected as a threat element in performed SWOT analysis (

Table A2). Agriculture, like any other labor-dependent sector, has shown poor resilience from the start of the pandemic [

56], but the learning curve from different levels of lockdown and response measures to reduce contact allowed field workers and logistics to operate under certain restrictions. The pandemic has increased uncertainty in biomass supply, which would force most biomass users to obtain their biomass from various sources without tracing their origin or quality. Such uncertainty consequently reduced the collaboration within the supply chain [

25,

55]. Simultaneously, the pandemic also exposed biomass versatility and flexibility [

20,

22,

25] when supplied for bioenergy.

The pandemic exposed limitations (short run) and opportunities (long run) in dealing with energy supply, in general, and the role of biomass, in particular. The food supply chain review identified small farmers as a group particularly affected by the pandemic, and study experts emphasized a need to avoid food protection policies to prevent an increase in food prices, consistent with other publications [

57,

58]. Others highlighted the vulnerability of SMEs in general [

3]. Yet, wood pellet producers in the southeastern United States fared better in terms of employment than the United States economy overall just because previously implemented systems designed to promote safe operations were fit to reduce the impact of the pandemic [

58].

Dewick et al. [

59] argue that in agri-food system production, the pandemic has led to concerns about fluctuations in international commodity prices, changes in patterns of consumption and disruptions to global distribution networks. Limiting access to inputs and markets disrupts the traditional supply chain interactions between rural and urban areas, especially in the developing countries. In this situation farmers will be forced into self-sufficient production, such as the Back to Basic scenario (

Table 2).

On the other hand, manufacturing experiences a unique set of risks, which include high uncertainty in increasing propagation and long-term disruption to supply chain actors [

60]. Often, disruptions in the manufacturing processes and systems and shifts in supply and demand are caused by exogenous supply chain disruptions. The types of disruptions faced by manufacturing seem to be qualitatively different from the usual (historically observed with known and documented consequences) disruptions in BSChs, thus unlikely to be captured by models using uncertainty as discussed above.

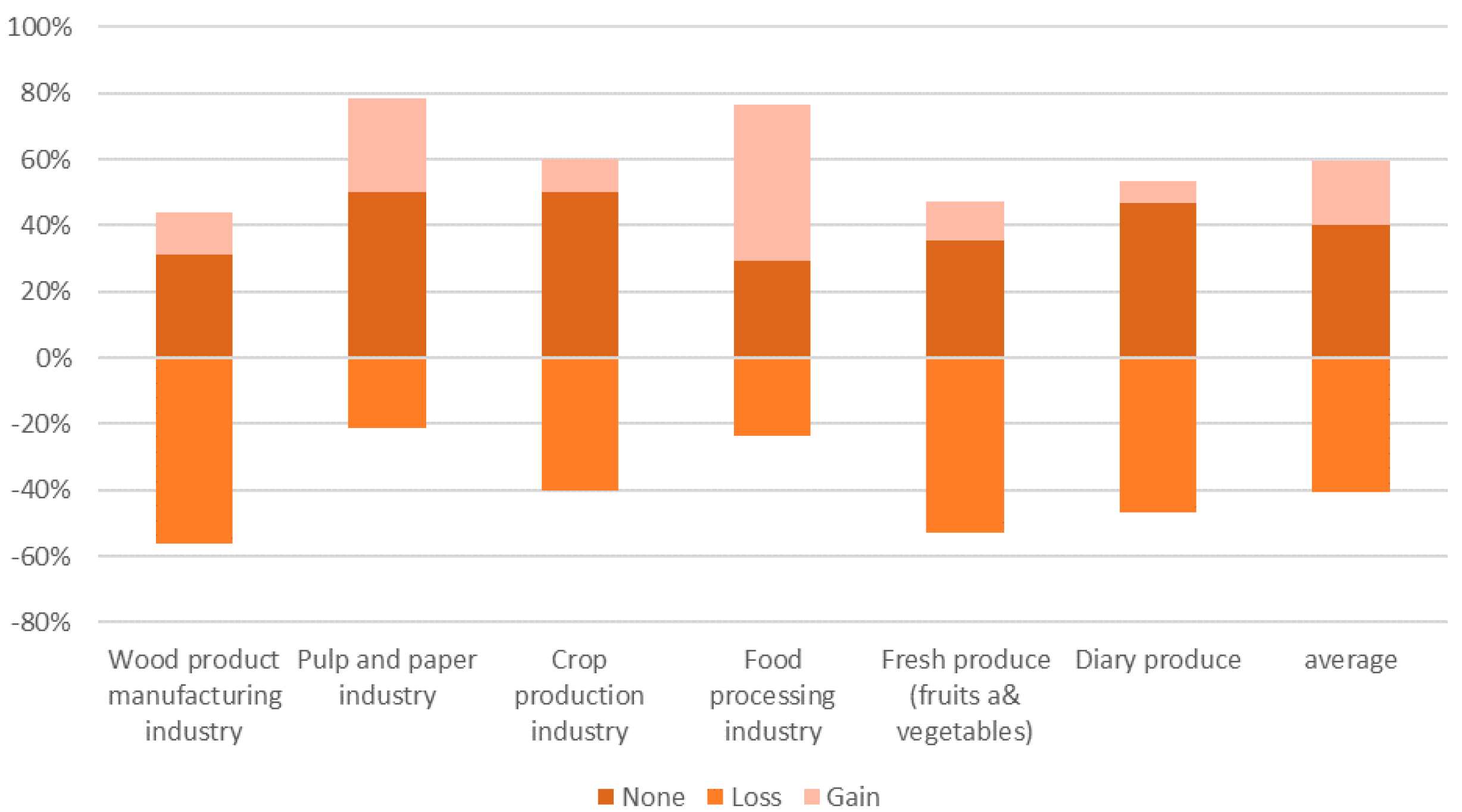

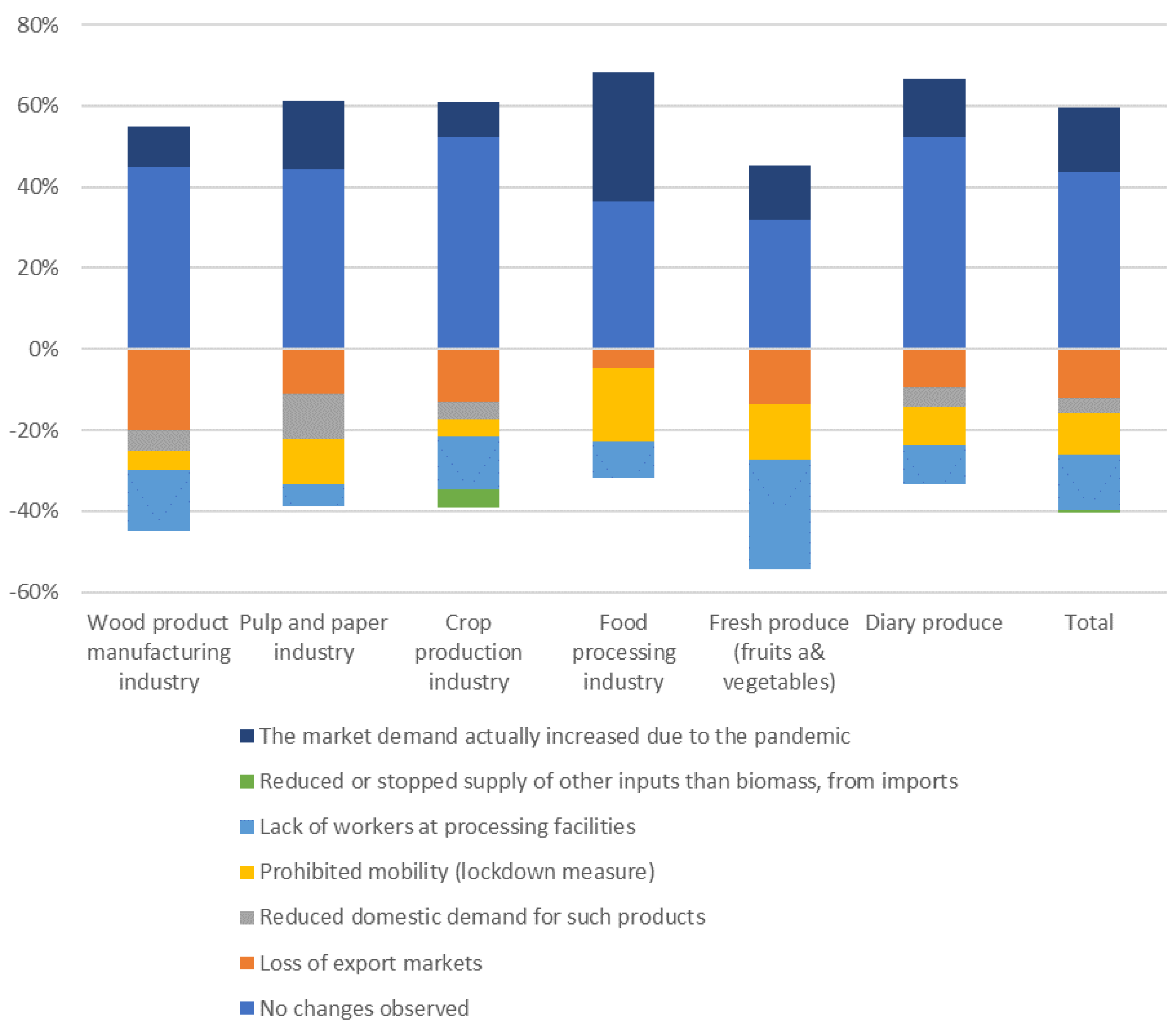

Experts reported different resilience of BSChs to the economic disturbances due to the pandemic during the first six months (by September 2020), which is supported by research (e.g., [

57,

58,

59]) published after the survey had been implemented. For instance, health and food safety measures resulted in increased interest in automation and robotics in the food and beverage industry as compensation for the limited availability of workers [

4,

60]. More automated food processing industries showed more resilience than those that were relying on manual work. Stocking up on food and stay-at-home measures increased home cooking and demand for ready-made products with increased layers of packaging [

4,

61,

62] and hygiene items. Industries supporting such changes in behavior thrived, and many of those rely on BSChs. Consequently, biomass supplied for bioenergy as secondary biomass sourced from primary product growth and processing followed the behavior of the primary product industry. Yet, most of the disruptions in biomass supply and demand were related to logistic, distribution and delivery limitations [

4,

25,

56]. While the pandemic exposed limitations to the BSChs in the short run, it also helped identify long-run opportunities for BSChs in responding to energy supply and co-productive systems. For instance, in the past, this variability in supply and technology challenged BSChs as resource markets competed with biomass for bioenergy and constrained the market [

28]. Now, due to a shift in the use of resources and energy caused by the ongoing COVID-19 pandemic, BSChs have the potential to overcome these constraints with strategies built around investments that experts tagged with positive contributions to the overall economic recovery.

Investments that experts identified as having the highest impact on recovery are investments that improve biomass material efficiency and circularity from forestry and agriculture biomass short-supply chains, including dedicated crops in the long term. In general, experts favored investments with short supply chains, specialized approaches, small-scale operations and decentralized facilities, instead of general measures supporting investments in BSChs and bioenergy. Small-scale bioenergy facilities will more likely face the challenge of competitiveness for which, again, tailored programs supported by R&D can aid in increasing the energy and material efficiency, improving the business models to source income not only from bioenergy but also from renewable CO

2 and other residues such as digestate, ash, biochar, etc., depending on the conversion technology or cascading use of biomass. In that context, not only BSChs, but also the general challenges that agri-food chains are facing, such as collaborative trust and community-focused energy production [

55], can be addressed. Small-scale, decentralized bioenergy facilities, coupled with substitution of fossil fuel use, fit for a local supply chain, combined with market incentive programs for replacing fossil energy for heating and cooling in agriculture and agri-food chain represent a solid option to invest on post-COVID-19 recovery. The absolute size of “small-scale” and “local” will be determined by the context where the investment in BSCh occurs, and will significantly differ between small countries (e.g., Croatia) and large countries (e.g., Canada). In addition, BSChs will face different ecological boundaries that also have to be placed in the broader context when considering such investments [

19].

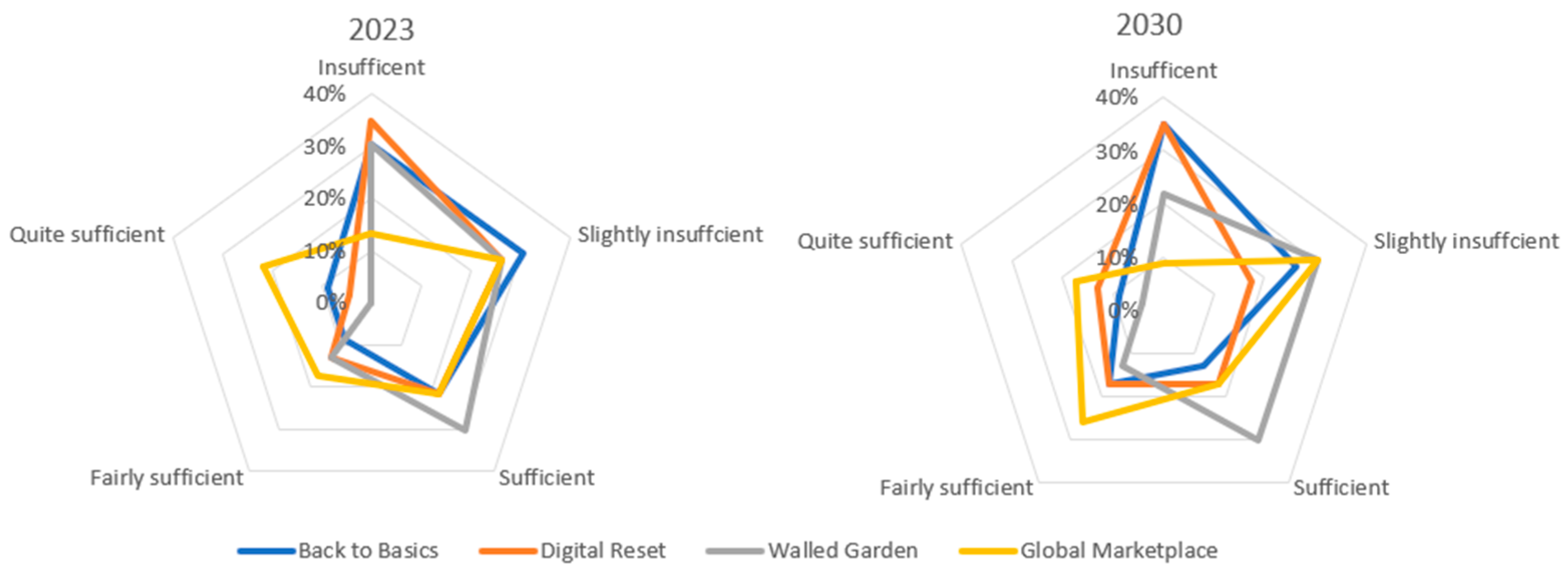

Additionally, infrastructure investments to stabilize biomass supply from forestry, agriculture and waste streams in terms of quantity, quality and sustainability were seen to have a similar “moderate to strong” impact across all tested scenarios (

Table 7: Statements 3 and 4). Such measures contribute not only to economic growth, but also job creation and to build cleaner and more resilient energy systems.

Technologies to replace fossil fuels with the highest multiplier effect on jobs can play an important role when job creation is the primary goal in post-COVID-19 recovery. Countering the focus on job creation, automatization and robotization to replace the manual work in mobilizing biomass would reduce supply costs and the vulnerability of labor supply from migrant workers in the pandemics where it has been reported as the reason for BSChs disruptions. In some countries, such labor shortages persist in sectors where work is demanding and provides low wages, in part because of emergency unemployment programs, thereby hampering possible recovery via investments in BSChs.

Experts give most value of the investments in BCSh to provide impact on economic growth and the least in job creation in the post-pandemic period, in the short term, but likely more visible over a longer time horizon.

There are several important lessons from the pandemic with respect to BSChs. The COVID-19 pandemic resulted in significant shifts in demand. Enhancement of supply chain resilience is seen as the key driver of the reduction in vulnerabilities in disruptive events. Consequently, supply chains might tend to be shorter, focusing on relocation and back-shoring [

63,

64]. Resilient BSChs need to be able to react to interference to overcome the stress placed on the economic system and mitigate the impact of the disruption as swiftly and as much as possible. When BSCh disturbances occur, adaptation of incentives need to be in place faster than recorded, which assumes reducing risks of uncertainty with scenario planning for future pandemics or similar scenarios.

Experts identified several investments as contributing to economic growth outcomes in all scenarios and timeframes with different intensity. The investment portfolios in BSChs to create future opportunities underline the strategy development process in the short and long term. The ability to take local action in the support and development of BSCh towards a strong local impact that has the scope to extend globally, stands out for biomass supply and strong economic lever in recovering economies. Relatively mature technologies in BSChs are positioned to excel in emerging carbon-constrained, biobased and circular economies, further strengthening the ability to sustain and grow their impact into the future.

Disparities between biomass supply and demand was identified by the SWOT analysis as a challenge for BSChs, particularly considering multiple, competing energy sources, that can be either fossil-based or renewable. To some degree, all challenges identified by the future scenarios accurately reflect current challenges, not only with BSChs, but with the management of the pandemic itself. Long-run repercussions of the pandemic include disruptions to joint research efforts, fragmentation and the potential for internalizing efforts toward national rather than global goals [

65]. Furthermore, the emergence of nationalist approaches that pre-dates the COVID-19 pandemic and their potential impact on international cooperation is characteristic of the Back to Basics and Walled Gardens scenarios. Rowan and Galanakis [

66] suggest the path of COVID-19 could take us to catastrophic global upheaval, with the potential to alter geopolitical and socio-economic norms. However, they also argue that the future looks bright for the creation of new sustainability multi-actor innovation hubs that will support, connect, and enable businesses to recover and pivot beyond the COVID-19 pandemic. The Back-to-Basics scenario is characterized by virus longevity over a year, digital skepticism, and global rejection. While the social and economic boundaries have shifted unevenly during the pandemic, both transportation and labor disruptions are in evidence. The concomitant contraction of the global mindset will persist until rolling pandemic waves and corresponding restrictions cease or ease. In terms of digital skepticism versus acceptance, an “infodemic” (or an over-abundance of information, both true and misleading) has emerged as a major challenge in managing the pandemic [

67]. While the current reality may not be as bleak as a complete “Back-to-Basics” scenario [

43], to some degree, all the challenges identified by the future scenarios accurately reflect ongoing challenges, not only with BSChs, but with the management of the pandemic itself. Further, while digital skepticism has increased and global supply chains have been constrained by labor mobility restrictions as well as health measures, in general, supply chains have shown resilience and adapted to new challenges posed by the pandemic effectively.

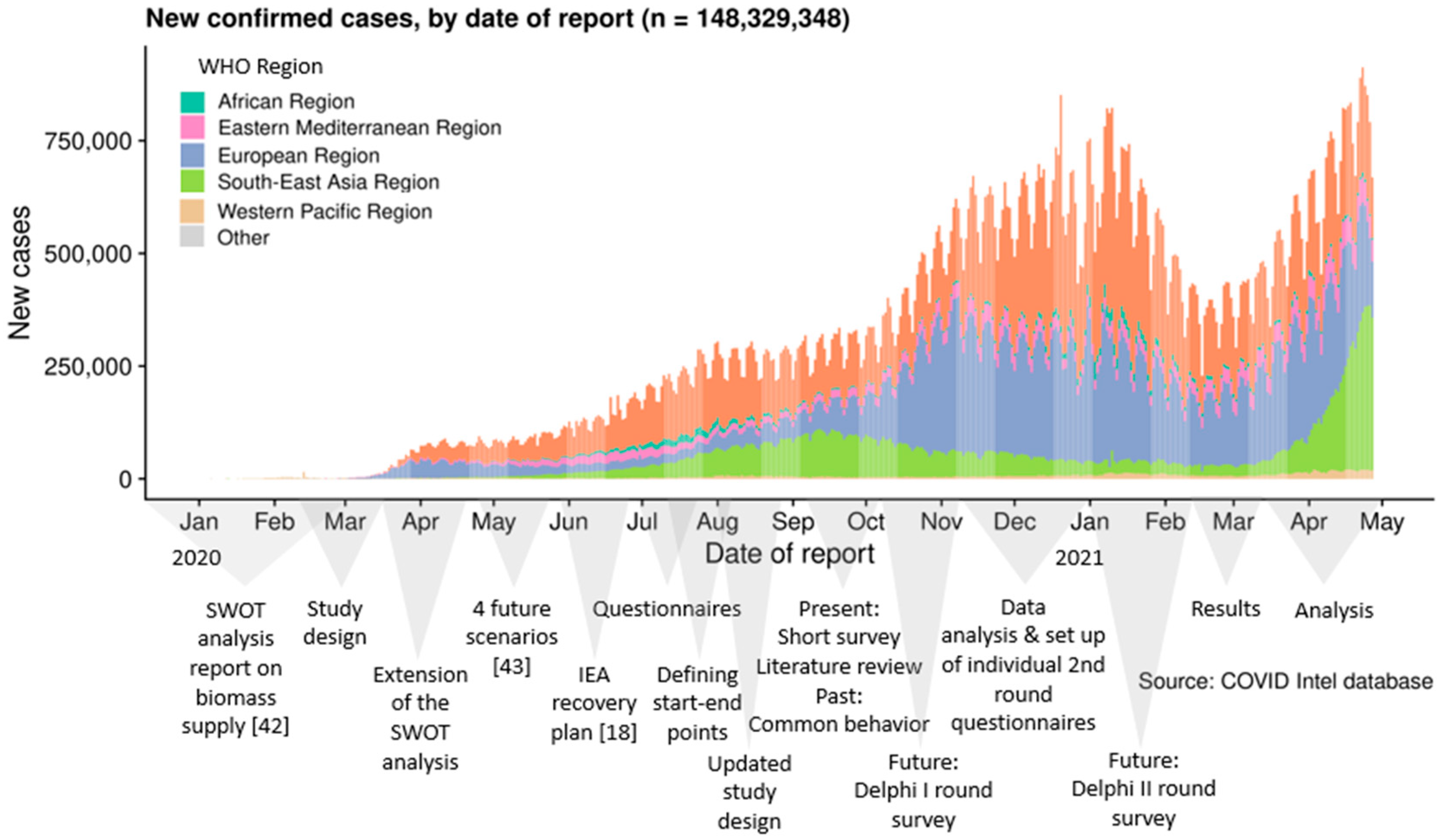

The question on how the COVID-19 pandemic will end is still open ended at the moment this paper is published. According to the WHO Coronavirus (COVID-19) Dashboard [

68] “Globally, as of 6:47 pm CEST, 13 August 2021, there have been 205,338,159 confirmed cases of COVID-19, including 4,333,094 deaths, reported to WHO. The first vaccines against COVID-19 were approved in early 2021; as of 12 August 2021, a total of 4,428,168,759 vaccine doses had been administered. WHO highlights that the vaccines will not stop the pandemic but rather vaccinations that are fairly and equitably shared across countries, regardless of income status.” As COVID-19 vaccines are rolled out across the world, there are growing concerns about the roles that trust, belief in conspiracy theories, and spread of misinformation through social media play on vaccine hesitancy [

67].

As of September 1, 2021, the fourth wave of COVID-19 had begun in the countries surveyed for our research. On August 24, 2021, the WHO reported that Europe and the Americas had the highest weekly case and deaths incidence rates per 100,000 population [

69]. Therefore, the Global Marketplace and Walled Gardens scenarios posed in this Delphi survey were too optimistic, in that these two scenarios assumed a virus longevity of one year or less. This brings some cause for concern; a consensus of experts from modern biomass sectors rated current national investments in the biomass supply chain as slightly insufficient to insufficient. However, the world economy is on track for strong growth in 2021, despite the recovery being uneven between countries, and sectors closely tied to bioenergy (agriculture and wood product manufacturing) coping better than most other sectors [

58].