Bidding Agents for PV and Electric Vehicle-Owning Users in the Electricity P2P Trading Market

Abstract

:1. Introduction

1.1. Background

1.2. Related Work

1.3. Contribution

- ①

- Individuals optimize their bidding by using energy storage facilities in order to maximize profits and satisfy their own preferences for renewable energy.

- ②

- By developing a bidding strategy that considers the individual’s preference for renewable energy, we have achieved both economic efficiency and satisfaction of the individual’s preference for renewable energy.

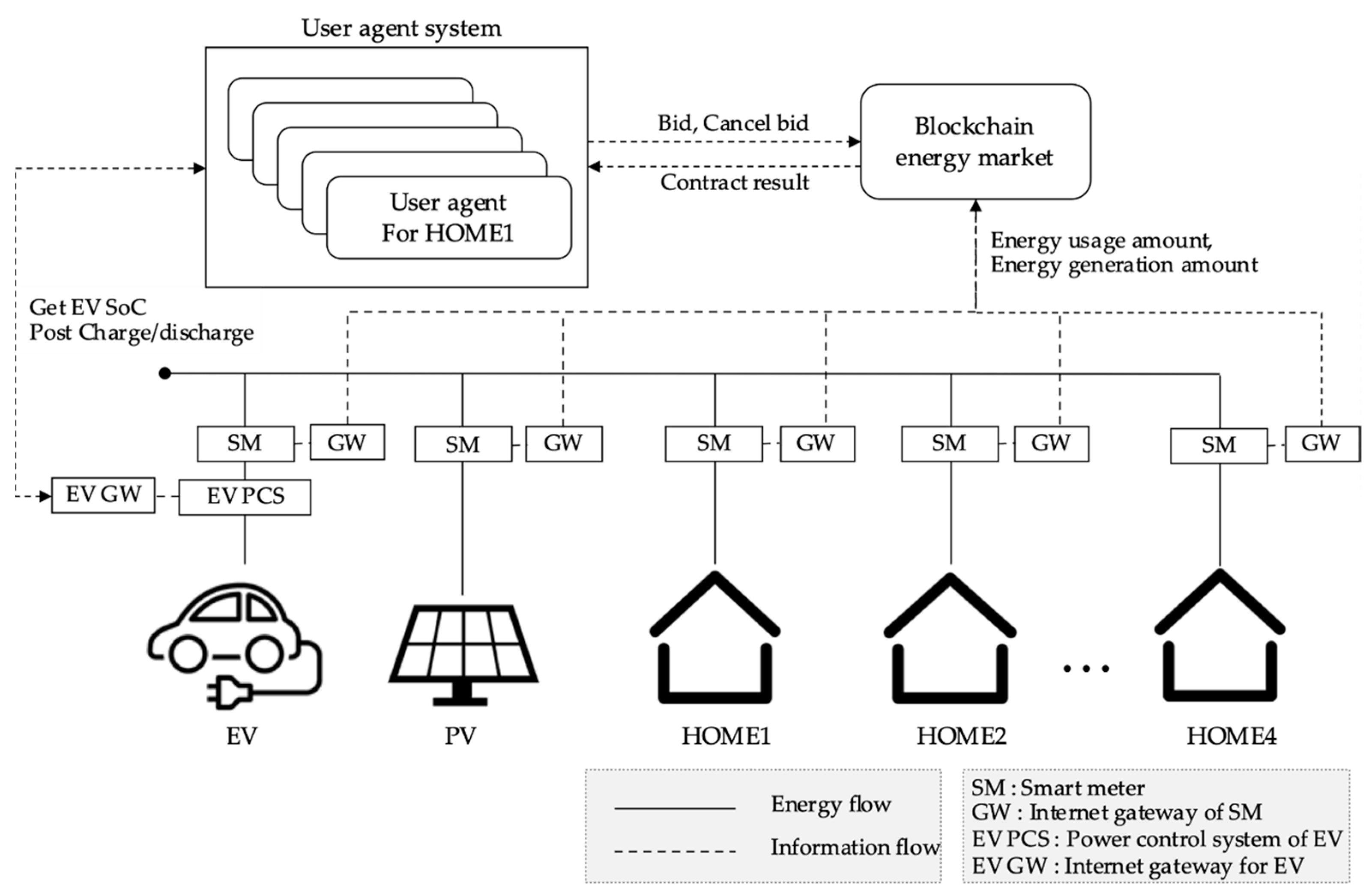

2. Overall Picture of the Demonstration Experiment

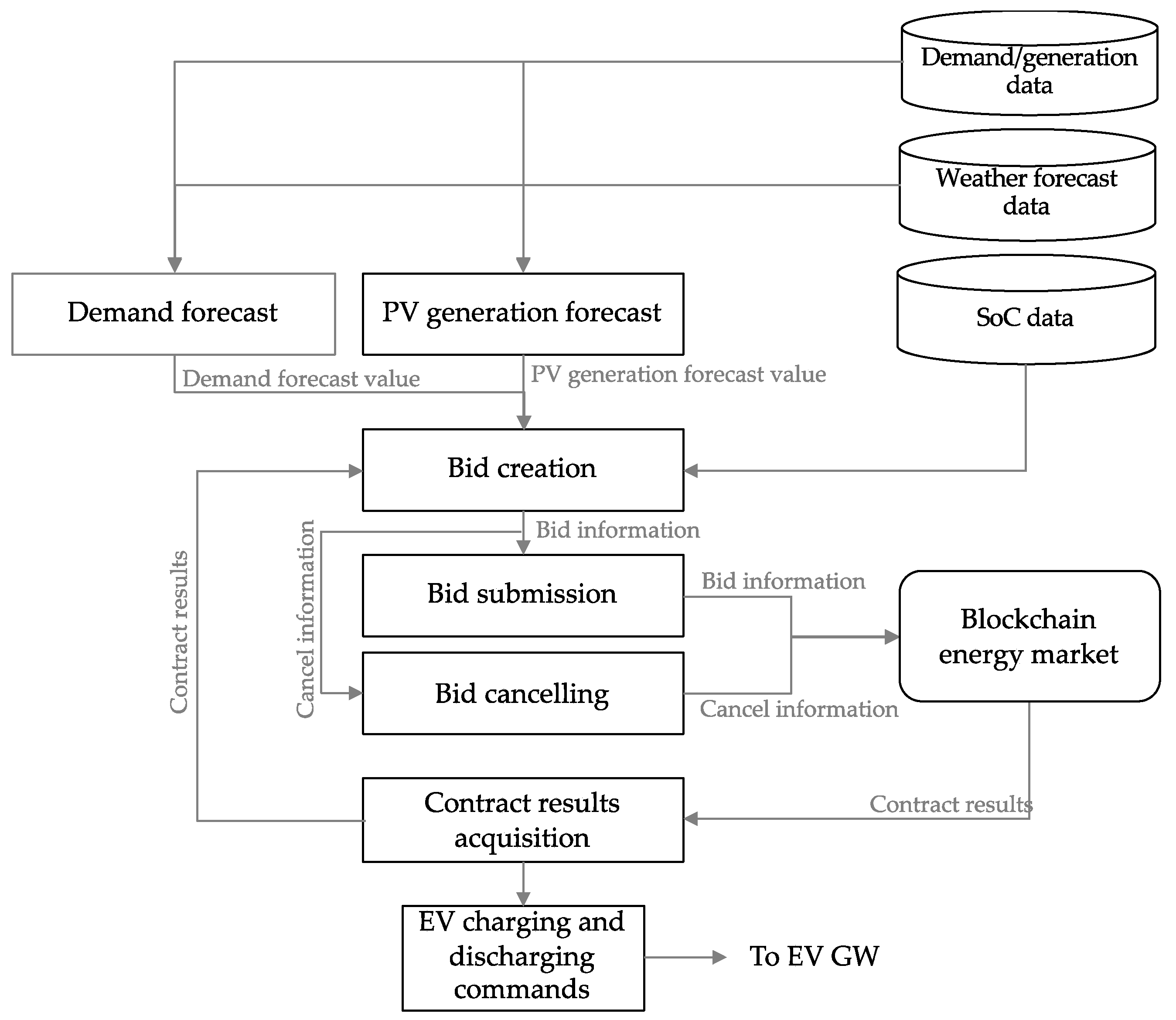

3. Functions of User Agents

4. User Agent Bidding Modes and Bid Optimization

| Amount of electricity to be purchased in the market at time t [kWh] (Optimization target) | |

| Amount of electricity to be sold in the market at time t [kWh] (Optimization target) | |

| Amount of electricity to be purchased from electricity retailers at time t [yen/kWh] (Optimization target) | |

| Amount of charge to the battery at time t [kWh] (Optimization target) | |

| Amount of discharge from the battery at time t [kWh] (Optimization target) | |

| Expected price at time t [yen/kWh] (estimated by each agent based on expected power generation) | |

| Retail price of electricity at time t [yen/kWh] (defined in advance) | |

| Expected demand at time t [kWh] (calculated by demand forecast) | |

| Expected power generation at time t [kWh] (calculated by power generation forecast) | |

| Percentage of remaining charge of the battery at time t [%] | |

| Maximum charging output of the battery [kW] (6.7 [kW]) | |

| Maximum discharge output of the battery [kW] (6.0 [kW]) | |

| Lower limit of SOC [%] (set to 20 percent) | |

| Upper limit of SOC [%] (set to 90%) | |

| Rated capacity of battery [kWh] (40 [kWh] was set.) | |

| Battery charging efficiency [%] (set to 86.6%, so that CHARGE_RATE*DISCHARGE_RATE=75%) | |

| Discharge efficiency of the battery [%] (set to 86.6%, the same as CHARGE_RATE) | |

| Expected energy consumption by driving at time t [kWh]. This is always set to 0 because the EV is not running in this demonstration experiment. | |

| The bool value indicating whether or not the EV is running at time t. It is always set to “false” because it is not run in this verification experiment. |

| Target RE ratio (set by user between 0~100%) |

5. About the Demonstration Experiment

5.1. Configuration of the Demonstration Experiment

- ▪

- Confirmation that electricity costs can be further reduced when EVs are owned in economy mode

- ▪

- Confirmation that the target RE ratio can be achieved at a relatively low cost when EVs are owned in green mode.

5.2. Results of the Demonstration Experiment

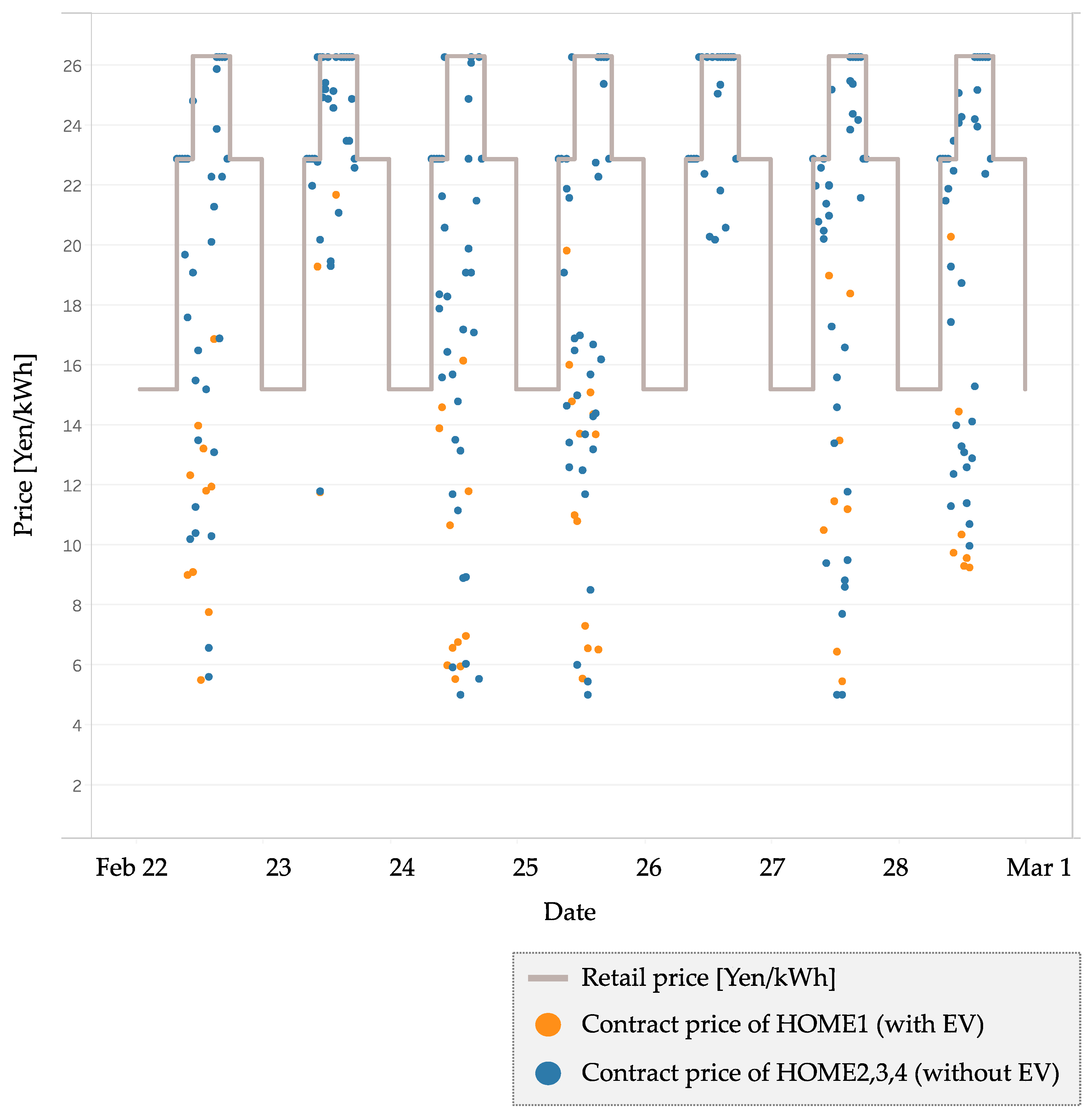

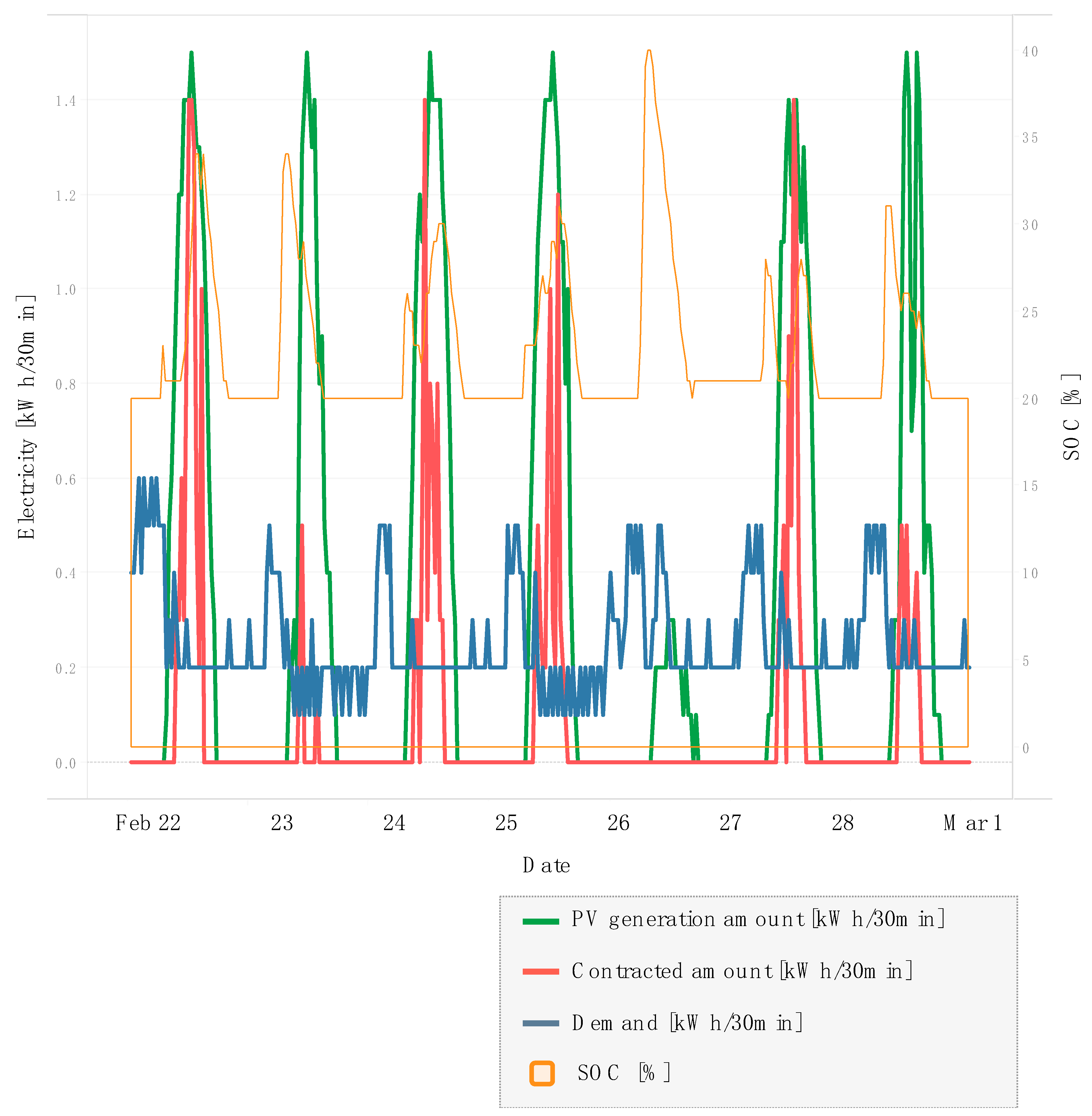

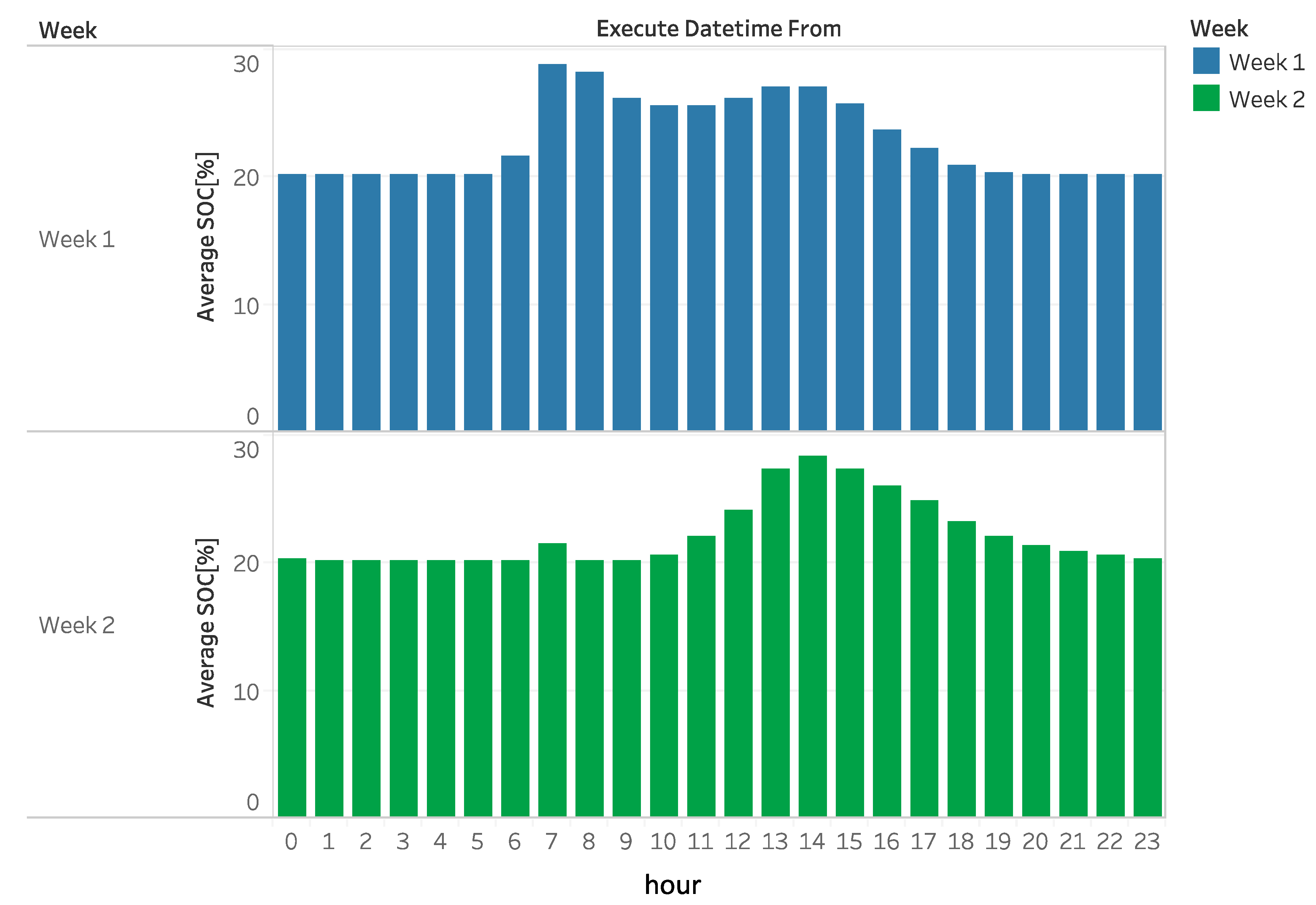

5.2.1. Results and Discussion of the First Week

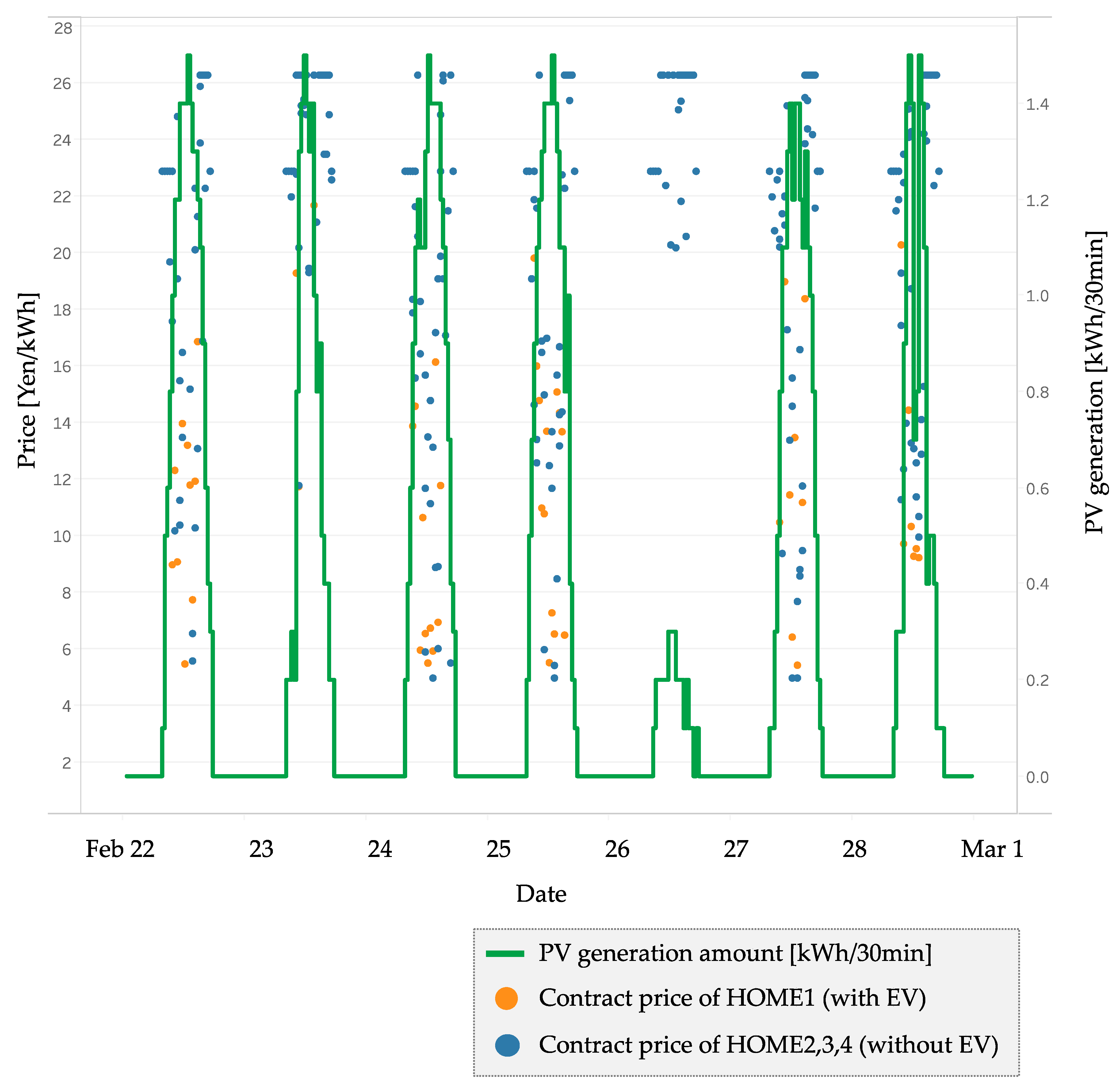

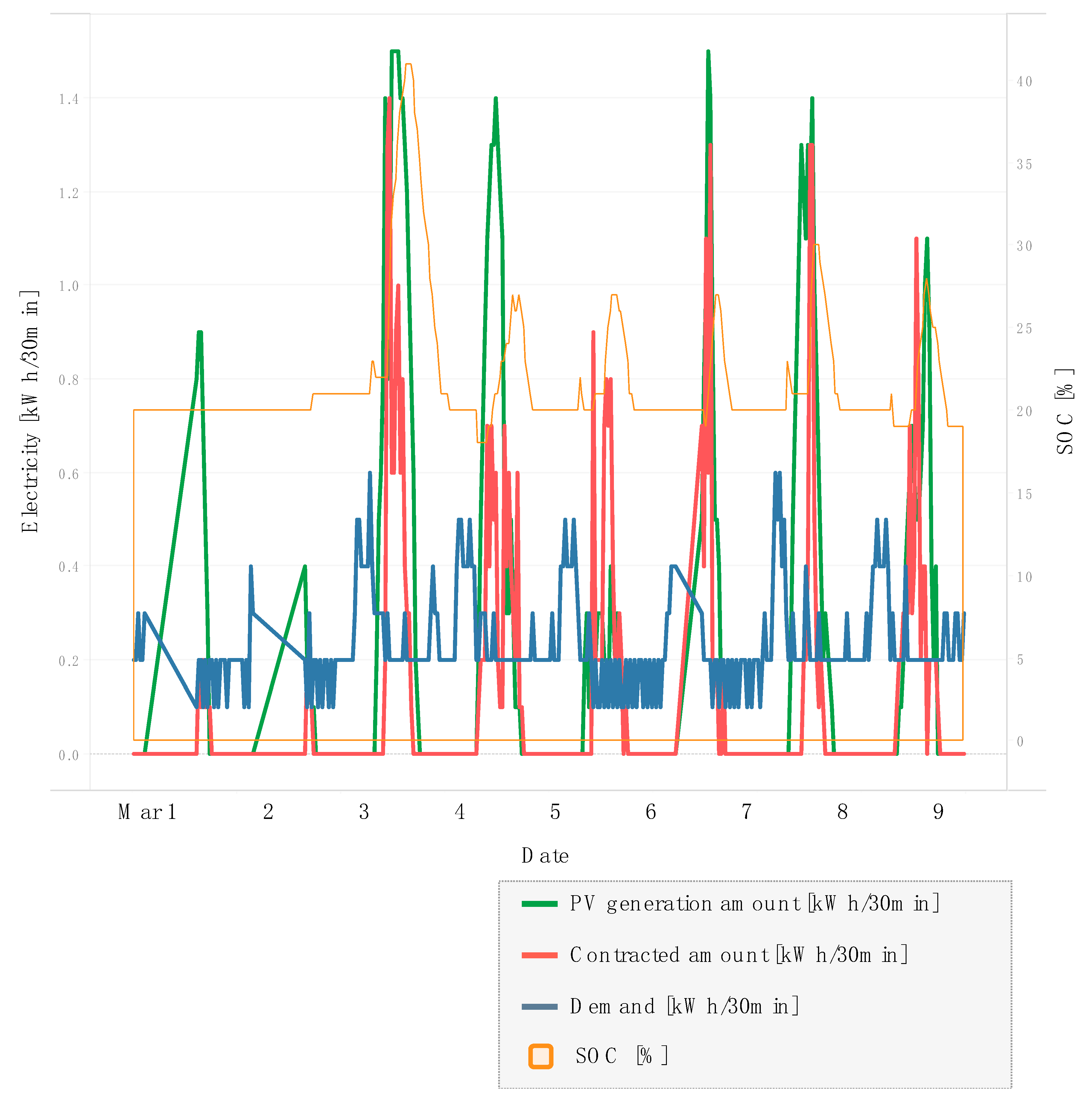

5.2.2. Results and Discussion of the Second Week

6. Conclusions

- ①

- The fact that individuals optimize their bidding by using energy storage facilities with the aim of maximizing profits and satisfying their own preferences regarding the ratio of renewable energy.

- ②

- By developing a bidding strategy that takes into account the individual’s preference for renewable energy, we have achieved both economic efficiency and satisfaction of the individual’s preference.

- ▪

- The user who owns an EV and is economically oriented can trade at a lower average price than the users who do not own EVs.

- ▪

- It is possible to increase the economic efficiency of storing nighttime electricity in batteries in advance by anticipating future power generation and market prices through forecasting.

- ▪

- Users who own EVs and have a preference for renewable energy can achieve a high RE ratio at a cost of about +1 yen/kWh compared to other users.

- ▪

- In real scale experiments, it is possible to control charging and discharging by actually issuing charging and discharging commands to electric vehicles, and to optimize the actual use of electricity according to the user’s preferences.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Acknowledgments

Conflicts of Interest

References

- European Union. 2030 Climate & Energy Framework. Available online: https://ec.europa.eu/clima/eu-action/climate-strategies-targets/2030-climate-energy-framework_en (accessed on 29 November 2021).

- European Union. European Climate Law. Available online: https://ec.europa.eu/clima/eu-action/european-green-deal/european-climate-law_en (accessed on 29 November 2021).

- Abdella, J.; Shuaib, K. Peer to Peer Distributed Energy Trading in Smart Grids: A Survey. Energies 2018, 11, 1560. [Google Scholar] [CrossRef] [Green Version]

- Sousa, T.; Soares, T.; Pinson, P.; Moret, F.; Baroche, T.; Sorin, E. Peer-to-peer and community-based markets: A comprehensive review. Renew. Sustain. Energy Rev. 2019, 104, 367–378. [Google Scholar] [CrossRef] [Green Version]

- Morstyn, T.; Teytelboym, A.; McCulloch, M.D. Bilateral Contract Networks for Peer-to-Peer Energy Trading. IEEE Trans. Smart Grid 2019, 10, 2026–2035. [Google Scholar] [CrossRef]

- Sorin, E.; Bobo, L.; Pinson, P. Consensus-Based Approach to Peer-to-Peer Electricity Markets with Product Differentiation. IEEE Trans. Power Syst. 2019, 34, 994–1004. [Google Scholar] [CrossRef] [Green Version]

- Mengelkamp, E.; Gärttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing microgrid energy markets: A case study: The Brooklyn Microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Shrestha, A.; Bishwokarma, R.; Chapagain, A.; Banjara, S.; Aryal, S.; Mali, B.; Thapa, R.; Bista, D.; Hayes, B.P.; Papadakis, A.; et al. Peer-to-Peer Energy Trading in Micro/Mini-Grids for Local Energy Communities: A Review and Case Study of Nepal. IEEE Access 2019, 7, 131911–131928. [Google Scholar] [CrossRef]

- Liu, T.; Tan, X.; Sun, B.; Wu, Y.; Guan, X.; Tsang, D.H.K. Energy management of cooperative microgrids with P2P energy sharing in distribution networks. In Proceedings of the 2015 IEEE International Conference on Smart Grid Communications (SmartGridComm), Miami, FL, USA, 2–5 November 2015; pp. 410–415. [Google Scholar]

- Longo, A.; Markandya, A.; Petrucci, M. The internalization of externalities in the production of electricity: Willingness to pay for the attributes of a policy for renewable energy. Ecol. Econ. 2008, 67, 140–152. [Google Scholar] [CrossRef] [Green Version]

- Zorić, J.; Hrovatin, N. Household willingness to pay for green electricity in Slovenia. Energy Policy 2012, 47, 180–187. [Google Scholar] [CrossRef]

- Tabi, A.; Hille, S.L.; Wüstenhagen, R. What makes people seal the green power deal?—Customer segmentation based on choice experiment in Germany. Ecol. Econ. 2014, 107, 206–215. [Google Scholar] [CrossRef]

- Dagher, L.; Harajli, H. Willingness to pay for green power in an unreliable electricity sector: Part 1. The case of the Lebanese residential sector. Renew. Sustain. Energy Rev. 2015, 50, 1634–1642. [Google Scholar] [CrossRef]

- Morstyn, T.; McCulloch, M.D. Multiclass Energy Management for Peer-to-Peer Energy Trading Driven by Prosumer Preferences. IEEE Trans. Power Syst. 2019, 34, 4005–4014. [Google Scholar] [CrossRef]

- Park, D.-H.; Park, J.-B.; Lee, K.Y.; Son, S.-Y.; Roh, J.H. A Bidding-Based Peer-to-Peer Energy Transaction Model Considering the Green Energy Preference in Virtual Energy Community. IEEE Access 2021, 9, 87410–87419. [Google Scholar] [CrossRef]

- Park, D.-H.; Park, Y.-G.; Roh, J.-H.; Lee, K.Y.; Park, J.-B. A Hierarchical Peer-to-Peer Energy Transaction Model Considering Prosumer’s Green Energy Preference. Int. J. Control. Autom. Syst. 2021, 19, 311–317. [Google Scholar] [CrossRef]

- Kobashi, T.; Yoshida, T.; Yamagata, Y.; Naito, K.; Pfenninger, S.; Say, K.; Takeda, Y.; Ahl, A.; Yarime, M.; Hara, K. On the potential of “Photovoltaics + Electric vehicles” for deep decarbonization of Kyoto’s power systems: Techno-economic-social considerations. Appl. Energy 2020, 275, 115419. [Google Scholar] [CrossRef]

- Zepter, J.M.; Lüth, A.; del Granado, P.C.; Egging, R. Prosumer integration in wholesale electricity markets: Synergies of peer-to-peer trade and residential storage. Energy Build. 2019, 184, 163–176. [Google Scholar] [CrossRef]

- Iria, J.; Soares, F.; Matos, M. Optimal bidding strategy for an aggregator of prosumers in energy and secondary reserve markets. Appl. Energy 2019, 238, 1361–1372. [Google Scholar] [CrossRef]

- Iria, J.; Soares, F.; Matos, M. Optimal supply and demand bidding strategy for an aggregator of small prosumers. Appl. Energy 2018, 213, 658–669. [Google Scholar] [CrossRef]

- Vagropoulos, S.I.; Bakirtzis, A. Optimal Bidding Strategy for Electric Vehicle Aggregators in Electricity Markets. IEEE Trans. Power Syst. 2013, 28, 4031–4041. [Google Scholar] [CrossRef]

- Englberger, S.; Gamra, K.A.; Tepe, B.; Schreiber, M.; Jossen, A.; Hesse, H. Electric vehicle multi-use: Optimizing multiple value streams using mobile storage systems in a vehicle-to-grid context. Appl. Energy 2021, 304, 117862. [Google Scholar] [CrossRef]

- Meteorological Engineering Center, Inc. Solar Power Output Forecasting System Apollon. Available online: https://www.meci.jp/apollon.html (accessed on 29 November 2021).

- Breiman, L. Random forests. Mach. Learn. 2001, 45, 5–32. [Google Scholar] [CrossRef] [Green Version]

- The Kansai Electric Power Co., Inc. Hapi-e-Time R. Available online: https://kepco.jp/ryokin/menu/hapie_r/ (accessed on 29 November 2021).

| Hour | Price [Yen/kWh] |

|---|---|

| 7:00–10:00 | 22.89 |

| 10:00–17:00 | 26.33 |

| 17:00–23:00 | 22.89 |

| 23:00–7:00 | 15.20 |

| Type | User | EV(40 kWh) | Data Description |

|---|---|---|---|

| Demand | Home1 | ○ | The electric load was reproduced in the experimental environment with a load device based on actual household demand data. |

| Home2 | - | An almost constant demand pattern was generated in the experimental environment. | |

| Home3 | - | An almost constant demand pattern was generated in the experimental environment. | |

| Home4 | - | An irregularly fluctuating demand pattern was generated in the experimental environment. | |

| Supply | PV1 | - | A PV system placed in the experimental environment was actually generating power. |

| User | Mode | Average Contracted Price [Yen/kWh] | Contracted Amount [kWh] | Demand [kWh] | RE Rate [%] |

|---|---|---|---|---|---|

| Home1 | Economy | 11.22 | 29.6 | 84.8 | 34.9 |

| Home2 | Economy | 20.13 | 9.4 | 16.6 | 56.6 |

| Home3 | Economy | 18.75 | 32.5 | 70.6 | 46.0 |

| Home4 | Economy | 20.32 | 38.2 | 102.6 | 37.2 |

| User | Mode | Average Contracted Price [Yen/kWh] | Contracted Amount [kWh] | Demand [kWh] | RE Rate [%] |

|---|---|---|---|---|---|

| Home1 | Green | 22.75 | 43.9 | 76.7 | 57.2 |

| Home2 | Economy | 21.0 | 5.0 | 15.8 | 31.6 |

| Home3 | Economy | 20.75 | 15.7 | 71.7 | 21.9 |

| Home4 | Economy | 21.6 | 21.4 | 102.3 | 20.9 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sagawa, D.; Tanaka, K.; Ishida, F.; Saito, H.; Takenaga, N.; Nakamura, S.; Aoki, N.; Nameki, M.; Saegusa, K. Bidding Agents for PV and Electric Vehicle-Owning Users in the Electricity P2P Trading Market. Energies 2021, 14, 8309. https://doi.org/10.3390/en14248309

Sagawa D, Tanaka K, Ishida F, Saito H, Takenaga N, Nakamura S, Aoki N, Nameki M, Saegusa K. Bidding Agents for PV and Electric Vehicle-Owning Users in the Electricity P2P Trading Market. Energies. 2021; 14(24):8309. https://doi.org/10.3390/en14248309

Chicago/Turabian StyleSagawa, Daishi, Kenji Tanaka, Fumiaki Ishida, Hideya Saito, Naoya Takenaga, Seigo Nakamura, Nobuaki Aoki, Misuzu Nameki, and Kosuke Saegusa. 2021. "Bidding Agents for PV and Electric Vehicle-Owning Users in the Electricity P2P Trading Market" Energies 14, no. 24: 8309. https://doi.org/10.3390/en14248309

APA StyleSagawa, D., Tanaka, K., Ishida, F., Saito, H., Takenaga, N., Nakamura, S., Aoki, N., Nameki, M., & Saegusa, K. (2021). Bidding Agents for PV and Electric Vehicle-Owning Users in the Electricity P2P Trading Market. Energies, 14(24), 8309. https://doi.org/10.3390/en14248309