Capacity Market and (the Lack of) New Investments: Evidence from Poland

Abstract

:1. Introduction

- The relatively high share of conventional, coal-fired power units in the fuel mix (at the time of considering and introduction of capacity remuneration mechanism).

- A similar design of the energy market before implementation of capacity remuneration mechanism (one unified market, with one Transmission System Operator (TSO) in the country vs. several regional markets in the US, with several TSOs).

1.1. Literature Review

1.2. Study Contributions

2. Materials and Methods

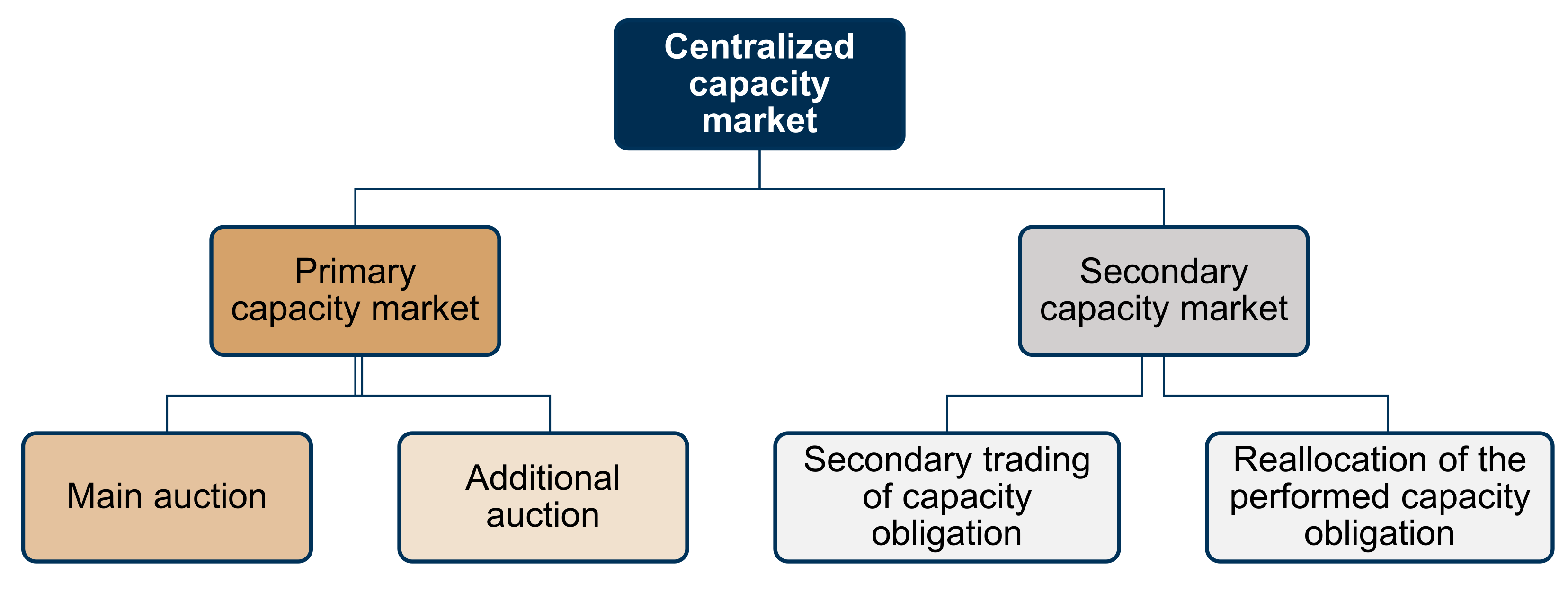

2.1. Capacity Market in Poland

- Exit price (when during a given or previous round there was an exit bid submitted),

- Starting price of another round (when a capacity provider did not bid an exit offer, and a given round is not the last round of the capacity auction) or

- Minimal price 0.2 Euro cents/kW/month (when a capacity provider did not submit an exit bid and a given round is the last round of the capacity auction).

- Existing and DSR units may sign contracts for one year,

- Refurbishing and DSR units (after meeting a criterion of the minimal level of investment) may sign contracts for five years, or

- New/planned units (after meeting a criterion of the minimal level of investment) may sign contracts for fifteen years.

- Have an individual CO2 emission factor lower than 450 kg CO2/MWh of produced energy, and

- Sell at least half of produced heat to the heating network where hot water is a heat carrier.

2.2. Method Applied

- ERO President’s Announcement No. 99/2018 of the Final Results of the Capacity Auctions for the Delivery Year 2021.

- ERO President’s Announcement No. 103/2018 of the Final Results of the Capacity Auctions for the Delivery Year 2022.

- ERO President’s Announcement No. 14/2019 of the Final Results of the Capacity Auctions for the Delivery Year 2023.

- ERO President’s Announcement No. 106/2019 of the Final Results of the Capacity Auctions for the Delivery Year 2024.

- ERO President’s Announcement No. 2/2021 of the Final Results of the Capacity Auctions for the Delivery Year 2025.

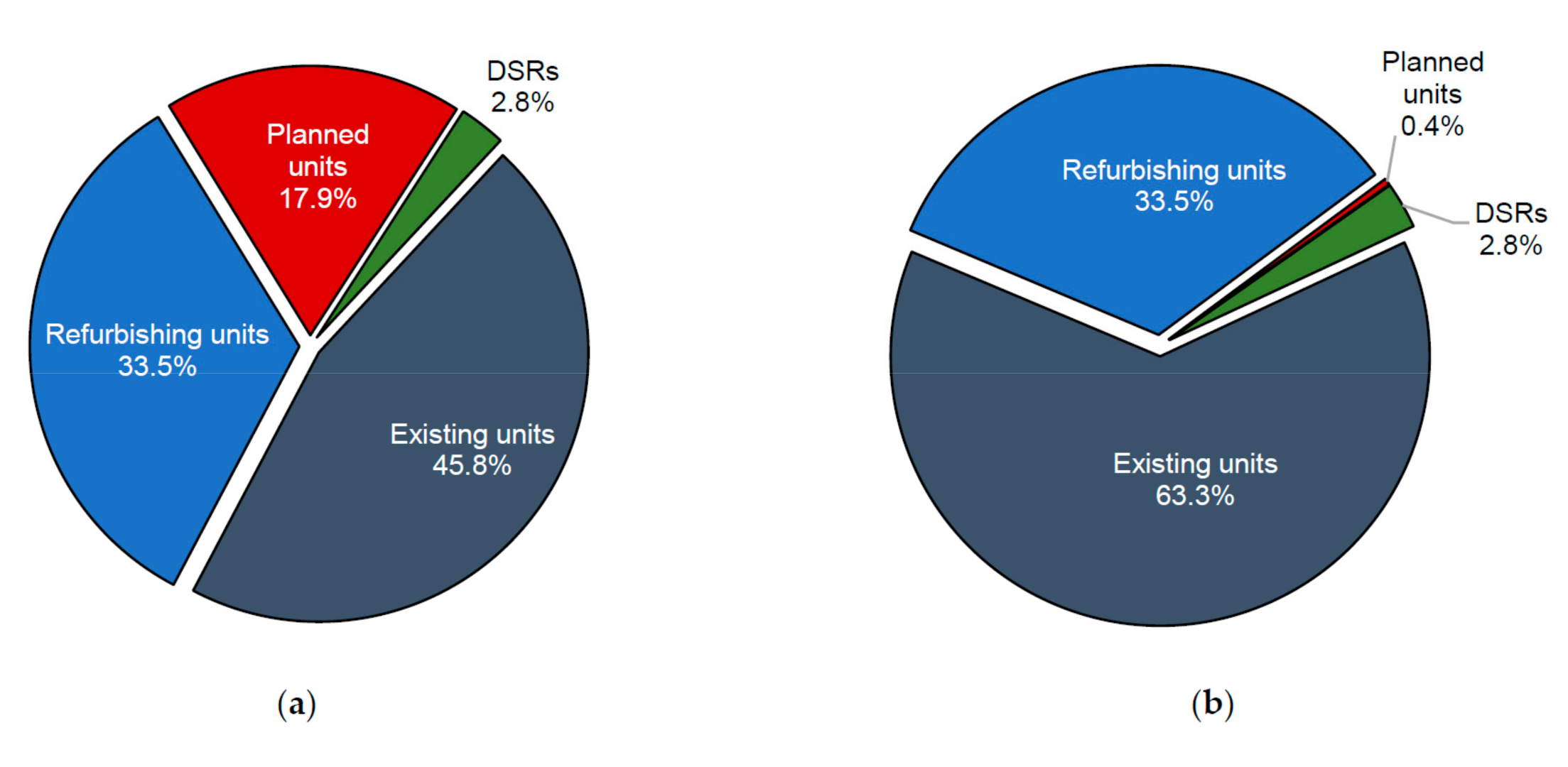

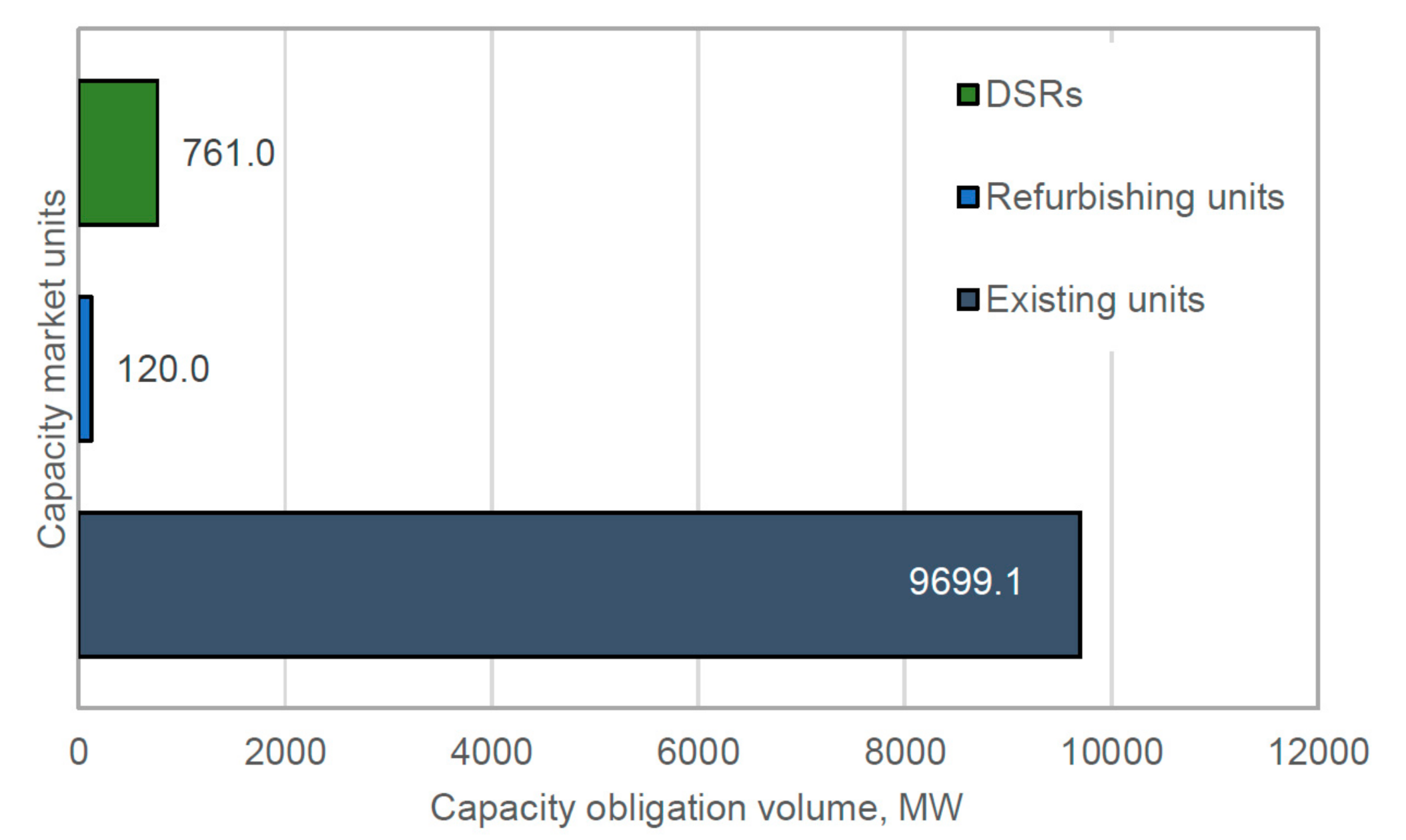

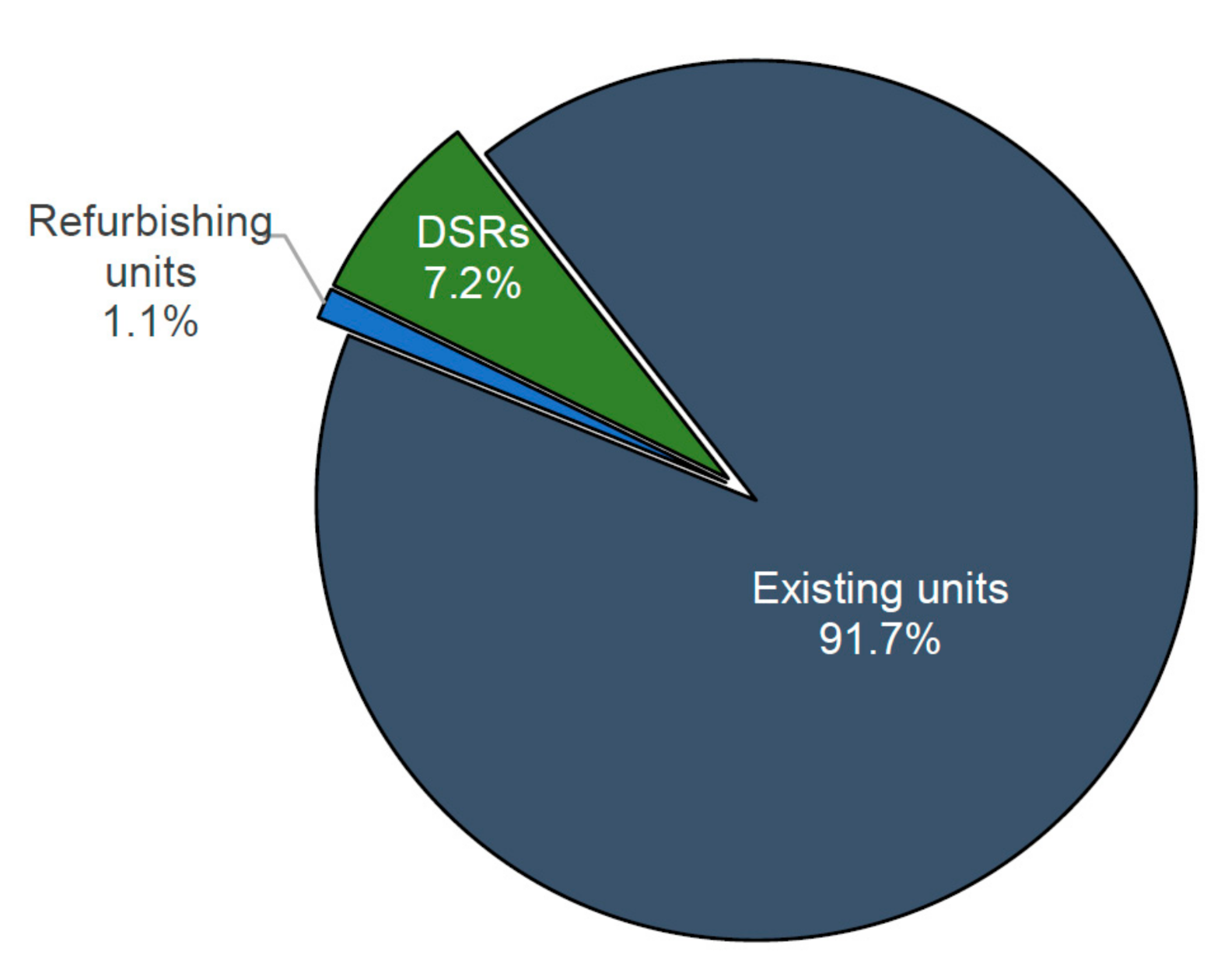

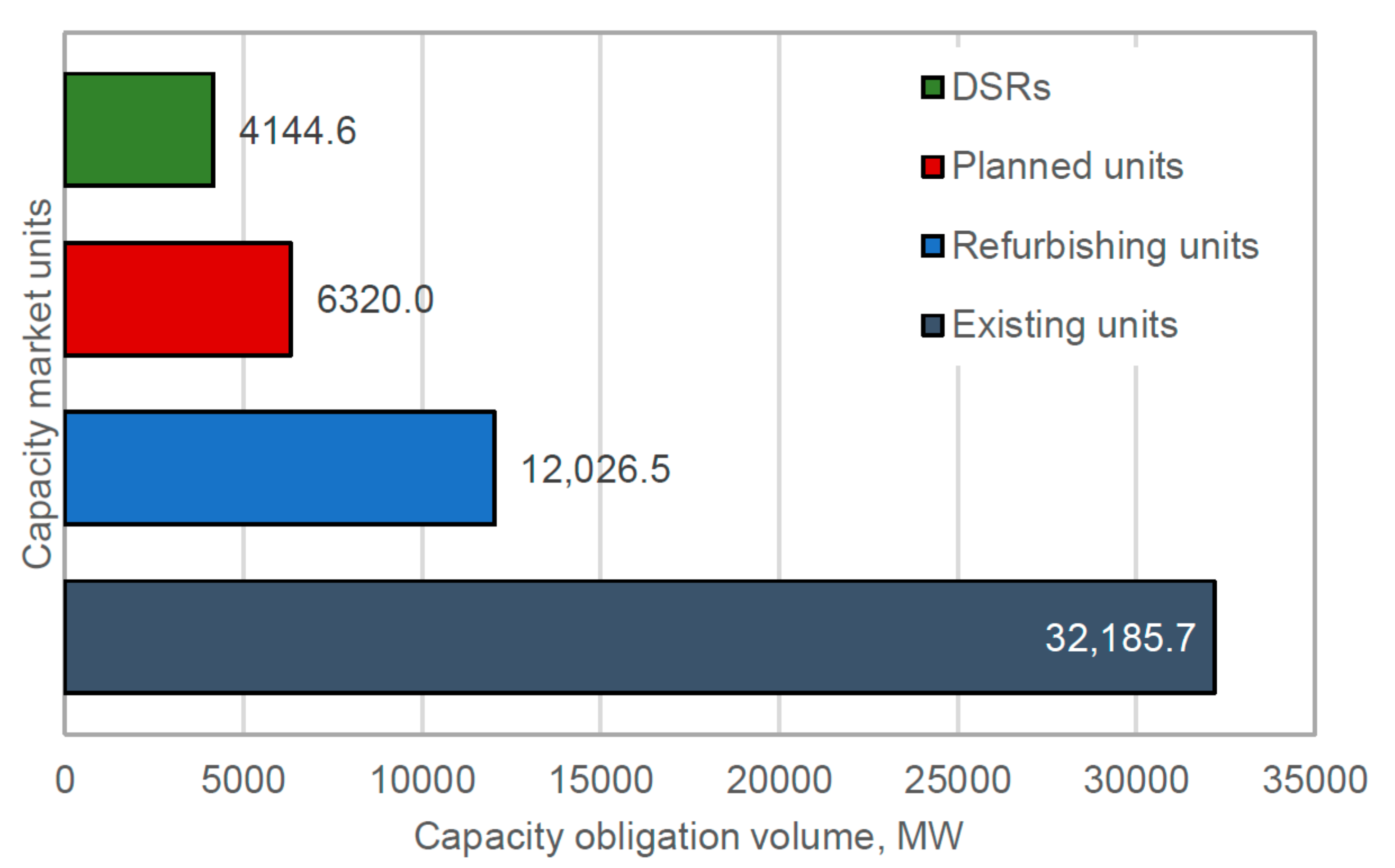

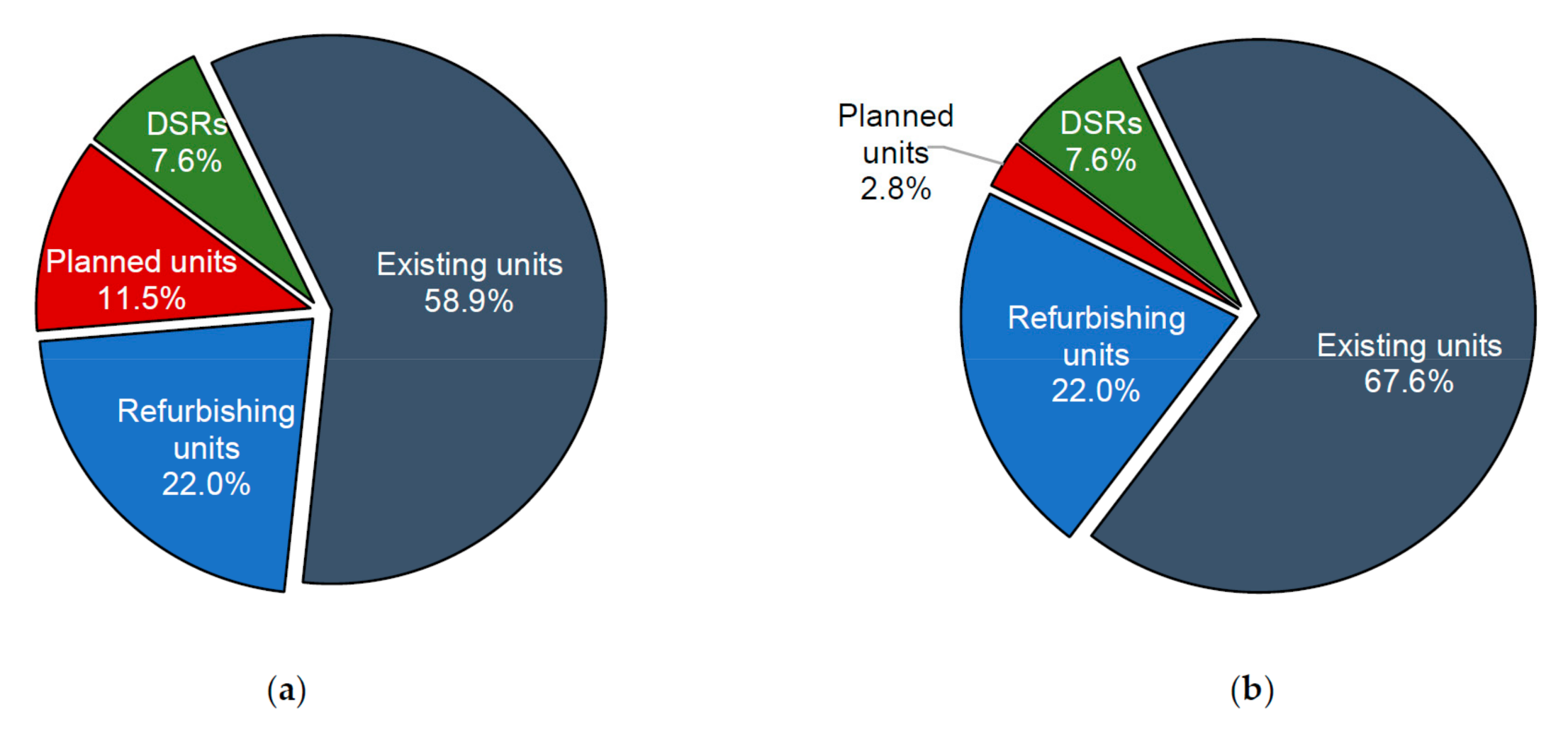

- Existing units which include mainly conventional coal-fired, gas-fired, and hydro-pumped storage power plants.

- Refurbishing units, which, in contrast to the existing units, need to declare minimal investments before the first delivery period given in the capacity agreement.

- New/planned units, which include all units that had not been commissioned before the general certification to a given capacity auction and meet the minimal level of investment criterion.

- Demand-side response units (DSRs) which consist of mainly planned demand-side response units.

3. Results

3.1. General Results

3.2. Detailed Analysis of Capacity Auctions: New vs. Refurbishing vs. Existing vs. DSR Units

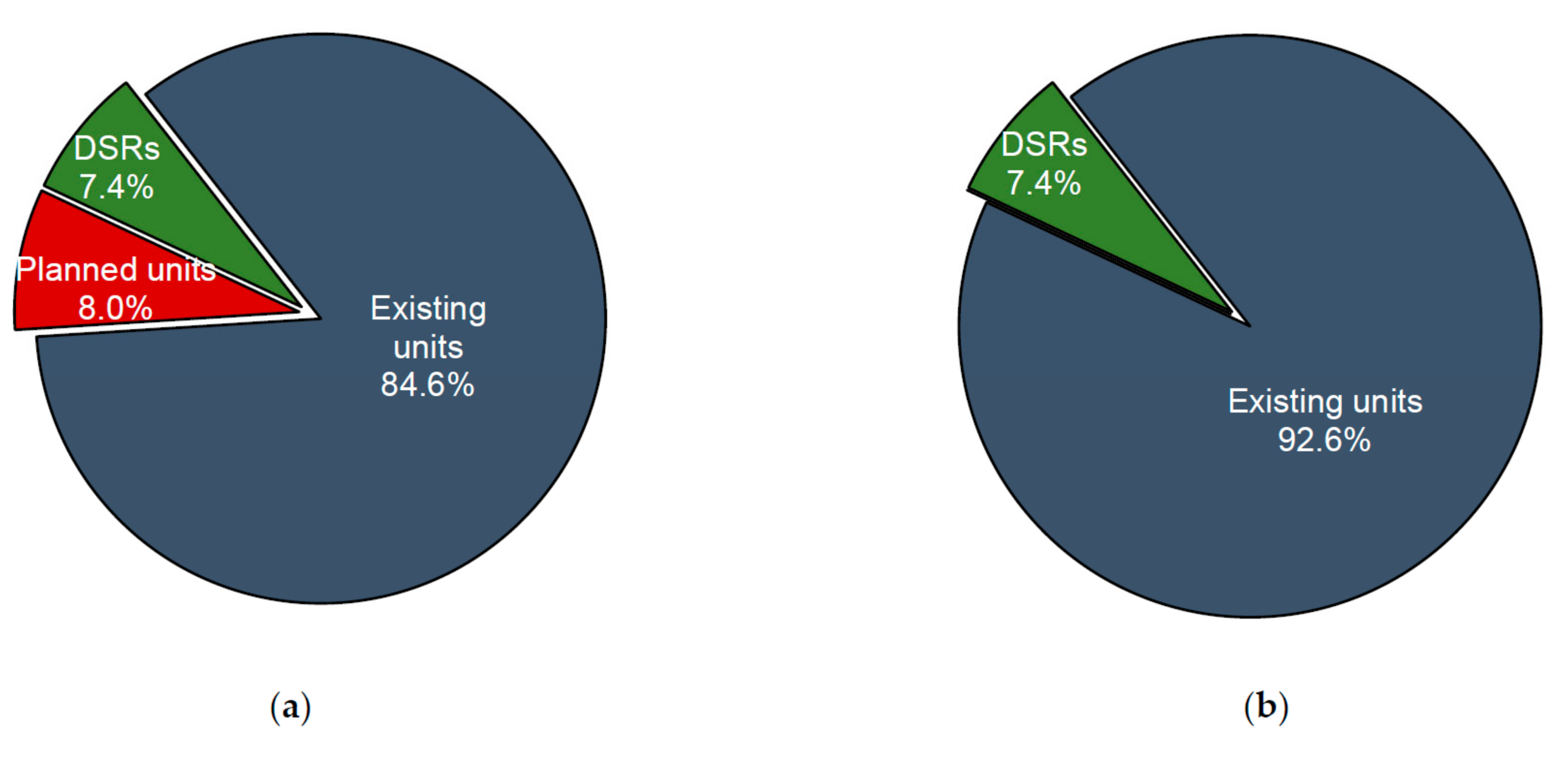

3.2.1. Main Capacity Auction for 2021 Delivery Year

3.2.2. Main Capacity Auction for 2022 Delivery Year

3.2.3. Main Capacity Auction for 2023 Delivery Year

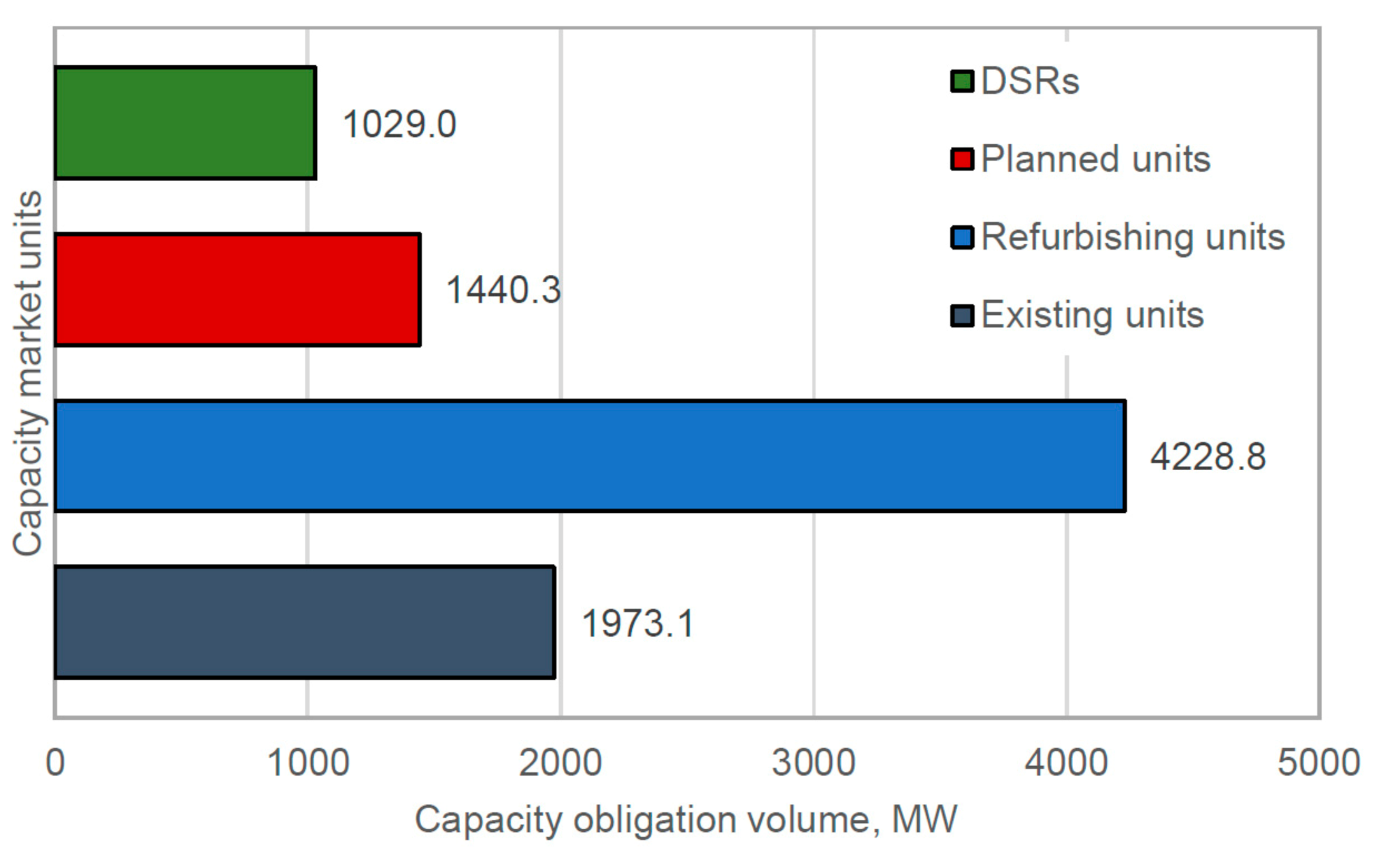

3.2.4. Main Capacity Auction for 2024 Delivery Year

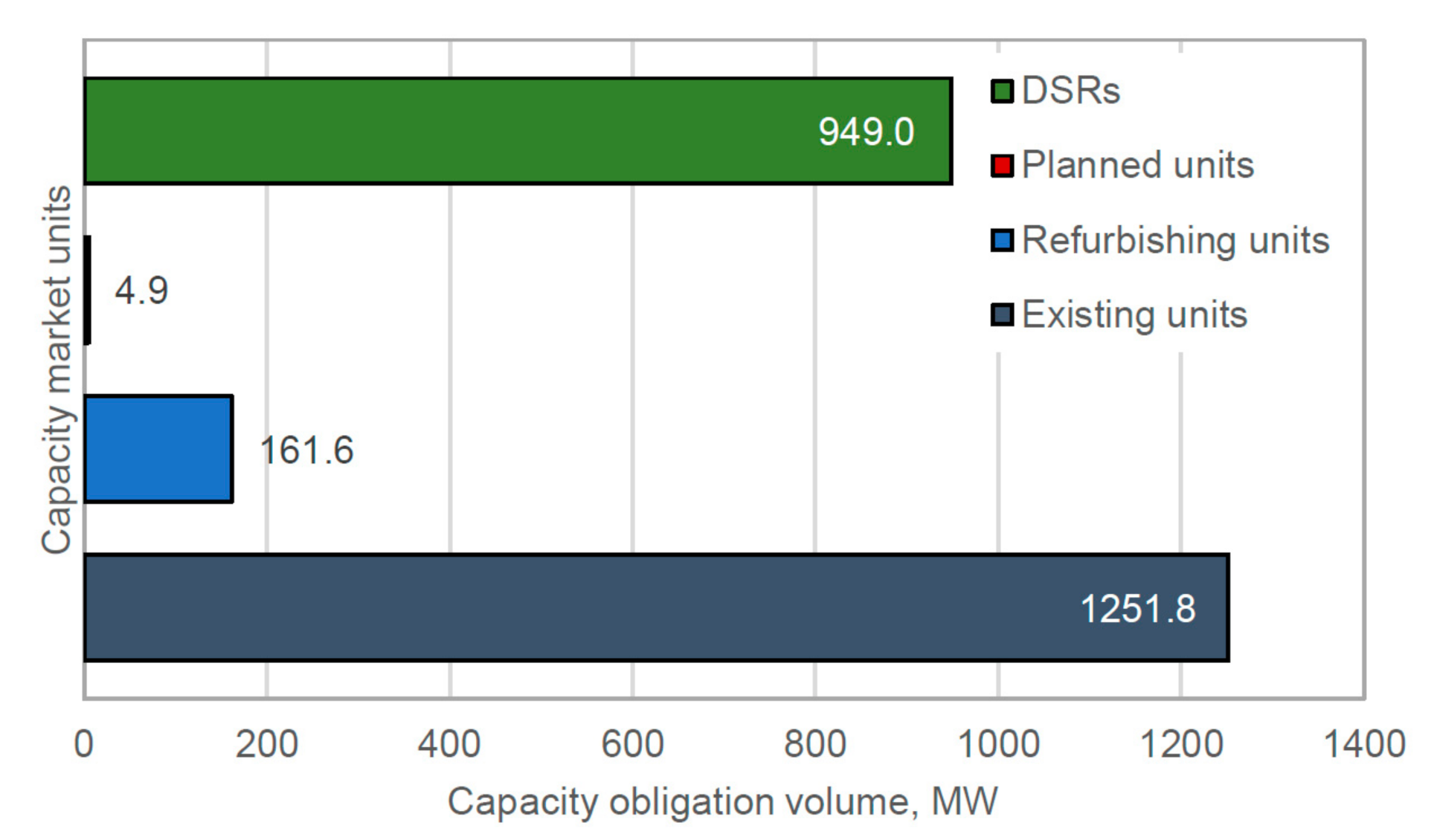

3.2.5. Main Capacity Auction for 2025 Delivery Year

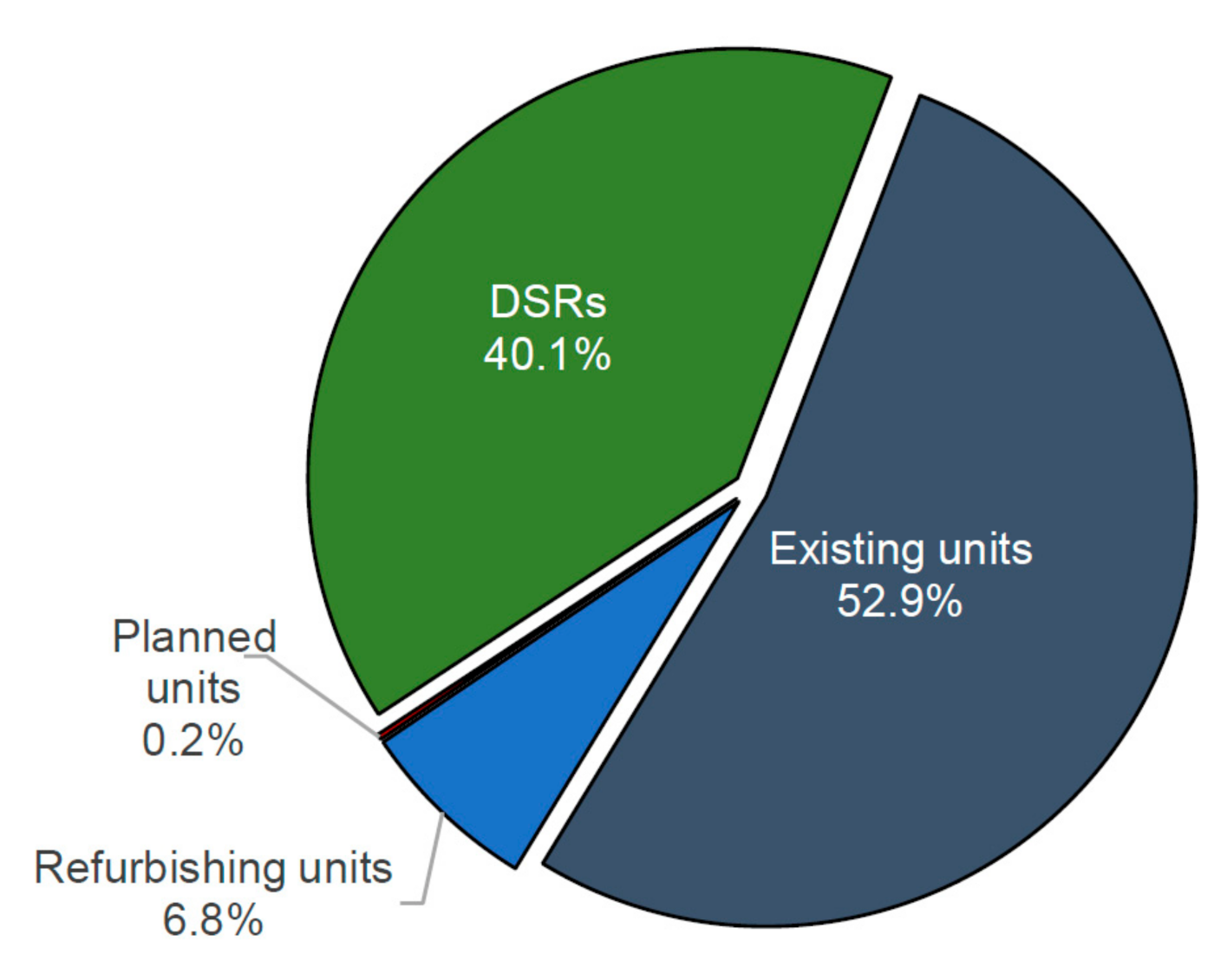

3.2.6. Aggregated Results of All Main Capacity Auctions for 2021–2025 Delivery Years

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

Abbreviations

| Name | Explanation |

| CCGT | Combined cycle gas turbine |

| CHP | Combined heat and power plant |

| CO | Capacity Obligation |

| CRM | Capacity Remuneration Mechanisms |

| CMU | Capacity Market Unit |

| CO2 | Carbon Dioxide |

| DSR | Demand-side response |

| ERO | Energy Regulatory Office |

| EU | European Union |

| RES | Renewable Energy Sources |

References

- Neuhoff, K.; Diekmann, J.; Kunz, F.; Rüster, S.; Schill, W.P.; Schwenen, S. A coordinated strategic reserve to safeguard the European energy transition. Util. Policy 2016, 41, 252–263. [Google Scholar] [CrossRef] [Green Version]

- Cramton, P.; Ockenfels, A.; Stoft, S. Capacity market fundamentals. Econ. Energy Environ. Policy 2013, 2, 27–46. [Google Scholar] [CrossRef] [Green Version]

- Neuhoff, K.; De Vries, L. Insufficient incentives for investment in electricity generations. Util. Policy 2004, 12, 253–267. [Google Scholar] [CrossRef]

- Pollitt, M.G.; Haney, A.B. Dismantling a Competitive Electricity Sector: The U.K.’s Electricity Market Reform. Electr. J. 2013, 26, 8–15. [Google Scholar] [CrossRef]

- Bhagwat, P.C.; Marcheselli, A.; Richstein, J.C.; Chappin, E.J.L.; De Vries, L.J. An analysis of a forward capacity market with long-term contracts. Energy Policy 2017, 111, 255–267. [Google Scholar] [CrossRef]

- Ozdemir, O.; de Joode, J.; Koutstaal, P.; van Hout, M. Financing investment in new electricity generation capacity: The impact of a German capacity market on Northwest Europe. In Proceedings of the 2013 10th International Conference on the European Energy Market (EEM), Stockholm, Sweden, 27–31 May 2013; pp. 1–8. [Google Scholar]

- Mastropietro, P.; Fontini, F.; Rodilla, P.; Batlle, C. The Italian capacity remuneration mechanism: Critical review and open questions. Energy Policy 2018, 123, 659–669. [Google Scholar] [CrossRef]

- Hancher, L.; De Hauteclocquoe, A.; Sadowska, M. Capacity Mechanisms in EU Energy Market; Oxford University Press: Oxford, UK, 2015. [Google Scholar]

- Cramton, P.; Ockenfels, A. Economics and Design of Capacity Markets for the Power Sector; Springer: Berlin/Heidelberg, Germany, 2012. [Google Scholar]

- ACER. ACER Marker Monitoring Report 2018—Electricity Wholesale Markets Volume; ACER: Ljubljana, Slovenia, 2019. [Google Scholar]

- Lin, J.; Vatani, B. Impact of capacity market design on power system decarbonization. In Proceedings of the 2017 14th International Conference on the European Energy Market (EEM), Dresden, Germany, 6–9 June 2017; pp. 1–6. [Google Scholar]

- Bowring, J. Capacity Markets in PJM. Econ. Energy Environ. Policy 2013, 2, 47–65. [Google Scholar] [CrossRef] [Green Version]

- Spees, K.; Newell, S.A.; Pfeifenberger, J.P. Capacity Markets—Lessons Learned from the First Decade. Econ. Energy Environ. Policy 2013, 2, 3–26. [Google Scholar] [CrossRef]

- Pfeifenberger, J.P.; Spees, K.; Shumacher, A. A Comparison of PJM’s RPM with Alternative Energy and Capacity Market Designs; The Brattle Group: Boston, MA, USA, 2009. [Google Scholar]

- Galetovic, A.; Muñoz, C.M.; Wolak, F.A. Capacity Payments in a Cost-Based Wholesale Electricity Market: The Case of Chile. Electr. J. 2015, 28, 80–96. [Google Scholar] [CrossRef]

- Ashokkumar Parmar, A.; Pranav, B.; Darji, B. Capacity market functioning with renewable capacity integration and global practices. Electr. J. 2020, 33, 106708. [Google Scholar] [CrossRef]

- Roques, F.A. Market design for generation adequacy: Healing causes rather than symptoms. Util. Policy 2008. [CrossRef] [Green Version]

- Komorowska, A. Can Decarbonisation and Capacity Market Go Together? The Case Study of Poland. Energies 2021, 14, 5151. [Google Scholar] [CrossRef]

- Bhagwat, P.C. Security of Supply during the Energy Transition: The Role of Capacity Mechanisms. Ph.D. Thesis, Delft University of Technology, Delft, The Netherlands, 2016. [Google Scholar]

- ARE SA. Energy Statistics. 2020. Available online: https://www.are.waw.pl/component/phocadownload/category/28-statystyka-elektroenergetyki-polskiej?download=104:statystyka-elektroenergetyki-polskiej-2020 (accessed on 8 August 2021).

- Majchrzak, K.; Olczak, P.; Matuszewska, D.; Wdowin, M. Economic and environmental assessment of the use of electric cars in Poland. Polityka Energetyczna-Energy Policy J. 2021, 24, 153–168. [Google Scholar] [CrossRef]

- Ministry of Climate and Environment Energy Policy of Poland until 2040. 2021. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WMP20210000264/O/M20210264.pdf (accessed on 8 August 2021).

- PSE SA. Report on the Reasons for the Introduction of Restrictions on the Supply and Consumption of Electricity in August 2015 in the Territory of the Country. 2015. Available online: https://www.pse.pl/biuro-prasowe/aktualnosci/-/asset_publisher/fwWgbbtxcZUt/content/pse-sa-opracowaly-raport-o-przyczynach-wprowadzenia-na-terenie-kraju-ograniczen-w-dostawach-i-poborze-energii-elektrycznej-w-sierpniu-2015-r-/exclusive?safeargs=696e686572 (accessed on 8 August 2021).

- Byers, C.; Levin, T.; Botterud, A. Capacity market design and renewable energy: Performance incentives, qualifying capacity, and demand curves. Electr. J. 2018, 31, 65–74. [Google Scholar] [CrossRef]

- Mastropietro, P.; Rodilla, P.; Battle, C. Performance incentives in capacity mechanisms: Conceptual considerations and empirical evidence. Econ. Energy Environ. Policy 2017, 6, 149–164. [Google Scholar] [CrossRef]

- Fang, X.; Hu, Q.; Bo, R.; Li, F. Redesigning capacity market to include flexibility via ramp constraints in high-renewable penetrated system. Int. J. Electr. Power Energy Syst. 2021, 128, 106677. [Google Scholar] [CrossRef]

- Schäfer, S.; Altvater, L. A Capacity Market for the Transition towards Renewable-Based Electricity Generation with Enhanced Political Feasibility. Energies 2021, 14, 5889. [Google Scholar] [CrossRef]

- McCullough, R.; Weisdorf, M.; Ende, J.C.; Absar, A. Exactly how inefficient is the PJM capacity Market? Electr. J. 2020, 33, 106819. [Google Scholar] [CrossRef]

- Komorowska, A.; Benalcazar, P.; Kaszyński, P.; Kamiński, J. Economic consequences of a capacity market implementation: The case of Poland. Energy Policy 2020, 144, 111683. [Google Scholar] [CrossRef]

- Zamasz, K.; Kapłan, R.; Kaszyński, P.; Saługa, P.W. An Analysis of Support Mechanisms for New CHPs: The Case of Poland. Energies 2020, 13, 5635. [Google Scholar] [CrossRef]

- Jezyna, B.; Lis, M.; Mesjasz-Lech, A. The DSR Scheme in the Capacity Market of Industrial Enterprises in Poland—Participation Determinants. Energies 2020, 13, 5462. [Google Scholar] [CrossRef]

- ACER. Capacity Remuneration Mechanisms and the Internal Market for Electricity; ACER: Ljubljana, Slovenia, 2013. [Google Scholar]

- Kirschen, D.; Strbac, G. Fundamentals of Power System Economics, 2nd ed.; John Wiley & Sons Ltd.: Hoboken, NJ, USA, 2019. [Google Scholar]

- Ministry of Energy. The Act of 8 December 2017 on Capacity Market (Dz.U. 2018 poz. 9); Ministry of Energy: Warsaw, Poland, 2018. [Google Scholar]

- Carare, O.; Rothkopf, M. Slow Dutch Auctions. Manage. Sci. 2005, 51, 365–373. [Google Scholar] [CrossRef] [Green Version]

- Saługa, P.; Kamiński, J. Rynek mocy w Polsce—aukcja jednocenowa vs. aukcja dyskryminacyjna. Polityka Energ.-Energy Policy J. 2017, 98, 167–176. [Google Scholar]

- Energy Regulatory Office. ERO President’s Announcement No. 99/2018 of the Final Results of the Capacity Auctions for the Delivery Year 2021. 2018. Available online: https://www.ure.gov.pl/pl/energia-elektryczna/rynek-mocy/informcjepure/8976,Informacja-nr-992018.html (accessed on 15 November 2021).

- Energy Regulatory Office. ERO President’s Announcement No. 103/2018 of the Final Results of the Capacity Auctions for the Delivery Year 2022. 2018. Available online: https://www.ure.gov.pl/pl/energia-elektryczna/rynek-mocy/informcjepure/8975,Informacja-nr-1032018.html (accessed on 15 November 2021).

- Energy Regulatory Office. ERO President’s Announcement No. 14/2019 of the Final Results of the Capacity Auctions for the Delivery Year 2023. 2019. Available online: https://www.ure.gov.pl/pl/energia-elektryczna/rynek-mocy/informcjepure/8973,Informacja-nr-102019.html (accessed on 15 November 2021).

- Energy Regulatory Office. ERO President’s Announcement No. 106/2019 of the Final Results of the Capacity Auctions for the Delivery Year 2024. 2019. Available online: https://www.ure.gov.pl/pl/energia-elektryczna/rynek-mocy/informcjepure/8971,Informacja-Nr-1062019.html (accessed on 15 November 2021).

- Energy Regulatory Office. ERO President’s Announcement No. 2/2021 of the Final Results of the Capacity Auctions for the Delivery Year 2025. 2021. Available online: https://www.ure.gov.pl/pl/energia-elektryczna/rynek-mocy/informcjepure?page=0 (accessed on 15 November 2021).

- Drożdż, W.; Kinelski, G.; Czarnecka, M.; Wójcik-Jurkiewicz, M.; Maroušková, A.; Zych, G. Determinants of Decarbonization—How to Realize Sustainable and Low Carbon Cities? Energies 2021, 14, 2640. [Google Scholar] [CrossRef]

- Mucha-Kuś, K.; Sołtysik, M.; Zamasz, K.; Szczepańska-Woszczyna, K. Coopetitive Nature of Energy Communities—The Energy Transition Context. Energies 2021, 14, 931. [Google Scholar] [CrossRef]

- Wójcik-Jurkiewicz, M.; Czarnecka, M.; Kinelski, G.; Sadowska, B.; Bilińska-Reformat, K. Determinants of Decarbonisation in the Transformation of the Energy Sector: The Case of Poland. Energies 2021, 14, 1217. [Google Scholar] [CrossRef]

- European Parliament and Council Regulation (EU). 2019/943 of the European Parliament and of the Council of 5 June 2019 on the Internal Market for Electricity. 2019. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32019R0943 (accessed on 8 August 2021).

| Parameter | Unit | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|

| Auction price cap | EUR/kW/year | 72.1 | 80.5 | 89.5 | 88.9 | 91.2 |

| Market entry price of a new generating unit (CONE) | EUR/kW | 65.5 | 67.0 | 68.8 | 68.4 | 70.1 |

| Auction clearing price | EUR/kW/year | 52.8 | 43.5 | 44.6 | 57.1 | 38.0 |

| Capacity obligation purchased | MW | 22,427.1 | 10,580.1 | 10,631.2 | 8671.2 | 2367.3 |

| Total capacity obligations | MW | 22,427.1 | 23,038.9 | 23,215.0 | 22,107.6 | 21,472.8 |

| Planned capacity volume | MW | 4022.3 | 0 | 852.6 | 1440.3 | 4.9 |

| Final round number | – | 5 | 7 | 8 | 5 | 7 |

| Number of winning bids | – | 160 | 120 | 94 | 103 | 55 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kaszyński, P.; Komorowska, A.; Zamasz, K.; Kinelski, G.; Kamiński, J. Capacity Market and (the Lack of) New Investments: Evidence from Poland. Energies 2021, 14, 7843. https://doi.org/10.3390/en14237843

Kaszyński P, Komorowska A, Zamasz K, Kinelski G, Kamiński J. Capacity Market and (the Lack of) New Investments: Evidence from Poland. Energies. 2021; 14(23):7843. https://doi.org/10.3390/en14237843

Chicago/Turabian StyleKaszyński, Przemysław, Aleksandra Komorowska, Krzysztof Zamasz, Grzegorz Kinelski, and Jacek Kamiński. 2021. "Capacity Market and (the Lack of) New Investments: Evidence from Poland" Energies 14, no. 23: 7843. https://doi.org/10.3390/en14237843

APA StyleKaszyński, P., Komorowska, A., Zamasz, K., Kinelski, G., & Kamiński, J. (2021). Capacity Market and (the Lack of) New Investments: Evidence from Poland. Energies, 14(23), 7843. https://doi.org/10.3390/en14237843