Analyzing Electricity Markets with Increasing Penetration of Large-Scale Renewable Power Generation

Abstract

:1. Introduction

2. Overview of Electricity Markets

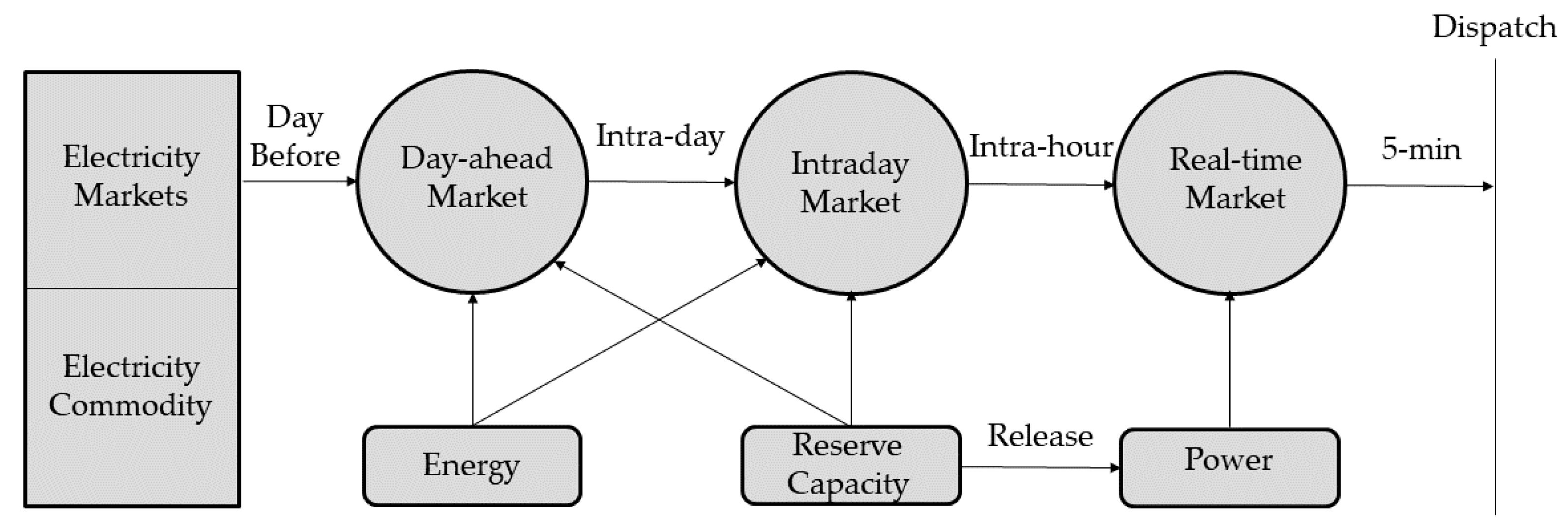

- Day-ahead market: for the settlement of an hour’s load demand 24 h in advance, based on forecasted load demand.

- Intra-day market: for the settlement of hour-ahead forecasted load demand.

- Real-time pricing: for the balance of the system during the operational hour.

- Uniform Marginal Pricing (UMP): one price signal for the entire network under the system operator.

- Locational Marginal Pricing (LMP): optimal power flow-based pricing; different prices for different buses (nodes) in the transmission network.

- Zonal Marginal Pricing (ZMP): one single price for a specific region or zone.

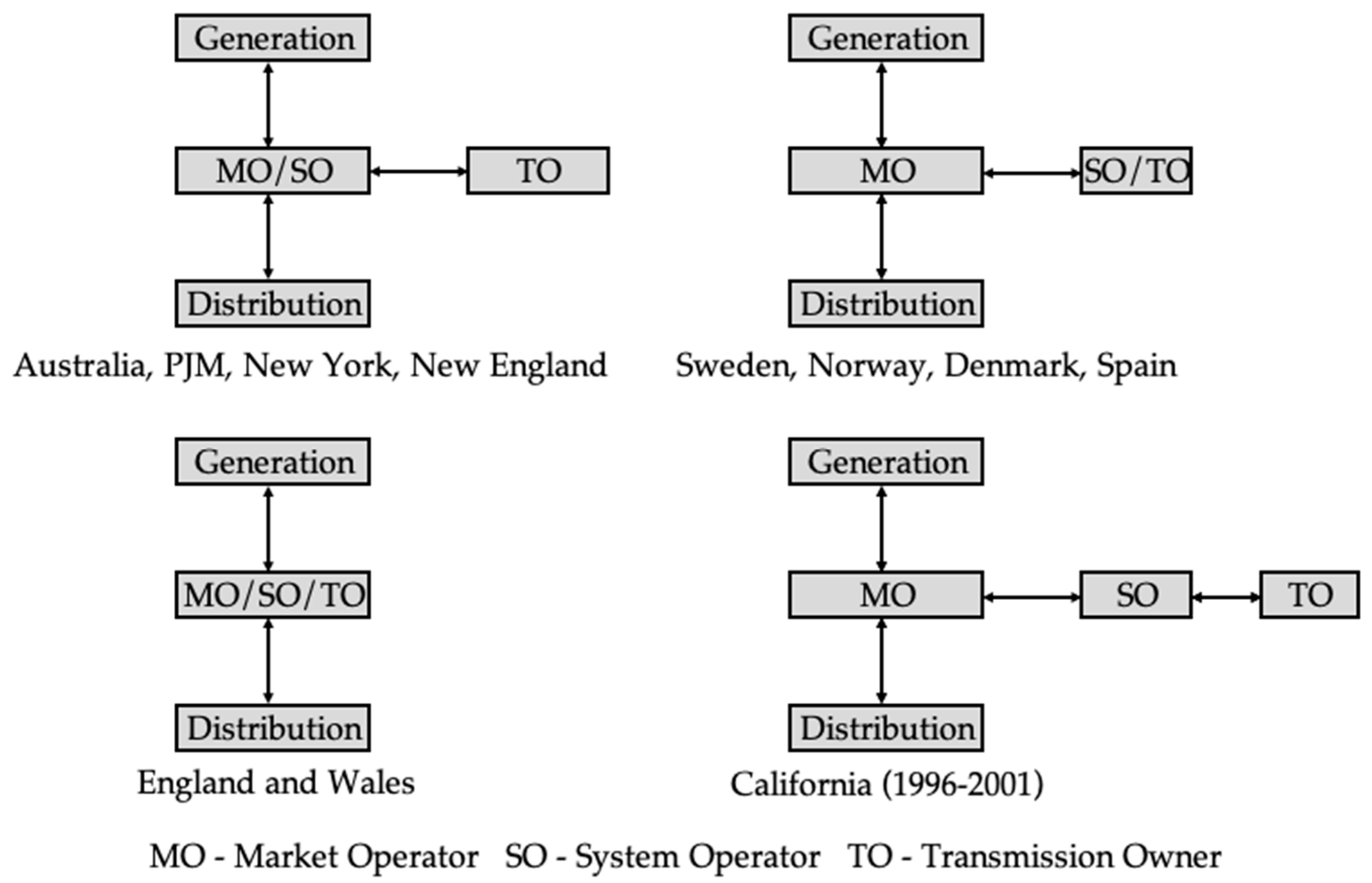

3. Electricity Markets around the World

- Frequency control ancillary services;

- Network control ancillary services;

- System restart ancillary services.

4. Challenges in Electricity Markets and Their Proposed Solutions

5. Future Research Directions

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Tang, Y.; Ling, J.; Ma, T.; Chen, N.; Liu, X.; Gao, B. A Game Theoretical Approach Based Bidding Strategy Optimization for Power Producers in Power Markets with Renewable Electricity. Energies 2017, 10, 627. [Google Scholar] [CrossRef] [Green Version]

- Kost, C.; Shammugam, S.; Jülch, V.; Nguyen, H.-T.; Schlegl, T. Levelized Cost of Electricity Renewable Energy Technologies; Fraunhofer Institute for Solar Energy Systems ISE: Freiburg, Germany, 2018. [Google Scholar]

- International Energy Agency. Global Energy Review 2021; IEA: Paris, France, 2021. [Google Scholar]

- Johnathon, C.; Agalgaonkar, A.; Kennedy, J.; Afandi, I. Optimal Power Flow with conventional and non-conventional generating resources in modern grids considering environmental impacts. In Proceedings of the 29th Australasian Universities Power Engineering Conference (AUPEC), Nadi, Fiji, 26–29 November 2019. [Google Scholar]

- Strielkowski, W.; Streimikiene, D.; Fomina, A.; Semenova, E. Internet of Energy (IoE) and High-Renewables Electricity System Market Design. Energies 2019, 12, 4790. [Google Scholar] [CrossRef] [Green Version]

- Australian Energy Market Operator. AEMO Observations: Operational and Market Challenges to Reliability and Security in the NEM; AEMO: Sydney, Australia, 2018. [Google Scholar]

- Kirschen, D.; Strbac, G. Fundamentals of Power System Economics; John Wiley & Sons Incorporated: Newark, NJ, USA, 2004. [Google Scholar]

- Ela, E.; Milligan, M.; Kirby, B. Operating Reserves and Variable; Nat. Renew. Energy Lab.: Golden, CO, USA, 2011. [Google Scholar]

- KarthikeyanI, S.P.; Raglend, J.; Kothari, D. A review on market power in deregulated electricity market. Electr. Power Energy Syst. 2013, 48, 139–147. [Google Scholar] [CrossRef]

- Valarezo, O.; Gómez, T.; Chaves-Avila, J.; Lind, L.; Correa, M.; Ziegler, D.U.; Escobar, R. Analysis of New Flexibility Market Models in Europe. Energies 2021, 14, 3521. [Google Scholar] [CrossRef]

- Tushar, W.; Saha, T.K.; Yuen, C.; Smith, D.; Poor, H.V. Peer-to-Peer Trading in Electricity Networks: An Overview. IEEE Trans. Smart Grid 2020, 11, 3185–3200. [Google Scholar] [CrossRef] [Green Version]

- Moran, A.; Sood, R. Evolution of Global Electricity Markets; Academic Press: Waltham, MA, USA, 2013. [Google Scholar]

- Bhattacharya, K.; Bollen, M.H.J.; Daalder, J.E. Operation of Restructured Power Systems; Ringgold Inc.: Portland, OR, USA, 2001. [Google Scholar]

- Karmel, F. Deregulation and Reform of the Electricity Industry in Australia: Lessons for Japan; Australian Government: Canberra, Australia, 2018.

- Morales, J.M.; Conejo, A.J.; Madsen, H.; Pinson, P.; Zugno, M. Integrating Renewables in Electricity Markets—Operational Problems, International Series in Operations Research & Management Science; Springer: New York, NY, USA, 2014. [Google Scholar]

- Conejo, A.J.; Carrion, M.; Morales, J.M. Decision Making under Uncertainty in Electricity Markets, International Series in Operations Research and Management Science; Springer: New York, NY, USA, 2010. [Google Scholar]

- Wang, Q.; Zhang, C.; Ding, Y.; Xydis, G.; Wang, J.; Østergaard, J. Review of real-time electricity markets for integrating Distributed Energy Resources and Demand Response. Appl. Energy 2015, 138, 695–706. [Google Scholar] [CrossRef]

- Chattopadhyay, D.; Alpcan, T. Capacity and Energy-Only Markets under High Renewable Penetration. IEEE Trans. Power Syst. 2015, 31, 1692–1702. [Google Scholar] [CrossRef]

- Australian Energy Market Operator. Guide to Ancillary Services in the National Electricity Market; AEMO: Sydney, Australia, 2015. [Google Scholar]

- Pineda, S.; Conejo, A.J. Using electricity options to hedge against financial risks of power producers. J. Mod. Power Syst. Clean Energy 2013, 1, 101–109. [Google Scholar] [CrossRef] [Green Version]

- Gan, D.; Feng, D.; Xie, J. Electricity Markets and Power System Economics; CRC Press: Boca Rotan, FL, USA, 2013. [Google Scholar] [CrossRef]

- Gil, H.A.; Lin, J. Wind Power and Electricity Prices at the PJM Market. IEEE Trans. Power Syst. 2013, 28, 3945–3953. [Google Scholar] [CrossRef]

- Office of Gas and Electricity Markets. State of the Energy Market; Crown: London, UK, 2019.

- Lundin, E.; Tangerås, T.P. Cournot competition in wholesale electricity markets: The Nordic power exchange, Nord Pool. Int. J. Ind. Organ. 2019, 68, 102536. [Google Scholar] [CrossRef]

- Borowski, P.F. Zonal and Nodal Models of Energy Market in European Union. Energies 2020, 13, 4182. [Google Scholar] [CrossRef]

- Independent Market Operator. Wholesale Electricity Market Design Summary; IMO: Perth, Australia, 2012. [Google Scholar]

- Australian Energy Market Operator. An Introduction to Australia’s National Electricity Market; AEMO: Melbourne, Australia, 2010. [Google Scholar]

- Australian Energy Regulator. State of the Energy Market; Australian Competition and Consumer Commission: Melbourne, Australia, 2009.

- Kwoka, J.; Majiarov, K. Making Markets Work: The Special Case of Electricity. Electr. J. 2007, 20, 24–36. [Google Scholar] [CrossRef]

- Lynch, M.A.; Devine, M.T. Investment vs. Refurbishment: Examining Capacity Payment Mechanisms Using Stochastic Mixed Complementarity Problems. Energy J. 2017, 38, 27–51. [Google Scholar] [CrossRef] [Green Version]

- Joskow, P.; Tirole, J. Reliability and competitive electricity markets. RAND J. Econ. 2007, 38, 60–84. [Google Scholar] [CrossRef] [Green Version]

- Meeus, L.; Purchala, K.; Belmans, R. Development of the Internal Electricity Market in Europe. Electr. J. 2005, 18, 25–35. [Google Scholar] [CrossRef]

- Dütschke, E.; Paetz, A.-G. Dynamic electricity pricing—Which programs do consumers prefer? Energy Policy 2013, 59, 226–234. [Google Scholar] [CrossRef] [Green Version]

- Cramton, P.; Stoft, S. A capacity market that makes sense. Electr. J. 2005, 7, 43–54. [Google Scholar]

- Keppler, J.H. Rationales for capacity remuneration mechanisms: Security of supply externalities and asymmetric investment incentives. Energy Policy 2017, 105, 562–570. [Google Scholar] [CrossRef]

- Aalami, H.; Moghaddam, M.P.; Yousefi, G. Demand response modeling considering Interruptible/Curtailable loads and capacity market programs. Appl. Energy 2010, 87, 243–250. [Google Scholar] [CrossRef]

- Chen, W.; Yan, H.; Pei, X.; Wu, B. Probabilistic load flow calculation in distribution system considering the stochastic characteristic of wind power and electric vehicle charging load. In Proceedings of the 2016 IEEE PES Asia-Pacific Power and Energy Engineering Conference (APPEEC), Xi′an, China, 25–28 October 2016. [Google Scholar]

- Zielke, M.; Brooks, A.; Nemet, G. The Impacts of Electric Vehicle Growth on Wholesale Electricity Prices in Wisconsin. World Electr. Veh. J. 2020, 11, 32. [Google Scholar] [CrossRef] [Green Version]

- Suyono, H.; Rahman, M.T.; Mokhlis, H.; Othman, M.; Illias, H.A.; Mohamad, H. Optimal Scheduling of Plug-in Electric Vehicle Charging Including Time-of-Use Tariff to Minimize Cost and System Stress. Energies 2019, 12, 1500. [Google Scholar] [CrossRef] [Green Version]

- Taylor, J.; Maitra, A.; Alexander, M.; Brooks, D.; Duvall, M. Evaluations of plug-in electric vehicle distribution system impacts. In Proceedings of the IEEE PES General Meeting, Minneapolis, MN, USA, 23 December 2010. [Google Scholar]

- Clement-Nyns, K.; Haesen, E.; Driesen, J. The Impact of Charging Plug-In Hybrid Electric Vehicles on a Residential Distribution Grid. IEEE Trans. Power Syst. 2009, 25, 371–380. [Google Scholar] [CrossRef] [Green Version]

- Suski, A.; Remy, T.; Chattopadhyay, D.; Song, C.S.; Jaques, I.; Keskes, T.; Li, Y. Analyzing Electric Vehicle Load Impact on Power Systems: Modeling Analysis and a Case Study for Maldives. IEEE Access 2021, 9, 125640–125657. [Google Scholar] [CrossRef]

- Keay, M.; Rhys, J.; Robinson, D. Electricity Markets and Pricing for the Distributed Generation Era. In Distributed Generation and its Implications for the Utility Industry; Academic Press: New York, NY, USA, 2014; pp. 166–187. [Google Scholar]

- Milligan, M.; Frew, B.A.; Bloom, A.; Ela, E.; Botterud, A.; Townsend, A.; Levin, T. Wholesale electricity market design with increasing levels of renewable generation: Revenue sufficiency and long-term reliability. Electr. J. 2016, 29, 26–38. [Google Scholar] [CrossRef] [Green Version]

- Sensfuß, F.; Ragwitz, M.; Genoese, M. The merit-order effect: A detailed analysis of the price effect of renewable electricity generation on spot market prices in Germany. Energy Policy 2008, 36, 3086–3094. [Google Scholar] [CrossRef] [Green Version]

- Hu, J.; Harmsen, R.; Crijns-Graus, W.; Worrell, E.; Broek, M.V.D. Identifying barriers to large-scale integration of variable renewable electricity into the electricity market: A literature review of market design. Renew. Sustain. Energy Rev. 2018, 81, 2181–2195. [Google Scholar] [CrossRef]

- Nicolosi, M. Wind power integration and power system flexibility—An empirical analysis of extreme events in Germany under the new negative price regime. Energy Policy 2010, 38, 7257–7268. [Google Scholar] [CrossRef] [Green Version]

- Hirth, L. What caused the drop in European electricity prices? A factor decomposition analysis. Energy J. 2018, 39, 143–157. [Google Scholar] [CrossRef] [Green Version]

- Schweppe, F.C.; Caramanis, M.C.; Tabors, R.D.; Bohn, R.E. Spot Pricing of Electricity; Kulwer Academic Publishers: Norwell, MA, USA, 2013. [Google Scholar]

- Vazquez, C.; Hallack, M.; Vazquez, M. Price computation in electricity auctions with complex rules: An analysis of investment signals. Energy Policy 2017, 105, 550–561. [Google Scholar] [CrossRef]

- Frew, B.; Stephen, G.; Lau, J.; Hytowitz, R.B.; Ela, E.; Singhal, N.; Bloom, A. Impacts of Price Formation Efforts Considering High Renewable Penetration Levels and System Resource Adequacy Targets; National Renewable Energy Lab. (NREL): Golden, CO, USA, 2020. [Google Scholar]

- Schiro, D.A.; Zheng, T.; Zhao, F.; Litvinov, E. Convex hull pricing in electricity markets: Formulation, analysis, and implementation challenges. IEEE Trans. Power Syst. 2015, 31, 4068–4075. [Google Scholar] [CrossRef]

- Shin, H.; Kim, T.; Kwag, K.; Kim, W. A Comparative Study of Pricing Mechanisms to Reduce Side-Payments in the Electricity Market: A Case Study for South Korea. Energies 2021, 14, 3395. [Google Scholar] [CrossRef]

- Wang, C.; Luh, P.B.; Gribik, P.; Peng, T.; Zhang, L. Commitment Cost Allocation of Fast-Start Units for Approximate Extended Locational Marginal Prices. IEEE Trans. Power Syst. 2016, 31, 4176–4184. [Google Scholar] [CrossRef]

- Vickrey, W. Counterspeculation, auctions, and competitive sealed tenders. J. Financ. 1961, 16, 8–37. [Google Scholar] [CrossRef]

- Gu, H.; Yan, R.; Saha, T. Review of System Strength and Inertia Requirements for the National Electricity Market of Australia. CSEE J. Power Energy Syst. 2019, 5, 295–305. [Google Scholar]

- Australian Energy Market Operator. Black System South Australia 28 September 2016; AEMO: Sydney, Australia, 2017. [Google Scholar]

- Simshauser, P. On the Stability of Energy-Only Markets with Government-Initiated Contracts-for-Differences. Energies 2019, 12, 2566. [Google Scholar] [CrossRef] [Green Version]

- Nelson, T.; Pascoe, O.; Calais, P.; Mitchell, L.; McNeill, J. Efficient integration of climate and energy policy in Australia’s National Electricity Market. Econ. Anal. Policy 2019, 64, 178–193. [Google Scholar] [CrossRef]

- Hach, D.; Chyong, K.C.; Spinler, S. Capacity market design options: A dynamic capacity investment model and a GB case study. J. Oper. Res. 2016, 249, 691–705. [Google Scholar] [CrossRef] [Green Version]

- Wang, Z.; Wang, Y.; Ding, Q.; Wang, C.; Zhang, K. Energy Storage Economic Analysis of Multi-Application Scenarios in an Electricity Market: A Case Study of China. Sustainability 2020, 12, 8703. [Google Scholar] [CrossRef]

- Hiesl, A.; Ajanovic, A.; Haas, R. On current and future economics of electricity storage. Greenh. Gases Sci. Technol. 2020, 10, 1176–1192. [Google Scholar] [CrossRef]

- Angarita, J.L.; Usaola, J.; Crespo, J.M. Combined hydro-wind generation bids in a pool-based electricity market. Electr. Power Syst. Res. 2009, 79, 1038–1046. [Google Scholar] [CrossRef] [Green Version]

- Castronuovo, E.D.; Lopes, J.A.P. On the Optimization of the Daily Operation of a Wind-Hydro Power Plant. IEEE Trans. Power Syst. 2004, 19, 1599–1606. [Google Scholar] [CrossRef] [Green Version]

- Bitar, E.; Khargonekar, P.; Poolla, K. On the marginal value of electricity storage. Syst. Control Lett. 2019, 123, 151–159. [Google Scholar] [CrossRef] [Green Version]

- Su, H.I.; Gamal, A.E. Modeling and analysis of the role of energy storage for renewable integration: Power balancing. IEEE Trans. Power Syst. 2013, 28, 4109–4117. [Google Scholar] [CrossRef]

- Khaloie, H.; Abdollahi, A.; Shafie-Khah, M.; Siano, P.; Nojavan, S.; Anvari-Moghaddam, A.; Catalão, J.P. Co-optimized bidding strategy of an integrated wind-thermal-photovoltaic system in deregulated electricity market under uncertainties. J. Clean. Prod. 2019, 242, 118434. [Google Scholar] [CrossRef]

- Zhao, Y.; Qin, J.; Rajagopal, R.; Goldsmith, A.; Poor, H.V. Wind Aggregation Via Risky Power Markets. IEEE Trans. Power Syst. 2019, 30, 1571–1581. [Google Scholar] [CrossRef]

- Papakonstantinou, A.; Pinson, P. Information Uncertainty in Electricity Markets: Introducing Probabilistic Offers. IEEE Trans. Power Syst. 2016, 31, 5202–5203. [Google Scholar] [CrossRef]

- Aguiar, N.; Gupta, V.; Khargonekar, P.P. A Real Options Market-Based Approach to Increase Penetration of Renewables. IEEE Trans. Smart Grid 2019, 11, 1691–1701. [Google Scholar] [CrossRef]

- D’Achiardi, D.; Aguiar, N.; Baros, S.; Gupta, V.; Annaswamy, A.M. Reliability Contracts between Renewable and Natural Gas Power Producers. IEEE Trans. Control Netw. Syst. 2019, 6, 1075–1085. [Google Scholar] [CrossRef]

- Australian Energy Market Commission. NEM Financial Market Resilience; AEMC: Sydney, Australia, 2015.

- Renewable Energy Hub. Renewable Energy Hub: A Wholesale Renewable Energy Firming Marketplace Demonstration Project; Renewable Energy Hub: Melbourne, Australia, 2021. [Google Scholar]

- Alshehri, K.; Bose, S.; Başar, T. Centralized volatility reduction for electricity markets. Int. J. Electr. Power Energy Syst. 2021, 133, 107101. [Google Scholar] [CrossRef]

| Peculiarities of the Studied Models | Main Highlights | Recommendations for Future Work |

|---|---|---|

| - A stochastic optimization technique that maximizes the joint profit of hydro and wind generators in a pool-based electricity market is proposed in [63,64]. - Hydro generation varies its output based on the realization of actual wind power generation. - The decisions to vary the output of hydro generation are made based on profit maximization. | - The proposed algorithm results in the reduction in penalties incurred by wind generators. - A decrease in the needs of conventional capacity reserves is also expected. | - Exploring the possibility of joint wind–hydro bids on the overall system reserves management. - Studying the effects of transmission network congestion on the profits for combined wind–hydro bidders. - Examining the proposed model without the assumption of a joint ownership and operation of the two generating plants. |

| - The coordinated operation of wind generation and battery energy storage is proposed in [65], in which the storage is operated by wind generators. - The use of battery storage as a palliative for the high variability of renewable production is proposed in [66], in which the utility company owns and operates the storage. | - Both models examine the ability of battery storage to reduce power imbalance due to variable wind generation based on storage capacity constraints. - Conducted research provides key insights into the trade-offs between energy storage capacity and maximum expected profit. | - Conducting extensive simulation studies for the proposed market framework on existing market models. - Formulating a problem, in which energy storage is owned by an independent rational market participant. - Formulating a problem, in which economic trade-offs that might emerge in using storage for the provision of ancillary services can be investigated. |

| - A bidding strategy for a wind–thermal–PV system participating in the energy and spinning reserve markets is proposed in [67]. - The bidding strategy is bi-objective, which maximizes the profits of the wind–thermal–PV system and minimizes emissions. - A hybrid weighted sum method and fuzzy satisfying approach are used. | - Uncertainty associated with the day-ahead energy, spinning reserve, imbalance prices, and VRE is modeled. - Increases the expected profit of generators.- Reduces the expected emission of generators. | - Considering a risk measuring index in the bi-objective bidding strategy to make decisions based on expected risk-adjusted profits. - Exploring the coordinated bidding from the wind–thermal–PV system as a price-maker in the market. |

| - An instrument for wind aggregation called a risky power contract is proposed in [68]. - Wind generators can trade uncertain future power generation with other VRE generators. - A competitive equilibrium is achieved in a non-cooperative game setting. | - Enables efficient uncertainty reduction. - Increases profits for wind generators. | - Studying the impact of risk power contracts on other market participants. - Exploring the proposed strategy for solar PV aggregation. |

| - A probabilistic market based on an affine transformation of strictly proper scoring rules, such as Brier Scores and Continuous Ranked Probability Scores is proposed in [69]. - The market accepts probabilistic offers from VRE generators. - Generators are rewarded or penalized based on the accuracy of submitted forecasts. | - The proposed market compels VRE generators to reveal their true forecasts. - The disclosure of actual estimates from VRE generators allows the system operator to schedule sufficient resources to meet the demand. - The VRE generators are held accountable for introducing the uncertainty in the system. | - Deriving mathematical proofs to evaluate whether a probabilistic market has the desirable attributes of electricity markets such as cost recovery, revenue adequacy, and incentive compatibility. - Supporting the proposed market framework with relevant simulation studies. |

| - A real options market-based approach is proposed in [70]. - Variable generators purchase options for reserve from flexible generators in an ex-ante options market. - Optimal strategies for generators in a coupled day-ahead and options markets are derived based on the Karush–Kuhn–Tucker (KKT) conditions. | - Increases renewable penetration. - Ensures delivery of reliable power. - No market participants are worse-off. | - Considering a cost model for renewable generators. - Considering both the strike price and the premium fee in the options contract to appropriately represent options trading. - Incorporating the ramifications of network congestion on the options market. |

| - A reliability contract between a renewable generator and a conventional generator is proposed in [71]. - A conventional generator fulfills the unmet commitments of a renewable generator for a reserve fee. - Optimal strategies for generators are derived by examining the first and second partial derivatives of the utility function. | - Increases the profits of both renewable and conventional generators. - Decreases the number of total unmet commitments. | - Studying the possibility of reducing fossil-fuel based generation under excess renewable generation. - Studying the impacts of varying penalty pricing to strategically vary the integration of renewable generation. - Modeling other flexible energy sources as providers of reserve such as energy storage. |

| - A Nash–Cournot energy-capacity market model is proposed in [18]. - A multi-commodity market that provides payments for generated electricity and investments in capacity is studied. | - Reduces spot price volatility. - Ensures cost recovery of generators. - Lower market power as compared to an energy-only market model. | - Considering risk management tools to manage the generated revenue based on spot price volatility. - Considering the impact of financial markets on market power. |

| Category | Challenge | Proposed Solution(s) |

|---|---|---|

| Traditional | Power balance | Flexible demand [35] Demand-side integration [36] Large-scale storage [61,62] |

| Unknown reliability of consumers | Desired reliability contracts for consumers [31] | |

| Failure of cost-recovery | Convex hull pricing [52] Extended locational marginal pricing [54] Vickrey pricing [55] | |

| VRE-induced | Variable generation | Risky power contracts [68] Probabilistic bidding [69] Energy storage [65,66] |

| Merit-order effect and negative pricing events | Paying for flexibility services [6] Enabling capacity payments [18,43] Appropriately designed renewable subsidy schemes [59] | |

| Unmet day-ahead commitments by VRE generators | Real options market [67] Reliability contracts [68] | |

| Lack of risk management tools for VRE assets | Solar shape and inverse solar shape contracts [73] Two-stage insurance market [74] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Johnathon, C.; Agalgaonkar, A.P.; Kennedy, J.; Planiden, C. Analyzing Electricity Markets with Increasing Penetration of Large-Scale Renewable Power Generation. Energies 2021, 14, 7618. https://doi.org/10.3390/en14227618

Johnathon C, Agalgaonkar AP, Kennedy J, Planiden C. Analyzing Electricity Markets with Increasing Penetration of Large-Scale Renewable Power Generation. Energies. 2021; 14(22):7618. https://doi.org/10.3390/en14227618

Chicago/Turabian StyleJohnathon, Chris, Ashish Prakash Agalgaonkar, Joel Kennedy, and Chayne Planiden. 2021. "Analyzing Electricity Markets with Increasing Penetration of Large-Scale Renewable Power Generation" Energies 14, no. 22: 7618. https://doi.org/10.3390/en14227618

APA StyleJohnathon, C., Agalgaonkar, A. P., Kennedy, J., & Planiden, C. (2021). Analyzing Electricity Markets with Increasing Penetration of Large-Scale Renewable Power Generation. Energies, 14(22), 7618. https://doi.org/10.3390/en14227618