Abstract

The largest companies that are part of the energy sector are defined by Forbes as those associated with the production of energy from nonrenewable sources and they play a very significant role in the world economy and in the generation of the command and control (C & C) function of cities. No comprehensive studies are available at the present time illustrating changes in financial performance in relation to the share of the largest firms in the energy sector in terms of their role in the generation of the C & C function. Thus, the aim of the paper is to show changes in financial performance and the impacts of energy sector companies on the C & C function of cities as well as to show spatial variances in the sector’s geography. The energy sector is developing most rapidly in Chinese cities, although it does not play a major role in the most important cities in the world via its impact on the C & C function—this may be due to rapid growth in other sectors of the economy. It is, however, very important in smaller cities. On the other hand, a large share of the energy sector involved in the development of renewable sources of energy may disturb the position of cities whose C & C function relies on energy sector companies. Thus, forecasts are needed for the sector and its impact on the command and control function of cities for the period of transition from nonrenewable sources to renewable ones. One new area of research is the formulation of methods that would allow the determination of the effects of economic recessions in the future on the financial health and C & C function impacts of the energy sector.

1. Introduction

Ongoing economic development and associated increases in industrial production across the world in conjunction with constant population growth in most regions of the Earth yield an increase in demand for electric energy and, consequently, the need for greater power generation [1]. Despite significant technological progress and the introduction of energy-efficient machines and devices, demand for electricity continues to grow across the world’s major economies. Thus, the drive to grow national economies is driving up demand for electricity across the world [2,3]. While increases in demand for electricity are rather small in highly developed countries, demand is growing rapidly in developing regions of the world [4,5]. According to [6], demand for electricity more than doubled in the years 1990–2020 across the world, as did power generation output. The global drop in power consumption in 2020 relative to 2019 equaled only 4% despite widespread lockdowns and transportation restrictions associated with the COVID-19 pandemic. It is noteworthy that the COVID-19 pandemic is producing a significant impact on the world’s energy sector and the shift to renewable energy sources [6].

In fact, power consumption in some countries such as China increased in 2020 despite the various limits on economic activity in that year [7]. This means that demand for power remains high regardless of economic lockdowns lasting from multiple weeks to multiple months. This growth in demand forces a change in the sources of electricity used. Such a change requires capital-intensive investment in order to assure adequate supplies of electricity and to meet ecological demands set forth by governments. This is true of both power generation plants and distribution systems. This also explains why the power generation sector is dominated by rather large companies whose economic potential grows due to mergers and acquisitions. Hence, electricity production firms represent an important element of the economy of every city.

Energy represents a key component of industrial development, which is needed to help other sectors function, including typical industrial sectors, service sectors, agriculture, and also household needs. Thus, it is fundamentally important in the economy of every country in the world, which is why it is the subject of research in many countries, mostly in the context of energy security [8,9,10]. In addition to affecting economic development, the energy sector affects the natural environment, which is especially true of sources of energy based on nonrenewable sources [11]. Thus, the issue of changes in the energy sector is examined by many researchers noting that energy market liberalization in the late 1990s has also helped to produce an impact upon the current state of affairs in the sector. Some researchers also note that the effort to mitigate the effects of climate change is also having an impact on the energy sector. This is due to the signing of the 1997 Kyoto Protocols on the shift toward renewable energy sources [11]. This process of liberalization made it possible for many new companies to enter the energy market, which triggered a change in the business models of existing large companies present in this market for many years. For many companies, this meant deep restructuring. This change applies not only to firms in Central and Eastern Europe that are experiencing deep economic transformation since 1989 [12,13] but also to countries with a stabilized economy. This is due to dynamic political change, especially in the area of industrial policy, energy security, and environmental protection. In addition, market transitions and technological change as well as adaptation to new cleaner energies are forcing shifts in the functioning of the energy sector. A good example of this is Germany [14]. Thus, it is reasonable to consider multiple factors that affect the functioning of companies in the energy sector. This is especially true of companies operating in the European Union and in those countries that have signed climate agreements in line with sustainable development goals set forth by the UN and OECD.

For example, the European Union has proposed a program called the Green Deal [15,16,17], which is set to reduce the negative impact on the natural environment mostly via carbon use reduction in the European energy sector [18] and increased use of renewable energy sources [19,20]. The principles set out in the program are still subject to heated debate, as the implementation of this program would lower the competitiveness level of traditional providers of energy across the continent. In some cases, the program may lead to their bankruptcy. Countries outside of the EU are also noting the need to protect the natural environment via investment in the renewable energy sector due to fears that the supply of fossil fuels may simply run out in the future [21]. It is noteworthy that the integration of renewable energy sources into the world’s energy system is important from the perspective of cities that wish to grow as smart cities [22].

In the modern economy, research on the ownership structure of companies and their linkages with other companies is very important [23]. The largest corporations are studied with respect to their plant location practices and headquarters location strategies as well as performance in the financial sense. This approach is taken by researchers promoting the idea of world cities [24], global cities [25], and the command and control function of cities. The location of corporate headquarters in a city helps create unique command and control functions in that city that make it a center of decision-making in the world [26] (Csomós, 2013). Corporate power tends to extend far beyond the walls of the corporation and often even affects decisions made by the national or regional government. This occurs via corporate financing of political parties that may lead to a power takeover at the top. Today, many corporations wield an immense amount of power in the world of politics—the consequences of which remain unknown [27]. Studies on a number of cities and companies located therein were conducted by a number of researchers from the 1960s to the early 1990s. The research mostly focused on corporation effects on the world economy [28,29,30].

This prompts the questions: In a globalizing world, is it reasonable to only examine a small number of cities acting as global centers of control? Currently it is believed that extensive linkages exist between several hundred cities around the world [23,31,32,33] and that hundreds of cities possess command and control functions [34]. This indicates that a very narrow approach to this subject matter may have been appropriate in the late 20th century but may no longer be valid in the first decades of the 21st century [35]. Corporations listed in Forbes Global 2000 are rapidly expanding their revenues, which stood only at USD 31 billion in 2006 but was USD 45 billion in 2016 [36]. Thus, it is reasonable to consider the impacts of the largest 2000 firms in the world, as listed by Forbes [37]. This type of research also helps to determine the center of gravity of corporate financial performance, which is moving from Western countries to East Asia [38]. The command and control function is mostly examined in terms of spatial distribution and key sector variances across the world [26], continental variances [39,40], and subcontinental [41,42], and country-scale variances [43,44,45].

Thus, investment in renewable sources of energy poses a challenge to many companies in the energy sector, but it is also an opportunity to accelerate growth due to strong support from many governments in the EU and outside of it. The overarching goal of many governments is to trigger a change in the structure of the energy sector in the direction of renewable resources. In this context, it is critical to examine the state of this sector and the role that it plays in the command and control function of the world economy in the period preceding major changes in the sector, especially in the EU.

According to Forbes Global 2000 reports, the energy sector consists of two subsectors: oil and gas operations and oil services and equipment, both of which are nonrenewable energy subsectors. The largest companies in the energy sector, as defined by Forbes, play a key role in the world economy. This is the second largest sector in terms of financial performance, after the financial services sector. While energy sector companies are some of the most important companies in the world [34] and global demand for energy is now growing, the supply side increasingly often relies on production using renewable sources. This sector also generates many jobs and, in the event that it does decline, its role in the C & C function may also decline along with its role in the local and regional economy. This context creates the need to examine changes in the financial performance of the largest companies in the studied energy sector.

Currently, there are no studies available that would provide a comprehensive picture of changes in the financial performance and market share of the largest energy companies and their effects on the command and control function of cities. Thus, the purpose of the present paper is to show changes in the financial performance and influence of companies in the energy sector in relation to the C & C function and its spatial variances across the world.

2. Data and Methods

The study focuses on firms in the “energy sector” as defined by the Global Industry Classification Standard (GICS) used in Forbes Global 2000 reports. This classification system is frequently used in research on control and command variances between major cities [37,38,46]. This definition includes firms associated with the oil and gas industry or fairly conventional sources of energy. Hence, the term “energy sector” used in this paper refers mostly to firms associated with the utilization of nonrenewable sources of energy such as solid, liquid, and gas fuels that remain staple fuels in the modern economy. Thus, it is important to note that the energy sector includes a broad array of companies that may be part of other sectors according to GICS. In this paper, the energy sector is defined as the sector based on firms that produce energy based on nonrenewable resources.

In light of the change in energy policy in highly developed countries in the direction of so-called sustainable energy sources based on renewable forms of energy [14,47,48], such an approach to analysis allows to capture the extent to which energy sector firms that use traditional energy sources are still able to exert influence on the command and control function of cities in the world economy. It seems that their role will decline over time due to the emergence of firms producing energy based on an array of renewable sources and the decline in the use of traditional cars powered by gasoline engines in favor of cars powered by electricity. Hence, many companies are beginning to diversify their portfolios in the direction of renewable energy sources, keeping in mind that demand for electricity will increase in the presence of an ever-increasing number of electric cars. This type of analysis makes it possible to assess the role of the traditional energy sector based on fossil fuels in the generation of the C & C function of cities around the world prior to its entry upon the path of sustainable energy source use in developed economies in the years to come.

The present study examines data from companies listed by Forbes Global 2000 for the period 2006–2018. Forbes used four parameters to create their list of the largest 2000 public companies: revenue, net income, assets, and market value. The companies listed by Forbes were placed in 10 distinct sectors based on GICS classifications: consumer discretionary, consumer staples, energy, financials, healthcare, industrials, information technology, materials, telecommunication services, and utilities. The data provided by Forbes 2000 have been used in the analysis of the command and control function of cities [37,46,49,50]. In the paper, we examine the energy sector and its impact on the C & C function of cities. The companies in our study were classified as energy sector entities by GICS. The corporate headquarters of 2000 companies covered by Forbes every year were examined based on their geographic location. The smallest number of cities occurred in 2006 at 353, while highest number was in 2012 at 408. The studied corporate headquarters for the energy sector were located in only a few dozen cities across the world. The smallest number of cities was noted in 2018 at 46, while the largest was in 2013 at 61.

Corporate financial performance data were used to calculate a financial performance index for metropolitan areas around the world (. The index is calculated as the sum of the proportion of financial performance data, expressed in USD (sales—S, assets—A, market value—MV). These data were obtained for cities that were part of metropolitan areas around the world and were compared to data totals for all the major metropolitan areas studied.

S—sales (billion USD); P—profits (billion USD); A—assets (billion USD); MV—market value (billion USD); om—metropolitan area; x—city.

In the same way as for the relative financial performance index ( for all companies listed on Forbes Global 2000 list, the was calculated. In this case, only data for cities for the energy sector were calculated.

S—sales (billion USD); P—profits (billion USD); A—assets (billion USD); MV—market value (billion USD); om—metropolitan area; xe—city with energy sector firms.

The value of the command and control index for cities without an energy sector (energy finoenergy) was calculated by subtracting the value of the relative index of financial performance of the energy sector () from the value of the relative index of financial performance of major metropolitan areas ().

In order to assess the significance of the energy sector, En index values normalized using the mean and standard deviation for fiom values were compared for all sectors and for all sectors without the energy sector (fiom − fienergy). A value of one means a lack of change. A value of less than one means high significance of the energy sector, while more than one means low significance of the sector in the generation of the command and control function of a city.

3. Results

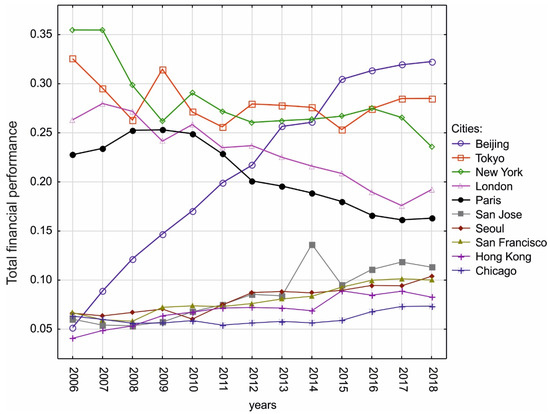

Financial performance data for each major metropolitan area, without division into specific sectors, were graphed to show changes in fiom for the period 2006–2018. Given the set of analyzed cities, the largest change was noted for Beijing from 0.05 in 2006 to 0.32 in 2018. This was one of the largest percentage gains in the studied period of time (640%). The largest increases were observed in the years 2006–2013 when the annual average reached almost 50%, with the annual average being only about 40% for the entire study period. Extremely high growth above 1000% was noted for the Chinese cities of Shenzhen and Shanghai, although the changes affected very low values—from 0.005 to 0.06 (Figure 1). A similar situation was observed for cities where energy sector firms showed weaker financial performance and fluctuations, therein, had led to large changes in index values. The cities of Bogota, Tianjin, and Manila recorded changes over 500%. In Europe, large changes were noted for the cities of Eindhoven, Valencia, Leuven, and Zurich (more than 300% each).

Figure 1.

Total financial performance of companies in all sectors listed in Forbes Global 2000 for cities with the highest performance in the years 2006–2018.

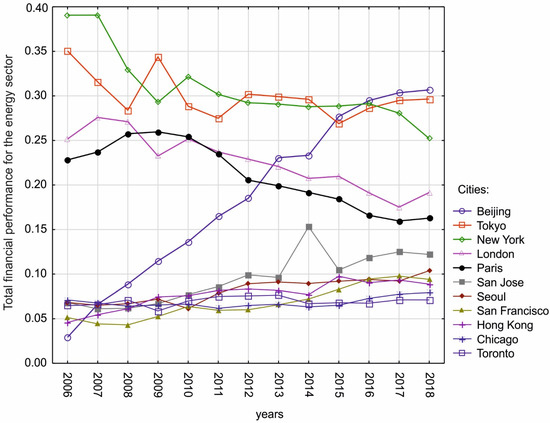

In the same period of time, cities with the highest index values (more than 0.20) experienced a decline (i.e., Paris and London) or stagnation with a small decline (Tokyo and New York). The largest decline for New York and Tokyo occurred in the years 2006–2009, which may have been caused by the Global Financial Crisis of 2008. On the other hand, large declines were not noted for London and Paris, as these cities experienced the largest declines after the year 2012 (Figure 2). Beijing noted the largest relative growth from 0.25 to 0.49 or about 96% relative to the start of the study period. The largest increase occurred in the years 2006–2010 during the years of the Global Financial Crisis of 2008. It appears that this crisis did not affect the energy sector in the city of Beijing. Another city characterized by large values of the financial index and large increases in this index for the energy sector was Moscow—rising from 0.20 to 0.37, for a growth of 85%.

Figure 2.

Total financial performance for the energy sector for metropolitan areas with the strongest financial performance in the years 2006–2018.

High index values were noted in the study period 2006 to 2018 for Dallas, Houston, and the Hague (over 0.35 in 2006); however, all three cities also noted a decline of about 28.7%, with the city of Houston experiencing the largest decline of 39.8%. Declines in the United States occurred mostly during the 2008 Global Financial Crisis, which was not the case for Beijing and Moscow. This suggests that the rise in the significance of the energy sector in the generation of the C & C function of Beijing and Moscow was also due to declines in the financial performance of the energy sector in Europe and North America. For example, New York experienced a decline of 93.1%, London and Denver 50% each, and Rome and Madrid about 40% each (Figure 2). Other cities characterized by strong financial performance in the energy sector and growth at about 25% were New Delhi, Tokyo, and San Antonio. In the case of Tokyo, the increase occurred after the year 2013. After 2016, large increases were noted for cities such as Tarko-Sale (almost 400%), Mumbai, Bangkok, and Almetyevsk (over 100%). Strong growth was also noted for Seoul and the city of Płock in Poland. However, aside from the cities of Mumbai and Bangkok, all the other cities possess a weak command and control function.

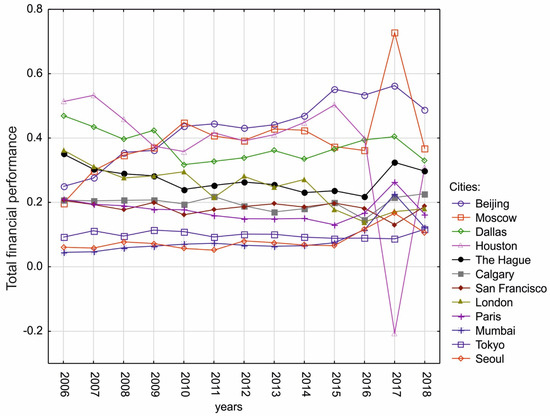

The significance of the energy sector in cities varies. The paper considers only cities with the highest fiom potential and at least two major sectors of the economy. The largest share of the energy sector in the C & C function was noted for Calgary (9% growth) and San Antonio (12% growth). In the latter case, as in the case of many other cities with a strong energy sector (i.e., Budapest, the Hague), the share of this sector increased after the 2008 Global Financial Crisis, lasting until 2012–2013. The following cities noted a decline: Beijing −28.5%, New Delhi −14%, Perth −13.7%, Moscow −12%, and San Francisco −11.8%. Major urban centers of command and control such as Tokyo and New York were not found to be affected by large changes (Figure 3).

Figure 3.

Share of the financial performance of the energy sector in the generation of the command and control function of cities where the energy sector was the dominant sector in 2006–2018.

Companies and consequently cities not listed by Forbes experienced growth throughout the entire study period, i.e., Lisbon with 10% growth in the years 2007–2018. Some were characterized by an energy sector that did not contribute a great deal to the city command and control function, i.e., Helsinki (growth from 4.9% to 9.6%). On the other hand, small and large cities mentioned on the Forbes Global 2000 list, such as Almetyevsk, Findlay, Mailiao Township, Midland, Texas, Oklahoma City, Płock, Stavanger, Surgut, and Tarko-Sale were only there because of their energy sector.

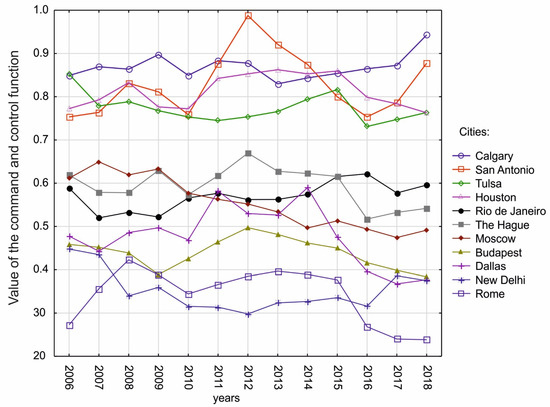

Looking at the rank of cities in terms of the C & C function and cities without the energy sector (), one may observe that the energy sector is not very relevant in cities characterized by a high total C & C function value (Figure 4). Compared with data in Figure 1, the significance of Beijing was smaller, while that of Toronto was greater.

Figure 4.

Value of the command and control function without considering the energy sector in the years 2006–2018.

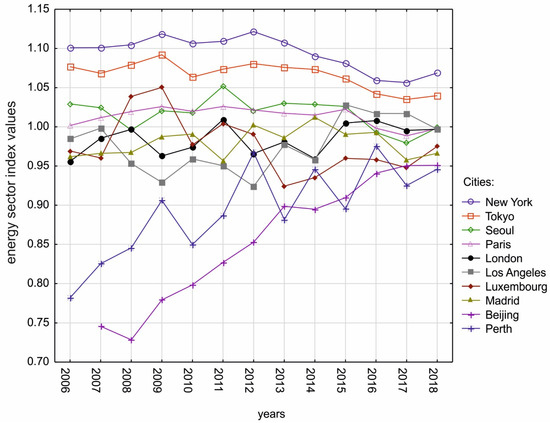

Today, cities characterized by the strongest command and control function in the world are Beijing, Tokyo, New York, London, and Paris [51]. When considering the top five cities, both New York and Tokyo are characterized by a stronger C & C function when the energy sector is excluded from the calculation (1.07 and 10.4, respectively) compared to the total value with the energy sector included. This means that the significance of this sector in generating the C & C function in these cities is low. In the case of Paris and London, this value fluctuated around 1.0 from year to year, settling on a final value of 0.99 at the end of the study period, which means that the energy sector does not affect the C & C function of these cities. A similar situation was observed for the city of Seoul. In Beijing, the decline in the relevance of the energy sector in the generation of the C & C function was significant—beginning with 0.56 in 2006 to 0.95 in 2018. In effect, this means that other sectors are developing much more rapidly than the energy sector. A similar situation was also observed for Perth and Mumbai as well as Moscow but to a lesser extent (Figure 5).

Figure 5.

Comparison of energy sector index values for selected cities with the strongest financial performance in the years 2006–2018.

Changes in other cities were not substantial and were characterized by a general decline of the energy sector prior to the 2008 Global Financial Crisis and an increase in significance during the crisis itself, followed by another decline until the year 2012. In many major cities, the energy sector experienced a resurgence in the years 2012–2017. Nevertheless, these are values above one, and this means that the command and control function of the city was stronger without the energy sector. This is in part due to the uneven distribution of this sector among cities with this function and in part due to large variances in the potential of this sector. In short, cities with a weak C & C function can be quite significant in terms of the energy sector, which strengthens the potential of these cities, but at the expense of being dependent on a single sector of the economy.

In large cities, the energy sector does not play a substantial role in the generation of the C & C function. As an economy becomes more sophisticated, the significance of the energy sector declines, as other sectors grow faster. On the other hand, in cities with a strong C & C function, this sector may become stronger to become one of the dominant sectors of the given city’s economy.

4. Discussion

Of the cities noted in Forbes Global 2000, the largest gains in terms of corporate financial performance were noted for Chinese cities such as Beijing, Shenzhen, and Shanghai. At the same time, cities with the strongest C & C function (i.e., Tokyo, New York, Paris, London) experienced small declines. In terms of the financial performance of the energy sector itself, Beijing is the dominant city and is experiencing growth, while most cities in Europe and North America are declining. While the energy sector is one of the most important sectors generating the C & C function of cities, it is not very relevant in cities with a very strong C & C function. Its share in the top five cities in terms of C & C is not great. It is dominant in cities with few economic sectors. The energy sector has a significant share of the potential of the C & C function in North American cities such as Calgary, Tulsa, San Antonio, and Houston. However, it is important to note that these cities have values over 1.0—in effect, the potential of their C & C function is larger without the energy sector. This occurs due to the uneven distribution of this sector among cities with the C & C function as well as large variances in the strength of the sector itself. Thus, cities with a weak C & C function have a strong energy sector, which does help them stand out due to this sector but also makes them exceedingly reliant on this sector.

The analysis of the energy sector based on the GICS classification—the sector based on nonrenewable sources of energy—indicates that the high impact of this sector on the C & C function of cities does not have to be a negative factor. In the 21st century, Chinese cities are gaining in importance in terms of their C & C function and are gaining rapidly. The rapid growth of Chinese cities in the energy sector is due to the country’s rapid rate of industrialization [52], which is why Beijing is now ranked as one of the most important cities worldwide in terms of the C & C function [26]. However, in the paper, we do argue that a city’s overreliance on the energy sector and its basis in nonrenewable energy sources may cause a negative impact in the future in light of the fact that now renewable sources of energy are gaining traction in the world markets.

The energy sector does not play a major role in the generation of the C & C function in major cities. The significance of this sector declines with increasing economic development due to a strong surge by companies that are part of other sectors of the economy. On the other hand, in cities with a strong C & C function, the energy sector can become one of the dominant sectors of the economy. Thus, it may be argued that, in cities with the strongest C & C function, the energy sector is actually a burden on the local economy, and these strong cities could be even stronger without the energy sector. One positive development among the Great Five (i.e., Beijing, New York, London, Tokyo, Paris) is the fact that the energy sector has become more important in these cities, especially after 2012.

One general way to summarize the situation is to assert that the energy sector and its role in the generation of the C & C function of cities is greatest in developing countries and in countries that produce mined raw materials. This pattern is problematic, as in the event of economic crisis or the bankruptcy of a major company, the entire city and region may decline in terms of the C & C function. One corporate bankruptcy may downgrade the economic status of an entire city or region [42]. On the other hand, cities that are not well known around the world can make their mark on the world by exporting a strong corporate brand. Zurich is one such example in the area of financial services. Milan is a strong brand in the area of fashion [53]. Thus, it may be argued that the presence of the energy sector in a city and its impact on its C & C function may serve to create a recognizable global brand for smaller cities around the world.

It seems that the energy sector is also bound to play a key role in the generation of the C & C function in the future. Growth in this sector and its shift toward renewable sources of energy stimulate the development of other economic sectors. In today’s world, the energy sector has in fact become an innovative sector characterized by a search for new sources of energy and research on renewable sources of energy. It appears that advanced economies are making the shift to renewable energy sources more rapidly. The ability and willingness of actors to make the shift is partly limited by national energy policy and different investment conditions in different countries [54]. The energy transition in the European Union [55] and in other highly developed regions of the world is the result of climate and energy policies and should trigger innovation and new growth in this sector and in sectors associated with the production of energy using various renewable sources. On the other hand, limits on the production of energy from nonrenewable sources (especially anthracite and brown coal) resulting from these policies may lead to limits on the role of traditional energy companies. However, these are attempting to adapt. Recent changes in the legal environment of energy production and new challenges in the market for energy are being reflected in actions taken by these companies. New R & D positions are being created by traditional companies to meet demand for new energy research, and new investment is growing in renewable energy sources. In effect, the significance of the energy sector may in fact increase in the future in relation to the C & C function of cities. In addition, the ongoing process of globalization [56] is creating opportunities for development across the energy sectors of developing countries [57].

Finally, the ongoing COVID-19 pandemic has somewhat reduced global demand for various forms of energy. Thus, energy usage forecasts created prior to the pandemic may be inaccurate. The various usage forecasts produced based on population growth and manufacturing growth need to be revised [58,59]. The need for any type of revision creates new opportunities for research in the years to come. More research is thus needed on the energy sector broadly defined by GICS. This may be especially true of cities that rely on the energy sector for strong inputs into their C & C function. Cities with a strong energy sector in most cases were already on the decline even prior to the pandemic. The new post-pandemic world economy may push many smaller cities out of the realm of the C & C function and its benefits.

5. Conclusions

Large corporations play an increasingly leading role in the world economy, and this includes firms in the energy sector. However, the role of energy sector firms has declined in the last decade. Even in the face of decline, this is an important sector in the world economy. Companies in other sectors cannot function in the absence of sources of energy, and this is true regardless of country. In most cases, the energy sector relies on nonrenewable sources of energy, although it is investing funds in the development of more ecological sources. The purpose of this shift is to attain at least a partial transition to sustainable development, as defined in the Goals for Sustainable Development stated by the United Nations. This is reflected in the national energy policy of many countries, especially those in the European Union [55]. Many countries are introducing limits on the production of energy from nonrenewable sources and promoting the use of renewable sources. Policies of this type were discussed in Glasgow in 2021 and may force some companies to search for alternative lines of business in the nonrenewable energy sector in order to maintain their strong position in the global economy and influence on the C & C function of cities.

Thus, the energy sector is important in the area of research, as it impacts the C & C function of cities and the world economy as a whole. The COVID-19 pandemic has impacted national economies and the energy sector itself, which leads to the need for research on the state of the sector before and after the pandemic and its impacts on the C & C function. Yet another area for new research is the formulation of research methods that would make it possible to determine the effects of future economic recessions on the financial state of the world’s energy sector.

Our research results may be useful in the determination of energy policy and urban policy as well as in urban area management. Such policies should factor in the declining role of traditional producers of energy and the opportunities associated with production using renewable sources. This shift in thinking may help cities generate jobs and enhance the impact of the newly emerging renewable energy sector in their C & C function.

It is important to note that the energy sector, as defined by GICS, consists of companies in the area of oil and gas extraction and processing as well as companies that use water, sunlight, and nuclear energy to produce useful forms of energy. The last group consists of public utilities that may be part of other GICS-defined sectors of the economy. This yields a number of analytical problems, as the GICS-defined energy sector includes public utility companies from other GICS-defined sectors—making some comparisons impossible. Future research should also focus on the identification of all energy-related firms listed in Forbes Global 2000, as this would enable an analysis of both renewable and nonrenewable sources of energy and the companies that utilize them. This more holistic view of the energy sector may help to produce a more complete picture of the impact of this sector on the C & C function of economically vital cities around the world.

Author Contributions

Conceptualization, P.R. and T.R.; Data curation, A.W.-R.; Formal analysis, S.D. and A.W.-R.; Investigation, P.R.; Methodology, S.D.; Resources, T.R.; Software, S.D.; Validation, A.W.-R.; Visualization, S.D.; Writing—original draft, P.R. and T.R.; Writing—review & editing, P.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

https://www.forbes.com/lists/global2000/#a828b515ac04 (accessed on 10 October 2021).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Türkan, S.; Ozel, G. Determinants of electricity consumption based on the NUTS regions of Turkey: A panel data approach. Reg. Stat. 2019, 9, 120–134. [Google Scholar] [CrossRef]

- Sun, M.; Wang, X.; Chen, Y.; Tian, L. Energy resources demand-supply system analysis and empirical research based on non-linear approach. Energy 2011, 36, 5460–5465. [Google Scholar] [CrossRef]

- Yildirim, H.H. Economic Growth and Energy Consumption for OECD Countries. In Regional Studies on Economic Growth, Financial Economics and Management. Eurasian Studies in Business and Economics; Bilgin, M., Danis, H., Demir, E., Can, U., Eds.; Springer: New York, NY, USA, 2017; pp. 245–255. [Google Scholar]

- Akinlo, A.E. Energy consumption and economic growth: Evidence from 11 Sub- Sahara African countries. Energy Econ. 2008, 30, 2391–2400. [Google Scholar] [CrossRef]

- Wang, S.; Li, Q.; Fang, C.; Zhou, C. The relationship between economic growth, energy consumption, and CO2 emissions: Empirical evidence from China. Sci. Total Environ. 2016, 542, 360–371. [Google Scholar] [CrossRef]

- Hoang, A.T.; Nižetić, S.; Olcer, A.I.; Ong, H.C.; Chen, W.H.; Chong, C.T.; Thomas, S.; Bandh, S.A.; Nguyen, X.P. Impacts of COVID-19 pandemic on the global energy system and the shift progress to renewable energy: Opportunities, challenges, and policy implications. Energy Policy 2021, 154, 112322. [Google Scholar] [CrossRef]

- Global Energy Statistical Yearbook. 2021. Available online: https://yearbook.enerdata.net/total-energy/world-consumption-statistics.html (accessed on 5 October 2021).

- Ellenbeck, S.; Beneking, A.; Ceglarz, A.; Schmidt, P.; Battaglini, A. Security of Supply in European Electricity Markets—Determinants of Investment Decisions and the European Energy Union. Energies 2015, 8, 5198–5216. [Google Scholar] [CrossRef]

- Carlini, E.M.; Caprabianca, M.; Falvo, M.C.; Perfetti, S.; Luzi, L.; Quaglia, F. Proposal of a New Procurement Strategy of Frequency Control Reserves in Power Systems: The Italian Case in the European Framework. Energies 2021, 14, 6105. [Google Scholar] [CrossRef]

- Sotnyk, I.; Kurbatova, T.; Kubatko, O.; Prokopenko, O.; Prause, G.; Kovalenko, Y.; Trypolska, G.; Pysmenna, U. Energy Security Assessment of Emerging Economies under Global and Local Challenges. Energies 2021, 14, 5860. [Google Scholar] [CrossRef]

- Leisen, R.; Steffen, B.; Weber, C. Regulatory risk and the resilience of new sustainable business models in the energy sector. J. Clean. Prod. 2019, 219, 865–878. [Google Scholar] [CrossRef]

- Rachwał, T. Industrial restructuring in Poland and other European Union states in the era of economic globalization. Procedia Soc. Behav. Sci. 2011, 19, 1–10. [Google Scholar] [CrossRef]

- Rachwał, T. Structural changes in Polish industry after 1989. Geogr. Pol. 2015, 88, 575–605. [Google Scholar] [CrossRef]

- Rösch, C.; Bräutigam, K.R.; Kopfmüller, J.; Stelzer, V.; Fricke, A. Sustainability assessment of the German energy transition. Energy Sustain. Soc. 2018, 8, 12. [Google Scholar] [CrossRef]

- Kougias, I.; Taylor, N.; Kakoulaki, G.; Jäger-Waldau, A. The role of photovoltaics for the European Green Deal and the recovery plan. Renew. Sustain. Energy Rev. 2021, 144, 111017. [Google Scholar] [CrossRef]

- Pietzcker, R.C.; Osorio, S.; Rodrigues, R. Tightening EU ETS targets in line with the European Green Deal: Impacts on the decarbonization of the EU power sector. Appl. Energy 2021, 293, 116914. [Google Scholar] [CrossRef]

- Ringel, M.; Bruch, N.; Knodt, M. Is clean energy contested? Exploring which issues matter to stakeholders in the European Green Deal. Energy Res. Soc. Sci. 2021, 77, 102083. [Google Scholar] [CrossRef]

- Dolge, K.; Blumberga, D. Economic growth in contrast to GHG emission reduction measures in Green Deal context. Ecol. Indic. 2021, 130, 108153. [Google Scholar] [CrossRef]

- Bogdanov, D.; Gulagi, A.; Fasihi, M.; Breyer, C. Full energy sector transition towards 100% renewable energy supply: Integrating power, heat, transport and industry sectors including desalination. Appl. Energy 2021, 283, 116273. [Google Scholar] [CrossRef]

- Defeuilley, C. Energy transition and the future(s) of the electricity sector. Utilities Policy 2019, 57, 97–105. [Google Scholar] [CrossRef]

- Opan, M.; Ünlü, M.; Özkale, C.; Çelik, C.; Saraç, H.I. Optimal energy production from wind and hydroelectric power plants. Energy Sources Part A Recovery Util. Environ. Eff. 2019, 41, 2219–2232. [Google Scholar] [CrossRef]

- Hoang, A.T.; Pham, V.V.; Nguyen, X.P. Integrating renewable sources into energy system for smart city as a sagacious strategy towards clean and sustainable process. J. Clean. Prod. 2021, 305, 127161. [Google Scholar] [CrossRef]

- Śleszyński, P. Research Topics of Geography of Enterprise and Decision-Control Functions in Poland against Global Trends. Prace Komisji Geografii Przemysłu Polskiego Towarzystwa Geograficznego 2018, 32, 23–47. [Google Scholar] [CrossRef]

- Friedmann, J.; Wolff, G. World city formation: An agenda for research and action (urbanization process). Int. J. Urban Reg. Res. 1982, 6, 309–344. [Google Scholar] [CrossRef]

- Hymer, S. The multinational corporation and the law of uneven development. In Economics and World Order from the 1970s to the 1990s; Bhagwati, J., Ed.; Collier-MacMillan: New York, NY, USA, 1972; pp. 113–140. [Google Scholar]

- Csomós, G. The Command and Control Centers of the United States (2006/2012): An Analysis of Industry Sectors Influencing the Position of Cities. Geoforum 2013, 12, 241–251. [Google Scholar] [CrossRef]

- Taylor, P.J. The New Political Geography of Corporate Globalization. L’Espace Politique 2017, 3. Available online: https://journals.openedition.org/espacepolitique/4330 (accessed on 29 October 2021).

- Hall, P. The World Cities; Heinemann: London, UK, 1966. [Google Scholar]

- Friedmann, J. The world city hypothesis. Dev. Change 1986, 17, 69–83. [Google Scholar] [CrossRef]

- Sassen, S. The Global City: Strategic Site/New Frontier. Am. Stud. 2000, 41, 79–95. [Google Scholar]

- Beaverstock, J.V.; Smith, R.G.; Taylor, P.J. A roster of world cities. Cities 1999, 16, 445–458. [Google Scholar] [CrossRef]

- Rozenblat, C.; Pumain, D. Firm linkages, innovation and the evolution of urban systems. In Cities in Globalization Practices Policies and Theories; Taylor, P., Ed.; Routledge: London, UK, 2007; pp. 130–156. [Google Scholar]

- Neal, Z.; Derudder, B.; Taylor, P.J. Should I Stay or Should I Go: Predicting Advanced Producer Services Firm Expansion and Contraction. Int. Reg. Sci. Rev. 2019, 42, 207–229. [Google Scholar] [CrossRef]

- Csomós, G. Cities as Command and Control Centres of the World Economy: An Empirical Analysis, 2006–2015. Bull. Geogr. Socio-Econ. Ser. 2017, 38, 7–26. [Google Scholar] [CrossRef]

- Parnreiter, C. Global cities and the geographical transfer of value. Urban Stud. 2019, 56, 81–96. [Google Scholar] [CrossRef]

- Dorocki, S.; Raźniak, P.; Winiarczyk-Raźniak, A. Zmiany funkcji kontrolno-zarządczych w miastach europejskich w dobie globalizacji. Prace Komisji Geografii Przemysłu Polskiego Towarzystwa Geograficznego 2018, 32, 128–143. [Google Scholar] [CrossRef]

- Taylor, P.; Csomós, G. Cities as control and command centres: Analysis and interpretation. Cities 2012, 29, 408–411. [Google Scholar] [CrossRef]

- Raźniak, P.; Dorocki, S.; Winiarczyk-Raźniak, A. Spatial changes in the command and control function of cities based on the corporate centre of gravity model. Misc. Geogr. 2020, 24, 35–41. [Google Scholar] [CrossRef]

- Dorocki, S.; Raźniak, P.; Winiarczyk-Raźniak, A. Changes in the command and control potential of European cities in 2006–2016. Geogr. Pol. 2019, 92, 275–288. [Google Scholar] [CrossRef]

- Zdanowska, N.; Rozenblat, C.; Pumain, D. Evolution of urban hierarchies under globalization in Western and Eastern Europe. Reg. Stat. 2020, 10, 1–23. [Google Scholar] [CrossRef]

- Zdanowska, N. Distribution of foreign direct investment across the national urban systems in countries of Central and Eastern Europe in 2013. Geogr. Pol. 2017, 90, 5–24. [Google Scholar] [CrossRef]

- Raźniak, P.; Dorocki, S.; Winiarczyk-Raźniak, A. Economic resilience of the command and control function of cities In Central and Eastern Europe. Acta Geogr. Slov. 2020, 60, 95–105. [Google Scholar] [CrossRef]

- Śleszyński, P. Gospodarcze funkcje kontrolne w przestrzeni Polski. Prace Geograficzne 2007, 213. [Google Scholar]

- Csomós, G. The ranking of cities as centres of the Hungarian economy, 1992–2012. Reg. Stat. 2015, 1, 66–85. [Google Scholar] [CrossRef]

- Freke, C.; Derudder, B. Changing Connectivities of Chinese Cities in World City Network, 2010–2016. Chin. Geogr. Sci. 2018, 28, 183–201. [Google Scholar]

- Csomós, G.; Derudder, B. Ranking Asia-Pacific cities: Economic performance of multinational corporations and the regional urban hierarchy. Bull. Geogr. Socio-Econ. Ser. 2014, 25, 69–80. [Google Scholar] [CrossRef][Green Version]

- Kern, F.; Smith, A. Restructuring energy systems for sustainability? Energy transition policy in the Netherlands. Energy Policy 2008, 36, 4093–4103. [Google Scholar] [CrossRef]

- Verhoog, R.; Finger, M. Governing Energy Transitions: Transition Goals in the Swiss Energy Sector. In Energy and Finance; Dorsman, A., Arslan-Ayaydin, Ö., Karan, M., Eds.; Springer: New York, NY, USA, 2016; pp. 107–121. [Google Scholar]

- Raźniak, P.; Dorocki, S.; Rachwał, T.; Winiarczyk-Raźniak, A. Znaczenie sektora energetycznego w kreowaniu funkcji kontrolno-zarządczych miast na świecie. Rynek Energii 2020, 5, 12–20. [Google Scholar]

- Raźniak, P.; Dorocki, S.; Rachwał, T.; Winiarczyk-Raźniak, A. Influence of Energy Sector Corporations on the Corporate Control Functions of Cities. Int. J. Energy Econ. Policy 2021, 11, 333–340. [Google Scholar] [CrossRef]

- Raźniak, P.; Csomós, G.; Dorocki, S.; Winiarczyk-Raźniak, A. Exploring the Shifting Geographical Pattern of the Global Command-and-Control Function of Cities. Sustainability 2021, in press. [Google Scholar]

- Wang, Y.; Teter, J.; Sperling, D. China’s soaring vehicle population: Even greater than forecasted? Energy Policy 2011, 39, 3296–3306. [Google Scholar] [CrossRef]

- Anttiroiko, A.V. City branding as a response to global intercity competition. Growth Chang. 2015, 46, 233–252. [Google Scholar] [CrossRef]

- Chen, Y.; Wang, Z.; Zhong, Z. CO2 emissions, economic growth, renewable and non-renewable energy production and foreign trade in China. Renew. Energy 2019, 131, 208–216. [Google Scholar] [CrossRef]

- Allen, M.L.; Allen, M.M.C.; Cumming, D.; Johan, S. Comparative Capitalisms and Energy Transitions: Renewable Energy in the European Union. Br. J. Manag. 2021, 32, 611–629. [Google Scholar] [CrossRef]

- Taylor, P.J.; Derudder, B. NY-LON 2020: The changing relations between London and New York in corporate globalization. Trans. Inst. Br. Geogr. 2021. Available online: https://rgs-ibg.onlinelibrary.wiley.com/doi/10.1111/tran.12498 (accessed on 29 October 2021). [CrossRef]

- Artoiñigo, I.; Capellán-Pérez, I.; Lago, R.; Bueno, G.; Bermejo, R. The Energy Requirements of a Developed World. Energy Sustain. Dev. 2016, 33, 1–13. [Google Scholar]

- Tóth, G.; Sebestyén Szép, T. Spatial Evolution of the Energy and Economic Centers of Gravity. Resources 2019, 8, 100. [Google Scholar] [CrossRef]

- Kaytez, F.; Taplamacioglu, C.M.; Cam, E.; Hardalac, F. Forecasting electricity consumption: A comparison of regression analysis, neural networks and least squares support vector machines. Int. J. Electr. Power Energy Syst. 2015, 67, 431–438. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).