1. Introduction

Climate change is one of the most relevant issues on a global scale. It is forcing the rethinking of all practices related to human activity, especially the industrial ones. According to the Intergovernmental Panel on Climate Change, the most negative impact on the current global warming is represented by the influence of human activities on the environment, which is typically measured through the quantification of greenhouse gases (GHG) emissions (i.e., CO

2, CH

4, NO

x, and F-bearing gases). The “Green Impact” indicates all activities aiming at measuring and minimizing the adverse effects on the environment of industrial activities [

1]. It is estimated that the current trend in GHG generation will lead to a global temperature rise of 3–5 °C by 2100. Therefore, to counter this alarming trend, 2 °C was set at the 2015 COP 21/CMP 11 Conference of the United Nations as the allowed limit for global warming by 2050; then, it was lowered to 1.5 °C at the COP 24 meeting in 2018. To meet these limits, it would be necessary to reduce current emissions by 80% by 2050 [

2]. Consistently, policies have been adopted at the European level to counter climate change and transform the EU into an energy-efficient and low-carbon economy. To this end, in February 2011, the European Council reconfirmed the EU objective of reducing greenhouse gas emissions by 80–95% by 2050 compared to 1990 [

3]. In April 2021, the Council’s and the European Parliament’s negotiators reached an agreement ensuring a climate-neutral EU by 2050, reducing at least 55% by 2030 compared to 1990 of net greenhouse gas emissions [

4]. On the one hand, global policies are targeting to reduce the impact of human activity on the environment. On the other hand, due to the fourth and fifth industrial revolutions [

5], the rapid growth of industrial applications leads to greater pollution due to anthropogenic carbon emissions. Therefore, it is mandatory and urgent to investigate all fields to find solutions to reduce emissions and fight climate change.

In terms of sustainability assessment, according to the triple bottom line approach (i.e., economic, environmental, and social factors) [

6], there are mathematical models developed to calculate the performance of companies, with an emphasis on studies conducted in the sectors of construction, agriculture, and manufacturing [

7]. In this context, the steelmaking sector is of utmost relevance. Indeed, steelmaking is an extremely energy-intensive and carbon-dependent process, resulting in significant direct emissions of CO

2. Although in the last few years, the large spread of sensors’ data processing [

8] has improved the performance of steelmaking processes, allowing monitoring online the dangerous airborne pollutants and reducing waste production. It is estimated that for 2018, emissions from global steel production represented 7–9% of direct emissions generated by the use of fossil fuels, with a specific emissions value of 1.8 tCO

2/t steel [

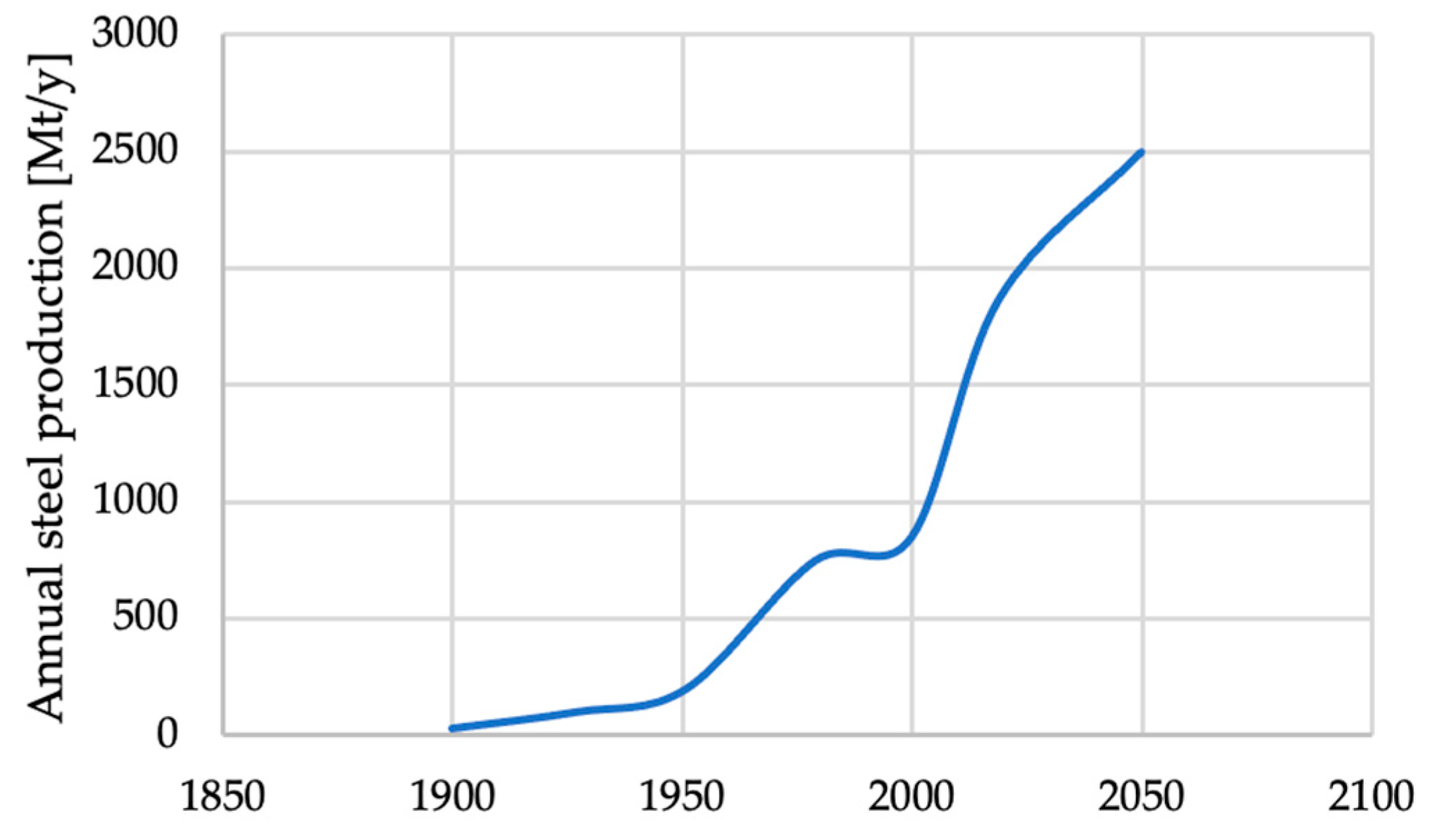

9]. As can be observed in

Figure 1, global steel production is expected to grow up to 2500 Mt/y by 2050, which would entail, following the current production process, the generation of 4500 tCO

2/y, which is a value that is not consistent with the achievement of the aforementioned objectives [

2].

The main steel production process is represented by the so-called primary steel production route or integrated steel production route. The process adopts a furnace to produce coke, a blast furnace (BF), and a basic oxygen furnace (BOF); this route is also called the BF-BOF route. The hard coal is transformed into coke through the coke oven, which, together with the agglomerated iron ores (pelleted, sintered) and coal, feeds the BF to produce pig iron. The carbon content is subsequently reduced in the BOF, resulting in the production of liquid steel (

Figure 2).

Table 1 shows the direct CO

2 emissions and direct energy consumption values by plants adopted in the production process.

As can be observed, the main sources of CO

2 emissions and energy consumption are the coke plant and the BF. The secondary steel production route (

Figure 2) is the most promising alternative to produce steel and reduce CO

2 emissions. It consists of melting 100% of recycled steel scrap in an electric arc furnace (EAF). In this case, the direct CO

2 emissions and the energy consumption generated by the process would be only those related to the EAF, which are equal to 0.240 tCO

2/t crude steel and 2.505 GJ/t crude steel, respectively [

3].

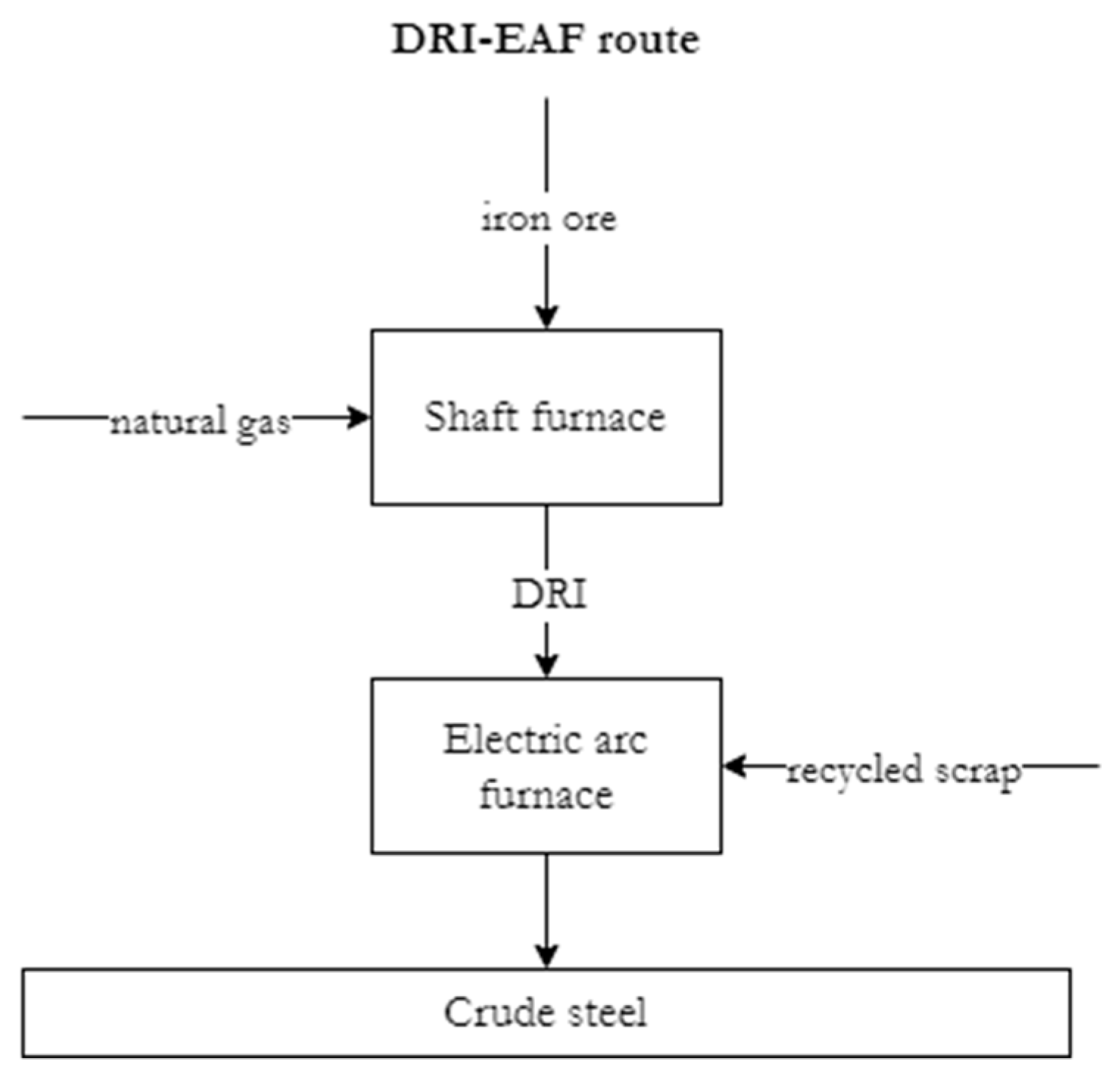

Further alternatives to reduce the environmental impact due to carbon emissions include the adoption of the direct reduced iron (DRI), which is also called iron sponge. DRI is produced from the reaction between iron oxides at the solid state (below the fusion temperature of pure iron, 1535 °C), hydrocarbon gases, and/or carbon-bearing materials. DRI is a highly metallized solid (i.e., metallization degree around 90–95%) with a more porous structure compared to feedstock iron oxides [

10].

According to Tosini (2020) [

11], in the next ten years, the offer of scraps will increase from 650 Mt/year (in 2020) to 1070 Mt/y (in 2030) due to the growth of recycled steel availability. Similar, the demand for scraps will increase from 700 Mt/y (in 2020) to 1050 Mt/y (in 2030), ensuring a break-even point between demand and offers. Nevertheless, the expected offers of recycled steel could include scraps with highly variable characteristics (low and high steel quality). Therefore, the crude steel production from the secondary route (i.e., recycled steel scraps and EAF), which requires only ‘high-quality steel scraps’ as raw material, is not a viable solution.

Consistent to the predicted unavailability of ‘high-quality steel scraps’, the DRI can be jointly adopted with recycled scrap to feed the EAF to ensure the expected liquid steel’s production (

Figure 3). This treatment ensures a good quality of the steel produced, reducing the emission by 34% compared to the BF-BOF treatment.

The DRI production processes can be classified as coal-based or hydrocarbon gas-based based on the adopted reducing agent.

In the first case, the reducing agents are C-bearing materials (e.g., coal, gasified coal, coke breeze), while in the second case, the reducing agents are hydrocarbon gases (e.g., hydrogen, carbon monoxide, and natural gas) [

10]. According to [

12], nowadays, the hydrocarbon gas-based for the DRI production processes ensures 92% of the total production of DRI. Green hydrogen (i.e., hydrogen produced from renewable energy) is a promising option to reduce the emissions generated by DRI production processes. According to experts, green hydrogen will replace natural gas over time, eliminating the carbon dependency of the DRI production processes.

Table 2 summarizes the strengths and weaknesses of the direct DRI production processes fueled by natural gas (NG) and hydrogen (H

2).

As shown in

Table 2, the DR-H

2 is the best option to reduce CO

2 emissions. However, the process is mainly limited by the obsolescence of the electrolysis technology, and by the difficulty of producing renewable energy to power the process, at competitive costs. Since the reduction of emissions from the steelmaking process is an urgent issue, the current best solution is represented by implementing the DR-NG process with a gradual transition to the hydrogen reduction process in the near future. The DR-NG plant is flexible, since it can also be used with an NG-H

2 mixture in variable share. Currently, the NG-H

2 transition is a more sustainable route under an environmental viewpoint; it will be more appealing when the corresponding investment is more profitable.

A wide literature is available on technical–economic models on three ore-based steelmaking routes (i.e., blast furnace with carbon capture and storage (BF-CCS), hydrogen direct reduction (H-DR), and electrowinning (EW)) compared to the BF-BOF. The BF-CCS is based on a regular BF-BOF equipped with top gas recycling and carbon capture and storage (CCS). H-DR is a solid-state reduction process for iron ore using hydrogen as a reducing gas. EW is a rather immature technology based on the electrolysis of iron ore in an alkaline solution of 110 °C with subsequent refining in EAF. The models found that the H-DR is the most attractive route in economic and environmental terms. Indeed, it proved that this kind of technology is technically marketable and economically the most profitable investment choice [

13,

14].

The same steelmaking routes above described (i.e., BF-CCS, H-DR, and EW) have been compared by a multicriteria analysis (MCA) including five different categories, i.e., technology, society and politics, economy, safety and vulnerability, and ecology. The MCA concludes that EW and, in particular, H–DR can be identified as the preferred future steelmaking technology across different perspectives [

15]. According to Vogl et al., the total production costs of adopting H-DR for fossil-free steelmaking are in the range of 361–640 EUR per ton of steel. The authors highlight a high sensitivity of total production cost to the electricity price and the amount of scrap used. In this regard, the study proved that H-DR becomes cost-competitive with an integrated steel plant at a carbon emission price of 34–68 EUR per ton of CO

2 and electricity costs of 40 EUR/MWh [

16].

Similarly, the cost analysis method of life cycle assessment has been adopted to analyze the environmental and economic impact of the steelmaking process in China industries. Quantitative analysis shows the cost of molten iron, accounting for 62%, and the total costs of scrap and oxygen, accounting for 10% and 13%, respectively, of the total cost per ton of steel produced. The total cost of auxiliary materials and labor is relatively small, accounting for 15% of the total cost. Therefore, optimizing the utilization of scrap steel and molten iron resources would significantly increase the process cost saving in the steelmaking system [

17]. On the one hand, the adoption of the scraps leads to advantages in economic and environmental terms.

On the other hand, the use of heterogeneous recycled scrap mixtures, not well characterized, increases the steelmaking process’s uncertainties. The ferrous scrap stored for long periods in scrap yards can be affected by atmospheric corrosion that degrades its initial quality. An empirical methodology is proposed in [

18] to quantify the economic impact of this degradation phenomenon on the EAF performance based on the value in use (VIU) of the scrap adopted. The VIU includes, besides the purchasing cost, the additional costs associated with extra energy consumption and other additional material consumption (electrode, refractories, fluxes, etc.) incurred due to the melting of non-metallic materials included in regular scrap.

The profitability of the investment in innovative steelmaking routes is strongly related to the variability of some cost figures, such as the cost of scraps, iron ore, and energy, which are generally affected by market conditions. Therefore, the reliability of an economic evaluation depends on how the main cost figures change over time.

In view of the above, the purpose of the present work consists of identifying a total cost function (including independent and dependent variables) to assess the economic convenience of investing in the steel production process through the steelmaking processes by adopting a direct reduction (DR) process fueled with natural gas (NG) to feed an electric arc furnace (EAF) using recycled steel scrap (DR-NG-EAF), considering the variability of market conditions. Consistently with the paper’s target, a stochastic approach has been adopted to evaluate the profitability of the investment in different scenarios by changing the value of independent variables and estimating the value assumed by dependent variables based on historical data. The introduced approach allows evaluating the investment’s profitability, including the effects due to the stochastic variability of the economic parameters considered. The results achieved allow practitioners, managers, and experts to make a preliminary assessment of the economic viability of the investment under market uncertainty.

2. Literature Review of Direct Reduction Iron Processes

This section includes a review of the sources reporting the optimization of DR processes fueled with NG or H

2. In Arasto (2015), a techno-economic evaluation of CO

2 emission reductions in the iron and steel industry with CCS was conducted. The processes were assessed by using two indicators: the break-even price of CO

2 emission allowances for CCS and the impact of CCS on steel production cost. The first indicator showed that CO

2 break-even prices are very sensitive to several factors; in most cases, its value can be included in the range of 74–158 €/t CO

2. Concerning the impact of CCS on steel production cost, the authors claim that CCS costs are heavily dependent not only on the characteristics of the facility and the operational environment but also on the chosen system boundaries and assumptions [

19]. A numerical study on the economic and environmental impact of an integrated steelmaking plant, using surrogate, empirical, and shortcut models, has been provided in [

20]. In the case of oxygen BF operation, lower environmental emission and higher economic profit were estimated. On the contrary, the route NG-based has been considered most competitive in terms of emissions from the system.

Regarding studies on energy conservation and carbon mitigation, four scenarios to analyze the utilization of CO

2 in the steelmaking process (i.e., BF-BOF, BF-BOF with waste heat and energy recovery, BF-BOF with CO

2 hydrogenation, and EAF) in China have been investigated. The results suggested that BF-BOF with CO

2 hydrogenation is most competitive in terms of energy consumption and from an economic perspective [

21]. Recently, an economic comparison between alternatives for liquid steel production with integrated electrolyzers based on hydrogen has been conducted by Krüger et al. (2020). The authors found that although the electricity cost represents the main contributor to the cost of liquid steel production using H

2, the low temperature needed for the electrolysis process reduces the overall cost, including investments and running costs [

22].

Béchara et al. (2018) developed a multiscale (i.e., from the iron ore grains scale, measured in µm, to the shaft furnace scale, measured in hm) process model. They integrated it in a systemic plant-size model to optimize, from an environmental point of view, an NG-based DR process. By conducting different simulations with different inlet gas compositions, they found that NG consumption and CO

2 emissions could be reduced by the setting of ratios H

2/CO and (H

2 + CO)/(H

2O + CO

2) at 1.23 and 12, respectively [

23]. The same authors solved an optimization problem aiming to identify the values of a DR-NG-based process operating parameters to minimize the emissions generated [

24]. Sarkar et al. developed a DR-NG shaft thermochemical model to estimate the energy requirement and predict the emissions due to crude steel production, adopting an EAF. According to the model developed, the crude steel production route based on a DR-NG ensures lower CO

2 emissions (i.e., 1269 tCO

2/t crude steel) compared with the traditional BF-BOF route and coke oven gas/syngas route. Similar results were identified by comparing the net energy requirement by DR-NG (i.e., 18.54 GJ/t crude steel) with the net energy requirement by traditional BF-BOF (i.e., 18.56 GJ/t crude steel) [

25]. In [

26], a mathematical model was developed to estimate the performance of a DRI production plant fueled with NG in terms of bustle gas temperature, reformer inlet temperature, metallization degree, carbon content ratio (H

2/CO), reductants to oxidants ratio (H

2 + CO)/(H

2O + CO

2), and required compression energy. The influences of the input parameters on the system performance were evaluated to optimize the system’s operating conditions. In a later work, the model was extended to describe the operating conditions of an EAF assessing the performance under an economic point of view [

27]. Further mathematical models that simulate the reduction of the iron ores in the shaft furnace occur in [

28,

29].

Rechberger et al. (2020) evaluated the CO

2 emissions and the electric energy required in systems fueled with NG-DR by varying the hydrogen percentage injected. The achieved result shows that starting from 453 kg CO

2/t DRI for the NG-DR case, the emissions could be reduced to a level of 40 kg CO

2/t DRI maximizing the hydrogen percentage injected. Moreover, the authors proved that in this case, most CO

2 emissions depend on the electricity required for the electrolysis process. Therefore, increasing the hydrogen percentage injected in the system increases the electrical consumption of the electrolyzer [

30]. Bhaskar et al. (2020) compared the CO

2 emissions generated from a system based on a hydrogen direct reduction process coupled to an EAF with a traditional liquid steel production system (i.e., the BF-BOF route). They found that the emissions of the hydrogen-based route were 1101 kgCO

2/t liquid steel, which is lower than the 35% liquid steel of the traditional route. Both CO

2 emissions were evaluated assuming a grid emission factor of 295 kgCO

2/MWh, corresponding to all EU countries’ average CO

2 emission factor [

31].

Similarly, Vogl et al. (2018) assessed the environmental impact of a hydrogen-based liquid steel production system, adopting a mechanistic model. They evaluated the performance of the steelmaking process by varying the share of iron scrap used to fuel the EAF. They proved that increasing the share of iron scrap reduces the Specific Energy Consumption (SEC) required by EAF. According to the authors, the lower energy requirement depends on two aspects. The first is related to the lower electric consumption of the electrolyzer due to the low volume of DRI needed to process, while the second aspect depends on the higher efficiency of EAF in steelmaking adopting scraps rather than DRI [

16]. The hydrogen-based route was investigated in Patisson and Mirgaux (2020), adopting a shaft furnace mathematical model. The research aimed to compare the DRI production process adopting two different reducing agents (i.e., CO-H

2 mixture and 100% hydrogen). It emerged that in the case of 100% hydrogen, the complete metallization of ores could be achieved in a shorter time than the CO-H

2 mixture, thus allowing the utilization of smaller reactors. It was also highlighted that by adopting 100% hydrogen, the emissions could be reduced by 89–99% compared to the traditional process, assuming that the utilization of only renewable or nuclear electricity was used in the electrolyze step [

32].

3. Materials and Methods

Consistent with the paper’s target, a stochastic approach has been adopted to identify the profitability of the investment in different scenarios by changing the independent variables’ values and estimating the values assumed by dependent variables based on the historical data.

The classification of the main components of the total cost function has been adopted from [

33]; to this concern, the considered cost breakdown with the respective cost components can be observed in

Table 3.

The parameters and the corresponding notation, considered for the formulation of the total cost function, are shown in

Table 4.

A synthetic representation of the process identifying the material flows considered for each phase is provided (

Figure 4).

It is possible to observe that the iron ore pellets (), bought on the market at -price, is an input to DR-NG, where the DRI () produced is used, with the contribution of recycled steel scrap () and lime (), to feed the EAF. According to our assumptions (listed in the following section), recycled steel scraps and lime are acquired on the market (). The price of the recycled steel scraps is assumed variable over time, and a percentage of scraps equal to 50% is considered to produce liquid steel (). Finally, casting and rolling operations have been adopted to transform liquid steel in hot-rolled coil (). A residual part of unprocessed material flow is disposed of as slag ().

Consistent with the DR-NG-EAF process summarized above, the price on the market of the iron ore pellets (

) and carbon tax

represents the input parameters of the total cost function (i.e., independent variables). Observing the historical data, included from July 2019 to June 2021, a strict dependency of the cost of scraps

and cost of hot-rolled coil (

φHRC) on the price of iron ore pellets

was observed. As noted in

Figure 5, the price variability (evaluated in the last 24 months) assumes the same trend over time.

Therefore, the price of the iron ore pellets led to estimate the price of scraps

φs and hot-rolled coil

to be included in the cost total function. The total cost function (

) allows identifying the convenience of the investment, in terms of profitability

, by varying the input parameters’ values (

Figure 6).

The iron ore pellet price (

) is subject to high uncertainty. A uniform probability density function was assumed to predict

. Consequently,

and

are stochastic variables given by historical data relations (

Figure 6).

The representation of the frequency distribution of the unit profit (

) has been identified, evaluating the economic convenience of the investment Equation (1).

where

is the production cost per ton of hot-rolled coil, which is defined below in Equation (2), and the total cost function (

) has been modeled, according to Equation (3), as a function of two independent variables (

.

where the amount of the material flows considered are given by Equations (4)–(11):

A numerical simulation has been carried out to evaluate the profitability of the investment in the DR-NG-EAF steelmaking process assuming different independent variables’ values. In this regard, different discrete values have been assigned to input parameters. For each of them, the total cost function Equation (3) and the corresponding profitability of the investment has been evaluated. In the first phase, the economic convenience has been analyzed by attributing random values to the independent variable

and assuming a null value of the independent variable

. In the second phase, the economic convenience has been analyzed considering the environmental costs in terms of the carbon tax (

) and evaluating the investment profitability. The methodology introduced led to evaluate the convenience of the investment in the steelmaking process considered (

Figure 4) under an economic perspective, including the environmental cost due to different values of the carbon tax. The iterations (around 3100) have been performed on an iMac equipped with a 2.6 GHz Intel Core i5 (dual-core) and 4 GB RAM by using Microsoft Office Visual Basic for Applications (VBA) version 7.1 interfaced with Microsoft Excel

®. The overall computational runtime to conduct all iterations was 8 h and 18 min.

5. Discussion

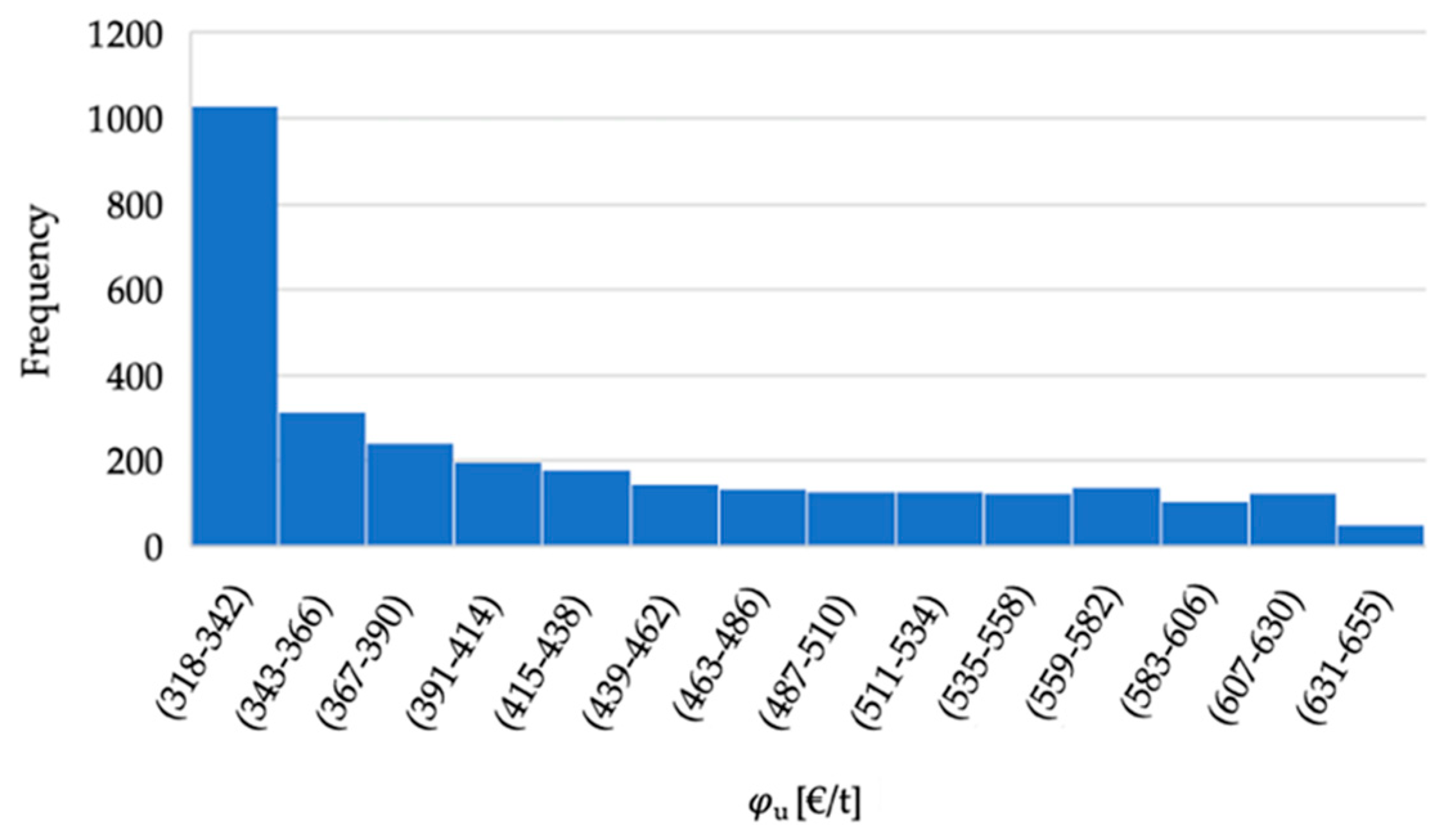

The model’s outputs described in the previous section on the economic and environmental aspects resulting from the numerical simulation provided interesting scenarios to be analyzed in detail. As regards the frequency distribution obtained for the

variable, it can be observed in

Figure 8 that in 33% of cases, the value of the variable is included between 318 and 342 €/t (i.e., the lowest cost per ton of hot-rolled coil). The likelihood that

is higher than 342 €/t decreases up to a relative frequency of 1.7%, corresponding to the maximum unit cost values (included between 630 and 654 €/t). The frequency distribution of steel scrap price (

) (

Figure 9a) shows the same trend of

. Therefore, considering the variability of

and the consequent values assumed by the dependent variable

, it is shown that there is a high probability (33%) to support the minimum possible cost to produce one ton of hot-rolled coil. Therefore, it has been observed that in most cases (40%), the price of steel scrap assumes the lower values included between 212 and 247 €/t. The relative frequency of observations for higher price values decreases and reaches a value of 2.4% in correspondence with the maximum observed values (i.e., (667,702) €/t). As regards the frequency distribution of the dependent variable

(

Figure 9b), it has been observed that in most cases (36.8%), the cost of the hot-rolled coil assumes the minimum values (i.e., (409,463) €/t). However, unlike in the previous case, in correspondence with the maximum price range identified (i.e., (949,1003) €/t), a not-negligible relative frequency (16%) has been estimated. As it can be observed in

Figure 10, the numerical simulation did not provide negative profitability in any case. Therefore, the risk of the investments can be considered very low. In most cases (around 45%), a profit between 75 and 149 €/t has been ensured. According to the economic assessment conducted, only in 0.02% of considered cases, the profitability can be lower than 75 €/t. On the contrary, a profit higher than 149 €/t has been estimated in 53.09% of cases. It is possible to observe that in cases of carbon tax lower than 130 €/tCO

2, the investment is profitable in all hypothesized scenarios. In the case where the

-value corresponds to 130 €/tCO

2, a maximum profit (i.e., 394 €/t) was ensured in scenario 3. Assuming a carbon tax of 150 €/tCO

2, the investment is not profitable in scenario 2, with an iron ore price (

) equal to 100 €/t. In the case of the

-value being equal to 210 €/tCO

2, a positive profit has been estimated only in scenario 3, with an iron ore price (

) of 174 €/t. Finally, it has been observed that in cases of carbon tax higher than 750 €/tCO

2, the investment results are not convenient in all the scenarios considered. The conducted analysis proved that the environmental costs do not compromise investment convenience. Moreover, the highest carbon tax, currently assumed in European countries, is 116.33 €/tCO

2e (Sweden); more generally, the average carbon tax, considering all EU countries, is about 30 €/ tCO

2e [

38]. Therefore, it is possible to claim that considering the market uncertainty of the steelmaking sector in the last 24 months and assuming a gradual increase of the carbon tax in the next years, the investment in the proposed process is profitable from an economic and environmental point of view.

6. Conclusions

The objective of the present work consists of identifying a total cost function to assess the economic convenience of investing in the steel production process adopting an innovative route, considering the variability of market conditions. To this end, a stochastic approach has been adopted to evaluate the profitability of the investment in different scenarios by changing the values of independent variables and estimating the values assumed by dependent variables based on the historical data. A numerical simulation has been conducted to assess the economic convenience of the investment by varying the iron ore pellets price () and carbon tax (). The investment was profitable in all cases, under an economic perspective. As such, a profit of 75–149 €/t and 150–519 €/t has been ensured in 45% and 53% of cases, respectively. Considering the environmental cost due to carbon tax, it has emerged that in the case of carbon tax higher than 150 €/tCO2, the investment could be not profitable in some scenarios, although the current EU policies set the carbon tax to significantly lower values. It was not possible to compare the results achieved conducted with outcomes already present in the available scientific literature. Nowadays, the topic was not faced in the same terms. Nevertheless, from the market, it emerges a certain optimism and an increased propensity of the investors in the innovative steelmaking solutions. Therefore, an investment addressed to the proposed route aiming to decarbonize the existing steelmaking processes can be considered convenient for economic and environmental costs.

A limitation of the present work is represented by the numerical discretization of the parameters used in the numerical simulations needed to reduce the processing time without significantly affecting the analysis accuracy. To this concern, the proposed approach could be rearranged by developing an analytical model with continuous functions. This could lead to an easily repeatable and applicable method.

Similarly, the range of variability of main parameters should be extended, and further variables should be included. It is possible that the price of electricity, as well as that of natural gas, could be new variables to be included to evaluate the profitability of the investment, especially observing the trends of last years.

Finally, future studies should evaluate the sustainability of the steel production process fueled with green hydrogen. Nowadays, it is considered a technology that is rather immature for the economic and environmental impacts due to energetic aspects. Nevertheless, it is considered one of the most promising technologies for future steelmaking processes. The methodology proposed in the present work could be extended by developing a model that estimates the profitability of an investment considering an H2-steelmaking process fueled with renewable sources.