Abstract

Connections to world markets facilitate local markets developments to support more efficient capital allocation and greater investment and growth opportunities. Under the framework of cross-market rebalancing theory, in this study, we aim to systematically examine the market connections among world financial, energy, renewable energy and European carbon markets by measuring the return spillovers from 2008 to 2021. We find that the renewable energy market is more closely connected to the world financial and energy markets in the sense of the return transmission, while the carbon market is less connected to them. However, due to improved market regulations and determinations related to fighting climate change, the connections between the carbon market and other markets have gradually intensified. Plotting the return spillover indexes, we observe that strong return spillovers from the renewable energy market to other markets occurred when large investment plans were announced. Regarding the carbon market, regulation changes introduced by the EU Commission to improve and stabilize market environment induced intensified return transmission from carbon market to other markets. Another interesting finding is that the highly intensified return transmission among markets due to the COVID-19 crisis started to loosen when COVAX published the first interim distribution forecast on 3 February 2021.

1. Introduction

Society ultimately benefits from efficient markets where capital can freely flow to the most productive or innovative destinations. Well-functioning capital markets efficiently match those needing capital with those seeking to invest their assets in revenue-generating ventures. To achieve this, the key ingredient is globally well-connected markets, which can facilitate worldwide capital flows between markets and countries to best allocate resources. If markets are well connected, available capital can find its way to the place where it will be of most benefit anywhere in the world. These investments are beneficial to society overall in that they allow goods and services to be produced, innovations and jobs to be funded, and living standards to be improved. In addition, connections with other markets improve a market’s efficiency of resource allocation by increasing market robustness and facilitating the price discovery process. Furthermore, investors can benefit from such a world market system, in which they can enjoy barrier-free access to any market to develop well-diversified portfolios.

Previous studies generally report an increasing degree of interdependence among financial markets [1,2,3,4,5,6,7,8,9]. However, these studies focus only on the connectedness between markets in advanced industrial countries. Starting in the mid-1990s, increasing attention has been paid to the interrelations between emerging and developed economies. One early study provided by Bekaert and Harvey (1995) estimates the degree of integration between major emerging markets and world equity markets and reports evidence against the perception that world capital markets are more intensively integrated [10]. Beginning from the end of the 20th century, accelerated globalization and financial liberalization resulted in a boom in the number of cross-border and cross-market transactions in assets, currencies and securities [11]. Therefore, more recent studies generally document evidence that the connectedness between emerging and developed markets has becomes stronger [12,13,14,15]. This finding indicates that financial markets in emerging economies are gradually integrated into the world financial market after several years of development. These markets become nodes in international capital flow networks and participate in global capital allocation. Capital inflows to emerging markets stimulate economic development in these regions.

The observed increasing interdependence of economies and markets worldwide also facilitates the transmission of shocks from one economy to another [16]. This kind of shock transmission can be understood as a spillover effect. If two markets are strongly connected, shocks in one market can cause strong turbulence in the other market. It is empirically documented that cross-border and cross-market correlations are especially strong in crisis times, when this kind of connectedness is most undesirable [17,18,19,20]. One good example is the 2008 Global Financial Crisis (GFC). The shock originated in the US real estate market and rapidly spread to other markets, i.e., stock markets, and then to the rest of the world, causing the most severe financial crisis since the Great Recession. However, note that connectedness here refers mainly to volatility transmission. As a sign of market maturity, a market’s connectedness to world major markets has advantages that still outweigh the disadvantages. As argued by Levine (1997), a connection to the world financial market facilitates domestic financial market development to support more efficient capital allocation and greater investment and growth opportunities [21]. Kose et al. (2009) show that connections to major world markets help local markets access a broader base of capital, which is a major engine for the growth of the local young market [22]. Capital flows from developed economies or markets rich in capital to developing economies or markets with limited capital help the latter decrease their cost of capital, leading to higher investment and greater market robustness. Furthermore, market connectedness provides risk hedge possibilities and vehicles for international risk sharing [23,24,25].

Renewable energy and carbon markets are two emerging markets and have gradually gained the attention of even the public at large in recent years. The development of these two markets has to do not only with market participants but also with the welfare of our human society, as renewable energy and carbon emissions allowances are two critical measures to mitigate climate change. Compared to traditional markets, such as stock, bond and commodity markets, renewable energy and carbon markets, as emerging markets, do not have a long history. However, these two climate change-related markets have experienced rapid growth since their establishment. Global annual investment in renewable energy capacity increased from USD 40.1 billion in 2004 to USD 282.2 billion in 2019, with the peak of USD 315.1 billion in 2017 [26]. The global renewable energy market was valued at USD 928.0 billion in 2017 and is expected to reach a valuation of USD 1512.3 billion by 2025, registering a compounded annual growth rate of 6.1% from 2018 to 2025 [27]. Similarly, the carbon market has also flourished in the last few years. In the European carbon market, for example, after the launch of the European Union Emissions Trading Scheme (EU ETS) in 2005, the total value of traded European Union Allowances (EUAs) increased significantly from USD 8.2 billion to USD 201 billion in 2020 [28,29].

The growing importance of renewable energy and carbon markets has drawn the attention of many scholars. Among their different research angles, one involves studying the market connectedness between these two emerging markets and other traditional markets by measuring spillover effects. A large body of literature examines the connection between carbon, energy and financial markets. Previous studies examine the spillover effect between the carbon market and traditional energy markets in a “Carbon–Energy” market system [30,31,32,33,34,35,36,37,38,39,40]. These works document that EUA prices are correlated with energy prices, such as crude oil, natural gas and coal. In terms of the market connectedness in the “Carbon–Financial” market system, most of the existing studies analyze the interrelation between carbon and stock markets [41,42,43,44,45]. More recent studies, such as Koch (2014) and Tan et al. (2020), comprehensively study the market linkages in the combined “Carbon–Energy–Financial” market system [46,47]. These studies investigate the interdependences between carbon, traditional energy and a wide range of financial asset markets, including stock, commodity and bond markets. Regarding the interrelation between the renewable energy market and other markets, i.e., the “Renewable Energy–Energy” market system, Ferrer et al. (2018), Song et al. (2019) and Jiang et al. (2021) provide evidence of interdependence between fossil energy markets, especially that for crude oil, and the renewable energy stock market [48,49,50]. More recently, Uddin et al. (2019) and Mroua, Bouattour, and Naifar (2021) investigate the dynamic links between renewable energy, traditional energy and other capital markets in a “Renewable Energy–Energy-Financial” market system [51,52]. However, previous studies are generally motivated by investors’ portfolio optimization and diversification or policy makers’ market governance objectives, focusing on studying volatility transmissions among the carbon, renewable energy, financial and energy markets.

In the current paper, we aim to study the return connectedness between carbon and renewable energy markets and major world financial and energy markets to understand how well two emerging markets, i.e., carbon and renewable energy markets, are connected to other asset markets (In the current study, by major world capital and asset markets, we refer to continental and international financial and energy commodity markets, i.e., the European stock and bond markets, the US stock and bond markets, the international non-energy commodity market, the EUR/USD foreign exchange market and the international energy commodity markets for crude oil, gasoline, natural gas and coal). The theoretical framework of this research is the cross-market rebalancing theory proposed by Kodres and Pritsker (2002): namely, that investors respond to return shocks in one market by optimally readjusting their portfolios in other markets, generating return spillovers [53] (Cross-market rebalancing theory is based on the rational investor hypothesis. In this framework, a return spillover is defined as a price movement in one market resulting from a shock in another market due to portfolio adjustments among investors. The comovements in prices in different markets are excessive relative to full information fundamentals). Therefore, if a large number of market participants hold positions in both traditional and emerging markets, e.g., the European stock market and carbon market, for purposes such as hedging or portfolio diversification, strong return spillovers can be observed between these markets. In this sense, intensified transmission of returns between the studied emerging markets and major financial and energy markets indicates that these young markets are also important destinations in global investors’ capital resource allocation. Another goal of the current research is to understand which kinds of market events intensify transmission of returns between carbon and renewable energy markets and other traditional markets. Our study covers the period from 2008 to 2021, within which there are many significant events, such as the post-2008 GFC period, the European Debt Crisis, Brexit, the Paris Agreement, the China–US trade war and the current COVID-19 crisis. By graphically illustrating the development of the connectedness among these markets, we have the chance to understand the return transmission behaviors of the studied markets during these events and analyze which markets and events have had significant impacts on these two emerging markets and vice versa.

Using the starting point of Phase III of the EU ETS, i.e., 1 January 2013, as the breakpoint, we divide the whole study sample into two subperiods. The first subperiod covers two well-known market events, namely, the post-2008 GFC period and the European Debt Crisis, whereas the second subperiod spans Brexit and the current COVID-19 crisis. By applying the Diebold and Yilmaz (2012) return spillovers index approach (DY2012), we quantify the return transmission among the studied markets [54]. We find evidence that the renewable energy market is significantly more closely connected than the carbon market to the world’s major markets. The return spillover behaviors of the renewable energy market indicate that this market is already a mature market in the global market system. The carbon market, in contrast, is relatively less connected to the major world markets in the sense of return transmission. However, we observe a clear trend of the linkages continually strengthening. When analyzing the “Carbon–Renewable Energy–Finance” and “Carbon–Renewable Energy–Energy” market systems, we observe that compared to the energy market, the renewable energy market is more strongly connected to major global financial markets. On the other hand, the carbon market shows closer linkages to traditional energy markets. The return transmission between carbon and renewable energy is weak, but an increase in the intensity is evident. Furthermore, graphical illustrations of the return spillover development of the carbon and renewable energy markets indicate that financial crises and turbulences in the oil market are the primary drivers of intensified return transmission from other markets to carbon and renewable energy markets. The surges in return spillovers from the renewable energy market to other markets are caused mainly by announcements of large investment plans and the introduction of new policies and development guidance (mostly by China). In terms of the carbon market, robust return transmission from this market to other markets is mainly due to EUA price turbulence resulting from changes in EU ETS market legislation. Finally, we document that carbon and renewable energy markets show different return spillover patterns for the period of the current COVID-19 crisis. Strong return spillovers from the renewable energy market to financial markets are observed during this period, while the carbon market is still a net return spillover receiver. Another interesting finding worth mentioning is that the intensified return spillovers among the studied markets due to the COVID-19 crisis dropped sharply after COVAX published the first interim distribution forecast on 3 February 2021.

As stated by Bouri et al. (2021), existing literature on return spillovers among a large set of asset classes is sparse [55]. The current study extends the previous literature by studying return spillovers among a great range of asset classes with more recent data. In addition, this study sheds new light on the topic of market interdependences between the carbon and renewable energy markets and major financial and energy markets in three ways. First, this is the first study to systematically investigate return transmission among these markets to understand market connectedness in the sense of capital resource allocation. Second, in this paper, we use the rolling-sample technique to graphically illustrate the development of dynamic return spillovers and the behavior of carbon and renewable energy markets in different market systems so that we can understand the impacts of different market and political events on the transmission of returns between the studied markets. Third, this is the first study to cover the period from the post-2008 GFC to the current COVID-19 crisis, a tumultuous period full of significant events. Therefore, we have the chance to study and compare the impacts of these events on the transmission of returns between major world markets and the two emerging markets. Furthermore, the findings regarding the carbon market in the current study have significant implications for countries just starting their own carbon markets, such as the UK, China and Brazil.

The remainder of the paper is organized as follows. In the next section, we describe the sample data and the methodology deployed in this research. In the third section, we examine the overall return spillovers of all the studied markets and pairwise return spillover indexes between the two emerging markets and financial and energy commodity markets. In addition, we present the spillover plots to graphically analyze the development of market connectedness in this section. In the following section, we briefly report the results of our robustness tests. Finally, we conclude the study in the fifth section.

2. Data and Methods

2.1. Data

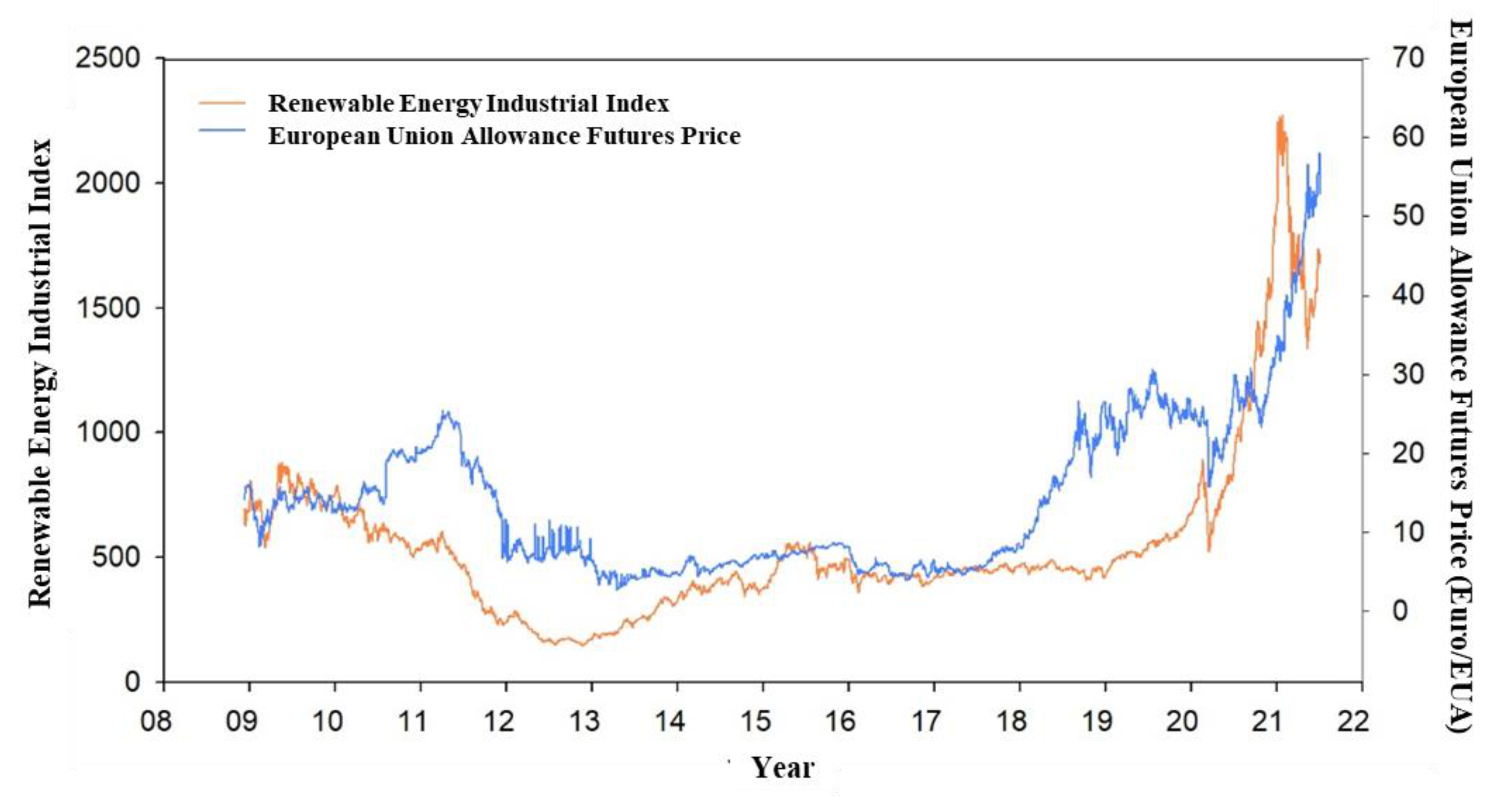

In our research, we focus on three market categories, namely, financial, energy and emerging markets. For financial markets, we collect data on the EURO STOXX 50 and S&P 500 to proxy the European and US stock markets (ES and US). For bond markets, we obtain data on the iShares Euro Government Bond ETF and US 10-Year Treasury bonds (EB and UB). The S&P GSCI Non-Energy Index is selected to proxy the international commodity market (CY). The foreign exchange market is represented by the EUR/USD exchange rate (FX). For the traditional energy commodity market, we collect the Intercontinental Exchange Europe Brent crude oil futures, Newcastle coal futures, New York Mercantile Exchange reformulated blendstock for oxygenate blending gasoline futures and natural gas futures for the international crude oil (CO), coal (CL) gasoline (GE) and natural gas (NG) markets. The datasets mentioned above are downloaded from the Thomson Reuters Datastream. In terms of emerging markets, the renewable energy (RE) market is proxied by the Renewable Energy Industrial Index (RENIXX, ISIN: DE000RENX014). This index is constituted by the 30 largest companies worldwide specializing in different branches of the renewable energy industry, e.g., wind power, solar energy, bioenergy, geoenergy, water power, electromobility and fuel cells, reflecting the development of the international renewable energy market. A more detailed description of the components and weights for the RENIXX is presented in Table A1 in Appendix A. Regarding the carbon market (CE), we collect data on EU ETS EUA prices. Figure A1 in Appendix A illustrates the developments of the RE and CE markets in the studied period.

All the data are collected on a daily basis for the period from 8 December 2008 to 8 July 2021. In total, for each studied market, we have 3249 daily price observations for the studied period. After calculating the log return, we have 3248 daily return observations for each market for our final examination. Table 1 shows the descriptive statistics of the studied financial, energy commodity and emerging markets.

Table 1.

Descriptive Statistics of the Studied Markets.

As shown in Table 1, the US and CE markets yielded the highest average daily returns, while the UB, FX and NG markets generated negative average daily returns during the focused period. Along with the high mean daily return, the highest and lowest daily returns of all the studied markets are observed in the CE market. This implies that the CE market is also the most volatile among all the studied markets, confirmed by its standard deviation, which is the highest of those observed. In contrast, the RE market is significantly less volatile and yields a mild mean daily return.

2.2. Methods

In the current study, we employ the DY2012 model proposed by Diebold and Yilmaz (2012) [54]. DY2012 was developed based on the spillover index (DY2009) proposed by Diebold and Yilmaz (2009) [56], which is an extension of the standard variance decomposition approach associated with the vector autoregressive model. As pointed out by Diebold and Yilmaz (2012), the fundamental DY2009 framework has some limitations. First, DY2009 relies on Cholesky decomposition of the variance–covariance matrix of error terms to orthogonalize shocks, so the resulting variance decompositions are dependent on the variable ordering. This means that the elements of the decomposed matrix vary with the reordering of variables. Second, DY2009 addresses only the total spillovers, meaning that it can quantify only spillovers from/to each market i, to/from all other markets. DY2012 addresses these limitations by exploiting the generalized vector autoregressive (VAR) framework of Koop, Pesaran and Potter (1996) and Pesaran and Shin (1998) (KPPS) to produce variance decompositions invariant to ordering [57,58]. In addition, the normalized elements of the generalized VAR approach allow directional spillovers across markets to be studied.

Consider a covariance stationary N-variable VAR(p) (1):

with t = 1, 2, …, T,

is an vector, and is an coefficient matrix. is an independently and identically distributed error vector with and for all , and is a positive definite variance–covariance matrix. This system can be rewritten into a moving average representation (2):

with t = 1, 2, …, T,

where is an coefficient matrix with for and with for . The moving average coefficients are the key to understanding the dynamics of the system. By exploiting the KPPS generalized VAR framework, we can assess the fractions of the H-step-ahead forecast error variance in forecasting the return of the stock market due to a shock to itself, with (own variance shares), and the fractions of the H-step-ahead forecast error variance in forecasting the return of the stock market due to a shock to the other markets , with and (cross-variance shares or spillovers).

The KPPS H-step-ahead market return forecast error variance decompositions, denoted by for , are defined as follows (3):

where is the variance matrix for the error term for the VAR, is the standard deviation of the error term for the equation and is the selection vector with one for the element and zero otherwise. As we do not orthogonalize the shocks to each studied variable, the sum of the elements of each row of the variance decomposition table is not necessarily equal to one (). Therefore, each entry in the variance decomposition matrix is normalized by the row sum (4):

Note that by construction, we have and .

Then, we construct the total spillover index, which measures the contribution of spillovers of shocks across the studied markets to the total market forecast error variance (5):

To learn about the direction of spillovers across the studied markets, we calculate the directional spillovers using the normalized elements of the generalized variance decomposition matrix. The directional spillovers received by market i from all other markets are measured as (6):

The return spillovers transmitted by market i to all other markets are gauged as (7):

We can further obtain the net return spillover from market i to all other markets j as (8):

The net return spillover is the difference between gross shocks transmitted to and gross shocks received from all other markets. A positive net return spillover from market i indicates that market i is less influenced by all other markets than it influences all j other markets.

In the current study, we first estimate the VAR model for the studied ES, US, EB, UB, CY, FX, CO, GE, NG, CL, RE and CE markets. Since the estimated VAR model must be stationary, we examine the stationarity of the studied market return time series using the augmented Dickey–Fuller (ADF) test and the KPSS stationarity test [59,60,61]. Table 2 summarizes the results of these tests. In addition, we report Jarque–Bera normality test results in this table [62]. As shown, all the time series are at least trend stationary based on the ADF test and the KPSS stationarity test. Thus, we include the trend in the following VAR model estimation. The lag order used in the underlying VAR model is selected based on the Akaike (AIC) and Bayesian (BIC) information criteria. If these two information criteria suggest different optimal lag lengths, we use the longer one in our VAR model estimation. The forecast horizon is chosen as five days, corresponding to one trading week. In general, we examine 12-variable VARs with one-week-ahead forecasts to calculate the return spillover index for the period from 29 September 2009 to 7 July 2021.

Table 2.

Results of Stationarity and Normality Tests.

The calculated spillover index provides a useful summary of average spillover behaviour during the studied period. However, given the evolution and turbulence of financial, traditional and renewable energy and carbon markets in recent years, the spillover index might miss important secular and cyclical movements in the spillovers occurring in the focal period [54]. Therefore, we further estimate the time series of the spillover index based on 252-day (one-year) rolling samples and graphically illustrate the behaviour of the spillovers using the spillover plot to assess the nature of spillover variations over time.

3. Empirical Results

In this section, we report the return spillover indexes and the return spillover plots in two subsections. The history of the EU ETS is structured in four phases (Phase I: 2005–2007; Phase II: 2008–2012; Phase III: 2013–2020; and Phase IV: 2021–2030). Therefore, we divide our whole studied sample into two subperiods: Period A, from 8 December 2008 to 31 December 2012, and Period B, from 1 January 2013 to 7 July 2021. We further classify the 12 focal markets into three market groups, namely, finance, energy and emerging. ES, US, EB, UB, CY and FX are categorized into the finance market group; the CO, GE, NG and CL markets are placed in the energy market category; and the RE and CE markets belong to the emerging market group.

3.1. Return Spillover Table

3.1.1. “Carbon–Renewable Energy–Finance–Energy” Market System

In Table 3, the return spillover indexes of all the markets in the “Carbon–Renewable Energy–Finance–Energy” market system for the whole studied period from 8 December 2008 to 7 July 2021, are summarized. This table provides a general overview of the market connectedness of the focal markets. The underlying variance decomposition is based on a VAR of order 7, as suggested by the AIC, and the forecasting horizon is 5 days ahead. In Table A2 in Appendix A, we report 2- and 10-day-ahead forecasting horizon return spillover indexes of the “Carbon–Renewable Energy–Finance–Energy” system.

Table 3.

Whole Period Return Spillover Indexes of Markets in the “Carbon–Renewable Energy–Finance–Energy” Market System.

Entry (2,3) in Table 3, with a value of 0.17, is the estimated contribution to the return forecast error variance of market US from innovations to the return of market EB or, in short, return spillovers from EB to US. The off-diagonal row sums labelled “Received Spillover” summarize the return spillovers received by one market from all other markets. The second last line of the table labelled “Delivered Spillover” is the off-diagonal column sums, documenting the total return spillovers from one market to all other markets. The last line of the table labelled “Net Spillover Effect” is the difference between the “Delivered Spillover” and “Received Spillover”. In the bottom right corner of the table is the “Total Spillover Index”, which reports the sum of the return spillovers of all the studied markets.

As shown in Table 3, compared to the CE market, the RE market is more closely connected to the major world financial and energy markets in the sense of return transmission. Approximately 48.77% of the error variance in forecasting one-week-ahead RE returns is caused by shocks to returns in other studied markets. Meanwhile, return turbulence in the RE market also considerably affects returns in other markets (40.10%). In terms of the CE market, its own variance shares are 91.03%. Only 8.97% of the return forecasting error variance is caused by shocks to returns in other markets. Overall, the RE market is significantly more closely connected than the CE market to major world asset markets in the sense of return transmission.

We report the periodic return spillovers of the markets in the “Carbon–Renewable Energy–Finance–Energy” market system for each subperiod and the differences between these two subperiods in Table 4. As shown in Panel A of Table 4, the return transmission between markets in the first subperiod is intensive. The cross-variance shares in forecasting one-week-ahead returns of ES, US, CY, CO and GE are all more than 50%. More than 40% of the error variance in forecasting one-week-ahead returns of UB, CY and CL markets results from shocks to returns in other markets. Meanwhile, these markets also have strong return spillover effects on other markets. In particular, the total delivered return spillovers from the ES, US and CO markets to other markets are all over 80%. The return spillover behaviours of the RE and CE markets are different in Period A. The returns of the RE market are strongly affected by other studied markets in the first subperiod, with almost 60% of the one-week-ahead return forecasting error variance being due to shocks to returns of other markets. At the same time, the RE market delivers significant return spillovers (46.85%) to other studied markets. In terms of the CE market, it receives significantly lower return spillovers from other markets (5.56%) and has very limited return spillover effects on returns in other asset classes (3.36%).

Table 4.

Return Spillover Indexes of Markets in the “Carbon–Renewable Energy–Finance–Energy” Market System.

Panel B reports the return spillovers for the period from 1 January 2013 to 7 July 2021. In this subperiod, we observe significantly less intensified return transmission between markets. The total spillover index is 32.27% in the second subperiod, while in period A, it is 45.35%. All markets except for the EB and CE markets receive and deliver lower return spillovers in the studied market system. The RE market emits and receives reduced return spillovers in the studied market system. The RE market receives approximately 14.23% and delivers approximately 6.10% lower return spillovers in Period B than in Period A. This pattern is also observed in other focal mature financial and energy markets, such as the ES, US, CO and GE markets. In contrast to most of the markets, the return transmission associated with the CE market is more robust in the second subperiod. In this period, approximately 83.68% of the error variance in forecasting one-week-ahead CE market returns is due to its own return shocks. In comparison, this number is 94.44% in the first subperiod. In addition, the total return spillovers from the CE market to other markets also increase from 3.36% to 9.86% from Periods A to B. The differences in the return spillover indexes between the two subperiods, summarized in Panel C, confirm that the return spillovers between CE and the other studied markets intensify starting from the beginning of Phase III. This finding indicates that the CE market, as an emerging market, has gradually grown connected to major global markets in the sense of return transmission. In contrast, like most mature markets, the RE market is more “independent” in the second subperiod, receiving and delivering lower return spillovers from and to other markets. This pattern suggests that the RE market is already mature in the world market system from a return transmission point of view. Another finding is that the return transmission between CE and RE markets slightly intensifies from the first to second subperiod.

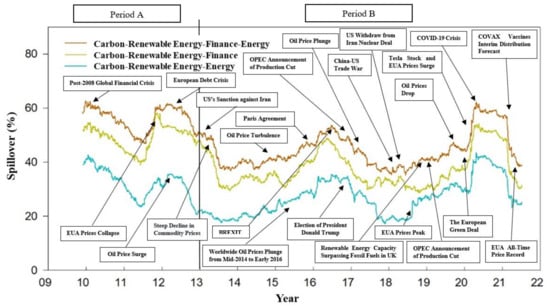

3.1.2. “Carbon–Renewable Energy–Finance” and “Carbon–Renewable Energy–Energy” Market Systems

In this section, we analyze the return spillovers between markets in two subsystems to understand with which type of markets the RE and CE markets are more closely connected. Table 5 and Table 6 present the periodic return spillovers of markets in the “Carbon–Renewable Energy–Finance” and “Carbon–Renewable Energy–Energy” market systems and the differences in the return spillovers between periods. The full-sample-period return spillover indexes of both systems with different forecasting horizons, i.e., 2-, 5- and 10-days-ahead, are reported in Table A3 and Table A4 in the Appendix A.

Table 5.

Return Spillover Indexes of Markets in the “Carbon–Renewable Energy–Finance” Market System.

Table 6.

Return Spillover Indexes of Markets in the “Carbon–Renewable Energy–Energy” Market System.

As shown in Panel A Table 5, the return spillovers between the RE market and other financial markets are intensive in the first subperiod. The shocks to returns to all other financial markets together account for more than 53% of the one-week-ahead return forecasting error variance of the RE market. In return, the RE market delivers a total of approximately 39% of the return spillovers to these markets. More specifically, the return transmission between the RE market and the ES and US markets are especially strong. In contrast, the return spillovers between the CE market and financial markets are less significant. The return spillovers from CE to all other markets are generally negligible in Period A. In terms of the received return spillovers, only the CY market has a very limited return spillover effect on the CE market. Shocks to CY market returns contribute approximately 1.16% of the error variance in forecasting one-week-ahead CE returns. As reported in Panel B Table 5, in the second subperiod, the RE market both affects and is affected less by the focal markets, with the own variance shares increasing to 59.21%. The two-way return spillovers between the RE market and UB, CY and FX markets shrink enormously in their magnitudes. Only the return transmission from (to) RE to (from) ES and US markets remains significant during this period. In comparison, the connectedness between the CE market and other capital asset markets gains strength in this period, so that the own variance shares decrease by 4.38% to 91.59%. In particular, bilateral return spillovers between CE, ES and US are more significant starting from Phase III. One more finding is that RE market returns show increasing impacts on CE market returns during Period B, with approximately 1.29% of the error variance in forecasting one-week-ahead CE returns being the result of the shocks to RE returns. The differences in the return spillover indexes between Periods A and B are summarized in Panel C Table 5. The net return spillovers of the RE market increase significantly by 10.40% in the second subperiod over those in Period A. This increment is the highest among all the studied markets, indicating that the RE market has gained in importance in the world financial market system.

Table 6 summarizes the return spillover indexes of markets in the “Carbon–Renewable Energy–Energy” market system. As shown in Panel A Table 6, the RE market is generally well connected with energy markets in the sense of return transmission, with its own variance shares being 74.39% in this period. Comparably strong return spillovers received by the RE market are from the CO, GE and CL markets, whereas the shocks to RE market returns contribute approximately 6.20%, 4.94% and 7.65% of the error variance in forecasting the one-week-ahead returns of these markets. In contrast, the CE market is significantly less connected to the studied energy markets. Innovations to CE market returns are, in total, responsible for only approximately 1% of the error variance in forecasting the one-week-ahead returns of these markets. In addition, the own variance shares of the CE market are approximately 98%. In the second subperiod, as reported in Panel B Table 6, the returns of the RE market are significantly less affected by the return shocks in other markets. In this period, previous return innovations in the RE market can explain approximately 87.43% of the error variance in forecasting one-week-ahead RE market returns. The CE market, however, is more closely linked to energy markets, with its own variance shares decreasing to 88.77% in this period. The return spillovers between the CE and CL markets are 3.55% (from CE to CL) and 3.91% (from CL to CE); both are the highest in each of the return spillover directions of CE. When we compare the return spillover indexes between Periods A and B (Panel C of Table 6), the CE market is the only market that delivers and receives more return spillovers (6.39% and 8.79%) from one period to the next, indicating that the CE market is more significantly connected to energy markets, particularly the RE market, starting from Phase III. The RE market, as before, shares the return spillover patterns of other mature energy markets in that it resumes its “independence” in the second subperiod.

When we cross-compare the results of Table 5 and Table 6, it is observed that the RE market is more strongly connected to financial markets and the CE market more closely linked with energy markets. While the RE market receives 53.45% and 40.79% and delivers 39.87% and 37.61% of the return spillovers from and to financial markets (including the CE market) for the two subperiods, the return interdependences between the RE and energy markets (including the CE market) are only 25.61% and 12.57% for the received return spillovers and 20% and 10.06% for the delivered return spillovers in Periods A and B. In the first subperiod, the CE market is more closely linked with financial markets than with energy markets, as the own variance shares of the CE market in the “Carbon–Renewable Energy–Finance” market system is 95.97% in this period, while in “Carbon–Renewable Energy–Energy” system it is 97.56%. However, starting from the second subperiod, the return transmission between the CE market and energy markets intensifies significantly. In Period B, the delivered and received return spillovers of the CE market to and from energy markets (including the RE market) are 8.15% and 11.23%, respectively, in comparison to 4.63% and 8.41% for financial markets (including the RE market).

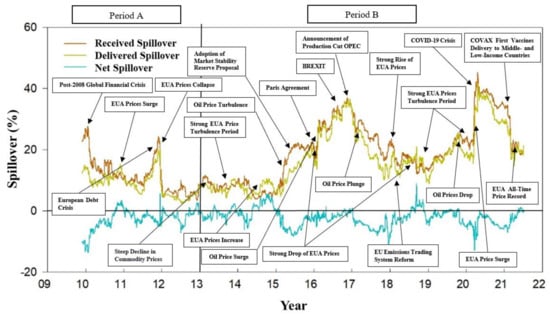

3.2. Return Spillover Plot

Since the return spillover tables presented in Section 3.1 provide only “average” return spillovers for all the studied markets, the return spillover indexes cannot capture the secular and cyclical movements in market spillovers during our eventful sample period stretching over 10 years. Therefore, in this section, we plot the calculated time series of return spillover indexes based on VAR models using 252-day rolling samples. We graphically illustrate the total return spillover indexes of the three studied market systems, namely, “Carbon–Renewable Energy–Finance–Energy”, “Carbon–Renewable Energy–Finance” and “Carbon–Renewable Energy–Energy”. In addition, we present the calculated time series of delivered and received return spillovers of RE and CE markets in their corresponding systems with financial and energy markets. While plotting these time series, we also mark all the key market events during the period to show their potential impacts on the return spillovers among the studied markets.

In Figure 1, we present the total return spillover indexes of the three market systems, namely, “Carbon–Renewable Energy–Finance–Energy”, “Carbon–Renewable Energy–Finance” and “Carbon–Renewable Energy–Energy” market systems. According to cross-market rebalancing theory, cross-market return transmissions intensify during crisis times. Therefore, we observe four clear peaks in the total return spillover indexes of these three systems, corresponding to four major economic and political events in the last 13 years, namely, the post-2008 GFC period, the European Debt Crisis, Brexit and the COVID-19 crisis. As shown, the behaviors of the total return spillover indexes of these three market systems have been unique during the COVID-19 crisis. We observe rapid increases at the beginning of the crisis in the total return spillover indexes of all three market systems. Then, they remain relatively stable at a high level for approximately one year, falling steeply starting in 2021 in a terrace shape. More precisely, the total return spillover indexes of these three systems decrease simultaneously on 3 February 2021, when COVAX published its first interim distribution forecast. The shapes of the total return spillover indexes formed during the other three important market events are, however, more like pyramids.

Figure 1.

Spillover Plot of Total Return Spillovers Indexes of “Carbon-Renewable Energy-Finance-Energy”, “Carbon-Renewable Energy-Finance” and “Carbon-Renewable Energy-Energy” Market Systems. Note: We plot the time series of the total return spillover indexes of the “Carbon-Renewable Energy-Finance-Energy”, “Carbon-Renewable Energy-Finance” and “Carbon-Renewable Energy-Energy” market systems based on 252-day rolling samples for the period from 1 December 2009 to 8 July 2021. The underlying variance decompositions are based on VAR models with lag orders of 7, 7 and 6, as suggested by the AIC. The forecast horizons are all 5 days. In the plot, we mark the major market and political events during the studied period.

Not only the crisis but also some important political events in the focal period, such as the Paris Agreement and the US withdrawal from the Iran nuclear deal, show impacts on global market return transmission. However, these impacts are mostly limited and short term. Crude oil is the most essential commodity, and turbulence in this market, such as oil price surges and plunges and the OPEC announcement of a production cut, has more potent influences on global market return spillovers. Surprisingly, the China–US trade war, a momentous event from both economic and political perspectives, did not cause significant return spillovers across markets.

Notably, the three studied market systems sometimes react differently to the same market events in the sense of return spillover insensitivity. For instance, from 2011 to 2013, global markets experienced three major events, namely, the European Debt Crisis, the EUA price crash from mid-2011 and the crude oil price hike in early 2012. For this period, we observe two significant peaks in the total returns spillovers index of the “Carbon–Renewable Energy–Energy” market system, whereas there is only one significant hike in the total return spillovers index that appears in mid-2011 in the “Carbon–Renewable Energy–Finance” market system. In terms of the “Carbon–Renewable Energy–Finance–Energy” system, we again identify only one peak in the total return spillovers index, which appear, however, in early 2012. The same situation can also be observed for the period of Brexit in 2016, when the total return spillover indexes of the three market systems show different behaviours.

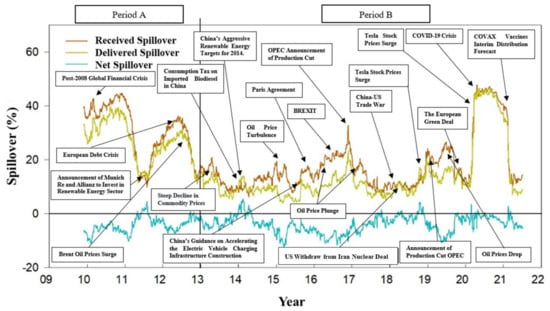

Figure 2 and Figure 3 present the received, delivered and net return spillovers of the RE market in the “Renewable Energy–Finance” and “Renewable Energy–Energy” market systems. As shown in Figure 2, before mid-2015, the RE market constantly received more return spillovers from financial markets than it delivered. Market events, such as the post-2008 GFC period and the European Debt Crisis, led to significant return transmissions from financial markets to the RE market. Other events, e.g., the commodity price plunge in early 2013, the introduction of a consumption tax on imported biodiesel in China and the price crash of gas and power in the US, also had some limited impacts on the return spillovers from financial markets to the RE market. Starting in mid-2015, several market events and newly introduced renewable energy policies led to more substantial return spillovers from the RE market to financial markets. In September 2015, the Chinese State Council issued guidance on accelerating the construction of electric vehicle charging infrastructure. This guidance called for charging infrastructure sufficient for 5 million electric vehicles by 2020, signalling a massive market for electric vehicle producers and infrastructure suppliers. In December 2015, the Paris Agreement was drafted in Le Bourget, France, and caused a hike in return spillovers from RE to financial markets. In addition, in March 2016, within a week of the unveiling of Tesla Model 3, Tesla revealed that it took 325,000 reservations for this car, representing potential sales of over $14 billion. Market uncertainties due to the Brexit referendum on 23 June 2016, led to increasing return spillovers between RE and financial markets. It is observed that both received and delivered return spillovers peak after the referendum. In November 2016, the EU Commission presented a legislative package entitled Clean Energy for All Europeans, leading to intensified return spillovers from the RE market to financial markets.

Figure 2.

Spillover Plot of Received, Delivered and Net Return Spillovers of the Renewable Energy Market in the “Renewable Energy-Finance” Market System. Note: We plot the time series of the received, delivered and net return spillovers of the RE market in the “Renewable Energy-Finance” market system based on 252-day rolling samples for the period from 1 December 2009 to 8 July 2021. The underlying variance decompositions are based on VAR models with lag orders of 7, as suggested by the AIC. The forecast horizon is 5 days. In the plot, we mark the major market and political events during the studied period.

Figure 3.

Spillover Plot of Received, Delivered and Net Return Spillovers of the Renewable Energy Market in the “Renewable Energy-Energy” Market System. Note: We plot the time series of the received, delivered and net return spillovers of the RE market in the “Renewable Energy-Energy” market system based on 252-day rolling samples for the period from 1 December 2009 to 8 July 2021. The underlying variance decompositions are based on VAR models with lag orders of 11, as suggested by the AIC. The forecast horizon is 5 days. In the plot, we mark the major market and political events during the studied period.

From 2017 to the period prior to the COVID-19 pandemic, the RE market generally received more return spillovers from financial markets than it delivered. The only exception was mid-2017, when the guiding opinion on implementing China’s 13th Renewable Energy Development Five-Year Plan (2016–2020) was published by the National Energy Administration of China. For the period of the COVID-19 crisis, we observe significant increments in both received and delivered return spillovers of the RE market starting on 21 February 2020, when world financial markets started to collapse. The return spillovers between RE and financial markets remained high for nearly one year, until COVAX published its first interim vaccine distribution forecast on 3 February 2021. Notably, during this period, the RE market emitted more return spillovers to financial markets than it received from them. This was mainly due to the massive capital inflow to the RE market in 2020 and 2021, leading to stock price surges in renewable energy stocks. For instance, Tesla, an important component stock of the RENIXX, saw its stock price rise from USD 85.51 on 16 March 2020, to USD 852.23 on 1 February 2021. Therefore, we could observe strong return spillovers from the RE market to financial markets as a result of investors’ cross-market portfolio rebalancing practice.

In Figure 3, we present the received, delivered and net return spillovers of the RE market in the “Renewable Energy–Energy” market system. We observe five peaks of received return spillovers in the RE market in the studied period. They correspond to the post-2008 GFC period, the European Debt Crisis, the announcement of an OPEC production cut in 2016, the oil price turbulence in 2019 and the COVID-19 crisis. Most of the time during the studied period, the RE market received more return spillovers from energy markets than it delivered to them. Nevertheless, some exceptions are observed. For instance, from the beginning of June to mid-August 2011, there was a peak in RE market return spillovers to energy markets. The driver behind this, from our point of view, was the investment plan announcements of large insurance companies in June and August 2011. In June 2011, Munich Re announced its plan to invest USD 3.5 billion in assets such as wind farms and solar parks over the ensuing five years, while Allianz released another plan in August aiming to add more renewable energy assets to its portfolio. At the beginning of 2014, several events in China intensified the return spillover effects from the RE market to other energy markets. On 2 January 2014, China started levying a consumption tax on imported biodiesel and some types of kerosene. This was a move aimed at curbing imports of fuels that have taken market share from state refiners. Two weeks later, the National Energy Administration of China announced aggressive renewable energy targets for 2014. These goals, 14 gigawatts of solar photovoltaics (of which approximately 8.4 gigawatts are to be distributed projects), 20 gigawatts of hydropower and 18 gigawatts of wind power installed capacity in 2014, stimulated the world RE market. In addition, return spillovers from energy markets to the RE market intensify when there are shocks to oil prices. We observe, in particular, an apparent surge in the received return spillovers of the RE market from energy markets on 30 November 2016, when the OPEC countries reached a deal to curtail oil production for the first time since 2008.

When we compare the “Renewable Energy–Finance” and “Renewable Energy–Energy” market systems presented in Figure 2 and Figure 3, many differences in return spillover patterns are identified. First, strong return spillovers from the RE market to financial markets are observed for the period from mid-2015 to mid-2016 as reactions to a series of market and political events, such as the Paris Agreement and Brexit. However, in the “Renewable Energy–Energy” market system, there are no significant return spillovers from the RE market to energy markets. Remarkably, Brexit did not cause significant return transmission in the “Renewable Energy–Energy” market system. In addition, we observe that during the COVID-19 crisis, return spillovers from the RE market to financial markets were significantly more substantial than the reverse spillovers. However, the same pattern is not evident in the “Renewable Energy–Energy” system, where the received and delivered return spillovers of the RE market are interlaced with each other. Although the RE market plays a role as a net return spillover receiver in both systems, returns in this market are more strongly affected by return shocks in financial markets. Taken as a whole, the behaviors and magnitude of return spillovers from the RE market to financial and energy markets are different. Financial crises, such as the European Debt Crisis and COVID-19 crisis, are the main drivers of the intensified return transmissions between the RE market and financial and energy markets, followed by turbulence in the global oil market.

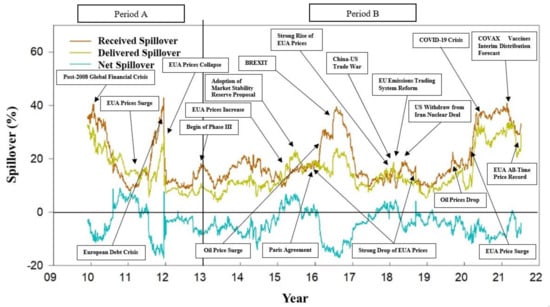

We plot the received, delivered and net return spillovers of the CE market in the “Carbon–Finance” and “Carbon–Energy” market systems in Figure 4 and Figure 5. As presented in Figure 4, in the “Carbon–Finance” system, the CE market generally received more return spillovers from other markets than it delivers during the studied period. There are four clear climaxes of the CE market’s received return spillovers in the post-2008 GFC period: during the European Debt Crisis, the oil price surge and Brexit in 2016 and the COVID-19 crisis. Notably, the upward trend in return spillovers from financial markets to the CE market during the European Debt Crisis lasted only until the end of 2011. Then, a sharp drop occurred. In the previous “Renewable Energy–Finance” and “Renewable Energy–Energy” market systems, the intensified return transmissions between markets lasted until mid-2012, to be followed by a less steep downward trend. The observed steep declines in both delivered and received return spillovers of the CE market in the “Carbon–Finance” market system indicate that the CC market suddenly became “isolated” from global market return transmission.

Figure 4.

Spillover Plot of Received, Delivered and Net Return Spillovers of the Carbon Market in the “Carbon-Finance” Market System. Note: We plot the time series of the received, delivered and net return spillovers of the CE market in the “Carbon-Finance” market system based on 252-day rolling samples for the period from 1 December 2009 to 8 July 2021. The underlying variance decompositions are based on VAR models with lag orders of 7, as suggested by the AIC. The forecast horizon is 5 days. In the plot, we mark the major market and political events during the studied period.

Figure 5.

Spillover Plot of Received, Delivered and Net Return Spillovers of the Carbon Market in the “Carbon-Energy” Market System. Note: We plot the time series of the received, delivered and net return spillovers of the CE market in the “Carbon-Energy” system based on 252-day rolling samples for the period from 1 December 2009 to 8 July 2021. The underlying variance decompositions are based on VAR models with lag orders of 6, as suggested by the AIC. The forecast horizon is 5 days. In the plot, we mark the major market and political events during the studied period.

We identify four periods when the delivered return spillovers from the CE market were higher than those received from financial markets in Figure 4. The first period is from mid-2010 to mid-2011, during which EUA prices jumped from €6.3 to €25 per ton as the result of the economic recovery from the 2008 GFC and the replacement of coal with gas in electricity generation towards the second half of 2010. Then, EUA prices collapsed to a record low of approximately €6.0 per ton on 14 December 2011, and perturbed strongly, leading to another dramatic increase in return spillovers from the CE market to financial markets. During 2012, the return transmissions between the CE market and financial markets remained low, despite EUA prices entering an intense turbulence period. Starting in 2014, due to the stable emission level and the decrease in the use of international credits, the reduced market oversupply led to a weak but constant increase in EUA prices. This positive trend in EUA prices might have driven the intensified return spillovers from the CE market to financial markets since the beginning of 2015. In addition, the approval of the EU Market Stability Reserve proposal on 7 July 2015, also resulted in another increase in the return spillovers from the CE to financial markets.

However, EUA prices experienced a sharp drop from the beginning of 2016, just after the Paris Agreement was drafted on 12 December 2015, in Le Bourget, France. Within six weeks, EUA prices lost almost 50% of their value and fell to a level of less than €5.0 per ton. After the collapse of the EUA price, the return spillovers from the CE market to financial markets became weaker, while the return spillovers from financial markets to the CE market increased significantly. In particular, Brexit caused an enormous return spillover effect of financial markets on the CE market, leading to another EUA price crash to EUR 4.5 per ton in June 2016. After one year of fluctuation, the EUA price began to rise in mid-2017, and the growth accelerated from the beginning of 2018. During this period, the CE market delivered more return spillovers than it received from financial markets. The EUA price plunge in October 2018 caused another short-term surge in return spillovers from the CE market to financial markets. During the COVID-19 crisis, strong return transmissions between the CE market and financial markets have been evident. The CE market has received significantly more return spillovers from financial markets, even though EUA prices skyrocketed from approximately EUR 15 to more than EUR 57 per ton, an all-time EUA price record, at the time of writing this paper.

In Figure 5, we plot the received, delivered and net return spillovers of the CE market in the “Carbon–Energy” system. Like in Figure 4, we identify four peaks of received return spillovers of the CE market from energy markets in the studied period. Notably, the climax of the received return spillovers of the CE market in 2016 seems not to have been caused by Brexit but by the OPEC announcement of a production cut at the end of the year. In addition, in contrast to the “Carbon–Finance” market system, the CE market received significantly more return spillovers than it delivered most of the time. The mutual return spillovers between the CE market and energy markets were more balanced. Generally, EUA price turbulence and energy commodities are the leading drivers of surges in return transmission between markets. Oil price plunges and the OPEC production announcement led to significant increments in return spillovers from energy markets to the CE market. In return, dramatic EUA price changes, such as the EUA price surges in 2010 and 2014 and price drops in 2012 and 2015, intensify return spillovers from the CE market to energy markets. In addition, we observe that the hikes in the CE market’s received and delivered return spillovers in 2016 and during the COVID-19 crisis were higher than those in the post-2008 GFC period and the European Debt Crisis. For the “uneventful” periods, the received and delivered return spillovers of the CE market never decline to their earlier lower range. This result is consistent with the finding in the spillover index section that there is a continuous increase in “Carbon–Energy” market integration.

4. Robustness Check

In this section, we perform some simple variations on our basic analysis to check whether our results are robust to these changes. We reproduce Table 3 with the underlying VAR model estimated using orders of lag 6 and 8 and present the results in Table 7 (The return spillovers presented in Table 3 are calculated based on vector autoregressions of order 7). As shown in Table 7, there is no significant difference in the return spillover indexes between the different VAR lag lengths, indicating the robustness of the return spillover indexes. In Figure 6, we replot the total return spillover indexes of “Carbon–Renewable Energy–Finance–Energy”, “Carbon–Renewable Energy–Finance” and “Carbon–Renewable Energy–Energy” market systems using different lag lengths. The patterns of the total return spillover indexes of these three studied systems presented in Figure 6 are similar to those in Figure 1. The results of the robustness check indicate that both return spillover indexes and return spillover plots are robust to variations in the selected lag length in estimating the underlying VAR model.

Table 7.

Spillover Indexes of All Markets, Robustness Check.

Figure 6.

Spillover Plot of Total Spillover Indexes, Robustness Check. Note: We plot the time series of the total return spillover indexes of “Carbon-Renewable Energy-Finance-Energy”, “Carbon-Renewable Energy-Finance” and “Carbon-Renewable Energy-Energy” market systems based on 252-day rolling samples for the period from 1 December 2009 to 8 July 2021. The underlying variance decompositions are based on VAR models with lag orders of 8, 8 and 7. The forecast horizons are all 5 days. In the plot, we also mark the major market and political events during the studied period.

5. Discussion

The results of the current study are largely in line with previous studies. For instance, the time-varying connections between CE market and other energy markets are also reported by Ji et al. (2018) and Chen et al. (2019) [33,36]. Strong interdependence between RE market and stock markets is also documented by Uddin et al. (2019), who use another proxy to represent the RE market [52]. In this section, we put our focus on some notable findings of this research.

Studying the return spillovers of the “Carbon–Renewable Energy–Finance–Energy” system, we observe different patterns of return transmissions between RE and CE markets and other studied markets. The RE market is more strongly connected to world major markets than the CE market. In addition, the RE market shares the return spillover pattern of other mature financial and energy markets, such as the ES, US, CO and GE markets, in that the return transmission abates in the second subperiod. This observation indicates that the RE market is more like a mature market in the sense of return transmission with world financial and energy commodity markets. The reason behind this is that the RE market is proxied by the RENIXX, which is a stock index consisting of 30 major companies in the renewable energy industry trading on the most prominent stock exchanges worldwide. Due to its stock asset nature, the RE market shows a return transmission pattern largely similar to that of the other two studied stock markets, namely, ES and US, and behaves more like a mature market. Therefore, compared to energy markets, the RE market has significantly more intensified return transmission with financial markets in both subperiods.

On the other hand, we document increasing interdependence in CE and other markets from the first to second subperiods. For Period A, from 2008 to 2011, the return transmission between the CE market and major world markets is considerably weak. However, for the second subperiod, these linkages are strengthened, indicating that the CE market has gradually integrated into the world market system and become a node in world capital flow networks. The main drivers of the enhanced connectedness, from our point of view, are a series of changes in market regulations and more decisive determinations to mitigate climate change. From 2008 to 2013, EUA prices decreased sharply from €28 to less than €5 per ton, wiping out more than 80% of the price. Such volatile and depressed prices could hardly provide sufficient incentives for investors to put this asset in their portfolios, despite the potential diversification benefits [63,64]. In contrast, for the second subperiod, we witness a steady upward trend in EUA prices. Indeed, many scholars have found evidence that economic downturns and pessimistic economic projections play an essential role in the changing demand for EUAs, which affects their prices [65,66]. However, economic crises are distributed evenly in both studied subperiods. Market uncertainties were even more significant in the second subperiod due to the US–China trade war [67]. Therefore, we believe that the series of market regulation changes introduced by the EU Commission from the beginning of Phase III were the factor stabilizing EUA prices. These regulation changes relate, for instance, to the prevention of the use of Certificated Emission Reductions and Emission Reduction Units and to the Market Stability Reserve. The constantly improving market regulations and reduced oversupply safeguard the stability of the CE market [68]. In turn, more stabilized and favorable price movements have made the CE market more attractive to investors. In addition, the determinations and commitments shown by nations in mitigating climate change make investors much more confident in holding EUA positions. For instance, the EU aims to cut greenhouse gas emissions by at least 55% by 2030 and to be climate neutral by 2050. These objectives are at the heart of the European Green Deal and in line with the EU’s commitment to global climate action under the Paris Agreement. Therefore, as EUAs are one of the Green Deal’s instruments, analysts generally expect their prices to rise in the future and attract more market participants [69]. Overall, the improved market environment and strong determinations to fight climate change give investors confidence to invest in the CE market, drawing this market closer to world major markets.

Another finding regarding the CE market is that we observe significantly enhanced market interdependence between CE and energy markets in the Phase III period. In the first subperiods, the received and delivered return spillovers of the CE market from and to other financial and energy markets were only 3.43% and 2.57% and 1.72% and 1.13%, respectively. It is evident that in the second subperiod, the return transmissions between CE and both financial and energy markets intensified. Starting in Phase III, the return transmissions (received and delivered return spillovers) between CE and financial markets increased to 7.12% and 3.93%, respectively. In the “Carbon–Renewable Energy–Energy” system, we observe even stronger market return interdependences in which the received and delivered return spillovers of the CE market from and to energy markets are 9.98% and 7.09%, respectively. In particular, the return linkages between the CE market and the CO, GE and CL markets were tied in the second subperiod. As reported by Zheng et al. (2015), investors’ speculation incentive is one of the most crucial factors that affects investment in EUAs [70]. Therefore, the reasons behind intensified return transmission between CE and energy markets, from our point of view, are more stabilized EUA price development, less ambiguous EUA price discovery, and more favorable price correlation between EUAs and other energy market assets. As stated by Wei and Lin (2016), the CE market is a policy-dominated market [71,72,73,74]. The unsound market regulations before Phase III, such as the large influx of Certified Emission Reductions and Emission Reduction Units and the high use of Kyoto credit, induced substantial turbulence in EUA prices, leading to difficulties in EUA pricing [75,76]. This problem was overcome by several changes in market regulations regarding the imports of credits from certain projects [66]. In addition, the introduced Market Stability Reserve further stabilized the EUA price by adjusting the volumes for auction to address imbalances between EUA supply and demand [34]. In addition, the change in the nature of the relationship between energy and carbon prices also made EUAs more favorable to energy commodity investors. The use of fossil fuels, such as crude oil, natural gas and coal, is the primary source of CO2 emissions [77]. Therefore, increasing and inelastic demand for traditional energy induces great demand for EUAs and hence a higher EUA price. Many previous studies document this relationship between the returns of energy markets and EUA returns [71,73,78]. However, as stated by Dhamija, Yadav, and Jain (2017), the nature of the relationship between energy and carbon prices varies depending on the period under consideration [34]. More recent studies uncover either weak or negative relationships between the CE market and traditional energy markets [33,35]. Therefore, from a hedging perspective, EUA and energy commodities are attractive to each other in hedging downside risks [79]. In addition, for financial market investors, both EUA and energy market assets are alternative investments for specific hedging strategies [33]. Therefore, we observe only a mild increase in the magnitude of the return transmission intensity between the CE market and financial markets.

Plotting the return spillovers, we find that most of the time, both the CE and RE markets are net return spillover receivers in market systems with financial and energy markets. However, we observe that some exogenous events, such as releases of large investment plans and development guidance in the renewable energy industry, cause hikes in return spillovers from the RE market to other markets. Such investment plans are issued mainly from China, for example, the release of China’s renewable energy targets for 2014, the guidance on accelerating electric vehicle charging infrastructure construction in 2015 and China’s 13th Five-Year Plan guiding opinions on renewable energy development in 2017. In addition, the price surge of Tesla also had a significant impact on return transmission between the RE market and other markets. In contrast, the strong return spillovers from the CE market were generally the result of endogenous events, such as EUA price turbulence and changes in market regulations. In addition, during the current COVID-19 crisis, we observe that the RE market has become a net return spillover emitter in the “Renewable Energy–Finance” system. The reason behind this is the boost to investment in the clean energy industry and the price surge of Tesla. BloombergNEF (2021) shows that the world committed a record $501.3 billion to decarbonization in 2020, beating the previous year by 9%, despite the economic disruption caused by the COVID-19 pandemic [80]. Meanwhile, we experienced the ballooning of the Tesla stock price from less than USD 100 to over USD 700 in less than one year. Another notable finding is that the highly intensified return transmission among markets due to the COVID-19 crisis started to loosen when COVAX published the first interim distribution forecast on 3 February 2021. After this, the total return spillovers quickly moved to their post-COVID-19 levels, indicating that investors might have interpreted this forecast as a sign that the COVID-19 crisis is under control.

6. Conclusions

In this paper, we systematically examine the return spillover effect in three market systems, namely, the “Carbon–Renewable Energy–Finance–Energy”, “Carbon–Renewable Energy–Finance” and “Carbon–Renewable Energy–Energy” market systems. We use the start point of Phase III of the EU ETS as the breakpoint to divide the whole study sample, i.e., from the post-2008 GFC period to the current COVID-19 crisis, into two subperiods. Each subperiod covers two major market events, i.e., the post-2008 GFC period and the European Debt Crisis in the first subperiod and Brexit and the COVID-19 crisis in the second subperiod. We then quantify the return spillovers among the focal markets in each subperiod and compare them between two subperiods. In addition, we plot the return spillover indexes of these market systems for the studied period. Furthermore, we graphically illustrate the dynamic development of the return transmission between the carbon and renewable energy markets and major world financial and energy markets. To our best knowledge, this study is the first one that examines return spillovers among such great range of asset classes and graphically illustrates the impacts of market events on returns transmission.

We find that the two studied emerging markets, namely, the RE and CE markets, show different return spillover patterns, indicating distinctions in their interdependence with major world financial and energy commodity markets. The RE market, behaving more like a mature market, is already well connected to major world financial and energy markets in the sense of return transmission. The CE market, in contrast, is still less connected to other important markets. However, due to the improved market regulations and the determinations related to fighting climate change, the return transmission magnitudes between the CE and other financial and energy markets have gradually intensified. In addition, exogenous market events, such as announcements of large investment plans, can strongly impact the return spillover behavior of the RE market, while the causes of CE market return spillover pattern changes are endogenous. Findings regarding the carbon market in the current study have significant implications for countries just starting their own carbon markets, such as the UK, China and Brazil.

One limitation of the current study is the proxy adopted for the RE market. As mentioned before, the RE market proxy RENIXX has its stock asset nature, which might disturb the returns transmission estimation due to the effect of systematic risk. Another proxy that is often used in previous studies, such as Song et al. (2019) and Uddin et al. (2019), is the S&P Global Green Energy Index [49,52]. However, this index is also constructed based on RE related stock prices. Therefore, future studies should choose more proper measures for the RE market, if they want to estimate the returns transmission free of the effect of systematic risk between RE market and other markets.

Author Contributions

Conceptualization, Y.L. and X.Y.; methodology, Y.L.; software, Y.L.; formal analysis, X.Y. and Y.L.; data curation, X.Y. and Y.L.; review and editing, X.Y., Y.L., and M.W.; supervision, M.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data analyzed in this study are collected from the Thomson Reuters Datastream. The data presented in this study are available on request from the corresponding author.

Acknowledgments

We are grateful to the anonymous reviewers for their constructive comments.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Components of RENIXX World Index.

Table A1.

Components of RENIXX World Index.

| Company | HQ | Branch | ISIN | Weight |

|---|---|---|---|---|

| Albioma | FRA | Wind and Solar Energy | FR0000060402 | 0.52% |

| Ballard Power Systems | CAN | Fuel Cell | CA0585861085 | 2.91% |

| Canadian Solar | CAN | Solar Energy | CA1366351098 | 1.14% |

| China Longyuan Power | CHN | Wind Power | CNE100000HD4 | 2.22% |

| Daqo New Energy | CHN | Solar Energy | US23703Q2030 | 2.31% |

| EDP Renováveis | ESP | Wind Power | ES0127797019 | 1.66% |

| ENCAVIS | GER | Wind and Solar Energy | DE0006095003 | 0.98% |

| Enphase Energy | USA | Solar Energy | US29355A1079 | 9.12% |

| First Solar | USA | Solar Energy | US3364331070 | 4.09% |

| Innergex Renewable Energy | USA | Hydro, Wind and Solar Energy | CA45790B1040 | 1.15% |

| ITM Power | GBR | Electrolysers | GB00B0130H42 | 1.16% |

| Jinko Solar | CHN | Solar Energy | US47759T1007 | 0.95% |

| Nel | NOR | Fuel Cell | NO0010081235 | 1.18% |

| Neoen | FRA | Wind and Solar Energy | FR0011675362 | 0.79% |

| Nordex | GER | Wind Power | DE000A0D6554 | 1.27% |

| Ormat Technologies | USA | Geothermal Power | US6866881021 | 1.00% |

| Ørsted | DNK | Wind Power | DK0060094928 | 10.00% |

| Plug Power | USA | Fuel Cell | US72919P2020 | 7.89% |

| PowerCell | SWE | Fuel Cell | SE0006425815 | 0.71% |

| Scatec | NOR | Solar Energy | NO0010715139 | 1.52% |

| Siemens Gamesa | ESP | Wind Power | ES0143416115 | 4.43% |

| SolarEdge | ISR | Solar Energy | US83417M1045 | 7.26% |

| Sunnova Energy | USA | Solar Energy | US86745K1043 | 1.55% |

| SunPower | USA | Solar Energy | US8676524064 | 1.32% |

| Sunrun | USA | Solar Energy | US86771W1053 | 5.94% |

| Tesla | USA | Electric Vehicle | US88160R1014 | 10.00% |

| Verbund | AUT | Hydropower | AT0000746409 | 2.41% |

| Vestas | DNK | Wind Power | DK0061539921 | 10.00% |

| Goldwind | CHN | Wind Power | CNE100000PP1 | 0.73% |

| Xinyi Solar | CHN | Solar Energy | KYG9829N1025 | 3.80% |

Note: This table reports all 30 companies that compose the RENIXX. “HQ” is the abbreviation for headquarters, that is, the countries where firms’ headquarters are reported. In the column labelled “Branch”, the companies’ detailed specializations in the renewable energy industry are reported. “ISIN” denotes the International Securities Identification Number, with the first two or three digits indicating the countries where the firms are listed. The column with the header “Weight” reports the weight of each company in the RENIXX based on the capitalization.

Figure A1.

RENIXX and EUA Price Time Series. Note: This figure reports the time series of the Renewable Energy Industry Index (RENIXX) and European Union Allowance (EUA) future prices from 8 December 2008 to 8 July 2021. The time series is collected at daily frequency.

Figure A1.

RENIXX and EUA Price Time Series. Note: This figure reports the time series of the Renewable Energy Industry Index (RENIXX) and European Union Allowance (EUA) future prices from 8 December 2008 to 8 July 2021. The time series is collected at daily frequency.

Table A2.

Whole Period Return Spillover Indexes of Markets in the “Carbon–Renewable Energy–Finance–Energy” Market System based on Different Forecast Windows.

Table A2.

Whole Period Return Spillover Indexes of Markets in the “Carbon–Renewable Energy–Finance–Energy” Market System based on Different Forecast Windows.

| From | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| To | Financial | Energy | Emerging | Received Spillover | |||||||||

| ES | US | EB | UB | CY | FX | CO | GE | NG | CL | RE | CE | ||

| Panel A: Short-Term 2-Day-Ahead Forecast Window | |||||||||||||

| ES | 42.86 | 20.60 | 0.10 | 7.10 | 4.50 | 0.88 | 5.13 | 4.03 | 0.17 | 1.26 | 12.75 | 0.61 | 57.14 |

| US | 18.87 | 41.45 | 0.02 | 8.80 | 4.44 | 2.12 | 6.41 | 6.25 | 0.23 | 1.15 | 9.76 | 0.51 | 58.55 |

| EB | 0.83 | 0.11 | 91.18 | 6.34 | 0.15 | 0.64 | 0.06 | 0.07 | 0.11 | 0.15 | 0.35 | 0.01 | 8.82 |

| UB | 9.67 | 12.68 | 3.77 | 58.36 | 1.26 | 0.01 | 4.66 | 4.43 | 0.27 | 0.44 | 4.22 | 0.22 | 41.64 |

| CY | 6.42 | 6.78 | 0.17 | 1.34 | 62.49 | 5.29 | 7.04 | 4.41 | 0.94 | 1.68 | 3.07 | 0.37 | 37.51 |

| FX | 1.56 | 4.31 | 0.18 | 0.05 | 6.91 | 82.97 | 1.36 | 0.67 | 0.37 | 1.16 | 0.08 | 0.39 | 17.03 |

| CO | 5.35 | 7.05 | 0.03 | 3.52 | 5.17 | 0.74 | 45.58 | 25.29 | 0.63 | 2.89 | 3.12 | 0.63 | 54.42 |

| GE | 4.52 | 7.25 | 0.00 | 3.51 | 3.42 | 0.40 | 26.97 | 48.55 | 0.53 | 1.51 | 2.89 | 0.45 | 51.45 |

| NG | 0.38 | 0.53 | 0.08 | 0.54 | 1.34 | 0.57 | 1.36 | 1.01 | 93.52 | 0.19 | 0.32 | 0.15 | 6.48 |

| CL | 2.45 | 2.81 | 0.09 | 0.74 | 2.65 | 1.43 | 5.04 | 2.50 | 0.16 | 78.91 | 1.83 | 1.38 | 21.09 |

| RE | 16.45 | 15.76 | 0.19 | 4.00 | 3.03 | 0.03 | 3.88 | 3.36 | 0.23 | 1.08 | 51.56 | 0.45 | 48.45 |

| CE | 1.29 | 1.02 | 0.01 | 0.31 | 0.50 | 0.37 | 1.22 | 0.84 | 0.15 | 1.72 | 0.75 | 91.82 | 8.18 |

| Delivered Spillover | 67.81 | 78.90 | 4.63 | 36.25 | 33.37 | 12.48 | 63.13 | 52.87 | 3.80 | 13.22 | 39.14 | 5.18 | Total Spillover |

| Net Spillover | 10.67 | 20.35 | −4.19 | −5.39 | −4.15 | −4.55 | 8.71 | 1.41 | −2.68 | −7.87 | −9.30 | −3.01 | 34.23 |

| Panel B: Long-Term 10-Day-Ahead Forecast Window | |||||||||||||

| ES | 42.06 | 20.47 | 0.15 | 7.26 | 4.59 | 1.17 | 5.29 | 4.09 | 0.31 | 1.31 | 12.66 | 0.63 | 57.94 |

| US | 18.66 | 40.53 | 0.28 | 8.83 | 4.44 | 2.50 | 6.55 | 6.33 | 0.41 | 1.17 | 9.78 | 0.52 | 59.47 |

| EB | 1.08 | 0.42 | 87.35 | 7.24 | 0.36 | 1.05 | 0.50 | 0.52 | 0.22 | 0.19 | 0.70 | 0.37 | 12.65 |

| UB | 9.64 | 12.78 | 3.87 | 57.31 | 1.36 | 0.16 | 5.10 | 4.42 | 0.39 | 0.48 | 4.23 | 0.25 | 42.69 |

| CY | 6.50 | 6.81 | 0.53 | 1.59 | 61.10 | 5.31 | 7.07 | 4.41 | 1.19 | 1.75 | 3.26 | 0.49 | 38.90 |

| FX | 1.71 | 4.35 | 0.29 | 0.22 | 6.94 | 81.65 | 1.36 | 0.76 | 0.72 | 1.23 | 0.29 | 0.50 | 18.35 |

| CO | 5.57 | 7.31 | 0.22 | 3.96 | 5.13 | 0.86 | 44.56 | 24.96 | 0.67 | 2.89 | 3.23 | 0.63 | 55.44 |

| GE | 5.14 | 7.49 | 0.20 | 4.21 | 3.39 | 0.58 | 26.33 | 46.92 | 0.61 | 1.50 | 3.18 | 0.47 | 53.08 |

| NG | 0.47 | 0.85 | 0.21 | 0.73 | 1.42 | 0.67 | 1.73 | 1.17 | 91.36 | 0.39 | 0.68 | 0.31 | 8.64 |

| CL | 2.55 | 2.84 | 0.23 | 0.85 | 2.82 | 1.49 | 5.31 | 2.60 | 0.23 | 77.49 | 2.13 | 1.46 | 22.51 |