Resource Intensity vs. Investment in Production Installations—The Case of the Steel Industry in Poland

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

- −

- analysis of the resource consumption in the steel industry in Poland in the years 2004–2018,

- −

- determining the impact of investments on resource consumption in the steel industry. The result of this stage of research was the development of econometric models presenting the correlation between investments and resource consumption in the analysed sector.

4. Results and Discussion

4.1. Analyses of Resource Intensity in Polish Steel Industry

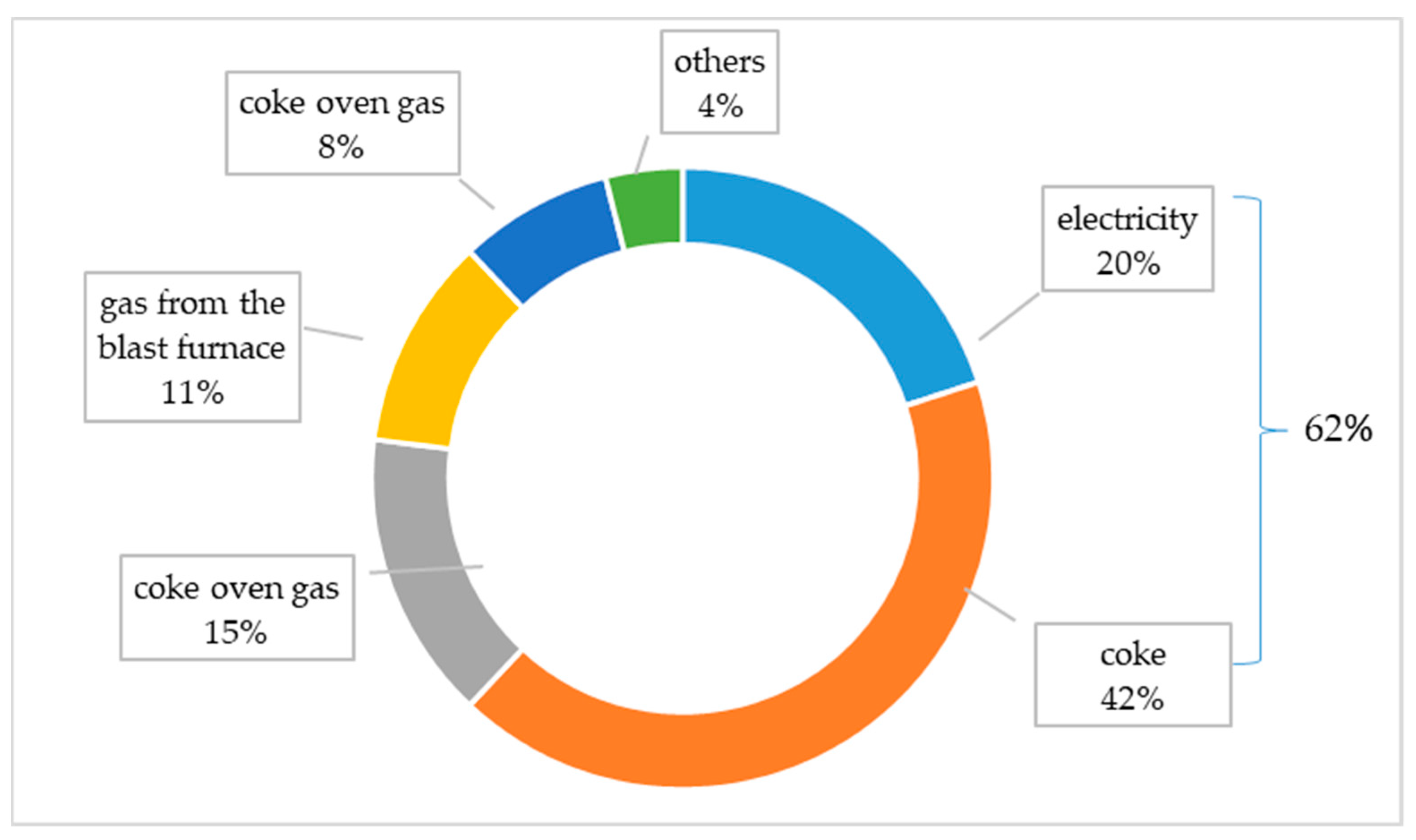

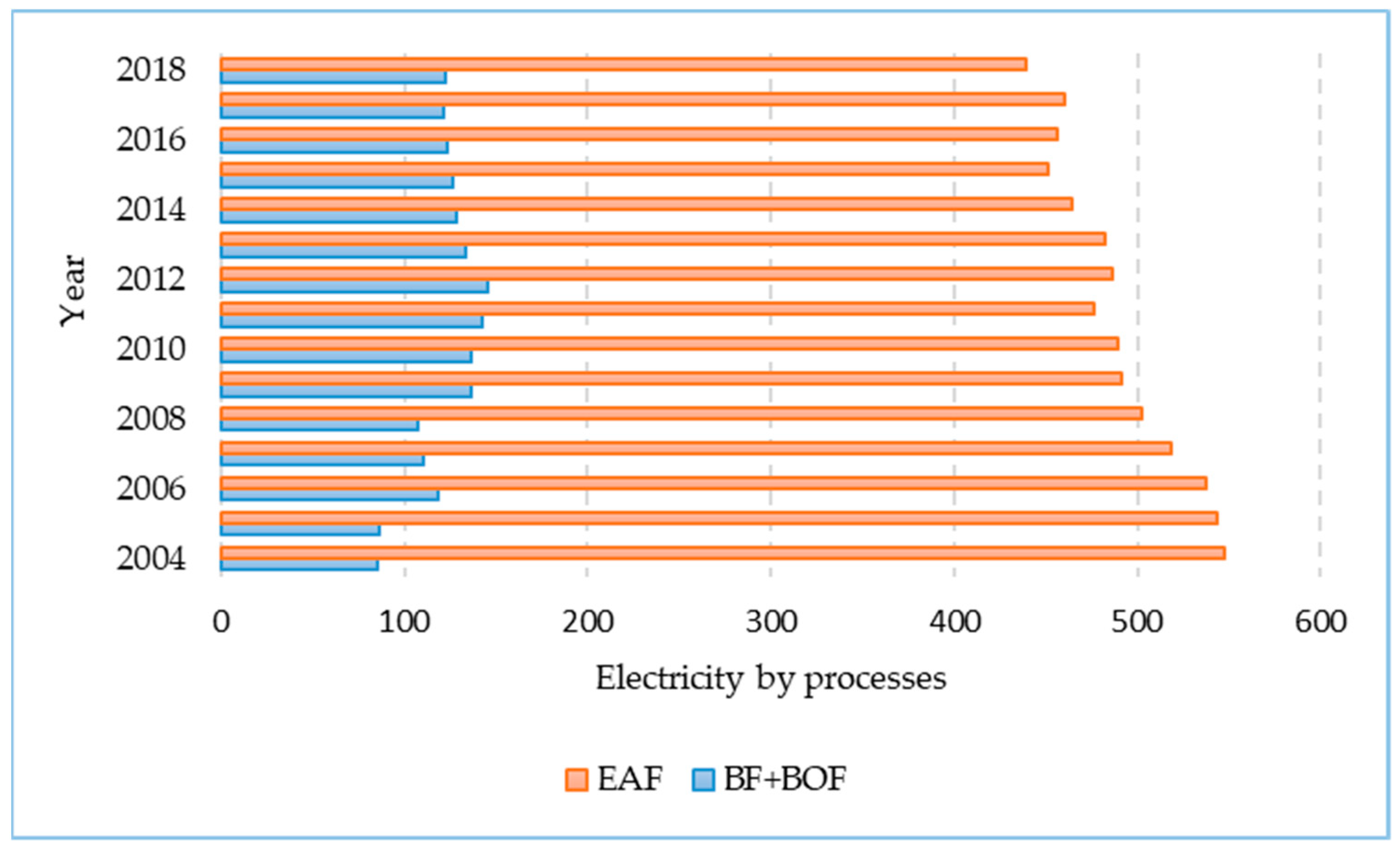

4.1.1. Electricity Intensity

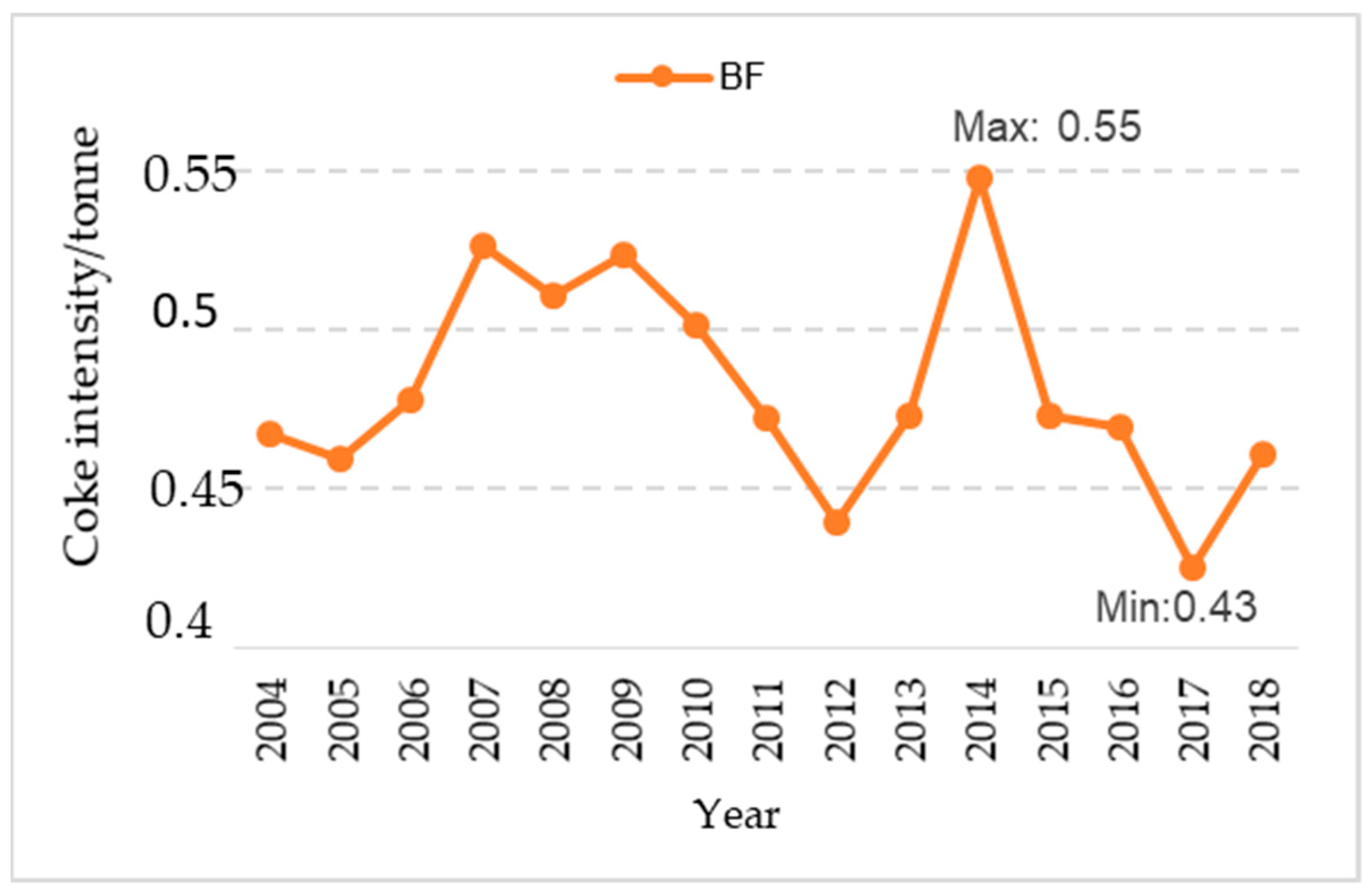

4.1.2. Coke Intensity

4.2. Analyses of Expenditure on Investment in Polish Steel Industry

4.3. Dependency Models between Realised Investment and Resource Intensity for Polish Steel Industry

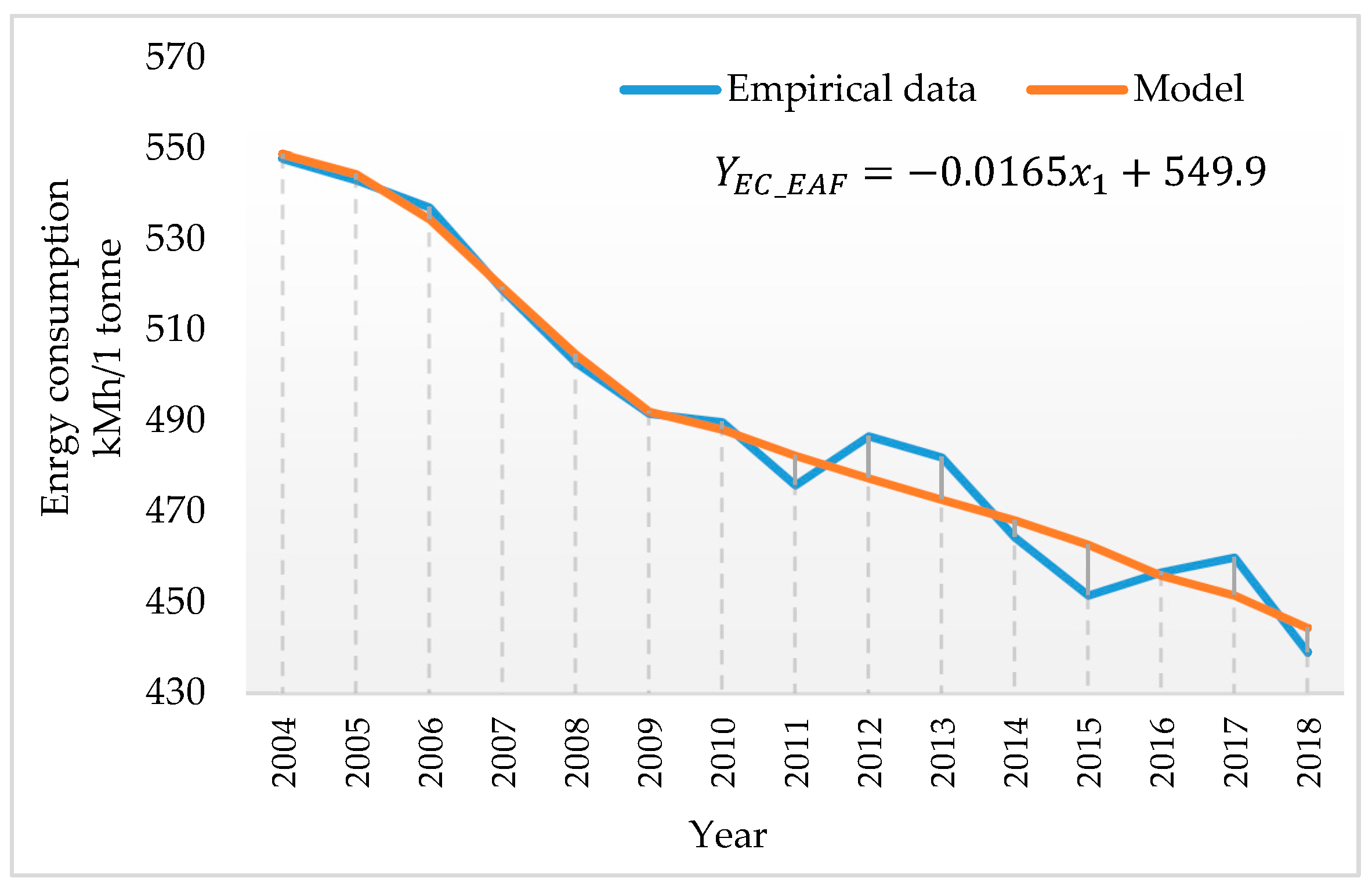

4.3.1. Investments and Energy Consumption in Steel Works with EAF Installations

4.3.2. Investments and Coke Consumption in Steel Works with the BF + BOF Installations

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wang, Z.; Jia, H.; Xu, T.; Xu, C. Manufacturing industrial structure and pollutant emission: An empirical study of China. J. Clean. Prod. 2018, 197, 462–471. [Google Scholar] [CrossRef]

- Kot, S.; Haque, A.U.; Kozlovski, E. Strategic SCM’s mediating effect on the sustainable operations: Multinational perspective. Organizacija 2019, 52, 219–235. [Google Scholar] [CrossRef]

- Mariyakhan, K.; Mohamued, E.A.; Asif Khan, M.; Popp, J.; Oláh, J. Does the level of absorptive capacity matter for carbon intensity? Evidence from the USA and China. Energies 2020, 13, 407. [Google Scholar] [CrossRef]

- Magda, R.; Bozsik, N.; Meyer, N. An evaluation of gross inland energy consumption of six central European countries. J. East. Eur. Central Asian Res. 2019, 6, 270–281. [Google Scholar] [CrossRef]

- Banerjee, S.B. Corporate environmental strategies and actions. Manag. Decis. 2001, 39, 633. [Google Scholar] [CrossRef]

- Androniceanu, A.; Tvaronavičienė, M. Developing a holistic system for social assistance services based on effective and sustainable partnerships. Adm. Manag. Public 2019, 33, 103–118. [Google Scholar] [CrossRef]

- Gunasekaran, A.; Irani, Z.; Papadopoulos, T. Modelling and analysis of sustainable operations 630 management: Certain investigations for research and applications. J. Oper. Res. Soc. 2014, 65, 806–823. [Google Scholar] [CrossRef]

- Elkington, J. Accounting for the Triple Bottom Line. Meas. Bus. Excell 1998, 2, 563. [Google Scholar] [CrossRef]

- Martínez, P.; Rodríguez del Bosque, I. Sustainability Dimensions: A Source to Enhance Corporate Reputation. Corp. Reput. Rev. 2014, 17, 239–253. [Google Scholar] [CrossRef]

- Pacana, A.; Ulewicz, R. Research of determinants motiving to implement the environmental management system. Pol. J. Manag. Stud. 2017, 16, 165–174. [Google Scholar] [CrossRef]

- Shpak, N.; Kuzmin, O.; Melnyk, O.; Ruda, M.; Sroka, W. Implementation of circular economy in Ukraine: Context of European integration. Resources 2020, 9, 96. [Google Scholar] [CrossRef]

- Šebestová, J.; Sroka, W. Sustainable development goals and SME decisions: The Czech Republic vs. Poland. J. East. Eur. Central Asian Res. 2020, 7, 39–50. [Google Scholar] [CrossRef]

- Hussain, H.I.; Slusarczyk, B.; Kamarudin, F.; Thaker, H.M.T.; Szczepańska-Woszczyna, K. An investigation of an adaptive neuro-fuzzy inference system to predict the relationship among energy intensity, globalization, and financial development in major ASEAN economies. Energies 2020, 13, 850. [Google Scholar] [CrossRef]

- Popp, J.; Kovács, S.; Oláh, J.; Divéki, Z.; Balázs, E. Bioeconomy: Biomass and biomass-based energy supply and demand. New Biotechnol. 2020, 60, 76–84. [Google Scholar] [CrossRef]

- Arasto, A.; Tsupari, E.; Kärki, J.; Sihvonen, M.; Lilja, J. Costs and potential of carbon capture and storage at an integrated steel mill. Energy Proc. 2013, 37, 7117–7124. [Google Scholar] [CrossRef]

- Flores-Granobles, M.; Saeys, M. Minimizing CO2 emissions with renewable energy: A comparative study of emerging technologies in the steel industry. Energy Environ. Sci. 2020, 13, 1923–1932. [Google Scholar] [CrossRef]

- Meyer, D.F.; Meyer, N. The relationships between entrepreneurial factors and economic growth and development: The case of selected European countries. Polish J. Manag. Stud. 2020, 21, 268–284. [Google Scholar] [CrossRef]

- Neef, C.; Hirzel, S.; Arens, M. Industry 4.0 in the European Iron and Steel Industry: Towards an Overview of Implementations and Perspectives; Fraunhofer Institute for Systems and Innovation Research ISI: Karlsruhe, Germany, 2018. Available online: https://www.isi.fraunhofer.de/content/dam/isi/dokumente/cce/2018/Industry-4-0-Implementation-and-Perspectives_Steel-Industry_Working%20document.pdf (accessed on 15 November 2020).

- Lorentzen, J. Resource Intensity, Knowledge and Development: Insights from Africa and South America; HSRC Press: Cape Town, South Africa, 2008; ISBN 978-07969-2213-7. [Google Scholar]

- International Energy Agency. Energy Technology Perspectives; IEA: Paris, France, 2012. [Google Scholar]

- Borocki, J.; Radisic, M.; Sroka, W.; Greblikaite, J.; Androniceanu, A. Methodology for strategic posture determination of SMEs-the case from a developing country. Eng. Econ. 2019, 30, 265–277. [Google Scholar] [CrossRef]

- OECD Manual. Measuring Productivity 2010. Available online: http://www.oecd.org/dataoecd/59/29/2352458.pdf (accessed on 7 May 2010).

- Frolov, V.G.; Kaminchenko, D.I.; Kovylkin, D.Y.; Popova, J.A.; Pavlova, A.A. The Main Economic Factors of Sustainable Manufacturing Within the Industrial Policy Concept of Industry 4.0. Acad. Strat. Manag. J. 2017, 16, 1–11. [Google Scholar]

- Rüßmann, M.; Lorenz, M.; Gerbert, P.; Waldner, M.; Justus, J.; Engel, P.; Harnisch, M. Industry 4.0: The Future of Productivity and Growth in Manufacturing Industries. Available online: www.inovasyon.org/pdf/bcg.perspectives_Industry.4.0_2015.pdf (accessed on 6 January 2020).

- Androniceanu, A.-M.; Georgescu, I.; Tvaronavičiene, M.; Androniceanu, A. Canonical correlation analysis and a new composite index on digitalization and labor force in the context of the industrial revolution 4.0. Sustainability 2020, 12, 6812. [Google Scholar] [CrossRef]

- Ślusarczyk, B.; Tvaronavičienė, M.; Ul Haque, A.; Oláh, J. Predictors of Industry 4.0 technologies affecting logistic enterprises’ performance: International perspective from economic lens. Technol. Econ. Dev. Econ. 2020, 26, 1263–1283. [Google Scholar] [CrossRef]

- Saniuk, S.; Grabowska, S.; Gajdzik, B. Social Expectations and Market Changes in the Context of Developing the Industry 4.0 Concept. Sustainability 2020, 12, 1362. [Google Scholar] [CrossRef]

- Afonasova, M.A.; Panfilova, E.E.; Galichkina, M.A.; Ślusarczyk, B. Digitalization in economy and innovation: The effect on social and economic processes. Polish J. Manag. Stud. 2019, 19, 22–32. [Google Scholar] [CrossRef]

- Wang, S.; Wan, J.; Li, D.; Zhang, C. Implementing Smart Factory of Industry 4.0: An Outlook. Int. J. Distrib. Sens. Netw. 2016, 12, 3159805. [Google Scholar] [CrossRef]

- Wolniak, R.; Saniuk, S.; Grabowska, S.; Gajdzik, B. Identification of Energy Efficiency Trends in the Context of the Development of Industry 4.0 Using the Polish Steel Sector as an Example. Energies 2020, 13, 2867. [Google Scholar] [CrossRef]

- Popp, J.; Oláh, J.; Farkas Fekete, M.; Lakner, Z.; Máté, D. The relationship between prices of various metals, oil and scarcity. Energies 2018, 11, 2392. [Google Scholar] [CrossRef]

- Tishkov, S.; Shcherbak, A.; Karginova-Gubinova, V.; Volkov, A.; Tleppayev, A.; Pakhomova, A. Assessment the role of renewable energy in socio-economic development of rural and Arctic regions. Entrep. Sustain. Issues 2020, 7, 3354–3368. [Google Scholar] [CrossRef]

- Dudin, M.N.; Frolova, E.E.; Protopopova, O.V.; Mamedov, A.A.; Odintsov, S.V. Study of innovative technologies in the energy industry: Nontraditional and renewable energy sources. Entrep. Sustain. Issues 2019, 6, 1704–1713. [Google Scholar] [CrossRef]

- Nasr, A.; Kashan, M.K.; Maleki, A.; Jafari, N.; Hashemi, H. Assessment of Barriers to Renewable Energy Development Using Stakeholders Approach. Entrep. Sustain. Issues 2020, 7, 2526–2541. [Google Scholar] [CrossRef]

- Pilipczuk, O. Sustainable Smart Cities and Energy Management: The Labor Market Perspective. Energies 2020, 13, 6084. [Google Scholar] [CrossRef]

- Sarma, U.; Karnitis, G.; Zuters, J.; Karnitis, E. District heating networks: Enhancement of the efficiency. Insights Reg. Dev. 2019, 1, 200–213. [Google Scholar] [CrossRef]

- Duan, H.; Mo, J.; Fan, Y.; Wang, S. Achieving China’s energy and climate policy targets in 2030 under multiple uncertainties. Energy Econ. 2018, 70, 45–60. [Google Scholar] [CrossRef]

- Pappas, D.; Chalvatzis, K.; Guan, D.; Ioannidis, A. Energy and carbon intensity: A study on the cross-country industrial shift from China to India and SE Asia. Appl. Energy 2018, 225, 183–194. [Google Scholar] [CrossRef]

- Yu, B.; Li, X.; Qiao, Y.; Shi, L. Low-carbon transition of iron and steel industry in China: Carbon intensity, economic growth and policy intervention. J. Environ. Sci. 2015, 28, 137–147. [Google Scholar] [CrossRef] [PubMed]

- Kan, K.; Mativengaa, P.; Marnewick, A. Understanding energy use in the South African manufacturing industry. Procedia CIRP 2020, 91, 445–451. [Google Scholar] [CrossRef]

- Johansson, M. Improved energy efficiency within the Swedish steel industry—the importance of energy management and networking. Energy Effic. 2015, 8, 713–744. [Google Scholar] [CrossRef]

- Soepardi, A.; Thollander, P. Analysis of Relationships among Organizational Barriers to Energy Efficiency Improvement: A Case Study in Indonesia’s Steel Industry. Sustainability 2018, 10, 216. [Google Scholar] [CrossRef]

- Ki-Hoon, L. Drivers and Barriers to Energy Efficiency Management for Sustainable Development. Sustain. Dev. 2015, 23, 16–25. [Google Scholar] [CrossRef]

- Martinez, C. Estimating and analyzing energy efficiency in German and Colombian manufacturing industries using DEA and data panel analysis. Part I: Strategic Planning for Energy and the Environment Energy-intensive Sectors. Energy Sources Part B Econ. Plan. Policy 2015, 10, 322–331. [Google Scholar] [CrossRef]

- Ohlan, R. Energy Efficiency in India’s Iron and Steel Industry: A Firm-level Data Envelopment Analysis. Strat. Plan. Energy Environ. 2019, 38, 27–36. [Google Scholar] [CrossRef]

- Czosnyka, M.; Wnukowska, B.; Karbowa, K. Energy efficiency as a base of the energy economy in a modern industrial plants. Prog. Appl. Electr. Eng. PAEE 2018, 8441086. [Google Scholar] [CrossRef]

- Martelaro, N. Energy Use in US Steel Manufacturing, Stanford University. 2016. Available online: http://large.stanford.edu/courses/2016/ph240/martelaro1/ (accessed on 21 November 2020).

- Lee, D.; Cheng, C. Energy savings by energy management systems: A review. Renew. Sustain. Energy Rev. 2016, 56, 760–777. [Google Scholar] [CrossRef]

- Kolloch, M.; Reck, F. Innovation networks in the German energy industry: An empirical analysis of inter-organizational knowledge transfer. Int. J. Energy Sect. Manag. 2017, 11, 268–294. [Google Scholar] [CrossRef]

- Gajdzik, B. The road of Polish steelworks towards market success—Changes after restructuring process. Metalurgija 2013, 52, 421–424. [Google Scholar]

- Borowiecki, R.; Nalepa, B. Restrukturyzacja w procesie funkcjonowania I rozwoju przedsiębiorstw. In Zarządzanie Restrukturyzacją Procesów Gospodarczych; Borowiecki, R., Ed.; Difin: Warsaw, Poland, 2003; p. 76. [Google Scholar]

- Gajdzik, B.; Sroka, W. Analytic study of the capital restructuring process in metallurgical enterprises around the World and in Poland. Metalurgija 2012, 51, 265–268. [Google Scholar]

- World Steel Association. Statistics: Steel Production in Figures. Available online: https://www.worldsteel.org/steel-by-topic/statistics/World-Steel-in-Figures.html (accessed on 20 November 2020).

- Gajdzik, B. Metallurgical sector in Poland before and after transformation restructuring. Ann. Fac. Eng. Hunedoara 2013, 176, 171–177. [Google Scholar]

- Gajdzik, B.; Gawlik, R. Choosing the production function model for an optimal measurement of the restructuring efficiency of the Polish metallurgical sector in years 2000–2015. Metals 2018, 8, 23. [Google Scholar] [CrossRef]

- European Commission. Restructuring in Europe. A Review of EU Action to Anticipate and Manage Employment Change; Directorate-General for Employment, Social Affairs and Equal Opportunities: Luxembourg, 2008; Chapter 4. [Google Scholar]

- Gajdzik, B.; Burchart-Korol, D. Eco-innovation in manufacturing plants illustrated with an example of steel products development. Metalurgija 2011, 50, 63–66. [Google Scholar]

- Swat, M.; Brünnet, H.; Bähre, D. Selecting manufacturing process chains in the early stage of the product engineering process with focus on energy consumption. In Technology and Manufacturing Process Selection: The Product Life Cycle Perspective; Springer: Berlin/Heidelberg, Germany, 2014. [Google Scholar]

- Polish Steel Association (HIPH). Expensive energy causes low competitiveness of the Polish economy on the example of the steel industry; The economic impact of the pandemic. In Proceedings of the Polish Economic Society Conference, Katowice, Poland, 22 September 2020. [Google Scholar]

- He, K.; Wang, L.; Li, X. Review of the energy consumption and production structure of China’s steel industry: Current situation and future development. Metals 2020, 10, 302. [Google Scholar] [CrossRef]

- Rock, M.T.; Toman, M.; Cui, Y.; Jiang, K.; Song, Y.; Wang, Y. Technological learning, energy efficiency, and CO2 emissions in China’s energy intensive industries 2013. Available online: https://23.21.67.251/handle/10986/15851 (accessed on 20 November 2020).

- Egilmez, G.; Bhutta, K.; Erenay, B.; Park, Y.; Gedik, R. Carbon Footprint Stock Analysis of U.S. Manufacturing: A Time Series Input-Output LCA. Ind. Manag. Data Syst. 2017, 117, 853–872. [Google Scholar] [CrossRef]

- Gajdzik, B. Modelling the impact of investments on energy intensity in the Polish steel industry as a step towards Industry 4.0. In Proceedings of the 29th International Conference on Metallurgy and Materials-Metal, Brno, Czech Republic, 20–22 May 2020; pp. 1210–1215. [Google Scholar] [CrossRef]

- World Steel Association. World Steel in Figures 2018. Available online: https://www.worldsteel.org/en/dam/jcr:f9359dff-9546-4d6b-bed0-996201185b12/World+Steel+in+Figures+2018.pdf (accessed on 23 November 2020).

- He, X.; Kim, H.C.; Wallington, T.J.; Zhang, S.; Shen, W.; De Kleine, R.; Keoleian, G.A.; Ma, R.; Zheng, Y.; Zhou, B.; et al. Cradle-to-gate greenhouse gas (GHG) burdens for aluminum and steel production and cradle-to-grave GHG benefits of vehicle lightweighting in China. Resour. Conserv. Recycl. 2020, 152, 104497. [Google Scholar] [CrossRef]

- El Iysaouy, L.; El Idrissi, N.E.; Tvaronavičienė, M.; Lahbabi, M.; Oumnad, A. Towards energy efficiency: Case of Morocco. Insights Reg. Dev. 2019, 1, 259–271. [Google Scholar] [CrossRef]

- Strategia na Rzecz Odpowiedzialnego Rozwoju do Roku 2020 (Z Perspektywą do 2030 R.); Ministerstwo Rozwoju-Departament Strategii Rozwoju: Warsaw, Poland, 2017.

- World Steel Association. 2015. Available online: https://www.worldsteel.org/media-centre/press-releases/2015/energy-use-in-the-steel-industry-report-available-now.html (accessed on 23 November 2020).

- Saługa, P.W.; Szczepańska-Woszczyna, K.; Miśkiewicz, R.; Chłąd, M. Cost of Equity of Coal-Fired Power Generation Projects in Poland: Its Importance for the Management of Decision-Making Process. Energies 2020, 13, 4833. [Google Scholar] [CrossRef]

- Saniuk, S.; Grabowska, S.; Gajdzik, B. Personalization of Products in the Industry 4.0 Concept and Its Impact on Achieving a Higher Level of Sustainable Consumption. Energies 2020, 13, 5895. [Google Scholar] [CrossRef]

- Gajdzik, B.; Gawlik, R.; Skoczypiec, S. Forecasting-scenario-heuristic method propos al for assessment of feasibility of steel production scenarios in Poland–Managerial implications for production engineering. Arch. Civ. Mech. Eng. 2018, 18, 1651–1660. [Google Scholar] [CrossRef]

| Statistical Indicator | Indicator Value | Assessment on the Basis of an Indicator |

|---|---|---|

| 1. Determination factor | R2 = 0.9713 | 97% variability of y is explained by the model; match of the model to empirical data is very good |

| 2. Indicator: | = 0.9690 | |

| 3. Statistics F | F = 439.44 p > 0.99 | Variables are correlated linearly |

| 4. Expressiveness factor | Se = 0.012 | Very good match |

| 5. Significance test: t-Student test | x1: t = −20.96 p > 0.99 | Significant parameter |

| Statistical Indicator | Indicator Value | Assessment on the Basis of an Indicator |

|---|---|---|

| 1. Autocorrelation test: Durbin-Watson statistics | DW = 2.41 DW < 4-du | There is no auto-correlation of the residuals in the model |

| 2. Residual distribution randomness test: series test statistics | Ke = 5 K1 ≤ Ke ≤ K2 | The residuals are randomly distributed (a random pattern of residuals supports a linear model) |

| 3. Jarque-Barre (JB) test for normality of residuals | JB = 0.866 JB ≤ 5.991 | The residuals are normally distributed |

| 4. Residuals symmetric test: t statistic | t = 2.429 t < tα | The residuals are symmetrically distributed |

| 5. Residuals homoscedasticity: White test | LM = 0.11 LM < χ2 | Homoscedasticity—variances for the residuals are equal |

| Statistical Indicator | Indicator Value | Assessment on the Basis of an Indicator |

|---|---|---|

| 1. Determination factor | R2 = 0.8000 | 80% variability of y is explained by the model; match of the model to empirical data is very good |

| 2. Indicator: | ||

| 3. Statistics F | F = 23.88 p > 0.99 | There is a linear relationship (statistics based on linearised empirical data: LN) |

| 4. Expressiveness factor | Se = 0.091 | Good match |

| 5. Significance test: t-Student test | x1: t = 4.95 p > 0.99 x2: t = −2.12 p > 0.95 | Parameter x1 is relevant Parameter x2 is relevant |

| Statistical Indicator | Indicator Value | Assessment on the Basis of an Indicator |

|---|---|---|

| 1. Autocorrelation test: Durbin-Watson statistics | DW = 2.41 DW < 4-du | No residual autocorrelation |

| 2. Residual distribution randomness test: series test statistics | Ke = 5 K1 ≤ Ke ≤ K2 | The residual distribution is random |

| 3. Jarque-Barre (JB) test for normality of residuals | JB = 0.866 JB ≤ 5.991 | The residuals are normally distributed |

| 4. Residual symmetry test: t statistic | t = 2.429 t < tα | The residuals are symmetrically distributed |

| 5. Random component homoscedasticity test: White test | LM = 0.11 LM < χ2 | The random component is homoscedastic |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gajdzik, B.; Sroka, W. Resource Intensity vs. Investment in Production Installations—The Case of the Steel Industry in Poland. Energies 2021, 14, 443. https://doi.org/10.3390/en14020443

Gajdzik B, Sroka W. Resource Intensity vs. Investment in Production Installations—The Case of the Steel Industry in Poland. Energies. 2021; 14(2):443. https://doi.org/10.3390/en14020443

Chicago/Turabian StyleGajdzik, Bożena, and Włodzimierz Sroka. 2021. "Resource Intensity vs. Investment in Production Installations—The Case of the Steel Industry in Poland" Energies 14, no. 2: 443. https://doi.org/10.3390/en14020443

APA StyleGajdzik, B., & Sroka, W. (2021). Resource Intensity vs. Investment in Production Installations—The Case of the Steel Industry in Poland. Energies, 14(2), 443. https://doi.org/10.3390/en14020443