Abstract

This paper aims to check the impact of investment and institutional determinants on the energy efficiency gap. The findings of the bibliometric analysis confirmed the growth of research interests in identifying the core determinants of the energy efficiency gap. The central hypothesises are: the increasing quality of the institutions leads to an increase of green investments in the energy sector and the dual relationships between investment and institutional determinants lead to additional synergy effects, which allow boosting the decline of energy efficiency gaps of the national economy. For the analysis, the times series were collected from the World Data Bank, Eurostat, Bloomberg, for Ukraine for the period of 2002–2019. The following methods were used: the unit root test—for checking the stationarity of data—and the Johansen test and VEC-modelling—for the cointegration analysis. The findings prove that to reduce the energy efficiency gaps in Ukraine by 1% next year, it is necessary to increase green energy investments by 1.5% this year, and the political stability and public perception of corruption by 3% and 1%. The increase of the public perception of corruption by 1.47 points and of political stability by 2.38 points leads to maximising the recovery speed of the Ukrainian energy sector. Thus, while developing the policy to decrease the energy efficiency gaps, the Ukrainian government should consider the level of public perception of corruption and political stability.

1. Introduction

In December 2019, the new climate strategy “Green Deal Policy” was accepted at the UN summit COP25, which promotes the transition to a circular and carbon-free economy. Considering this, together with the EU accession vector of the Ukrainian development, it is necessary to synchronise the national energy policy with the basic principles of the EU energy policy. The results of the comparative analysis of Ukraine and EU countries showed that Ukrainian energy efficiency was lower compared with the EU countries. At the same time, the level of energy efficiency increased in 2019 compared to 2018. However, this increase resulted from the industrial production decline due to the political instability in Ukraine, not from improving governance in the energy sector or extending green innovations in the energy sector, which contribute to attracting green investment. Considering the experts’ estimation, Ukraine has a huge potential to become an energy-efficient country and to boost its transformation into a carbon-free economy. In this case, in Ukraine, one of the main goals is to decrease the energy efficiency gap of the national economy. At the same time, the experience of the EU countries confirmed that the energy efficiency gap could be decreased if the government provides an effective policy based on the empirically justified targets and the core bullet points of “Green Deal Policy”.

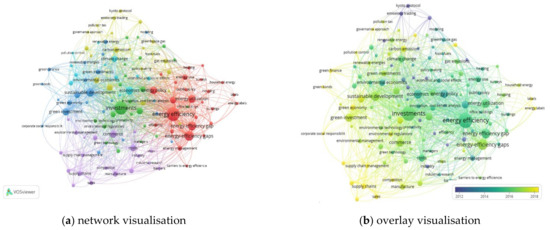

Findings of the scientific research on the energy efficiency gaps confirmed that scholars mostly analysed the energy gap from a technical viewpoint. The scientists in [1,2,3,4,5,6,7,8,9,10,11,12] analysed the energy efficiency gap at the company level as a result of insufficient technologies in the industrial sector. Moreover, the researchers in [13,14,15,16,17,18,19,20,21] defined the internal factors which influenced the company’s performance, involving energy efficiency. The bibliometric analysis (by means of the software VOSViewer v.1.6.10.) of 10,357 papers (with keywords: energy efficiency, energy efficiency gap, energy gap) published in a Scientific Journal indexed in Scopus and Web of Science showed that the scholars began to investigate the impact of the institutional quality and green investment on energy efficiency gaps. Thus, in Figure 1a, the investment (green cluster) was the mediator between sustainable development (navy blue cluster) and good governance (yellow cluster). Moreover, the overlay visualisation (Figure 1b) confirms that issues of the energy efficiency gap that has been studied since 2017. The relations between energy efficiency gaps, social and economic effects, and carbon trade have been studied since 2012. Scientists have been investigating the issues of green investment, green finance, and green bond concerning energy efficiency gaps since 2018 (Figure 1a). Thus, the authors of [22,23,24] proved that social and economic growth of a country influenced the energy sector development. The findings of the bibliometric analysis allowed defining the energy efficiency gap as a discrepancy between potentially possible and actual levels of the national economy’s energy efficiency due to the use of inefficient technologies of production, transportation and use of energy, limited green investment for energy renewal, and asynchrony of certain measures of the energy sector’s state regulation in the national economy.

Figure 1.

The finding of co-occurrence analyses: network and overlay visualisation (source: developed by the authors).

The scientists in [25,26,27,28,29,30,31] proved that institutional determinants should be considered while estimating different types of gaps. Moreover, in [32,33,34,35,36,37,38,39,40], the authors analysed the investment market development in Ukraine, allocating the core determinants which limit the green investment in the energy sector. The scientists confirmed that innovation technologies allowed achieving direct and indirect effects in the energy sector [41,42,43,44,45,46]. Salman [47] studied the link of economic growth, greenhouse gas emissions, and energy consumption and defined the institutional quality as a mediator in that relation. The findings in [47] confirmed the long-run relation among institutional quality, economic growth, and energy consumption. Despite the considerable background in the analysis of the energy sector development and a decline of the energy efficiency gap, the issues of estimating institutional, economic, and ecological impact have not been investigated yet. This paper aims to check the impact of investment and institutional determinants on the energy efficiency gap in the case for Ukraine for the period of 2002–2019.

This paper is organised as follows: the second section “Materials and Methods” provides the compilation of the scientific approaches to testing the hypothesis of the link between the range of the determinants and the energy efficiency of the national economy, the explanations of hypothesises and methods to test them; the third section “Results” presents the analytical results of the cointegration test between the selected parameters in the short and long run; the fourth section contains the conclusion based on these findings.

2. Materials and Methods

A focus of current scientific research is to confirm empirically a mutual link among institutional environment, the efficiency of economic, social, and ecological development, the dynamic of energy consumption from renewable energy, and the energy efficiency of a national economy. For this, scientists have used the various economic and mathematical models [48,49,50,51,52,53,54,55,56] (Table 1).

Table 1.

Approaches to testing the hypothesis of the link among institutional environment, efficiency of economic, social, and ecological development, the dynamic of energy consumption from renewable energy, and the energy efficiency of the national economy (source: compiled by the authors).

The assessment of the energy efficiency gap was based on the findings in [57,58]. It should be noted that technological determinants were beyond the framework of the economic research. In this case, the paper focused on analysing investments and institutional determinants due to implementing the state policy on reducing the energy efficiency gap. The investment determinants were explained by the volume of green investment, which directs to the energy-efficient technologies. The efficiency of government regulation described institutional determinants. Agreeing with the authors of [57,58], the institutions of the national economy should be developed based on the concept of “Good Governance”. Thus, six indicators of Worldwide Governance Indicators (WGI) were chosen for this research:

- Political and civil liberties (WGIVIA);

- Government political stability (WGIPS);

- Freedoms and qualifications of public authorities (WGIGE);

- Public confidence in government action (WGIRL);

- Public perception of corruption (WGICC);

- The government’s ability to implement policies and regulations (WGIRQ) [59].

The World Bank calculated a broader range of institutional indicators, unlike Transparency International, which estimated the index of corruption only. Moreover, the World Bank used the unification methodology for all indicators, which allowed eliminating the scaling issues. Considering the Word Bank methodology, the indicators of institutional quality was estimated using the scale from −2.5 (low quality) to 2.5 (high quality).

Considering the abovementioned, the main hypothesises of the paper are:

H1: the increasing quality of the institutions leads to an increase of green investments in the energy sector.

H2: the dual relations between investment and institutional determinants lead to additional synergy effects, which allow boosting the decline of energy efficiency gaps of the national economy.

In the first stage, the impact of the World Governance Indicators (WGI) (as the indicators of the institutional quality) on energy efficiency gaps in the national economy was analysed using model 1. It allowed allocating the most significant indicators among WGI for the further steps of the analysis:

where is a constant; refers to the searching parameters; refers to the indexes of the institutional quality; PE refers to the energy efficiency gaps (calculated based on the findings of the paper [58]); and refers to the errors.

Based on the findings, the statistically significant indexes of the institutional quality were selected for the next step—checking a link among selected indexes of the institutional quality, green investments, and energy efficiency gaps. For this purpose, the VEC-model and Johansen test were used. It allowed defining the targets of the investment and institutional determinants, which lead to an annual decline of the energy efficiency gap and to boosting the energy sector development. The approach developed contained the following stages:

- Collecting the statistics data for developing the economic model. The information base was obtained from World Data Bank, Eurostat, Bloomberg [59,60].

- Checking the stationarity of the selected data.

- Checking the cointegration among the selected indicators.

- Checking the hypothesis H1: the short- and long-run relations among energy consumption, green investment in the energy sector, and selected statistically significant indexes of the institutional quality.

Considering model 1, the economic model for testing H2 could be presented as follows:

where refers to the energy efficiency gaps; is green investment; refers to the selected indicators WGI, which were of statistical significance; ECT is a parameter that describes the long-term relationship between the time series of the energy efficiency gaps, the green investment in the energy sector, and the selected indexes of the institutional quality; ϕ is a constant; α, β, γ, η are regression parameters; µ is a statistical error; i = 1, …, N; t = 1, …, T; and ∆ is the operator of the first difference of the model parameters.

The stationarity of the data was checked by Unit root test, Levin, Lin and Chu, Im Pesaran and Shin, Fisher Chi-square tests. Using the Johansen test, the cointegration among the selected parameters was done. The analysis was performed using EViews10 software for Ukraine for 2002–2019.

3. Results

In the first stage, in order to select the statistically significant indicators, the WGI indicators were analysed. The descriptive statistics and graphical interpretation of the WGI dynamic are shown in Table 2 and Figure 1.

Table 2.

The descriptive statistics of WGI for Ukraine, 2002–2019 (Source: developed by the authors).

The findings in Table 2 confirmed that only two indicators were positive. Thus, in 2007, the government political stability (WGIPS) amounted to 0.173, while in 2018, political and civil liberties (WGIVIA) accounted for 0.09. This confirmed the low institutional quality in Ukraine in 2002–2019.

Two indexes demonstrated the most positive trend of improving the quality of the institutions in the recent years:

- Freedoms and qualifications of public authorities (WGIGE);

- The government’s ability to implement policies and regulations (WGIRQ).

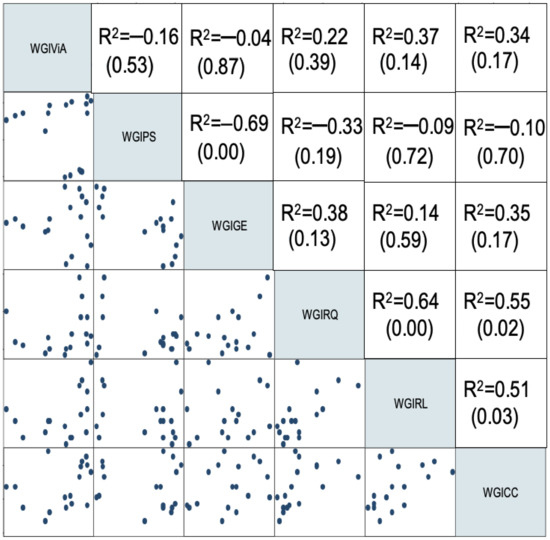

With the purpose to identify the significant indicators among WGI, the paired correlation coefficients and their statistical significance were calculated. The findings are summarised in Figure 2.

Figure 2.

A correlation matrix of WGI for Ukraine, 2002–2019 (Source: developed by the authors). WGIVIA—political and civil liberties; WGIPS—government political stability; WGIGE—freedoms and qualifications of public authorities; WGIRL—public confidence in government action; WGICC—public perception of corruption; WGIRQ—the government’s ability to implement policies and regulations; R2—coefficient of determination.

The findings showed that the correlation coefficient was not higher than 0.7, with the statistical significance being no more than 0.05. It confirmed that the integrated indicators could not be allowed for obtaining adequate results without considering the relevant weight coefficients. The results of the element-by-element assessment of the WGI impact on the energy efficiency gaps are shown in Table 3.

Table 3.

Results of the element-by-element assessment of the WGI Impact on the energy efficiency gaps for Ukraine, 2002–2019 (Source: developed by the authors).

Thus, the general impact of instructional indicators on the energy efficiency gap was explained by the political stability—more than 30%—and public perception of corruption—60%. The relevant coefficient of the determination accounted for 0.312 and 0.616, with high statistical significance. Thus, the core indicators among WGI, which influenced the energy gap, were political stability and public perception of corruption.

The findings in Table 4 showed that information criteria defined by Akaike, Schwartz and Hannan-Quinn were higher for the model, with a lag of one year. The statistical significance of the parameters for this type of a model was higher—1%.

Table 4.

Determining the optimal number of time lags for inclusion in the model for Ukraine in 2002–2019 (source: developed by the authors).

In this case, in the next stage of VEC modelling in the short term, a one-year lag was considered. The results of the Johansen test confirmed the cointegration between two indicators. That conclusion was based on the fact that the null hypothesis of the Johansen test (lack of cointegration) was rejected, as evidenced by the high value of statistical significance (1%) of the indicator “Maximum eigenvalue of Hannan—Quinn” (Table 5). The findings of the cointegration analysis between the selected parameters are shown in Table 5.

Table 5.

The findings of the cointegration analysis between the selected parameters using the Johansen test for Ukraine in 2002–2019 (source: developed by the authors).

Considering the findings in Table 3, the government’s ability to implement policies and regulations (WGIRQ) did not have significant impact on energy efficiency gaps. At the same time, in [61], the authors maintain that the regulatory policy had a significant impact on extending renewable energy and attracting green investment. Thus, they [61] proved that the strict government regulations in the energy sector led to an outflow of green investments, which limit the extension of renewable energy. Moreover, renewable energy and green investment were the core determinants in reducing the energy efficiency gap. At the same time, the authors of [62] proved that without a strict regulatory policy in the energy sector, the country could not reduce the GHG emissions and increase its energy efficiency. In this case, the WGIRQ would be considered for further analysis as a control variable.

The findings of the Johansen test confirmed the cointegration in the chain “quality of the institutions ⇔ green investments in energy ⇔ energy efficiency gaps”, with a one-year lag. In this case, in the roadmap for reforms in the energy sector of Ukraine, the government should indicate the annual target for investment and institutional determinants, the achievement of which leads to the corresponding annual reduction of energy efficiency gaps. Based on empirical results, it was established that in order to reduce energy efficiency gaps in Ukraine by 1% next year, it was necessary to increase green energy investments by 1% this year, and government political stability and public corruption indices to 3% and 1%.

In the last stage, the VEC-model was used for testing the hypothesis on the short and long-run relations among energy efficiency gaps, green investments in the energy sector, the index of political stability, public perception of corruption, and the government’s ability to implement policies and regulations. The findings of VEC-model are shown in Table 6.

Table 6.

The findings of the cointegration test among the energy efficiency gaps, green investment in the energy sector, the index of political stability, public perception of corruption for a short period, and the government’s ability to implement policies and regulations with a one-year lag for Ukraine in 2002–2019 (source: developed by the authors).

The number in the corresponding cells of the matrix (Table 6) characterised the change of indicators in the t year, shown in the matrix column, depending on the change in the t−1 year of the indicator in the corresponding matrix row.

The findings allowed confirming the pairwise cointegration relations with a statistical significance of 5% in the short term among the following indicators:

- Energy efficiency gaps and green investments in the energy sector;

- Energy efficiency gaps and the index of public perception of corruption;

- Green investments in the energy sector and government political stability;

- Green investments in the energy sector and the index of public perception of corruption.

Moreover, the empirical results allowed concluding that the Ukrainian government should reorient the regulatory policy in the energy sector considering the economic and ecological conditions in the country. It could become the basis for developing the integrated energy policy considering the EU requirements.

The findings for the long-run relation are shown in Table 7. Empirical results of checking the cointegration among the selected parameters for the long term (for Ukraine in the period of 2002–2019).

Table 7.

The findings of cointegration between the selected parameters in the long run for Ukraine in 2002–2019 (source: developed by the authors).

- The energy efficiency gaps depended on the green investment in the energy sector, political stability, and public perception of corruption, as ECMt_1 was less than 0, and the statistical significance was 10%.

- The green investment in the energy sector depended on the energy efficiency gaps, political stability, and public perception of corruption, as ECMt_1 was higher than 0 and the statistical significance (Prob.) was higher than 10%.

- The government political stability did not depend on energy efficiency gaps, public perception of corruption, as ECMt_1 was less than 0, and the statistical significance (Prob.) was more than 10%.

- The public perceptions of corruption did not depend on energy efficiency gaps and political stability, as ECMt_1 was less than 0, and the statistical significance (Prob.) was more than 10%.

4. Discussion

In the framework of transitioning to a carbon-free economy, the core requirements of the energy efficiency decline are to boost reforms, implement long-term paradigms of extending sustainable development. In Ukraine, the most of legislative base was formed according to the principles of the “rent paradigm”, where the traditional resources were the core driver of economic growth. It should be noted that Ukraine has already taken the powerful steps to change the old paradigm. Thus, Ukraine developed the “Concepts of Sustainable Development of Ukraine until 2030”, “The Energy Strategy of Ukraine for the Period up to 2035”, “The National Action Plan for Renewable Energy until 2030”, “Concepts for Implementing the State Policy in the Field of Climate Change until 2030”, etc. Moreover, in January 2020, the “Concepts of “Green” Energy Transition of Ukraine until 2050” were accepted. The efficiency of the abovementioned regulations depends on the quality of the institutional environment, which relates to political restrictions, minimisation of bureaucracy, democratic structure, prevention of corruption, constitutional features, transparency in decision-making, etc. The government has a core role in developing the energy system and strategy. Therefore, the attraction of direct foreign investment in the country and energy sector requires coordination and coopetition of all stakeholders of the energy market, developing an energy infrastructure. At the same time, the high level of crime and corruption in the government energy policy limits implementation of the effective mechanism to minimise the uncontrolled flows of energy and energy resources, which contributed to increasing energy efficiency gaps. Thus, the findings obtained in this paper were similar to those in [63,64,65,66]. Moreover, the same conclusion as in this research was made by the scientists in [67], using examples of EU countries and countries that are potential candidates for EU membership. The authors highlighted that the anti-corruption policy was an essential driver of the economic growth, stimulating the extension of renewable energy and reducing greenhouse gas emissions in Ukraine. Moreover, the fight against corruption also allowed identifying the transparent support systems for cleaner and renewable energy sources, which guarantees the reduction of greenhouse gas emissions. Another aspect that can impact on the energy efficiency gap through the institutional quality is the macroeconomic environment in which investment decisions are taken. In fact, in [68], the scholars highlighted that the level of riskiness and uncertainly of the investment can influence the performance of energy efficiency investment, which could affect the energy efficiency gap. This riskiness in the investment relates to the macroeconomic indicators which depend even on institutional quality. In this case, for further research, it would be useful to consider the macroeconomic environment in which investment decisions are taken, to better appraise its level of riskiness and uncertainly.

5. Conclusions

One of the core requirements of the practical policy for reducing the energy efficiency gaps should be to provide political stability and active anti-corruption policy. The findings of the Johansen test proved the cointegration between the institution quality, green investments in energy, and energy efficiency gaps. Thus, in order to reduce energy efficiency gaps in Ukraine by 1% next year, it is necessary to increase green energy investments by 1.5% this year, and the political stability and public perception of corruption by 3% and 1%. It means that the government should provide proactive measures to recover the political stability in the country and implement the transparency mechanisms of financial reporting in the energy sector. Moreover, it is necessary to develop the national reporting system on green investment, noticing that it allowed increasing the green investors’ trust to Ukraine and attracting additional financial resources to green technologies from the worldwide organisation.

The findings of VEC modelling showed that in case of significant endogenous or exogenous shocks, which would destabilize the long-term equilibrium in the Ukrainian energy sector, there was a weak rate of its return to equilibrium on its own, without the radical regulatory interventions by the government. The relevant indicator in the VEC model was 0.612, with a reference value of 0. The increase of the public perception of corruption by 1.47 points and of political stability by 2.38 points leads to maximising the recovery speed of the Ukrainian energy sector. Thus, the government should implement the complex of the coordinated and synchrony mechanisms on increasing efficiency of the energy policy.

The increase of institutional quality led to increasing green investment in the energy sector. Therefore, the mutual influence of institutional and investment determinants creates additional synergetic effects that cumulatively accelerate the dynamics of minimising energy efficiency gaps. Moreover, the government should annually indicate the targets for energy reforms with the purpose to achieve the stable development of the energy sector considering the EU requirements. Reports of reforms’ implementation could increase transparency, and consequently, reduce corruption in the energy sector.

Author Contributions

Conceptualisation, methodology, software, investigation, and data curation, V.P., T.P., and O.L.; writing—original draft preparation, writing—review and editing, and visualisation, T.P., O.L., A.K., H.D., M.D.-B., and P.B. All authors have read and agreed to the published version of the manuscript.

Funding

The research was funded by a grant from the National Research Foundation of Ukraine “Stochastic modelling of a road map for harmonising the national and European standards for energy market regulation in transition to a circular and carbon-free economy” (ID 2020.02/0231) and a grant from the Ministry of Education and Science of Ukraine (No. 0120U102002).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Miśkiewicz, R. The Importance of Knowledge Transfer on the Energy Market. Polityka Energetyczna 2018, 21, 49–62. [Google Scholar] [CrossRef]

- Pająk, K.; Kvilinskyi, O.; Fasiecka, O.; Miśkiewicz, R. Energy Security in Regional Policy in Wielkopolska Region of Poland. Econ. Environ. 2017, 2, 122–138. Available online: https://www.ekonomiaisrodowisko.pl/uploads/eis%2061/11_pajak.pdf (accessed on 4 January 2021).

- Mazurkiewicz, J.; Lis, P. Diversification of Energy Poverty in Central and Eastern European Countries. Virtual Econ. 2018, 1, 26–41. [Google Scholar] [CrossRef]

- Muhammed, G.; Tekbiyik-Ersoy, N. Development of Renewable Energy in China, USA, and Brazil: A Comparative Study on Renewable Energy Policies. Sustainability 2020, 12, 9136. [Google Scholar] [CrossRef]

- Kong, Y.; Feng, C.; Yang, J. How does China Manage its Energy Market? A Perspective of Policy Evolution. Energy Policy 2020, 147, 111898. [Google Scholar] [CrossRef]

- Adua, L.; Clark, B.; York, R. The Ineffectiveness of Efficiency: The Paradoxical Effects of State Policy on Energy Consumption in the United States. Energy Res. Soc. Sci. 2021, 71, 101806. [Google Scholar] [CrossRef]

- Doggart, N.; Ruhinduka, R.; Meshack, C.K.; Ishengoma, R.S.; Morgan-Brown, T.; Abdallah, J.M.; Spracklen, D.V.; Sallu, S.M. The Influence of Energy Policy on Charcoal Consumption in Urban Households in Tanzania. Energy Sustain. Dev. 2020, 57, 200–213. [Google Scholar] [CrossRef]

- Saługa, P.W.; Szczepańska-Woszczyna, K.; Miśkiewicz, R.; Chłąd, M. Cost of Equity of Coal-Fired Power Generation Projects in Poland: Its Importance for the Management of Decision-Making Process. Energies 2020, 13, 4833. [Google Scholar] [CrossRef]

- Chygryn, O.; Bilan, Y.; Kwilinski, A. Stakeholders of Green Competitiveness: Innovative Approaches for Creating Communicative System. Mark. Manag. Innov. 2020, 3, 356–368. [Google Scholar] [CrossRef]

- Kwilinski, A.; Zaloznova, Y.; Trushkina, N.; Rynkevych, N. Organizational and Methodological Support for Ukrainian Coal Enterprises Marketing Activity Improvement. E3s Web Conf. 2020, 168, 00031. [Google Scholar] [CrossRef]

- Pavlyk, V. Institutional Determinants of Assessing Energy Efficiency Gaps in The National Economy. Socioecon. Chall. 2020, 4, 122–128. [Google Scholar] [CrossRef]

- Kwilinski, A. Mechanism of Formation of Industrial Enterprise Development Strategy in the Information Economy. Virtual Econ. 2018, 1, 7–25. [Google Scholar] [CrossRef]

- Makarenko, I.; Sirkovska, N. Transition to Sustainability Reporting: Evidence from EU and Ukraine. Bus. Ethics Leadersh. 2017, 1, 16–24. [Google Scholar] [CrossRef]

- Biewendt, M.; Blaschke, F.; Böhnert, A. An Evaluation of Corporate Sustainability in Context of the Jevons. Socioecon. Chall. 2020, 4, 46–65. [Google Scholar] [CrossRef]

- Salihaj, T.; Pryimenko, S. Modification of the International Energy Agency Model (the IEA Model of Short-term Energy Security) for Assessing the Energy Security of Ukraine. Socioecon. Chall. 2017, 1, 95–103. [Google Scholar] [CrossRef][Green Version]

- Singh, S.N. Regional Disparity and Sustainable Development in North-Eastern States of India: A Policy Perspective. Socioecon. Chall. 2018, 2, 41–48. [Google Scholar] [CrossRef]

- Mercado, M.P.S.R.; Vargas-Hernández, J.G. Analysis of the Determinants of Social Capital in Organisations. Bus. Ethics Leadersh. 2019, 3, 124–133. [Google Scholar] [CrossRef]

- Mačaitytė, I.; Virbašiūtė, G. Volkswagen Emission Scandal and Corporate Social Responsibility—A Case Study. Bus. Ethics Leadersh. 2018, 2, 6–13. [Google Scholar] [CrossRef]

- Andrade, H.S.; Loureiro, G. A Comparative Analysis of Strategic Planning Based on a Systems Engineering Approach. Bus. Ethics Leadersh. 2020, 4, 86–95. [Google Scholar] [CrossRef]

- Miskiewicz, R. Efficiency of Electricity Production Technology from Post-Process Gas Heat: Ecological, Economic and Social Benefits. Energies 2020, 13, 6106. [Google Scholar] [CrossRef]

- Karakasis, V.P. The Impact of “Policy Paradigms” on Energy Security Issues in Protracted Conflict Environments: The Case of Cyprus. Socioecon. Chall. 2017, 1, 5–18. [Google Scholar] [CrossRef]

- Mentel, G.; Vasilyeva, T.; Samusevych, Y.; Pryymenko, S. Regional Differentiation of Electricity Prices: Social-Equitable Approach. Int. J. Environ. Technol. Manag. 2018, 21, 354–372. [Google Scholar] [CrossRef]

- Vasylyeva, T.A.; Pryymenko, S.A. Environmental Economic Assessment of Energy Resources in the Context of Ukraine’s Energy Security. Actual Probl. Econ. 2014, 160, 252–260. [Google Scholar]

- Shindina, T.; Streimikis, J.; Sukhareva, Y.; Nawrot, Ł. Social and Economic Properties of the Energy Markets. Econ. Sociol. 2018, 11, 334–344. [Google Scholar] [CrossRef]

- Bilan, Y.; Vasilyeva, T.; Lyeonov, S.; Bagmet, K. Institutional Complementarity for Social and Economic Development. Bus. Theory Pract. 2019, 20, 103–115. [Google Scholar] [CrossRef]

- Vorontsova, A.; Vasylieva, T.; Bilan, Y.; Ostasz, G.; Mayboroda, T. The Influence of State Regulation of Education for Achieving the Sustainable Development Goals: Case Study of Central and Eastern European Countries. Adm. Manag. Public 2020, 6–26. [Google Scholar] [CrossRef]

- Vasilyeva, T.; Bilan, S.; Bagmet, K.; Seliga, R. Institutional Development Gap in the Social Sector: Crosscountry Analysis. Econ. Sociol. 2020, 13, 271–294. [Google Scholar] [CrossRef]

- Kharazishvili, Y.; Kwilinski, A.; Grishnova, O.; Dzwigol, H. Social Safety of Society for Developing Countries to Meet Sustainable Development Standards: Indicators, Level, Strategic Benchmarks (with Calculations Based on the Case Study of Ukraine). Sustainability 2020, 12, 8953. [Google Scholar] [CrossRef]

- Pavlyk, V. Assessment of Green Investment Impact on the Energy Efficiency Gap of the National Economy. Financ. Mark. Inst. Risks 2020, 4, 117–123. [Google Scholar] [CrossRef]

- Dalevska, N.; Khobta, V.; Kwilinski, A.; Kravchenko, S. A Model for Estimating Social and Economic Indicators of Sustainable Development. Entrep. Sustain. Issues 2019, 6, 1839–1860. [Google Scholar] [CrossRef]

- Palienko, M.; Lyulyov, O.; Denysenko, P. Fiscal Decentralisation as a Factor of Macroeconomic Stability of the Country. Financ. Mark. Inst. Risks 2017, 1, 74–86. [Google Scholar] [CrossRef]

- Kwilinski, A.; Vyshnevskyi, O.; Dzwigol, H. Digitalization of the EU Economies and People at Risk of Poverty or Social Exclusion. J. Risk Financ. Manag. 2020, 13, 142. [Google Scholar] [CrossRef]

- Bilan, Y.; Vasylieva, T.; Lyeonov, S.; Tiutiunyk, I. Shadow Economy and its Impact on Demand at the Investment Market of the Country. Entrep. Bus. Econ. Rev. 2019, 7, 27–43. [Google Scholar] [CrossRef]

- Dzwigol, H.; Dzwigol-Barosz, M. Sustainable Development of the Company on the Basis of Expert Assessment of the Investment Strategy. Acad. Strateg. Manag. J. 2020, 19, 1–7. [Google Scholar]

- Vasilyeva, T.A.; Leonov, S.V.; Lunyakov, O.V. Analysis of Internal and External Imbalances in the Financial Sector of Ukraine’s Economy. Actual Probl. Econ. 2013, 150, 176–184. [Google Scholar]

- El Amri, A.; Boutti, R.; Rodhain, F. Sustainable Finance at the Time of Institutions: Performativity through the Lens of Responsible Management in Morocco. Financ. Mark. Inst. Risks 2020, 4, 52–64. [Google Scholar] [CrossRef]

- Chygryn, O.Y.; Krasniak, V.S. Theoretical and Applied Aspects of the Development of Environmental Investment in Ukraine. Mark. Manag. Innov. 2015, 3, 226–234. [Google Scholar]

- Boutti, R.; Amri, A.E.; Rodhain, F. Multivariate Analysis of a Time Series EU ETS: Methods and Applications in Carbon Finance. Financ. Mark. Inst. Risks 2019, 3, 18–29. [Google Scholar] [CrossRef]

- Dkhili, H. Environmental Performance and Institutions Quality: Evidence from Developed and Developing Countries. Mark. Manag. Innov. 2018, 3, 333–344. [Google Scholar] [CrossRef]

- Leonov, S.V.; Vasylieva, T.A.; Tsyganyuk, D.L. Formalization of Functional Limitations in Functioning of Co-Investment Funds Basing on Comparative Analysis of Financial Markets within FM CEEC. Actual Probl. Econ. 2012, 134, 75–85. [Google Scholar]

- Tkachenko, V.; Kwilinski, A.; Klymchuk, M.; Tkachenko, I. The Economic-Mathematical Development of Buildings Construction Model Optimisation on the Basis of Digital Economy. Manag. Syst. Prod. Eng. 2019, 27, 119–123. [Google Scholar] [CrossRef]

- Kendiukhov, I.; Tvaronaviciene, M. Managing Innovations in Sustainable Economic Growth. Mark. Manag. Innov. 2017, 3, 33–42. [Google Scholar] [CrossRef]

- Boiko, V.; Kwilinski, A.; Misiuk, M.; Boiko, L. Competitive Advantages of Wholesale Markets of Agricultural Products as a Type of Entrepreneurial Activity: The Experience of Ukraine and Poland. Econ. Ann. XXI 2019, 175, 68–72. [Google Scholar] [CrossRef]

- Miśkiewicz, R.; Wolniak, R. Practical Application of the Industry 4.0 Concept in a Steel Company. Sustainability 2020, 12, 5776. [Google Scholar] [CrossRef]

- Kuzior, A.; Kwilinski, A.; Tkachenko, V. Sustainable Development of Organisations Based on the Combinatorial Model of Artificial Intelligence. Entrep. Sustain. 2019, 7, 1353–1376. [Google Scholar] [CrossRef]

- Kwilinski, A.; Kuzior, A. Cognitive Technologies in the Management and Formation of Directions of the Priority Development of Industrial Enterprises. Manag. Syst. Prod. Eng. 2020, 28, 119–123. [Google Scholar] [CrossRef]

- Salman, M.; Long, X.; Dauda, L.; Mensah, C.N. The Impact of Institutional Quality on Economic Growth and Carbon Emissions: Evidence from Indonesia, South Korea and Thailand. J. Clean. Prod. 2019, 118331. [Google Scholar] [CrossRef]

- Dzwigol, H. Innovation in Marketing Research: Quantitative and Qualitative Analysis. Mark. Manag. Innov. 2020, 1, 128–135. [Google Scholar] [CrossRef]

- Dźwigoł, H.; Dźwigoł-Barosz, M. Scientific Research Methodology in Management Sciences. Financ. Credit Act. Probl. Theory Pract. 2018, 2, 424–437. [Google Scholar] [CrossRef]

- Tamazian, A.; Rao, B.B. Do Economic, Financial and Institutional Developments Matter for Environmental Degradation? Evidence from Transitional Economies. Energy Econ. 2010, 32, 137–145. [Google Scholar] [CrossRef]

- Solarin, S.A.; Al-Mulali, U.; Ozturk, I. Validating the Environmental Kuznets Curve Hypothesis in India and China: The Role of Hydroelectricity Consumption. Renew. Sustain. Energy Rev. 2017, 80, 1578–1587. [Google Scholar] [CrossRef]

- Abid, M. Impact of Economic, Financial, and Institutional Factors on CO2 Emissions: Evidence from Sub-Saharan Africa Economies. Util Policy 2016, 41, 85–94. [Google Scholar] [CrossRef]

- Farzanegan, M.R.; Markwardt, G. Development and Pollution in the Middle East and North Africa: Democracy Matters. J. Policy Model 2018, 40, 350–374. [Google Scholar] [CrossRef]

- Le, H.P.; Ozturk, I. The Impacts of Globalisation, Financial Development, Government Expenditures, and Institutional Quality on CO2 Emissions in the Presence of Environmental Kuznets Curve. Environ. Sci. Pollut. Res. 2020, 1–22. [Google Scholar] [CrossRef]

- Azam, M.; Liu, L.; Ahmad, N. Impact of Institutional Quality on Environment and Energy Consumption: Evidence from Developing World. Environ. Dev. Sustain. 2020, 1–22. [Google Scholar] [CrossRef]

- Uzar, U. Political Economy of Renewable Energy: Does Institutional Quality Make a Difference in Renewable Energy Consumption? Renew. Energy 2020, 155, 591–603. [Google Scholar] [CrossRef]

- Ukraine 2030. The Doctrine of Sustainable Development. 2017. Available online: http://ekmair.ukma.edu.ua/bitstream/handle/123456789/13431/Ukraina_2030.pdf?sequence=3&isAllowed=y (accessed on 10 June 2020).

- Pavlyk, V.V. Determinants of the Minimisation of the Energy Efficiency Gap in the National Economy. Ph.D. Thesis, Sumy State University, Sumy, Ukraine. Available online: https://essuir.sumdu.edu.ua/handle/123456789/79261 (accessed on 4 September 2020).

- Kaufmann, D.; Kraay, A.; Mastruzzi, M. The Worldwide Governance Indicators: A Summary of Methodology, Data and Analytical Issues. World Bank Policy Research Working Paper No. 5430. 2008–2019. Available online: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1682130 (accessed on 4 January 2021).

- Eurostat. Energy Efficiency. 2018. Available online: https://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=nrg_ind_eff&lang=en (accessed on 4 January 2021).

- Boute, A. Regulatory Stability and Renewable Energy Investment: The Case of Kazakhstan. Renew. Sustain. Energy Rev. 2020, 121, 109673. [Google Scholar] [CrossRef]

- Adedoyin, F.F.; Gumede, M.I.; Bekun, F.V.; Etokakpan, M.U.; Balsalobre-Lorente, D. Modelling Coal Rent, Economic Growth and CO2 Emissions: Does Regulatory Quality Matter in BRICS Economies? Sci. Total Environ. 2020, 710, 136284. [Google Scholar] [CrossRef]

- Ozturk, I.; Al-Mulali, U.; Solarin, S.A. The Control of Corruption and Energy Efficiency Relationship: An Empirical Note. Environ. Sci. Pollut. Res. 2019, 26, 17277–17283. [Google Scholar] [CrossRef]

- Hao, Y.; Gai, Z.; Wu, H. How do Resource Misallocation and Government Corruption Affect Green Total Factor Energy Efficiency? Evidence from China. Energy Policy 2020, 143, 111562. [Google Scholar] [CrossRef]

- Sekrafi, H.; Sghaier, A. Examining the Relationship between Corruption, Economic Growth, Environmental Degradation, and Energy Consumption: A Panel Analysis in MENA Region. J. Knowl. Econ. 2018, 9, 963–979. [Google Scholar] [CrossRef]

- Fredriksson, P.G.; Vollebergh, H.R.G.; Dijkgraaf, E. Corruption and Energy Efficiency in OECD Countries: Theory and Evidence. J. Environ. Econ. Manag. 2004, 47, 207–231. [Google Scholar] [CrossRef]

- Vasylieva, T.; Lyulyov, O.; Bilan, Y.; Streimikiene, D. Sustainable Economic Development and Greenhouse Gas Emissions: The Dynamic Impact of Renewable Energy Consumption, GDP, and Corruption. Energies 2019, 12, 3289. [Google Scholar] [CrossRef]

- Baldoni, E.; Coderoni, S.; D’Orazio, M.; Di Giuseppe, E.; Esposti, R. The Role of Economic and Policy Variables in Energy-efficient Retrofitting Assessment. A Stochastic Life Cycle Costing Methodology. Energy Policy 2019, 129, 1207–1219. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).