1. Introduction

In recent years, climate change and energy shortages have become global problems. To better control greenhouse gas emissions and improve energy efficiency, the European Union (EU) took the lead in introducing the Emission Trading Scheme (ETS) in 2005 [

1]. ETS is a cap-and-trade scheme in which the regulated companies trade carbon allowances based on the caps set by the ETS and their own emissions [

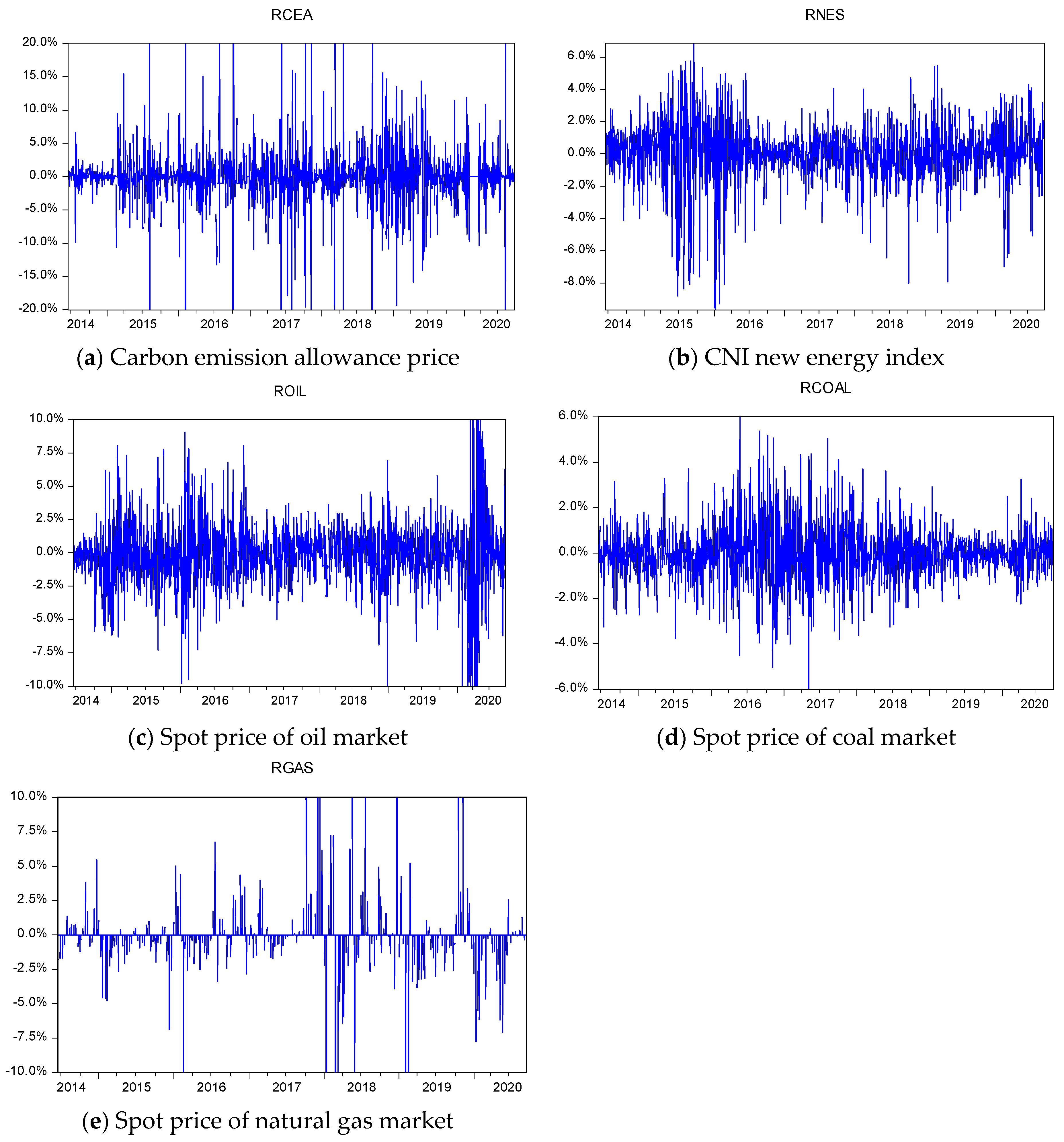

2]. After years of operation, ETS has been recognized as a cost-effective way to promote both carbon emission reduction and the development of renewable energy technology, and is gradually being adopted by regions and countries outside of Europe. It is worth mentioning that China’s ETS has rapidly developed in recent years and the role of China’s carbon trading market in promoting global carbon emission reduction has gradually emerged.

As the world’s largest developing country and second largest economy, China is the world’s largest consumer of energy production and has been working hard in recent years to fulfill its carbon emission reduction commitments. In 2009, China promised at the Copenhagen Climate Conference that by 2020, China’s carbon emission intensity would be reduced by 40–45% compared to 2005 [

3]. By the end of 2020, China has achieved a 48% reduction in carbon emission intensity compared with 2005 [

4]. In 2016, China signed the Paris Agreement, promising to reduce carbon emissions per unit of GDP by 60–65% by 2030 compared to 2005 and to increase the proportion of non-fossil fuels in primary energy consumption to 20% [

5]. In order to achieve the emission reduction target, China has been actively exploring the construction of a carbon trading market in recent years. In 2013, China established its first carbon trading pilot market in Shenzhen. In the next few years, pilot markets such as in Beijing, Shanghai, Guangdong, Tianjin, Hubei, Chongqing, and Fujian have been established, and the construction of a national carbon trading market began. By 2017, China had established eight pilot carbon trading markets across the country. As of the end of August 2020, the cumulative transaction volume of China’s carbon trading pilots reached 406 million tons and the cumulative turnover reached 6.8 billion yuan [

6]. In September 2020, China announced at the UN General Assembly that it will strive to reach the peak of carbon emissions by 2030 and achieve carbon neutrality by 2060 [

7]. So far, China has become the first developing country among the world’s major emitters to set a carbon neutral deadline. This is a huge challenge for China, who has ranked first in total carbon emissions since 2006. Therefore, the further improvement of the construction of the carbon trading market is not only essential for China to achieve its emission reduction goals but also for the global carbon emission reduction process.

China has actively developed new energy industries in recent years to reduce carbon emissions, improve the energy consumption structure, and realize the low-carbon transition of economic development. In the past few years, the new energy sector has become one of the fastest growing sectors in China’s energy industry. According to the white paper “Energy in China’s New Era”, released by China in 2020, as of the end of 2019, the installed capacity of wind power, photovoltaic power, and biomass power had reached 210 GW, 204 GW, and 23.69 GW, respectively, all ranking first in the world [

4]. Since 2010, China has invested approximately USD 818 billion in new energy power generation, accounting for 30% of global investment in new energy power generation during the same period [

4]. In addition, new energy vehicles are developing rapidly. In 2019, the number of new energy vehicles increased by 1.2 million and new energy vehicle ownership reached 3.8 million, both accounting for half of the global total [

4]. As of the end of 2019, China’s electric vehicle charging infrastructures reached 1.2 million [

4]. The development of the new energy industry has also attracted a large number of financial market investors to invest in some new energy listed companies, such as new energy vehicle companies, photovoltaic cell companies, and power generation companies. These investments from the financial market are very important for new energy companies because the development of new energy often depends on the development and upgrading of technology, which requires a great amount of funds, otherwise the development of the new energy industry will be hindered. Therefore, studying the new energy financial market is of great significance for the development of the new energy industry.

The construction of the carbon trading market and the development of new energy are two important approaches to reduce the dependence on fossil energy and emissions of greenhouse gases. Therefore, policy-makers pay great attention to the interactions between carbon allowances, new energy, and fossil energy. In addition, investors in the market have begun to pay more and more attention to this issue because understanding the interactions between the three is conducive to investment portfolio optimization, risk management, and hedging of different assets. At present, there are abundant research results in the field regarding the relationship between the carbon trading market, fossil energy market, and new energy financial market. The following is a review of the existing literature from three aspects: interaction relationship between the carbon trading market and fossil energy market; fossil energy and new energy stock market; and carbon trading market and new energy capital market.

Fossil energy, as a carbon-intensive energy, is considered to be closely related to the carbon trading market. Many existing studies have shown that the price of fossil energy is an important factor affecting the carbon price. Alberola et al. found that in the early stages of EU ETS, crude oil, natural gas, coal, and electricity will significantly affect carbon prices, and this effect may be different before and after structural breaks [

8]. Hammoudeh et al. and Balcılar et al. expanded the sample period and obtained similar conclusions. They constructed a Bayesian structural VAR model and found that crude oil, natural gas, coal, and electricity have different effects on the price of carbon allowances [

9]. By building a Markov regime-switching GARCH model with dynamic conditional correlations, Balcılar et al. found that the price of carbon futures will be affected by the price volatility of natural gas, electricity, and coal futures [

10]. Some scholars believe that energy prices affect carbon prices through switching prices. Creti et al. emphasized that in Phase II of EU ETS, crude oil prices, stock price indices, and the switching price between coal and natural gas are significant long-term determinants of carbon prices [

11]. Boersen and Scholtens found that the price of oil, natural gas, electricity, and the switching price of coal and natural gas will affect carbon prices through building the GARCH model [

12]. In addition, some studies show that there is not only a unidirectional driving relationship between energy price and carbon price. Keppler and Mansanet-Bataller conducted a Granger causality test for EU ETS and found that there is unidirectional or bidirectional Granger causality between temperature, coal, gas, electricity, and the stock market or carbon market [

13]. Cao and Xu used a Granger causality test on the relationship between carbon markets and energy markets throughout the Phase II of the EU ETS. They found that in the long run, there is a bidirectional Granger causality relationship between coal and carbon markets [

14]. Wang and Guo also considered the interactions between the carbon market, crude oil, and natural gas market, and investigated the return and volatility spillovers between the markets. They found that the WTI crude oil market has a stronger spillover effect on the system compared to the Brent and natural gas markets [

15]. Lee and Yoon found that compared with biofuels, the price of Brent oil has a stronger spillover effect on the price of EU carbon allowances [

16]. Wu et al. came to different conclusions from a non-linear perspective. They stated that the impact of crude oil market volatility on the carbon market is far less than the impact of the coal and natural gas markets on the carbon market [

17]. Yu et al. believed that while there may be no correlation between crude oil and the carbon market on a short-time scale, there is a strong linear or non-linear relationship between the two markets on a medium-time scale and long-time scale [

18]. It can be seen from the above literature that although scholars have various conclusions regarding the relationship between the energy market and the carbon market, it is generally believed that there is a close relationship between the carbon market and the fossil energy market.

The development of the new energy industry requires a large amount of innovation and research investment, and thus the new energy stock market is very important as a financing market for the industry. Meanwhile, the price of fossil energy is considered an important factor influencing the profitability of new energy projects. Therefore, the relationship between the investment in clean energy and the price of traditional fossil energy has attracted more and more attention with the massive development and utilization of clean energy worldwide. The relationship between crude oil and the new energy stock market has become a hot topic in this field. Some of these scholars believe that fossil energy such as oil is an important factor in the price of new energy stocks. Henriques and Sadorsky stated that oil price is the Granger cause of the clean energy stock price [

19]. Kumar et al. believed that clean energy stocks are affected by oil price, high-tech stock price, and interest rates [

20]. By introducing the Wavelet method, Reboredo et al. found that the correlation between oil price and new energy stock price in the short-term is very low and there is no Granger causality, but in the medium and long-term time scales, the correlation is enhanced and Granger causality exists [

21]. Through the research on the energy sector implied volatility index (VXXLE) and clean energy exchange-traded funds (ETFs), Dutta et al. found that the volatility of the energy sector has a negative impact on clean energy price returns and that the energy sector plays an important role in the price changes of clean energy ETFs [

22]. In addition to oil, Reboredo and Ugolini also studied the impact of natural gas, electricity, and coal price on new energy stock price. They found that in the United States and Europe, oil and electricity prices are the main factors affecting the price of new energy stocks in the United States and there is a positive dependence between energy prices and the return of new energy stocks [

23]. Song et al. stressed that compared with the coal and natural gas markets, the oil market has a greater impact on the returns and volatility of new energy stock price [

24]. Xia et al. found that different fossil energies have varying degrees of impact on the price of new energy stocks and the interactions between the oil and coal price and the return of the new energy stock price are more active [

25]. However, some other scholars believe that there is no significant correlation between oil price and new energy stock market. By constructing the GARCH model, Sadorsky found that the correlation between clean energy stocks and technology stocks is higher than that between clean energy and oil price, and investing in crude oil can effectively hedge the risks generated by investing in new energy stocks [

26]. Similarly, Ahmad stressed that the interdependence between crude oil and clean energy stocks is very limited when considering technology stocks [

27]. Taking the United States as an example, Ferrer et al. found that crude oil price do not seem to be a key factor in the price volatility of the stock price of clean energy companies [

28]. It can be seen that previous studies have different views on the relationship between traditional energy prices and the financial performance of new energy companies, and this field is worthy of further study.

Although there are few studies on the carbon trading market and new energy financial market, existing studies have shown that there is a close relationship between the carbon trading market and macroeconomic factors. The macroeconomic situation is closely correlated to companies’ production activities and the production activities directly affect the companies’ carbon emissions; therefore, economic factors will affect the supply and demand of carbon allowances. Some studies suggest that carbon markets are related to macroeconomic factors. Sousa et al. selected the European stock market FTSEurofirst 300 Index as an economic variable and found that carbon price is not only related to fossil energy prices but also to economic growth trends [

29]. Koch et al. came to a similar conclusion that in Phase II and in the early Phase Ⅲ of the EU ETS, economic factors have the greatest explanatory power for carbon price changes among the fundamental factors [

30]. Lutz et al. stated that the stock market and energy price are the most important drivers of carbon price [

31]. Yuan and Yang established a Gas-DCS-Copula and found that the uncertainty of the financial market has a considerable asymmetric risk spillover effect on the carbon market [

32]. Considering that both fossil energy and macroeconomic factors are closely related to the new energy capital market, this paper believes that the relationship between the new energy capital market and the carbon trading market is also worthy of in-depth study.

There are also some studies that have focused on the relationship between China’s carbon trading market, traditional energy market, and new energy financial market. First, some scholars have explored the relationship between carbon allowance prices and energy prices in China. Zeng et al. investigated the relationship between Beijing carbon allowance prices, macroeconomic factors, and fossil energy prices by constructing a structural vector autoregression (SVAR) model and found that the carbon allowance price is mainly affected by its own historical price, and there is an insignificant but positive correlation between the price of crude oil, the price of natural gas, and economic development [

33]. Chang et al. employed the DCC-GARCH model to respectively study the relationship between spot prices of carbon allowances in China’s five pilot carbon trading markets and the prices of coal, crude oil, and natural gas, and found that the volatility of the three energy prices have a long-term or short-term impact on the spot prices of carbon allowances; from the perspective of dynamic correlation, however, the spillover effect between energy price volatility and carbon allowance price volatility was relative low [

34]. Second, some scholars have conducted research on the relationship between the fossil energy market and new energy stocks. Zhang and Du found that the volatility of new energy stocks will not affect the stock prices of fossil energy companies and the correlation between the two is lower than that of new energy and high-tech stocks [

35]. Wen et al. built an asymmetric BEKK model and found that positive information about new energy stock price returns leads to a decline in the fossil fuel stock price return, while positive information about fossil fuel stock price returns leads to an increase in the new energy stock price returns [

36]. Chang et al. studied the dependence structure between China’s carbon trading pilot markets and three major energy markets, namely coal, oil and natural gas, and found that there are significant regional differences in the dependence relationship between the carbon market and energy market [

37]. In addition, there are a few studies on the relationship between China’s new energy stock market, fossil energy, and the carbon trading market. Lin and Chen studied the volatility spillover effect on the new energy stock market, coal market, and carbon trading market by establishing multivariate GARCH models and found that there is no significant volatility spillover effect between China’s carbon market and the fossil energy market, or between the carbon market and new energy stock market [

38]. Jiang et al. introduced a multivariate wavelet method to investigate the dynamic correlation between the new energy stock market, coal market, and carbon trading market under different time-frequencies [

39].

It can be seen from the above literature that although there is abundant research on the carbon trading market, new energy stock market, and fossil energy market, there are still some research gaps, which are mainly reflected in the following two aspects. One aspect concerns the fact that many previous studies have mainly focused on mature carbon trading markets in Europe or the US, but research on China, an emerging carbon trading market, is limited. However, the research on China’s carbon trading market is very important. This is because China has been the world’s largest emitter of greenhouse gases since 2006 and the efficiency of China’s emission reduction work is critical to the progress of global greenhouse gas reduction. At the same time, with the proposal of carbon neutral and carbon emission peak targets, China will accelerate the improvement and development of the carbon trading market, and research on China’s carbon trading market will be an important complement to the current research on carbon trading markets. Moreover, the study of China’s carbon trading market can provide reference for the construction of other emerging carbon trading markets. The second aspect concerns the fact that previous studies on the carbon trading market, new energy stock market, and fossil energy market have focused on the interactions between the two markets, and there are few studies considering the interactions between them from a systematic perspective. In contrast, conducting research from a system perspective can help in gaining a better understanding of the relationship between the three, which allows investors to engage in asset portfolio optimization and risk management, and is also conducive to policy-makers to establish effective policies. In consideration of the above research gap, this paper selects the Hubei carbon trading pilot market and builds a connectedness network model, as proposed by Diebold and Yilmaz, to study the time-varying spillover effect and asymmetry of the spillover effect of China’s carbon trading market, fossil energy market, and new energy stock market from 20 June 2014 to 18 September 2020 [

40].

The purpose of this paper is to explore the interactions between the three markets from a systematic perspective and to provide more information for investors and policy-makers by studying the quantitative spillovers among markets in the carbon–energy–stock system in China. The contributions of this paper are as follows:

(1) This may be the first study on the dynamic spillovers between China’s carbon trading market, fossil energy market, and new energy stock market from a systematic perspective. Different from using VAR and GARCH models to study the spillovers between every two markets in turn, this paper constructs a connectedness network model to measure both the system-wide and pairwise spillovers in the carbon–energy–stock system.

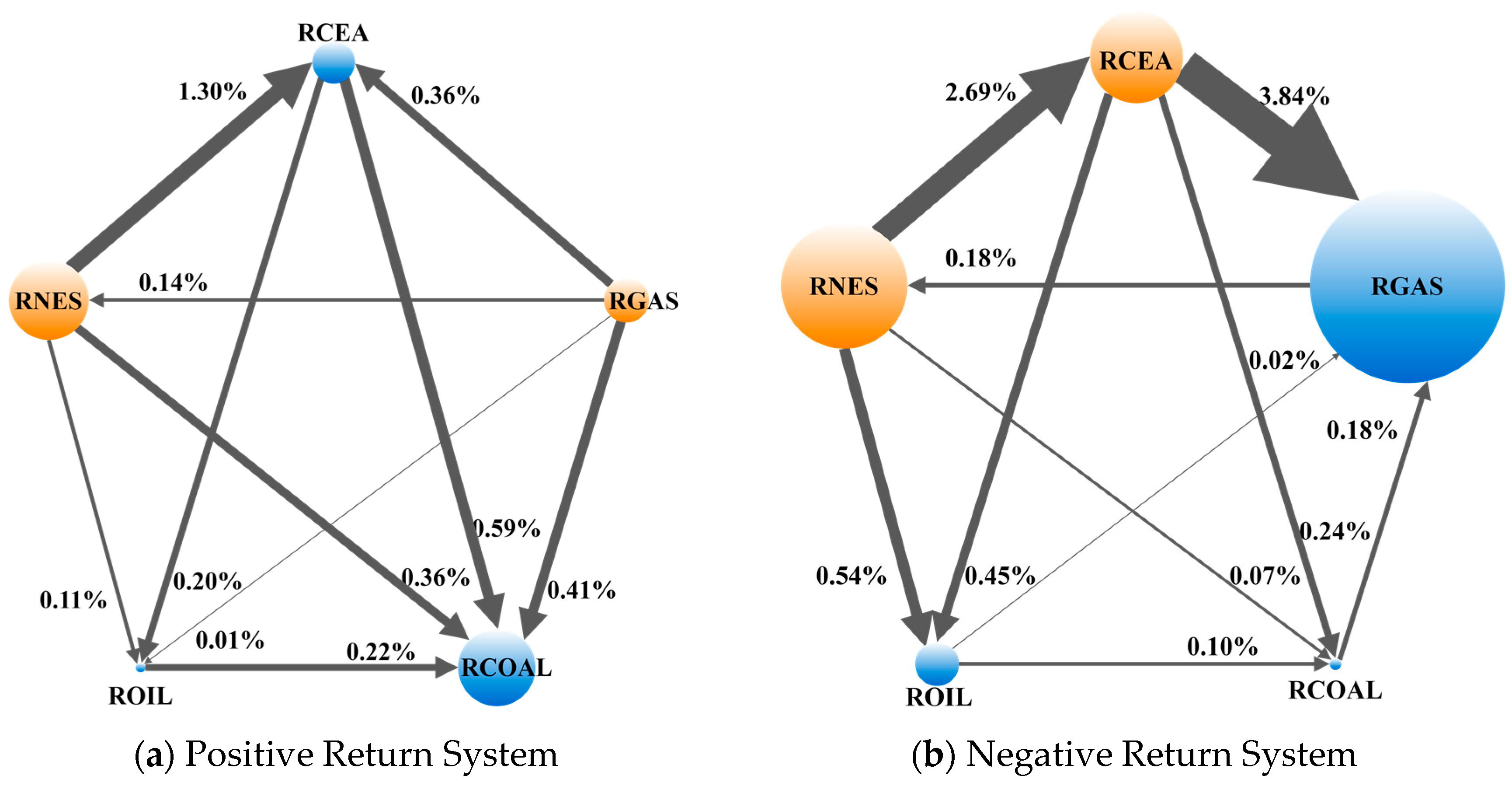

(2) Although there have been previous studies on the spillover effect between China’s carbon trading market, fossil energy market, and new energy stock market, there is no research on the asymmetry of the spillover effect of their spillover effect. This paper studies the asymmetry of the spillover effect by constructing a positive return connectedness network and a negative return connectedness network. The results show that the spillover effect of the carbon–energy–stock system is asymmetric, that is, the system is more sensitive to the negative information about price returns. Research on the asymmetry of the spillover effect can provide important information for market investors and policy-makers.

(3) In previous studies on the relationship between China’s carbon trading market, fossil energy market, and new energy stock market, scholars often chose the oil or coal market as the representative of the fossil energy market, but this paper selects three fossil energy sources: oil, coal, and natural gas. Thus, this paper takes into account the interactions between different fossil energy markets when analyzing the relationship between fossil energy and other markets. This can also provide more evidence for the relationship between different energy sources and the carbon trading market, which is conducive to assessing the role of the carbon trading market in improving China’s energy consumption structure.

(4) The existing research mainly focuses on mature carbon trading markets in Europe or the US, while this paper is a research study on the emerging carbon trading market, namely China’s carbon trading market, which is an important complement to the existing research. China’s carbon trading market has a different market structure. So far, it is a decentralized carbon trading market composed of several pilot carbon trading markets throughout the country. The research on China’s carbon trading market is not only of great significance to China but also can provide reference for other emerging carbon trading markets. Moreover, promoting the improvement of China’s carbon emission reduction work and the development of the new energy industry is conducive to accelerating the process of global carbon emission reduction; thus, the research in this paper has important theoretical and practical significance.

The structure of the remainder of this paper is as follows:

Section 2 introduces the connectedness network model;

Section 3 explains the contents of the variables and the source of the data, and makes a preliminary analysis of the original data; in

Section 4, we investigate the spillover from the static and dynamic perspectives of the carbon–energy–stock connectedness network and analyze the asymmetry of the spillover effect; lastly,

Section 5 summarizes the main findings of this paper and makes recommendations for policy-makers and market investors.

2. Methodology

In order to study the spillover effect of the carbon–energy–stock system, this paper introduces the connectedness network method proposed by Diebold and Yilmaz in 2014 [

40]. This method is based on forecast error variance decompositions from vector auto regressions (VAR). Different from standard approaches relying on Cholesky factorization, the result of variance decomposition in this method proposed by Diebold and Yilmaz is invariant to the ordering of the variables. In addition, this method can not only measure the pairwise spillovers between variables but can also measure the spillovers of the whole system.

First, we establish a standard p-order lag VAR model with N variables.

where

is an

vector, which can be expressed as,

. In this paper,

is a

vector that includes the prices of oil, natural gas, coal, clean energy, and carbon allowances.

is an

vector autoregressive coefficient matrix. The error term

is a vector of independently and identically distributed disturbances. Equation (1) can also be expressed by the equation of the moving average, that is,

.

,

is an

identity matrix. Additionally, this applies when

,

. Based on the generalized variance decomposition framework proposed by Koop et al. and Pesaran and Shin, Diebold and Yilmaz defined variable

j’s contribution to variable

i’s H-step-ahead generalized forecast error variance as that in [

40,

41,

42].

where

is the variance matrix of error vector

;

is the standard deviation of the error term of the

j-th variable;

is a selection variable whose

i-th element is 1, and the other elements are 0.

measures the pairwise directional connectedness between variable

i and variable

j, which can also be denoted as

.

In order to make the sum of each row of the variance decomposition matrix (the matrix with the

ij-th element in Equation (2)) equal to 1, the elements in the matrix are normalized.

Now,

and

. Sometimes, we need to measure the net pairwise directional connectedness between variables

If the net connectedness between the two variables is positive, it means that variable i is a net information transmitter to j, and if it is negative, it means that variable i is a net information receiver from j.

To determine how all variables together contribute to a single variable, the total directional connectedness from all variables to

i is defined as

The total directional connectedness from

i to all variables is computed as

To determine the role of the market in the overall system as a net information transmitter or receiver, the net total directional connectedness is calculated as

In order to get system-wide connectedness, the total spillover index of the system is computed as

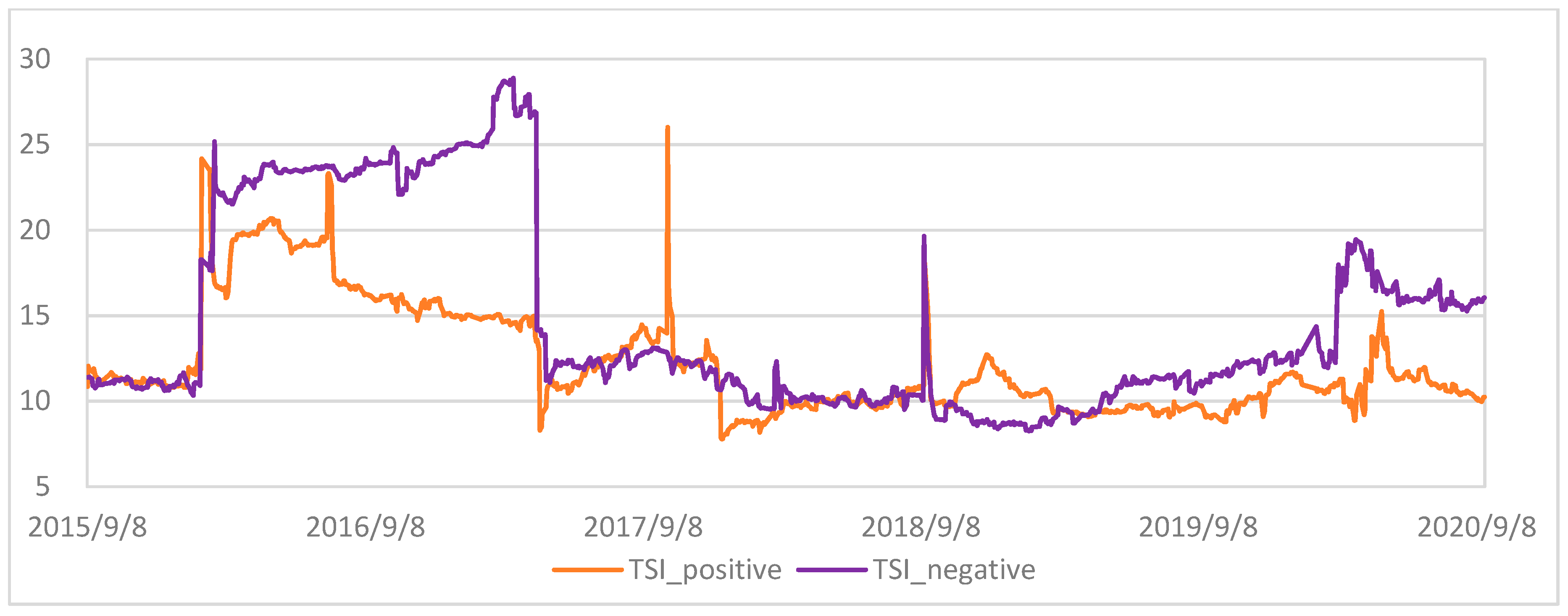

In order to study the asymmetry of market return volatility, it is necessary to construct the connectedness network of positive returns and negative returns. Referring to the research of Ji et al., this paper processed the original price return as follows to derive the time series of positive returns and negative returns [

43]. When

, set

, and otherwise set

. Similarly, when

, set

, and otherwise set

. The total spillover indexes of the positive and negative return connectedness networks are denoted as

and

, respectively. Then, we define the spillover asymmetry measure as

When the system does not have asymmetry, , which means that the system reacts to positive information as much as to negative information. When , it indicates that the system has asymmetry and there are two cases. When , it indicates that the volatility of the system affected by positive information is greater than that of negative information. When , it indicates that the system is more affected by negative information than by positive information. With the asymmetry of the spillover effect, we can know whether the system is more sensitive to positive or negative information about price returns.

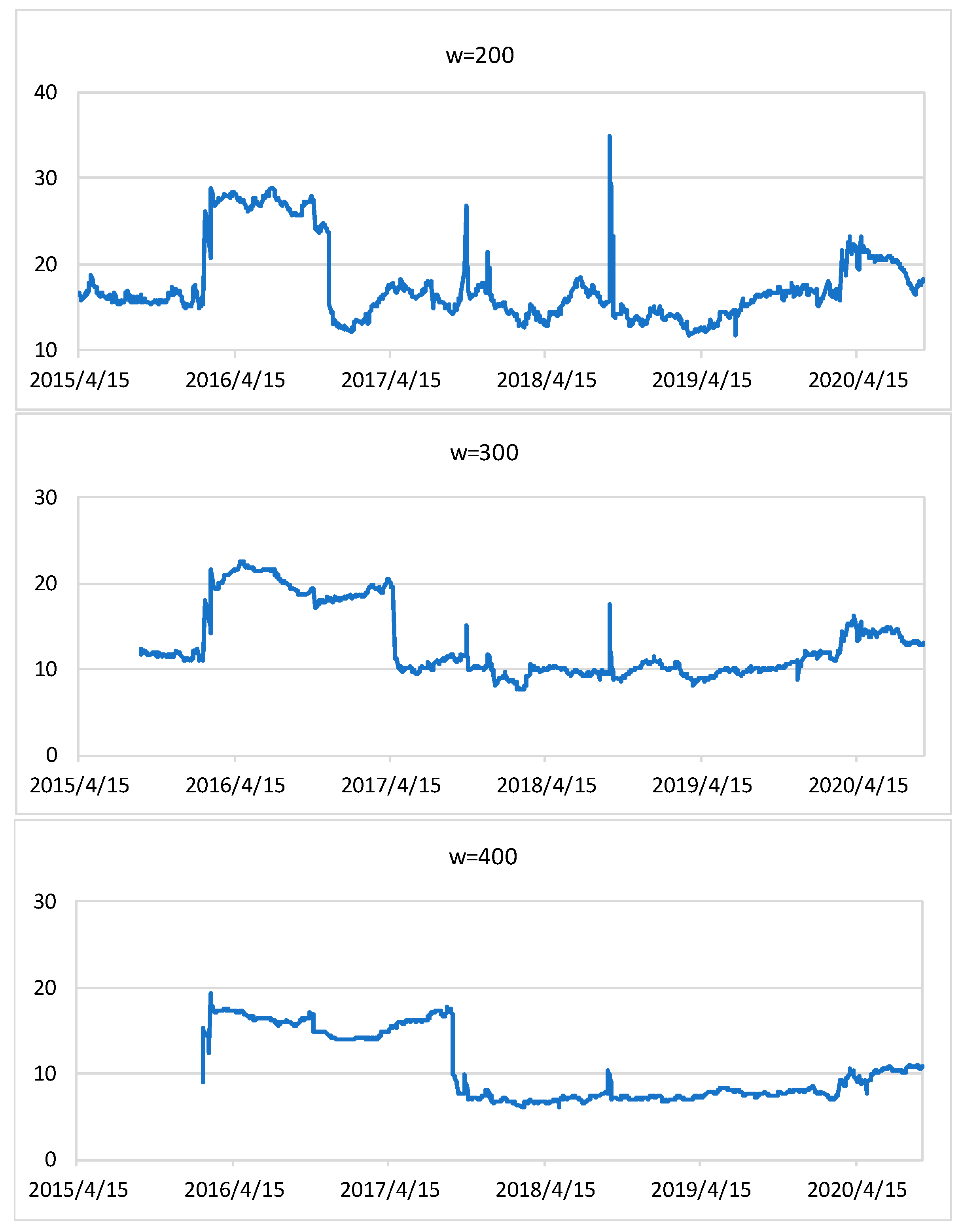

In order to study the dynamic spillovers between markets, the rolling window method is introduced. In the rolling window method, the full sample period is divided into several overlapping sub-sample periods and the connectedness network within each small sample period is studied. Then, time-varying characteristics of the volatility within the system are detected.

5. Conclusions

The study of the spillovers between China’s carbon trading market, new energy stock market, and fossil energy market is of great significance for China and for other developing countries that are in the early stages of establishing a carbon trading market. For China, this is useful for policy-makers and market participants to understand the interactions between markets and to establish energy policies or investment strategies. For other developing countries, this paper provides ideas and methods to analyze the dynamic linkages between the three markets. By constructing a connectedness network model of the carbon–energy–stock system, this paper conducted an empirical study on the spillovers between the carbon trading market, new energy stock market, and fossil energy market in China from June 2014 to September 2020.

5.1. Main Findings

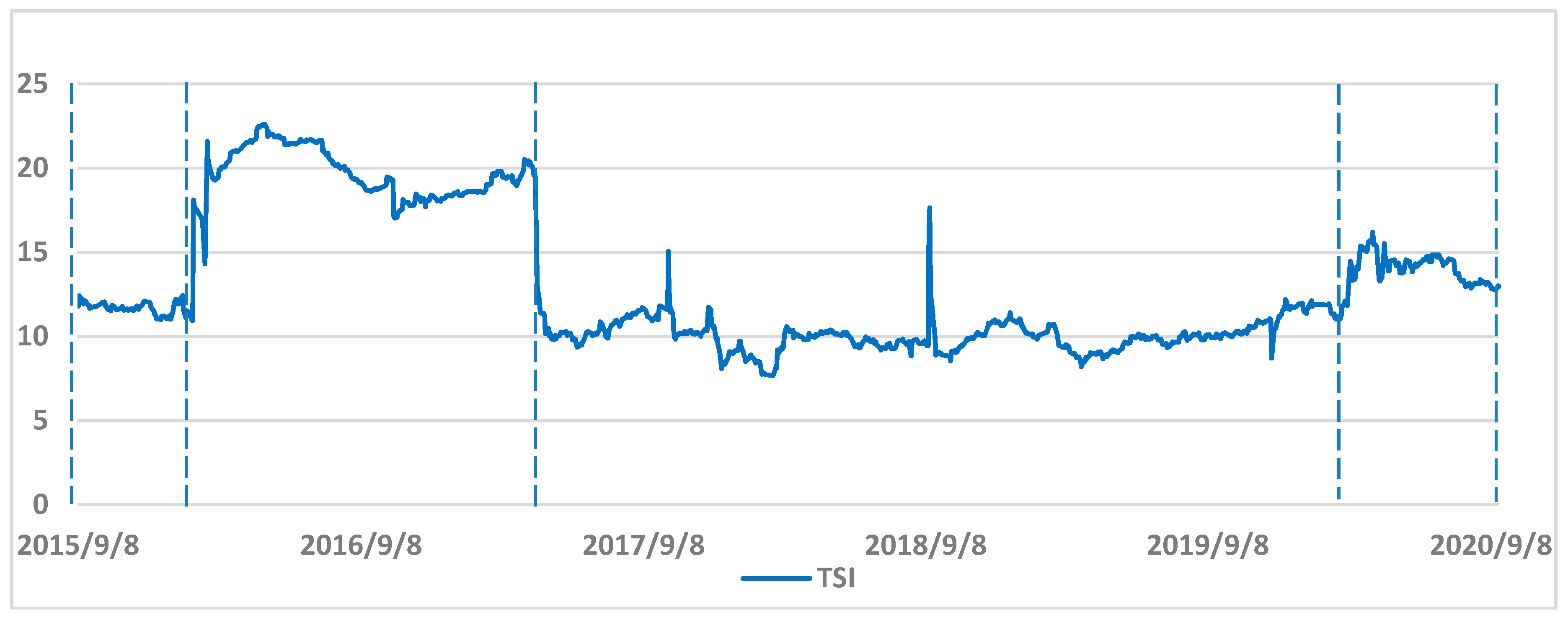

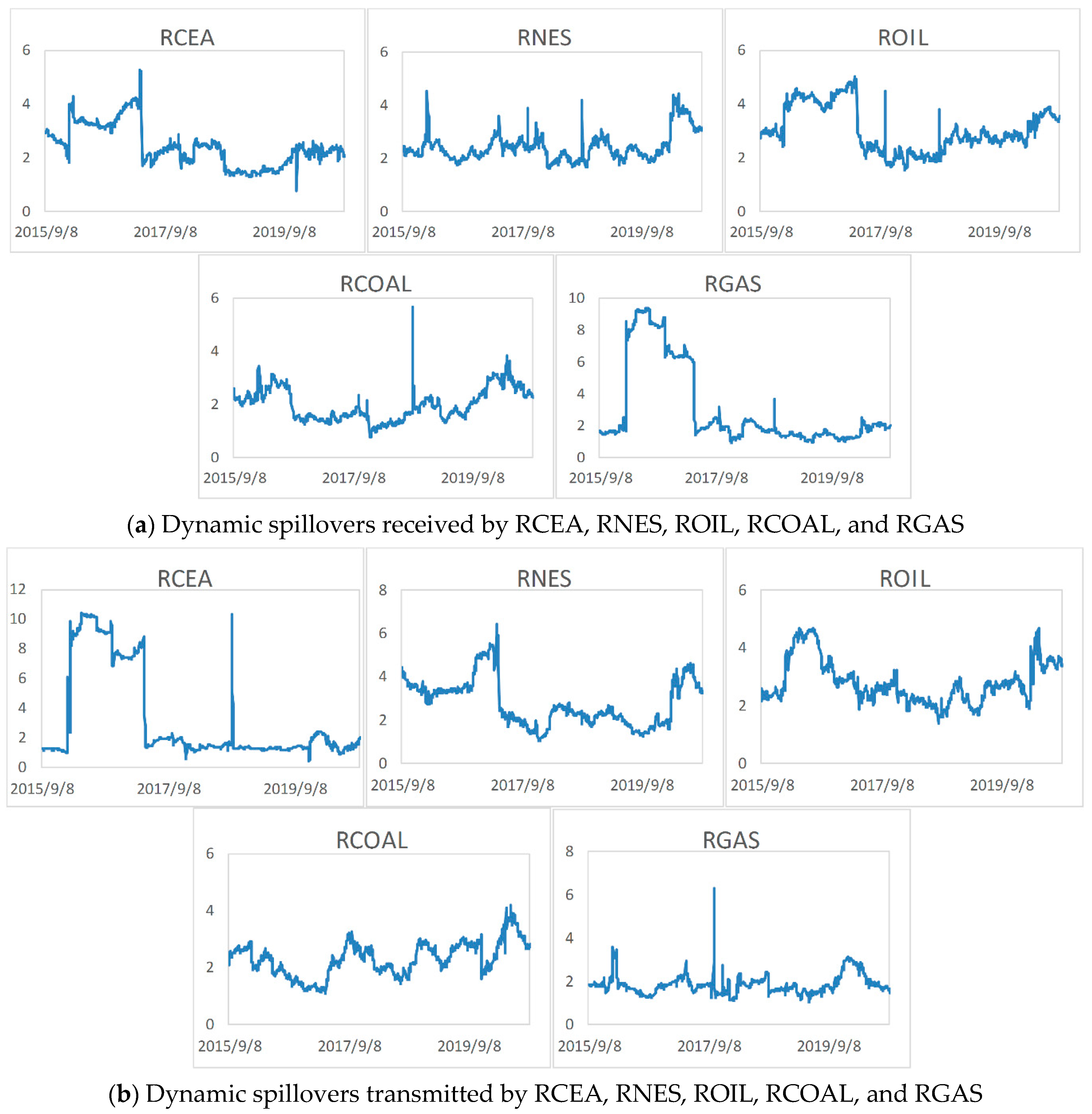

First, from a systematic perspective, the spillover effect between China’s carbon trading market, new energy stock market, and fossil energy market is relatively weak. The empirical results show that the total spillover index of the carbon–energy–stock system is low from both static and dynamic perspectives.

Second, in the carbon–energy–stock system, the new energy market plays a strong leading role. For the whole system, the new energy market always acts as a net information transmitter from both static and dynamic perspectives. For the carbon market, during the full sample period, the new energy market had a higher degree of information spillover to the carbon trading market than other fossil energy markets, which indicates that the price return changes in the new energy market have a greater impact on the price changes in the carbon trading market than in the fossil energy market.

Third, for the carbon market, the new energy stock market and coal market always play the role of net information transmitters, which indicates that China’s carbon trading has yet to have a significant impact on the energy market and cannot effectively promote the low-carbon energy structure. This is consistent with Lin and Chen’s conclusion that China’s carbon market is currently unable to effectively stimulate new energy sources to replace traditional fossil fuel [

38].

Fourth, the spillover effect of the carbon–energy–stock system is asymmetric, that is, the system is more sensitive to negative news about price return than to positive news about price return, and this asymmetric effect is much greater when the market interaction is active.

Fifth, by studying the time-varying characteristics of the dynamic total connectedness index, we found that the index is correlated with events in the fossil energy market. The spillover effect of the system may be related to energy prices, especially crude oil and coal prices.

5.2. Implications for Policy-Makers

According to the main conclusions above, we can observe that the total spillover effect of China’s carbon–energy–stock system is weak and the three markets are less related. In particular, the carbon market has yet to have a significant impact on energy markets and cannot promote the low-carbon energy structure in China, which indicates that the market efficiency of China’s carbon market is low. The development of China’s carbon trading market faces some obstacles, such as decentralized pilot markets where market participants in different markets cannot trade with each other; loose caps and quotas; vague rewards and punishment mechanism; and so on. These issues have had a negative impact on market liquidity and trading activity.

Policy-makers should take active measures to solve the problems mentioned above. First, they should promote the construction of the national carbon trading market and launch national legislative guidance for regional pilot markets. Establishing the national legislation would prevent carbon pilot projects from being subject to administrative interference that affects the flexibility of the market. In addition, the establishment of strict national laws and regulations can improve the legal restriction of carbon trading. Second, policy-makers should improve the quota allocation mechanism as well as the reward and punishment mechanism. The cap and quota in the pilot markets are loose and the carbon price is low, which has not yet been able to motivate enterprises to actively participate in carbon trading. Third, policy-makers should encourage investment institutions and individual investors to participate in carbon market trading to enrich market participants, thereby enhancing market liquidity.

In addition, since this paper finds that the new energy market plays a leading role in the carbon–energy–stock system, policy-makers should provide policy support for the development of new energy technologies as well as for energy-saving and emission reduction technologies of fossil energy. The government should provide favorable tax policies or financial services for these companies. This is conducive to ensuring the stable development of the new energy industry and to preventing the volatility of the new energy industry from having a huge impact on the system or carbon market.

Moreover, because of the asymmetric spillover effect of the carbon–energy–stock system, policy-makers should pay more attention to falling energy prices to prevent serious impacts on the system. This paper believes that in addition to paying attention to the development of new energy, it is necessary to improve the price regulation mechanism of the fossil energy market to prevent the fossil energy price from being greatly impacted by the international energy price or by the supply and demand conditions in the domestic market, which both transmit risks to the entire system.

5.3. Suggestions for Market Investors

For investors, this paper provides useful information regarding the relationship between market price changes. Considering the new energy market has a certain leading role in the system, investors in the market should pay attention to the price return changes of the new energy stock market in cases where they are considering long-term or short-term investment.

5.4. Limitations and Future Research

This paper may be the first study to explore the spillover effect and asymmetry of the spillover effect between China’s carbon trading market, fossil energy market, and new energy financial market from a systematic perspective, which provides a new perspective for the research on the interaction relationship between China’s energy market and carbon trading market. The limitation of this paper is that it focuses on the results of spillovers between markets but pays less attention to the transmission path of spillovers between markets. Future research can investigate the transmission path and influencing factors of the spillover effect so as to have a better understanding of the relationship between the energy market and carbon trading market in China.