Abstract

This paper is the first country-specific analysis of the market-driven Smart Metering innovation system, covering technologies, actors, and policies. It provides new insights on the key enablers and barriers in the rollout of electricity Smart Meters (SMs) without binding regulatory mandate. The presented research is based on the Technology Innovation System (TIS) analysis for Poland, where an obligation scheme for the rolling out of SMs has been introduced very recently. Still, the number of SMs installed places the country in the top 10 Member States of the European Union. The implementation of SMs is progressing in a complex, multi-actor innovation system, shaped by the leading role of Distribution System Operators (DSOs). The article analyses the key elements of the SM innovation system (technologies and infrastructures, actors and networks, institutions and policies) and characterizes their interaction based on desk research and a critical assessment of regulations, statistics, and literature. The major enablers of the rollout are DSOs expectations of benefits, which have been instigated by the market regulator’s benevolence in tariffs approval. On the other hand, the major barriers are delayed and incomplete public policy instruments. Results of the study can inform the development of other market-driven SM deployments around the world.

1. Introduction

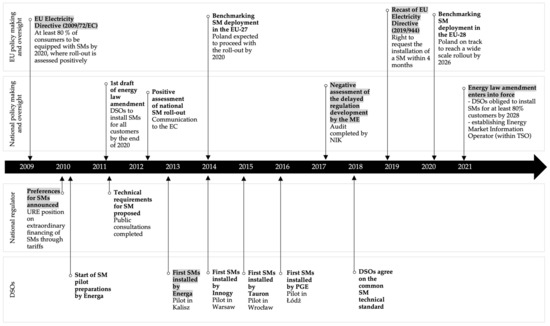

In 2009, the European Union (EU) Directive 2009/72/EC was introduced. It required that at least 80% of consumers shall be equipped with Smart Meters (SMs) by 2020, where the rollout of SMs is evaluated positively by Member States [1]. Each EU Member State was left to decide whether the national SM rollout was economically sound and to choose between a mandated and a market-driven approach. In any case, the proper regulatory intervention has been identified as a necessary measure for both approaches [2].

In 2012, Poland assessed that the long-term benefits of SMs rollout would exceed the costs [3]. The Polish government has concluded that SMs would allow for further liberalization of the electricity market, including the improved access of consumers to electricity consumption data, easier process of supplier switching, and facilitated access to the market for prosumers [4]. The analysis identified several types of benefits for different stakeholders of the energy system: energy savings of final users and simpler supplier change (benefits for customers), reduced time to issue an invoice and new options of demand management (benefits for suppliers), reduction of commercial and technical losses, decrease of meter readings cost, and limiting peak power demand (benefits for Distribution System Operators (DSOs)). Poland was thus included in the group of 17 EU Member States in which cost-benefit analyses yielded a positive result. According to the update of the government study in 2014, by the end of 2018, about 3.5 m remote reading meters were to be installed across the country. In monetary terms, the benefits of the SM implementation were estimated to exceed 9.48 bn PLN and costs to exceed 9 bn PLN [3]. However, until mid-2021, no obligation scheme for DSOs to install SMs was enforced, no state-approved technical requirements were set, and no operator for acquiring and sharing SM data was appointed.

Despite the missing regulatory framework, by the end of 2018, Polish DSOs had already installed nearly 1.5 m SMs. This placed Poland in the top 10 Member States of the European Union in terms of the number of devices connected to the power grids [5], at the same time being the only country in this group that did not have clear and legally binding regulations for SM deployment. This intriguing observation, suggesting at least a moderate success of the market-driven approach that was followed in Poland, is an important motivation for investigating the enablers and barriers affecting the effectiveness of the Polish case. Both types of factors can be considered as contextual factors of the SM innovation diffusion within the Technology Innovation System (TIS).

Even though market-driven SM rollouts have been progressing within innovation systems of many countries around the world (further discussed in the next section), several questions remain unanswered concerning this approach to SM deployment, and also with regard to Poland. They include, in particular:

- What are the incumbent, emerging, and complementary technologies as well as technological trajectories in market-driven SM rollouts?

- What is the impact of key actors’ positions towards SMs on the effectiveness of market-driven SM deployments?

- What is the influence of regulations, economic and financial instruments, and soft instruments on market-driven SM deployments?

- What are the key enablers and barriers in market-driven rollouts of SMs?

This paper aims to provide new insights on these issues, following the framework of TIS analysis, and referring to the Polish experiences in the SM rollout. Even though it focuses on Poland, its results can inform other market-driven SM deployments. In this context, our key contribution is providing a comprehensive country-specific analysis of the market-driven SM innovation system, covering technologies, actors, and policies. We demonstrate that SM rollout can be successful at the level of a single DSO, even without a binding regulatory framework. We also identify the key enablers and barriers in such a case and provide several policy and practice recommendations.

The rest of this paper is organized as follows. Section 2 describes the literature review concerning prior related work and provides background information on the electricity sector in Poland. Section 3 explains our research approach and methods. Section 4 presents the results, while Section 5 analyses them with respect to the research topic and state-of-the-art. Section 6 draws conclusions.

2. Literature Review

2.1. Market-Driven SM Rollouts around the World

Market-driven SM deployments are progressing in many EU Member States, such as Bulgaria, Croatia, Cyprus, the Czech Republic, Hungary, Poland, Portugal, Slovakia, and Latvia, as well as outside Europe, e.g., Brazil and Australia [6,7]. Studying SM deployment based on such voluntary actions of stakeholders of energy systems is of paramount importance for the worldwide implementation of smart grids, smart buildings, and energy management [8,9,10].

While the diffusion of SM has been discussed in several prior works (Table 1), a comprehensive and single country-specific study of all TIS elements affecting the success of market-driven SM rollouts has not yet been conducted. Still, market-driven SM rollouts (voluntary implementation of SMs without clear legal mandates) deserve attention, especially at a country level, which allows for providing more profound insights than in the case of multi-country comparisons.

Table 1.

Prior related works on TIS of SM rollouts.

Prior national studies on market-driven SM deployments describe selected aspects of Brazilian, Hungarian, and Portuguese experiences:

- In Brazil, the SM rollout has not been enshrined in any public policy, similar to Poland. Another similarity is the key driver of the SM implementation: the tariff schemes. In particular, the voluntary white tariffs provide customers with a possibility of benefitting from reduced price rates at times of lowest electricity consumption in the power system. Contrary to the Polish case, the pace of the SM rollout is dictated, not by DSOs, but by consumers signing up for this tariff type [15].

- In Hungary, the SM penetration rate in 2018 was among the lowest in the EU—1%, while at the same time in Poland it was 8.3% [5]. Similar to Poland, Hungarian policymakers have not set clear procedures, timelines, or obligation schemes for DSOs to implement SMs. A potential explanation for the difference in the effectiveness of rollouts between the two countries is the role of the regulatory authorities. While in Poland they demonstrated an early and clear support for SM implementation (described further in Section 4.3), their Hungarian counterparts failed to move the SM agenda forward [17].

- In Portugal, the SM penetration rate in 2018 was 25%, after a jump from 10% in 2017 [5]. The primary difference between the Polish and Portuguese SM cases is the number of DSOs engaged in the rollout; in Portugal there is only one main DSO, whose active role in SM deployment was sufficient to push the rollout even without binding regulations. Its main motivation was to enable demand response programs. They were seen as a promising way of dealing with the increasing share of renewables in the Portuguese power grid [13].

2.2. Context of the Market-Driven SM Rollout in Poland—The National Electricity Industry

The SM rollout in Poland is important for all sectors of the Polish electricity industry, including power generation, transmission, and distribution:

- Generation: Poland has the largest share of fossil generation in the EU. In 2020, the share of fossil fuels in power generation exceeded 80% [22]. In absolute values terms, between February and July 2020, Poland was Europe’s biggest coal-based power generator for the first time ever, as Germany saw a significant coal generation fall [22]. Still, electricity production from renewables is increasing rapidly. A spectacular growth has been observed in Photovoltaics (PVs), especially in prosumer installations. In 2020, PVs supplied the power system with 176% more energy than in 2019 [23]. In May 2021, the number of prosumers exceeded 0.5 m, i.e., nearly 3% of electricity end users had their own RES installation [24,25]. Prosumers are the DSOs’ priority customers for installing SMs, because introducing an RES installation typically requires replacement of conventional electricity meters with bidirectional ones.

- Transmission: The Polish transmission system is composed of 280 lines with a total length of 15,202 km (220 and 400 kV), one 750 kV line with a total length of 114 km (currently not in use), 109 extra-high voltage stations, and an under-sea 450 kV DC Poland–Sweden connector [26]. The Polish Transmission System Operator (TSO) is expected to be the biggest beneficiary of the SM rollout [4], mainly due to the peak savings.

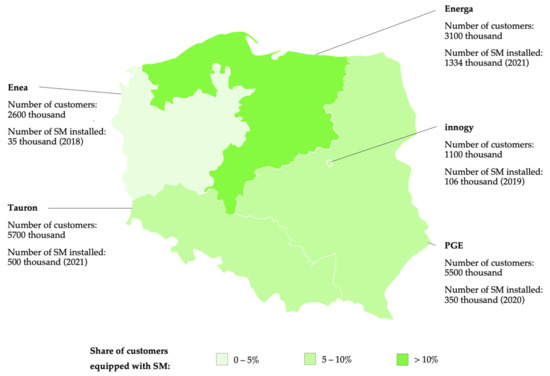

- Distribution: The Polish distribution system is dominated by five of the biggest DSOs. PGE, operating in eastern and central Poland, covers the biggest area. The largest distributor in terms of number of customers is Tauron, which supplies energy to over 5.5 million customers on a twice smaller area than PGE. Then there is Energa, which serves 3 million customers in the northern and central part of the country, and Enea, with 2.5 million customers in the west. Innogy in Warsaw provides electricity to 1 m users. Unlike other players, it is a private company [27]. All DSOs play a central role in SM implementation, as they own the metering systems, and they are in charge of installing them.

3. Materials and Methods

Similar to prior research at the EU level [11], our study of the SM rollout in Poland is framed within the approach of TIS analysis. Exploring the processes of the SM diffusion entails the identification and characterization of not only technological but also economic and social domains in which the innovation processes run, at the same time investigating the interactions between the system actors and institutions [28]. To this end, we address the following three specific elements of SM TIS in Poland:

- Technologies and infrastructures, with regard to which we analyze the past development of SM technologies and infrastructures in which SMs are rolled out;

- Actors and networks in the SM rollout, with regard to which we map key stakeholders, i.e., public and private institutions as well as their collaboration platforms;

- Policy instruments affecting SM rollouts, with regard to which we follow the classification of the policy instruments of Peñasco, Verdolini, and Larkin [29]. We exclude from the analysis five policy instruments from the classification that are not applicable to SM TIS (i.e., emissions standards, funds to sub-national governments, auctions, green certificates, and comparison labels).

Based on the analysis of the above TIS elements, we investigate how their interactions affect the SM implementation by tracing the development and diffusion of SM innovation. To this end, we critically analyze the scientific and grey literature (e.g., market research reports) and regulations published between 1990 and July 2021. To narrow down the scope of the study on the one hand, and to ensure a sufficient level of detail of the research findings on the other, the scope of research concerning SM in this paper is limited to SM systems in Poland, yet its conclusions are relevant for SM implementations at other locations as well. Furthermore, only electricity SM are studied, while meters used for other energy carriers (e.g., gas SMs) are excluded.

4. Results

4.1. Technologies and Infrastructures

4.1.1. Incumbent and Emerging Technologies

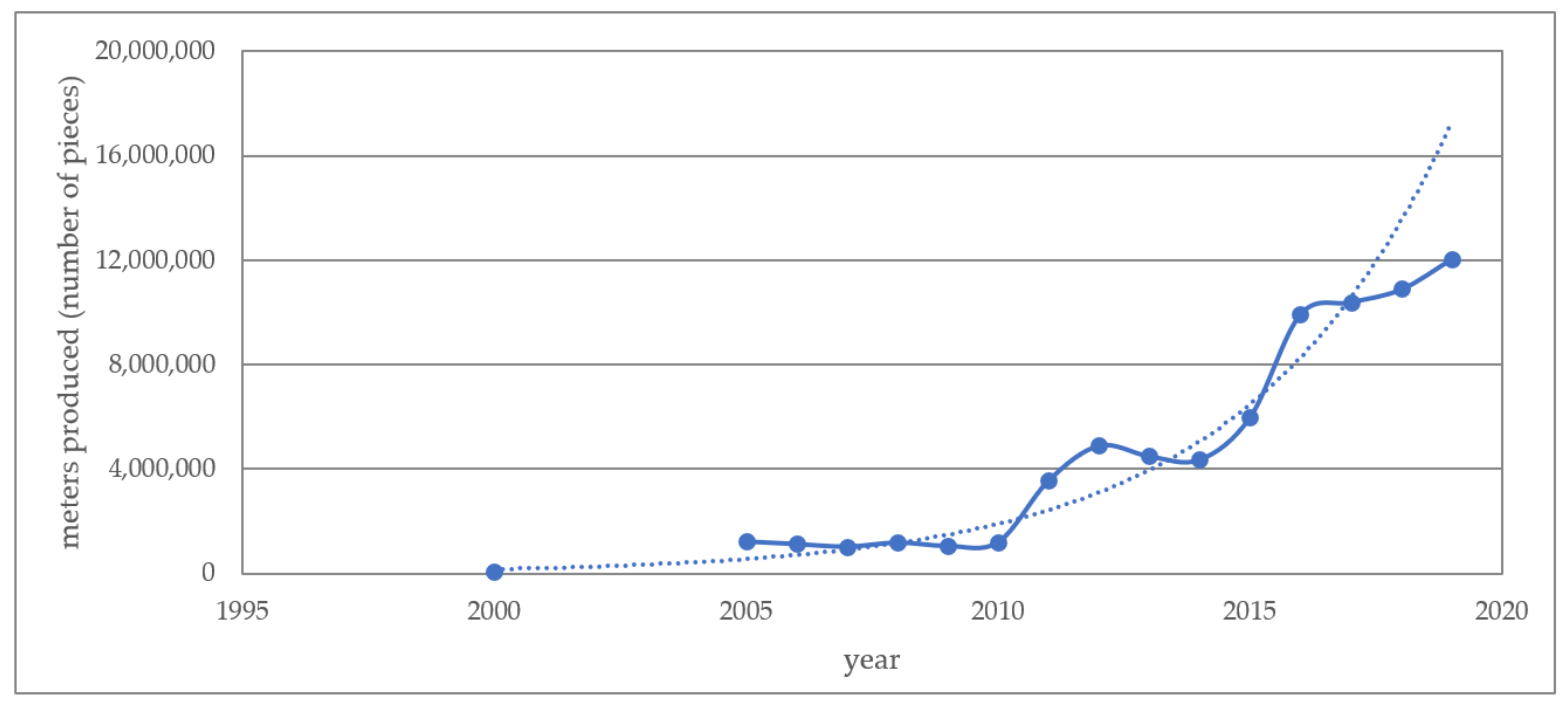

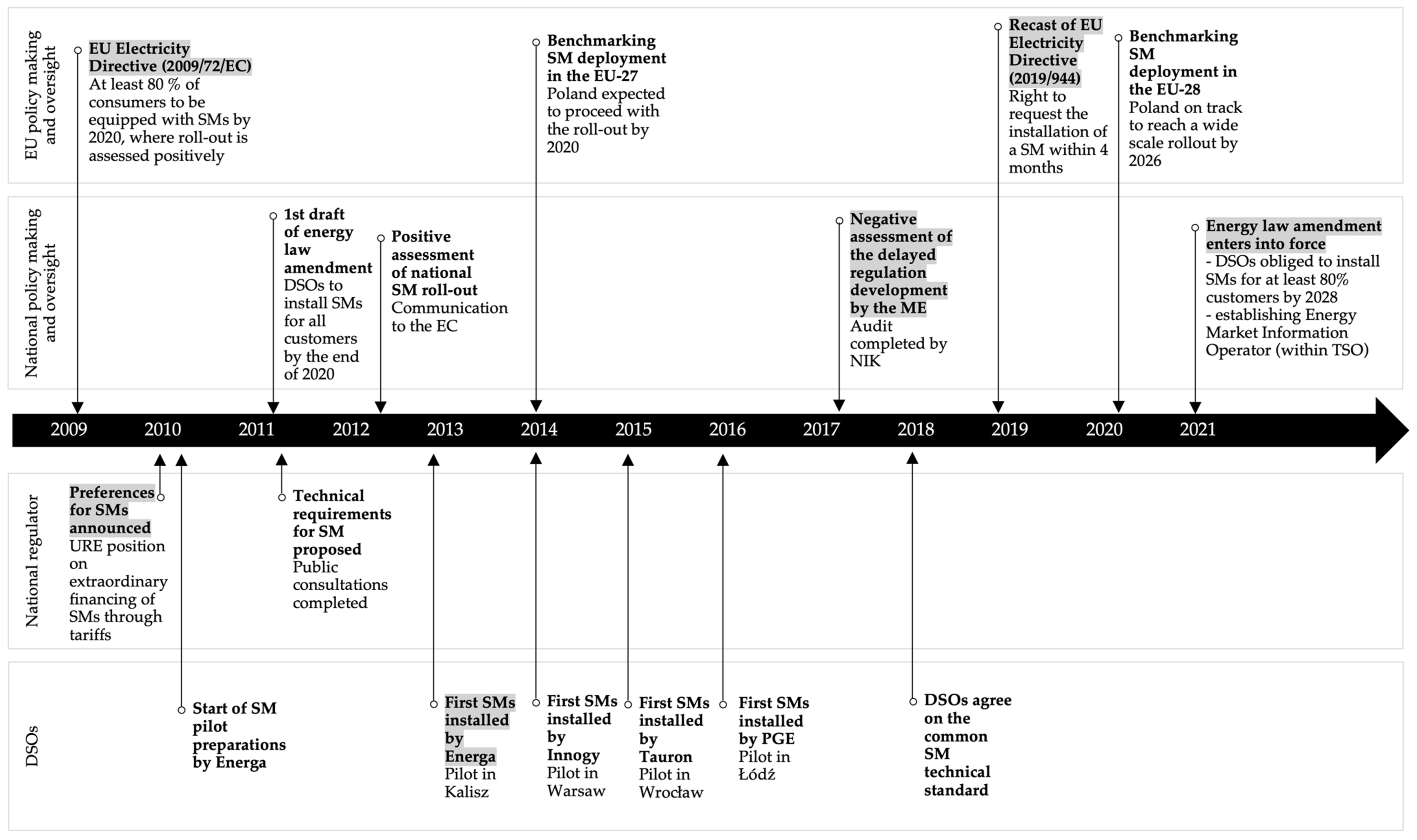

In 2019, over 12 m electricity meters (including SMs) were produced in Poland, hitting a record high (Figure 1, based on [30,31,32]). Between 2009 and 2019, the annual production of electricity meters increased by over eleven times. In view of the number of electricity end-users (17.4 m) [25], this suggests a strong export capacity of the Polish market.

Figure 1.

Production of electricity meters (all types, including SMs) in Poland between 2000 and 2019 (pcs).

The energy induction meters are the most prevalent and oldest commonly used meter type in Poland [33]. However, Polish DSOs started installing more advanced measuring devices (SMs) in 2013 [34]. By the end of 2020, 9.2% of Polish households had been equipped with SMs, including both consumers and prosumers of energy (1.6 m and 0.4 m SMs, respectively) [35,36].

The legal validity period for active energy induction meters with a capacity not higher than 30 kW in Poland is 15 years, while for other types of meters, the period is 8 years [37]. After this time, each meter must be checked to ensure it has not become obsolete or replaced with a new meter (e.g., a smart one). In this context, as well as in view of the recent changes in the regulatory framework (explained in the later sections of this paper), it is expected that standard, non-electronic induction meters will become obsolete in Poland by 2030. Other technologies likely to become obsolete are unidirectional energy meters (which do not allow for net metering for prosumers) and meters not resistant to the external magnetic field (due to the threat of meter tampering).

An example of an SM produced in Poland is the SMARTEMU-3 by Apator, which uses PLC or 3G communications, depending on the product version. Another type of SM solution is the OneMeter beacon, produced by a start-up of the same name, which enables SM functionalities in existing standard electricity meters. In its standard operation mode, OneMeter beacons read data from meters every 15 min and store it in an internal memory. A stored energy profile can be viewed in a dedicated web application. The beacon uses communications working in the 2.4 GHz range and an AES-128 encryption protocol. Electronic meters, which, after equipping with additional telecommunications devices, such as OneMeter beacons, would allow for a remote acquisition of measurement data, are used by three of the five largest DSOs: Tauron, PGE, and Innogy. However, the DSOs are sceptical about upgrading their existing meters with additional external devices enabling remote readings [38].

4.1.2. Complementary Technologies and Services

The level of disturbances in the low voltage network is constantly growing due to the increasing use of switched power supplies, frequency converters, nonlinear inductive devices, thyristor controllers, and LED lighting. In this context, a complementary technology emerges, i.e., anti-interference filters, e.g., by Maschek Polska, which reduce interferences to a level that enables reliable communication between energy meters and data concentrators. In addition to complementary products, complementary services are also emerging on the market. In 2017, Tauron Dystrybucja was the first DSO in Poland to provide its clients with the Home Area Network (HAN): a Tauron AMIplus service that allows remote activation of the wireless communication interface with an SM using Wireless M-Bus. Data on energy consumption is passed to the domestic receiving device. The HAN network allows households not only to connect several different ‘smart home’ devices but also enables data exchange with SM and control of BAS devices and communication with other IoT devices.

4.1.3. Technological Trajectories

Five main technological areas of SM development in Poland can be distinguished: data collection (measurement), data storage, data communication (technology/protocol), data security, and data display (Table 2). These are the areas of technological advancements in SM that consistently develop over time through the accumulation of knowledge. The presented specification of technological trajectories is a generalization based, on the one hand, on the technical standard published in 2018 by the PTPiREE—an industrial association uniting inter alia Polish DSOs [39]) and, on the other hand, on two products offered on the Polish market on a large scale, namely: (1) SMARTEMU-3—an SM produced by Apator, a Polish company, which are sold inter alia to Tauron and Energa, the DSO that is the SM leader in Poland; (2) AD13A.1-3-1—an SM produced by ADD Group, a company based in Moldova, which are used also by Energa.

Table 2.

Examples of technical specifications of SMs installed in Poland—emerging technological trajectories and the level of technology and market development.

While assessing the maturity of the discussed five technological areas, the first two (measurement and data storage) could be regarded as well-established, with limited innovation potential. Technological accelerations (experimentation, research activities, new standards) are most visible in the last three fields. First, in the data communications area, there is an observable process of technology pathway testing (PLC vs. GSM/GPRS/EDGE/LTE). Second, in the data security area, the requirements concerning Advanced Encryption Standard (AES) are becoming stricter—from 128 bit to higher levels. Third, in the data display and identification area, the Object Identification System (OBIS) codes are subject to frequent amendments (For instance: (1) PN-EN 62056-61:2003—published on 15 June 2003, revoked on 26 June 2007; (2) PN-EN 62056-61:2007—published on 26 June 2007, revoked on 22 April 2009; (3) PN-EN 62056-61:2009—published on 22 April 2009, revoked on 05 February 2014; (4) PN-EN 62056-6-1:2014-02—published on 05 February 2014, revoked on 07 February 2017; (5) PN-EN 62056-6-1:2017-02—published on 07 February 2017, revoked on 07 February 2018; (6) PN-EN 62056-6-1:2018-02—published on 07 February 2018.) [40].

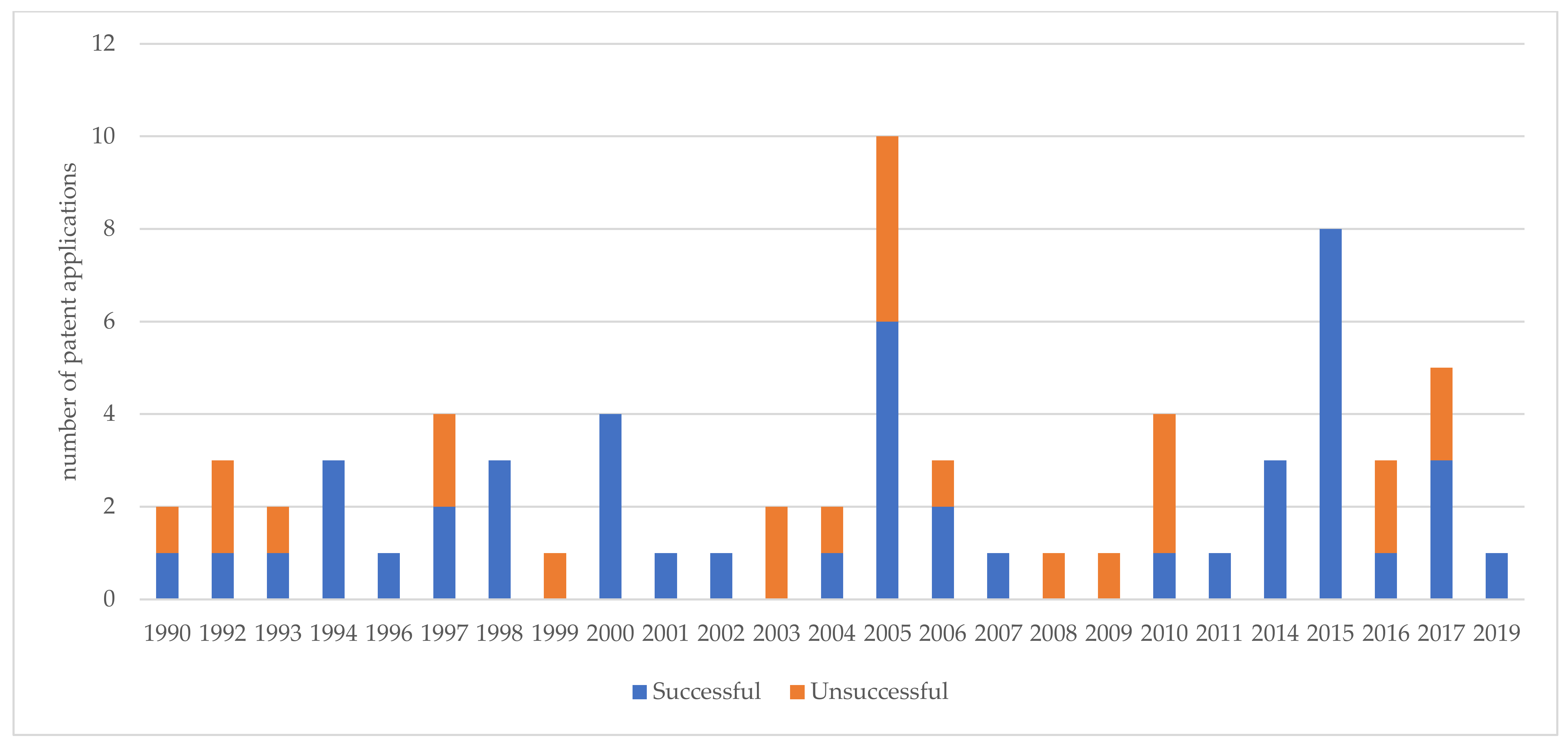

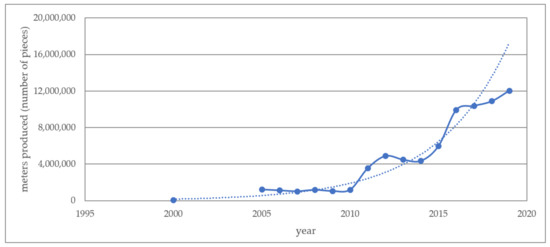

Despite the identified areas for technological developments and innovation, low patenting activities in SMs are observed. Between 2010 and 2020, only 18 successful patents in electricity metering were granted by the Polish Patent Office (Figure 2, key words used: ‘electricity meter’, 70 relevant results found in the Polish Patent Office, status as of July 2021).

Figure 2.

Patent applications in the field of electricity metering submitted to Polish Patent Office (1990–2020).

4.2. Actors and Networks

4.2.1. Demand

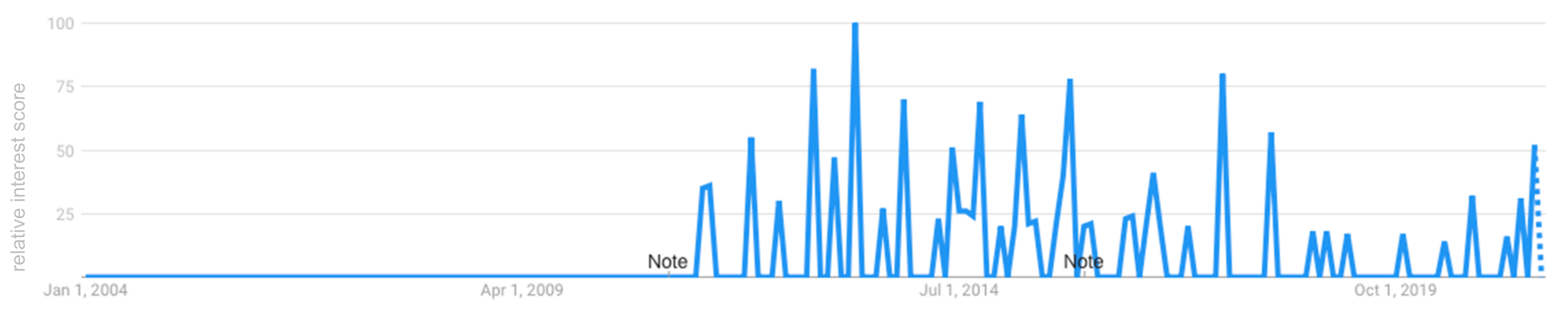

The first group of demand-side actors of SM systems in Poland are their main end-users, i.e., consumers. Polish consumers have a low level of awareness regarding SM as a technology and their benefits in terms of energy efficiency and savings. Forty percent of Poles have never encountered the term ‘SM’ and usually cannot define its meaning [45]. Only every fifth person (21.2%) declares that they know exactly what the term means. Television and friends were among the most essential sources of information on SM (respectively, 26.6 and 26.4%) [45]. However, people who came across this concept acquired their knowledge most often from the Internet (62.8%) [45]. The first significant wave of interest in SM was observed in March 2009 (Figure 3, based on Google Trends; numbers represent search interest relative to the highest point on the chart for the given region and time. A value of 100 is the peak popularity for the term. A value of 50 means that the term is half as popular. A score of 0 means there was not enough data for this term). The biggest interest on this topic online was registered in April 2013, which was potentially caused by the publication of the cost-benefit analysis of the SM rollout by the Polish Ministry of Economy [4].

Figure 3.

Interest over time results for ‘Inteligentne liczniki’ (in English: ‘Smart Meters’) over 2004—July 2021.

Consumers do not play an essential role in the current stage of the SM rollout in Poland. They have no power to push DSOs to install SMs, or to install them on their own. However, they could inhibit the rollout in case of their active disagreement for SM. This phenomenon, for instance, can be observed in France [11]. Still, no such anti-SM movement has been observed in Poland so far.

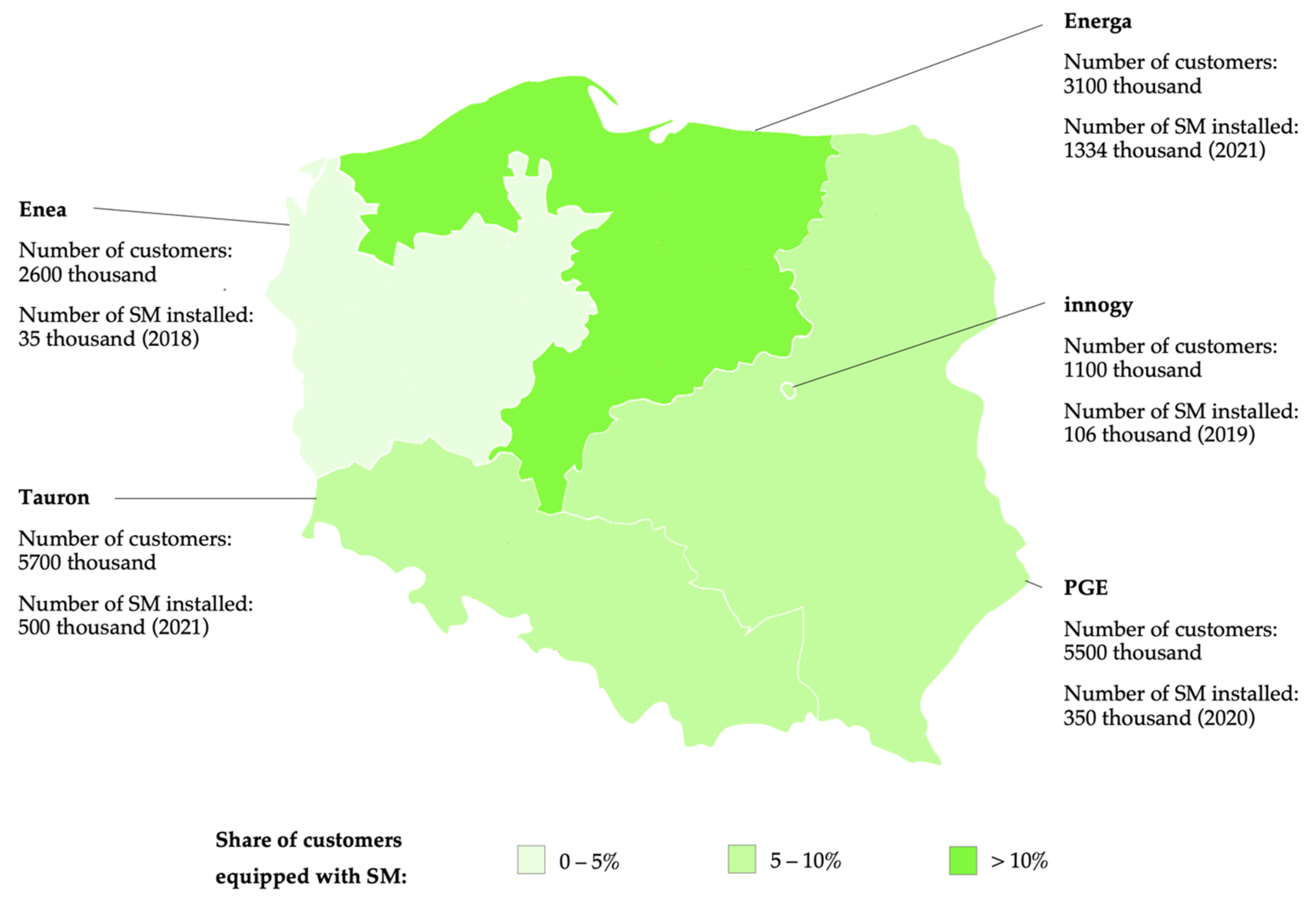

The second group of demand-side actors of SM systems in Poland are their owners, i.e., DSOs. There are five major DSOs in Poland (Figure 4, based on [38,46,47,48,49,50]). They play a crucial role in the Polish SM innovation system, as they are responsible for SM deployment, as well as several critical functions in power grids [51]. According to Energy Law, the DSOs must submit their development plans to the Energy Regulatory Office (URE) for approval. The plans must include inter alia information about projects in acquisition, transmission, and processing of measurement data from remote reading meters. However, there is no obligation to include any SM rollout projects in the plan.

Figure 4.

SM penetration in the power grids of the five main DSOs in Poland.

The national leader in terms of the share of SM in the total number of owned meters is Energa-Operator (SMs installed at nearly 50% of customers), followed by Innogy Stoen Operator, Dystrybucja and PGE Dystrybucja. Energa-Operator started the implementation of the Tauron pilot SM projects as the first DSO in Poland in 2013 (pilot in Kalisz City) [34]. Already in the following year, in the districts in which Energa-Operator installed SMs, technical and commercial losses decreased by approximataly 10%, which resulted from fraud prevention and eliminating technical losses. It resulted in significant savings, which were partly invested in further modernization of the power grid [33,34].

While the success of Energa was preceded by a long preparatory phase that started in 2011, the other four operators have not been so enthusiastic about SMs in the early 2010’s. For instance, Enea Operator, already in 2011, explained that investments in SMs are not fully profitable for DSOs [52]. Still, all four DSOs started their SM rollouts after the positive experiences of Energa. As of July 2021, customers of PGE, Tauron, and Energa that are equipped with SMs have the option of tracking their energy consumption on the website or in the mobile application. Enea announced the launch of such functionality in 2019, and Innogy Stoen Operator declared the same with no specific date set.

4.2.2. Supply

The total value of sold electricity meters in Poland in 2019 was over 1.2 bn PLN [32], though there is no data on the share of SMs in this number. The major suppliers of SMs are Grupa Apator (Toruń, Poland), T-MATIC System SA (Warsaw, Poland), Systemy Pomiarowe Elgama Ltd. (Świdnica, Poland), and Landis+Gyr (Zug, Switzerland). The leading manufacturers of the SMs installed in Poland are from Poland, Switzerland, and Moldova.

Grupa Apator is a capital group with over a 50% market share in the supply of SMs in Poland [36]. It currently consists of fifteen companies—nine domestic and six foreign. The parent entity of the group is Apator Joint Stock Company—a Polish company of the electromechanical industry with headquarters in Toruń, listed on the Warsaw Stock Exchange. Apator offers systems for measuring and providing electricity, compliant with IEC and PRIME standards, available with various communication technologies (PLC: PRIME and OSGP; G3 and LTE: Cat.1, Cat.4, Cat. M1, LTE 450) [53]. Every year, it produces more than 1 m electricity meters [54]. The company’s SMs have been installed both in Poland (e.g., in Wroclaw for Tauron Dystrybucja and in Warsaw for Innogy), as well as abroad, e.g., in Lithuania [55]. The firm considers that the key challenges for the SM rollout are the human resources required for meter installation and cybersecurity requirements [53]. Apator expects that, by 2028, roughly13–14 m new meters with a remote reading functionality will be placed on the domestic market, with 1.6 to 2.5 m units to be installed per year [36]. In view of the further expected price erosion, the company plans to profit from production capacity growth and faster sales.

T-MATIC System SA, based in Warsaw, is an official distributor of products of the Moldovan producer, ADD Group, as well as a member of the international association promoting an open standard of communication in intelligent energy networks, PRIME Alliance. Four-hundred thousand Moldovan SMs have been installed in Poland by Energa-Operator.

The company Systemy Pomiarowe Elgama Ltd., based in Świdnica (Lower Silesia), has been operating on the market of SM systems since 2004. In 2014, Energa-Operator signed a contract for the installation of 450,000 SMs compliant with the requirements of URE with the consortium of Elgama and its Lithuanian partners (UAB Sigma Telas Energy and UAB Elgama-Elektronika) [54].

Landis+Gyr is a Swiss corporation operating in 30 countries on 5 continents. Owned by Toshiba, it is currently one of the world’s largest producers of SMs. In 2014, the company signed a contract with the RWE Group (currently, Innogy) for providing 100,000 devices and software for the installation of SMs in Warsaw.

Apart from the above-listed big suppliers, there are also niche actors: start-ups and spinoffs (e.g., OneMeter), who work on innovations that deviate from existing regimes (e.g., the OneMeter beacon).

4.2.3. Research and Education

The number of research and education institutions engaged in SM research in Poland is not very high. According to a Polish National Science Centre database query, the Centre has funded only five projects, whose titles refer to Smart Grids (SGs) or SMs (query date: July 2021). They were implemented by: (1) AGH University of Science and Technology in Cracow; (2) Wroclaw University of Technology, (3) Gdańsk University of Technology; (4) University of Zielona Góra; and (5) Warsaw University of Life Sciences. An interesting initiative implemented by the research and education actors in the field of SMs were the ‘AMI Picnics’, events popularizing SMs, organized by AGH University of Science and Technology in Cracow in collaboration with Wrocław University of Technology and Tauron Dystrybucja [56]. During these events, held in 2014 and 2015, comparative tests of SMs from various producers were performed.

4.2.4. Supporting Institutions—Government Bodies

The Ministry for Energy (ME) sets and implements the national energy policy in accordance with the EU legislation. In particular, the ME is responsible for controlling energy markets, providing energy security to the country, and promoting and implementing energy efficiency schemes. Furthermore, the ME is in charge of energy infrastructure, including the electricity metering system regulations and supervising the Energy Regulatory Office [57].

The Energy Regulatory Office (Urząd Regulacji Energetyki, URE) is a central body of the state administration, established in 1997 based on the Energy Law. URE approves tariffs prepared by DSOs as well as their draft development plans, including planned investments in SM rollouts [58].

The Personal Data Protection Office (Urząd Ochrony Danych Osobowych, UODO) is another central body of state administration, established in 2018 on the basis of the Protection of Personal Data Act. The main duty of UODO is to protect people in connection with the processing of personal data, according to the requirements of the General Data Protection Regulation (EU 2016/679). As SM data are treated in Poland as personal data, UODO plays the role of a guard, upholding unjustified processing of data from SMs.

The Central Office of Measures (Główny Urząd Miar, GUM) is a central body of the state administration, established on the basis of the Law on Measures in 2004. GUM’s main competence is to ensure the compliance and accuracy of the national measurement standards and their traceability to the international measurement standards. Electricity meters installed by DSOs must be approved by GUM.

The Supreme Audit Office (Najwyższa Izba Kontroli, NIK) is the top independent state audit body, which is subordinate to the Sejm (the lower chamber of the Polish Parliament). NIK’s objective is to ensure that public finance is spent reasonably and according to the law. NIK is in charge of controlling public authorities as well as four out of the five largest Polish DSOs, which are partially owned by the state (all except Innogy Stoen Operator).

4.2.5. Supporting Institutions—Industrial and Financial Institutions

The Polish Power Transmission and Distribution Association (Polskie Towarzystwo Przesyłu i Rozdziału Energii Elektrycznej, PTPiREE) is an industrial organization established in 1990 by several DSOs (Enea Operator, Energa-Operator, PGE Dystrybucja, Tauron Dystrybucja, Innogy Stoen Operator, and PKP Energetyka) and the Transmission System Operator. Its aim is to support the transformation of the Polish power industry by consulting services, training, and publications. PTPiREE actively works on new technologies and standards. In 2018, in the absence of public regulations, PTPiREE developed and published a technical standard for SM: “Draft of technical requirements for static direct electricity meters” [39].

The Polish Chamber of Informatics and Telecommunication (Polska Izba Informatyki i Telekomunikacji, PIIT) is an organization gathering Polish companies working in the field of digital transformation. PIIT’s aim is to provide supporting conditions for the development of the ICT industry, to ease collaboration between the ICT industry and public administration, and to support the development of regulations that would support digital innovation. In 2018, PIIT joined the technical dialogue concerning SMs in Poland, pointing out that the frequency bands proposed in the SM specification by PTPiREE should be expanded by 450 MHz, as omitting this band would mean the inability to ensure proper electricity readings in this frequency range or the need to replace communication modules in all meters in the future, which would be associated with high costs [59].

Polskie Sieci Elektroenergetyczne S.A. (PSE) is the National Transmission System Operator in Poland, fully owned by the State Treasury. According to the energy law amendment of 2021, it was entrusted with the tasks of Energy Market Information Operator [60]. The company has been mandated to establish and manage the Central Energy Market Information System (CSIRE). Therefore, it will collect and process all electricity metering data necessary, inter alia, to change the electricity supplier or make settlements for its sale and delivery. Thanks to the unification of information standards processed in CSIRE, the processes taking place on the retail electricity market in Poland are expected to be significantly streamlined and accelerated.

The Bank for Environmental Protection (Bank Ochrony Środowiska, BOŚ) is a Polish bank providing preferential loans for environmental investments, such as renewables, energy efficiency, waste and water management, urban areas revitalization, and others [61]. Since its establishment in 1991, BOŚ contributed 18.6 bn PLN (EUR 4.5 bn) to finance environmental projects [62].

The National Fund for Environmental Protection and Water Management (Narodowy Fundusz Ochrony Środowiska i Gospodarki Wodnej, NFOŚiGW) is a public body supporting the ecological activities of Polish institutions, both public and private ones. Its budget comes from charges and fines for using the environment, maintenance and concession charges, energy sector charges, charges resulting from the Act on recycling of vehicles withdrawn from use, and sales of GHG emission units. NFOŚiGW is also funded from foreign sources. NFOŚiGW provides beneficiaries with grants and soft loans for activities related to water and sewage treatment, thermal upgrade of buildings, and renewable energy sources. In 2014, NFOŚiGW launched a program “Energy efficiency improvement, Part 1, SGs” with a budget of 172 m PLN (EUR 43 m). The program was addressed to DSOs and electricity suppliers and aimed at launching pilots of SGs, which could include SM. The project was finished in 2017 [63]. As of 2021, no other program for SMs is available at NFOŚiGW.

4.3. Policy Instruments

This section analyses and assesses regulations, economic and financial instruments, and soft instruments addressing SMs in Poland (Table 3).

Table 3.

Assessment of policy instruments addressing SM TIS in Poland.

4.3.1. Regulation—Building Codes

The Polish building code requires equipping buildings with electricity meters [64]. However, no requirements concerning SMs are provided. Therefore, building codes can be regarded as regulation instruments that are not effectively used in Poland for SM TIS development.

4.3.2. Regulations—Product Standards

As of July 2021, no regulation on technical requirements for SM has been formally adopted by the Polish government. The currently binding related standard is the general regulation on the measuring instruments subject to legal metrological control [24], which does not include any requirements concerning remote reading, data storage, or communication protocols. In the absence of legal regulations of SM standards, Polish producers of SMs in principle also refer to the technical requirements binding standard electricity meters: Measuring Instruments Directive [65] and technical standards, such as PN-EN 50470-1, PN-EN 50470-3, PN-EN 62053-23 418. On the other hand, DSOs refer to their own internally-developed technical requirements (e.g., [66]) or the standards developed by PTPiREE [39].

The main governmental document explicitly dedicated to SM was published to provide guidelines for the public procurement of SM systems by URE in 2015 [67]. The technical documentation comprises the requirements for meters and concentrators and the organization of communication at each stage: from the data acquisition system at the level of the network operator to the home gateway in the client’s home network infrastructure. The specification was the result of the work of URE and industrial organizations, including PTPiREE and DSOs. In the metrological and construction section of the documentation, the parties involved in the process reached an agreement. Hence, this section of the specification has a reference value. With regard to the communication section of the document, it was not possible to establish a unified position, and a number of decisions were left to individual investors.

The Polish Chamber of Commerce for Electronics and Telecommunications proposed technical and performance requirements for 1- and 3-phase meters, designed for operation in Polish AMI systems [68]. The document was based on international standards and specifications developed in previous years by the PTPiREE and URE and experience gained from the first SM pilots. The document covers all aspects related to the construction and functions of a modern energy meter, in particular the requirements for measurement and communication functions as well as the availability of data for the end-user to optimize energy consumption and production using renewable sources. The specification is based on open standards, and the emphasis is on the measurement of energy quality, the availability of measurement data in real time, interoperability, and information security. The document was sent to the relevant ministries with a request to adopt the relevant technical regulation. In 2018, the Chamber announced that consultations concerning the “Draft of technical requirements for static direct electricity meters” had been completed [69]. The requirements were targeted in particular at industrial consumers. The document may be used by all interested parties and, in particular, for procurement procedures carried out by DSOs associated with the Chamber. Despite several industry-led standardization initiatives, in view of the limited government’s activity in the SM standardization area, product standards can be regarded as regulation instruments that are not effectively used in Poland to support the SM TIS development.

4.3.3. Regulations—Sectoral Standards

The standardization for cross-sectoral digitization of the Polish energy transition is not coordinated by any designated governmental body. There are fragmented regulations, e.g., according to art. 117 of the Law on Personal Data Protection [70], the DSOs, who install remote reading meters at the sites of end-users connected to their network, are obliged to protect measurement data regarding these end-users on the terms set out in the provisions of the Law on Personal Data Protection. Even though there were several governmental declarations on the planned sectoral standards concerning SGs, as of July 2021, there were no binding governmental regulations. Overall, sectoral standards can be regarded as regulation instruments supporting SM TIS development that are significantly delayed in Poland.

4.3.4. Regulations—Auditing

In 2018, NIK negatively assessed the activity of the ME in the area of the SM rollout [3]. It stressed that the prolonging process of the SM deployment and the missing obligation scheme negatively affected Polish consumers’ capacities for active energy management and achieving energy savings. NIK noted that the directive 2009/72/EC had not been fully implemented in the Polish legislation, as a strategy of the SM rollout had been delayed, and no division of tasks and responsibilities among energy market participants had been set. The ME did not specify uniform technical and functional requirements for DSOs for SM and good practices that would ensure the same standard of network and SM operation at individual DSOs throughout the country. The delay resulted in lost benefits. It was estimated that Polish households lost 78 m PLN (EUR 18.5 m) in 2017 alone.

Overall, auditing can be regarded as an SM TIS development regulation instrument that is effectively used in Poland. Still, no evidence has been found on the effective follow-up of the audit findings.

4.3.5. Regulations—Obligation Schemes

Following EU regulations [1] and the positive results of the cost-benefit assessment [3], Poland was required to prepare a timetable with a target for the implementation of Smart Metering systems in at least 80% of households by 2020. The first draft of the energy law amendment, setting an obligation for DSOs to install SMs, was presented in 2011 [71]. However, according to the ME, the work had to be stopped until the new European regulation on the internal electricity market is adopted [3]. Due to the prolonging policy making process, it took over 10 years to pass the bill’s final version. The regulation adopted in 2021 requires DSOs to install SMs in at least 80% of end-users, including at least 80% of households, by 2028, with intermediate targets set for 2023, 2025, and 2027 (15%, 35%, 65%, respectively) [60]. Overall, the obligation scheme can be regarded as a regulation instrument that has been significantly delayed.

4.3.6. Regulations—Carbon Emissions Reduction Target

No Polish regulation setting Carbon Emissions Reduction Targets for SM has been identified. Therefore, Carbon Emissions Reduction Targets can be regarded as regulation instruments that are not used to support SM TIS development in Poland.

4.3.7. Regulations—Net Metering

The crucial regulation on net metering in Poland is the Law on Renewable Energy Sources [72]. Producers of energy from renewables may conclude an agreement for the sale of electricity, based on which the settlement of the difference between the amount of electricity collected from the grid and the amount of electricity introduced into the grid is carried out in the given half-year. Settlements are made on the basis of actual indications of metering and billing devices. Therefore, installing SMs at the facilities of prosumers has been a priority for DSOs, as evidenced by the fact that 20% of SMs are installed for this type of consumers [36]. However, the power grid regulations in net metering do not require the use of SM systems. Therefore, net metering can be regarded as a regulation instrument that is not used effectively in Poland for SM TIS development.

4.3.8. Economic and Financial Instruments—Government Procurement

Forty-seven public procurements related to SM were awarded in Poland between 2012 and 2019. Most procurements (42 awards) were run by utilities [73]. Furthermore, three out of four notices on “Innovation Partnerships” for the supply of energy meters in the whole EU were announced in Poland. Enea Operator, one of the main Polish DSOs, published three notices for the design, production, and delivery of up to 30,000 electricity balancing meters to measure the MV/LV stations meeting the requirements specified in the model technical specification published by URE. No evidence shows that URE or the ME have commissioned any expert reports or technical standards concerning SM. Overall, the government procurement can be regarded as a direct investment used in Poland for SM TIS development, although only to some extent.

4.3.9. Economic and Financial Instruments—RD&D Funding

Five SM-related areas have been included in the Polish National Smart Specializations, which set priorities for RD&D funding from the European Structural and Investment Funds in Poland. They include: (1) Digital measuring systems, including remote measuring systems (Advanced Metering Infrastructure—AMI)—new structures of AMI elements, technologies for communication and smart software for central AMI systems, interoperability and exchangeability of AMI elements; (2) Development of techniques and technologies of data transmission for the electricity industry needs; (3) Development of cybersecurity techniques—development of software, devices, and IT security services in the electricity sector; (4) Integration of measuring and reading systems for utilities (electricity, water, gas, heating), including the Smart Cities solution; and (5) Application of the Phasor Measurement Units (PMU) systems in transmission and distribution networks [74]. The main funding lines for RD&D in the field of SM are national funds (National Fund for Environment Protection and Water Management) and EU funds (Smart Growth Operational Program, funded from the European Regional Development Fund and the Infrastructure and Environment Operational Program, funded from the European Regional Development Fund and the Cohesion Fund). However, even though SM is explicitly listed in Polish National Smart Specialization, only a few projects related to SM have been co-financed from the EU funds (7 projects with the key word ‘SM’ in the project title according to mapadotacjigov.pl database query as of July 2021 [75]). Additional national funding for RD&D for SM projects was provided by the National Fund for Environment Protection and Water Management (NFOŚiGW) through the program “Smart Grids” in 2013. In response to the call, NFOŚiGW received 21 proposals requesting the total co-financing amount of 366.6 m PLN (approx. EUR 86 m). As a result, 12 projects have been selected, with the total subsidy value of 171.9 m PLN (approx. EUR 40 m) [76]. The beneficiaries of the program were: entrepreneurs, local government units, universities, research institutes, and the Polish Academy of Sciences and its organizational units. However, the funded research focused instead on power grid solutions other than SM.

Overall, RD&D funding can be regarded as a direct investment instrument that is moderately used for SM TIS development in Poland.

4.3.10. Economic and Financial Instruments—Tariffs

Dynamic pricing tariffs have been regarded as fundamental measures for exploiting the full potential and benefits offered by SM since 2012 [71]. However, such instruments are still not legally possible in Poland.

On the other hand, any costs of SM system installation can be charged to the users indirectly, through energy tariffs. According to article 45 of the Energy Law, when calculating electricity prices covered by tariffs, the reasonable costs of the business activity of energy companies in the generation, processing, transmission, distribution, or trade of energy are taken into account. In particular, DSOs’ return on capital approved in their tariff may significantly depend on parameters set by the President of URE, which have a certain degree of discretion and individuality for particular DSOs [77]. In 2011, this discretion was used by the regulator in the Position of URE President [78]. It was a major milestone that instigated the SM rollout in Poland, yet it was neither a formal regulation nor a legally binding decision. Nevertheless, the regulator announced that, due to the many benefits that SM implementation may bring, both to consumers and electricity companies, the President of URE is determined to apply extraordinary remuneration for such projects, which would be higher than the one expected for other investments of DSOs. Furthermore, the regulator declared that not only the investment effort would be rewarded in tariffs. Additionally, the individual actions of DSOs leading to increasing the benefits from the implementation would also be accepted by URE as justified costs in tariff approval procedures.

Considering this tariff-based support for the financing of SM rollouts in Poland, they can be regarded as financial instruments that are actively used in Poland to support SM TIS development.

4.3.11. Economic and Financial Instruments—Grants and Subsidies

Poland’s government and its agencies have not provided any grants or subsidies for SM deployment, apart from the grants and subsidies for RD&D projects described in the previous section. Overall, grants and subsidies can be regarded as financial instruments that are not widely used in Poland to support SM TIS development.

4.3.12. Economic and Financial Instruments—Loans

Even though no loan mechanisms dedicated specifically to the SM rollout have been identified in Poland, these types of financial instruments are used to support SM TIS development. For instance, thanks to the support of EUR 250 m from the European Fund for Strategic Investment, Energa, one of Poland’s three largest electricity suppliers, has acquired EUR 750 m for the installation of SMs [79]. In this context, loans can be regarded as financial instruments used in Poland to support SM TIS development.

4.3.13. Economic and Financial Instruments—Tax Relief/Exemption

No tax relief or exemptions for the SM rollout have been identified in Poland [80]. Therefore, such instruments can be regarded as fiscal incentives not used in Poland to support SM TIS development.

4.3.14. Economic and Financial Instruments—User Charges

According to §13 point 4 of the Regulation of the Minister of Economy of 4 May 2007 on the detailed conditions for the operation of the power system [81], the DSO installs, at its own expense, the metering and billing systems, except for energy producers. Therefore, any direct user charges for SM systems are not legally allowed (except energy producers). In this context, user charges can be regarded as fiscal incentives not used in Poland to support SM TIS development.

4.3.15. Economic and Financial Instruments—GHG Emission Allowance Trading Scheme

In 2017, Poland sold GHG emission allowances worth over EUR 0.5 bn, while, in 2018, this value increased to over EUR 1 bn [82]. In 2019, it reached EUR 2.4 bn, and in 2020 it remained at a similar level (EUR 2.5 bn) [83,84]. However, there is no evidence that any share of these revenues has enabled the financing of SM TIS development. Therefore, the EU GHG emission allowance trading scheme can be regarded as a financial instrument for which there is no evidence that it is effectively used to support SM TIS development in Poland.

4.3.16. Economic and Financial Instruments—White Certificates

According to the Polish Law on Energy Efficiency, white certificates are tradable assets that can be awarded for the implementation of ‘projects aimed to improve energy efficiency’, which have been defined as activities consisting of introducing changes or improvements in a facility, in a technical device, or in an installation, as a result of which energy saving is achieved and positively audited [85]. Poland’s white certificates scheme allows for granting certificates for measures indicated in the eligible energy-saving measures list published by the Minister of Energy [86]. However, the auditing guidelines do not allow for collecting evidence on the energy savings achieved directly thanks to SM deployment [87]. Therefore, no SM deployments can be considered as projects enabling the acquisition of white certificates. In this context, white certificates can be regarded as financial instruments that are not used to support SM TIS development in Poland.

4.3.17. Soft Instruments—Endorsement Labels

There is no evidence for the existence of any scheme for SM endorsement labels in Poland. There is also no evidence that any non-endorsement labels (labels discouraging SM installations) have gained wide popularity. Overall, endorsement labels can be regarded as soft instruments that are not effectively used to support SM TIS in Poland.

4.3.18. Soft Instruments—Information Campaigns

According to a public opinion survey performed in 2014, the most essential perceived benefit related to SM is greater control over consumption and expenses related to electricity, i.e., payment for actual electricity consumption instead of only estimates (56.9%), lower electricity prices (41.9%), and lower power consumption (41.4%) [45]. Similarly, according to a public opinion survey performed in 2012 by GfK Polonia Research, 82% of Poles indicated that paying for actual electricity consumption is more important than the invariability of the electricity bill, and it is also the main advantage of remote reading meters [88]. On the other hand, the basic concerns related to the use of SM include fear of being charged with additional installation costs (33.8%) and uncertainty related to the frequent failure of the new system (32%).

Without changing the behavior of consumers, the costs incurred for the SM rollout may pay off over a longer time or, in extreme cases, not pay back at all [3]. In view of the low level of awareness regarding SM, DSOs and their organizations have initiated information campaigns. For instance, a nationwide information and education campaign entitled “Smart Grids—for home, environment, and economy”, was organized by the PTPiREE in 2013 and 2014 in cooperation with DSOs, URE, the transmission system operator, and the Association of Energy Trading. The campaign included a range of educational activities in the field of rational and effective use of electricity using modern solutions in SGs, with particular emphasis on SM. The essential elements of the campaign were, among others: opinion polls, research and educational activities in demonstration buildings with SM installed, an educational campaign in the press, television and the Internet, distribution of information brochures, specialist training for meter installers and helpline staff, and a nationwide conference and experts’ debates. The campaign was co-financed by the National Fund for Environmental Protection and Water Management [89].

In 2020, the Ministry of Climate started the project entitled “Intelligence in the energy sector. Support for the construction of smart grids in Poland”, co-financed by the EU. The project assumes the implementation of a nationwide educational and information campaign and training on the functionalities of SMs and other related SG topics [90]. However, no data on the project progress or results are yet available.

Overall, information campaigns can be regarded as soft instruments that are used only to some extent to support SM TIS in Poland.

4.3.19. Soft Instruments—Voluntary Approaches

No unilateral commitments of the private sector (e.g., organization of DSOs), setting voluntary SM targets in Poland, have been identified. Therefore, voluntary schemes can be regarded as soft instruments that are not used to support SM TIS development in Poland.

5. Discussion

5.1. DSOs as Major Innovating Actors

Typically, the leading role in creating innovations, including in the stage of developing standards, is played by technology providers [91]. However, the Polish experiences in the market-driven rollout of SMs show that technology users (here: DSOs) may also have a critical function in these processes. A prime reason for this is that, unlike typical markets, power distribution is a specific type of oligopoly, including only a few companies, with a large part of ownership by the state. At least at first glance, they should have fairly uniform interests as well as risk appetite and risk aversion levels. However, our findings suggest that DSOs may react differently in response to the same signal of benevolence from the market regulator. This result could be explained by the fact that their expectations of benefits vary [34,52]. While the regulator’s long-term vision was the necessary first step in starting the national rollout of SMs in Poland, the still low rates of SM penetration in the power grids of some of the Polish DSOs show that such signals may be insufficient for convincing more risk-averse stakeholders. Surprisingly, this observation holds even within the studied cost-plus tariff regime, which lowers the financial risks for the operators as compared to more market-based approaches.

Our findings illustrate well the contrasting examples of DSOs’ expectations of benefits from SMs rollout. On the one hand, the limited activity of Enea in the SM deployment ties well with the previous studies that stress that network regulations need to be fine-tuned to ensure clean energy transition [92]. On the other hand, Energa’s experiences show the opposite. Their high penetration rate of SMs suggest that, for some DSOs, only a small amount of assurance from the market regulator may be sufficient to initiate significant technological changes without modifying the pre-existing regulations.

5.2. Knowledge Development and Exchange

The major actors responsible for the SM deployment in Poland are ME, URE, and DSOs. However, these actors do not cooperate effectively. The Ministry has delayed the SM rollout obligation scheme for DSOs and has not approved the technical standards designed by the operators and their networks. Even though without initial incentivizing DSO investments by URE, the rollout would probably not start; over time the regulator became less active, leaving DSOs to develop and implement their individual rollout plans on their own [3]. Lack of cooperation increased the overall costs, as each DSO developed its procedures and standards. Still, some bottom-up collaboration initiatives emerged, e.g., joint procurements of SMs by three Polish DSOs.

The SM innovation system in Poland is characterized by relatively low-risk incremental innovation, as evidenced by the low number of patents in this technology area. The knowledge exchange is facilitated by PTPiREE and consultations on standards and procedures for SM installations. Similarly, the intensity of the creation of novel products and services is limited, as illustrated inter alia by the low interest of Polish firms and research organizations in acquiring EU and national funding for research, development, and demonstration projects. The knowledge exchange between science and industry is fair (e.g., the AMI picnic), although the exchange with the end-users of SMs (consumers) remains underexploited. Civil society is not actively involved in the SM rollout. Social awareness of SM is low, and the information campaigns that would inform customers about the benefits of SMs have been limited.

5.3. Actors’ Vision and Expectations

The Polish SM rollout has been initiated due to the strong vision of the EU and Polish governmental stakeholders, as stated in the European Commission’s proposal of the Electricity Directive Recast from 2007 (which led to the directive adoption in 2009) and in the URE President’s position from 2010 [1,77]. Based on this shared vision of benefits and assurance of benevolence for SM investments by the regulator, DSOs have been taking up several individual initiatives in the field of SM, anticipating several types of benefits [34]. Still, due to the underdeveloped policy framework (Table 3), they do not expect to reach the government targets [38]. In this context, the visions of different actors within the innovation system are not aligned. Even though the expectations of benefits within the population of Polish DSOs are also not homogenous, they share a fairly common vision for SM technology in terms of its industrial design, as evidenced by the PTPIREE-proposed industrial standards.

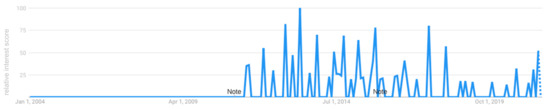

5.4. Market Formation and Governance Processes

Similar to other markets around the world, such as Brazil [15], SM TIS in Poland is still in the early phase of development. It still requires some form of regulatory support, as evidenced by the fact that the market formation is relatively slow, even with the existing strong domestic SM production capacities. In line with the findings on SM diffusion in the Netherlands, the UK, Portugal, and Norway, the observed market formation involves struggles between policymakers and companies [13]. Our research shows that a more focused study, concentrating at the sub-national level of SM diffusion, provides significant additional insights into the dynamics of market-driven SM rollouts, allowing the study of different companies’ reactions to the same policy framework (Figure 5). The Polish case illustrates that acceleration of SM diffusion relies not only on policy choices but also on the expectations of benefits by the market stakeholders. What is more, an active role of the national regulator (here illustrated by URE’s anticipatory position of 2010 and its declared benevolence in approval of tariffs) can replace the policymakers in navigating the technology forcing described by Geels et al. [13], at least to some extent.

Figure 5.

Timeline of market formation and governance processes in the SM rollout in Poland (2009–2021, major milestones highlighted in grey) [1,3,5,34,39,60,71,78,93,94,95,96,97,98,99].

In a sense, our results also clarify and expand the findings of Schaechtele and Uhlenbrock [2], who claim that regulatory intervention is required not only for mandated SM rollouts but also for market-driven ones. The provided empirical evidence from the Polish case shows that, without binding regulatory intervention, the SM rollout may start and even be successful at the level of single DSOs. Still, to ensure that no one is left behind and the rollout progresses in a balanced way across the country, adequate and timely policy instruments need to be designed and applied by different relevant actors.

5.5. Resources, Costs and Sustainability

High investment costs related to meter purchase and installation and the development of the surrounding infrastructure inhibit SM rollout. On the other hand, the strong SM production capacities may be seen as significant resources that accelerate innovation diffusion.

According to NIK, the installation of an SM is from 30% to 66% more expensive than a traditional one [3]. ME estimated in 2013 that the total costs of the SM rollout program would be 3.85 bn PLN (EUR 0.91 bn) by 2026, while the expected net benefits would be 4.61 bn PLN (EUR 1.1 bn). Most of the costs are incurred by DSOs, mainly for meters, their installation, development of software, and system maintenance. The benefits, on the other hand, are gathered mainly after the rollout and are split between customers (18%), suppliers (15%), DSOs (29%), and TSO (38%) [4]. The delay in SM implementation results in the loss of benefits for all stakeholders. For households, the ME estimated that these were 78 m PLN (EUR §18.6 m) in 2017 and 117 m PLN (EUR 27.9 m) in 2018 [3]. The poor state (age) of the Polish power infrastructure represents another barrier for the adoption of SMs. Replacement and upgrading of power grids to address the needs of growing distributed energy sources constitute a higher priority for the DSOs than the SM rollout, creating a significant sustainability dilemma that should also be addressed by the policymakers.

5.6. Policy and Practice Recommendations

The results of our analysis imply several policies and practical recommendations addressing SM policymakers, DSOs, and other stakeholders, which can facilitate and accelerate SM rollouts in Poland and beyond (Table 4). They can have implications for policy and practice, as they directly answer the call of the EC: “A system-wide approach is needed so digitalization of energy can help deliver on the EC’s ambitious political priorities, including the European Green Deal and making the EU fit for the digital age” [100].

Table 4.

Policy and practice recommendations addressing stakeholders of market-driven SM rollouts.

6. Conclusions

The article has shown new evidence on the market-driven rollouts of Smart Metering, based on Technology Innovation System analysis for Poland. The country’s experiences illustrate that the SM rollout may be successful at the level of single Distribution System Operators, even without binding regulatory intervention, because their expectations of benefits and the benevolence of regulators in tariff approval may be sufficient driving forces. Still, to ensure balanced rollout progress across the country, an adequate policy framework is necessary. The major push for SM TIS development in Poland comes from the energy industry, which started the pilot activities following the signal of benevolence from the regulator. A shared understanding of benefits from the SM implementation by the national market regulator and the EU policymakers was the main reason for starting the rollout. Pre-existing national policy instruments, such as tariffs enabling financing of SM systems and detailed public auditing of SM deployment processes, can be recognized as substantial factors accelerating SM TIS development. On the other hand, several barriers to the SM rollout are present in the policy instruments landscape, including inexistent, legally binding national SM standards. The limited supporting and coordinating role of the government can be considered as another barrier. This passive role entailed delaying large-scale SM deployment and decreasing the benefits available for customers. Furthermore, lack of the precise EU-level or national standardization framework encouraged the DSOs to introduce their own set of regulations, which have not been validated or certified by any public authority, e.g., for cybersecurity or interoperability conformance with relevant standards.

Our assessment on the outlook for SM in Poland is moderately positive. While the first phase of the rollout was driven mainly by one DSO, the recently introduced obligation scheme can be a sufficient motivating factor for the companies that were skeptical towards introduction of SM. A few critical issues will decide whether the SM implementation is successful. First, it is yet to be seen whether the obligation scheme, without clear incentives and penalties for the DSOs for reaching the targets set by the government, will be effective. Second, because the introduced obligation scheme is formulated in isolation from targets on energy savings, the potential energy efficiency improvements due to the SM introduction will mostly rely on the DSOs’ voluntary activities in the field of soft measures.

Several limitations and implications for further studies are also apparent in the performed research. The qualitative approach utilized in this research suffers from inevitable subjectivity. To minimize the impact of this limitation on the research quality, we avoided providing opinions or assessments that would not be supported with relevant justifications and references. This limitation might be further addressed in future research, e.g., involving a multi-stakeholder expert panel to assess different policy instruments applicable for stimulating SM rollouts.

Author Contributions

Conceptualization, M.K. and T.S.; methodology, M.K. and T.S.; validation, T.S. and K.K.; investigation, M.K. and K.K.; resources, T.S.; data curation, M.K.; writing—original draft preparation, M.K.; writing—review and editing, K.K. and T.S.; visualization, M.K.; supervision, T.S.; project administration, T.S.; funding acquisition, T.S. All authors have read and agreed to the published version of the manuscript.

Funding

The article has been prepared under the projects: (1) INNOPATHS: Innovation pathways, strategies and policies for the Low-Carbon Transition in Europe. The project has received funding from the European Union’s Horizon 2020 research and innovation program under grant agreement No. 730403; (2) NEWTRENDS: New trends in energy demand modeling. The project has received funding from the European Union’s Horizon 2020 research and innovation program under grant agreement No. 893311.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Glossary

| AMI | Advanced Metering Infrastructure |

| BAS | Building Automation System |

| CSIRE | Central Energy Market Information System (in Polish: Centralny System Informacji o Rynku Energii) |

| DSO | Distribution System Operator |

| EC | European Commission |

| EU | European Union |

| GHG | Greenhouse Gas |

| HAN | Home Area Network |

| ICT | Information and Communication Technologies |

| ME | Ministry responsible for Energy (in Polish: Minister właściwy ds. Energii) |

| NIK | Supreme Audit Office (in Polish: Najwyższa Izba Kontroli) |

| OBIS | Object Identification System |

| PLN | Polish zloty |

| PTPiREE | Polish Electricity Transmission and Distribution Association (in Polish: Polskie Towarzystwo Przesyłu i Rozdziału Energii Elektrycznej) |

| RD&D | Research, Development and Demonstration |

| SGs | Smart Grids |

| SM | Smart Meter/Smart Metering |

| TIS | Technology Innovation System |

| TSO | Transmission System Operator |

| UKE | Office of Electronic Communications (in Polish: Urząd Komunikacji Elektronicznej) |

| URE | Energy Regulatory Office (in Polish: Urząd Regulacji Energetyki) |

| WAN | Wide Area Network |

References

- European Parliament; Council of the European Union. Directive 2009/72/EC of 13 July 2009 Concerning Common Rules for the Internal Market in Electricity and Repealing Directive 2003/54/EC; European Parliament and Council of the European Union: Brussels, Belgium, 2009; Volume L 211/55. [Google Scholar]

- Schaechtele, J.; Uhlenbrock, J. How to Regulate a Market-Driven Rollout of Smart Meters? A Multi-Sided Market Perspective. SSRN Electron. J. 2012, 1–30. [Google Scholar] [CrossRef]

- Supreme Audit Office. Wystąpienie Pokontrolne P/17/022—Ochrona Praw Konsumentów Energii Elektrycznej (Audit Report P/17/022—Protection of the Rights of Electricity Consumers); Supreme Audit Office: Warsaw, Poland, 2018. (In Polish)

- Ministry of Economy. Analiza Skutków Społeczno-Gospodarczych Wdrożenia Inteligentnego Opomiarowania (Analysis of the Socio-Economic Effects of Implementing Smart Metering); Ministry of Economy: Warsaw, Poland, 2013. (In Polish)

- European Commission. Benchmarking Smart Metering Deployment in the EU-28; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- Smart Energy International. Market Driven Smart Meter Rollouts. Available online: https://www.smart-energy.com/magazine-article/market-driven-smart-meter-rollouts/ (accessed on 28 July 2021).

- Energy Retailers Association of Australia. Enabling a Market-Driven Smart Meter Rollout. Available online: https://www.aer.gov.au/system/files/ERAA%20-%20Report%20supporting%20submission%20-%20ERAA%27s%20Market-driven%20smart%20meter%20rollout%20paper%20-%20September%202012.pdf (accessed on 28 July 2021).

- Sial, A.; Singh, A.; Mahanti, A. Detecting anomalous energy consumption using contextual analysis of smart meter data. Wirel. Netw. 2019, 27, 4275–4292. [Google Scholar] [CrossRef]

- Sial, A.; Singh, A.; Mahanti, A.; Gong, M. Heuristics-Based Detection of Abnormal Energy Consumption. In Smart Grid and Innovative Frontiers in Telecommunications. SmartGIFT 2018. Lecture Notes of the Institute for Computer Sciences, Social Informatics and Telecommunications Engineering; Chong, P., Seet, B.C., Chai, M., Rehman, S., Eds.; Springer: Cham, Switzerland, 2018; Volume 245. [Google Scholar] [CrossRef]

- Sial, A.; Jain, A.; Singh, A.; Mahanti, A. Profiling Energy Consumption in a Residential Campus. In Proceedings of the 2014 CoNEXT on Student Workshop (CoNEXT Student Workshop ’14, Sydney, Australia, 2 December 2014); Association for Computing Machinery: New York, NY, USA, 2014; pp. 15–17. [Google Scholar] [CrossRef]

- Kochański, M.; Korczak, K.; Skoczkowski, T. Technology Innovation System Analysis of Electricity Smart Metering in the European Union. Energies 2020, 13, 916. [Google Scholar] [CrossRef]

- Spodniak, P.; Jantunen, A.; Viljainen, S. Diffusion and drivers of smart meters: The case of Central and Eastern Europe. Int. J. Innov. Technol. Manag. 2014, 11, 1–16. [Google Scholar] [CrossRef]

- Geels, F.W.; Sareen, S.; Hook, A.; Sovacool, B.K. Navigating implementation dilemmas in technology-forcing policies: A comparative analysis of accelerated smart meter diffusion in the Netherlands, UK, Norway, and Portugal (2000–2019). Res. Policy 2021, 50, 104272. [Google Scholar] [CrossRef]

- Zhou, S.; Brown, M.A. Smart meter deployment in Europe: A comparative case study on the impacts of national policy schemes. J. Clean. Prod. 2017, 144, 22–32. [Google Scholar] [CrossRef]

- Carvalho, P. Smart metering deployment in Brazil. Energy Procedia 2015, 83, 360–369. [Google Scholar] [CrossRef]

- Järventausta, P. Smart Grids with Large-Scale Implementation of Automatic Meter Reading: Experiences from Finland. In Handbook of Clean Energy Systems; John Wiley & Sons, Ltd.: Chichester, UK, 2015; pp. 1–8. [Google Scholar]

- Gordon, J.A. Hungary’s Disconnect from a Smart Energy Reality: Can a Weak Waverer Become a Determined Driver in the EU Smart Metering Landscape? Central European University: Budapest, Hungary, 2019. [Google Scholar] [CrossRef]

- Balasubramanya, C. Challenges in Adoption of International Model of Consumer Protection in India for Mass Roll Out of Smart Energy Meters-Indian Journals. Power Eng. J. 2014, 16, 50–55. [Google Scholar]

- AlAbdulkarim, L.O.; Lukszo, Z. Smart metering for the future energy systems in the Netherlands. In Proceedings of the 2009 4th International Conference on Critical Infrastructures, Linköping, Sweden, 27 March–30 April 2009; IEEE: New York, NY, USA, 2009. [Google Scholar]

- Hoenkamp, R.; Huitema, G.B.; De Moor-van Vugt, A.J.C. The Neglected Consumer: The Case of the Smart Meter Rollout in the Netherlands. JSTOR. Renew. Energy Law Policy Rev. 2011, 2, 269–282. [Google Scholar] [CrossRef]

- Chawla, Y.; Kowalska-Pyzalska, A.; Silveira, P.D. Marketing and communications channels for diffusion of electricity smart meters in Portugal. Telemat. Inform. 2020, 50, 101385. [Google Scholar] [CrossRef]

- Redl, C.; Hein, F.; Buck, M.; Graichen, P.; Jones, D. The European Power Sector in 2020. Up-to-Date Analysis on the Electricity Transition. Analysis. Available online: https://ember-climate.org/wp-content/uploads/2021/01/Report-European-Power-Sector-in-2020.pdf (accessed on 28 July 2021).

- Derski, B. Źródła Energii w Polsce w 2020: Mniej Węgla, Więcej Gazu i OZE (Energy Sources in Poland in 2020: Less Coal, More Gas and RES). Available online: https://wysokienapiecie.pl/35619-zrodla-energii-w-polsce-w-2020-mniej-wegla-wiecej-gazu-oze/ (accessed on 28 July 2021). (In Polish).

- Gramwzielone.pl Liczba Prosumentów w Polsce Przekroczyła Pół Miliona (The Numer of Prosumers in Poland has Exceeded 0.5 Million). Available online: https://www.gramwzielone.pl/energia-sloneczna/105406/liczba-prosumentow-w-polsce-przekroczyla-pol-miliona (accessed on 28 July 2021). (In Polish).

- Energy Regulatory Office. Charakterystyka Rynku Energii Elektrycznej 2017. Available online: https://www.ure.gov.pl/pl/rynki-energii/energia-elektryczna/charakterystyka-rynku/7562,2017.html (accessed on 28 July 2021). (In Polish)

- Polskie Sieci Elektroenergetyczne System in General. Available online: https://www.pse.pl/web/pse-eng/areas-of-activity/polish-power-system/system-in-general (accessed on 20 August 2021).

- Tomaszewski, R. Sieć do Zmiany. Jak Zreformować Polski Sektor Dystrybucji Energii Elektrycznej (The Grid to Change. How to Reform the Polish Electricity Distribution Sector). Available online: https://www.politykainsight.pl/prawo/_resource/multimedium/20182100 (accessed on 28 July 2021). (In Polish).

- Skoczkowski, T.; Verdolini, E.; Bielecki, S.; Kochański, M.; Korczak, K.; Węglarz, A. Technology Innovation System analysis of decarbonisation options in the EU steel industry. Energy 2020, 212, 118688. [Google Scholar] [CrossRef] [PubMed]

- Peñasco, C.; Verdolini, E.; Larkin, P. INNOPATHS Prototype of Policy Evaluation Tool; INNOPATHS: Cambridge, UK, 2018. [Google Scholar]

- Statistics Poland. Produkcja Wyrobów Przemysłowych w 2016 Roku (Production of Industrial Products in 2016); Statistics Poland: Warsaw, Poland, 2017. (In Polish)

- Statistics Poland. Produkcja Wyrobów Przemysłowych w 2018 Roku (Production of Industrial Products in 2018); Statistics Poland: Warsaw, Poland, 2019. (In Polish)

- Statistics Poland. Produkcja Wyrobów Przemysłowych w 2019 Roku (Production of Industrial Products in 2019); Statistics Poland: Warsaw, Poland, 2020. (In Polish)

- Lewczuk, Ł. Do Pomiaru Poboru Energii—Liczniki Energii Elektrycznej (For Measuring Energy Consumption—Electricity Meters). Available online: http://www.fachowyelektryk.pl/technologie/zasilanie/2070-do-pomiaru-poboru-energii-liczniki-energii-elektrycznej.html (accessed on 3 January 2020). (In Polish).

- Energa-Operator SA. Podsumowanie Pierwszego Etapu Wdrożenia Systemu Inteligentnego Opomiarowania (Summary of the First Stage of Smart Metering System Implementation); Energa Operator: Gdańsk, Poland, 2014. (In Polish) [Google Scholar]

- Ministry of Climate and Environment. Uzasadnienie do Rządowego Projektu Ustawy o Zmianie Ustawy—Prawo Energetyczne Oraz Niektórych Innych Ustaw. (Druk nr 808) (Justification for the Government Bill Amending the Energy Law and Certain Other Acts. (Print No. 808)); Ministry of Climate and Environment: Warsaw, Poland, 2020. (In Polish)

- PAP. Apator Chce Utrzymać Udział w Rynku Dostaw Liczników Inteligentnych w Polsce (Apator Wants to Maintain the Share in the Market of Supplies of Smart Meters in Poland). Available online: https://www.bankier.pl/wiadomosc/Apator-chce-utrzymac-udzial-w-rynku-dostaw-licznikow-inteligentnych-w-Polsce-8090021.html (accessed on 28 July 2021). (In Polish).

- Minister of Entrepreneurship and Technology. Rozporządzenie Ministra Przedsiębiorczości i Technologii z Dnia 22 Marca 2019 r. w Sprawie Prawnej Kontroli Metrologicznej Przyrządów Pomiarowych (Dz. U. 2019 poz. 759) (Regulation of the Minister of Entrepreneurship and Technology of March 22, 2019 on Legal Metrological Control of Measuring Equipment (Journal of Laws 2019 pos. 759); Minister of Entrepreneurship and Technology: Warsaw, Poland, 2019. (In Polish)

- CIRE. Liczniki Smart, Jak to Wygląda? (Smart Meters, What Does It Look Like?). Available online: https://biznesalert.pl/liczniki-smart-jak-to-wyglada/ (accessed on 28 July 2021). (In Polish).

- PTPiREE. Wymagania Techniczne dla Statycznych Bezpośrednich 1-Fazowych Liczników Energii Elektrycznej (Technical Requirements for Static Direct 1-Phase Electricity Meters); PTPiREE: Warsaw, Poland, 2018. (In Polish) [Google Scholar]

- Polish Committee for Standardization. PN-EN 62056-6-1:2018-02—Wersja Angielska. Wymiana Danych w Pomiarach Energii Elektrycznej—Zespół DLMS/COSEM—Część 6-1: System Identyfikacji Obiektów (OBIS); Polish Committee for Standardization: Warsaw, Poland, 2018. (In Polish) [Google Scholar]

- Apator. Karta Techniczna: SMART EMU 3 Trójfazowy Licznik Energii Elektrycznej (Technical Card: SMART EMU 3 Three-Phase Electricity Meter); Apator: Toruń, Poland, 2014. (In Polish) [Google Scholar]

- ADD Grup. AD13A.1-3-1 Multi-Function & Multi-Tariff Three-Phase Electronic Meters; ADD Grup: Chisinau, Republic of Moldova, 2017. [Google Scholar]

- ADD Grup. Rtr8s.lx-x-x Data Concentrator Technical Description; ADD Grup: Chisinau, Republic of Moldova, 2017. [Google Scholar]

- PTPiREE. Wymagania Bezpieczeństwa Wobec Statycznych Bezpośrednich 1-Fazowych i 3-Fazowych Liczników Energii Elektrycznej (Security Requirements for Static Direct 1-Phase and 3-Phase Electricity Meters); PTPiREE: Warsaw, Poland, 2018. (In Polish) [Google Scholar]

- Procontent Communication; SW Research. Wiedza Polaków na Temat Inteligentnych Liczników—Raport z Badania (Knowledge of Poles on Smart Meters—Report from the Study); Procontent Communication & SW Research: Warsaw, Poland, 2014. (In Polish) [Google Scholar]