Results-Based Financing (RBF) for Modern Energy Cooking Solutions: An Effective Driver for Innovation and Scale?

Abstract

:1. Introduction

2. Background: Results-Based Financing (RBF) as a Catalyst for Services and Infrastructure Investment

2.1. RBF Terminology and Drivers for Evolution

2.2. The Rise of RBF as a Preferred Tool in the Energy Sector

2.3. RBF Function-Logic and Potential Outcomes: Theoretical Considerations

2.4. RBF Literature Review: Central Narratives and Research Implications

2.5. Research Approach and Methods: Landscaping Current RBF Initiatives and Critical Questions

- ◦

- Under what circumstances are RBF programmes an effective form of development impact funding for achieving impact at scale in the clean cooking and broader modern energy access sectors?

- ◦

- Are the balance sheets of clean cooking companies strong enough to raise the required bridge financing under an RBF scheme?

- ◦

- To what extent are local capital markets able to cover such bridge financing, and at what cost?

- ◦

- Are RBF programmes flexible enough to incentivise the distribution of emerging improved cooking technologies and account for fast-paced technological changes in the market?

- ◦

- How could RBF programmes facilitate the integration of CCS into electricity access projects?

- ◦

- Under what circumstances can RBF (including carbon credits) accelerate the scaling of the clean cooking markets?

- The first stage involved a comprehensive literature review and an in-depth evaluation of three case studies of current and/or previous funding programmes (see Appendix A Table A2). The programme case studies have been selected according to their scope (specifically the promotion of clean cooking and/or energy access), data availability and programme logic (RBF).

- Secondly, two rounds of online surveys with closed questions were completed by 40 clean cooking companies and 28 capital providers, supported by Energy4Impact, a project partner of the MECS programme.

- Thirdly, 26 semi-structured interviews with clean cooking companies and capital providers were carried out to explore specific issues identified in the previous stages.

3. Clean Cooking RBF in Action: Programme Evaluation Results

3.1. Overview: Clean Cooking RBFs in Africa and Asia

3.2. Kenya Clean Cookstove Market Acceleration Project—EnDev 2.0 Clean Cooking RBF

3.3. EnDev/CLASP Kenya EPC RBF

3.4. BRILHO RBF Mozambique

4. Discussion: RBF Cross-Sectoral and Regional Evidence on CCS Funding Landscape and Market Size

4.1. Financing

4.2. Verification Process

4.3. Technology, End-User Acceptance and Market Dynamics

4.4. Beyond RBF: Towards Outcome-Focused Finance, Impact Funding and Climate Finance

4.5. CCS RBF in the Humanitarian Context

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Source | Country of Study | Intervention/ Financing Type | Sector | Approach Measurement Indicators | Methodology | Main Findings/ Conclusion | Key Success Indicators for RBF |

|---|---|---|---|---|---|---|---|

| Abagi et al., 2020 [45] | Africa, Asia, Latin America | RBF procurement incentives | Energy access and cooling | Number of appliances sold | Case study; meta-data evaluation; technology focus | Programme not focused enough on local innovation; consumer data collection and evaluation key before selecting appliances for RBF | Product design must be suitable for consumer needs. |

| Vigdor (2012) [84] | USA | Teachers’ performance incentives | Education | Average test score gains | Experimental evaluation—regression discontinuity design | Improvement in average test scores | Questions about cost-effectiveness of the scheme; needs-based approach necessary; simplification of scheme necessary. |

| Bonfrer et al. (2014) [48] | Burundi | Healthcare services—PBF | Health | Antenatal, postnatal, family planning | Non-randomised study | Quantitative improvement of healthcare access but no qualitative improvement of care provided | RBF needs to incentivise serving poorer and vulnerable households, otherwise RBF will widen inequality gaps |

| Cohen and Patel (2019) [15] | North Kenya, including displacement settings | Mini-grid RBF | Energy | Number of connections provided | Case study | Pre-feasibility study showed that 34% of the local population can afford to pay $15/month for electricity, meaning that 66% cannot afford that rate and will require further subsidy. Post-implementation findings are yet to be published | While the RBF scheme supported by GIZ is an important factor to facilitate improved access to electricity in the Kalobeyei settlement, it will not be sufficient to connect all households and therefore additional funding to offer further subsidies will be needed |

| Grittner (2013) [21] | 13 developing countries in Africa, Asia and South America | Healthcare supply and coverage—PBF | Health | Quality and coverage of healthcare services | Qualitative and quantitative methods | Improvement in supply and coverage of healthcare services. Evidence on quality and efficiency not sufficient. | Cannot cleanly associate these healthcare improvements to only the PBF. Rigorous evaluation methods are needed. |

| Hufen and de Bruijn (2016) [85] | Netherlands | Energy conservation—performance-based contracts | Energy | Energy savings | Case study | Energy savings realised; adverse effects (e.g., complex contracts, with financial consequences for the agent) | Performance-based contracts (PBCs) should be tailor-made. Flexibility and simplicity in the design of PBCs required. |

| Johnstone (2020) [86] | Malawi | Improved cookstove; RB; Carbon Credits | Clean cooking | No. of stoves distributed; Emissions reductions | Case study | Delays in RBF payments; uncertainty about who funding provision for future stove replacements; carbon credits’ verification time-consuming and expensive; credits subject to price volatility | Rigorous verification |

| Kalk et al. (2010) [49] | Rwanda | healthcare services—PBF | Health | Quality of healthcare services; health workers’ motivation and performance | Semi-structured interviews; desk reviews | Higher worker performance and motivation levels. Issues such as ‘gaming’ threaten the provision of quality health care services. | To maximise impact the RBF design should be adapted to the local context. |

| Lambe et al. (2015) [43] | Kenya | Improved cookstoves; RBF (carbon finance) | Clean cooking | Usage and after-sales service | Semi-structured interviews | Carbon finance can facilitate better follow up on customers’ usage and satisfaction levels, and after-sales service. Risks of perverse incentives. | Carbon finance schemes need be meticulously designed and carefully implemented. |

| Ngo and Bauhoff (2021) [87] | Rwanda | Healthcare services—PBF | Health | Institutional deliveries and antenatal visits | Difference-in-difference regressions; secondary data | Positive effect on institutional delivery and visits in the short and medium term; Qualitative effects not significant | Alignment of national reforms and local policies with RBF key to success. |

| Petross et al. (2020) [52] | Malawi | Healthcare services; PBF | Health | Intended and unintended consequences. | Focus groups | Intended and unintended effects for Service Delivery Integration; issues with overcrowding of the health facilities | Design of RBF/PBI programmes needs to consider the cultural expectations of end users. |

| Rietbergen and Blok (2013) [88] | Netherlands | Reduction in CO2 emissions—Performance Ladder (CO2PL) | Energy | CO2 emissions | Desk reviews | Application of the CO2PL incentive scheme can lead to significant reduction in CO2. | Other energy and climate policies may have contributed to the RFB effects. Aligning RBF programmes with local policies can optimise impact. |

| Shen et al. (2017) [89] | Zambia | Healthcare services; PBF | Health | Job satisfaction, motivation and attrition rates | Mixed methods | RBF led to significant increase in job satisfaction amongst health workers, decreasing attrition rates; but effect on job motivation was insignificant | RBF not very effective in improving intrinsic values, e.g., motivation is intrinsic and cannot be induced by financial incentives, consistent with Lohmann et al. (2018). |

| Turcotte-Tremblay et al. (2017) [90] | Burkina Faso | Maternal healthcare—PBF | Health | Workers’ satisfaction, patient confidentiality, patients and family members’ fears and apprehensions during community verification | Longitudinal (multiple) case study; Semi-structured interviews, informal discussions and non-participant observation | Unintended consequences associated with community verification—workers’ dissatisfaction, breach of patient confidentiality, fears and apprehension amongst patients and family members. | Only focused on short-term effects. RBF should aim to evaluate long-term impacts as well. |

| Turcotte-Tremblay et al. (2020) [91] | Burkina Faso | Healthcare services; PBF | Health | Unintended consequences: dissatisfaction with health services, quality of health services | Innovation theory and multiple case study; semi-structured interviews and observations | Unintended consequences (e.g., long delays with payments resulting in dissatisfaction and demotivation) outweighed intended impact (i.e., provision of quality primary healthcare services.) | Without accounting for unintended effects, we may be overstating the effectiveness of RBF programmes. |

| Widijantoro and Windarti (2019) [44] | Indonesia | ICS—RBF | Clean cooking | Quantity of cookstoves sold | Single case study based on empirical data analysis including consumer satisfaction and distribution | M&E key for RBF—challenging to implement and operate; RBF timeline too short; qualitative achievement but continued usage of stoves problematic. | Consumer awareness and training; maintenance; timeline must allow unforeseen events; incentivise continued usage |

| Zeng et al. (2018) [50] | Zambia | Healthcare services; RBF | Health | Coverage and quality effectiveness of maternal and child health services | Cluster-randomised trial | Increased use and enhanced quality of maternal and child health services. RBF found to be a cost-effective mechanism from the value for money perspective. | Evaluation of RBF needs to be more rigorous (e.g., RCTs) to get the full picture. |

| Zhang and Adams (2015) [91] | China and Indonesia | ICS; RBF | Clean cooking | Number of stoves delivered, number of stoves used, stove-use training of households, actual usage levels. | Pilot studies | Led to the manufacture of high-quality stoves, and subsequently frequent usage among users. improvement in after-sale service in China | To maximise impact, timely disbursement of incentives, especially for smaller firms is essential. RBF design needs to be as flexible as possible. |

| Zhang and Knight (2012) [92] | China, Lao PDR, Mongolia, Indonesia | Clean biomass stove; RBF | Clean cooking | Number of stoves delivered, number of stoves used, stove-use training of households, actual usage levels. | Pilot studies | Indoor air quality improved; cost savings derived; increased user satisfaction | Role of both government and the private sector essential. If not well-designed, verification costs and lack of pre-financing for smaller firms may lead to undesirable effects. |

| Zhang et al. (2018) [42] | Indonesia | Clean biomass stove—RBF | Clean cooking | Stock, actual sale, satisfaction, level of performance after 3 months | Pilot study (case study) | Number of stoves sold increased; better performing stoves were made; customers reported of cost-savings. | Wider community level engagement needs to be considered more. |

| Programme | RBF Programme Management | Pre-Defined, Output-Based Targets | Investment Volume | Consumer Focus | Technology | Bidding Mechanism | Financial Incentive | Monitoring and Evaluation | Region/ Country | Results Achieved (Y/N) | Major Issues Reported | Positive Impacts |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Beyond the Grid Fund Zambia (BGFZ) 2016–2021 | Renewable Energy and Energy Efficiency (REEEP) | Output-based; 300,000 connections target; 150 RE MGs | Overall budget of €69 million; clean cooking component €25.25 million | Rural areas; non-electrified customers | SHS; mini-grids; ICS | Reverse auction | Incentives for sales of stoves and installation of SHS | Third-party verification of stove sales and SHS installation, disbursement upon third-party verification of achieved pre-agreed results. | Zambia | Ongoing/ partially on-track | Ambitious RBF distribution targets; expansion plan not well-managed | Provided off-grid electricity and/or clean cooking to 150,000 households in Zambia |

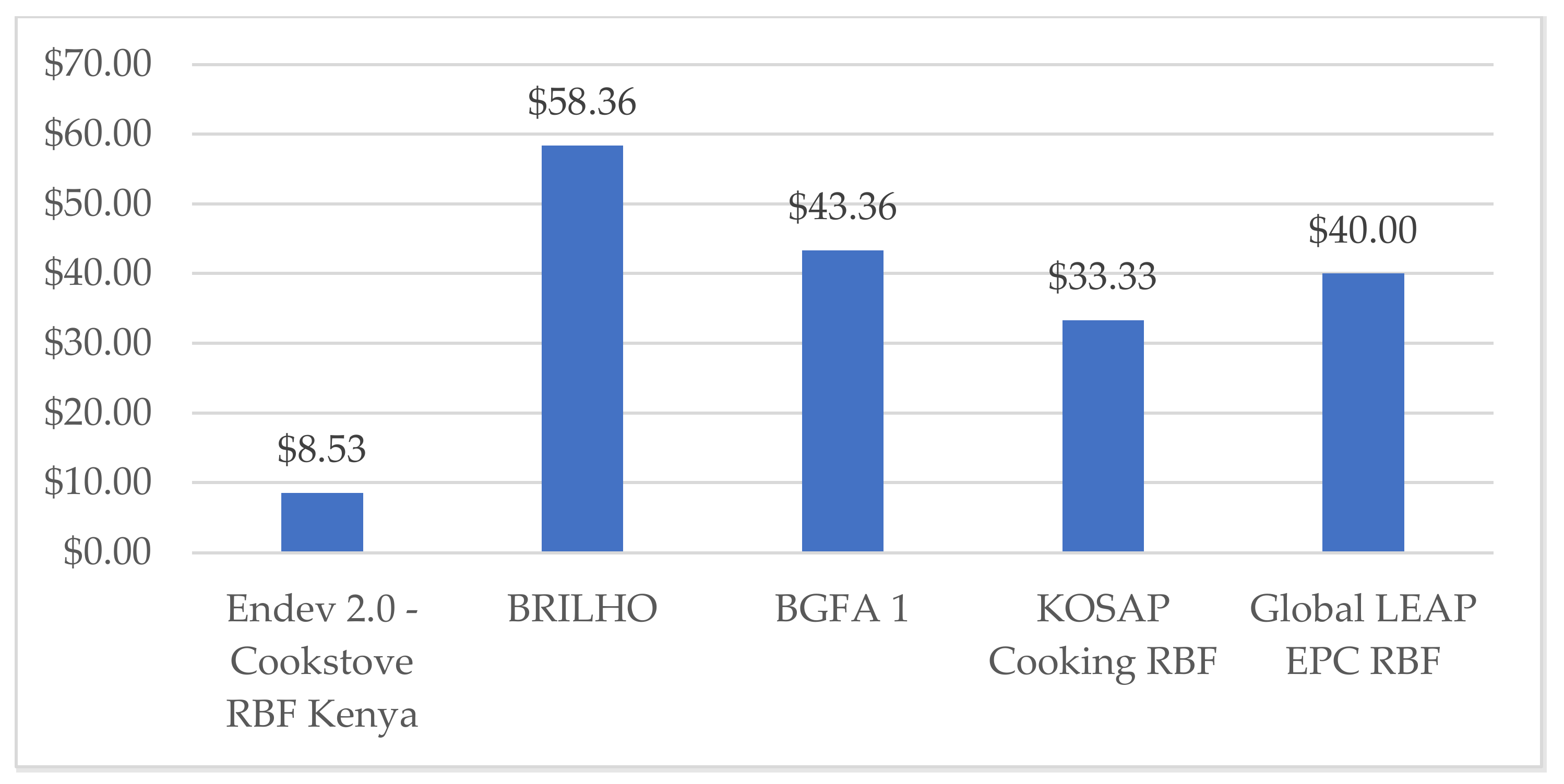

| BRILHO Mozambique 2019–2024 | SNV Netherlands Development Organisation | Predefined: in terms of specific target areas + number of units sold; target is to serve 750,000 households | Budget for whole programme is £22.8 million, with the clean cooking budget estimated at around £6 million | Underserved areas: rural poor and peri-urban | ICS, LPG, SHS, mini-grids and electric stoves | Reverse auction | Multi-incentive structure: Base incentive set at £10 per electric stove; £5 per advanced improved cookstove + catalytic grant + bonus incentive for serving remote areas | Third-party verification of stove sales, recruitment of key staff, completion of market assessment reports | Mozambique | On-track despite the original programme start date being delayed by the COVID-19 pandemic | Application process and procedures quite lengthy and somewhat overly bureaucratic | Expanded outreach to more challenging market segment |

| Clean cooking fund Rwanda 2018–2023 | Rwandan Development Bank | Output- (number of stoves sold), outcome- and impact-based (health benefits, gender equality and reduction in black carbon) | $20 million | Rural areas; low-income customers | Tier 2+- cookstoves | Not decided yet | Multi-tiered incentives | Third-party verification of inventory, sales, adoption, as well as climate, gender and health impacts. | Rwanda | On track | Programme still nascent | Anticipated impacts include reduced ADALYS, improved gender equality, reduction in black carbon and carbon emissions |

| EEP Africa 2018–2023 | Nordic Development Fund (NDF), supported by KPMG | Output-based: (number of units sold and % of units sold to marginalised rural areas) | €20 million | Rural bottom of the pyramid customers | ICS, LPG and Electric stoves | Fixed incentive (up to 50% of price of stove) | Incentives for sales of stoves | Third-party verification of the sale of improved cookstoves, proof of serving the bottom of the pyramid customers and training for buyers on how to use the cookstoves. | Botswana, Burundi, Kenya, Lesotho, Mozambique, Namibia, Rwanda South Africa: Swaziland, Tanzania, Uganda, Zambia | Tba | COVID-19 negatively impacted on sales; supply chain challenges | Increased uptake among bottom of the pyramid customers |

| Endev 2 Kenya 2009–2019 | GIZ | Output-based: number of units sold, and % of units sold in underserved rural areas | €3.9 million/ €1.5 million | No exclusion or inclusion criteria for consumers served during first phase. Underserved rural areas during the second phase. | SHS; solar lanterns/ Tier2+ cookstoves (intermediate, advanced and non-biomass) | Fixed incentive based on Tier 2 stove/region (€8–10) | Multi-tiered incentives based on the performance tier ratings of the stoves. Periodic modification of incentives to encourage increased uptake in underserved areas | Third-party verification process for the sale of ICS included phone and field visits, plus review of project documents | Kenya | Yes | Issues with quality of stoves; problems and delays in the verification process; limited off-take through financial institutions | Increased uptake in underserved counties; 110,807 units of cookstoves sold under the RBF programme |

| Global LEAP EPC 01/2020–11/2020 | CLASP | Output-based: volume of EPCs sold | $266,000 | No specific target/supplier-driven but mainly grid-connected clients in urban and peri-urban areas | EPC | Reverse auction | Multi-tiered incentives | Third-party verification involving random sample of phone calls to check if the purchases of EPCs were made | Kenya | No | Call for proposal and implementation period too short; supply-chain problems due to COVID-19 | Serving underserved areas; RBF had funded cf. 500 sales and 3400 as inventory |

| Indonesia Clean Stove Initiative 2012–2016 | Indonesia Ministry of Energy and Mineral Resources and World Bank | Predefined in terms of target areas to serve plus output-based (sale and usage) | $490,000 | First pilot focused on urban areas; second round focused on rural poor customers | ICS | Fixed incentive—up to 50% of stove cost (~US$20 max) | Multi-tiered incentives for sales and usage of stoves | Third-party monitoring/verification of pre-agreed results (70% following verified sale/30% after verification of actual usage of the stove after 3 months). M&V involved phone calls and field visits | Indonesia | Partially (~80%). Target was 10,000 stoves | Relatively longer time to implement the pilot. High cost of monitoring and evaluation. Issues with missing data, cultural sensitivities affecting the M&V process | Technical assistance to participating entities; greater capacity building of stove suppliers leading to high quality stoves; 7900 stoves sold |

| KOSAP 2 2020–2023 | SNV Netherlands Development Organisation/SunFunder Inc. | Output-based (sales target of 150,000 clean stoves) | $5 million | No specific target so far as consumers were resident in a particular county. | ICS and Liquified Petroleum Gas (LPG). | Fixed incentive—37% of product selling price | Incentives for sales of stoves | Third-party verification of number of units sold. Process involves a combination of desktop work, phone calls and field visits | Kenya | Tba | Programme still nascent; calls for proposals just ended February 2021 | Programme still nascent |

| The REACT Kenya Results-Based Financing program (REACT RBF) 2021–2024 | AECF | Output-based (verified sales) plus predefined in terms of serving poor households (25% or greater of verified sales should be towards poor households) | $4 million | Rural poor; off-grid households | Tier 2+ cookstoves | Fixed incentive—up to 50% of stove price | Incentives for sales of stoves | Third-party verification of the sale of improved cookstoves, performance and quality of the stoves, as well as the provision of after-sales support service. | Kenya | Tba | Programme still nascent | Programme still nascent |

| Universal Energy Facility 2020–2023 | Sustainable Energy for All (SEforALL) | Output-based (number of ICS and SHS units sold) | Aspires to be a $500 million facility by 2023 ($100 million by 2021) | No specific target consumers | Mini-grids (first wave), SHS and other clean cooking solutions (second wave) | Tba | Multi-tiered incentives for SHS and incentives for sale of ICS | Third-party verification of proof of the delivery and deployment of mini-grids, SHS and other clean cooking solutions. | Sierra Leone, Madagascar, Benin (more to follow) | Tba | Programme still nascent | Programme still nascent |

| #1 | 1,107,000,000 | Total SSA population 2021 | |

| #2 | 526,932,000 | 46% estimated energy access * | |

| #3 | 79,039,800 | Estimated 15% of population who currently use electric-cooking ** | |

| #4 | 74,648,700 | Households without e-cooking but with energy access (average household size 6) ** | |

| #5 | 87,822,000 | Overall number of households with electricity access * | |

| Baseline: Average cooking emissions in t/CO2 per year **** | |||

| Firewood | Charcoal | Market/country to estimate average SSA baseline | |

| #6 | 3.42 | 5.4 | Kenya |

| #7 | 4.4 | 7.4 | Uganda |

| #8 | 3.9 | 7.5 | Ghana |

| #9 | 3.91 | 6.77 | Average value |

| #10 | 5.34 | t/CO2 total average value for firewood and charcoal | |

| #11 | 398,375,229 | Total CO2 emissions in t per year for electrified # of households that don’t use e-cooking (=#10 × #4)—Estimation | |

References

- Clean Cooking Alliance (CCA). 2021 Clean Cooking Industry Snapshot. Available online: https://www.cleancookingalliance.org/resources/620.html (accessed on 12 April 2021).

- World Health Organization. Air Pollution: Indoor Air Pollution. Available online: https://www.who.int/news-room/q-a-detail/air-pollution-indoor-air-pollution (accessed on 16 March 2021).

- Broto, V.C.; Stevens, L.; Ackom, E.; Tomei, J.; Parikh, P.; Bisaga, I.; To, L.S.; Kirshner, J.; Mulugetta, Y. A research agenda for a people-centred approach to energy access in the urbanizing global south. Nat. Energy 2017, 2, 776–779. [Google Scholar] [CrossRef] [Green Version]

- Rao, N.D.; Pachauri, S. Energy access and living standards: Some observations on recent trends. Environ. Res. Lett. 2017, 12, 025011. [Google Scholar] [CrossRef]

- Simkovich, S.M.; Williams, K.N.; Pollard, S.; Dowdy, D.; Sinharoy, S.; Clasen, T.F.; Puzzolo, E.; Checkley, W. A systematic review to evaluate the association between clean cooking technologies and time use in low- and middle-income countries. Int. J. Environ. Res. Public Health 2019, 16, 2277. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Jürisoo, M.; Serenje, N.; Mwila, F.; Lambe, F.; Osborne, M. Old habits die hard: Using the energy cultures framework to understand drivers of household-level energy transitions in urban Zambia. Energy Res. Soc. Sci. 2019, 53, 59–67. [Google Scholar] [CrossRef]

- Vigolo, V.; Sallaku, R.; Testa, F. Drivers and Barriers to Clean Cooking: A Systematic Literature Review from a Consumer Behavior Perspective. Sustainability 2018, 10, 4322. [Google Scholar] [CrossRef] [Green Version]

- Aemro, Y.B.; Moura, P.; de Almeida, A.T. Experimental evaluation of electric clean cooking options for rural areas of developing countries. Sustain. Energy Technol. Assess. 2021, 43, 100954. [Google Scholar] [CrossRef]

- Stritzke, S.; Jain, P. The sustainability of decentralised renewable energy projects in developing countries: Learning lessons from Zambia. Energies 2021, 14, 3757. [Google Scholar] [CrossRef]

- Quinn, A.K.; Bruce, N.; Puzzolo, E.; Dickinson, K.; Sturke, R.; Jack, D.W.; Mehta, S.; Shankar, A.; Sherr, K.; Rosenthal, J.P. An analysis of efforts to scale up clean household energy for cooking around the world. Energy Sustain. Dev. 2018, 46, 1–10. [Google Scholar] [CrossRef]

- Batchelor, S.; Brown, E.; Scott, N.; Leary, J. Two birds, one stone-reframing cooking energy policies in Africa and Asia. Energies 2019, 12, 1591. [Google Scholar] [CrossRef] [Green Version]

- Stritzke, S.; Trotter, P.A.; Twesigye, P. Towards responsive energy governance: Lessons from a holistic analysis of energy access in Uganda and Zambia. Energy Policy 2021, 148, 111934. [Google Scholar] [CrossRef]

- Patel, L.; Gross, K. Cooking in Displacement Settings. Engaging the Private Sector in Non-Wood-Based Fuel Supply. Available online: https://energy4impact.org/file/2206/download?token=PHsi699L (accessed on 20 July 2021).

- Whitehouse, K. Adopting a Market-Based Approach to Boost Energy Access in Displaced Contexts. Available online: https://www.chathamhouse.org/sites/default/files/publications/research/2019-03-25-MEIWhitehouse.pdf (accessed on 20 July 2021).

- Cohen, Y.; Patel, L. Innovative Financing for Humanitarian Energy Interventions. Available online: https://energy4impact.org/file/2210/download?token=mcc7FbdF (accessed on 25 May 2021).

- To, L.S.; Subedi, N. Towards community energy resilience. In Energy Access and Forced Migration; Routledge: London, UK, 2019; pp. 81–91. [Google Scholar] [CrossRef]

- Batchelor, A.S.; Brown, E. Cooking Health Energy Environment and Gender (CHEEG)-Guiding Covid Recovery Plans. Available online: https://mecs.org.uk/wp-content/uploads/2020/07/:CHEEG-Covid-recovery-strategies-Final.pdf (accessed on 1 March 2021).

- Energy Sector Management Assistance Program (ESMAP) MTF: Multi-Tier Framework. Tracking Progress toward Sustainable Energy Goals. Available online: https://mtfenergyaccess.esmap.org/methodology/cooking (accessed on 1 April 2021).

- Energy 4 Impact (E4I); Modern Energy Cooking Solutions (MECS). Results-Based Financing for Modern Energy Cooking Appliances: Analysis of RBF as a Scale-Up Tool and Potential Interventions by MECS. Loughborough University Working Paper. 2021.

- Bisaga, I.; To, L.S. Funding and Delivery Models for Modern Energy Cooking Services in Displacement Settings: A Review. Energies 2021, 14, 4176. [Google Scholar] [CrossRef]

- Grittner, A.M. Results-Based Financing. Evidence from Performance-Based Financing in the Health Sector; Discussion Paper; Deutsches Institut fur Entwicklungspolitik: Bonn, Germany, 2013. [Google Scholar]

- Modern Energy Cooking Solutions (MECS); Energy 4 Impact (E4I). Clean Cooking: Review of the Funding Landscape, the TA Needs of Companies, the Data Needs of Funders and Recommendations on Potential Interventions by MECS. Loughborough University Working Paper. 2021.

- Mumssen, Y.; Johannes, L.; Kumar, G. Output-Based Aid: Lessons Learned and Best Practices; World Bank Publications, World Bank: Washington, DC, USA. Available online: https://openknowledge.worldbank.org/handle/10986/2423 (accessed on 15 March 2021).

- Canavan, A.; Toonen, J.; Elovainio, R. Performance Based Financing: An International Review of the Literature; KIT Development and Practice: Amsterdam, The Netherlands. Available online: https://www.kit.nl/wp-content/uploads/2018/08/1533_PBF-literature-review_December-2008.pdf (accessed on 27 July 2021).

- Pearson, M.; Johnson, M.; Ellison, R. Review of major Results Based Aid (RBA and Results Based Financing (RBF) Schemes. 2010. DFID Human Resource Centre, London, UK. Available online: https://www.oecd.org/dac/peer-reviews/Review-of-Major-RBA-and-RBF-Schemes.pdf (accessed on 27 July 2021).

- Birdsall, N.; Mahgoub, A.; Savedoff, W.D. Cash on Delivery: A New Approach to Foreign Aid; Centre for Global Development Brief: Washington, DC, USA, 2010; pp. 1–8. Available online: https://www.cgdev.org/sites/default/files/1423949_file_CODAid_SECOND_web.pdf (accessed on 27 July 2021).

- Hüls, M.; Raats, M.; Sebastian, J.; Veen, M.; Ward, J. Results-Based Financing a Promising New Tool for Energy Access. Available online: https://documents1.worldbank.org/curated/en/793121494941318265/pdf/BRI-P148200-PUBLIC-FINALSEARSFResultsBasedFinancing.pdf (accessed on 20 July 2021).

- Eichler, R.; Levine, R. Performance Incentives for Global Health: Potential and Pitfalls. Available online: https://www.cgdev.org/sites/default/files/archive/doc/books/PBI/00_CGD_Eichler_Levine-FM.pdf (accessed on 20 July 2021).

- Vivid Economics. Results-Based Financing in the Energy Sector. An Analytical Guide. Energy Sector Management Assistance Program (ESMAP). Available online: https://openknowledge.worldbank.org/handle/10986/17481 (accessed on 20 July 2021).

- DFID. DFID’s Evaluation Framework for Payment by Results. Available online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/436051/Evaluation-Framework-Payment-by-Results3.pdf (accessed on 20 July 2021).

- Vivid Economics; Savedoff, W. Results-Based Aid in the Energy Sector: An Analytical Guide. Available online: https://openknowledge.worldbank.org/handle/10986/21622 (accessed on 20 July 2021).

- Rousseau, N.; Leach, M.; Scott, N.; Bricknell, M.; Leary, J.; Abagi, N.; Kumar, V.; Rastogi, S.; Brown, E.; Batchelor, S. Overcoming the “Affordability Challenge” Associated with the Transition to Electric Cooking. MECS Programme Report. 2021. Available online: https://mecs.org.uk/wp-content/uploads/2021/01/MECS-report-affordability-challenge-Final-2.1.pdf (accessed on 27 July 2021).

- Perakis, R.; Savedoff, W. Does Results-Based Aid Change Anything? Pecuniary Interests, Attention, Accountability and Discretion in Four Case Studies. CGD Policy Paper, 52. Centre for Global Development: Washington, DC, USA, 2015. Available online: https://www.cgdev.org/sites/default/files/CGD-Policy-Paper-52-Perakis-Savedoff-Does-Results-Based-Aid-Change-Anything.pdf (accessed on 27 July 2021).

- Clist, P.; Verschoor, A. The Conceptual Basis of Payment by Results. Available online: https://assets.publishing.service.gov.uk/media/57a089bb40f0b64974000230/61214-The_Conceptual_Basis_of_Payment_by_Results_FinalReport_P1.pdf (accessed on 20 July 2021).

- Basak, R.; van der Werf, E. Accountability mechanisms in international climate change financing. Int. Environ. Agreem. Politics Law Econ. 2019, 19, 297–313. [Google Scholar] [CrossRef] [Green Version]

- Bovens, M. Analysing and Assessing Accountability: A Conceptual Framework1. Eur. Law J. 2007, 13, 447–468. [Google Scholar] [CrossRef]

- Adam, C.S.; Gunning, J.W. Redesigning the Aid Contract: Donors’ Use of Performance Indicators in Uganda. World Dev. 2002, 30, 2045–2056. [Google Scholar] [CrossRef]

- Holzapfel, S. Boosting or Hindering Aid Effectiveness? An Assessment of Systems for Measuring Donor Agency Results. Public Adm. Dev. 2016, 36, 3–19. [Google Scholar] [CrossRef] [Green Version]

- Pritchett, L.; Andrews, M.; Woolcock, M. Escaping Capability Traps Through Problem-Driven Iterative Adaptation (PDIA). SSRN Electron. J. 2012. [Google Scholar] [CrossRef] [Green Version]

- Barder, O.; Ramalingam, B. Complexity, adaptation, and results. Glob. Dev. Views Cent. 2012. Available online: https://www.cgdev.org/blog/complexity-adaptation-and-results (accessed on 27 July 2021).

- Wisor, S. Aid on the Edge of Chaos: Rethinking International Cooperation in a Complex World. By Ben Ramalingam; Oxford University Press: New York, NY, USA, 2013; Volume 20, Available online: https://heinonline.org/HOL/LandingPage?handle=hein.journals/glogo20&div=46&id=&page= (accessed on 20 July 2021).

- The World Bank Group. Incentivizing a Sustainable Clean Cooking Market: Lessons from a Results-Based Financing Pilot in Indonesia; No. 128162; The World Bank: Washington, DC, USA, 2018; Available online: https://openknowledge.worldbank.org/handle/10986/30181 (accessed on 20 July 2021).

- Lambe, F.; Jürisoo, M.; Lee, C.; Johnson, O. Can carbon finance transform household energy markets? A review of cookstove projects and programs in Kenya. Energy Res. Soc. Sci. 2015, 5, 55–66. [Google Scholar] [CrossRef]

- Widijantoro, J.; Windarti, Y. Fostering clean and healthy energy in rural communities: Lessons from the Indonesia clean stove initiative pilot program. Int. J. Energy Econ. Policy 2019, 9, 107–114. [Google Scholar] [CrossRef]

- Abagi, N.; Erboy Ruff, Y.; Smith, J.C.; Spiak, M. State of play and innovations in off-grid refrigeration technology: Lessons learned from current initiatives. Energy Effic. 2020, 13, 307–322. [Google Scholar] [CrossRef] [Green Version]

- Thoday, K.; Benjamin, P.; Gan, M.; Puzzolo, E. The Mega Conversion Program from kerosene to LPG in Indonesia: Lessons learned and recommendations for future clean cooking energy expansion. Energy Sustain. Dev. 2018, 46, 71–81. [Google Scholar] [CrossRef]

- Clemens, H.; Bailis, R.; Nyambane, A.; Ndung’u, V. Africa Biogas Partnership Program: A review of clean cooking implementation through market development in East Africa. Energy Sustain. Dev. 2018, 46, 23–31. [Google Scholar] [CrossRef]

- Bonfrer, I.; Soeters, R.; van de Poel, E.; Basenya, O.; Longin, G.; van de Looij, F.; van Doorslaer, E. Introduction Of Performance-Based Financing In Burundi Was Associated With Improvements in Care And Quality. Health Aff. 2014, 33, 2179–2187. [Google Scholar] [CrossRef]

- Kalk, A.; Paul, F.A.; Grabosch, E. “Paying for performance” in Rwanda: Does it pay off? Trop. Med. Int. Health 2010, 15, 182–190. [Google Scholar] [CrossRef] [PubMed]

- Zeng, W.; Shepard, D.S.; Nguyen, H.; Chansa, C.; Das, A.K.; Qamruddin, J.; Friedman, J. Cost–effectiveness of results-based financing, Zambia: A cluster randomized trial. Bull. World Health Organ. 2018, 96, 760–771. [Google Scholar] [CrossRef] [PubMed]

- Lemiere, C.; Torsvik, G.; Maestad, O.; Herbst, C.H.; Leonard, K.L. Evaluating the Impact of Results-Based Financing on Health Worker Performance: Theory, Tools and Variables to Inform an Impact Evaluation; HNP discussion paper series; World Bank: Washington, DC, USA, 2013; Available online: https://openknowledge.worldbank.org/handle/10986/22375 (accessed on 27 July 2021).

- Petross, C.; McMahon, S.; Lohmann, J.; Chase, R.P.; Muula, A.S.; De Allegri, M. Intended and unintended effects: Community perspectives on a performance-based financing programme in Malawi. BMJ Glob. Health 2020, 5, e001894. [Google Scholar] [CrossRef] [Green Version]

- Turcotte-Tremblay, A.-M.; Gali Gali, I.A.; Ridde, V. The Unintended Consequences of combining equity measures with performance-based financing in Burkina Faso. Int. J. Equity Health 2018, 17, 109. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Clements, W.; Silwal, K.; Pandit, S.; Leary, J.; Gautam, B.; Williamson, S.; Tran, A.; Harper, P. Unlocking electric cooking on Nepali micro-hydropower mini-grids. Energy Sustain. Dev. 2020, 57, 119–131. [Google Scholar] [CrossRef]

- IMC Worldwide. Results-Based Financing for Clean Cookstoves in Uganda. Available online: https://documents1.worldbank.org/curated/en/903171468009998836/pdf/884500WP0REPLA0April20140Box385191B.pdf (accessed on 20 July 2021).

- Rosenthal, J.; Quinn, A.; Grieshop, A.P.; Pillarisetti, A.; Glass, R.I. Clean cooking and the SDGs: Integrated analytical approaches to guide energy interventions for health and environment goals. Energy Sustain. Dev. 2018, 42, 152–159. [Google Scholar] [CrossRef]

- Oxman, A.D.; Fretheim, A. An Overview of Research on the Effects of Results-Based Financing [Internet]. Oslo, Norway: Knowledge Centre for the Health Services at the Norwegian Institute of Public Health (NIPH); 2008 Jun. Report from Norwegian Knowledge Centre for the Health Services (NOKC) No. 16-2008. PMID: 29320068. Available online: https://pubmed.ncbi.nlm.nih.gov/29320068/ (accessed on 20 July 2021).

- Mohamed, S.; Mutisya, I. Accelerating Uptake of Pico PV Systems and High Tier Cookstoves in Kenya through Results-Based Financing; Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ): Eschborn, Germany. Available online: https://endev.info/wp-content/uploads/2021/01/pico-PV_systems_and_high_tier_cookstoves_in_Kenya_through_RBF_report.pdf (accessed on 20 July 2021).

- Global Leap Awards. Electric Pressure Cookers. Available online: https://globalleapawards.org/electric-pressure-cookers (accessed on 24 May 2021).

- Modern Energy Cooking Solutions (MECS). Kenya eCookbook Beans and Cereals Edition. Available online: https://mecs.org.uk/publications/kenya-ecookbook-beans-and-cereals-edition/ (accessed on 20 July 2021).

- Monk, N. An Investigation into the Functionality and Efficiency of an Electric Pressure Cooker Bought in Kenya Intended for the Domestic Market: ‘Sayona PPS 6 Litre’. Available online: https://mecs.org.uk/publications/an-investigation-into-the-functionality-and-efficiency-of-an-electric-pressure-cooker-bought-in-kenya-intended-for-the-domestic-market-sayona-pps-6-litre/ (accessed on 20 July 2021).

- Kenya Household Cooking Sector Study. Assessment of the Supply and Demand of Cooking Solutions at the Household Level. Available online: https://eedadvisory.com/wp-content/uploads/2020/09/MoE-2019-Kenya-Cooking-Sector-Study-compressed.pdf (accessed on 20 July 2021).

- MECS; Energy4Impact. Clean Cooking: Financing Appliances for End Users. Available online: https://mecs.org.uk/wp-content/uploads/2021/07/Clean-Cooking-Financing-Appliances-for-End-Users.pdf (accessed on 20 July 2021).

- Hsu, E.; Forougi, N.; Gan, M.; Muchiri, E.; Pope, D.; Puzzolo, E. Microfinance for clean cooking: What lessons can be learned for scaling up LPG adoption in Kenya through managed loans? Energy Policy 2021, 154, 112263. [Google Scholar] [CrossRef]

- Kumar, S.; Professor, M. Exploitative Microfinance Interest Rates. Asian Soc. Sci. 2009, 5, 87–93. Available online: https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.894.3609&rep=rep1&type=pdf (accessed on 27 July 2021).

- Bisaga, I. Innovation for off–grid solar rural electrification. In Affordable and Clean Energy. Encyclopedia of the UN Sustainable Development Goals; Filho, W.L., Azul, A., Brandli, L., Salvia, A.L., Wall, T., Eds.; Springer: Berlin/Heidelberg, Germany, 2020. [Google Scholar]

- Bisaga, I.; Hamayun, M. Overcoming the data wall: Harnessing big data to understand the energy needs of off-grid communities and the displaced. In Energy Access and Forced Migration; Grafham, O., Ed.; Routledge: London, UK, 2019; pp. 143–155. ISBN 9781351006941. [Google Scholar]

- Micro Energy Credits Corp (MEC) Mobile Technology Advancing Last-Mile Access to Clean Energy. Available online: https://eepafrica.org/wp-content/uploads/2020/09/KEN14312_MEC.pdf (accessed on 11 May 2021).

- Jewitt, S.; Atagher, P.; Clifford, M. “We cannot stop cooking”: Stove stacking, seasonality and the risky practices of household cookstove transitions in Nigeria. Energy Res. Soc. Sci. 2020, 61, 101340. [Google Scholar] [CrossRef]

- Yadav, P.; Davies, P.J.; Asumadu-Sarkodie, S. Fuel choice and tradition: Why fuel stacking and the energy ladder are out of step? Sol. Energy 2021, 214, 491–501. [Google Scholar] [CrossRef]

- Ochieng, C.A.; Zhang, Y.; Nyabwa, J.K.; Otieno, D.I.; Spillane, C. Household perspectives on cookstove and fuel stacking: A qualitative study in urban and rural Kenya. Energy Sustain. Dev. 2020, 59, 151–159. [Google Scholar] [CrossRef]

- Batchelor, S.; Khan, R.; Scott, N.; Leary, J. Ecook—The Near Future Landscape of Cooking in Urban Areas in Africa. Available online: https://www.lcedn.com/sites/default/files/files/Ed%20Brown.pdf (accessed on 20 July 2021).

- Global Alliance of Clean Cookstoves (GACC). Energy Projects in Humanitarian Settings 1983 to 2015—Humanitarian Data Exchange. Available online: https://data.humdata.org/dataset/energy-projects-in-humanitarian-settings (accessed on 20 July 2021).

- Aung, T.W.; Jain, G.; Sethuraman, K.; Baumgartner, J.; Reynolds, C.; Grieshop, A.P.; Marshall, J.D.; Brauer, M. Health and Climate-Relevant Pollutant Concentrations from a Carbon-Finance Approved Cookstove Intervention in Rural India. Environ. Sci. Technol. 2016, 50, 7228–7238. [Google Scholar] [CrossRef] [PubMed]

- Donofrio, S.; Maguire, P.; Zwick, S.; Merry, W.; Wildish, J.; Myers, K. State of the Voluntary Carbon Markets. Available online: https://www.forest-trends.org/publications/state-of-the-voluntary-carbon-markets-2020-2/ (accessed on 20 July 2021).

- Cavanagh, C.; Benjaminsen, T.A. Virtual nature, violent accumulation: The ‘spectacular failure’ of carbon offsetting at a Ugandan National Park. Geoforum 2014, 56, 55–65. [Google Scholar] [CrossRef]

- Green, J.F. Beyond Carbon Pricing: Tax Reform is Climate Policy. Glob. Policy 2021. [Google Scholar] [CrossRef]

- Parry, I. Putting a PrIce on Pollution: Carbon-pricing strategies could hold the key to meeting the world’s climate stabilization goals. Financ. Dev. 2019, 12. [Google Scholar] [CrossRef] [Green Version]

- Stiglitz, J.; Stern, N.; Duan, M.; Edenhofer, O.; Giraud, G.; Heal, G.; Lèbre la Rovere, E.; Morris, A.; Moyer, E.; Pangestu, M.; et al. Report of the High-Level Commission on Carbon Prices. Available online: https://academiccommons.columbia.edu/doi/10.7916/d8-w2nc-4103 (accessed on 20 July 2021).

- Tran, A.; Bisaga, I.; To, L.S. Landscape Analysis of Modern Energy Cooking in Displacement Settings. Available online: https://mecs.org.uk/wp-content/uploads/2020/12/Landscape-Analysis-of-MECS-in-Displacement-Settings_17022021.pdf (accessed on 20 July 2021).

- Fair Climate Fund Chad-Solar Cookers for Refugee Families. Available online: https://www.fairclimatefund.nl/en/projects/chad-solar-cookers-for-refugee-families (accessed on 28 April 2021).

- Solar Cookers International (SCI)—CooKit. Available online: https://solarcooking.fandom.com/wiki/CooKit (accessed on 1 May 2021).

- SOWTech One World Technology; MECS. MECS-TRIID Project Report. Delivering eCook at Ground Level. Available online: https://mecs.org.uk/wp-content/uploads/2020/12/MECS-TRIID-SOWTech-Final-Report-2.pdf (accessed on 20 July 2021).

- Vigdor, J.L. How Salient are Performance Incentives in Education? Evidence from North Carolina Thomas Ahn. Available online: http://www.umdcipe.org/conferences/EducationEvaluationItaly/COMPLETE_PAPERS/VIGDOR/F.pdf (accessed on 20 July 2021).

- Hufen, H.; De Bruijn, H. Getting the incentives right. Energy performance contracts as a tool for property management by local government. J. Clean. Prod. 2016, 112, 2717–2729. [Google Scholar] [CrossRef]

- Johnstone, K. Stoking finance for affordable cookstoves: Experience from Malawi and Zimbabwe. Available online: https://pubs.iied.org/g04472 (accessed on 20 July 2021).

- Ngo, D.K.L.; Bauhoff, S. The medium-run and scale-up effects of performance-based financing: An extension of Rwanda’s 2006 trial using secondary data. World Dev. 2021, 139, 105264. [Google Scholar] [CrossRef]

- Rietbergen, M.G.; Blok, K. Assessing the potential impact of the CO2 Performance Ladder on the reduction of carbon dioxide emissions in the Netherlands. J. Clean. Prod. 2013, 52, 33–45. [Google Scholar] [CrossRef]

- Shen, G.C.; Nguyen, H.T.H.; Das, A.; Sachingongu, N.; Chansa, C.; Qamruddin, J.; Friedman, J. Incentives to change: Effects of performance-based financing on health workers in Zambia. Hum. Resour. Health 2017, 15, 1–15. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Turcotte-Tremblay, A.M.; Gali-Gali, I.A.; De Allegri, M.; Ridde, V. The unintended consequences of community verifications for performance-based financing in Burkina Faso. Soc. Sci. Med. 2017, 191, 226–236. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Y.; Adams, N. Results-Based Financing to Promote Clean Stoves: Initial Lessons from Pilots in China and Indonesia Results-Based Financing to Promote Clean Stoves. Available online: https://openknowledge.worldbank.org/handle/10986/22114 (accessed on 20 July 2021).

- Zhang, Y.; Knight, O. Results Based Financing: Framework for Promoting Clean Stoves. Available online: https://olc.worldbank.org/content/results-based-financing-framework-promoting-clean-stoves%C2%A0 (accessed on 20 July 2021).

- Batchelor, S.; Brown, E.; Leary, J.; Scott, N.; Alsop, A.; Leach, M. Solar electric cooking in Africa: Where will the transition happen first? Energy Res. Soc. Sci. 2018, 40, 257–272. [Google Scholar] [CrossRef]

| RBF | RBA | |

|---|---|---|

| Principal | Central Government or local Government | Donor |

| Agent | Implementing agency (private sector, NGO, local Government or individual) | National or Central Government |

| Funds | Donor funds | Domestic or donor funds |

| Relationship between Principal and Agent | Contract- or incentive-based relationship | Aid partnership |

| Examples | BRILHO Mozambique, KOSAP, Clean Cooking Fund and all other RBFs reviewed in this paper | EU’s Millennium Development Goals (MDG) contracts, Rural Household Energy-Efficient Improvement Project (RHEEIP) |

| Cookstove RBF (Phase 2) | |

|---|---|

| Total number of units sold/Target | 110,796/80,000 |

| % of units sold by distributors/manufacturers | 77% |

| % of units sold by financial institutions | 23% |

| Units sold in marginalised counties | 6% |

| Product type | Improved Cookstoves (73%), LPG (21%) and Ethanol (3%) |

| Tonnes of CO2 eq. avoided | 65,600 |

| Risk/Barriers | Explanation | Severity | Impact | Observed in (Country/Programme) | Mitigation Approach |

|---|---|---|---|---|---|

| Pre-financing challenges | Upfront financing required; high national interest rates in Africa (20–40%), pure RBF does not provide pure concessionary upfront financing | Medium | Potential market distortion; local players without international financing access disadvantaged; limits R&D/Innovation; insolvency of RBF participants; risk of project failure | Rwanda SHS RBF programme and Global LEAP EPC Kenya (partially) | Due diligence: access to financing = pre-selection criteria. Provide bridge funding; % of grant disbursement upfront |

| Inflexibility | Market development faster than RBF programme (RBF-approved appliances overtaken by newer/cheaper models) | Medium | Lower distribution rates; targets cannot be fulfilled; creates irritation among consumers and disadvantages RBF participants over other players; RBF players lose trust | EnDev Kenya; EnDev-III Nepal | Keeping RBF design and implementation flexible, allowing a wide range of CC technologies |

| Short timeline | Short RBF implementation periods and unforeseen events (e.g., COVID-19/national disasters, etc.). | High | Speed before quality; no/limited consumer information; long-term uptake, use and overall sustainability; default/financial risk for RBF participants (cannot sell all units obtained) | Global LEAP EPC | Flexibility in the RBF design and implementation so that timetable for award and implementation can always be adjusted to accommodate any unforeseen events, while also ensuring that technologies do not go obsolete |

| End-user/community dynamics | No differentiation of incentives between products and end-user market. Varying levels of community acceptance | Medium | No differentiation of incentives between products and end-user market. Varying levels of community acceptance | EnDev Kenya and KOSAP CCS | Introduce tiered incentives based on energy service levels; periodically incentivise participating firms to sell in underserved areas. Increase community and end-user awareness |

| Transaction costs/results verification | Delays in monitoring and verification (M&V); M&V costs too high; finding right M&V agent sometimes difficult | Medium | Delays in the disbursement of funds to companies | Endev Kenya | Proper due diligence so as to find right M&V agent. Where possible, introduce remote monitoring technologies to reduce cost and delays |

| Transition from RBF to market-driven business models | Given the relatively nascent industry, firms may find it difficult to transition to market-driven models beyond RBF | Medium | Financial sustainability issues; risk of using RBF grant for inventory rather than sales | Global LEAP EPC RBF Pilot Kenya | Provision of upfront financing plus capacity building and TA support, especially for seed and early-growth businesses as they move along the growth curve |

| Currency depreciation/fluctuation | Procurement of technology in hard currency’ ($); customer payments in local currency | Medium | In case of significant currency depreciation and fixed incentive rates, margins lower/capital contribution of participants higher; especially challenging for smaller companies and for longer disbursement timelines | Kenya | Regular review of incentive rates; adaptation to currency fluctuations |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Stritzke, S.; Sakyi-Nyarko, C.; Bisaga, I.; Bricknell, M.; Leary, J.; Brown, E. Results-Based Financing (RBF) for Modern Energy Cooking Solutions: An Effective Driver for Innovation and Scale? Energies 2021, 14, 4559. https://doi.org/10.3390/en14154559

Stritzke S, Sakyi-Nyarko C, Bisaga I, Bricknell M, Leary J, Brown E. Results-Based Financing (RBF) for Modern Energy Cooking Solutions: An Effective Driver for Innovation and Scale? Energies. 2021; 14(15):4559. https://doi.org/10.3390/en14154559

Chicago/Turabian StyleStritzke, Susann, Carlos Sakyi-Nyarko, Iwona Bisaga, Malcolm Bricknell, Jon Leary, and Edward Brown. 2021. "Results-Based Financing (RBF) for Modern Energy Cooking Solutions: An Effective Driver for Innovation and Scale?" Energies 14, no. 15: 4559. https://doi.org/10.3390/en14154559

APA StyleStritzke, S., Sakyi-Nyarko, C., Bisaga, I., Bricknell, M., Leary, J., & Brown, E. (2021). Results-Based Financing (RBF) for Modern Energy Cooking Solutions: An Effective Driver for Innovation and Scale? Energies, 14(15), 4559. https://doi.org/10.3390/en14154559