1. Introduction

International attention on the effects of excessive energy consumption began with the United Nations Framework Convention on Climate Change (UNFCCC), as adopted by the United Nations Headquarters in 1992. (The United Nations Framework Convention on Climate Change: the purpose is to stabilize the concentrations of greenhouse gases in the atmosphere in order to adapt the climate system to climate changes without any human interference and to take food production and economic development into account.)Then, it continued to the Kyoto Protocol (Kyoto Protocol: the creation of detailed regulations and legally enforceable reduction targets, including how to mitigate and combat climate change, and promotion of the “Kyoto Protocol” to become international law are the first steps to reverse global climate change), which represents the supplementary terms of the UNFCCC and was passed in Kyoto, Japan, in 1997, and to the Paris Agreement (Paris Agreement: to keep the earth’s temperature rise within a maximum of 2 °C, as compared with the temperature in preindustrial times, and to strive to achieve the abovementioned temperature rise standard and continue to reduce to the target of within 1.5 °C. Unlike the Kyoto Protocol, the Paris Agreement extends the emission reduction obligations to China and India and requires developed countries to provide climate change funds to help developing countries reduce their carbon dioxide emissions and to be capable of facing the consequences resulting from global climate change. It also makes all countries set their own emission reduction targets over a five-year cycle), which was passed at the United Nations Climate Summit in 2015. It is known that energy issues are closely related to world climate change issues, food issues, population issues, and water resources. (The eight major issues discussed at the 2016 World Economic Forum (WEF) indicated that climate change is the most serious global problem at present, and failure to efficiently deal with climate change is the biggest threat to the global economy (WEF, 2016). The 2017 Climate Vulnerable Forum (CVF) also explicitly indicated that the main cause of global climate change is global temperature warming, which comes from the excessive emissions of carbon dioxide, and such massive greenhouse gas emissions arising from fossil fuel cause an increase in the average global temperature, melt the ice caps, and cause extreme weather, drought, and rising sea levels. If climate change cannot be dealt with efficiently, hundreds of millions of people may die by 2030, and the annual global gross domestic product will decrease.) Therefore, ways to save energy, improve energy efficiency, develop green energy, and reduce carbon dioxide emissions have long been important issues of international concern.

According to the data on carbon dioxide emissions, as collected by CDIAC for the United Nations, and the gross domestic product (GDP) statistics collected in the United Nations database (UN data), in 2015, the world’s top 10 carbon dioxide emitters accounted for 67.07% of the world’s total emissions, as shown in

Table 1, and their gross domestic products rank among the highest in the United Nations. Six of these countries are APEC economies: China, the United States, Russia, Japan, Korea, and Canada. Moreover, China ranked first in terms of global carbon dioxide emissions in 2015, accounting for 29.51% of total global emissions.

The Asia-Pacific Economic Cooperation (APEC) (The official website of Asia–Pacific Economic Cooperation (APEC):

https://www.apec.org/ (accessed on 29 June 2021)) is one of the most significant multilateral official economic cooperation forums in the Asia Pacific region, and there are a total of 21 participant economies: The United States, Russia, China, Japan, Canada, Singapore, Australia, Taiwan, Brunei, Chile, Hong Kong, Indonesia, Korea, Malaysia, Mexico, New Zealand, Peru, Papua New Guinea, the Philippines, Thailand, and Vietnam. It cannot be ignored that the total population of APEC economies accounts for 40.00% of the global population, their gross domestic products account for nearly 55.00% of the global total, and their total trades account for nearly 44.00% of the global total. In terms of geographical range, overall economic strength, and organizational activities, the consensus reached by APEC has a substantial influence on global economic and trade policies, as well as norms.

As shown in

Table 1, there were a total of 6 APEC economies among the world’s top 10 carbon dioxide emitters in 2015, as previously mentioned. Among them, China is the largest energy demander, and in 2015, its emissions accounted for 29.51% of the global total and ranked first, while its gross domestic product ranked second in the United Nations. The United States is a large energy consumer and importer, and in 2015, its emissions accounted for 14.34% of the global total and ranked second, and its gross domestic product ranked first in the United Nations. Russia is the largest oil and natural gas exporter in the world, and in 2015, its emissions accounted for 4.88% of the global total and ranked fifth, and its gross domestic product ranked twelfth in the United Nations. Japan is currently the fifth-largest energy consumer and the second-largest energy importer in the world, and in 2015, its emissions accounted for 3.47% of the global total and ranked sixth, and its gross domestic product ranked third in the United Nations. Korea is the eighth largest energy consumer in the world, and in 2015, its emissions accounted for 1.71% of the global total and ranked ninth, and its gross domestic product ranked eleventh in the United Nations. Canada is an important petrochemical energy producer, and in 2015, its emissions accounted for 1.54% of the global total and ranked tenth, and its gross domestic product ranked tenth in the United Nations. Environmental protection and proper resource allocation have long been a focus issue of international concern, and energy efficiency is the core of this issue. As shown in

Table 1 and

Table 2, in 2015, the total gross domestic products of six APEC economies, China, the United States, Russia, Japan, Korea, and Canada, accounted for 45.15% of the global total, and their carbon dioxide emissions accounted for 55.45% of the global total, which was more than half of the total global emissions. These notable statistical data once again stress the necessity and importance of evaluating the energy efficiency of APEC economies.

All economies pursue economic development, so is it possible to look back and consider the living environment that has been created for the next generation? This research collects the data of APEC economies from 2010 to 2014 and uses the dynamic DEA model to evaluate and analyze the energy efficiency rankings of 20 economies based on their CO2 emissions calculated from fossil fuels. The targets of this research are as follows: (1) discussing the annual and overall energy efficiency of APEC economies; (2) making suggestions for improvement directions and ranges of different variables; (3) exploring changes in the intertemporal conversion variables of APEC economies and suggestions for improvement; (4) analyzing the energy inputs and efficiency policy implications of APEC economies.

Over the past several decades, many studies have focused on the themes of energy and the environment to find appropriate solutions balancing economic growth and environmental protection, energy consumption and CO

2 emissions (Pittman [

1], Weber and Domazlicky [

2], Zofio and Prieto [

3]). Among these, DEA models have been applied to measure the energy efficiency [

4,

5,

6,

7,

8,

9,

10,

11,

12,

13,

14,

15,

16,

17,

18,

19,

20,

21,

22,

23,

24,

25,

26,

27,

28,

29]. Studies related to energy efficiency usually take undesirable outputs into account and assess the value of energy efficiency through various DEA models (Pittman [

30], Fär, Grosskopf, Lovell, and Pasurka [

31], Färe, Grosskopf, and Kokkelenberg [

32], Scheel [

33], Pasupathy [

34]). There are two main methods to analyze undesirable outputs: 1) considering them as weak disposable (WD) variables in their original forms (Färe and Grosskopf [

35,

36,

37]) and 5) treating them as strong (free) disposable (SD) variables in their different forms, such as in the form of their additive inverse or in the form of their reciprocals (see AlirenzaAmirteimoori, Kordrostami and Sarparast [

38], Seiford and Zhu [

39], Lovell [

40], Athanassopoulos and Thanassoulis [

41], Arcelus and Arocena [

42]).

Nevertheless, one limitation of such research is that they evaluated the efficiency of bad outputs within cross-sectional data but not time-series data. The changes in carry-over variables that persist during the sample period were not considered. To be more specific, previous studies usually applied traditional DEA models to evaluate the production efficiency and technical efficiency of decision-making units (DMUs) during a certain period of time in a static way, while if we adopt the assumption of static optimization, there may be inefficient biased measurements. Therefore, in the long term, the quasi-fixed inputs may not be allocated efficiently or adjusted to optimal levels, according to the results of Nemoto and Goto [

43]. Moreover, when considering some terms with intertemporal effects to assess overall efficiency, the interrelationship between successive periods must be analyzed dynamically (Kao [

44]). It is necessary for us to establish a dynamic DEA model to calculate the energy efficiency of 20 APEC economies.

Sengupta [

45] and Färe and Grosskopf [

6] mainly contributed to the development of the dynamic data envelopment analysis model. Sengupta [

45] showed a dynamic DEA model by introducing the adjusted cost method to analyze the risk and output fluctuation of a dynamic production frontier when the shadow value of quasi-fixed input and its optimal path are incorporated into the analysis of linear programming. Färe and Grosskopf [

3] formulated different intertemporal variables and input them into actual multioutput production processes for various periods. Since then, much research has followed and developed dynamic DEA models [

46,

47,

48,

49,

50,

51,

52]. Tone and Tsutsui [

53] connected two consecutive periods by merging the carry-over variable, establishing a slack-based model for measuring period and overall efficiencies. Jafarian-Moghaddam and Ghoseiri [

54] built a fuzzy dynamic multi-objective DEA model to evaluate railway efficiency performance. Soleimani-damaneh [

55] developed a new technique to estimate the return on a scale using the dynamic DEA model to obtain the advantages of the algorithm. Based on the quarterly data of the Zagreb Stock Exchange, Tihana [

56] used a dynamic slack-based measure (SBM) DEA model to assess the relative efficiency during the period 2009–2012. Sueyoshi et al. [

57] evaluated the environmental performance of coal-fired power plants in the United States from 1995 to 2007 by using dynamic DEA window analysis at the time-shifting front.

Our study aims to respond to the results estimated by Seiford and Zhu [

39], which use CO

2 emissions as undesirable output and view real GDP as a carry-over variable in dynamic DEA models (Tone and Tsutsui [

53]). The method commonly used in the literature for assessing efficiency tends to produce overestimated efficiency scores when the essence of dynamics is neglected. This presents a dynamic analysis of data as it becomes available. We contribute by introducing the translation adjustment model of Seiford and Zhu (2002) into dynamic DEA models so that we can decompose the data into different elements of efficiency variance. Additionally, the data can be applied to deal with the variance.

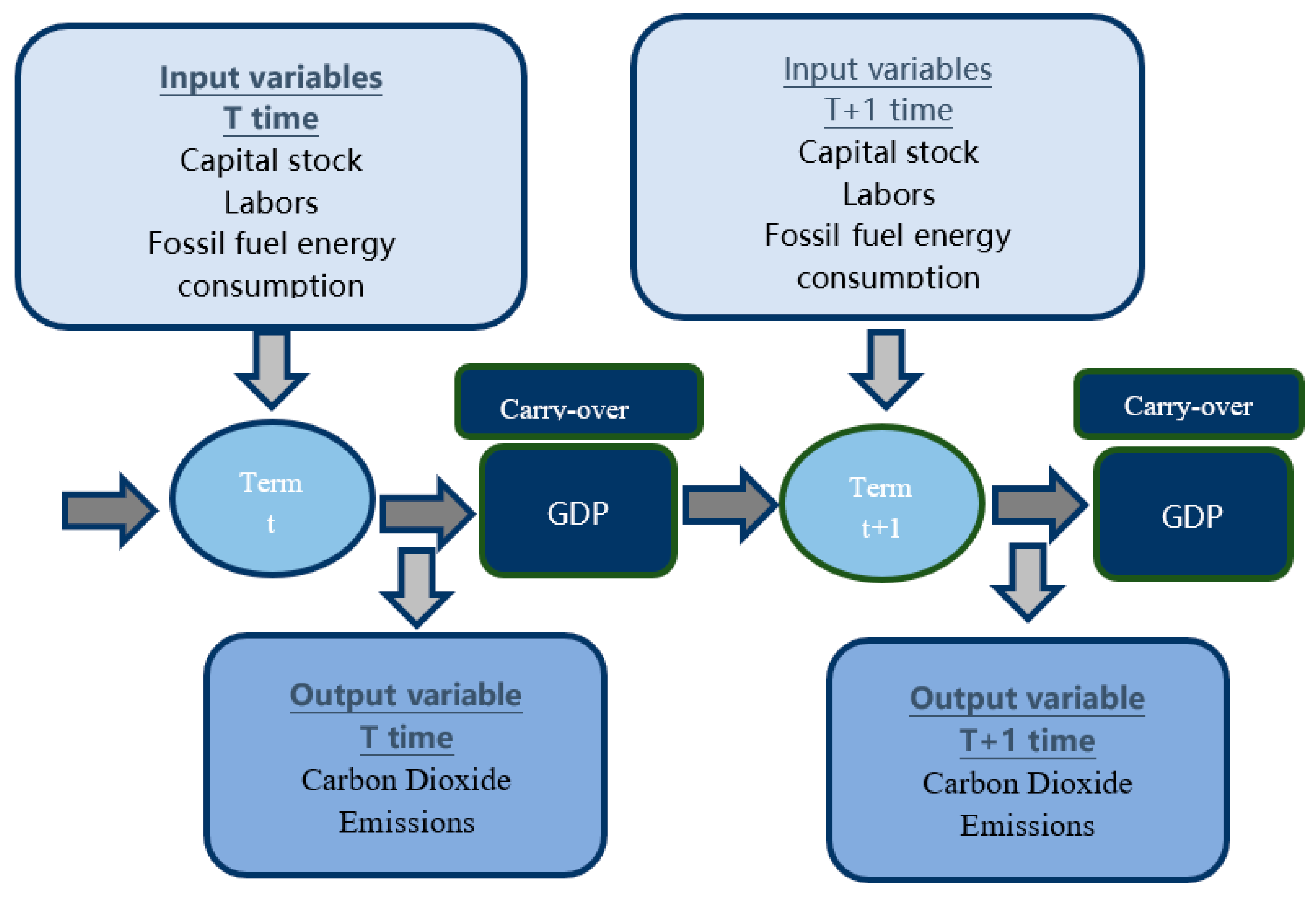

In this study, the energy efficiency rates of APEC economies are evaluated by dynamic DEA with nonoriented variable returns-to-scale models, which intend to estimate the energy efficiency values and analyze related policy implications of APEC economies, based on empirical results, and to expand the applicable measurements of all economies’ energy efficiency, based on this study, so that energy policies can be adjusted in a timely manner under the condition that all economies can pursue economic development and thus make the ecological environment of the earth sustainable. Therefore, this study collects the data of APEC economies to measure their energy efficiency over the period 2010–2014 and studies the impacts of undesirable outputs vs. energy efficiency ranking. We use labor force, actual capital stock, and energy consumption as the input variables in dynamic DEA models, while the undesirable output variable is CO2 emissions, which is calculated by fossil fuel from 2010 to 2014. In the model, the carry-over variable is the real GDP. Dynamic DEA with nonoriented variable returns-to-scale models is utilized for related discussions.

This study is organized as follows:

Section 2 presents the dynamic DEA model;

Section 3 displays the estimated results of empirical measurement;

Section 4 offers a discussion based on the results from the last section;

Section 5 presents the conclusions and policy implications.

3. Empirical Results and Analysis

In this study, the nonoriented variable returns-to-scale of dynamic DEA was employed to measure the energy efficiency of 20 APEC economies from 2010 to 2014, determine the relatively inefficient parts, and make suggestions for improvement directions, as well as the ranges of different variables, to explore changes in the intertemporal conversion variables of APEC economies and make improvement suggestions.

3.1. Energy Efficiency Analysis

The study employs the nonoriented variable returns-to-scale dynamic DEA model to measure the annual and overall energy efficiency of 20 APEC economies from 2010 to 2014. The results are analyzed and collected in

Table 6.

From 2010 to 2014, the average overall energy efficiency was 0.5813, the maximum value was 1.000, the minimum value was 0.0007, and the standard deviation was 0.3162. The average energy efficiency rankings of eight economies, Taiwan, Australia, Brunei, Canada, Japan, New Zealand, Singapore, and the United States, were higher than the average overall energy efficiency ranking, while the average energy efficiency rankings of 12 economies, Chile, China, Hong Kong, Indonesia, Korea, Mexico, Malaysia, Peru, the Philippines, Russia, Thailand, and Vietnam, were lower than the average overall energy efficiency ranking. From 2010 to 2014, the APEC economies of the four economies with the best overall energy efficiency were Australia, Brunei, New Zealand, and the United States, meaning that all of their annual energy efficiencies were 1.0000 during the study period. Those with excellent performance can be regarded as the models from which other economies can learn. The overall ranking was Japan, Singapore, Canada, Taiwan, Russia, Chile, Hong Kong, Malaysia, Korea, the Philippines, Peru, Thailand, and Vietnam. The top three economies with the worst overall energy efficiency ratings were Indonesia (0.2737), Mexico (0.2622), and China (0.0007), meaning there was much room for efficiency improvement. This is where the main findings of this paper differ from other literature. Regarding the energy use efficiency of China, the results of this paper are quite different from other results. China uses a large amount of energy and thus emits a large amount of carbon dioxide. Lu et al., 2019 concluded that China uses energy efficiently, but they failed to adjust the CO2 data. In the future, the largest output of CO2 will become the benchmark and then overmeasure the energy use efficiency of China.

Taiwan had the best energy efficiency levels in 2010 and 2011; however, its efficiency dropped in the last three years. While Vietnam has improved its energy efficiency level each year, its efficiency level is still less than 0.4. While Indonesia experienced a decrease in the first three years, its overall efficiency still shows a decreasing trend.

3.2. Improvement of the Input Items

The suggestions for improvement, as well as the ranges of different variables as inputs for APEC economies from 2010 to 2014, as selected by this study, are shown in

Table 7. From 2010 to 2014, the average adjustment range of the capital stock was −15.97%, and the adjustment ranges of the capital stocks of five economies, Australia, Brunei, New Zealand, the Philippines, and the United States, were 0.00%, representing no need for adjustment. In contrast, the average suggested adjustment ranges of six economies, Taiwan, China, Indonesia, Korea, Malaysia, and Thailand, were higher than the overall average; these economies saw improvements in their usage of capital, especially Taiwan and China. This study finds that the adjustment ranges of the capital stocks of Russia and Vietnam show a gradual downward trend; in particular, the adjustment range of the capital stock of Russia was reduced to 0 in 2014, as it engaged in efficient capital usage. Canada, Mexico, Malaysia, and Peru show a downward trend of capital stocks.

The overall average adjustment range of labor was −44.97%, and the average suggested adjustment ranges of 11 economies, Chile, China, Indonesia, Korea, Mexico, Malaysia, Peru, the Philippines, Russia, Thailand, and Vietnam, were higher than the overall average, indicating that there is much room for improvement in the use of labor in these economies, particularly the Philippines and Indonesia. Furthermore, the adjustment ranges of China, Thailand, and Vietnam in terms of labor remained at an average level (88.41; 88.57; 95.48). The adjustment range of labor of three economies, Korea, Mexico, and Malaysia, showed a slight upward trend from 2010 to 2014.

Regarding the consumption of fossil fuel energy, the average adjustment range of the overall APEC economies was −52.04%. The adjustment range between 2010 and 2014 shows a fluctuation of rising, followed by falling. The average suggested adjustment ranges of 13 economies, Taiwan, Canada, Chile, China, Indonesia, Korea, Mexico, Malaysia, Peru, the Philippines, Russia, Thailand, and Vietnam, were higher than the overall average.

Based on the above information, four economies, Australia, Brunei, New Zealand, and the United States, had the best overall performance, and no adjustment was required for their input variables during the study period. Five economies, China, Indonesia, Korea, Malaysia, and Thailand, had the worst overall performance, meaning that their input variables during the study period were in the most urgent need of improvement, and the average suggested improvement range was higher than the overall average.

3.3. Improvement of Undesirable Outputs

The adjustment results of outputs are mainly summarized in

Table 8 and

Table 9. Based on the energy efficiency evaluation of 20 APEC economies, the analysis results in

Table 8 show that the overall average adjustment range of carbon dioxide emissions of undesirable output variables for APEC economies from 2010 to 2014 was −3871.60%, and only China’s average suggested adjustment range was higher than the overall average. According to the definition of Seiford and Zhu (2002), regarding the adjustment mode of undesirable outputs, the high carbon dioxide emissions of China will cause underestimation of its energy use efficiency during evaluation, as high emissions will move China closer to the frontier in terms of possible production and even become the benchmark. Therefore, another translation adjustment mode of carbon dioxide emission is provided in this paper to measure the actual energy use efficiency of all economies to calculate whether they can actually be controlled or adjusted.

Based on the above information, the seven economies of Australia, Brunei, Canada, Japan, New Zealand, Singapore, and the United States had the best overall performance, and no adjustment was needed for their undesirable output variables during the study period. China was the country with the worst overall performance, its undesirable output variables during the study period were in the most urgent need of improvement, and the average suggested improvement range was higher than the overall average.

3.4. Changes in Intertemporal Conversion Variables and Improvement Suggestions

In this study, gross domestic product (GDP) was selected as the carry-over to link the current period and the next period to facilitate a more complete analysis of the effects of gross domestic product for overall energy efficiency evaluation. Moreover, an adjustment rate was proposed for intertemporal conversion variables, which would help APEC economies achieve a relatively efficient reference and facilitate desirable outputs (good results) being brought into the next period.

In this study, changes in intertemporal conversion variables and suggestions for the improvement of APEC economies from 2010 to 2014 were selected. The analysis results in

Table 9 show that the overall average adjustment range of the gross domestic product of desirable output variables for APEC economies from 2010 to 2014 was 3.65%, and the average suggested adjustment range of eight economies, Taiwan, Chile, China, Indonesia, Peru, the Philippines, Russia, and Vietnam, was higher than the overall average. Based on the above information, five economies, Australia, Brunei, New Zealand, Singapore, and the United States, had the best overall performance, and no adjustment was needed for their desirable output variables during the study period. Eight economies, Taiwan, Chile, China, Indonesia, Peru, the Philippines, Russia, and Vietnam, have the worst overall performance, and their intertemporal conversion variables are in the most urgent need of improvement. Furthermore, while China and Vietnam have the largest adjustments at 13.5% and 16.57%, respectively, their adjustments show a declining trend year by year, particularly China, where the adjustment range of the GDP was reduced to 0 in 2013. In other words, when considering the economic growth of the previous period, China’s adjustment to GDP output is optimal.

4. Energy Policy Implications of APEC Economies

The variables selected in this study were used to analyze the energy inputs and policy improvement directions of all economies, as well as efficiency policy implications, to achieve the optimal efficiency targets. While reducing capital stock, labor, fossil fuel energy consumption, and carbon dioxide emissions and increasing gross domestic production can increase energy efficiency, economies do not want to reduce the state’s capital stock; because labor is related to population birth, adjustments are difficult; thus, adjustments can only start from fossil fuel energy consumption, carbon dioxide emissions, and gross domestic production. Hence, this study analyzes the effects of adjustments to fossil fuel energy consumption and carbon dioxide emissions on gross domestic production to analyze the implications of efficiency policies.

As shown in

Table 10, the average overall energy efficiency of APEC economies from 2010 to 2014 was 0.5813. The overall energy efficiency of eight economies, Australia, Brunei, New Zealand, the United States, Japan, Singapore, Canada, and Taiwan, was higher than the average overall energy efficiency of APEC economies, and, except for Brunei, those above eight are developed economies. (Developed country: also known as an advanced country. It refers to a country with high levels of economic and social development, as well as high living standards, also known as a more economically developed country (MEDC). The general characteristics of a developed country are a high human development index, per-capita gross national product, industrialization level, and life quality.) The overall energy efficiency ratings of 12 economies, Russia, Chile, Hong Kong, Malaysia, Korea, the Philippines, Peru, Thailand, Vietnam, Indonesia, Mexico, and China, were lower than the average overall energy efficiency of APEC economies, and, except for Hong Kong and Korea, the above 12 economies were developing economies. (Developing country: also known as a less developed country. It refers to a country with lower levels of economic and social development than a developed country. With the development of the economy, the difference in living standards between some developing countries and developed countries is not large.) To pursue national competitiveness and improve their international status, developing economies excessively input fossil fuel energy while actively increasing their gross domestic product, which increases excessive carbon dioxide emissions and leads to low national energy efficiency. Based on the empirical results, the inputs of fossil fuel energy can improve the gross domestic product and carbon dioxide emissions with changes in the same direction, while inputs of fossil fuel energy and outputs of carbon dioxide emissions can reduce energy efficiency with changes in the opposite direction.

In conclusion, it is difficult to reduce fossil fuel energy consumption and carbon dioxide emissions while simultaneously raising gross domestic production. In pursuit of economic growth, it is difficult for economies to increase their desirable output—gross domestic product while reducing undesirable outputs—carbon dioxide emissions. These study results are the same as those proposed by Chiu et al., 2017; economies must enact cuts in policy and technical areas, appropriately adjust their energy policies, and actively develop new energy technologies, such as collecting carbon taxes, replacing fossil fuel energy with renewable energy, developing clear alternative energy programs, and establishing diversified energy structures, to effectively reduce carbon dioxide emissions and achieve optimal energy efficiency.