3.1. Portfolio Optimization in the Energy Domain

The conceptual formulation of the portfolio model was first introduced by [

68] and has since been extensively applied in financial analysis and other fields. The theoretical framework consists of the minimization of a portfolio risk (i.e., the variance) for a given level of expected return. The mirror concept consists, obviously, of the maximization of the expected return for a given level of risk.

One of the first applications of portfolio theory in the energy sector was related to the optimization of the procurement process by the utilities in the U.S. back in the 1970s [

69]. Later, the scope expanded to include the optimization of energy consumption [

70] and other performance metrics [

71] on the national scale, as well as the assessment of individual projects and investment decisions [

72,

73], including the focus on particular customer groups [

74]. Matching the classic portfolio theory studies in the field of finance, the risk in the energy optimization problems is generally represented by the portfolio variance. However, the optimization parameters vary from fuel input costs and investment outcomes to non-financial targets such as capacity or emissions.

Recent studies in the energy field have applied a number of methodological innovations supplementing the classic portfolio optimization approach. These include the decomposition hybrid interval prediction method [

75], multi-objective (value-at-risk and conditional value-at-risk) risk optimization [

76] and encompassing the forecast error as part of the risk asset [

77]. However, despite the expanding scope and methodological progress, the application of portfolio optimization in the energy sector remains primarily focused on the domestic issues, with limited coverage of the energy trade and energy security areas.

As shown in the previous section, energy security has been primarily viewed from the importer’s perspective. A similar trend can be observed in the studies that apply a portfolio optimization method to this problem. Methodologically, these studies define risks as either the fluctuation in import costs [

78,

79,

80] or the supplier’s economic and political state [

81,

82]. The latter, index-based approach is also used in the rare exporter-focused study of Iranian gas exports [

83]. Note that when the indices that characterize energy importers or exporters are used as a proxy for supply security or price risks, the method becomes susceptible to the drawbacks typical for energy security coefficients highlighted in the previous chapter.

The case study developed in this article attempts to address these gaps in the scope and method of the previous literature. We use the optimal portfolio theory approach to evaluate the notion of security for energy exporters, considering two facets: physical supply security and price security.

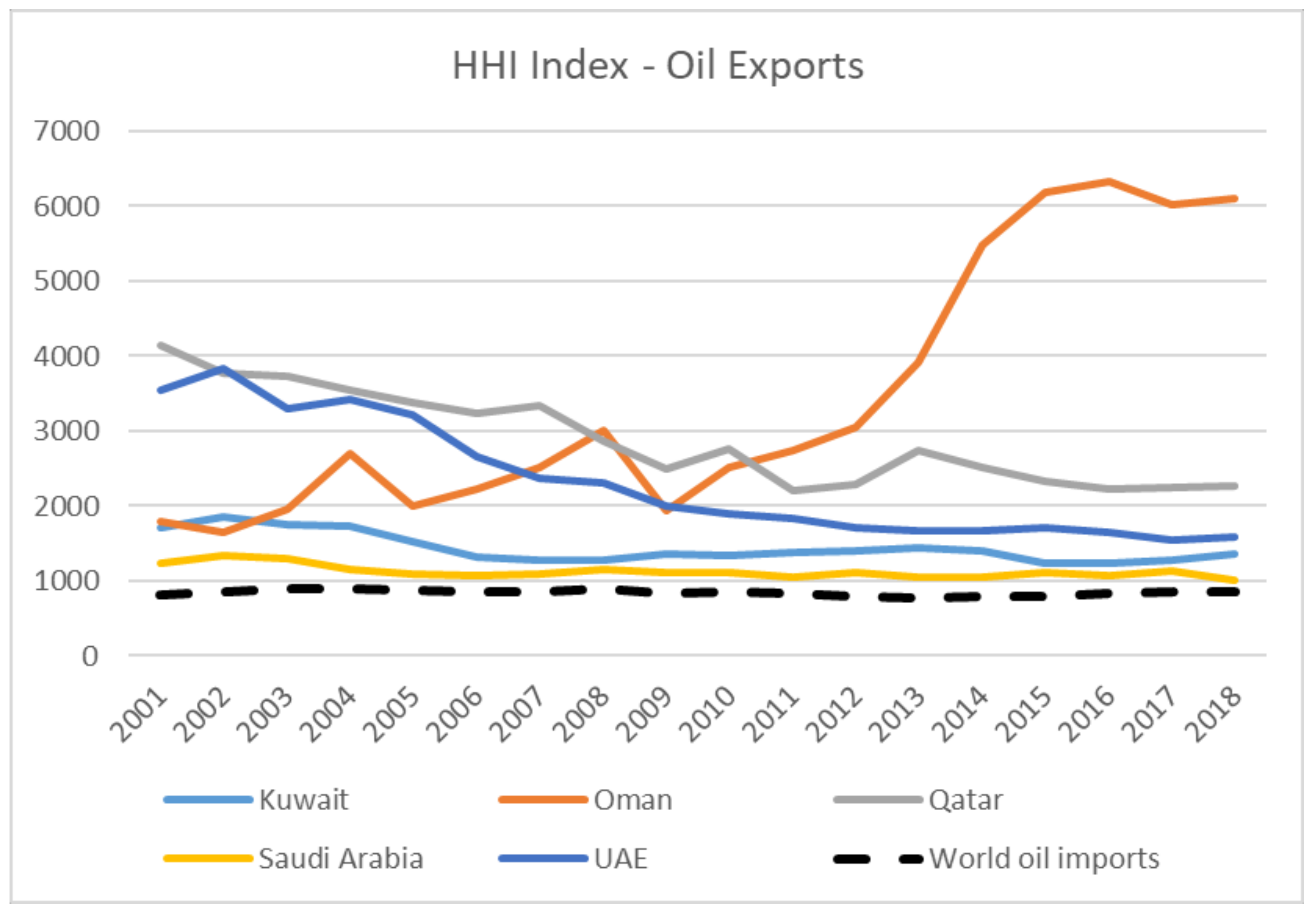

3.2. Methods and Data

This paper explores the growth-volatility and price-volatility dynamics of oil export portfolio structures for five GCC economies: Kuwait, Oman, Qatar, Saudi Arabia, and the UAE. (We exclude Bahrain, whose current oil export structure does not permit construction of an efficient frontier portfolio). This approach provides an innovative assessment tool for the two major pillars of energy security—security of demand and price optimization—from the exporter’s perspective. It can be applied to assess the current composition of the energy export portfolios, test the potential impacts of market development scenarios, and help inform relevant response (prevention) strategies.

A country’s energy exports generally comprise a set of flows to different buyers that vary in volume, growth rate, and price terms. These can be represented as a portfolio, in which the total export volume growth rate (or export price) equals the weighted sum of the relevant values associated with specific buyers, and where these total portfolio characteristics are subject to a diversification effect. In this case, the return is represented by the export growth rate (or export price) and uncertainty as to the underlying volatility of the return variables. Under these assumptions, energy exporters will strive to maximize their expected portfolio returns for a given level of risk or, conversely, minimize the risks associated with a certain level of expected returns.

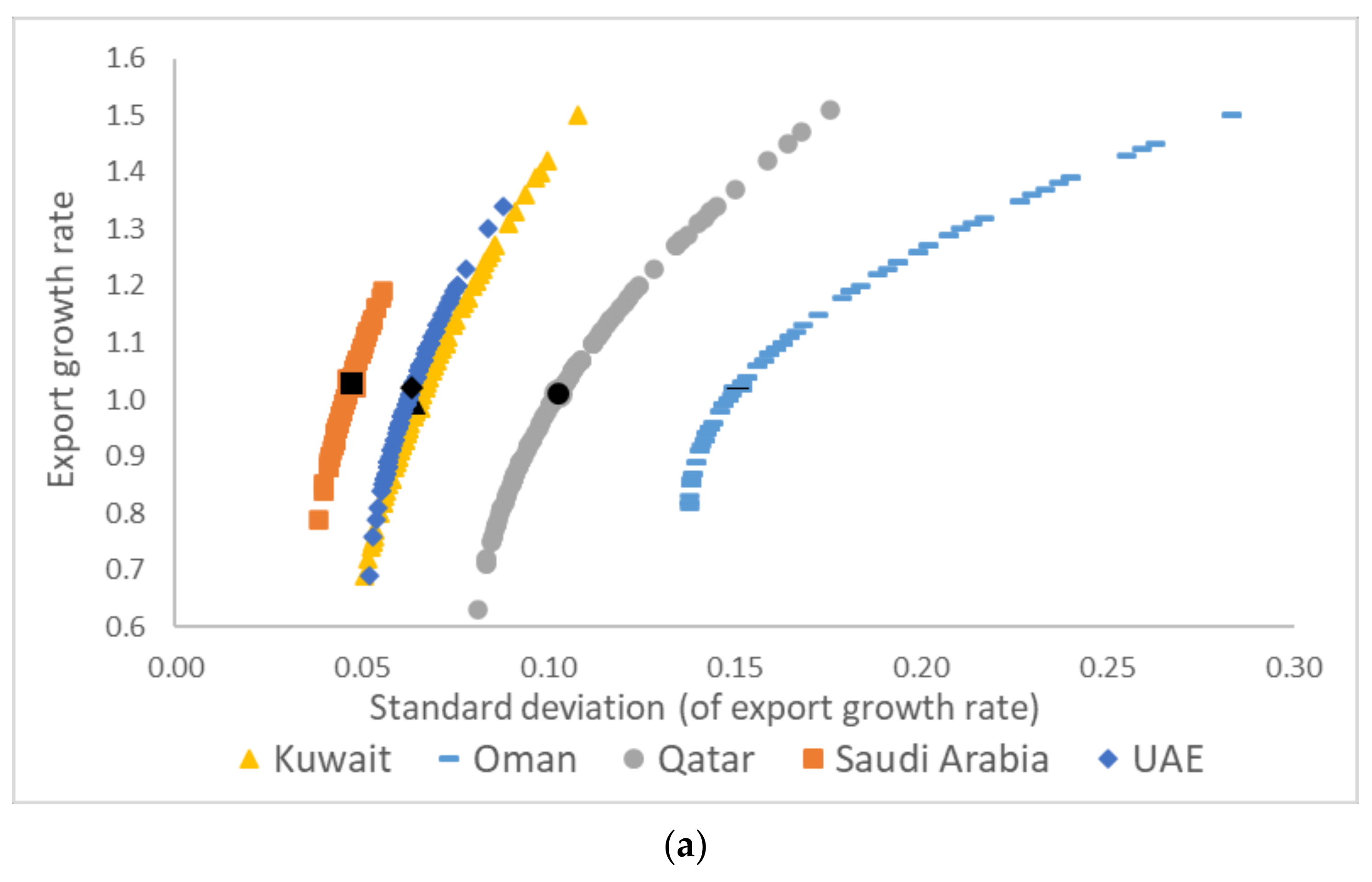

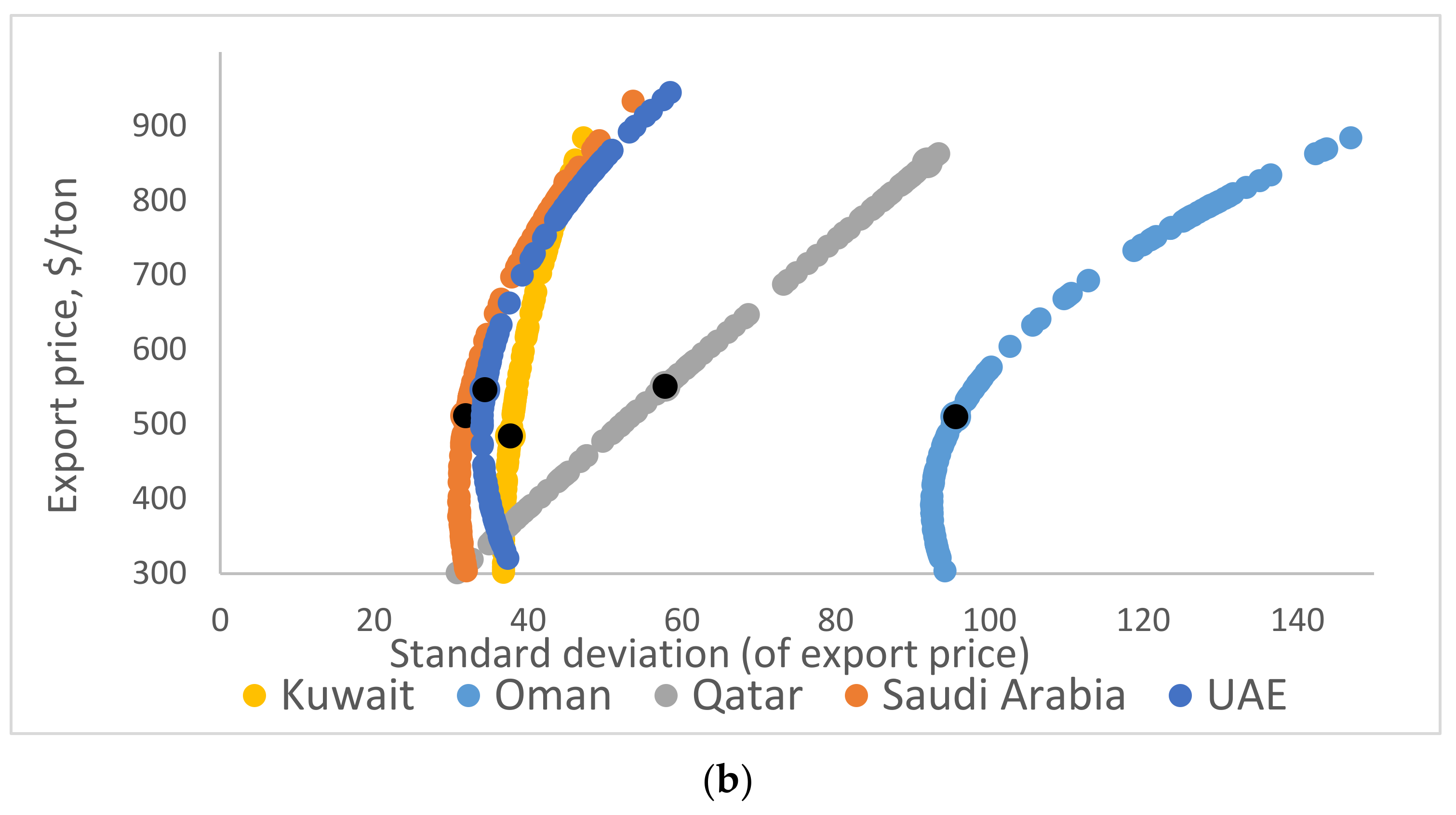

We assess the trade-offs facing oil exporters, constructing two efficient portfolio frontiers for the five countries in focus with the following characteristics. (i) The oil export volume growth portfolio is characterized by a return. We assume that this is measured by the monthly growth rate of oil export volumes. In addition, there is a variance associated with the structural composition of the portfolio; we assume that this is measured by the historical export data for individual buyers. The portfolio composition shows the trade-off between a higher growth of exports and concentration of customer countries, while a lower risk is associated with a higher diversification of customer countries. (ii) The oil export price portfolio is characterized by a return, reflecting the average monthly price received by the exporter. The variance of the portfolio is estimated based on the price fluctuations paid by the individual customer countries, which is weighted by their shares of importance in the total oil exports of each exporter. The portfolio shows different combinations of high expected return with high concentration on a few best buyers and low expected return with a more diversified composition of buyers. These portfolios cover the two primary aspects of energy security from the exporter’s perspective: minimize the risk while securing demand and obtaining favorable price terms.

In detail, the theoretical specification is as follows. Based on the standard portfolio theory, we assume that agents minimize the variance of the portfolio for a given level of expected return [

11]. As explained above, we consider in the first case the return as measured by the monthly growth rate in oil export volumes. The variance of the portfolio is the sample variance of the weighted growth rates of exports to individual buyers. In the second case, the return variable reflects the average monthly oil price recorded by an exporter. Thus, the portfolio variance is the variance of the weighted prices paid by individual buyers.

We consider that from the viewpoint of the exporter j, there is a world demand for oil export f

j(∙), which is the optimal oil demand for exporter j:

The desired or optimal level of oil demand implies a desired growth rate of energy export to be satisfied with an export portfolio g(∙) to different n customer countries:

Therefore, the return is the overall export growth rate, which is computed as the monthly growth rate of oil export volumes to n suppliers (country subscript omitted for simplicity):

and the uncertainty is the variability of the export growth rate across suppliers:

In the second case, we consider that maximizing the return of the export portfolio implies a benefit for the exporting country that is the price benefit associated with the oil exports:

We measure the return of this benefit pb as the average oil export price attained in the world market. This is a function of the export composition of the different n prices charged the n customer countries.

For each exporter, the standard portfolio optimization theory prescribes to minimize the weighted average of the elements of the covariance matrix:

where v is the square root of the return’s covariance matrix and s

i is the i-th export shares, given the constraint of the optimal total return rate of i-th economy

, which can be viewed as the sum of the returns weighted by each customer’s relative importance:

This gives the relation between the minimum variance and its return for different values of the constraint, which is the efficient frontier for empirical estimation, as a relation of the standard deviation with the return and return squared, which is expressed as follows:

We can consider SDt as the standard deviation of the i-th oil export flows or of the i-th price benefit, while a is the fixed effect, Θt as the annual growth rate of the total oil quantity flow or of the average profitability index, the coefficients b1 and b2 define the frontier convexity, and et captures the residual error.

In the space mean-standard deviation, it is possible to show that Equation (9) defines the upper arm of a parabolic function of efficient portfolios, which constitutes the portfolios frontier characterized by the minimum variance associated to a given return.

The dataset used in this study comprises monthly volumes and prices of crude oil exports disaggregated by destination country for each of the five major oil exporters from the GCC region: Kuwait, Oman, Qatar, Saudi Arabia, and the UAE. The data availability for Bahrain oil exports shows an erratic pattern to a narrow range of buyers. Thus, there is an insufficient history of oil exports data that does not allow applying the portfolio analysis approach. Therefore, we leave Bahrain out of the scope of this study. However, the GCC countries neither publicly release direct exports data nor make it available to open-source data platforms, such as those provided by the World Bank or International Trade Centre [

43,

44]. Therefore, we used these sources to obtain the ‘mirror’ exports data, i.e., the monthly volumes and prices of crude oil imported from each of the GCC countries by every other economy in the world. These datasets for oil importing countries are publicly available at [

43,

44].

To determine a proxy for the price at the exporter’s border, we subtracted the estimated shipping costs (calculated on a per unit, monthly basis for all major oil export routes from the GCC ports) from the corresponding price recorded at the importer’s border. We note that the model captures short-term effects, as the portfolios are estimated using monthly exports data. Risk assessment in this study is also limited to the specific risks associated with a particular route from the exports to the customer country that can be diversified. It does not include systemic risks (such as the COVID-19 pandemic) that can destabilize an entire industry, market, or the entire global economy. Regarding the issue of seasonality, the existing literature suggests that it exists in the futures market for gas [

84] but is arguably negligible for oil [

85]. Therefore, it is not considered in this study.

The variable of oil exports in physical terms is measured with the monthly growth rates of exports and its associated standard deviations across the portfolio of buyers. The variable of price benefit in dollar terms is measured using as proxy the FOB price associated with each buyer in US $1000 per tonne.

The data are aggregated for each exporting country studied for the period T = (2008:1–2018:12) for a total of 132 monthly observations and a specific number of buyers. We preliminary noted that for each GGC exporter, the datasets contained a number of buyers that report very small amounts with an intermittent frequency. These are occasional flows for only one or a few periods, accounting for less than 1% of the total export flows. We decided to exclude these small occasional buyers, and therefore, we consider the set of buyers that constitute 99% of the total exports. The number of buyers M considered for each country is M99%,Kuwait = 11, M99%,Oman = 4, M99%,Qatar = 4, M99%,SaudiArabia = 24, and M99%,UAE = 13.

To estimate Equation (9), we analyze the properties of cointegration of the series. The Dickey-Fuller test shows that all series, as expected, have a unit root. We also perform the Engle-Granger tests (results are reported in

Table 3). These tests are all showing that there exists cointegration, allowing estimation of the equation avoiding spurious correlation.

The results of the estimation of Equation (9) for the two variables for the five countries are reported in

Table 4, reporting the values and signs of the estimated coefficients b

1 and b

2. All estimates are generally significant, and the estimated values confirm the theory, namely, b

1 is negative and b

2 is positive, so that the frontier curvature is convex in the mean-return space. The sample period is 132 observations for all the quantity equations, while it is slightly lower for the price equations, as some outliers due to poor data quality have been eliminated from the estimation sample (as reported in

Table 4). Note that the coefficient b

2 greater than one indicates increasing diversification and vice versa. The empirical results show that diversification is decreasing for all countries.