Energy Security and Portfolio Diversification: Conventional and Novel Perspectives

Abstract

:1. Introduction: The Bounds of Conventional Approaches to Energy Security

1.1. Creeping Scope vs. Immutable Priorities

- -

- The International Energy Agency speaks of “uninterrupted availability of energy sources at an affordable price” [13];

- -

- The United Nations advocate a world where there is “the continuous availability of energy, in varied forms, in sufficient quantities, and at reasonable prices” [14];

- -

- The European Union theorizes a long-term strategy for energy supply security that “must be geared to ensure, for the well-being of its citizens and the proper functioning of the economy, the uninterrupted physical availability of energy products on the market, at a price which is affordable for all consumers (private and industrial), while respecting environmental concerns and looking towards sustainable development.” [15].

1.2. Methodological Limitations

2. Energy Security from the Exporter’s Viewpoint

2.1. Expanding the Conventional Energy Security Framework

2.2. Energy Security Challenges for Exporters

- -

- Negative macroeconomic dynamics (globally, and in importing economies)

- -

- Slowing demand for energy and specific fuels (globally, and in importing economies)

- -

- Downside price fluctuations in the global markets

- -

- Increasing competition, including from new exporters

- -

- Buyer-related risks including breach of contract and default

- -

- Protectionism, including tariff and non-tariff market access barriers

- -

- Sanctions, ranging from export embargoes to technological, financial, investment, and other collaboration restrictions

- -

- Shifts in legislation in energy importing markets

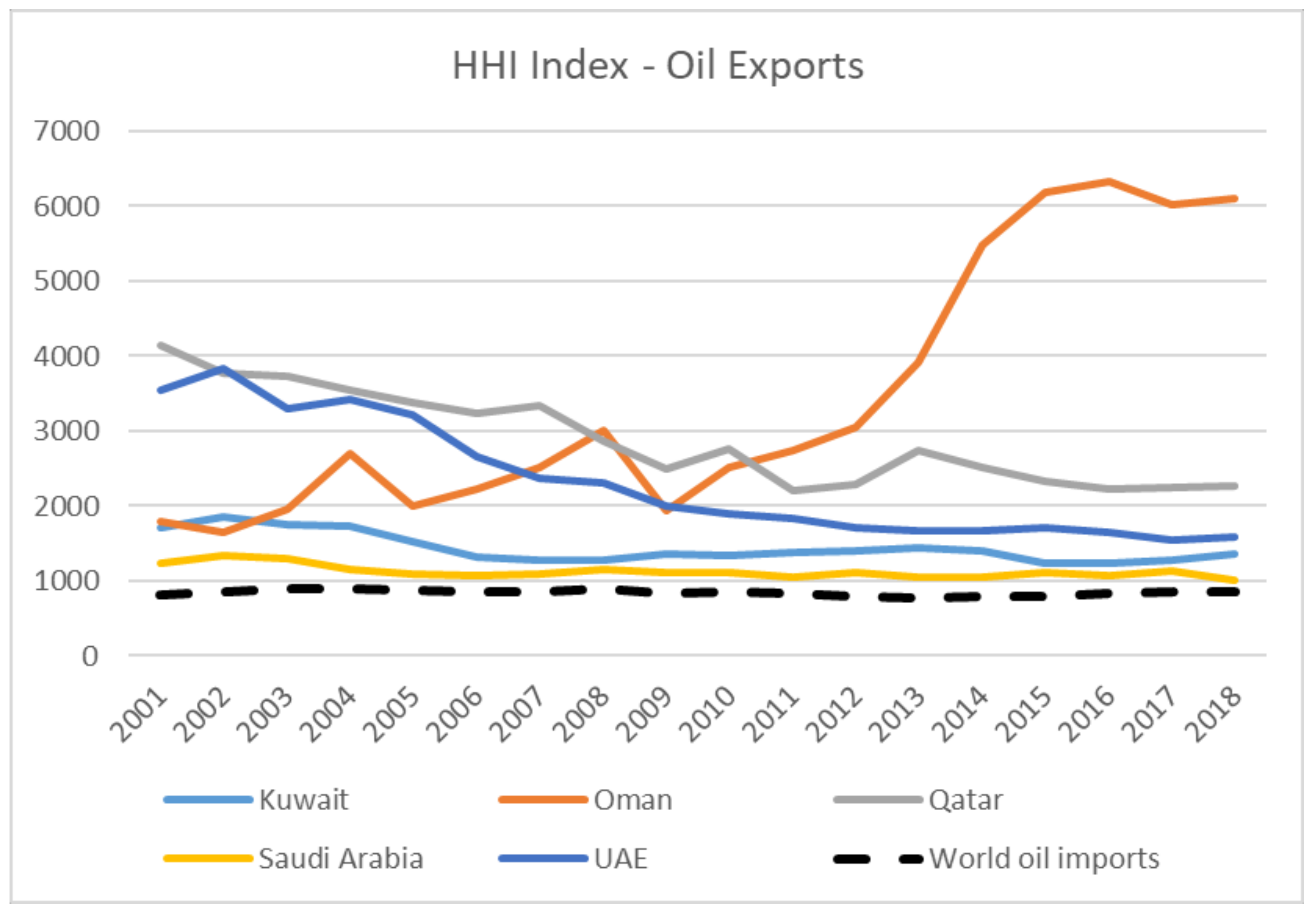

2.3. Measuring Energy Security

| Energy Production, MTOE | Total Final Consumption MTOE | Total EXP, MTOE | EXP/Energy Production, % | EXP/TFEC, % | |

|---|---|---|---|---|---|

| Bahrain | 22.4 | 6.3 | 8.3 | 37% | 132% |

| Kuwait | 162.2 | 19.3 | 128.3 | 79% | 665% |

| Oman | 77.9 | 21.3 | 50.1 | 64% | 235% |

| Qatar | 225.2 | 18.3 | 179.5 | 80% | 981% |

| Saudi Arabia | 646.8 | 140.7 | 425.4 | 66% | 302% |

| UAE | 229.4 | 62.3 | 136.9 | 60% | 220% |

2.4. Policy Tools

3. Portfolio Optimization of Energy Exports

3.1. Portfolio Optimization in the Energy Domain

3.2. Methods and Data

3.3. Scenario Design

4. Results and Discussion

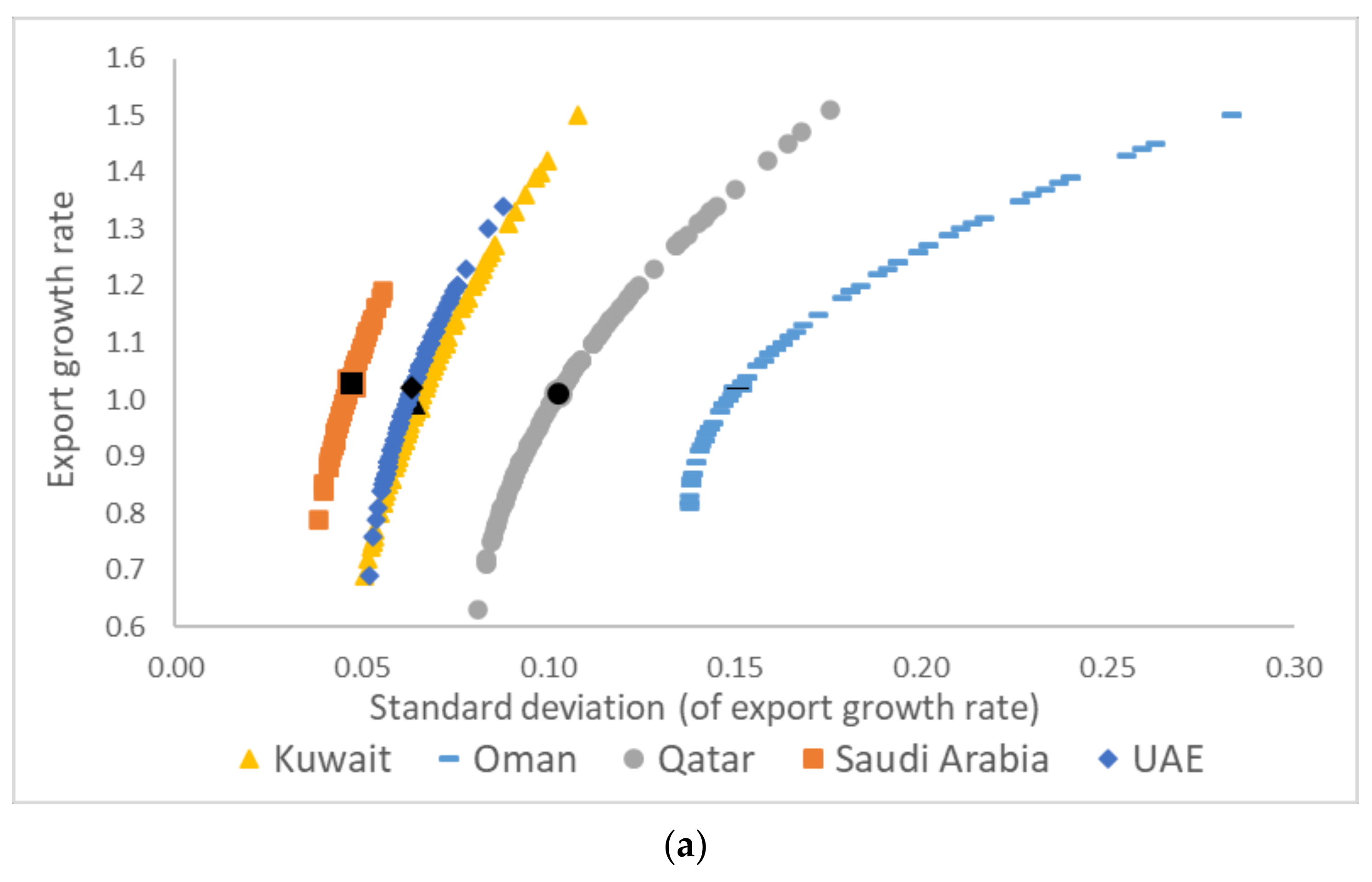

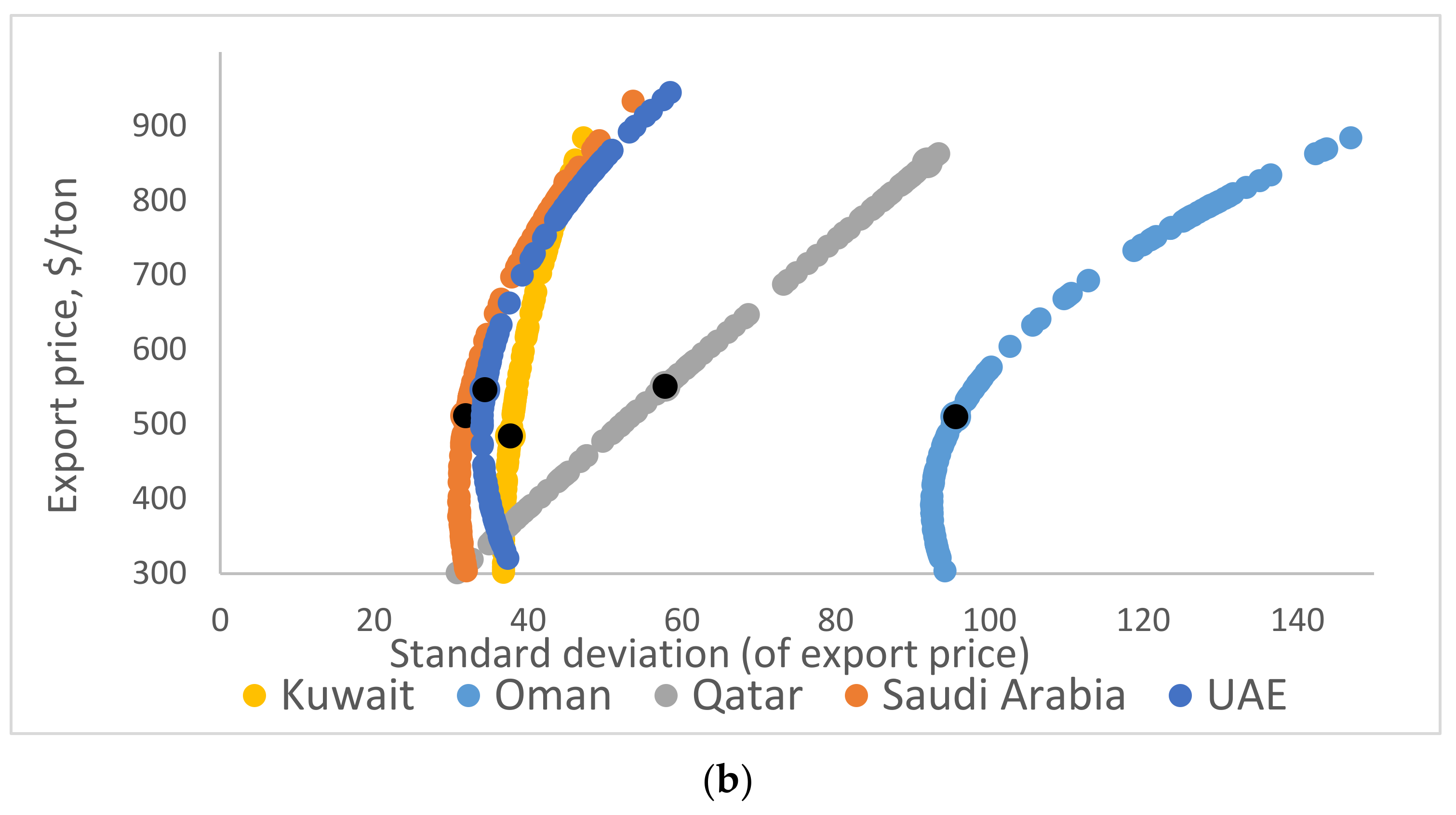

4.1. Efficient Frontiers of Oil Exports

4.2. Scenario Analysis

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Willrich, M. International energy issues and options. Annu. Rev. Energy 1976, 1, 743–772. [Google Scholar] [CrossRef]

- Deese, D.A. Energy: Economics, politics, and security. Int. Secur. 1979, 4, 140–153. [Google Scholar] [CrossRef]

- Yergin, D. Energy security in the 1990s. Foreign Aff. 1988, 67, 110–132. [Google Scholar] [CrossRef]

- Sohn, I. US energy security: Problems and prospects. Energy Policy 1990, 18, 149–161. [Google Scholar] [CrossRef]

- Toman, M.A. The Economics of energy security: Theory, evidence, policy. Handb. Nat. Resour. Energy Econ. 1993, 3, 1167–1218. [Google Scholar] [CrossRef]

- Scheepers, M.; Seebregts, A.; De Jong, J.; Maters, H. EU Standards for Energy Security of Supply; Energy Research Centre of The Netherlands: Petten, The Netherlands, 2007; Available online: http://www.biee.org/wpcms/wpcontent/uploads/EU_standards_for_energy_security_of_supply_2006_pres.pdf (accessed on 7 May 2020).

- Greenleaf, J.; Harmsen, R.; Angelini, T.; Green, D.; Williams, A.; Rix, O.; Lefevre, N.; Blyth, W. Analysis of Impacts of Climate Change Policies on Energy Security. ECOFYS. 2009. Available online: http://ec.europa.eu/environment/integration/energy/pdf/cces.pdf (accessed on 7 May 2020).

- Kemmler, A.; Spreng, D. Energy indicators for tracking sustainability in developing countries. Energy Policy 2007, 35, 2466–2480. [Google Scholar] [CrossRef]

- Hughes, L. The Four ‘R’s of Energy Security; Dalhousie University: Halifax, NS, Canada, 2009; Available online: http://lh.ece.dal.ca/enen/2009/ERG200902.pdf (accessed on 7 May 2020).

- Yergin, D. Ensuring Energy Security. Foreign Affairs 2006. Available online: https://www.foreignaffairs.com/articles/2006-03-01/ensuring-energy-security (accessed on 7 May 2020). [CrossRef]

- Bigerna, S.; Bollino, C.A.; Galkin, P. Balancing Energy Security Priorities: Portfolio Optimization Approach to Oil Imports. Appl. Econ. 2020, 53, 555–574. [Google Scholar] [CrossRef]

- Mohammed, M. Five Decades of Modeling Oil Price Shocks: A Critical Review. Int. Rev. Environ. Resour. Econ. 2020, 14, 241–297. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). Energy Security. 2018. Available online: https://www.iea.org/topics/energysecurity/ (accessed on 20 May 2020).

- United Nations Development Programme (UNDP). World Energy Assessment: Energy and the Challenge of Sustainability. 2000. Available online: http://www.undp.org/content/dam/aplaws/publication/en/publications/environment-energy/wwwee-library/sustainable-energy/world-energy-assessmentenergy-and-the-challenge-of-sustainability/World%20Energy%20Assessment-2000.pdf (accessed on 20 May 2020).

- European Commission. Towards a European Strategy for the Security of Energy Supply. Available online: https://iet.jrc.ec.europa.eu/remea/sites/remea/files/green_paper_energy_supply_en.pdf (accessed on 20 May 2020).

- Ministry of Commerce of the People’s Republic of China (MOFCOM). 13th Five-Year Plan for the Development of Foreign Trade. 2017. Available online: http://english.mofcom.gov.cn/article/newsrelease/significantnews/201701/20170102500999.shtml (accessed on 20 May 2020).

- Ministry of Trade, Industry and Energy, Republic of Korea (MOTIE). Korea Energy Master Plan: Outlook and Policies to 2035. 2014. Available online: http://www.motie.go.kr/common/download.do?fid=bbs&bbs_cd_n=72&bbs_seq_n=209286&file_seq_n=2 (accessed on 25 May 2020).

- Sovacool, B.K. Evaluating energy security in the Asia Pacific: Towards a more comprehensive approach. Energy Policy 2011, 39, 7472–7479. [Google Scholar] [CrossRef]

- Global Energy Institute. Index of U.S. Energy Security Risk. 2017. Available online: https://www.globalenergyinstitute.org/sites/default/files/USIndexFinal2PDF.pdf (accessed on 25 May 2020).

- Zhang, X.N.; Zhong, Q.-Y.; Qu, Y.; Li, H.-L. Liquefied natural gas importing security strategy considering multi-factor: A multi-objective programming approach. Expert Syst. Appl. 2017, 87, 56–69. [Google Scholar] [CrossRef]

- Rioux, B.; Galkin, P.; Wu, K. An Economic Analysis of China’s Domestic Crude Oil Supply Policies. Chin. J. Popul. Resour. Environ. 2019, 17, 217–228. [Google Scholar] [CrossRef] [Green Version]

- Garrison, J.A.; Redd, S.B.; Carter, R.G. Energy security under conditions of uncertainty: Simulating a comparative bureaucratic politics approach. J. Political Sci. Educ. 2010, 6, 19–48. [Google Scholar] [CrossRef]

- Hughes, L.; Phillip, Y.L. The politics of energy. Annu. Rev. Political Sci. 2013, 16, 449–469. [Google Scholar] [CrossRef] [Green Version]

- Organization of the Petroleum Exporting Countries (OPEC) 2012. OPEC Statute. Available online: https://www.opec.org/opec_web/static_files_project/media/downloads/publications/OPEC_Statute.pdf (accessed on 20 May 2020).

- Organization of the Petroleum Exporting Countries (OPEC). Energy Security and Supply. 4 February 2008. Available online: https://www.opec.org/opec_web/en/press_room/862.html (accessed on 20 May 2020).

- Organization of the Petroleum Exporting Countries (OPEC). Energy Security: A Global Perspective. 27 July 2006. Available online: https://www.opec.org/opec_web/en/press_room/996.html (accessed on 20 May 2020).

- Organization of the Petroleum Exporting Countries (OPEC). Security Breeds Security. In OPEC Bulletin Commentary, January–February 2006; Ueberreuter Print and Digimedia: Vienna, Austria, 2006; Available online: https://www.opec.org/opec_web/en/press_room/853.html (accessed on 20 May 2020).

- Gas Exporting Countries Forum (GECF). Gas Exporting Countries Forum Long-term Strategy. 2017. Available online: https://www.gecf.org/_resources/files/events/the-gas-exporting-countries-forum-long-term-strategy/gecf_lts_document_14122017.pdf (accessed on 21 May 2020).

- Gas Exporting Countries Forum (GECF). Global Gas Outlook. 2018. Available online: https://www.enerjiportali.com/wp-content/uploads/2018/12/2018-Global-Gas-Outlook.pdf (accessed on 21 May 2020).

- Peña-Ramos, J.A.; Bagus, P.; Amirov-Belova, D. The North Caucasus Region as a Blind Spot in the “European Green Deal”: Energy Supply Security and Energy Superpower Russia. Energies 2021, 14, 17. [Google Scholar] [CrossRef]

- Minenergo. The Ministry of Energy of the Russian Federation, Mиниcтepcтвo Энepгeтики Poccийcкoй Φeдepaции (Mинэнepгo). Дoктpинa энepгeтичecкoй бeзoпacнocти Poccийcкoй Φeдepaции [The Doctrine of Energy Security of the Russian Federation]. 2019. Available online: https://minenergo.gov.ru/node/14766 (accessed on 25 May 2020).

- Aminzadeh, E.; Khodaparast, N. Legal Approach to Energy Security of Iran: With Special References to Crude Oil and Gas. J. East Asia Int. Law 2019, 12, 71–90. [Google Scholar] [CrossRef] [Green Version]

- Department of Resources, Energy and Tourism of the Government of Australia. National Energy Security Assessment. 2011. Available online: https://www.energy.gov.au/sites/default/files/national-energy-security-assessment-2011_0.pdf (accessed on 21 May 2020).

- Ministry of Natural Resources of Canada. The Energy Safety and Security Act. 2016. Available online: https://laws-lois.justice.gc.ca/PDF/2015_4.pdf (accessed on 21 May 2020).

- Energy Commission of Nigeria. National Energy Policy. 2018. Available online: http://www.energy.gov.ng/Energy_Policies_Plan/National%20Energy%20Policy.pdf (accessed on 25 May 2020).

- Energy Commission of Nigeria. National Energy Masterplan. 2014. Available online: http://www.energy.gov.ng/Energy_Policies_Plan/Draft%20 (accessed on 25 May 2020).

- Kruyt, B.; van Vuuren, D.; de Vries, H.; Groenenberg, H. Indicators for energy security. Energy Policy 2009, 37, 2166–2181. [Google Scholar] [CrossRef]

- Kanchana, K.; Unesaki, H. ASEAN energy security: An indicator-based assessment. Energy Procedia 2014, 56, 163–171. [Google Scholar] [CrossRef] [Green Version]

- Ang, B.; Choong, W.; Ng, A. Energy security: Definitions, dimensions and indexes. Renew. Sustain. Energy Rev. 2015, 42, 1077–1093. [Google Scholar] [CrossRef]

- Spero, J.E. Energy self-sufficiency and national security. Proc. Acad. Political Sci. 1973, 31, 123–136. [Google Scholar] [CrossRef]

- Dike, J.C. Measuring the Security of Energy Exports Demand in OPEC Economies. Energy Policy 2013, 60, 594–600. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). IEA Atlas of Energy. 2019. Available online: http://energyatlas.iea.org (accessed on 23 December 2019).

- World Bank. World Integrated Trade Solution. 2019. Available online: https://wits.worldbank.org (accessed on 19 December 2019).

- International Trade Centre (ITC). Trade Map. 2019. Available online: https://www.trademap.org/ (accessed on 19 December 2019).

- CEIC. Global Database. 2019. Available online: https://insights.ceicdata.com (accessed on 19 December 2019).

- Pregger, T.; Lavagno, E.; Labriet, M.; Seljom, P.; Biberacher, M.; Blesl, M.; Trieb, F.; O’Sullivan, M.; Gerboni, R.; Schranz, L.; et al. Resources, capacities and corridors for energy imports to Europe. Int. J. Energy Sect. Manag. 2011, 5, 125–156. [Google Scholar] [CrossRef]

- Zhang, L.; Bai, W. Risk assessment of China’s natural gas Importation: A supply chain perspective. SAGE Open 2020, 10. [Google Scholar] [CrossRef]

- Bakdolotov, A.; De Miglio, R.; Akhmetbekov, Y.; Baigarin, K. Techno-economic modelling to strategize energy exports in the Central Asian Caspian region. Heliyon 2017, 3, e00283. [Google Scholar] [CrossRef]

- Geng, Z. Russian energy strategies in the natural gas market for energy security. Int. J. Energy Econ. Policy 2020, 11, 62–66. [Google Scholar] [CrossRef]

- United States Department of Justice. Herfindahl–Hirschman Index. 2018. Available online: https://www.justice.gov/atr/herfindahl-hirschman-index (accessed on 27 November 2019).

- Kalt, J.P.; Robert, S.S. The role of governmental incentives in energy production: A historical overview. Ann. Rev. Energy 1980, 5, 1–32. [Google Scholar] [CrossRef]

- Cone, B.W. A historical perspective of federal incentives to stimulate energy production. Energy 1982, 7, 51–60. [Google Scholar] [CrossRef]

- Marks, R.E. Australian energy policy and conservation. In IFAC Proceedings Volumes; Elsevier: Amsterdam, The Netherlands, 1989; Volume 22, pp. 409–415. [Google Scholar] [CrossRef]

- Khatib, H.; Energy security. World Energy Assessment: Energy and the Challenge. UNDP, 2015. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&cad=rja&uact=8&ved=2ahUKEwjut6uF3OLxAhWvw4sKHcplAIcQFnoECAQQAA&url=https%3A%2F%2Fwww.undp.org%2Fcontent%2Fdam%2Fundp%2Flibrary%2FEnvironment%2520and%2520Energy%2FSustainable%2520Energy%2Fwea%25202000%2Fchapter4.pdf&usg=AOvVaw2j8VwuUmNJFtFO1n69u2u4 (accessed on 13 June 2021).

- National Energy Board of Canada. Canada’s Energy Future. Infrastructure Changes and Challenges to 2020; 2009. Available online: https://www.cer-rec.gc.ca/en/data-analysis/canada-energy-future/archive/2009/2009-infrastructure-changes-challenges/2009nfrstrctrchngchllng-eng.pdf (accessed on 13 April 2020).

- Balza, L.; Espinasa, R. Oil Sector Performance and Institutions: The Case of Latin America. Inter-American Development Bank, 2014. Available online: https://publications.iadb.org/publications/english/document/Oil-Sector-Performance-and-Institutions-The-Case-of-Latin-America.pdf (accessed on 13 April 2020).

- Oxford Business Group. Investments in Spare Energy Capacity Aim to Protect Saudi Arabia from Future oil and Gas Crises. 2018. Available online: https://oxfordbusinessgroup.com/analysis/building-cushion-investments-spare-capacity-aim-protect-saudi-arabia-future-oil-and-gas-crises (accessed on 10 May 2020).

- Erickson, E.W.; Millsaps, S.W.; Spann, R.M. Oil supply and tax incentives. Brook. Pap. Econ. Act. 1974, 2, 449–493. [Google Scholar] [CrossRef]

- Deloitte. Tax Credits and Incentives for Oil & Gas Producers in a Low-Price Environment. 2017. Available online: https://www2.deloitte.com/content/dam/Deloitte/us/Documents/Tax/us-tax-credits-and-incentives-for-oil-and-gas-producers.pdf (accessed on 23 December 2019).

- International Monetary Fund (IMF). Issues in Domestic Petroleum Pricing in Oil Producing Countries. IMF Working Paper. 2002. Available online: https://www.imf.org/external/pubs/ft/wp/2002/wp02140.pdf (accessed on 15 April 2020).

- Kpodar, K.K.; Fabrizio, S.; Eklou, K.M. Export Competitiveness—Fuel Price Nexus in Developing Countries: Real or False Concern? 2019. Available online: https://www.imf.org/en/Publications/WP/Issues/2019/02/04/Export-Competitiveness-Fuel-Price-Nexus-in-Developing-Countries-Real-or-False-Concern-46424 (accessed on 15 April 2020).

- Vivoda, V. LNG import diversification and energy security in Asia. Energy Policy 2019, 129, 967–974. [Google Scholar] [CrossRef]

- Karatayev, M.; Hall, S. Establishing and comparing energy security trends in resource-rich exporting nations (Russia and the Caspian Sea region). Resour. Policy 2020, 68, 101746. [Google Scholar] [CrossRef]

- Daniel, J. Hedging Government Oil Price Risk. IMF eLibrary. 2001. Available online: https://www.elibrary.imf.org/view/IMF001/03085-9781451859416/03085-9781451859416/03085-9781451859416_A001.xml?language=en&redirect=true (accessed on 9 May 2020).

- Bacon, R.; Masami, K. Coping with Oil Price Volatility. Energy Sector Management Assistance Program. 2008. Available online: https://www.esmap.org/sites/default/files/esmap-files/8142008101202_coping_oil_price.pdf (accessed on 9 May 2020).

- Moneef, M. Vertical integration strategies of the national oil companies. Dev. Econ. 2007, 36, 203–222. [Google Scholar] [CrossRef]

- Mitrova, T. Energy security and evolution of gas markets. Energy Environ. 2008, 19, 1123–1130. [Google Scholar] [CrossRef]

- Markowitz, H. Portfolio Selection. J. Financ. 1952, 7, 77–91. [Google Scholar]

- Bar-Lev, D.; Katz, S. A portfolio approach to fossil fuel procurement in the electric utility industry. J. Financ. 1976, 31, 933–947. [Google Scholar] [CrossRef]

- Humphreys, B.H.; Katherine, T.M. Reducing the impacts of energy price volatility through dynamic portfolio selection. The Energy J. 1998, 19, 107–131. [Google Scholar] [CrossRef]

- Awerbuch, S.; Berger, M. Applying Portfolio Theory to EU Electricity Planning and Policy-Making. IEA/EET Working Paper. 2003. Available online: https://awerbuch.com/shimonpages/shimondocs/iea-portfolio.pdf (accessed on 21 June 2021).

- Gunther, W.; Madlener, R. The benefit of regional diversification of cogeneration investments in Europe: A mean-variance portfolio analysis. Energy Policy 2010, 38, 7911–7920. [Google Scholar] [CrossRef]

- Medimorec, D.; Tomsic, Z. Portfolio theory application in wind potential assessment. Renew. Energy 2015, 76, 494–502. [Google Scholar] [CrossRef]

- Canelas, E.; Pinto-Varela, T.; Sawik, B. Electricity Portfolio Optimization for Large Consumers: Iberian Electricity Market Case Study. Energies 2020, 13, 2249. [Google Scholar] [CrossRef]

- Sun, X.; Hao, J.; Li, J. Multi-objective optimization of crude oil-supply portfolio based on interval prediction data. Ann. Oper. Res. 2020, 1–29. [Google Scholar] [CrossRef]

- Sawik, B. Downside Risk Approach for Multi-Objective Portfolio Optimization. In Operations Research Proceedings 2011; Klatte, D., Lüthi, H.J., Schmedders, K., Eds.; Springer: Berlin/Heidelberg, Germany, 2012. [Google Scholar] [CrossRef]

- Faia, R.; Pinto, T.; Vale, Z.; Corchado, J.M. Portfolio optimization of electricity markets participation using forecasting error in risk formulation. Int. J. Electr. Power Energy Syst. 2021, 129, 106739. [Google Scholar] [CrossRef]

- Bigerna, S.; Bollino, C.A.; Polinori, P. Oil import portfolio risk and spillover volatility. Resour. Policy 2021, 70, 101976. [Google Scholar] [CrossRef]

- Wu, G.; Wei, Y.-M.; Fan, Y.; Liu, L.-C. An empirical analysis of the risk of crude oil imports in China using improved portfolio approach. Energy Policy 2007, 35, 4190–4199. [Google Scholar] [CrossRef]

- Wang, J.; Sun, X.; Li, J.; Chen, J.; Liu, C. Has China’s oil-import portfolio been optimized from 2005 to 2014? A perspective of cost-risk tradeoff. Comput. Ind. Eng. 2018, 126, 451–464. [Google Scholar] [CrossRef]

- Ge, F.; Fan, Y. Quantifying the risk to crude oil imports in China: An improved portfolio approach. Energy Econ. 2013, 40, 72–80. [Google Scholar] [CrossRef]

- Wabiri, N.; Amusa, H. Quantifying South Africa’s crude oil import risk: A multi-criteria portfolio model. Econ. Modeling 2010, 27, 445–453. [Google Scholar] [CrossRef]

- Nowrouzi, A.; Panahi, M.; Ghaffarzadeh, H.; Ataei, A. Optimizing Iran’s natural gas export portfolio by presenting a conceptual framework for non-systematic risk based on portfolio theory. Energy Strategy Rev. 2019, 26, 100403. [Google Scholar] [CrossRef]

- Moreno, M.; Novales, A.; Platania, F. Long-term Swings and Seasonality in Energy Markets. Eur. J. Oper. Res. 2019, 279, 1011–1023. [Google Scholar] [CrossRef] [Green Version]

- Inchauspe, J.; Li, J.; Park, J. Seasonal Patterns of Global Oil Consumption: Implications for Long Term Energy Policy. J. Policy Modeling 2020, 42, 536–556. [Google Scholar] [CrossRef]

- U.S. Energy Information Administration (EIA). NEMS Overview and Brief Description of Cases. 2019. Available online: https://www.eia.gov/outlooks/archive/aeo16/appendixe.php (accessed on 13 June 2021).

- International Trade Centre (ITC). Trade Map. 2020. Available online: https://www.trademap.org/ (accessed on 3 December 2020).

| Country | Exports of Mineral Fuels, $ Million | Total Exports, $ Million | GDP, $ Million | Exports of Mineral Fuels/Total Exports, % | Exports of Mineral Fuels/GDP, % | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | |

| Bahrain | 5564 | 6921 | 11,088 | 12,979 | 35,305 | 37,740 | 50% | 53% | 16% | 18% |

| Kuwait | 49,573 | 65,391 | 52,977 | 71,941 | 120,449 | 139,742 | 94% | 91% | 41% | 47% |

| Oman | 18,655 | 27,323 | 32,404 | 43,281 | 70,577 | 79,253 | 58% | 63% | 26% | 34% |

| Qatar | 54,351 | 72,509 | 63,968 | 81,571 | 166,929 | 192,009 | 85% | 89% | 33% | 38% |

| Saudi Arabia | 170,245 | 231,587 | 213,210 | 285,847 | 686,549 | 779,167 | 80% | 81% | 25% | 30% |

| UAE | 69,182 | 92,538 | 313,510 | 316,860 | 377,701 | 414,179 | 22% | 29% | 18% | 22% |

| Kuwait | |||||

| Oil export growth rate | Oil export price | ||||

| Engle-Granger test | Engle-Granger test | ||||

| TestStat | p-value | Number of lags | TestStat | p-value | Number of lags |

| −4.08 | 0.05 | 3 | −3.94 | 0.076 | 2 |

| Oman | |||||

| Oil export growth rate | Oil export price | ||||

| Engle-Granger test | Engle-Granger test | ||||

| TestStat | p-value | Number of lags | TestStat | p-value | Number of lags |

| −7.26 | 0.0000 | 2 | −5.24 | 0.005 | 2 |

| Qatar | |||||

| Oil export growth rate | Oil export price | ||||

| Engle-Granger test | Engle-Granger test | ||||

| TestStat | p-value | Number of lags | TestStat | p-value | Number of lags |

| −4.04 | 0.06 | 5 | −6.24 | 0.000021 | 2 |

| Saudi Arabia | |||||

| Oil export growth rate | Oil export price | ||||

| Engle-Granger test | Engle-Granger test | ||||

| TestStat | p-value | Number of lags | TestStat | p-value | Number of lags |

| −5.42863 | 0.0005 | 7 | −5.14 | 0.0017 | 10 |

| UAE | |||||

| Oil export growth rate | Oil export price | ||||

| Engle-Granger test | Engle-Granger test | ||||

| TestStat | p-value | Number of lags | TestStat | p-value | Number of lags |

| −3.53 | 0.18 | 5 | −6.24 | 0.00012 | 2 |

| Oil Export Growth Rate | |||||

| Coeff | Saudi A. | Kuwait | UAE | Oman | Qatar |

| Const | 0 | 0.02 ** | 0 | −0.6 ** | 0 |

| B1 | −0.046 ** | −0.027 ** | −0.07 ** | −0.51 ** | −0.11 ** |

| B2 | 0.045 ** | 0.045 ** | 0.062 ** | 0.31 ** | 0.10 ** |

| N. obs | 132 | 132 | 132 | 132 | 132 |

| R-squared | 0.74 | 0.92 | 0.58 | 0.33 | 0.76 |

| Schwarz B.I.C. | −623.2 | −501.4 | −499 | −144.7 | −413.7 |

| Log likelihood | 628.2 | 508.8 | 503.9 | 152 | 418 |

| Oil Price Benefit | |||||

| Coeff | Saudi A. | Kuwait | UAE | Oman | Qatar |

| Const | 50.7 ** | 3.1 | 62.2 ** | 126.9 ** | 0 |

| B1 | −0.08 ** | −1.5 | −0.115 | −0.176 | −0.09 ** |

| B2 | 0.044 * | 1.8 | 0.001 ** | 0.0002 * | 0.0001 * |

| N obs | 121 | 125 | 124 | 113 | 119 |

| R-squared | 0.27 | 0.02 | 0.08 | 0.21 | 0.93 |

| Schwarz B.I.C. | 490.2 | 545 | 563.6 | 557.2 | 383.9 |

| Log likelihood | −478.2 | −537.8 | −556.4 | −550.1 | −379.1 |

| Scenario | Description |

|---|---|

| Baseline 2018 | For the five oil exporters—Kuwait, Oman, Qatar, Saudi Arabia, and the UAE—we estimate the optimal points on their efficient frontier curves, corresponding to the 2018 observed average monthly growth rates of oil export volumes and export prices. |

| Increased Chinese demand | We increase the oil export volumes to China by 20% compared to Baseline 2018 for each exporter. The exports to other markets remain unaffected. |

| Exports redistribution | We reduce the share of the US imports by 20% compared to Baseline 2018 for each exporter. Then, the reduced volumes are redistributed among the other buyers in proportion to their shares observed under the Baseline 2018 scenario. |

| Malacca Strait blockade | We assume that the Malacca Strait is blocked, and it takes oil cargoes an additional 3.5 days to reach the East Asian markets. This leads to a 20% reduction in exports volumes to the region. The other markets remain unaffected. |

| Exporter | Changes Compared to Baseline 2018 | |

|---|---|---|

| Export Volumes | Standard Deviation | |

| Kuwait | 4.7% | 2.2% |

| Oman | 15.3% | 11.7% |

| Qatar | 0.7% | 0% |

| Saudi Arabia | 3.3% | −8.8% |

| UAE | 2.0% | −1.0% |

| Exporter | Changes Compared to Baseline 2018, % | ||

|---|---|---|---|

| Standard Deviation (of Export Growth) | Weighted Average Price | Standard Deviation (of Export Price) | |

| Kuwait | 1.0% | 0.04% | −12.1% |

| Oman | .. | .. | .. |

| Qatar | .. | .. | .. |

| Saudi Arabia | −13.0% | 0.05% | 0% |

| UAE | .. | .. | .. |

| Exporter | Changes Compared to Baseline 2018, % | |

|---|---|---|

| Export Volumes | Standard Deviation | |

| Kuwait | −13.6% | 2.7% |

| Oman | −16.6% | −1.4% |

| Qatar | −10.0% | −2.8% |

| Saudi Arabia | −9.8% | −16.1% |

| UAE | −10.0% | −8.2% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bollino, C.A.; Galkin, P. Energy Security and Portfolio Diversification: Conventional and Novel Perspectives. Energies 2021, 14, 4257. https://doi.org/10.3390/en14144257

Bollino CA, Galkin P. Energy Security and Portfolio Diversification: Conventional and Novel Perspectives. Energies. 2021; 14(14):4257. https://doi.org/10.3390/en14144257

Chicago/Turabian StyleBollino, Carlo Andrea, and Philipp Galkin. 2021. "Energy Security and Portfolio Diversification: Conventional and Novel Perspectives" Energies 14, no. 14: 4257. https://doi.org/10.3390/en14144257

APA StyleBollino, C. A., & Galkin, P. (2021). Energy Security and Portfolio Diversification: Conventional and Novel Perspectives. Energies, 14(14), 4257. https://doi.org/10.3390/en14144257