Linkages between Energy Delivery and Economic Growth from the Point of View of Sustainable Development and Seaports

Abstract

:1. Introduction

1.1. Presentation of Research Problems

1.2. Organisation of the Paper

2. Literature Review

2.1. The Concept of Sustainable Development and Decoupling

2.2. Seaports as a Major Element of Integration in Global Economic System

2.3. A ‘Smart Port’ Concept

2.4. Economic Cycles and Their Synchronisation for Economic Management

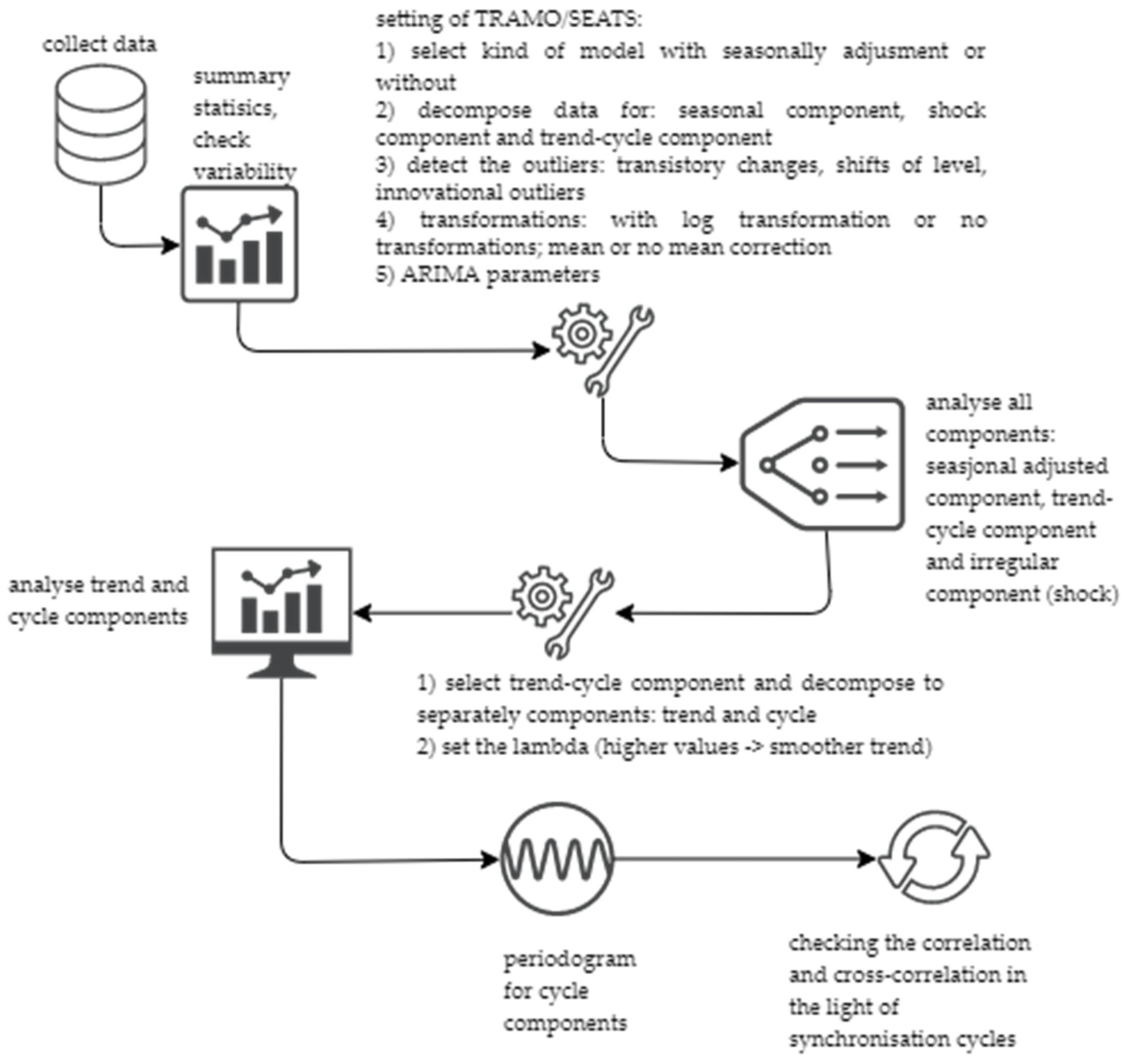

3. Data and Methods

- T is the number of observations;

- t is the index of time, t = 1, 2, …, T;

- λ is the smoothing parameter;

- is the smoothed series, trend;

- is the input series: decompose into trend, cycle and shock;

- is the cycle, cyclical component;

- is the shock, irregular component.

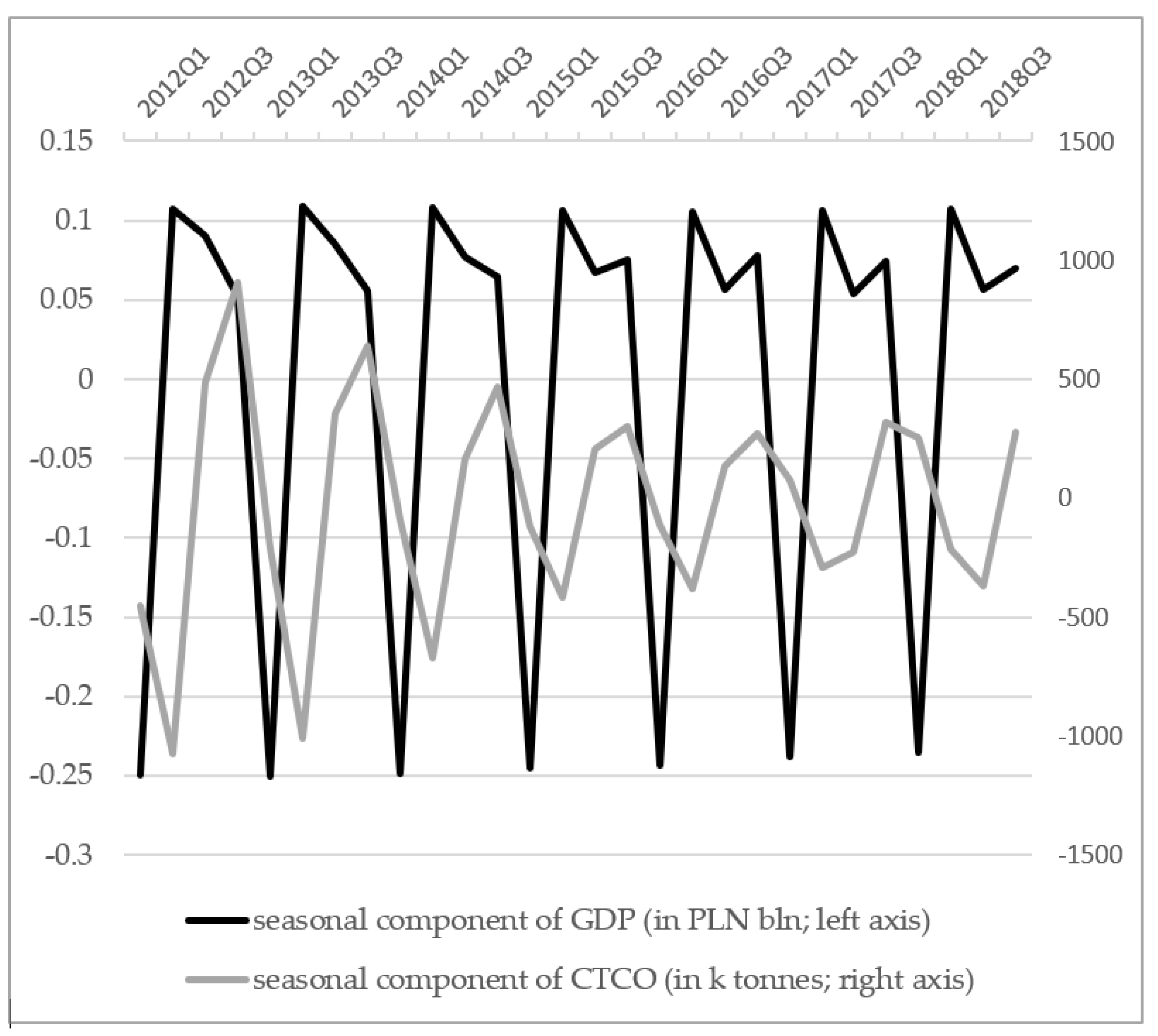

- GDP—Gross Domestic Product (raw data in bln PLN, at constant prices)

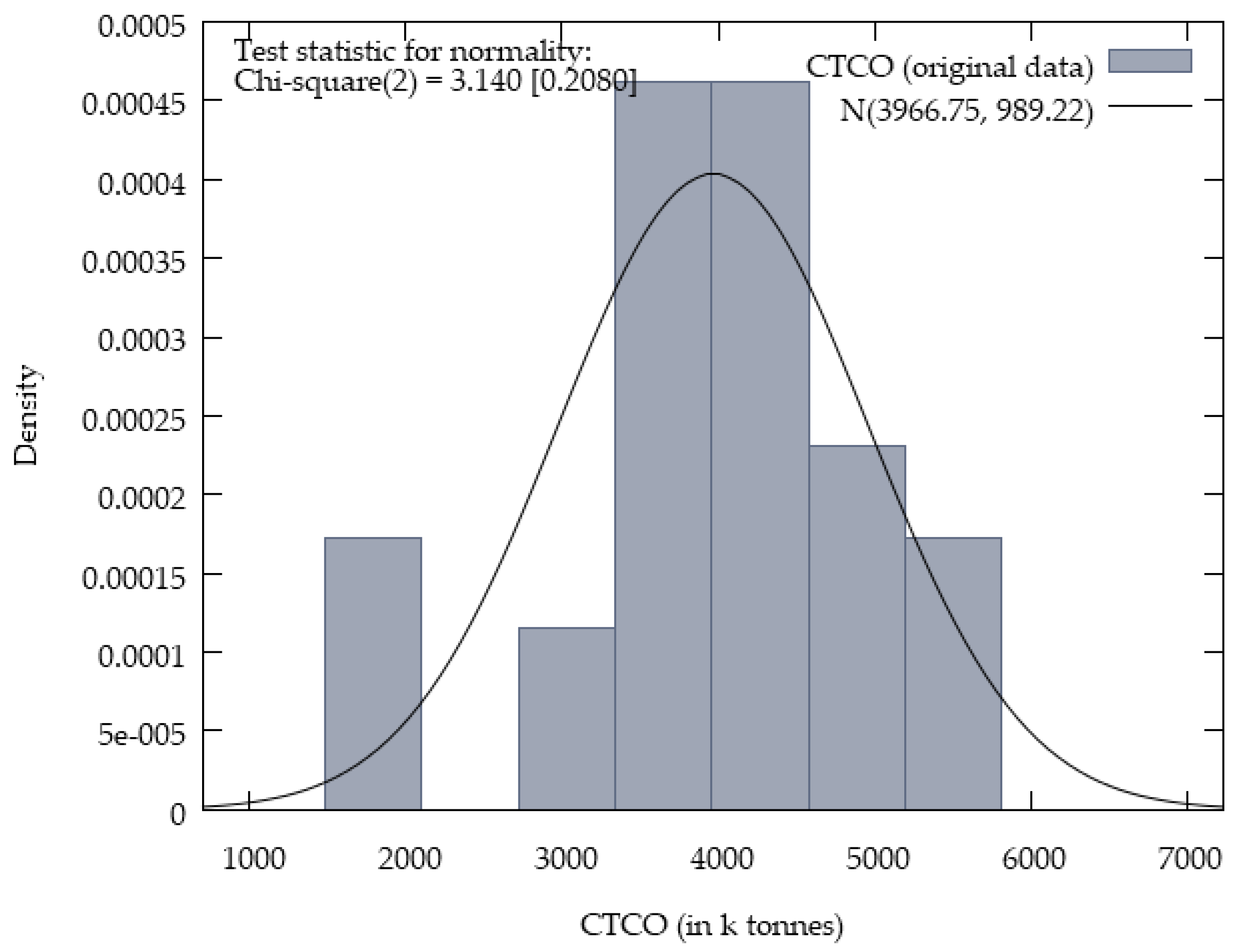

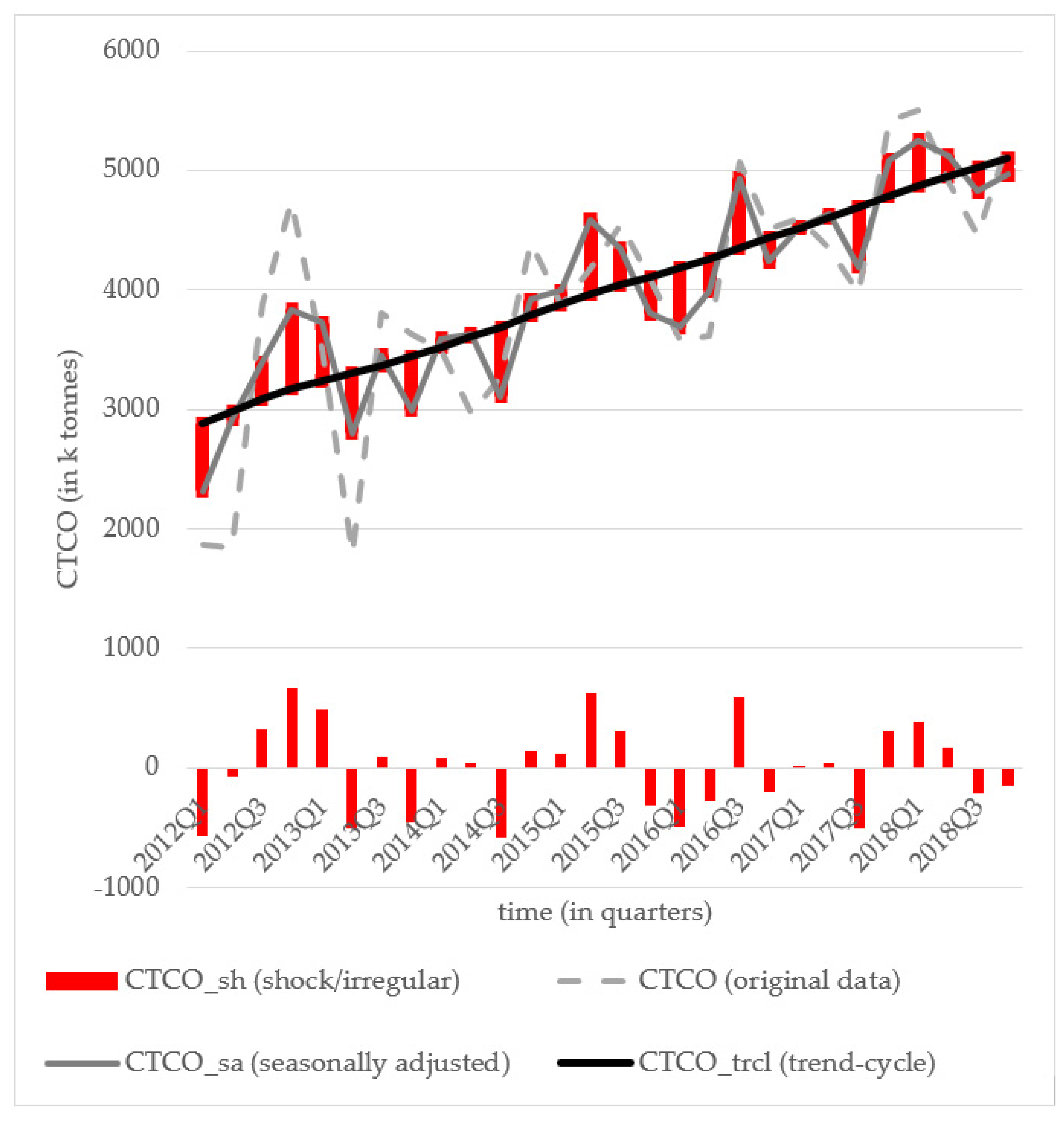

- CTCO—cargo traffic of crude oil and oil products (k tonnes)

- GDP_sa—seasonally adjusted GDP (estimated using TRAMO/SEATS)

- GDP_trcl—trend/cycle for GDP (estimated using TRAMO/SEATS)

- GDP_sh—irregular/shock component for GDP (estimated using TRAMO/SEATS)

- GDP_tr—trend for GDP (filtered using the Hodrick–Prescott filter)

- GDP_cl—cycle for GDP (filtered using the Hodrick–Prescott filter)

- CTCO_sa—seasonally adjusted CTCO (estimated using the TRAMO/SEATS)

- CTCO_trcl—trend/cycle for CTCO (estimated using the TRAMO/SEATS)

- CTCO_sh—irregular/shock component for CTCO (estimated using the TRAMO/SEATS)

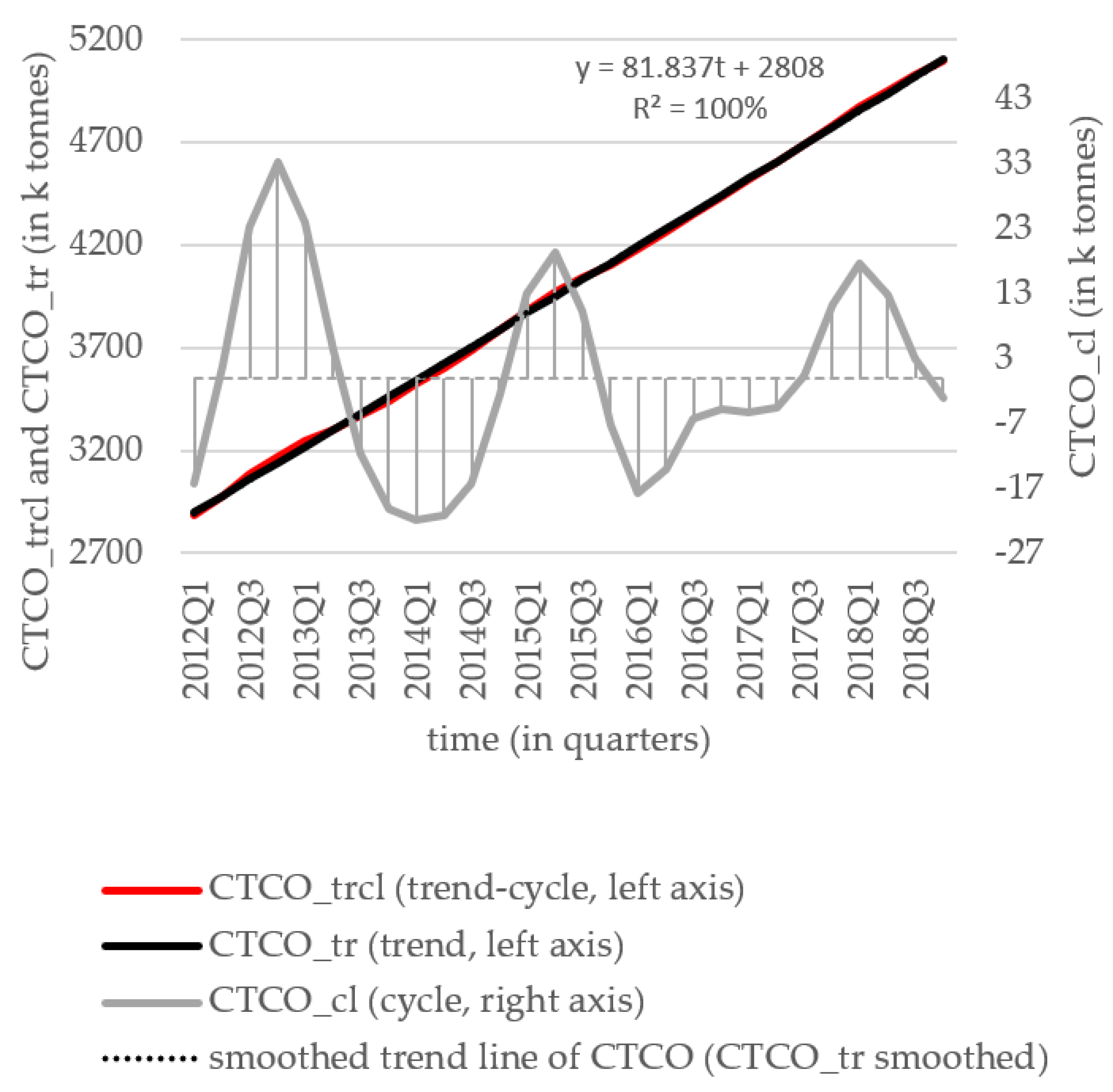

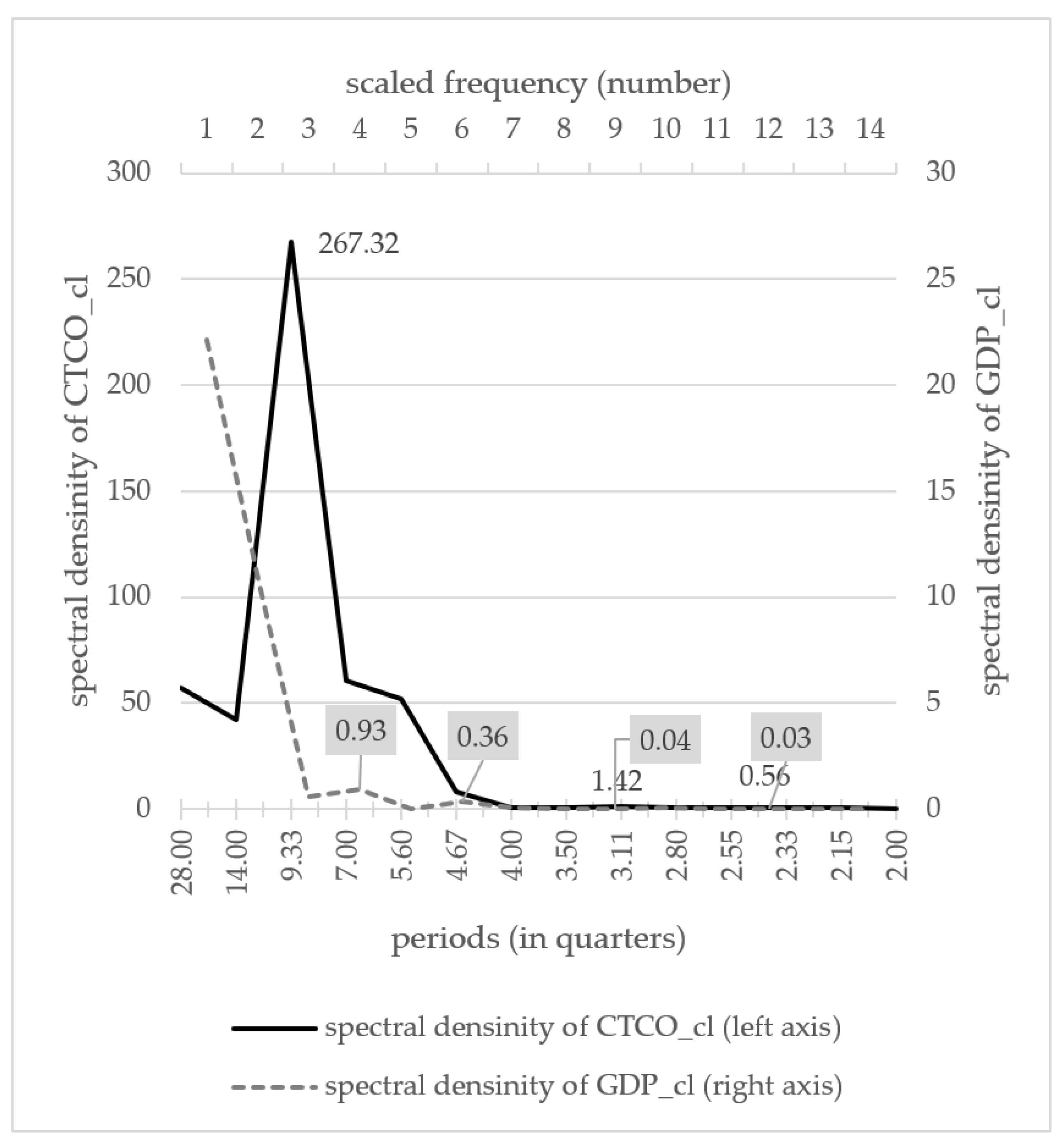

- CTCO_tr—trend for CTCO (filtered using the Hodrick–Prescott filter)

- CTCO_cl—cycle for CTCO (filtered using the Hodrick–Prescott filter)

4. Empirical Results

5. Discussion and Conclusions

- Firstly, the obtained warning information may be used for development programming or planning via a shock analysis and analysing when they occur and phase out.

- Secondly, they are significant from the point of view of trends and development rate evaluation.

- Thirdly, they are valuable for the forecasting of development, as they take into account the cycle spans, multiplexity and complexity of various cycle occurrences (their leakage) and time lags (via specifying their lengths) as well as the depth of their occurrence. Thanks to the obtained results, it is known for how long the cycle phases may be extended.

- Fourthly, the possibility to forecast the cycles and development gives the chance to effectively distribute and manage goods that stand in line with sustainable development and a fair system of global economy. It also leads to necessary changes in the business sector, which needs to improve sustainability conditions. As Vuong [96] stated, there is a need to move away from the downward spiral of eco-deficits to a new eco-surplus culture and that value created for the environment should be rewarded with money.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| AI | artificial intelligence |

| bln | billion |

| cycle, cyclical component in Hodrick–Prescott filter formula | |

| CO2 | carbon dioxide |

| CTCO | cargo traffic of crude oil and oil products (k tonnes) |

| CTCO_cl | cycle for CTCO (filtered using the Hodrick–Prescott filter) |

| CTCO_sa | seasonally adjusted CTCO (estimated using TRAMO/SEATS) |

| CTCO_sh | irregular/shock component for CTCO (estimated using TRAMO/SEATS) |

| CTCO_tr | trend for CTCO (filtered using the Hodrick–Prescott filter) |

| CTCO_trcl | trend/cycle for CTCO (estimated using TRAMO/SEATS) |

| EU | European Union |

| EUR | euro currency |

| GDP | Gross Domestic Product (raw data in bln PLN, at constant prices) |

| GDP_cl | cycle for GDP (filtered using the Hodrick–Prescott filter) |

| GDP_sa | seasonally adjusted GDP (estimated using TRAMO/SEATS) |

| GDP_sh | irregular/shock component for GDP (estimated using TRAMO/SEATS) |

| GDP_tr | trend for GDP (filtered using the Hodrick–Prescott filter) |

| GDP_trcl | trend/cycle for GDP (estimated using TRAMO/SEATS) |

| IMO | International Maritime Organisation |

| IoT | Internet of Things |

| k | thousand |

| n | number of observations for correlation coefficients |

| OECD | Organisation for Economic Co-operation and Development |

| p-value | probability value, asymptotic significance |

| PLN | Polish currency, Polish zloty |

| R&D | Research and Development |

| SDG | Sustainable Development Goals |

| SEATS | Signal Extraction in ARIMA Time Series |

| SPI | Smart Port Index |

| T | number of observations in the formula of the Hodrick–Prescott filter |

| t | index of time, t = 1, 2, …, T |

| TRAMO | Time series Regression with ARIMA noise, Missing observations, and Outliers |

| UN | United Nations |

| UNCTAD | United Nations Conference on Trade and Development |

| USD | currency of the USA, American dollar |

| WCED | United Nation’s World Commission on Environment and Development |

| XCF | cross-correlation function |

| shock, irregular component | |

| λ | smoothing parameter in the formula of the Hodrick–Prescott filter |

| τt | smoothed series in the formula of the Hodrick–Prescott filter, trend |

| yt | input series in formula of the Hodrick–Prescott filter: decompose into trend, cycle and shock |

Appendix A

| SIGNAL EXTRACTION IN ‘ARIMA’ TIME SERIES (BETA VERSION) (*) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BY | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| V. GOMEZ and A. MARAVALL, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| with the programming assistance of G. CAPORELLO | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Thanks are due to G. FIORENTINI and C. PLANAS for their research assistance | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Based on an original program developed by J. P. BURMAN at the Bank of England, version 1982) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (*) Copyright: V. GOMEZ, A. MARAVALL (1994,1996) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FIRST PART: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ARIMA ESTIMATION | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SERIES TITLE: CTCO | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PREADJUSTED WITH TRAMO: YES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| METHOD: MAXIMUM LIKELIHOOD | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NO OF OBSERVATIONS = 28 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2012 | 1866.600 | 1839.200 | 3880.600 | 4736.000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2013 | 3518.100 | 1790.600 | 3804.300 | 3626.200 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 | 3504.800 | 2961.200 | 3275.800 | 4386.700 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | 3873.600 | 4169.600 | 4551.700 | 4099.000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | 3574.600 | 3609.100 | 5070.800 | 4507.400 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 4600.100 | 4343.600 | 3966.400 | 5408.300 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 5506.200 | 4903.300 | 4457.000 | 5238.100 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| INPUT PARAMETERS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LAM = 1 | IMEAN = 0 | RSA = 0 | MQ = 4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| P = 0 | BP = 0 | Q = 1 | BQ = 1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| D = 1 | BD = 1 | NOADMISS = 1 | RMOD = 0.500 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| M = 36 | QMAX = 36 | BIAS = 1 | SMTR = 0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| THTR = −0.400 | MAXBIAS = 0.500 | IQM = 16 | OUT = 1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| EPSPHI = 2.000 | MAXIT = 20 | XL = 0.990 | SEK = 3.000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| TRANSFORMATION: Z → Z | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NONSEASONAL DIFFERENCING D = 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SEASONAL DIFFERENCING BD = 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DIFFERENCED SERIES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2013 | −1700.100 | −27.700 | −1033.500 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 | 1096.500 | 1183.900 | −1699.100 | 1289.000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | −391.700 | 839.600 | 67.500 | −1563.600 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | −11.300 | −261.500 | 1079.600 | −110.700 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 617.100 | −291.000 | −1838.900 | 2005.300 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 5.200 | −346.400 | −69.100 | −660.800 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| MEAN OF DIFFERENCED SERIES −0.7920E+02 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MEAN SET EQUAL TO ZERO | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| VARIANCE OF Z SERIES = 0.9436E+06 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| VARIANCE OF DIFFERENCED SERIES = 0.1048E+07 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AUTOCORRELATIONS OF STATIONARY SERIES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.3547 | −0.0206 | −0.0072 | −0.3347 | 0.4402 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.2085 | 0.2333 | 0.2334 | 0.2334 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.1370 | −0.2394 | −0.0033 | 0.2356 | −0.1264 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.2925 | 0.2952 | 0.3036 | 0.3036 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.3459 | −0.0064 | 0.1586 | −0.1106 | 0.1547 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.3261 | 0.3417 | 0.3417 | 0.3449 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| PARTIAL AUTOCORRELATIONS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.3547 | −0.1675 | −0.0884 | −0.4429 | 0.1750 | −0.1285 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.2085 | 0.2085 | 0.2085 | 0.2085 | 0.2085 | 0.2085 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0781 | −0.4014 | 0.0580 | −0.0773 | 0.1178 | 0.1088 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.2085 | 0.2085 | 0.2085 | 0.2085 | 0.2085 | 0.2085 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0062 | −0.1237 | 0.1370 | −0.0079 | −0.0526 | 0.0278 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.2085 | 0.2085 | 0.2085 | 0.2085 | 0.2085 | 0.2085 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| MODEL FITTED | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NONSEASONAL P = 0 D = 1 Q = 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SEASONAL BP = 0 BD = 1 BQ= 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PERIODICITY MQ = 4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CONVERGED AFTER 11 ITERATIONS AND 29 FUNCTION VALUES F = 0.13265435E+08 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.990000E+00 | 0.462399E+00 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PARAMETERS FIXED | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PARAMETER ESTIMATES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MEAN = 0.00000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SE = ******* | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CORRELATION MATRIX | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ****** | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ****** 1.000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ARIMA PARAMETERS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THETA = −0.9900 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SE = ******* | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BTHETA= −0.4624 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SE = 0.1678 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RESIDUALS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2012 | −531.546 | −55.657 | 302.937 | 626.179 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2013 | 1072.403 | −420.828 | −278.764 | −1158.608 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 | 158.707 | 655.510 | −986.401 | −95.666 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | 117.359 | 1186.241 | 485.691 | −675.451 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | −581.937 | −342.824 | 421.755 | −227.828 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 431.668 | 244.226 | −1245.160 | 474.174 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 778.530 | 339.667 | −420.391 | −287.726 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| TEST-STATISTICS ON RESIDUALS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MEAN = −0.4907E+00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ST.DEV. = 0.1171E+03 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| OF MEAN | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| T-VALUE = −0.0042 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NORMALITY TEST = 0.5396 (CHI-SQUARED (2)) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SKEWNESS = −0.1451 (SE = 0.4629) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| KURTOSIS = 2.3850 (SE = 0.9258) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SUM OF SQUARES = 0.1076E+08 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DURBIN–WATSON = 1.8390 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STANDARD DEVI. = 0.7156E+03 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| OF RESID. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| VARIANCE = 0.5121E+06 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| OF RESID. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AUTOCORRELATIONS OF RESIDUAL | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0636 | −0.3430 | −0.3254 | −0.0905 | 0.2781 | −0.1048 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.1890 | 0.1897 | 0.2107 | 0.2280 | 0.2292 | 0.2410 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.0029 | −0.2030 | 0.0156 | 0.2835 | 0.1447 | 0.1077 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.2426 | 0.2426 | 0.2486 | 0.2486 | 0.2599 | 0.2628 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.3836 | −0.1436 | 0.1633 | 0.1171 | 0.0161 | −0.2165 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.2644 | 0.2835 | 0.2861 | 0.2894 | 0.2911 | 0.2912 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| THE LJUNG–BOX Q VALUE IS 29.04 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| IF RESIDUALS ARE RANDOM, IT SHOULD BE DISTRIBUTED AS CHI-SQUARED (14) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| INPUT PARAMETERS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LAM = 1 | IMEAN = 0 | RSA = 0 | MQ = 4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| P = 0 | BP = 0 | Q = 1 | BQ = 1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| D = 1 | BD = 1 | NOADMISS = 1 | RMOD = 0.500 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| M = 23 | QMAX = 36 | BIAS = 1 | SMTR = 0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| THTR = −0.400 | MAXBIAS = 0.500 | IQM = 16 | OUT = 1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| EPSPHI = 2.000 | MAXIT = 20 | XL = 0.990 | SEK = 3.000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| TRANSFORMATION: Z → Z | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NONSEASONAL DIFFERENCING D = 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SEASONAL DIFFERENCING BD = 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DIFFERENCED SERIES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2013 | −1700.100 | −27.700 | −1033.500 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 | 1096.500 | 1183.900 | −1699.100 | 1289.000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | −391.700 | 839.600 | 67.500 | −1563.600 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | −11.300 | −261.500 | 1079.600 | −110.700 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 617.100 | −291.000 | −1838.900 | 2005.300 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 5.200 | −346.400 | −69.100 | −660.800 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| MEAN OF DIFFERENCED SERIES | −0.7920 × 102 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MEAN SET EQUAL TO ZERO | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| VARIANCE OF Z SERIES = | 0.9436 × 106 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| VARIANCE OF DIFFERENCED SERIES = 0.1048 × 107 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AUTOCORRELATIONS OF STATIONARY SERIES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.3547 | −0.0206 | −0.0072 | −0.3347 | 0.4402 | −0.2271 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.2085 | 0.2333 | 0.2334 | 0.2334 | 0.2534 | 0.2847 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.1370 | −0.2394 | −0.0033 | 0.2356 | −0.1264 | 0.3032 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.2925 | 0.2952 | 0.3036 | 0.3036 | 0.3114 | 0.3136 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.3459 | −0.0064 | 0.1586 | −0.1106 | 0.1547 | −0.1622 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.3261 | 0.3417 | 0.3417 | 0.3449 | 0.3464 | 0.3494 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| PARTIAL AUTOCORRELATIONS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.3547 | −0.1675 | −0.0884 | −0.4429 | 0.1750 | −0.1285 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.2085 | 0.2085 | 0.2085 | 0.2085 | 0.2085 | 0.2085 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0781 | −0.4014 | 0.0580 | −0.0773 | 0.1178 | 0.1088 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.2085 | 0.2085 | 0.2085 | 0.2085 | 0.2085 | 0.2085 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0062 | −0.1237 | 0.1370 | −0.0079 | −0.0526 | 0.0278 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.2085 | 0.2085 | 0.2085 | 0.2085 | 0.2085 | 0.2085 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| MODEL FITTED | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NONSEASONAL P = 0 D = 1 Q = 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SEASONAL BP = 0 BD = 1 BQ = 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PERIODICITY MQ = 4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CONVERGED AFTER 11 ITERATIONS AND 29 FUNCTION VALUES F = 0.13265435E+08 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.990000E+00 0.462399E+00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PARAMETERS FIXED | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PARAMETER ESTIMATES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MEAN = 0.00000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SE = ******* | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CORRELATION MATRIX | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ****** | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ****** 1.000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ARIMA PARAMETERS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THETA = −0.9900 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SE = ******* | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BTHETA = −0.4624 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SE = 0.1678 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RESIDUALS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2012 | −531.546 | −55.657 | 302.937 | 626.179 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2013 | 1072.403 | −420.828 | −278.764 | −1158.608 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 | 158.707 | 655.510 | −986.401 | −95.666 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | 117.359 | 1186.241 | 485.691 | −675.451 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | −581.937 | −342.824 | 421.755 | −227.828 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 431.668 | 244.226 | −1245.160 | 474.174 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 778.530 | 339.667 | −420.391 | −287.726 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| TEST-STATISTICS ON RESIDUALS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MEAN = −0.4907E+00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ST.DEV. = 0.1171E+03 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| OF MEAN | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| T-VALUE = −0.0042 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NORMALITY TEST = 0.5396 (CHI-SQUARED (2)) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SKEWNESS = −0.1451 (SE = 0.4629) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| KURTOSIS = 2.3850 (SE = 0.9258) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SUM OF SQUARES = 0.1076E+08 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DURBIN–WATSON = 1.8390 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STANDARD DEVI. = 0.7156E+03 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| OF RESID. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| VARIANCE = 0.5121E+06 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| OF RESID. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AUTOCORRELATIONS OF RESIDUAL | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0636 | −0.3430 | −0.3254 | −0.0905 | 0.2781 | −0.1048 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.1890 | 0.1897 | 0.2107 | 0.2280 | 0.2292 | 0.2410 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.0029 | −0.2030 | 0.0156 | 0.2835 | 0.1447 | 0.1077 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.2426 | 0.2426 | 0.2486 | 0.2486 | 0.2599 | 0.2628 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.3836 | −0.1436 | 0.1633 | 0.1171 | 0.0161 | −0.2165 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.2644 | 0.2835 | 0.2861 | 0.2894 | 0.2911 | 0.2912 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| THE LJUNG–BOX Q VALUE IS 29.04 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| IF RESIDUALS ARE RANDOM, IT SHOULD BE DISTRIBUTED AS CHI-SQUARED (14) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| APPROXIMATE TEST OF RUNS ON RESIDUALS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NUM.DATA = 28 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NUM. (+) = 14 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NUM. (−) = 14 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| T-VALUE = −0.770 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AUTOCORRELATIONS OF SQUARED RESIDUAL | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.2569 | −0.1377 | 0.2115 | −0.2014 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.1890 | 0.2011 | 0.2044 | 0.2121 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.0975 | −0.1342 | 0.3623 | −0.1160 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.2384 | 0.2399 | 0.2425 | 0.2611 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.0688 | −0.1339 | 0.2076 | −0.0929 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| SE | 0.2636 | 0.2642 | 0.2666 | 0.2723 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| THE LJUNG–BOX Q VALUE IS 21.34 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| IF RESIDUALS ARE RANDOM, IT SHOULD BE DISTRIBUTED AS CHI-SQUARED (14) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BACKWARD RESIDUALS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2012 | −1161.151 | −144.921 | 635.738 | 1354.892 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2013 | 382.797 | −1104.070 | 515.712 | −195.358 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 | 66.066 | −570.972 | −761.273 | 497.780 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | 216.779 | 673.934 | 429.115 | −242.701 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | −888.413 | −484.704 | 1324.585 | −366.122 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | −412.914 | −160.287 | −255.526 | 437.112 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 359.691 | 161.981 | −189.797 | −131.714 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| SECOND PART: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DERIVATION OF THE MODELS FOR THE COMPONENTS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SERIES TITLE: CTCO | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MODEL PARAMETERS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (0,1,1) (0,1,1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PARAMETER VALUES PASSED FROM ARIMA ESTIMATION (TRUE SIGNS) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THETA PARAMETERS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1.00 −0.99 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BTHETA PARAMETERS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1.00 | 0.00 | 0.00 | 0.00 | −0.46 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| PHI PARAMETERS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BPHI PARAMETERS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NUMERATOR OF THE MODEL | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1.0000 | −0.9900 | 0.0000 | 0.0000 | −0.4624 | 0.4578 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| STATIONARY AUTOREGRESSIVE TREND-CYCLE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NON-STATIONARY AUTOREGRESSIVE TREND-CYCLE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1.0000 | −2.0000 | 1.0000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AUTOREGRESSIVE TREND-CYCLE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1.0000 | −2.0000 | 1.0000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STATIONARY AUTOREGRESSIVE TRANSITORY COMP. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NON-STATIONARY AUTOREGRESSIVE TRANSITORY COMP. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AUTOREGRESSIVE TRANSITORY COMP. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STATIONARY AUTOREGRESSIVE SEASONAL COMPONENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NON-STATIONARY AUTOREGRESSIVE SEASONAL COMPONENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1.0000 | 1.0000 | 1.0000 | 1.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| AUTOREGRESSIVE SEASONAL COMPONENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1.0000 | 1.0000 | 1.0000 | 1.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| STATIONARY AUTOREGRESSIVE SEASONALLY ADJUSTED COMPONENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NON-STATIONARY AUTOREGRESSIVE SEASONALLY ADJUSTED COMPONENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1.0000 | −2.0000 | 1.0000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AUTOREGRESSIVE SEASONALLY ADJUSTED COMPONENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1.0000 | −2.0000 | 1.0000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL DENOMINATOR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1.0000 | −1.0000 | 0.0000 | 0.0000 | −1.0000 | 1.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| MA ROOTS OF TREND−CYCLE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| REAL PART | IMAGINARY PART | MODULUS | ARGUMENT (DEG.) | PERIOD | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.990 | 0.000 | 0.990 | 0.000 | − | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| −1.000 | 0.000 | 1.000 | 180.000 | 2.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL SQUARED ERROR= 0.1194682E−35 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MA ROOTS OF SEAS. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| REAL PART | IMAGINARY PART | MODULUS | ARGUMENT (DEG.) | PERIOD | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.410 | 0.420 | 0.587 | 134.295 | 2.681 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1.000 | 0.000 | 1.000 | 0.000 | − | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL SQUARED ERROR = 0.3123552E−29 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MA ROOTS OF SEASONALLY ADJUSTED SERIES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| REAL PART | IMAGINARY PART | MODULUS | ARGUMENT (DEG.) | PERIOD | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.825 | 0.000 | 0.825 | 0.000 | - | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.990 | 0.000 | 0.990 | 0.000 | - | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL SQUARED ERROR = 0.3729890E−30 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MODELS FOR THE COMPONENTS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TREND-CYCLE NUMERATOR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1.0000 | 0.0100 | −0.9900 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TREND-CYCLE DENOMINATOR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1.0000 | −2.0000 | 1.0000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| INNOV. VAR. (*) 0.00453 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SEAS. NUMERATOR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1.0000 | −0.1805 | −0.4752 | −0.3442 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| SEAS. DENOMINATOR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1.0000 | 1.0000 | 1.0000 | 1.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| INNOV. VAR. (*) 0.06494 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| IRREGULAR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| VAR. 0.48461 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SEASONALLY ADJUSTED NUMERATOR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1.0000 | −1.8147 | 0.8165 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SEASONALLY ADJUSTED DENOMINATOR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1.0000 | −2.0000 | 1.0000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| INNOV. VAR. (*) 0.58804 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (*) IN UNITS OF VAR (A) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MOVING AVERAGE REPRESENTATION OF ESTIMATORS (NONSTATIONARY) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The last column (the sum of the Psi-Weights) should be zero | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| for negative lags, 1 for lag = 0, and equal to the Box–Jenkins | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Psi-Weights for positive lags. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PSIEP (LAG), for example, represents the effect of the overall | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| innovation a (t-lag) on the estimator of the trend for period t. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Similarly for the other components. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LAG | PSIEP | PSIES | PSIEC | PSIEA | PSIUE | PSIEP + PSIES + PSIUE | ||||||||||||||||||||||||||||||||||||||||||||||||||

| −8 | 0.0310 | 0.0914 | 0.0000 | −0.0914 | −0.1225 | 0.0000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| −7 | 0.0386 | −0.0366 | 0.0000 | 0.0366 | −0.0020 | 0.0000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| −6 | 0.0473 | −0.0453 | 0.0000 | 0.0453 | −0.0020 | 0.0000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| −5 | 0.0561 | −0.0541 | 0.0000 | 0.0541 | −0.0020 | 0.0000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| −4 | 0.0675 | 0.1978 | 0.0000 | −0.1978 | −0.2652 | 0.0000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| −3 | 0.0838 | −0.0791 | 0.0000 | 0.0791 | −0.0047 | 0.0000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| −2 | 0.1027 | −0.0979 | 0.0000 | 0.0979 | −0.0048 | 0.0000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| −1 | 0.1218 | −0.1170 | 0.0000 | 0.1170 | −0.0048 | 0.0000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 0 | 0.1366 | 0.3788 | 0.0000 | 0.6212 | 0.4846 | 1.0000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | 0.1424 | −0.1324 | 0.0000 | 0.1424 | 0.0000 | 0.0100 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | 0.1437 | −0.1337 | 0.0000 | 0.1437 | 0.0000 | 0.0100 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | 0.1451 | −0.1351 | 0.0000 | 0.1451 | 0.0000 | 0.0100 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 0.1464 | 0.4012 | 0.0000 | 0.1464 | 0.0000 | 0.5476 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 5 | 0.1478 | −0.1324 | 0.0000 | 0.1478 | 0.0000 | 0.0154 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 6 | 0.1491 | −0.1337 | 0.0000 | 0.1491 | 0.0000 | 0.0154 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 7 | 0.1504 | −0.1351 | 0.0000 | 0.1504 | 0.0000 | 0.0154 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 8 | 0.1518 | 0.4012 | 0.0000 | 0.1518 | 0.0000 | 0.5530 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| WIENER–KOLMOGOROV FILTERS (ONE SIDE) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TREND-CYCLE COMPONENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0859 | 0.0798 | 0.0674 | 0.0550 | 0.0443 | 0.0369 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0311 | 0.0254 | 0.0205 | 0.0170 | 0.0144 | 0.0117 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0095 | 0.0079 | 0.0067 | 0.0054 | 0.0044 | 0.0036 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0031 | 0.0025 | 0.0020 | 0.0017 | 0.0014 | 0.0012 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0009 | 0.0008 | 0.0006 | 0.0005 | 0.0004 | 0.0004 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0003 | 0.0002 | 0.0002 | 0.0002 | 0.0001 | 0.0001 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0001 | 0.0001 | 0.0001 | 0.0000 | 0.0000 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| SA SERIES COMPONENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.7552 | 0.0796 | 0.0672 | 0.0548 | −0.1358 | 0.0368 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0311 | 0.0254 | −0.0628 | 0.0170 | 0.0144 | 0.0117 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.0290 | 0.0079 | 0.0066 | 0.0054 | −0.0134 | 0.0036 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0031 | 0.0025 | −0.0062 | 0.0017 | 0.0014 | 0.0012 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.0029 | 0.0008 | 0.0007 | 0.0005 | −0.0013 | 0.0004 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0003 | 0.0002 | −0.0006 | 0.0002 | 0.0001 | 0.0001 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.0003 | 0.0001 | 0.0001 | 0.0001 | −0.0001 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0000 | 0.0000 | −0.0001 | 0.0000 | 0.0000 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| SEASONAL COMPONENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.2448 | −0.0796 | −0.0672 | −0.0548 | 0.1358 | −0.0368 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.0311 | −0.0254 | 0.0628 | −0.0170 | −0.0144 | −0.0117 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0290 | −0.0079 | −0.0066 | −0.0054 | 0.0134 | −0.0036 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.0031 | −0.0025 | 0.0062 | −0.0017 | −0.0014 | −0.0012 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0029 | −0.0008 | −0.0007 | −0.0005 | 0.0013 | −0.0004 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.0003 | −0.0002 | 0.0006 | −0.0002 | −0.0001 | −0.0001 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0003 | −0.0001 | −0.0001 | −0.0001 | 0.0001 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0000 | 0.0000 | 0.0001 | 0.0000 | 0.0000 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| IRREGULAR COMPONENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.6692 | −0.0002 | −0.0002 | −0.0001 | −0.1801 | −0.0001 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.0001 | −0.0001 | −0.0833 | 0.0000 | 0.0000 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.0385 | 0.0000 | 0.0000 | 0.0000 | −0.0178 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0000 | 0.0000 | −0.0082 | 0.0000 | 0.0000 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.0038 | 0.0000 | 0.0000 | 0.0000 | −0.0017 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0000 | 0.0000 | −0.0008 | 0.0000 | 0.0000 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| −0.0004 | 0.0000 | 0.0000 | 0.0000 | −0.0002 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0000 | 0.0000 | −0.0001 | 0.0000 | 0.0000 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| AUTOCORRELATION FUNCTION OF COMPONENTS (STATIONARY TRANSFORMATION) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TREND-CYCLE | ADJUSTED | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LAG | COMPONENT | ESTIMATOR | ESTIMATE | COMPONENT | ESTIMATOR | ESTIMATE | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | 0.000 | 0.667 | 0.508 | −0.665 | −0.662 | −0.598 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | −0.500 | 0.122 | −0.258 | 0.165 | 0.119 | 0.112 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | 0.000 | −0.178 | −0.496 | 0.000 | 0.178 | 0.079 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 0.000 | −0.268 | −0.235 | 0.000 | −0.269 | −0.343 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| VAR. (*) | 0.009 | 0.000 | 0.000 | 2.917 | 1.959 | 1.297 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (*) IN UNITS OF VAR (A) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AUTOCORRELATION FUNCTION OF COMPONENTS (STATIONARY TRANSFORMATION) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| IRREGULAR | SEASONAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LAG | COMPONENT | ESTIMATOR | ESTIMATE | COMPONENT | ESTIMATOR | ESTIMATE | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | 0.000 | 0.000 | 0.077 | 0.050 | −0.156 | 0.058 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | 0.000 | 0.000 | −0.224 | −0.300 | −0.522 | −0.781 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | 0.000 | 0.000 | −0.365 | −0.250 | −0.230 | −0.255 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 0.000 | −0.269 | −0.285 | 0.000 | 0.614 | 0.531 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| VAR. (*) | 0.485 | 0.324 | 0.263 | 0.089 | 0.027 | 0.029 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (*) IN UNITS OF VAR (A) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For all components it should happen that: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| -Var (Component) > Var (Estimator) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| -Var (Estimator) close to Var (Estimate) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CROSSCORRELATION BETWEEN STATIONARY TRANSFORMATION OF ESTIMATORS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ESTIMATOR | ESTIMATE | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TREND/SEASONAL | −0.208 | −0.420 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SEASONAL/IRREGULAR | 0.223 | 0.122 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TREND-CYCLE/IRREGULAR | −0.408 | −0.359 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PSEUDO-INNOVATIONS IN THE COMPONENTS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PSEUDO INNOVATIONS IN TREND-CYCLE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2012 | 1.29 | 4.44 | 4.71 | −0.40 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2013 | −6.70 | −4.82 | −0.43 | −0.76 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 | 1.04 | −2.49 | −5.30 | 1.83 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | 9.17 | 9.08 | 0.44 | −6.32 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | −8.52 | −4.30 | 0.85 | −0.09 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 3.42 | 6.81 | 10.67 | 10.76 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 0.06 | −8.95 | −11.17 | −5.26 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| PSEUDO INNOVATIONS IN SEASONAL | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2012 | 6.43 | 11.78 | −9.71 | −50.48 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2013 | −20.87 | 98.15 | 47.08 | −73.89 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 | −130.08 | 146.66 | 38.63 | −55.92 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | 0.43 | −2.75 | −48.00 | −42.55 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | 106.03 | 83.07 | −99.34 | −62.87 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 16.90 | 172.35 | −87.56 | −154.34 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 31.35 | 74.57 | 80.36 | −75.40 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| PSEUDO INNOVATIONS IN SEASONALLY ADJUSTED SERIES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2012 | −138.15 | −169.71 | 241.55 | 412.81 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2013 | 253.23 | −607.35 | 27.64 | −2.49 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 | −207.53 | 610.11 | −366.37 | −517.66 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | −226.93 | 445.16 | 687.41 | 45.90 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | 45.79 | −690.94 | 41.11 | 78.88 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | −456.70 | 170.87 | −429.09 | 662.73 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 727.65 | 239.23 | −204.89 | −682.81 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| THIRD PART: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ERROR ANALYSIS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FINAL ESTIMATION ERROR | REVISION IN CONCURRENT ESTIMATOR | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ACF (LAG) | TREND-CYCLE | ADJUSTED | TREND-CYCLE | AD-JUSTED | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | 0.912 | −0.320 | 0.827 | −0.104 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | 0.752 | −0.277 | 0.677 | −0.216 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | 0.620 | −0.224 | 0.555 | −0.313 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 0.511 | 0.553 | 0.460 | 0.462 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| VAR. (*) | 0.043 | 0.120 | 0.047 | 0.087 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL ESTIMATION ERROR (CONCURRENT ESTIMATOR) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ACF (LAG) | TREND-CYCLE | ADJUSTED | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | 0.867 | −0.229 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | 0.713 | −0.251 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | 0.586 | −0.262 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 0.484 | 0.515 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| VAR. (*) | 0.089 | 0.207 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (*) IN UNITS OF VAR (A) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| VARIANCE OF THE REVISION ERROR (*) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ADDITIONAL | TREND-CYCLE | ADJUSTED | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PERIODS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0 | 0.4687E−01 | 0.8729E−01 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 0.9909E−02 | 0.1866E−01 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8 | 0.2071E−02 | 0.3990E−02 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 12 | 0.4239E−03 | 0.8532E−03 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 16 | 0.8437E−04 | 0.1824E−03 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 20 | 0.1723E−04 | 0.3900E−04 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PERCENTAGE REDUCTION IN THE STANDARD ERROR OF THE REVISION AFTER ADDITIONAL YEARS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (COMPARISON WITH CONCURRENT ESTIMATORS) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AFTER 1 YEAR | 54.02 | 53.76 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AFTER 2 YEAR | 78.98 | 78.62 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AFTER 3 YEAR | 90.49 | 90.11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AFTER 4 YEAR | 95.76 | 95.43 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AFTER 5 YEAR | 98.08 | 97.89 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| VARIANCE OF THE REVISION ERROR FOR THE SEASONAL COMPONENT (ONE YEAR AHEAD ADJUSTMENT) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PERIODS AHEAD | VARIANCE (*) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0 | 0.8729E−01 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | 0.2308 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | 0.2483 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | 0.2662 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 0.2845 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE PERCENTAGE REDUCTION IN RMSE FROM CONCURRENT ADJUSTMENT 35.24 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (*) IN UNITS OF VAR (A) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DECOMPOSITION OF THE SERIES: RECENT ESTIMATES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PERIOD | SERIES | TREND-CYCLE | ADJUSTED | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| ESTIMATE | STANDARD ERROR | ESTIMATE | STANDARD ERROR | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL OF REVISION | TOTAL OF REVISION | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| −8 | 4507 | 4438 | 151.3 | 32.57 | 4238 | 251.6 | 45.21 | |||||||||||||||||||||||||||||||||||||||||||||||||

| −7 | 4600 | 4520 | 152.9 | 39.41 | 4526 | 260.0 | 79.54 | |||||||||||||||||||||||||||||||||||||||||||||||||

| −6 | 4344 | 4604 | 155.4 | 48.11 | 4634 | 261.3 | 83.73 | |||||||||||||||||||||||||||||||||||||||||||||||||

| −5 | 3966 | 4691 | 159.0 | 58.83 | 4193 | 263.3 | 89.78 | |||||||||||||||||||||||||||||||||||||||||||||||||

| −4 | 5408 | 4785 | 164.0 | 71.24 | 5088 | 266.1 | 97.77 | |||||||||||||||||||||||||||||||||||||||||||||||||

| −3 | 5506 | 4875 | 171.0 | 86.06 | 5254 | 301.4 | 172.0 | |||||||||||||||||||||||||||||||||||||||||||||||||

| −2 | 4903 | 4953 | 181.2 | 104.9 | 5121 | 306.7 | 181.1 | |||||||||||||||||||||||||||||||||||||||||||||||||

| −1 | 4457 | 5026 | 195.5 | 128.1 | 4824 | 314.6 | 194.2 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 0 | 5238 | 5103 | 214.1 | 154.9 | 4963 | 325.5 | 211.4 | |||||||||||||||||||||||||||||||||||||||||||||||||

| STANDARD ERROR OF 147.7 247.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FINAL ESTIMATOR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PERIOD | SEASONAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ESTIMATE | STANDARD ERROR | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL OF REVISION | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| −8 | 269.2 | 251.6 | 45.21 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| −7 | 73.99 | 260.0 | 79.54 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| −6 | −290.0 | 261.3 | 83.73 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| −5 | −226.1 | 263.3 | 89.78 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| −4 | 320.3 | 266.1 | 97.77 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| −3 | 252.5 | 301.4 | 172.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| −2 | −217.4 | 306.7 | 181.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| −1 | −366.6 | 314.6 | 194.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0 | 274.9 | 325.5 | 211.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| STANDARD ERROR OF 247.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FINAL ESTIMATOR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DECOMPOSITION OF THE SERIES: FORECAST | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PERIOD | SERIES | TREND-CYCLE | ADJUSTED | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| FORECAST | S.E. | FORECAST | STANDARD ERROR | FORECAST | STANDARD ERROR | |||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL OF REVISION | TOTAL OF REVISION | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | 5478 | 715.6 | 5184 | 235.3 | 183.2 | 5184 | 551.0 | 492.3 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | 5074 | 715.7 | 5266 | 256.4 | 209.6 | 5266 | 560.3 | 502.7 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | 4978 | 715.7 | 5349 | 276.3 | 233.5 | 5349 | 569.7 | 513.1 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 5700 | 715.8 | 5431 | 295.2 | 255.5 | 5431 | 579.1 | 523.5 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 5 | 5808 | 816.0 | 5514 | 313.2 | 276.2 | 5514 | 588.5 | 533.9 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 6 | 5404 | 816.1 | 5596 | 330.6 | 295.7 | 5596 | 597.9 | 544.3 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 7 | 5308 | 816.2 | 5679 | 347.4 | 314.4 | 5679 | 607.3 | 554.6 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 8 | 6029 | 816.2 | 5761 | 363.7 | 332.3 | 5761 | 616.8 | 565.0 | ||||||||||||||||||||||||||||||||||||||||||||||||

| PERIOD | SEASONAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FORECAST | STANDARD ERROR | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL OF REVISION | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | 294.1 | 423.6 | 343.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | −191.9 | 434.1 | 356.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | −370.8 | 444.5 | 369.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 268.5 | 454.9 | 381.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5 | 294.1 | 537.9 | 477.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6 | −191.9 | 546.2 | 486.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7 | −370.8 | 554.5 | 496.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8 | 268.5 | 562.9 | 505.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| CONFIDENCE INTERVAL AROUND A SEASONAL COMPONENT OF 0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FINAL ESTIMATOR | CONCURRENT ESTIMATOR | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 95% CONFIDENCE INTERVAL | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| −485.1 | 485.1 | −638.0 | 638.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 70% CONFIDENCE INTERVAL | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| −256.7 | 256.7 | −337.6 | 337.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| SAMPLE MEANS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| COMPLETE PERIOD | LAST THREE YEARS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SERIES | 3967 | 4599 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TREND-CYCLE | 3995 | 4649 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ADJUSTED | 3995 | 4621 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SEASONAL | −27.94 | −22.18 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STANDARD ERROR OF ALTERNATIVE MEASURES OF GROWTH | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (NONANNUALISED GROWTH) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1. PERIOD TO PERIOD GROWTH OF THE SERIES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TREND-CYCLE | SEASONALLY ADJ. SERIES | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CONCURRENT ESTIMATOR | 67.534 | 503.460 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1—PERIOD REVISION | 66.137 | 503.275 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2—PERIOD REVISION | 64.737 | 503.094 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3—PERIOD REVISION | 63.674 | 462.453 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4—PERIOD REVISION | 63.155 | 425.890 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5—PERIOD REVISION | 62.838 | 425.843 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6—PERIOD REVISION | 62.526 | 425.798 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7—PERIOD REVISION | 62.292 | 415.829 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8—PERIOD REVISION | 62.179 | 407.393 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FINAL ESTIMATOR | 61.911 | 402.215 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3. ACCUMULATED GROWTH OVER THE LAST QUARTER OF PREVIOUS YEAR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CONCURRENT ESTIMATOR | FINAL ESTIMATOR | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TREND-CYCLE | SEASONALLY ADJ. SERIES | TREND-CYCLE | SEASONALLY ADJ. SERIES | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| QUARTER 1 | 270.135 | 2013.839 | 247.645 | 1608.859 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| QUARTER 2 | 230.983 | 1006.489 | 208.088 | 791.175 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| QUARTER 3 | 194.733 | 669.655 | 171.699 | 516.343 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| QUARTER 4 | 168.324 | 260.152 | 146.033 | 234.006 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (CENTERED) ESTIMATOR OF THE PRESENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ANNUAL GROWTH | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STANDARD ERROR | TREND-CYCLE | SEAS. ADJ. SERIES | ORIGINAL SERIES | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| CONCURRENT ESTIMATOR | 182.745 | 643.638 | 715.714 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| FINAL ESTIMATOR | 146.033 | 234.006 | 0.000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| FOURTH PART: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ESTIMATES OF THE COMPONENTS (LEVELS) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ORIGINAL SERIES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2012 | 1866.600 | 1839.200 | 3880.600 | 4736.000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2013 | 3518.100 | 1790.600 | 3804.300 | 3626.200 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 | 3504.800 | 2961.200 | 3275.800 | 4386.700 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | 3873.600 | 4169.600 | 4551.700 | 4099.000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | 3574.600 | 3609.100 | 5070.800 | 4507.400 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 4600.100 | 4343.600 | 3966.400 | 5408.300 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 5506.200 | 4903.300 | 4457.000 | 5238.100 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| SEASONAL COMPONENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2012 | −450.816 | −1075.008 | 485.251 | 904.432 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2013 | −209.543 | −1007.740 | 354.343 | 636.675 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 | −88.342 | −669.293 | 167.830 | 468.889 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | −117.503 | −418.540 | 204.620 | 298.699 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | −113.237 | −379.628 | 135.842 | 269.207 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 73.989 | −289.983 | −226.118 | 320.264 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 252.491 | −217.390 | −366.567 | 274.923 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| STANDARD ERROR OF SEASONAL | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2012 | 325.516 | 314.570 | 306.666 | 301.403 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2013 | 266.112 | 263.283 | 261.281 | 259.968 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 | 251.597 | 250.960 | 250.512 | 250.220 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | 248.384 | 248.149 | 248.246 | 248.384 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | 250.220 | 250.512 | 250.960 | 251.597 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 259.968 | 261.281 | 263.283 | 266.112 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 301.403 | 306.666 | 314.570 | 325.516 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| TREND-CYCLE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2012 | 2880.125 | 2978.811 | 3080.988 | 3171.839 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2013 | 3243.089 | 3303.945 | 3368.921 | 3441.254 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 | 3520.524 | 3602.370 | 3688.396 | 3783.659 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | 3880.790 | 3968.908 | 4041.723 | 4105.986 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | 4177.612 | 4263.672 | 4353.976 | 4437.923 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 4520.136 | 4603.811 | 4691.496 | 4785.336 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 4874.685 | 4952.665 | 5025.900 | 5102.613 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| STANDARD ERROR OF TREND-CYCLE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2012 | 214.081 | 195.529 | 181.186 | 170.973 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2013 | 164.011 | 159.016 | 155.370 | 152.899 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 | 151.280 | 150.151 | 149.346 | 148.811 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | 148.466 | 148.060 | 148.228 | 148.466 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | 148.811 | 149.346 | 150.151 | 151.280 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 152.899 | 155.370 | 159.016 | 164.011 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 170.973 | 181.186 | 195.529 | 214.081 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| SEASONALLY ADJUSTED SERIES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2012 | 2317.416 | 2914.208 | 3395.349 | 3831.568 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2013 | 3727.643 | 2798.340 | 3449.957 | 2989.525 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 | 3593.142 | 3630.493 | 3107.970 | 3917.811 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | 3991.103 | 4588.140 | 4347.080 | 3800.301 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | 3687.837 | 3988.728 | 4934.958 | 4238.193 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 4526.111 | 4633.583 | 4192.518 | 5088.036 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 5253.709 | 5120.690 | 4823.567 | 4963.177 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| STANDARD ERROR OF SEASONALLY ADJUSTED SERIES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2012 | 325.516 | 314.570 | 306.666 | 301.403 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2013 | 266.112 | 263.283 | 261.281 | 259.968 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 | 251.597 | 250.960 | 250.512 | 250.220 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | 248.384 | 248.149 | 248.246 | 248.384 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | 250.220 | 250.512 | 250.960 | 251.597 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 259.968 | 261.281 | 263.283 | 266.112 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 301.403 | 306.666 | 314.570 | 325.516 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| IRREGULAR COMPONENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2012 | −562.710 | −64.604 | 314.361 | 659.729 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2013 | 484.554 | −505.605 | 81.036 | −451.729 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 | 72.618 | 28.123 | −580.425 | 134.152 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | 110.313 | 619.232 | 305.357 | −305.686 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | −489.775 | −274.944 | 580.982 | −199.730 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 5.975 | 29.772 | −498.978 | 302.699 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 379.024 | 168.025 | −202.333 | −139.436 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| * * PROCESSING COMPLETED * * | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SIGNAL EXTRACTION IN ‘ARIMA’ TIME SERIES (BETA VERSION) (*) | |||||||||||||||||||||||||||

| BY | |||||||||||||||||||||||||||

| V. GOMEZ and A. MARAVALL, | |||||||||||||||||||||||||||

| with the programming assistance of G. CAPORELLO | |||||||||||||||||||||||||||

| Thanks are due to G. FIORENTINI and C. PLANAS for their research assistance | |||||||||||||||||||||||||||

| (Based on an original program developed by J. P. BURMAN at the Bank of England, version 1982) | |||||||||||||||||||||||||||

| (*) Copyright: V. GOMEZ, A. MARAVALL (1994,1996) | |||||||||||||||||||||||||||

| FIRST PART: | |||||||||||||||||||||||||||

| ARIMA ESTIMATION | |||||||||||||||||||||||||||

| SERIES TITLE: GDP | |||||||||||||||||||||||||||

| PREADJUSTED WITH TRAMO: YES | |||||||||||||||||||||||||||

| METHOD: MAXIMUM LIKELIHOOD | |||||||||||||||||||||||||||

| NO OF OBSERVATIONS = 28 | |||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | |||||||||||||||||||||||

| 2012 | 413.498 | 412.485 | 414.295 | 412.108 | |||||||||||||||||||||||

| 2013 | 412.408 | 416.854 | 420.011 | 421.123 | |||||||||||||||||||||||

| 2014 | 425.472 | 430.316 | 433.917 | 436.726 | |||||||||||||||||||||||

| 2015 | 442.944 | 446.427 | 452.085 | 457.642 | |||||||||||||||||||||||

| 2016 | 456.344 | 462.331 | 463.510 | 474.004 | |||||||||||||||||||||||

| 2017 | 478.603 | 482.829 | 488.264 | 496.584 | |||||||||||||||||||||||

| 2018 | 503.152 | 509.849 | 516.884 | 520.822 | |||||||||||||||||||||||

| INPUT PARAMETERS | |||||||||||||||||||||||||||

| LAM = 1 | IMEAN = 1 | RSA = 0 | MQ = 4 | ||||||||||||||||||||||||

| P = 0 | BP = 0 | Q = 1 | BQ = 1 | ||||||||||||||||||||||||

| D = 1 | BD = 1 | NOADMISS = 1 | RMOD = 0.500 | ||||||||||||||||||||||||

| M = 36 | QMAX = 36 | BIAS = 1 | SMTR = 0 | ||||||||||||||||||||||||

| THTR = −0.400 | MAXBIAS = 0.500 | IQM = 16 | OUT = 1 | ||||||||||||||||||||||||

| EPSPHI = 2.000 | MAXIT = 20 | XL = 0.990 | SEK = 3.000 | ||||||||||||||||||||||||

| TRANSFORMATION: Z → Z | |||||||||||||||||||||||||||

| NONSEASONAL DIFFERENCING D = 1 | |||||||||||||||||||||||||||

| SEASONAL DIFFERENCING BD = 1 | |||||||||||||||||||||||||||

| DIFFERENCED SERIES | |||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | |||||||||||||||||||||||

| 2013 | 5.459 | 1.347 | 3.299 | ||||||||||||||||||||||||

| 2014 | 4.049 | 0.398 | 0.444 | 1.697 | |||||||||||||||||||||||

| 2015 | 1.869 | −1.361 | 2.057 | 2.748 | |||||||||||||||||||||||

| 2016 | −7.516 | 2.504 | −4.479 | 4.937 | |||||||||||||||||||||||

| 2017 | 5.897 | −1.761 | 4.256 | −2.174 | |||||||||||||||||||||||

| 2018 | 1.969 | 2.471 | 1.600 | −4.382 | |||||||||||||||||||||||

| SERIES HAS BEEN MEAN CORRECTED | |||||||||||||||||||||||||||

| DIFFERENCED AND CENTERED SERIES | |||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | |||||||||||||||||||||||

| 2013 | 4.358 | 0.246 | 2.198 | ||||||||||||||||||||||||

| 2014 | 2.948 | −0.703 | −0.657 | 0.596 | |||||||||||||||||||||||

| 2015 | 0.768 | −2.462 | 0.956 | 1.647 | |||||||||||||||||||||||

| 2016 | −8.617 | 1.403 | −5.580 | 3.836 | |||||||||||||||||||||||

| 2017 | 4.796 | −2.862 | 3.155 | −3.275 | |||||||||||||||||||||||

| 2018 | 0.868 | 1.370 | 0.499 | −5.483 | |||||||||||||||||||||||

| MEAN OF DIFFERENCED SERIES 0.1101E+01 | |||||||||||||||||||||||||||

| VARIANCE OF Z SERIES = 0.1188E+04 | |||||||||||||||||||||||||||

| VARIANCE OF DIFFERENCED SERIES = 0.1091E+02 | |||||||||||||||||||||||||||

| AUTOCORRELATIONS OF STATIONARY SERIES | |||||||||||||||||||||||||||

| −0.2790 | 0.1059 | 0.0428 | −0.2485 | 0.1982 | −0.0861 | ||||||||||||||||||||||

| SE | 0.2085 | 0.2242 | 0.2263 | 0.2267 | 0.2382 | 0.2453 | |||||||||||||||||||||

| 0.0100 | −0.1925 | 0.0074 | −0.0569 | 0.0277 | 0.0559 | ||||||||||||||||||||||

| SE | 0.2466 | 0.2466 | 0.2531 | 0.2531 | 0.2536 | 0.2538 | |||||||||||||||||||||

| −0.1045 | 0.1487 | 0.0480 | −0.0832 | 0.0882 | −0.0228 | ||||||||||||||||||||||

| SE | 0.2543 | 0.2562 | 0.2599 | 0.2603 | 0.2614 | 0.2627 | |||||||||||||||||||||

| PARTIAL AUTOCORRELATIONS | |||||||||||||||||||||||||||

| −0.2790 | 0.0304 | 0.0868 | −0.2388 | 0.0738 | 0.0231 | ||||||||||||||||||||||

| SE | 0.2085 | 0.2085 | 0.2085 | 0.2085 | 0.2085 | 0.2085 | |||||||||||||||||||||

| −0.0148 | −0.2932 | −0.0428 | −0.0584 | 0.0085 | −0.0450 | ||||||||||||||||||||||

| SE | 0.2085 | 0.2085 | 0.2085 | 0.2085 | 0.2085 | 0.2085 | |||||||||||||||||||||

| −0.0546 | 0.0925 | 0.1576 | −0.1486 | −0.0489 | 0.0870 | ||||||||||||||||||||||

| SE | 0.2085 | 0.2085 | 0.2085 | 0.2085 | 0.2085 | 0.2085 | |||||||||||||||||||||

| MODEL FITTED | |||||||||||||||||||||||||||

| NONSEASONAL P = 0 D = 1 Q = 1 | |||||||||||||||||||||||||||

| SEASONAL BP = 0 BD = 1 BQ = 1 | |||||||||||||||||||||||||||

| PERIODICITY MQ = 4 | |||||||||||||||||||||||||||

| 20 ITERATIONS COMPLETED | |||||||||||||||||||||||||||

| 58 FUNCTION VALUES F = 0.18578351E+03 | |||||||||||||||||||||||||||

| 0.276250E+00 0.940575E+00 | |||||||||||||||||||||||||||

| PARAMETERS FIXED | |||||||||||||||||||||||||||

| 0 | |||||||||||||||||||||||||||

| PARAMETER ESTIMATES | |||||||||||||||||||||||||||

| MEAN = 1.10122 | |||||||||||||||||||||||||||

| SE = 0.226077 | |||||||||||||||||||||||||||

| CORRELATION MATRIX | |||||||||||||||||||||||||||

| 1.000 | |||||||||||||||||||||||||||

| 0.141 | 1.000 | ||||||||||||||||||||||||||

| ARIMA PARAMETERS | |||||||||||||||||||||||||||

| THETA = −0.2762 | |||||||||||||||||||||||||||

| SE = 0.1965 | |||||||||||||||||||||||||||

| BTHETA= −0.9406 | |||||||||||||||||||||||||||

| SE = 0.1811 | |||||||||||||||||||||||||||

| RESIDUALS | |||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | |||||||||||||||||||||||

| 2012 | 0.482 | −1.680 | 0.642 | −2.966 | |||||||||||||||||||||||

| 2013 | −1.520 | 2.233 | 1.902 | −0.233 | |||||||||||||||||||||||

| 2014 | 2.225 | 2.406 | 1.217 | 0.218 | |||||||||||||||||||||||

| 2015 | 2.981 | 0.046 | 1.488 | 1.947 | |||||||||||||||||||||||

| 2016 | −5.332 | −0.801 | −4.414 | 4.061 | |||||||||||||||||||||||

| 2017 | 0.397 | −2.121 | −1.375 | 1.312 | |||||||||||||||||||||||

| 2018 | 0.548 | −0.577 | −0.403 | −4.003 | |||||||||||||||||||||||

| TEST-STATISTICS ON RESIDUALS | |||||||||||||||||||||||||||

| MEAN = −0.4711E−01 | |||||||||||||||||||||||||||

| ST.DEV. = 0.4233E+00 | |||||||||||||||||||||||||||

| OF MEAN | |||||||||||||||||||||||||||

| T-VALUE = −0.1113 | |||||||||||||||||||||||||||

| NORMALITY TEST = 1.516 (CHI-SQUARED (2)) | |||||||||||||||||||||||||||

| SKEWNESS = −0.5638 (SE = 0.4629) | |||||||||||||||||||||||||||

| KURTOSIS = 2.8329 (SE = 0.9258) | |||||||||||||||||||||||||||

| SUM OF SQUARES = 0.1405E+03 | |||||||||||||||||||||||||||

| DURBIN–WATSON = 1.9335 | |||||||||||||||||||||||||||

| STANDARD DEVI. = 0.2651E+01 | |||||||||||||||||||||||||||

| OF RESID. | |||||||||||||||||||||||||||

| VARIANCE = 0.7026E+01 | |||||||||||||||||||||||||||

| OF RESID. | |||||||||||||||||||||||||||

| AUTOCORRELATIONS OF RESIDUAL | |||||||||||||||||||||||||||

| −0.0239 | 0.0514 | −0.0728 | 0.0292 | 0.1018 | −0.0367 | ||||||||||||||||||||||

| SE | 0.1890 | 0.1891 | 0.1896 | 0.1906 | 0.1907 | 0.1927 | |||||||||||||||||||||

| −0.0842 | −0.2723 | 0.0634 | −0.0344 | 0.0437 | −0.1325 | ||||||||||||||||||||||

| SE | 0.1929 | 0.1942 | 0.2074 | 0.2081 | 0.2083 | 0.2086 | |||||||||||||||||||||

| −0.0027 | 0.0900 | 0.0348 | −0.1867 | 0.0267 | −0.0489 | ||||||||||||||||||||||

| SE | 0.2116 | 0.2116 | 0.2130 | 0.2132 | 0.2190 | 0.2191 | |||||||||||||||||||||

| THE LJUNG–BOX Q VALUE IS 8.44 | |||||||||||||||||||||||||||

| IF RESIDUALS ARE RANDOM, IT SHOULD BE DISTRIBUTED AS CHI-SQUARED (14) | |||||||||||||||||||||||||||

| INPUT PARAMETERS | |||||||||||||||||||||||||||

| LAM = 1 | IMEAN = 1 | RSA = 0 | MQ = 4 | ||||||||||||||||||||||||

| P = 0 | BP = 0 | Q = 1 | BQ = 1 | ||||||||||||||||||||||||

| D = 1 | BD = 1 | NOADMISS = 1 | RMOD = 0.500 | ||||||||||||||||||||||||

| M = 23 | QMAX = 36 | BIAS = 1 | SMTR = 0 | ||||||||||||||||||||||||

| THTR = −0.400 | MAXBIAS = 0.500 | IQM = 16 | OUT = 1 | ||||||||||||||||||||||||

| EPSPHI = 2.000 | MAXIT = 20 | XL = 0.990 | SEK = 3.000 | ||||||||||||||||||||||||

| TRANSFORMATION: Z → Z | |||||||||||||||||||||||||||

| NONSEASONAL DIFFERENCING D = 1 | |||||||||||||||||||||||||||

| SEASONAL DIFFERENCING BD = 1 | |||||||||||||||||||||||||||

| DIFFERENCED SERIES | |||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | |||||||||||||||||||||||

| 2013 | 5.459 | 1.347 | 3.299 | ||||||||||||||||||||||||

| 2014 | 4.049 | 0.398 | 0.444 | 1.697 | |||||||||||||||||||||||

| 2015 | 1.869 | −1.361 | 2.057 | 2.748 | |||||||||||||||||||||||

| 2016 | −7.516 | 2.504 | −4.479 | 4.937 | |||||||||||||||||||||||

| 2017 | 5.897 | −1.761 | 4.256 | −2.174 | |||||||||||||||||||||||

| 2018 | 1.969 | 2.471 | 1.600 | −4.382 | |||||||||||||||||||||||

| SERIES HAS BEEN MEAN CORRECTED | |||||||||||||||||||||||||||

| DIFFERENCED AND CENTERED SERIES | |||||||||||||||||||||||||||

| YEAR | 1ST | 2ND | 3RD | 4TH | |||||||||||||||||||||||

| 2013 | 4.358 | 0.246 | 2.198 | ||||||||||||||||||||||||

| 2014 | 2.948 | −0.703 | −0.657 | 0.596 | |||||||||||||||||||||||

| 2015 | 0.768 | −2.462 | 0.956 | 1.647 | |||||||||||||||||||||||

| 2016 | −8.617 | 1.403 | −5.580 | 3.836 | |||||||||||||||||||||||

| 2017 | 4.796 | −2.862 | 3.155 | −3.275 | |||||||||||||||||||||||