Opening Up Transactive Systems: Introducing TESS and Specification in a Field Deployment

Abstract

:1. Introduction

2. Background

2.1. Transactive Energy Background

2.2. Transactive Energy Economic Theory

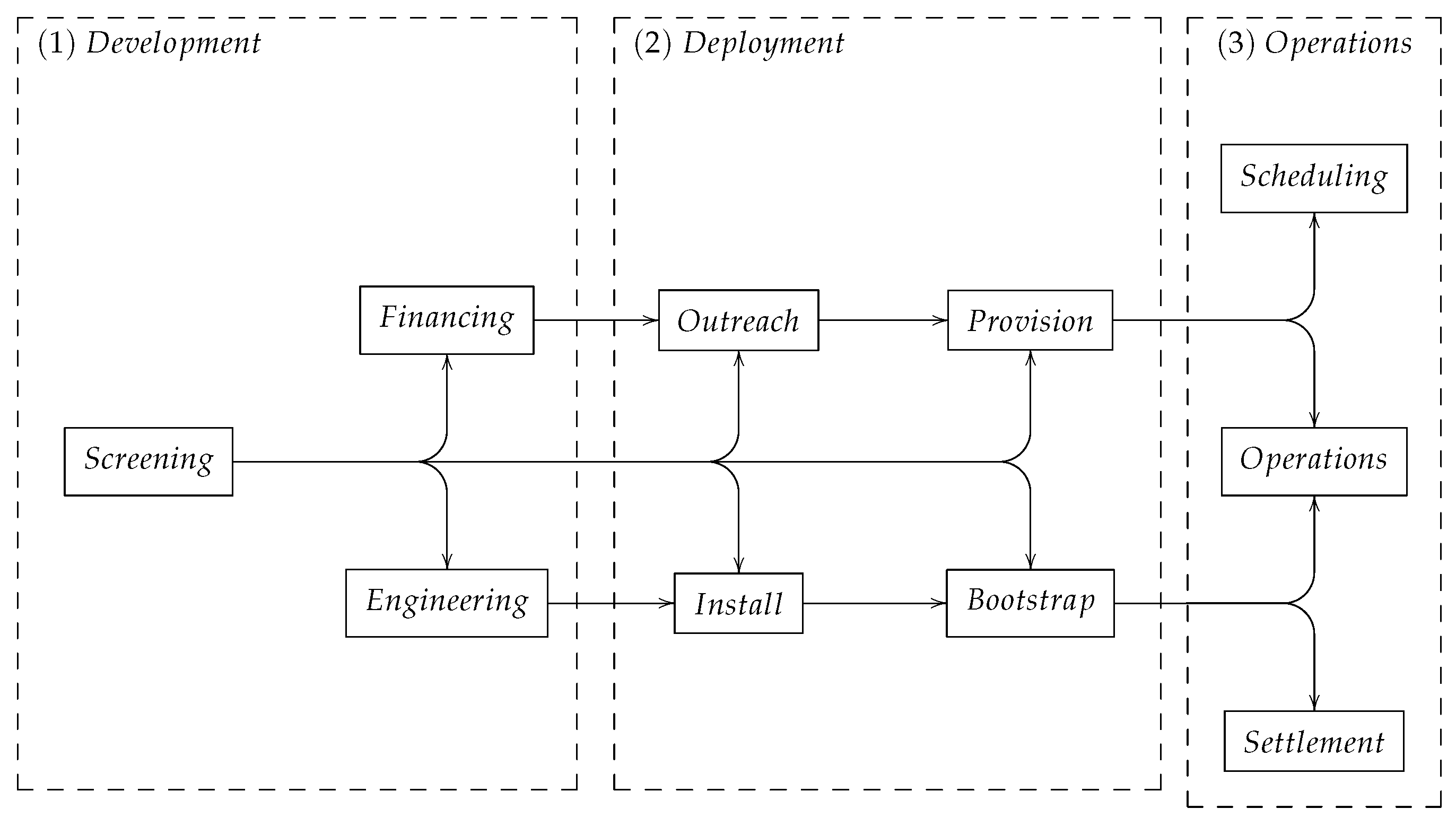

3. TESS Standard Design

3.1. Technical Setup of Market Operations

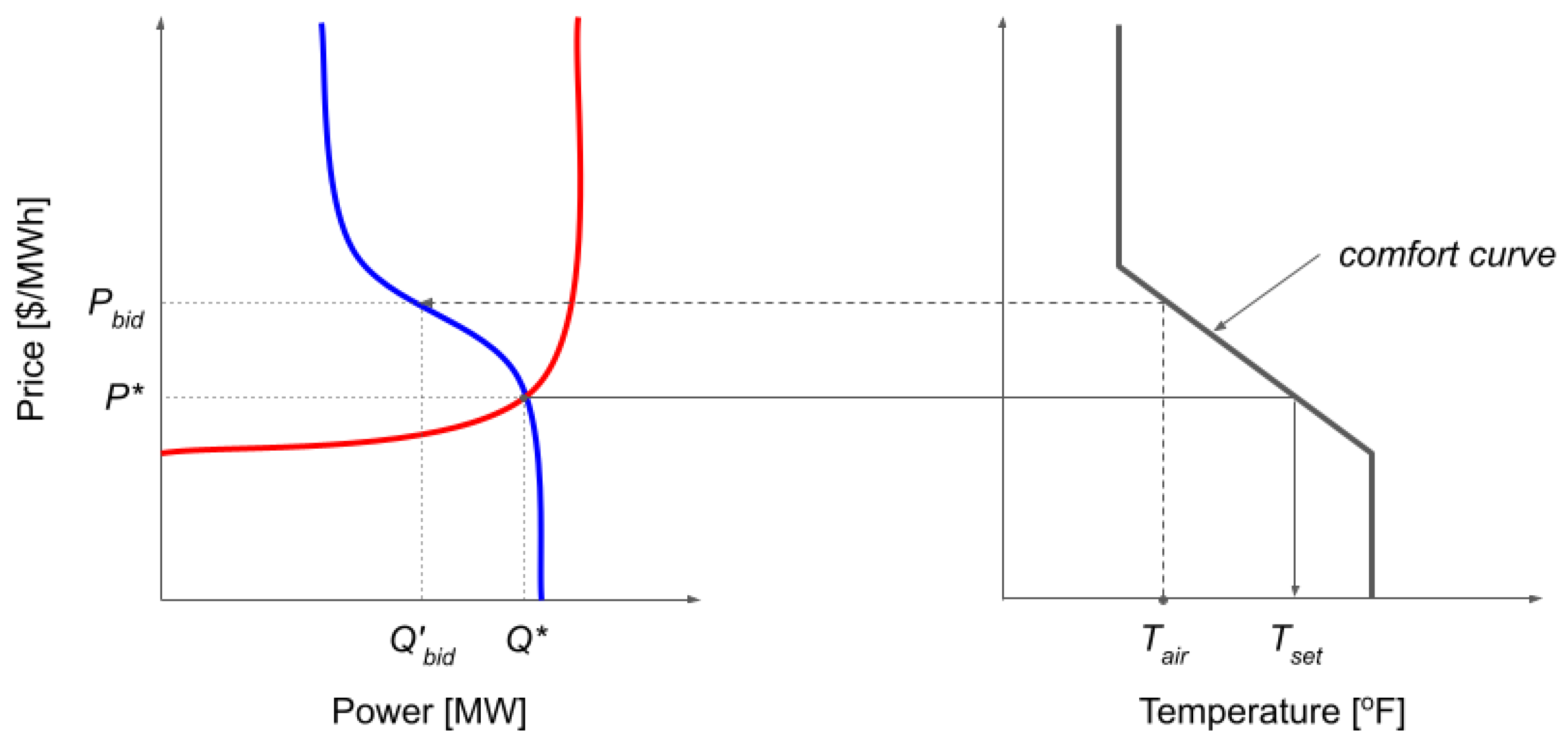

3.2. TESS Design: Price Discovery Mechanisms

3.3. TESS Design: Participating Devices and Bidding Functions

3.4. TESS Design: Settlement Mechanisms

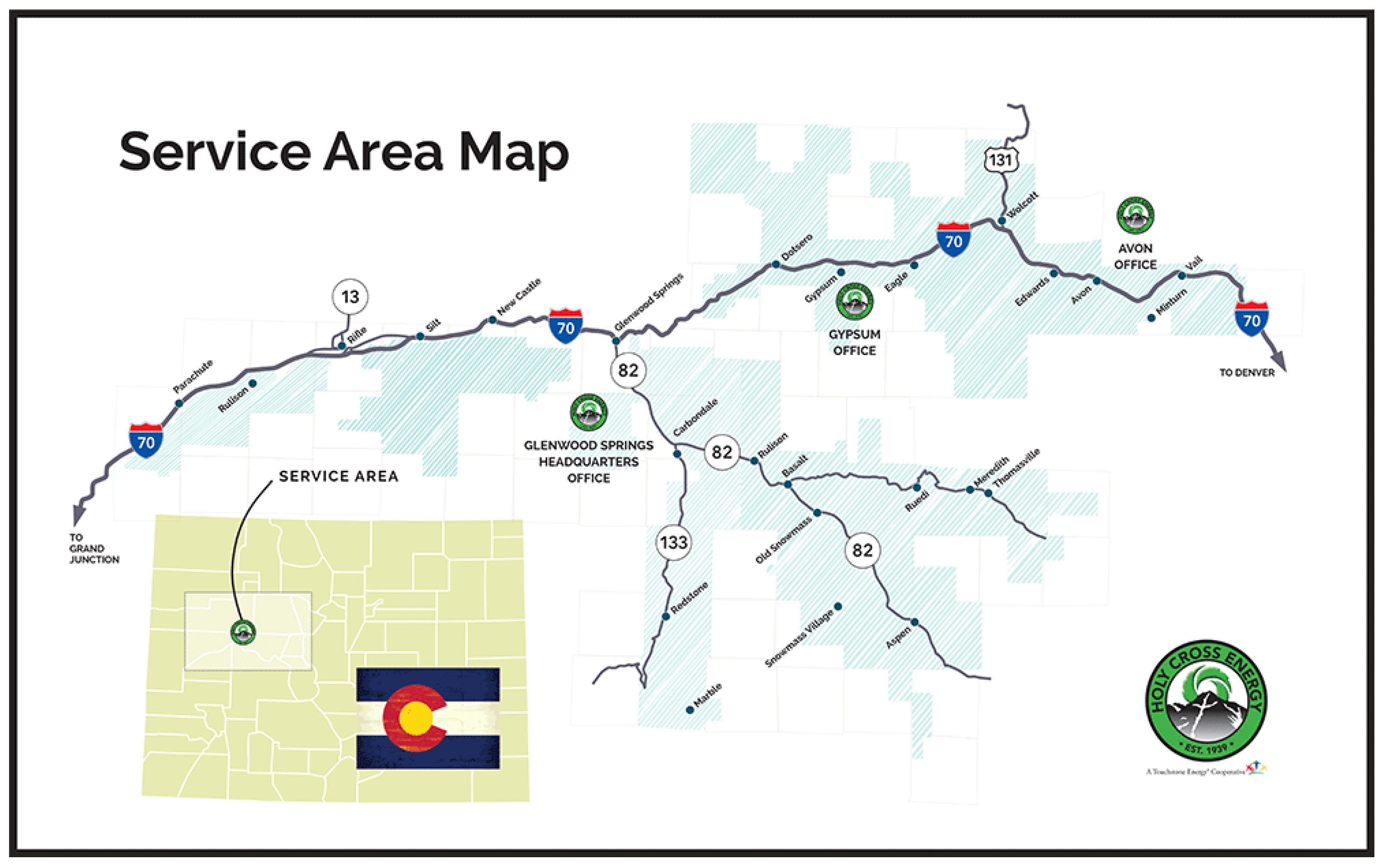

4. The Holy Cross Energy Project

4.1. Holy Cross Energy

4.2. Basalt Vista

4.3. Existing Tariff System

5. Implementation in an Existing Environment

5.1. General Setup

5.2. Positioning TESS in the Current Tariff System

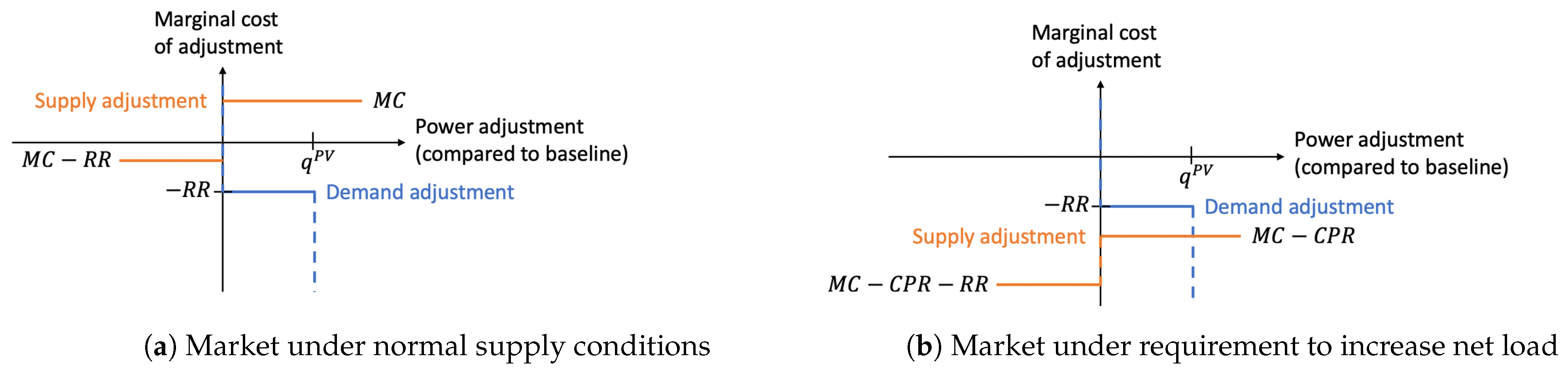

5.3. Designing Bidding Functions in an Existing Tariff Structure

5.4. Settlement in TESS

5.5. Implementation Challenges

5.6. Planned Extensions

6. Conclusions and Future Work

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| CPR | Critical Peak Rate |

| DER | Distributed Energy Resources |

| HCE | Holy Cross Energy |

| HVAC | Heating, Ventilation, and Air Conditioning |

| MW | Megawatt |

| MWh | Megawatt hour |

| NEM | Net Energy Metering |

| PV | Photovoltaics |

| RR | Retail Rate |

| TE | Transactive Energy |

| TESS | Transactive Energy Service System |

| TS | Transactive System |

References

- Katipamula, S.; Chassin, D.P.; Hatley, D.D.; Pratt, R.G.; Hammerstrom, D.J. Transactive Controls: Market-Based GridWise™ Controls for Building Systems; Technical Report; Pacific Northwest National Laboratory: Richland, WA, USA, 2006.

- Hammerstrom, D.J.; Ambrosio, R.; Carlon, T.A.; DeSteese, J.G.; Horst, G.R.; Kajfasz, R.; Kiesling, L.L.; Michie, P.; Pratt, R.G.; Yao, M.; et al. Pacific Northwest GridWise™ Testbed Demonstration Projects; Part I. Olympic Peninsula Project; Technical Report; Pacific Northwest National Lab.(PNNL): Richland, WA, USA, 2008.

- Adhikari, R.; Pipattanasomporn, M.; Kuzlu, M.; Rahman, S. Simulation study of transactive control strategies for residential HVAC systems. In Proceedings of the 2016 IEEE PES Innovative Smart Grid Technologies Conference Europe (ISGT-Europe), Ljubljana, Slovenia, 9–12 October 2016; pp. 1–5. [Google Scholar] [CrossRef]

- Arlt, M.L. Flexible Load for Renewable Energy Economic Approaches to Integrate Flexible Demand in Power Systems. Dissertation, Albert Ludwig University Freiburg, Breisgau, Germany, 2020. Available online: https://freidok.uni-freiburg.de/data/167953 (accessed on 30 June 2021).

- Widergren, S.; Huang, Q.; Kalsi, K.; Lian, J.; Makhmalbaf, A.; Sivaraman, D.; Tang, Y.; Veeramany, A. Transactive Systems Simulation and Valuation Platform Trial Analysis. Pac. Northwest Natl. Lab. Richland Wash. 2017, 4, 1–111. [Google Scholar]

- Li, S.; Lian, J.; Conejo, A.J.; Zhang, W. Transactive Energy Systems: The Market-Based Coordination of Distributed Energy Resources. IEEE Control Syst. Mag. 2020, 40, 26–52. [Google Scholar] [CrossRef]

- Behboodi, S.; Crawford, C.; Djilali, N.; Chassin, D.P. Integration of price-driven demand response using plug-in electric vehicles in smart grids. In Proceedings of the 2016 IEEE Canadian Conference on Electrical and Computer Engineering (CCECE), Vancouver, BC, Canada, 15–18 May 2016; pp. 1–5. [Google Scholar] [CrossRef]

- Behboodi, S.; Chassin, D.P.; Crawford, C.; Djilali, N. Electric Vehicle Participation in Transactive Power Systems Using Real-Time Retail Prices. In Proceedings of the 2016 49th Hawaii International Conference on System Sciences (HICSS), Koloa, HI, USA, 5–8 January 2016; pp. 2400–2407. [Google Scholar] [CrossRef]

- Sajjadi, S.M.; Mandal, P.; Tseng, T.L.B.; Velez-Reyes, M. Transactive energy market in distribution systems: A case study of energy trading between transactive nodes. In Proceedings of the 2016 North American Power Symposium (NAPS), Denver, CO, USA, 18–20 September 2016; pp. 1–6. [Google Scholar] [CrossRef]

- Ableitner, L.; Tiefenbeck, V.; Meeuw, A.; Wörner, A.; Fleisch, E.; Wortmann, F. User behavior in a real-world peer-to-peer electricity market. Appl. Energy 2020, 270, 115061. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Gärttner, J.; Weinhardt, C. Decentralizing energy systems through local energy markets: The LAMP-project. In Proceedings of the MKWI 2018—Multikonferenz Wirtschaftsinformatik, Lüneburg, Germany, 6–9 March 2018; pp. 924–930. [Google Scholar]

- Parandehgheibi, M.; Pourmousavi, S.A.; Nakayama, K.; Sharma, R.K. A two-layer incentive-based controller for aggregating BTM storage devices based on transactive energy framework. In Proceedings of the 2017 IEEE Power & Energy Society General Meeting, Chicago, IL, USA, 16–20 July 2017; pp. 1–5. [Google Scholar] [CrossRef]

- Fuller, J.C.; Schneider, K.P.; Chassin, D. Analysis of Residential Demand Response and double-auction markets. In Proceedings of the 2011 IEEE Power and Energy Society General Meeting, San Diego, CA, USA, 24–28 July 2011; pp. 1–7. [Google Scholar] [CrossRef]

- Widergren, S.; Fuller, J.; Marinovici, C.; Somani, A. Residential transactive control demonstration. In Proceedings of the ISGT 2014, Washington, DC, USA, 19–22 February 2014; pp. 1–5. [Google Scholar] [CrossRef]

- Zhang, C.; Wu, J.; Long, C.; Cheng, M. Review of Existing Peer-to-Peer Energy Trading Projects. Energy Procedia 2017, 105, 2563–2568. [Google Scholar] [CrossRef]

- Sousa, T.; Soares, T.; Pinson, P.; Moret, F.; Baroche, T.; Sorin, E. Peer-to-peer and community-based markets: A comprehensive review. Renew. Sustain. Energy Rev. 2019, 104, 367–378. [Google Scholar] [CrossRef] [Green Version]

- Masiello, R.; Aguero, J.R. Sharing the Ride of Power: Understanding Transactive Energy in the Ecosystem of Energy Economics. IEEE Power Energy Mag. 2016, 14, 70–78. [Google Scholar] [CrossRef]

- Abrishambaf, O.; Lezama, F.; Faria, P.; Vale, Z. Towards transactive energy systems: An analysis on current trends. Energy Strategy Rev. 2019, 26, 100418. [Google Scholar] [CrossRef]

- Katipamula, S.; Corbin, C.D.; Haack, J.N.; Hao, H.; Kim, W.; Hostick, D.J.; Akyol, B.A.; Allwardt, C.H.; Carpenter, B.J.; Huang, S.; et al. Transactive Campus Energy Systems: Final Report; Pacific Northwest National Laboratory Technical Report, Richland WA–26866, 1398229; PNNL: Richland, WA, USA, 2017. [CrossRef]

- Wörner, A.; Ableitner, L.; Meeuw, A.; Wortmann, F.; Tiefenbeck, V. Peer-to-peer energy trading in the real world: Market design and evaluation of the user value proposition. In Proceedings of the 40th International Conference on Information Systems, ICIS 2019, Munich, Germany, 15–18 December 2019. [Google Scholar]

- Mengelkamp, E.; Gärttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing microgrid energy markets: A case study: The Brooklyn Microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Weinhardt, C.; Mengelkamp, E.; Cramer, W.; Hambridge, S.; Hobert, A.; Kremers, E.; Otter, W.; Pinson, P.; Tiefenbeck, V.; Zade, M. How far along are local energy markets in the DACH+ Region? A comparative market engineering approach. In Proceedings of the e-Energy 2019—10th ACM International Conference on Future Energy Systems, Phoenix, AZ, USA, 25–28 June 2019; pp. 544–549. [Google Scholar] [CrossRef]

- Chassin, D.P. Multi-Scale Transactive Control in Interconnected Bulk Power Systems under High Renewable Energy Supply and High Demand Response Scenarios. Ph.D. Dissertation, University of Victoria, Victoria, BC, Canada, 2017. [Google Scholar]

- Kiesling, L.L. An Economic Analysis of U.S. Market Design: Local Energy Markets for Energy and Grid Services. In Local Energy Markets; Pinto, T., Vale, Z., Widergren, S., Eds.; Elsevier: Amsterdam, The Netherlands, 2021. [Google Scholar]

- Kiesling, L.L. Implications of Smart Grid Innovation for Organizational Models in Electricity Distribution. In Wiley Smart Grid Handbook; Liu, C.C.L., McArthur, S., Lee, S.J., Eds.; Wiley Online Library: London, UK, 2016; pp. 1–15. [Google Scholar]

- Friedman, D.; Rust, J. (Eds.) The Double Auction Market. Santa Fe Institute Studies in the Sciences of Complexity; Addison-Wesley: Reading, MA, USA, 1993. [Google Scholar]

- Easley, D.; Ledyard, J.O. Theories of price formation and exchange in double oral auctions. In The Double Auction Market: Institutions, Theories, and Evidence; Friedman, D., Rust, J., Eds.; Addison-Wesley: Reading, MA, USA, 1993. [Google Scholar]

- Widergren, S.; Somani, A.; Subbarao, K.; Marinovici, C.; Fuller, J.; Hammerstrom, J.; Chassin, D.P. AEP Ohio gridSMART® Demonstration Project Real-Time Pricing Demonstration Analysis; Technical Report; Pacific Northwest National Laboratory: Richland, WA, USA, 2014. [Google Scholar]

- CAISO. Four Colorado Utilities to Join the West’s Real-Time Energy Market (21 May 2020); CAISO: Folsom, CA, USA, 2020. [Google Scholar] [CrossRef]

- Holy Cross Energy. CO2 Emission Report; Technical Report; Holy Cross Energy: Glenwood Springs, CO, USA, 2019. [Google Scholar]

- Kroposki, B.; Bernstein, A.; King, J.; Ding, F. Tomorrow’s Power Grid Will Be Autonomous. IEEE Spectr. Available online: https://spectrum.ieee.org/energy/the-smarter-grid/tomorrows-power-grid-will-be-autonomous (accessed on 30 June 2021).

- Holy Cross Energy. Electric Service Tariffs, Rules and Regulations; Technical Report Effective 1 October 2020; Holy Cross Energy: Glenwood Springs, CO, USA, 2020. [Google Scholar]

- Arlt, M.L.; Cezar, G.; Chassin, D.; Rivetta, C.; Schelhas, L. Powernet: Cloud-Based Method to Manage Distributed Energy Resources, CEC-500-2021-030; Technical Report; California Energy Commission: Sacramento, CA, USA, 2021.

- OhmConnect. Available online: https://www.ohmconnect.com (accessed on 13 May 2020).

| References | Limitations |

|---|---|

| [3] | HVAC only; no brownfield bidding; no consistent utility framework |

| [4] | HVAC only; no brownfield bidding |

| [8] | EV only; heuristic bidding function; no brownfield |

| [2] | No brownfield bidding; no consistent utility framework |

| Li et al. [6] | General economic framework of bidding, without specification for devices |

| [9] | No active bidding, but response to real-time price signal; PV only; no brownfield bidding |

| [5] | General economic framework of bidding, without specification for devices |

| Project | References | Limitations |

|---|---|---|

| Olympic Peninsula Project | [1,2] | Closed system; heuristic bidding functions; no brownfield |

| Quartierstrom | [10,20] | Closed system; fixed supply cost; no automated bidding determination |

| LAMP | [21] | Closed system; fixed supply cost; no automated bidding determination |

| Rate | Terms | |

|---|---|---|

| Residential Services | Small Base | Monthly consumer charge $12, energy charge $0.105/kWh |

| Large Base | Monthly consumer charge $28, demand charge $5.32/kW, energy charge $0.077/kWh | |

| Time of Use (TOU) | Monthly consumer charge $12, off-peak energy charge $0.06/kWh, peak energy charge $0.24/kWh (4–9 p.m.) | |

| Net Energy Metering (NEM) | On-premise generation offset at HCE’s retail rate/kWh | |

| Settlement calculated and payment made annually for excess generation at cost | ||

| Distribution Flexibility Pricing | Distribution Flexibility Program (DFP) | Bill credit, amount based on agreed measurement and demand response performance |

| Customer grants DER control to HCE | ||

| HCE receives attributes, e.g., RECs | ||

| Peak Time Rebate Program (PTR) | Bill credit for actual measured reduction | |

| $1/kWh during Critical PTR, $0.50/kWh during High PTR | ||

| DER Service Agreement (DERSA) | HCE pays most of initial DER cost, and recoups that cost through monthly amortized customer payments | |

| Customer grants DER control to HCE | ||

| DER payments are on Net Energy Metering terms | ||

| DERSA customers thus are automatically on DFP |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Arlt, M.-L.; Chassin, D.P.; Kiesling, L.L. Opening Up Transactive Systems: Introducing TESS and Specification in a Field Deployment. Energies 2021, 14, 3970. https://doi.org/10.3390/en14133970

Arlt M-L, Chassin DP, Kiesling LL. Opening Up Transactive Systems: Introducing TESS and Specification in a Field Deployment. Energies. 2021; 14(13):3970. https://doi.org/10.3390/en14133970

Chicago/Turabian StyleArlt, Marie-Louise, David P. Chassin, and L. Lynne Kiesling. 2021. "Opening Up Transactive Systems: Introducing TESS and Specification in a Field Deployment" Energies 14, no. 13: 3970. https://doi.org/10.3390/en14133970

APA StyleArlt, M.-L., Chassin, D. P., & Kiesling, L. L. (2021). Opening Up Transactive Systems: Introducing TESS and Specification in a Field Deployment. Energies, 14(13), 3970. https://doi.org/10.3390/en14133970