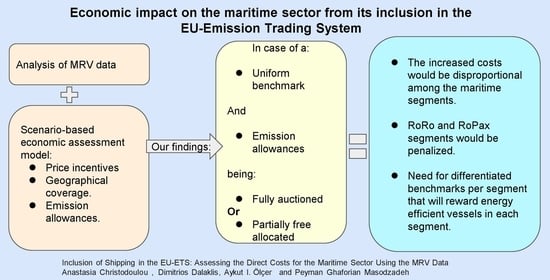

Inclusion of Shipping in the EU-ETS: Assessing the Direct Costs for the Maritime Sector Using the MRV Data

Abstract

:1. Introduction

2. Background

2.1. Market-Based Measures (MBMs) and Abatement of GHG Emissions from Shipping

2.2. Inclusion of Shipping in the EU-ETS

Economic Impact from the Inclusion of Shipping in the EU-ETS

3. Data and Method

4. Results

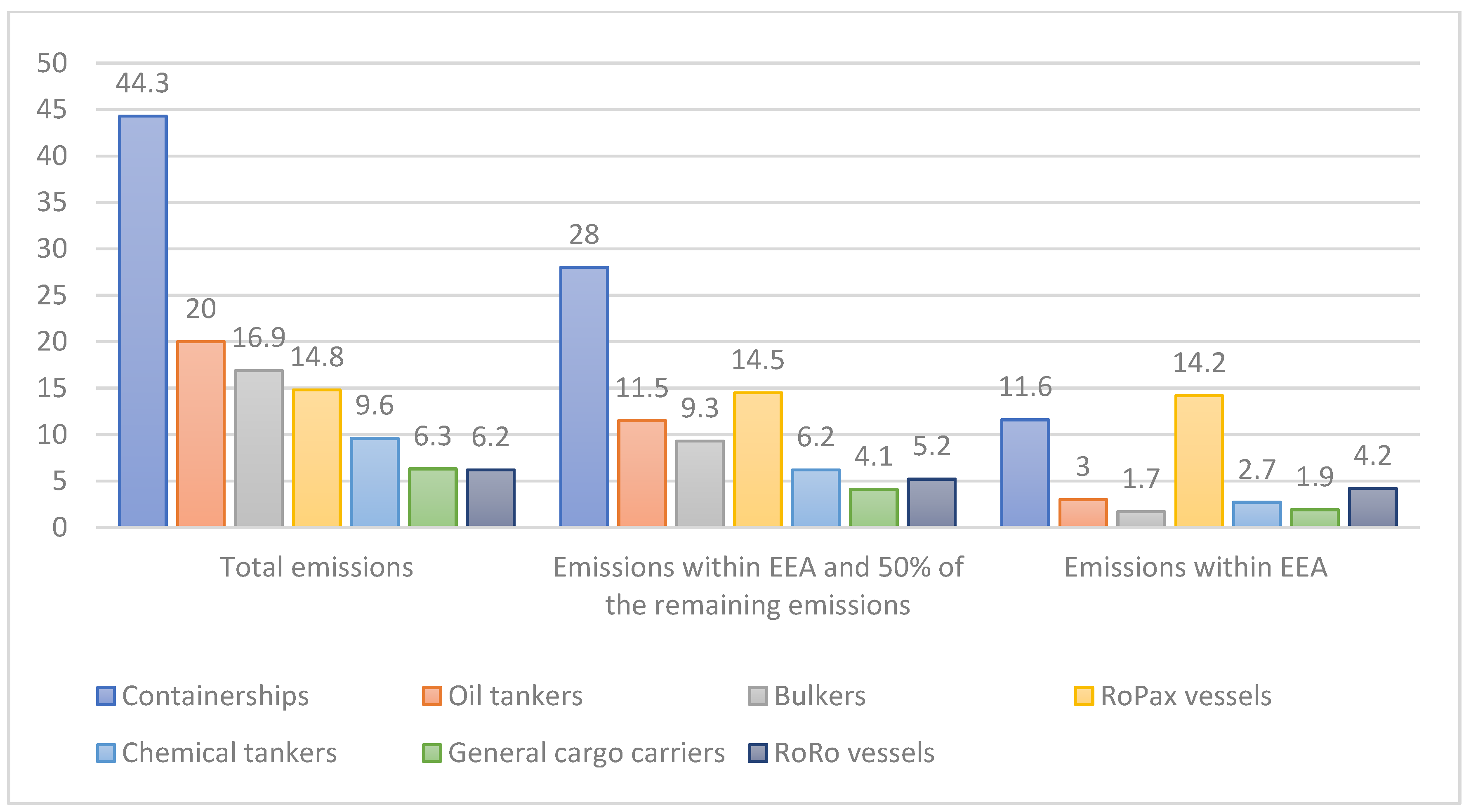

4.1. Analysis of the MRV Data

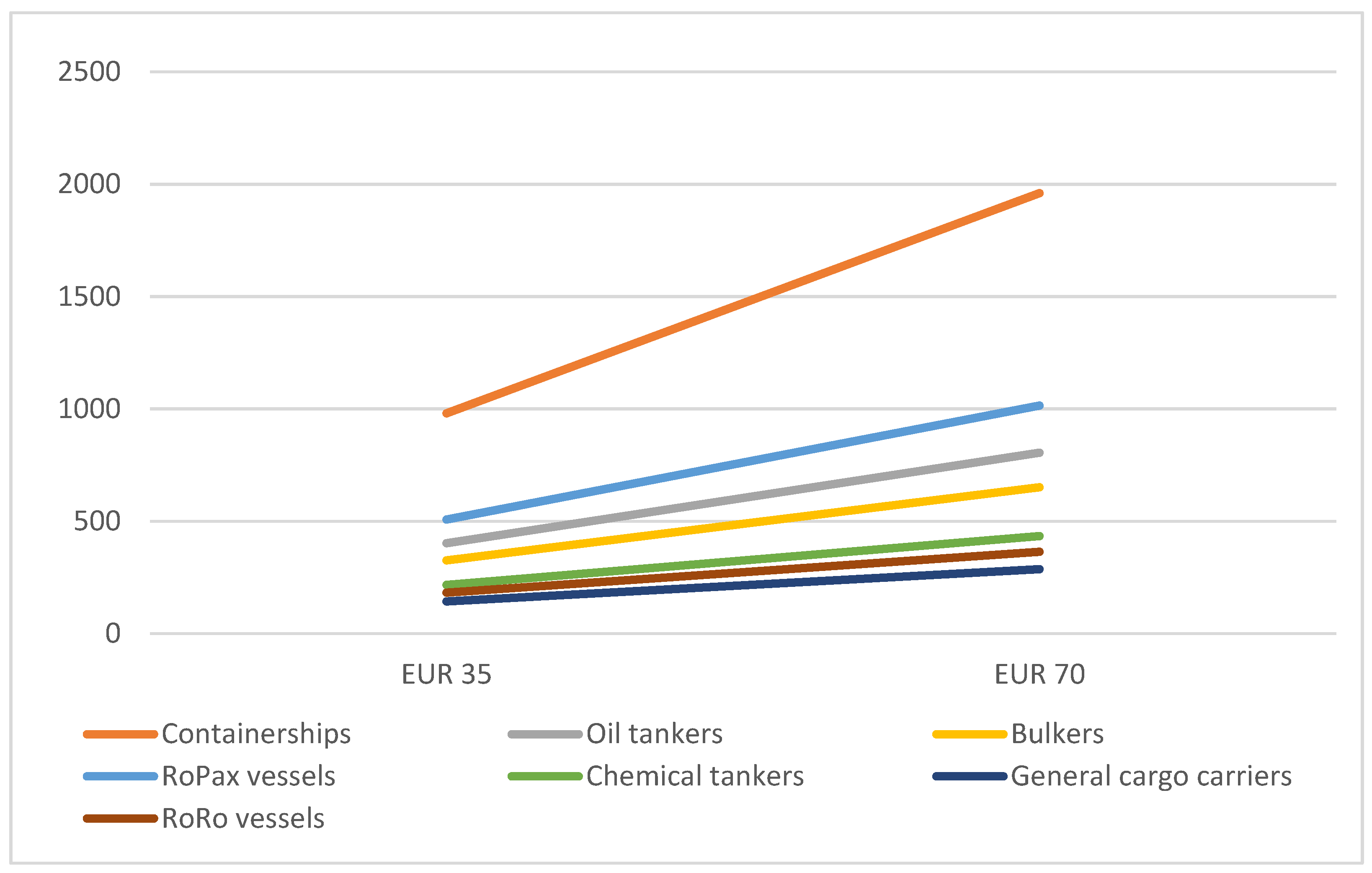

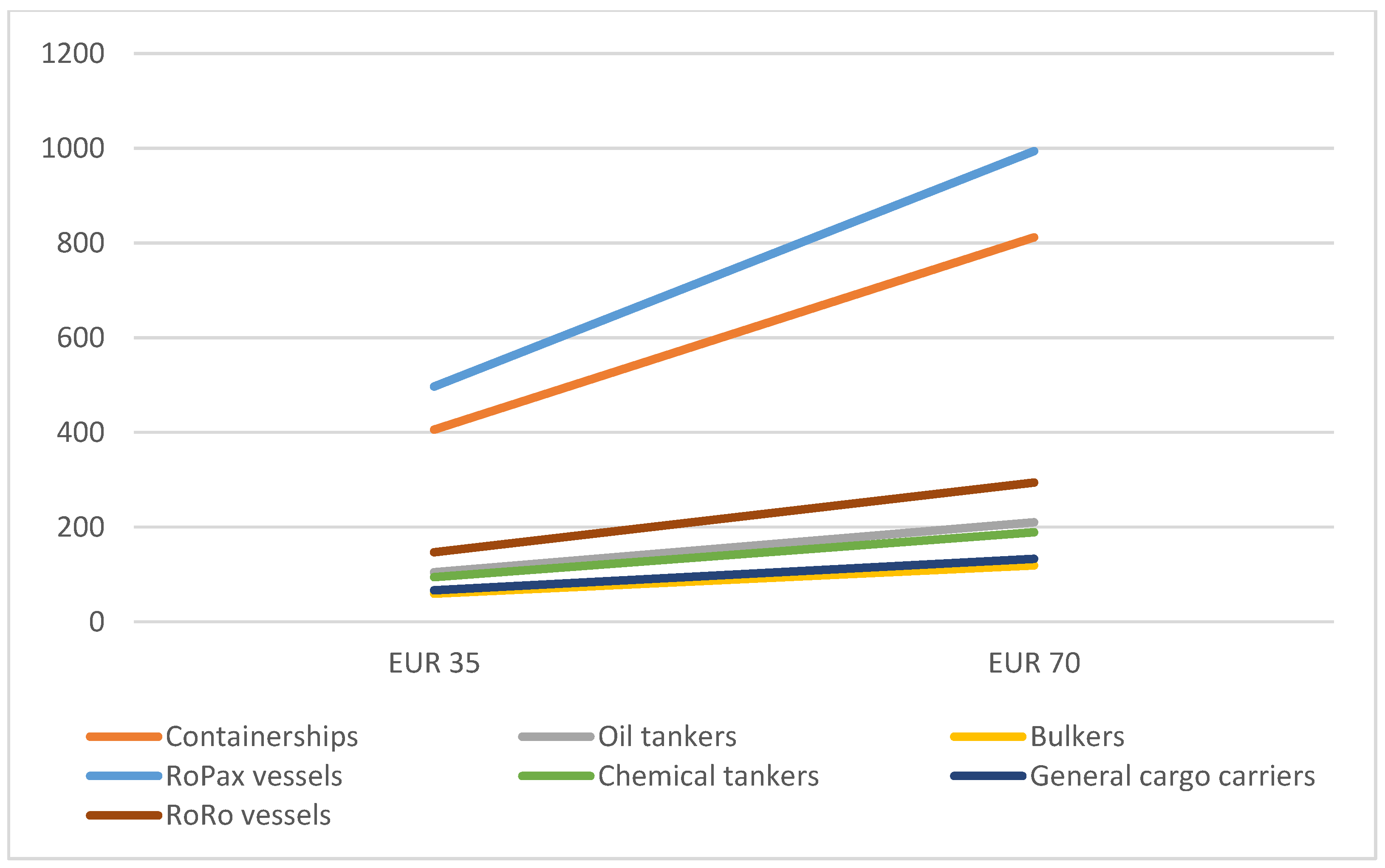

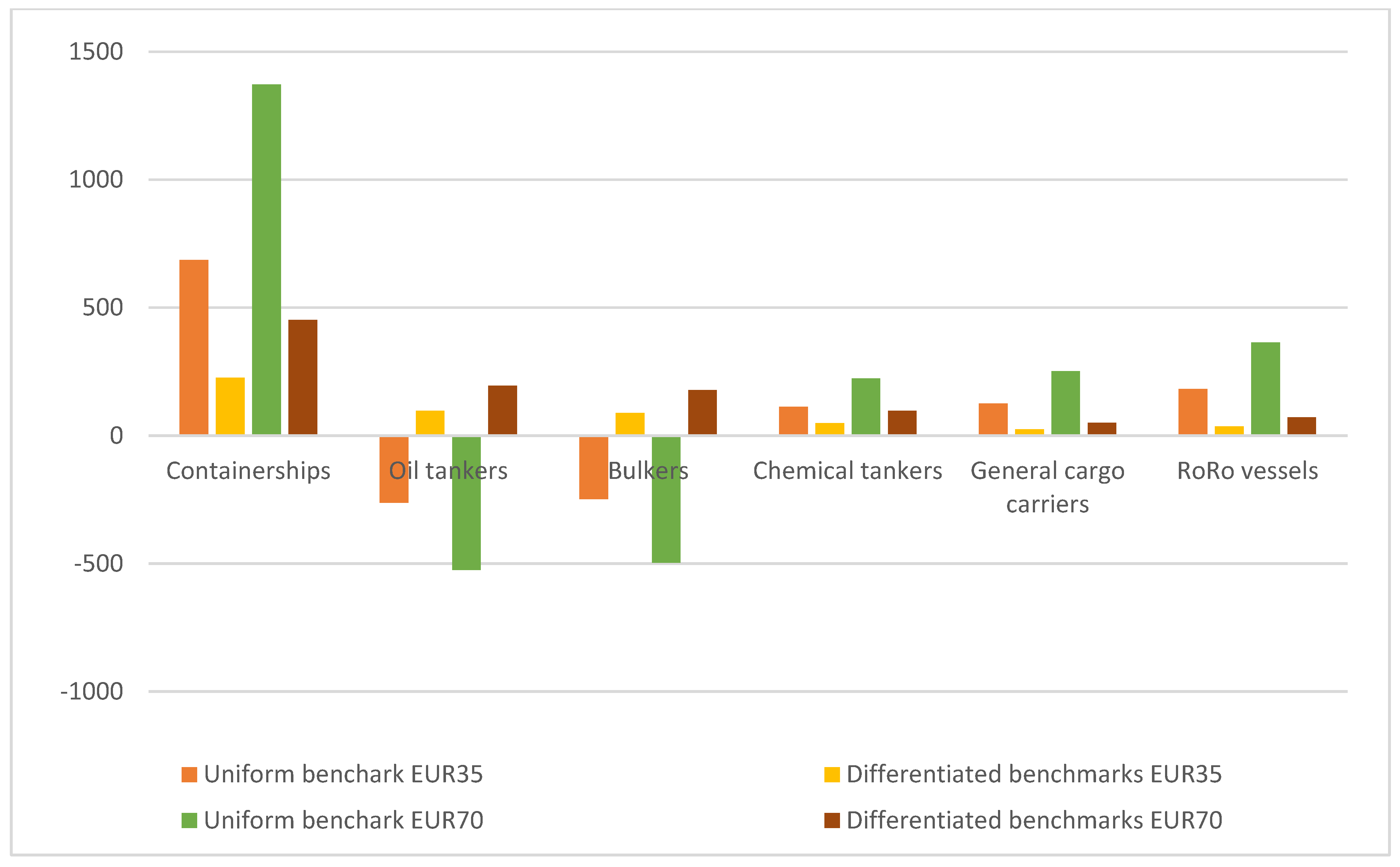

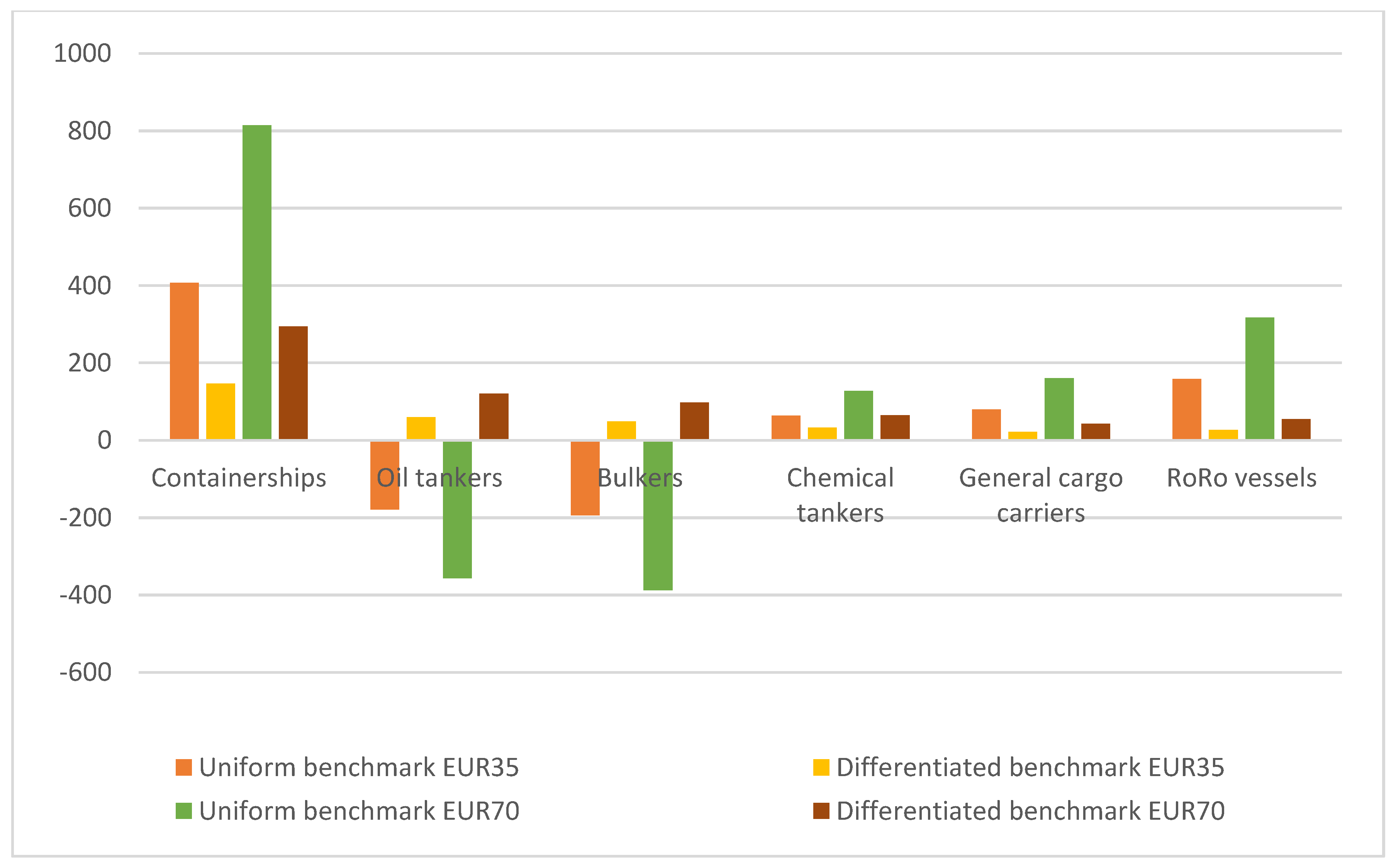

4.2. Economic Impact Assessment for Different Maritime Segments

- Geographical scope of the system. Include (a) only internal EU voyages, (b) all incoming voyages from non-EU to EU ports and outgoing voyages from EU to non-EU ports, (c) all internal EU voyages and 50% of incoming voyages from non-EU to EU ports and outgoing voyages from EU to non-EU ports. All three assumptions are made on the basis of the different geographical scopes considered by the European Commission in its communication, released in 2020, concerning the available policy options to achieve Europe’s 2030 climate ambition on climate neutrality [57].

- Price of emission allowance units. The price of emission allowances has been around EUR 25 during the year 2019 with a sharp drop to 15 EUR on 23 March 2020 due to the Coronavirus crisis and has come up to 35 EUR on 9 January 2021. Given the target of the European Green Deal for net zero emissions in the EU before 2050, the emission allowances price can be expected to increase till 2050 reaching or approaching the cost of carbon capture and storage, somewhere between EUR 60 and 90 per tonne [60]. In this study, we assume two different scenarios of emission allowance price: 35 and 70, considering the short-term horizon of the inclusion of shipping in the EU-ETS.

- Emission allowances allocation method. Two scenarios are analysed in relation to the allocation of emission allowances: (a) full auctioning (100%) and (b) auctioning of 15% of the allowances with 85% free-allocated. The assumptions are based on the previous experience with the inclusion of aviation in the EU-ETS; during the first phase of this inclusion, 82% of the allowances for the aviation sector were free-allocated. Considering, also, the need for urgent action to achieve climate neutrality in Europe and the call of the EC for reduced free-allocated allowances in the EU-ETS, we assume 85% of emission allowances for the maritime sector to be allocated for free during the first phase of this scheme.

5. Discussion

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Smith, T.; Jalkanen, J.; Anderson, B.; Corbett, J.; Faber, J.; Hanayama, S.; O’Keefe, E.; Parker, S.; Johansson, L.; Aldous, L. Third IMO GHG Study 2014; International Maritime Organization (IMO): London, UK, 2014. [Google Scholar]

- Ölçer, A.I.; Kitada, M.; Dalaklis, D.; Ballini, F. (Eds.) Trends and Challenges in Maritime Energy Management; WMU Studies in Maritime Affairs; Springer International Publishing: Cham, Switzerland, 2018; ISBN 978-3-319-74575-6. [Google Scholar]

- Christodoulou, A. Maritime Environmental Performance Indices: Useful Tools for Evaluating Transport Supplier Environmental Performance? In Proceedings of the 27th International Conference on Urban and Maritime Transport and the Environment, Rome, Italy, 19 November 2019; pp. 187–198. [Google Scholar]

- Mepc, R. 2016 Guidelines for the Development of a Ship Energy Efficiency Management Plan (SEEMP); International Maritime Organization (IMO): London, UK, 2012; Volume 2. [Google Scholar]

- Mepc, I.R. 304 Initial IMO Strategy on Reduction of GHG Emissions from Ships; MEPC: London, UK, 2018. [Google Scholar]

- UNFCCC. Adoption of the Paris Agreement’, fccc/cp/2015/L 9; UNFCCC: New York, NY, USA, 2015; Volume 9. [Google Scholar]

- Psaraftis, H.N. Market-Based Measures for Greenhouse Gas Emissions from Ships: A Review. WMU J. Marit. Aff. 2012, 11, 211–232. [Google Scholar] [CrossRef] [Green Version]

- Nikolakaki, G. Economic Incentives for Maritime Shipping Relating to Climate Protection. WMU J. Marit. Aff. 2013, 12, 17–39. [Google Scholar] [CrossRef] [Green Version]

- Bouman, E.A.; Lindstad, E.; Rialland, A.I.; Strømman, A.H. State-of-the-Art Technologies, Measures, and Potential for Reducing GHG Emissions from Shipping—A Review. Transp. Res. Part Transp. Environ. 2017, 52, 408–421. [Google Scholar] [CrossRef]

- Shi, Y. Reducing Greenhouse Gas Emissions from International Shipping: Is It Time to Consider Market-Based Measures? Mar. Policy 2016, 64, 123–134. [Google Scholar] [CrossRef]

- Kosmas, V.; Acciaro, M. Bunker Levy Schemes for Greenhouse Gas (GHG) Emission Reduction in International Shipping. Transp. Res. Part Transp. Environ. 2017, 57, 195–206. [Google Scholar] [CrossRef]

- European Parliament. Directive (EU) 2018/410 of the European Parliament and of the Council of 14 March 2018 Amending Directive 2003/87. EC Enhance Cost Eff. Emiss. Reduct. Low-Carbon Invest. 2018, L76, 3–27. [Google Scholar]

- Economic and Financial Crimes Commission. The European Green Deal; 2019. Available online: https://ec.europa.eu/info/sites/default/files/european-green-deal-communication_en.pdf (accessed on 8 February 2021).

- Egenhofer, C.; Marcu, A.; Georgiev, A. Reviewing the EU ETS Review? CEPS Task Force Rep. 2012, 2012, 37. [Google Scholar]

- Perino, G.; Willner, M. EU-ETS Phase IV: Allowance Prices, Design Choices and the Market Stability Reserve. Clim. Policy 2017, 17, 936–946. [Google Scholar] [CrossRef]

- Sachweh, C.; Larkin, J.; Winkel, R.; Deman, J.; McEwen, B.; Peddie-Burch, C.; Turtle, G.; Williams, K. Maritime Transport Greenhouse Gas Data Collection and Management: MRV Procedures; 2014. Available online: https://ec.europa.eu/clima/sites/clima/files/transport/shipping/docs/maritime_mrav_report_en.pdf (accessed on 8 March 2021).

- Wang, K.; Fu, X.; Luo, M. Modeling the Impacts of Alternative Emission Trading Schemes on International Shipping. Transp. Res. Part Policy Pract. 2015, 77, 35–49. [Google Scholar] [CrossRef] [Green Version]

- Meckling, J.; Hepburn, C. Economic Instruments for Climate Change. Handb. Glob. Clim. Environ. Policy 2013, 468–485. [Google Scholar]

- Mendes, L.M.; Santos, G. Using Economic Instruments to Address Emissions from Air Transport in the European Union. Environ. Plan. A 2008, 40, 189–209. [Google Scholar] [CrossRef]

- Stewart, R.B. Models for Environmental Regulation: Central Planning versus Market-Based Approaches. BC Envtl. Aff. Rev. 1991, 19, 547. [Google Scholar]

- Stavins, R.N. Experience with market-based environmental policy instruments. In Handbook of Environmental Economics; Elsevier: Amsterdam, The Netherlands, 2003; Volume 1, pp. 355–435. ISBN 1574-0099. [Google Scholar]

- Tuladhar, S.D.; Mankowski, S.; Bernstein, P. Interaction Effects of Market-Based and Command-and-Control Policies. Energy J. 2014, 35. [Google Scholar] [CrossRef]

- Tietenberg, T.H. Economic Instruments for Environmental Regulation. Oxf. Rev. Econ. Policy 1990, 6, 17–33. [Google Scholar] [CrossRef]

- Barde, J.-P. Economic Instruments in Environmental Policy: Lessons from the OECD Experience and Their Relevance to Developing Economies; OECD: Paris, France, 1994. [Google Scholar]

- Panaiotov, T. Economic Instruments for Environmental Management and Sustainable Development; UNEP: Nairobi, Kenya, 1994. [Google Scholar]

- Blackman, A.; Harrington, W. The Use of Economic Incentives in Developing Countries: Lessons from International Experience with Industrial Air Pollution. J. Environ. Dev. 2000, 9, 5–44. [Google Scholar] [CrossRef] [Green Version]

- Winebrake, J.J.; Corbett, J.J. Improving the Energy Efficiency and Environmental Performance of Goods Movement. Clim. Transp. Solut. 2010, 13, 145–154. [Google Scholar]

- Christodoulou, A.; Dalaklis, D.; Ölcer, A.; Ballini, F. Can Market-Based Measures Stimulate Investments in Green Technologies for the Abatement of GHG Emissions from Shipping? A Review of Proposed Market-Based Measures. Trans. Marit. Sci. 2021, 10. [Google Scholar] [CrossRef]

- Bullock, S.; Mason, J.; Broderick, J.; Larkin, A. Shipping and the Paris Climate Agreement: A Focus on Committed Emissions. BMC Energy 2020, 2, 5. [Google Scholar] [CrossRef]

- Doelle, M.; Chircop, A. Decarbonizing International Shipping: An Appraisal of the IMO’s Initial Strategy. Rev. Eur. Comp. Int. Environ. Law 2019, 28, 268–277. [Google Scholar] [CrossRef]

- Walsh, C.; Lazarou, N.-J.; Traut, M.; Price, J.; Raucci, C.; Sharmina, M.; Agnolucci, P.; Mander, S.; Gilbert, P.; Anderson, K.; et al. Trade and Trade-Offs: Shipping in Changing Climates. Mar. Policy 2019, 106, 103537. [Google Scholar] [CrossRef]

- Christodoulou, A.; Cullinane, K. Potential for, and Drivers of, Private Voluntary Initiatives for the Decarbonisation of Short Sea Shipping: Evidence from a Swedish Ferry Line. Marit. Econ. Logist. 2020. [Google Scholar] [CrossRef]

- Deling, W.; Yuli, C.; Changhai, H.; Liang, C.; Changyue, W. Study on IMO New Requirement: Ship Fuel Oil Consumption Data Collection and Reporting. Am. J. Water Sci. Eng. 2020, 6, 50. [Google Scholar] [CrossRef]

- Lagouvardou, S.; Psaraftis, H.N.; Zis, T. A Literature Survey on Market-Based Measures for the Decarbonization of Shipping. Sustainability 2020, 12, 3953. [Google Scholar] [CrossRef]

- Psaraftis, H.N. Decarbonization of Maritime Transport: To Be or Not to Be? Marit. Econ. Logist. 2018, 1–19. [Google Scholar] [CrossRef]

- Karim, S. Marked-Based Measures for Reduction of GHG Emissions from International Shipping. In Proceedings of the 12th IUCN Academy of Environmental Law Annual Colloquium, Tarragona, Spain, 30 June 2014. [Google Scholar]

- Miola, A.; Marra, M.; Ciuffo, B. Designing a Climate Change Policy for the International Maritime Transport Sector: Market-Based Measures and Technological Options for Global and Regional Policy Actions. Energy Policy 2011, 39, 5490–5498. [Google Scholar] [CrossRef]

- Antrim, L.N. The United Nations Conference on Environment and Development. In The Diplomatic Record 1992–1993; Goodman, A.E., Ed.; Routledge: London, UK, 2019; pp. 189–210. ISBN 978-0-429-31008-9. [Google Scholar]

- Kågeson, P.; Bahlke, C.; Hader, A.; Hübscher, A. Market Based Instruments for Abatement of Emissions from Shipping; Federal Environment Agency: Dessau-Roßlau, Germany, 2008; p. 119. [Google Scholar]

- Christodoulou, A.; Gonzalez-Aregall, M.; Linde, T.; Vierth, I.; Cullinane, K. Targeting the Reduction of Shipping Emissions to Air: A Global Review and Taxonomy of Policies, Incentives and Measures. Marit. Bus. Rev. 2019, 4, 16–30. [Google Scholar] [CrossRef]

- Nikopoulou, Z.; Cullinane, K.; Jensen, A. The Role of a Cap-and-Trade Market in Reducing NOx and SOx Emissions: Prospects and Benefits for Ships within the Northern European ECA. Proc. Inst. Mech. Eng. Part M J. Eng. Marit. Environ. 2013, 227, 136–154. [Google Scholar] [CrossRef]

- Baeuerle, T.; Graichen, J.; Meyer, K.; Seum, S.; Kulessa, M.; Oschinski, M. Integration of Marine Transport into the European Emissions Trading System. Environmental, Economic and Legal Analysis of Different Options; Federal Environment Agency: Dessau-Roßlau, Germany, 2010. [Google Scholar]

- Convery, F.J. Origins and Development of the EU ETS. Environ. Resour. Econ. 2009, 43, 391–412. [Google Scholar] [CrossRef]

- European Parliament. Directive 2008/101/EC of the European Parliament and of the Council of 19 November 2008 Amending Directive 2003/87/EC so as to Include Aviation Activities in the Scheme for Greenhouse Gas Emission Allowance Trading within the Community (Text with EEA Relevance); European Parliament: Brussels, Belgium, 2009. [Google Scholar]

- Meleo, L.; Nava, C.R.; Pozzi, C. Aviation and the Costs of the European Emission Trading Scheme: The Case of Italy. Energy Policy 2016, 88, 138–147. [Google Scholar] [CrossRef]

- Faber, J.; Markowska, A.; Nelissen, D.; Davidson, M.; Eyring, V.; Cionni, I.; Selstad, E.; Kågeson, P.; Lee, D.; Buhaug, Ø.; et al. Technical Support for European Action to Reducing Greenhouse Gas Emissions from International Maritime Transport; CE Delft: Delft, The Netherlands, 2009. [Google Scholar]

- Eide, M.S.; Chryssakis, C.; Endresen, Ø. CO2 Abatement Potential towards 2050 for Shipping, Including Alternative Fuels. Carbon Manag. 2013, 4, 275–289. [Google Scholar] [CrossRef]

- Buhaug, Ø.; Endresen, Ø.C.; Eyring, V.; Faber, J.; Hanayama, S.; Lee, D.S.; Lee, D.; Lindstad, H.; Markowska, A.Z. Second IMO GHG Study 2009. Available online: http://www.imo.org/ (accessed on 9 February 2021).

- Hermeling, C.; Klement, J.H.; Koesler, S.; Köhler, J.; Klement, D. Sailing into a Dilemma: An Economic and Legal Analysis of an EU Trading Scheme for Maritime Emissions. Transp. Res. Part Policy Pract. 2015, 78, 34–53. [Google Scholar] [CrossRef]

- Transport & Environment. Cost-benefit Analysis of policy evasion under a future maritime ETS. 2021. Available online: https://www.transportenvironment.org/sites/te/files/publications/ETS_shipping_study.pdf (accessed on 20 March 2021).

- Faber, J.; Markowska, A.; Eyring, V.; Cionni, I.; Selstad, E. A Global Maritime Emissions Trading System. In Design and Impacts on the Shipping Sector, Countries and Regions; CE Delft: Delft, The Netherlands, 2010. [Google Scholar]

- Real Time Awareness for MRV Data. Available online: https://www.springerprofessional.de/en/real-time-awareness-for-mrv-data/15737302 (accessed on 18 June 2021).

- European Parliament. Regulation (EU) 2015/757 of the European Parliament and of the Council of 29 April 2015 on the Monitoring, Reporting and Verification of Carbon Dioxide Emissions from Maritime Transport, and Amending Directive 2009/16/EC (Text with EEA Relevance); European Parliament: Brussels, Belgium, 2015; Volume 123. [Google Scholar]

- Wickham, H.; Averick, M.; Bryan, J.; Chang, W.; McGowan, L.D.; François, R.; Grolemund, G.; Hayes, A.; Henry, L.; Hester, J.; et al. Welcome to the Tidyverse. J. Open Source Softw. 2019, 4, 1686. [Google Scholar] [CrossRef]

- R Core Team (2020)—European Environment Agency. Available online: https://www.eea.europa.eu/data-and-maps/indicators/oxygen-consuming-substances-in-rivers/r-development-core-team-2006 (accessed on 31 May 2021).

- Saltelli, A. (Ed.) Sensitivity Analysis in Practice: A Guide to Assessing Scientific Models; Wiley: Hoboken, NJ, USA, 2004; ISBN 978-0-470-87093-8. [Google Scholar]

- EUR-Lex—52020DC0562—EN—EUR-Lex. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52020DC0562 (accessed on 9 February 2021).

- Christodoulou, A.; Kappelin, H. Determinant Factors for the Development of Maritime Supply Chains: The Case of the Swedish Forest Industry. Case Stud. Transp. Policy 2020, 8, 711–720. [Google Scholar] [CrossRef]

- Christodoulou, A.; Woxenius, J. Sustainable Short Sea Shipping. Sustainability 2019, 11, 2847. [Google Scholar] [CrossRef] [Green Version]

- Naucler, T.; Campbell, W.; Ruijs, J. Carbon Capture and Storage: Assessing the Economics; McKinsey & Company, Climate Change Special Initiative: New York, NY, USA, 2008. [Google Scholar]

- Eide, M.S.; Longva, T.; Hoffmann, P.; Endresen, Ø.; Dalsøren, S.B. Future Cost Scenarios for Reduction of Ship CO2 Emissions. Marit. Policy Manag. 2011, 38, 11–37. [Google Scholar] [CrossRef]

| Emission Allowance Unit Price | Scenario A | Scenario B | Scenario C |

|---|---|---|---|

| EUR 35 | 5075 | 1680 | 3381 |

| EUR 70 | 10,150 | 3360 | 6762 |

| Ship Type | Total Emissions | Free- Allocated Emissions (Uniform Benchmark) | Free- Allocated Emissions (Differentiated Benchmarks) |

|---|---|---|---|

| Containerships | 44.3 | 24.7 | 37.8 |

| Oil tankers | 20 | 27.5 | 17.2 |

| Bulkers | 16.9 | 25.7 | 14.4 |

| Chemical tankers | 9.6 | 6.5 | 7.8 |

| General cargo carriers | 6.4 | 2.7 | 5.4 |

| RoRo vessels | 6.2 | 0.8 | 4.9 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Christodoulou, A.; Dalaklis, D.; Ölçer, A.I.; Ghaforian Masodzadeh, P. Inclusion of Shipping in the EU-ETS: Assessing the Direct Costs for the Maritime Sector Using the MRV Data. Energies 2021, 14, 3915. https://doi.org/10.3390/en14133915

Christodoulou A, Dalaklis D, Ölçer AI, Ghaforian Masodzadeh P. Inclusion of Shipping in the EU-ETS: Assessing the Direct Costs for the Maritime Sector Using the MRV Data. Energies. 2021; 14(13):3915. https://doi.org/10.3390/en14133915

Chicago/Turabian StyleChristodoulou, Anastasia, Dimitrios Dalaklis, Aykut I. Ölçer, and Peyman Ghaforian Masodzadeh. 2021. "Inclusion of Shipping in the EU-ETS: Assessing the Direct Costs for the Maritime Sector Using the MRV Data" Energies 14, no. 13: 3915. https://doi.org/10.3390/en14133915

APA StyleChristodoulou, A., Dalaklis, D., Ölçer, A. I., & Ghaforian Masodzadeh, P. (2021). Inclusion of Shipping in the EU-ETS: Assessing the Direct Costs for the Maritime Sector Using the MRV Data. Energies, 14(13), 3915. https://doi.org/10.3390/en14133915