Coal Pricing in China: Is It a Bit Too Crude?

Abstract

:1. Introduction

- We model a previously unexplored (trivariate) relationship between coal, methanol and crude oil prices in China. To our knowledge, this is the first paper that explicitly analyzes these prices in a time-series modelling framework. By doing so, we are able to establish the empirical robustness of the relations, and importantly, the role of methanol in passing through the oil price uncertainty to coal price formation.

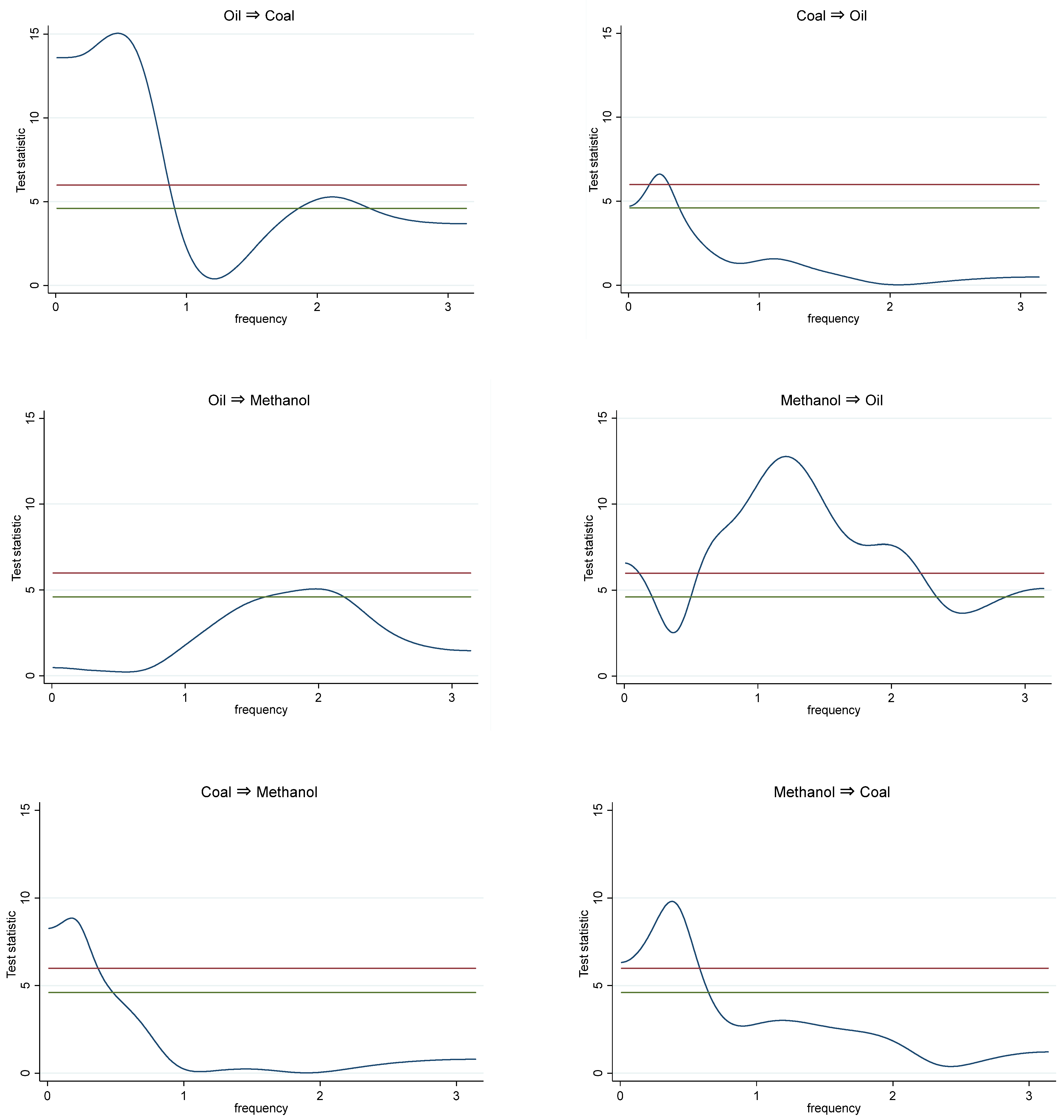

- In keeping with previous literature, we adopt conventional cointegration and Granger causality methods to gain an initial understanding on the general relationships. To ensure that our results reflect recent advances in econometric techniques we also apply frequency domain-based Granger causality tests as proposed by Breitung and Candelon [25] to elaborate more detail on the causal relationships. By testing causality in the frequency domain, we can more clearly position the nature of causal influences between the prices in our tri-variate system and offer a richer account of how rapidly shocks propagate through the system.

- The results of this paper help uncover questions of potential regulatory importance that have emerged only in the most recent phase of coal price determination. To be more specific, our analysis verifies that coal pricing is not immune to methanol price shocks, which can in turn be driven by oil price shocks. Since much of coal consumption in China is to support electric power generation, this gives rise to a possible channel through which domestic electric prices are tainted by international oil price movements.

- The results of this paper help guide future efforts in the energy price modelling, both in the Chinese context and globally. More specifically, we add to the growing evidence base that energy markets embed increasingly connected and complex relations that benefit in analysis, from the application of leading-edge econometric techniques. Traditional vector auto-regressive (VAR) modeling would give an incomplete characterization of the relation between variables in our system. Conversely, by using frequency domain-based tests we obtain incrementally important insights that would otherwise not be available to us.

2. Materials and Methods

2.1. Unit Root Test

2.2. Cointegration Analysis

2.3. Granger Causality

2.4. Data

3. Results

3.1. Unit Root and Cointegration

3.2. Granger Causality

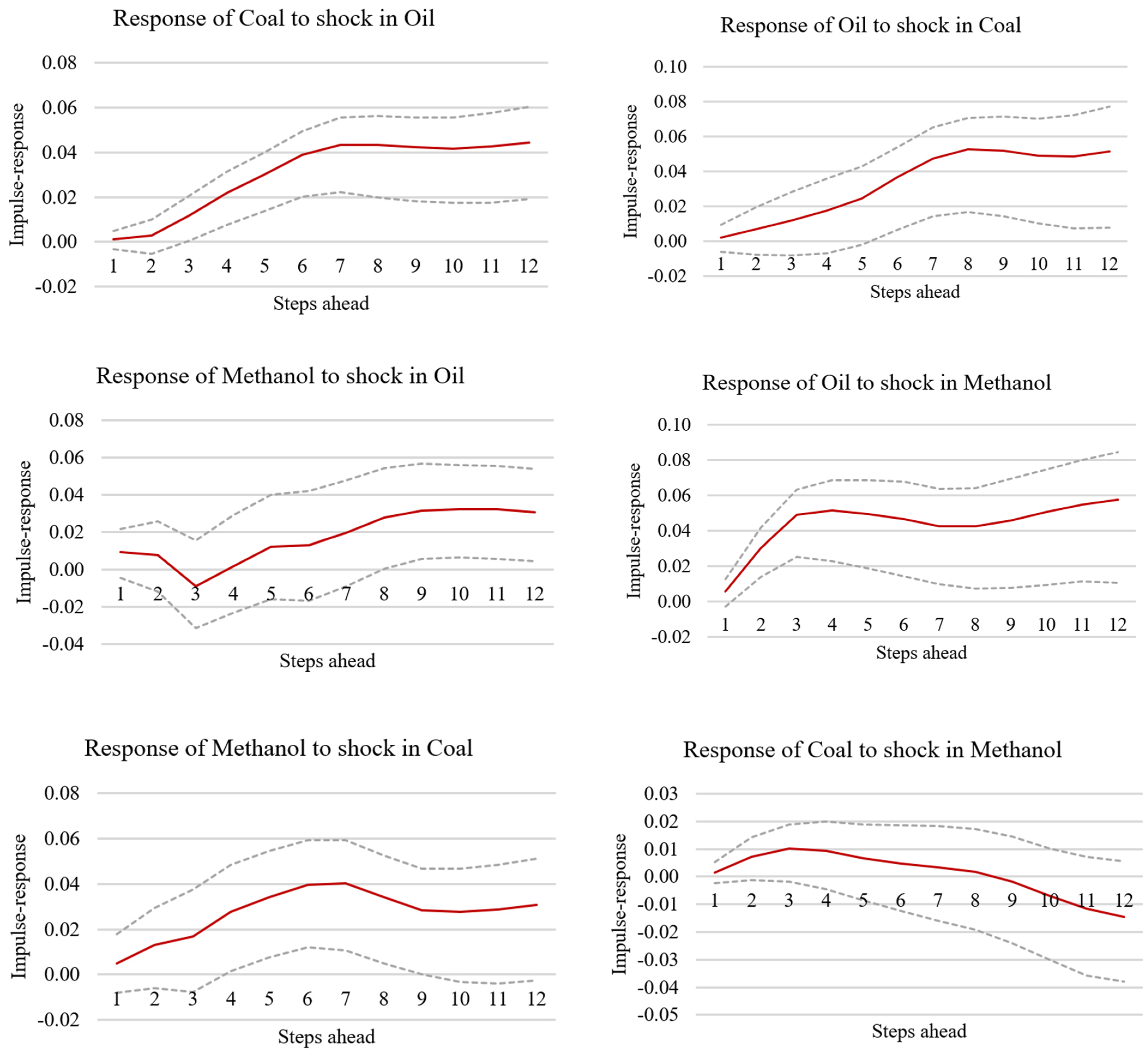

3.3. Generalized Impulse-Response Functions

4. Policy Implications and Future Research

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- IEA. World Energy Outlook 2019; International Energy Agency: Paris, France, 2019. [Google Scholar]

- Yang, C.J.; Xuan, C.W.; Jackson, R.B. China’s coal price disturbances: Observations, explanations, and implications for global energy economies. Energy Policy 2012, 51, 720–727. [Google Scholar] [CrossRef]

- Meng, T.; Huo, X.F. Study on the factors affecting international coal price. Price Theory Pract. 2008, 5, 55–56. (In Chinese) [Google Scholar]

- Cao, C.F. Empirical study on changing tendency and influencing factors of coal price in China. Master’s Thesis, Xi’an University of Science and Technology, Xi’an, China, 2010. (In Chinese). [Google Scholar]

- Hao, X.; Song, M.; Feng, Y.; Zhang, W. De-Capacity Policy Effect on China’s Coal Industry. Energies 2019, 12, 2331. [Google Scholar] [CrossRef] [Green Version]

- BP. World Energy Statistics 2019; BP: London, UK, 2019. [Google Scholar]

- Warell, L. Market Integration in the International Coal Industry: A Cointegration Approach. Energy J. 2006, 27, 99–118. [Google Scholar] [CrossRef] [Green Version]

- Li, R.; Joyeux, R.; Ripple, R.D. International steam coal market integration. Energy J. 2010, 31, 181–202. [Google Scholar] [CrossRef] [Green Version]

- IEA. Medium-Term Coal Market Report 2016; International Energy Agency: Paris, France, 2016. [Google Scholar]

- Park, C.; Chung, M.; Lee, S. The effects of oil price on regional economies with different production structures: A case study from Korea using a structural VAR model. Energy Policy 2011, 39, 8185–8195. [Google Scholar] [CrossRef]

- Masih, R.; Peters, S.; De Mello, L. Oil price volatility and stock price fluctuations in an emerging market: Evidence from South Korea. Energy Econ. 2011, 33, 975–986. [Google Scholar] [CrossRef]

- He, Y.N.; Wang, S.Y.; Lai, K.K. Global economic activity and crude oil prices: A cointegration analysis. Energy Econ. 2011, 32, 868–876. [Google Scholar] [CrossRef]

- Zhang, Y.J.; Wei, Y.M. The crude oil market and the gold market: Evidence for cointegration causality and price discovery. Resour. Policy 2010, 35, 168–177. [Google Scholar] [CrossRef]

- Esmaeili, A.; Shokoohi, Z. Assessing the effect of oil price on world food prices: Application of principal component analysis. Energy Policy 2011, 39, 1022–1025. [Google Scholar] [CrossRef]

- Nazlioglu, S.; Soytas, U. Oil price, agricultural commodity prices, and the dollar: A panel cointegration and causality analysis. Energy Econ. 2012, 34, 1098–1104. [Google Scholar] [CrossRef]

- Zamani, N. The Relationship between Crude Oil and Coal Markets: A New Approach. Int. J. Energy Econ. Policy 2016, 6, 801–805. [Google Scholar]

- Bachmeier, L.J.; Griffin, J.M. Testing for Market Integration Crude Oil, Coal, and Natural Gas. Energy J. 2006, 27, 55–72. [Google Scholar] [CrossRef]

- He, W.; Lu, X.S. Study on the relationship between coal and crude oil prices. Energy Tech. Manag. 2011, 5, 16–27. (In Chinese) [Google Scholar]

- Mjelde, J.W.; Bessler, D.A. Market integration among electricity markets and their major fuel source markets. Energy Econ. 2009, 31, 482–491. [Google Scholar] [CrossRef]

- Jiao, J.L.; Fan, Y.; Wei, Y.M. The structural break and elasticity of coal demand in China: Empirical findings from 1980–2006. Int. J. Glob. Energy Issues 2009, 31, 331–344. [Google Scholar] [CrossRef]

- Joets, M.; Mignon, V. On the link between forward energy prices: A nonlinear panel cointegration approach. Energy Econ. 2012, 34, 1170–1175. [Google Scholar] [CrossRef] [Green Version]

- Mohammadi, H. Electricity prices and fuel costs: Long-run relations and short-run dynamics. Energy Econ. 2009, 31, 503–509. [Google Scholar] [CrossRef]

- Mohammadi, H. Long-run relations and short-run dynamics among coal, natural gas and oil prices. Appl. Econ. 2011, 43, 129–137. [Google Scholar] [CrossRef]

- Huang, H.; Fletcher, J.J.; Sun, Q. Modeling the impact of coal-to-liquids technologies on China’s energy markets. J. Chin. Econ. Foreign Trade Stud. 2008, 1, 162–177. [Google Scholar] [CrossRef]

- Breitung, J.; Candelon, B. Testing for short- and long-run causality: A frequency-domain approach. J. Econom. 2006, 132, 363–378. [Google Scholar] [CrossRef]

- Elliott, G.; Rothenberg, T.J.; Stock, J.H. Efficient tests for an autoregressive unit root. Econometrica 1996, 64, 813–836. [Google Scholar] [CrossRef] [Green Version]

- Perron, P.; Qu, Z. A simple modification to improve the finite sample properties of Ng and Perron’s unit root tests. Econ. Lett. 2007, 94, 12–19. [Google Scholar] [CrossRef]

- Kwiatkowski, D.; Phillips, P.C.B.; Schmidt, P.; Shin, Y. Testing the null of stationarity against the alternative of a unit root: How sure are we that economic time series have a unit root? J. Econom. 1992, 54, 159–178. [Google Scholar] [CrossRef]

- Johansen, S. Likelihood-Based Inference in Cointegrated Vector Autoregressive Models; Oxford University Press: Oxford, UK, 1995. [Google Scholar]

- Gonzalo, J.; Pitarakis, J.-Y. Specification via model selection in vector error correction models. Econ. Lett. 1998, 60, 321–328. [Google Scholar] [CrossRef] [Green Version]

- Aznar, A.; Salvador, M. Selecting the rank of the cointegration space and the form of the intercept using an information criterion. Econom. Theory 2002, 18, 926–947. [Google Scholar] [CrossRef]

- Toda, H.Y.; Yamamoto, T. Statistical inference in vector autoregressions with possibly integrated processes. J. Econom. 1995, 66, 225–250. [Google Scholar] [CrossRef]

- Dolado, J.J.; Lutkepohl, H. Making Wald tests work for cointegrated VAR systems. Econom. Rev. 1996, 15, 369–386. [Google Scholar] [CrossRef]

- Geweke, J. Measurement of linear dependence and feedback between multiple time series. J. Am. Stat. Assoc. 1982, 77, 304–313. [Google Scholar] [CrossRef]

- Hosoya, Y. The decomposition and measurement of interdependency between second-order stationary process. Probab. Theory Relat. Fields 1991, 88, 429–444. [Google Scholar] [CrossRef]

- Ciner, C. Oil and stock returns: Frequency domain evidence . J. Int. Financ. Mark. Inst. Money 2013, 23, 1–11. [Google Scholar] [CrossRef]

- Wei, Y.; Guo, X. An empirical analysis of the relationship between oil prices and the Chinese macro-economy. Energy Econ. 2016, 56, 88–100. [Google Scholar] [CrossRef]

- Ahmed, M.; Azam, M. Causal nexus between energy consumption and economic growth for high, middle and low income countries using frequency domain analysis. Renew. Sustain. Energy Rev. 2016, 60, 653–678. [Google Scholar] [CrossRef]

- Batten, J.A.; Ciner, C.; Lucey, B.M. The dynamic linkages between crude oil and natural gas markets. Energy Econ. 2017, 62, 155–170. [Google Scholar] [CrossRef]

- Aydin, M. Natural gas consumption and economic growth nexus for top 10 natural Gas–Consuming countries: A granger causality analysis in the frequency domain. Energy 2018, 165, 179–186. [Google Scholar] [CrossRef]

- Gorus, M.S.; Aydin, M. The relationship between energy consumption, economic growth, and CO2 emission in MENA countries: Causality analysis in the frequency domain. Energy 2019, 168, 815–822. [Google Scholar] [CrossRef]

- Lemmens, A.; Croux, C.; Dekimpe, M.G. Measuring and testing Granger causality over the spectrum: An application to European production expectation surveys. Int. J. Forecast. 2008, 24, 414–431. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y. Generalized impulse response analysis in linear multivariate models. Econ. Lett. 1998, 58, 17–29. [Google Scholar] [CrossRef]

| Authors | Geographic Coverage | Period | Frequency | Variables | Conclusion |

|---|---|---|---|---|---|

| Bachmeier and Griffin [17] | US | 1990–2004 | Weekly | Coal and crude oil prices | Weak linkage |

| He and Lu [18] | China | 1998–2010 | Monthly | Coal and crude oil prices | Oil → coal |

| Mjelde and Bessler [19] | US | 2001–2008 | Weekly | Coal, crude oil, natural gas and electricity prices | Weak linkage |

| Jiao et al. [20] | China | 1980–2006 | Annual | Coal price, oil price, coal demand and income | Cointegration |

| Joets and Mignon [21] | Europe | 2005–2010 | Daily | Coal, crude oil, natural gas and electricity forward prices | Cointegration |

| Mohammadi [22] | US | 1960–2007 | Annual | Coal, crude oil and electricity prices | No relationship |

| Mohammadi [23] | US | 1970–2007 | Monthly | Coal, crude oil and natural gas prices | No relationship |

| Zamani [16] | Global | 1989–2013 | Monthly | Coal and crude oil prices; economic activity index; crude oil production | Oil → coal |

| DF-GLS | KPSS | |||

|---|---|---|---|---|

| Variable | Level | 1st Diff | Level | 1st Diff |

| Ct | −1.325 | −1.876 * | 0.419 *** | 0.142 |

| Ot | −1.490 | −6.462 *** | 0.276 *** | 0.119 |

| Mt | −2.393 | −8.960 *** | 0.138 * | 0.052 |

| Rank | Eigenvalue | Trace | λ-max | SBIC | HQIC |

|---|---|---|---|---|---|

| 0 | 0.171 | 31.384 * | 21.398 ** | −7.987 | −8.671 |

| 1 | 0.052 | 9.986 | 6.164 | −7.967 | −8.723 |

| 2 | 0.033 | 3.822 | 3.822 | −7.897 | −8.695 |

| Causal Direction | Test Statistic | p-Value |

|---|---|---|

| Mt→ Ot | 28.08 | 0.000 |

| Ct→ Ot | 9.84 | 0.132 |

| Ot→ Mt | 6.50 | 0.370 |

| Ct→ Mt | 12.65 | 0.049 |

| Mt→ Ct | 14.00 | 0.030 |

| Ot→ Ct | 19.80 | 0.003 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, R.; Broadstock, D.C. Coal Pricing in China: Is It a Bit Too Crude? Energies 2021, 14, 3752. https://doi.org/10.3390/en14133752

Li R, Broadstock DC. Coal Pricing in China: Is It a Bit Too Crude? Energies. 2021; 14(13):3752. https://doi.org/10.3390/en14133752

Chicago/Turabian StyleLi, Raymond, and David C. Broadstock. 2021. "Coal Pricing in China: Is It a Bit Too Crude?" Energies 14, no. 13: 3752. https://doi.org/10.3390/en14133752

APA StyleLi, R., & Broadstock, D. C. (2021). Coal Pricing in China: Is It a Bit Too Crude? Energies, 14(13), 3752. https://doi.org/10.3390/en14133752