1. Introduction

Today, the transport sector accounts for a large share of global pollutant emissions. Indeed, in the last few years, the majority of transportation emissions-related health impacts occurred in the top global vehicle markets. In 2015, 70% of transportation-attributable deaths occurred in the four largest vehicle markets: China, India, the European Union (EU), and the United States [

1]. As discussed in [

2], reducing air pollution from transportation, and especially carbon dioxide emissions, are at the center stage of discussion by the world community. For that reason, over the last decade, there has been a dramatic increase in the number of electric vehicles (EV) in industrialized countries.

The main motivation behind this study is that the large penetration of EV leads to situations where charging puts pressure on the distribution grid. However, the peak loads occur only throughout a small part of the day, while during the rest of the day, the grid has excess capacity. Hence, it is worthwhile to investigate if, utilizing charging flexibility on the demand side to reduce the peak-loads, can be a valid alternative to grid reinforcements within charging sites’ expansion [

3]. In the distribution grid, this can be done through demand response, that aims at leveling out the load curve in order to avoid that the power consumption exceeds the grid capacity.

Two types of demand responses exist. With a direct demand response, customers’ loads are controlled by a third party, such as a retailer, or by the DSO; while with an indirect demand response, the customer responds to signals, such as price, that are sent to motivate a certain behaviour that is beneficial for the operator and for the grid [

4]. A conceptual introduction to indirect control for demand-side management is proposed in [

5].

This study utilizes elasticity matrices in indirect control scheduling models for managing the charging of electric vehicles. The objective is to ensure better utilization of the grid and to reduce the probability of congestion. Assuming that electric vehicle drivers are willing to change their behaviour according to price variations, the paper provides mathematical optimization models to define optimal charging prices. A price list will be created according to drivers’ flexibility and sensitivity to price, in order to reduce their charging in those periods that are critical for the grid because of capacity shortage. The objective is to minimize the curtailment of charging loads by planning load-shifting and, whenever it is not possible to only shift demand, find a solution with minimal curtailment.

Compared to other works in the literature that focus on charging patterns’ optimization, such as [

6,

7,

8,

9], the present paper focuses on micro-economics strategies rather than technical properties of the storage technologies. The proposed approach is not about individual pattern optimization. The proposed approach uses an aggregated perspective where customers’ behaviour can be described by elasticity. From this perspective, customers are grouped into clusters that have different sensitivity to prices.

The key contribution of this study is the inclusion of the micro-economic concept of elasticity in the optimization strategy. In particular, the proposed mathematical models will make use of an elasticity matrix to map the driver’s sensitivity to price and forecast their reactions to the price signals in terms of a demand increase or decrease. Although the general concept of elasticity is well-established, its use within the pricing of electric vehicle charging is relatively new. Due to the novelty of this approach, real-world data relating the elasticity values to the electric vehicles’ drivers’ behaviour are currently nonexistent. Hence, beyond the methodological contribution in terms of mathematical modeling, the present paper will provide an analytical contribution in terms of sensitivity analyses and representative case studies aimed at understanding the effect of the elasticity in the pricing of electric vehicles. The proposed mathematical models are used to investigate how elasticity data may affect the pricing, the behaviour of drivers, and the ability of the operator to successfully handle critical periods of capacity shortage.

The rest of the paper is organized as follows.

Section 2 will present an overview of previous literature dedicated to control schemes for EV drivers.

Section 3 will discuss the main concepts of demand curves and the elasticity matrix in the EV sector, while

Section 4 will propose mathematical optimization strategies for indirect scheduling of EV charging with price signals. Computational experiments and sensitivity analyses will be presented in

Section 5 and conclusions will be drawn in

Section 8.

2. Literature Review

This section aims at providing a short overview of previous literature dealing with how to affect EV drivers decisions in a way that is beneficial for the grid. The main areas are charging scheduling schemes, demand response strategies, and more specifically, the use of microeconomic concepts, such as elasticity to define charging prices.

A survey on economy-driven approaches for charging electric vehicles in the smart city is proposed in [

10], where the most common approaches are presented and compared.

An example of indirect control can be found in [

11], where a fuzzy logic controller is used to control and manage the charging process in order to maximize electric utility and the electric vehicles’ owner benefits. Another study presented in [

12] compares three approaches (heuristic, optimization, and stochastic programming) used to schedule under uncertainty the charging process of three different electric vehicles’ fleets at a common charging infrastructure. Dynamic price signals are developed in [

13] to implement demand-side management, and alleviate the stress of concurrent charging on the distribution network. A statistical demand-price model with its application in optimal real-time price is presented in [

14], and a similar work is proposed in [

15]. Demand response opportunities of EV to improve the reliability of distribution networks are explored in [

16]. A stochastic approach to handle uncertainty in price elasticities of electricity demand is proposed in [

17]. A price-based approach to prevent distribution grid congestions by integrating indirect control in a hierarchical EV’s management system is developed in [

18].

None of the above works include elasticity formulations within mathematical optimization models, to study the price sensitivity of the drivers. As previously outlined, there are no papers that use elasticities within scheduling models for the charging of electric vehicles, which in the same way is proposed in this paper. However, a few papers make use of it in related models and analyses.

The broad concept of real-time price elasticity of electricity has been addressed in [

19], where the authors provide a quantification of the real-time relationship between total peak demand and spot market prices. Elasticity theory and its relevance within a scheduling program is presented in [

20], but the focus is on general electric load management, and not related to electric vehicles’ management in conditions where there is a lack of capacity. Elasticities are used in [

21] to analyse investment decision-making and investigate the propensity to switch from a private car trip to a car-sharing service, as well as the propensity to choose an electric vehicle for such a service. A heuristic method is proposed in [

22] to forecast elasticity values, but the main application is households’ electric load management and not indirect control of electric vehicles. A demand response model with elasticity inclusion to handle general electric loads is proposed in [

23], but without the objective of defining an optimal set of prices. Indeed, prices are not generated by the model, but rather provided as input parameters within the case studies. Moreover, the study is not directly related to electric vehicle scheduling. Similarly, in [

24], the authors make use of an elasticity matrix to develop models for residential demand response. Both [

25,

26] propose methodologies to handle demand response in systems that include electric vehicles, but their main focus is the possibility to manage the uncertainty by using the renewable resources in the system rather than the electric vehicles and their impact on the available capacity of the grid. The optimal installed capacity allocation of renewable resources in conjunction with demand response is also analysed in [

27], where authors do make use of an elasticity matrix to forecast the consumers’ behaviour. The study in [

28] proposes a smart-charging management system considering the elastic response of electric vehicle users to the electricity charging price. However, a deeper investigation of the actual sensitivity of elasticity values is not provided. A behavioural modeling of electric vehicles using price elasticities is proposed in [

29] to provide insights into the degree of demand-shifting that can occur across various day-ahead electricity market scenarios. An approach to model demand flexibility of electric vehicles is proposed in [

30], where the demand flexibility offered by an EV is represented using a price elasticity matrix which is calculated with respect to a flat reference price scenario. However, the work does not provide enough insights into the value of an elasticity matrix due to the lack of elasticity data.

A methodology for an optimal operation and bidding strategy of a Virtual Power Plant integrated with energy storage and an elasticity-based demand response is presented in [

31]. The price elasticity of consumers is also taken into account in [

32], where the objective is the development of a decentralized robust model for optimal operation of distribution companies with private micro-grids. An optimal real-time pricing of electricity based on demand response is tested in [

33] to encourage customers to participate in the electricity market operation.

One of the challenges in all of the above papers that include elasticities in real-world applications for energy systems, is the lack of actual elasticity data. Additionally, no sensitivity analyses are performed to actually show what is the impact of including an elasticity matrix within the proposed optimization models. Most of the papers propose the use of elasticity values, but they do not provide a thorough investigation of the elasticity impact on the pricing strategies and on the models’ results. There is a need to gain a better understanding of the impact that such elasticity data would have within specific optimization models, and how heavily such values would affect the final results and decisions.

While indirect control in pricing has been used already in the past for demand management, the price elasticity has not been combined together with indirect control strategies in ways suitable for inclusion within real-time decision-making tools based on optimization within the green transportation sector. In addition, while the concept of pricing in a certain time-period is well-established (self-elasticity), the concept of switching between time-periods through price sensitivity (cross-elasticity) has not been fully investigated in the literature, especially for the particular application of electric vehicle charging scheduling. The cross-elasticity of demand is an economic concept that measures the responsiveness in the quantity demanded of one commodity when the price for another commodity changes. The proposed work identifies charging time as a commodity for real-time decision-making processes, where different time-periods are regarded as different alternative commodities, and where drivers are aggregated into segments with different sensitivities to the charging price in different time-periods.

Therefore, the key contribution of the proposed study is to combine indirect control together with price elasticities and check the insights that can be gathered through sensitivity analyses. From this point of view, the key contribution of the present paper is not only proposing a methodology to define optimal price lists to send to electric vehicles’ drivers in order to better manage critical periods of a lack of capacity in the grid, but also performing sensitivity analyses with an in-depth investigation of how the elasticity values would affect the pricing and the ability of the system to fulfill the demand requirements.

The main purpose of the study is to discuss what kind of insight can be gathered by using elasticity within mathematical optimization models for indirect control of electric vehicle charging. Therefore, the focus is on demonstrating the use of elasticity for this specific application, and understanding the value of using elasticity in analysing the outcome of a real-time decision-making process.

3. Demand Curves in the Electric Vehicles Sector

The relationship between the demand of a good and its price is represented with a demand curve. Normally, the demand for goods decreases as the price of the good increases. However, there is also a relation to the price of so-called “substitute goods” that consumers consider as similar or comparable, meaning that demand is reduced if the price of a substitute good decreases.

For EV charging, the demand curve represents the relationship between the charging price of electric vehicles and the amount of drivers that are willing to charge at a certain price in a certain time-step. The substitute goods can be described as the possibility to shift the load and charge in a time-step that is different from the desired one because the related charging price potentially is lower. This study proposes a stylized approach in order to study how elasticities can be used to understand the effect that prices have in order to move demand between time-periods. For the purposes of demonstrating the concept, we simplify the charging scheduling problem to depend only on price. Such simplification is reasonable, since we do not refer to individual drivers, but rather to the aggregated markets’ demand curves. The main purpose of this work is to show how elasticities can be used to better understand the effects that price have on shifting demand between time-periods. In sum, as shown in Formula (

1), the charging demand of electric vehicles is a function of both the price in a certain time-step

t and the price that the operator shows in alternative time-steps (

).

Moreover, it is important to note that when analysing consumers’ response to price, the focus is generally not on the single consumer demand, but on the aggregated demand curve stemming from aggregating the demand curves of individual consumers. As a first approximation, it is possible to consider one whole aggregated demand curve for charging, aggregating all the electric vehicles’ drivers. As an extension, it is possible to imagine market segmentation, that aims at aggregating the electric vehicles’ drivers into groups, or segments, where drivers within a group respond similarly to a market action (i.e., price change).

Aggregated Demand Curves within Multiperiod Optimiztion Models

It is difficult, if not impossible, to quantify exactly a real non-linear demand curve that is a function of several prices and that involves consideration of prices in different time-steps. Still, using Taylor’s first-order approximation theorem, we know that a multivariate function, that is,

can be approximated linearly in the neighborhood of the point of evaluation

as:

where

denotes the partial derivative of the function with respect to

x and similarly for

y. The same approximation can be easily extended if

f is a function of more than two variables. This can be used to approximate the demand function showed in Equation (

1), where demand is a function of different prices in different time-steps. Hence, through the Taylor’s theorem, we are now moving into a description of demand based on point-price elasticity.

The standard definition of elasticity

is shown in Formula (

3). In this formula,

is the partial derivative of the quantity demanded taken with respect to the price,

is a specific price for the good, and

is the quantity demanded at the price

.

In order to include this concept within mathematical optimization models, the standard formulation can be approximated, as shown in Formula (

4), where the elasticity

is defined as the ratio of the percentage change in quantity to the percentage change in price.

Within the electric vehicle charging sector, two types of elasticities can be identified, the self-elasticity and the cross-time elasticity.

The self-elasticity defines the percentage change in demand Q at time-step t, due to the corresponding percentage change in the price P, at the same time-step t. It has a negative sign, meaning that an increase of price in a certain time-step will cause a decrease of demand in the same time-step.

The cross-time elasticity describes the percentage change in demand Q at time-step t due to a change in price at a different time-step . It has a positive sign, meaning that an increase of price in a certain time-step t can cause an increase of demand in a different time-step .

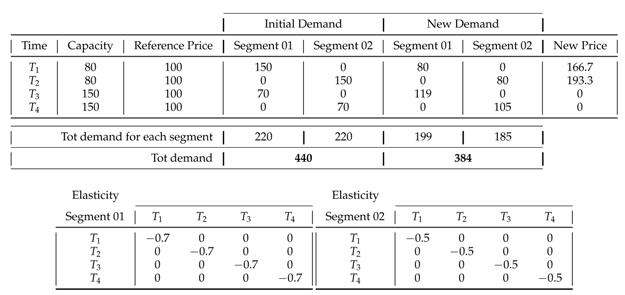

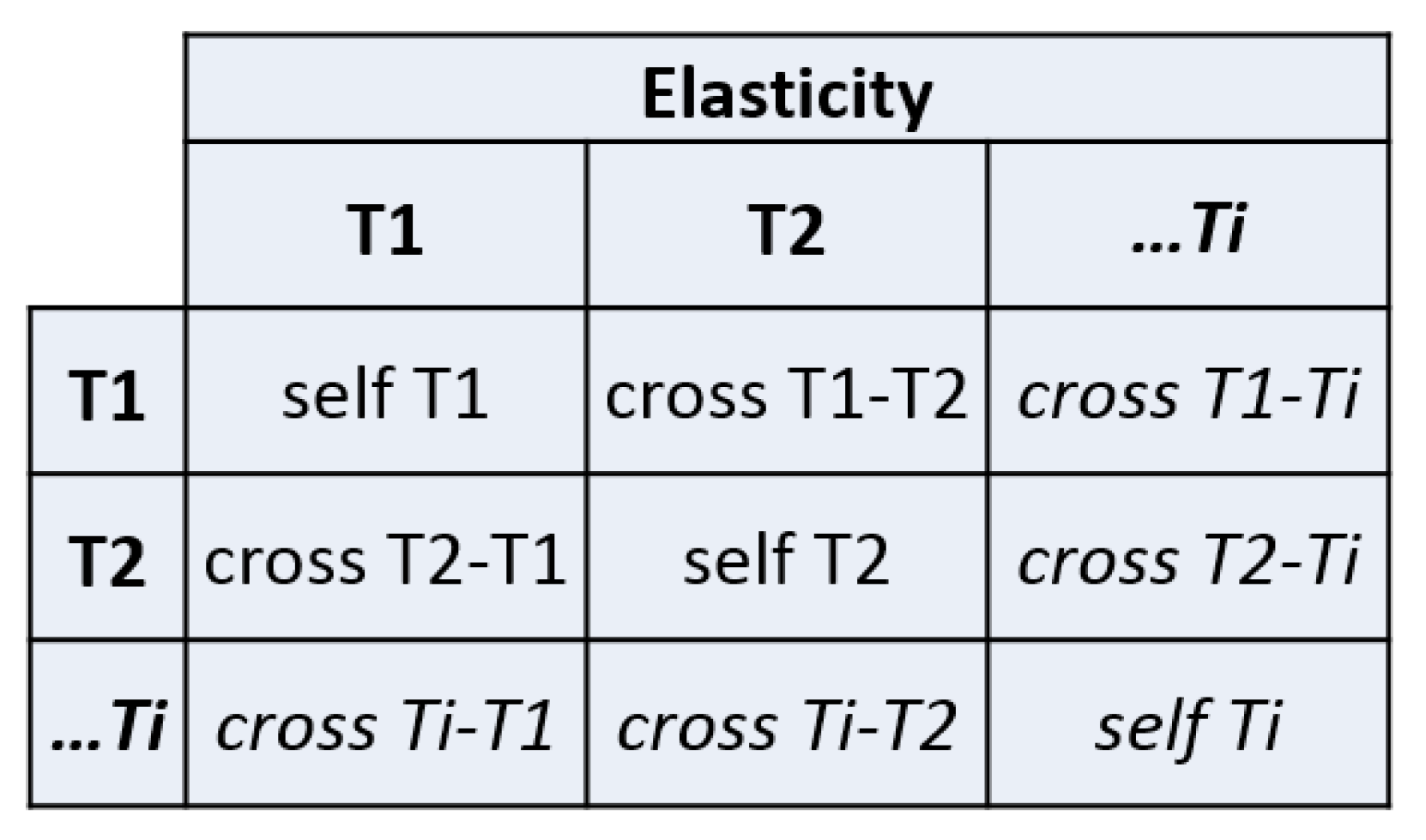

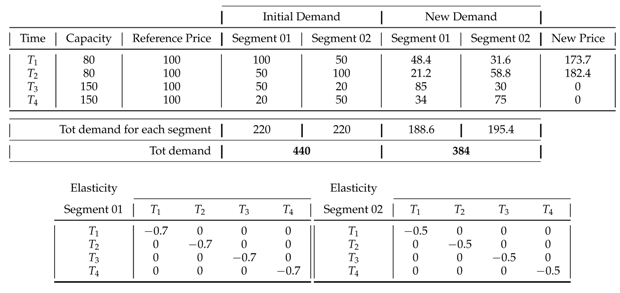

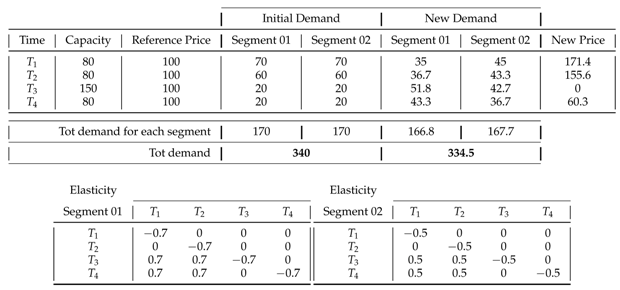

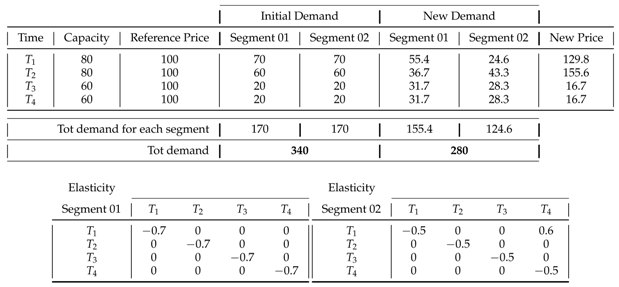

As shown in

Figure 1, such elasticity values can be summarized into matrices that give us a quick view of consumers’ sensitivity to prices in different time-steps. Hence, we will no more rely on an exact demand function, but rather on a mapping of drivers’ flexibility, expressed by elasticities and applied to a first-order Tailor approximation.

Here, it is important to remember that the elasticity is a concept to be applied to large groups of users. It does not represent a single driver’s behaviour, but rather the behaviour of a group of drivers that belong to the same market segment and respond similarly to a market action like price variation. We will refer to a group of drivers as a . The idea behind the mathematical model that will be proposed later, is that when a price signal is sent to a group of drivers, some of them will be discouraged and give up the charging, while others will still decide to connect. The objective of the pricing scheme is to shift a portion of drivers in such a way that the capacity limit is respected.

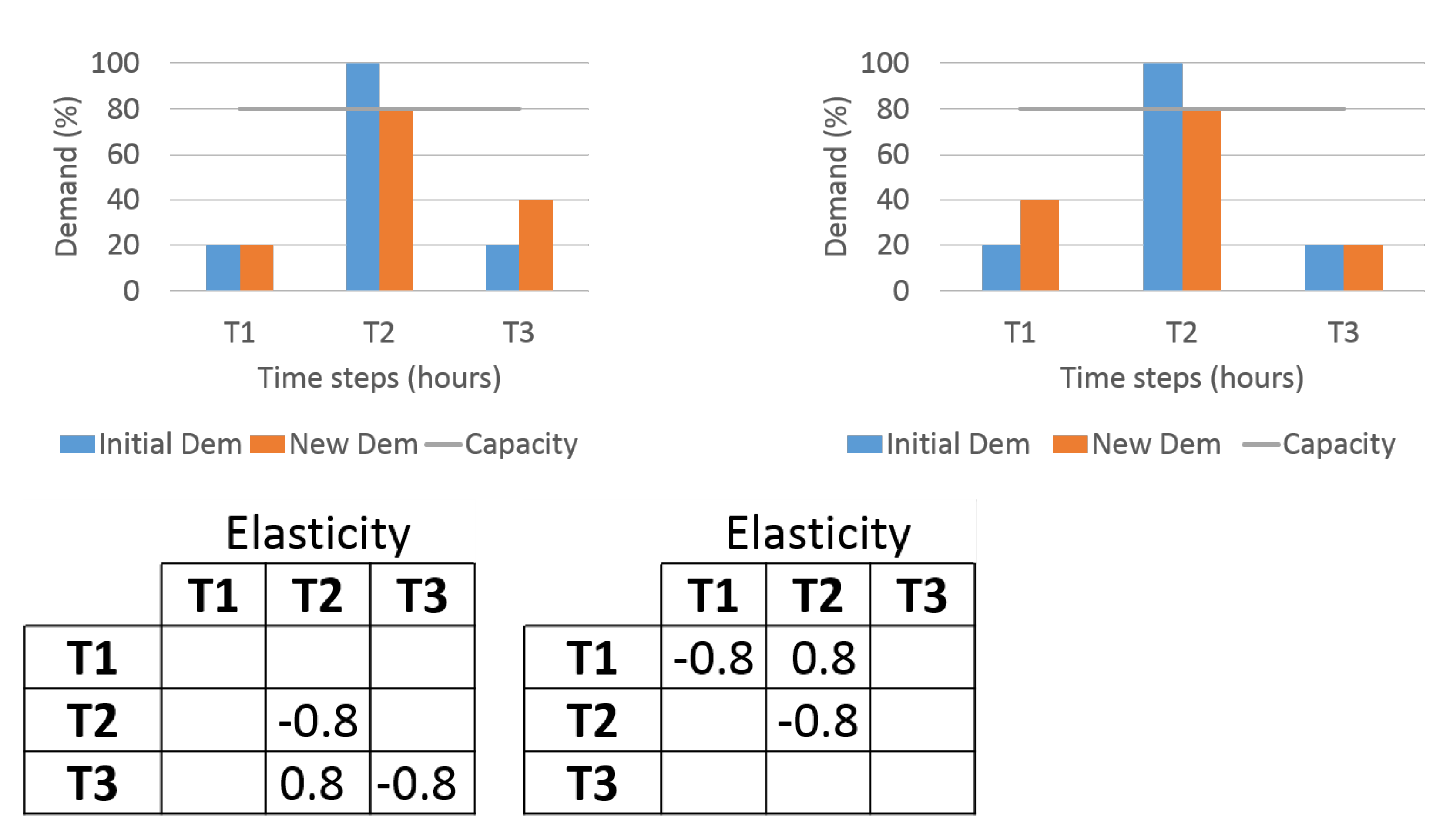

Figure 2 shows the basic idea behind the pricing models.

Figure 3 shows a simple example. In time-step

, there is a load that exceeds the capacity and that has to be reduced. Therefore, the objective is to send a price signal that motivates the shifting of the exceeding load in

or

. The elasticity tells us how sensitive a cluster of drivers is. The elements on the diagonal represent the self-elasticity: in this particular example, we assume we increase the price in

to get a decrease of demand in

, and we decrease the price in

or

to get an increase of demand in

or

. Elements above or below the diagonal represent the cross-elasticity. On the left diagram of

Figure 3, there is a cross-elasticity

below the diagonal, that represents the variation of the demand in

due to a change in price in

. Therefore, an increase of price in

will not only cause a reduction of demand in

, but it will also motivate a demand increase in

; hence, part or all the load that has been cut in

can be shifted in

as a function of the cross-time elasticity of drivers. On the right diagram of

Figure 3, there is a cross-elasticity

above the diagonal, that represents the variation of demand in

due to a variation of price in

. Therefore, for that group of drivers, an increase of price in

not only causes a reduction of demand in

, but it will also motivate a demand increase in

, hence part or all the load that has been cut in

can be shifted in

as a function of the cross-time elasticity of drivers. When only one market segment is involved, such load movements in time are easy to handle. However, when more market segments with different sensitivities react to the same price signal, then a model is needed to define the optimal price in order to shift the total load while taking into account the different reactions of different clusters. The next section will discuss a mathematical optimization approach for that purpose.

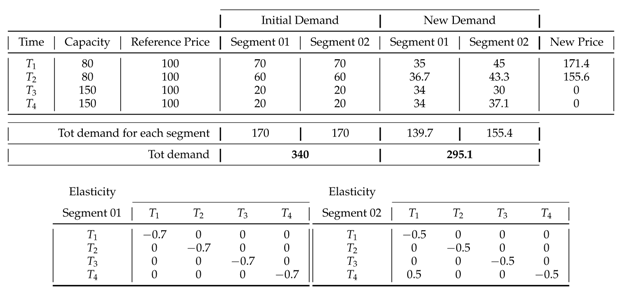

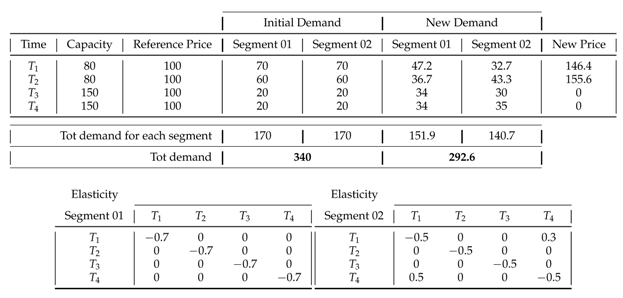

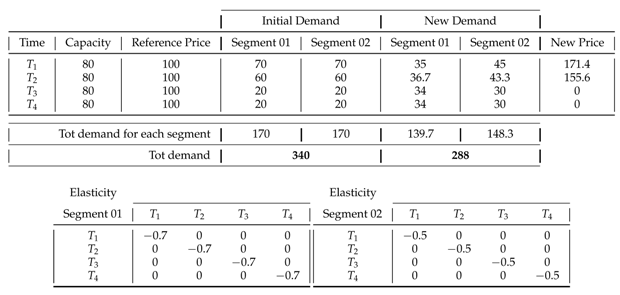

5. Computational Experiments and Sensitivity Analyses

5.1. Introduction to the Case Studies

While elasticises are routinely calculated in a number of areas, the research literature on EV-charging has had little focus on them, and as a result, no empirical studies also exist. In our case study, we therefore focus on sensitivity analyses illustrating the effect that different values of the elasticities will have on the scheduling. We provide some basic case studies to investigate the effect of the elasticity concept within the indirect control of electric vehicles. We are particularly interested in investigating how the elasticity affects the price, the forecast behaviour of drivers, and the ability of the operator to successfully handle critical periods of capacity shortage. In sub-cases with different demand segments, we aim at understanding how the elasticity matrix of different segments affect the solution, how they interact, and how the combination of different matrices affect the pricing and the demand reactions. We investigate only the situation with one charging quality.

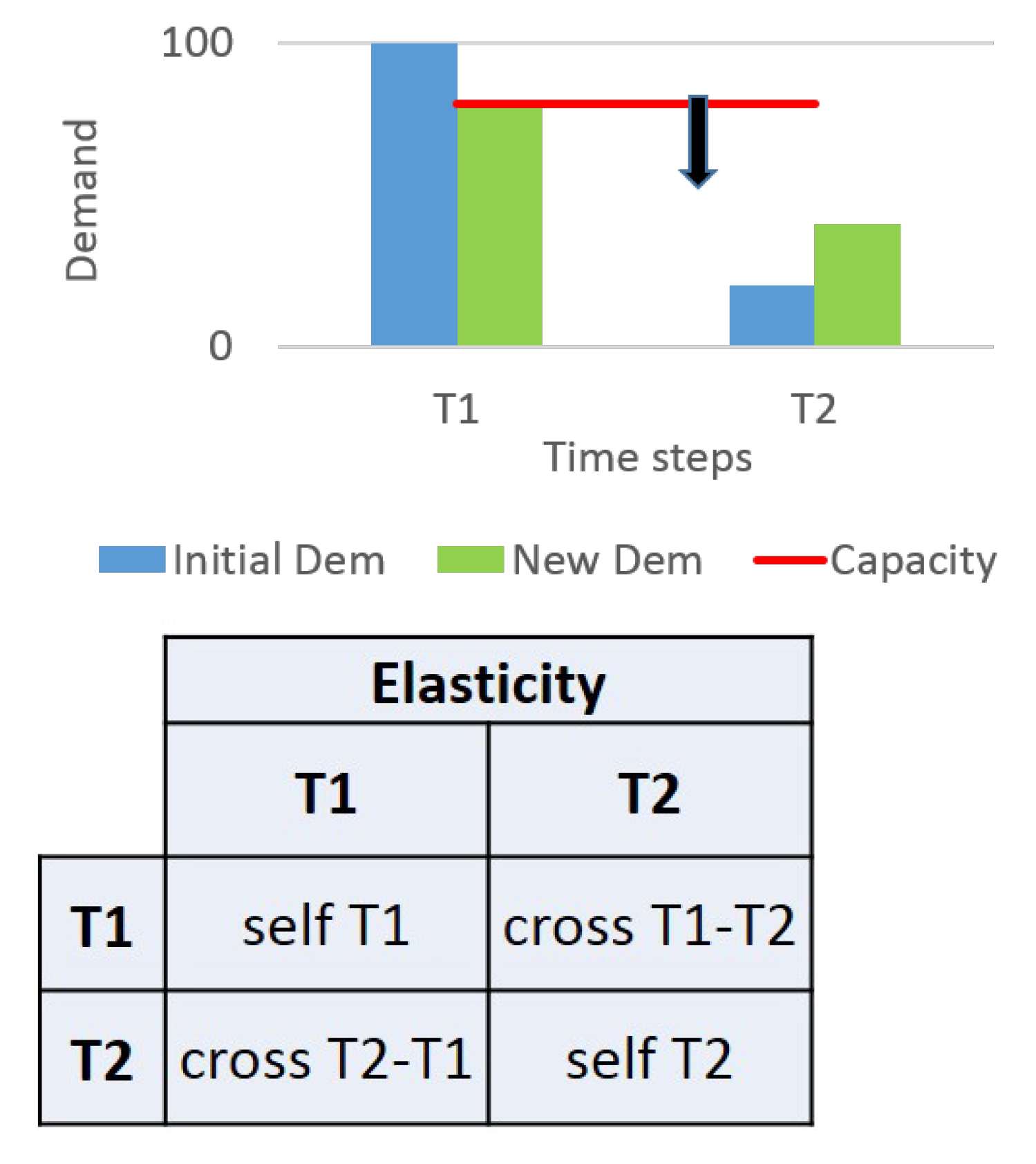

5.2. Case Studies with One Aggregated Demand Segment

The basic case study with one aggregated demand segment is shown in

Figure 4. We consider a basic sub-case of two time-steps

and

. In

we assume a total demand

D that exceeds the available capacity

C, while lower demand is assumed in

. The model will therefore cut loads in

and increase loads in

according to different self- and cross-elasticity values in an elasticity matrix like the one shown in

Figure 4.

In particular, looking at

Figure 4, the value in the cell

defines the self-elasticity in

(variation of demand in

as a result of a variation of price in

), the value in the cell

defines the self-elasticity in

(variation of price in

as a result of a variation of price in

), the value in the cell

defines the cross-elasticity (variation of demand in

as a result of a change of price in

), and the value in the cell

defines another cross-elasticity (variation of demand in

as a result of a change of price in

).

Price signals will be sent to (increasing the price to cut the load) and to (decreasing the price to motivate load increase in this time-step). The price in will be allowed to drop to zero. No minimum price will be set in order to observe the model behaviour without lower bounds that may hide some relevant price-signal variations in .

We will vary the ratio capacity/demand C/D and the elasticity values in order to create patterns and trends that will show the elasticity effects on prices and load variations. The objective is to investigate how the different self- and cross-elasticity values affect the pricing and the ability of the system to manage critical periods.

When studying price signals, it is also worthwhile to make a comparison between the charging price and the price of an alternative diesel solution to see if and when the pricing of electric vehicles is going to be competitive with a traditional combustion engine vehicle. In order to compare the charging cost of an electric vehicle and the cost of filling a traditional diesel vehicle, we calculate the cost per km. The analyses are based on Norwegian cases. Hence, the prices will be given in Norwegian Krones (kr).

The reference price of charging at home is 1kr (100 øre). We assume that an average vehicle requires 1.7 kWh to make 10 km, that means that a realistic cost per km of a home-charged electric vehicle can be assumed to be 17 øre/km.

As for a diesel vehicle, the cost per liter in Norway is set on 1200 øre/liter. We assume that an average vehicle requires 0.7 L to make 10 km. Therefore, a realistic cost per km of a diesel vehicle can be assumed as 84 øre/km. The proposed approximation is suitable to get a preliminary idea of cost levels.

5.3. Case Study 5.01—Effect of Self-Elasticity on the Price and Comparison with a Diesel Vehicle

The main objective of this case study is to analyse the price signal in

that is necessary to cut the load to match capacity. The other objective is making a comparison with the cost of filing a traditional diesel vehicle in order to see in which elasticity range the pricing of electric vehicles can still be competitive. For that purpose, we run the model with different ratios’ capacity/demand (C/D) and by varying only the self-elasticities while keeping the cross-elasticities to zero. In practice, that means that there is no willingness to move demand in time, but demand is price-dependent.

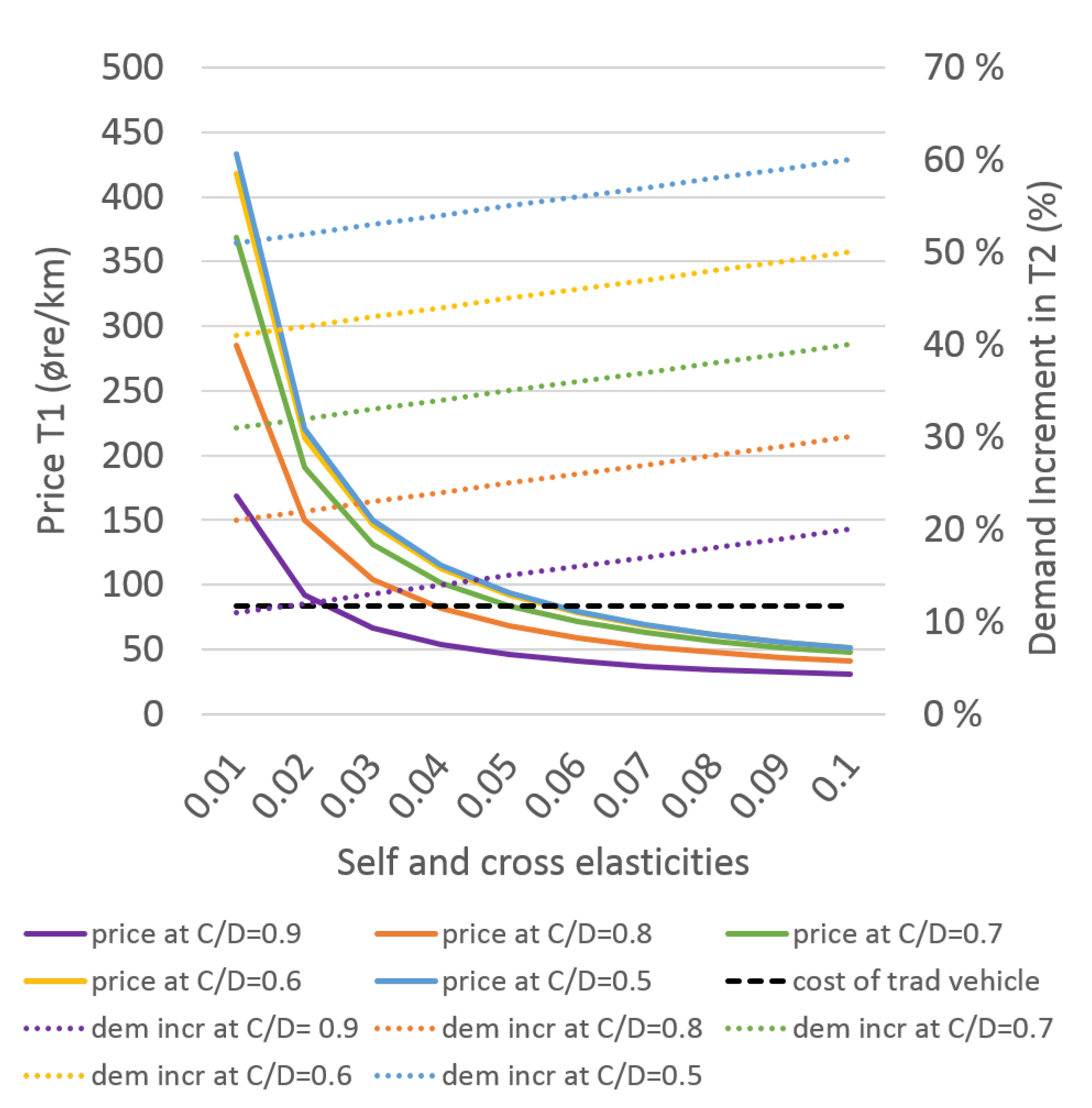

Figure 5 shows the results.

The curves show that as the self-elasticity in increases, the users become more sensitive to the price, and therefore a lower price change can be used to cut the same amount of load as compared to a low elasticity. Therefore, for every single curve, the required price in decreases as the self-elasticity in increases.

Within every curve, a constant value of the ratio capacity/demand (C/D) is kept. Looking at all the curves together, as the ratio C/D decreases, more loads have to be cut in , and therefore a higher price signal has to be sent. This can be noted watching the curves that are shifted up for higher values of C/D.

The red line shows the linear load increase in according to the price decrease in . Note that no cross-elasticity has been considered so far.

The black line represents the cost of a traditional diesel vehicle and it gives a preliminary idea of how and when the pricing of electric vehicles are competitive with the alternative use of a traditional diesel car—in particular, it is possible to see which combinations of C/D and self-elasticity values are below the curve and are therefore still competitive.

It is important to note that comparing the price of charging an electric vehicle with the current cost of the fuel for a traditional vehicle, does not mean that charging at a higher cost than diesel is not feasible in the short-term.

5.4. Case Study 5.02—Effect of Cross-Elasticity - on the Load-Shifting

The objective of this case study is to observe the effect of the cross-elasticities on the loads in time-step and make a comparison for different sub-cases with different ratios of capacity/demand (C/D).

Figure 6 shows the results. Looking at every single dotted line, it can be observed that as the cross-elasticity increases, the effect on load in time

increases, as well as a response to a price increase in

. Every dotted line represents a constant value of the ratio C/D. Looking at all the dotted lines together, we see that as the ratio C/D decreases, a higher amount of load has to be cut, meaning that the price signal in

has to be higher. Per definition, the cross-elasticity

defines the variation of the demand in

as a function of the variation of price in

, hence a price signal in

works better the lower the C/D ratio is. This can be noted from the different dotted lines that correspond to different C/D ratios and that are shifted up as the ratio C/D decreases. A lower C/D ratio means that the amount of demand D that exceeds the capacity C is very high. Hence, the lower the C/D ratio, the higher is the amount of demand that exceeds the capacity. This implies that the amount of demand that has to be cut is higher; therefore, the price that has to be sent in order to shift the demand is higher too. The reader will observe a higher demand shifted in

, if the ratio C/D is lower, because a higher cut must be done in

in order to bring the demand back within the available capacity limits.

The price signals work better when cross-elasticities’ effects add on top of the self elasticities’ effects. Indeed, compared to the previous example where only self-elasticity was considered, here the demand increase is higher, because the cross-elasticity effect is summing over the self-elasticity effect.