2.1. CSR and Its Profitability in Literature

Most authors consider the publication of the book Social Responsibilities of the Businessman by R. Bowen [

4] to be the beginning of the modern period of interest in the concept of corporate social responsibility (CSR). In this publication, Bowen presented a preliminary definition of social obligations of entrepreneurs, describing them as conducting such a policy and making certain decisions that are desirable from the point of view of the goals and values of a given society ([

5], p. 6).

The proposal to extend business obligations beyond economic goals has been criticized by supporters of economic liberalism. In his article ‘Social responsibility of business is to increase its profit’, M. Friedman stated that the only thing that business is responsible for is the use of resources in activities aimed at increasing its profit ([

6], p. 12). It should be noted that Friedman saw the legitimacy of corporate social activity as long as it was aimed at improving the corporate image, leading to increased sales and profits. He identified CSR with activities performed on the basis of altruistic and ethical foundations [

1].

Some authors supported Friedman’s position, stating that enterprises should act responsibly, but this should not be equated with the extended CSR doctrine [

7]. Managers mainly act as ‘agents’ to shareholders. Investing in CSR activities can have a negative impact on financial results as it entails additional costs that, at least in the short term, may reduce profitability. Financing of CSR activities competes with other important strategic activities, perhaps more profitably [

8,

9,

10]. Additionally, managers cannot be held morally accountable, and the task of regulating the social system is solely the task of the government [

1].

Currently, most authors postulate that the principles of CSR should be included in the enterprise’s strategy [

11,

12,

13,

14,

15]. What is more, CSR from the minimum obligation undertaken by enterprises began to be presented as a strategic necessity [

16]. Porter and Kramer presented the view that companies can achieve a competitive advantage by implementing ‘strategic CSR’ aimed at creating common value, taking into account both the company’s interests and the creation of benefits for society [

17,

18]. Striving to create shared value is presented as a necessary step in business evolution to identify and expand the links between social and economic progress [

19]. Including CSR rules in the enterprise’s strategy should contribute to its sustainable development. Achieving such a goal is supported by focusing CSR activities on care for reputation (including emphasis on reliability, credibility, honesty, responsibility), relations with stakeholders, sensitivity to the needs of the environment (understanding and responding to market trends, stakeholder needs), effective use of resources, and increasing their value (positively influencing the enterprise’s competitiveness) [

20,

21,

22].

Taking into account the views of the authors who are skeptical about CSR, one of the basic problems of implementing CSR rules into business practice is the difficulty in reconciling the interests of shareholders (interested in profit) with the enterprise’s activities for social welfare [

23,

24]. Strong pressure from owners may cause managers to show a tendency to marginalize activities aimed at social interests and the environment, due to uncertainty about the return on investment [

25]. In response to these doubts, the authors presenting the economic approach indicate that CSR activities should have a business justification [

21,

26], and only those that bring positive financial results can be treated as socially responsible [

27]. CSR does not have to mean a compromise between profit and social benefits [

4], and the decision to undertake CSR activities may be based on a cost benefit analysis. Managers may try to define the ideal scope of CSR activities [

28], that is the level at which maximum profit is achieved, and at the same time take into account the broadest possible range of social expectations (expectations of the enterprise’s stakeholders) [

29,

30].

The approach to CSR continues to evolve [

31,

32,

33], new definitions are proposed, and there are disputes about the scope of socially responsible activities and the need for their implementation [

34,

35]. One of the ways of perceiving CSR activities undertaken by enterprises is the triple bottom line (TBL) concept, according to which, apart from financial results, social and environmental effects should be taken into account among the criteria for assessing the enterprise’s activity [

36]. These criteria are interrelated and mutually dependent, e.g., achieving an appropriate level of social goals supports the organization’s ability to deliver the expected economic and environmental outcomes. With regard to ecological goals, organizations should, as a minimum, comply with expected standards with regard to the protection of the state of air, water, land, and biodiversity resources [

37].

It is emphasized in the financial literature that activities in the field of social and ecological commitment usually support the growth of the market value of the enterprise, but this happens in the long term. From a theoretical perspective, undertaking CSR activities can contribute to improving the financial results of an enterprise thanks to reducing risk, improving adaptability, larger flexibility, improved reputation (among business partners, employees, and customers), increased trust (resulting in lower transaction costs), easier access to information conducive to innovation, etc. [

38,

39,

40].

2.2. CSR in the Energy Industry

The economic sector discussed in the article is a separate issue. Research shows that there are significant differences as to the optimal set of activities depending on the sector represented by the enterprise. The requirements of sustainable development and the effects of including it in the enterprise’s strategy turn out to be varied in different sectors [

41,

42]. Individual enterprises can improve the effectiveness of their CSR initiatives, adapting them to the specific nature of the sector, which is reflected in their financial results [

43].

Publications on CSR in the energy sector emphasize that it is of great importance in this sector. The energy sector has enormous potential to contribute to economic and social development, and at the same time can have a devastating impact on the environment and communities. Energy demand is expected to grow in the coming decades, due to the increase in world population and the accompanying increase in economic activity, especially in developing countries. Challenges for the energy sector result from the fact that obtaining electricity is still based on the combustion of fossil fuels, in conditions of their gradual depletion, with limitations in obtaining renewable energy [

44]. Consequently, the power industry is the main source of air and water pollution and one of the largest emitters of greenhouse gases, which contribute to climate change [

45,

46]. These factors mean that in the case of energy companies more than in the case of companies from other sectors, it is justified to engage in CSR practices and report the results of these activities, which helps to alleviate the environmental concerns of the society [

47].

As in the case of other sectors, three areas of responsibility are indicated in the energy sector. These are social (displacement, community lifestyle impact, indigenous right, consumer right, affordability, access to electricity, public health and safety, labor issues, gender equality), environmental (natural resource depletion, climate change and greenhouse gas emissions, renewable sources of energy for electricity, biodiversity, waste and pollution, ecosystem impact), and economic responsibility (local economic development, competition, corruption, reliability of supply, due diligence, eco-efficiency, taxation, research and development, demand-side initiatives). The degree of implementation of CSR recommendations in practice largely depends on the degree of development of a given economy (e.g., the level of corruption risk depends on it) [

48].

Responsibility for direct and indirect social impacts includes influencing people in the company, in the company’s supply chain, customers, and the local communities where the company operates. The company’s management, in its choices and actions, should take into account the impact on the interests of society (including health and well-being). One of the proposed directions of action is the dissemination of information among customers about incentives and tips on energy saving, greenhouse gas emissions related to energy consumption, the effects of the enterprise’s activities on the social well-being of the country or community, etc. [

46]. Fukuda and Ouchida (2020) state that CSR invariably enhances social well-being. However, they point out a potential conflict between social and economic and environmental liability. If an enterprise has a monopolistic or oligopolistic position, then when environmental activities are associated with low efficiency (emission reduction is costly), environmental goals may lose to economic goals, which may even lead to an increase in pollution [

49].

To avoid such a situation, enterprises generating negative externalities are charged with environmental pollution fees. This is especially true of energy companies, which society expects to contribute to environmental sustainability by increasing efficiency, investing in renewable energy sources, improving air quality, reducing carbon dioxide emissions, and protecting biodiversity [

50,

51]. They should comply with national and international laws and regulations and follow international energy resource efficiency initiatives and practices in order to protect their image [

52]. This requires adjusting the CSR strategy to the pressure of external stakeholders, including taking initiatives to stimulate the increase in the use of RES, with the gradual phasing out of fossil fuels (ultimately a complete transition to RES), installing waste and pollution control systems to minimize the impact on the ecosystem, etc. [

46,

53].

The literature emphasizes that the environmental reputation obtained by the enterprise improves the company’s image and reduces the risk of a crash in the price of its shares [

51,

54]. From this perspective, CSR can bring benefits to companies by reducing the costs of acquiring new capital (e.g., by issuing new shares). Investors are interested in buying shares of such companies because they believe that CSR management will not hide too much bad news (the asymmetry of information between investors and shareholders will decrease) [

54]. According to the signaling theory, companies with better CSR results are likely to provide more information on the actions taken by issuing CSR reports, subject to external verification of their reliability [

52].

Unfortunately, with this awareness, in order to attract environmentally friendly investors and customers (which should result in improved financial results) companies may adopt a greenwashing strategy, revealing manipulated information (reporting CSR activities that they do not undertake or that they undertake to a small extent) [

51]. Research on the energy sector supports the occurrence of the signaling theory, without showing the tendency to greenwashing (Karaman).

Directive 95/2014 of the European Parliament and the EU Council, which obliges large companies to disclose non-financial information (on environmental, social, and labor issues, respect for human rights, and anti-corruption) as part of the activity report, may significantly reduce the possibility of greenwashing. An essential requirement is that company statements be checked by a statutory auditor or audit firm (

https://eur-lex.europa.eu/legal-content, accessed on 30 April 2021). Referring to the content of non-financial information, it seems that the most important information for the stakeholders of a company is the extent to which the company exceeds the minimum standards regulated by law (in the field of labor law, consumer rights, environmental protection, etc.). In the case of energy, information on the pace of reducing greenhouse gas emissions, investing in RES, plans in this regard, and the degree of their implementation would be important. Currently, there is insufficient comparability of non-financial data presented by companies, due to the freedom of choice of standards (uncertainty of companies related to the selection of information that is significant and should be reported). This situation is to be changed by another directive, which is to apply from 2023, introducing a uniform European standard for reporting ESG issues (environmental, social, and management), the draft of which was announced by the European Commission on 21 April 2021 (

https://www.gov.pl/web/fundusze-regiony/raportowanie-spoleczne, accessed on 30 April 2021).

In recent years, the sector of electricity producers in Poland, which is the subject of the considerations, has faced the need to drastically change its strategy, including reshaping its production. Climate change has meant that political decision-makers, in addition to economic considerations, require the electricity generation sector to reduce greenhouse gas emissions. The transition to sustainable production based on renewable sources (RES) is very difficult and requires time and is also opposed by shareholders (investment funds) involved in the energy sector [

55]. In a situation where most of the produced energy comes from non-renewable sources, a drastic shift towards RES poses a serious risk of instability, therefore it requires a gradual redirection of investments taking into account the transition period, all the more so as renewable energy production is associated with lower profitability [

56].

Leading the efforts to reduce the environmental impact of energy is the European Union [

57]; through the European Commission it has been consistently pursuing policies aimed at decarbonizing member state economies. Its basic tool is regulations causing additional costs of generating electricity from non-renewable sources, due to carbon dioxide emissions, related to the operation of the emissions trading system in the European Union [

58]. The permissible limits of free CO

2 emissions are being reduced and the prices of allowances for additional emissions tend to increase. The expected consequence of the tightening of emission limits will be the loss of competitiveness of energy obtained from coal [

59], the profitability of investing in additional fossil fuel capacity from 2025, and in the longer term, the withdrawal of coal and natural gas from the energy sector in the 1940s [

60].

The impact of environmental regulations introduced in the energy sector is of key importance for the energy generation system in Poland, which is still based on coal. Poland refrained from investing in RES, justifying it with rich deposits and experience in mining (scientific, engineering and technical support, access to modern machinery) and a significantly lower cost of energy production from fossil resources [

61]. The Polish energy market is unique in the European Union, due to the largest share of hard coal and the use of lignite to produce electricity (48% hard coal and 29% lignite in 2018) [

62,

63]. This is due to, inter alia, delays in the implementation of the European energy policy [

64,

65], which will result in an accumulation of changes in the sector in a relatively short time. One of the main challenges of decarbonization in Poland is the abandonment of lignite, which is enforced by the regulations on the reduction of pollutant emissions [

66]. The use of lignite (with its much lower calorific value) is associated with higher CO

2 emissions (in Poland, respectively, 104.14 kg/GJ for lignite and 94.71 kg/GJ for hard coal) (

https://www.kobize.pl/uploads/materialy/WO_i_WE_do_monitorowania-ETS-2019.pdf, accessed on 30 April 2021).

The scale of restructuring challenges for the mining and energy sector is unprecedented in other economies [

3,

67], which is confirmed by the structure of coal sales. In 2017, more than half of the hard coal was sent to power plants and combined heat and power plants, and in the case of lignite it was about 98%. Kaszyński and Kamiński [

68] presented five scenarios of changes in the structure of the energy sector in Poland until 2050, taking into account the EU environmental policy. They predict a drastic reduction in the demand for hard coal, while the consumption of lignite will drop practically to zero in all the scenarios considered.

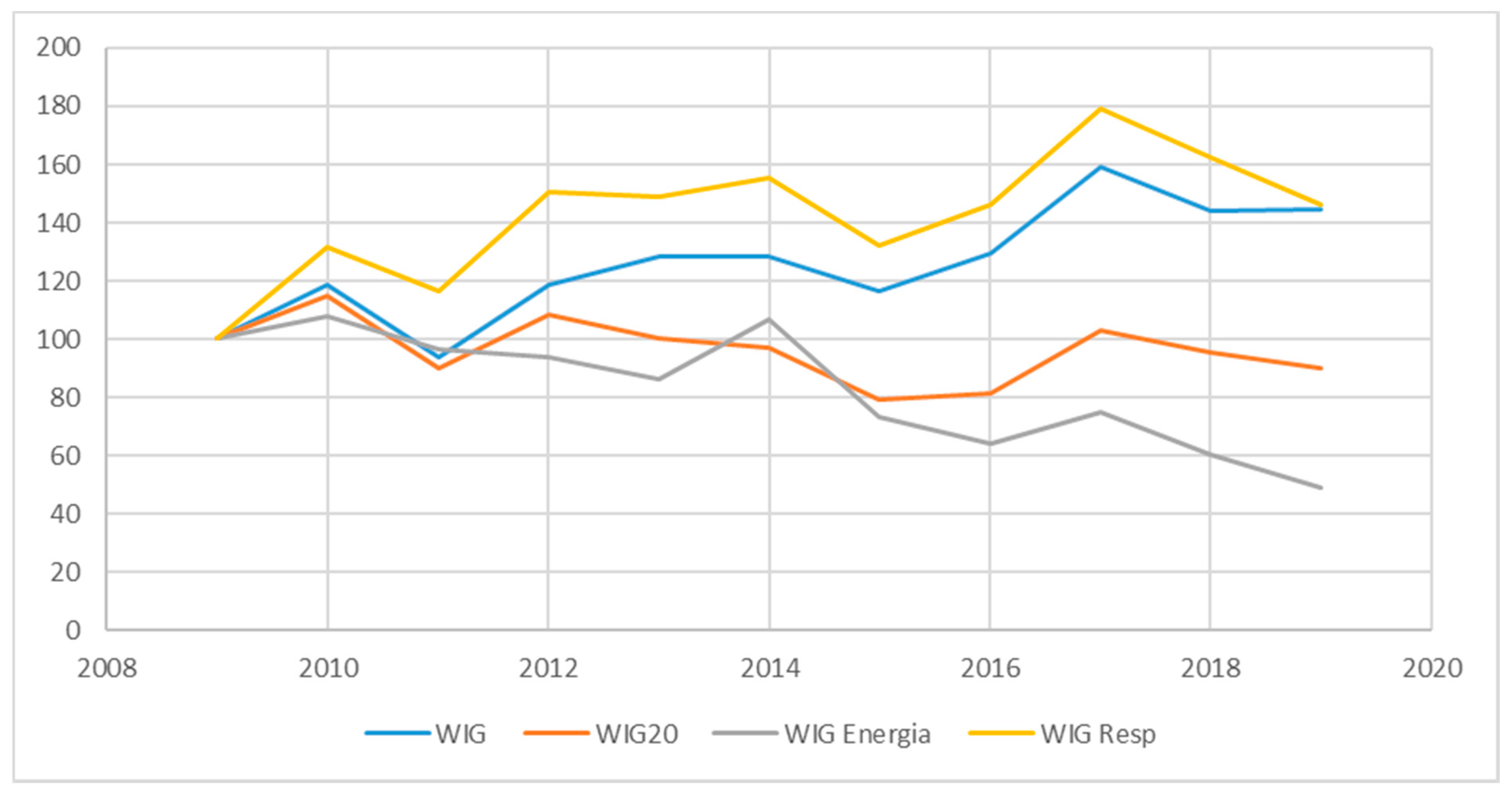

Due to the strategic and financial challenges faced by the energy sector, the results of its companies may become incomparable to those of companies in other sectors. This problem is addressed by the first of the research questions posed in the article:

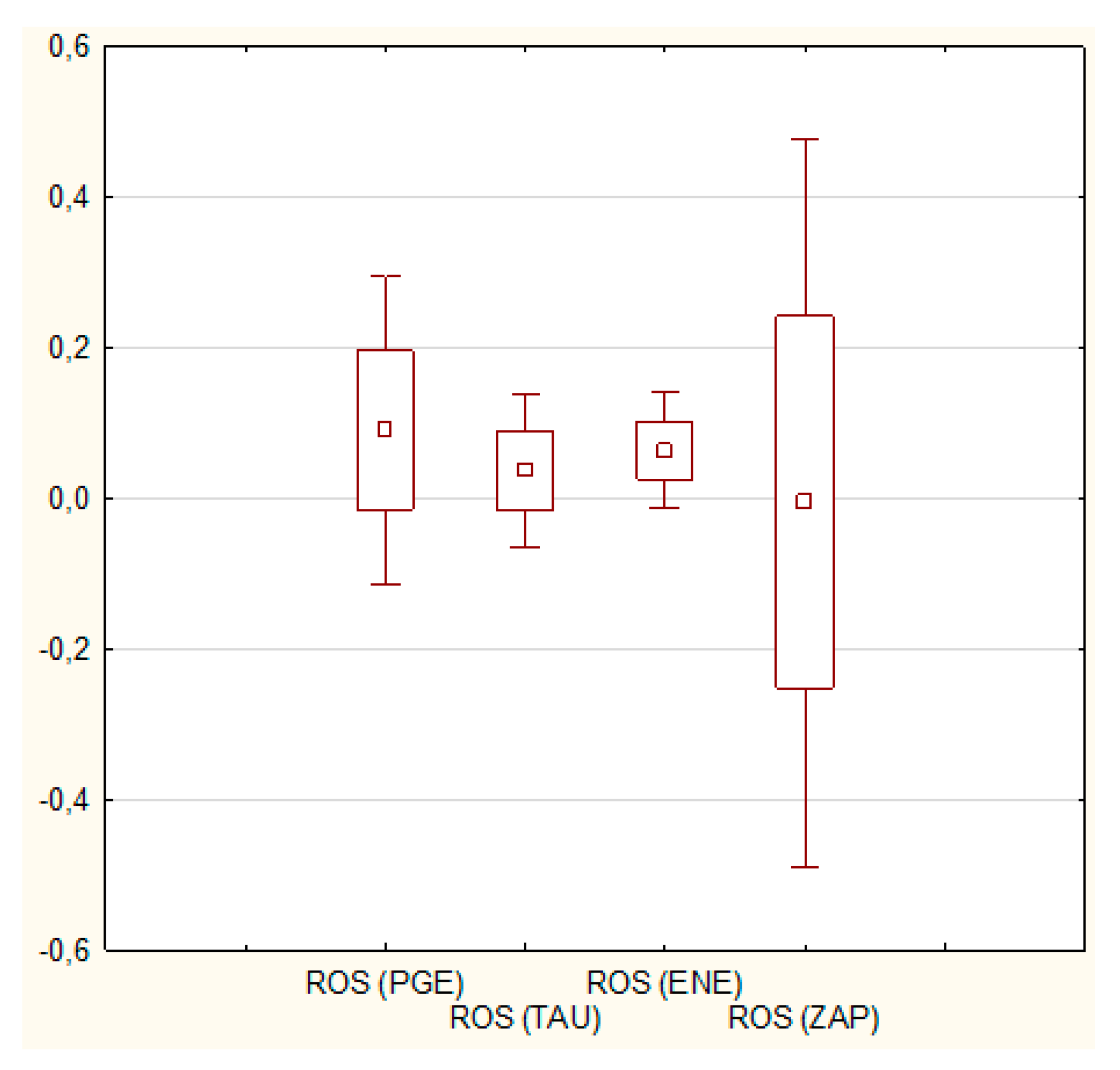

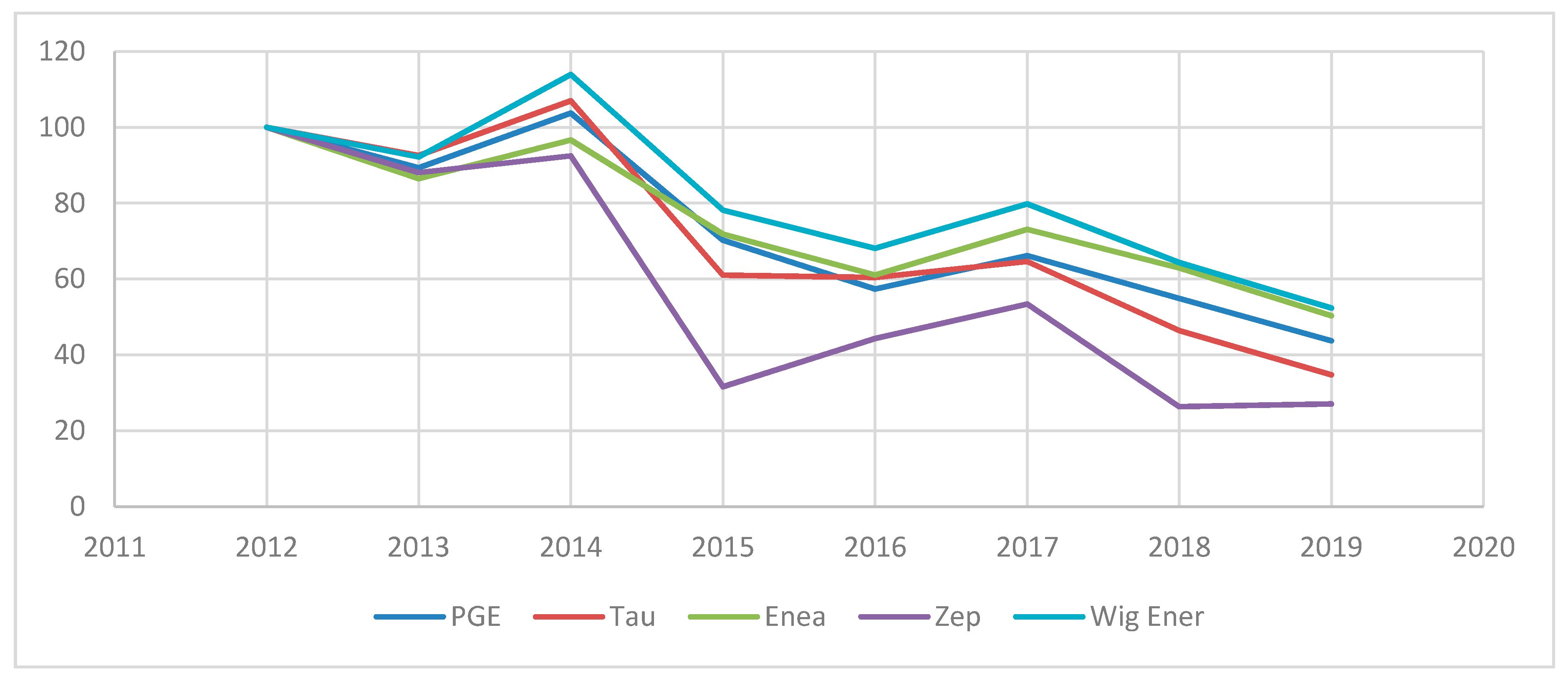

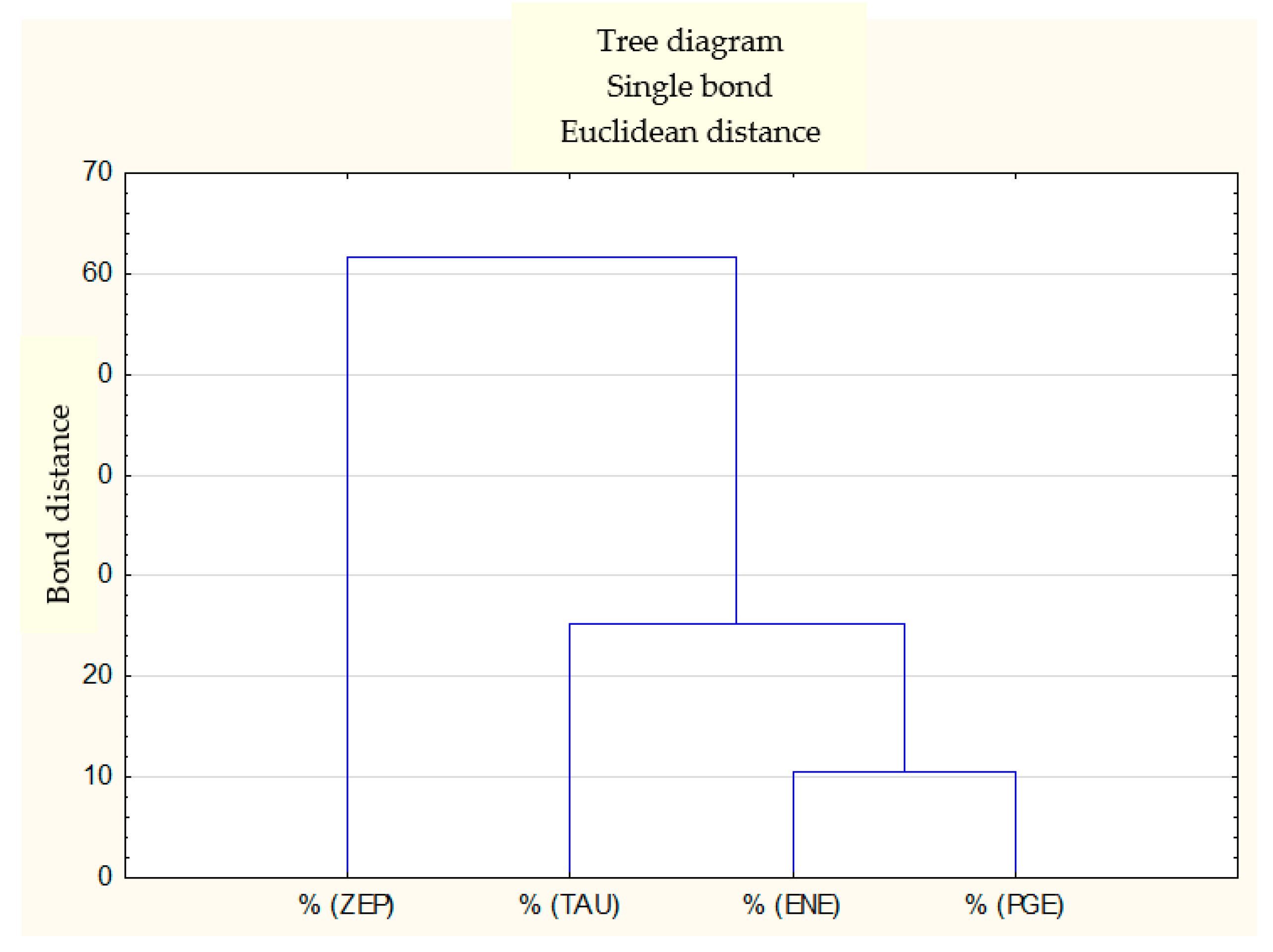

(Q1) Are the strategic challenges facing the Polish energy sector reflected in the level of its stock market quotations?

Regardless of whether or not it is legitimate to compare the performance of companies belonging to different sectors, comparisons can be made between the profitability and performance of companies belonging to the same sector with similar economic activities and the factors affecting them. One of the factors influencing profitability and market valuation may be an appropriate CSR strategy.

Research on the effectiveness of CSR most often focuses on the relationship between CSR activities and the enterprise’s financial results and is directed to top-level managers [

69]. Due to the large number of studies, for the overall assessment of the profitability of CSR activities, it was decided to compile the results of meta-analyses. Meta-analyses allow one to synthesize divergent empirical results of a large number of primary works. Some of the meta-analyses indicate that the impact of CSR on the financial performance of enterprises is positive, but small [

70,

71]. However, most meta-analyses indicate a positive impact of the implementation of CSR rules in an enterprise on its profitability [

69,

72,

73,

74,

75,

76].

The reasons for the success of CSR activities in the form of improved profitability and increased value on the market are most often indicated in the improvement of the image, competitive position, and positive response from customers and stock market investors [

77,

78,

79,

80]. Publications emphasize that in order to achieve such an effect, CSR activities should be properly directed and constitute a relatively coherent system, and the environment should be informed about CSR activities [

81,

82,

83]. It is also noticed that managers’ knowledge of sustainable development increases over time, which results in increased investments in CSR and reorganization of business strategies [

84].

Although meta-analyses indicate the advantage of publications with a positive relationship between CSR and profitability and market valuation, it should be remembered that some of the published studies do not confirm such a relationship, and even indicate a negative correlation [

85,

86,

87,

88]. This situation not only concerns individual enterprises, but also funds investing in socially responsible companies [

89]. In conclusion, the authors of the research return to the reservations formulated by Friedman’s followers, concluding that even in the long run, CSR activities may have a neutral or insignificant impact on financial results due to the high costs of their implementation.

A very important issue from the perspective of the sector in question is the ecological aspect of CSR. Responsibility for the environment may become a source of competitive advantage for an enterprise [

90,

91,

92]. Important in this respect is the pursuit of cleaner production, reduction of material consumption, efficient use of energy, water, and land, etc. [

93]. Although environmental protection entails costs, lack of care for the environment leads to a deterioration of the image and an increase in fees (penalties) for pollution [

94]. Meta-analyses on the issue in question showed that the inclusion of environmental issues in the strategic planning process, resulting in the use of technologies aimed at preventing pollution (as opposed to ‘end-of-pipe’ technology), not only improved the condition of the environment but also provided better financial results [

95,

96]. In retrospect, higher profits cannot be expected when environmental investments are made, but financial results improve in the coming years. Enterprises that invest less in environmental activities have better results in the short term but have lower profitability and lower growth rates in the following years [

97].

The research question that is fundamental from the point of view of the aim of the article refers to the above review of research:

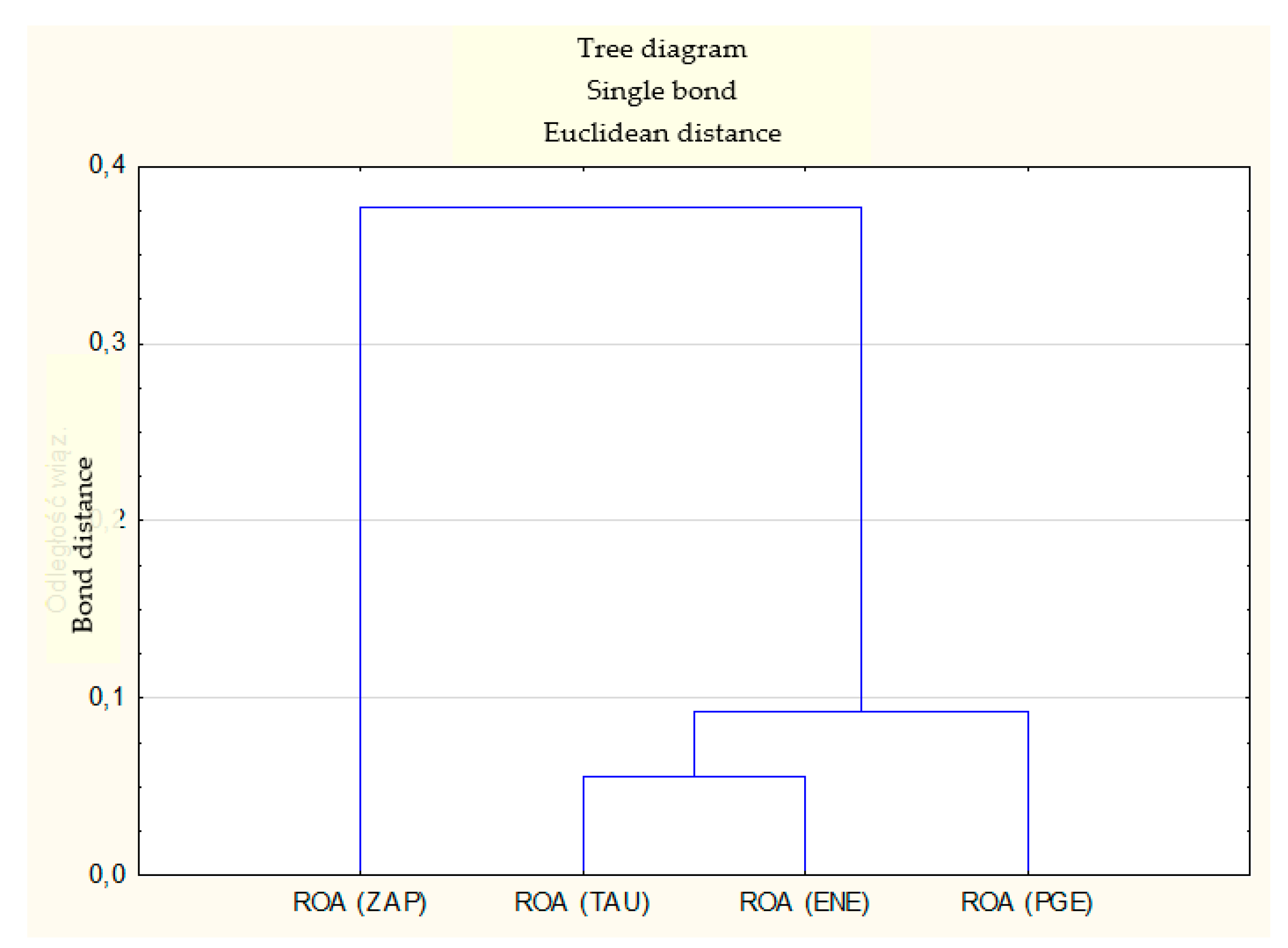

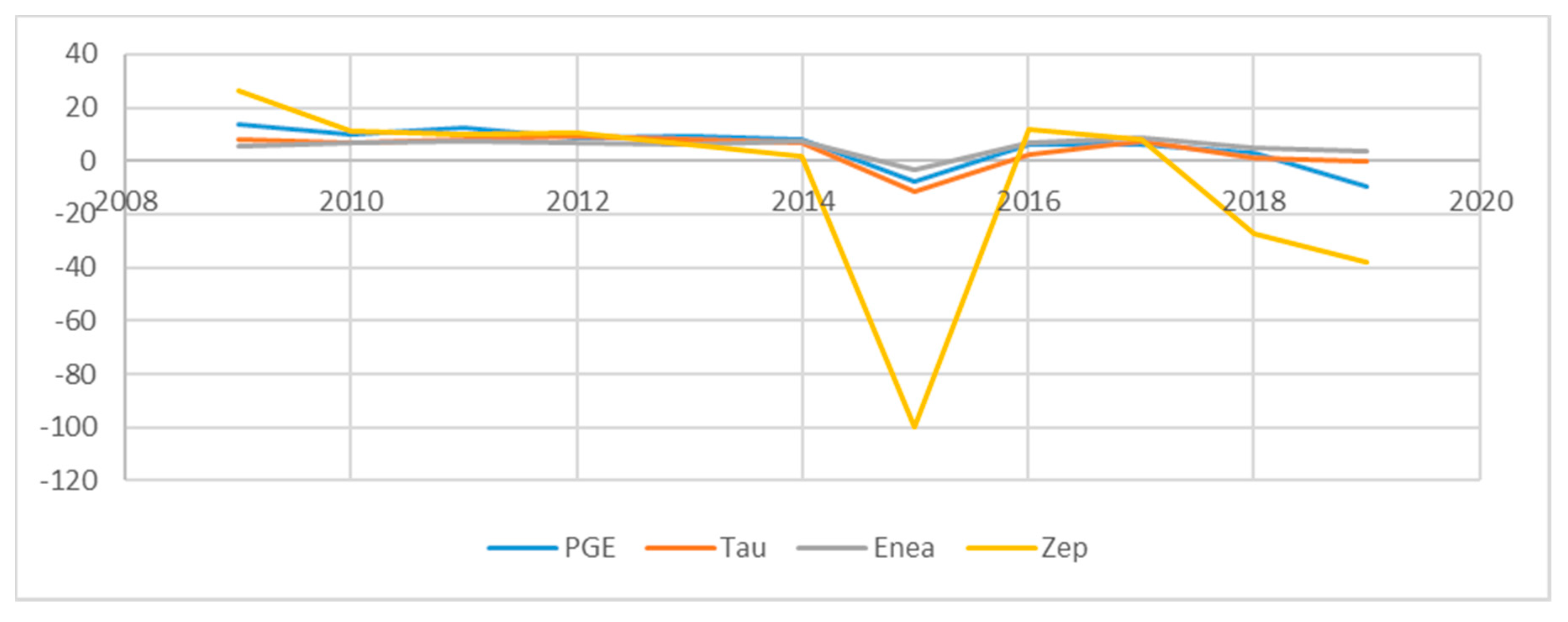

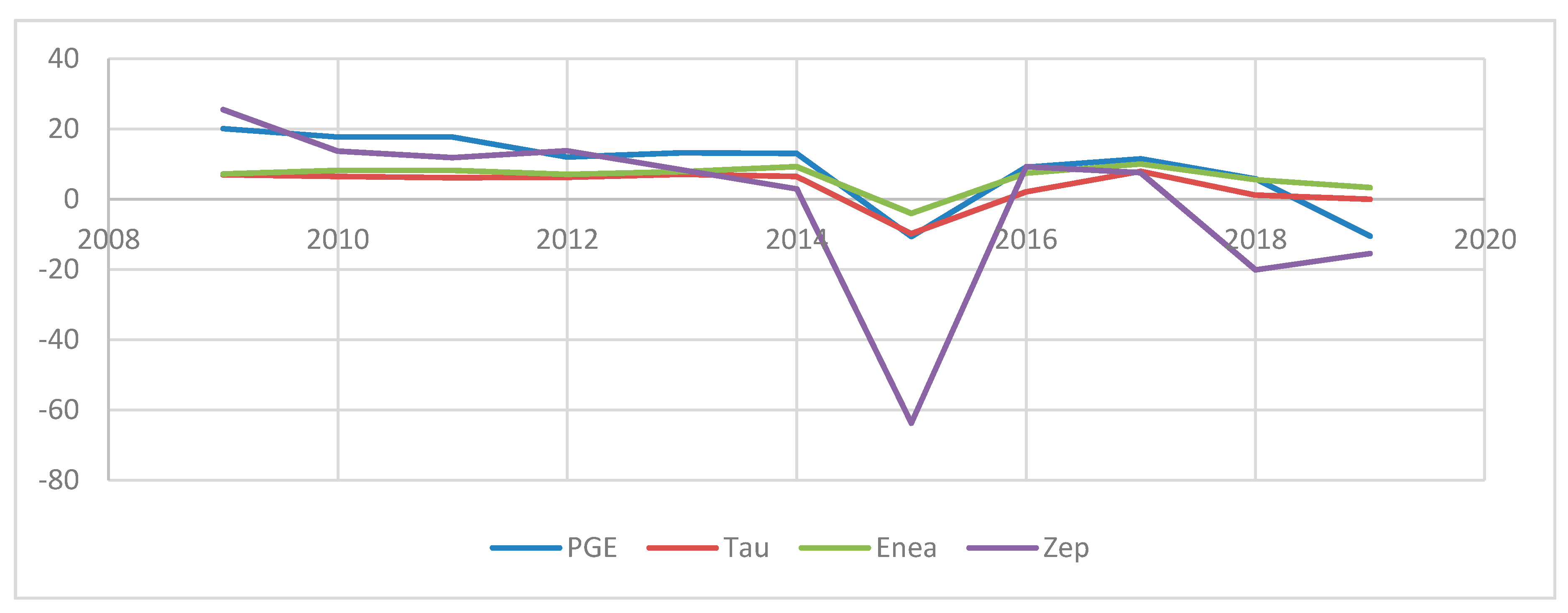

(Q2) Do energy companies that declare compliance with CSR rules achieve higher profitability and market valuation than other companies in the sector?

Companies adhering to the principles of corporate social responsibility are perceived as implementing more predictable strategies, which means that the risk of investing in such companies is lower. Therefore, there should be greater interest in such companies by stock market investors, especially institutional investors (e.g., large pension funds) looking for long-term stable investments. It should be added that institutional shareholders may influence the strategic activities of the enterprise, including the implementation of activities in the field of corporate social responsibility [

98,

99]. Based on the above considerations, the third research question was formulated:

(Q3) Are the profitability ratios and quotations of socially responsible companies more stable over time (characterized by lower volatility)?