Abstract

To identify the trends in new flexibility markets, a set of market and aggregator platforms were selected and compared. The analyzed initiatives are relevant to consider alternative designs for European electricity markets. This review proposes a common methodology for analyzing these market models by comparing their description, market structure, market timing, and implementation. Furthermore, a range of policy implications and future research directions towards implementing these markets are presented. The results provide compelling evidence that the new market models represent a promising business with technical and economic justification, as they incentivize the uptake of flexibility from distributed resources by providing services to Distribution System Operators (DSOs) in coordination with Transmission System Operators (TSOs). Moreover, the interactions between these new market platforms and existing markets are of particular interest, and the contributions from aggregator platforms are also relevant to enhance the political vision of empowering the customers through their active participation in markets.

1. Introduction

The energy system is undergoing a profound transformation driven by public policies focused on reducing greenhouse gas emissions, increasing the quota of renewable energy generation, and increasing energy efficiency. This process involves a change in the final use of energy supplied by fossil fuels, replaced in a large part by electricity, assuming that electricity generation soon would be more efficiently decarbonized. In this energy transition, consumers will play a central role with more active participation in electricity markets. New technologies, such as self-generation based on renewable energy and digitalization, allowing higher monitoring and control of energy loads, would allow savings in the electricity bill by actively managing those distributed resources.

In this context, distributed energy resources (DERs) connected to distribution networks may become an important flexibility source to support the operation of a highly decarbonized electricity system based on renewables []. The Clean Energy Package mandates DSOs to take advantage of these flexibility resources by integrating them in both planning and operation tools using market mechanisms to select the most efficient resources [].

In addition, in Europe, the digitalization of networks and smart metering implementations allow consumers and DSOs to know, almost in real time, the load and generation patterns. In response to this situation, new digital platforms that implement new market models are arising. Under these market models, and by using these platforms, consumers and aggregators exploiting flexible distributed resources can provide services to DSOs and TSOs, or trade energy between them [,]. In general, these platforms may differ widely between them in terms of the services they provide, the functions they perform, the required coordination between system operators (TSOs and DSOs), their ownership, or the interrelations with existing markets, among other factors.

A growing body of literature has examined the market models rising at the European level in the context described above. For example, in [], the authors systematically compare local markets for flexibility based on twelve projects. In [], flexibility markets are analyzed in four pioneering European projects within a six-question framework that considers aspects such as the level of integration into the existing sequence of markets, roles of the market operator, reservation payments, and cooperation between the market TSOs and DSOs. Similarly, the authors in [] analyzed a set of relevant initiatives and projects that provide important inputs related to flexibility needs, services and products, market organizations, and tools to integrate the existing flexibility into the planning and operation of the DSO.

In addition, preliminary studies have defined the concepts, designs, and technical aspects of flexibility markets. For example, in [], the authors reviewed local flexibility markets and summarized the potential designs, formulations, and clearing methods. Furthermore, ref. [] provides a review of the flexibility products and market mechanisms and classifies the different approaches according to the purposes of the flexibility products.

This paper aims to go beyond the existing reviews in the literature, seeking to address how the European electricity markets could adapt to the new trends in flexibility markets by opening current models to new participants or innovating in the formulation of new platforms. The arguments for allowing more decentralized and flexible resources to participate in the required services of a more decarbonized renewable-based power system are of particular interest.

The contributions of this paper are summarized as follows: (1) identify an appropriate set of new flexibility markets whose proposals could be decisive in defining future designs for European electricity markets. These markets have been implemented since 2014 and most of them are completed or in full operation. However, this analysis also considers some initiatives that are still at the development stage because of their relevant approaches; (2) propose a common methodology that allows comparison between several flexibility markets focused on three aspects: market description, market structure, and market timing and implementation; and (3) provide insights into new trends in flexibility markets and explore the potential impacts of these markets in future deployments, policy implications, and future research directions.

This paper is organized as follows. Section 2 introduces the identified initiatives and projects. Section 3 proposes a common methodology to evaluate the selected flexibility markets. Section 4 and Section 5 apply the methodology to market and aggregator platforms, respectively. Section 6 highlights a range of policy implications and future research directions in implementing these initiatives, and Section 7 discusses the main findings of the analysis.

2. New Flexibility Market Models in Europe

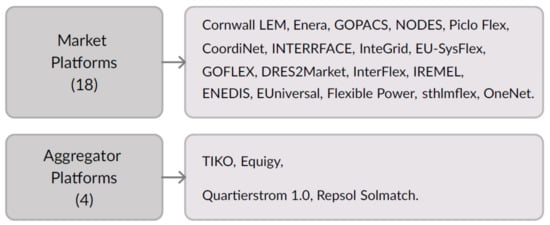

In this study, the selected flexibility market models developed in recent years in Europe are analyzed in detail. They are divided into two categories, namely, market platforms and aggregator platforms. The former is understood as marketplaces in which DER and/or aggregators can offer their flexibility and DSOs and/or TSOs can procure it. The latter refers to platforms where DER can provide flexibility through an independent aggregator or a supplier acting as an aggregator. Their names or acronyms are included in Figure 1.

Figure 1.

New flexibility market models in Europe.

Under market platforms, we identified eighteen European initiatives. Among these, Cornwall Local Energy Market (LEM) [], Enera [], GOPACS [], NODES [], and Piclo Flex [] are quite recent initiatives developed in the last four years. These platforms share the same objective: enabling flexible resources connected to distribution networks to act as Flexibility Service Providers (FSPs). In general, these flexibility markets are promoted by DSOs that require those resources to solve network congestions (e.g., thermal or voltage violations). Given the locational characteristics of these constraints, information on the location of FSPs is required by DSOs when activating local flexibility. This information is not usually available in existing energy markets, day-ahead (DA), intraday (ID), nor in balancing markets managed by TSOs, and therefore specific local flexibility mechanisms are required.

Moreover, several research projects financed by the European Research Program H2020, which focus on how DSOs and TSOs can procure flexibility from distributed resources, are analyzed. For example, CoordiNet [] and INTERRFACE [] are two recent projects initiated in 2019, devoted to intensifying the coordination between TSO and DSOs when procuring flexibility for solving network congestion or running balancing markets. InteGrid [] is a project finished in 2020 and mainly focused on how DSOs may procure flexibility from distributed resources to perform a more active operation of their networks following the new Electricity Directive and Regulation directions.

Similarly, since 2017, different solutions have been proposed to support effective use of distributed resources focused on the provision of services for grid operators in EU-SysFlex [] and GOFLEX [], the participation of Distributed Generation (DG) based on renewables in electricity markets in DRES2Market [], and the implementation of local markets in InterFlex [] and IREMEL []. In these projects, the aim is to demonstrate in large-scale pilots the potential alternatives for standardization of products and services and implement solutions through platforms, often using innovative technologies such as Blockchain, which allow for market-based procurement of these services.

In this paper, four initiatives classified as aggregator platforms are analyzed. These platforms are TIKO [], Equigy [], Quartierstrom 1.0 [], and Repsol Solmatch []. TIKO and Equigy can be understood as aggregator platforms specially devoted to cluster small flexible resources connected behind-the-meter, but not only, and offer this flexibility to TSO markets of ancillary services. Quartierstrom 1.0 and Solmatch aim to create new supplier business opportunities in the retail market by promoting peer-to-peer (P2P) transactions, taking advantage of solar photovoltaic (PV) installations located at prosumer premises.

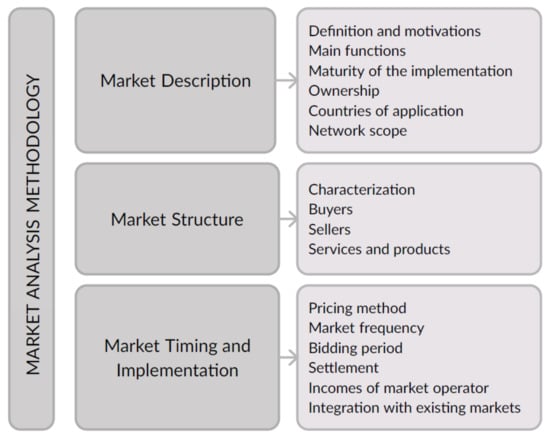

3. Market Analysis Methodology

The selected new flexibility market mechanisms are classified and analyzed under the methodology illustrated in Figure 2. Three main dimensions are analyzed, namely Market Description, Market Structure, and Market Timing and Implementation. Section 4 and Section 5 present the key information of each of these dimensions, followed by a summary and discussion on the main findings.

Figure 2.

Market analysis methodology.

4. Market Platforms Analysis

4.1. Description of Market Platforms

Table 1 collects the main attributes that describe the selected market platforms. These market models have been implemented since 2016. Most of them are completed or in full operation, except CoordiNet, INTERRFACE, EU-Sysflex, DRES2Market, and IREMEL, which are still at a development stage. Furthermore, although the network scope varies between these alternatives, the majority of the market platforms consider resources connected both at transmission and distribution networks.

Table 1.

Description of the market platforms.

Three of the market platforms analyzed, namely, Enera, GOPACS, and NODES, are organized by market operators, EPEX SPOT, ETPA, and Nord Pool, respectively. The same platforms plus Cornwall LEM allow for the coordination between the involved DSOs with the corresponding TSOs to manage congestion at different voltage levels or include the flexibility bids also in the offer of balancing services managed by the TSOs. However, Piclo Flex is centered on flexibility services to be used by DSOs, who can book flexibility in advance through availability contracts. These contracts would support the operation of the network in peak load periods and help with specific location requirements of the grid because of faults or maintenance. Therefore, in the long term, they will help reduce the need for grid reinforcement.

On the other hand, CoordiNet and INTERRFACE are both at an initial development stage and will last until 2022. They are implementing large-scale demonstration pilots in different European countries. CoordiNet counts on three demonstration countries (Spain, Sweden, and Greece), while INTERRFACE is testing solutions in nine demonstrations. However, others are centered only on DSO services with innovative ways of procuring flexibility from small residential consumers. EU-SysFlex also focuses on providing flexibility to TSOs and DSOs, including 12 demos in Germany, Italy, Finland, and Portugal.

As highlighted in Table 1, InteGrid, InterFlex, GOFLEX, and IREMEL are focused more on providing flexibility services mainly to DSOs. They also focus on enabling the participation of DERs in existing energy markets, particularly the DRES2Market project. InteGrid has implemented demos in Portugal, Sweden, and Slovenia to demonstrate how new tools used by DSOs are required to efficiently manage low voltage and medium voltage networks, taking advantage of the flexibility procured by small connected customers and corresponding aggregators.

InterFlex includes six different demos in five countries, namely, the Netherlands, Germany, Sweden, Czech Republic, and France, involving a wide range of resources: electric vehicles (EVs), energy storage, demand response (DR), and aggregators. GOFLEX promoted demonstrations in Cyprus, Germany, and Switzerland. The demos aim to delay grid reinforcements by reducing electricity peaks, preventing congestion, maintaining the quality of supply and reliability, and data management services for energy and flexibility trading. IREMEL is a Spanish initiative promoted by the Iberian market operator, and the DRES2Market includes Spain, Austria, France, Greece, Norway, and Poland. Both projects aim to enable the participation of DG and DR in the energy and flexibility markets.

4.2. Market Structure

Table 2 presents the main features of the structure of the analyzed market platforms together with the market participants acting as buyers and sellers. On the one hand, buyers are DSOs and corresponding TSOs if the platform allows for coordination between them. On the other hand, sellers are FSPs that residential and business customers can form, and other asset owners, such as EV charging points or generators, municipalities, or communities, which can be aggregated by specialized operators acting as aggregators. Furthermore, in NODES, the role of BRPs in the interaction of the activation of flexibility bids with the existing energy and balancing markets is clearly identified.

Table 2.

Market structure of the market platforms.

As reported in Table 2, the market characterization of each initiative varies according to the demos and the countries where they are implemented. The majority corresponds to a one-sided market where FSPs compete to fulfill the service requirements or needs set by the DSOs or/and TSOs. The exceptions are Cornwall LEM, Enera, GOPACS, NODES, and IREMEL that have been designed as a two-sided market. Here, market participants (buyers and sellers, directly or through intermediaries) determine the demand and supply sides in a market exchange, and through a market-clearing, determine the cleared prices and quantities. For instance, in GOPACS, flexibility bids are matched when they are adequately located in the network to solve the selected congestion, and the DSO or TSO pays the price difference between the matched buyer and seller offers.

Furthermore, in the Swedish demo of CoordiNet, the flexibility market for congestion is day-ahead but is run before the Nord-Pool day-ahead energy market. In this way, BRPs participating in the CoordiNet congestion market may adjust their consumption/production in the Nord-Pool market. The buyers of flexibility services in CoordiNet, EU-SysFlex, and INTERRFACE are both TSOs and DSOs, with different coordination structures for clearing the markets and flexibility activation. In InteGrid, the buyer of services is mainly the DSO acting in a separate platform from the one of the TSO. Therefore, it is a decentralized decision-making process. The sellers of flexibility are FSPs, aggregators, and asset operators. The applications demonstrated in InteGrid and EU-SysFlex are based on the concept of virtual power plants and low voltage customers with home energy management systems acting as sellers of flexibility.

With regards to P2P markets, some are being tested in demonstrations of CoordiNet and INTERRFACE. Part of the Swedish demo in CoordiNet aims to enable a P2P market to handle temporary congestions among peers when production is curtailed. The purpose of using a P2P market is to give flexibility for producers to either sell their capacity or to buy capacity during the curtailment period [].

Regarding market structure, another important feature is what the services and products to be traded are. According to Table 3, the type of services and products vary depending on the projects and demos. The services identified include balancing, improving network congestion management, voltage control, controlled islanding, restoration support, among others. This summary is illustrated for the two groups analyzed in this study, the market and aggregator platforms.

Table 3.

Services and products in the new flexibility market models.

4.3. Market Timing and Implementation

Table 4 describes the main attributes of the market platforms regarding pricing methods, market frequency, bidding periods, settlement, and integration with existing energy markets. In addition, the market operator incomes are specified.

Table 4.

Market timing of the market platforms.

Starting with the commercial platforms, we can observe that the NODES, GOPACS, and Enera markets are synchronized with existing intraday continuous markets in Nord Pool, ETPA, and EPEX SPOT, respectively, with trading intervals of 15 min blocks in Enera. However, Cornwall LEM and Piclo Flex are based on auctions that can be called according to the needs of DSOs. In the case of Cornwall LEM, market sessions typically take place on a daily basis for flexibility reserve and utilization. In contrast, in the case of Piclo Flex, auctions are organized much more in advance, with a lead-time of at least six months for booking long-term flexibility contracts.

In general, the pricing method is pay-as-bid in line with continuous trading and selecting bids that are solving local congestions located in their respective order books. The only exception to this rule is Cornwall LEM that organizes auctions separated from the functioning of the UK existing markets, and the winners are paid-as-cleared.

As a rule, the settlement of the market is always made through the corresponding platform. Moreover, the market operator incomes in the commercial platforms are mainly paid by DSOs. In Cornwall LEM, buyers are invoiced by LEM for the aggregated service, and sellers have contracts with LEM to use the platform. In Enera, research funds are used to maintain the platform in service at this pilot stage.

Concerning research and innovation projects, it was observed that market timing attributes are dependent on the demo characteristics, and in general, there is a great variety in the experiments and designs. Nevertheless, research projects do aim to integrate flexibility markets into existing electricity markets. For instance, in the CoordiNet and INTERRFACE demos, the platforms exchange information with parallel existing day-ahead, intraday, and balancing markets. In this way, market participants or BRPs are aware of their position, resulting in each flexibility market, and they can adjust that position in the following energy or balancing market. In InteGrid, the integration between the DSO congestion and voltage control market and the TSO balancing market is achieved by a traffic light system and exchanging the information through a data hub. In EU-SysFlex, two market operators are identified for TSO and DSO services, and these market operators run in parallel to the day-ahead and intraday markets. For IREMEL and DRES2Market, the market operator who runs the day-ahead and intraday energy market also manages the flexibility market.

Finally, regarding the market operator incomes, we can highlight that in CoordiNet, the flexibility platforms will be operated by the network operators TSO and DSOs. Furthermore, in InteGrid, InterFlex, and GOFLEX, the market hub is considered a market facilitator, which must presumably be remunerated by its users.

5. Aggregator Platforms Analysis

5.1. Description of Aggregator Platforms

Table 5 presents the descriptive attributes for all four selected platforms. On the one hand, TIKO and Equigy can be distinguished by their different level of maturity. While TIKO started in 2014 and is fully operational, Equigy started recently as a pilot project involving three European TSOs. In TIKO, behind-the-meter assets in households are clustered to provide primary and secondary regulation to the Swiss TSO. TIKO is also operating as a technology provider for these types of applications in Austria, France, Belgium, and Germany. Equigy is a blockchain platform that aggregates small consumer-based resources to participate in TSO balancing markets with a European standard design covering Germany, the Netherlands, Switzerland, and Italy markets.

Table 5.

Description of the aggregator platforms.

On the other hand, Quartierstrom 1.0 and Repsol Solmatch are very recent initiatives. Quartierstrom 1.0 started first in 2019 but still operates as a pilot project, while Repsol Solmatch began in 2020 directly under commercial operation. Quartierstrom 1.0 is based in Switzerland as a blockchain platform for energy trading among prosumers with solar PV installations together with the local utility. Solmatch is a Spanish initiative promoted by the Repsol supplier to trade energy between ‘roofers’ (consumers with solar PV installations in their premises) and ‘matchers’ (consumers that belong to the same community defined by a 500-meter radius). Repsol installs and maintains the PV installations and acts as a supplier of both ‘roofers’ and ‘matchers’.

Finally, it is important to note that the network scope of these initiatives is generally focused on low voltage levels, such as in TIKO, Quartierstrom 1.0, and Repsol Solmatch.

5.2. Market Structure

The market structure behind these platforms is simpler when compared to market platforms. Table 6 collects the main attributes for the aggregator platforms. Moreover, the summary of services and products provided by these markets is included in Table 3 of Section 4.2.

Table 6.

Market structure of the aggregator platforms.

TIKO and Equigy, as aggregator platforms, build the portfolio bids from small flexible resources connected to households. These bids are offered in the TSO market platforms that act as a single buyer. Both aggregator platforms interact with the flexibility providers collecting their offers and TIKO as a technology provider, supporting technology deployment that makes it possible to obtain flexibility from households. Quartierstrom 1.0 is a P2P market model for clearing transactions of buying and selling energy between all the participant prosumers, including the DSO local generation, which in Switzerland is not unbundled and acts as a supplier in the market. Repsol Solmatch is the platform used by Repsol to clear energy transactions between ‘roofers’ that sell energy and ‘matchers’ that buy this energy. The customized price combines two different energy prices: a price for solar energy and another one for the energy coming from the grid.

5.3. Market Timing and Implementation

TIKO and Equigy are focused on participation in daily TSO balancing markets. In TIKO, the settlement is made first on the TSO balancing platform, and then the TIKO platform settles the payments with the flexibility providers. The Crowd Balancing Platform at Equigy is a pilot that integrates the same settlement that is currently used in the TSO balancing markets (Germany, Netherlands, Switzerland, and Italy) and simultaneously with many small market participants through blockchain.

The pilot at Equigy highlights how to enlarge existing wholesale markets to enable the participation of many smaller active participants directly through adequate technology, such as Blockchain. The Quartierstrom 1.0 pilot runs a market with 15 min periods as intraday auctions. The clearing is made bilaterally between seller and buyer offers through an order book based on Blockchain. The excess bids that cannot be matched between the local offers are settled at existing tariffs with the local utility. The Repsol Solmatch commercial platform settles transactions based on agreed tariffs offered by the supplier Repsol to ‘roofers’ and ‘matchers’. The primary incomes for the supplier come from monthly fees paid by matchers participating in the solar community and the margins obtained from the energy tariffs agreed with ‘roofers’ and ‘matchers.’

In general, the platforms promoted by suppliers for local trading between prosumers represent business opportunities that take advantage of existing tariffs or regulations, e.g., shared self-consumption or subsidies to energy communities. This can be considered as opportunistic behavior of suppliers that profit from that. Still, at the same time, they are contributing to the policies that aim to empower consumers and put them in the center of the energy transition. Table 7 summarizes the commented market timing and implementation features.

Table 7.

Market timing of the aggregator platforms.

6. Discussion on Policy Implications and Future Research Directions

As illustrated in previous sections, the implementation of the flexibility market models has many design challenges to be considered, and complex coordination with existing markets and different roles for involved agents are required. Therefore, this section highlights a range of policy implications and future research directions in implementing these market models.

6.1. Policy Implications

- (1)

- New roles and responsibilities of DSOs: Several policy and regulatory barriers need to be resolved to enable the full operability of flexibility markets. For example, the role, functions, and responsibilities of the different agents involved in flexibility markets still need to be defined. Particularly, the tasks performed by DSOs may vary depending on the market design and the regulatory framework, which is still to be developed. For some traditional roles, such as determining or solving network problems, it is clear that the DSO is better placed to perform them. However, some functions in the local flexibility markets, including prequalification, settlement, market-clearing processes, etc., are not fully defined as to who will perform them. As stated in [], DSOs have no or little experience operating a marketplace to procure grid services. Moreover, due to neutrality being required for operating a market, a neutral entity can ensure fair and equal treatment of all market participants and the correct operation of a local flexibility market. Therefore, an independent market operator can perform certain functions related to the procurement of grid services. Furthermore, there is uncertainty regarding what services the DSOs will be able to procure from the market and what they will be managing themselves as the network operator. Thus, clarification should be made regarding DSO functions to ensure a competitive marketplace.

- (2)

- Role of Aggregator: According to [], the two leading roles of the aggregator can be summarized as a flexibility expert and market expert. As flexibility experts, they sum up small flexibility capacities from individual DERs, so the final amount is large enough to build marketable flexibility products. On the other hand, one of the main functionalities of the aggregator as an independent market participant is to assume, develop, and excel in the role of a market expert on behalf of its aggregated portfolio, to maximize its value through time. Furthermore, FSPs, DSO, and TSO are linked to the aggregator through a communication interface, allowing it to evaluate the capability to provide power and energy services. Although there are various opportunities for aggregation business models, there are also many regulatory barriers that need to be removed for the participation of aggregators in the wholesale and ancillary services markets, especially with regards to independent aggregation [].

- (3)

- Regulatory barriers and sandboxes: The development of flexibility markets encounters several challenges, which vary from technical, economic, stakeholder, environmental, and regulatory barriers. As highlighted in [], national regulations and the lack of regulation incentives are identified as the principal barrier to create local flexibility markets. Therefore, regulatory sandboxes could be used to overcome this gap. A sandbox brings an adaptive regulatory approach that facilitates regulatory analysis and provides an environment for innovation. Here actors can operate out of the conventional regulatory framework for a certain period of time, and this would allow testing new services and products that are not yet stipulated or permitted under the existing regulation. For instance, reference [] identifies the main barriers that prevent the implementation of flexibility mechanisms by DSOs in Spain and then presents a proposal for a regulatory sandbox in this context. Furthermore, ref. [] examines current barriers for market access flexibility resources in five European countries, focusing on regulatory, technical, and economic aspects with the purpose of providing relevant country-specific recommendations.

- (4)

- Flexibility remuneration mechanisms: The procurement of local flexibility requires an adaptation in the economic regulation of DSOs. In this new context, OPEX should increase by the inclusion of costs associated with flexibility procurement. By contrast, costly CAPEX on grid reinforcements are expected to be reduced, either by deferment or avoidance of investments, as local flexibility will be used to keep grids within limits []. Therefore, new regulatory frameworks should incorporate mechanisms that not only allow DSOs to procure system flexibility services but also to ensure the recovery of flexibility procurement costs and provide economic incentives for the use of local flexibility as an alternative for grid reinforcement.

6.2. Future Research Directions

According to the findings of this paper, further research may be accomplished in the following areas.

- (1)

- Mechanisms for procuring grid services: The DSO has different mechanisms to procure flexibility, both market- and non-market-based alternatives. In this paper, we focus on the analysis of flexibility markets; however, more regulated mechanisms, such as access and connection agreements, dynamic network tariffs, bilateral contracts, regulated cost-based remuneration, and obligations for suppliers, are alternatives when markets cannot work correctly due to market failures or implementation costs. Each of the mechanisms has different design elements that should be carefully considered when applied in different jurisdictions to provide adequate solutions to the DSO’s needs. Therefore, specific features of these mechanisms and a combination of them for acquiring grid services could be explored in future research.

- (2)

- Flexibility markets structure: The organizational structure of the flexibility markets requires a series of functions divided into five main phases []: the preparation phase, forecasting phase, market operation/bid selection phase, monitoring and activation phase, and measurement and settlement phase. In this study, we have analyzed some of them; for example, in Table 1 and Table 5, we listed the main functions performed by the market and aggregator platforms, respectively. Furthermore, in Table 4 and Table 7, some market operation/bid selection functions and settlement phases were illustrated. Future studies should examine the selected initiatives in terms of the preparation phase (product definition, registration, and prequalification) and monitoring and activation phase to produce insights based on these functions.

- (3)

- Services and products characteristics: This study identified services and products of the selected new flexibility market models according to Table 3. Products can be grouped into standard products and specific products, which can be described by a set of technical attributes. One of the main benefits of harmonized products is the increased standardization and, therefore, the better comparability of bids and lower entry barriers for FSPs. However, we should also consider those specific characteristics of the DSOs’ needs would require specific product parameters, making product standardization not always desirable. Thus, the definition of product characteristics is a crucial aspect that should be addressed in the preparation phase of flexibility markets. This is being developed in some European research projects such as CoordiNet, where one or more standard products are defined for each of the grid services, with some commonly defined attributes [].

- (4)

- Additional implementation considerations: On a wider level, research is also needed to examine additional implementation aspects in flexibility markets, such as metering requirements, baseline methodologies, and TSO/DSO coordination principles. For instance, the requirements for the resolution of metering data depend on the services provided and on the settlement period. As a minimum requirement, the granularity of the metering data shall be higher than the one used for the settlement period. On the other hand, the baseline methodology is critical because payments for FSPs are directly based on the difference between the baseline and actual metered demand. Therefore, an optimal baseline methodology is necessary to measure the effective performance of a demand resource and to compensate the FSP adequately. In general, five baseline methodologies are considered: a historical data approach, statistical sampling, maximum base load, meter before/meter after, and metering generator output []. Finally, it is relevant to highlight that the coordination between DSOs, TSOs, market operators, and aggregators is in the process of being defined and evaluated in current research initiatives such as CoordiNet, INTERRFACE, and OneNet [].

7. Conclusions

We have analyzed the new flexibility markets in Europe focused on market description, market structure, and market timing and implementations. Taken together, the analysis suggests the following trends and insights.

Firstly, some market platforms are promoted and managed by actual market operators, such as Nord Pool in NODES and EPEX SPOT in Enera. They extend their functions from well-established wholesale energy markets to other network services for DSOs in coordination with TSOs. An important issue that differentiates the analyzed initiatives is how these flexibility markets for congestion management are integrated with the existing energy markets. Here, the expertise of market operators can be very relevant to make this interface simple and effective for all participating FSPs. However, FSPs participating in congestion management markets may be subject to imbalances depending on the overall market design. For this reason, the interactions between these new congestion management market platforms and existing wholesale and balancing markets are a key aspect in fostering FSP participation and creating an efficient environment for local flexibility provision. Furthermore, the involvement of DSOs and TSOs in these new models is essential as they are the users of the flexibility. Hence, it is recommended to use the experience and knowledge available to develop and implement a flexibility mechanism linking existing markets with the participation of DSOs and TSOs.

Secondly, the selected market platforms reinforce the importance of incorporating DER flexibility into the markets. They focus primarily on the new roles of DSOs when procuring flexibility for solving congestion and network problems under market-based approaches. As shown in Section 4.2, many new services and products are being demonstrated in experimental platforms by research and innovation projects. These services include balancing, congestion management, voltage control, and controlled islanding, directly affecting DSOs in coordination with TSOs. Although most pilot platforms being demonstrated are still not ready for a large-scale commercial deployment, certain market platforms have demonstrated, in some cases and for some solutions, that it is possible as of today. For instance, NODES as an independent market operator is addressing the trading of flexibility in two locations, in Norway and Germany, since 2018. Furthermore, in 2019, the Cornwall LEM enabled a DSO and the National Grid ESO of the UK to buy flexibility in a coordinated way via a local third-party platform.

Thirdly, the second group of analyzed new flexibility markets corresponds to aggregator platforms. On the one hand, TIKO and Equigy are totally aligned with the market models previously described. There is a need for specialized aggregators that cluster small DER, even at a household level, to offer services to the TSO’s balancing markets. On the other hand, suppliers also have developed platforms, acting as aggregators, by promoting P2P transactions among customers. In some cases, they have a clear opportunistic justification, taking advantage of some benefits that arise from actual legislation, promoting, for instance, energy communities or shared renewable self-consumption. Nevertheless, they contribute to enhancing the political vision of empowering the customers through their active participation in electricity markets.

Overall, these results provide compelling evidence that the new market models that incentivize the uptake of flexibility from small DER, even at a household level, aiming at providing services to DSOs and in coordination with TSOs, is a promising business with technical and economic justification. However, to facilitate their deployment, the policy implications discussed in Section 6 need to be addressed, where it was highlighted that regulatory sandbox frameworks could aid regulators and policymakers in testing these flexibility platforms. The sandboxes’ experiences could serve as the basis for developing new regulations, enabling the implementation of these innovative market models.

In conclusion, across the new market models under analysis, congestion management at the local level/network is identified as the main priority for platform developers. However, the same DER would become active participants in existing electricity markets, namely, wholesale and balancing markets. Consequently, these markets should be adapted to incorporate the ever-growing number of resources and associated aggregators. Finally, the so-called P2P trading in local and limited scope platforms may have an opportunistic interest, but their continuity and sustainability in the long term are still to be proven.

This paper has also identified future areas that need to be studied to determine the overall impact of new flexibility market models, namely, (i) the development of mechanisms for flexibility procurement; (ii) the structure of the flexibility market; (iii) the definition of services and product characteristics; and (iv) additional considerations, such as metering requirements, TSO-DSO coordination, and baseline methodologies.

Author Contributions

Conceptualization, O.V., T.G. and J.P.C.-A.; methodology, O.V., T.G. and J.P.C.-A.; formal analysis, O.V., T.G., J.P.C.-A., L.L., M.C. and D.U.Z.; investigation, O.V., T.G., J.P.C.-A., L.L., M.C., D.U.Z. and R.E.; writing—original draft preparation, O.V.; writing—review and editing, T.G., J.P.C.-A., L.L., M.C., D.U.Z. and R.E.; supervision, T.G. and J.P.C.-A.; project administration, T.G., J.P.C.-A. and R.E. All authors have read and agreed to the published version of the manuscript.

Funding

This research was partially funded by the Iberian Electricity Market Operator—OMIE.

Data Availability Statement

Not applicable.

Acknowledgments

The authors would like to thank Dionisio Arredondo and Morsy Nour for their contributions in reviewing some selected flexibility market models.

Conflicts of Interest

The authors declare no conflict of interest.

Abbreviations

| aFRR | Frequency Restoration Reserves with automatic activation |

| ATP | Automatic Trading Platform |

| BRP | Balancing Responsible Party |

| BUC | Business Use Case |

| CAPEX | Capital expenditure |

| DA | Day-ahead market |

| DER | Distributed Energy Resource |

| DG | Distributed Generation |

| DR | Demand Response |

| DSO | Distribution System Operator |

| ESO | Electric System Operator (UK) |

| ETPA | Energy Trading Platform of Amsterdam |

| EV | Electric Vehicle |

| FCR | Frequency Containment Reserve |

| FMAN | Flex-Offer Manager |

| FMAR | Flex-Offer Market |

| FOA | Flex-Offer Agent |

| FSP | Flexibility Service Provider |

| ID | Intraday market |

| IDCONS | Intraday Congestion Spread |

| IEGSA | Interoperable pan-European Grid Services Architecture |

| LEM | Local Energy Market |

| LV | Low Voltage |

| mFRR | Frequency Restoration Reserves with manual activation |

| MV | Medium Voltage |

| OMIE | Iberian Electricity Market Operator (Spain) |

| OPEX | Operational expenditure |

| OPF | Optimal Power Flow |

| P2P | Peer-to-peer |

| PV | Photovoltaic |

| RR | Replacement Reserves |

| TSO | Transmission System Operator |

| VPP | Virtual Power Plant |

| WPD | Western Power Distribution (UK) |

References

- Minniti, S.; Haque, N.; Nguyen, P.; Pemen, G. Local markets for flexibility trading: Key stages and enablers. Energies 2018, 11, 3074. [Google Scholar] [CrossRef]

- European Commission. Directive (EU) 2019/944 of the European Parliament and of the Council of 5 June 2019 on Common Rules for the internal market for electricity and amending Directive 2012/27/EU (Text with EEA relevance). Off. J. Eur. Union 2019, 62, 125–199. [Google Scholar]

- Gerard, H.; Rivero Puente, E.I.; Six, D. Coordination between transmission and distribution system operators in the electricity sector: A conceptual framework. Util. Policy 2018, 50, 40–48. [Google Scholar] [CrossRef]

- Zhang, K.; Troitzsch, S.; Hanif, S.; Hamacher, T. Coordinated Market Design for Peer-to-Peer Energy Trade and Ancillary Services in Distribution Grids. IEEE Trans. Smart Grid 2020, 11, 2929–2941. [Google Scholar] [CrossRef]

- Radecke, J.; Hefele, J.; Hirth, L. Markets for Local Flexibility in Distribution Networks; ZBW—Leibniz Information Centre for Economics: Kiel/Hamburg, Germany, 2019. [Google Scholar]

- Schittekatte, T.; Meeus, L. Flexibility markets: Q&A with project pioneers. Util. Policy 2020, 63, 101017. [Google Scholar] [CrossRef]

- Gouveia, C.; Alves, E.; Villar, J.; Ferreira, R.; Silva, R.; Chaves Ávila, J.P. EUniversal—D1.2: Observatory of Research and Demonstration Initiatives on Future Electricity Grids and Markets. 2020. Available online: https://euniversal.eu/wp-content/uploads/2021/02/EUniversal_D1.2.pdf (accessed on 12 June 2021).

- Jin, X.; Wu, Q.; Jia, H. Local flexibility markets: Literature review on concepts, models and clearing methods. Appl. Energy 2020, 261. [Google Scholar] [CrossRef]

- Villar, J.; Bessa, R.; Matos, M. Flexibility products and markets: Literature review. Electr. Power Syst. Res. 2018, 154, 329–340. [Google Scholar] [CrossRef]

- Cornwall Local Energy Market Project Website. Available online: https://www.centrica.com/innovation/cornwall-local-energy-market (accessed on 27 April 2021).

- Enera Project Website. Available online: https://projekt-enera.de/ (accessed on 27 April 2021).

- GOPACS Project Website. Available online: https://en.gopacs.eu/about-gopacs/ (accessed on 27 April 2021).

- NODES Project Website. Available online: www.nodesmarket.com (accessed on 27 April 2021).

- Piclo Flex Project Website. Available online: https://picloflex.com/ (accessed on 27 April 2021).

- CoordiNet Project Website. Available online: https://coordinet-project.eu/projects/coordinet (accessed on 27 April 2021).

- INTERRFACE Project Website. Available online: http://www.interrface.eu/ (accessed on 27 April 2021).

- InteGrid Project Website. Available online: https://integrid-h2020.eu/ (accessed on 27 April 2021).

- EU-SysFlex Project Website. Available online: https://eu-sysflex.com/ (accessed on 27 April 2021).

- GOFLEX Project Website. Available online: https://goflex-project.eu/ (accessed on 27 April 2021).

- DRES2Market Project Website. Available online: https://www.dres2market.eu/ (accessed on 27 April 2021).

- InterFlex Project Website. Available online: https://interflex-h2020.com/ (accessed on 27 April 2021).

- IREMEL Project Website. Available online: https://www.omie.es/es/proyecto-iremel (accessed on 27 April 2021).

- TIKO Project Website. Available online: https://tiko.energy/ (accessed on 27 April 2021).

- Equigy Project Website. Available online: https://equigy.com/ (accessed on 27 April 2021).

- Quartierstrom 1.0 Project Website. Available online: https://quartier-strom.ch/index.php/qs1-inkuerze/ (accessed on 27 April 2021).

- Repsol Solmatch Project Website. Available online: https://solmatch.repsolluzygas.com/ (accessed on 27 April 2021).

- ENEDIS Project Website. Available online: https://www.enedis.fr/construct-jointly-local-flexibility-process (accessed on 31 May 2021).

- EUniversal Project Website. Available online: https://euniversal.eu/ (accessed on 31 May 2021).

- Flexible Power Project Website. Available online: https://www.flexiblepower.co.uk/ (accessed on 31 May 2021).

- Sthlmflex Project Website. Available online: https://www.svk.se/sthlmflex (accessed on 31 May 2021).

- OneNet Project Website. Available online: https://onenet-project.eu/ (accessed on 31 May 2021).

- Moreira, R.; Strbac, G. Business Case for Flexibility Providers: Cornwall Local Energy Market. 2019. Available online: https://www.centrica.com/media/4378/busines-case-for-flexibility-providers.pdf (accessed on 12 June 2021).

- Woodruff, J. Visibility Plugs and Sockets: Closedown Report. 2020. Available online: https://www.centrica.com/media/4383/vpas-phase-1-trial-report-v10-28-10-19.pdf (accessed on 12 June 2021).

- ETPA: Frequently Asked Questions. Available online: https://etpa.nl/wp-content/uploads/2018/06/Frequently_Asked_Questions-15062018.pdf (accessed on 27 April 2021).

- STEDIN; Liander; Tennet; Enexis. IDCONS Product Specification: GOPACS. 2019. Available online: https://en.gopacs.eu/wpcms/wp-content/uploads/2019/05/20190228-IDCONS-product-specifications_EN.pdf (accessed on 12 June 2021).

- NODES. White Paper: A Fully Integrated Marketplace for Flexibility. 2018. Available online: https://nodesmarket.com/download/whitepaper/ (accessed on 12 June 2021).

- Piclo. Flexibility & Visibility: Investment and Opportunity in a Flexibility Marketplace. 2019. Available online: https://piclo.energy/publications/Piclo+Flex+-+Flexibility+and+Visibility.pdf (accessed on 12 June 2021).

- Delnooz, A.; Vanschoenwinkel, J.; Rivero, E.; Madina, C. CoordiNet Deliverable D1.3: Definition of Scenarios and Products for the Demonstration Campaigns; WP1/T1.3. 2019. Available online: https://private.coordinet-project.eu//files/documentos/5d72415ced279Coordinet_Deliverable_1.3.pdf (accessed on 12 June 2021).

- Bachoumis, T.; Dratsas, P.; Kaskouras, C.; Charilaos Sousounis, M.; Martinez Garcia, A.I.; Viachos, I.; Dimeas, A.; Trakas, D.; Botsis, A.; Sideratos, G.; et al. CoordiNet Deliverable D5.1 Demonstrator Analysis & Planning; WP5/T5.1. 2020. Available online: https://private.coordinet-project.eu//files/documentos/5e4c2778aea24D5_1%20coordinet.pdf (accessed on 12 June 2021).

- Bessa, R. InteGrid D1.2 Uses Cases and Requirements; WP1—Use Cases and System Architecture Use. 2017. Available online: https://integrid-h2020.eu/uploads/public_deliverables/D1.2%20Read%20Use%20Cases%20and%20Requirements.pdf (accessed on 12 June 2021).

- Effantin, C.; Loevenbruck, P. EU-SysFlex D3.3: T3.3 Business Use Cases for Innovative System Services; WP3/T3.3. 2018. Available online: http://eu-sysflex.com/wp-content/uploads/2019/03/D3.3_Business-Use-Cases-for-Innovative-System-Services.pdf (accessed on 12 June 2021).

- Berlet, R.; von Jagwitz, A.; Jander, D. GOFLEX D10.2: Demand Side Management, Opportunities and Restrictions in the European Market; WP10. 2017. Available online: https://www.goflex-project.eu/Deliverables.html (accessed on 12 June 2021).

- Šikšnys, L.; Neupane, B.; Brus, S.; Černe, G. GOFLEX D2.1: Automatic Trading Platform Requirement & Interface Specification; WP2. 2017. Available online: https://www.goflex-project.eu/Deliverables.html (accessed on 12 June 2021).

- RSE; EMP; ENTSO; UPRC. INTERRFACE: D3.1 Definition of New/Changing Requirements for Services; WP3/T3.1. 2020. Available online: http://www.interrface.eu/sites/default/files/publications/INTERRFACE_D3.1_V1.0.pdf (accessed on 12 June 2021).

- Stevens, N.; Merckx, K.; Cricifix, P.; Gómez, I.; Santos-Mugica, M.; Díaz, Á.; Sanjab, A.; Kessels, K.; Rivero, E.; Mou, Y.; et al. CoordiNet Deliverable D2.1-Markets for DSO and TSO Procurement of Innovative grid Services: Specification of the Architecture, Operation and Clearing Algorithms. 2020. Available online: https://private.coordinet-project.eu//files/documentos/6033b5fe475cdCoordiNet_WP2_D2.1_Markets%20for%20DSO%20and%20TSO%20procurement%20of%20innovative%20grid%20services_V1.0_20.02.2021.pdf (accessed on 12 June 2021).

- UK Power Networks. Flexibility Services Invitation to Tender—2018/19—UK Power Networks (Operations) Limited. 2018. Available online: https://www.ukpowernetworks.co.uk/internet/asset/9ed338e5-b879-4642-8470-8b90e0a730bJ/Invitation+to+Tender+-+PE1-0074-2018+Flexibility+Services.pdf (accessed on 12 June 2021).

- Chaves-Ávila, J.P.; Gómez San Román, T.; Lind, L.; Sánchez Fornié, M.Á.; Olmos Camacho, L. CoordiNet Deliverable D3.1: Report of Functionalities and Services of the Spanish Demo; WP3/T3.1. 2020. Available online: https://private.coordinet-project.eu//files/documentos/5e4c274e8190dD3.1%20Coordinet.pdf (accessed on 12 June 2021).

- ENTSO-E; UPRC; EMP; BME; RTU; TUT; RSE; EUI. INTERRFACE: D3.2 Definition of New/Changing Requirements for Market Designs; WP3/T3.2. 2020. Available online: http://www.interrface.eu/sites/default/files/publications/INTERRFACE_D3.2_v1.0.pdf (accessed on 12 June 2021).

- Cossent, R.; Lind, L.; Simons, L.; Frías, P.; Valor, C.; Correa, M. InteGrid D7.5 Business Models to Support the Developed Concepts; WP7—CBA, Regulatory Analysis and Business Models Business. 2020. Available online: https://integrid-h2020.eu/uploads/public_deliverables/D7.5_Business%20Models.pdf (accessed on 12 June 2021).

- Van Cuijk, T.; Fonteijn, R.; Geelen, D.; Laarakkers, J.; Rademakers, P. InterFlex D7.3 Innovative Solutions to be Tested in the Use Cases, Version 1.0; WP07. 2018. Available online: https://interflex-h2020.com/wp-content/uploads/2020/02/D7.3-Enexis-DEMO-innovative-solutions-to-be-tested-in-the-use-cases_Enexis_InterFlex.pdf (accessed on 12 June 2021).

- Schweren, K. Tiko—Delivering Value as Virtual Power Plant & Home Energy Management System. 2020. Available online: https://ec.europa.eu/energy/sites/default/files/documents/session_2_-_5_katrinschweren_tiko.pdf (accessed on 12 June 2021).

- Brenzikofer, A.; Meuw, A.; Schopfer, S.; Wörner, A.; Dürr, C. QUARTIERSTROM: A decentralized local P2P energy market pilot on a self-governed blockchain. In Proceedings of the 25th International Conference on Electricity Distribution, CIRED. Madrid, Spain, 3–6 June 2019. [Google Scholar]

- Zannini, A. Blockchain Technology as the Digital Enabler to Scale up Renewable Energy Communities and Cooperatives in Spain. Master’s Thesis, Utrecht University, Utrecht, The Netherlands, 2020. [Google Scholar]

- Repsol External Relations—Management Division. REPSOL Launches SOLMATCH, the First Large Solar Community in Spain; Madrid, Spain. 2020. Available online: https://www.repsol.com/imagenes/global/en/PR30042020_Solmatch_tcm14-176594.pdf (accessed on 12 June 2021).

- Equigy Webinar 2020. Available online: https://www.youtube.com/watch?v=pCUEznpO394&feature=youtu.be&ab_channel=TenneT (accessed on 27 April 2021).

- Ableitner, L.; Meeuw, A.; Schopfer, S.; Tiefenbeck, V.; Wortmann, F.; Wörner, A. Quartierstrom: Implementation of a Real World Prosumer Centric Local Energy Market in Walenstadt, Switzerland. Available online: http://arxiv.org/abs/1905.07242 (accessed on 27 April 2021).

- Nousios, D.; Aebi, S. Swissgrid: Principles of Ancillary Services Products—Products Description. 2020. Available online: https://www.swissgrid.ch/dam/swissgrid/customers/topics/ancillary-services/as-documents/D201223-AS-Products-V16-en.pdf (accessed on 12 June 2021).

- Chaves-Ávila, J.P.; Troncia, M.; Herding, L.; Morell, N.; Valarezo, O.; Kessels, K.; Delnooz, A.; Vanschoenwinkel, J.; Villar, J.; Budke, J.; et al. EUniversal: D5.1 Identification of Relevant Market Mechanisms for the Procurement of Flexibility Needs and Grid Services. 2021. Available online: https://euniversal.eu/wp-content/uploads/2021/02/EUniversal_D5.1.pdf (accessed on 12 June 2021).

- Jimeno, J.; Merino, J.; Cortes, A.; Santos, M.; Sanchez, E.; Camargo, J.; Manna, C.; Verbeeck, J.; Ziu, D.; Marroquin, M. CoordiNet: D2.3—Aggregation of Large-Scale and Small-Scale Assets Connected to the Electricity Network; WP2. 2021. Available online: https://private.coordinet-project.eu//files/documentos/6026502c9cb56CoordiNet_WP2_D2.3_Aggregation%20of%20large-scale%20and%20small-scale%20assets%20connected%20to%20the%20electricity%20network_V1.0_10.02.2021_.pdf (accessed on 12 June 2021).

- Poplavskaya, K.; De Vries, L. A (not so) independent aggregator in the balancing market theory, policy and reality check. In Proceedings of the 15th International Conference on the European Energy Market (EEM), Lodz, Poland, 27–29 June 2018. [Google Scholar]

- Valarezo, O.; Chaves-Ávila, J.P.; Rossi, J.; Hillberg, E.; Baron, M. Survey Results on Local Markets to Enable Societal Value. In Proceedings of the 14th IEEE PowerTech Conference, Madrid, Spain, 28 June–2 July 2021; Available online: https://www.iit.comillas.edu/publicacion/mostrar_publicacion_conferencia.php.en?id=11976 (accessed on 12 June 2021).

- Correa, M.; Gomez, T.; Cossent, R. Local Flexibility Mechanisms for Electricity Distribution Through Regulatory Sandboxes: International Review and a Proposal for Spain. In Proceedings of the 14th IEEE PowerTech Conference, Madrid, Spain, 28 June–2 July 2021; Available online: https://www.iit.comillas.edu/publicacion/mostrar_publicacion_conferencia.php.en?id=11975 (accessed on 12 June 2021).

- Forouli, A.; Bakirtzis, E.A.; Papazoglou, G.; Oureilidis, K.; Gkountis, V.; Candido, L.; Ferrer, E.D.; Biskas, P. Assessment of Demand Side Flexibility in European Electricity Markets: A Country Level Review. Energies 2021, 14, 2324. [Google Scholar] [CrossRef]

- CEDEC; E.DSO; ENTSO-E; EUROELECTRIC; GEODE. TSO-DSO Report: An Integrated Approach to Active System Management. Available online: https://eepublicdownloads.blob.core.windows.net/public-cdn-container/clean-documents/Publications/Position%20papers%20and%20reports/TSO-DSO_ASM_2019_190416.pdf. (accessed on 28 May 2021).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).