Investigating the Sustainable Impact of Seaport Infrastructure Provision on Maritime Component of Supply Chain

Abstract

1. Introduction

- How does the improved port maritime excess affect foreland (maritime) transport performance?

- What is the impact of improved port nautical excess on costs of sea freight transport?

- What is the structure of port users cost efficiency gains?

2. Research Concept and Methodological Framework

- GC(D)—generalized transport cost,

- P(D)—shipping operating cost,

- H—time cost per hour,

- T(D)—port-to-port transit time.

3. Inputs and Parameters

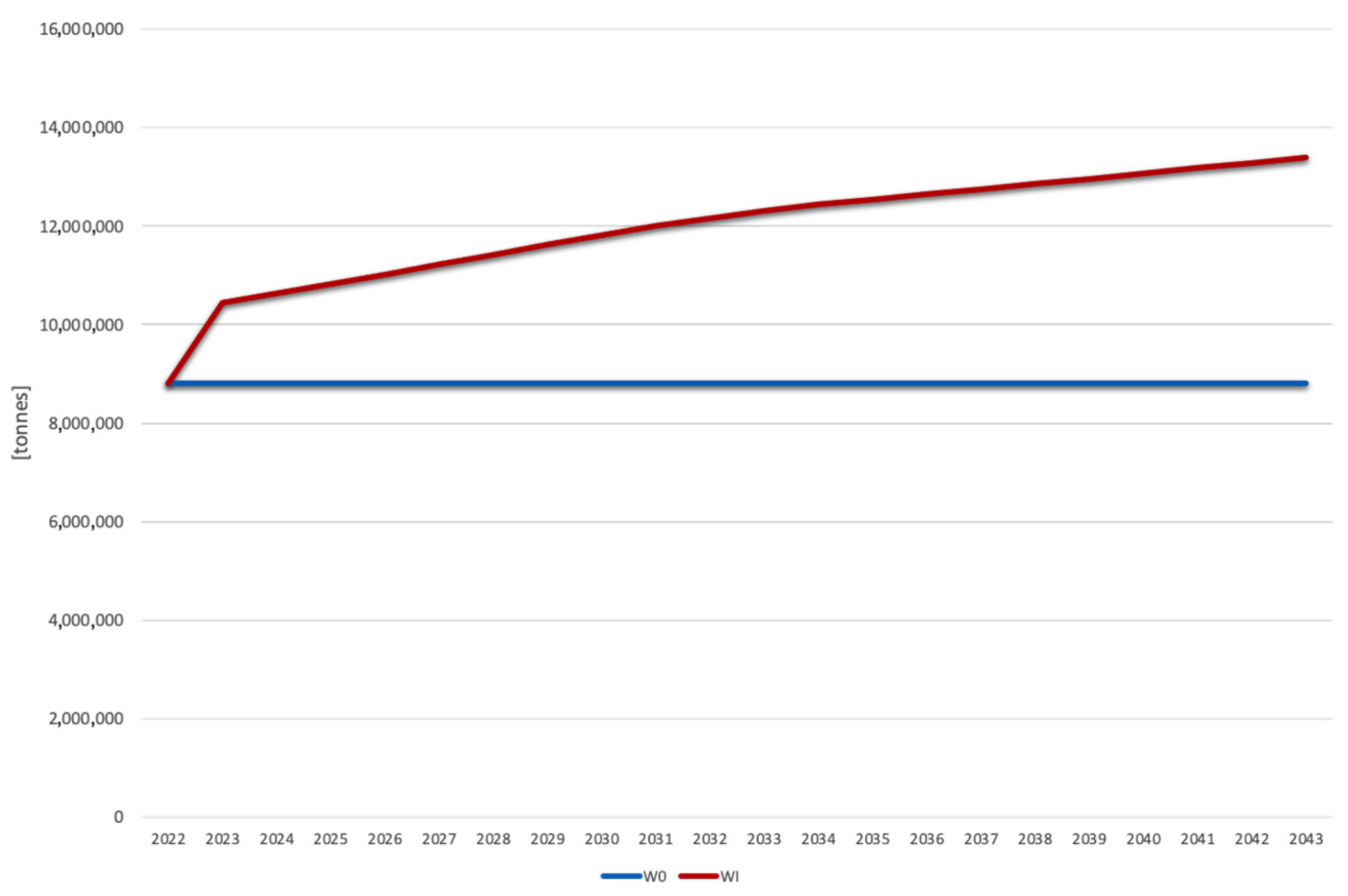

3.1. Forecasted Demand for Port Transhipment

- —forecasts for j-th cargo group in time t,

- —forecasts for j-th cargo group in time t − 1,

- —the annual chain indexes of dynamics of cargo throughput growth in j-th cargo group, and

- —the average level of transit in j-th cargo group determined from k time periods.

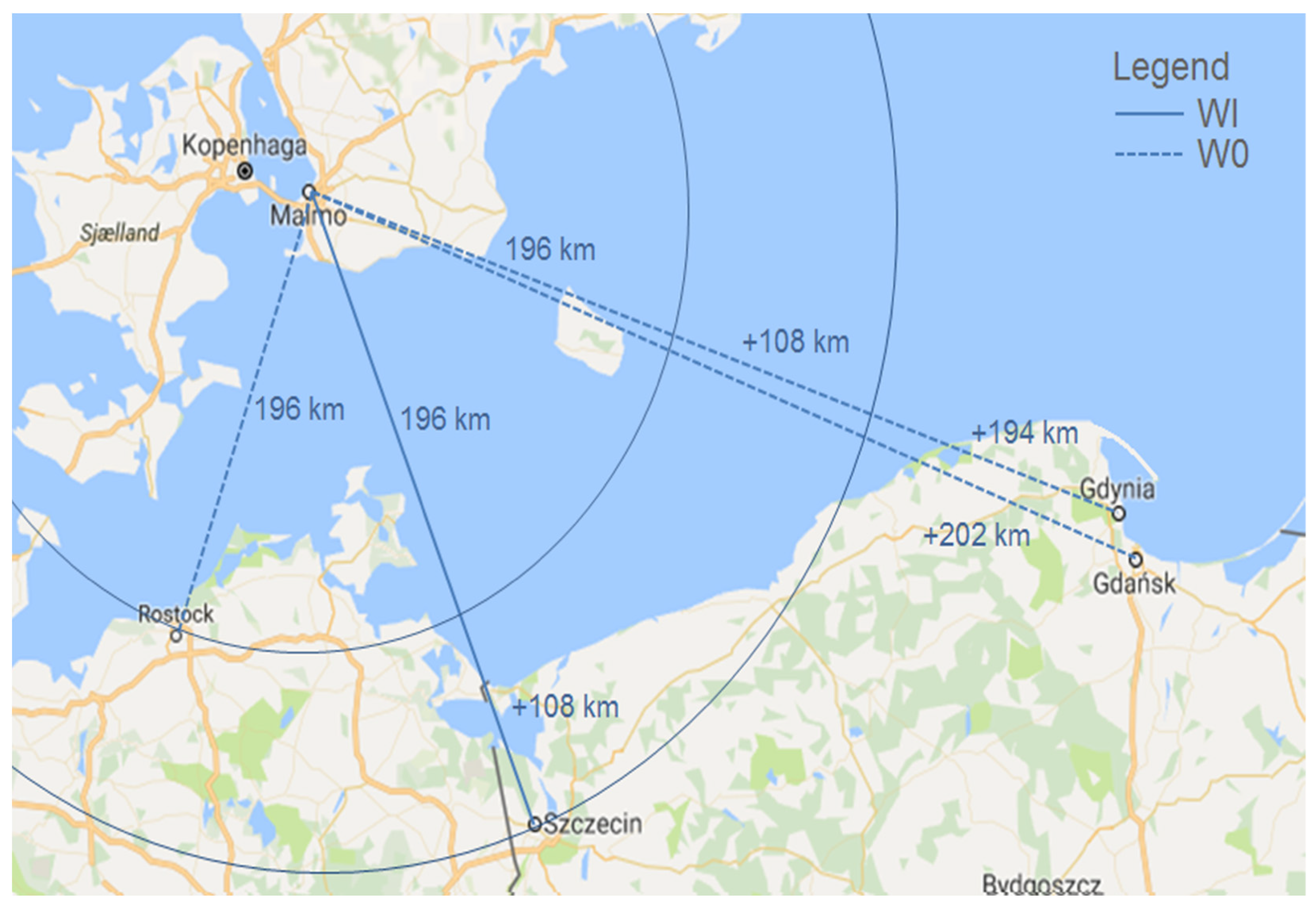

3.2. Sea Distances of Freights Traded to and from Port of Szczecin

3.3. Port Competitiveness in the Range

3.4. Shipping Route Alternatives and Dispersion of Sea Distances

3.5. Daily and Unit Shipping Cost of Dry Bulk and Container Cargo

- -

- operating costs (administration, repairs and maintenance, staffing, stores and lubricants, and insurance),

- -

- voyage expenses (fuel cost and port dues), and

- -

- capital costs (interest and capital repayments).

- DSC—the daily shipping cost,

- DOC—the daily operating cost,

- DVC—the daily voyage cost (fuel cost and port dues), and

- DCC—the daily capital cost.

- for dry bulk carrierwhere:1336.6 is the estimate of the parameter of the cost model and0.2909 is the average elasticity of the ship-day operation cost in relation to the i-th bulk carrier deadweight.

- for container shipwhere:121.974 is parameter of the cost model and

- 0.565 is the average elasticity of the ship-day operation cost in relation to the i-th container ship deadweight.

- The ship capacity is fully used (in tonnes of cargo).

- Sailing speed for a given ship size is constant; consequently, the travel distance that the ship can cover in a 24-h period is constant too (in km).

- —the unit shipping costs,

- —the daily shipping cost,

- —the daily operating cost,

- —the daily voyage cost (fuel cost and port dues),

- —the daily capital cost,

- —the full cargo weight (tonne)/vessel,

- —the maximum daily distance (km),

- —speed (km/h, constant), and

- = S × 24 h.

- The maximum distance of a sea voyage that a vessel can cover in 24 h was established. The cruising speed of a vessel was in use. Sea knots were converted into kilometers per hour. Then, the daily shipping cost was divided by the maximum voyage distance per day to obtain the cost of operating the ship per kilometer.

- The 1 tonne-kilometer cost of ship travel was calculated by dividing the operating cost per 1 kilometer of a ship’s voyage by its full cargo weight.

- The operating cost data for bulk carriers and container ships were obtained for 2010; the nominal GDP growth rate in 2010–2018 at 28.07% was used to update operating costs for 2018. Applying indexing gives plausible values of unit shipping costs, although some operating costs are quite volatile (e.g., fuel costs), while others tend to increase at an inflationary rate (e.g., crewing and administration costs).

3.6. Value of Time (VOT) and External Cost Coefficients in Freight Sea Transport

3.7. Estimates of Marine Fuel Consumption and CO2 Emission

4. Measurements and Results

4.1. Cost Savings as Result of Reduced Freight Travel Distance

- externalities,

- time travel, and

- travel costs.

- —reducing of externalities due to the shortening of the travel distance in time t,

- —forecasts of i-th cargo category (containers, dry bulk cargo, and grain) in time t,

- —the reduction of freight travel distance for i-th cargo category (constant in time), and

- —marginal environmental transport costs of air pollution and climate change for i-th cargo type in time t.

- —reducing of time travel costs due to the shortening of the travel time in time t,

- —forecasts of i-th cargo category (containers, dry bulk cargo, and grain) in time t,

- —the reduction of freight travel time for i-th cargo category (constant in time), and

- —unit time costs of freight travel in time t.

- —reducing freight travel costs due to the shortening of the travel distance in time t,

- —forecasts of i-th cargo category (containers, dry bulk cargo, and grain) in time t,

- —the reduction of freight travel distance for i-th cargo category (constant in time), and

- —unit freight travel costs for i-th cargo type.

- —the transport savings due to the shortening of the travel distance in time t,

- —reducing externalities due to the shortening of the travel distance in time t,

- —reducing time travel costs due to the shortening of the travel time in time t, and

- —reducing freight travel costs due to the shortening of the travel distance in time t.

4.2. Cost Savings as Result of Economies of Vessel Size

- —an increment of scale economies in time t,

- —forecasts of i-th cargo category (containers, dry bulk cargo, and grain) in time t,

- —the reduction of freight travel distance for i-th cargo category (constant in time),

- —weighted average distance of freight travel to/from port of Szczecin,

- —unit freight travel costs for i-th cargo type in W0 scenario, and

- —unit freight travel costs for i-th cargo type in WI scenario.

4.3. Savings in Marine Fuel Consumption and in Emission of CO2

5. Conclusions

- shipping operators, who will benefit from the savings in operating costs resulting from shortening freight travel distance and, for most, from economies of vessel size, and in total, it accounts for 74% of the total effects the port investment;

- shippers, exporters, and importers—because of shorter sea freight travel and thus time cost savings, and these benefits account for 11,0% of the total benefits of the port investment; and

- the community—thanks to the decreased maritime transport-related environmental externalities as an effect of shorter sea freight travel, which amounts to 15% of port investment impact.

6. Discussion

- the concept of generalized transport costs in sea freight shipping as well as the concept of a reference point to research re-routings of trades and dispersion in distances, as well as their consequences in transport performance and costs;

- models of daily operating cost estimates as a function of dry bulk carriers and container ship size; and

- revealed values of time and external cost coefficients in freight sea transport.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Vigarie, A. Ports de Commerce et vie Littorale; Hachette: Paris, France, 1979. [Google Scholar]

- Hintjens, J. Cooperation between Seaports Concerning Hinterland Transport. Ph.D. Dissertation, University of Antwerp, Antwerp, Belgium, 2019; p. 34. [Google Scholar]

- Weigend, G.G. Some elements in the study of port geography. Geogr. Rev. 1958, 48, 185–200. [Google Scholar] [CrossRef]

- Grzelakowski, A. Rynki Usług Portowych (Funkcjonowanie, Wartościowanie, Regulacja); Wydawnictwo Uniwersytetu Gdańskiego: Gdańsk, Poland, 1983; p. 13. [Google Scholar]

- Talley, W.K. Port Economics; Routledge: London, UK; New York, NY, USA, 2009; p. 13. [Google Scholar]

- Parola, F.; Risitano, M.; Ferretti, M.; Panetti, E. The drivers of port competitiveness: A critical review. Transp. Rev. 2016, 37, 116–138. [Google Scholar] [CrossRef]

- Ferrari, C.; Benacchio, M. Recent trends in the market structure of terminal services. Which way to integration? Pomorski Zbornik Ann. Marit. Stud. 2003, 40, 153–176. [Google Scholar]

- Haralambides, H.E. Gigantism, in container shipping, port and global logistics: A time-laps into the future. Marit. Econ. Logist. 2019, 21, 1–60. [Google Scholar] [CrossRef]

- Talley, W.K. Optimal Containership Size. Marit. Policy Manag. 1990, 17, 165–175. [Google Scholar] [CrossRef]

- Haralambides, H.E.; Benacchio, M.; Cariou, P. Dedicated terminals: Cost and benefits and pricing of dedicated container terminals. Int. J. Marit. Econ. 2002, 4, 21–34. [Google Scholar] [CrossRef]

- Musso, E.; Ferrari, C.; Benacchio, M. Port investment: Profitability, economic impact and financing. In Port Economics. Research in Transportation Economics 16; Cullinane, K., Talley, W., Eds.; Elsevier JAI Press: Oxford, UK, 2006; pp. 171–218. [Google Scholar]

- Dekker, S. Port Investment Towards an Integrated Planning of Port Capacity. Ph.D. Thesis, TRAIL Research School/Delft University of Technology, Delft, The Netherlands, 2005. [Google Scholar]

- Notteboom, T.; Yap, W.Y. Port competition and competitiveness. In The Blackwell Companion to Maritime Economics; Wayne, K., Talley, W., Eds.; Blackwell Publishing: Malden, MA, USA; Oxford, UK, 2012; pp. 549–570. [Google Scholar]

- Lin, C.L.; Tseng, C.C. Operational performance evaluation of major container ports in the Asia-Pacific region. Marit. Policy Manag. 2007, 34, 535–551. [Google Scholar] [CrossRef]

- Wang, Y.; Cullinane, K. Measuring container port accessibility: An application of the Principal Eigenvector Method (PEM). Marit. Econ. Logist. 2008, 10, 75–89. [Google Scholar] [CrossRef]

- Low, M.J.; Lam, S.W.; Tang, L.C. Assessment of hub status among Asian ports from a network perspective. Transp. Res. Part A Policy Pract. 2009, 43, 593–606. [Google Scholar] [CrossRef]

- Low, J.M. Capacity investment and efficiency cost estimations in major East Asian ports. Marit. Econ. Logist. 2010, 12, 370–391. [Google Scholar] [CrossRef]

- Aronietis, R.; van de Voorde, E.; Vanelslander, T. Port competitiveness determinants of selected European ports in the containerized cargo market. In Proceedings of the IAME 2010 Conference, Lisbon, Portugal, 7–9 July 2010. [Google Scholar]

- Meersman, H.; van de Voorde, E.; Vanelslander, T. Port competition revisited. Rev. Bus. Econ. 2010, 55, 210–232. [Google Scholar]

- Magala, M.; Sammons, A. A new approach to port choice modelling. Marit. Econ. Logist. 2008, 10, 9–34. [Google Scholar] [CrossRef]

- Panayides, P.; Song, D.-W. Determinants of Users’ Port Choice. In The Blackwell Companion to Maritime Economics; Wayne, K., Talley, W., Eds.; Blackwell Publishing: Malden, MA, USA; Oxford, UK, 2012; pp. 599–622. [Google Scholar]

- Malchow, M.; Kanafani, A. A disaggregate analysis of factors influencing port selections. Marit. Policy Manag. 2001, 28, 265–277. [Google Scholar] [CrossRef]

- Malchow, M.; Kanafani, A. Disaggregate analysis of port selection. Transp. Res. Part E 2004, 40, 317–338. [Google Scholar] [CrossRef]

- Veldman, S.; Buckmann, E. A model on container port competition, an application for the West European container hub-ports. Marit. Econ. Logist. 2003, 5, 3–22. [Google Scholar] [CrossRef]

- Veldman, S.; Buckmann, E.; Saitua, R. River depth and container port market shares: The impact of deepening the Scheldt River on the West European container hub-port market shares. Marit. Econ. Logist. 2005, 7, 336–355. [Google Scholar] [CrossRef]

- Veldman, S.; van Drunen, E. Measuring competition between ports. In International Handbook of Maritime Economics; Cullinane, K., Ed.; Edward Elgar Publishing: Cheltenham, UK, 2011; pp. 322–347. [Google Scholar]

- Zondag, B.; Bucci, P.; Gutzkow, P.; de Jong, G. Port competition modelling including maritime, port, and hinterland characteristics. Marit. Policy Manag. 2010, 37, 179–194. [Google Scholar] [CrossRef]

- Dekker, S.; Verhaeghe, R.J.; Pols, A.A.J. Economic impacts and public financing of port capacity investments: The case of Rotterdam port expansion. Transp. Res. Rec. J. Transp. Res. Board 2003, 1820, 55–61. [Google Scholar] [CrossRef]

- Sanders, F.M.; Verhaeghe, R.J.; Dekker, S. Investment dynamics for a congested transport network with competition: Application to port planning. In Proceedings of the 23rd International Conference of the System Dynamics Society, Boston, MA, USA, 17–21 July 2005. [Google Scholar]

- Dekker, S.; Verhaeghe, R.J. Port investment and Finance. In The Blackwell Companion to Maritime Economics; Wayne, K., Talley, W., Eds.; Blackwell Publishing: Malden, MA, USA; Oxford, UK, 2012; pp. 623–637. [Google Scholar]

- Van Hassel, E.; Meersman, H.; van de Voorde, E.; Vanelslander, T. Impact of scale increase of container ships on the generalized chain costs. Marit. Policy Manag. 2006, 43, 192–208. [Google Scholar] [CrossRef]

- Jensen, A.; Bergqvist, R. The value of direct call services by container shipping lines in Northern Europe: Support model for strategic scenario development and case study. In International Handbook of Maritime Economics; Cullinane, K., Ed.; Edward Elgar Publishing: Cheltenham, UK, 2011; pp. 256–283. [Google Scholar]

- Czermanski, E.; Cirella, G.T.; Oniszczuk-Jastrzabek, A.; Pawłowska, B.; Notteboom, T. An Energy consumption approach to estimate air emission reductions in container shipping. Energies 2021, 14, 278. [Google Scholar] [CrossRef]

- Carriou, P.; Parola, F.; Notteboom, T. Towards low carbon global supply chains: A multi-trade analysis of CO2 emission reductions in container shipping. Int. J. Prod. Econ. 2019, 208, 17–28. [Google Scholar] [CrossRef]

- Eide, M.S.; Tore, L.; Hoffman, P.; Øyvind, E.; Dalsøren, S. Future cost scenarios for reduction of ship CO2 emissions. Marit. Policy Manag. 2011, 38, 11–37. [Google Scholar] [CrossRef]

- Stevens, L.; Sys, C.; Vanelslander, T.; van Hassel, E. Is new emission legislation stimulating the implementation of sustainable and energy-efficient maritime technologies? Res. Transp. Bus. Manag. 2015, 17, 14–25. [Google Scholar] [CrossRef]

- Lähdeaho, O.; Hilmola, O.-P.; Kajatkari, R. Maritime supply chain sustainability: South-East Finland case study. J. Shipp. Trade 2020, 5, 1–16. [Google Scholar] [CrossRef]

- De Langen, P.; Sornn-Friese, H. Ports and the Circular Economy. In Green Ports; Bergquist, R., Monios, J., Eds.; Elsevier: Amsterdam, The Netherlands, 2019; pp. 63–84. [Google Scholar]

- Mankowska, M.; Kotowska, I.; Plucinski, M. Seaports as nodal points of circular supply chains: Opportunities and challenges for secondary ports. Sustainability 2020, 12, 3926. [Google Scholar] [CrossRef]

- Mankowska, M.; Kotowska, I.; Plucinski, M. Biomass Sea-Based Supply Chains and the Secondary Ports in the Era of Decarbonization. Energies 2021, 14, 1796. [Google Scholar] [CrossRef]

- Oniszczuk-Jastrzabek, A.; Czermański, E. The evolution of the ship owner profile in global container shipping. Sci. J. Marit. Univ. Szczec. 2019, 58, 105–112. [Google Scholar]

- Notteboom, T.; van der Lungt, L.; van Saase, N.; Sel, S.; Neyens, K. The role of seaports in green supply chain management: Initiatives, Attitudes, and Perspectives in Rotterdam, Antwerp, North Sea Port, and Zeebrugge. Sustainability 2020, 12, 1688. [Google Scholar] [CrossRef]

- Mekhum, W. The impact of sustainability concept on supply chain dynamic capabilities. Pol. J. Manag. Stud. 2019, 20, 267–276. [Google Scholar]

- Bilan, Y.; Hussain, H.I.; Haseeb, H.I.; Kot, S. Sustainability and economic performance: Role of organizational learning and innovation. Eng. Econ. 2020, 31, 93–103. [Google Scholar] [CrossRef]

- Kot, S.; Haque, U.; Baloch, A. Supply chain management in smes: Global perspective. Montenegrin J. Econ. 2020, 16, 87–104. [Google Scholar] [CrossRef]

- European Commission. Guide to Cost-Benefit Analysis of Investment Projects. Economic Appraisal Tool for Cohesion Policy 2014–2020; European Commission Directorate-General for Regional and Urban Policy: Brussels, Belgium, 2014; p. 26. [Google Scholar]

- Van Exel, J.; Rienstra, S.; Gommers, M.; Pearman, A.; Tsamboulas, D. EU involvement in TEN developments: Network Effects and European Value Added. Transp. Policy 2002, 9, 299–311. [Google Scholar] [CrossRef]

- Mackie, P.; Graham, D.; Laird, J. The Direct and Wider Impacts of Transport Projects: A Review. In A Handbook of Transport Economics; De Palma, A., Lindsey, R., Quinet, E., Vickerman, R., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2013; pp. 501–527. [Google Scholar]

- Borkowski, P. Bezpośrednie efekty ekonomiczne-podejście metodologiczne. In Infrastruktura Transportu a Konkurencyjność Regionów w Unii Europejskiej; Pawłowska, B., Ed.; Gdańsk University Press: Gdańsk, Poland, 2015; pp. 160–166. [Google Scholar]

- Lakshmanan, T.R.; Anderson, W.P. Transportation Infrastructure, Freight Services Sector and Economic Growth. A White Paper Prepared for The U.S. Department of Transportation Federal Highway Administration; U.S. Department of Transportation Federal Highway Administration: Washington, DC, USA, 2002.

- Button, K. Transport Economics; Edward Elgar Publishing: Cheltenham, UK, 2010; pp. 145–146. [Google Scholar]

- Combes, P.-P.; Lafourcade, M. Transport costs: Measures, determinants, and regional policy implications for France. J. Econ. Geogr. 2005, 5, 319–349. [Google Scholar] [CrossRef]

- Mackie, P.; Nellthorp, J. Cost-Benefit Analysis in transport. In Handbook of Transport Systems and Traffic Control; Button, K.J., Hensher, D.A., Eds.; Emerald Group Publishing: Bingley, UK, 2009; p. 149. [Google Scholar]

- Teodorovic, D.; Janic, M. Transportation Engineering. Theory, Practice, and Modeling; Elsevier: Amsterdam, The Netherlands, 2017; p. 642. [Google Scholar]

- Hansen Sandberg, T.-E.; Mathisen, T.A.; Jørgensen, F. Generalized transport costs in intermodal freight transport. Procedia Soc. Behav. Sci. 2012, 54, 189–200. [Google Scholar] [CrossRef]

- Rothengatter, W. Evaluation of infrastructure investments in Germany. Transp. Policy 2000, 7, 17–23. [Google Scholar] [CrossRef]

- Naess, P.; Nicolaisen, M.S.; Strand, A. Traffic forecasts ignoring induced demand: A shaky fundament for costs-benefit analyses. Eur. J. Transp. Infrastruct. Res. 2012, 12, 291–309. [Google Scholar]

- De Langen, P.W.; van Meijeren, J.; Tavasszy, J.A. Combining Models and Commodity Chain Research for Making Long-term Projections of Port Throughput: An Application to the Hamburg-Le Havre Range. Eur. J. Transp. Infrastruct. Res. 2012, 12, 310–331. [Google Scholar]

- Hayuth, Y.; Fleming, D.F. Concepts of Strategic Commercial Location: The Case of Container Ports. Marit. Policy Manag. 1994, 21, 187–193. [Google Scholar] [CrossRef]

- Notteboom, T. The Peripheral Port Challenge in Container Port Systems. In International Maritime Transport: Perspectives; Leggate, H., Mcconville, J., Morvillo, A., Eds.; Routledge: London, UK, 2005; pp. 173–188. [Google Scholar]

- Feng, L.; Notteboom, T. Small and Medium-Sized Ports (SMPs) in Multi-Port Gateway Regions: The Role of Yingkou in the Logistics System of the Bohai Sea. In Current Issues in Shipping, Ports and Logistics; Notteboom, T., Ed.; University Press Antwerp: Antwerp, Belgium, 2011; pp. 543–563. [Google Scholar]

- Feng, L.; Notteboom, T. Peripheral Challenge by Small and Medium Sized Ports (SMPs) in Multi-Port Gateway Regions: The Case Study of Northeast China. Pol. Marit. Res. Spec. Issue 2013, 20, 55–66. [Google Scholar] [CrossRef]

- Slack, B.; Wang, J.J. The Challenge of Peripheral Ports; An Asian Perspective. Geojournal 2002, 65, 159–166. [Google Scholar] [CrossRef]

- Wang, C.J.; Wang, J.; Ducret, C. Peripheral Challenge in Container Port System: A Case Study of Pearl River Delta. Chin. Geogr. Sci. 2012, 22, 97–108. [Google Scholar] [CrossRef]

- Wilmsmeier, G.; Monios, J. Counterbalancing Peripherality and Concentration: An Analysis of the UK Container Port System. Marit. Policy Manag. 2013, 40, 116–132. [Google Scholar] [CrossRef]

- Wilmsmeier, G.; Monios, J.; Pérez-Salas, G. Port System Evolution: The Case of Latin America and the Caribbean. J. Transp. Geogr. 2014, 39, 208–221. [Google Scholar] [CrossRef]

- Stopford, M. Maritime Economics, 3rd ed.; Routledge: London, UK; New York, NY, USA, 2009. [Google Scholar]

- Delhaye, E.; Breemersch, T.; Vanherle, K. COMPASS. The Competitiveness of European Short-Sea Freight Shipping Compared with Road and Rail Transport; Final Report; European Commission DG Environment: Brussels, Belgium, 2010. [Google Scholar]

- Bernacki, D.; Lis, C. Cost-Benefit Analysis for the Project; Enhancement of Transport Accessibility to the Port of Szczecin in Debicki Canal Area; Municipality Office: Szczecin, Poland, 2019.

- De Jong, G.; Kouwenhoven, M.; Bates, J.; Koster, P.; Verhoef, E.; Taavasszy, L.; Warffemius, P. New SP-values of time and reliability for freight transport in the Netherlands. Transp. Res. Part E Logist. Transp. Rev. 2014, 64, 71–87. [Google Scholar] [CrossRef]

- Significance; VU University of Amsterdam; John Bates Services. Values of Time and Reliability in Passenger and Freight Transport. in the Netherlands. Report for the Ministry of Infrastructure and the Environment; Significance, VU University of Amsterdam; John Bates Services: Amsterdam, The Netherlands, 2012. [Google Scholar]

- Brons, M.; Christidis, P. External Costs Calculator for Marco Polo Freight Transport. Project; Call 2013 Updated Version; Joint Scientific and Policy Reports; European Commission: Brussels, Belgium, 2013. [Google Scholar]

- Notteboom, T. Spatial and functional integration of container port systems and hinterland networks in Europe. In Land Access to Seaports; ECMT Report 113; Economic Research Centre ECMT-OECD: Paris, France, 2001; pp. 5–55. [Google Scholar]

| Specification | Scenario without Investment W0 | Scenario with Investment WI |

|---|---|---|

| Max. vessel draft (m) | 9.15 | 11.1 |

| Dry bulk carrier deadweight (tonnes) | 20,000 | 40,087 |

| Container ship capacity (TEU) | 1000 | 1800 |

| Transshipment capacity-grain (tonnes) | 1,400,000 | 2,280,000 |

| Transshipment capacity-containers (tonnes) | 2,800,000 | 3,600,000 |

| Transshipment capacity-dry bulk (coal, ore, other dry bulk) (tonnes) | 2,900,000 | 4,600,000 |

| Year | Coal | Iron Ore + Other Bulk | Grain | Container Cargo | Total |

|---|---|---|---|---|---|

| 2023 | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

| 2028 | 3.1% | 8.6% | 22.1% | 22.3% | 9.4% |

| 2033 | 6.2% | 17.3% | 39.0% | 44.7% | 17.9% |

| 2038 | 9.1% | 25.4% | 40.2% | 65.8% | 23.2% |

| 2043 | 12.1% | 33.6% | 40.3% | 87.1% | 28.3% |

| Year | Coal | Iron Ore + Other Bulk | Grain | Container Cargo | Total |

|---|---|---|---|---|---|

| 2023 | 110,363 | 566,648 | 737,518 | 224,846 | 1,639,375 |

| 2028 | 170,390 | 874,852 | 1,164,006 | 412,719 | 2,621,966 |

| 2033 | 230,842 | 1,185,235 | 1,488,387 | 601,920 | 3,506,383 |

| 2038 | 287,846 | 1,477,918 | 1,512,801 | 780,332 | 4,058,897 |

| 2043 | 345,176 | 1,772,275 | 1,514,552 | 959,764 | 4,591,767 |

| Year | Annual Weighted Average Sea Distance (km) | ||

|---|---|---|---|

| Container Cargo | Dry Bulk Cargo | Grain | |

| 2011 | 1037 | 1983 | 4085 |

| 2012 | 993 | 2433 | 2900 |

| 2013 | 1010 | 2262 | 4034 |

| 2014 | 1024 | 2700 | 4308 |

| 2015 | 997 | 2824 | 6925 |

| 2016 | 896 | 2386 | 9882 |

| Weighted average sea distances | 992 | 2429 | 5772 |

| Maximum Draft of Container Ships | |||

| Scenario | Port of Szczecin Draft (m) | Port of Gdynia Draft (m) | |

| W0 | 9.15 | Gdynia Container Terminal 11.0 m Baltic Container Terminal 12.7 m | |

| WI | 11.1 | ||

| Maximum Draft of Dry Bulk Carriers | |||

| Port of Szczecin Draft (m) | Port of Gdańsk Draft (m) | ||

| W0 | 9.15 | Outer port 15.0 m Inner port 10.2 m | |

| WI | 11.1 | ||

| Maximum Draft of Vessels with Grain | |||

| Port of Szczecin Draft (m) | Port of Rostock Draft (m) | Port of Gdynia Draft (m) | |

| W0 | 9.15 | Berths (no 13, 17 and 18) for grain handling 13.0 m | Baltic Grain Terminal 11.0 m |

| WI | 11.1 | ||

| Port | Gdynia | Gdańsk | Rostock | Szczecin |

|---|---|---|---|---|

| Malmö (in nautical miles) | 269 | 273 | 106 | 164 |

| Malmö (in kilometers) | 498 | 506 | 196 | 304 |

| Difference in sea transport distance from Szczecin to other ports (in kilometers) | 194 | 202 | (−107) | 0 |

| Vessel Size | Handy Size | Panamax | Post Panamax | Capesize |

|---|---|---|---|---|

| Size range dwt | 10,000–40,000 | 60,000–80,000 | 80,000–110,000 | 110,000–200,000 |

| Guide dwt | 25,000 | 70,000 | 85,000 | 155,000 |

| Manning | 1389 | 1847 | 1847 | 2069 |

| Insurance | 473 | 702 | 756 | 817 |

| Repairs and maintenance | 1107 | 1458 | 1656 | 1824 |

| Stores and lube oil | 374 | 511 | 557 | 611 |

| Administration | 947 | 1099 | 1160 | 1237 |

| Capital repayments | 3847 | 5837 | 6102 | 6898 |

| Interest | 3162 | 4798 | 5016 | 5671 |

| Gross margin | 1921 | 2763 | 2906 | 3251 |

| Port | 2100 | 2800 | 3000 | 3500 |

| Fuel (tonne/day) | 32.0 | 38.0 | 42.0 | 55.0 |

| Fuel (EUR/day) | 10,198 | 12,111 | 13,385 | 17,528 |

| Speed (knots) | 12.0 | 13.0 | 13.0 | 13.0 |

| Full cargo weight (tonne) | European relations | Relations via Panama Canal | Relations via Suez Canal | Relations via Cape of Good Hope |

| 24,739 | 69,252 | 83,448 | 151,931 | |

| Total daily shipping cost (EUR/day) | 25,519 | 33,927 | 36,387 | 43,406 |

| Vessel size (TEUs) | 500–700 | 1000–2000 | 5000–6000 | 8000–9000 | 10,000–12,000 |

| Average containership capacity (TEUs) | 600 | 1500 | 5500 | 8500 | 11,000 |

| Guide dwt | 7308 | 18,270 | 66,991 | 103,532 | 133,982 |

| Manning | 1588 | 1588 | 2176 | 2313 | 2466 |

| Insurance | 313 | 443 | 931 | 1168 | 1336 |

| Repairs and maintenance | 802 | 977 | 2603 | 2786 | 3092 |

| Stores and lube oil | 351 | 580 | 1557 | 1847 | 2122 |

| Administration | 504 | 550 | 931 | 962 | 1008 |

| Capital repayments | 2189 | 4378 | 11,276 | 16,848 | 20,430 |

| Interest | 1799 | 3599 | 9269 | 13,850 | 16,794 |

| Gross margin | 1283 | 2059 | 4886 | 6762 | 8032 |

| Port | 1200 | 2500 | 5200 | 6800 | 8300 |

| Fuel (tonne/day) | 28.0 | 45.0 | 77.0 | 91.0 | 116.0 |

| Fuel (EUR/day) | 8924 | 14,341 | 24,540 | 29,002 | 36,969 |

| Speed (knots) | 14.0 | 14.0 | 18.0 | 18.0 | 18.0 |

| Full cargo weight (tonne) | European relations | European relations | Relations via Panama Canal | Relations via Suez Canal | Relations via Cape of Good Hope |

| 7200 | 18,000 | 66,000 | 102,000 | 132,000 | |

| Total daily shipping cost (EUR/day) | 18,952 | 31,015 | 63.370 | 82,337 | 100,547 |

| Ship Type | DWT (W0) | Daily Shipping Cost EUR | DWT (WI) | Daily Shipping Cost EUR |

|---|---|---|---|---|

| Dry bulk carrier | 20,000 | 23,833 | 40,087 | 29,175 |

| Feeder container ship | TEU (W0) | 24,907 | TEU (WI) | 34,726 |

| 1000 | 1800 |

| Dry Bulk Carrier | ||

| W0 | WI | |

| DWT | 20,000 | 40,087 |

| Daily shipping cost (EUR/day) | 23,833 | 29,175 |

| Maximum load coefficient | 0.95 | 0.95 |

| Full cargo weight (tonnes) | 19,000 | 38,082 |

| Cruising speed in knots (NM/h) | 12 | 12 |

| Speed converter knots/km | 1.85 | 1.85 |

| Cruising speed km/h | 22.22 | 22.22 |

| Maximum daily voyage distance (km/day) | 533.38 | 533.38 |

| Operating costs EUR/km | 44.68 | 54.70 |

| Operating cost EUR/tkm 2010 | 0.0024 | 0.0014 |

| Operating cost EUR/tkm 2018 | 0.0029 | 0.0018 |

| Container Ship | ||

| W0 | WI | |

| Vessel size (TEUs) | 1000 | 1800 |

| Daily shipping cost (EUR/day) | 24,907 | 34,726 |

| Maximum load per 1 TEU (tonnes) | 10 | 10 |

| Full cargo weight (tonnes) | 10,000 | 18,000 |

| Cruising speed in knots | 14 | 14 |

| Speed converter knots/km | 1.85 | 1.85 |

| Cruising speed km/h | 25.93 | 25.93 |

| Maximum daily voyage distance (km/day) | 622.27 | 622.27 |

| Operating cost EUR/km | 40.03 | 55.81 |

| Operating cost EUR/tkm 2010 | 0.0040 | 0.0031 |

| Operating cost EUR/tkm 2018 | 0.0049 | 0.0038 |

| Externality | Ship Type | |||

|---|---|---|---|---|

| General Cargo/Dry Bulk Carrier EUR/1000 tkm | General Cargo/Dry Bulk Carrier EUR/1000 tkm | Container Ship EUR/1000 tkm | Container Ship EUR/1000 tkm | |

| 2011 | 2018 | 2011 | 2018 | |

| Air pollution | 4.48 | 5.17 | 3.09 | 3.56 |

| Climate change | 0.21 | 0.24 | 0.40 | 0.46 |

| Total | 4.69 | 5.41 | 3.49 | 4.03 |

| Container Ship | ||

|---|---|---|

| Average capacity of container ship (TEU) | 2000 | 5500 |

| Fuel consumption (tonnes/day) | 45 | 77 |

| Scaling parameter a | 0.00914 | |

| Constant b | 26.71429 | |

| Container ship | W0 (1000 TEU) | WI (1800 TEU) |

| Fuel consumption (tonnes/day) | 35.86 | 43.17 |

| Fuel consumption (tonnes/kilometer) | 0.058 | 0.069 |

| Fuel consumption (tonnes/million tonne-kilometers) | 5.762 | 3.854 |

| Bulk Carrier | ||

|---|---|---|

| Average capacity of bulk carrier (DWT) | 25,000 | 70,000 |

| Fuel consumption (tonnes/day) | 32 | 38 |

| Scaling parameter a | 0.00013 | |

| Constant b | 28.66667 | |

| Bulk carrier | W0 (20,000 DWT) | WI (40,087 DWT) |

| Fuel consumption (tonnes/day) | 31.33 | 34.01 |

| Fuel consumption (tonnes/kilometer | 0.059 | 0.064 |

| Fuel consumption (tonnes/million tonne-kilometers) | 3.092 | 1.674 |

| Vessel Type | Type of Engine | CO2 (kg/t) |

|---|---|---|

| Dry bulk carrier | low speed diesel engine | 3200 |

| Container ship | medium speed diesel engine | 3200 |

| Economic Effects Induced by Port Investment | ||

|---|---|---|

| Savings resulting from the shorter maritime travel distance in: | Discounted Value | Structure (%) |

| - external/environmental costs | 57,240,487.10 | 15.0 |

| - shipping operating costs | 15,125,027.64 | 4.0 |

| - costs of travel time | 41,962,390.76 | 11.0 |

| Savings in operating shipping costs resulting from the increased ship size (economies of scale) | 266,918,647.06 | 70.0 |

| Total | 381,246,552.56 | 100.0 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bernacki, D.; Lis, C. Investigating the Sustainable Impact of Seaport Infrastructure Provision on Maritime Component of Supply Chain. Energies 2021, 14, 3519. https://doi.org/10.3390/en14123519

Bernacki D, Lis C. Investigating the Sustainable Impact of Seaport Infrastructure Provision on Maritime Component of Supply Chain. Energies. 2021; 14(12):3519. https://doi.org/10.3390/en14123519

Chicago/Turabian StyleBernacki, Dariusz, and Christian Lis. 2021. "Investigating the Sustainable Impact of Seaport Infrastructure Provision on Maritime Component of Supply Chain" Energies 14, no. 12: 3519. https://doi.org/10.3390/en14123519

APA StyleBernacki, D., & Lis, C. (2021). Investigating the Sustainable Impact of Seaport Infrastructure Provision on Maritime Component of Supply Chain. Energies, 14(12), 3519. https://doi.org/10.3390/en14123519