Revisiting the Environmental Kuznets Curve Hypothesis: A Case of Central Europe

Abstract

1. Introduction

2. Data and Methodological Framework

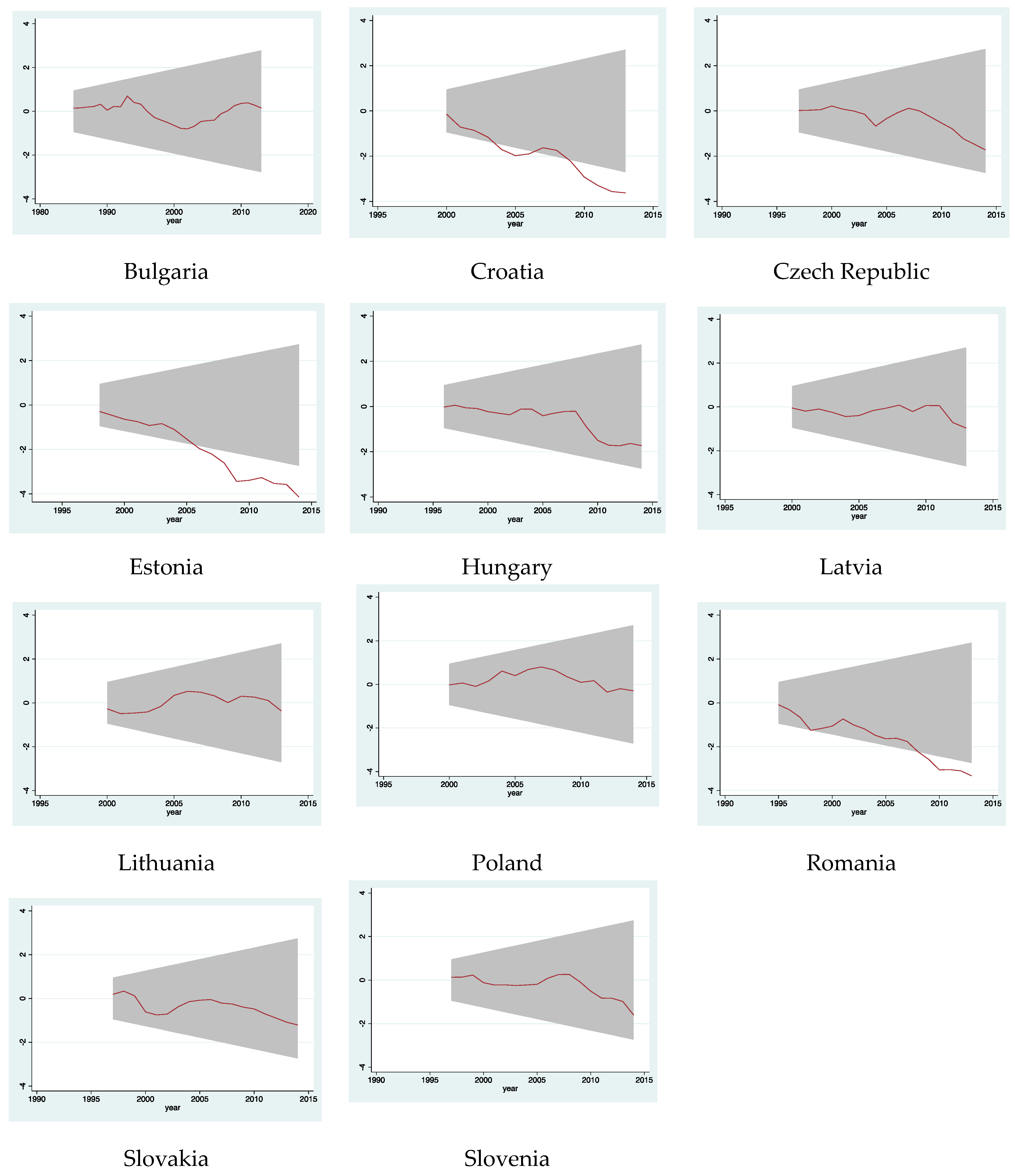

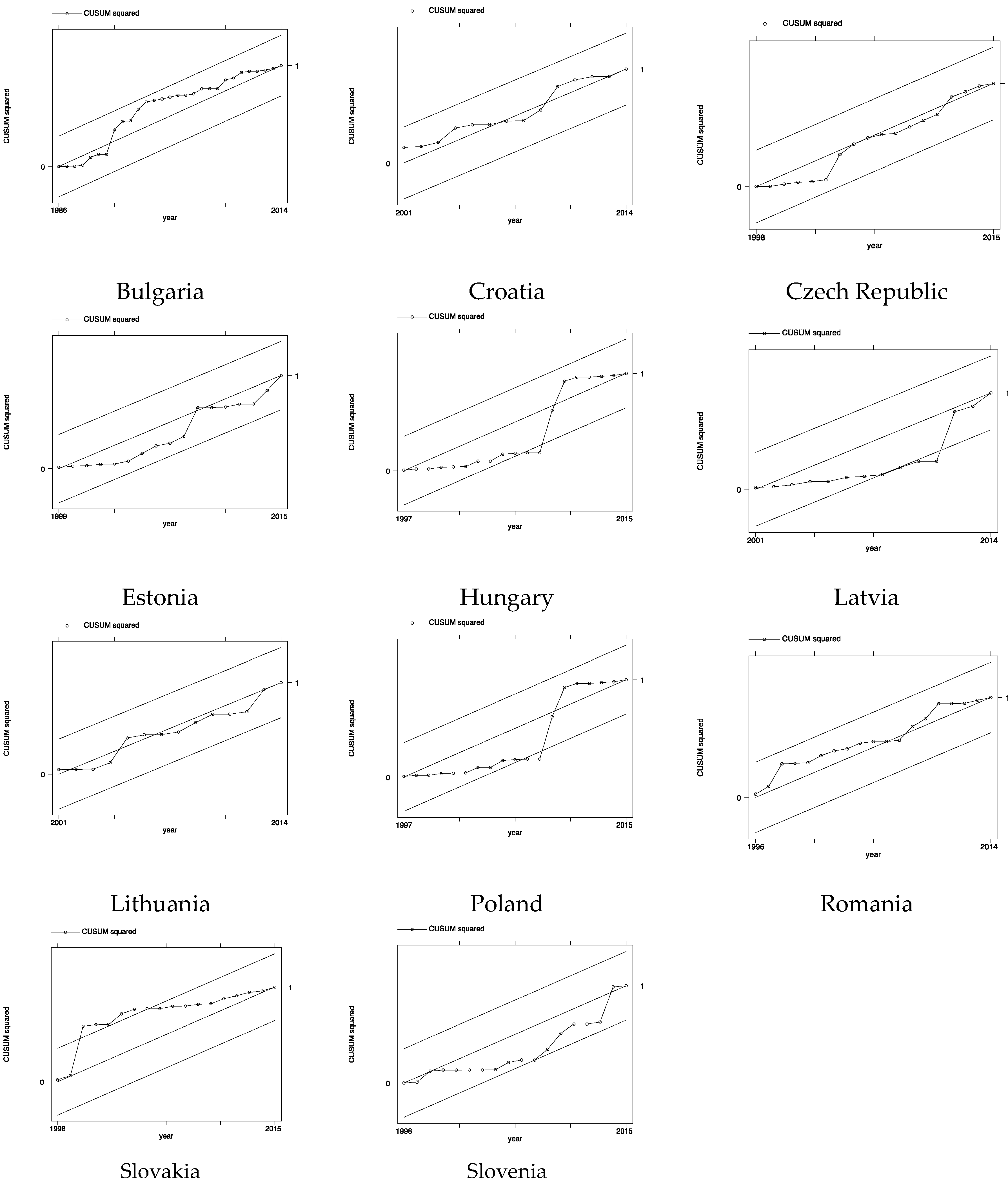

3. Results and Discussion

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| C | CO2 emissions (metric tons per capita) |

| Y | Gross Domestic Product per capita (constant 2010 US$) |

| E | energy use (kg of oil equivalent per capita) |

| T | trade openness (% of GDP) the sum of exports and imports of goods and services measured as a share of gross domestic product |

| Ln | the natural logarithm of variable, e.g., lnC the natural logarithm of CO2 emissions |

| EU | the European Union |

| CEE | Central and Eastern European countries |

| GDP | Gross Domestic Product |

| GHG | Greenhouse Gas |

| EKC | Environmental Kuznets Curve |

| FMOLS | Fully Modified Ordinary Least Squares |

| DMOLS | Dynamic Ordinary Least Squares |

Appendix A

| Country | Variable | Level Z(t) | First Difference Z(t) | ||||

|---|---|---|---|---|---|---|---|

| Drift Term | Drift and Trend Terms | None | Drift Term | Drift and Trend Terms | None | ||

| Bulgaria | lnC | −1.205 | −1.959 | −0.975 | −5.557 *** | −5.492 *** | −5.340 *** |

| lnY | −0.383 | −1.386 | 1.419 | −2.465 | −2.481 | −2.269 ** | |

| lnYsq | −0.350 | −1.372 | 1.417 | −2.466 | −2.487 | −2.261 ** | |

| lnE | −1.636 | −2.290 | −0.573 | −4.487 *** | −4.447 *** | −4.450 *** | |

| lnT | −1.391 | −2.597 | 0.931 | −5.774 *** | −5.696 *** | −5.590 *** | |

| Croatia | lnC | −1.912 | −0.970 | −0.009 | −2.188 | −3.762 ** | −2.346 ** |

| lnY | −1.723 | −0.884 | 0.832 | −2.377 | −3.017 | −2.232 ** | |

| lnYsq | −1.716 | −0.896 | 0.807 | −2.357 | −2.969 | −2.211 ** | |

| lnE | −1.640 | −0.015 | 0.057 | −1.757 | −2.800 | −1.994 ** | |

| lnT | −2.009 | −2.407 | 0.789 | −4.404 *** | −4.133 ** | −4.352 *** | |

| Czech Republic | lnC | −0.488 | −1.870 | −1.668 | −4.796 *** | −4.923 *** | −4.104 *** |

| lnY | −1.133 | −2.502 | 2.141 ** | −3.306 ** | −3.293 * | −1.978 ** | |

| lnYsq | −1.082 | −2.511 | 2.109 ** | −3.288 ** | −3.259 * | −1.966 ** | |

| lnE | −1.581 | −1.403 | −0.346 | −3.504 ** | −3.741 ** | −3.593 *** | |

| lnT | −0.433 | −3.887 ** | 1.867 * | −4.480 *** | −4.302 ** | −3.205 *** | |

| Estonia | lnC | −2.367 | −2.904 | −0.136 | −5.366 *** | −5.293 *** | −5.506 *** |

| lnY | −1.910 | −1.823 | 1.753 * | −3.315 ** | −3.799 ** | −2.337 ** | |

| lnYsq | −1.819 | −1.881 | 1.658 * | −3.393 ** | −3.812 ** | −2.392 ** | |

| lnE | −1.528 | −2.601 | 0.457 | −4.889 *** | −4.747 *** | −4.802 *** | |

| lnT | −2.239 | −2.559 | −0.031 | −3.805 *** | −3.691 ** | −3.889 *** | |

| Hungary | lnC | 0.050 | −1.539 | −1.535 | −2.906 * | −2.922 | −2.636 ** |

| lnY | −1.025 | −1.696 | 2.372 ** | −2.416 | −2.464 | −1.295 | |

| lnYsq | −0.977 | −1.721 | 2.328 ** | −2.401 | −2.433 | −1.289 | |

| lnE | −1.714 | −1.767 | −0.053 | −2.768 * | −2.706 | −2.879 *** | |

| lnT | −2.156 | −1.804 | 1.632 * | −3.139 ** | −3.952 ** | −2.385 ** | |

| Latvia | lnC | −1.899 | −2.640 | −0.342 | −2.733 * | −2.661 | −2.839 *** |

| lnY | −1.693 | −2.191 | 1.311 | −3.368 ** | −3.579 * | −2.379 ** | |

| lnYsq | −1.626 | −2.269 | 1.242 | −3.447 ** | −3.617 ** | −2.422 ** | |

| lnE | −0.689 | −2.196 | 0.857 | −2.331 | −2.232 | −2.226 ** | |

| lnT | −0.583 | −2.846 | 0.790 | −3.024 ** | −3.075 | −2.848 *** | |

| Lithuania | lnC | −2.033 | −2.498 | −0.103 | −3.913 *** | −3.925 ** | −4.048 *** |

| lnY | −1.120 | −1.995 | 2.130 ** | −3.331 ** | −3.353 * | −1.967 ** | |

| lnYsq | −1.032 | −2.088 | 2.081 ** | −3.379 ** | −3.363 * | −1.983 ** | |

| lnE | −2.375 | −2.324 | −0.251 | −3.604 ** | −3.535 * | −3.730 *** | |

| lnT | −0.791 | −3.295 * | 0.907 | −3.534 ** | −3.576 * | −3.359 *** | |

| Poland | lnC | −2.369 | −2.331 | −1.446 | −2.813 * | −2.815 | −2.532 ** |

| lnY | −0.996 | −2.447 | 2.543 ** | −3.234 ** | −3.243 * | −1.191 * | |

| lnYsq | −0.844 | −2.546 | 2.540 ** | −3.299 ** | −3.245 * | −1.127 | |

| lnE | −2.123 | −2.637 | −0.516 | −2.574 | −2.671 | −2.619 ** | |

| lnT | −1.914 | −2.964 | 2.964 *** | −4.409 *** | −4.813 *** | −2.551 ** | |

| Romania | lnC | −1.287 | −2.612 | −1.134 | −4.270 *** | −4.186 ** | −3.862 *** |

| lnY | −0.548 | −2.355 | 2.014 ** | −3.736 ** | −3.486 * | −2.625 ** | |

| lnYsq | −0.498 | −2.335 | 1.993 ** | −3.674 ** | −3.440 * | −2.579 ** | |

| lnE | −2.017 | −2.675 | −0.744 | −3.718 ** | −3.563 * | −3.660 *** | |

| lnT | −1.825 | −2.808 | 1.633 * | −6.002 *** | −6.023 *** | −5.744 *** | |

References

- Bałtowski, M.; Miszewski, M. Transformacja Gospodarcza w Polsce; Wydawnictwo Naukowe PWN: Warszawa, Poland, 2007. [Google Scholar]

- Williamson, J.G. Globalization, convergence, and history. Econ. Hist. 1996, 56, 277–306. Available online: https://www.jstor.org/stable/2123967 (accessed on 6 December 2020). [CrossRef]

- O’Rourke, K.H. Economic integration and convergence: An historical perspective. J. Econ. Integr. 1999, 14, 133–168. Available online: http://www.jstor.org/stable/23000477 (accessed on 6 December 2020).

- Ben-David, D. Equalizing exchange: Trade liberalization and income convergence. Q. J. Econ. 1993, 108, 653–679. [Google Scholar] [CrossRef]

- Falvey, R. Trade liberalization and factor price convergence. J. Int. Econ. 1999, 49, 195–210. [Google Scholar] [CrossRef]

- Cieślik, A.; Rokicki, B. Cohesion policy in the EU new member states. Rocz. Inst. Eur. Srod. Wschod. 2011, 9, 103–117. [Google Scholar]

- Próchniak, M. Determinants of economic growth in Central and Eastern Europe: The global crisis perspective. Post Communist Econ. 2011, 23, 449–468. [Google Scholar] [CrossRef]

- Jóźwik, B. Realna Konwergencja Gospodarcza Państw Członkowskich Unii Europejskiej z Europy Środkowej i Wschodniej. Transformacja, Integracja i Polityka Spójności; Wydawnictwo Naukowe PWN: Warszawa, Poland, 2017. [Google Scholar]

- European Commission: DG Climate Action. Kick-starting the journey, towards a climate-neutral Europe by 2050. In EU Climate Action Progress Report; 2020; Available online: https://www.europeansources.info/record/kick-starting-the-journey-towards-a-climate-neutral-europe-by-2050-eu-climate-action-progress-report-2020/ (accessed on 2 June 2021).

- Eurostat. News Release; Eurostat, 2020. Available online: https://ec.europa.eu/eurostat/documents/2995521/10820684/8-06052020-BP-EN.pdf/e1dd6cf1-09b5-d7ee-b769-ffe63e94561e (accessed on 7 January 2021).

- Shahbaz, M.; Sinha, A. Environmental Kuznets curve for CO2 emissions: A literature survey. J. Econ. Stud. 2019, 46, 106–168. [Google Scholar] [CrossRef]

- Kuznets, S. Economic growth and income inequality. Am. Econ. Rev. 1995, 45, 1–28. [Google Scholar]

- Grossman, G.M.; Krueger, A.B. Environmental impacts of a north american free trade agreement. NBER Work. Pap. Ser. 1991, 3914. Available online: http://www.nber.org/papers/w3914 (accessed on 6 December 2020).

- Arango Miranda, R.; Hausler, R.; Romero Lopez, R.; Glaus, M.; Pasillas-Diaz, J.R. Testing the Environmental Kuznets Curve hypothesis in North America’s free trade agreement (NAFTA) countries. Energies 2020, 13, 3104. [Google Scholar] [CrossRef]

- Ali, M.; Raza, S.A.; Khamis, B. Environmental degradation, economic growth, and energy innovation: Evidence from European countries. Environ. Sci. Pollut. Res. 2020, 27, 28306–28315. [Google Scholar] [CrossRef]

- Dogan, E.; Inglesi-Lotz, R. The impact of economic structure to the environmental Kuznets curve (EKC) hypothesis: Evidence from European countries. Environ. Sci. Pollut. Res. 2020, 27, 12717–12724. [Google Scholar] [CrossRef]

- Vasylieva, T.; Lyulyov, O.; Bilan, Y.; Streimikiene, D. Sustainable economic development and greenhouse gas emissions: The dynamic impact of renewable energy consumption, GDP, and corruption. Energies 2019, 12, 3289. [Google Scholar] [CrossRef]

- Baležentis, T.; Streimikiene, D.; Zhang, T.; Liobikienė, G. The role of bioenergy in greenhouse gas emission reduction in EU countries An Environmental Kuznets Curve modelling. Resour. Conserv. Recycl. 2019, 142, 225–231. [Google Scholar] [CrossRef]

- Bozkurt, C.; Okumus, I. Environmental Kuznets curve hypothesis in selected EU countries: Kyoto effect. Balkans JETSS 2019, 2, 134–139. [Google Scholar] [CrossRef]

- Chen, S.; Saud, S.; Bano, S.; Haseeb, A. The nexus between financial development, globalization, and environmental degradation: Fresh evidence from Central and Eastern European Countries. Environ. Sci. Pollut. Res. 2019, 26, 24733–24747. [Google Scholar] [CrossRef]

- Armeanu, D.; Vintila, G.; Andrei, J.V.; Gherghina, S.C.; Dragoi, M.C.; Teodor, C. Exploring the link between environmental pollution and economic growth in EU-28 countries: Is there an environmental Kuznets curve? PLoS ONE 2018, 13, e0195708. [Google Scholar] [CrossRef]

- Borozan, D. Efficiency of energy taxes and the validity of the residential electricity environmental Kuznets curve in the European Union. Sustainability 2018, 10, 2464. [Google Scholar] [CrossRef]

- Destek, M.A.; Balli, E.; Manga, M. The Relationship between CO2 emission, energy consumption, urbanization and trade openness for selected CEECs. Res. World Econ. 2016, 7, 52–58. [Google Scholar] [CrossRef]

- Destek, M.A.; Ulucak, R.; Dogan, E. Analyzing the environmental Kuznets curve for the EU countries: The role of ecological footprint. Environ. Sci. Pollut. Res. 2018, 25, 29387–29396. [Google Scholar] [CrossRef] [PubMed]

- Marinas, M.-C.; Dinu, M.; Socol, A.-G.; Socol, C. Renewable energy consumption and economic growth. Causality relationship in Central and Eastern European countries. PLoS ONE 2018, 13, 1–29. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Narayan, P.K. The saving and investment nexus for China: Evidence from cointegration tests. Appl. Econ. 2005, 37, 1979–1990. [Google Scholar] [CrossRef]

- Kripfganz, S.; Schneider, D.C. Ardl: Estimating autoregressive distributed lag and equilibrium correction models. In Proceedings of the London Stata Conference, London, UK, 6–7 September 2018. [Google Scholar]

- Kripfganz, S.; Schneider, D.C. Response surface regressions for critical value bounds and approximate p-values in equilibrium correction models 1. Oxf. Bull. Econ. Stat. 2019, 82, 1456–1481. [Google Scholar] [CrossRef]

- Ang, J.B. CO2 emissions, energy consumption, and output in France. Energy Policy 2007, 35, 4772–4778. [Google Scholar] [CrossRef]

- Ang, J.B. Economic development, pollutant emissions and energy consumption in Malaysia. J. Policy Model 2008, 30, 271–278. [Google Scholar] [CrossRef]

- Soytas, U.; Sari, R.; Ewing, B.T. Energy consumption, income, and carbon emissions in the United States. Ecol. Econ. 2007, 62, 482–489. [Google Scholar] [CrossRef]

- Jalil, A.; Mahmud, S.F. Environment Kuznets curve for CO2 emissions A cointegration analysis for China. Energy Policy 2009, 37, 5167–5172. [Google Scholar] [CrossRef]

- Halicioglu, F. An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 2009, 37, 1156–1164. [Google Scholar] [CrossRef]

- Shahbaz, M.; Lean, H.H.; Shabbir, M.S. Environmental kuznets curve hypothesis in Pakistan: Cointegration and granger causality. Renew. Sustain. Energy Rev. 2012, 16, 2947–2953. [Google Scholar] [CrossRef]

- Kohler, M. CO2 emissions, energy consumption, income and foreign trade: A South African perspective. Energy Policy 2013, 63, 1042–1050. [Google Scholar] [CrossRef]

- Arouri, M.; Shahbaz, M.; Onchang, R.; Islam, F.; Teulon, F. Environmental kuznets curve in Thailand: Cointegration and causality analysis. Energy Sustain. Dev. 2013, 39, 149–170. Available online: https://www.jstor.org/stable/24812900 (accessed on 14 December 2020).

- Kisswani, K.M.; Harraf, A.; Kisswani, A.M. Revisiting the environmental Kuznets curve hypothesis: Evidence from the ASEAN-5 countries with structural breaks. Appl. Econ. 2019, 51, 1855–1868. [Google Scholar] [CrossRef]

- Nasreen, S.; Anwar, S.; Ozturk, I. Financial stability, energy consumption and environmental quality. Evidence from South Asian economies. Renew. Sustain. Energy Rev. 2017, 67, 1105–1122. [Google Scholar] [CrossRef]

- Gardiner, R.; Hajek, P. Interactions among energy consumption, CO2, and economic development in European Union countries. Sustain. Dev. 2019, 28, 723–740. [Google Scholar] [CrossRef]

- Ozatac, N.; Gokmenoglu, K.K.; Taspinar, N. Testing the EKC hypothesis by considering trade openness, urbanization, and financial development: The case of Turkey. Environ. Sci. Pollut. Res. 2017, 24, 16690–16701. [Google Scholar] [CrossRef] [PubMed]

- Pal, D.; Mitra, S.K. The environmental Kuznets curve for carbon dioxide in India and China: Growth and pollution at crossroad. J. Policy Model 2017, 39, 371–385. [Google Scholar] [CrossRef]

- Bölük, G.; Mert, M. The renewable energy, growth and environmental Kuznets curve in Turkey: Nn ARDL approach. Renew. Sustain. Energy Rev. 2015, 52, 587–595. [Google Scholar] [CrossRef]

- Sharif, A.; Afshan, S.; Chrea, S.; Amel, A.; Khan, S.A.R. The role of tourism, transportation and globalization in testing environmental Kuznets curve in Malaysia: New insights from quantile ARDL approach. Environ. Sci. Pollut. Res. 2020, 27, 25494–25509. [Google Scholar] [CrossRef] [PubMed]

- Moutinho, V.; Madaleno, M. Economic growth assessment through an ARDL approach: The case of African OPEC countries. Energy Rep. 2020, 6, 305–311. [Google Scholar] [CrossRef]

- Zhang, J. Environmental kuznets curve hypothesis on CO2 Emissions: Evidence for China. Risk Financ. Manag. 2021, 14, 93. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.P. Pooled mean group estimation of dynamic heterogeneous panels. J. Am. Stat. Assoc. 1999, 94, 621–634. [Google Scholar] [CrossRef]

- Galeotti, M.; Manera, M.; Lanza, A. On the robustness of robustness checks of the environmental Kuznets curve hypothesis. Environ. Resour. Econ. 2009, 42, 551–574. [Google Scholar] [CrossRef]

- StataCorp, L.P. Stata Time-Series Reference Manual. Release 16; A Stata Press Publication: College Station, TX, USA, 2013; Available online: https://www.stata.com/manuals/ts.pdf (accessed on 8 June 2021).

- Johansen, S. Likelihood-Based Inference in Cointegrated Vector Autoregressive Models; Oxford University Press: New York, NY, USA, 1995. [Google Scholar]

- Brown, R.L.; Durbin, J.; Evans, J.M. Techniques for testing the constancy of regression relationships over time. J. R. Stat. Soc. Ser. B Stat. Methodol. 1975, 37, 149–163. [Google Scholar] [CrossRef]

- Ganda, F. Carbon emissions, diverse energy usage and economic growth in South Africa: Investigating existence of the environmental Kuznets curve (EKC). Environ. Prog. Sustain. Energy 2019, 38, 30–46. [Google Scholar] [CrossRef]

- Dong, K.; Sun, R.; Jiang, H.; Zeng, X. CO2 emissions, economic growth, and the environmental Kuznets curve in China: What roles can nuclear energy and renewable energy play? J. Clean. Prod. 2018, 196, 51–63. [Google Scholar] [CrossRef]

- Dong, K.; Sun, R.; Li, H.; Liao, H. Does natural gas consumption mitigate CO2 emissions: Testing the environmental Kuznets curve hypothesis for 14 Asia-Pacific countries. Renew. Sustain. Energy Rev. 2018, 94, 419–429. [Google Scholar] [CrossRef]

- Zambrano-Monserrate, M.A.; Silva-Zambrano, C.A.; Davalos-Penafiel, J.L.; Zambrano-Monserrate, A.; Ruano, M.A. Testing environmental Kuznets curve hypothesis in Peru: The role of renewable electricity, petroleum and dry natural gas. Renew. Sustain. Energy Rev. 2018, 82 Pt 3, 4170–4178. [Google Scholar] [CrossRef]

- Shahbaz, M.; Khan, S.; Tahir, M.I. The dynamic links between energy consumption, economic growth, financial development and trade in China: Fresh evidence from multivariate framework analysis. Energy Econ. 2013, 40, 8–21. [Google Scholar] [CrossRef]

- Shota, M.; Masayuki, S.A. Simultaneous investigation of the environmental Kuznets curve for the agricultural and industrial sectors in China. J. Asia Pac. Econ. 2021. [Google Scholar] [CrossRef]

- Gyamfi, B.A.; Adedoyin, F.F.; Bein, M.A.; Bekun, F.V. Environmental implications of N-shaped environmental Kuznets curve for E7 countries. Environ. Sci. Pollut. Res. 2021. [Google Scholar] [CrossRef] [PubMed]

- Nepal, R.; Jamasb, T.; Tisdell, C.A. On environmental impacts of market-based reforms_ Evidence from the European and Central Asian transition economies. Renew. Sustain. Energy Rev. 2017, 73, 44–52. [Google Scholar] [CrossRef]

- Madaleno, M.; Moutinho, V. Analysis of the new kuznets relationship: Considering emissions of carbon, methanol and nitrous oxide greenhouse gases—Evidence from EU countries. Int. J. Environ. Res. Public Health 2021, 18, 2907. [Google Scholar] [CrossRef]

- Soylu, Ö.B.; Adebayo, T.S.; Kirikkaleli, D. The imperativeness of environmental quality in china amidst renewable energy consumption and trade openness. Sustainability 2021, 13, 5054. [Google Scholar] [CrossRef]

| Author/s | Sample (Countries)/ and Period | Variables (Mostly Per Capita) | Results |

|---|---|---|---|

| Ali et al. [15] | 33 European countries/ 1996–2017 | GDP, renewable energy, energy consumption, import and export, CO2, and urbanization. | All variables are integrated in the long run. GDP has a U-shaped and significant relationship with environmental degradation supporting the EKC hypothesis. Energy innovation has a negative and significant impact on environmental degradation. |

| Dogan et al. [16] | EU countries/ 1980–2014 | CO2, GDP, Industry (value added), energy structure, energy intensity, urbanization, population. | The industrial share decreases emissions through the development and absorption of energy-efficient and environmentally friendly technologies. The EKC hypothesis is confirmed. |

| Vasylieva et al. [17] | EU countries and Ukraine/ 2000–2016 | GDP, GHG, renewable energy consumption, corruption. | The empirical results of FMOLS and DMOLS panel cointegration tests confirmed the EKC hypothesis. The increase in renewable energy led to a decline in GHG, and the rise in the control corruption index prompted a drop in GHG. |

| Baležentis et al. [18] | EU countries (Malta excl.); 1995–2015 | GDP, GHG, biomass, other renewable energy consumption. | The models without renewable resources indicate the presence of the EKC of the GHG emission. The effect of biomass on reducing GHG emission is higher than that caused by the other renewable resources. |

| Bozkurt et al. [19] | selected 20 EU countries/ 1991–2013 | Energy consumption, GDP, CO2 and Kyoto dummy variable. | There is a long run cointegration relationship between CO2, energy consumption, GDP growth, trade openness, and the Kyoto dummy variable. Energy consumption and GDP growth increase the level of CO2 emissions, but the Kyoto dummy variable decreases CO2 emissions in the European Union countries. The inverted U-shape EKC hypothesis is invalid. |

| Chen et al. [20] | 16 CEE countries/ 1980–2016 | CO2, GDP, financial development index, index of globalization, energy use, renewable energy. | The EKC hypothesis is confirmed for the selected panel countries. Globalization is enhancing the environmental quality of the CEE countries. |

| Armeanu et al. [21] | EU countries/ 1990–2014 | GDP, GHG, Emissions of Sulfur Oxides, Environmental Tax Revenues, Gross Fixed Capital Formation, and many others. | The EKC hypothesis is confirmed in sulphur oxides emissions and emissions of nonmethane volatile organic compounds. |

| Borozan et al. [22] | EU countries/ 2005–2016 | GDP, prices of electricity and gas, taxes, education, poverty, climate conditions, recession. | The research corroborates the inverted U-shaped Residential Electricity EKC, assuming thereby at least the same level of policy efforts directed to accomplish the energy targets and household willingness to use goods in an environmentally friendly way. |

| Destek et al. [23,24] | 10 selected CEE countries;/1991–2011 | GDP, CO2, energy consumption, urbanization, trade openness. | The EKC hypothesis is confirmed. |

| Marinas et al. [25] | 10 EU countries from CEE;/1990–2014 | GDP, renewable energy consumption. | The hypothesis of bi-directional causality between renewable energy consumption and economic growth is validated in the long run for both the whole group of analyzed countries and in the case of seven CEE states that were studied individually. |

| Country | Decision | Selected Model | Statistics | Kripfganz and Schneider (2018) Critical Values | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Significance 10% | Significance 5% | Significance 1% | p-Value | |||||||||

| I(0) | I(1) | I(0) | I(1) | I(0) | I(1) | I(0) Bound | I(1) Bound | |||||

| Bulgaria | cointegration | Selected model | F | 22.946 *** | 2.728 | 3.931 | 3.320 | 4.683 | 4.742 | 6.475 | 0.000 | 0.000 |

| t | −10.398 *** | −2.574 | −3.679 | −2.929 | −4.096 | −3.660 | −4.947 | 0.000 | 0.000 | |||

| Croatia | cointegration | ARDL (1 0 0 0 0) | F | 20.634 *** | 3.060 | 4.426 | 3.878 | 5.515 | 6.081 | 8.429 | 0.000 | 0.000 |

| t | −5.597 *** | −2.591 | −3.700 | −3.013 | −4.220 | −3.936 | −5.363 | 0.001 | 0.007 | |||

| Czech Rep. | no levels relationship | ARDL (1 0 0 0 0) | F | 1.062 | 2.924 | 4.269 | 3.664 | 5.249 | 5.591 | 7.790 | 0.605 | 0.855 |

| t | −1.949 | −2.568 | −3.679 | −2.970 | −4.167 | −3.832 | −5.216 | 0.254 | 0.589 | |||

| Estonia | cointegration | ARDL (1 0 0 1 0) | F | 7.651 ** | 2.959 | 4.365 | 3.742 | 5.415 | 5.838 | 8.198 | 0.003 | 0.013 |

| t | −3.866 * | −2.554 | −3.674 | −2.971 | −4.182 | −3.872 | −5.286 | 0.010 | 0.077 | |||

| Hungary | cointegration | ARDL (1 0 0 1 1) | F | 22.305 *** | 2.896 | 4.226 | 3.615 | 5.176 | 5.470 | 7.614 | 0.000 | 0.000 |

| t | −8.906 *** | −2.567 | −3.677 | −2.963 | −4.156 | −3.808 | −5.180 | 0.000 | 0.000 | |||

| Latvia | cointegration | ARDL (1 1 0 0 0) | F | 24.443 *** | 3.088 | 4.560 | 3.973 | 5.753 | 6.455 | 9.048 | 0.000 | 0.000 |

| t | −8.057 *** | −2.560 | −3.687 | −3.002 | −4.233 | −3.981 | −5.449 | 0.000 | 0.000 | |||

| Lithuania | no levels relationship | ARDL (1 1 0 0 1) | F | 2.373 | 3.074 | 4.493 | 3.926 | 5.634 | 6.268 | 8.738 | 0.185 | 0.406 |

| t | −2.114 | −2.576 | −3.694 | −3.008 | −4.226 | −3.959 | −5.406 | 0.197 | 0.504 | |||

| Poland | cointegration | ARDL (1 0 1 0 0) | F | 9.228 *** | 3.050 | 4.548 | 3.924 | 5.732 | 6.374 | 8.998 | 0.002 | 0.009 |

| t | −6.077 *** | −2.542 | −3.674 | −2.984 | −4.219 | −3.959 | −5.427 | 0.000 | 0.004 | |||

| Romania | cointegration | ARDL (1 0 1 1 1) | F | 19.800 *** | 2.896 | 4.266 | 3.630 | 5.245 | 5.548 | 7.785 | 0.000 | 0.000 |

| t | −9.231 | −2.552 | −3.669 | −2.955 | −4.157 | −3.818 | −5.204 | 0.000 | 0.000 | |||

| Slovakia | cointegration | ARDL (1 1 0 0 1) | F | 13.175 *** | 2.923 | 4.225 | 3.644 | 5.173 | 5.499 | 7.600 | 0.000 | 0.001 |

| t | −6.334 *** | −2.584 | −3.687 | −2.978 | −4.165 | −3.821 | −5.188 | 0.000 | 0.001 | |||

| Slovenia | cointegration | ARDL (1 0 0 0 0) | F | 14.588 *** | 2.924 | 4.269 | 3.664 | 5.249 | 5.591 | 7.790 | 0.000 | 0.000 |

| t | −6.271 *** | −2.568 | −3.679 | −2.970 | −4.167 | −3.832 | −5.216 | 0.000 | 0.002 | |||

| Country | |||||

|---|---|---|---|---|---|

| Bulgaria | −0.9279025 *** (−10.40) | −7.132273 (−1.46) | 0.4084599 (1.43) | 1.512325 *** (22.45) | 0.0763897 (0.98) |

| Croatia | −0.7160752 *** (−5.60) | 1.207842 (0.15) | −0.0986388 (−0.22) | 2.029567 *** (10.11) | 0.3750321 ** (2.27) |

| Czech Rep. | no levels relationship | ||||

| Estonia | −0.515706 *** (−3.87) | −1.584854 (−0.65) | 0.0857118 (0.66) | 0.4912333 ** (2.35) | 0.1529776 (1.33) |

| Hungary | −0.7190076 *** (−8.91) | 6.922897 (1.15) | −0.3886803 (−1.21) | 1.747893 *** (13.17) | −0.0756772 * (−1.82) |

| Latvia | −0.8154661 *** (−8.06) | −4.102585 (−1.59) | 0.2141292 (1.49) | 1.740268 *** (7.11) | −0.2719155 (−2.96) |

| Lithuania | no levels relationship | ||||

| Poland | −1.443825 *** (−6.08) | 3.393525 *** (7.04) | −0.1944176 *** (−7.69) | 1.054645 *** (40.71) | 0.0265788 (0.93) |

| Romania | −0.9919402 *** (−9.23) | −3.024831 (−1.11) | 0.1677077 (1.07) | 1.292806 *** (19.87) | −0.1872444 *** (−3.13) |

| Slovakia | −0.7125795 *** (−6.33) | −9.614154 ** (−2.19) | 0.5059201 ** (2.14) | 1.773542 *** (4.92) | −0.124479 (−0.98) |

| Slovenia | −0.6979881 *** (−6.27) | −22.26621 *** (−3.38) | 1.105588 *** (3.30) | 1.85127 *** (7.69) | −0.1913531 (−1.54) |

| Country | The Trace Statistics | The Maximum Eigenvalue Statistics | ||||

|---|---|---|---|---|---|---|

| Maximum Rank | Trace Statistics | 5% Critical Value | Maximum Rank | Max Statistics | 5% Critical Value | |

| Bulgaria | 2 | 6.5735 | 12.53 | 3 | 6.4521 | 11.44 |

| Croatia | 3 | 6.5735 | 12.53 | 3 | 6.4521 | 11.44 |

| Czech Rep. | 2 | 23.1559 | 24.31 | 1 | 21.0415 | 23.80 |

| Estonia | 2 | 16.7707 | 24.31 | 2 | 11.6739 | 17.89 |

| Hungary | 4 | 3.0253 | 3.84 | 4 | 3.0253 | 3.84 |

| Latvia | 1 | 32.9198 | 39.89 | 1 | 13.5667 | 23.80 |

| Lithuania | 3 | 8.0099 | 15.41 | 3 | 7.9666 | 14.07 |

| Poland | 1 | 39.8512 | 39.89 | 0 | 29.3755 | 30.04 |

| Romania | 4 | 2.0856 | 3.84 | 4 | 2.0856 | 3.84 |

| Slovakia | 2 | 19.6038 | 24.31 | 2 | 13.9347 | 17.89 |

| Slovenia | 3 | 7.9118 | 12.53 | 3 | 7.4636 | 11.44 |

| Type of Causality | |||||

|---|---|---|---|---|---|

| Short-Run | Long-Run | ||||

| Bulgaria | 19.52732 (0.334) | −1.141072 (0.340) | 0.2777692 (0.657) | 0.1403034 (0.304) | 0.1085911 (0.625) |

| Croatia | 44.48498 *** (0.000) | −2.27491 *** (0.000) | −0.9074855 (0.229) | −0.1295292 (0.507) | −0.0292138 (0.889) |

| Czech Rep. | 37.55787 ** (0.023) | −1.893389 ** (0.025) | −0.7194569 (0.186) | 0.1027063 (0.530) | −0.5910012 * (0.108) |

| Estonia | −5.671992 (0.73) | 0.2951767 (0.739) | −1.253437 (0.293) | −0.411933 (0.203) | −0.2695648 (0.760) |

| Latvia | 10.00946 (0.623) | −0.5446163 (0.617) | 1.440446 (0.205) | −0.0190665 (0.958) | 0.0748077 (0.448) |

| Lithuania | 22.12051 (0.392) | −1.186595 (0.389) | 0.0164719 (0.961) | 0.328258 (0.229) | 0.2042606 (0.472) |

| Poland | −5.761343 (0.440) | 0.3983925 (0.353) | −1.274876 (0.503) | −0.1517343 (0.327) | −6.922366 ** (0.018) |

| Romania | 27.44555 *** (0.003) | −1.551871 *** (0.003) | −1.093496 * (0.060) | 0.1992621 (0.125) | −0.2062757 (0.275) |

| Slovakia | 18.29915 ** (0.021) | −0.9652483 ** (0.020) | −0.2777244 (0.610) | 0.2744206 ** (0.049) | 0.0435621 (0.648) |

| Slovenia | −21.44961 (0.583) | 1.093192 (0.575) | 0.2635823 (0.753) | 0.1410367 (0.490) | −0.1098107 (0.154) |

| Type of Causality | |||||

|---|---|---|---|---|---|

| Short-Run | Long-Run | ||||

| Bulgaria | 0.0473663 (0.808) | 0.4506616 (0.491) | 0.1244479 (0.716) | −0.1061008 (0.155) | 0.1046299 (0.389) |

| Croatia | −0.1204909 (0.783) | −0.4228583 (0.496) | 0.1330792 (0.858) | 0.0707448 (0.714) | 0.048466 (0.815) |

| Czech Rep. | 0.1178013 (0.697) | −0.6149802 (0.288) | −0.3170827 (0.395) | 0.082952 (0.459) | −0.1769793 (0.482) |

| Estonia | −0.0736962 (0.891) | 0.7375369 (0.137) | 0.1636688 (0.806) | 0.0553634 (0.760) | −1.178289 ** (0.017) |

| Latvia | 0.1572548 (0.629) | 1.002061 (0.056) | −0.0079399 (0.988) | −0.0906455 (0.606) | −0.1420247 *** (0.003) |

| Lithuania | −4.636562 (0.804) | 0.2573678 (0.797) | −0.21239 (0.379) | 0.0025929 (0.990) | −0.1481043 (0.472) |

| Poland | 0.9298013 (0.300) | −0.1690673 (0.440) | −0.8010967 (0.411) | −0.0861874 (0.276) | −1.84046 (0.219) |

| Romania | 0.6795092 ** (0.021) | 1.465229 (0.805) | −0.0702363 (0.834) | −0.6420375 (0.086) | 0.1624228 (0.183) |

| Slovakia | 0.1481264 (0.568) | −0.5052178 * (0.105) | −0.6785857 * (0.097) | 0.1931795 * (0.065) | −0.0918972 (0.199) |

| Slovenia | 0.0536932 (0.858) | 0.3428979 (0.767) | −0.709142 (0.154) | 0.1019946 (0.400) | −0.0668872 (0.143) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jóźwik, B.; Gavryshkiv, A.-V.; Kyophilavong, P.; Gruszecki, L.E. Revisiting the Environmental Kuznets Curve Hypothesis: A Case of Central Europe. Energies 2021, 14, 3415. https://doi.org/10.3390/en14123415

Jóźwik B, Gavryshkiv A-V, Kyophilavong P, Gruszecki LE. Revisiting the Environmental Kuznets Curve Hypothesis: A Case of Central Europe. Energies. 2021; 14(12):3415. https://doi.org/10.3390/en14123415

Chicago/Turabian StyleJóźwik, Bartosz, Antonina-Victoria Gavryshkiv, Phouphet Kyophilavong, and Lech Euzebiusz Gruszecki. 2021. "Revisiting the Environmental Kuznets Curve Hypothesis: A Case of Central Europe" Energies 14, no. 12: 3415. https://doi.org/10.3390/en14123415

APA StyleJóźwik, B., Gavryshkiv, A.-V., Kyophilavong, P., & Gruszecki, L. E. (2021). Revisiting the Environmental Kuznets Curve Hypothesis: A Case of Central Europe. Energies, 14(12), 3415. https://doi.org/10.3390/en14123415