1. Introduction

In today’s world, crude oil is one of the most important resources. It is a leading fuel and its price has a direct effect on the global economy, oil exploration and exploitation, as well as many other activities. Crude oil plays a key role in numerous areas of the world economy as an input in the production of numerous types of goods in many sectors of the economy. Crucially, despite the quickly growing share of renewable energy sources, transport and delivery of almost all goods and many services still rely on crude oil.

Previous studies have shown that crude oil price fluctuations have a significant impact on the level of economic activity and consumer sentiment. This correlation was especially noticeable during the financial crisis in 2007–2008 [

1]. There has also been a lot of research on the relation between oil prices and the rate of real GDP growth, unemployment, and inflation rate in the USA [

2,

3,

4,

5,

6,

7,

8] and other countries [

9,

10] as well as general studies on the impact of commodity price volatility on growth [

11].

Literature has also identified the impact of oil price shocks on macroeconomic aggregates such as the level of investment, stock prices and returns [

12,

13,

14,

15,

16,

17], inflation rate [

18], industrial production and exchange rates [

19,

20,

21,

22,

23], as well as financial and monetary policy [

24]. There has also been a large number of studies concerning the impact of crude oil prices on various groups of commodities such as: gold [

25,

26], silver, platinum and palladium [

27], zinc, copper and molybdenum [

28], agricultural [

29,

30,

31,

32], and energy commodities [

33,

34,

35,

36,

37].

The impact of oil prices on the level of countries’ risks is also an increasingly popular subject of research. Liu et al. [

38] have suggested that properties of country risk remain comparatively steady despite the oil price volatility. They have also found that oil price fluctuations can expand a country’s risk under some special conditions. Said-Zada identified technical progress as an important additional source of economic modernisation [

39]. In turn, Lee et al. [

40] investigated the dynamic relationship between oil price shocks and country risk using a Structural VAR framework for a sample of both net oil-exporting and net oil-importing countries. They have shown that positive oil price shocks trigger a reduction in country risk for net oil-exporting country. The opposite is also true. The issue of risk and oil prices was also discussed by Lee and Yoon [

41]. They found the effect of volatility spillover from the Brent oil market to the European Union carbon emission allowance (EUA) market. They also showed that investors can effectively hedge their investment risk by holding EUAs and energy sources together as assets. Zeng and others investigated the dynamic volatility spillover effect between EUAs and similar market-based approaches [

42].

Numerous studies showing the impact of fluctuations in crude oil prices on macroeconomic indicators and the level of risk incurred by countries and enterprises in various industries, confirm the importance of effective hedging against resource price changes. However, to the best of our knowledge existing papers have focused on price forecasting and regression, whereas we have reformulated this to a classification problem, which can be a useful approach, especially on the commodity derivatives market.

Derivatives are one of the instruments that can support the price risk management process. Moreover, due to the variety of delivery methods for raw materials and other products (their completion is assigned to a specific moment in the future), they constitute an important part of commodity exchanges. Nonetheless, the misuse of derivatives may be perceived as an additional source of risk, based on the events preceding the 2007–2008 financial crisis.

For long options, that are the subject of our research, the maximum loss is limited and equal to the value of the total option premium (the unit option premium multiplied by the number of options that were bought). This makes it possible to use long options as a tool offering protection against unfavourable changes in oil prices, without generating additional risk. Furthermore, taking a long position in a call option does not require the buyer to make an initial deposit or add to it during the term of the contract. Therefore, the only cost for the option buyer is the option premium, which is paid on the day the position is opened. It is also worth noting that this amount is known and it is up to the buyer to decide whether or not to accept this cost.

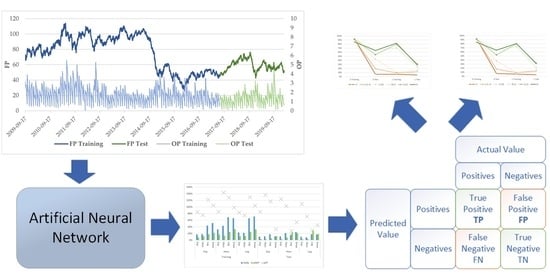

The main aim of this paper is to analyse the effectiveness of using artificial neural networks in search for buy signals for European call options, referring to the nearest expiration date for future contracts on WTI crude oil (front month futures).

The choice of artificial neural networks (ANNs) to search for option buy signals was dictated by the complexity of this problem. ANNs are nonlinear methods that imitate the human brain. They are characterised by: self-organisation, data-driven memory, self-learning, self-adaptation and associated memory [

43]. ANNs use large amounts of processed information and can capture hidden functional relationships in data, even if the functional relationships are unknown or difficult to identify.

In order to choose ANNs as a tool to support the decision-making process in the crude oil options market, we were also influenced by numerous attempts to use this tool in oil price prediction. Azadeh et al. [

44] used a flexible algorithm based on ANNs and fuzzy regression (FR) to forecast annual oil prices. They showed that the selected ANNs models considerably outperform the FR models in terms of mean absolute percentage error (MAPE). Chiroma et al. [

45] proposed an approach based on a genetic algorithm and neural network (GA–NN) for the prediction of WTI crude oil prices. Mann–Whitney test results indicated no significant difference between median WTI crude oil prices predicted by GA–NN and prices observed from May 2008 to December 2011. In turn, Wang and Wang [

43], in an attempt to forecast crude oil prices and oil stock prices, used a combination of multilayer perception (MLP), and Elman recurrent neural networks (ERNN) with stochastic time effective function (ST) to develop a forecasting model, called ST-ERNN. The forecasting results of the proposed model were more accurate than the backpropagation neural network (BPNN) and ERNN models. The issue of volatility forecast and option-trading strategy was explored by Liu and others using an improved Artificial Bee Colony with Back Propagation (BP) natural network model. They found that the ANN model is better at predicting implied volatility than for example Monte Carlo simulation [

46].

These and other ANNs models [

47,

48,

49,

50,

51,

52,

53,

54,

55,

56] have shown that ANNs provide an important alternative to econometrics (both linear and nonlinear) in forecasting crude oil prices. Dbouk et al. [

57] noted, however, that the accuracy of price predictions is not a key aspect of successful investment or hedging strategies. It is also worth noting that the main aim of our research was not to use the ANNs to predict future oil prices, but to search for call options purchase signals with the use of this tool. There are currently no studies other than our previous article [

58] that consider hedging against changes in prices of oil (and other raw materials) as a classification problem. In the case of options market participants, especially buyers, the problem of the correct classification (profit or loss) of the return on hedging is particularly important. Based on copious market data, buyers must make quicks decision whether the purchase of options at a given point in time will be an effective form of hedging against oil price fluctuations in the future. In our opinion, using ANNs to make this type of decisions may facilitate hedging against oil price changes. Thus, this paper focused on finding network parameters that maximise network effectiveness indicators which are defined later in the study.

This paper builds on an approach proposed by the authors in [

58]. In order to be able to extend the results, the analyses are carried out on the same data set. To the best of our knowledge, that was the only study until now indicating that neural networks can be a useful tool supporting the process of managing the risk of changes in oil prices using option contracts. Significantly, in this study, we showed the interdependence between two seemingly unrelated network indicators—the first assessing the quality of the network and the second the share of options that were purchased.

The dataset that was used covers the period of time from 16 June 2009 to 14 February 2020. In this paper, we present an analysis based on new network effectiveness indicators which are directly related to the hedging costs (sum of option premiums) and the number of buy signals generated by a given network. These indicators had a significant impact on the analysis and our final results.

The remainder of this article is structured as follows:

Section 2 presents the proposed method: the commodity option pricing (

Section 2.1), multilayer perception structure (

Section 2.2) and network quality assessment indicators that we use (

Section 2.3).

Section 3 provides data and reports its statistical properties. Our empirical results are introduced in

Section 4. The summary, conclusions and future research directions are presented in

Section 5.

3. Data and Preliminary Analysis

In the empirical part of this study, we focus on the final results in long call options with European style between 16 June 2009 and 14 February 2020. The study contains ATM (at-the-money) options and the settlement price of the nearest crude oil futures contract. The prices of ATM options were determined by the Black model (see

Section 2.1.), whereas the parameters required for the option pricing were from the NYMEX (The New York Mercantile Exchange) and QuikStrike software. The established values for the options premium allowed us to determine the final result for the buyer of the call option. The difference between the non-negative payout function and the option premium was established concerning the method of options contract settlement (see Formula (6)). We analysed the options underlying the price of the first futures contract, thus in each of the analysed months, we obtained about 30 final results for the buyer of the call option. The number of final results for the analysed period was 2630.

The set of observations was divided into a training set and a test set at a ratio of 75% to 25%, respectively. A continuous set of observations, starting on 17 September 2009, and ending on 14 July 2017, was chosen as the training set. The observations constituting the test set covered the period from 17 July 2017 to 14 February 2020.

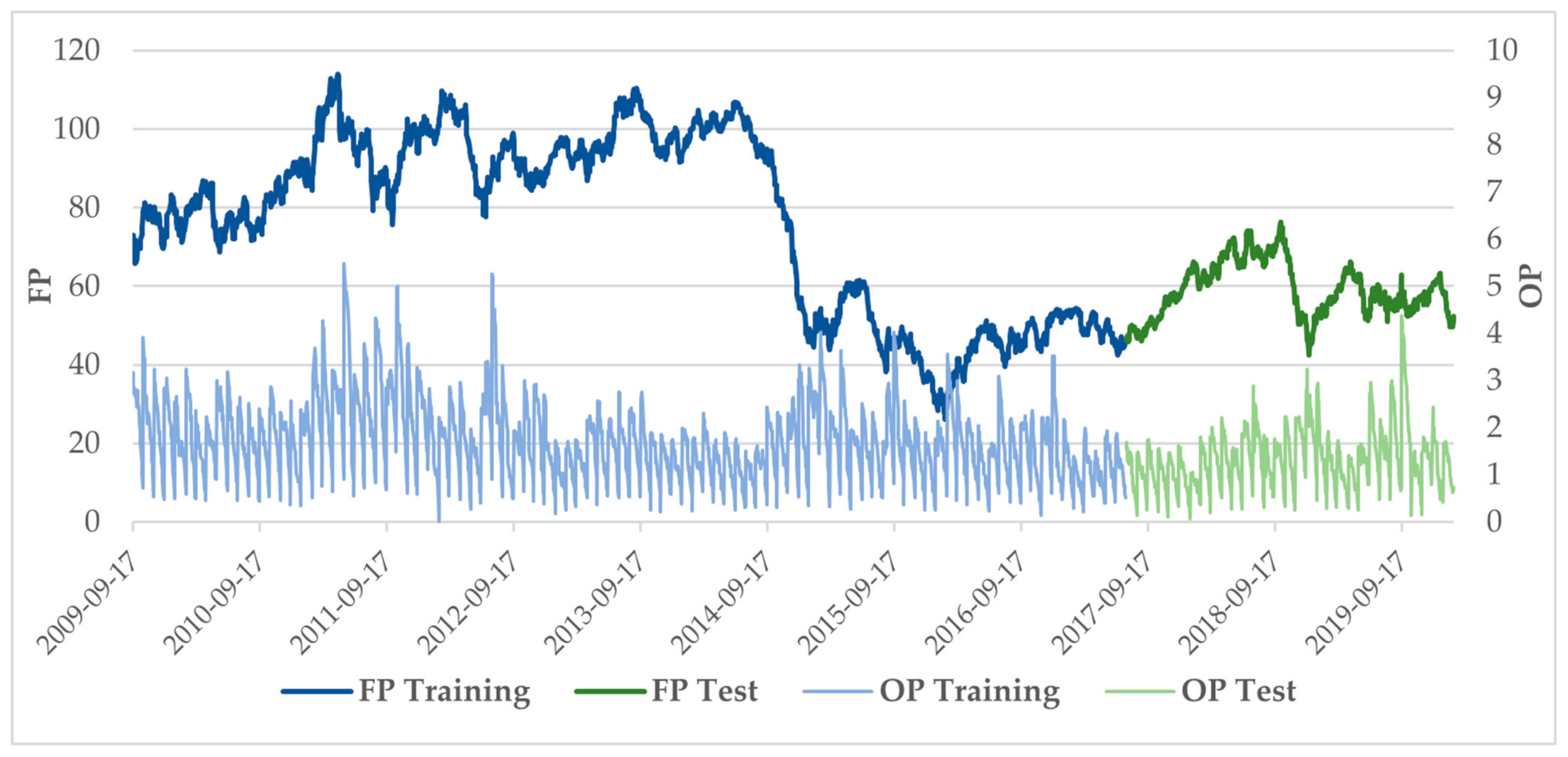

Figure 1 presents the chart of WTI futures prices and the value of ATM call options. The descriptive statistics for WTI futures prices, option premiums and the long call final results for the training and test sets are presented in

Table 1.

The presented results show that the fluctuations in both oil prices and option premiums were greater in the training set than in the test set. Moreover, mean and median values for these variables are noticeably higher in the training set. This may be a consequence of the fact that the training set covers a period of time three times longer than the test set. Negative mean values and medians for long calls show that both in the training set and the test set, the process of buying call options was much more likely to bring losses than profits (almost twice as often the purchase of ATM options generated a loss rather than a profit).

The skewness value suggests that only in the training set the oil prices have negatively skewed distributions. For option premiums and long call final results, the distribution was leptokurtic, while for WTI futures prices they were platykurtic (both for training and test set). The Jorque–Bera statistics give evidence of the non-normality of the oil price, option premium and long call results distributions for both the training and test sets.

In the next stage of empirical research, we use WTI oil prices from the analysed period to determine the following indicators:

Standard deviation for n recent settlement prices of the WTI futures, where ;

Arithmetic mean of n recent settlements price of the WTI futures (moving average), where .

WTI nearest futures prices and the number of days remaining until option expiry, as well as standard deviations and moving averages based on WTI futures prices, were used as input data for artificial neural networks. It should be emphasised that the role of these variables is to reflect the state of the oil market at the time of opening a long position in a call option (WTI futures price as the level of the current oil price; standard deviation as a of the dynamics of oil price changes). We also take into account the impact of the number of days remaining until option expiry as it is a parameter that has a significant impact on the level of option premiums. In turn, the moving average is widely used in technical analysis to reflect market trends. Furthermore, Dbouk et al. [

57] have shown that this parameter can be used to predict the directional movement of oil prices with high accuracy.

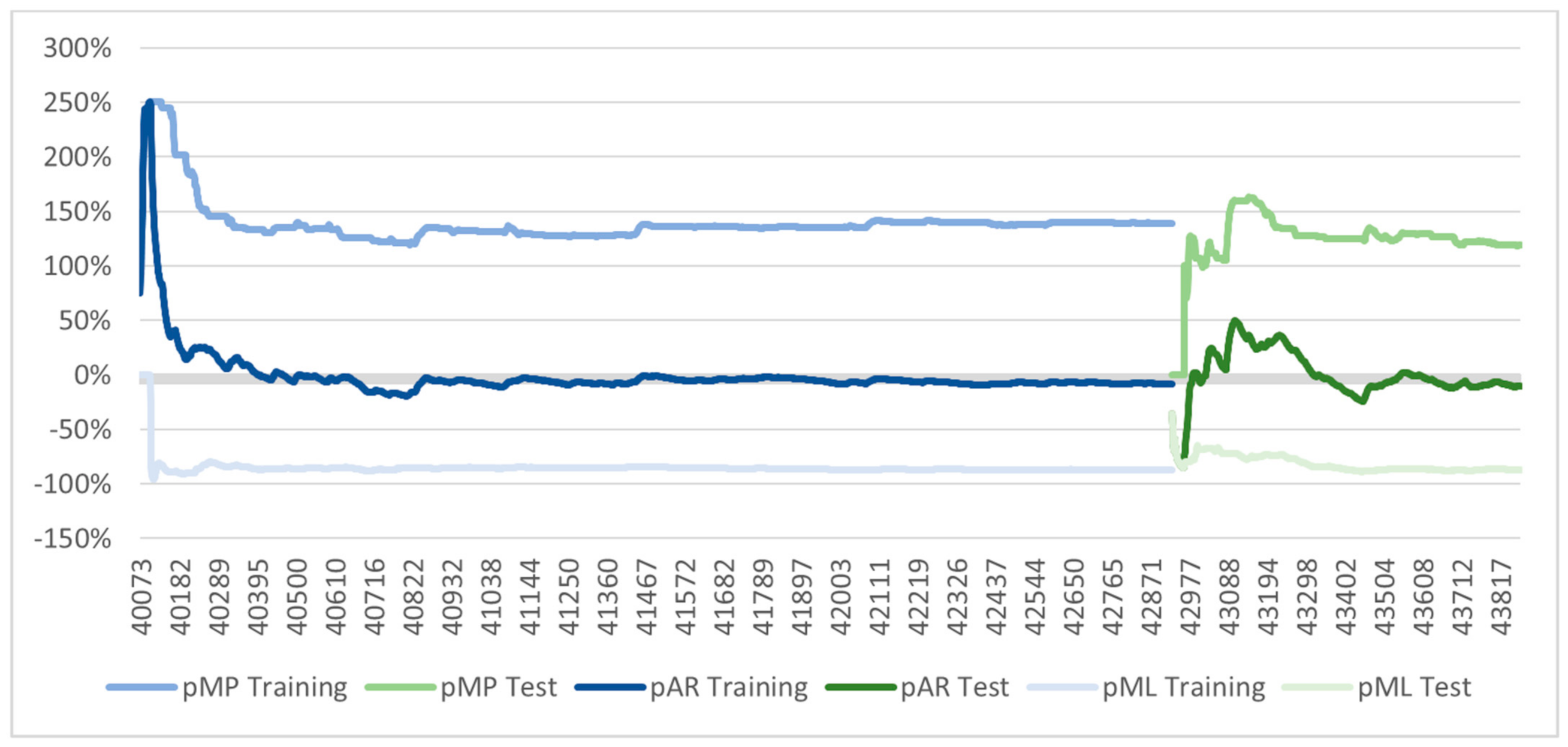

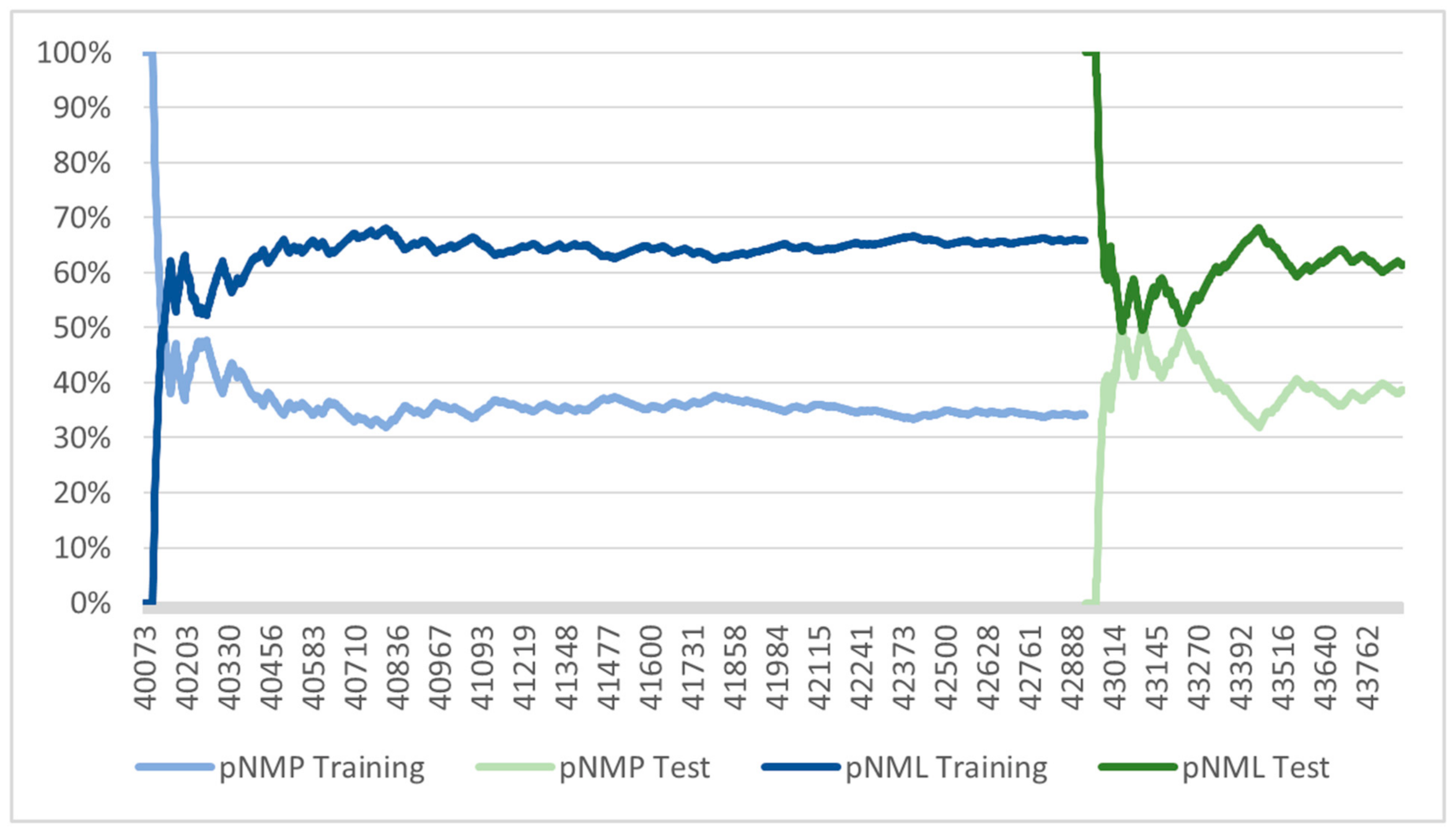

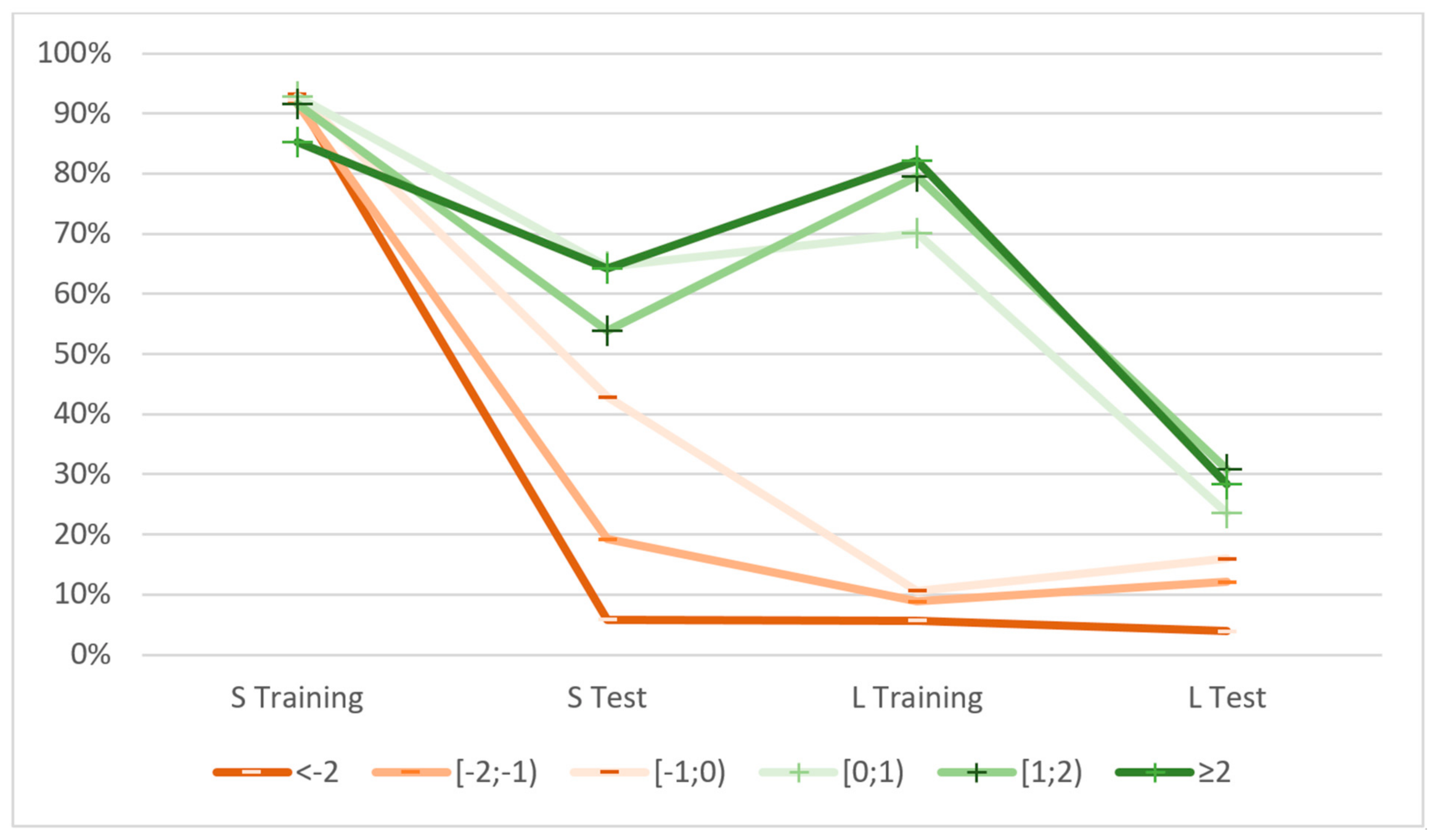

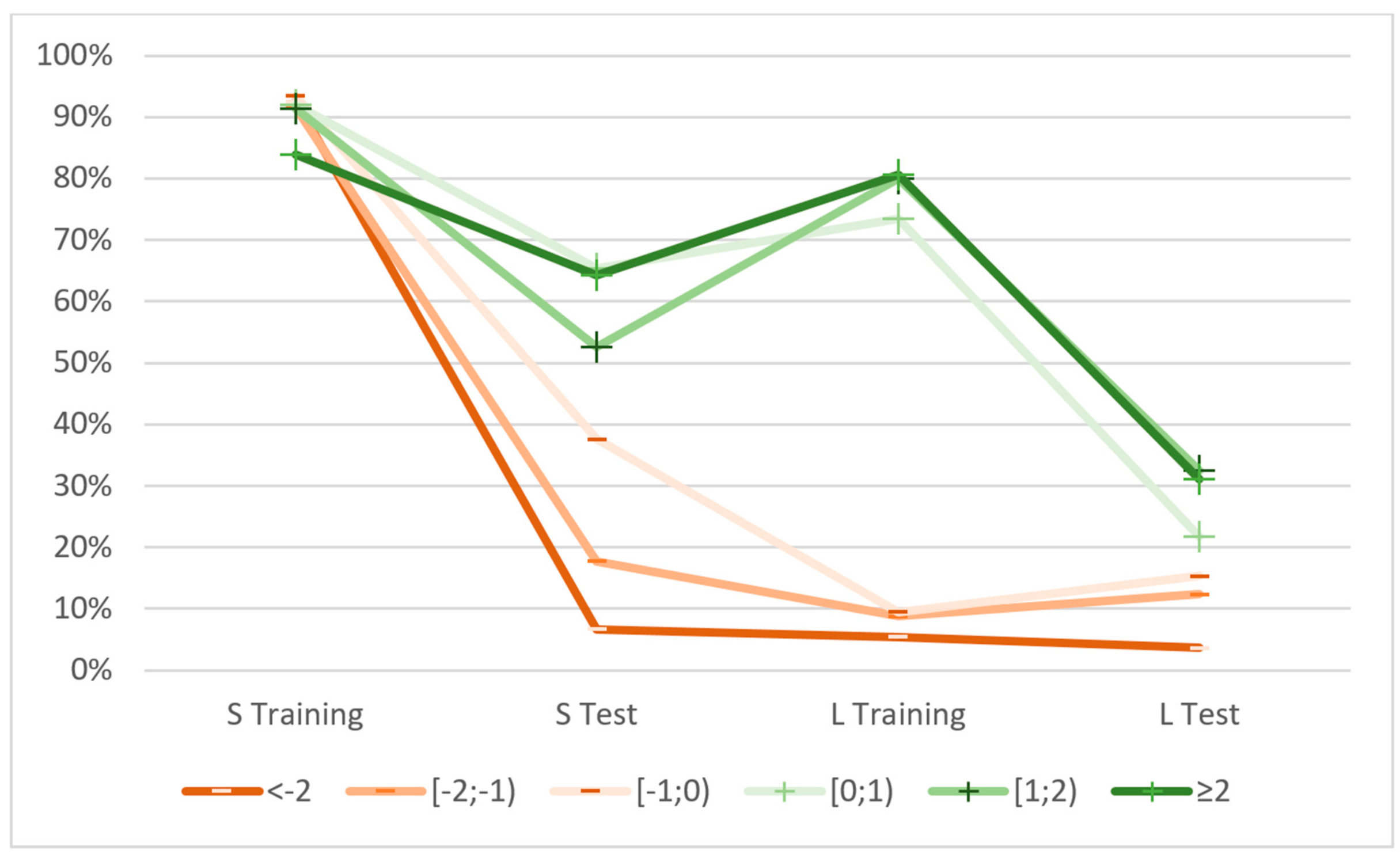

The last element presented in this part is the values of indicators such as pMP, pML, pAR (

Figure 2), pNMP and pNML (

Figure 3) in the training and test sets. These indicators provide information about the maximum profit, maximum loss and total sum of returns (losses) that could be achieved in the given period by taking long positions in call options. This information was used to compare the results obtained from artificial neural networks.

The values of the analysed indicators were at a similar level in the training and test sets. Moreover, there is a noticeable tendency of the pAR indicator to reach negative values quickly and not to exceed the value of 0 at the end of each of the analysed periods of time. This confirms that taking long positions in call options is much more likely to bring losses than profits, which is also shown in

Figure 3.

4. Results

Next, we analysed the impact of the following parameters on the results of the network (SANN):

The number of neurons in the hidden layer, for which three ranges were established: [5; 30], [31; 55] and [56; 80];

Activation functions in the hidden layer: linear, logistic, exponential, sine and hyperbolic tangent;

Activation functions in the output layer: linear, logistic, exponential, sine, hyperbolic tangent and softmax (for the joint entropy error evaluation function).

Additionally, the sum of squares and joint entropy were used as network error functions. The number of neurons in the hidden layer ranged from 5 to 80. For this study, the values of the proposed indicators for 1,000,000 networks described in [

58] were recalculated and over new 1,500,000 networks were trained.

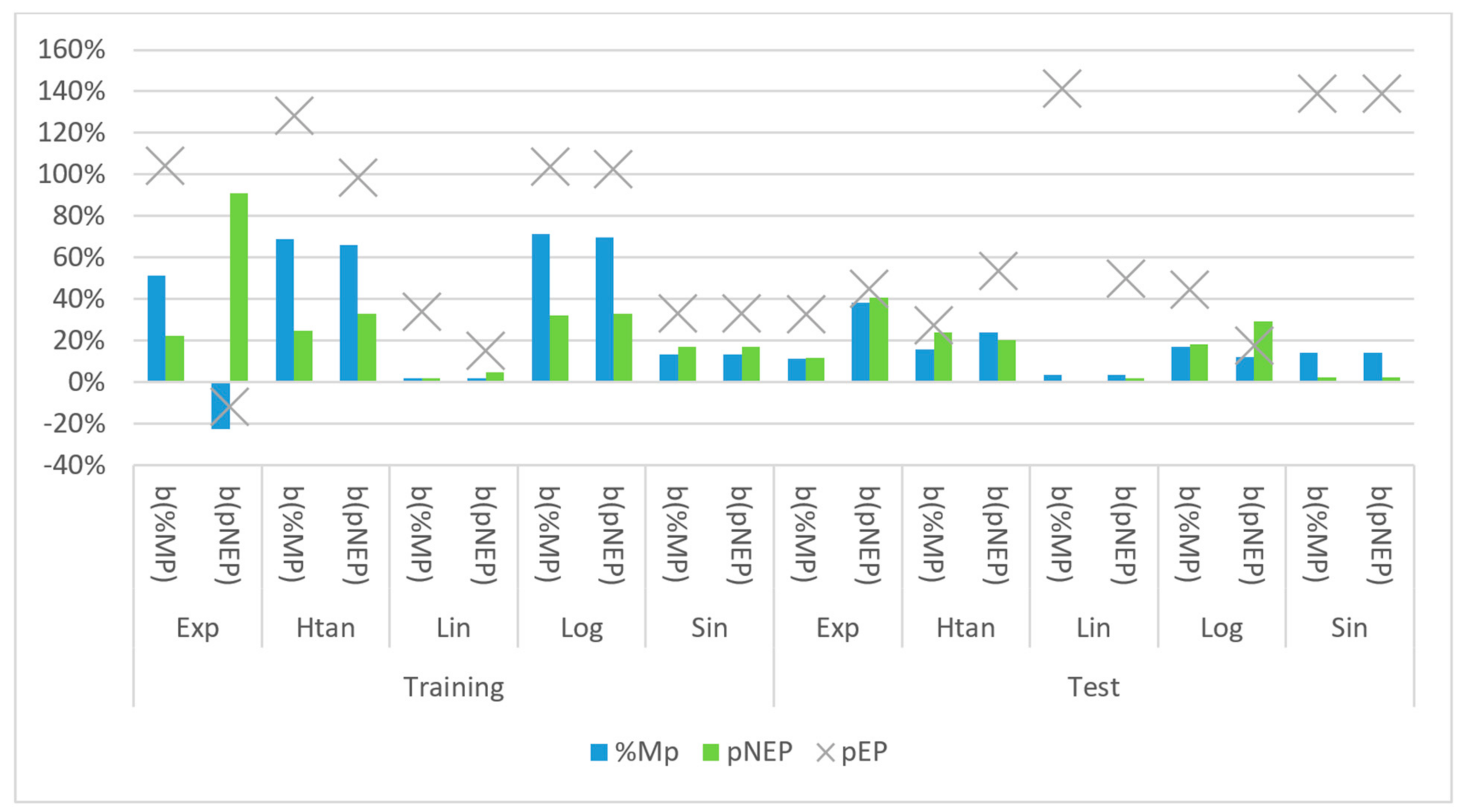

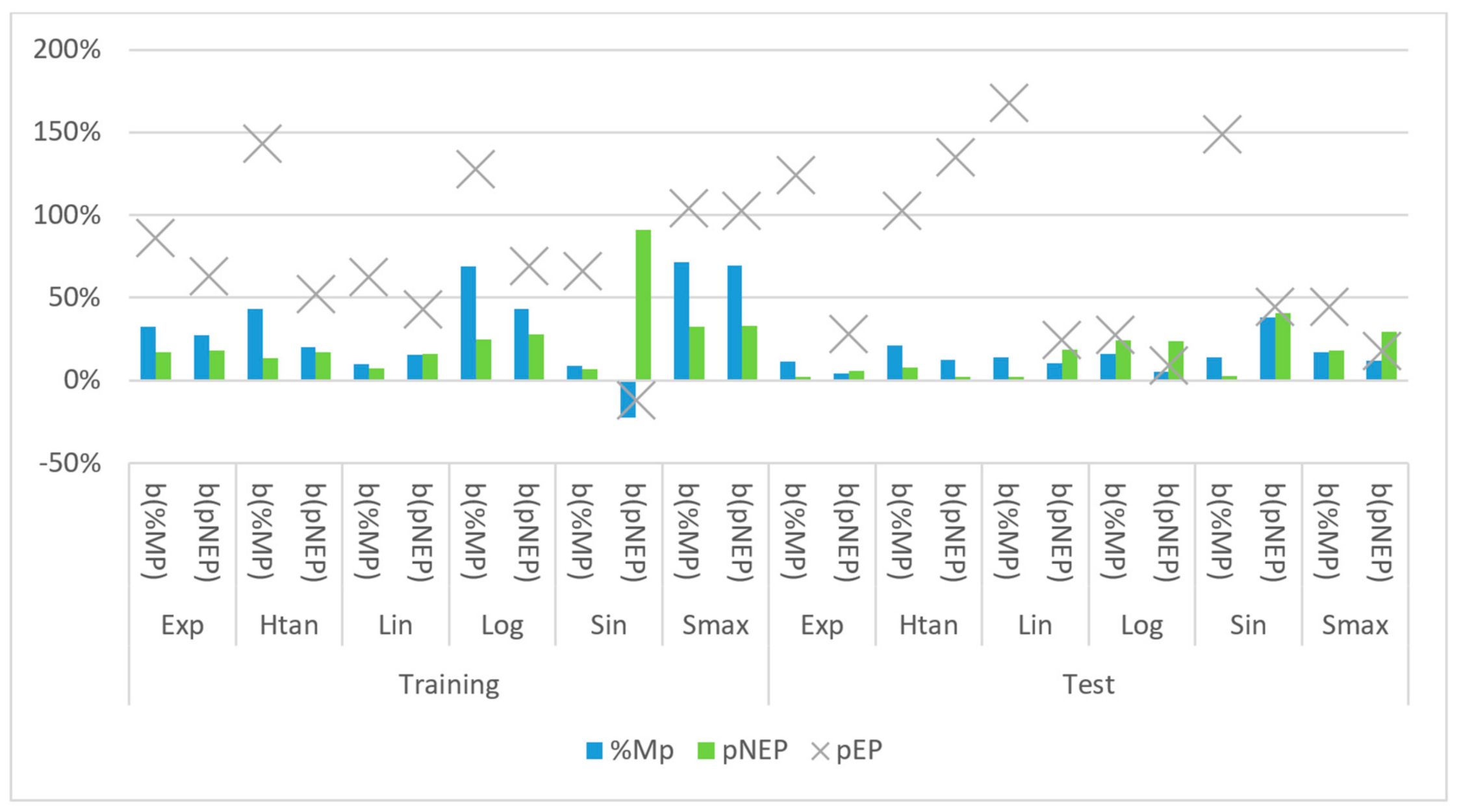

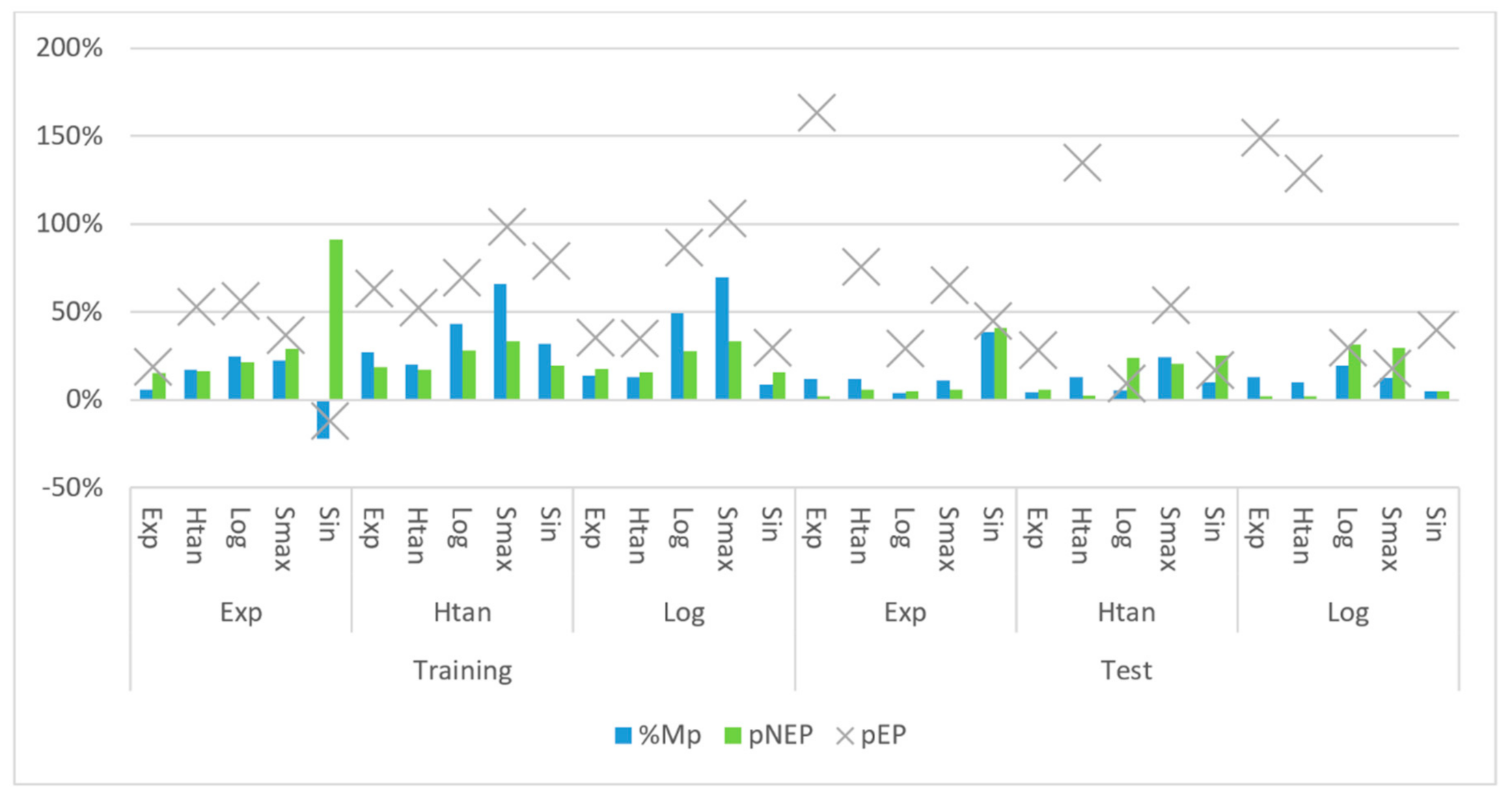

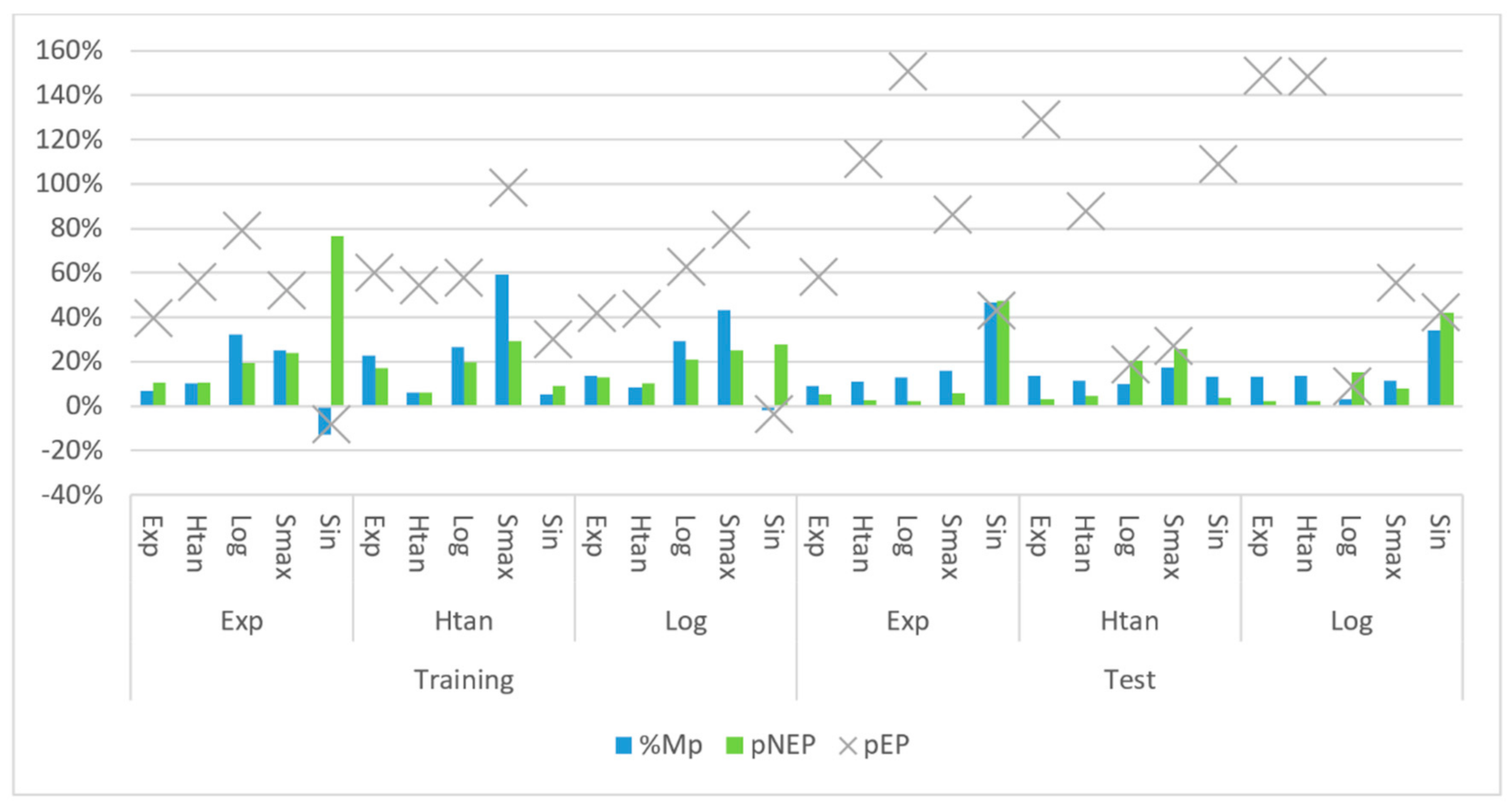

In the first part of the analysis of the results, we present the impact of such parameters as the number of neurons, and the activation functions in the output and hidden layer on %MP, pEP and pNEP indicators. The pEP indicator was used only to illustrate the ratio of the result (EP) achieved by a given network to the amount of capital needed to open positions in option contracts (the sum of option premiums). Due to the nature of the proposed study (i.e., hedging against oil price fluctuations), the pEP indicator was not used as the parameter for selecting the best networks. For %MP and pNEP indicators, the best network results were included, marked as b(%MP) and b(pNEP) respectively, where b is the function that returns the best results for a given indicator—it means ‘the best results’. It is also worth noting that since the networks were trained on the training set, the best results will also be for this set, not the test set. For comparison, the results of other indicators obtained by a given network were also included.

Appendix A (

Table A1) summarises all the best results for the %MP and pNEP indicators, classified on the basis of the listed network parameters, i.e., the number of neurons and activation functions in the output and hidden layers.

In the figures, we used the following abbreviated names for activation functions:

Exp—exponential,

HTan—hyperbolic tangent,

Lin—linear,

Log—logistic,

Sin—sine,

Smax—softmax.

Figure 4,

Figure 5 and

Figure 6 show the impact of network parameters such as the number of neurons, activation functions in the output and hidden layer on the values of %MP, pEP, and pNEP indicators. For all the values of each parameter, we presented the values of two networks, namely those that allowed us to obtain the best result for the %MP indicator (b(%MP)) and for the pNEP indicator (b(pNEP)) in the training set.

Based on

Figure 4, it should be noted that for both the %MP and pNEP indicators, the highest values were obtained for exponential, hyperbolic tangent and logistic activation functions in the hidden layer. The obtained rate of return was lower than zero (which is also referred to as a negative value of the pEP index for this network) only in the case of maximising the value of the pNEP index for the exponential activation function. Moreover, all these networks, defined as the best from the perspective of the training set, achieved positive values of the %MP and pEP indicators in the test set.

For activation functions in the output layer, and for the %MP indicator, the best results were achieved for the following functions: exponential, hyperbolic tangent, logistic and softmax. In the case of the pNEP index, the list of activation functions that gives the best results should also include the sine function, for which the pNEP index had by far the highest value.

The %MP indicator achieved by far the best values for the neural network for which the number of neurons ranged from 5 to 30. In terms of the pNEP indicator, we also checked networks in which the number of neurons in the hidden layer ranged from 31 to 55.

A detailed list of results that were the source for data presented in

Figure 7 is attached in

Table 2.

The highest levels of %MP indicator for the training set were obtained for the hyperbolic tangent activation function in the hidden layer with the logistic activation function in the output layer (69%), and logistic function with softmax (71.4%). Additionally, the highest values of the pNEP index were achieved for hyperbolic tangent with softmax (33.1%) and logistic with softmax (32.3%) activation functions.

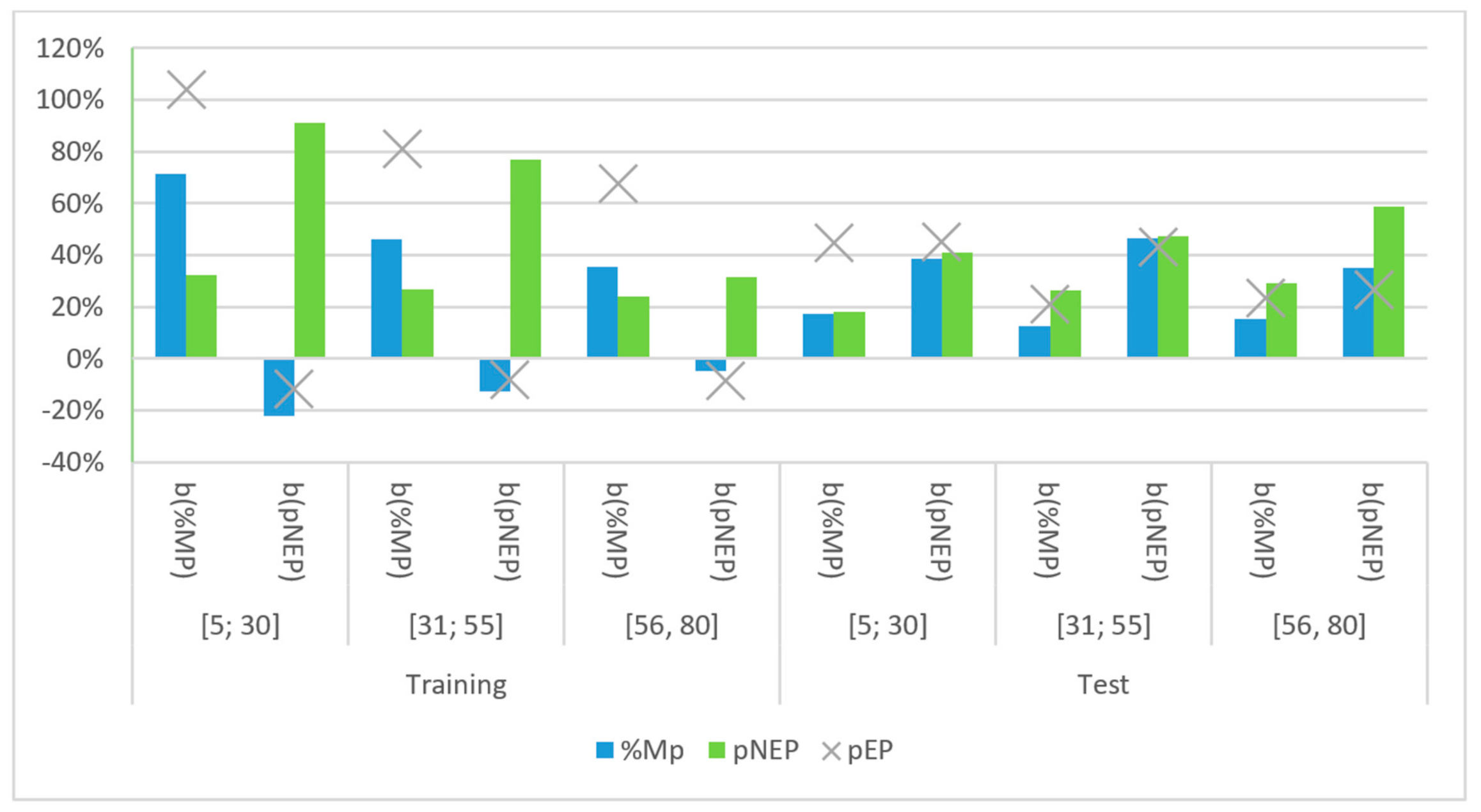

Figure 8 and

Figure 9 present the best networks in terms of the value of the pNEP indicator (selected in accordance with the previously presented approach).

Figure 8 shows the networks for the number of neurons in the range [5; 30], while

Figure 9 depicts a summary for the number of neurons in the range [31; 55].

Significantly, the best results for the pNEP indicator were obtained with the use of the exponential activation function in the hidden layer and the sine activation function in the output layer (91.1% for 5–30 neurons and 76.7% for 31–55 neurons). The results presented in

Table 3 show that the sine activation function in the output layer was the only function that returned negative %MP values for the training set. Such a relationship can be observed both in the case of the two previously indicated combinations, as well as the logistic and the sine function (with 31–55 neurons). Similarly, the use of sine function in the output layer resulted in the highest %MP values for the test set (38.4% for 5–30 neurons with the exponential function, 46.5% for 31–55 neurons with the exponential function and 34.2% for 31–55 neurons with the logistic function). Crucially, the %MP indicators for the test set for these three networks are much higher than for the networks that were chosen based on the highest b(%MP) values.

Networks with hyperbolic tangent or logistic activation functions in the hidden layer, and logistic or softmax activation functions in the output layer are considered.

As shown in

Figure 8 and

Figure 9, the highest values of %MP and pNEP indicators for various parameters (activation functions in the hidden layer and the output layer, number of neurons in the hidden layer) are correlated. This aspect is analysed in the next part of the study.

4.1. Correlation Analysis

The correlation between %MP and pNEP indicators is shown in

Table 4 and

Figure 4,

Figure 5 and

Figure 6. Correlation coefficients were calculated for three different categories. In the first, the basis for classification is the type of set for which the indicators were selected. In the second, it was the type of indicator maximisation criterion used in the hidden layer. Category 3 is a combination of categories 1 and 2.

This shows that grouping the data by training and test sample as well as selecting the ‘best’ networks, as shown by b(%MP) and b(pNEP), gives the greatest indication of the relationships between the observed results.

Following the data presented in

Table 4, we conclude that there is a strong positive correlation between %MP and pNEP indicators for the training sample as reflected in a correlation coefficient of 0.902. Equally, there is no statistically significant relationship between the indicators for the test set (0.391). However, as for the maximisation of the pNEP coefficient, we notice completely different dependence, namely a moderate negative correlation for the training set. This may be the result of the negative values for the networks that use the sine as an activation function in the output layer. It is also worth noting that there is a strong correlation between the indicators for the test set, which appears to be an interesting and important phenomenon and is analysed in a further part of the study.

Due to the disadvantage of the sine function, which as the only activation function in the output layer returned negative %MP values, we decided to exclude this function in further analysis. The results are presented in

Table 5.

Exclusion of the sine function resulted in obtaining positive correlation values for both parameters selected for both the training and test sets. For b(%MP) indicator, the correlation for the training set is significantly higher than for the test set. Whereas, for b(pNEP), the correlation between the training and test set is at a similar, high level.

Due to the discrepancy between the parameters of the best results, we decided to analyse the overall results with the use of the objective function that considers different weights of both parameters.

4.2. Network Assessment Using a Weighted Rating Function

In this part of the study, we present the results of using a weighted objective function to assess the quality of a given solution. The objective (evaluation) function (RF) has the following formula:

where coefficients a and b are weights of a given indicator.

The use of the presented objective function was possible due to the percentage nature of both indicators. Additionally, the following condition was added:

It was added to facilitate the comparison of the results obtained by the objective function and the %MP and pNEP indicators.

Investor’s preferences were analysed based on the combinations of weights presented in

Table 6. In combination 1, an investor prefers profit maximisation over the share of the number of days on which the options brought profit. Combination 3 is appropriate for investors with opposite preferences, i.e., those who place more emphasis on the number of days on which options were profitable. Whereas combination 2 puts equal weight on both parameters.

For each combination (1, 2, 3), the five highest values of the objective function are presented in

Table 7.

For combinations 1 and 2, the same networks gave the highest results. Two of these five networks were also included in the results for combination 3. This may be due to the high level of correlation between the %MP and pNEP indicators (see

Table 5). The comparison also includes two networks with a sine activation function. They are noteworthy despite the negative result of the %MP index obtained by these networks. The networks with the sine activation function allowed us to obtain the highest RF values for both the training and test sets.

In the last stage of the comparative analysis of the results, network performance indicators for different ranges of returns from long position in call option are analysed.

4.3. Comparison of Networks Based on Effectiveness Indicators

Due to the discrepancy in the results obtained from the perspective of the %MP and pNET indicators, the authors decided to analyse the level of returns generated by networks in given value ranges (classes). For this purpose, the final results for the call option buyer (payoff) were divided into the following six classes:

‘<−2’: the end result from taking a long position in the call option was less than −2 USD/barrel;

‘[−2; −1)’: the end result from taking a long position in the call option was not less than −2 USD/barrel, but less than −1 USD/barrel;

‘[−1; 0)’: the end result from taking a long position in the call option was not less than −1 USD/barrel, but less than 0 USD/barrel;

‘[0; 1)’: the end result from taking a long position in the call option was not less than 0 USD/barrel, but less than 1 USD/barrel;

‘[1; 2)’: The end result from taking a long position in the call option was not less than 1 USD/barrel but less than 2 USD/barrel;

‘>2’: the end result from taking a long position on a call option was greater than 2 USD/barrel.

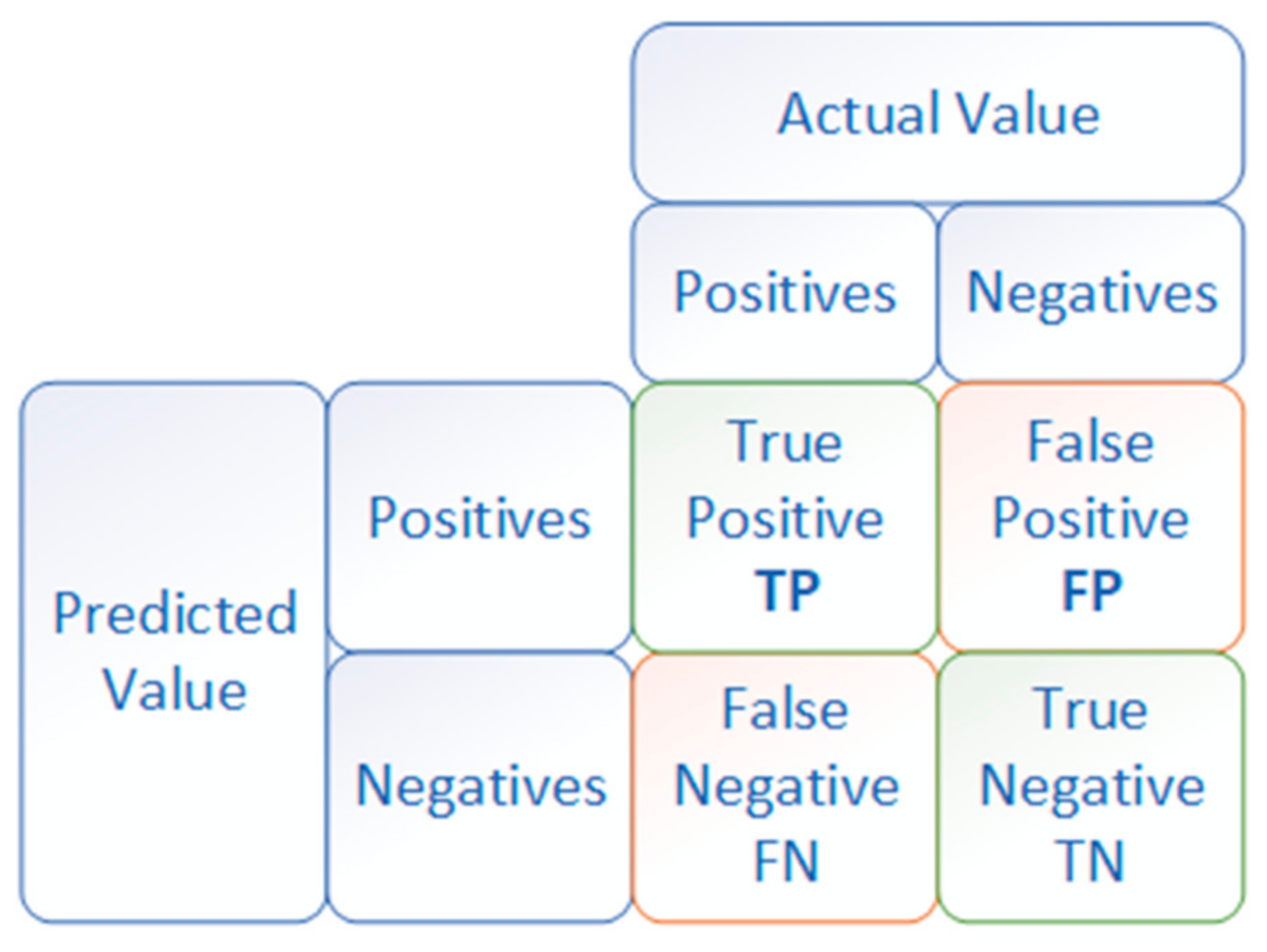

For each class, the number of options that were included in it was determined, as well as the sum of all results (payoffs) obtained from these options. Based on classes defined in this way, the networks that generated the highest values of %MP or pNEP were subjected to a detailed analysis. The confusion matrix (

Figure 10) was also used to assess these networks. It shows whether the classification made as a result of the prediction was correct or incorrect (and if so what type of error was made). In the case of the problem under consideration, the main emphasis was placed on the value of ‘True Positive’, which shows the number of correctly predicted buy signals for call options, and the value of ‘False Positive’, which in turn represents the number of erroneous signals for taking a long position in the aforementioned type of option.

Among the networks, which made it possible to achieve the highest values of the pNEP indicator for the training set, the network stands out, which used a sine function as one of the activation functions (in the hidden layer or the output layer). The authors compared this group of networks with networks for which the value of the %MP indicator for the training set was the highest.

Figure 11 and

Figure 12 were constructed for the best networks from each of the analysed groups (based on %MP and pNEP indicators). The first one shows the ratio of the number of signals generated by a given network, which were assigned to one of the six classes, to the total number of elements in a given class (divided into training and test sets).

Figure 12 shows analogous values, but in relation to the sum of the results obtained from the options (payoffs) belonging to the given classes. These values are expressed as percentage points.

As can be seen in

Figure 11 and

Figure 12, for both values being considered, the graphs show very similar values.

The network with a sine activation function in the output layer is characterised by a very large number of generated buy signals for the training set, both for options generating losses (ranges with values <0) and for options generating profits (ranges with values >0). This translates into very high pNEP indicators and negative %MP indicators (the vast majority of long positions in call options in the training set generated losses). At the same time, for the test set, the values of the %MP indicator increased drastically, with a very significant drop in the pNEP indicator (from 91.6% to 40.8%). This is largely due to the marked decrease in the number of buy signals generated for options that result in losses. The example of the analysed network shows the characteristic (repeating itself for the network with a sine activation function) that the number of False Positive signals is very high for the training set and it drops significantly for the test set. At the same time, the True Positive signals show much lower drops, which allows the network to achieve a very high %MP value for the test set.

In the case of the network which reached the highest value for the %MP indicator (marked with the letter L in

Figure 11), the network for the training set is characterised by a very large number of profit-generating buy signals and a small number of signals that bring losses. This very high level of signals-generating profits, combined with a moderate level of signals-generating losses, translates into the highest %MP level achieved for the training set (71.5%). At the same time, this network generates moderate results for the test set (17.1%). It is worth noting that the drastic decline in this indicator is to a much lesser extent the result of an increase in the number of loss signals (False Positive) and to a much greater extent a decrease in the number of profit signals (True Positive). This tendency repeats itself for the remaining networks generating the highest values of the %MP indicator.

Based on the analyses that were conducted, it may be concluded that the main challenge for networks with sine activation functions is the excess number of buy signals generated in the test set, which bring a loss (False Positive). In the case of other networks, the problem of the buy signals being generated takes on a completely different dimension—the main challenge is the insufficient number of correct buy signals (True Positive).

5. Conclusions and Future Research Directions

Analysis of indicators related to maximum profit (MP, pMP, pNMP), maximum loss (ML, pML, pMNL) and overall results (AR, pAR) that were achieved for the period of time being considered show that it is very difficult to generate profits by buying call options. The tool proposed in the study guarantees a limited level of losses but oil prices must deviate by values exceeding the option premiums that were paid for the options to generate profits. This does diminish the effectiveness and popularity of options among the participants of various markets, such as the WTI market that was analysed in this study, as a tool designed primarily to hedge against the negative consequence of price fluctuations.

This study employs artificial neural networks to support the decision-making process of taking long position in crude oil options on the WTI market. Using the Statistica software, over 2.5 million artificial neural networks were trained for this purpose. Compared to study [

58], two new indicators were proposed to assess the quality of solutions returned by the networks. The first one (pNEP) showed how often buy signals were generated in our data set. The second one (pEP) was the ratio of expected profit to the price paid for the options in a given period of time. Based on the pNEP and %MP indicators, a criterion for selecting the best networks was formulated. The results for these networks were subjected to a detailed analysis. Furthermore, the pEP index provided additional information on the rate of return obtained from these networks in relation to the level of capital employed.

The best values of the %MP indicator were obtained for networks with the smallest number of neurons (between 5 and 30) and hyperbolic tangent or logistic activation functions. On the other hand, based on this indicator, the logistic and softmax activation functions were the most effective in the output layer. For the pNEP index, ranges of 5 to 55 ([5; 30] and [31, 55]) neurons in the hidden layer of the network gave the best results. Moreover, exponential activation functions for the hidden layer and sine for the output layer were the most effective from this perspective. It is also worth noting that in the output layer only the sine activation function resulted in negative %MP values for the training set. The aforementioned indicators were used to select a network from the set of networks that were already trained. In this case, the selection criterion was the level of correctly classified buying signals from the given network which may encourage market players to take further actions or discourage them.

Excluding networks with the sine activation function resulted in a high level of correlation between the %MP and pNEP indicators. An analysis based on a weighted objective function (RF), based on %MP and pNEP indicators, confirmed a statistically significant correlation between them. The last stage of the analyses that were conducted, showed in turn, that networks with sine activation functions (in the hidden or output layers) tended to generate a large number of buy signals that brought losses in the training set. On the other hand, in the test set, the number of signals of this type showed a marked decrease—as opposed to signals generating profits. As a result, some of the networks with sine activation functions achieved very high %MP indicators of over 40% in the test set. In turn, in the case of the best networks based on the %MP indicator in the training set, large drops in %MP in the test set were caused by a significant decrease in the number of profits generating buy signals. An important characteristic of these networks was the low level of erroneously generated buy signals for both the training and test sets.

In further research, we plan to focus on improving the results from the neural networks from the perspective of their use in hedging against price risk. For this purpose, we plan to implement our own software in the field of neural networks, which will help to analyse the neural networks in detail, with regard to the various evaluation functions that may contribute to assess the network. We also plan to test different types of learning algorithms, including genetic algorithms for weighting the connections between network neurons.